Cash Salary, Inside Equity, or Inside Debt?—The Determinants and Optimal Value of Compensation Structure in a Long-term Incentive Model of Banks

Abstract

1. Introduction

2. Materials and Methods

2.1. Model Assumptions

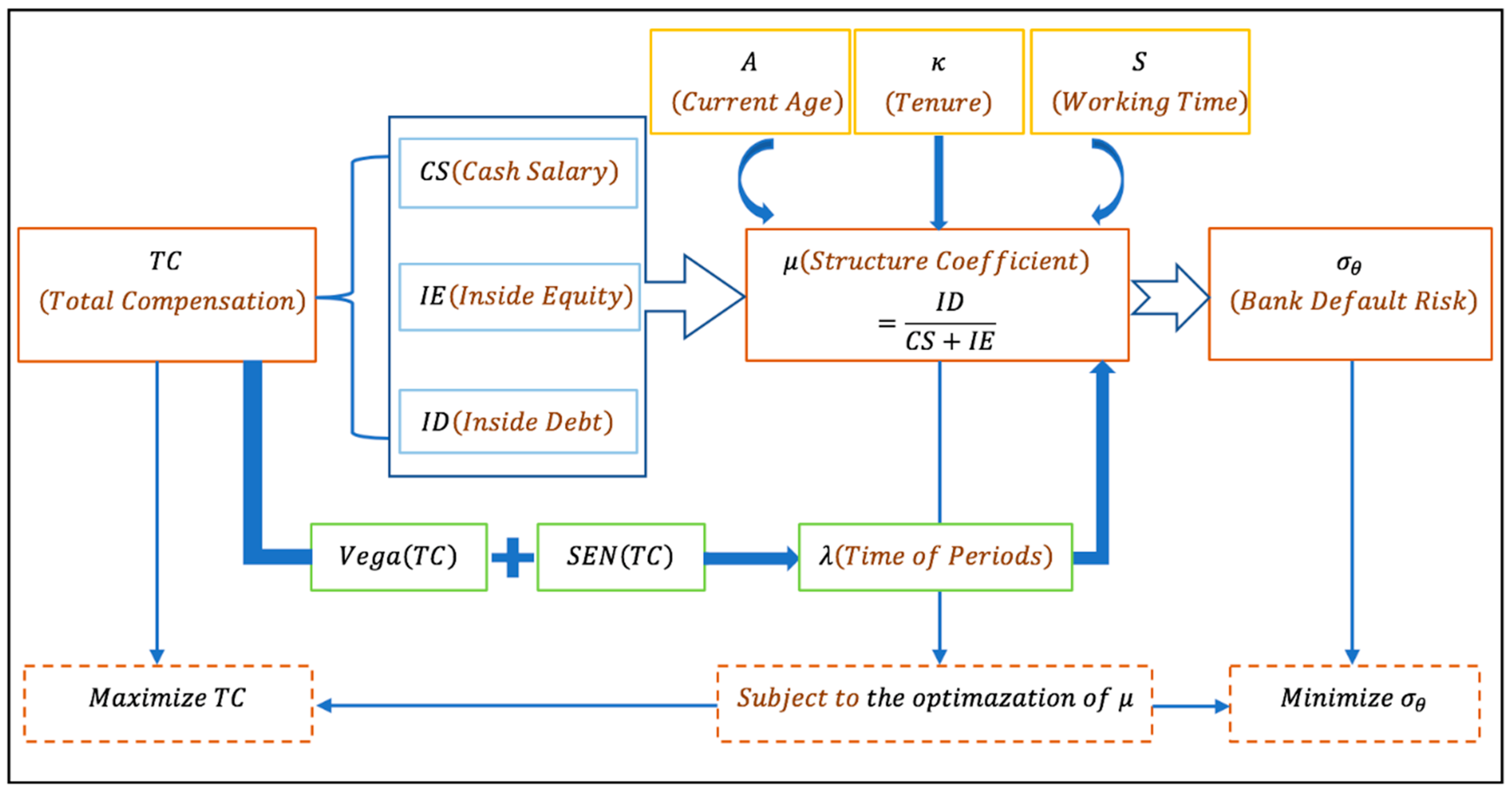

2.2. The Long-Term Incentive Model of Banks

2.2.1. Call Option and Total Compensation Value

2.2.2. The Vega and Sensitivity of Total Compensation

2.2.3. The Structure Coefficient of Pay Contract

2.3. Compensation Structure

2.3.1. Derivation of Using Survival Function

2.3.2. The Expression of Compensation Structure

2.3.3. Case for the Value of

3. Results

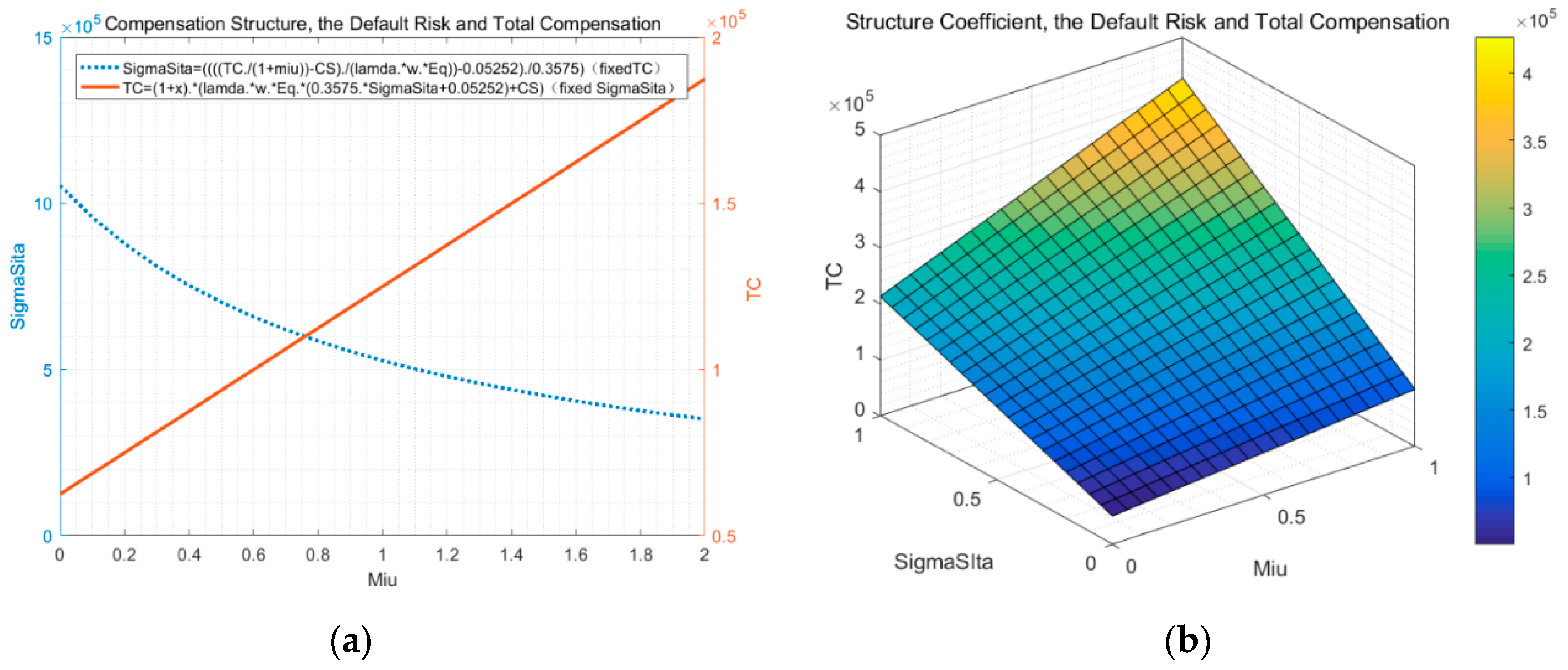

3.1. Total Compensation and the Structure Coefficient

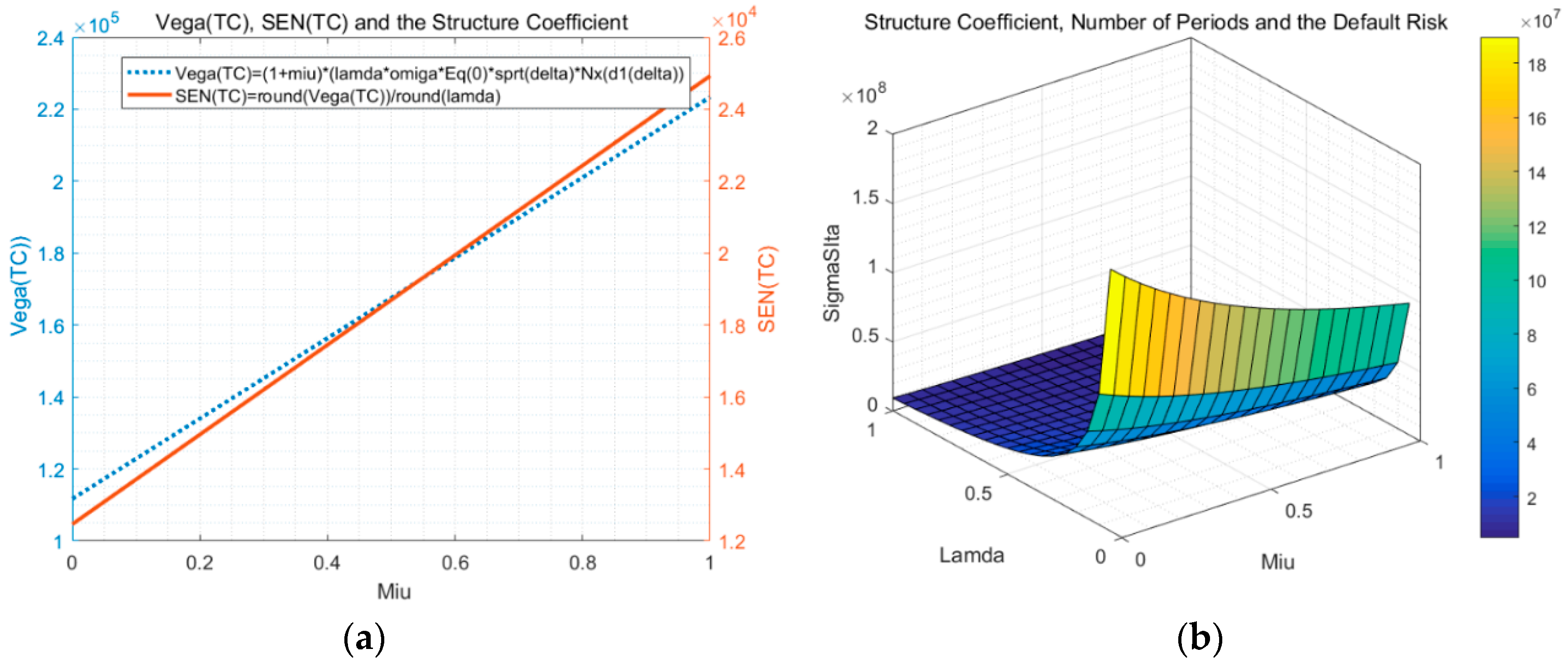

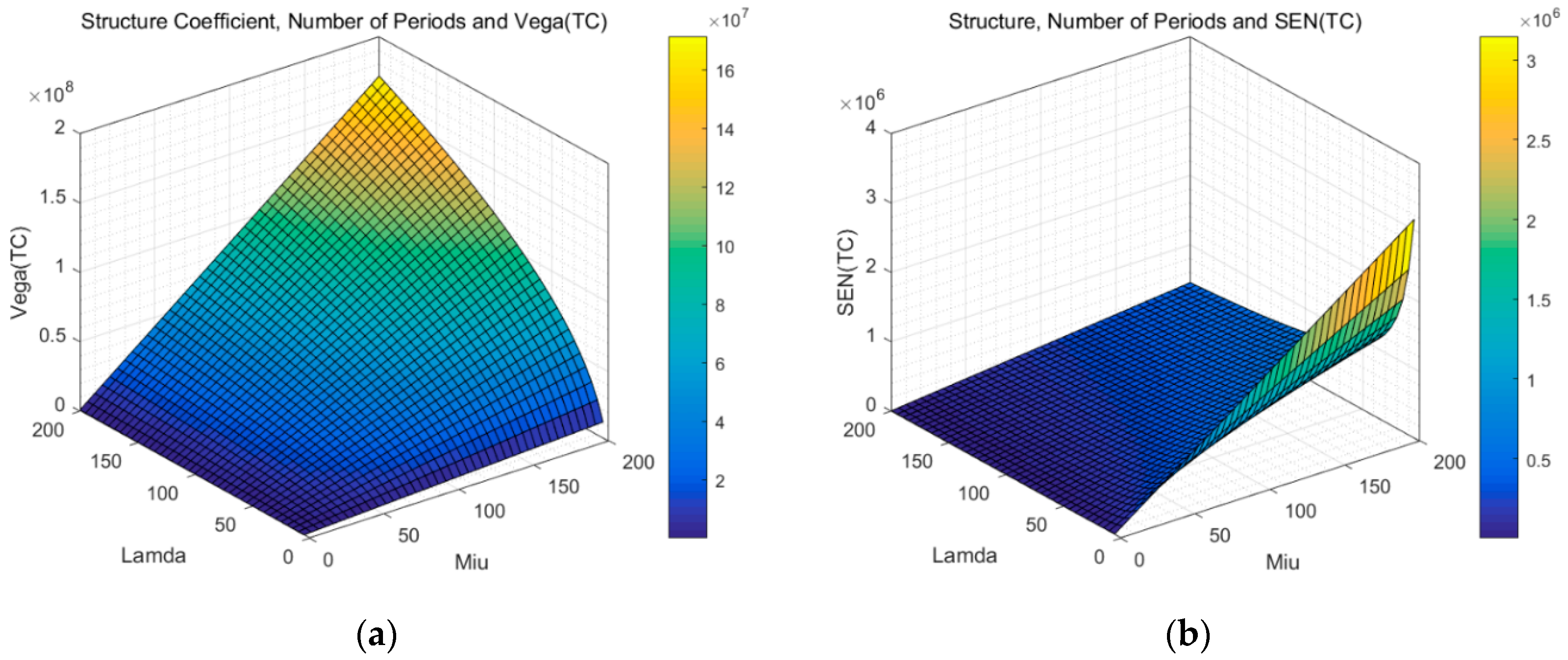

3.2. Total Compensation Vega and the Structure Coefficient

3.3. Sensitivity of Total Compensation and the Number of Periods

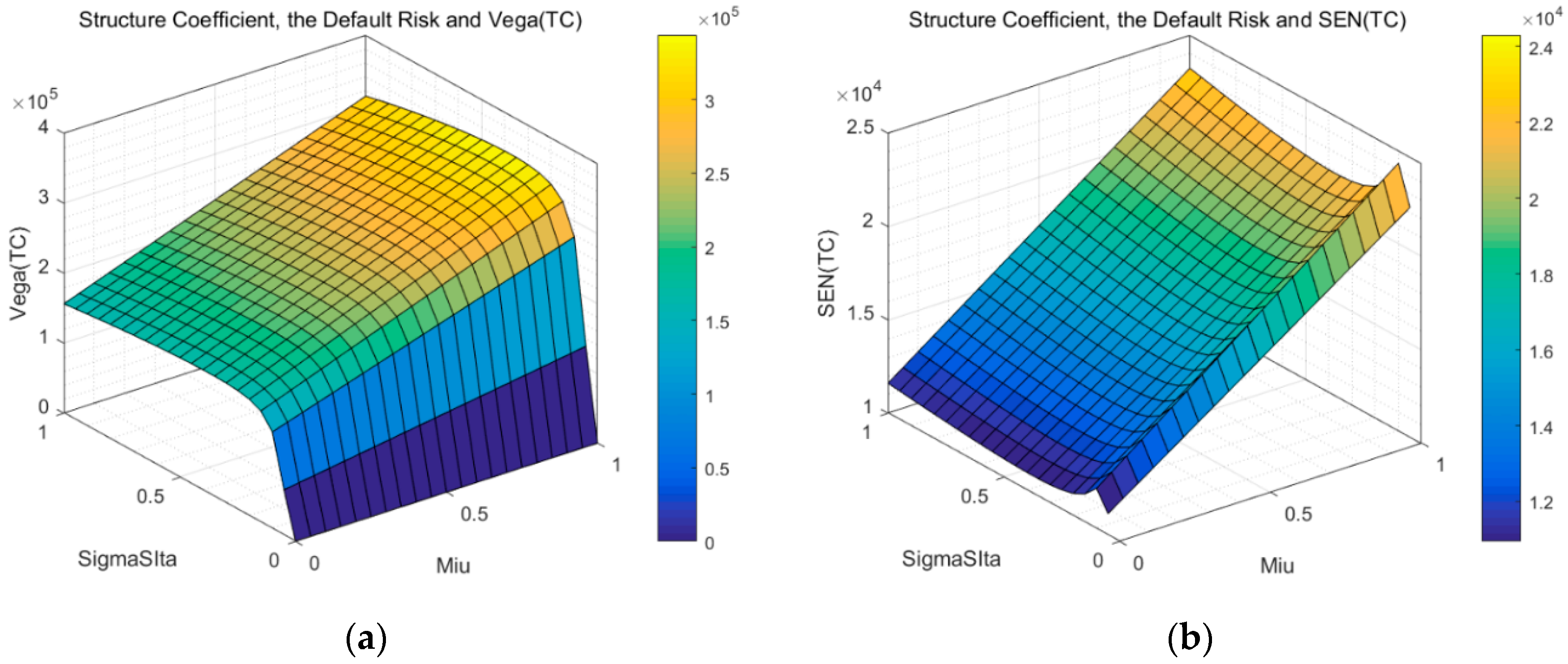

3.4. Optimal Value of the Structure Coefficient with Respect to the Default Risk

