Stakeholder Protection, Public Trust, and Corporate Social Responsibility: Evidence from Listed SMEs in China

Abstract

1. Introduction

2. Related Literature and Hypothesis Development

2.1. Institutional Background of the SME Board

2.2. Literature Review and Development of Our Hypotheses

3. Data and Methodology

3.1. Sample Selection

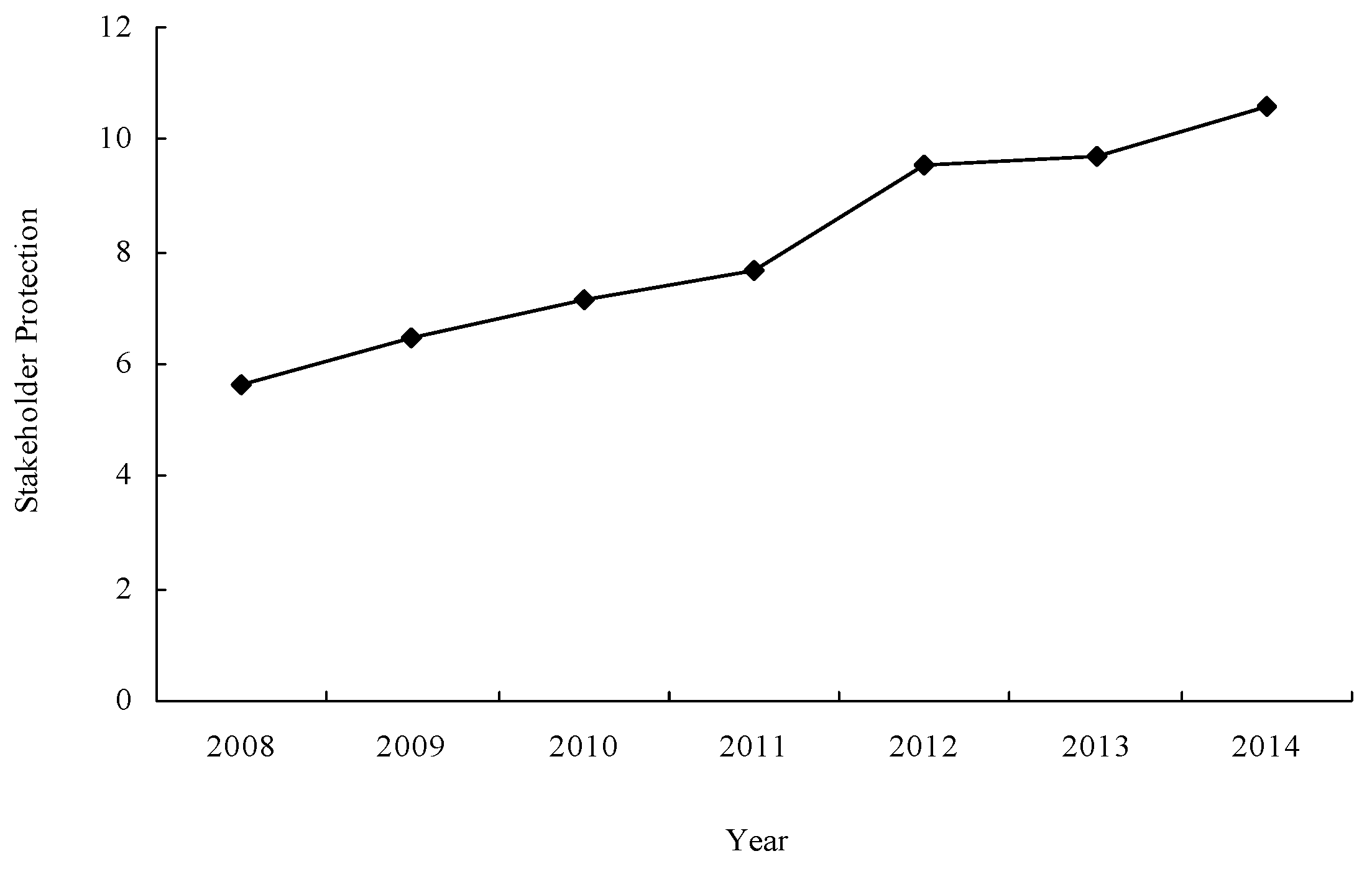

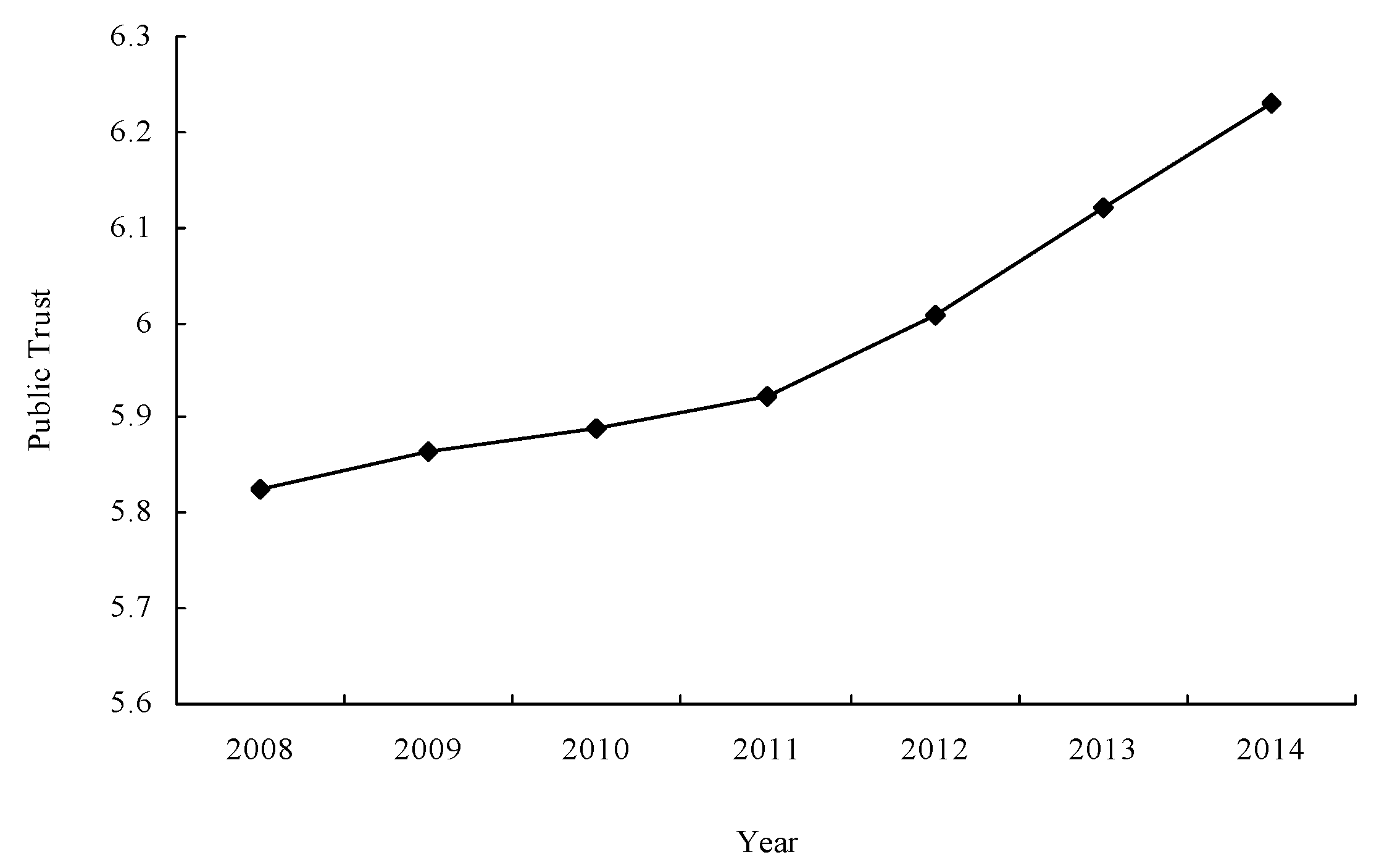

3.2. Variable Definition and Summary Statistics

3.3. Estimation Methods

4. Empirical Results

4.1. The Effects of Stakeholder Protection and Public Trust on SME CSR Activities

4.2. Robustness Tests

5. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Carter, C.R.; Kale, R.; Grimm, C.M. Environmental purchasing and firm performance: An empirical investigation. Transp. Res. Part E Logist. Transp. Rev. 2000, 36, 219–228. [Google Scholar] [CrossRef]

- Staples, C. What does corporate social responsibility mean for charitable fundraising in the UK. Int. J. Nonprofit Volunt. Sect. Mark. 2004, 9, 154–158. [Google Scholar] [CrossRef]

- Mellahi, K.; Frynas, J.G.; Sun, P.; Siegel, D. A review of the nonmarket strategy literature: Toward a multi-theoretical integration. J. Manag. 2016, 42, 143–173. [Google Scholar] [CrossRef]

- Chahal, H.; Sharma, R.D. Implications of corporate social responsibility on marketing performance: A conceptual framework. J. Serv. Res. 2006, 6, 205–216. [Google Scholar]

- Bogdanich, W. Heparin is Now Suspected in 62 Fatalities across US. New York. 2008. Available online: http://www.nytimes.com/2008/04/10/health/policy/10heparin.html (accessed on 10 January 2019).

- Li, S.; Fetscherin, M.; Alon, I.; Lattemann, C.; Yeh, K. Corporate social responsibility in emerging markets: The importance of the governance environment. Manag. Int. Rev. 2010, 50, 635–654. [Google Scholar] [CrossRef]

- Wang, J.; Chaudhri, V. Corporate social responsibility engagement and communication by Chinese companies. Public Relat. Rev. 2009, 35, 247–250. [Google Scholar] [CrossRef]

- Krueger, D.A. The ethics of global supply chains in China—Convergences of east and west. J. Bus. Ethics 2008, 79, 113–120. [Google Scholar] [CrossRef]

- Marquis, C.; Qian, C. Corporate social responsibility reporting in China: Symbol or substance. Organ. Sci. 2014, 25, 127–148. [Google Scholar] [CrossRef]

