Automated Sustainability Assessment System for Small and Medium Enterprises Reporting

Abstract

1. Introduction

- The sustainability report should reflect not only the positive but also the negative aspects of the organization under scrutiny.

- The reports should be accurate and prepared in a way that allows stakeholders to analyze changes in the organization’s performance over time.

- A regular time schedule should be assigned for each report.

- The information included in the sustainability report should be understandable, reliable, transparent, and accessible.

- The report should be able to adapt to future improvements in its content.

2. Materials and Methods

2.1. Sustainability Assessment Indicators

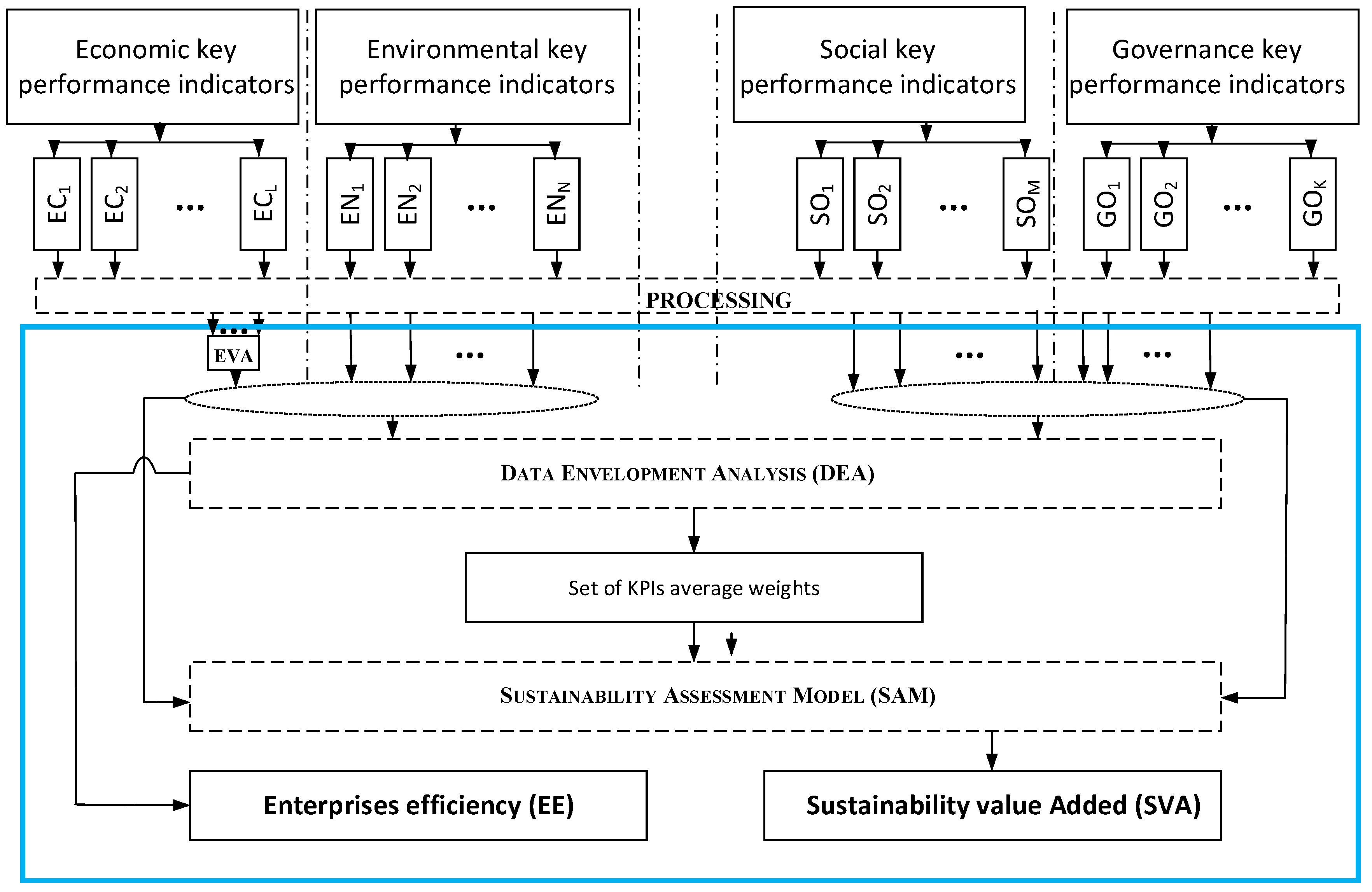

2.2. Efficiency and Sustainability Assessment Models

2.2.1. Economic Value Added (EVA)

2.2.2. Data Envelopment Analysis (DEA)

2.2.3. Sustainability Value Added (SVA)

2.3. Information Systems for Sustainability Assessment

3. Results

- Phase 1 is indicators collection and selection. It includes determining the available, suitable and efficient set of the KPIs for small and medium enterprises (SMEs) that can be used in sustainability assessment. This process starts after performing a deep study of the barriers that make the sustainability reporting for SMB/SME a challenging process.

