Financial and Non-Financial Practices Driving Sustainable Firm Performance: Evidence from Banking Sector of Developing Countries

Abstract

1. Introduction

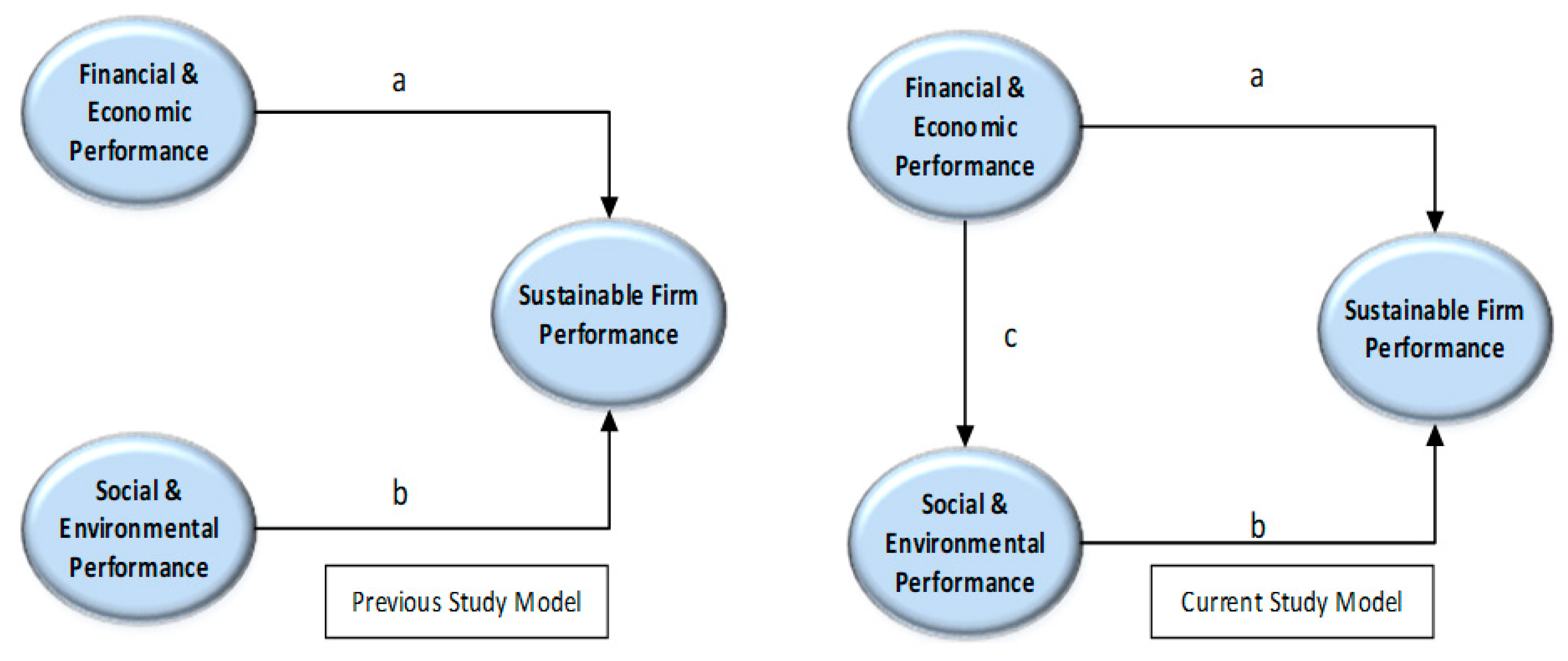

