Has China’s Belt and Road Initiative Intensified Bilateral Trade Links between China and the Involved Countries?

Abstract

:1. Introduction

2. Literature Review

3. Dynamics of Bilateral Trade Preferentiality between China and Belt-Road Countries

3.1. Measuring Bilateral Trade Preferentiality

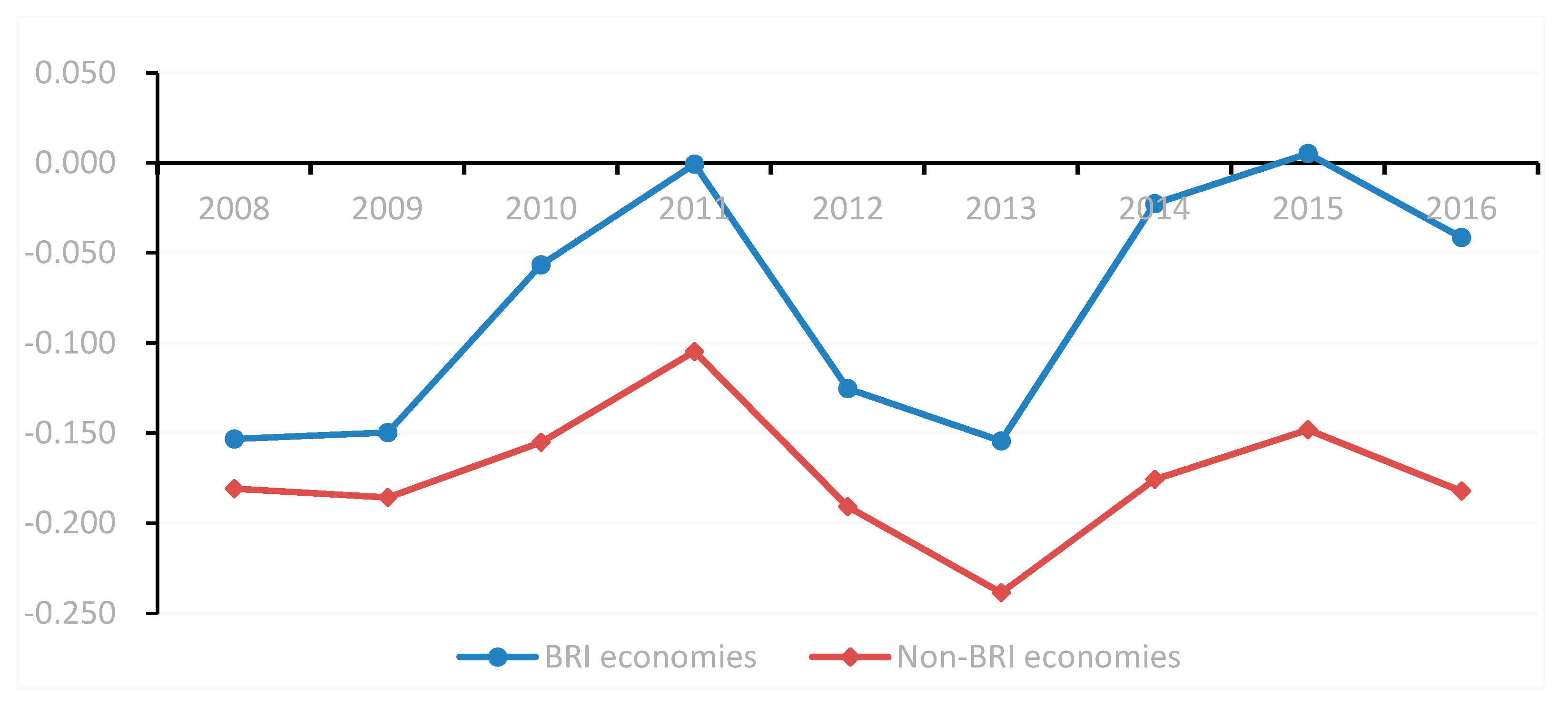

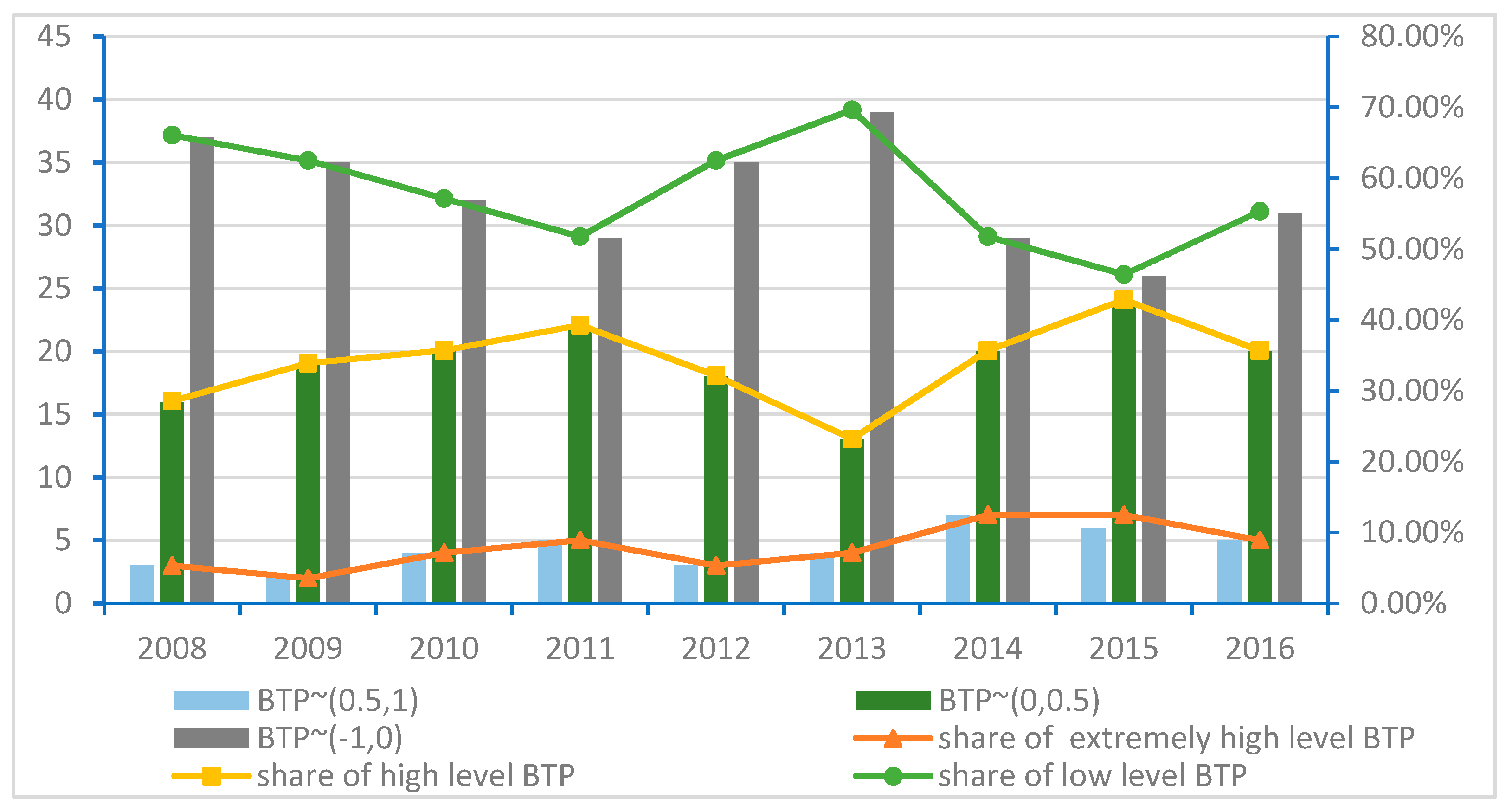

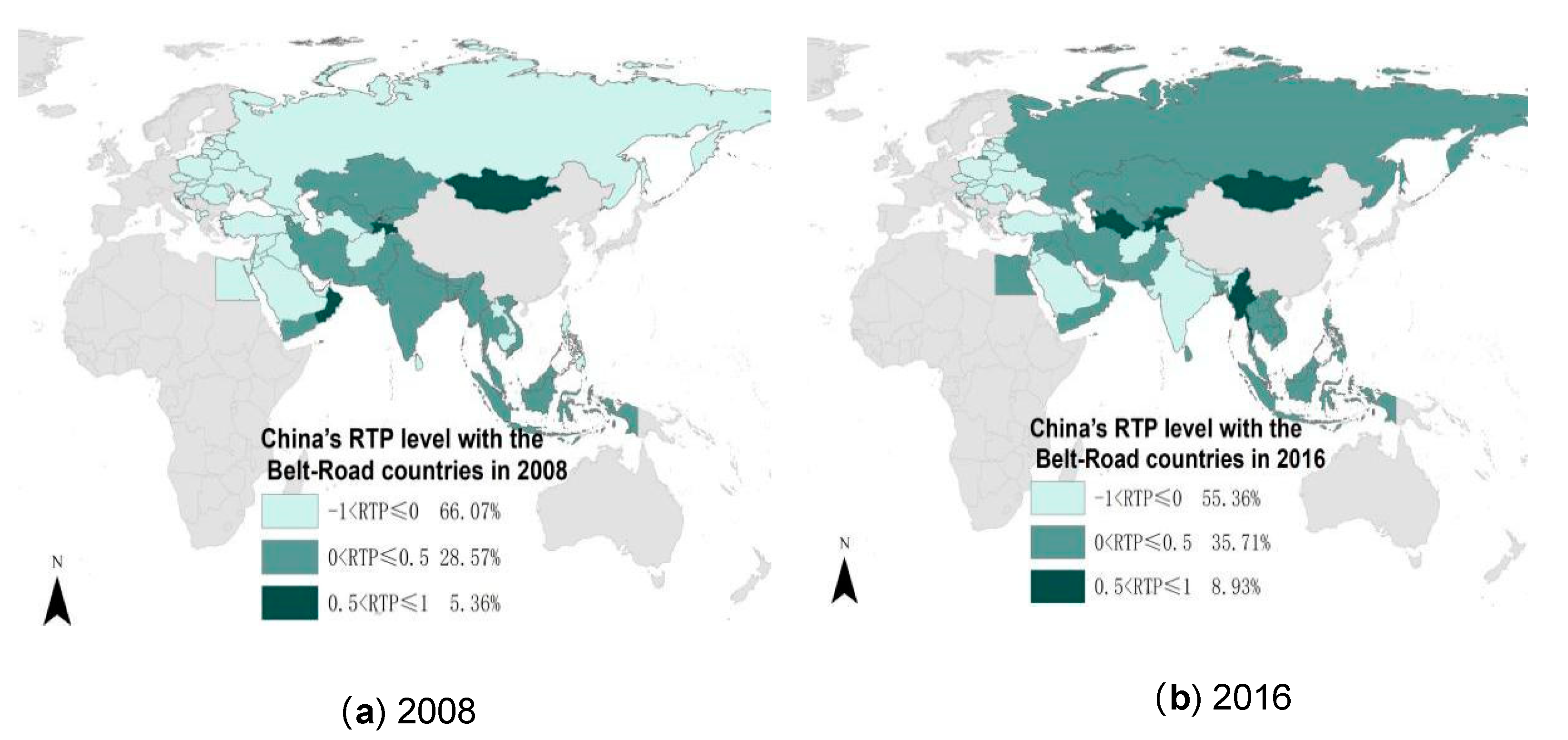

3.2. The Dynamics of Bilateral Preferential Trade Links between China and Belt-Road Countries

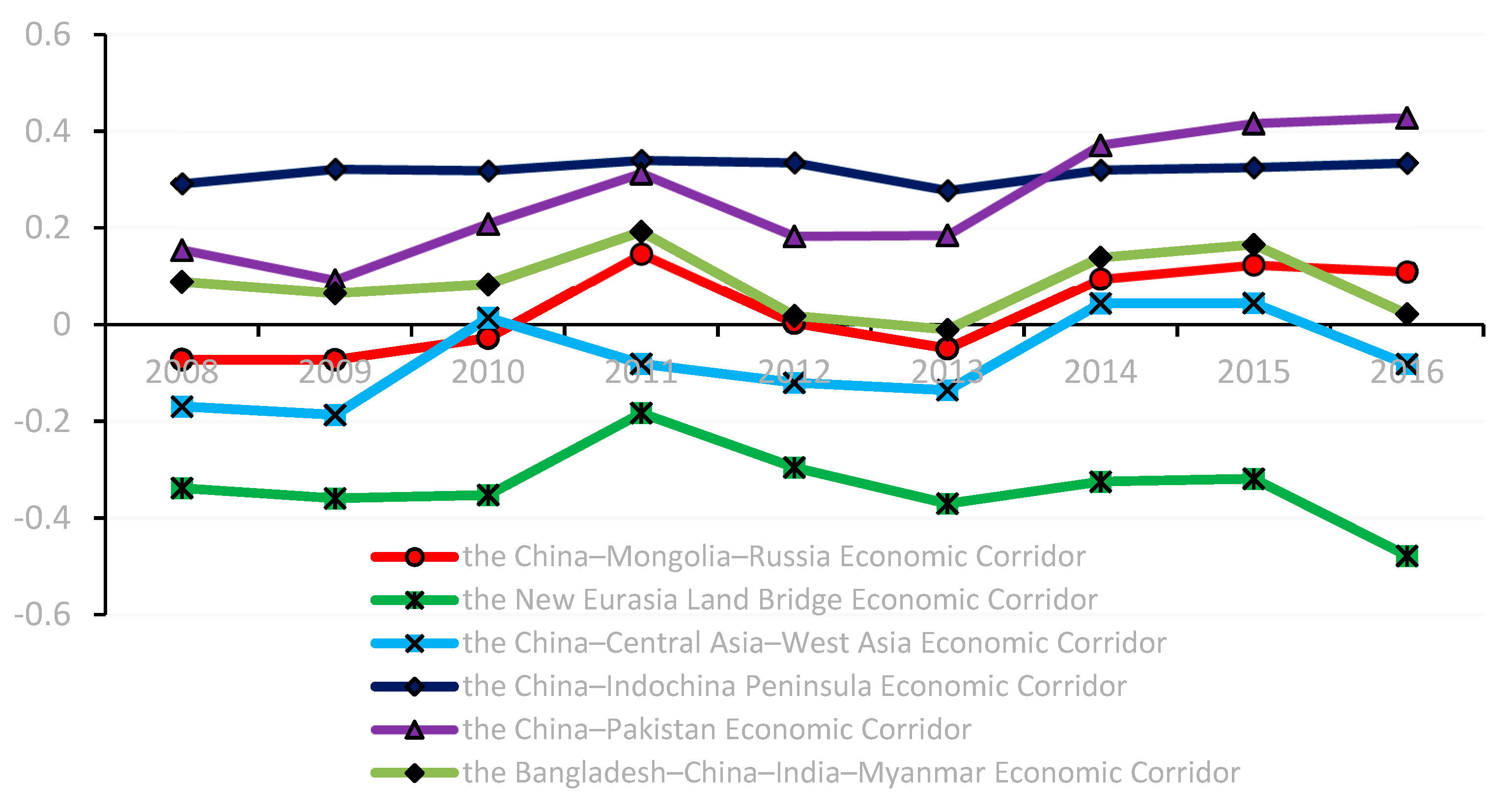

3.3. Dynamics of RTP between China and the Six Economic Corridors

4. Model Specifications

5. Empirical Results

5.1. Baseline Regression Results

5.2. Extended Regression Results

5.3. Robustness Checks

6. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

| Country | 2008 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 |

|---|---|---|---|---|---|---|---|---|

| Afghanistan | −0.145 | −0.498 | −0.293 | −0.290 | −0.804 | 0.031 | 0.105 | −0.341 |

| Albania | −0.169 | −0.293 | −0.161 | −0.319 | −0.322 | −0.252 | −0.230 | −0.182 |

| Armenia | 0.062 | −0.472 | 0.180 | 0.046 | −0.039 | 0.163 | 0.186 | −0.269 |

