1. Introduction

Prior studies have examined the influences of corporate social responsibility (hereafter, CSR) on important outcomes in the financial markets. Recent studies have examined various elements of this relationship. For example, Chen, Dong and Lin [

1], Nguyen, Kecskés and Mansi [

2] and Oikonomou, Yin and Zhan [

3] investigate the relevance of CSR to investors’ investment decisions; Jin, Cheng and Zeng [

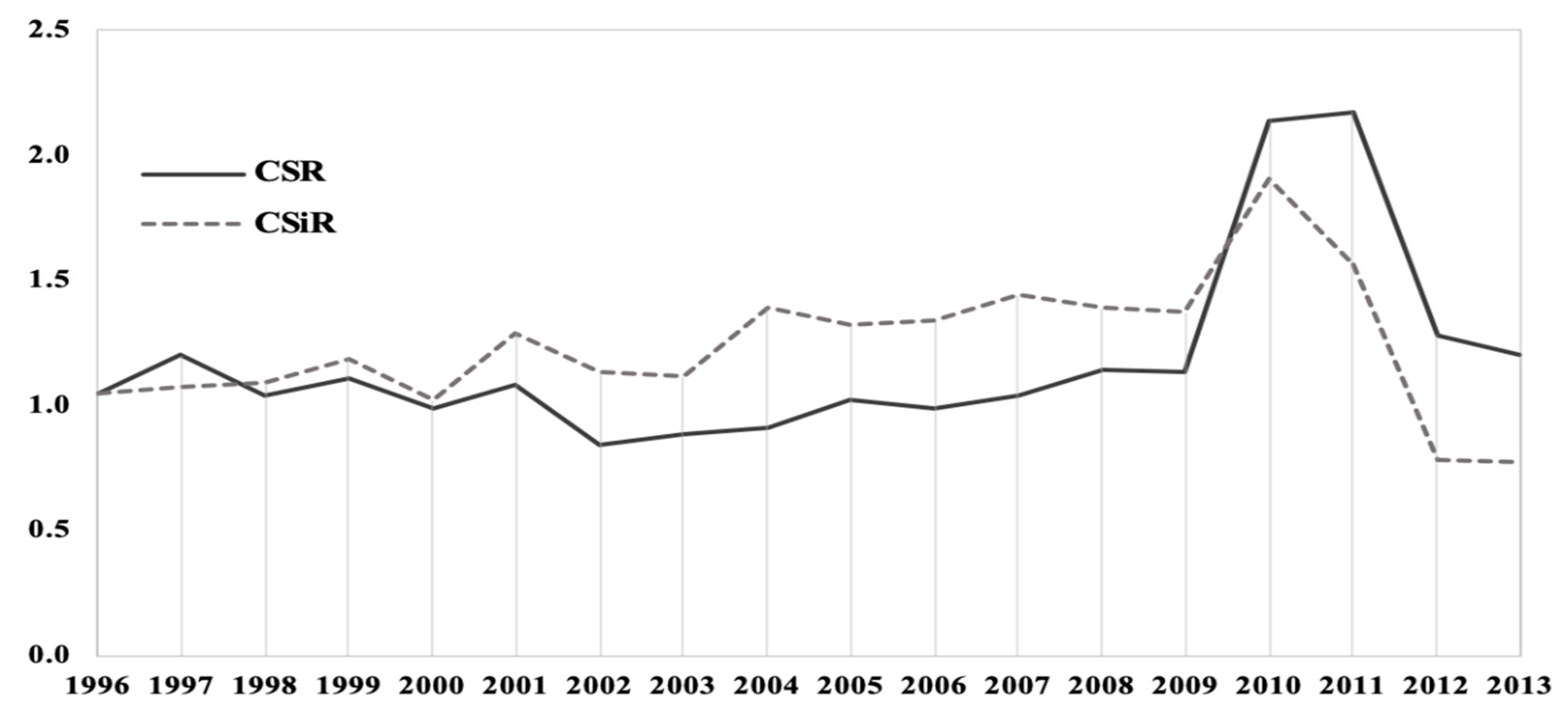

4] investigate the stock market’s impact on firms’ corporate socially irresponsible (hereafter, CSiR) events. While previous research explicitly indicates CSR and customer satisfaction as intangible assets that work in achieving a firm’s sustainable competitive advantage and higher performance. However, research regarding the impact of CSR, CSiR, customer satisfaction and their interaction on firm performance for a firm is relatively few. From an investment perspective, this paper investigates the relationship between CSR, CSiR, customer satisfaction and their interaction and stock returns.

