The Incentives and Efforts for Innovation and Entrepreneurship in a Resource-Based Economy: A Survey on Perspective of Qatari Residents

Abstract

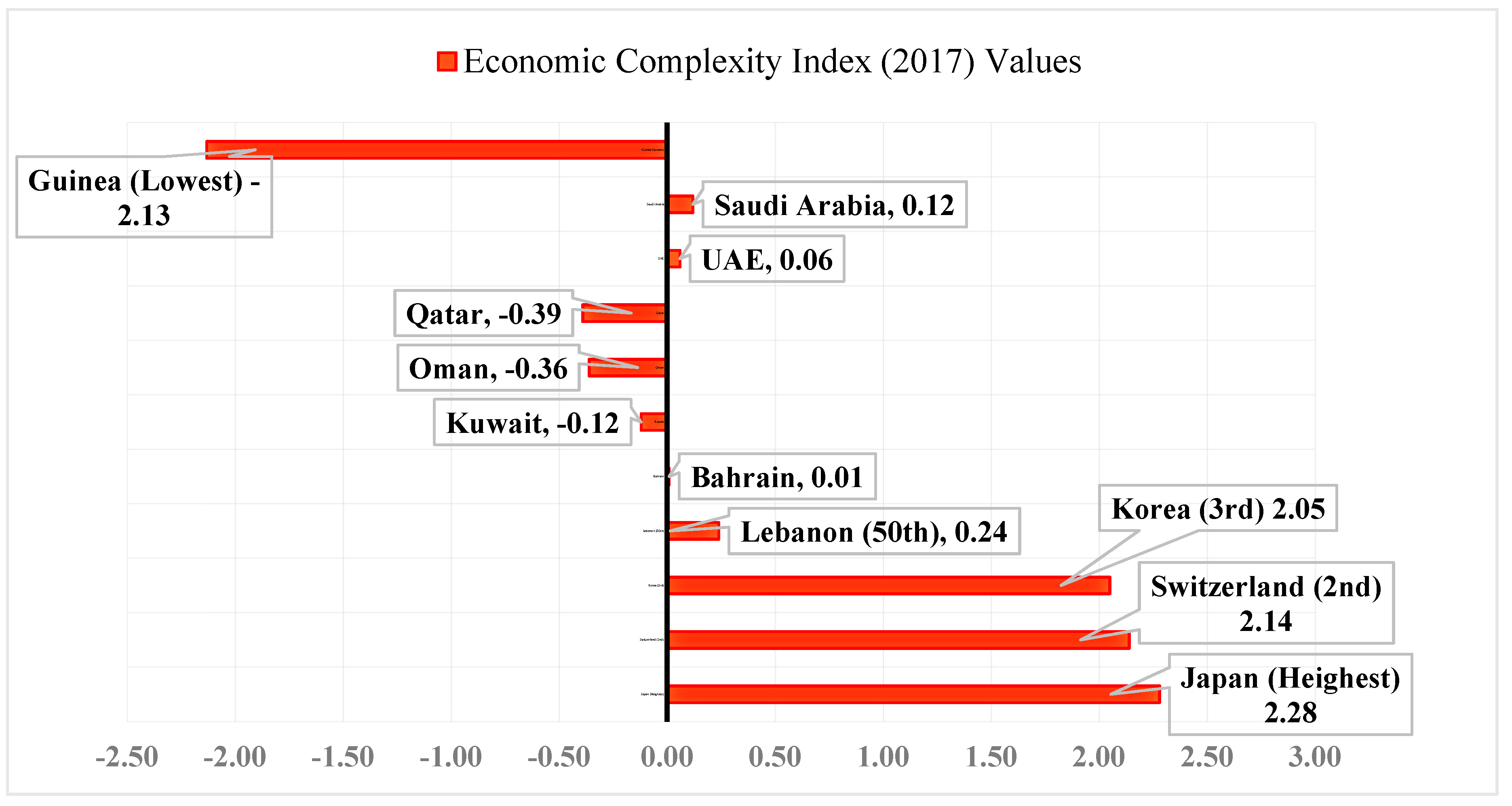

1. Introduction: A Resource-Based State and Economic Diversification: The Case of Qatar

2. The Background, Scope, and Methodology of the Paper

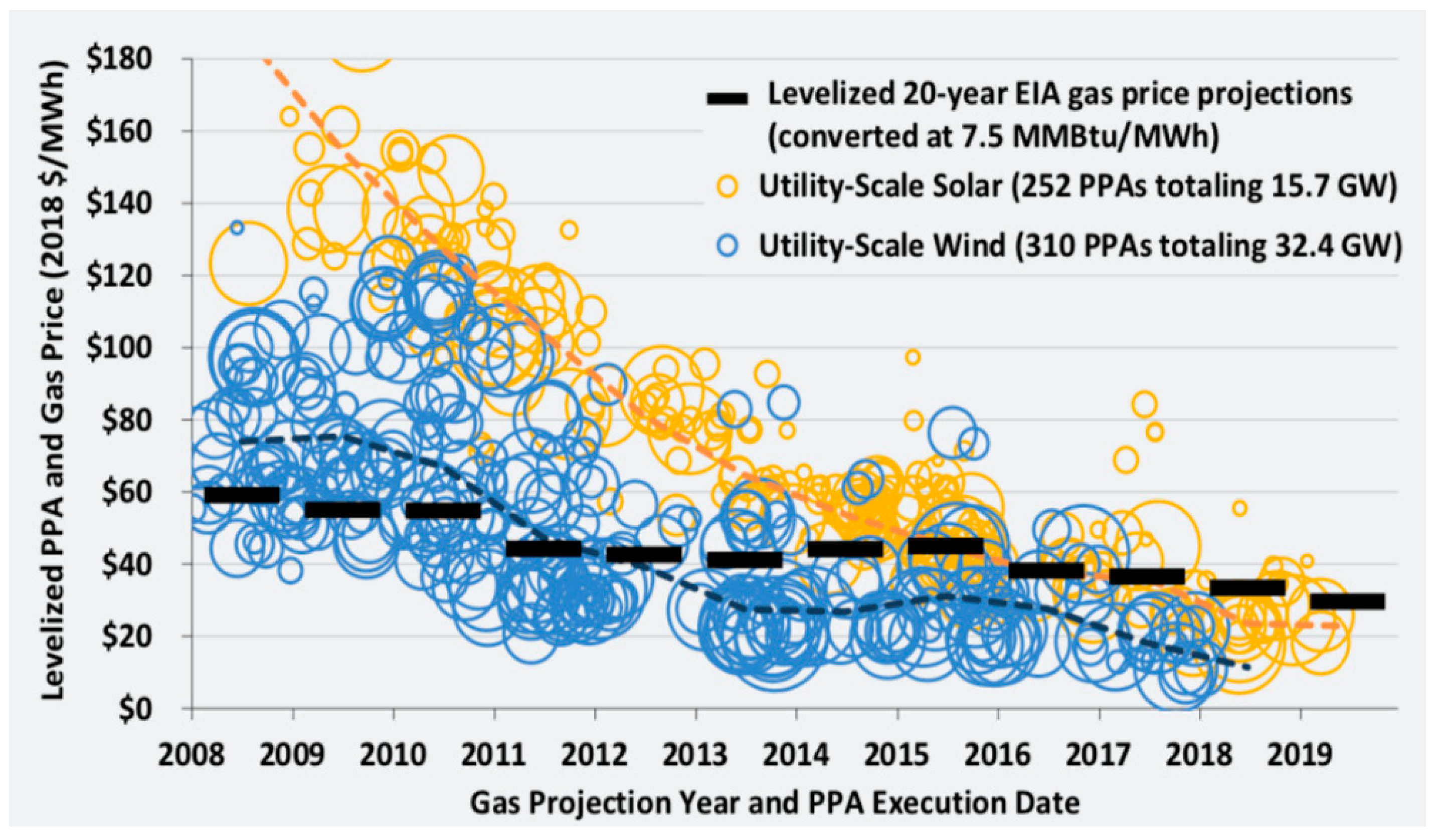

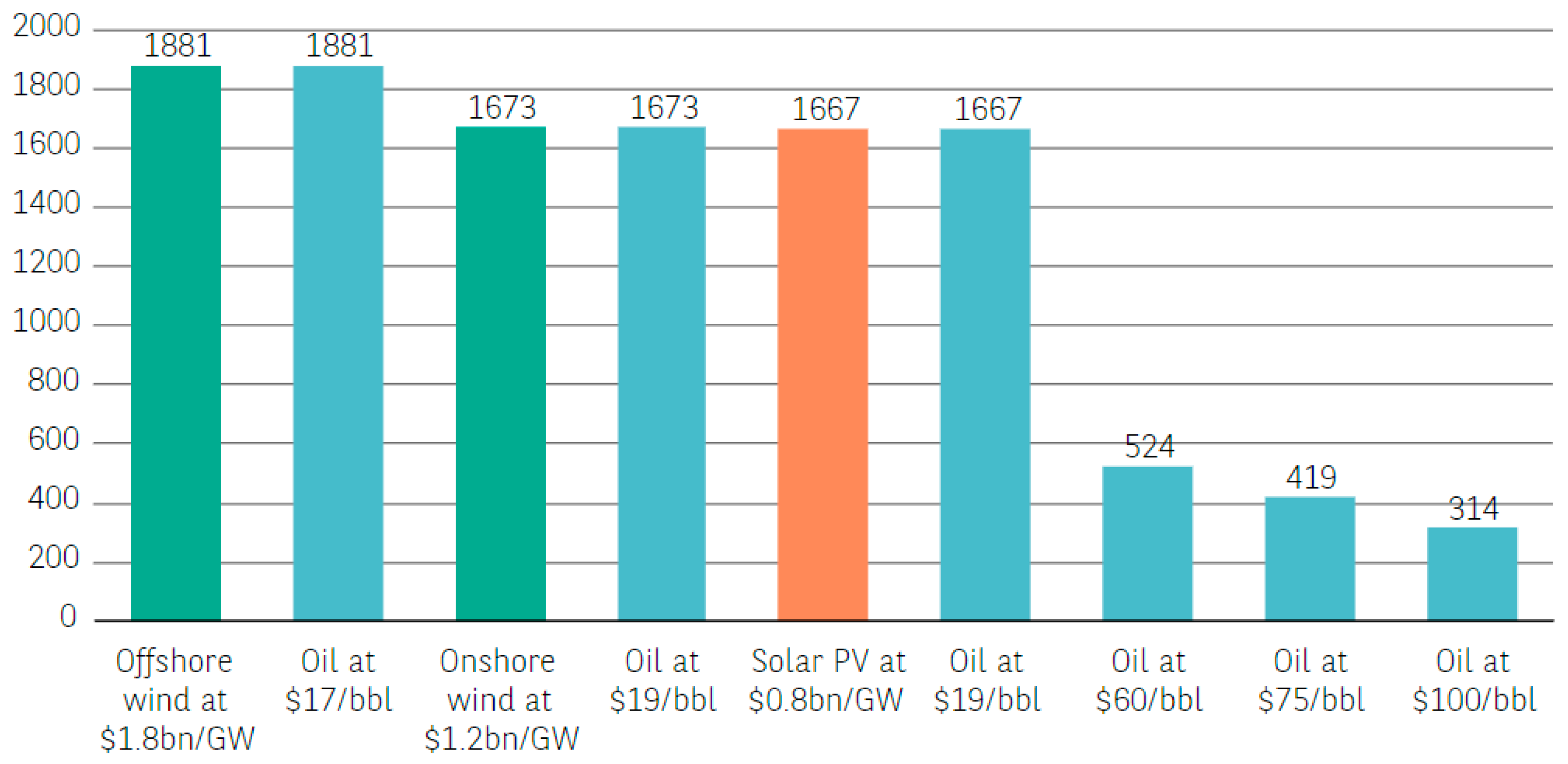

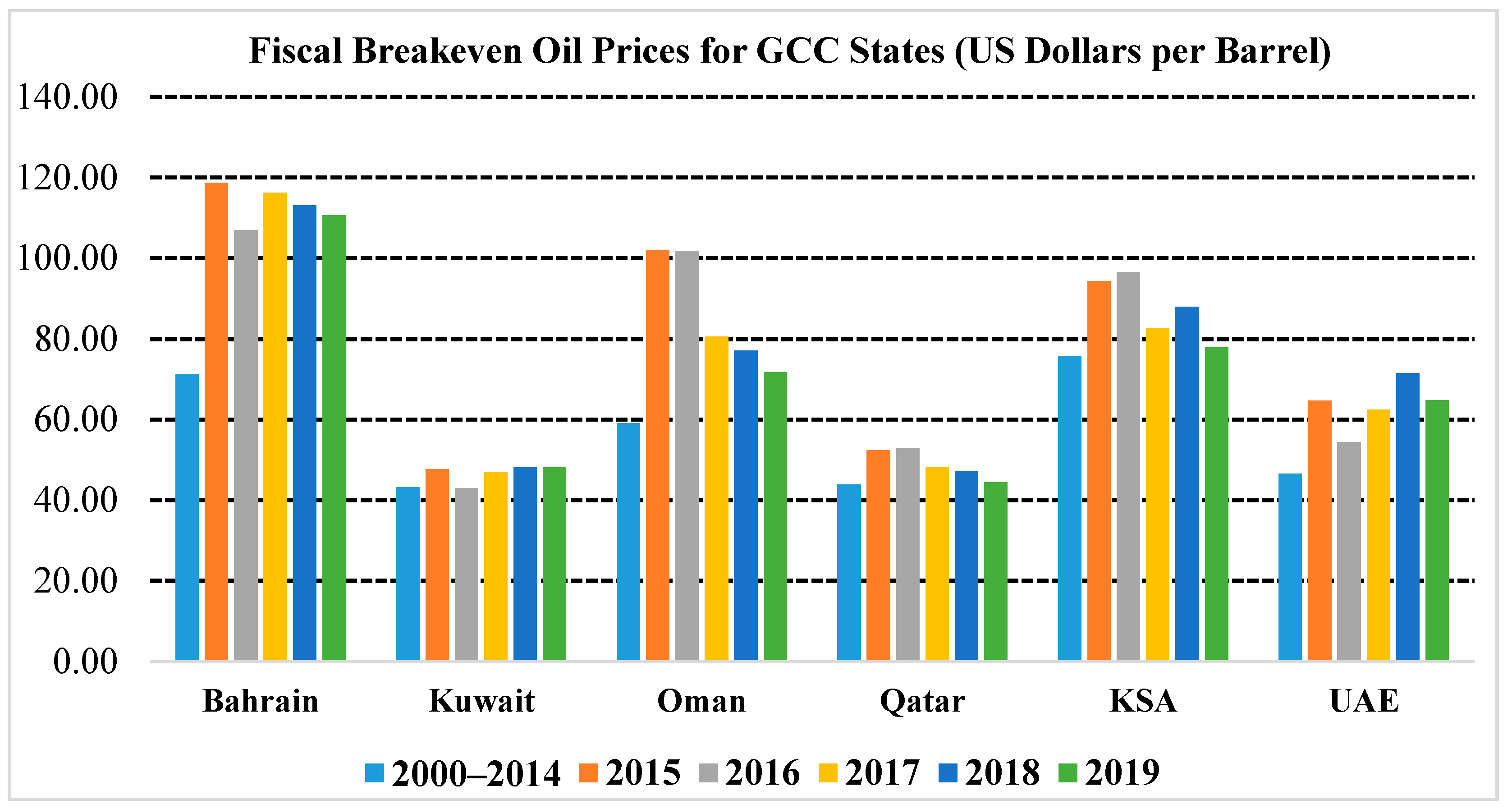

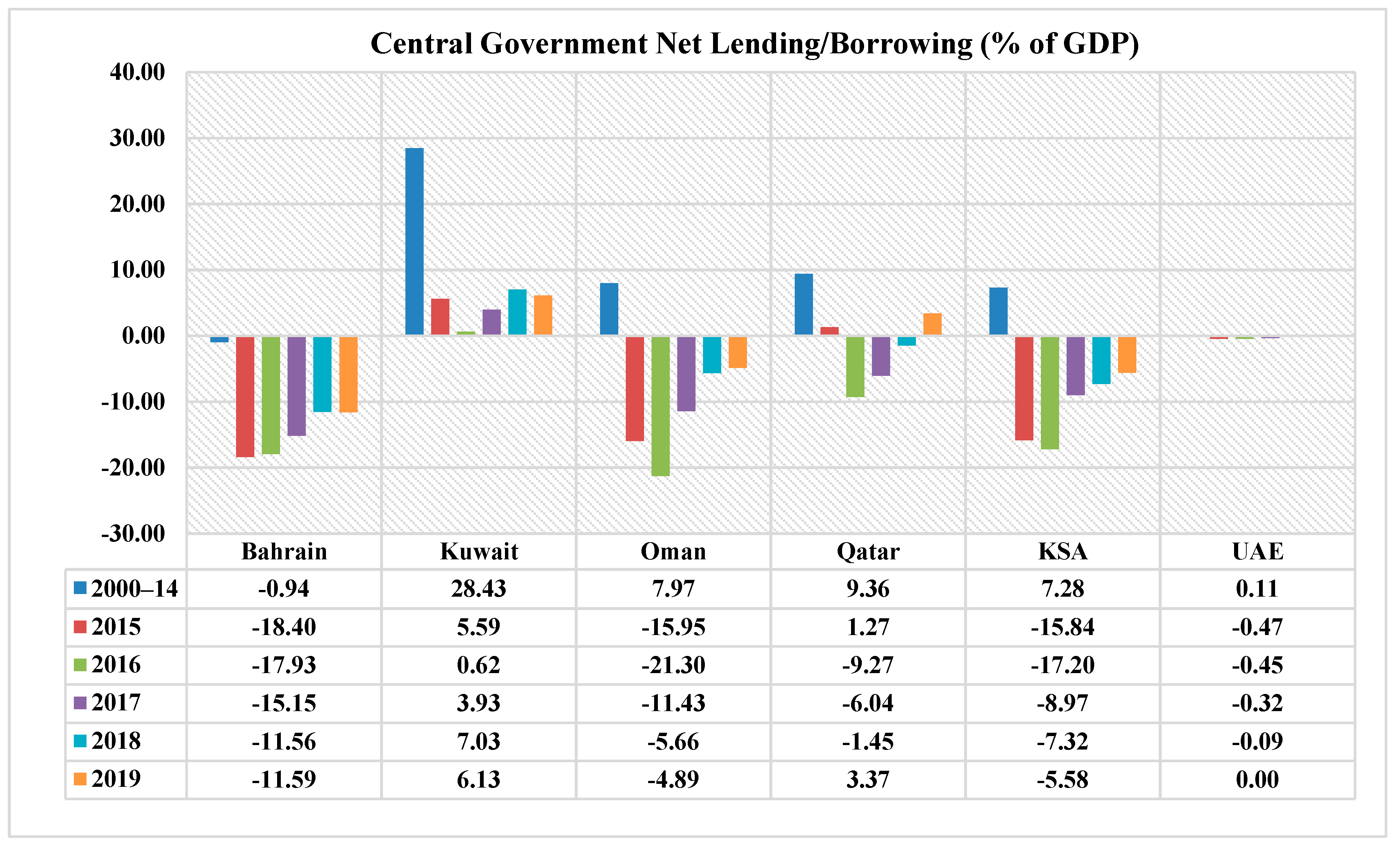

3. Potential Fall in Hydrocarbons’ Value Around 2030 and Implications for Oil and Gas-Rich States

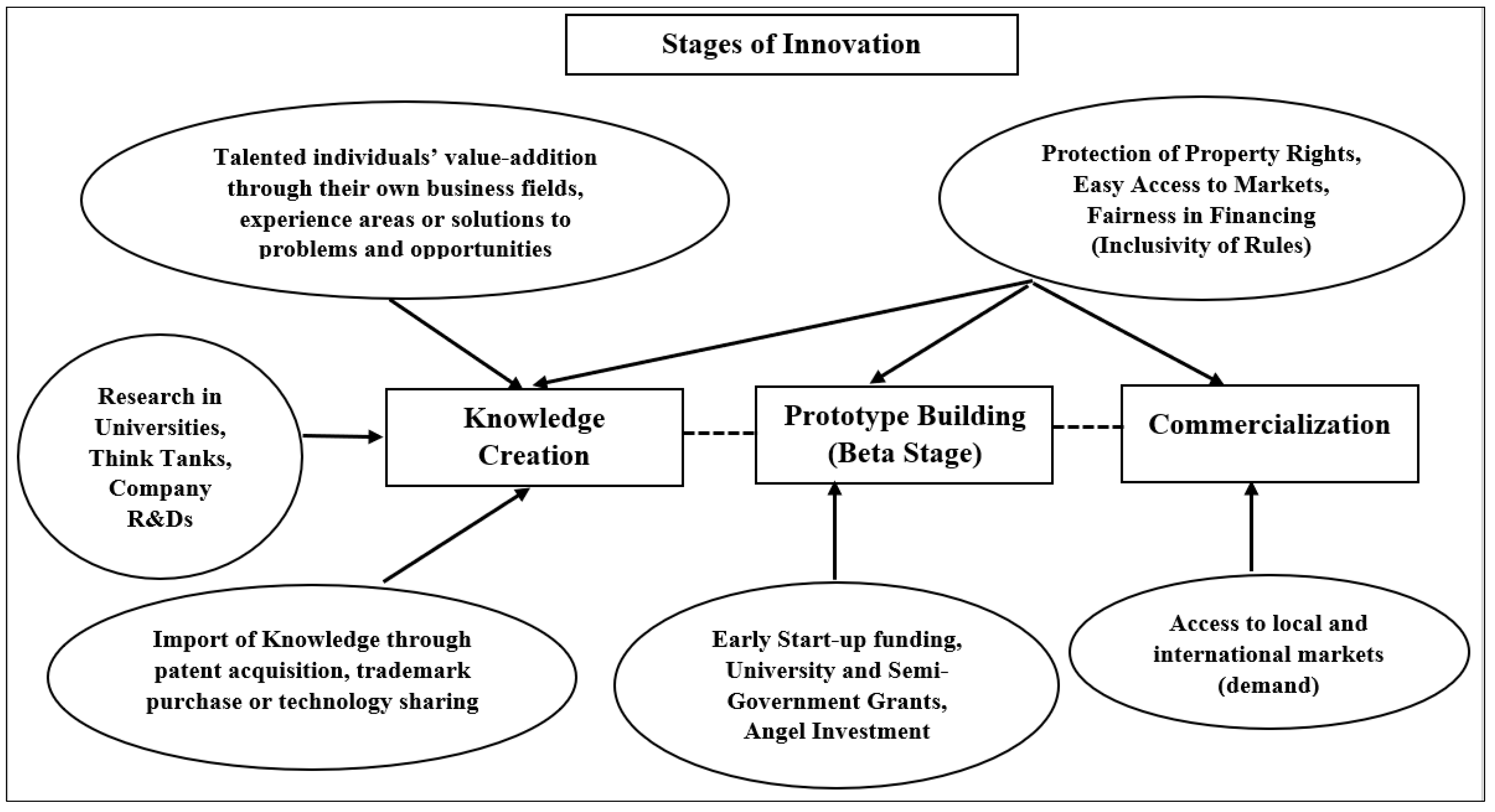

4. Theory of Innovation and Entrepreneurship and Implications for the Resource-Rich States

Determinants and Characteristics of Innovation

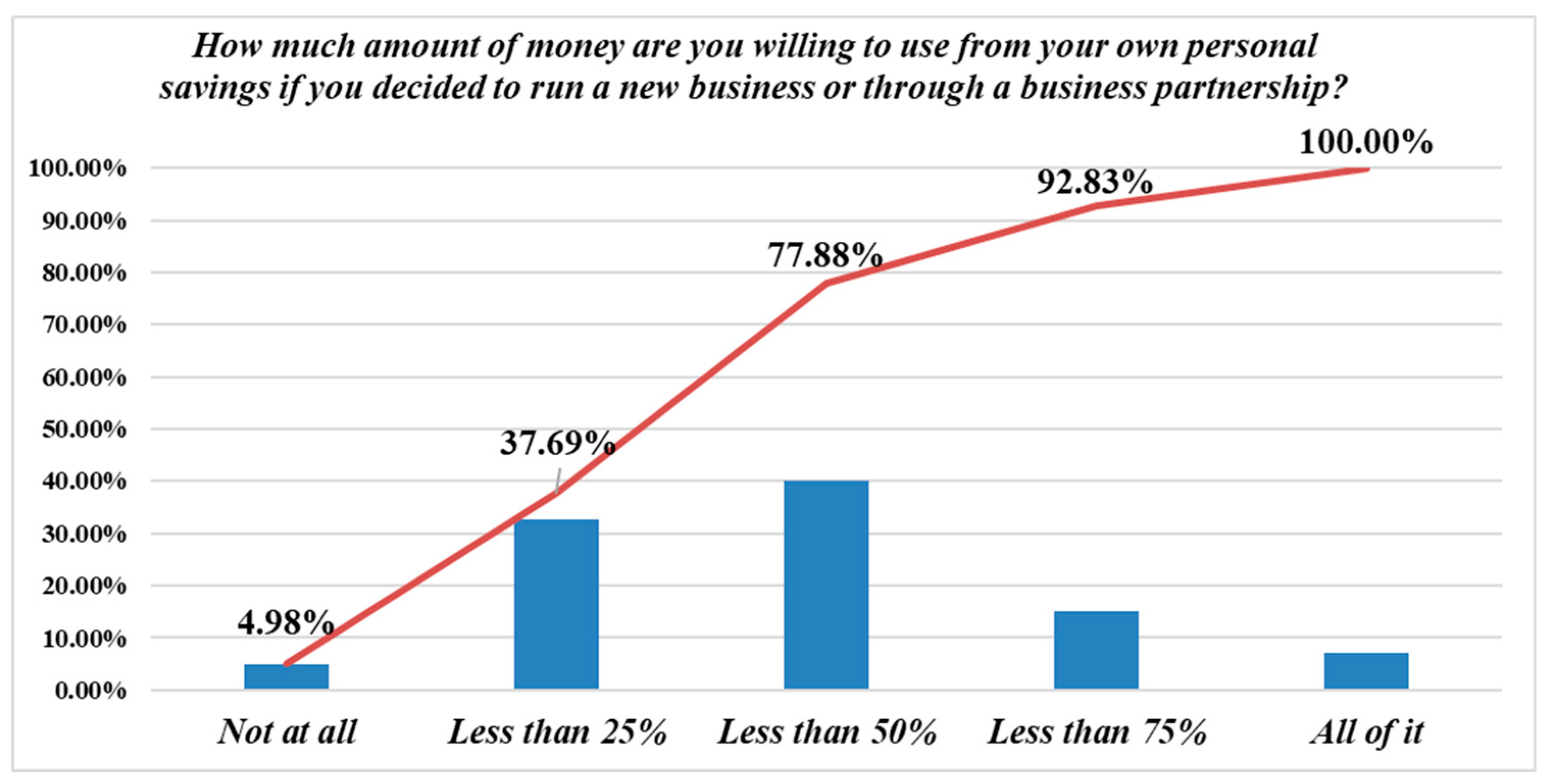

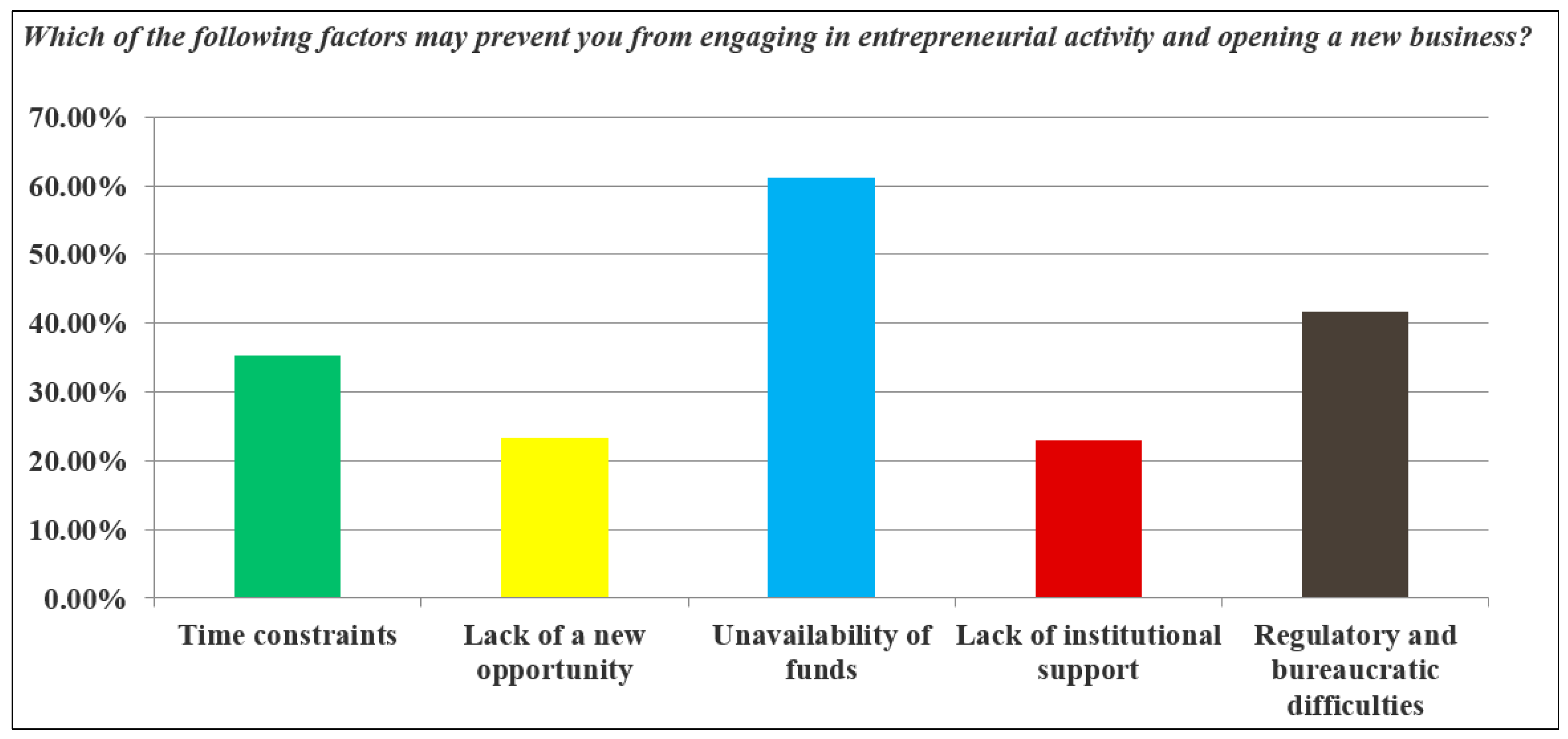

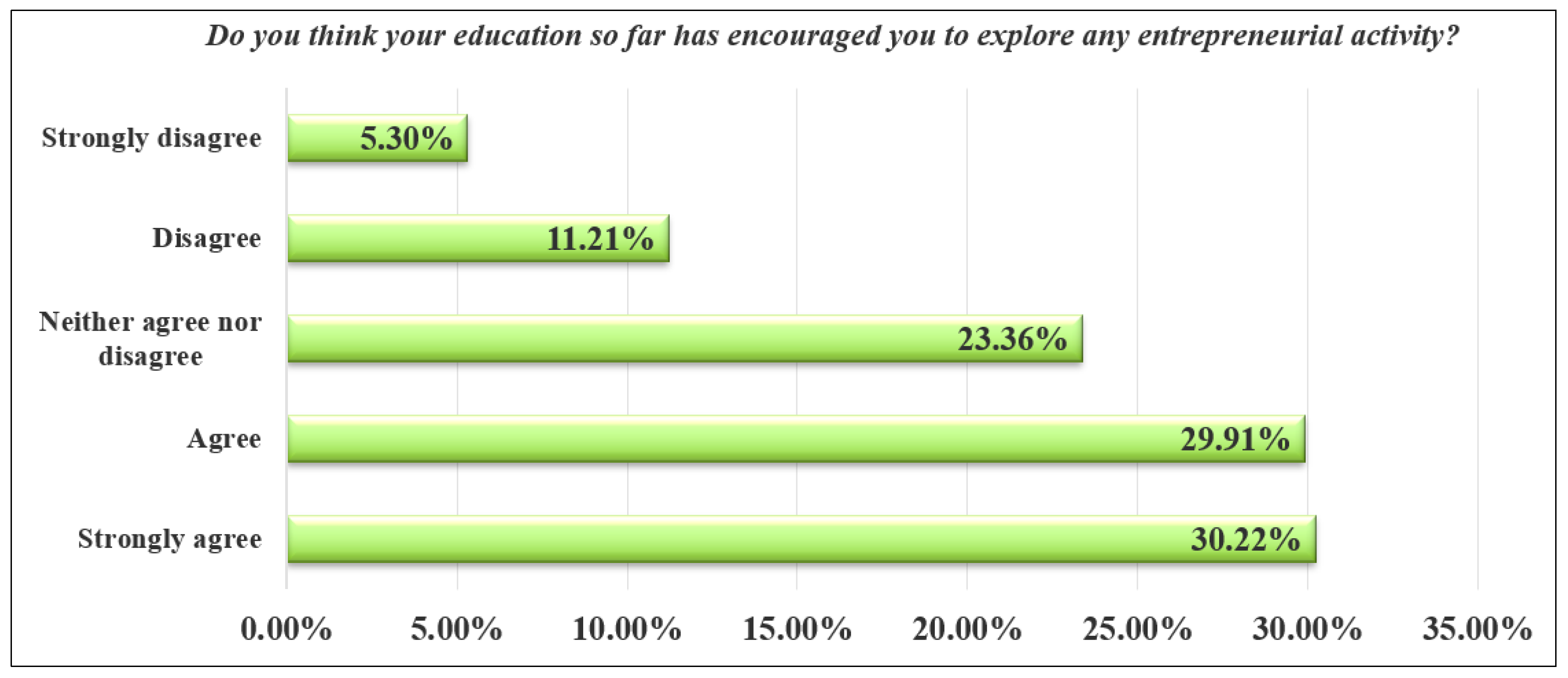

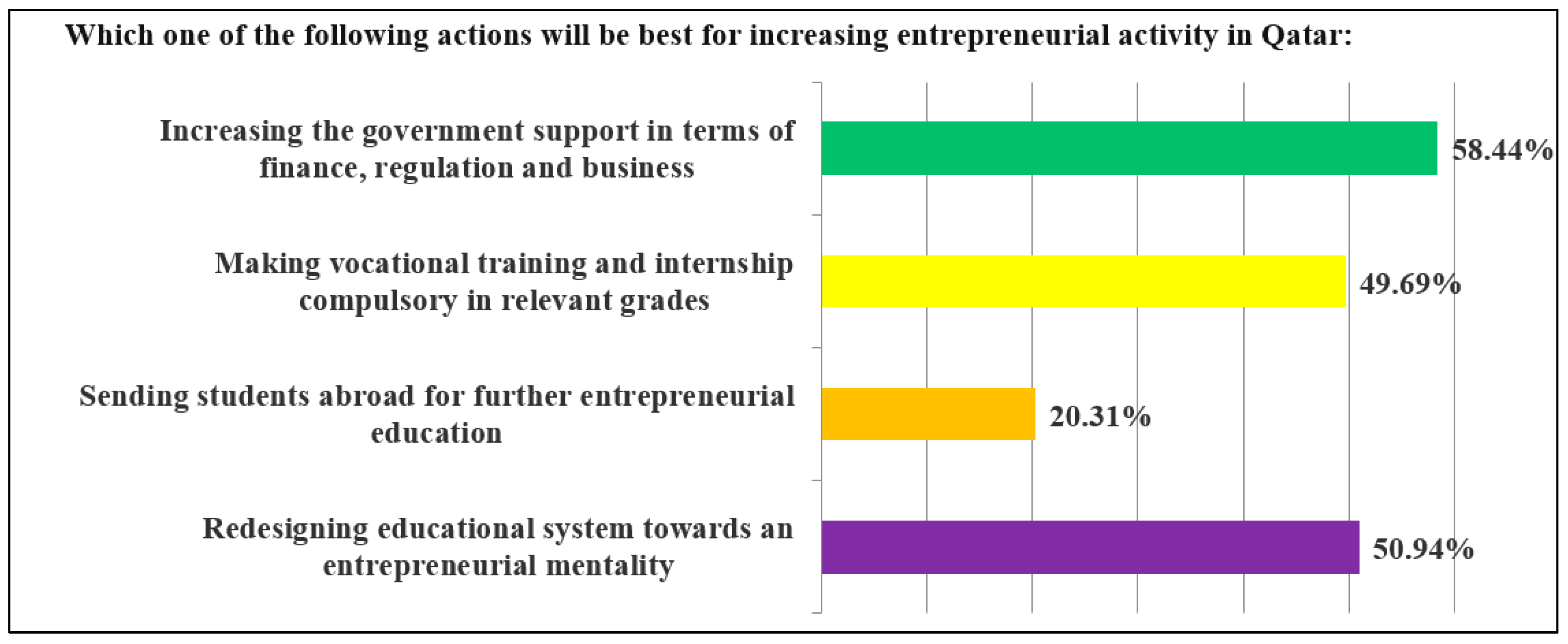

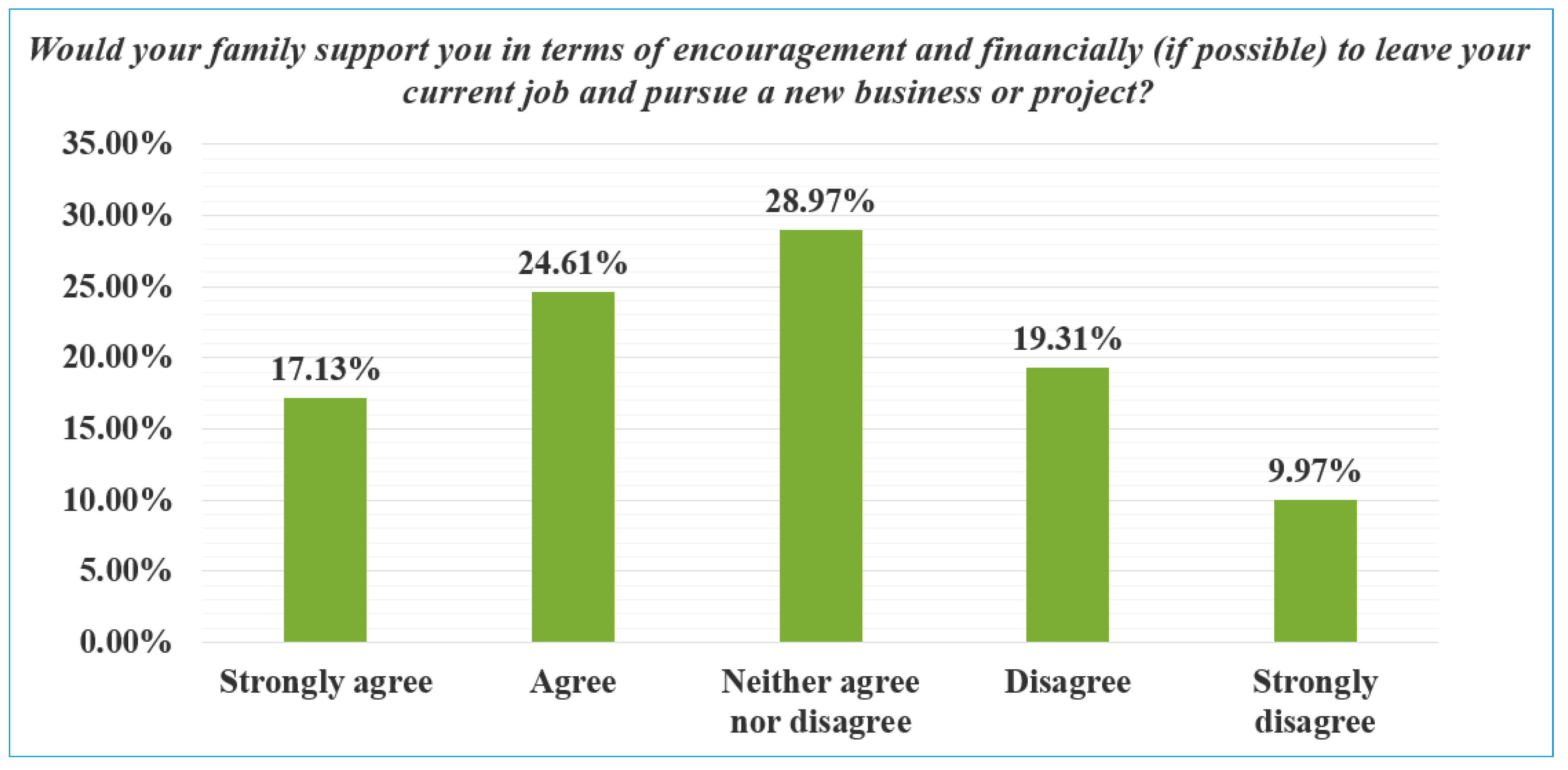