| Azerbaijan | −0.528 | −0.520 | −0.707 | −0.708 | −0.806 | −0.722 | −0.714 | −0.528 |

| Bahrain | −0.254 | −0.444 | 0.034 | −0.250 | −0.275 | −0.029 | −0.125 | −0.625 |

| Bangladesh | 0.225 | 0.190 | −0.060 | 0.035 | −0.003 | 0.286 | 0.185 | 0.210 |

| Belarus | −0.491 | −0.661 | −0.371 | −0.440 | −0.412 | −0.596 | −0.211 | −0.647 |

| Brunei Darussalam | −0.700 | −0.058 | −0.272 | −0.463 | −0.611 | −0.586 | −0.463 | −0.164 |

| Cambodia | −0.096 | 0.178 | 0.116 | −0.043 | 0.021 | 0.176 | 0.132 | 0.301 |

| Croatia | −0.315 | −0.417 | −0.264 | −0.385 | −0.657 | −0.711 | −0.695 | −0.630 |

| Czech Republic | −0.299 | −0.498 | −0.065 | −0.269 | −0.359 | −0.275 | −0.205 | −0.583 |

| Egypt | −0.225 | −0.068 | −0.100 | −0.198 | −0.221 | −0.130 | 0.018 | 0.016 |

| Estonia | −0.404 | −0.522 | −0.278 | −0.421 | −0.492 | −0.429 | −0.419 | −0.558 |

| Georgia | −0.458 | −0.377 | −0.205 | −0.304 | −0.385 | −0.213 | −0.187 | −0.229 |

| Hungary | −0.435 | −0.373 | −0.343 | −0.464 | −0.549 | −0.519 | −0.539 | −0.516 |

| India | 0.072 | 0.052 | 0.206 | 0.011 | −0.039 | 0.085 | 0.119 | −0.075 |

| Indonesia | 0.021 | 0.204 | 0.242 | 0.067 | 0.079 | 0.134 | 0.164 | 0.225 |

