1. Introduction

The origin of startups can be traced back to the 1970s. This is when in developed countries small, agile, and highly innovative companies started to emerge, revolutionizing the traditional market of goods and services and the management of organizations [

1]. Back then, the term “startup” referred to a few emerging high-tech microcompanies, active mainly in the field of electronics and computer technologies. These companies were challenging the hitherto theories on company and society development [

2,

3]. They also became the first highly specialized chain link in the development of well-known business network clusters of advanced technologies, such as IT in the Silicon Valley [

4,

5,

6], biotech in the San Francisco Bay Area [

7] and New Anglia [

8], nanotech in NanoMat, Germany [

9,

10], or photonics in the Scottish Photonic Glen [

11,

12] and in the German Bayern Photonics [

13]. Nowadays, there are thousands of such centers in the world, active in numerous areas of technology. Their development rate is closely tied to the progress of information and communication technologies (ICT), the Internet (e.g., 5G), the international trade in intellectual property rights, and the industrial revolution (Industry 4.0). Startups also trigger the boost of economic and social growth of states, especially after an economic [

14], environmental, or epidemic COVID-19 crisis [

15]. The key insight on startups in Europe and the world comes from reports issued by consulting companies (e.g., [

16,

17,

18,

19]), as well as by the European Commission [

20], and individual states, e.g., Germany [

21], Israel [

22], Australia [

23,

24], India [

25], Poland [

26,

27], or groups of states such as the Visegrád Four [

28]. Such reports seek to identify the structural and quantitative development of startups. However, they are all heterogeneous in terms of determinants, theoretical and geographical scope, and methodology, making direct comparison of data impossible.

The European Union acknowledged the economic significance of startups, and in 2014 launched the Startup Europe (SE) Initiative [

29] under the EU Research and Innovation Program, Horizon 2020. Its aim was to improve and expand the European entrepreneurial ecosystem through improvement of institutions and infrastructure, as well as systemic conditions relating to social capital, networks, talent, and leadership. The results achieved in this program have been published lately [

30] and deliver a brief outline of the European startup landscape: “A typical SE beneficiary is an early stage, financially constrained venture that operates in the digital domain and comes from a country with limited private investments in young firms” (ibid., p. 38). The majority of companies benefitting from the SE Initiative were also found to operate on the domestic market exclusively, presumably due to the lack of know-how necessary to pursue international business strategies. As it is believed that “improving the ecosystem for startups and scale-ups in Europe will have a direct beneficial effect on jobs and growth in the EU” [

31]; in 2016, the European Commission adopted another program to improve the economic and regulatory situation for startups. In total, 46 different policy actions were proposed in order to make the European policy more supportive for young enterprises, i.e., companies that had been recently created or were in the early years of their existence [

31].

The existing differentiation between individual countries related not only to the business of startups but also their rate of growth, functions, sources of finance, etc. leads to the following question as a research problem: what factors shape and differentiate the qualitative development of startups, contributing to their success, reduced development, or decline in the EU? We looked for key success factors using a criterion or relying on the type of competitive advantage, its sources among many intangible exposed and presented in resource management theory. The aforementioned scientific problem has not been yet approached or identified at the research level. This paper puts forth the following study hypotheses: 1) success drivers which are strategic for the development of startups in the EU are different in highly developed countries than in the so-called catching-up or lagging countries and 2) restrictions on the development of startups in catching-up countries mainly have an institutional dimension.

The purpose of this paper is to determine key but hidden drivers behind the development of startups in EU states, examine differences and gaps related to startup development drivers, and identify the gap in these drivers in lagging states in comparison to highly developed ones. This is important for showing ways how to bridge the gap in startup development in catching-up countries, as it boosts the innovativeness of these companies, leading to an increase in the innovativeness of economies and enabling startups to gain a better position in a competitive global market. Moreover, by generating innovations for the economy, startups have an indirect influence on social development as they satisfy the needs of consumers and entrepreneurs and create new business solutions. A discussion on the presented research problem and the choice of the paper’s purpose is justified in the light of the continued existence of diversified economic structures in EU Member States and differences in labor productivity, as well as other economic efficiency measures [

32]. Startups can play an important role in the improvement of the above in catching-up countries [

20]. In the rationale for addressing this problem one should also stress that the state of knowledge related to startups is still low, and in particular, there is no uniform scientific taxonomy.

The authors’ contribution to scientific literature consists in the presentation of the results of pilot studies carried out using the principal component analysis and classification methods on key startup development drivers that are decisive for the success of startup businesses in European countries, with an indication of the differences between developed and catching-up countries. The recent literature did not use similar approach. Next, identification of European startups’ success factors and limitations based on eight types of competitive advantages as sources of success factors which were conceptualized (selected) from intangible resources. These results lay foundations for further in-depth research. The second part of the paper is static in nature (based on data from 2015), limited to 13 countries [

33], and should be seen as a first step toward a better understanding of startup differentiation among European countries.

2. Literature Review on Startups—The Concept of Startups and Their Development

Following an analysis of literature, authors conclude that there exist a large variety of definitions given by authors and by national and international organizations, which makes it difficult to perform an in-depth analysis of success factors and business barriers for startups for a large set of the latter. Generally, one can assume that the concept of a startup appears:

in the area of science—primarily as a “new,” “novice,” “young,” and “temporary” company with limited own financial funds and human resources at the start, in subsequent development stages increasingly using external funds, both domestic and foreign [

27,

34,

35];

in the area of management practice—most often as a business model based on innovation, breaking ground, scalability, and high rate of growth [

36,

37].

Detailed definitions of the startup concept also include the scope of activity of such entities, covering the type of activity in the economic and noneconomic sphere, e.g., banking, social, and public sphere (medicine, culture, education, insurance, etc.), which presently constitutes a criterion differentiating authors’ definitions. Selected concepts of this category, with key constituent elements and goals, existing in approaches of different authors and international organizations, are presented in

Table 1. For explicatory purposes, we included both general/broad definitions and narrow ones, i.e., referring to specific or niche startups.