- Zheng, Y.; Chen, M. China’s Recent State-Owned Enterprise Reform and Its Social Consequences, China Policy Institute Briefing Series-Issue 23. University of Nottingham. 2007. Available online: http://www.Nottingham.ac.uk/cpi/documents/briefings/briefing-23-china-state-owned-enterprise-reform.pdf (accessed on 10 January 2019).

- Liu, X. SME development in China: A policy perspective on SME industrial clustering. In SME in Asia and Globalization; ERIA Research Project Report 2007-5; Lim, H., Ed.; Institute for International Economic Research: Jakarta, Indonesia, 2008. [Google Scholar]

- Allen, F.; Qian, J.; Qian, M. China’s financial system: Past, present, and future. In China’s Great Economic Transformation; Brandt, L., Rawski, T.G., Eds.; Cambridge University Press: New York, NY, USA, 2008; pp. 506–568. [Google Scholar]

- Clark, D.; Murrell, P.; Whiting, S. The role of law in China’s economic development. In China’s Great Economic Transformation; Brandt, L., Rawski, T.G., Eds.; Cambridge University Press: New York, NY, USA, 2008; pp. 375–428. [Google Scholar]

- He, Y.; Tian, Z. Government-oriented corporate public relation strategies in transitional China. Manag. Organ. Rev. 2008, 4, 367–391. [Google Scholar] [CrossRef]

- Tan, J. Institutional structure and firm social performance in transitional economies: Evidence of multinational corporations in China. J. Bus. Ethics 2009, 86 (Suppl. 2), 171. [Google Scholar] [CrossRef]

- Li, W.; Zhang, R. Corporate social responsibility, ownership structure, and political interference: Evidence from China. J. Bus. Ethics 2010, 96, 631–645. [Google Scholar] [CrossRef]

- Wang, H.; Qian, C. Corporate philanthropy and financial performance of Chinese firms: The roles of social expectations and political access. Acad. Manag. J. 2011, 54, 1159–1181. [Google Scholar] [CrossRef]

- Yin, J.; Zhang, Y. Institutional dynamics and corporate social responsibility (CSR) in an emerging country context: Evidence from China. J. Bus. Ethics 2012, 111, 301–316. [Google Scholar] [CrossRef]

- Li, Q.; Luo, W.; Wang, Y.; Wu, L. Firm performance, corporate ownership, and corporate social responsibility disclosure in China. Bus. Ethics Eur. Rev. 2013, 22, 159–173. [Google Scholar] [CrossRef]