| Iran | 0.354 | 0.418 | −0.050 | 0.349 | 0.521 | 0.680 | 0.643 | 0.489 |

| Iraq | −0.895 | 0.048 | 0.246 | 0.083 | 0.229 | −0.069 | 0.400 | 0.270 |

| Israel | −0.354 | −0.177 | −0.168 | −0.273 | −0.321 | −0.259 | −0.240 | −0.209 |

| Jordan | −0.029 | −0.039 | 0.037 | −0.167 | −0.196 | −0.088 | 0.038 | −0.025 |

| Kazakhstan | 0.257 | 0.474 | 0.483 | 0.335 | 0.322 | 0.317 | 0.287 | 0.234 |

| Kuwait | −0.524 | −0.023 | −0.368 | −0.080 | −0.549 | −0.430 | −0.217 | −0.064 |

| Kyrgyzstan | 0.381 | 0.807 | 0.475 | 0.180 | 0.294 | 0.784 | 0.407 | 0.824 |

| Lao People’s Dem. Rep. | −0.076 | 0.490 | 0.009 | −0.218 | −0.082 | 0.154 | 0.291 | 0.492 |

| Latvia | −0.792 | −0.444 | −0.743 | −0.791 | −0.810 | −0.785 | −0.734 | −0.497 |

| Lebanon | −0.792 | −0.242 | −0.044 | −0.185 | −0.141 | −0.005 | 0.023 | −0.163 |

| Lithuania | −0.733 | −0.649 | −0.719 | −0.753 | −0.778 | −0.713 | −0.690 | −0.677 |

| Macedonia | −0.491 | −0.731 | −0.292 | −0.332 | −0.477 | −0.445 | −0.434 | −0.845 |

| Malaysia | 0.076 | 0.379 | 0.208 | 0.022 | 0.074 | 0.142 | 0.148 | 0.329 |

| Maldives | −0.598 | −0.336 | −0.185 | −0.326 | −0.351 | −0.221 | −0.099 | 0.056 |

