Fluctuations in Hong Kong Hotel Industry Room Rates under the 2019 Novel Coronavirus (COVID-19) Outbreak: Evidence from Big Data on OTA Channels

Abstract

1. Introduction

2. Literature Review

2.1. Research on the Effects of Infectious Diseases on Hotels

2.2. Research on Hotel Room Rates

2.3. Revenue Management in the Hospitality Industry Associated with Crisis Management

3. Methodology

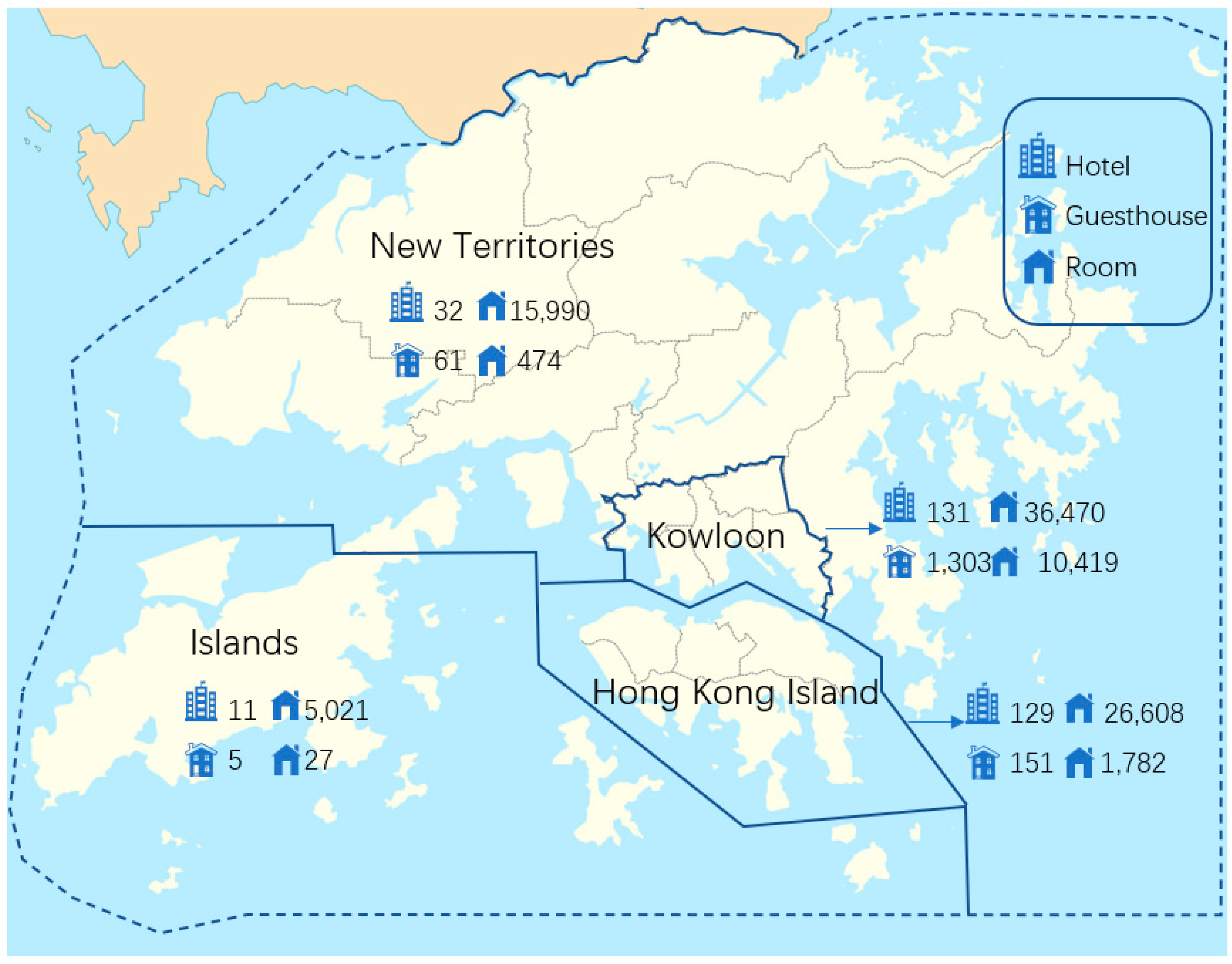

3.1. Data Collection and Preprocessing

3.2. Method of Analysis

4. Findings

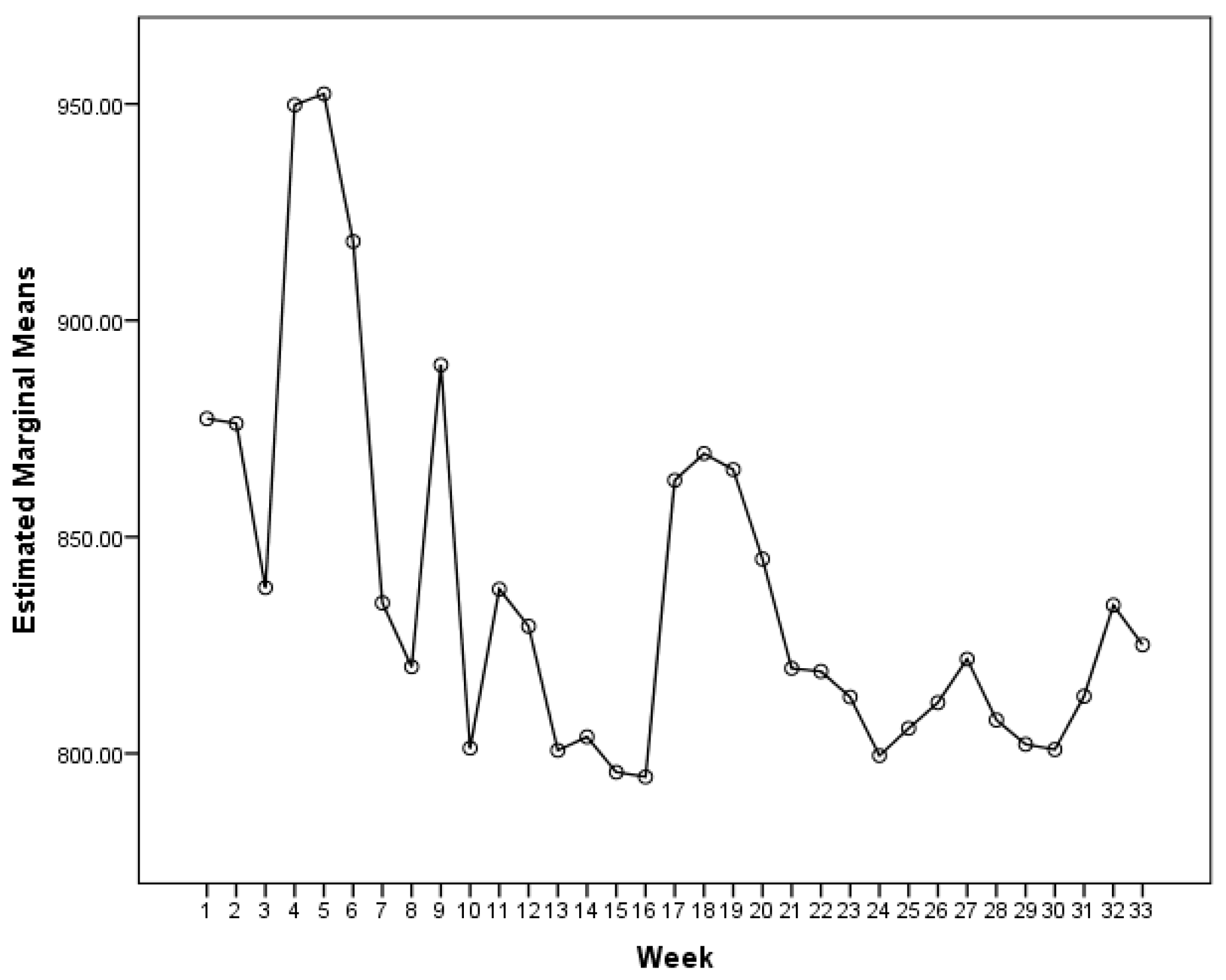

4.1. Overall Trends in Room Rate Fluctuations

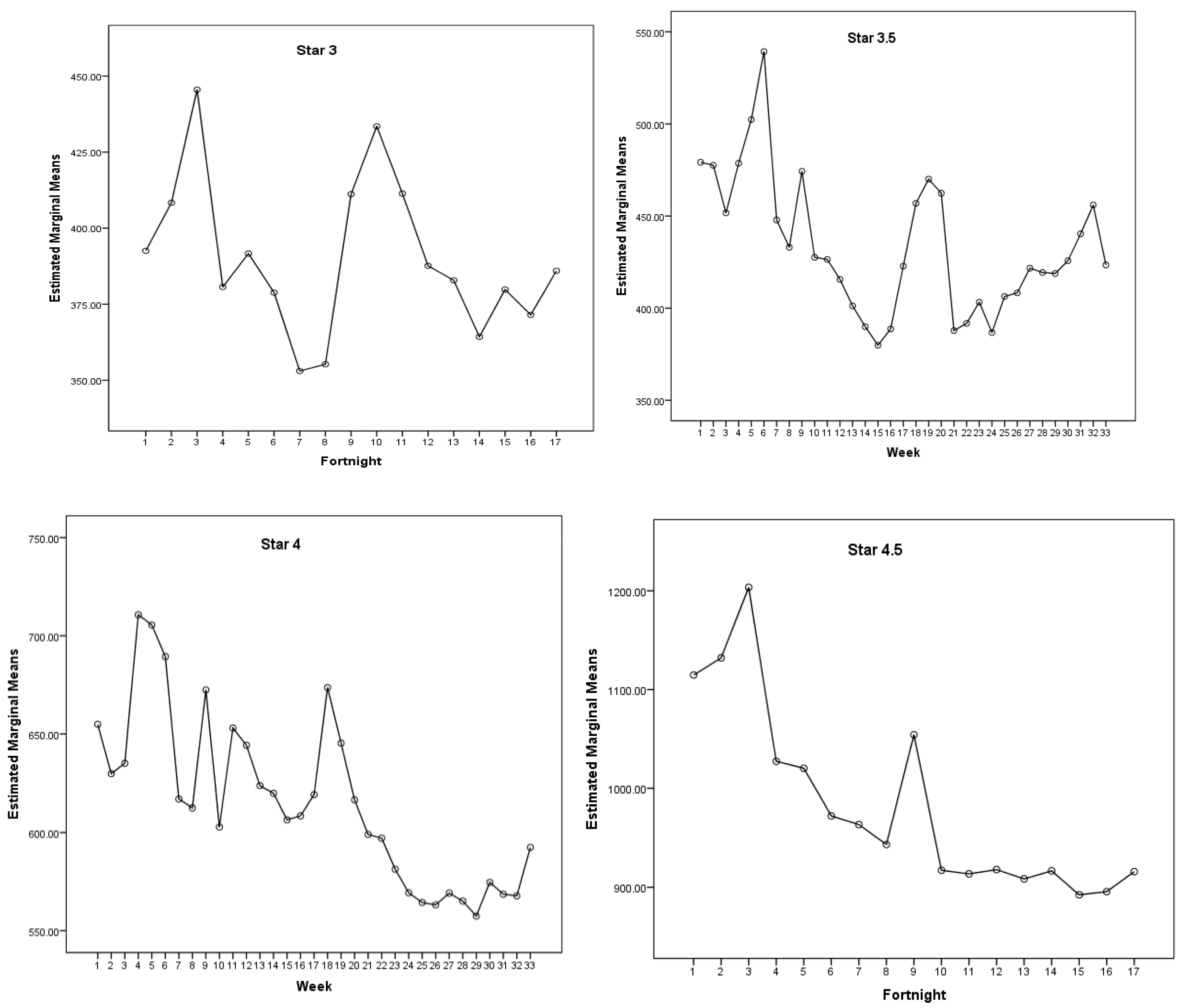

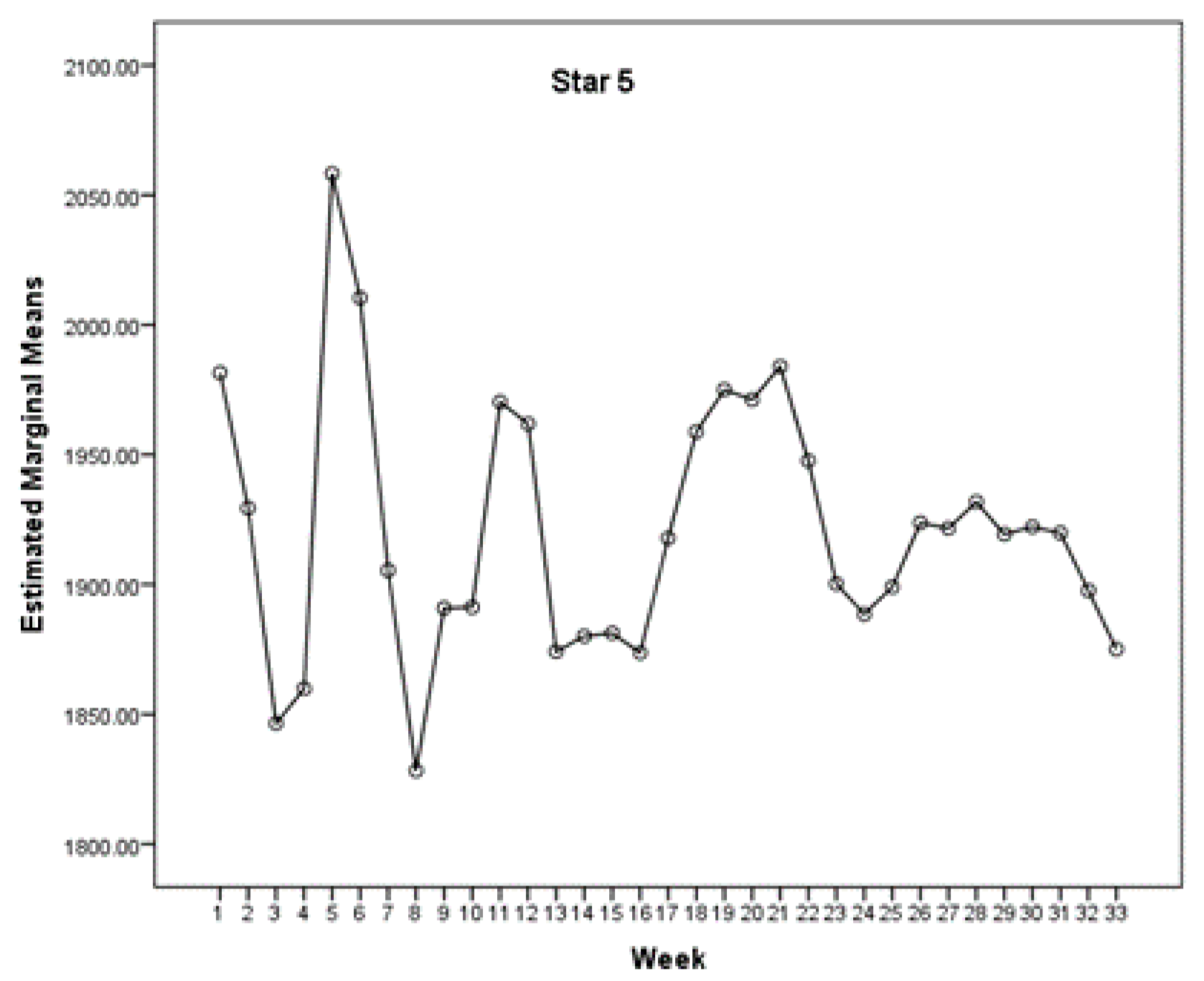

4.2. Fluctuations in Hotel Room Rates by Star Rating

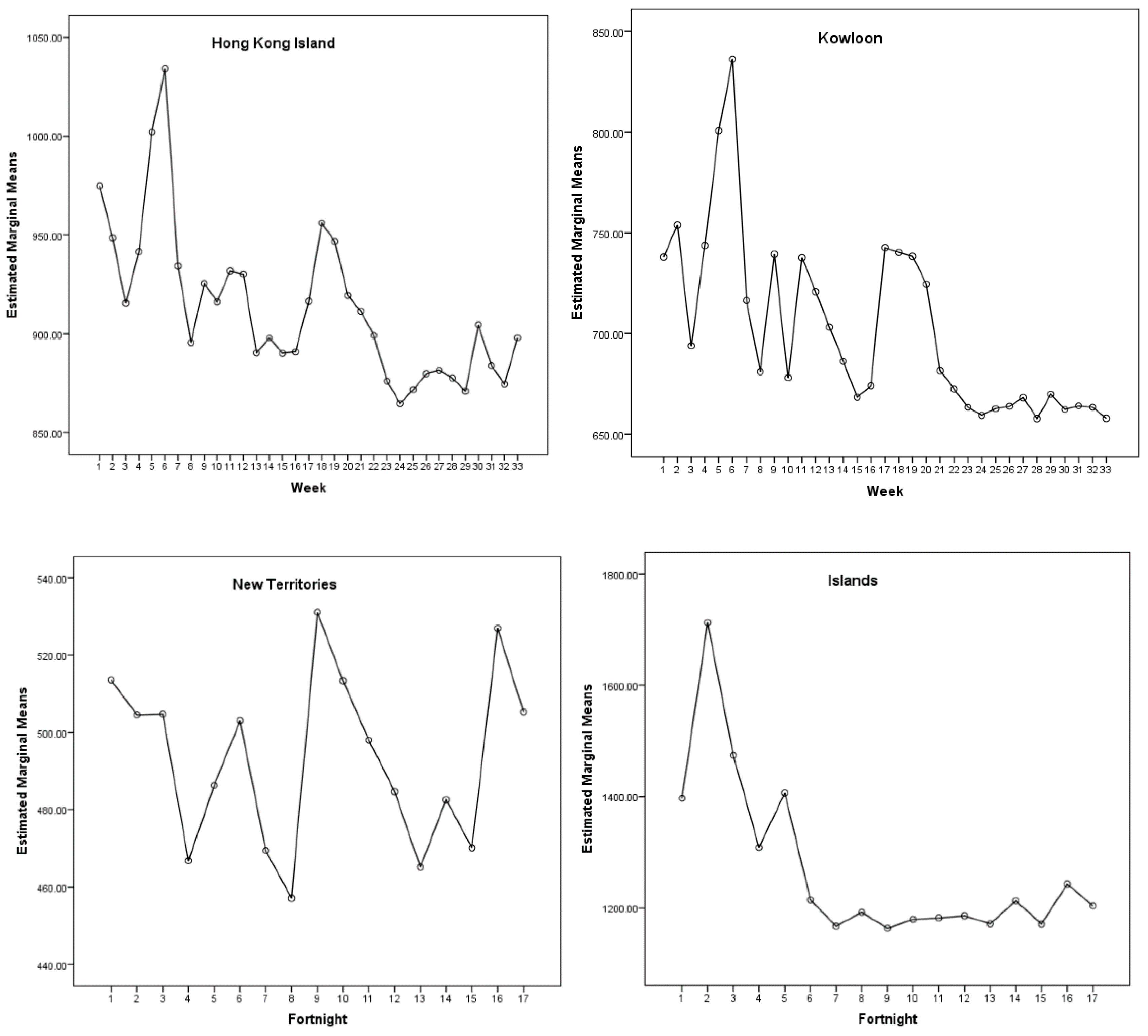

4.3. Fluctuations in Hotel Room Rates by District

4.4. Summary

5. Discussion and Implications

