Implications of Energy Intensity Ratio for Carbon Dioxide Emissions in China

Abstract

1. Introduction

2. Data and Methods

2.1. Data Description

2.2. Methods

2.2.1. Energy Intensity Ratio (EIR) and Net Energy

2.2.2. Net Energy and Logarithmic Mean Divisia Index (LMDI)

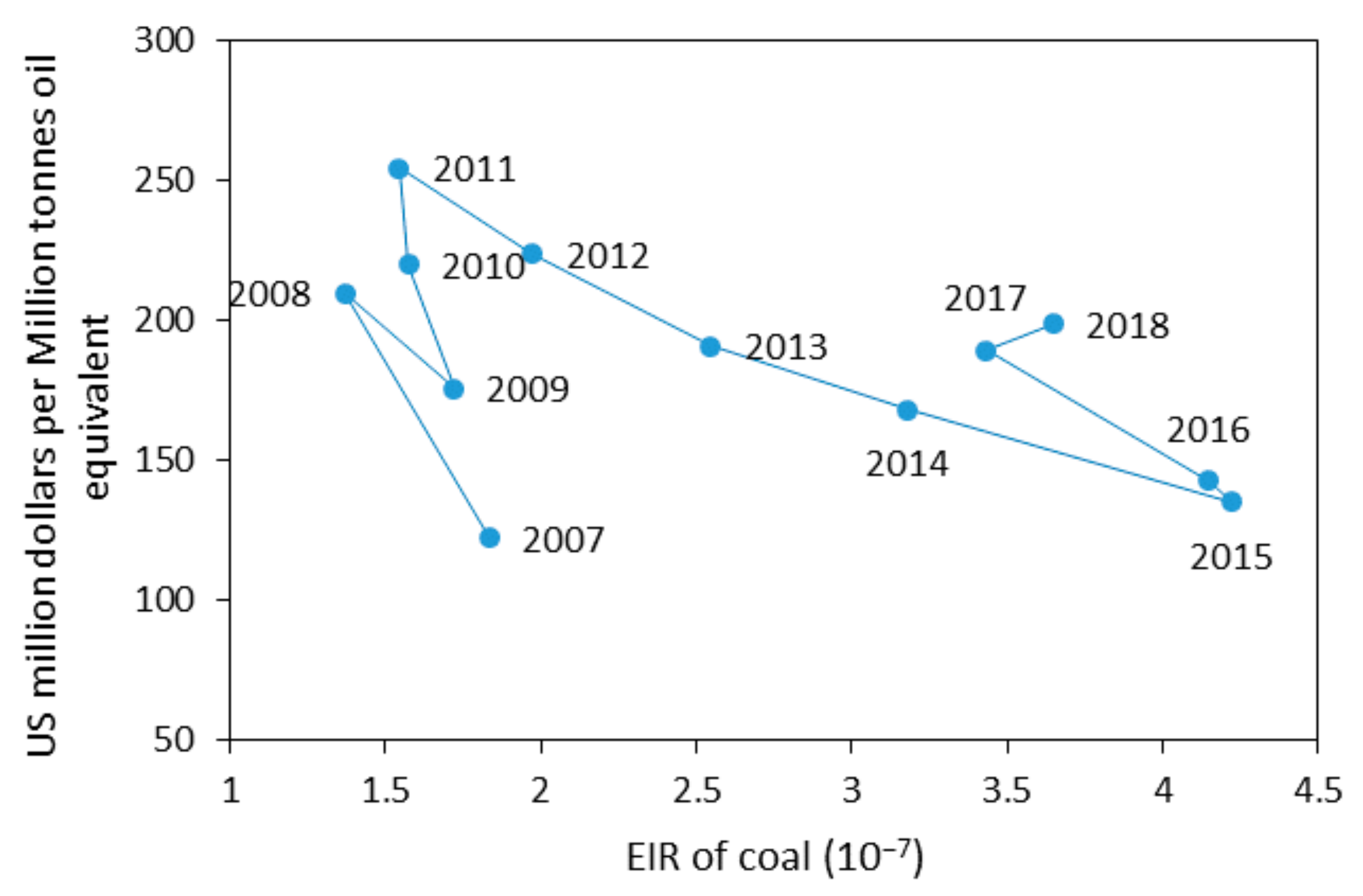

3. Results