5. The Survey Results

6. Conclusions

7. Discussions and Future Work

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Sachs, J.D.; Warner, A.M. The big push, natural resource booms and growth. J. Dev. Econ. 1999, 59, 43–76. [Google Scholar] [CrossRef]

- Ross, M.L. The political economy of the resource curse. World Polit. 1999, 51, 297–322. [Google Scholar] [CrossRef]

- Van der Ploeg, F. Natural resources: Curse or blessing? J. Econ. Lit. 2011, 49, 366–420. [Google Scholar] [CrossRef]

- Apergis, N.; Payne, J.E. The oil curse, institutional quality, and growth in MENA countries: Evidence from time-varying cointegration. Energy Econ. 2014, 46, 1–9. [Google Scholar] [CrossRef]

- Sachs, J.D.; Warner, A.M. The curse of natural resources. Eur. Econ. Rev. 2001, 45, 827–838. [Google Scholar] [CrossRef]

- Gylfason, T. Lessons from the Dutch disease: Causes, treatment, and cures. Oxf. Econ. Pap. 1984, 36, 359–380. [Google Scholar]

- Mehlum, H.; Moene, K.; Torvik, R. Institutions and the resource curse. Econ. J. 2006, 116, 1–20. [Google Scholar] [CrossRef]

- Beblawi, H. The rentier state in the Arab world. Arab Stud. Q. 1987, 9, 383–398. [Google Scholar]

- Heard-Bey, F. Labour Migration and Culture. The Impact of Immi-gration on the Culture of the Arab Societies of the Gulf. In Proceedings of the BRISMES Conference, Oxford, UK, 6 July 1997. [Google Scholar]

- Gray, M. A Theory of’Late Rentierism’in the Arab States of the Gulf. SSRN Elec. J. 2011. [Google Scholar] [CrossRef]

- Atalay, Y. Understanding Input and Output Legitimacy of Environmental Policymaking in The Gulf Cooperation Council States. Environ. Policy Gov. 2018, 28, 39–50. [Google Scholar] [CrossRef]

- Al-Siddiqi, A.; Dawe, R.A. Qatar’s oil and gasfields: A review. J. Pet. Geol. 1999, 22, 417–436. [Google Scholar] [CrossRef]

- Ibrahim, I.; Harrigan, F. Qatar’s economy: Past, present and future. Q. Sci. Connect 2012, 9, 24. [Google Scholar] [CrossRef]