3.5. Optimal Value of the Structure Coefficient with Respect to the Number of Periods

3.6. The Determinants of The Structure Coefficient

3.6.1. Working Time and the Corresponding Structure Coefficient

3.6.2. Current Age and the Corresponding Structure Coefficient

3.6.3. Tenure and the Corresponding Structure Coefficient

4. Discussion

4.1. A Case Study: John G. Stumpf of Wells Fargo and Co.

4.1.1. Data

4.1.2. Calculation of Variables

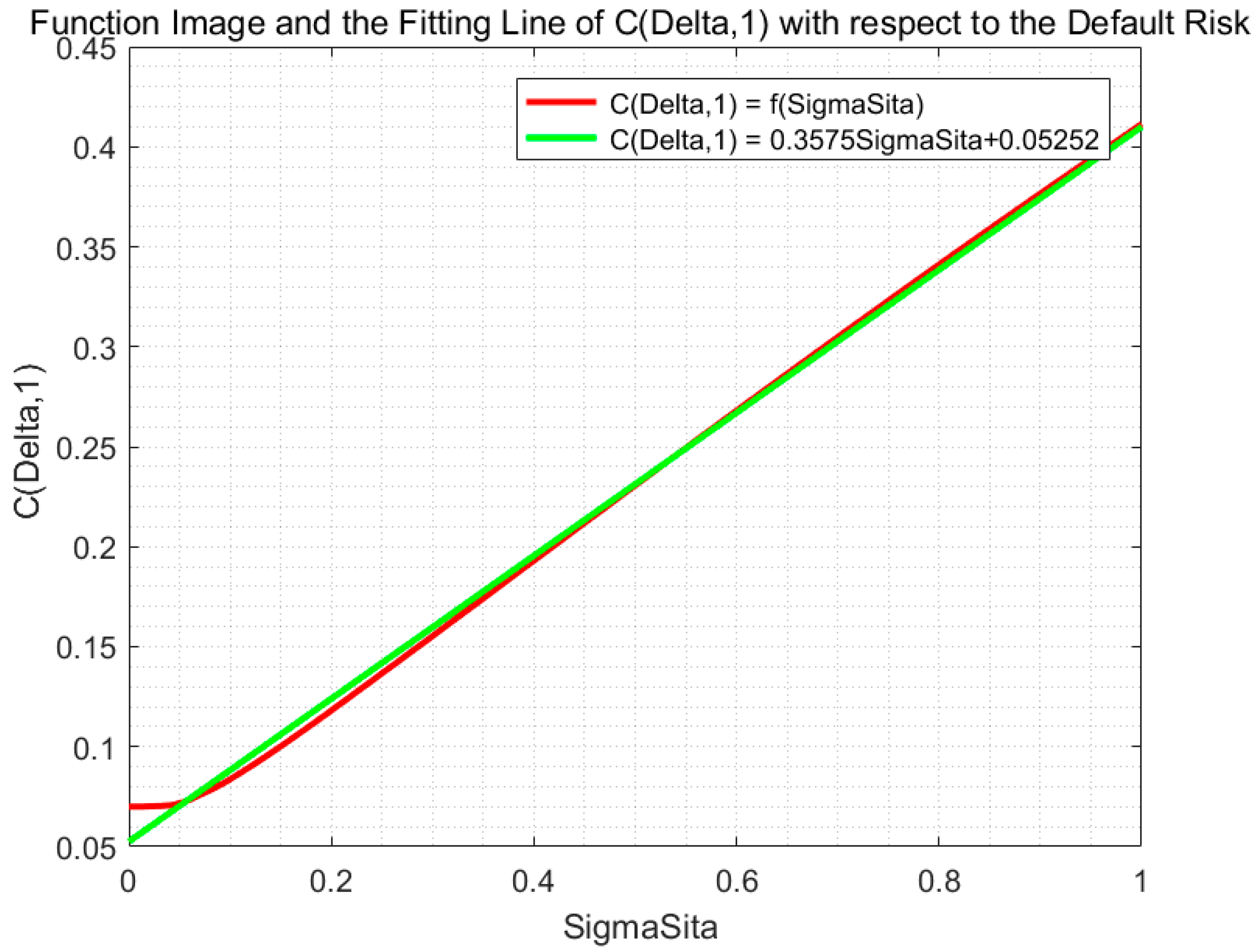

4.1.3. Function Image and the Fitting Line of Call Option with Respect to the Default Risk

4.2. Simulation Analysis

4.2.1. Significance of Fitting Maps

4.2.2. Analysis of Simulation Result

4.3. Robustness

5. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

| Classification | Long-Term Model | ||||

|---|---|---|---|---|---|

| From Predecessors or Intuition | From Theoretical Analysis | From Simulation Results | Corresponding Figure | ||