| Mongolia | 0.805 | 0.756 | 0.886 | 0.670 | 0.796 | 0.880 | 0.867 | 0.809 |

| Myanmar | 0.461 | 0.602 | 0.509 | 0.197 | 0.422 | 0.566 | 0.623 | 0.663 |

| Nepal | 0.106 | 0.109 | 0.296 | 0.032 | −0.049 | 0.153 | 0.189 | −0.161 |

| Oman | 0.517 | 0.362 | 0.567 | −0.547 | −0.518 | 0.597 | 0.507 | 0.455 |

| Pakistan | 0.155 | 0.208 | 0.313 | 0.183 | 0.185 | 0.371 | 0.416 | 0.428 |

| Philippines | −0.027 | 0.437 | 0.061 | −0.176 | −0.077 | 0.057 | 0.063 | 0.457 |

| Poland | −0.305 | −0.520 | −0.256 | −0.362 | −0.417 | −0.309 | −0.309 | −0.506 |

| Qatar | −0.523 | −0.513 | −0.405 | −0.276 | −0.266 | −0.140 | −0.152 | −0.375 |

| Romania | −0.515 | −0.518 | −0.475 | −0.608 | −0.686 | −0.611 | −0.589 | −0.605 |

| Russian Federation | −0.093 | −0.059 | 0.114 | −0.026 | −0.078 | 0.061 | 0.089 | 0.083 |

| Saudi Arabia | −0.420 | 0.171 | −0.226 | −0.383 | −0.391 | −0.278 | −0.083 | −0.041 |

| Singapore | 0.251 | −0.062 | 0.308 | 0.147 | 0.153 | 0.256 | 0.279 | −0.063 |

| Slovakia | −0.445 | −0.542 | −0.299 | −0.397 | −0.408 | −0.309 | −0.353 | −0.593 |

| Slovenia | −0.554 | −0.542 | −0.503 | −0.559 | −0.658 | −0.568 | −0.565 | −0.480 |

| Sri Lanka | −0.206 | 0.000 | 0.018 | −0.024 | −0.029 | 0.056 | 0.115 | 0.105 |

| Syria | −0.070 | −0.086 | 0.061 | 0.000 | −0.176 | 0.076 | 0.261 | 0.171 |

| Tajikistan | 0.687 | 0.628 | 0.789 | 0.547 | 0.645 | 0.744 | 0.700 | 0.665 |

| Thailand | 0.130 | 0.192 | 0.307 | 0.157 | 0.129 | 0.231 | 0.245 | 0.205 |

| Turkey | −0.227 | −0.325 | −0.051 | −0.201 | −0.214 | −0.136 | −0.118 | −0.407 |

| Turkmenistan | −0.162 | 0.345 | 0.775 | 0.657 | 0.762 | 0.794 | 0.827 | 0.702 |

| Ukraine | −0.406 | −0.200 | −0.192 | −0.223 | −0.242 | −0.173 | −0.159 | −0.214 |

| United Arab Emirates | −0.263 | −0.155 | −0.345 | −0.183 | −0.221 | −0.002 | −0.250 | −0.337 |

| Uzbekistan | 0.021 | 0.244 | 0.280 | 0.220 | 0.353 | 0.430 | 0.376 | 0.289 |

| Vietnam | 0.418 | 0.430 | 0.419 | 0.412 | 0.408 | 0.421 | 0.419 | 0.451 |

| Yemen | 0.439 | 0.473 | 0.464 | 0.282 | 0.069 | 0.090 | −0.048 | 0.362 |

| Country | 2008 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 |

|---|---|---|---|---|---|---|---|---|

| Algeria | −0.394 | −0.269 | −0.213 | −0.207 | −0.249 | −0.159 | −0.070 | −0.073 |

| Bolivia | −0.323 | −0.166 | 0.027 | −0.073 | −0.259 | −0.046 | 0.060 | 0.067 |

| Argentina | 0.104 | 0.039 | 0.124 | −0.043 | −0.020 | 0.002 | 0.118 | 0.022 |

| Australia | 0.320 | 0.482 | 0.478 | 0.383 | 0.472 | 0.421 | 0.392 | 0.436 |

| Austria | −0.511 | −0.474 | −0.398 | −0.490 | −0.543 | −0.463 | −0.496 | −0.553 |

| Belgium | −0.486 | −0.489 | −0.373 | −0.493 | −0.549 | −0.520 | −0.535 | −0.586 |

| Botswana | 0.167 | −0.533 | −0.073 | −0.680 | −0.836 | −0.829 | −0.811 | −0.873 |

| Brazil | 0.064 | 0.205 | 0.275 | 0.171 | 0.224 | 0.195 | 0.203 | 0.187 |

| Cameroon | −0.191 | 0.036 | 0.009 | 0.040 | −0.110 | 0.169 | 0.164 | 0.060 |

| Canada | −0.222 | −0.186 | −0.090 | −0.176 | −0.256 | −0.211 | −0.208 | −0.268 |

| Chile | 0.235 | 0.438 | 0.403 | 0.326 | 0.366 | 0.347 | 0.325 | 0.429 |

| Colombia | −0.180 | −0.045 | 0.014 | −0.003 | 0.001 | 0.133 | 0.044 | −0.020 |

| Costa Rica | −0.267 | −0.493 | −0.411 | −0.518 | −0.498 | −0.449 | −0.245 | −0.276 |

| Cyprus | −0.547 | −0.590 | −0.617 | −0.715 | −0.780 | −0.662 | −0.651 | −0.680 |

| Denmark | −0.388 | −0.342 | −0.312 | −0.395 | −0.464 | −0.395 | −0.369 | −0.416 |

| Dominican Republic | −0.156 | −0.100 | 0.038 | −0.088 | −0.175 | −0.132 | −0.099 | −0.174 |

| Ecuador | −0.240 | −0.337 | −0.053 | −0.251 | −0.123 | −0.079 | 0.004 | −0.091 |

| Ethiopia | 0.642 | 0.604 | 0.473 | 0.470 | 0.563 | 0.617 | 0.651 | 0.663 |

| Finland | −0.316 | −0.281 | −0.385 | −0.310 | −0.418 | −0.379 | −0.377 | −0.413 |

| French | −0.369 | −0.321 | −0.209 | −0.291 | −0.386 | −0.322 | −0.309 | −0.373 |

| Germany | −0.239 | −0.134 | −0.009 | −0.168 | −0.188 | −0.143 | −0.185 | −0.257 |

| Ghana | −0.100 | −0.127 | 0.020 | −0.043 | −0.153 | 0.254 | 0.351 | −0.010 |

| Greece | −0.307 | −0.323 | −0.307 | −0.434 | −0.495 | −0.431 | −0.445 | −0.450 |

| Ireland | −0.497 | −0.621 | −0.578 | −0.623 | −0.672 | −0.592 | −0.621 | −0.621 |

| Italy | −0.380 | −0.307 | −0.238 | −0.406 | −0.488 | −0.418 | −0.416 | −0.484 |

| Jamaica | −0.464 | −0.381 | −0.300 | −0.378 | −0.385 | −0.247 | −0.199 | −0.324 |

