Dow Jones Sustainability Indices, Do They Make a Difference? The U.S. and the European Union Companies

Abstract

:1. Introduction

2. Literature Review and Research Goals

2.1. Studies on DJSI

2.2. Research Goals

- (1)

- To explore the relationship between the environmental regulations, market value, and sustainability and CSR strategies of the publicly traded EU and U.S. firms listed on the Dow Jones Sustainability Indices (DJSI).

- (2)

- To examine the impact of addition to or deletion from DJSI per different market sectors and the valuation of the firms by the investors.

3. Materials and Methods

3.1. Selected Years, 2015–2018

3.2. Selected Companies

3.3. Event Study and Cumulative Abnormal Returns (CAR) Regression Methodology

4. Results

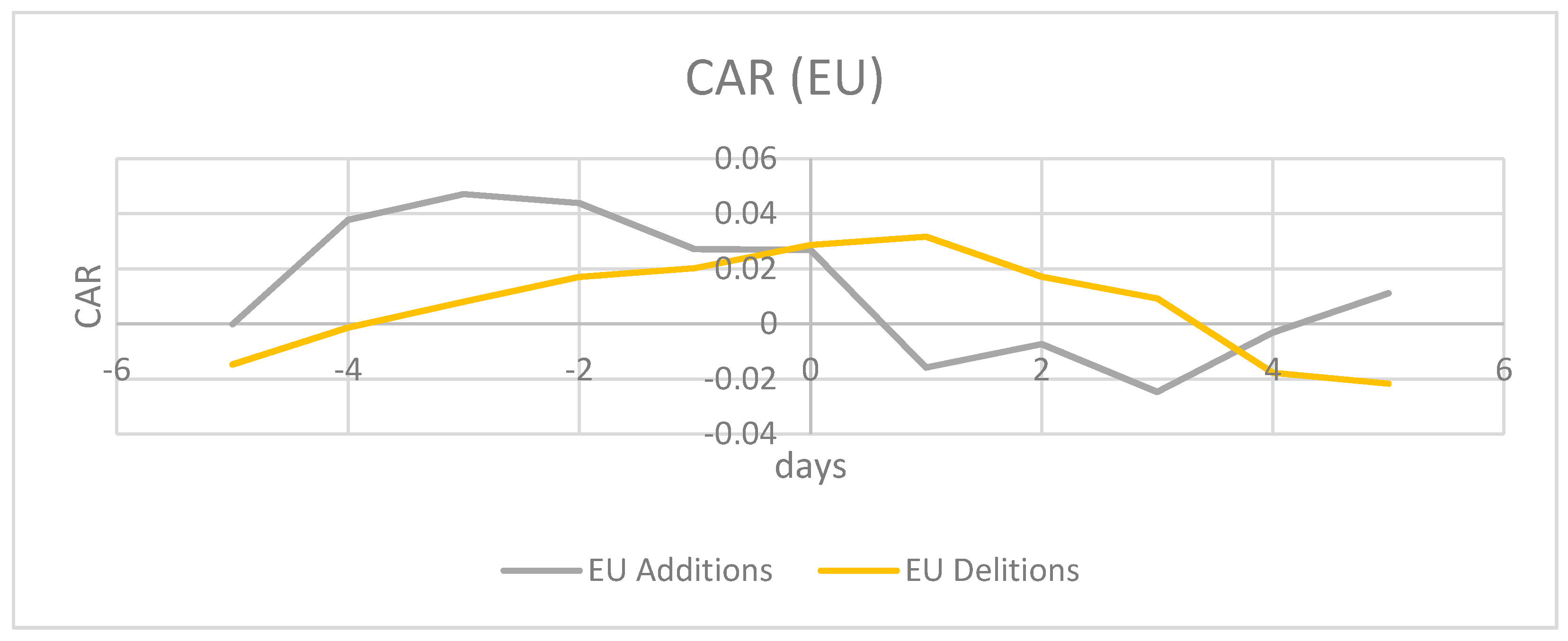

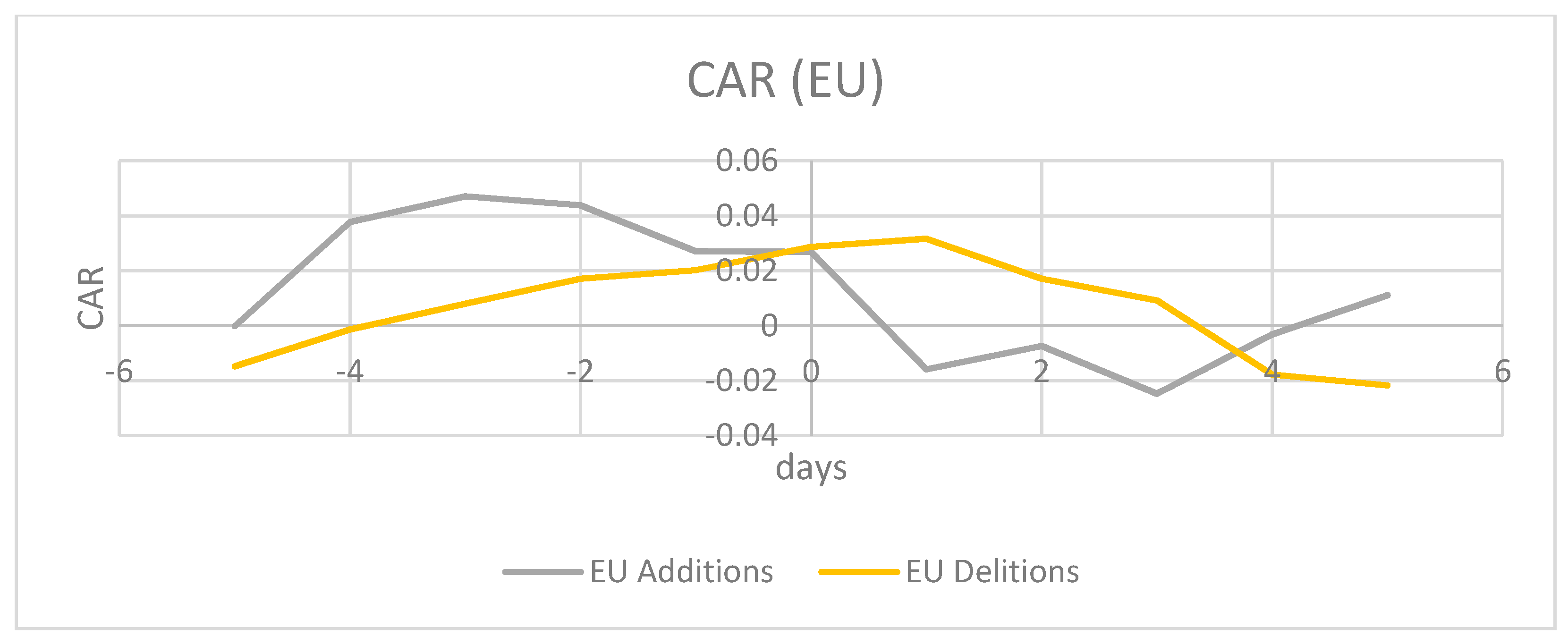

4.1. EU versus US Event Study

4.2. Regression Analysis

4.3. Market Value and Market Sector Regression Analysis

5. Discussion

6. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Searcy, C.; Elkhawas, D. Corporate sustainability ratings: An investigation into how corporations use the Dow Jones Sustainability Index. J. Clean. Prod. 2012, 35, 79–92. [Google Scholar] [CrossRef]

- RobecoSAM. 2018. Available online: https://www.robecosam.com/en/media/press-releases/2018/robecosam-publishes-the-sustainability-yearbook-2018.html (accessed on 27 June 2020).

- Elkington, J. Cannibals with Forks: The Triple Bottom Line of 21st Century Business; New Society Publishers: Gabriola Island, BC, Ganada, 1998. [Google Scholar]

- RobecoSAM. 2019. Available online: https://www.robecosam.com/csa/ (accessed on 27 June 2020).

- Dow Jones Sustainability North America Composite Index-S&P Dow Jones Indices. Available online: https://www.spglobal.com/spdji/en/indices/equity/dow-jones-sustainability-north-america-composite-index/#overview (accessed on 27 June 2020).

- Dow Jones Sustainability Europe Index-S&P Dow Jones Indices. Available online: https://www.spglobal.com/spdji/en/indices/equity/dow-jones-sustainability-europe-index/#overview (accessed on 27 June 2020).