5.1. Discussion

5.2. Implications

6. Conclusions and Limitations

Author Contributions

Funding

Conflicts of Interest

References

- Xian, F. Analysis of the Impact of the Epidemic on Hotel and Tourism Industry. China. Conf. Exhib. 2020, 4, 56–61. (In Chinese) [Google Scholar]

- Huang Yin, C.; Goh, E.; Law, R. Developing inter-organizational relationships with online travel agencies (OTAs) and the hotel industry. J. Travel. Tour. Mark. 2019, 36, 428–442. [Google Scholar] [CrossRef]

- Braden, C.R.; Dowell, S.F.; Jernigan, D.B.; Hughes, J.M. Progress in Global Surveillance and Response Capacity 10 Years after Severe Acute Respiratory Syndrome. Emerg. Infect. Dis. 2013, 19, 864–869. [Google Scholar] [CrossRef]

- Chen, M. The response of hotel performance to international tourism development and crisis events. Int. J. Hosp. Manag. 2011, 30, 200–212. [Google Scholar] [CrossRef] [PubMed]

- Hung, K.K.C.; Mark, C.K.M.; Yeung, M.P.S.; Chan, E.Y.Y.; Graham, C.A. The role of the hotel industry in the response to emerging epidemics: A case study of SARS in 2003 and H1N1 swine flu in 2009 in Hong Kong. Global. Heal. 2018, 14, 117. [Google Scholar] [CrossRef] [PubMed]

- Wu, E.H.C.; Law, R.; Jiang, B. The impact of infectious diseases on hotel occupancy rate based on independent component analysis. Int. J. Hosp. Manag. 2010, 29, 751–753. [Google Scholar] [CrossRef]

- Olugasa, B.O.; Oshinowo, O.Y.; Odigie, E.A. Preventive and social cost implications of Ebola Virus Disease (EVD) outbreak on selected organizations in Lagos state, Nigeria. Pan. Afric. Medi. J. 2015, 22, 20. [Google Scholar] [CrossRef]

- Wen, J.; Aston, J.; Liu, X.; Ying, T. Effects of misleading media coverage on public health crisis: A case of the 2019 novel coronavirus outbreak in China. Anato. Int. J. Tour. Hosp. Res. 2020, 31, 331–336. [Google Scholar] [CrossRef]