| Japan | 0.428 | 0.454 | 0.476 | 0.328 | 0.368 | 0.334 | 0.312 | 0.332 |

| Luxembourg | −0.805 | −0.789 | −0.751 | −0.760 | −0.799 | −0.751 | −0.753 | −0.773 |

| Madagascar | 0.427 | 0.113 | 0.037 | 0.012 | −0.047 | −0.017 | 0.016 | 0.090 |

| Mali | 0.307 | 0.250 | 0.158 | −0.016 | −0.317 | −0.314 | −0.382 | −0.118 |

| Malta | −0.811 | −0.771 | −0.745 | −0.793 | −0.845 | −0.852 | −0.813 | −0.806 |

| Mauritius | −0.039 | −0.018 | 0.035 | 0.133 | −0.059 | −0.012 | −0.022 | 0.043 |

| Mexico | −0.151 | −0.094 | −0.019 | −0.118 | −0.177 | −0.111 | −0.115 | −0.178 |

| Morocco | −0.324 | −0.212 | −0.263 | −0.343 | −0.386 | −0.319 | −0.344 | −0.365 |

| Mozambique | −0.508 | −0.613 | −0.286 | −0.177 | −0.435 | −0.416 | −0.217 | −0.430 |

| Namibia | 0.197 | −0.405 | −0.428 | −0.463 | −0.563 | −0.460 | −0.305 | −0.555 |

| Netherlands | −0.390 | −0.357 | −0.309 | −0.411 | −0.416 | −0.386 | −0.412 | −0.473 |

| New Zealand | 0.079 | 0.182 | 0.236 | 0.223 | 0.289 | 0.265 | 0.221 | 0.274 |

| Nicaragua | −0.336 | −0.335 | −0.278 | −0.298 | −0.353 | −0.173 | −0.214 | −0.151 |

| Nigeria | −0.430 | −0.155 | −0.083 | −0.011 | −0.268 | −0.179 | 0.134 | −0.056 |

| Norway | −0.516 | −0.428 | −0.337 | −0.449 | −0.482 | −0.377 | −0.334 | −0.407 |

| Panama | −0.287 | −0.141 | −0.054 | −0.257 | −0.372 | −0.294 | −0.222 | −0.255 |

| Paraguay | 0.386 | 0.455 | 0.447 | 0.324 | 0.205 | 0.200 | 0.135 | 0.132 |

| Peru | 0.248 | 0.328 | 0.302 | 0.251 | 0.255 | 0.277 | 0.305 | 0.354 |

| Portugal | −0.701 | −0.692 | −0.643 | −0.648 | −0.736 | −0.669 | −0.670 | −0.707 |

| Republic of Korea | 0.529 | 0.503 | 0.463 | 0.364 | 0.417 | 0.367 | 0.353 | 0.399 |

| Senegal | −0.343 | −0.289 | −0.367 | −0.541 | −0.429 | −0.425 | −0.265 | −0.297 |

| South Africa | −0.077 | 0.067 | 0.100 | −0.063 | 0.041 | −0.048 | −0.004 | 0.020 |

| Spain | −0.298 | −0.329 | −0.273 | −0.383 | −0.474 | −0.384 | −0.372 | −0.417 |

| Sweden | −0.534 | −0.424 | −0.398 | −0.490 | −0.519 | −0.467 | −0.453 | −0.512 |

| Switzerland | −0.641 | −0.593 | −0.531 | −0.518 | −0.456 | −0.362 | −0.337 | −0.311 |

| The United States | 0.245 | 0.280 | 0.299 | 0.190 | 0.180 | 0.204 | 0.212 | 0.192 |

| Tunisia | −0.601 | −0.486 | −0.415 | −0.405 | −0.537 | −0.437 | −0.407 | −0.436 |

| Uganda | 0.076 | 0.056 | 0.182 | 0.216 | 0.027 | 0.254 | 0.312 | 0.288 |

| United Kingdom | −0.230 | −0.158 | −0.100 | −0.256 | −0.335 | −0.172 | −0.150 | −0.279 |

| United Republic of Tanzania | 0.178 | 0.252 | 0.193 | 0.019 | −0.035 | 0.106 | 0.135 | 0.150 |

| Uruguay | −0.100 | −0.010 | 0.037 | −0.023 | 0.097 | 0.075 | 0.044 | 0.007 |

| Zimbabwe | −0.429 | 0.076 | −0.043 | −0.300 | −0.261 | −0.305 | −0.251 | −0.242 |

| Region | Countries |

|---|---|

| the New Eurasia Land Bridge Economic Corridor (NELBEC) | Albania, Belarus, Croatia, Czech Republic, Estonia, Hungary, Kazakhstan, Latvia Lithuania Macedonia, Poland, Romania, Slovakia, Slovenia, Ukraine |

| the China-Central Asia-West Asia Economic Corridor (CCWAEC) | Afghanistan, Armenia, Azerbaijan, Bahrain, Georgia, Iran, Iraq, Israel, Jordan, Kazakhstan, Kuwait, Kyrgyzstan, Lebanon, Turkey, Turkmenistan, Oman, Saudi Arabia, T ajikistan, Qatar, Uzbekistan, United Arab Emirates, Syria, Yemen |

| the China-Indochina Peninsula Economic Corridor (CICPEC) | Brunei, Cambodia, Malaysia, Thailand, Singapore, Indonesia, Laos, Vietnam, Myanmar, Philippines |

| The China-Mongolia-Russia Economic Corridor (CMREC) | Mongolia, Russia |

| the Bangladesh-China-India-Myanmar Economic Corridor (BCIMEC) | Bangladesh, India, Myanmar, Maldives, Nepal, Sri Lanka |

| China–Pakistan Economic Corridor (CPEC) | Pakistan |

References

- Chung, C.P. What are the strategic and economic implications for South Asia of China’s maritime silk road initiative? Pac. Rev. 2017, 31, 315–332. [Google Scholar] [CrossRef]

- Khan, M.K.; Sandano, I.A.; Pratt, C.B.; Farid, T. China’s Belt and Road Initiative: A Global Model for an Evolving Approach to Sustainable Regional Development. Sustainability 2018, 10, 4234. [Google Scholar] [CrossRef] [Green Version]

- Flint, C.; Zhu, C. The geopolitics of connectivity, cooperation, and hegemonic competition: The belt and road initiative. Geoforum 2019, 99, 95–101. [Google Scholar] [CrossRef]

- Lin, Y. The belt and road and a new model of international development cooperation. In China’s Belt and Road Initiatives; Liu, W., Ed.; Springer: Singapore, 2018. [Google Scholar]

- Zhao, H. Institute of Southeast Asian studies. In China’s New Maritime Silk Road: Implications and Opportunities for Southeast Asia: Trends in Southeast Asia; ISEAS: Singapore, 2015. [Google Scholar]