- Tsafos, N. Qatar Leaves OPEC. Available online: https://www.csis.org/analysis/qatar-leaves-opec (accessed on 23 December 2019).

- Kaya, A.; Choucri, N.; Tsai, I.-T.; Mezher, T. Energy consumption and transition dynamics to a sustainable future under a rentier economy the case of the GCC states. In Sustainability in the Gulf: Challenges and Opportunities; Routledge: Abingdon, UK, 2017. [Google Scholar]

- Flamos, A.; V Roupas, C.; Psarras, J. GCC economies diversification: Still a myth? Energy Sources Part B Econ. Plan. Policy 2013, 8, 360–368. [Google Scholar] [CrossRef]

- Gengler, J.; Lambert, L.A. Renegotiating the ruling bargain: selling fiscal reform in the GCC. Middle East J. 2016, 70, 321–329. [Google Scholar] [CrossRef]

- Yalcin, S. Adam Hanieh: Capitalism and Class in the Gulf Arab States. Cap. Cl. 2015, 39, 167–170. [Google Scholar]

- Kaya, A.; Tsai, I.-T. Inclusive Economic Institutions in the Gulf Cooperation Council States: Current Status and Theoretical Implications. Rev. Middle East Econ. Financ. 2016, 12, 139–173. [Google Scholar] [CrossRef]