Literature Review and Hypothesis Development

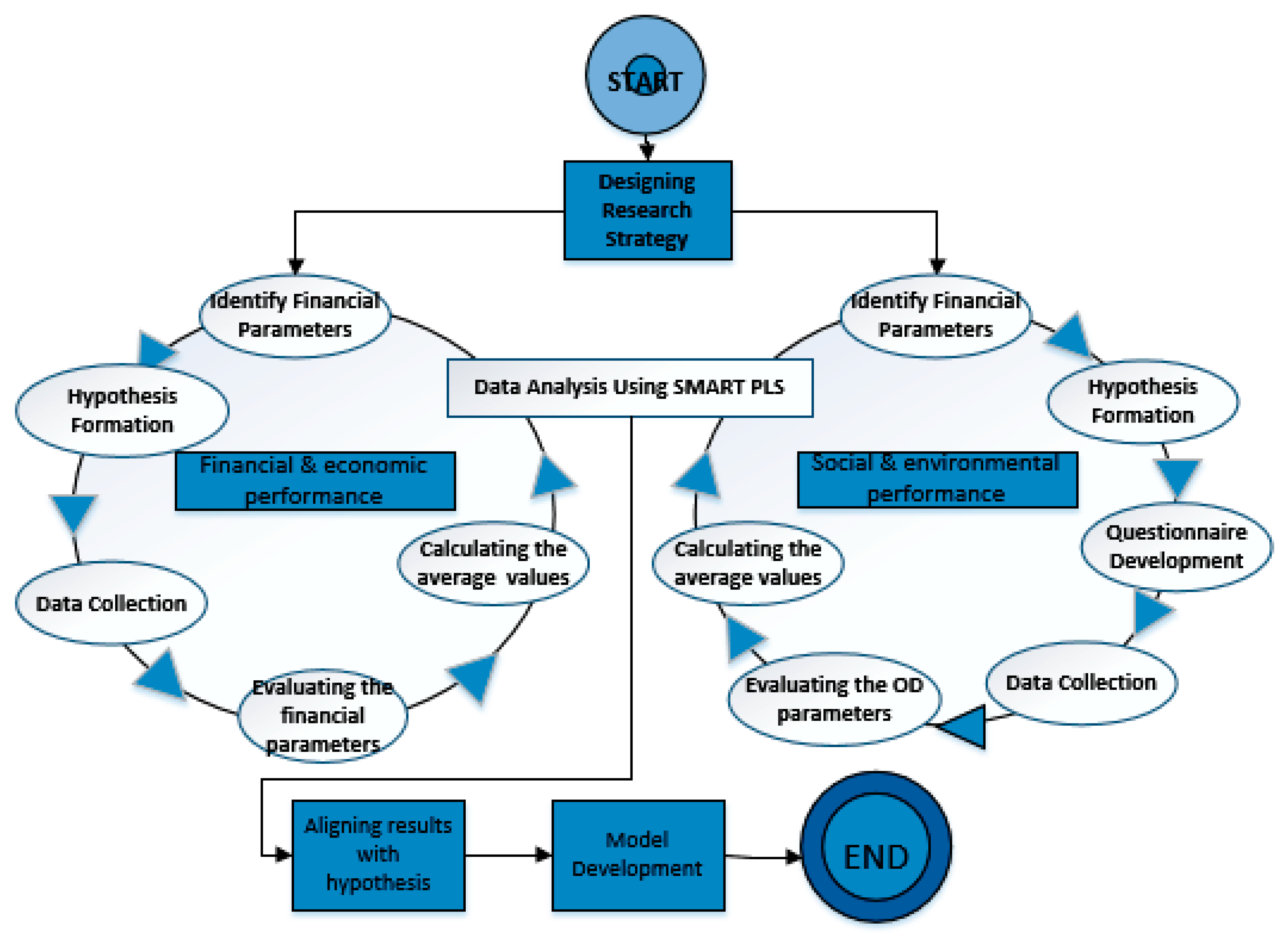

2. Materials and Methods

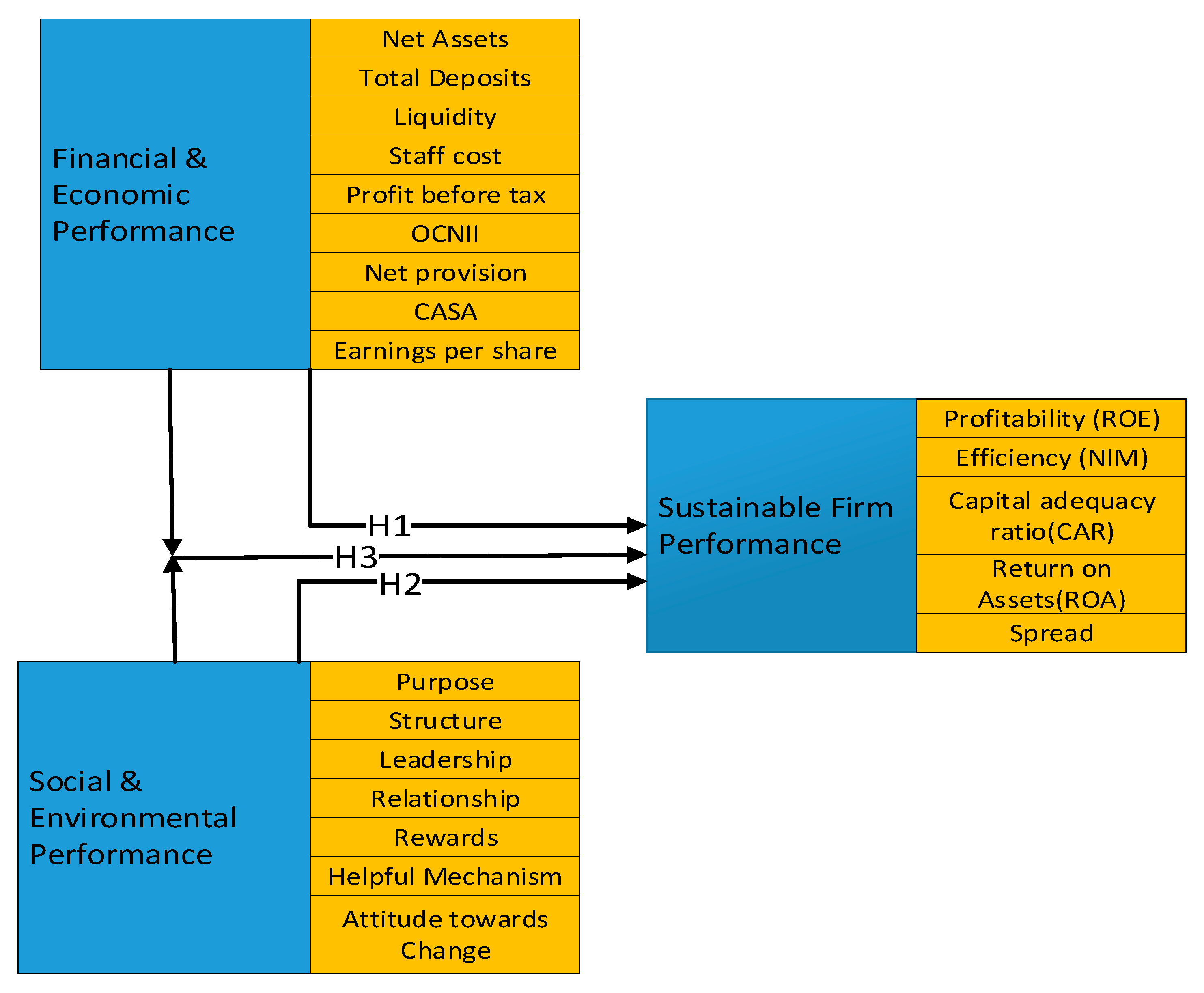

2.1. Financial and Economic Performance