- Foo, N.; Lean, H.H.; Salim, R. The impact of China’s one belt one road initiative on international trade in the ASEAN region. North Am. J. Econ. Financ. 2019. [Google Scholar] [CrossRef]

- Ehizuelen, M.M.O. More African countries on the route: The positive and negative impacts of the belt and road initiative. Transnatl. Corp. Rev. 2017, 9, 341–359. [Google Scholar] [CrossRef]

- Ehizuelen, M.M.O.; Abdi, H.O. Sustaining China-Africa relations: Slotting Africa into China’s one belt, one road initiative makes economic sense. Asian J. Comp. Pol. 2018, 3, 285–310. [Google Scholar] [CrossRef]

- Ndzendze, B.; Monyae, D. China’s Belt and Road Initiative: Linkages with the African union’s agenda 2063 in historical perspective. Transnatl. Corp. Rev. 2019, 11, 38–49. [Google Scholar] [CrossRef]

- China’s Trade with BRI Countries Surges to $1.34 trillion in 2019. The Economic Times, 15 January 2020. Available online: https://economictimes.indiatimes.com/news/international/business/chinas-trade-with-bri-countries-surges-to-1-34-trillion-in2019/articleshow/73271222.cms?utm_source=contentofinterest&utm_medium=text&utm_campaign=cppst(accessed on 20 March 2020).

- China’s Foreign Trade with Belt & Road Countries Robust in 2019. Business Reporting Desk. Available online: https://www.beltandroad.news/2020/01/15/chinas-foreign-trade-with-belt-road-countries-robust-in-2019/ (accessed on 15 January 2020).

- The Advancement of Construction of the Six Economic Corridors. 26 April 2019. Available online: http://www.cssn.cn/jjx/jjx_zt/jjx_zt_ydyl2019/jjx_zt_ydyl2019_gtgzhzxd/201904/t20190426_4870885.shtml (accessed on 22 October 2019). (In Chinese).

- Rana, P.B. Trade intensity and business cycle synchronization: The case of east Asian Countries. Singap. Econ. Rev. 2008, 53, 279–292. [Google Scholar] [CrossRef]

- Rana, P.B.; Cheng, T.; Chia, W.M. Trade intensity and business cycle synchronization: East Asia versus Europe. J. Asian Econ. 2012, 23, 701–706. [Google Scholar] [CrossRef]

- Frankel, J.A.; Rose, A.K. The endogeneity of the optimum currency area criteria. Econ. J. 1998, 108, 1009–1025. [Google Scholar] [CrossRef]

- Calderon, C.; Chong, A.; Stein, E. Trade intensity and business cycle synchronization: Are developing countries any different? J. Int. Econ. 2007, 71, 2–21. [Google Scholar] [CrossRef] [Green Version]

- Juvenal, L.; Monteiro, P.S. Trade and synchronization in a multi-country economy. Eur. Econ. Rev. 2017, 92, 385–415. [Google Scholar] [CrossRef] [Green Version]

- Grossman, V.; Enrique, M.G.; Wynne, M.A.; Zhang, R. Ties That Bind: Estimating the Natural Rate of Interest for Small Open Economies; Federal Reserve Bank of Dallas Globalization and Monetary Policy Institute: Dallas, TX, USA, 2019. [Google Scholar]

- Wynne, M.A.; Zhang, R. Measuring the world natural rate of interest. Econ. Inq. 2018, 56, 530–544. [Google Scholar] [CrossRef] [Green Version]

- Zysman, J.; Doherty, E.; Schwartz, A. Tales from the global economy: Cross-national production networks and the reorganisation of the European Economy. Struct. Chang. Econ. Dyn. 1997, 8, 45–85. [Google Scholar] [CrossRef] [Green Version]

- Brülhart, M.; Thorpe, M. East-Asian export growth, intra-industry trade and adjustment. Asia Pac. J. Econ. Bus. 1999, 3, 34–47. [Google Scholar]

- Önder, A.S.; Yilmazkuday, H. Trade partner diversification and growth: How trade links matter. J. Macroecon. 2016, 50, 241–258. [Google Scholar] [CrossRef] [Green Version]

- Zhang, J. Oil and gas trade between China and countries and regions along the “Belt and Road”: A panoramic perspective. Energy Policy 2019, 129, 1111–1120. [Google Scholar] [CrossRef]

- An, L.; Wynne, M.A.; Zhang, R. Shock-Dependent Exchange Rate Pass-Through: Evidence Based on a Narrative Sign Approach; Federal Reserve Bank of Dallas Globalization and Monetary Policy Institute: Dallas, TX, USA, 2020. [Google Scholar]

- Iapadre, L.; Tironi, F. Measuring Trade Regionalisation: Case of Asia; UNU-CRIS Working Paper: Bruges, Belgium, 2009. [Google Scholar]

- Iapadre, L.; Tajoli, L. Emerging countries and trade regionalization. A network analysis. J. Policy Model. 2014, 36, S89–S110. [Google Scholar] [CrossRef]

- Kalirajan, K.P. Indian ocean rim association for regional cooperation (IOR-ARC): Impact on Australia’s trade. J. Econ. Integr. 2000, 15, 533–547. [Google Scholar] [CrossRef] [Green Version]

- Fei, D. Worlding developmentalism: China’s economic zones within and beyond its border. J. Int. Dev. 2017, 29, 825–850. [Google Scholar] [CrossRef]

- Williams, J.; Robinson, C.; Bouzarovski, S. China’s belt and road initiative and the emerging geographies of global urbanisation. Geogr. J. 2020, 186, 128–140. [Google Scholar] [CrossRef]

- Zhang, C.; Xiao, C.; Liu, H. Spatial big data analysis of political risks along the belt and road. Sustainability 2019, 11, 2216. [Google Scholar] [CrossRef] [Green Version]

- Han, Y.; Luo, X.; Zou, J. Trade cooperation competitiveness and complementarities of China and West Asia under the background of silk road economic belt and maritime silk road strategy. World Econ. Stud. 2015, 3, 89–98. (In Chinese) [Google Scholar]

- Sang, B.; Yang, L. China’s trading relations with the countries of “one belt one road”: Based on the trade competitiveness and trade complementarities. Econ. Issue 2015, 8, 1–5. (In Chinese) [Google Scholar]

- Zhai, F. China’s belt and road initiative: A preliminary quantitative assessment. J. Asian Econ. 2018, 55, 84–92. [Google Scholar] [CrossRef]

- Herrero, A.G.; Xu, J.W. China’s belt and road initiative: Can Europe expect trade gains? China World Econ. 2017, 25, 84–99. [Google Scholar] [CrossRef] [Green Version]

- Ramasamy, B.; Yeung, M.C.H. China’s one belt one road initiative: The impact of trade facilitation versus physical infrastructure on exports. World Econ. 2019, 42, 1673–1694. [Google Scholar] [CrossRef]