- Ates, S. Membership of sustainability index in an emerging market: Implications for sustainability. J. Clean. Prod. 2020, 250, 119465. [Google Scholar] [CrossRef]

- Chang, D.-S.; Chen, D.-S.; Hsu, C.-W.; Hu, A.H. Identifying Strategic Factors of the Implantation CSR in the Airline Industry: The Case of Asia-Pacific Airlines. Sustainability 2015, 7, 7762–7783. [Google Scholar] [CrossRef] [Green Version]

- Cheung, A.W.K. Do Stock Investors Value Corporate Sustainability? Evidence from an Event Study. J. Bus. Ethics 2011, 99, 145–165. [Google Scholar] [CrossRef]

- Cheung, A.; Roca, E. The effect on price, liquidity and risk when stocks are added to and deleted from a sustainability index: Evidence from the Asia Pacific context. J. Asian Econ. 2013, 24, 51–65. [Google Scholar] [CrossRef] [Green Version]

- Durand, R.; Paugam, L.; Stolowy, H. Do investors actually value sustainability indices? Replication, development, and new evidence on CSR visibility. Strateg. Manag. J. 2019, 40, 1471–1490. [Google Scholar] [CrossRef]

- Gómez-Bezares, F.; Przychodzen, W. Corporate sustainability and shareholder wealth—Evidence from British companies and lessons from the crisis. Sustainability 2016, 8, 276. [Google Scholar] [CrossRef] [Green Version]

- Hawn, O.; Chatterji, A.K.; Mitchell, W. Do investors actually value sustainability? New evidence from investor reactions to the Dow Jones Sustainability Index (DJSI). Strateg. Manag. J. 2018, 39, 949–976. [Google Scholar] [CrossRef]

- Ioannou, I.; Serafeim, G. The impact of corporate social responsibility on investment recommendations: Analysts’ perceptions and shifting institutional logics. Strateg. Manag. J. 2015, 36, 1053–1081. [Google Scholar] [CrossRef] [Green Version]

- Lee, H.S.; Kim, I.; Hun, C. Who Values Corporate Social Responsibility in the Korean Stock Market? Sustainability 2019, 11, 5924. [Google Scholar] [CrossRef] [Green Version]

- López, M.V.; Garcia, A.; Rodriguez, L. Sustainable Development and Corporate Performance: A Study Based on the Dow Jones Sustainability Index. J. Bus. Ethics 2007, 75, 285–300. [Google Scholar] [CrossRef]

- Oberndorfer, U.; Schmidt, P.; Wagner, M.; Ziegler, A. Does the stock market value the inclusion in a sustainability stock index? An event study analysis for German firms. J. Environ. Econ. Manag. 2013, 66, 497–509. [Google Scholar] [CrossRef] [Green Version]

- Robinson, M.; Kleffner, A.; Bertels, S. Signaling Sustainability Leadership: Empirical Evidence of the Value of DJSI Membership. J. Bus. Ethics 2011, 101, 493–505. [Google Scholar] [CrossRef]

- Santis, P.; Albuquerque, A.; Lizarell, F. Do sustainable companies have a better financial performance? A study on Brazilian public companies. J. Clean. Prod. 2016, 133, 735–745. [Google Scholar] [CrossRef]

- Sharkey, A.J.; Bromley, P. Can Ratings Have Indirect Effects? Evidence from the Organizational Response to Peers’ Environmental Ratings. Am. Sociol. Rev. 2014, 80, 63–91. [Google Scholar] [CrossRef]

- Su, C.H.; Chen, C.D. Does sustainability index matter to the hospitality industry? Tour. Manag. 2020, 81. [Google Scholar] [CrossRef]

- Waddock, S.; Graves, S. The corporate social Perfromace-Financial perfromance link. Strateg. Manag. J. 1997, 18, 303–319. [Google Scholar] [CrossRef]

- Yilmaz, M.K.; Aksoy, M.; Tatoglu, E. Does the stock market value inclusion in a sustainability Index? Evidence from Borsa Istanbul. Sustainability 2020, 12, 483. [Google Scholar] [CrossRef] [Green Version]

- Zhao, X.; Murrell, A.J. Revisiting the corporate social performance-financial performance link: A replication of Waddock and Graves. Strateg. Manag. J. 2016, 37, 2378–2388. [Google Scholar] [CrossRef]

- EU. 2050 Long-Term Strategy. Available online: https://ec.europa.eu/clima/policies/strategies/2050_en/ (accessed on 27 June 2020).