2.2. Social and Environmental Performance

2.3. Performance Indicators

2.4. Proposed Scheme

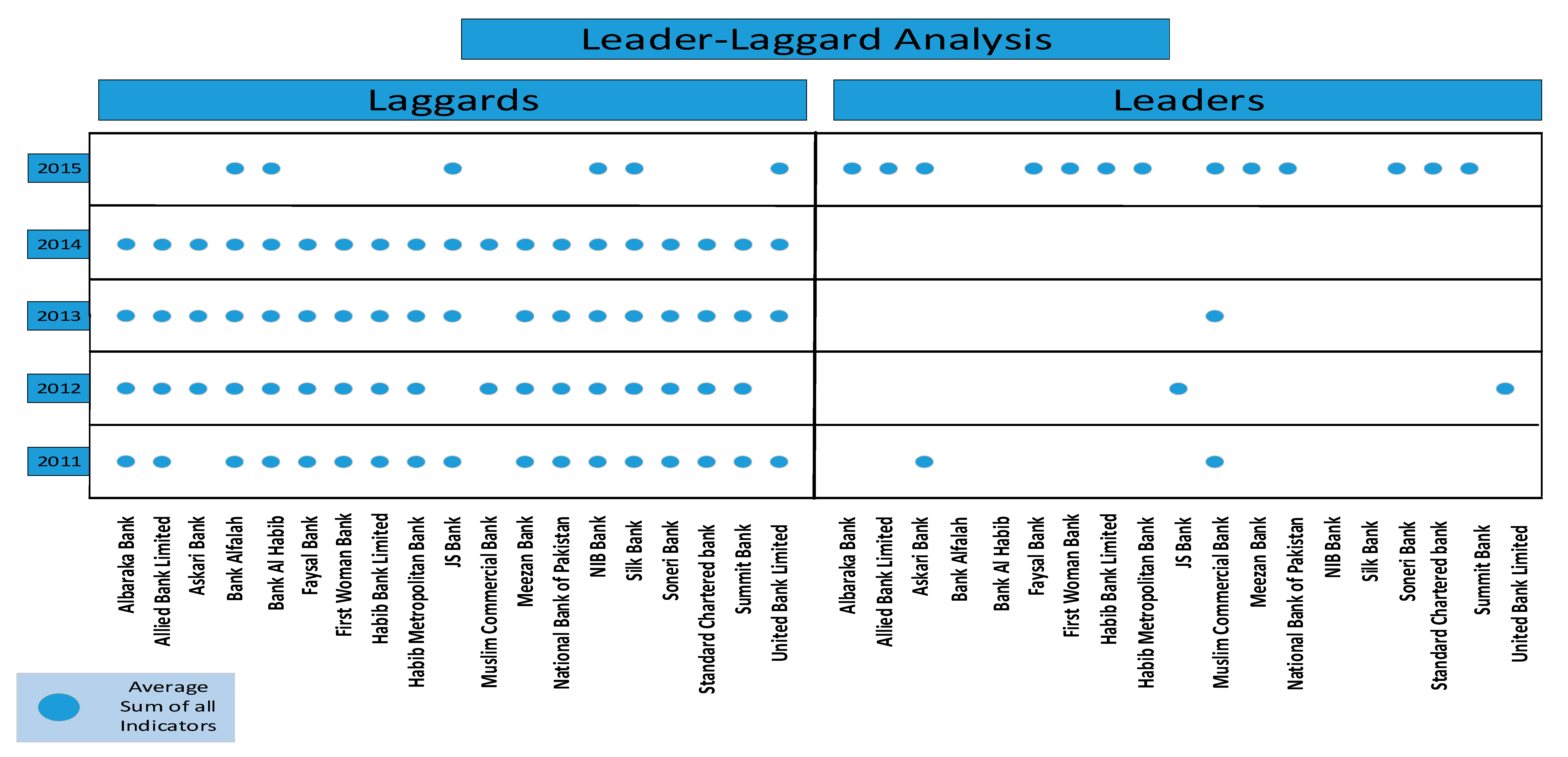

3. Results and Discussion

3.1. Model Evaluation