- Graafland, J.; Zhang, L. Corporate social responsibility in China: Implementation and challenges. Bus. Ethics Eur. Rev. 2014, 23, 34–49. [Google Scholar] [CrossRef]

- Su, W.; Peng, M.W.; Tan, W.; Cheung, Y. The signaling effect of corporate social responsibility in emerging economies. J. Bus. Ethics 2016, 134, 479–491. [Google Scholar] [CrossRef]

- North, D.C. Institutions, Institutional Change and Economic Performance; Cambridge University Press: New York, NY, USA, 1990. [Google Scholar]

- Campbell, J.L. Why would corporations behave in socially responsible ways. An institutional theory of corporate social responsibility. Acad. Manag. Rev. 2007, 32, 946–967. [Google Scholar] [CrossRef]

- Goergen, M. International Corporate Governance; Pearson Education Prentice Hall: Harlow, UK, 2012. [Google Scholar]

- Algan, A.; Cahuc, P. Inherited trust and growth. Am. Econ. Rev. 2010, 100, 2060–2092. [Google Scholar] [CrossRef]

- Guiso, L. Trust and insurance markets. Econ. Notes 2012, 41, 1–26. [Google Scholar] [CrossRef]

- Swedberg, R. The role of confidence in finance. In The Oxford Handbook of The Sociology of Finance; Cetina, K.K., Preda, A., Eds.; Oxford University Press: Oxford, UK, 2012; pp. 529–545. [Google Scholar]

- Akerlof, G.; Shiller, R. Animal Spirits: How Human Psychology Drives the Economy, and Why It Matters for Global Capitalism; Princeton University Press: Princeton, NJ, USA, 2009. [Google Scholar]

- Guiso, L.; Sapienza, P.; Zingales, L. Trusting the stock market. J. Financ. 2008, 63, 2557–2600. [Google Scholar] [CrossRef]

- Jin, D.; Wang, H.; Wang, P.; Yin, D. Social trust and foreign ownership: Evidence from qualified foreign institutional investors in China. J. Financ. Stab. 2016, 23, 1–14. [Google Scholar] [CrossRef]

- Reynolds, P.D.; Storey, D.; Westhead, P. Regional Characteristics Affecting Entrepreneurship: A Cross-National Comparison; Frontiers of Entrepreneurship Research: Wellesley, MA, USA, 1994. [Google Scholar]

- Ghani, E.; Kerr, W.R.; O’Connell, S. Spatial Determinants of Entrepreneurship in India. Reg. Stud. 2014, 48, 1071–1089. [Google Scholar] [CrossRef]

- Harjoto, M.A.; Jo, H. Corporate governance and CSR nexus. J. Bus. Ethics 2011, 100, 45–67. [Google Scholar] [CrossRef]

- Mallin, C.A.; Michelon, G. Board reputation attributes and corporate social performance: An empirical investigation of the US best corporate citizens. Account. Bus. Res. 2011, 41, 119–144. [Google Scholar] [CrossRef]

- Walls, J.L.; Berrone, P.; Phan, P.H. Corporate governance and environmental performance: Is there really a link? Strat. Manag. J. 2012, 33, 885–913. [Google Scholar] [CrossRef]

- Arora, P.; Dharwadkar, R. Corporate governance and corporate social responsibility (CSR): The moderating roles of attainment discrepancy and organization slack. Corp. Gov. Int. Rev. 2011, 19, 136–152. [Google Scholar] [CrossRef]

- Dam, L.; Scholtens, B. Does ownership type matter for corporate social responsibility. Corp. Gov. Int. Rev. 2012, 20, 233–252. [Google Scholar]

- Anderson, R.C.; Mansi, S.A.; Reeb, D.M. Founding family ownership and the agency cost of debt. J. Financ. Econ. 2003, 68, 263–285. [Google Scholar] [CrossRef]

- Deegan, C. Introduction-the legitimising effect of social and environmental disclosures—A theoretical foundation. Account Audit. Acc. J. 2002, 15, 282–311. [Google Scholar] [CrossRef]

- Ashford, B.E.; Gibbs, B.W. The double-edge of organizational legitimation. Organ. Sci. 1990, 1, 177–194. [Google Scholar] [CrossRef]

- Branco, M.C.; Rodrigues, L.L. Corporate social responsibility and resource-based perspectives. J. Bus. Ethics 2006, 69, 111–132. [Google Scholar] [CrossRef]

- Baughn, C.C.; Bodie, N.L.; McIntosh, J.C. Corporate social and environmental responsibility in Asian countries and other geographical regions. Corp. Soc. Responsib. Environ. Manag. 2007, 14, 189–205. [Google Scholar] [CrossRef]

- Frynas, J.G.; Yamahaki, C. Corporate social responsibility: Review and roadmap of theoretical perspectives. Bus. Ethics Eur. Rev. 2016, 25, 258–285. [Google Scholar] [CrossRef]

- Moir, L.; Taffler, R.J. Does corporate philanthropy exist? Business giving to the arts in the UK. J. Bus. Ethics 2004, 54, 149–161. [Google Scholar] [CrossRef]

- Lamberti, L.; Lettieri, E. CSR practices and corporate strategy: Evidence from a longitudinal case study. J. Bus. Ethics 2009, 87, 153–168. [Google Scholar] [CrossRef]

- Sobczak, A.; Havard, C. Stakeholders’ influence on French unions’ CSR strategies. J. Bus. Ethics 2015, 129, 311–324. [Google Scholar] [CrossRef]

- DiMaggio, P.J.; Powell, W.W. The iron cage revisited: Institutional isomorphism and collective rationality in organizational fields. Am. Sociol. Rev. 1983, 48, 147–160. [Google Scholar] [CrossRef]

- Oh, W.; Chang, Y.; Martynov, A. The effect of ownership structure on corporate social responsibility: Empirical evidence from Korea. J. Bus. Ethics 2011, 104, 283–297. [Google Scholar] [CrossRef]

- Cross, F.B.; Prentice, R.A. Law & Corporate Finance; The Edward Elgar Publishing Limited: Cheltenham, UK, 2007. [Google Scholar]

- Easley, D.; Kleinberg, J. Networks, Crowds, and Markets: Reasoning about a Highly Connected World; Cambridge University Press: Cambridge, UK, 2010. [Google Scholar]