- Phase 2 is an improved sustainability assessment model. The suggested model should reflect all the dimensions of sustainability assessment (economic, environmental, social and governance), and be able to determine the sustainability level of the studied enterprises. This model is verified on a selected market segment.

- Phase 3 is a web-based portal for corporate sustainability evaluation. This phase is considered to automate the assessment process, and encourage SMEs to perform sustainability reporting. It will be deployed for free use and data collection.

3.1. Phase 1: Indicators Collection and Selection

3.2. Phase 2: Improved Sustainability Assessment Model

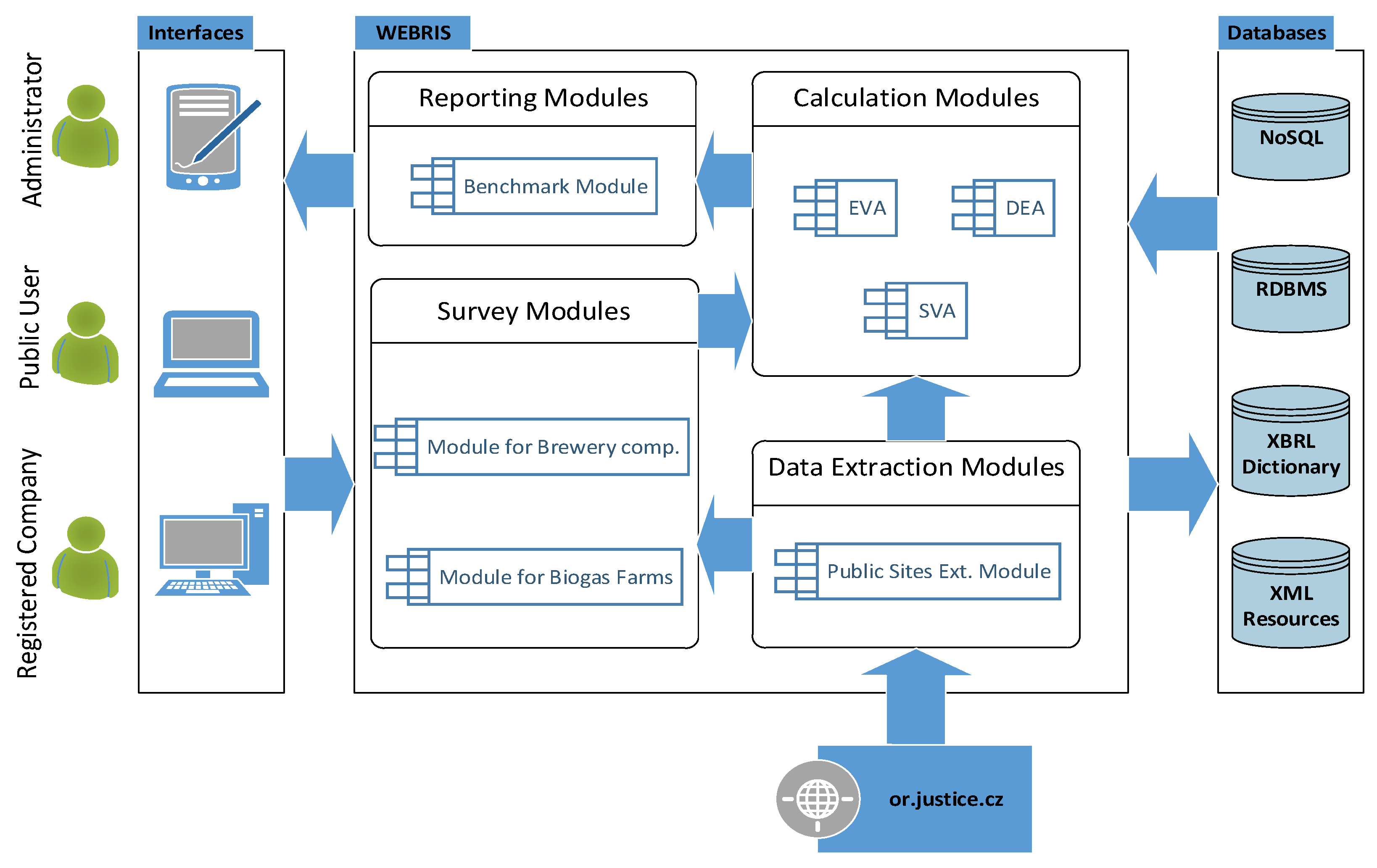

3.3. Phase 3: Web Portal for Corporate Sustainability Evaluation

- It stores the data of all registered companies.