| Total compensation | Equation (5): Equation (58): | Corollary 1: | Figure 3a,b | ||

| Risk incentives of total compensation | Equation (6): | Corollary 2: | Figure 4a, Figure 5a and Figure 6a | ||

| Sensitivity of total compensation | Equation (7): | Corollary 3: | Figure 4a, Figure 5b and Figure 6b | ||

| Bank default risk | Equation (59): | Corollary 4: | Figure 3a,b, Figure 4b and Figure 6a,b | ||

| Number of periods | Equation (60): | Corollary 5: | Figure 4b and Figure 5a,b | ||

| Determinants of structure | Working time | Corollary 6: | - | ||

| Current age | Corollary 7: | and | - | ||

| Tenure | Corollary 8: | - | |||

| Compensation Structure | Equation (9): | Survival function | Lemma 1: | ||

| Proposition 1: | |||||

References

- Jensen, M.C.; William, H.M. Theory of the firm: Managerial behavior, agency cost, and ownership structure. J. Financ. Econ. 1976, 3, 305–360. [Google Scholar] [CrossRef]

- Agnieszka, A.; Anna, S. Corporate Governance in the cooperative banking sector in Poland. Financ. Credit Act. Theor. Pract. 2019, 1, 4–15. [Google Scholar]

- Tang, C.H. Impacts of future compensation on the incentive effects of existing executive stock options. Int. Rev. Econ. Financ. 2016, 45, 273–285. [Google Scholar] [CrossRef]

- Shan, Y.; Walter, T. Towards a Set of Design Principles for Executive Compensation Contracts. Abacus 2016, 52, 619–684. [Google Scholar] [CrossRef]

- Kline, W. Executive compensation: An examination of the influence of TMT compensation on risk-adjusted performance. J. Strategy Manag. 2017, 10, 187–205. [Google Scholar] [CrossRef]

- Fried, J.M. Share Repurchases, Equity Issuances, and the Optimal Design of Executive Pay. Tex. Law Rev. 2011, 89, 1113–1147. [Google Scholar] [CrossRef][Green Version]

- Dutcher, E.G. The Economic Psychology of Incentives: New Design Principles for Executive Pay. J. Econ. Psychol. 2018, 64, 140–142. [Google Scholar] [CrossRef]

- Conyon, M.J. Executive compensation and incentives. Acad. Manag. Perspect. 2006, 20, 25–44. [Google Scholar] [CrossRef]

- Canyon, M.J. Compensation Consultants and Executive Pay: Evidence from the United States and the United Kingdom. Acad. Manag. Perspect. 2009, 23, 43–55. [Google Scholar] [CrossRef]

- Burak, E. Is The Sky the Limit? Fair Executive Pay as Performance Rises. Soc. Probl. 2018, 65, 211–230. [Google Scholar] [CrossRef]

- Bebchuk, L.A. Managerial power and rent extraction in the design of executive compensation. Univ. Chic. Law Rev. 2002, 69, 751–846. [Google Scholar] [CrossRef]

- Banghoj, J. Determinants of executive compensation in privately held firms. Account. Financ. 2010, 50, 481–510. [Google Scholar] [CrossRef]

- Milidonis, A.; Nishikawa, T.; Shim, J. CEO Inside Debt and Risk Taking: Evidence from Property-Liability Insurance Firms. J. Risk Insur. 2019, 86, 451–477. [Google Scholar] [CrossRef]

- Deng, K.; He, J.; Kong, D.; Zhang, J. Does inside debt alleviate banks’ risk taking? Evidence from a quasi-natural experiment in the Chinese banking industry. Emerg. Mark. Rev. 2019, 40, 100622. [Google Scholar] [CrossRef]