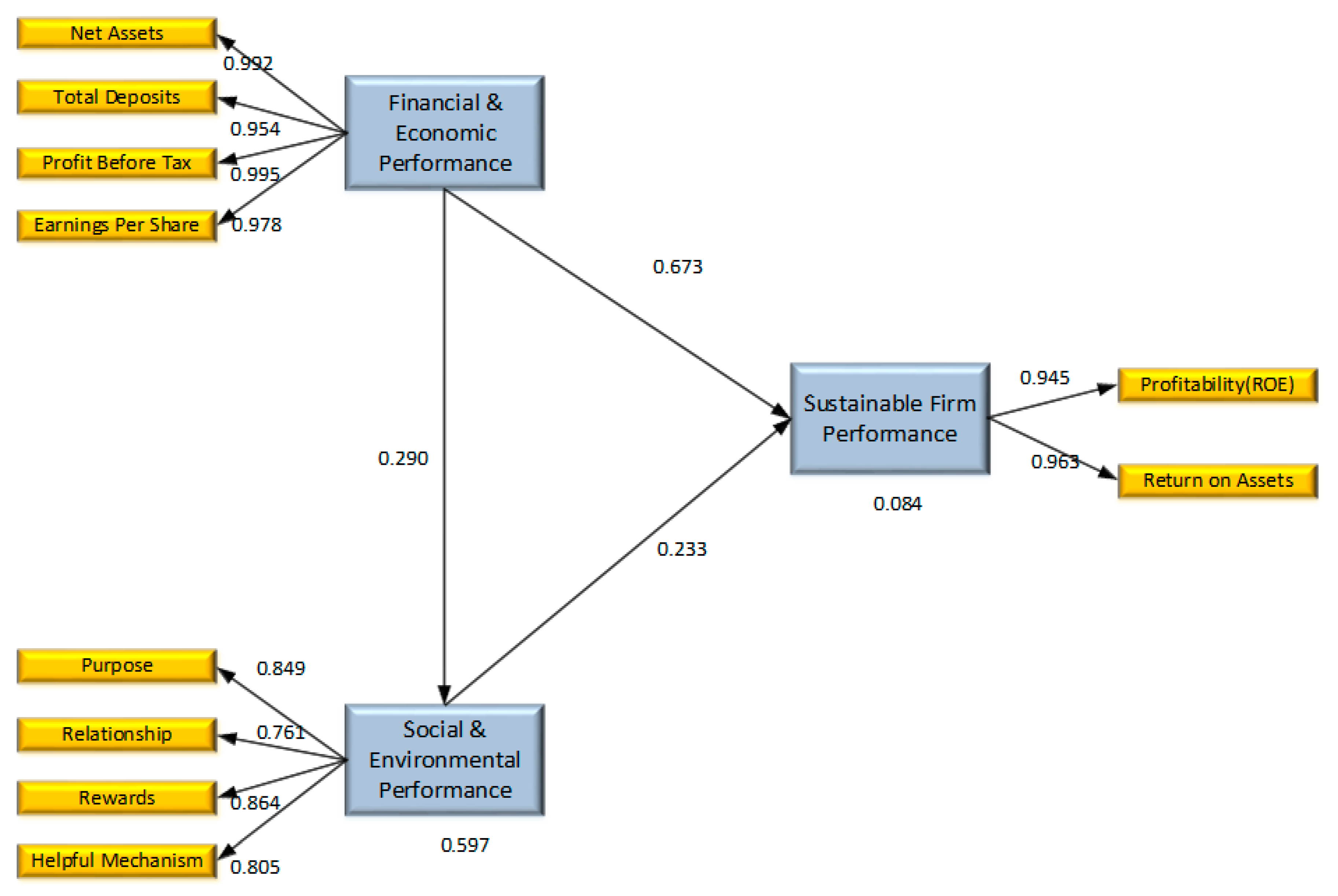

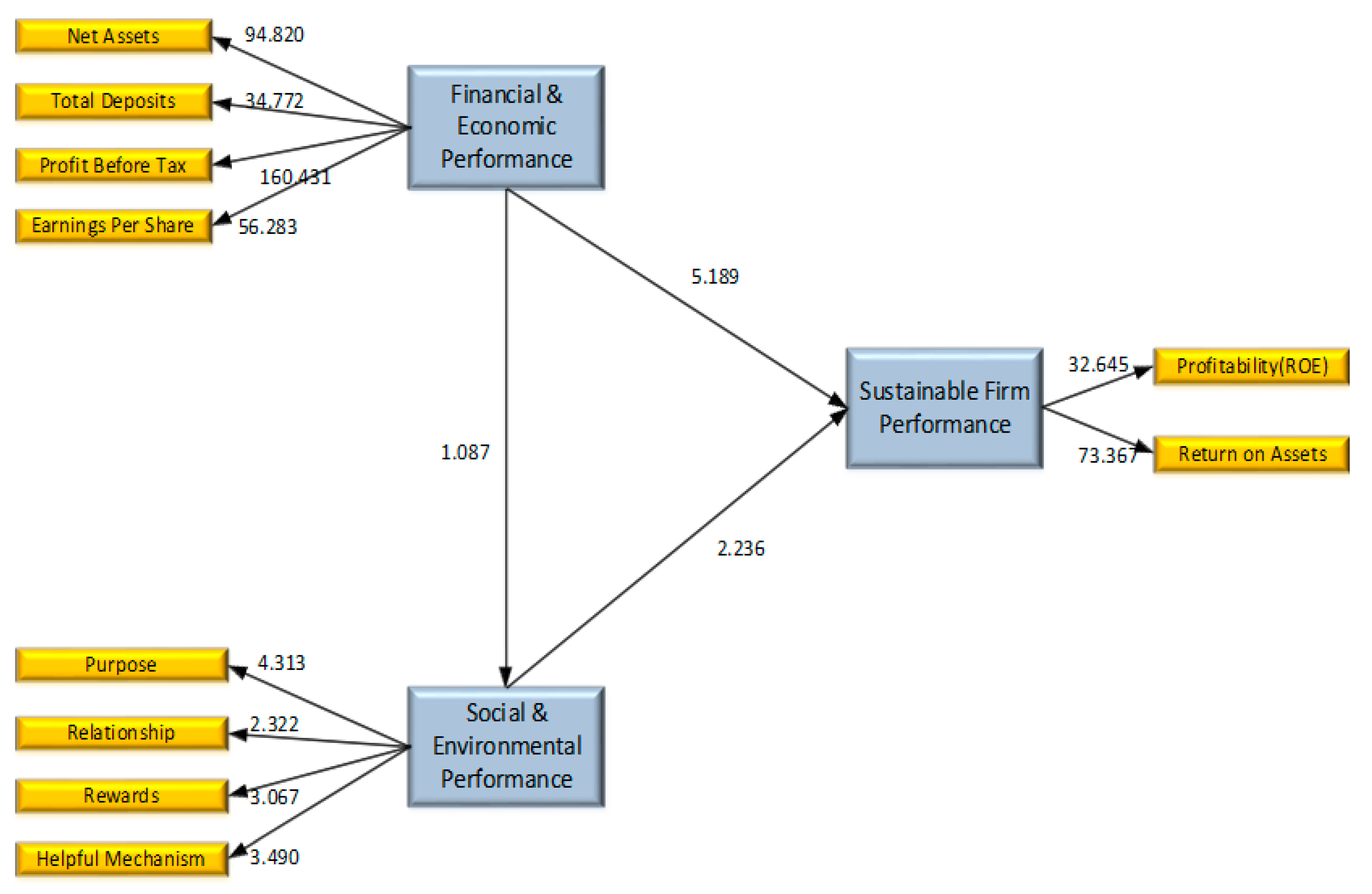

3.2. PLS Result Evaluation

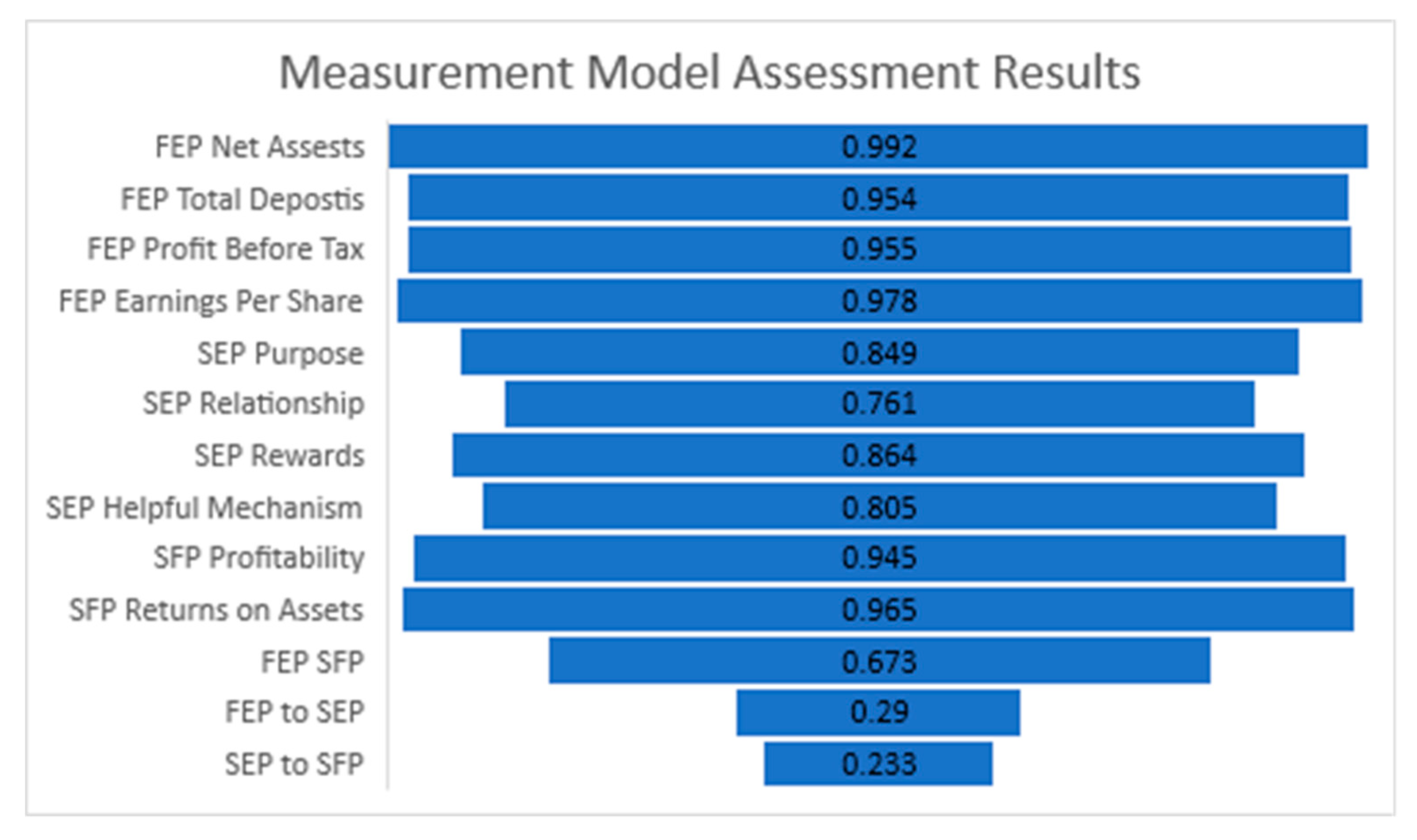

3.3. Measurement Model Evalutaion

3.4. Structural Model Evalutaiton

3.5. Mediation Analysis

- Is the direct effect between financial and economic performance and sustainable firm performance significant when the mediator variable is excluded from the path model?