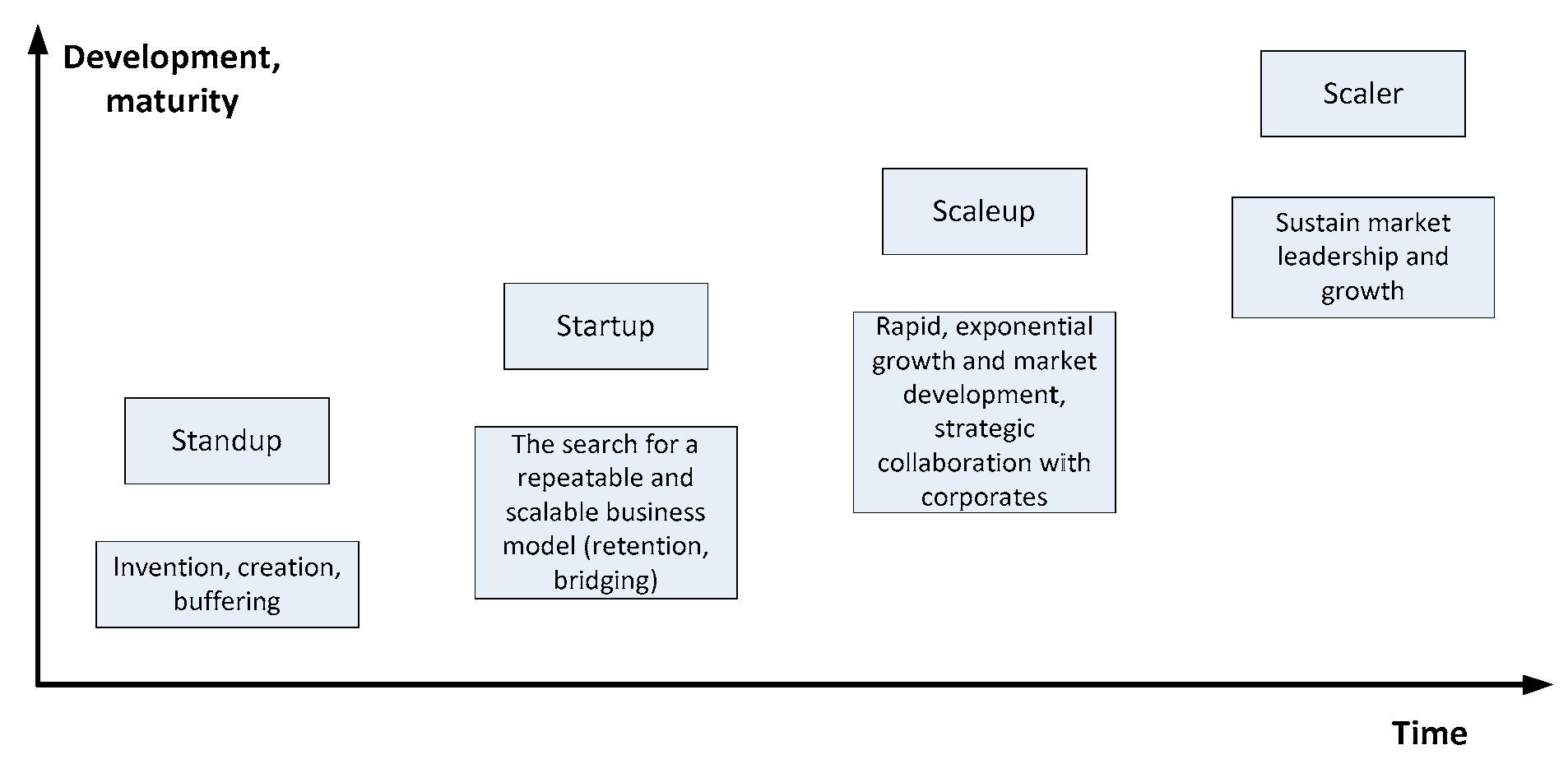

It is also important to distinguish the two different approaches to the term “startup.” Sometimes the expression is used to describe an innovative microventure from its very beginning (seed phase) up to its market maturity, encompassing the entirety of the entrepreneurial development process. At other times, it refers only to a specific development phase of ventures, occurring between other stages, as shown in

Figure 1. The life-cycle of startups consists of several periods, which allow us to identify at least three categories, namely, standup, startup, and scaleup. Additionally, there is a separate category of the unicorn (scaler), with revenues exceeding EUR 1 billion [

44].

Companies belonging to the standup type are created by people fascinated by the concept of discovery, an idea of closing a perceived or identified gap related to fulfilling needs of companies or consumers, or related to the streamlining of processes, e.g., “through platform-based circular innovations pursued by circular startups (CSUs), pursuing sharing/trading business models built around B2B (Busines-to-Busines), B2C (Busines-to-Customers), C2C (Customers-to-Customers) marketplaces” [

46]. Possessing their own creative potential and some financial resources, these people seek personal satisfaction from creating, implementing, or commercializing innovations. Managing their company as owners, they are fully committed to making their goals come true and, at the same time, improving the well-being of others (e.g., CallPage, Apple). They are characterized by being relatively young, well educated, having a high level of social capital, and often significant experience gained in other companies [

55]. Despite that, however, their ventures not always end in success, understood as high level of accomplishment of predefined goals. Studies [

56] show that it depends on the type of leadership (transformational, transactional, or laissez-faire) and startup size. This is because in pursuing the business goal, startups encounter different barriers: internal (e.g., related to the financial, human, or relational capital) and external (related to markets, institutions, and other parts of their ecosystem). Especially, as they try to solve new problems in uncertain conditions. Most often this is an unidentified market, i.e., the demand and the competitive forces are unknown. However, sources of finance, the macroenvironment, as well as the capacity and skills of the company team to flexibly adapt to change, are not known [

57].

The next stage of company development is the startup—a microventure, based on perfecting and selling of the previously created innovations. A startup’s overriding goal is to organize as a company and to grow company value by driving sales of new products (goods or services) through the creation and application of innovative technologies leading to a growth in productivity and increase in domestic and global market share [

44].

Some startups, as a result of rapid, exponential headcount, and revenue growth transform into, so-called scale-ups [

54,

58,

59] as illustrated in

Figure 1. Further, some authors suggest [

56,

60] that leadership should change when a startup develops into a scale-up.

Table 2 presents several illustrative definitions of such entities.

Based on the aforementioned sources, we adopted the following definition: a startup is a young, small, independent enterprise, which is creative, innovative, conducting research and development activity (R&D) to solve actual problems, and proposing prospective solutions, striving for talented employees, and sales growth, with an attractive business model. This paper also assumes a predominant, generalized view that startups are organizations based on knowledge, with a rapid revenue growth, whose subject of activity is focused on different innovations. In the EU, startups are usually managed by their founders, with only a small share being publicly listed. This share, however, is much higher in other regions. For example, in the United States, more than 45% undergo the IPO (Initial Public Offering) process [

66]. In addition, for the purpose of this study, and in order to be aligned with data sources, the authors assumed that the concept of startup shall comprise all stages of company development, from its establishment up to maturity inclusively [

33].

Since there is no consistency in the methodologies used to conduct research generating data and the data available is mainly narrow in scope and time reference, the knowledge on startups is still fragmentary. It should be stated that there is a research gap in literature related to key factors of success of startup development in EU national regions. In order to provide more insight into the competitiveness of startups in the EU, and at least to some extent close that gap, we used a multivariate statistical analysis of data characterizing startup features available for a set of EU countries. The empirical study used data from 2015 for 12 EU Member States, and for Israel, a country associated with the EU with a very significant qualitative and quantitative development of startups, mainly hi-tech [

33], from the European Startup Monitor (ESM 2015). The research process used the following order:

preparation of a general characterization of companies’ competitive advantages and their sources in the light of resource-based theory,

usage of the concept of sources of competitive advantage to identify startup key success factors, against the backdrop of contemporary management paradigms,

application of a multivariate statistical analysis performed on data sets on various startup features in 13 countries from the European Startup Monitor 2015 [

33],

interpretation of startup competitive advantage and success factors in European countries and gap in this advantage in catching-up countries, in comparison to highly developed ones,

presentation of ways of bridging the gap in institutional factors and in human capital in catching-up EU countries, explaining the barriers for startup development.

In conclusion, the structure of the article is a consequence of five chapters according to the analysis of logical thinking. It contains a theoretical and practical part.