- Yang, Y.; Chen, X. Coronavirus pandemic and tourism: Dynamic stochastic general equilibrium modeling of infectious disease outbreak. Ann. Tourism. Res. 2020, 83. [Google Scholar] [CrossRef]

- China Tourism Academy. Blue Book of Chinese Tourism Economics No.12; China Tourism Academy: Beijing, China, 2020. (In Chinese) [Google Scholar]

- Tian, X.; Wang, X.; Li, K.; Chen, J. The Driving Factors of Hotel Revenue Management Strategy: An Empirical Study Based on Chinese Starred-Hotel Data. Tour. Sci. 2014, 28, 65–80. (In Chinese) [Google Scholar] [CrossRef]

- Gao, B.; Sun, H.; Wang, H. Influence of Online Reviews on Hotels’ Full-occupancy Rates. Tour. Trib. 2016, 31, 109–117. (In Chinese) [Google Scholar] [CrossRef]

- Zhang, Y.; Yu, Y.; Pan, H. A Comparison Research on Hotel Attributes to Customer Satisfaction:A Study based on Web Content Analysis. Tour. Forum. 2017, 10, 45–57. (In Chinese) [Google Scholar] [CrossRef]

- Shen, H.; Zhao, J.; Hu, F. The Influence of e-WOM Characteristics on Hotel Purchasing Decision online. Tour. Forum. 2020, 13, 35–44. (In Chinese) [Google Scholar] [CrossRef]

- Toh, R.S.; Raven, P.; DeKay, F. Selling Rooms: Hotels vs. Third-Party Websites. Cornell. Hosp. Q. 2011, 52, 181–189. [Google Scholar] [CrossRef]

- Ling, L.; Guo, X.; Yang, C. Opening the online marketplace: An examination of hotel pricing and travel agency on-line distribution of rooms. Tour. Manag. 2014, 45, 234–243. [Google Scholar] [CrossRef]

- Yan, K.; Gao, Q.; Hu, X. Pricing and revenue optimization between hotel and online travel agencies. J. Nanjing Univ. Sci. Technol. 2017, 41, 779–783. (In Chinese) [Google Scholar] [CrossRef]