- Is the indirect effect via the mediator variable significant after organizational development has been included in the path model?

- How much of the direct effect does the indirect effect via the mediator absorb?

4. Conclusions

4.1. Limitation of Study

4.2. Suggestion for Future Research

Supplementary Materials

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Goyal, P.; Rahman, Z.; Kazmi, A. Corporate sustainability performance and firm performance research. Manag. Decis. 2013, 51, 361–379. [Google Scholar] [CrossRef]

- Brundtland, G.H. World Commission on environment and development. Environ. Policy Law 1985, 14, 26–30. [Google Scholar] [CrossRef]

- Arora, P.; Dharwadkar, R. Corporate Governance and Corporate Social Responsibility (CSR): The Moderating Roles of Attainment Discrepancy and Organization Slack. Corp. Gov. Int. Rev. 2011, 19, 136–152. [Google Scholar] [CrossRef]

- Luqmani, M.; Quraeshi, Z. Privatizing state-owned enterprises: A model for developing countries. Int. J. Commer. Manag. 2011, 21, 256–272. [Google Scholar] [CrossRef]

- Newberry, D.M. Privatization, Restructuring, and Regulation of Network Utilities; MIT Press: Cambridge, MA, USA, 2002; Volume 2. [Google Scholar]

- Al-Surmi, A.; Cao, G.; Duan, Y. The impact of aligning business, IT, and marketing strategies on firm performance. Ind. Mark. Manag. 2020, 84, 39–49. [Google Scholar] [CrossRef]

- Carlucci, F.; Cirà, A.; Coccorese, P. Measuring and Explaining Airport Efficiency and Sustainability: Evidence from Italy. Sustainability 2018, 10, 400. [Google Scholar] [CrossRef]

- Bachiller, P. A meta-analysis of the impact of privatization on firm performance. Manag. Decis. 2017, 55, 178–202. [Google Scholar] [CrossRef]

- Shukurov, S.; Maitah, M.; Smutka, L. The impact of privatization on economic growth: The case of Uzbekistan. Int. J. Econ. Financ. Issues 2016, 6, 948–957. [Google Scholar]

- Ruggiero, P.; Cupertino, S. CSR Strategic Approach, Financial Resources and Corporate Social Performance: The Mediating Effect of Innovation. Sustainability 2018, 10, 3611. [Google Scholar] [CrossRef]

- Fauzi, H.; Svensson, G.; Rahman, A.A. “Triple Bottom Line” as “Sustainable Corporate Performance”: A Proposition for the Future. Sustainability 2010, 2, 1345–1360. [Google Scholar] [CrossRef]

- Nicolăescu, E.; Alpopi, C.; Zaharia, C. Measuring Corporate Sustainability Performance. Sustainability 2015, 7, 851–865. [Google Scholar] [CrossRef]

- Fijalkowska, J.; Zyznarska-Dworczak, B.; Garsztka, P. Corporate Social-Environmental Performance versus Financial Performance of Banks in Central and Eastern European Countries. Sustainability 2018, 10, 772. [Google Scholar] [CrossRef]

- Esteban-Sanchez, P.; De La Cuesta-Gonzalez, M.; Paredes-Gazquez, J.D. Corporate social performance and its relation with corporate financial performance: International evidence in the banking industry. J. Clean. Prod. 2017, 162, 1102–1110. [Google Scholar] [CrossRef]

- Fraser, D.R.; Zhang, H. Mergers and Long-Term Corporate Performance: Evidence from Cross-Border Bank Acquisitions. J. Money Crédit. Bank. 2009, 41, 1503–1513. [Google Scholar] [CrossRef]

- Soto-Acosta, P.; Cismaru, D.-M.; Vatamanescu, E.-M.; Ciochina, R.S. Sustainable Entrepreneurship in SMEs: A Business Performance Perspective. Sustainability 2016, 8, 342. [Google Scholar] [CrossRef]

- Alam Siddik, N.; Kabiraj, S.; Joghee, S.; Siddik, N. Impacts of Capital Structure on Performance of Banks in a Developing Economy: Evidence from Bangladesh. Int. J. Financial Stud. 2017, 5, 13. [Google Scholar] [CrossRef]

- Novickytė, L.; Droždz, J. Measuring the Efficiency in the Lithuanian Banking Sector: The DEA Application. Int. J. Financial Stud. 2018, 6, 37. [Google Scholar] [CrossRef]

- Akben-Selcuk, E. Factors Affecting Firm Competitiveness: Evidence from an Emerging Market. Int. J. Financ. Stud. 2016, 4, 9. [Google Scholar] [CrossRef]

