The Game of Developers and Planners: Ecosystem Services as a (Hidden) Regulation through Planning Delay Times

Abstract

1. Introduction

2. Background and Conceptual Model

3. Materials and Methods

3.1. The Case of a Single Green Parcel

3.2. The Case of a Large Green Area

4. Results

4.1. The Case of a Single Green Parcel

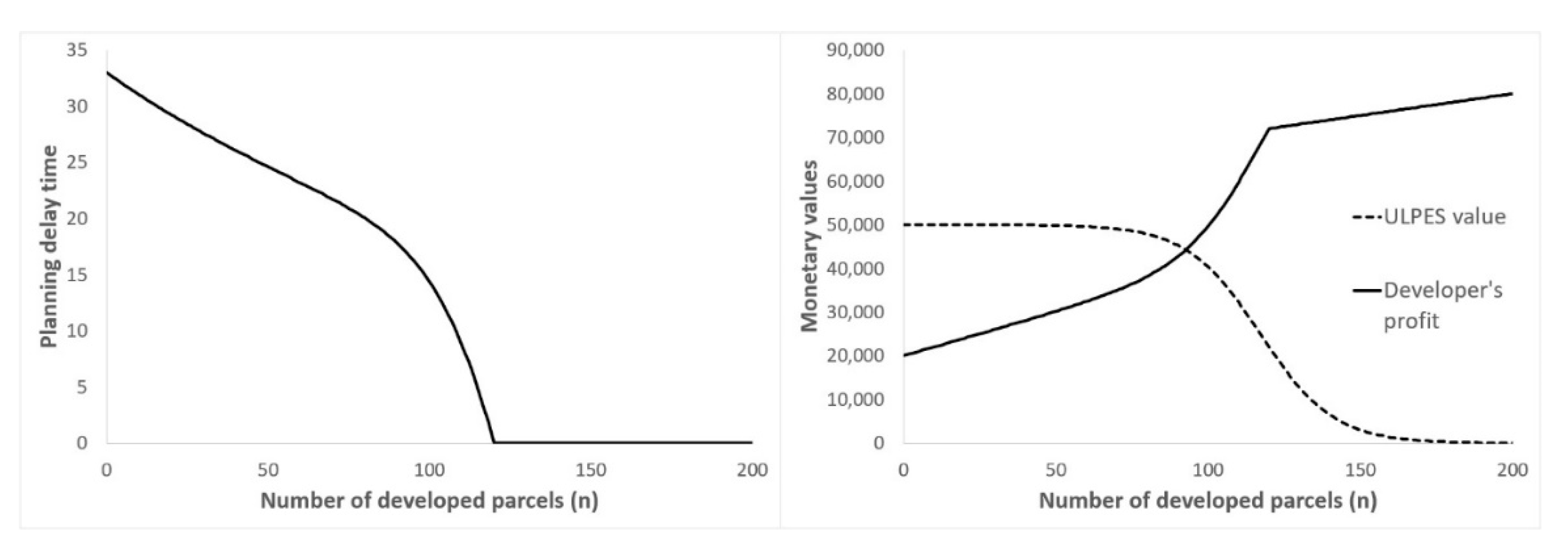

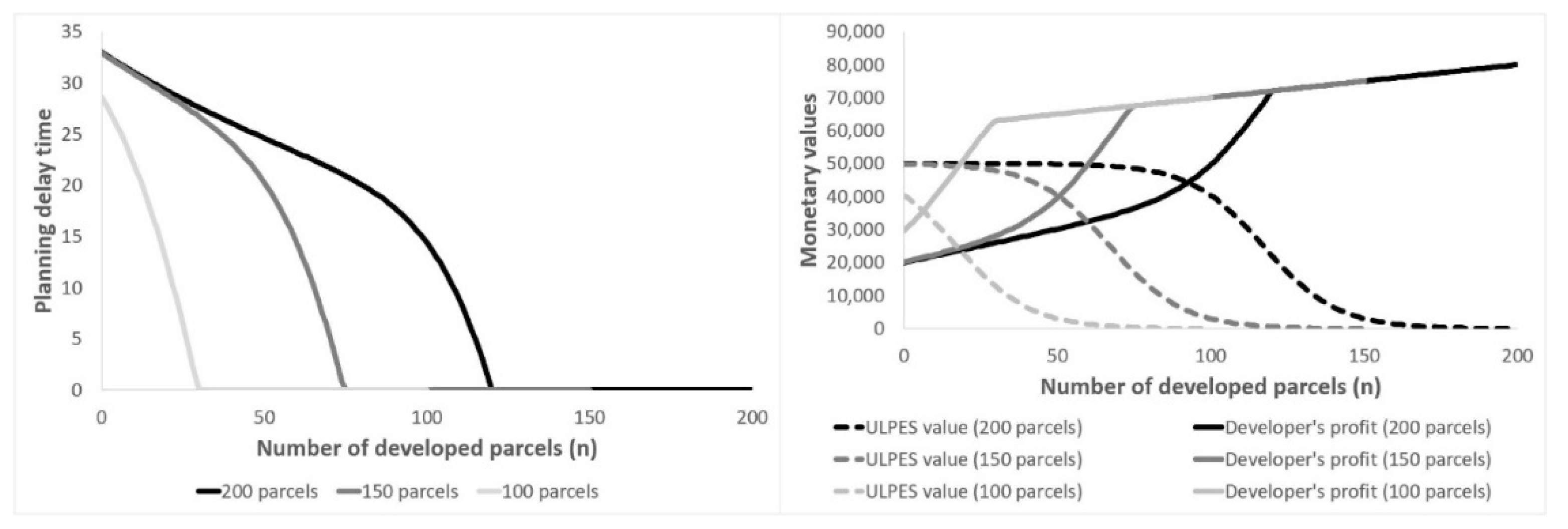

4.2. The Case of a Large Green Area

5. Discussion

6. Conclusions

Supplementary Materials

Funding

Conflicts of Interest

Appendix A

- If (A1) holds and P sets a waiting time as defined previously, then the following separating equilibrium exists: a developer of type will develop the parcel, and a developer of type will do nothing. This follows immediately from the proposition that will not deviate because he will lose the opportunity to make a profit, and will not deviate either, since developing the parcel will result in net losses. Additionally, any type of pooling equilibrium is impossible due to the single crossing property and the fact that is initially defined by the planner.

- If , the following pooling equilibrium emerges: both types of developers will seek to develop the parcel. will not deviate because he will lose the opportunity to make a profit, but the same holds for . Any imposed waiting time will unnecessarily lower the social utility. Therefore, .

- If , the following pooling equilibrium emerges: both types of developers will not be interested in the parcel’s development. Both and will incur net losses if they develop the parcel. They will not deviate from the do-nothing action because in so doing they will incur net losses. The planner will define depending on and relations, but the outcome will be an undeveloped parcel and a planner payoff .

References

- Fu, P.; Weng, Q. A time series analysis of urbanization induced land use and land cover change and its impact on land surface temperature with Landsat imagery. Remote Sens. Environ. 2016, 175, 205–214. [Google Scholar] [CrossRef]

- Kabisch, N.; Strohbach, M.; Haase, D.; Kronenberg, J. Urban green space availability in European cities. Ecol. Indic. 2016, 70, 586–596. [Google Scholar] [CrossRef]

- Kabisch, N.; Qureshi, S.; Haase, D. Human–environment interactions in urban green spaces—A systematic review of contemporary issues and prospects for future research. Environ. Impact Assess. Rev. 2015, 50, 25–34. [Google Scholar] [CrossRef]