3. Startup Key Success Factors

In order to reduce the research and cognitive gap on factors contributing to the emergence and development of startups, the authors applied a methodology approach that that uses literature and a typological method recommended in it. The authors assumed (after Grunert and Ellegard) [

67] key success factors should be sought for among types of startups selected on the basis of a specific criterion, due to their diversity in different areas of activity. Similar approaches are proposed [

67,

68] with respect to startup business models, due to them being very diversified and not very specific. The achievement of company goals must be supported by success factors, which in turn must be aligned with the goals. Furthermore, the investigated definitions mention more than 15 attributes and features.

A company’s measurement of success is competitive advantage, which means that for the company to develop it needs to succeed. Consequently, it was assumed that types of companies will be categorized using as the criterion their competitive advantage and its source. In the resource-based view of strategic management theories, competitive advantage stems from key tangible and nontangible factors. However, since 1990s, attention to cost and quality is a commonly prevailing requirement [

69], pp. 89–90, for companies participating in the competition process, as is their drive to obtain a competitive advantage related to cost and quality. These advantages come mainly from tangible factors, which do not explain the phenomenon of the development of startups and their success in the competition process. Startups use mainly intangible factors already in the first stage of operations. Hence, below, we highlight company competitive advantages and their sources among intangible factors, pointed up by resource-based theories [

70] (pp. 99–120) [

71,

72], including the advantages of competence [

73] and distinctive capabilities [

74], p. 185. In the 21st century, from this perspective, competitive advantage in the market is achieved by companies mainly through the possession and application of distinctive and unique intangible resources and skills to satisfy market needs faster and in a better way than competitors.

The effectiveness of a startup’s initial operations and its success depends on the idea for a product, its quick creation, checking response of the potential target group, measuring quality, drawing conclusions to streamline the product, and transition into the next development phase [

75]. The sequence of these actions is modeled after Deming’s PDCA (Plan–Do–Check–Act) cycle [

76] and should be reiterated until a high-quality product is obtained, by continuous improvement of quality and usability and reduction in errors and waste in production and supply chain. This remark applies not only to the initial but also to all life-cycle phases of startups. This rapid iteration allows teams to discover a feasible path towards the product/market fit and to continue optimizing and refining the business model after reaching the initial product/market fit [

75]. This is supported by several studies showing gradual change “through serendipitous events” [

77] or legitimized and embraced through a gradual change process culminating in radical innovation [

78,

79].

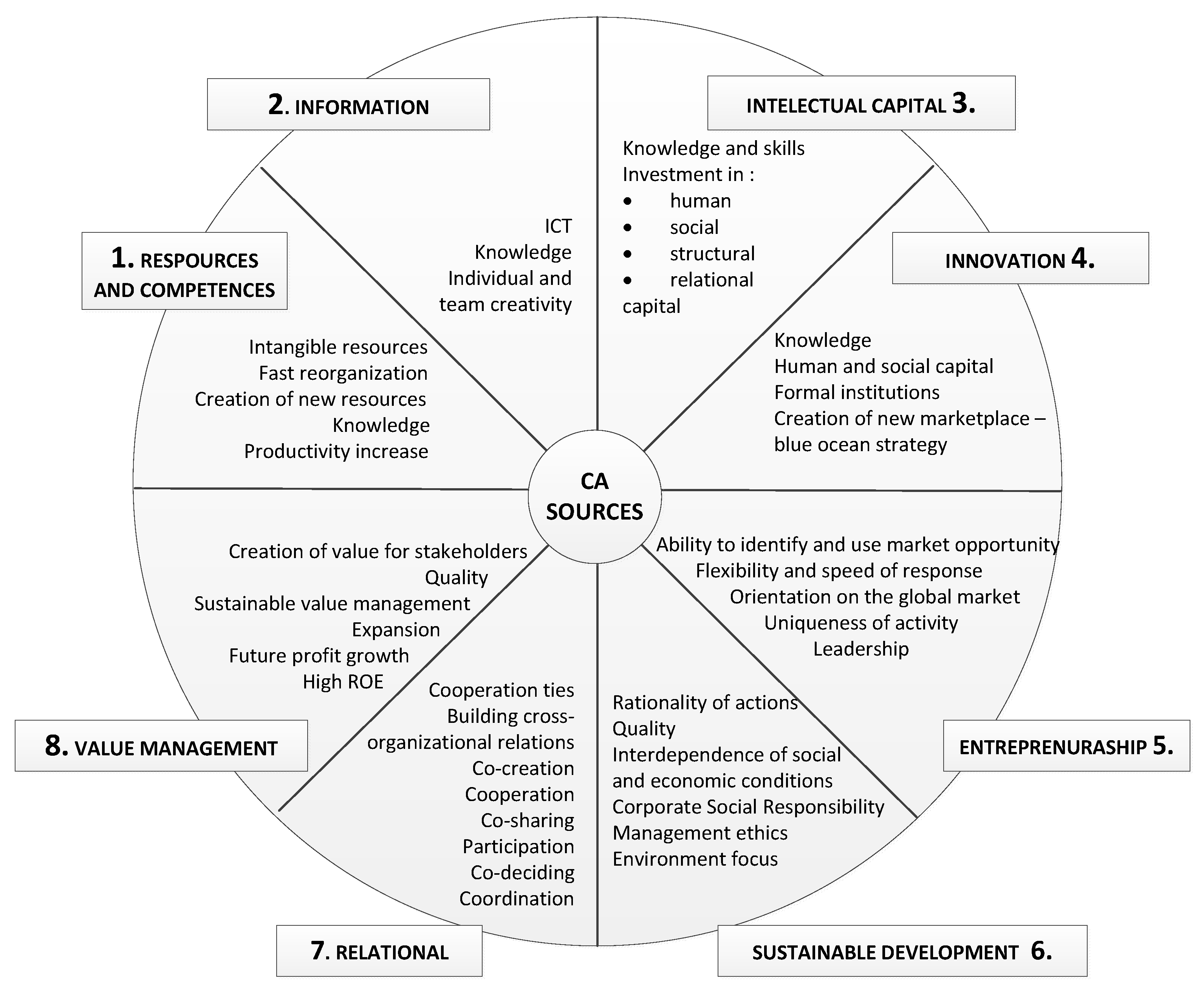

In the absence of a uniform scientific theory on the sources of startup competitive advantages, our first step was taking stock of competitive advantages (CA) of contemporary companies as worded in scientific works and identification of key sources used in the creation of such advantages. Following that, on the basis of collected definitions of startups and literature, we singled out key sources of these companies’ competitive advantages. The results of this analysis are shown in

Figure 2. It shows eight types of startups by types of competitive advantages and their key sources as success factors resulting from intangible resources. The following are the advantages: innovation [

80,

81], entrepreneurship [

82,

83,

84], resource and competence [

85,

86,

87], intellectual capital [

88,

89,

90,

91], sustainable development [

92], relationships [

86,

93,

94], value management [

95], and information [

96,

97].

The quoted literature mentions the authors of these advantages. However, the sources that create them evolve and their identification over a specific time requires representative empirical research. The success factors presented in

Figure 2 are extracted from the basic scientific literature cited on page 7. Its task is to identify the most important groups of factors and give them “labels”—in this case, eight.

It was not our intention to make meta-analysis of literature, as it is a separate task. It is clear that the list of success factors of different intensity (weight) will be much wider.