- The Paris Agreement. Available online: https://climatefocus.com/sites/default/files/20151228%20COP%2021%20briefing%20FIN.pdf (accessed on 27 June 2020).

- EU. Food Waste. Available online: https://ec.europa.eu/food/safety/food_waste_en/ (accessed on 27 June 2020).

- Chung, D.Y.; Hrazdil, K.; Novak, J.; Suwanyangyuan, N. Does the large amount of information in corporate disclosures hinder or enhance price discovery in the capital market? J. Contemp. Account. Econ. 2019, 15, 36–52. [Google Scholar] [CrossRef]

- Chai, S.; Kim, M.; Rao, H.R. Firms’ information security investment decisions: Stock market evidence of investors’ behavior. Decis. Support. Syst. 2011, 50, 651–661. [Google Scholar] [CrossRef]

- Chan, W.S. Stock price reaction to news and no-news: Drift and reversal after headlines. J. Financ. Econ. 2003, 70, 223–260. [Google Scholar] [CrossRef]

- MacKinlay, A.C. Event Studies in Economics and Finance. J. Econ. Lit. 1997, 35, 13–39. [Google Scholar]

- Sorescu, A.; Warren, N.L.; Ertekin, L. Event study methodology in the marketing literature: An overview. J. Acad. Mark. Sci. 2017, 45, 186–207. [Google Scholar] [CrossRef]

- Kothari, S.P.; Warner, J.B. The econometrics of event studies. SSRN Electron. J. 2004. [Google Scholar] [CrossRef]

- Brown, S.J.; Warner, J.B. Measuring security price performance. J. Financ. Econ. 1980, 8, 205–258. [Google Scholar] [CrossRef]

- Brown, S.; Warner, J.B. Using daily stock returns: The case of event studies. J. Financ. Econ. 1985, 14, 3–31. [Google Scholar] [CrossRef]

- Campbell, J.Y.; Lo, A.W.; MacKinlay, A.C. Event-Study Analysis. In The Econometrics of Financial Markets; Princeton University Press: Princeton, NJ, USA, 1997; pp. 149–180. [Google Scholar] [CrossRef]

- Fuji, H.; Managi, S. Economic development and multiple air pollutant emissions from the industrial sector. Environ. Sci. Pollut. Res. 2016, 23, 2802–2812. [Google Scholar] [CrossRef]

- Rehfeldt, M.; Worrell, E.; Eichhammer, E.; Fleiter, T. A review of the emission reduction potential of fuel switch towards biomass and electricity in European basic materials industry until 2030. Renew. Sustain. Energy Rev. 2020, 120, 109672. [Google Scholar] [CrossRef]

- Fuji, H.; Managi, S. Which industry is greener? An empirical study of nine industries in OECD countries. Energy Policy 2013, 57, 381–388. [Google Scholar] [CrossRef] [Green Version]

- Shen, W.; Liu, Y.; Yan, B.; Wang, J.; He, P.; Zhou, C.; Huo, X.; Zhang, W.; Xu, G.; Ding, Q. Cement industry of China: Driving force, environment impact and sustainable development. Renew. Sustain. Energy Rev. 2017, 75, 618–628. [Google Scholar] [CrossRef]

- Renaud, J.; Bart, T. Oil Company Total Faces Historic Legal Action in France for Human Rights and Environmental Violations in Uganda. 2020. Available online: https://www.foei.org/news/total-legal-action-france-human-rights-environment-uganda (accessed on 27 June 2020).

- Dive, U. Fossil Fuels on Trial: New York’s Lawsuit Against Exxon Begins. Available online: https://oglinks.news/exxonmobil/news/fossil-fuels-trial-new-yorks-lawsuit-exxon-begins (accessed on 27 June 2020).