- Long, Y.; Shi, P. Pricing strategies of tour operator and online travel agency based on cooperation to achieve O2O model. Tour. Manag. 2017, 62, 302–311. [Google Scholar] [CrossRef]

- Raab, C.; Berezan, O.; Christodoulidou, N.; Jiang, L.; Shoemaker, S. Creating strategic relationships with online travel agents to drive hotel room revenue: An OTA perspective. J. Hosp. Tour. Technol. 2018, 9, 125–140. [Google Scholar] [CrossRef]

- Herrmann, R.; Herrmann, O. Hotel roomrates under the influence of a large event: The Oktoberfest in Munich 2012. Int. J. Hosp. Manag. 2014, 39, 21–28. [Google Scholar] [CrossRef]

- Gricar, S.; Bojnec, S. Prices of short-stay accommodation: Time series of a eurozone country. Int. J. Contemp. Hosp. Manag. 2019, 31, 4500–4519. [Google Scholar] [CrossRef]

- Leung, R.; Guillet, B.D.; Law, R. The channel that offers the lowest online room rates: A case study of hotels in Hong Kong. Int. J. Hosp. Tour. Admin. 2014, 15, 103–120. [Google Scholar] [CrossRef]

- Sun, S.; Law, R.; Tse, T. Exploring price fluctuations across different online travel agencies: A case study of room reservations in an upscale hotel in Hong Kong. J. Vacat. Mark. 2016, 22, 167–178. [Google Scholar] [CrossRef]

- Mohammed, I.; Guillet, B.D.; Law, R. Last-minute hotel-booking and frequency of dynamic price adjustments of hotel rooms in a cosmopolitan tourism city. J. Hosp. Tour. Manag. 2019, 41, 12–18. [Google Scholar] [CrossRef]

- Israeli, A.A.; Reichel, A. Hospitality crisis management practices: The Israeli case. Int. J. Hosp. Manag. 2003, 22, 353–372. [Google Scholar] [CrossRef]

- Kimes, S.E. Hotel revenue management in an economic downturn: Results from an international study. Cornell. Hosp. Report. 2009, 9, 6–17. [Google Scholar]

- Caudillo-Fuentes, L.A.; Li, Y. Revenue management during times of recession. J. Reve. Pric. Manag. 2010, 9, 185–188. [Google Scholar] [CrossRef]

- Racherla, P.; Hu, C. A Framework for Knowledge-Based Crisis Management in the Hospitality and Tourism Industry. Cornell. Hosp. Q. 2009, 50, 561–577. [Google Scholar] [CrossRef]

- Song, H.; Lin, S.; Witt, S.F.; Zhang, X. Impact of financial/economic crisis on demand for hotel rooms in Hong Kong. Tour. Manag. 2011, 32, 172–186. [Google Scholar] [CrossRef]

- Malhotra, R.; Venkatesh, U. Pre-crisis period planning: Lessons for hospitality and tourism. World. Hosp. Tour. Them. 2009, 1, 66–74. [Google Scholar] [CrossRef]

- Alonso-Almeida, M.D.M.; Bremser, K. Strategic responses of the Spanish hospitality sector to the financial crisis. Int. J. Hosp. Manag. 2013, 32, 141–148. [Google Scholar] [CrossRef]

- Kapiki, S. The impact of economic crisis on tourism and hospitality: Results from a study in Greece. Cen. Eur. Revi. Econ. Fina. 2012, 2, 19–30. [Google Scholar]

- Gehrels, S.; Blanar, O. How economic crisis affects revenue management: The case of the Prague Hilton hotels. Res. Hosp. Manag. 2013, 2, 9–15. [Google Scholar] [CrossRef]

- Ivanov, S.H.; Webster, C.; Stoilova, E.; Slobodskoy, D. Biosecurity, crisis management, automation technologies and economic performance of travel, tourism and hospitality companies—A conceptual framework. Tourism. Econ. 2020. [Google Scholar] [CrossRef]

- Soler, I.P.; Gemar, G.; Guzman-Parra, V.F. A comparison of destinations’ impacts on hotel rates. Int. J. Hosp. Manag. 2019, 77, 226–237. [Google Scholar] [CrossRef]

- Martin-Fuentes, E. Are guests of the same opinion as the hotel star-rate classification system? J. Hosp. Tour. Manag. 2016, 29, 126–134. [Google Scholar] [CrossRef]

- Law, R.; Chan, I.; Goh, C. Where to find the lowest hotel room rates on the internet? The case of Hong Kong. Int. J. Contemp. Hosp. Manag. 2007, 19, 495–506. [Google Scholar] [CrossRef]

- Tso, A.; Law, R. An empirical study of online pricing practices for Hong Kong hotels. In Information and Communication Technologies in Tourism 2005; Frew, A.J., Ed.; Springer: Vienna, Austria, 2005; pp. 328–337. [Google Scholar] [CrossRef]