Figure 2 shows that contemporary sources of competitive advantages are rooted in both startup ecosystem. Some sources of competitive advantages exist in all eight types, forming the basis for market success. They include, in accordance with endogenous growth economics, knowledge, human capital, and technological progress, as factors largely dependent on firms. This highlights the overriding role of intellectual capital. Among external independent factors are listed public policy institutions of the EU and individual states that lay down the economic, innovation, internationalization, and social conditions for startups. The interaction of internal and external sources leads to the creation of a key advantage among many competitive advantages. The authors sought confirmation of conclusions from the theoretical analysis in the next part of this paper (parts 5 and 6) by performing pilot studies.

4. Data Set on EU Startups

As we have mentioned before, there is no systematic data on startups for all European countries. Presently, the most comprehensive data sets are included in the European Startup Monitor (ESM), periodically gathered by research institutions on behalf of the EU. In the following empirical analysis, we used data from the 2015 European Startup Monitor [

33], as the most recent available source of raw data. ESM 2015 is based on information from 2365 startups located in the European Union and Israel. It includes only startups younger than 10 years, using innovative technologies and/or business models and having or striving for a significant employee and/or sales growth. Unfortunately, in some countries, the number of responding startups was small which prevents the creation of a sufficiently large sample. For that reason, we limited our analysis to data from 13 countries: Germany, France, Italy, Poland, Spain, Romania, Austria, the Netherlands, Belgium, the Czech Republic, Sweden, the United Kingdom, and Israel (as an associated country). The mean values for the abovementioned countries were available as well. The survey consists of six chapters, which are highlighted in

Table 3. Each chapter contains several questions, which we used as variables. To evaluate them, three scales were used: average (e.g., the average age of a startup or the average number of founders), the percentage of fractions (e.g., current markets on which startups generate revenue, e.g., the country of origin, European countries, or worldwide), and a ranking of 1–6 (1–very bad and 6–very good).

Table 3 presents the symbols of 33 variables selected from the data source and their full description as used in this paper. For reasons of simplicity, for two-variant variables (e.g., woman/man), we used only one of them (e.g., M). For n-variant variables (e.g., age range and current business situation) n−1 variants were used (with the last value omitted to avoid redundancy). In the case of a few variables, boundary variants were combined. Variables were put in order of their appearance in the European Startup Monitor.

The data for 13 countries (including Israel) and the average for the EU (ESM) and 33 selected variables form a data matrix of 14 rows (for countries) and 33 columns (for selected variables). The variables are expressed in different units and have different mean values and standard deviations. Thus a normalization to a common scale was required before further analysis. For each variable

X from 1 to

n = 33, we used the standardization

which converts the real values of the variables to a common scale with the mean equal to zero. In this way, we can bring exceptional behavior to light, i.e., an above-average performance of a given indicator yields higher scores than consistent average scores across all indicators.

6. Gap in the Quality of Institutional Factors and Human Capital between EU States

Many economists stress the importance of institution analysis in the processes of developing the competitiveness of companies [

112,

113,

114]. A growth in the number of competing companies, like startups, requires the establishment of new institutions and a continuous improvement of existing ones [

113] in a direction that will drive startup competitive capabilities. Assuming after D.C. North [

115] that institutions are divided into formal (codified) and informal (soft) ones, what follows is the state of institutions in analyzed countries.

Institutions, being an external factor of startup development, can be a source of their competitive advantage or a barrier in different European countries. This is determined by the quality of such institutions [

116]. For example, Woodside et al. [

117] point to the significant role of such institutions as the government, education, R&D, corporations, community, and foundations. On the other hand, others underline the significance of institutions as being regulatory, normative, and cognitive [

118,

119]. Still others enumerate in detail different formal institutions within legal and administrative frameworks and within informal social institutions, which highlight culture and social capital [

120]. Institutions shape rules of social behavior as rules of economic game of business entities and sociopolitical interactions [

115]. In the case of formal institutions, it relates, e.g., to ownership, financial market, and labor market regulation mechanisms, i.e., monetary, fiscal, and insurance policy. According to G.C. North [

115], what plays a significant role here is the constitution, resolutions, acts of law, directives, decisions, guidelines, regulations, and codes. Transparent and stable formal institutions help close the gap of social and economic development between catching-up countries and highly developed ones by reducing uncertainty in making decisions and by decreasing transactional costs of individual companies [

121,

122]. The condition for the effectiveness of these institutions is their flexible adaptation to changes in the environment, transparency, common acceptance, and adherence to their rules [

123].

The quality of such institutions by country can be evaluated indirectly, e.g., on the basis of the following indicators: ease of doing business (EDB) [

124], Corruption Perception Index (CPI) [

125], and Index of Economic Freedom (IEF) [

126]. The indicators given in

Table 8 are the average of 10 subindicators having the same weight, on a scale of 1 to 100 (highest level). They clearly show a higher quality of these institutions in highly developed countries (the United Kingdom, Sweden, Germany, Austria, and the Netherlands), in comparison with catching-up states (Romania, Poland, Czech Republic, and Italy). Consequently, the institutions create there a better base (context) for startup ecosystem development understood by Porter [

127] and Isenberg [

128] as business environmental conditions. The first indicator—the ease of doing business—improved in the studied period of 5 years in all 12 European countries and in Israel, however, to different degrees, and stayed flat only in Germany. The second one—CPI (lack of corruption)—increased in Austria, Italy, Spain, and in the Czech Republic, deteriorating in all other countries. This means that despite the fight with corruption in public and economic life, there has been a deterioration in its effectiveness in EU countries in question. The third one–IEF (index of economic freedom)–declined only in Spain, improving in all other countries.

The above observations show that the formal institutions’ quality gap reflected by the above indicators between more developed and catching-up EU states is maintained, which in turn does not improve the ecosystem of startups in the latter ones. Developing common policy for innovation growth, both on the national and EU level, requires coordination, in order to secure that each member country is in the same situation, e.g., regarding taxes. The creation of innovations and their use depends on the state’s innovation policy that uses instruments of direct and indirect influence. In the first case, these include loans and outlays on R&D, whereas in the second case, these are instruments, which aim at institutions of the business environment (ecosystem), help in the commercialization of results of innovations, and cooperate with the sector of science (e.g., subsidies, grants, programs, innovation vouchers, etc.). This ecosystem provides training, consultancy, and information services for startups. However, the stability of the ranking positions of European countries on the European Innovation Scoreboard between 2010 and 2019 shows that in less developed countries, innovation policy has been ineffective and probably implemented too narrowly. Suggestions for efficient innovation policy actions regarding regional aspects has been offered by Camagni and Capello [

129]. They believe that “Regional innovation paths strongly depend on territorial elements rooted in the local society, its history, its culture, and its typical learning processes” [

129], p. 362. “The territorial innovation patterns concept stresses complex interplays between phases of the innovation process and the territorial context” [

129], p. 368. This means that the innovation policy-makers in the lagging countries have to consider the national and regional predispositions. Although, generally, it should be intensified and broadened by incentives boosting the role of innovation instruments (e.g., technology relief, employment of creative, high-salaried employees, assistance in obtaining grants, support of so-called business accelerators etc.), the most effective policy actions might vary from country to country [

130].