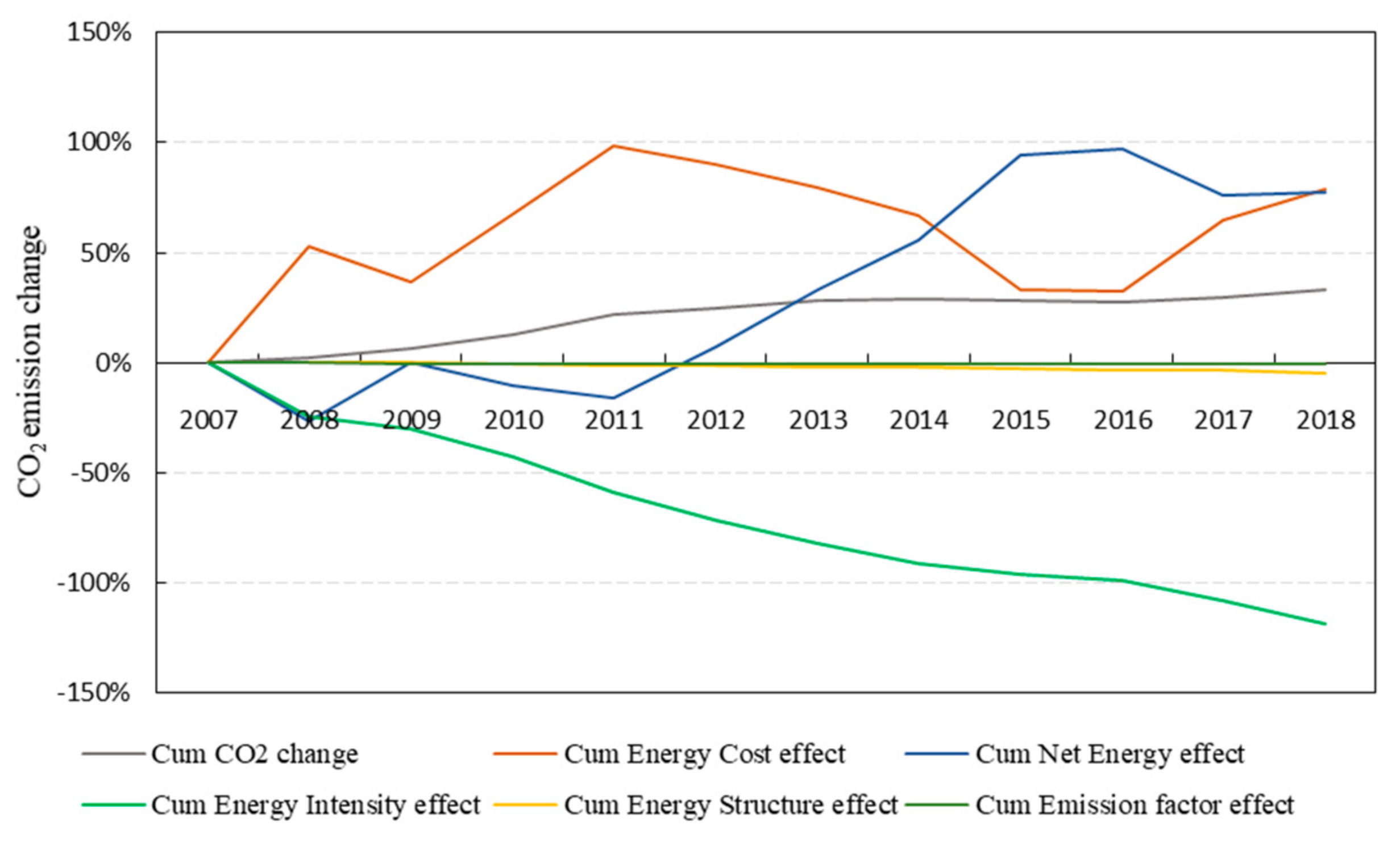

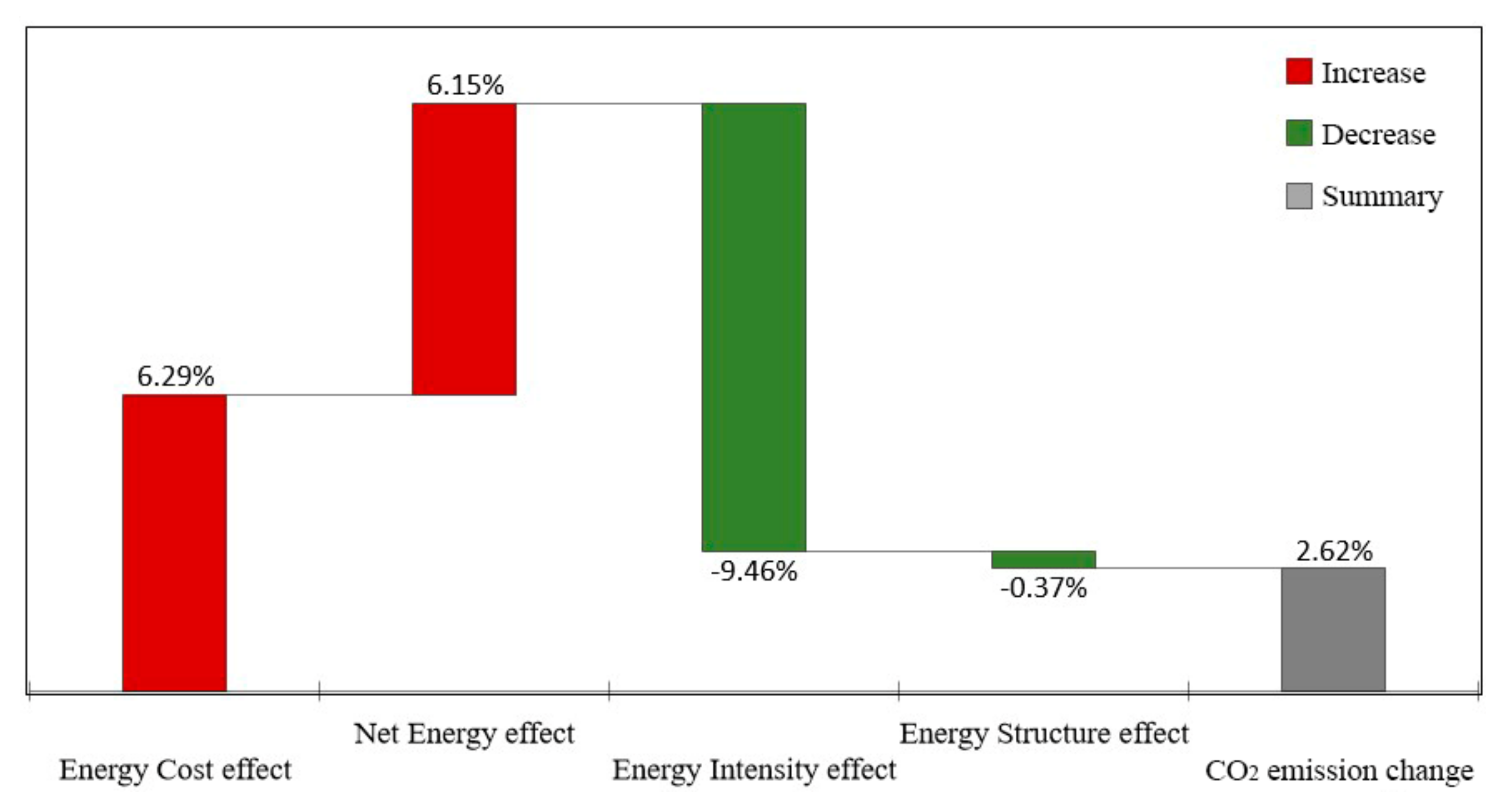

3.1. Net Energy Effect Gradually Becomes the Greatest Factor Driving the CO2 Emissions Up

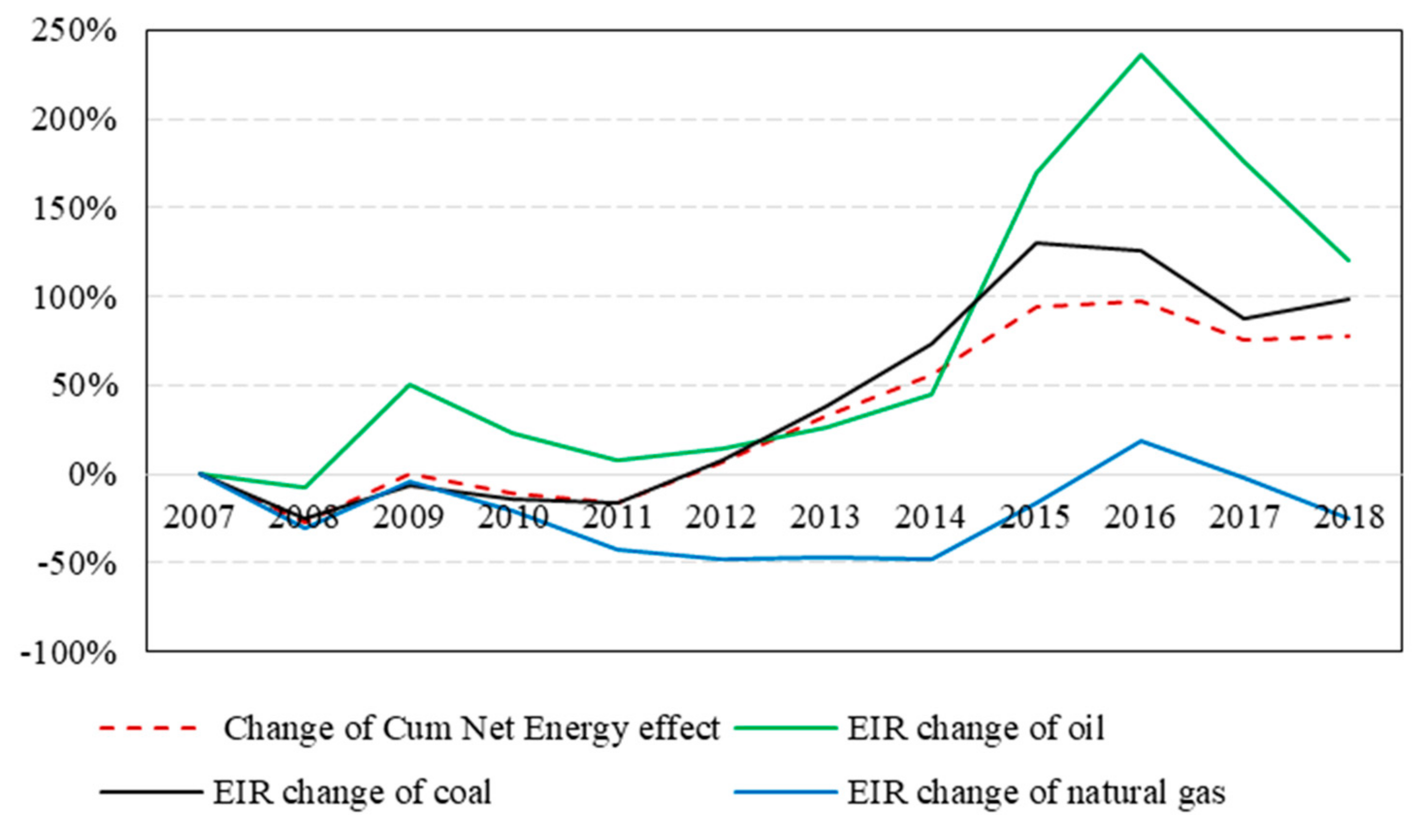

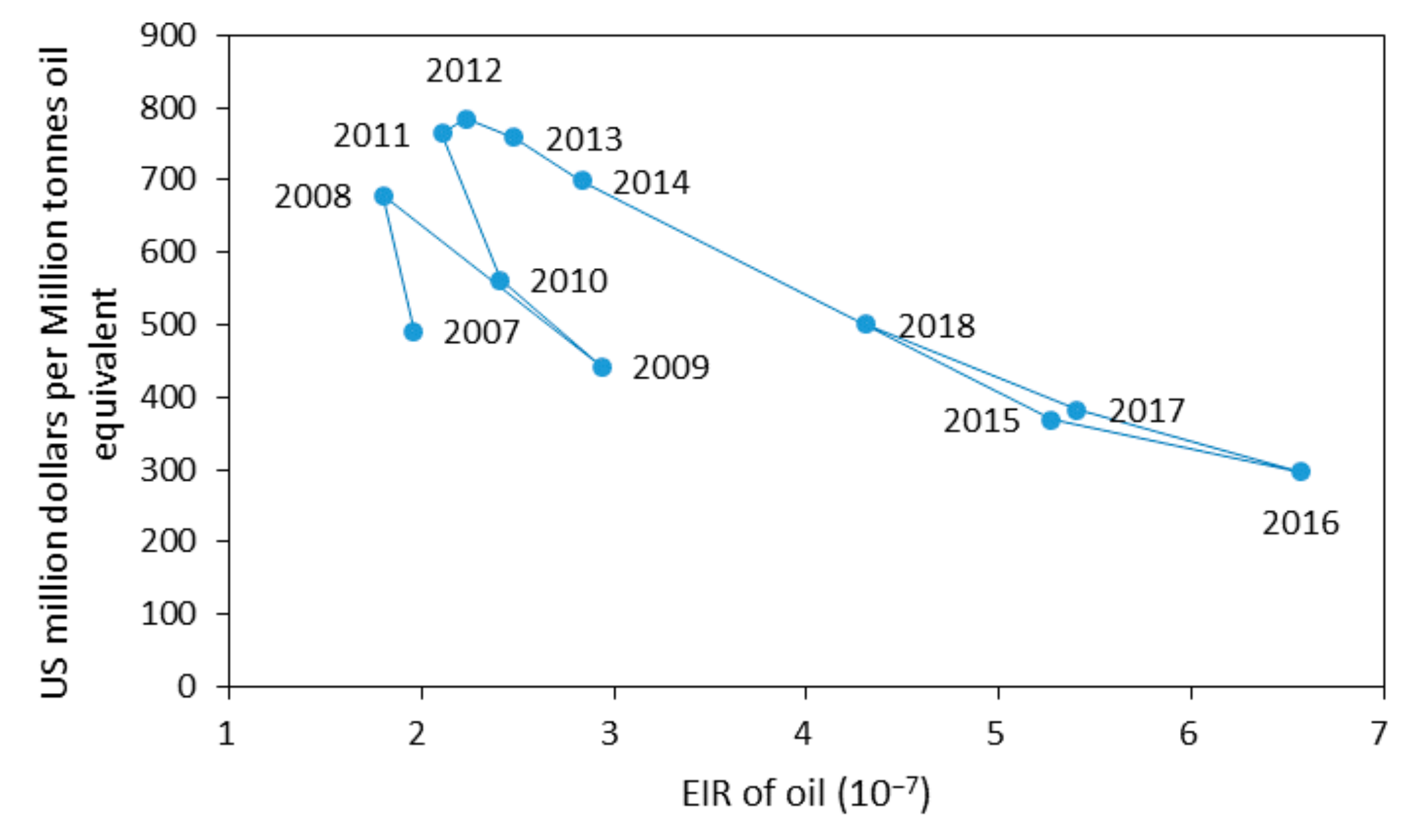

3.2. Two Mechanisms of Net Energy Effect

4. Discussion and Conclusions

4.1. Discussion

4.2. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Feleki, E.; Vlachokostas, C.; Moussiopoulos, N. Characterisation of sustainability in urban areas: An analysis of assessment tools with emphasis on european cities. Sustain. Cities Soc. 2018, 43, 563–577. [Google Scholar] [CrossRef]

- Li, G.; Zakari, A.; Tawiah, V. Energy resource melioration and CO2 emissions in China and Nigeria: Efficiency and trade perspectives. Resour. Policy 2020, 68, 101769. [Google Scholar] [CrossRef]

- Ortega-Ruiz, G.; Mena-Nieto, A.; García-Ramos, J.E. Is India on the right pathway to reduce CO2 emissions? Decomposing an enlarged Kaya identity using the LMDI method for the period 1990–2016. Sci. Total Environ. 2020, 737, 139638. [Google Scholar] [PubMed]

- Yang, J.; Cai, W.; Ma, M.; Li, L.; Liu, C.; MA, X.; Li, L.; Chen, X. Driving forces of China’s CO2 emissions from energy consumption based on Kaya-LMDI methods. Sci. Total Environ. 2020, 711, 134569. [Google Scholar] [CrossRef]