- Denizci, G.B.; Law, R. Analyzing hotel star ratings on third-party distribution websites. Int. J. Contemp. Hosp. Manag. 2010, 22, 797–813. [Google Scholar] [CrossRef]

- Tang, C.M.F.; King, B.E.M.; Kulendran, N. Estimating Future Room Occupancy Fluctuations to Optimize Hotel Revenues. J. Travel. Tour. Mark. 2015, 32, 870–885. [Google Scholar] [CrossRef]

- Zhou, L.; Zhang, Q.; Zhu, Q.; Lu, L. Spatio-temporal Differentiation in the Effects of Canton Fair on Hotel Prices: A Case Study of the 117th and 118th Canton Fair. Sci. Geo. Sin. 2017, 37, 1363–1373. (In Chinese) [Google Scholar] [CrossRef]

| Star Rating | Number | District | Number |

|---|---|---|---|

| 2.5 | 2 | Hong Kong Island | 97 |

| 3 | 35 | Kowloon | 106 |

| 3.5 | 55 | New Territories | 24 |

| 4 | 94 | Islands | 10 |

| 4.5 | 22 | - | |

| 5 | 29 | - | |

| Total | 237 | Total | 237 |

| Fortnight NUM | Week NUM | DATE | Fortnight NUM | Week NUM | DATE | Fortnight NUM | Week NUM | DATE |

|---|---|---|---|---|---|---|---|---|

| 1 | 1 | 1–7 December 2019 | 7 | 13 | 23–29 February 2020 | 13 | 25 | 17–23 May 2020 |

| 2 | 8–14 December 2019 | 14 | 1–7 March 2020 | 26 | 24–30 May 2020 | |||

| 2 | 3 | 15–21 December 2019 | 8 | 15 | 8–14 March 2020 | 14 | 27 | 31 May–6 June 2020 |

| 4 | 22–28 December 2019 | 16 | 15–21 March 2020 | 28 | 7–13 June 2020 | |||

| 3 | 5 | 29 December 2019–4 January 2020 | 9 | 17 | 22–28 March 2020 | 15 | 29 | 14–20 June 2020 |

| 6 | 5–11 January 2020 | 18 | 29 March–4 April 2020 | 30 | 21–27 June 2020 | |||

| 4 | 7 | 12–18 January 2020 | 10 | 19 | 5–11 April 2020 | 16 | 31 | 28 June–4 July 2020 |

| 8 | 19–25 January 2020 | 20 | 12–18 April 2020 | 32 | 5–11 July 2020 | |||

| 5 | 9 | 26 January–1 February 2020 | 11 | 21 | 19–25 April 2020 | 17 | 33 | 12–17 July 2020 |

| 10 | 2–8 February 2020 | 22 | 26 April–2 May 2020 | |||||

| 6 | 11 | 9–15 February 2020 | 12 | 23 | 3–9 May 2020 | |||

| 12 | 16–22 February 2020 | 24 | 10–16 May 2020 |

| Week (I) | Week (J) | Mean Difference (I–J) | Std. Error | Sig | |

|---|---|---|---|---|---|

| Before ninth week | 3 | 5 | −114.045 *** | 13.010 | 0.000 |

| 5 | 8 | 132.310 *** | 12.683 | 0.000 | |

| 8 | 9 | −69.709 *** | 8.303 | 0.000 | |

| After ninth week | 9 | 16 | 495.137 *** | 22.242 | 0.000 |

| 16 | 19 | −70.963 *** | 17.835 | 0.000 | |

| 19 | 24 | 66.049 *** | 18.201 | 0.000 | |

| 9 | 33 | 64.659 ** | 27.463 | 0.020 |

| Star Rating | χ2 | p | Greenhouse–Geisser | |

|---|---|---|---|---|

| F | p | |||

| 3 (fortnightly) | 781.036 | 0.000 | 3.668 | 0.000 |

| 3.5 (weekly) | 3581.950 | 0.000 | 5.787 | 0.001 |

| 4 (weekly) | 4735.678 | 0.000 | 4.359 | 0.000 |

| 4.5 (fortnightly) | 956.667 | 0.000 | 3.778 | 0.006 |

| 5 (weekly) | 2105.363 | 0.000 | 1.324 | 0.270 |

| Star Rating | Fortnight (I) | Fortnight (J) | Mean Difference (I–J) | Std. Error | Sig. |