The institutional gap that continues to prevail in catching-up countries is closing, albeit slowly, which is due to small but progressing changes related to:

facilitation in running a company (obtaining permissions, access to loans, investor protection, reduction in the risk in obtaining resources, etc.),

labor market (more staff using flexible forms of employment and increase in minimum wage),

ownership (protection against eviction, loss, etc.),

freedom of trade (lower government interventions).

These results are partially confirmed by other authors’ studies, who write: “we observe a weak positive trend regarding social trust as well as subjective well-being over time, but no significant change in institutional trust. However, trends are far from homogeneous across countries” [

131].

A similar conclusion can be drawn with regard to the connection between startup development and human and social capital. Both these capitals are complementary in nature [

132]. They can stimulate or restrict technological and organizational progress in a given country. The influence of these capitals on investment growth, professional activity, entrepreneurship, and company innovation is well documented in literature, e.g., [

133,

134,

135]. We assume the concept of social capital in two forms: individual (personal) and collective (group based on relations). In the shaping of both forms of this capital, one can see the influence of human capital understood as the body of knowledge, skills, competencies, experiences, and motivation determining people’s capacity to work [

136]. Social capital, on the other hand, according to Ostrom is collective knowledge, understanding, norm, rules, and expectations with regard to interaction models, which are contributed by groups of individuals to a recurring activity [

137]. According to the World Bank, an important role in social capital is played by its dimensions, e.g., trust, credibility, cooperation, and values [

120].

Conversely, De Vaan et al. [

138] find “…that social capital defined as a regional characteristic, discourages entrepreneurship in a new and contested industry.” The argument follows the logic that high levels of social capital reinforce conformity in values and ideas, and inhibit deviant entrepreneurial activity. Once an industry becomes more legitimized—as a result of an increase in the number of firms present in a region—social capital becomes less restrictive on entrepreneurship and can even have a positive effect on the subsequent number of firms founded in a region.” However, for social capital to be able to effectively deliver economic functions, it must represent a specific level. The state of this capital in researched countries, including human capital, is presented in

Table 9, in the context of indicators and formal institutions.

In the case of social and human capital institutions, as evident from the data in the table above, there is also a gap between developing and highly developed countries. This points to the necessity of changes in the catching-up countries in these formal institutions, which can bridge this gap. These changes refer to quality improvement of legislation towards greater political pluralism, civic participation, freedom of speech, economic freedom, independence, and social trust. The legal system can be seen as a tool for building relations between people in a given country, shaping their value systems, and fostering market institutions (agreements). Legal regulations created by the state, as well as the effectiveness of the government [

141], political stability, and quality of the regulatory sphere [

142] all have impact on social trust to the state and influence the development of cooperation ties or lack thereof [

143,

144]. This opinion is supported by research results made by Seunghwan Myeong and Hyungjun Seo [

145], who studied, in particular, relations between bridging and bonding capital and trust.

Furthermore, Ponzetto and Troiano [

146] point out that “social capital increases economic growth by raising government investment in human capital. Countries with higher social capital spend a higher share of output on public education.” Consequently, the state has influence on the education system. Education plays an important role in the creation and development of such social capital designates as empathy, trust, solidarity, self-discipline, and cooperation [

147]. The results of a meta-analysis [

148], p. 454, “lend support to the argument that education plays a crucial role in the generation of social capital. Further analysis confirms the existence of a relative effect of education on social participation, and of a reciprocal mechanism between the dimensions of social capital.” Having influence on the organization of general and university schooling, the state shapes the quality and level of education, e.g., [

149,

150], as well as dimensions and attributes of social capital. According to global research, a low level of social capital is prone to produce corruption and nepotism at the meeting point of power and business, which also leads to a deficit in morality, low levels of trust to state organizations, and depreciation of other social capital attributes [

117,

151]. Thus, the last authors draw the following research conclusion: “(…) Entrepreneur strategy implications include the observation that actions nurturing firm startups by nations low in entrepreneurship will unlikely to be successful without reducing such nations’ high levels of corruption.”

Consequently, the state has an important role to play in the shaping of startup ecosystems. The shortcomings in social capital and other informal institutions leading to no noteworthy competitive advantages in catching-up countries is a factor limiting the development of startup firms. The current state of the institutional system in these countries is not very attractive for innovative companies. This stems from an excessive number of regulations governing businesses, bureaucracy, low level of trust, and a slowdown in structural changes in such economies. This opinion is supported by the results of Paolo Pasimeni’s [

152] analysis. In his research, he included “formal institutions through the concept of good governance, whereas informal institutions are included through the concept of social capital as a trust.” Similar opinions were expressed by other authors [

153,

154].

7. Conclusions and Outlook

In order to determine the development of startup competitive potential one needs to identify not only the characteristic features of startup businesses but also, first and foremost, their key success factors.

This paper discusses startups from the perspective of the competitive advantage criterion. In the resource-based view of strategic management theories, it is assumed that this advantage results from key tangible and nontangible resources (factors). On the basis of literature analysis and recognized definitions of startups, eight types of competitive advantages were systematized as success factors, namely, innovation, entrepreneurship, resource, competence, intellectual capital, sustainable development, content management, and information advantages. It was also assumed that there are differences in the situation in catching-up and better developed EU Member States.

In order to investigate the key success factors of startups in the EU, we analyzed data from the 2015 European Startup Monitor, selecting 13 countries with a sufficient number of respondents. A limitation of the analysis is the number of countries included in the 2015 ESM set. Studies conducted in later years (ESM 2018) included a larger number of European countries, but the number and variation of variables (variables) were significantly limited in substance and incomparable. In our opinion, startup organizations at European level should develop a single and stable research tool. It will make it easier to compare progress and diversification across countries. It can be useful in the development by the European institutions of startup development program aimed at countries and/or economic sectors (e.g., circular economy, green-, bio-, nanotechnology, and ecology).