- Andersson, E.; Barthel, S.; Borgström, S.; Colding, J.; Elmqvist, T.; Folke, C.; Gren, Å. Reconnecting Cities to the Biosphere: Stewardship of Green Infrastructure and Urban Ecosystem Services. AMBIO 2014, 43, 445–453. [Google Scholar] [CrossRef]

- Elmqvist, T.; Fragkias, M.; Goodness, J.; Güneralp, B.; Marcotullio, P.J.; McDonald, R.I.; Parnell, S.; Schewenius, M.; Sendstad, M.; Seto, K.C.; et al. Urban Ecosystem Services. In Urbanization, Biodiversity and Ecosystem Services: Challenges and Opportunities; Elmqvist, T., Fragkias, M., Goodness, J., Güneralp, B., Marcotullio, P.J., McDonald, R.I., Parnell, S., Schewenius, M., Sendstad, M., Seto, K.C., Wilkinson, C., Eds.; Springer: Dordrecht, The Netherlands, 2013; pp. 175–251. [Google Scholar]

- Campbell, S. Green Cities, Growing Cities, Just Cities? Urban Planning and the Contradictions of Sustainable Development. J. Am. Plan. Assoc. 1996, 62, 296–312. [Google Scholar] [CrossRef]

- Aevermann, T.; Schmude, J. Quantification and monetary valuation of urban ecosystem services in Munich, Germany. Z. Wirtsch 2015, 59, 188–200. [Google Scholar] [CrossRef]

- Dowall, D.E. The Role and Function of Urban Land Markets in Market Economies. In Workshop on Privatization of Land in Ukraine; Ministry of Construction and Architecture, State Committee on Land Resources, United States Agency for International Development: Kiev, Ukraine, 1993; p. 15. [Google Scholar]

- Ortiz, A.; Bertaud, A. Land Markets and Urban Management: The Role of Planning Tools. In The Challenge of Urban Government: Policies and Practices; Maria, E.F., Richard, S., Eds.; The International Bank for Reconstruction and Development/The World Bank: Washington, DC, USA, 2001. [Google Scholar] [CrossRef]

- Rubin, Z.; Felsenstein, D. Is planning delay really a constraint in the provision of housing? Some evidence from Israel. Pap. Reg. Sci. 2019, 98, 2179–2200. [Google Scholar] [CrossRef]

- Czamanski, D.; Roth, R. Characteristic time, developers’ behavior and leapfrogging dynamics of high-rise buildings. Ann. Reg. Sci. 2011, 46, 101–118. [Google Scholar] [CrossRef]

- Ball, M. Planning Delay and the Responsiveness of English Housing Supply. Urban Stud. 2011, 48, 349–362. [Google Scholar] [CrossRef]

- Mayo, S.; Sheppard, S. Housing Supply and the Effects of Stochastic Development Control. J. Hous. Econ. 2001, 10, 109–128. [Google Scholar] [CrossRef]

- Broitman, D.; Czamanski, D. Cities in Competition, Characteristic Time, and Leapfrogging Developers. Environ. Plan. B Plan. Des. 2012, 39, 1105–1118. [Google Scholar] [CrossRef]

- Broitman, D.; Czamanski, D. Bursts and Avalanches: The Dynamics of Polycentric Urban Evolution. Environ. Plan. B Plan. Des. 2015, 42, 58–75. [Google Scholar] [CrossRef]

- Cheshire, P.C. Land market regulation: Market versus policy failures. J. Prop. Res. 2013, 30, 170–188. [Google Scholar] [CrossRef]

- Meijer, R.; Jonkman, A. Land-policy instruments for densification: The Dutch quest for control. Town Plan. Rev. 2020, 91, 239–258. [Google Scholar] [CrossRef]

- Brueckner, J.K.; Helsley, R.W. Sprawl and blight. J. Urban Econ. 2011, 69, 205–213. [Google Scholar] [CrossRef]

- Brueckner, J.K. Urban Sprawl: Diagnosis and Remedies. Int. Reg. Sci. Rev. 2000, 23, 160–171. [Google Scholar] [CrossRef]