- Cruden, J.C.; O’Rourke, S.; Himmelhoch, S.D. The Deepwater Horizon oil spill litigation: Proof of concept for the manual for complex litigation and the 2015 amendments to the Federal Rules of Civil Procedure. Mich. J. Environ. Adm. Law 2016, 6, 65. [Google Scholar]

| Additions—Number of Firms | Deletions—Number of Firms | ||||||

|---|---|---|---|---|---|---|---|

| Year | EU | U.S. | Total | Year | EU | U.S. | Total |

| 2015–2018 | 29 | 28 | 57 | 2015–2018 | 31 | 24 | 55 |

| 2015 | 8 | 6 | 14 | 2015 | 7 | 7 | 14 |

| 2016 | 8 | 7 | 15 | 2016 | 5 | 6 | 11 |

| 2017 | 6 | 7 | 13 | 2017 | 10 | 6 | 16 |

| 2018 | 7 | 8 | 15 | 2018 | 9 | 5 | 14 |

| EU Additions | 2015 | U.S. Additions |

| BNP Paribas SA France | General Motors Co | |

| Societe Gernerale SA France | Goldman Sachs | |

| Sanofi France | Bristol-Myers Squibb Co | |

| Vinci SA France | Ecolab Inc | |

| GDF Suez France | Bank of America Group | |

| Deutsche Telecom Germany | Proctor and Gamble Co | |

| Telefonica SA Spain | ||

| BHP Billiton PLC UK | ||

| EU Additions | 2016 | U.S. Additions |

| Novo Nordisk A/S Denmark | PepsiCo Inc | |

| Nokia OYJ Finland | Merck and Co Inc | |

| TOTAL SA France | Allergan Plc | |

| Essilor Intl SA France | Schlumberger Ltd. | |

| Henkel AG and Co Germany | Adobe Systems Inc | |

| E.ON SE Germany | Cisco Systems Inc | |

| Iberdrola SA Spain | Reynolds American Inc | |

| Royal Dutch Shell Plc. Netherlands | ||

| EU Additions | 2017 | U.S. Additions |

| Capgemini SA France | Visa Inc | |

| Henkel AG and Co Germany | Cigna Corp | |

| Compass Group Plc. UK | Comcast Corp | |

| CRH Plc. Ireland | AT and T Inc | |

| ASML Holding NV Netherlands | Altria Group Inc | |

| British American Tobacco UK | General Motors Co | |

| Colgate-Palmolive Co | ||

| EU Additions | 2018 | U.S. Additions |

| Siemens AG Germany | MasterCard Inc | |

| STMicoelectronics Italy | Johnson and Johnson | |

| Assicurazioni Generali Italy | Schlumberger Ltd. | |

| Banco Bilbao Spain | Salesforce.com Inc | |

| Essily AB Sweden | Anthem Inc | |

| RELX Plc. UK | General Mills Inc | |

| Diageo Plc. UK | Sempra Energy | |

| Waste Management Inc |

| EU Deletions | 2015 | U.S. Deletions |

| Novo Nordisk A/S Denmark | United Technologies Corp | |

| Total SA France | Ford Motor Co | |

| Siemens Germany | PepsiCo Inc | |

| Henkel AG and Co Germany | Air Products and Chemical Inc | |

| UniCredit SPA Italy | Schlumberger Ltd. | |

| Diageo Plc UK | Waste Management Inc | |

| Experian Plc | UK | |

| EU Deletions | 2016 | U.S. Deletions |

| Eni SpA Italy | EMC Corp | |

| Banco Bilbao Spain | Target Corp | |

| WPP Plc UK | Spectra Energy Corp | |

| ARM Holdings Plc UK | Allstate Corp | |

| BT Group Plc UK | Halliburton Co | |

| British American Tobacco UK | Baker Hughes Inc | |

| Exxon Mobil Corp | ||

| Intl Corp | ||

| EU Deletions | 2017 | U.S. Deletions |

| Novo Nordisk A/S Denmark | Johnson and Johnson | |

| Sanofi France | Cardinal Health Inc | |

| Vinci SA France | Schlumberger Ltd. | |

| Cie Generale des Est France | Halliburton Co | |

| BASF SE Germany | Autodesk Inc | |

| E. ON SE Germany | Waste Management | |

| BAE Systems Plc UK | ||

| Recitt Benckiser Gr UK | ||

| Rio Tinto Plc UK | ||

| RELX Plc UK | ||

| EU Deletions | 2018 | U.S. Deletions |

| BNP Paribas SA France | PepsiCo Inc | |

| Dassault Systems Se France | Morgan Stanley | |

| BASF AG Germany | Merck and Co | |

| Henke AG and Co Germany | Humana Inc | |

| Telefonica SA Spain | Altria Group Inc | |

| Barclays Plc UK | ||

| Anglo American Plc UK | ||

| Compass Group Plc UK |

| Additions—Market Sectors | Total = 57 | Deletions—Market Sectors | Total = 55 |