- Iwu, C.G.; Kapondoro, L.; Twum-Darko, M.; Tengeh, R.K. Determinants of Sustainability and Organisational Effectiveness in Non-Profit Organisations. Sustainability 2015, 7, 9560–9573. [Google Scholar] [CrossRef]

- Pantouvakis, A.; Vlachos, I.; Zervopoulos, P.D. Market orientation for sustainable performance and the inverted-U moderation of firm size: Evidence from the Greek shipping industry. J. Clean. Prod. 2017, 165, 705–720. [Google Scholar] [CrossRef]

- San, O.T.T.; Teh, B.H.; Lee, A.S. Contingent Factors and Sustainable Performance Measurement (SPM) Practices of Malaysian Electronics and Electrical Companies. Sustainability 2019, 11, 1058. [Google Scholar] [CrossRef]

- Lau, C.-M. Organisation development practices in Hong Kong: Current state and future challenges. Asia Pac. J. Manag. 1995, 12, 101–114. [Google Scholar] [CrossRef]

- Pheko, M.M. Privatization of Public Enterprises in Emerging Economies: Organizational Development (OD) Perspectives. Int. J. Bus. Manag. 2013, 8, 25. [Google Scholar] [CrossRef]

- Hodge, G. Privatization: An International Review of Performance; Routledge: Abingdon, UK, 2018. [Google Scholar]

- Vitale, D.C.; Armenakis, A.A.; Feild, H.S. Integrating Qualitative and Quantitative Methods for Organizational Diagnosis. J. Mix. Methods Res. 2008, 2, 87–105. [Google Scholar] [CrossRef]

- Alian, S.M. Organizational Diagnosis of Universities in the Gaza Strip Based on the Six Box Model: Acomparative Study; The Islamic University: Islamabad, Pakistan, 2015. [Google Scholar]

- Realyvásquez, A.; Maldonado-Macías, A.A.; García-Alcaráz, J.L.; Blanco-Fernandez, J. Effects of Organizational Macroergonomic Compatibility Elements over Manufacturing Systems’ Performance. Procedia Manuf. 2015, 3, 5715–5722. [Google Scholar] [CrossRef][Green Version]

- Kelly, J. Rethinking Industrial Relations: Mobilisation, Collectivism and Long Waves; Routledge: Abingdon, UK, 2012. [Google Scholar]

- Wyche-Seawood, N. The Predictive Relationships between Organizational Citizenship Behaviors and Turnover Intention on Employee Motivation in the Public Sector; Northcentral University: San Diego, CA, USA, 2019. [Google Scholar]

- Behn, R.D. Why Measure Performance? Different Purposes Require Different Measures. Public Adm. Rev. 2003, 63, 586–606. [Google Scholar] [CrossRef]

- Greenhaus, J.H.; Parasuraman, S.; Wormley, W.M. Effects of Race on Organizational Experiences, Job Performance Evaluations, and Career Outcomes. Acad. Manag. J. 1990, 33, 64–86. [Google Scholar] [CrossRef]

- Jenatabadi, H.S.; Ismail, N.A. Application of structural equation modelling for estimating airline performance. J. Air Transp. Manag. 2014, 40, 25–33. [Google Scholar] [CrossRef]

- Mohammad, J.; Quoquab, F.; Omar, R. Factors Affecting Organizational Citizenship Behavior among Malaysian Bank Employees: The Moderating Role of Islamic Work Ethic. Procedia Soc. Behav. Sci. 2016, 224, 562–570. [Google Scholar] [CrossRef][Green Version]

- Nourani, M.; Ting, I.W.K.; Lu, W.-M.; Kweh, Q.L. Capital structure and dynamic performance: Evidence from asean-5 banks. Singap. Econ. Rev. 2019, 64, 495–516. [Google Scholar] [CrossRef]

- Wong, K.K.-K. Partial least squares structural equation modeling (PLS-SEM) techniques using SmartPLS. Mark. Bull. 2013, 24, 1–32. [Google Scholar]

- Gomes, L.; Ramaswamy, K. An Empirical Examination of the Form of the Relationship between Multinationality and Performance. J. Int. Bus. Stud. 1999, 30, 173–187. [Google Scholar] [CrossRef]

- Sarstedt, M.; Ringle, C.M.; Hair, J.F. Partial Least Squares Structural Equation Modeling. Handb. Mark. Res. 2017, 26, 1–40. [Google Scholar] [CrossRef]

- Ping, R.A., Jr. On assuring valid measures for theoretical models using survey data. J. Bus. Res. 2004, 57, 125–141. [Google Scholar] [CrossRef]

- Hair, J.F., Jr.; Sarstedt, M.; Hopkins, L.; Kuppelwieser, V.G. Partial least squares structural equation modeling (PLS-SEM). Eur. Bus. Rev. 2014, 26, 106–121. [Google Scholar] [CrossRef]

- Parolia, N.; Goodman, S.; Li, Y.; Jiang, J.J. Mediators between coordination and IS project performance. Inf. Manag. 2007, 44, 635–645. [Google Scholar] [CrossRef]

- Henseler, J.; Dijkstra, T.K.; Sarstedt, M.; Ringle, C.M.; Diamantopoulos, A.; Straub, D.W.; Ketchen, D.J.; Hair, J.; Hult, G.T.M.; Calantone, R.J. Common Beliefs and Reality About PLS. Organ. Res. Methods 2014, 17, 182–209. [Google Scholar] [CrossRef]