- Duraiappah, A.K.; Naeem, S.; Agardy, T.; Ash, N.J.; Cooper, H.D.; Diaz, S.; Faith, D.P.; Mace, G.; McNeely, J.A.; Mooney, H.A.; et al. Ecosystems and Human Well-Being: Biodiversity Synthesis; a Report of the Millennium Ecosystem Assessment. Available online: https://experts.umn.edu/en/publications/ecosystems-and-human-well-being-biodiversity-synthesis-a-report-o (accessed on 11 June 2020).

- Steffen, W. Interdisciplinary research for managing ecosystem services. Proc. Natl. Acad. Sci. USA 2009, 106, 1301–1302. [Google Scholar] [CrossRef]

- Broitman, D.; Czamanski, D.; Malkinson, D. Cities and Nature. Int. Rev. Environ. Resour. Econ. 2018, 12, 47–83. [Google Scholar] [CrossRef]

- Andersson-Sköld, Y.; Klingberg, J.; Gunnarsson, B.; Cullinane, K.; Gustafsson, I.; Hedblom, M.; Knez, I.; Lindberg, F.; Sang, O.Å.; Pleijel, H.; et al. A framework for assessing urban greenery’s effects and valuing its ecosystem services. J. Environ. Manag. 2018, 205, 274–285. [Google Scholar] [CrossRef]

- Tzoulas, K.; Korpela, K.; Venn, S.; Kaz, V.Y. Promoting ecosystem and human health in urban areas using Green Infrastructure: A literature review. Landsc. Urban Plan. 2007, 81, 167–178. [Google Scholar] [CrossRef]

- Grahn, P.; Stigsdotter, U.A. Landscape planning and stress. Urban For. Urban Green. 2003, 2, 1–18. [Google Scholar] [CrossRef]

- Chang, C.-R.; Li, M.-H.; Chang, S.-D. A preliminary study on the local cool-island intensity of Taipei city parks. Landsc. Urban Plan. 2007, 80, 386–395. [Google Scholar] [CrossRef]

- Nowak, D.J.; Hirabayashi, S.; Bodine, A.; Greenfield, E. Tree and forest effects on air quality and human health in the United States. Environ. Pollut. 2014, 193, 119–129. [Google Scholar] [CrossRef] [PubMed]

- Derkzen, M.L.; van Teeffelen, A.J.A.; Verburg, P.H. REVIEW: Quantifying urban ecosystem services based on high-resolution data of urban green space: An assessment for Rotterdam, the Netherlands. J. Appl. Ecol. 2015, 52, 1020–1032. [Google Scholar] [CrossRef]

- Asabere, P.K.; Huffman, F.E. The Relative Impacts of Trails and Greenbelts on Home Price. J. Real Estate Financ. Econ. 2009, 38, 408–419. [Google Scholar] [CrossRef]

- Conway, D.; Li, C.Q.; Wolch, J.; Kahle, C.; Jerrett, M. A Spatial Autocorrelation Approach for Examining the Effects of Urban Greenspace on Residential Property Values. J. Real Estate Financ. Econ. 2010, 41, 150–169. [Google Scholar] [CrossRef]

- Gibbons, S.; Mourato, S.; Resende, G.M. The Amenity Value of English Nature: A Hedonic Price Approach. Environ. Resour. Econ. 2014, 57, 175–196. [Google Scholar] [CrossRef]

- Balzan, M.V.; Caruana, J.; Zammit, A. Assessing the capacity and flow of ecosystem services in multifunctional landscapes: Evidence of a rural-urban gradient in a Mediterranean small island state. Land Use Policy 2018, 75, 711–725. [Google Scholar] [CrossRef]

- Baró, F.; Gómez-Baggethun, E.; Haase, D. Ecosystem service bundles along the urban-rural gradient: Insights for landscape planning and management. Ecosyst. Serv. 2017, 24, 147–159. [Google Scholar] [CrossRef]