- Fernández, R. Does culture matter? In Handbook of Social Economics; Benhabib, J., Jackson, M.O., Bisin, A., Eds.; North Holland: Amsterdam, The Netherlands, 2011; Volume 1A, pp. 481–510. [Google Scholar]

- Wang, X.; Fan, G.; Yu, J. Marketization Index of China’s Provinces: NERI Report 2016; Social Science Academic Press: Beijing, China, 2017. (In Chinese) [Google Scholar]

- Chenhall, R.H.; Hall, M.; Smith, D. Social capital and management control systems: A study of non-government organizations. Acc. Organ. Soc. 2010, 35, 737–756. [Google Scholar] [CrossRef]

- Wu, W.; Firth, M.; Rui, O.M. Trust and the provision of trade credit. J. Bank. Financ. 2014, 39, 146–159. [Google Scholar] [CrossRef]

- Petersen, M.A. Estimating standard errors in finance panel data sets: Comparing approaches. Rev. Financ. Stud. 2009, 22, 435–480. [Google Scholar] [CrossRef]

- Thompson, S.B. Simple formulas for standard errors that cluster by both firm and time. J. Financ. Econ. 2009, 99, 1–10. [Google Scholar] [CrossRef]

- Cameron, A.C.; Gelbach, J.B.; Miller, D.L. Robust inference with multiway clustering. J. Bus. Econ. Stat. 2011, 29, 238–249. [Google Scholar] [CrossRef]

- Cameron, A.C.; Trivedi, P.K. Microeconometrics Using Stata; Stata Press: College Station, TX, USA, 2009. [Google Scholar]

- Ang, J.S.; Cheng, Y.; Wu, C. Trust, investment, and business contracting. J. Financ. Quant. Anal. 2015, 50, 569–595. [Google Scholar] [CrossRef]

- Acock, A.C. Discovering Structural Equation Modeling Using Stata; Stata Press: College Station, TX, USA, 2013. [Google Scholar]

- Fang, Y.; Zhao, Y. Looking for instruments for institutions: Estimating the impact of property rights protection on Chinese economic performance. Econ. Res. J. 2011, 5, 138–148. (In Chinese) [Google Scholar]

- Valeri, M.; Baggio, R. Social network analysis: Organizational implications in tourism management. Int. J. Organ. Anal. 2020. [Google Scholar] [CrossRef]

- Valeri, M.; Baggio, R. Italian tourism intermediaries: A social network analysis exploration. Curr. Issues Tour. 2020, 2, 1–14. [Google Scholar] [CrossRef]

- Valeri, M.; Baggio, R. A critical reflection on the adoption of blockchain in tourism. J. Inf. Technol. Tour. 2020, 1, 1–12. [Google Scholar] [CrossRef]

| Subjects | Literature References |

|---|---|

| Board characteristics play a particularly important role in a firm’s CSR performance. | Harjoto and Jo [33]; Mallin and Michelon [34]; and Walls, Berrone, and Phan [35]. |

| Financial resources have significant impacts on firm CSR activities. | Li, Luo, Wang, and Wu [19]; and Arora and Dharwadkar [36]. |

| Ownership structure and identity of firm ownership influence patterns of engagement with CSR. | Marquis and Qian [9]; Dam and Scholtens [37]; and Anderson, Mansi, and Reeb [38] |

| Greater legitimacy needs influence corporate CSR activities. | Deegan [39]; Ashford and Gibbs [40]; and Branco and Rodrigues [41] |

| Studies additionally document the relationship between the level of economic development, or growth opportunities, and CSR. | Li, Fetscherin, Alon, Lattemann, and Yeh [6]; Li and Zhang [16]; and Baughn, Bodie, and McIntosh [42]. |

| Institutional infrastructure and cultural ethics may exert an abiding influence on CSR approaches. | Yin and Zhang [18]; and Frynas and Yamahaki [43]. |