In 2015, 92% of the world’s 250 largest companies released a CSR report to illustrate the importance that they attached to CSR activities. According to a recent special report in the Harvard Business Review [

5], Fortune Global 500 companies annually spend approximately US

$20 billion on socially responsible investment (SRI). SRI is becoming increasingly popular because of the increase in funds invested according to socially responsible criteria, constituting more than US

$11.6 trillion in assets under management in the Unites States in 2018. (

https://www.ussif.org/files/2018%20_Trends_OnePager_Overview(2).pdf) A recent survey indicated that a large majority of chief executive officers (CEOs) believe that CSR improves firm competitiveness and is crucial for a firm’s future success [

6]. CSR is a high-profile notion that has strategic importance to numerous companies. During the last two decades, the concept of CSR performance has become a mainstream preoccupation in the corporate world as well as the academic domain. The widespread practice of emphasizing CSR goals and multiple theoretical perspectives supporting a firm’s strategic emphases imply that empirical evidence on the CSR–performance relationship should consistently support a positive relationship [

7,

8,

9]. However, a qualitative review of the literature reveals that evidence of the CSR–performance relationship is relatively inconsistent [

10,

11,

12]. One reason for the conflicting findings on the CSR–performance relationship is the aggregation of CSR and corporate social irresponsibility (CSiR) into an overall measure by the majority of studies [

13,

14]. Another potential question to address before we proceed is this: do investors follow firms’ CSR or CSiR announcements?

CSR initiatives are a firm’s activities which aim to improve the wellbeing of stakeholders or society at large [

15]. By contrast, CSiR refers to a firm’s actions that negatively affect the welfare of stakeholders or society at large [

16]. Strike, Gao and Bansal [

17] and Lee, Oh and Kim [

18] indicate that a firm is likely to simultaneously engage in CSR and CSiR. For instance, Walmart has implemented fair labor practices in its foreign subsidiaries and suppliers; however, the Bangladeshi factories that produced goods for Walmart were found to have mistreated their workers [

19]. Lenz et al. [

13] decompose a firm’s CSR activities into CSR and CSiR activities and determine that a positive CSR–performance relationship is significantly attenuated by the existence of CSiR. Kim et al. [

14] demonstrate that CSR enhances firm value when a firm’s competitive action level is high, whereas CSiR improves firm performance when the competitive action level is low. However, studies have extensively used Tobin’s Q, a financial-market-based measure used as a proxy for firm performance, to examine the link between CSR activities and firm performance (for reviews of the literature, see [

8,

20]). Scholars have emphasized the theoretical relevance of Tobin’s Q as a financial determinant of investment behavior [

21]; however, the performance of investments such as asset expected returns is essential to the financial wellbeing of investors and thus affects their trading decisions [

22]. From an investment perspective, these results raise the intriguing question of whether CSR relates to a firm’s stock returns as it does to a firm’s Tobin’s Q.

From the market force perspective, Brønn and Vrioni [

23] indicate that strong CSR implies a powerful cause-related marketing tool that can enhance customer perceptions such as loyalty; strong CSR builds and shape a company’s reputation, thereby increasing profitability, and therefore, a firm’s CSR activities can be viewed as a form of reputation building or maintain [

24], and CSR strategies can be used to create a sustainable competitive advantage [

25]. The stakeholder theory literature also confirms the evidence of CEOs beliefs that CSR strategies can reinforce intangible assets such as reputation, contributing to a firm’s competitiveness and economic performance [

14,

20]. However, CSR addresses social objectives and stakeholders other than shareholders [

26], implying that firms’ intangible assets are developed through voluntary corporate actions instead of efforts regarding products or services. Researchers and managers have begun to examine which factors affect firms’ intangible assets, such as company reputation, and thus influence firm value. A rising strand of research shows that intangible values of firms in the form of customer satisfaction bring about significant benefit to stakeholders [

27,

28,

29]. In particular, customer value is on the mission statements of many large corporations (e.g., Amazon, TOYOTA and CISICO) and has become a sought-after source of competitive advantage. According to a resource-based view of the firm [

25], CSR strategies can be used to create sustainable competitive advantage. We posed the following question: if customer satisfaction is associated with firm value, can higher customer satisfaction facilitate (alleviate) the positive (negative) relationship between CSR (CSiR) and firm performance?

As mentioned above, there is a rich body of literature that examines the linkage between customer satisfaction and financial performance [

29,

30] or analyzes the influence of firms’ CSR and CSiR activities on firms’ value [

13,

14]. However, Luo and Bhattacharya [

7] conducted the first study investigating the potential relationship between CSR, customer satisfaction and firm performance. Because of data availability, they do not examine the potential negative effect of CSiR on firm performance. The relationship between CSR and firm performance is discovered to be amplified in firms with higher product quality. They conclude that a proper mix of internal corporate abilities such as customer satisfaction and external CSR initiatives are more likely to generate and sustain firm value. Surroca, Tribó and Waddock [

31] suggest that internal corporate capabilities such as customer satisfaction can moderate the relationships between CSR and market value. Based on a resource-based view of the firm, the present study relies on the insight of Luo and Bhattacharya [

7] that the impact of CSR on firm performance depends on the level of customer satisfaction. We expect that customer satisfaction may negatively affect the relationship between CSiR and firm stock return. Accordingly, the second goal of this study is to investigate whether CSR (CSiR) and customer satisfaction synergistically affect firms’ stock returns. Following the criteria of Kim et al. [

14], this study decomposes CSR initiatives into CSR and CSiR to investigate whether CSR, CSiR, customer satisfaction and the interactive effects between CSR (CSiR) and customer satisfaction influence stock returns.