- Larondelle, N.; Haase, D. Urban ecosystem services assessment along a rural–urban gradient: A cross-analysis of European cities. Ecol. Indic. 2013, 29, 179–190. [Google Scholar] [CrossRef]

- Dierwechter, Y. The spaces that smart growth makes: Sustainability, segregation, and residential change across Greater Seattle. Urban Geogr. 2014, 35, 691–714. [Google Scholar] [CrossRef]

- Adams, D.; Tiesdell, S. Planners as Market Actors: Rethinking State–Market Relations in Land and Property. Plan. Theory Pract. 2010, 11, 187–207. [Google Scholar] [CrossRef]

- Healey, P. The Reorganisation of State and Market in Planning. Urban Stud. 1992, 29, 411–434. [Google Scholar] [CrossRef]

- Dierwechter, Y. Home: Residential Geographies of Contained (Re)ordering. In Urban Sustainability through Smart Growth: Intercurrence, Planning, and Geographies of Regional Development across Greater Seattle; Dierwechter, Y., Ed.; Springer International Publishing: Cham, Switzerland, 2017; pp. 143–178. [Google Scholar]

- Healey, P.; Williams, R. European Urban Planning Systems: Diversity and Convergence. Urban Stud. 1993, 30, 701–720. [Google Scholar] [CrossRef]

- van der Krabben, E.; Jacobs, H.M. Public land development as a strategic tool for redevelopment: Reflections on the Dutch experience. Land Use Policy 2013, 30, 774–783. [Google Scholar] [CrossRef]

- Gyourko, J.; Saiz, A.; Summers, A. A New Measure of the Local Regulatory Environment for Housing Markets: The Wharton Residential Land Use Regulatory Index. Urban Stud. 2008, 45, 693–729. [Google Scholar] [CrossRef]

- Quigley, J.M.; Rosenthal, L.A. The Effects of Land Use Regulation on the Price of Housing: What Do We Know? What Can We Learn? Cityscape 2005, 8, 69–137. [Google Scholar]

- Mayo, S.; Sheppard, S. Housing Supply under Rapid Economic Growth and Varying Regulatory Stringency: An International Comparison. J. Hous. Econ. 1996, 5, 274–289. [Google Scholar] [CrossRef]

- Needham, B.; Segeren, A.; Buitelaar, E. Institutions in Theories of Land Markets: Illustrated by the Dutch Market for Agricultural Land. Urban Stud. 2011, 48, 161–176. [Google Scholar] [CrossRef]

- Sorensen, A. Institutions and Urban Space: Land, Infrastructure, and Governance in the Production of Urban Property. Plan. Theory Pract. 2018, 19, 21–38. [Google Scholar] [CrossRef]

- Levy, S.; Martens, K. Negotiated Heights: An Agent-Based Model of Density in Residential Patterns. In Proceedings of the 13th International Conference on Computers in Urban Planning and Urban Management (CUPUM 2013), Utrecht, The Netherlands, 2–5 July 2013. [Google Scholar]

- Knaap, G.J.; Hopkins, L.D.; Donaghy, K.P. Do Plans Matter? A Game-Theoretic Model for Examining the Logic and Effects of Land Use Planning. J. Plan. Educ. Res. 1998, 18, 25–34. [Google Scholar] [CrossRef]

- Lai, S.K.; Ding, C.; Tsai, P.C.; Lan, I.C.; Xue, M.; Chiu, C.P.; Wang, L.G. A game-theoretic approach to urban land development in China. Environ. Plan. B Plan. Des. 2008, 35, 847–862. [Google Scholar] [CrossRef]

- Samsura, D.A.A.; van der Krabben, E.; van Deemen, A.M.A. A game theory approach to the analysis of land and property development processes. Land Use Policy 2010, 27, 564–578. [Google Scholar] [CrossRef]