- Ang, B.W. LMDI decomposition approach: A guide for implementation. Energy Policy 2015, 86, 233–238. [Google Scholar] [CrossRef]

- Ang, B.W. The LMDI approach to decomposition analysis: A practical guide. Energy Policy 2005, 33, 867–871. [Google Scholar] [CrossRef]

- Paul, S.; Bhattacharya, R.N. CO2 emission from energy use in India: A decomposition analysis. Energy Policy 2004, 32, 585–593. [Google Scholar]

- Cai, R.-G.; Kim, S. First law of thermodynamics and Friedmann equations of Friedmann-Robertson-Walker universe. J. High Energy Phys. 2005, 2005, 050. [Google Scholar] [CrossRef]

- Gale, D. The law of supply and demand. Math. Scandin. 1955, 3, 155–169. [Google Scholar] [CrossRef]

- Odum, H.T. The energy ethic. (Book reviews: Environment, power, and society). Science 1971, 172, 664–666. [Google Scholar]

- Hall, C.A.; Cleveland, C.J. Petroleum drilling and production in the United States: Yield per effort and net energy analysis. Science 1981, 211, 576–579. [Google Scholar] [CrossRef] [PubMed]

- Cleveland, C.J.; Costanza, R.; Hall, C.A.S.; Kaufmann, R. Energy and the US economy: A biophysical perspective. Science 1984, 225, 890–897. [Google Scholar] [CrossRef] [PubMed]

- Ulgiati, S.; Brown, M.T. Monitoring patterns of sustainability in natural and man-made ecosystems. Ecol. Model. 1998, 108, 23–36. [Google Scholar] [CrossRef]

- Brown, J.H.; Burger, J.R.; Burnside, W.R.; Chang, M.; Davidson, A.D.; Fristoe, T.S.; Hamilton, M.J.; Hammond, S.T.; Kodric-Brown, A.; Mercado-Silva, N.; et al. Macroecology meets macroeconomics: Resource scarcity and global sustainability. Ecol. Eng. 2014, 65, 24–32. [Google Scholar] [CrossRef] [PubMed]

- Brown, J.H.; Burnside, W.R.; Davidson, A.D.; DeLong, J.P.; Dunn, W.C.; Hamilton, M.J.; Mercado-Silva, N.; Nekola, J.C.; Okie, J.G.; Woodruff, W.H.; et al. Energetic limits to economic growth. BioScience 2011, 61, 19–26. [Google Scholar] [CrossRef]

- Tainter, J. The Collapse of Complex Societies; Cambridge University Press: Cambridge, UK, 1988. [Google Scholar]

- Tainter, J.A. Energy, complexity, and sustainability: A historical perspective. Environ. Innov. Soc. Transitions 2011, 1, 89–95. [Google Scholar] [CrossRef]

- Tainter, J.A. Energy and existential sustainability: The role of reserve capacity. J. Environ. Account. Manag. 2013, 1, 213–228. [Google Scholar] [CrossRef]

- Kander, A.; Stern, D. Economic growth and the transition from traditional to modern energy in Sweden. Energy Econ. 2014, 46, 56–65. [Google Scholar] [CrossRef]

- Stern, D.I.; Kander, A.J. The role of energy in the industrial revolution and modern economic growth. Int. Assoc. Energy Econ. 2012, 33, 125–152. [Google Scholar] [CrossRef]

- Cleveland, C.J.; Kaufmann, R.K.; Stern, D.I. Aggregation and the role of energy in the economy. Ecol. Econ. 2000, 32, 301–317. [Google Scholar] [CrossRef]

- King, C.W.; Maxwell, J.P.; Donovan, A. Comparing world economic and net energy metrics, part 1: Single technology and commodity perspective. Energies 2015, 8, 12949–12974. [Google Scholar] [CrossRef]

- Kojima, M.; Bacon, R. Changes in CO2 Emissions from Energy Use: A multicountry Decomposition Analysis; World Bank Group: Washington, DC, USA, 2009. [Google Scholar]