| Industry Classification | Total Enterprises | CSR Firms | Non-CSR Firms |

|---|---|---|---|

| Agriculture | 16 | 3 | 13 |

| Forestry | 16 | 2 | 14 |

| Livestock farming | 64 | 17 | 47 |

| Fishery | 24 | 0 | 24 |

| Coal mining and preparation | 8 | 5 | 3 |

| Nonferrous metal mining | 8 | 8 | 0 |

| Mining auxiliary activities | 32 | 0 | 32 |

| Agro-food processing | 136 | 24 | 112 |

| Food manufacturing | 104 | 11 | 93 |

| Liquor, beverages, and tea | 40 | 6 | 34 |

| Textiles | 120 | 21 | 99 |

| Clothes | 152 | 34 | 118 |

| Leather, fur, feathers, and footwear | 16 | 4 | 12 |

| Wood, bamboo, rattan, palm, and grass products | 32 | 0 | 32 |

| Furniture | 24 | 0 | 24 |

| Paper making | 72 | 12 | 60 |

| Printing and recording media reproduction | 32 | 8 | 24 |

| Education, art, sports, and entertainment | 56 | 12 | 44 |

| Petroleum, coking, and nuclear fuel processing | 16 | 0 | 16 |

| Chemical raw materials and chemical products | 504 | 54 | 450 |

| Medical products | 376 | 48 | 328 |

| Chemical fiber manufacturing | 48 | 13 | 35 |

| Rubber and plastic | 152 | 19 | 133 |

| Nonmetallic mineral products | 160 | 29 | 131 |

| Ferrous metal smelting and rolling | 24 | 8 | 16 |

| Non-ferrous metal smelting and rolling | 152 | 22 | 130 |

| Metal products | 232 | 10 | 222 |

| General equipment manufacturing | 312 | 35 | 277 |

| Special equipment manufacturing | 344 | 39 | 305 |

| Automobile manufacturing | 256 | 7 | 249 |

| Railway, shipbuilding, and aerospace | 24 | 1 | 23 |

| Electrical machinery and equipment | 560 | 47 | 513 |

| Computer and communications | 648 | 77 | 571 |

| Instrument and apparatus manufacturing | 48 | 7 | 41 |

| Other manufacturing | 72 | 9 | 63 |

| Comprehensive utilization of waste resources | 16 | 7 | 9 |

| Electric power, heat production, and supply | 16 | 7 | 9 |

| Gas production and supply | 24 | 0 | 24 |

| Civil engineering | 128 | 22 | 106 |

| Architectural decoration and other construction | 88 | 8 | 80 |

| Wholesale trade | 56 | 5 | 51 |

| Retail sales | 104 | 13 | 91 |

| Road transportation | 24 | 0 | 24 |

| Water transportation | 16 | 0 | 16 |

| Handling and forwarding agents | 8 | 0 | 8 |

| Warehousing industry | 16 | 0 | 16 |

| Catering industry | 8 | 0 | 8 |

| Telecommunications, radio, and television | 8 | 0 | 8 |

| Internet and related services | 104 | 16 | 88 |

| Software and information technology services | 248 | 61 | 187 |

| Estate industry | 88 | 15 | 73 |

| Business services | 96 | 3 | 93 |

| Professional technical services | 48 | 1 | 47 |

| Ecological and environmental protection | 16 | 0 | 16 |

| Public facility management | 24 | 7 | 17 |

| Public health | 8 | 1 | 7 |

| Film and video recording | 32 | 1 | 31 |

| Culture and art | 8 | 0 | 8 |

| Variable | Observations | Mean | Std. Dev. | Minimum | Maximum |

|---|---|---|---|---|---|

| Disclosure | 6064 | 0.125 | 0.331 | 0.000 | 1.000 |

| Scores | 429 | 34.683 | 9.538 | 18.770 | 63.610 |

| Stakeprotect | 5306 | 8.103 | 4.117 | 1.480 | 16.190 |

| Ptrust | 6064 | 6.022 | 0.350 | 4.652 | 6.915 |

| Mpconnection | 4645 | 0.675 | 0.468 | 0.000 | 1.000 |

| Bpconnection | 4645 | 0.745 | 0.436 | 0.000 | 1.000 |

| Boardscale | 4627 | 2.133 | 0.174 | 1.610 | 2.480 |

| Indirector | 4600 | 37.398 | 8.087 | 22.220 | 60.000 |

| Largeshare | 4658 | 63.804 | 13.210 | 31.060 | 90.040 |

| Firmage | 6060 | 2.556 | 0.467 | 1.100 | 3.660 |

| Roa | 4646 | 5.163 | 4.934 | −13.230 | 21.060 |

| Firmsize | 4651 | 7.629 | 0.845 | 5.890 | 10.060 |

| Slackres | 4641 | 2.151 | 14.740 | −29.530 | 59.140 |

| Debtoasset | 4646 | 35.640 | 18.933 | 3.320 | 80.920 |

| Tobinq | 4443 | 2.930 | 1.764 | 1.040 | 10.200 |

| Fsales | 4575 | 16.988 | 24.219 | 0.000 | 93.300 |

| Gdppc | 6064 | 1.587 | 0.449 | 0.370 | 2.440 |

| Variable | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) |

|---|---|---|---|---|---|---|---|---|---|---|

| Stakeprotect | 0.081 ** | 0.081 ** | 0.085 ** | 0.094 ** | 0.084 ** | 0.179 ** | 0.180 ** | 0.165 * | 0.226 *** | 0.183 ** |

| (0.039) | (0.039) | (0.040) | (0.039) | (0.039) | (0.087) | (0.087) | (0.087) | (0.086) | (0.087) | |

| Ptrust | −0.186 | −0.278 | −0.184 | −0.573 | −0.178 | 0.088 | −0.228 | 0.384 | −1.041 | 0.098 |

| (0.393) | (0.387) | (0.392) | (0.408) | (0.390) | (1.112) | (1.099) | (1.085) | (1.030) | (1.114) | |

| Mpconnection | 0.682 *** | 0.080 | 0.357 | 0.566 ** | 0.129 | 0.130 | 0.127 | 0.131 | ||

| (0.254) | (0.184) | (0.270) | (0.247) | (9.118) | (9.078) | (8.797) | (8.552) | |||

| Bpconnection | −0.948 *** | −0.488 | −0.696 ** | -- | 0.153 | 0.131 | ||||

| (0.278) | (0.311) | (0.275) | (12.837) | (17.197) | ||||||

| Boardscale | 0.137 | 0.285 | −0.059 | 0.108 | −0.140 | −0.246 | −0.370 | −0.167 | ||

| (0.718) | (0.729) | (0.699) | (0.721) | (1.462) | (1.424) | (1.409) | (1.463) | |||

| Indirector | −0.006 | −0.003 | −0.007 | −0.006 | −0.029 | −0.024 | −0.026 | −0.029 | ||

| (0.015) | (0.015) | (0.015) | (0.015) | (0.030) | (0.029) | (0.030) | (0.030) | |||

| Largeshare | −0.008 | −0.007 | −0.004 | −0.009 | −0.008 | −0.011 | −0.010 | −0.006 | −0.009 | −0.009 |

| (0.007) | (0.007) | (0.007) | (0.007) | (0.007) | (0.018) | (0.018) | (0.017) | (0.017) | (0.018) | |

| Firmage | 0.848 *** | 0.829 *** | 0.695 *** | 1.017 *** | 0.834 *** | −3.905 * | −3.793 * | −3.849 * | −0.653 | −4.033 * |

| (0.242) | (0.234) | (0.236) | (0.246) | (0.237) | (2.227) | (2.191) | (2.128) | (2.025) | (2.225) | |

| Roa | 0.032 ** | 0.035 ** | 0.033 ** | 0.033 ** | 0.028 | 0.034 | 0.030 | 0.029 | ||

| (0.016) | (0.016) | (0.016) | (0.016) | (0.032) | (0.032) | (0.031) | (0.032) | |||

| Firmsize | 1.060 *** | 1.041 *** | 1.043 *** | 1.095 *** | 1.045 *** | 1.567 *** | 1.518 *** | 1.639 *** | 1.444 *** | 1.579 *** |

| (0.174) | (0.170) | (0.169) | (0.165) | (0.171) | (0.498) | (0.489) | (0.448) | (0.442) | (0.498) | |

| Slackres | 0.002 | 0.002 | 0.002 | 0.002 | 0.004 | 0.005 | 0.005 | 0.004 | ||

| (0.004) | (0.004) | (0.004) | (0.004) | (0.007) | (0.006) | (0.007) | (0.006) | |||

| Debtoasset | −0.002 | −0.0004 | −0.003 | −0.002 | 0.008 | 0.011 | 0.002 | 0.008 | ||

| (0.006) | (0.006) | (0.006) | (0.006) | (0.014) | (0.014) | (0.013) | (0.014) | |||