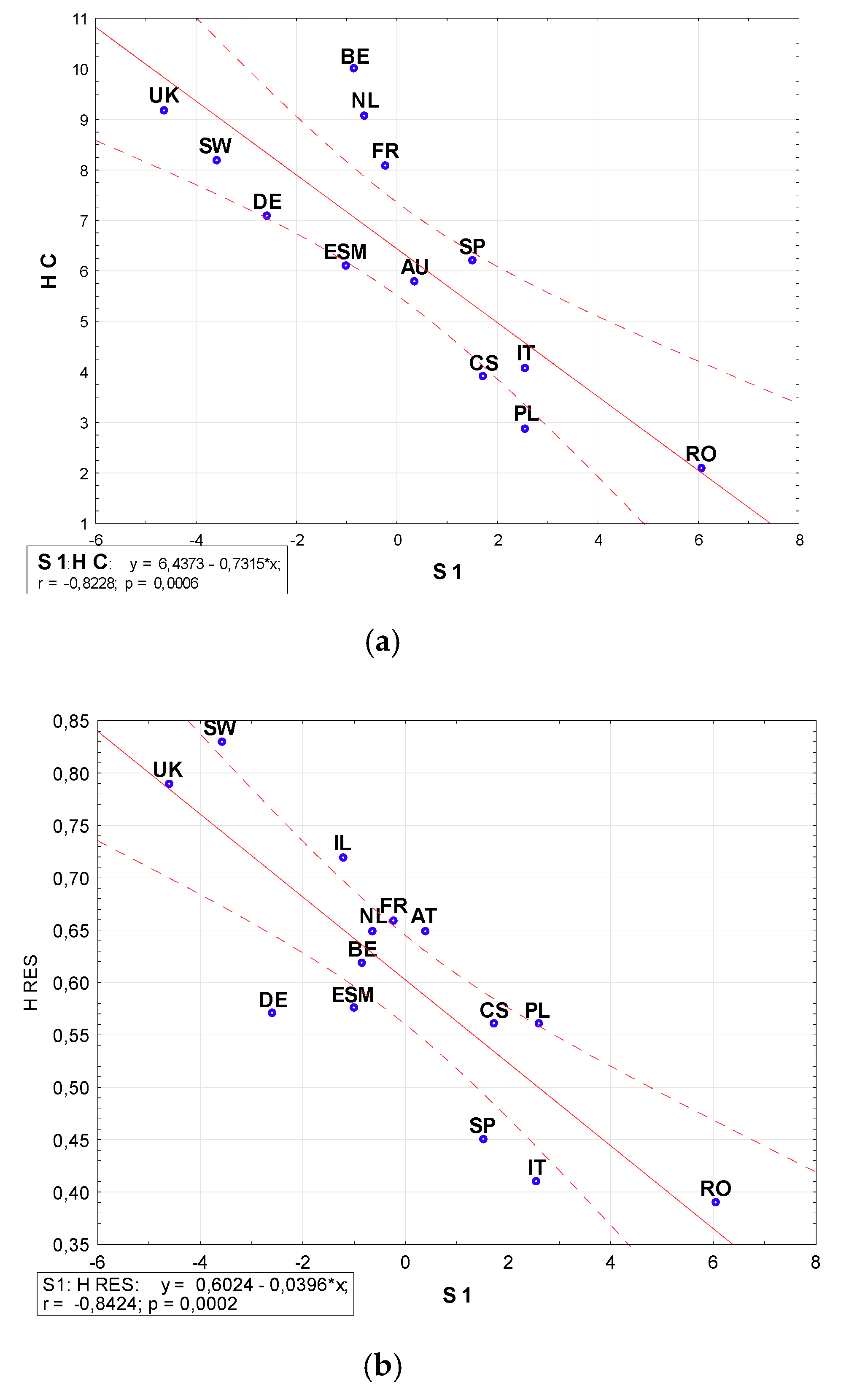

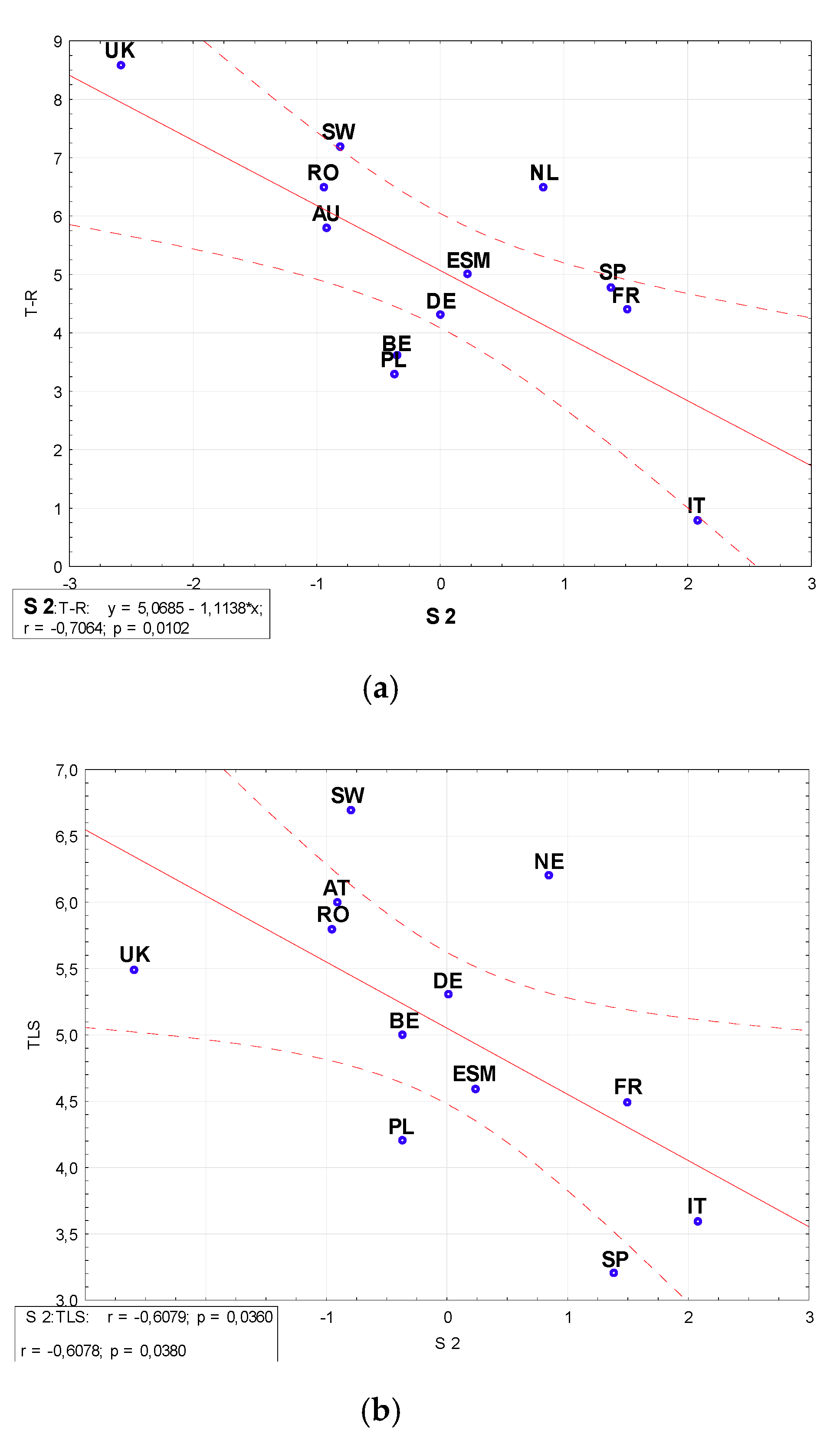

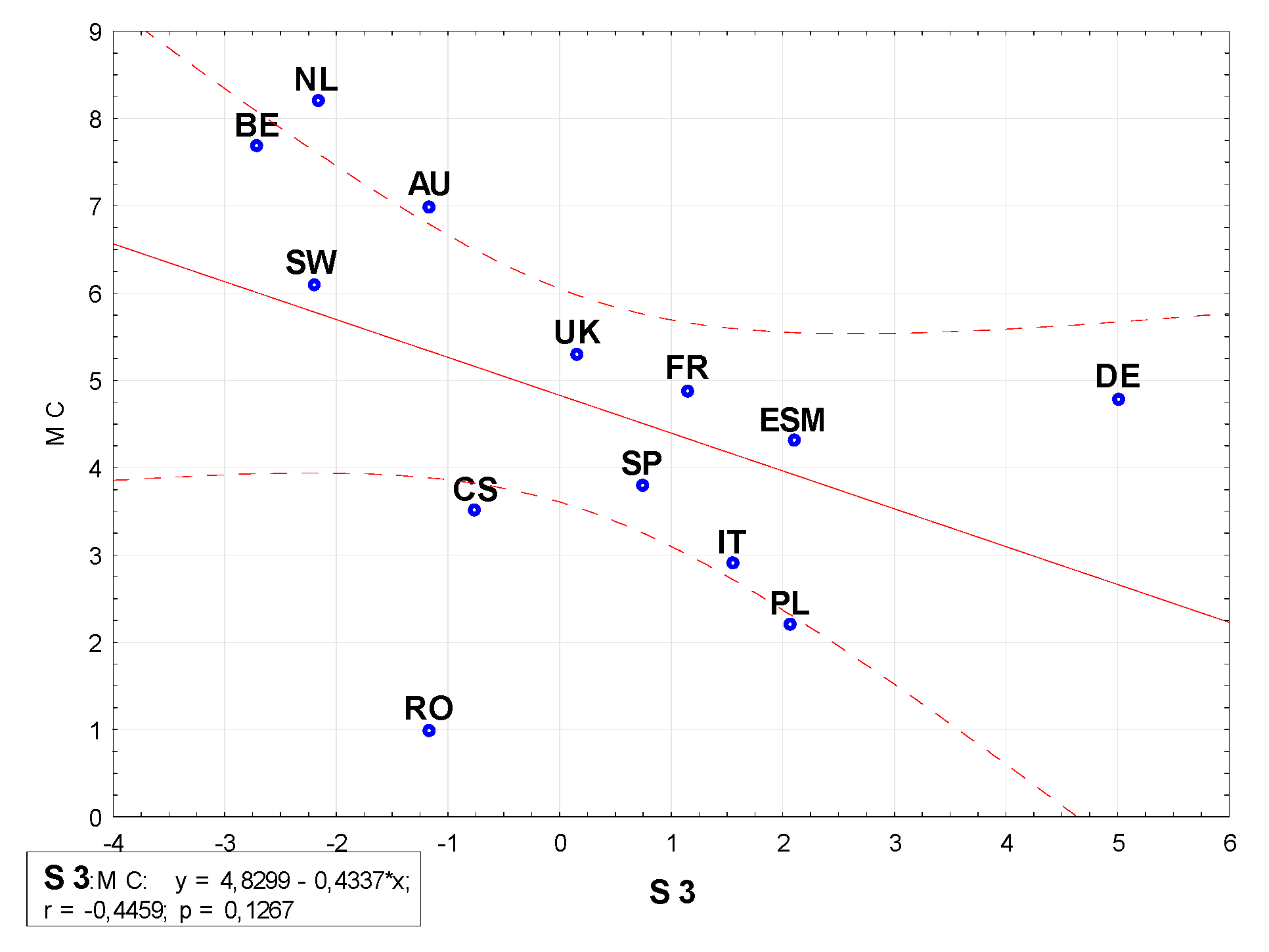

Using the method of multivariate statistical analysis, we determined five components explaining 72.4% of total data variability. We interpret these five key success factors as follows: 1. access to human capital, 2. quality and outcomes of institutions and business relations, 3. focus on market situation, 4. business experience, and 5. development potential. Components 1–3 were explained using appropriate and independent scales, with fairly good linear correlation. The linear relationships shown in

Figure 3,

Figure 4, and

Figure 5 point to deficit of: first, human capital and human resources; second, the trust to standards, regulations, legal system; and third, to the deficit of market regulation. This deficit is particularly evident in central and southern European countries. This information can be useful for authorities and startup managers. The meaning of component 4 is connected to experience, prudence, and business knowledge of founders and staff. Some loadings in the 5th component are of a magnitude below the validity level (|0.7500|). However, they offer valuable information indicating problems in person-to-person or person-to-authority relationships, intention of a startup to expand towards international markets with its own financial resources, and a tendency for startup growth in the direction of scale-ups based on more experienced staff and higher headcount.