- Gray, M. Theorising politics, patronage, and corruption in the Arab monarchies of the Gulf. In Clientelism and Patronage in the Middle East and North Africa; Routledge: Abingdon, UK, 2018; pp. 59–80. [Google Scholar]

- Amar, J.; Carpantier, J.-F.; Lecourt, C. GCC Sovereign Wealth Funds: Why Do They Take Control? HAL: Paris, France, 2018. [Google Scholar]

- Kim, S.; Sheikh, N.J. Developing a Decision Model Framework to Assess Arms Supplier Policies. In Proceedings of the 2018 Portland International Conference on Management of Engineering and Technology (PICMET), Honolulu, HI, USA, 19–23 August 2018; pp. 1–15. [Google Scholar]

- Kaya, A.; Tok, E.; Koc, M.; Mezher, T.; Tsai, I. Economic Diversification Potential in the Rentier States Towards for a Sustainable Development: A Theoretical Model. Sustainability 2019, 11, 911. [Google Scholar] [CrossRef]

- Kaya, A.; Csala, D.; Sgouridis, S. Constant elasticity of substitution functions for energy modeling in general equilibrium integrated assessment models: A critical review and recommendations. Clim. Chang. 2017, 145, 27–40. [Google Scholar] [CrossRef]

- Khalil, H.A.E.E.; Ibrahim, A.; Elgendy, N.; Makhlouf, N. Could/should improving the urban climate in informal areas of fast-growing cities be an integral part of upgrading processes? Cairo case. Urban Clim. 2018, 24, 63–79. [Google Scholar] [CrossRef]

- Al-Khatteeb, L. Gulf Oil Economies Must Wake Up or Face Decades of Decline. Brook. Inst. 2015, 8, 14. [Google Scholar]

- Kilian, L. The impact of the shale oil revolution on US oil and gasoline prices. Rev. Environ. Econ. Policy 2016, 10, 185–205. [Google Scholar] [CrossRef]

- Arbib, J.; Seba, T. Rethinking Transportation 2020–2030; RethinkX: CA, USA, 2017. Available online: http://static1.squarespace.com/static/585c3439be65942f022bbf9b/t/591a2e4be6f2e1c13df930c5/1494888038959/RethinkX+Report_051517.pdf (accessed on 15 December 2019).