- De Soyres, F.; Mulabdic, A.; Murray, S.; Rocha, N.; Michele, R. How much will the belt and road initiative reducetrade costs? Int. Econ. 2019, 159, 151–164. [Google Scholar] [CrossRef] [Green Version]

- Yang, G.; Huang, X.; Huang, J.; Chen, H. Assessment of the effects of infrastructure investment under thebelt androad initiative. China Econ. Rev. 2020, 60, 101418. [Google Scholar] [CrossRef]

- Devadason, P.; Govindaraje, V.C. What does the “One belt, one road” initiative mean for ASEAN? Asia Res. News 2017, 47, 189–205. [Google Scholar]

- Boffa, M. Policy Research Working Paper#8423. In Trade Linkages between the Belt and Road Economies; The World Bank: Washington, DC, USA, 2018. [Google Scholar]

- Sun, C.; Zhang, N.; Liu, Y. One belt one road initiatives and the export growth of China to the related countries. Int. Trade Issues 2017, 2, 83–96. (In Chinese) [Google Scholar]

- Chen, S.C.; Hou, J.; Xiao, D. “One Belt, One Road” initiative to stimulate trade in China: A counter-factual analysis. Sustainability 2018, 10, 3242. [Google Scholar] [CrossRef] [Green Version]

- Li, J.; Liu, B.; Qian, G. The belt and road initiative, cultural friction and ethnicity: Their effects on the export performance of SMEs in China. J. World Bus. 2019, 54, 50–359. [Google Scholar] [CrossRef]

- Yu, L.; Zhao, D.; Niu, H.; Lu, F. Does the belt and road initiative expand China’s export potential to countries along the belt and road? China Econ. Rev. 2020, 60, 1–16. [Google Scholar] [CrossRef]

- Zheng, L.; Liang, S.; Liu, L. Research on the trade links between China and the countries along the six economic corridors. Contemp. Econ. Manag. 2019, 3, 45–52. (In Chinese) [Google Scholar]

- Karim, M.A.; Islam, F. Bangladesh-China-India-Myanmar (BCIM) economic corridor: Challenges and prospects. Korean J. Def. Anal. 2018, 30, 283–302. [Google Scholar]

- Cingolani, I.; Piccardi, C.; Tajoli, L. Discovering preferential patterns in sectoral trade networks. PLoS ONE 2015, 10, e0140951. [Google Scholar] [CrossRef] [Green Version]

- Sequeira, S.; Hartmann, O.; Kunaka, C. Reviving Trade Routes: Evidence from the Maputo Corridor. Sub-Saharan Africa Transport Policy Program (SSATP); World Bank: Washington, DC, USA, 2014. [Google Scholar]

- Tinbegen, J. Shaping the World Economy-Suggestions for an International Economic Policy; Twentieth Century Fund: New York, NY, USA, 1962. [Google Scholar]

- Linnemann, H. An Econometric Study of World Trade Flows; North Holland: Amsterdam, The Netherlands, 1966. [Google Scholar]

- Kojima, K. The pattern of international trade among advanced countries. Hitotsubashi J. Econ. 1964, 5, 16–36. [Google Scholar]

- Balassa, B. Trade liberalization and ‘revealed’ comparative advantage. Manch. Sch. Econ. Soc. Stud. 1965, 33, 99–123. [Google Scholar] [CrossRef]

- Kunimoto, K. Typology of trade intensity indices. Hitotsubashi J. Econ. 1977, 17, 15–32. [Google Scholar]

- Zhang, J.; Witteloostuijn, A.V. economic openness and trade linkages of China: An empirical study of the determinants of Chinese trade intensities from 1993 to 1999. Rev. World Econ. 2004, 140, 254–281. [Google Scholar] [CrossRef]

- Gaulier, G.; Sébastien, J. Regionalism and the Regionalization of International Trade; Pitard, G., Ed.; CEPII Working Paper: Paris, France, 2004; Volume 16. [Google Scholar]

- Shen, G.; Zhang, X. The Evolution of parts and components trade intensity between countries and its main influencing factors within global production networks. World Econ. Stud. 2016, 6, 73–86. (In Chinese) [Google Scholar]

- Huang, Y. Understanding China’s belt & road initiative: Motivation, framework and assessment. China Econ. Rev. 2016, 40, 314–321. [Google Scholar]

| Variables | Description | Source |

|---|---|---|

| lnTechcj | Logarithm of technology gap measured by the equation: lnTechcj = Ln{1+|m(rdit)-m(rdjt)]}, where rdit and rdjt represent the number of R&D personnel in every one million people in China and country j, respectively. | World Bank database |

| lnPGPDcj | Logarithm of the gap of real GDP per capita between China and the trading partner j | World Bank database |

| lnInfrjt | Logarithm of the level of information and communication Infrastructure measured by the number of domestic Internet security servers of country j | World Bank database |

| lnEFjt | Logarithm of Economic Freedom index measured by the annual Index of Economic Freedom Report issued by the Heritage Foundation | The Heritage Foundation |

| lnOFDIjt | Logarithm of China’s Outward Foreign Direct Investment (FDI) to country j measured by the stock of China’s FDI to the host country | http://olap.epsnet.com.cn/ |

| FTAcj | Dummy variable that takes a value of 1 if the FTA between China and country j entered into force, otherwise 0 | CEPII database |

| Borcj | Dummy variable that takes a value of 1 if country j shares a common border with China, otherwise 0 | Statistics from WTO |