- Chen, L.; Fan, H. CEO inside debt and bank loan syndicate structure. Rev. Financ. Econ. 2017, 34, 74–85. [Google Scholar] [CrossRef]

- Bhandari, A.; Mammadov, B.; Thevenot, M. The impact of executive inside debt on sell-side financial analyst forecast characteristics. Rev. Quant. Financ. Account. 2018, 51, 283–315. [Google Scholar] [CrossRef]

- Sheikh, S. CEO inside debt, market competition and corporate risk taking. Int. J. Manag. Financ. 2019, 15, 636–657. [Google Scholar] [CrossRef]

- Li, Z.F.; Lin, S.; Sun, S.; Tucker, A. Risk-adjusted inside debt. Glob. Financ. J. 2018, 35, 12–42. [Google Scholar] [CrossRef]

- Li, Y.; Zhang, X.-Y. Impact of board gender composition on corporate debt maturity structures. Eur. Financ. Manag. 2019, 25, 1286–1320. [Google Scholar] [CrossRef]

- Merton, R.C. On the Pricing of Corporate Debt: The Risk Structure of Interests Rates. J. Financ. 1974, 29, 449–470. [Google Scholar]

- Boyle, P.P.; Scott, W.R. Executive Stock Options and Concavity of the Option Price. J. Deriv. 2006, 13, 72–84. [Google Scholar] [CrossRef]

- Galletta, S.; Mazzù, S. Liquidity Risk Drivers and Bank Business Models. Risks 2019, 7, 89. [Google Scholar] [CrossRef]

- Pelizzon, L.; Subrahmanyam, M.G.; Tomio, D.; Uno, J. Sovereign credit risk, liquidity, and European Central Bank intervention: Deus ex machina? J. Financ. Econ. 2016, 122, 86–115. [Google Scholar] [CrossRef]

- Douglas, W. Diamond. Debt Maturity Structure and Liquidity Risk. Q. J. Econ. 1991, 106, 709–773. [Google Scholar]

- Imbierowicz, B.; Rauch, C. The Relationship between Liquidity Risk and Credit Risk in Banks. J. Bank. Financ. 2014, 40, 242–256. [Google Scholar] [CrossRef]

- Abad-Segura, E.; Cortés-García, F.J.; Belmonte-Ureña, L.J. The Sustainable Approach to Corporate Social Responsibility: A Global Analysis and Future Trends. Sustainability 2019, 11, 5382. [Google Scholar] [CrossRef]

- Ma, T. Pay Me Later is Not Always Positively Associated with Bank Risk Reduction—From the Perspective of Long-Term Compensation and Black Box Effect. Sustainability 2020, 12, 35. [Google Scholar] [CrossRef]

- Black, F.; Scholes, M. The Pricing of Options and Corporate Liabilities. J. Polit. Econ. 1973, 81, 637–654. [Google Scholar] [CrossRef]

- Kaplan, E.L.; Meier, P. Nonparametric estimation from incomplete observations. J. Am. Stat. Assoc. 1958, 53, 456–481. [Google Scholar] [CrossRef]

- The Period Life Table. Available online: http://www.ssa.gov/OACT/STATS/table4c6.html (accessed on 18 December 2019).

- Freund, S.; Latif, S.; Phan, H.V. Executive compensation and corporate financing policies: Evidence from CEO inside debt. J. Corp. Financ. 2018, 50, 484–504. [Google Scholar] [CrossRef]

- Hagendorff, J.; Vallascas, F. CEO pay incentives and risk taking: Evidence from bank acquisitions. J. Corp. Financ. 2011, 17, 1078–1095. [Google Scholar] [CrossRef]

- International Monetary Fund. Risk-taking by banks: The role of governance and executive pay. In Global Financial Stability Report: Risk-Taking, Liquidity, and Shadow Banking: Curbing Excess While Promoting Growth; IMF: Washington, DC, USA, 2014. [Google Scholar]

- Gopalan, R.; Milbourn, T.; Song, F.; Thakor, A.V. The Optimal Duration of Executive Compensation: Theory and Evidence AFA 2012 Chicago Meetings Paper. Available online: http://ssrn.com/abstract=1656603 (accessed on 10 November 2019).

- Sundaram, P.K.; Yermack, D.L. Pay me later: Inside debt and its role in managerial compensation. J. Financ. 2007, 62, 1551–1588. [Google Scholar] [CrossRef]

- Laeven, L.; Levine, R. Bank governance, regulation and risk taking. J. Financ. Econ. 2009, 93, 259–275. [Google Scholar] [CrossRef]

- Jokivuolle, E.; Keppo, J.; Yuan, X. Bonus Caps, Deferrals and Bankers’ Risk-Taking. Manag. Sci. under review.