|---|---|---|---|---|---|

| 3 | 5 | 7 | 38.632 *** | 9.826 | 0.000 |

| 8 | 10 | −78.221 *** | 12.231 | 0.000 | |

| 5 | 17 | 5.708 | 14.332 | 0.692 | |

| 4.5 | 5 | 8 | 76.877 ** | 25.939 | 0.005 |

| 8 | 9 | −110.841 | 57.010 | 0.059 | |

| 5 | 9 | −33.964 | 63.447 | 0.595 | |

| 9 | 17 | 138.357 * | 55.170 | 0.016 | |

| 5 | 17 | 104.393 *** | 25.999 | 0.000 | |

| Star Rating | Week (I) | Week (J) | Mean Difference (I–J) | Std. Error | Sig |

| 3.5 | 9 | 15 | 94.410 *** | 14.920 | 0.000 |

| 15 | 19 | −120.352 *** | 27.604 | 0.000 | |

| 9 | 19 | 4.221 | 24.712 | 0.865 | |

| 9 | 33 | 50.816 ** | 15.299 | 0.002 | |

| 4 | 9 | 15 | 65.973 ** | 18.595 | 0.001 |

| 15 | 19 | −38.848 *** | 10.482 | 0.000 | |

| 18 | 33 | 81.173 * | 31.548 | 0.012 | |

| 9 | 33 | 80.016 ** | 26.487 | 0.003 | |

| 5 | 11 | 16 | 96.574 * | 43.421 | 0.033 |

| 16 | 21 | −110.290 ** | 29.283 | 0.001 | |

| 21 | 24 | 95.450 ** | 33.633 | 0.008 | |

| 9 | 33 | 15.840 | 65.635 | 0.811 |

| District | χ2 | p | Greenhouse–Geisser | |

|---|---|---|---|---|

| F | p | |||

| Hong Kong Island | 5124.855 | 0.000 | 2.175 | 0.097 |

| Kowloon | 5213.122 | 0.000 | 2.247 | 0.096 |

| New Territories | 1003.582 | 0.000 | 1.968 | 0.102 |

| Islands | 520.706 | 0.000 | 2.345 | 0.092 |

| District | Week (I) | Week (J) | Mean Difference (I–J) | Std. Error | Sig. |

|---|---|---|---|---|---|

| Hong Kong Island | 16 | 18 | −65.229 *** | 11.997 | 0.000 |

| 18 | 24 | 91.480 *** | 17.296 | 0.000 | |

| 9 | 33 | 27.482 | 32.635 | 0.402 | |

| Kowloon | 15 | 17 | −74.318 * | 34.459 | 0.034 |

| 17 | 24 | 83.421 * | 34.750 | 0.018 | |

| 9 | 33 | 81.564 *** | 10.506 | 0.000 | |

| District | Fortnight (I) | Fortnight (J) | Mean Difference (I–J) | Std. Error | Sig |

| New Territories | 6 | 8 | 45.896 ** | 16.502 | 0.008 |

| 8 | 9 | −73.997 *** | 18.595 | 0.000 | |

| 9 | 13 | 65.887 ** | 23.614 | 0.008 | |

| 12 | 16 | −42.304 | 50.040 | 0.403 | |

| 5 | 17 | −19.036 | 24.314 | 0.438 | |

| Islands | 5 | 7 | 238.583 *** | 40.029 | 0.000 |

| 5 | 17 | 202.172 ** | 57.013 | 0.003 |

| Variables | Period of Significant Decline | |

|---|---|---|

| Overall | W: 9–16, 19–24, 9–33 | |

| Star Rating | 3 | F: 5–7 |

| 3.5 | W: 9–15 | |

| 4 | W: 9–15, 18–33 | |

| 4.5 | F: 9–17, 5–17 | |

| 5 | W: 11–16, 21–24 | |

| District | Hong Kong Island | W:18–24 |

| Kowloon | W: 17–24, 9–33 | |

| New Territories | F: 6–8, 9–13 | |

| Islands | F: 5–7, 5–17 | |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wu, F.; Zhang, Q.; Law, R.; Zheng, T. Fluctuations in Hong Kong Hotel Industry Room Rates under the 2019 Novel Coronavirus (COVID-19) Outbreak: Evidence from Big Data on OTA Channels. Sustainability 2020, 12, 7709. https://doi.org/10.3390/su12187709

Wu F, Zhang Q, Law R, Zheng T. Fluctuations in Hong Kong Hotel Industry Room Rates under the 2019 Novel Coronavirus (COVID-19) Outbreak: Evidence from Big Data on OTA Channels. Sustainability. 2020; 12(18):7709. https://doi.org/10.3390/su12187709

Chicago/Turabian StyleWu, Feiran, Qianxi Zhang, Rob Law, and Tianxiang Zheng. 2020. "Fluctuations in Hong Kong Hotel Industry Room Rates under the 2019 Novel Coronavirus (COVID-19) Outbreak: Evidence from Big Data on OTA Channels" Sustainability 12, no. 18: 7709. https://doi.org/10.3390/su12187709

APA StyleWu, F., Zhang, Q., Law, R., & Zheng, T. (2020). Fluctuations in Hong Kong Hotel Industry Room Rates under the 2019 Novel Coronavirus (COVID-19) Outbreak: Evidence from Big Data on OTA Channels. Sustainability, 12(18), 7709. https://doi.org/10.3390/su12187709