The rest of this paper is organized as follows.

Section 2 presents the literature review and develops our research hypotheses from an investment perspective to reconcile our evidence.

Section 3 details the empirical models in this study.

Section 4 describes the data. This is followed by a discussion of the empirical results and managerial implications. Finally, the conclusions are presented.

5. Discussion and Conclusions

This study investigates whether CSR, CSiR, customer satisfaction and their interaction terms affect individual stock returns. Scholars have asserted that CSR helps a firm to acquire a competitive advantage over its competitors by building up its reputation and obtaining support from diverse stakeholders, thereby enhancing the firm’s financial performance. According to the United Nations-supported Principles for Responsible Investment (PRI) survey (the PRI survey is a survey of 1100 financial professionals, predominantly CFA members, around the world), the size of assets managed by institutions incorporated into environment, social and governance (ESG) factors has exceeded US

$86 trillion, and the number of institutions which had signed up to the PRI increased from 63 to more than 2370 companies between 2006 and 2018. Recent research has revealed that firms with higher CSR scores experienced less volatility [

71], as well as higher profitability, growth and sales per employee [

36], during the financial crisis. Despite the fact that an increasing number of studies have supported the positive effect on firms’ performance in an investment perspective, more and more portfolio managers and analysts have selected firms on the basis of CSR criteria [

72,

73] but have rarely adjusted their models based on ESG information. (Brzeszczyński and McIntosh [

10] and Statman, Fisher and Anginer [

38] report that investors are willing to sacrifice their investment returns if social benefits can be achieved through their investments. Bollen [

39] determines that investors have a multi-attribute utility function: they combine their investments’ social responsibility and return characteristics during their investment decision making.) Only 20% and 17% of the respondents believed that CSR factors such as environmental and social issues would affect their stock returns. This study obtains statistical evidence that financial markets in the United States earn rewards for CSR and are penalized for CSiR. Managers of firms can consider the potential implications of the results of this research and maintain or increase their resources on CSR activities to enhance their firms’ value.

CSR is a subject of increasing interest in business practice and marketing research, but we devote very little attention to the issue of corporate social irresponsibility [

13]. CSiR is a phenomenon that is encountered time and again. CSiR may involve intentional or unintentional CSiR. Intentional CSiR indicates behavior which violates the law and legal but irresponsible behavior (potential lack of morality and opportunism) on the part of the firm. An example of violation of law like Enron is the extreme case of intentional CSiR that entails the demise of a company, while the case of a fast food manufacturer engaging in advertising near primary schools is a kind of legal but irresponsible behavior. An example like the explosion at the BP Deepwater Horizon oil rig, which released over 130 million gallons of crude oil into the Gulf of Mexico, constitutes unintentional CSiR but the pollution incident harmed wildlife and the marine environment and temporarily resulted in more than 50% loss in BP’s stock price. In theory, public disclosure of CSiR may result in a variety of negative consequences for companies and attenuate firms’ sustainable competitive advantages. However, the market may not systematically reward firms’ actions that activate and advance social good, while it does consistently punish firms exposed to CSiR. Kim et al. [

14] find that firms’ CSiR improve firms’ Tobin’s Q when the competitive action level is low. In this study, we find that CSiR is significantly and negatively associated with firms’ stock returns. Investors do not appreciate firms that engage in n corporate social irresponsibility activities.

Higher customer satisfaction should increase loyalty, insulate the current market share from competitors, help to build a firm’s reputation, open the opportunity for new sources of revenue and increase investor recognition, and anticipated future cash flows should increase, boosting firm value and stock returns [

27,

47,

74,

75,

76]. Previous research has presented the idea that customer satisfaction as an intangible asset works in achieving a sustainable competitive advantage. Regarding the direct effect of customer satisfaction, using Aksoy et al.’s [

30] approach, the findings of this study are consistent with the marketing literature: higher customer satisfaction positively affects a firm’s stock returns [

20]. With regard to the interactive effects of CSR, CSiR and ACSI on a firm’s financial performance, we do not find a significant synergistic effect of CSR and ACSI on firm performance. However, our research shows evidence that the relationship between the synergistic effect of CSiR and ACSI is positive.

Our results suggest that our understanding of the ACSI mechanism is strongly enriched when firms encounter difficulties in a series of unfortunate events not deliberately inflicted by a corporation. This study makes two key contributions. Firstly, our evidence offers a novel understanding of the stock market effects of CSR, CSiR and the interaction between CSR (CSiR) and customer satisfaction to the growing literature on CSR. This understanding is essential for researchers, practitioners and investors considering the ongoing debate regarding whether investors benefit from SRI. For instance, a firm’s CSiR can be caused by unforeseen events such as an earthquake that could lead to the explosion of a power plant. This unintentional CSiR may entail a variety of negative consequence for the company value. Secondly, our results reveal that firms with higher customer satisfaction can undermine and reverse the negative effect of CSiR on their stock return. These findings are useful for management executives and investors. For firm managers, our findings can help them to allocate limited resources more efficiently to increase their customer satisfaction and then increase firm performance. From an investment perspective, investors can look to invest in firms with strong ACSI scores.