|---|---|---|---|

| Industrials | 3 | Industrials | 7 |

| Basic Materials | 3 | Basic Materials | 5 |

| Financial Services | 8 | Financial Services | 6 |

| Technology | 7 | Technology | 4 |

| Consumer Defense | 11 | Conumser Defense | 9 |

| Consumer Cyclical | 3 | Consumer Cyclical | 3 |

| Healthcare | 9 | Healthcare | 8 |

| Energy | 4 | Energy | 8 |

| Communication Services | 5 | Communication Services | 4 |

| Utilities | 4 | Utilities | 1 |

| U.S. Additions | U.S. Deletions | EU Additions | EU Deletions | |

|---|---|---|---|---|

| n = 29 | n = 25 | n = 22 | n = 34 | |

| Day | Cumulative Abnormal Return | |||

| −5 | −0.0182475 | −0.0208032 | −0.0001171 | −0.0147359 |

| −4 | 0.0125626 | −0.0101438 | 0.0377317 | −0.0013163 |

| −3 | −0.0036320 | −0.0364558 | 0.0471392 | 0.0080623 |

| −2 | 0.0059064 | −0.0387933 | 0.0438605 | 0.0170888 |

| −1 | 0.0055572 | −0.0705078 | 0.0270714 | 0.0202253 |

| 0 | 0.0011186 | −0.1069450 | 0.0268761 | 0.0286871 |

| 1 | 0.0228153 | −0.1385233 | −0.0158339 | 0.0316696 |

| 2 | 0.0241182 | −0.1283157 | −0.0073473 | 0.0171266 |

| 3 | −0.0051642 | −0.1448410 | −0.0247007 | 0.0092496 |

| 4 | −0.0229824 | −0.1362925 | −0.0031249 | −0.0177682 |

| 5 | −0.0141983 | −0.1451793 | 0.0110849 | −0.0217336 |

| Variables | CAR (0, 2) Estimate | p Value | CAR (−5, 5) Estimate | p Value |

|---|---|---|---|---|

| Log (Total Assets) | 0.001 | 0.550 | 0.006 | 0.139 |

| Return on Assets | 0.029 | 0.312 | 0.015 | 0.779 |

| Market to Book | 0.000 | 0.649 | 0.000 | 0.638 |

| Financial Leverage | 0.000 | 0.398 | 0.000 | 0.560 |

| Tobin’s Q | −0.003 | 0.304 | 0.000 | 0.913 |

| Indictor (Addition = 1) | −0.005 | 0.360 | 0.005 | 0.634 |

| Indicator (U.S. = 1)) | 0.012 * | 0.066 | 0.007 | 0.531 |

| Interaction Variable (U.S. = 1) × (Addition = 1) | 0.003 | 0.761 | −0.017 | 0.291 |

| Variables | CAR (0, 2) Estimate | p Value | CAR (−5, 5) Estimate | p Value |

| Log (Total Assets) | 0.003 | 0.18 | 0.006 | 0.15 |

| Return on Assets | 0.014 | 0.65 | 0.001 | 0.98 |

| Market to Book | 0.000 | 0.27 | 0.000 | 0.61 |

| Financial Leverage | −0.001 * | 0.10 | −0.001 | 0.50 |

| Tobin’s Q | −0.001 | 0.72 | −0.001 | 0.78 |

| Indictor (Addition = 1) | −0.001 | 0.77 | −0.002 | 0.84 |

| Indicator (Energy. = 1)) | 0.008 | 0.39 | −0.003 | 0.87 |

| Interaction Variable (Energy = 1) × (Add. = 1) | −0.028 * | 0.06 | −0.017 | 0.54 |