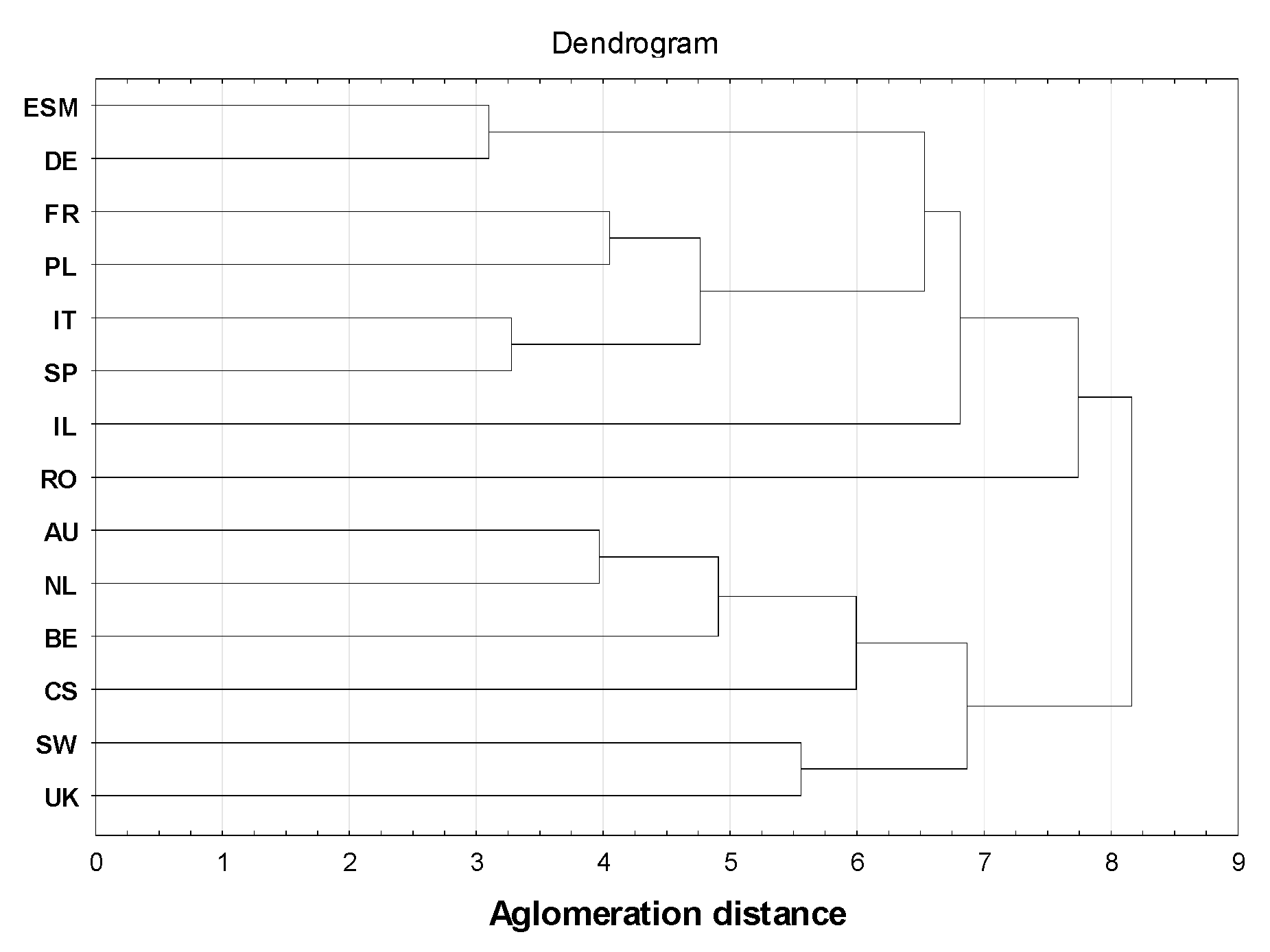

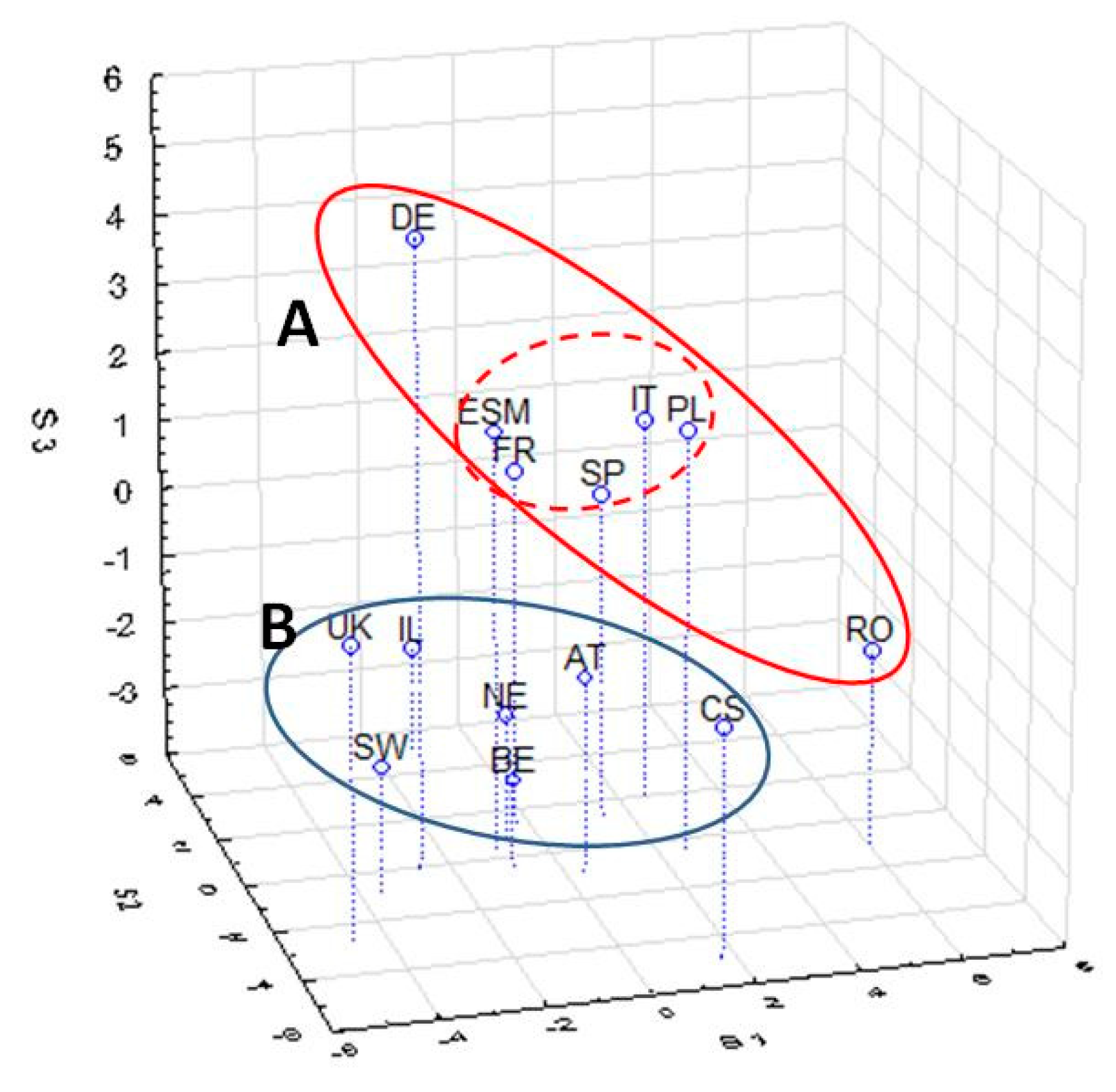

In order to confirm the existing gap between the sampled countries, score values for countries from PCA analysis have been used in the Ward method cluster analysis. The results show two groups of countries with higher, as well as lower, levels of economic and social development. A similar clustering emerged in a three-dimensional picture of three components scores (

Figure 7). We found that the most crucial factor splitting countries into two groups is factor 3 (see

Table 7). The significant value of factor 1 for Romanian and of factor 2 for Czech startups positions them as outliers.

The performed analysis determined that institutions, human capital, and dimensions of social capital form a significant factor differentiating startup development. Therefore, to provide an explanation for the gap in startup development, we included an assessment of institutional factors in the light of neoinstitutional economics. Additionally, we analyzed leading indicators and scales of formal institutions. We conclude that in catching-up European countries, the economic factors of institutional competitiveness, both formal and informal, need to be improved in terms of their quality and level, to boost startup development. In particular, this applies to the efficiency of the judiciary, higher outlays on R&D, and easier access to financial capital.

The analysis verified our hypothesis and the achievement of objectives set out in our research. The results bring new insights about the functioning and development of startups in the European Union and can be used to determine the prerequisites for shaping macroeconomic and innovation policies in relation to startups in the catching-up EU countries.

To conclude, we call for the responsible activity of policymakers towards the development of programs and actions fostering startups. We do not suggest, however, that all Member States should follow the path of the top-ranked countries. In this respect, the European Startup Monitor and our analysis serve as a supportive tool to help outline and define the future challenges of entrepreneurship policies in Europe and EU Member States. In the nearest future, in order to remain competitive, the economies of EU Member States must meet the need for increasing entrepreneurship and innovation potential. They need to create a higher level of international technological competitiveness, especially in IT. However, some opinions suggest that the development of Industry 4.0, based on digitalization, can deepen social changes, environmental impact, and conservation needs in the EU [

155]. As such, startups need to be considered as a factor impacting sustainability [

156]. In our opinion, the prevailing interest of startups in certain sectors (e.g., IT, ICT, and e-commerce) can be moderated by some additional mechanisms, including financial support from the EU or governmental agencies. The European Union is introducing a new strategy for the future, e.g., European Green Deal, launching 11 programs [

157]. It is expected accelerating and navigating the necessary transitions, deploying, demonstrating and de-risking solutions, and engaging citizens in social innovation. There is no doubt that "…Startup offers an important advance to help companies design business models for novelty and impact…" [

77]. They can also serve as "social proof of viability or possibility associated with belief, hypothesis, and theory of a future reality” [

158]. We could mention here the need for innovative solutions for food-, green-, and biotechnological; organic, nano- and medical products; new packaging materials; recycling; the sharing economy; and many other branches. This could strengthen the efficiency of EU’s sustainability policy and, at the same time, improve the startup ecosystem in the catching-up EU countries.