- Krane, J.; Hung, S.Y. Energy Subsidy Reform in the Persian Gulf: The End of the Big Oil Giveaway. Issue Br. 2016, 28, 16. [Google Scholar]

- Ali, I.; Elbadawi, O. The Political Economy of Public Sector Employment in Resource Dependent Countries; Economic Research Forum: Cairo, Egypt, 2012. [Google Scholar]

- Hvidt, M. Economic diversification in GCC countries: Past record and future trends. Lond. Sch. Econ. Polit. Sci. 2013, 27, 1–55. [Google Scholar]

- Callen, M.T.; Cherif, R.; Hasanov, F.M.; Hegazy, A.; Khandelwal, P. Economic Diversification in the GCC: Past, Present, and Future; International Monetary Fund: Washington, DC, USA, 2014. [Google Scholar]

- Levins, C.M. The rentier state and the survival of Arab absolute monarchies. Rutgers JL Relig. 2012, 14, 388. [Google Scholar]

- Hvidt, M. Economic and Institutional Reforms in the Arab Gulf Countries. Middle East J. 2011, 65, 85–102. [Google Scholar] [CrossRef]

- Tsai, I.-T.; Kaya, A. Economic Diversification and the Emergence of Inclusive Economic Institutions in the Gulf Cooperation Council States. In Policy-Making in the GCC: State, Citizens and Institutions; I.B. Tauris: London, UK, 2016; pp. 118–143. [Google Scholar]

- Hertog, S. The Private Sector and Reform in the Gulf Cooperation Council; LSE Kuwait Programme: London, UK, 2013. [Google Scholar]

- Hvidt, M. The United Arab Emirates: Modernity and Traditionalism in Petroleum Sector Management. In Public Brainpower; Springer: Cham, Switzerland, 2018; pp. 311–328. [Google Scholar]

- Ennis, C.A. Between trend and necessity: Top-down entrepreneurship promotion in Oman and Qatar. Muslim World 2015, 105, 116–138. [Google Scholar] [CrossRef]

- Tseng, C.-Y. Technological innovation capability, knowledge sourcing and collaborative innovation in Gulf Cooperation Council countries. Innovation 2014, 16, 212–223. [Google Scholar] [CrossRef]

- Alabbasi, Y.; Sandhu, K. Blockchain Technologically Driven Innovation at the Gulf Cooperation Council Countries: An Overview. In Technology-Driven Innovation in Gulf Cooperation Council (GCC) Countries: Emerging Research and Opportunities; IGI Global: Hershey, PA, USA, 2019; pp. 89–110. [Google Scholar]

- Hertog, S. Defying the resource curse: Explaining successful state-owned enterprises in rentier states. World Polit. 2010, 62, 261–301. [Google Scholar] [CrossRef]

- Sawin, J.L.; Sverrisson, F.; Rutovitz, J.; Dwyer, S.; Teske, S.; Murdock, H.E.; Hamirwasia, V. Advancing the Global Renewable Energy Transition-Highlights of the REN21 Renewables 2018 Global Status Report in Perspective; Renewables 2018-Global Status Report. A Comprehensive Annual Overview of the State of Renewable Energy; REN21: Paris, France, 2018. [Google Scholar]

- Bloomberg NEF. World Reaches 1,000GW of Wind and Solar, Keeps Going; BloombergNEF: London, UK, 2018. [Google Scholar]

- Timmer, J. Wind Power Prices Now Lower than the Cost of Natural Gas. Available online: https://arstechnica.com/science/2019/08/wind-power-prices-now-lower-than-the-cost-of-natural-gas/ (accessed on 15 December 2019).

- Lewis, M. WELLS, WIRES, AND WHEELS—EROCI AND THE TOUGH ROAD AHEAD FOR OIL. Available online: https://investors-corner.bnpparibas-am.com/investment-themes/sri/petrol-eroci-petroleum-age/ (accessed on 10 December 2019).

- IMF. November 2018 Regional Economic Outlook: Middle East and Central Asia; IMF: Washington, DC, USA, 2018. [Google Scholar]

- Kshetri, N.; Ajami, R. Institutional reforms in the Gulf Cooperation Council economies: A conceptual framework. J. Int. Manag. 2008, 14, 300–318. [Google Scholar] [CrossRef][Green Version]

- Krane, J. City of Gold: Dubai and the Dream of Capitalism; Macmillan: London, UK, 2009. [Google Scholar]

- Ross, M.L. Does taxation lead to representation? Br. J. Polit. Sci. 2004, 34, 229–249. [Google Scholar] [CrossRef]

- Hausmann, R.; Hidalgo, C.A.; Bustos, S.; Coscia, M.; Simoes, A.; Yildirim, M.A. The Atlas of Economic Complexity: Mapping Paths to Prosperity; Mit Press: Cambridge, MA, USA, 2014. [Google Scholar]

- Hartmann, D.; Guevara, M.R.; Jara-Figueroa, C.; Aristarán, M.; Hidalgo, C.A. Linking economic complexity, institutions, and income inequality. World Dev. 2017, 93, 75–93. [Google Scholar] [CrossRef]

- Luciani, G.; Ferroukhi, R. Political Economy of Energy Reform: The Clean Energy-Fossil Fuel Balance in the Gulf States; Gerlach Press: Cicerostraße, Germany, 2014. [Google Scholar]

- Gengler, J. Political segmentation and diversification in the rentier Arab Gulf. In Proceedings of the Gulf Research Meeting 2013 Conference at the University of Cambridge, Cambridge, UK, 1–5 July 2013. [Google Scholar]

- Quintane, E.; Mitch Casselman, R.; Sebastian Reiche, B.; Nylund, P.A. Innovation as a knowledge-based outcome. J. Knowl. Manag. 2011, 15, 928–947. [Google Scholar] [CrossRef]

- Rogers, M. The Definition and Measurement of Innovation; Citeseer: Melbourne, Australia, 1998. [Google Scholar]

- Scheel, C. Knowledge clusters of technological innovation systems. J. Knowl. Manag. 2002, 6, 356–367. [Google Scholar] [CrossRef]

- Fuchs, G.; Shapira, P. Rethinking Regional Innovation and Change: Path Dependency or Regional Breakthrough; Springer Science & Business Media: Berlin, Germany, 2005. [Google Scholar]

- Acemoglu, D. Oligarchic versus democratic societies. J. Eur. Econ. Assoc. 2008, 6, 1–44. [Google Scholar] [CrossRef]

- Nelson, R.R. National Innovation Systems: It is. In Regional Innovation and Global; Routledge: Abingdon, UK, 2013; pp. 19–34. [Google Scholar]

- Lau, A.K.W.; Lo, W. Regional innovation system, absorptive capacity and innovation performance: An empirical study. Technol. Forecast. Soc. Chang. 2015, 92, 99–114. [Google Scholar] [CrossRef]

- Rystad Energy, Qatar Is Poised To Win Race For New LNG Projects. Available online: https://www.rystadenergy.com/newsevents/news/press-releases/liquefaction-projects-FIDs/ (accessed on 21 December 2019).