- Azadeh, A.; Amalnick, M.S.; Ghaderi, S.F.; Asafzadeh, S.M. An integrated DEA PCA numerical taxonomy approach for energy efficiency assessment and consumption optimization in energy intensive manufacturing sectors. Enegy Ploicy 2007, 35, 3792–3806. [Google Scholar] [CrossRef]

- Misra, A.; Haydock, H. Energy Efficiency Policies and Measures in UK ODYSSEE-MURE 2012; AEA Technology Plc.: Harwell, UK, 2012. [Google Scholar]

- Tang, X.; Snowden, S.; Höök, M. Analysis of energy embodied in the international trade of UK. Energy Policy 2013, 57, 418–428. [Google Scholar] [CrossRef]

- Minx, J.C.; Baiochhi, G.; Wiedmann, T.; Barrett, J. Understanding Changes in UK CO2 Emissions 1992–2004: A Structural Decomposition Analysis; Stockholm Environment Institute and Durham Business School: London, UK, 2009. [Google Scholar]

- Ang, B.; Xu, X. Tracking industrial energy efficiency trends using index decomposition analysis. Energy Econ. 2013, 40, 1014–1021. [Google Scholar] [CrossRef]

- Hammond, G.; Norman, J. Decomposing Changes in the Energy Demand of UK Manufacturing. In 23rd International Conference on Efficiency, Cost, Optimization, Simulation and Environmental Impact of Energy (ECOS2010); Favrat, D., Marechal, F., Eds.; ECOS: Lausanne, Switzerland, 2010; pp. 395–402. [Google Scholar]

- Liu, F.; Ang, B. Eight methods for decomposing the aggregate energy-intensity of industry. Appl. Energy 2003, 76, 15–23. [Google Scholar] [CrossRef]

- Ang, B.; Huang, H.; Mu, A. Properties and linkages of some index decomposition analysis methods. Energy Polciy 2009, 37, 4624–4632. [Google Scholar] [CrossRef]

- Hoekstra, R.; Van den Bergh, J.C. Comparing structural decomposition analysis and index. Energy Econ. 2003, 25, 39–64. [Google Scholar] [CrossRef]

- Acemoglu, D.; Robinson, J.A. Why Nations Fail: The Origins of Power, Prosperity and Poverty; Crown Books; Crown Business: New York, NY, USA, 2012. [Google Scholar]

- Hall, C.A.S. Congratulations to Carey King. Environ. Res. Lett. 2012, 7, 011006. [Google Scholar] [CrossRef]

- King, C.W. Energy intensity ratios as net energy measures of United States energy production and expenditures. Environ. Res. Lett. 2010, 5, 044006. [Google Scholar] [CrossRef]

- Guilford, M.C.; Hall, C.A.S.; O’Connor, P.; Cleveland, C.J.; Connor, P.O. A new long term assessment of energy return on investment (EROI) for US oil and gas discovery and production. Sustainability 2011, 3, 1866–1887. [Google Scholar] [CrossRef]

- Cleveland, C.J. Net energy from the extraction of oil and gas in the United States. Energy 2005, 30, 769–782. [Google Scholar] [CrossRef]

- Ang, B.W. Decomposition analysis for policymaking in energy: Which is the preferred method? Energy Policy 2004, 32, 1131–1139. [Google Scholar] [CrossRef]

- King, C.W. An integrated biophysical and economic modeling framework for long-term sustainability analysis: The HARMONEY model. Ecol. Econ. 2020, 169, 106464. [Google Scholar] [CrossRef]

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chen, J.; Wen, S. Implications of Energy Intensity Ratio for Carbon Dioxide Emissions in China. Sustainability 2020, 12, 6925. https://doi.org/10.3390/su12176925

Chen J, Wen S. Implications of Energy Intensity Ratio for Carbon Dioxide Emissions in China. Sustainability. 2020; 12(17):6925. https://doi.org/10.3390/su12176925

Chicago/Turabian StyleChen, Jiabin, and Shaobo Wen. 2020. "Implications of Energy Intensity Ratio for Carbon Dioxide Emissions in China" Sustainability 12, no. 17: 6925. https://doi.org/10.3390/su12176925

APA StyleChen, J., & Wen, S. (2020). Implications of Energy Intensity Ratio for Carbon Dioxide Emissions in China. Sustainability, 12(17), 6925. https://doi.org/10.3390/su12176925