| Tobinq | 0.014 | 0.019 | 0.005 | 0.014 | −0.060 | −0.057 | −0.070 | −0.061 | ||

| (0.063) | (0.063) | (0.060) | (0.064) | (0.114) | (0.113) | (0.108) | (0.114) | |||

| Fsales | −0.006 | −0.007 | −0.009 * | −0.007 | −0.015 | −0.015 | −0.016 | −0.015 | ||

| (0.005) | (0.004) | (0.005) | (0.004) | (0.018) | (0.017) | (0.017) | (0.017) | |||

| Gdppc | −1.350 *** | −1.241 *** | −1.302 *** | −1.301 *** | −1.384 *** | −4.001 * | −2.957 | −4.060 * | −3.203 | −4.079 * |

| (0.462) | (0.448) | (0.463) | (0.451) | (0.461) | (2.249) | (2.184) | (2.205) | (2.147) | (2.250) | |

| Hdummy | −0.214 | −0.240 | −0.174 | −0.241 | -- | -- | -- | -- | ||

| (0.190) | (0.189) | (0.180) | (0.189) | |||||||

| Yeardummies | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| p-value of χ2 test | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| Number of obs. | 3642 | 3675 | 3787 | 3701 | 3642 | 625 | 641 | 641 | 673 | 625 |

| Variable | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) |

|---|---|---|---|---|---|---|---|---|---|---|

| Stakeprotect | 0.542 ** | 0.476 ** | 0.556 *** | 0.596 *** | 0.485 ** | 0.501 *** | 0.681 *** | 0.510 *** | 0.486 | 0.619 *** |

| (0.223) | (0.218) | (0.208) | (0.217) | (0.216) | (0.173) | (0.244) | (0.170) | (1.348) | (0.234) | |

| Ptrust | −8.664 *** | −8.539 *** | −8.839 *** | −8.454 *** | −8.486 *** | −8.491 *** | −10.133 *** | −8.770 *** | −0.742 | −9.578 *** |

| (2.606) | (2.715) | (2.774) | (2.714) | (2.649) | (1.921) | (2.348) | (1.807) | (11.550) | (2.257) | |

| Mpconnection | 4.386 *** | 1.711 | 3.405 *** | 4.406 *** | 4.665 ** | 1.796 | 3.498 ** | 14.718 | ||

| (1.503) | (1.543) | (1.307) | (1.489) | (1.838) | (1.113) | (1.746) | (13.481) | |||

| Bpconnection | −3.150 *** | −2.603 ** | −3.170 *** | −3.512 * | −2.800 | −16.368 | ||||

| (1.131) | (1.103) | (1.219) | (1.877) | (1.784) | (16.446) | |||||

| Boardscale | 7.283 * | 7.143 | 8.648 ** | 7.883 * | 6.298 * | 6.417 * | 10.090 | 6.285 * | ||

| (4.077) | (4.550) | (4.219) | (4.065) | (3.563) | (3.577) | (13.854) | (3.788) | |||

| Indirector | 0.065 | 0.086 | 0.093 | 0.083 | 0.048 | 0.074 | 0.098 | 0.059 | ||

| (0.099) | (0.111) | (0.096) | (0.097) | (0.081) | (0.081) | (0.298) | (0.085) | |||

| Largeshare | −0.164 *** | −0.167 ** | −0.170 *** | −0.152 *** | −0.172 *** | −0.172 *** | −0.146 *** | −0.169 *** | −0.283 | −0.160 *** |

| (0.063) | (0.065) | (0.062) | (0.056) | (0.063) | (0.039) | (0.045) | (0.038) | (0.190) | (0.042) | |

| Firmage | 0.309 | −0.162 | 0.157 | 0.314 | −0.029 | 0.216 | −3.208 | 0.243 | 16.516 | −2.178 |

| (1.500) | (1.564) | (1.489) | (1.549) | (1.565) | (1.397) | (2.451) | (1.362) | (19.513) | (2.391) | |

| Roa | −0.284 * | −0.236 | −0.295 ** | −0.254 | −0.219 * | −0.378 ** | 0.705 | −0.330 * | ||

| (0.154) | (0.157) | (0.149) | (0.157) | (0.127) | (0.180) | (1.181) | (0.171) | |||

| Firmsize | 3.001 ** | 3.043 ** | 1.860 ** | 2.771 ** | 2.805 ** | 3.487 *** | 0.624 | 2.379 *** | 17.666 | 1.274 |

| (1.353) | (1.388) | (0.866) | (1.375) | (1.324) | (1.141) | (1.977) | (0.894) | (17.053) | (1.905) | |

| Slackres | −0.026 | −0.022 | −0.029 * | −0.026 | −0.024 | −0.010 | −0.082 | −0.017 | ||

| (0.017) | (0.015) | (0.016) | (0.017) | (0.030) | (0.033) | (0.126) | (0.032) | |||

| Debtoasset | −0.074 | −0.061 | −0.073 | −0.047 | −0.074 ** | −0.085 ** | 0.009 | −0.063 * | ||

| (0.068) | (0.066) | (0.065) | (0.061) | (0.034) | (0.039) | (0.157) | (0.036) | |||

| Tobinq | 0.645 | 0.526 | 0.678 * | 0.658 | 0.497 | −0.265 | 3.617 | 0.045 | ||

| (0.402) | (0.405) | (0.348) | (0.427) | (0.410) | (0.578) | (3.977) | (0.561) | |||

| Fsales | 0.027 | 0.032 | 0.028 | 0.026 | 0.027 | 0.037 * | 0.029 | 0.031 | ||

| (0.033) | (0.032) | (0.033) | (0.034) | (0.019) | (0.020) | (0.019) | (0.019) | |||

| Gdppc | 0.856 | 0.748 | 0.709 | 0.325 | 1.175 | 0.589 | 0.670 | 0.374 | −0.781 | 0.954 |

| (1.871) | (1.887) | (1.934) | (1.918) | (1.862) | (1.823) | (1.967) | (1.816) | (7.031) | (1.884) | |

| Hdummy | 0.094 | 0.275 | 0.731 | 0.469 | 0.167 | 0.573 | 0.609 | 0.752 | ||

| (1.371) | (1.345) | (1.347) | (1.401) | (0.972) | (1.063) | (0.957) | (0.992) | |||