- Kreps, D.M.; Sobel, J. Chapter 25 Signalling. In Handbook of Game Theory with Economic Applications; Elsevier: Amsterdam, The Netherlands, 1994; Volume 2, pp. 849–867. [Google Scholar]

- Spence, M. Job Market Signaling. Econ. Q. J. 1973, 87, 355. [Google Scholar] [CrossRef]

- Jensen, C.; Meckling, H. Theory of the Firm: Managerial Behavior, Agency Costs, and Ownership Structure; Springer: Dordrecht, The Netherlands, 1979; pp. 163–231. [Google Scholar]

- Gupta, K.; Kumar, P.; Pathan, S.K.; Sharma, K.P. Urban Neighborhood Green Index—A measure of green spaces in urban areas. Landsc. Urban Plan. 2012, 105, 325–335. [Google Scholar] [CrossRef]

- Baguette, M. The classical metapopulation theory and the real, natural world: A critical appraisal. Basic Appl. Ecol. 2004, 5, 213–224. [Google Scholar] [CrossRef]

- Pellet, J.; Fleishman, E.; Dobkin, D.S.; Gander, A.; Murphy, D.D. An empirical evaluation of the area and isolation paradigm of metapopulation dynamics. Biol. Conserv. 2007, 136, 483–495. [Google Scholar] [CrossRef]

- Kremen, C.; Williams, N.M.; Bugg, R.L.; Fay, J.P.; Thorp, R.W. The area requirements of an ecosystem service: Crop pollination by native bee communities in California: Area requirements for pollination services to crops. Ecol. Lett. 2004, 7, 1109–1119. [Google Scholar] [CrossRef]

- Barral, M.P.; Oscar, M.N. Land-use planning based on ecosystem service assessment: A case study in the Southeast Pampas of Argentina. Agric. Ecosyst. Environ. 2012, 154, 34–43. [Google Scholar] [CrossRef]

- Sugiyama, T.; Francis, J.; Middleton, N.J.; Owen, N.; Giles-Corti, B. Associations Between Recreational Walking and Attractiveness, Size, and Proximity of Neighborhood Open Spaces. Am. J. Public Health 2010, 100, 1752–1757. [Google Scholar] [CrossRef] [PubMed]

- Jaganmohan, M.; Knapp, S.; Buchmann, C.M.; Schwarz, N. The Bigger, the Better? The Influence of Urban Green Space Design on Cooling Effects for Residential Areas. J. Environ. Qual. 2016, 45, 134–145. [Google Scholar] [CrossRef] [PubMed]

- Czembrowski, P.; Kronenberg, J. Hedonic pricing and different urban green space types and sizes: Insights into the discussion on valuing ecosystem services. Landsc. Urban Plan. 2016, 146, 11–19. [Google Scholar] [CrossRef]

- Lutzenhiser, M.; Netusil, N.R. The Effect of Open Spaces on a Home’s Sale Price. Contemp. Econ. Policy 2001, 19, 291–298. [Google Scholar] [CrossRef]

- Barbier, E.B. A spatial model of coastal ecosystem services. Ecol. Econ. 2012, 78, 70–79. [Google Scholar] [CrossRef]

- Fang, C.; Bao, C.; Huang, J. Management Implications to Water Resources Constraint Force on Socio-economic System in Rapid Urbanization: A Case Study of the Hexi Corridor, NW China. Water Resour. Manag. 2007, 21, 1613–1633. [Google Scholar] [CrossRef]

- Mitchell, M.G.E.; Bennett, E.M.; Gonzalez, A. Strong and nonlinear effects of fragmentation on ecosystem service provision at multiple scales. Environ. Res. Lett. 2015, 10, 094014. [Google Scholar] [CrossRef]

- Damer, S.; Hague, C. Public Participation in Planning: A Review. Town Plan. Rev. 1971, 42, 217. [Google Scholar] [CrossRef]