| Classification | Notation | Definition | Notation | Definition |

|---|---|---|---|---|

| Compensation in long-term model | Total compensation during banker’s tenure | Cash salary during banker’s tenure | ||

| Inside equity during banker’s tenure | Inside debt during banker’s tenure | |||

| The inside equity and inside debt frequency | The fraction of equity | |||

| The risk-free rate | BS call option price | |||

| The time interval | Strike price of the call option | |||

| Standard cumulative normal distribution | Standard normal density | |||

| Structure coefficient | Coefficient of compensation structure | The minimum retirement age | ||

| Chief executive officer’s (CEO’s) current age | The executive’s tenure | |||

| A multiplier factor | The executive’s number of working years | |||

| The firm’s cost of long-term debt | The terminal year of the pension | |||

| Survival function | The probability that one is alive years | Survival function in this paper | ||

| Survival probability | Death probability | |||

| Kaplan survival function | The number under observations just after Kaplan deaths | |||

| Death rate of Kaplan | ||||

| Related measure | Vega of total compensation | Sensitivity of total compensation | ||

| Volatility of return on equity (ROE) | The bank equity | |||

| Fit slope | Fit intercept | |||

| Goodness of fit | Sum of squares due to error | Coefficient of determination | ||

| Degree-of-freedom adjusted coefficient of determination | Root mean square error |

| 0 | 49 | 0.005208 | 0.994792 | 1 | 1 | 36 | 85 | 0.112468 | 0.887532 | 0.283633746 | 0.283633746 | ||

| 1 | 50 | 0.005657 | 0.994343 | 0.994343 | 1 | 37 | 86 | 0.124164 | 0.875836 | 0.248416646 | 0.248416646 | ||

| 2 | 51 | 0.006134 | 0.993866 | 0.9882437 | 1 | 38 | 87 | 0.136917 | 0.863083 | 0.214404184 | 0.214404184 | ||

| 3 | 52 | 0.006595 | 0.993405 | 0.981726233 | 1 | 39 | 88 | 0.150754 | 0.849246 | 0.182081896 | 0.182081896 | ||

| 4 | 53 | 0.007027 | 0.992973 | 0.974827643 | 1 | 40 | 89 | 0.165704 | 0.834296 | 0.151910197 | 0.151910197 | ||

| 5 | 54 | 0.007457 | 0.992543 | 0.967558353 | 1 | 41 | 90 | 0.181789 | 0.818211 | 0.124294594 | 0.124294594 | ||

| 6 | 55 | 0.007921 | 0.992079 | 0.959894323 | 1 | 42 | 91 | 0.199019 | 0.800981 | 0.099557608 | 0.099557608 | ||

| 7 | 56 | 0.008467 | 0.991533 | 0.951766898 | 1 | 43 | 92 | 0.217396 | 0.782604 | 0.077914183 | 0.077914183 | ||

| 8 | 57 | 0.009121 | 0.990879 | 0.943085832 | 1 | 44 | 93 | 0.236906 | 0.763094 | 0.059455845 | 0.059455845 | ||

| 9 | 58 | 0.009912 | 0.990088 | 0.933737965 | 1 | 45 | 94 | 0.257525 | 0.742475 | 0.044144479 | 0.044144479 | ||

| 10 | 59 | 0.010827 | 0.989173 | 0.923628384 | 1 | 46 | 95 | 0.278031 | 0.721969 | 0.031870945 | 0.031870945 | ||

| 11 | 60 | 0.011858 | 0.988142 | 0.912675999 | 1 | 47 | 96 | 0.298111 | 0.701889 | 0.022369866 | 0.022369866 | ||

| 12 | 61 | 0.012966 | 0.987034 | 0.900842242 | 1 | 48 | 97 | 0.317432 | 0.682568 | 0.015268955 | 0.015268955 | ||

| 13 | 62 | 0.014123 | 0.985877 | 0.888119647 | 1 | 49 | 98 | 0.335655 | 0.664345 | 0.010143854 | 0.010143854 | ||

| 14 | 63 | 0.015312 | 0.984688 | 0.874520759 | 1 | 50 | 99 | 0.352438 | 0.647562 | 0.006568774 | 0.006568774 | ||

| 15 | 64 | 0.016567 | 0.983433 | 0.860032574 | 1 | 51 | 100 | 0.37006 | 0.629940 | 0.004137934 | 0.004137934 | ||

| 16 | 65 | 0.017976 | 0.982024 | 0.844572628 | 1 | 52 | 101 | 0.388563 | 0.611437 | 0.002530086 | 0.002530086 | ||

| 17 | 66 | 0.019564 | 0.980436 | 0.828049409 | 0.828049409 | 53 | 102 | 0.407991 | 0.592009 | 0.001497834 | 0.001497834 | ||

| 18 | 67 | 0.021291 | 0.978709 | 0.810419409 | 0.810419409 | 54 | 103 | 0.42839 | 0.571610 | 0.000856177 | 0.000856177 | ||

| 19 | 68 | 0.023162 | 0.976838 | 0.791648475 | 0.791648475 | 55 | 104 | 0.44981 | 0.550190 | 0.00047106 | 0.00047106 | ||

| 20 | 69 | 0.025217 | 0.974783 | 0.771685475 | 0.771685475 | 56 | 105 | 0.4723 | 0.527700 | 0.000248578 | 0.000248578 | ||

| 21 | 70 | 0.027533 | 0.972467 | 0.750438659 | 0.750438659 | 57 | 106 | 0.495915 | 0.504085 | 0.000125305 | 0.000125305 | ||

| 22 | 71 | 0.030131 | 0.969869 | 0.727827192 | 0.727827192 | 58 | 107 | 0.520711 | 0.479289 | 6.00571 × 10−5 | 6.00571 × 10−5 | ||

| 23 | 72 | 0.032978 | 0.967022 | 0.703824907 | 0.703824907 | 59 | 108 | 0.546747 | 0.453253 | 2.72211 × 10−5 | 2.72211 × 10−5 | ||