- Shi, H.; Yin, G. Reconnecting p-Value and Posterior Probability Under One- and Two-Sided Tests. Am. Stat. 2020, 1–11. [Google Scholar] [CrossRef]

- Hoque, R.; Sorwar, G. Understanding factors influencing the adoption of mHealth by the elderly: An extension of the UTAUT model. Int. J. Med. Inform. 2017, 101, 75–84. [Google Scholar] [CrossRef]

- Hair, J.F.; Ringle, C.M.; Sarstedt, M. PLS-SEM: Indeed a Silver Bullet. J. Mark. Theory Pr. 2011, 19, 139–152. [Google Scholar] [CrossRef]

- Chow, I.H.-S.; Teo, S.; Chew, I.K.-H. HRM systems and firm performance: The mediation role of strategic orientation. Asia Pac. J. Manag. 2012, 30, 53–72. [Google Scholar] [CrossRef]

- Ting, I.W.K.; Lean, H.H. Does government ownership matter? Comparative study between glcs and nglcs in malaysia. Singap. Econ. Rev. 2015, 60, 1550019. [Google Scholar] [CrossRef]

- Yiu, D.W.; Su, J.; Xu, Y. Alternative financing and private firm performance. Asia Pac. J. Manag. 2012, 30, 829–852. [Google Scholar] [CrossRef]

- Clarke, G.R.; Cull, R.; Shirley, M.M. Bank privatization in developing countries: A summary of lessons and findings. J. Bank. Financ. 2005, 29, 1905–1930. [Google Scholar] [CrossRef]

| Constructs | Items | Loading | T-stat | p-Val | AVE | CR | CA | Rho A | Comment |

|---|---|---|---|---|---|---|---|---|---|

| Social & performance | Purpose | 0.849 | 4.339 | 0.000 | 0.673 | 0.892 | 0.851 | 0.908 | Accepted |

| Relationship | 0.761 | 2.359 | 0.018 | Accepted | |||||

| Rewards | 0.864 | 3.174 | 0.002 | Accepted | |||||

| Helpful | 0.805 | 3.463 | 0.001 | Accepted | |||||

| Mechanism | |||||||||

| Financial & performance | Net assets | 0.992 | 0.000 | 0.960 | 0.990 | 0.986 | 0.989 | Accepted | |

| Total deposit | 0.954 | 35.172 | 0.000 | Accepted | |||||

| Profit before | 0.995 | 165.809 | 0.000 | Accepted | |||||

| Tax | |||||||||

| Earnings per share | 0.978 | 61.898 | 0.000 | Accepted | |||||

| Sustainable firm | Profitability | 0.945 | 33.831 | 0.000 | 0.910 | 0.953 | 0.902 | 0.926 | Accepted |

| (SFP) | Return assets | 0.963 | 71.263 | 0.000 | Accepted | ||||

| Constructs | Composite Reliability (CR) | Status | Convergent Validity (AVE) | Status |

|---|---|---|---|---|

| Social & environmental performance | 0.892 (>0.7) | Accepted | 0.673 (>0.5) | Accepted |

| Financial & economic performance | 0.990 (>0.7) | Accepted | 0.960 (>0.5) | Accepted |

| Sustainable firm performance | 0.953 (>0.7) | Accepted | 0.910 (>0.5) | Accepted |

| Constructs | Sustainable Firm Performance | Social & Environmental Performance | Financial & Economic Performance |

|---|---|---|---|

| Sustainable firm performance | 0.954 | ||

| Social & environmental performance | 0.428 | 0.820 | |

| Financial & economic performance | 0.740 | 0.290 | 0.980 |

| Effect | Hypothesis | t-Value | p-Value | Decision | |

|---|---|---|---|---|---|

| Financial & economic performance → sustainable firm performance | Direct | H1 | 5.189 | 0.000 | Accepted |

| Social & environmental performance → sustainable firm performance | Indirect | H2 | 2.336 | 0.0196 | Accepted |

| Financial & economic performance Social & environmental performance → sustainable firm performance | Total | H3 | 7.619 | 0.00001 | Accepted |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Asghar, B.; Wasim, A.; Qazi, U.; Rasool, A. Financial and Non-Financial Practices Driving Sustainable Firm Performance: Evidence from Banking Sector of Developing Countries. Sustainability 2020, 12, 6164. https://doi.org/10.3390/su12156164

Asghar B, Wasim A, Qazi U, Rasool A. Financial and Non-Financial Practices Driving Sustainable Firm Performance: Evidence from Banking Sector of Developing Countries. Sustainability. 2020; 12(15):6164. https://doi.org/10.3390/su12156164

Chicago/Turabian StyleAsghar, Bilal, Ahmad Wasim, Usama Qazi, and Azfar Rasool. 2020. "Financial and Non-Financial Practices Driving Sustainable Firm Performance: Evidence from Banking Sector of Developing Countries" Sustainability 12, no. 15: 6164. https://doi.org/10.3390/su12156164

APA StyleAsghar, B., Wasim, A., Qazi, U., & Rasool, A. (2020). Financial and Non-Financial Practices Driving Sustainable Firm Performance: Evidence from Banking Sector of Developing Countries. Sustainability, 12(15), 6164. https://doi.org/10.3390/su12156164