| Constant | 52.077 *** | 66.049 *** | 59.964 *** | 47.587 ** | 46.846 ** | 46.070 * | 132.242 *** | 53.181 ** | −311.278 | 95.247 * |

| (18.907) | (18.761) | (21.169) | (21.315) | (22.402) | (26.283) | (51.195) | (23.685) | (421.277) | (52.489) | |

| Yeardummies | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| p value of F test | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | |||||

| p value of χ2 test | 0.000 | 0.000 | 0.000 | 0.932 | 0.000 | |||||

| Number of obs. | 415 | 416 | 420 | 422 | 415 | 3448 | 3448 | 3448 | 3448 | 3448 |

| Variable | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) |

|---|---|---|---|---|---|---|---|---|---|---|

| Stakeprotect | 0.042 * | 0.039 * | 0.038 * | 0.058 * | 0.043 * | 0.520 * | 0.574 * | 0.510 * | 0.580 * | 0.559 * |

| (0.023) | (0.021) | (0.022) | (0.031) | (0.025) | (0.310) | (0.311) | (0.307) | (0.310) | (0.309) | |

| Ptrust | −0.218 | −0.313 | −0.222 | −0.603 | −0.212 | −8.552 *** | −8.536 *** | −8.590 *** | −8.387 *** | −8.377 *** |

| (0.392) | (0.388) | (0.395) | (0.409) | (0.391) | (2.862) | (2.975) | (2.984) | (2.913) | (2.870) | |

| Stakeprotect × Ptrust | 0.143 | 0.155 | 0.169 | 0.134 | 0.146 | 0.105 | 0.003 | 0.214 | 0.065 | 0.103 |

| (0.104) | (0.103) | (0.105) | (0.105) | (0.104) | (0.740) | (0.755) | (0.743) | (0.710) | (0.766) | |

| Mpconnection | 0.659 *** | 0.063 | 0.345 | 0.543 ** | 4.387 *** | 1.711 | 3.418 *** | 4.410 *** | ||

| (0.248) | (0.182) | (0.261) | (0.242) | (1.497) | (1.549) | (1.300) | (1.478) | |||

| Bpconnection | −0.937 *** | −0.500 * | −0.683 ** | −3.155 *** | −2.622 ** | −3.171 *** | ||||

| (0.274) | (0.301) | (0.273) | (1.123) | (1.106) | (1.214) | |||||

| Boardscale | 0.141 | 0.271 | −0.057 | 0.112 | 7.327 * | 7.193 | 8.673 ** | 7.920 ** | ||

| (0.719) | (0.730) | (0.702) | (0.722) | (4.008) | (4.531) | (4.145) | (3.994) | |||

| Indirector | −0.006 | −0.004 | −0.008 | −0.006 | 0.065 | 0.086 | 0.094 | 0.083 | ||

| (0.015) | (0.015) | (0.015) | (0.015) | (0.099) | (0.111) | (0.096) | (0.096) | |||

| Largeshare | −0.009 | −0.007 | −0.004 | −0.009 | −0.008 | −0.164 *** | −0.167 ** | −0.171 *** | −0.152 *** | −0.173 *** |

| (0.007) | (0.007) | (0.007) | (0.007) | (0.007) | (0.063) | (0.066) | (0.061) | (0.056) | (0.064) | |

| Firmage | 0.837 *** | 0.818 *** | 0.686 *** | 1.004 *** | 0.824 *** | 0.130 | −0.162 | 0.125 | 0.305 | −0.044 |

| (0.242) | (0.235) | (0.237) | (0.246) | (0.237) | (1.647) | (1.567) | (1.489) | (1.553) | (1.572) | |

| Roa | 0.033 * | 0.036 ** | 0.034 ** | 0.033 ** | −0.285 * | −0.236 | −0.297 ** | −0.256 * | ||

| (0.016) | (0.016) | (0.016) | (0.016) | (0.151) | (0.155) | (0.146) | (0.155) | |||

| Firmsize | 1.060 *** | 1.043 *** | 1.063 *** | 1.096 *** | 1.045 *** | 2.986 ** | 3.043 ** | 1.842 ** | 2.761 ** | 2.791 ** |

| (0.175) | (0.171) | (0.172) | (0.166) | (0.172) | (1.381) | (1.417) | (0.872) | (1.403) | (1.355) | |

| Slackres | 0.002 | 0.003 | 0.003 | 0.003 | −0.026 | −0.022 | −0.029 * | −0.026 | ||

| (0.004) | (0.004) | (0.004) | (0.004) | (0.016) | (0.015) | (0.015) | (0.016) | |||

| Debtoasset | −0.002 | 0.0004 | −0.002 | −0.001 | −0.074 | −0.061 | −0.073 | −0.046 | ||

| (0.006) | (0.006) | (0.006) | (0.006) | (0.068) | (0.066) | (0.065) | (0.061) | |||

| Tobinq | 0.011 | 0.016 | 0.002 | 0.010 | 0.640 | 0.526 | 0.676 * | 0.652 | ||

| (0.064) | (0.064) | (0.061) | (0.064) | (0.408) | (0.411) | (0.351) | (0.434) | |||

| Fsales | −0.006 | −0.007 | −0.009 * | −0.007 | 0.027 | 0.031 | 0.027 | 0.026 | ||

| (0.004) | (0.004) | (0.005) | (0.004) | (0.033) | (0.032) | (0.033) | (0.034) | |||

| Gdppc | −0.967 ** | −0.832 * | −0.851 * | −0.956 ** | −0.988 ** | 1.125 | 0.756 | 1.231 | 0.490 | 1.438 |

| (0.460) | (0.446) | (0.458) | (0.451) | (0.457) | (2.072) | (2.247) | (2.346) | (2.072) | (2.132) | |

| Hdummy | −0.207 | −0.233 | −0.169 | −0.236 | 0.118 | 0.275 | 0.767 | 0.491 | ||

| (0.189) | (0.188) | (0.181) | (0.188) | (1.428) | (1.394) | (1.386) | (1.443) | |||

| Constant | −11.345 *** | −11.137 *** | −12.105 *** | −9.521 *** | −11.433 *** | 51.110 *** | 66.021 *** | 58.025 *** | 47.046 ** | 45.950 ** |

| (3.283) | (2.832) | (3.431) | (3.144) | (3.294) | (19.186) | (19.657) | (21.877) | (20.983) | (22.200) | |