| 24 | 73 | 0.036086 | 0.963914 | 0.678426681 | 0.678426681 | 60 | 109 | 0.574084 | 0.425916 | 1.15939 × 10−5 | 1.15939 × 10−5 | ||

| 25 | 74 | 0.039506 | 0.960494 | 0.651624757 | 0.651624757 | 61 | 110 | 0.602788 | 0.397212 | 4.60523 × 10−6 | 4.60523 × 10−6 | ||

| 26 | 75 | 0.043415 | 0.956585 | 0.623334468 | 0.623334468 | 62 | 111 | 0.632928 | 0.367072 | 1.69045 × 10−6 | 1.69045 × 10−6 | ||

| 27 | 76 | 0.047789 | 0.952211 | 0.593545937 | 0.593545937 | 63 | 112 | 0.664574 | 0.335426 | 5.67021 × 10−7 | 5.67021 × 10−7 | ||

| 28 | 77 | 0.052464 | 0.947536 | 0.562406143 | 0.562406143 | 64 | 113 | 0.697803 | 0.302197 | 1.71352 × 10−7 | 1.71352 × 10−7 | ||

| 29 | 78 | 0.057413 | 0.942587 | 0.530116719 | 0.530116719 | 65 | 114 | 0.732693 | 0.267307 | 4.58036 × 10−8 | 4.58036 × 10−8 | ||

| 30 | 79 | 0.062789 | 0.937211 | 0.49683122 | 0.49683122 | 66 | 115 | 0.769327 | 0.230673 | 1.05657 × 10−8 | 1.05657 × 10−8 | ||

| 31 | 80 | 0.068836 | 0.931164 | 0.462631346 | 0.462631346 | 67 | 116 | 0.807794 | 0.192206 | 2.03078 × 10−9 | 2.03078 × 10−9 | ||

| 32 | 81 | 0.075724 | 0.924276 | 0.42759905 | 0.42759905 | 68 | 117 | 0.848183 | 0.151817 | 3.08307 × −10 | 3.08307 × −10 | ||

| 33 | 82 | 0.083466 | 0.916534 | 0.391909068 | 0.391909068 | 69 | 118 | 0.890592 | 0.109408 | 3.37313 × −11 | 3.37313 × −11 | ||

| 34 | 83 | 0.092144 | 0.907856 | 0.355796999 | 0.355796999 | 70 | 119 | 0.935122 | 0.064878 | 2.18842 × −12 | 2.18842 × −12 | ||

| 35 | 84 | 0.101803 | 0.898197 | 0.319575797 | 0.319575797 | 71 | 120 | - | - | - | - | 0 |

| Year | ||||||

|---|---|---|---|---|---|---|

| 2007 | 749.615 | 10,334.11 | 0 | 11,083.72 | 0.2443 | 47,432,000,000 |

| 2008 | 878.92 | 10,061.95 | 0 | 10,940.87 | 0.0324 | 70,949,000,000 |

| 2009 | 5600 | 12,646.33 | 0 | 28,491.73 | 0.1574 | 105,846,000,000 |

| 2010 | 3239.847 | 14,051.66 | 10,245.404 | 41,604.93 | 0.1486 | 119,155,000,000 |

| 2011 | 2800 | 15,979.96 | 24,313.422 | 51,497.13 | 0.167 | 130,189,000,000 |

| 2012 | 2800 | 19,538.04 | 32,717.168 | 64,298.74 | 0.1792 | 145,953,000,000 |

| 2013 | 2800 | 18,744.93 | 41,960.701 | 56,481.34 | 0.1908 | 154,646,000,000 |

| 2014 | 2800 | 20,853.09 | 34,936.416 | 58,523.76 | 0.1829 | 166,075,000,000 |

| 2015 | 2800 | 19,972.58 | 34,870.673 | 50,760.26 | 0.1735 | 171,567,000,000 |

| 2016 | 2070.498 | 22,660.3 | 27,987.681 | 24,730.8 | 0.1602 | 175,820,000,000 |

| Sum | 26,538.88 | 164,842.9 | 207,031.465 | 398,413.3 | – | – |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ma, T.; Jiang, M.; Yuan, X. Cash Salary, Inside Equity, or Inside Debt?—The Determinants and Optimal Value of Compensation Structure in a Long-term Incentive Model of Banks. Sustainability 2020, 12, 666. https://doi.org/10.3390/su12020666

Ma T, Jiang M, Yuan X. Cash Salary, Inside Equity, or Inside Debt?—The Determinants and Optimal Value of Compensation Structure in a Long-term Incentive Model of Banks. Sustainability. 2020; 12(2):666. https://doi.org/10.3390/su12020666

Chicago/Turabian StyleMa, Tianyi, Minghui Jiang, and Xuchuan Yuan. 2020. "Cash Salary, Inside Equity, or Inside Debt?—The Determinants and Optimal Value of Compensation Structure in a Long-term Incentive Model of Banks" Sustainability 12, no. 2: 666. https://doi.org/10.3390/su12020666

APA StyleMa, T., Jiang, M., & Yuan, X. (2020). Cash Salary, Inside Equity, or Inside Debt?—The Determinants and Optimal Value of Compensation Structure in a Long-term Incentive Model of Banks. Sustainability, 12(2), 666. https://doi.org/10.3390/su12020666