| Count | Mean | sd | Min | Max | |

|---|---|---|---|---|---|

| RTPcjt | 798 | −0.11 | 0.37 | −0.873 | 0.886 |

| BRI*Postt | 798 | 0.21 | 0.41 | 0.000 | 1.000 |

| lnTechcj | 798 | 6.98 | 0.87 | 0.641 | 8.886 |

| lnPGPDcj | 798 | 8.76 | 1.43 | 2.022 | 11.622 |

| lnInfrjt | 798 | 6.70 | 2.81 | 0.000 | 15.122 |

| lnEFjt | 798 | 4.13 | 0.17 | 3.063 | 4.493 |

| lnOFDIjt | 798 | 10.07 | 2.46 | 2.485 | 15.617 |

| FTAcj | 798 | 0.07 | 0.22 | 0.000 | 1.000 |

| Borcj | 798 | 0.11 | 0.31 | 0.000 | 1.000 |

| Variables | (1) | (2) | (3) | (4) | (5) |

|---|---|---|---|---|---|

| BRI*Postt | 0.0637 *** | 0.0826 *** | 0.0823 *** | 0.0760 *** | 0.0756 *** |

| (3.65) | (4.54) | (4.55) | (4.19) | (4.18) | |

| lnTechcj | 0.00910 | 0.00793 | 0.00804 | 0.00682 | |

| (0.76) | (0.67) | (0.68) | (0.58) | ||

| lnPGPDcj | 0.0131 * | 0.0136 * | 0.0125 | 0.0129 * | |

| (1.66) | (1.73) | (1.59) | (1.65) | ||

| lnInfrjt | −0.0190 ** | −0.0227 *** | −0.0153 * | −0.0191 ** | |

| (−2.16) | (−2.64) | (−1.76) | (−2.24) | ||

| lnEFjt | −0.253 ** | −0.269 ** | −0.197 * | −0.214 * | |

| (−2.21) | (−2.39) | (−1.73) | (−1.91) | ||

| lnOFDIjt | 0.0267 *** | 0.0233 *** | 0.0222 *** | 0.0189 *** | |

| (3.73) | (3.28) | (3.09) | (2.66) | ||

| FTAcj | 0.521 *** | 0.511 *** | |||

| (4.24) | (4.27) | ||||

| Borcj | 0.352 *** | 0.340 *** | |||

| (3.89) | (3.94) | ||||

| Year fixed effect | Y | Y | Y | Y | Y |

| N | 798 | 798 | 798 | 798 | 798 |

| Variables | (1) | (2) | (3) | (4) | (5) |

|---|---|---|---|---|---|

| BRI*Postt*area 1 | −0.0501 * | −0.0264 | −0.0255 | −0.0329 | −0.0323 |

| (−1.87) | (−0.95) | (−0.92) | (−1.19) | (−1.17) | |

| BRI* Postt *area 2 | 0.112 *** | 0.121 *** | 0.123 *** | 0.117 *** | 0.119 *** |

| (4.80) | (5.16) | (5.25) | (5.02) | (5.11) | |

| BRI* Postt *area 3 | 0.0971 | 0.124 * | 0.130 * | 0.104 | 0.109 |

| (1.45) | (1.82) | (1.92) | (1.54) | (1.62) | |

| BRI* Postt *area 4 | 0.0844 *** | 0.112 *** | 0.103 *** | 0.101 *** | 0.0920 *** |

| (2.65) | (3.42) | (3.15) | (3.12) | (2.83) | |

| BRI* Postt *area 5 | 0.0896 ** | 0.0929 ** | 0.0963 ** | 0.0858 ** | 0.0888 ** |

| (2.07) | (2.13) | (2.21) | (1.98) | (2.05) | |

| BRI* Postt *area 6 | 0.192 ** | 0.211 ** | 0.215 ** | 0.191 ** | 0.195 ** |

| (2.05) | (2.23) | (2.28) | (2.04) | (2.07) | |

| lnTECHcj | 0.00500 | 0.00374 | 0.00388 | 0.00255 | |

| (0.42) | (0.32) | (0.33) | (0.22) | ||

| lnPGPDcj | 0.00983 | 0.0102 | 0.00914 | 0.00938 | |

| (1.25) | (1.31) | (1.17) | (1.21) | ||

| lnInfrjt | −0.0163 * | −0.0202 ** | −0.0124 | −0.0162 * | |

| (−1.87) | (−2.38) | (−1.42) | (−1.92) | ||

| lnEFjt | −0.256 ** | −0.271 ** | −0.200 * | −0.214 * | |

| (−2.26) | (−2.44) | (−1.77) | (−1.94) | ||

| OFDIjt | 0.0242 *** | 0.0214 *** | 0.0196 *** | 0.0168 ** | |

| (3.42) | (3.05) | (2.75) | (2.39) | ||

| FTAcj | 0.514 *** | 0.504 *** | |||

| (4.29) | (4.32) | ||||

| Borcj | 0.347 *** | 0.335 *** | |||

| (3.88) | (3.98) | ||||

| Year fixed effect | Y | Y | Y | Y | Y |

| N | 798 | 798 | 798 | 798 | 798 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| BRI*Postt−1 | 0.0242 | 0.0317 | ||

| (1.27) | (1.62) | |||

| BRI*Postt−2 | 0.0294 | 0.0295 | ||

| (1.24) | (1.23) | |||

| lnTECHcj | 0.00334 | 0.00262 | ||

| (0.28) | (0.22) | |||

| lnPGPDcj | 0.0114 | 0.0110 | ||

| (1.45) | (1.40) | |||

| lnInfrjt | −0.0152 * | −0.0141 * | ||

| (−1.78) | (−1.66) | |||

| lnEFjt | −0.207 * | −0.206 * | ||

| (−1.84) | (−1.83) | |||

| OFDIjt | 0.0177 ** | 0.0173 ** | ||

| (2.44) | (2.38) | |||

| FTAcj | 0.509 *** | 0.507 *** | ||

| (4.25) | (4.23) | |||

| Borcj | 0.354 *** | 0.356 *** | ||

| (4.09) | (4.07) | |||

| Year fixed effect | Y | Y | Y | Y |

| N | 798 | 798 | 798 | 798 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| BRI*Postt+1 | 0.0482 ** | 0.0562 *** | ||

| (2.54) | (2.86) | |||

| BRI*Postt+2 | 0.0298 | 0.0410 * | ||

| (1.24) | (1.65) | |||

| lnTECHcj | 0.000703 | −0.00117 | ||

| (0.05) | (−0.08) | |||

| lnPGPDcj | 0.00270 | −0.00778 | ||

| (0.31) | (−0.73) | |||

| lnInfrjt | −0.0220 ** | −0.0265 *** | ||

| (−2.43) | (−2.75) | |||

| lnEFjt | −0.0844 | −0.0400 | ||

| (−0.69) | (−0.29) | |||

| OFDIjt | 0.0182 ** | 0.0213 ** | ||

| (2.32) | (2.51) | |||

| FTAcj | 0.503 *** | 0.507 *** | ||

| (4.13) | (4.07) | |||

| Borcj | 0.358 *** | 0.358 *** | ||

| (4.07) | (3.98) | |||

| Year fixed effect | Y | Y | Y | Y |

| N | 684 | 684 | 570 | 570 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yu, C.; Zhang, R.; An, L.; Yu, Z. Has China’s Belt and Road Initiative Intensified Bilateral Trade Links between China and the Involved Countries? Sustainability 2020, 12, 6747. https://doi.org/10.3390/su12176747

Yu C, Zhang R, An L, Yu Z. Has China’s Belt and Road Initiative Intensified Bilateral Trade Links between China and the Involved Countries? Sustainability. 2020; 12(17):6747. https://doi.org/10.3390/su12176747

Chicago/Turabian StyleYu, Chunjiao, Ren Zhang, Lian An, and Zhixing Yu. 2020. "Has China’s Belt and Road Initiative Intensified Bilateral Trade Links between China and the Involved Countries?" Sustainability 12, no. 17: 6747. https://doi.org/10.3390/su12176747

APA StyleYu, C., Zhang, R., An, L., & Yu, Z. (2020). Has China’s Belt and Road Initiative Intensified Bilateral Trade Links between China and the Involved Countries? Sustainability, 12(17), 6747. https://doi.org/10.3390/su12176747