| Variables | CAR (0, 2) Estimate | p Value | CAR (−5, 5) Estimate | p Value |

| Log (Total Assets) | 0.003 | 0.26 | 0.006 | 0.15 |

| Return on Assets | 0.010 | 0.72 | 0.011 | 0.84 |

| Market to Book | 0.000 | 0.31 | 0.000 | 0.72 |

| Financial Leverage | −0.001 | 0.11 | 0.000 | 0.63 |

| Tobin’s Q | −0.001 | 0.78 | −0.001 | 0.90 |

| Indictor (Addition = 1) | −0.004 | 0.42 | −0.003 | 0.73 |

| Indicator (Industrials. = 1)) | −0.001 | 0.92 | 0.005 | 0.76 |

| Interaction Variable (Industrials = 1) × (Add. = 1) | −0.004 | 0.83 | 0.009 | 0.78 |

| Variables | CAR (0, 2) Estimate | p Value | CAR (−5, 5) Estimate | p Value |

| Log (Total Assets) | 0.002 | 0.31 | 0.005 | 0.21 |

| Return on Assets | 0.007 | 0.79 | 0.006 | 0.91 |

| Market to Book | 0.000 | 0.32 | 0.000 | 0.76 |

| Financial Leverage | −0.001 | 0.10 | 0.000 | 0.65 |

| Tobin’s Q | −0.001 | 0.76 | −0.001 | 0.85 |

| Indictor (Addition = 1) | −0.001 | 0.75 | 0.002 | 0.85 |

| Indicator (Basic Mat. = 1)) | 0.011 | 0.32 | 0.028 | 0.16 |

| Interaction Variable (Basic Mat. = 1) × (Add. = 1) | −0.035 ** | 0.05 | −0.058 * | 0.07 |

| Variables | CAR (0, 2) Estimate | p Value | CAR (−5, 5) Estimate | p Value |

| Log (Total Assets) | 0.003 | 0.25 | 0.004 | 0.36 |

| Return on Assets | 0.013 | 0.64 | 0.008 | 0.88 |

| Market to Book | 0.000 | 0.35 | 0.000 | 1.00 |

| Financial Leverage | −0.001 | 0.15 | 0.000 | 0.89 |

| Tobin’s Q | −0.001 | 0.72 | −0.003 | 0.56 |

| Indictor (Addition = 1) | −0.005 | 0.25 | −0.001 | 0.86 |

| Indicator (Utilitiies = 1)) | −0.058 ** | 0.01 | −0.085 ** | 0.04 |

| Interaction Variable (Utilities = 1) × (Add. = 1) | 0.063 ** | 0.02 | 0.052 | 0.27 |

| Variables | CAR (0, 2) | p Value | CAR (−5, 5) | p Value |

|---|---|---|---|---|

| Log (Total Assets) | 0.002 | 0.37 | 0.005 | 0.29 |

| Return on Assets | 0.005 | 0.87 | 0.001 | 0.99 |

| Market to Book | 0.000 | 0.32 | 0.000 | 0.72 |

| Financial Leverage | −0.001 | 0.13 | 0.000 | 0.69 |

| Tobin’s Q | −0.002 | 0.54 | −0.003 | 0.57 |

| Indictor (Addition = 1) | 0.001 | 0.87 | 0.005 | 0.62 |

| Indicator (Sector group A = 1) | 0.003 | 0.67 | 0.004 | 0.72 |

| Interaction Variable (Group A = 1) × (Addition = 1) | −0.017 * | 0.08 | −0.026 | 0.14 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Schmutz, B.; Tehrani, M.; Fulton, L.; Rathgeber, A.W. Dow Jones Sustainability Indices, Do They Make a Difference? The U.S. and the European Union Companies. Sustainability 2020, 12, 6785. https://doi.org/10.3390/su12176785

Schmutz B, Tehrani M, Fulton L, Rathgeber AW. Dow Jones Sustainability Indices, Do They Make a Difference? The U.S. and the European Union Companies. Sustainability. 2020; 12(17):6785. https://doi.org/10.3390/su12176785

Chicago/Turabian StyleSchmutz, Bryan, Minoo Tehrani, Lawrence Fulton, and Andreas W. Rathgeber. 2020. "Dow Jones Sustainability Indices, Do They Make a Difference? The U.S. and the European Union Companies" Sustainability 12, no. 17: 6785. https://doi.org/10.3390/su12176785