- D’Alessandro, C. Liquefied Natural Gas (LNG): Prospects and Opportunities for Qatar in Sub-Saharan Africa. Arab World Geogr. 2018, 21, 93–113. [Google Scholar]

- Miniaoui, H.; Schilirò, D. Innovation and entrepreneurship for the diversification and growth of the gulf cooperation council economies. Bus. Manag. Stud. 2017, 3, 69–81. [Google Scholar] [CrossRef]

- Fischer, M.M. Innovation, knowledge creation and systems of innovation. Ann. Regional Sci. 2001, 35, 199–216. [Google Scholar] [CrossRef]

- Zhou, K.Z.; Li, C.B. How knowledge affects radical innovation: Knowledge base, market knowledge acquisition, and internal knowledge sharing. Strateg. Manag. J. 2012, 33, 1090–1102. [Google Scholar] [CrossRef]

- Tödtling, F. The role of universities in innovation systems and regional economies. In Proceedings of the Expert Meeting on The Future of Academic Research, Vienna, Austria, 19–20 October 2006. [Google Scholar]

- Gunasekara, C. Reframing the role of universities in the development of regional innovation systems. J. Technol. Trans. 2006, 31, 101–113. [Google Scholar] [CrossRef]

- Brundenius, C.; Lundvall, B.-Å.; Sutz, J. The role of universities in innovation systems in developing countries: Developmental university systems–empirical, analytical and normative perspectives. In Handbook of Innovation Systems and Developing Countries; Edward Elgar Publishing: Trotterham, UK, 2009; Chapter 11. [Google Scholar]

- Martin, S.; Scott, J.T. The nature of innovation market failure and the design of public support for private innovation. Res. Policy 2000, 29, 437–447. [Google Scholar] [CrossRef]

- Gann, D.M.; Wang, Y.; Hawkins, R. Do regulations encourage innovation?-the case of energy efficiency in housing. Build. Res. Inf. 1998, 26, 280–296. [Google Scholar] [CrossRef]

- Nonaka, I.; Nishiguchi, T. Knowledge Emergence: Social, Technical, and Evolutionary Dimensions of Knowledge Creation; Oxford University Press: Oxford, UK, 2001. [Google Scholar]

- Parcero, O.J.; Ryan, J.C. Becoming a knowledge economy: The case of Qatar, UAE, and 17 benchmark countries. J. Knowl. Econ. 2017, 8, 1146–1173. [Google Scholar] [CrossRef]

- Elitzur, R.; Gavious, A. Contracting, signaling, and moral hazard: A model of entrepreneurs,‘angels,’and venture capitalists. J. Bus. Ventur. 2003, 18, 709–725. [Google Scholar] [CrossRef]

- Mitteness, C.R.; Baucus, M.S.; Sudek, R. Horse vs. jockey? How stage of funding process and industry experience affect the evaluations of angel investors. Ventur. Cap. 2012, 14, 241–267. [Google Scholar] [CrossRef]

- Enos, J.L. Invention and innovation in the petroleum refining industry. In The Rate and Direction of Inventive Activity: Economic and Social Factors; Princeton University Press: Princeton, NJ, USA, 1962; pp. 299–322. [Google Scholar]

- Kline, S.J.; Rosenberg, N. An overview of innovation. In Studies On Science And The Innovation Process: Selected Works of Nathan Rosenberg; World Scientific: London, UK, 2010; pp. 173–203. [Google Scholar]

- Millar, C.; Udalov, Y.; Millar, H. The ethical dilemma of information asymmetry in innovation: Reputation, investors and noise in the innovation channel. Creat. Innov. Manag. 2012, 21, 224–237. [Google Scholar] [CrossRef]

- Minniti, M. Entrepreneurial alertness and asymmetric information in a spin-glass model. J. Bus. Ventur. 2004, 19, 637–658. [Google Scholar] [CrossRef]

- Muscio, A.; Quaglione, D.; Vallanti, G. Does government funding complement or substitute private research funding to universities? Res. Policy 2013, 42, 63–75. [Google Scholar] [CrossRef]

- Borlaug, S.B. Moral hazard and adverse selection in research funding: Centres of excellence in Norway and Sweden. Sci. Public Policy 2015, 43, 352–362. [Google Scholar] [CrossRef]

- Kelm, K.M.; Narayanan, V.K.; Pinches, G.E. Shareholder value creation during R&D innovation and commercialization stages. Acad. Manag. J. 1995, 38, 770–786. [Google Scholar]

- Buettner, B. Entry barriers and growth. Econ. Lett. 2006, 93, 150–155. [Google Scholar] [CrossRef]

- Van Hemert, P.; Nijkamp, P.; Masurel, E. From innovation to commercialization through networks and agglomerations: Analysis of sources of innovation, innovation capabilities and performance of Dutch SMEs. Ann. Reg. Sci. 2013, 50, 425–452. [Google Scholar] [CrossRef]

- McCann, P.; Simonen, J. Innovation, knowledge spillovers and local labour markets. Pap. Reg. Sci. 2005, 84, 465–485. [Google Scholar] [CrossRef]

- Acemoglu, D.; Johnson, S.; Robinson, J.A. The Colonial Origins of Comparative Development: An Empirical Investigation; National Bureau of Economic Research: Cambridge, MA, USA, 2000. [Google Scholar]

- Weingast, B.R. The economic role of political institutions: Market-preserving federalism and economic development. J. Law Econ. Organ. 1995, 11, 1–31. [Google Scholar]

- Acemoglu, D.; Johnson, S.; Robinson, J.A. Institutions as a fundamental cause of long-run growth. Handb. Econ. Growth 2005, 1, 385–472. [Google Scholar] [CrossRef]

- Acemoglu, D. Why not a political Coase theorem? Social conflict, commitment, and politics. J. Comp. Econ. 2003, 31, 620–652. [Google Scholar] [CrossRef]

- Minniti, M.; Bygrave, W. A dynamic model of entrepreneurial learning. Entrep. Theory Pract. 2001, 25, 5–16. [Google Scholar] [CrossRef]

- Parker, S.C. Why do small firms produce the entrepreneurs? J. Soc. Econ. 2009, 38, 484–494. [Google Scholar] [CrossRef]

- Fargues, P. Immigration without inclusion: Non-nationals in nation-building in the Gulf States. Asian Pac. Migr. J. 2011, 20, 273–292. [Google Scholar] [CrossRef]

- Ulrichsen, K.C. Lessons and Legacies of the Blockade of Qatar. Insight Turk. 2018, 20, 11–20. [Google Scholar] [CrossRef]

- Hertog, S. The Political Economy of Labour Markets and Migration in the Gulf: Workshop Proceedings; LSE Kuwait Programme: London, UK, 2016. [Google Scholar]

- Khodr, H. The dynamics of international education in Qatar: Exploring the policy drivers behind the development of Education City. J. Emerg. Trends Educ. Res. Policy Stud. 2011, 2, 514–525. [Google Scholar]

- Ibnouf, A.; Dou, L.; Knight, J. The evolution of Qatar as an education hub: Moving to a knowledge-based economy. In International Education Hubs; Springer: Cham, Switzerland, 2014; pp. 43–61. [Google Scholar]

- Malik, M.; Nagesh, T. FISCAL SUSTAINABILITY AND HYDROCARBON ENDOWMENT PER CAPITAIN THE GCC. Available online: https://www.oxfordenergy.org/wpcms/wp-content/uploads/2019/06/OEF-118.pdf?v=7516fd43adaa (accessed on 20 December 2019).

- Morakabati, Y.; Beavis, J.; Fletcher, J. Planning for a Qatar without oil: Tourism and economic diversification, a battle of perceptions. Tour. Plan. Dev. 2014, 11, 415–434. [Google Scholar] [CrossRef]

- Agence France-Presse. Qatar Spending $500m a Week on World Cup Projects; Agence France-Presse: Paris, France, 2017. [Google Scholar]

© 2020 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Tok, E. The Incentives and Efforts for Innovation and Entrepreneurship in a Resource-Based Economy: A Survey on Perspective of Qatari Residents. Sustainability 2020, 12, 626. https://doi.org/10.3390/su12020626

Tok E. The Incentives and Efforts for Innovation and Entrepreneurship in a Resource-Based Economy: A Survey on Perspective of Qatari Residents. Sustainability. 2020; 12(2):626. https://doi.org/10.3390/su12020626

Chicago/Turabian StyleTok, Evren. 2020. "The Incentives and Efforts for Innovation and Entrepreneurship in a Resource-Based Economy: A Survey on Perspective of Qatari Residents" Sustainability 12, no. 2: 626. https://doi.org/10.3390/su12020626

APA StyleTok, E. (2020). The Incentives and Efforts for Innovation and Entrepreneurship in a Resource-Based Economy: A Survey on Perspective of Qatari Residents. Sustainability, 12(2), 626. https://doi.org/10.3390/su12020626