| Yeardummies | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| p-value of F test | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | |||||

| p-value of χ2 test | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | |||||

| Number of obs. | 3642 | 3675 | 3787 | 3701 | 3642 | 415 | 416 | 420 | 422 | 415 |

| Endogenous Variables: Disclosure and Stakeprotect | |||||

| Structural Disclosure | |||||

| Variable | (1) | (2) | Variable | (1) | (2) |

| Stakeprotect | 0.104 * | 0.060 ** | Roa | 0.101 *** | 0.103 *** |

| (0.062) | (0.029) | (0.015) | (0.015) | ||

| Ptrust | 0.005 | Firmsize | 0.206 *** | 0.200 *** | |

| (0.018) | (0.015) | (0.015) | |||

| Stakeprotect × Ptrust | 0.020 | Slackres | −0.013 | −0.011 | |

| (0.026) | (0.013) | (0.013) | |||

| Mpconnection | 0.071 *** | 0.071 *** | Debtoasset | 0.021 | 0.022 |

| (0.019) | (0.019) | (0.016) | (0.016) | ||

| Bpconnection | −0.073 *** | −0.072 *** | Tobinq | 0.019 | 0.018 |

| (0.019) | (0.019) | (0.014) | (0.015) | ||

| Boardscale | 0.007 | 0.008 | Fsales | 0.007 | 0.007 |

| (0.019) | (0.019) | (0.013) | (0.013) | ||

| Indirector | 0.002 | 0.003 | Gdppc | 0.054 | 0.043 |

| (0.019) | (0.019) | (0.052) | (0.040) | ||

| Largeshare | −0.031 ** | −0.029 ** | Hdummy | −0.008 | −0.007 |

| (0.013) | (0.013) | (0.013) | (0.013) | ||

| Firmage | 0.114 *** | 0.111 *** | Constant | −2.164 *** | −2.203 *** |

| (0.013) | (0.013) | (0.342) | (0.438) | ||

| Structural Stakeprotect | |||||

| Variable | (1) | (2) | Variable | (1) | (2) |

| Instrument | 0.026 *** | 0.019 ** | Gdppc | 0.619 *** | 0.616 *** |

| (0.009) | (0.008) | (0.009) | (0.009) | ||

| Ptrust | 0.302 *** | 0.303 *** | Constant | −5.328 *** | −5.340 *** |

| (0.009) | (0.010) | (0.145) | (0.145) | ||

| p-value of χ2 test | 0.000 | 0.000 | |||

| Number of obs. | 6064 | 6064 | |||

| Endogenous variables: Scores, Stakeprotect, and Ptrust | |||||

| Structural Scores | |||||

| Variable | (1) | (2) | Variable | (1) | (2) |

| Stakeprotect | 0.246 *** | 0.252 ** | Roa | −0.151 ** | −0.151 ** |

| (0.083) | (0.104) | (0.068) | (0.069) | ||

| Ptrust | −0.332 *** | −0.332 *** | Firmsize | 0.342 *** | 0.342 *** |

| (0.074) | (0.074) | (0.071) | (0.072) | ||

| Stakeprotect × Ptrust | −0.007 | Slackres | −0.054 | −0.055 | |

| (0.066) | (0.049) | (0.049) | |||

| Mpconnection | 0.175 * | 0.175 * | Debtoasset | −0.170 ** | −0.171 ** |

| (0.091) | (0.091) | (0.078) | (0.079) | ||

| Bpconnection | −0.141 | −0.140 | Tobinq | 0.001 | 0.001 |

| (0.087) | (0.087) | (0.062) | (0.062) | ||

| Boardscale | 0.065 | 0.065 | Fsales | 0.097 * | 0.097 * |

| (0.079) | (0.079) | (0.051) | (0.051) | ||

| Indirector | −0.023 | −0.023 | Gdppc | 0.088 | 0.083 |

| (0.079) | (0.079) | (0.079) | (0.096) | ||

| Largeshare | −0.209 *** | −0.208 *** | Hdummy | 0.043 | 0.043 |

| (0.050) | (0.051) | (0.057) | (0.057) | ||

| Firmage | 0.003 | 0.004 | Constant | 6.977 *** | 6.998 *** |

| (0.049) | (0.049) | (1.896) | (1.907) | ||

| Structural Stakeprotect | |||||

| Variable | (1) | (2) | Variable | (1) | (2) |

| Instrument | 0.356 *** | 0.357 *** | Gdppc | 0.525 *** | 0.524 *** |

| (0.035) | (0.035) | (0.066) | (0.066) | ||

| Ptrust | 0.449 *** | 0.449 *** | Constant | −8.285 *** | −8.285 *** |

| (0.098) | (0.098) | (1.486) | (1.486) | ||

| Structural Ptrust | |||||

| Variable | (1) | (2) | Variable | (1) | (2) |

| Instrument | 0.493 *** | 0.493 *** | Socialtrust | 0.182 *** | 0.181 *** |

| (0.027) | (0.027) | (0.028) | (0.028) | ||

| Stakeprotect | 0.824 *** | 0.824 *** | Constant | 12.039 *** | 12.039 *** |

| (0.032) | (0.032) | (0.834) | (0.835) | ||

| p-value of χ2 test | 0.013 | 0.000 | |||

| Number of obs. | 332 | 332 | |||

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hou, X.; Wang, B.; Gao, Y. Stakeholder Protection, Public Trust, and Corporate Social Responsibility: Evidence from Listed SMEs in China. Sustainability 2020, 12, 6085. https://doi.org/10.3390/su12156085

Hou X, Wang B, Gao Y. Stakeholder Protection, Public Trust, and Corporate Social Responsibility: Evidence from Listed SMEs in China. Sustainability. 2020; 12(15):6085. https://doi.org/10.3390/su12156085

Chicago/Turabian StyleHou, Xiaohui, Bo Wang, and Yu Gao. 2020. "Stakeholder Protection, Public Trust, and Corporate Social Responsibility: Evidence from Listed SMEs in China" Sustainability 12, no. 15: 6085. https://doi.org/10.3390/su12156085

APA StyleHou, X., Wang, B., & Gao, Y. (2020). Stakeholder Protection, Public Trust, and Corporate Social Responsibility: Evidence from Listed SMEs in China. Sustainability, 12(15), 6085. https://doi.org/10.3390/su12156085