- Macintosh, A.; Gibbons, P.; Jones, J.; Constable, A.; Wilkinson, D. Delays, stoppages and appeals: An empirical evaluation of the adverse impacts of environmental citizen suits in the New South Wales land and environment court. Environ. Impact Assess. Rev. 2018, 69, 94–103. [Google Scholar] [CrossRef]

- Silvertown, J. Have Ecosystem Services Been Oversold? Trends Ecol. Evol. 2015, 30, 641–648. [Google Scholar] [CrossRef]

- Cordier, M.; Agúndez, J.A.P.; Hecq, W.; Hamaide, B. A guiding framework for ecosystem services monetization in ecological–economic modeling. Ecosyst. Serv. 2014, 8, 86–96. [Google Scholar] [CrossRef]

- Venkatachalam, L. Environmental economics and ecological economics: Where they can converge? Ecol. Econ. 2007, 61, 550–558. [Google Scholar] [CrossRef]

- Atif, S.B. Identification of Key-Trends and Evaluation of Contemporary Research Regarding Urban Ecosystem Services: A Path towards Socio-Ecological Sustainability of Urban Areas. Appl. Ecol. Environ. Res. 2018, 16, 3545–3581. [Google Scholar] [CrossRef]

- Hansen, R.; Frantzeskaki, N.; McPhearson, T.; Rall, E.; Kabisch, N.; Kaczorowska, A.; Kain, J.H.; Artmann, M.; Pauleit, S. The uptake of the ecosystem services concept in planning discourses of European and American cities. Ecosyst. Serv. 2015, 12, 228–246. [Google Scholar] [CrossRef]

- Livesley, S.J.; McPherson, E.G.; Calfapietra, C. The Urban Forest and Ecosystem Services: Impacts on Urban Water, Heat, and Pollution Cycles at the Tree, Street, and City Scale. J. Environ. Qual. 2016, 45, 119–124. [Google Scholar] [CrossRef] [PubMed]

- McDonald, R.I.; Forman, R.T.T.; Kareiva, P. Open Space Loss and Land Inequality in United States’ Cities, 1990–2000. PLoS ONE 2010, 5, e9509. [Google Scholar] [CrossRef]

| If develops the parcel | |||

| If develops the parcel | |||

| If the parcel is not developed |

| Parameter | Value | Meaning |

|---|---|---|

| 200 | The initial number of green parcels in the green area | |

| 50,000 | The maximal ULPES value provided by the green area | |

| 1000 | Parameter of the ULPES value logistical decay function | |

| 0.92 | Parameter of the ULPES value logistical decay function | |

| 0.05 | The rate of interest, assumed to be fixed | |

| 30,000 | The building costs incurred by the developer | |

| 100,000 | The initial willingness to pay for the real-estate project developed on a single parcel. Each new parcel converted increases its value by 200 | |

| 10,000 | The initial purchasing price of a single parcel. Each new parcel converted increases its cost by 100 |

© 2020 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Broitman, D. The Game of Developers and Planners: Ecosystem Services as a (Hidden) Regulation through Planning Delay Times. Sustainability 2020, 12, 5940. https://doi.org/10.3390/su12155940

Broitman D. The Game of Developers and Planners: Ecosystem Services as a (Hidden) Regulation through Planning Delay Times. Sustainability. 2020; 12(15):5940. https://doi.org/10.3390/su12155940

Chicago/Turabian StyleBroitman, Dani. 2020. "The Game of Developers and Planners: Ecosystem Services as a (Hidden) Regulation through Planning Delay Times" Sustainability 12, no. 15: 5940. https://doi.org/10.3390/su12155940

APA StyleBroitman, D. (2020). The Game of Developers and Planners: Ecosystem Services as a (Hidden) Regulation through Planning Delay Times. Sustainability, 12(15), 5940. https://doi.org/10.3390/su12155940