- It provides all required calculations according to the selected sector with its assigned model.

- It generates all kinds of economic, environmental, social, governance and sustainability reports.

- It provides selected information in the form of reports accessible online to all registered accounts.

- It provides selected information in different formats, like PDF, EXCEL, and the standardized XBRL format, to be interchanged with other systems. It is able to dynamically generate the XBRL taxonomies for a given report.

- It provides the possibility of evaluating the company EP anonymously, and compare reports among the companies of the same sector.

WEBRIS Architecture

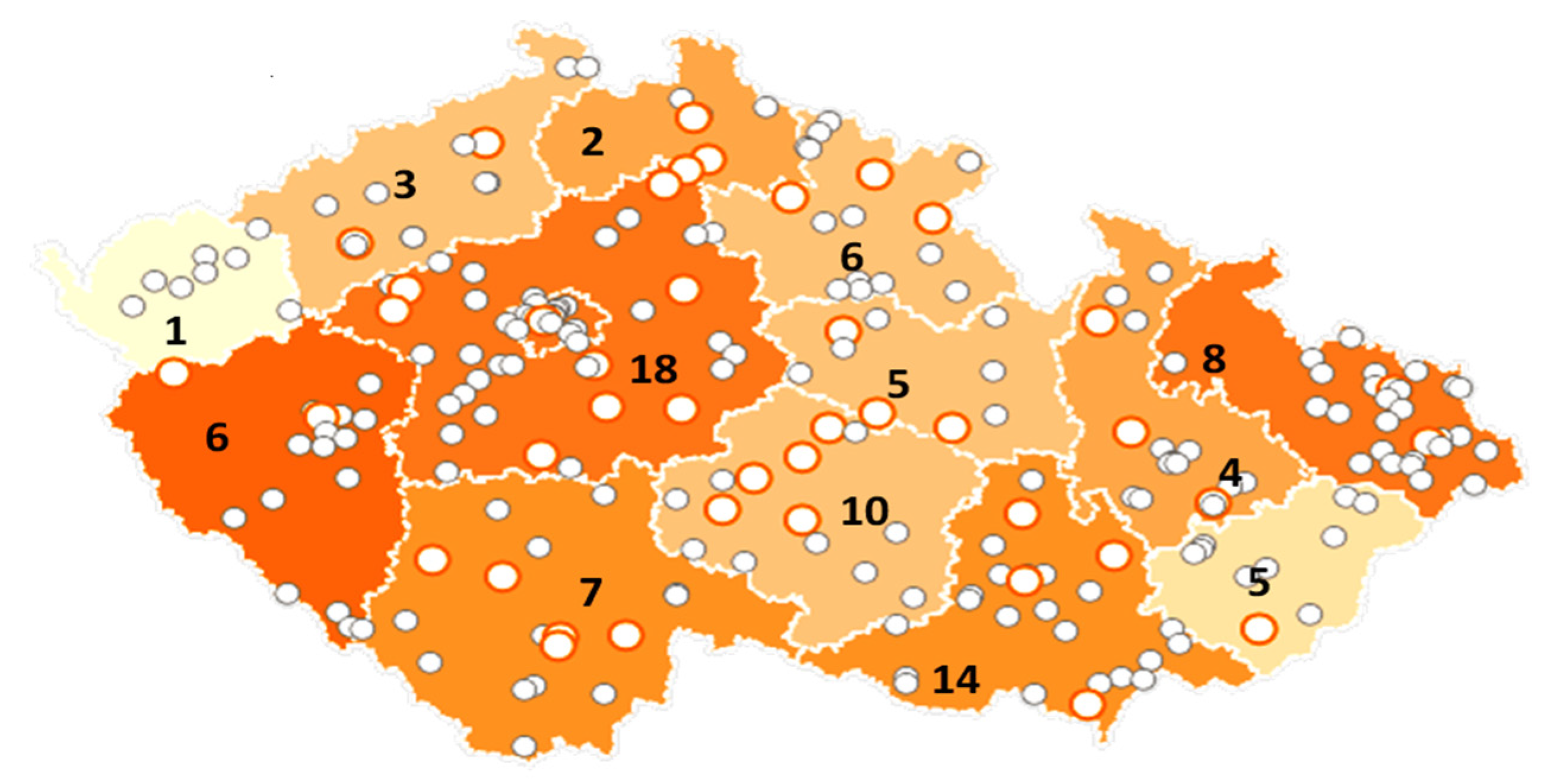

3.4. Case Study: Czech Brewery Companies

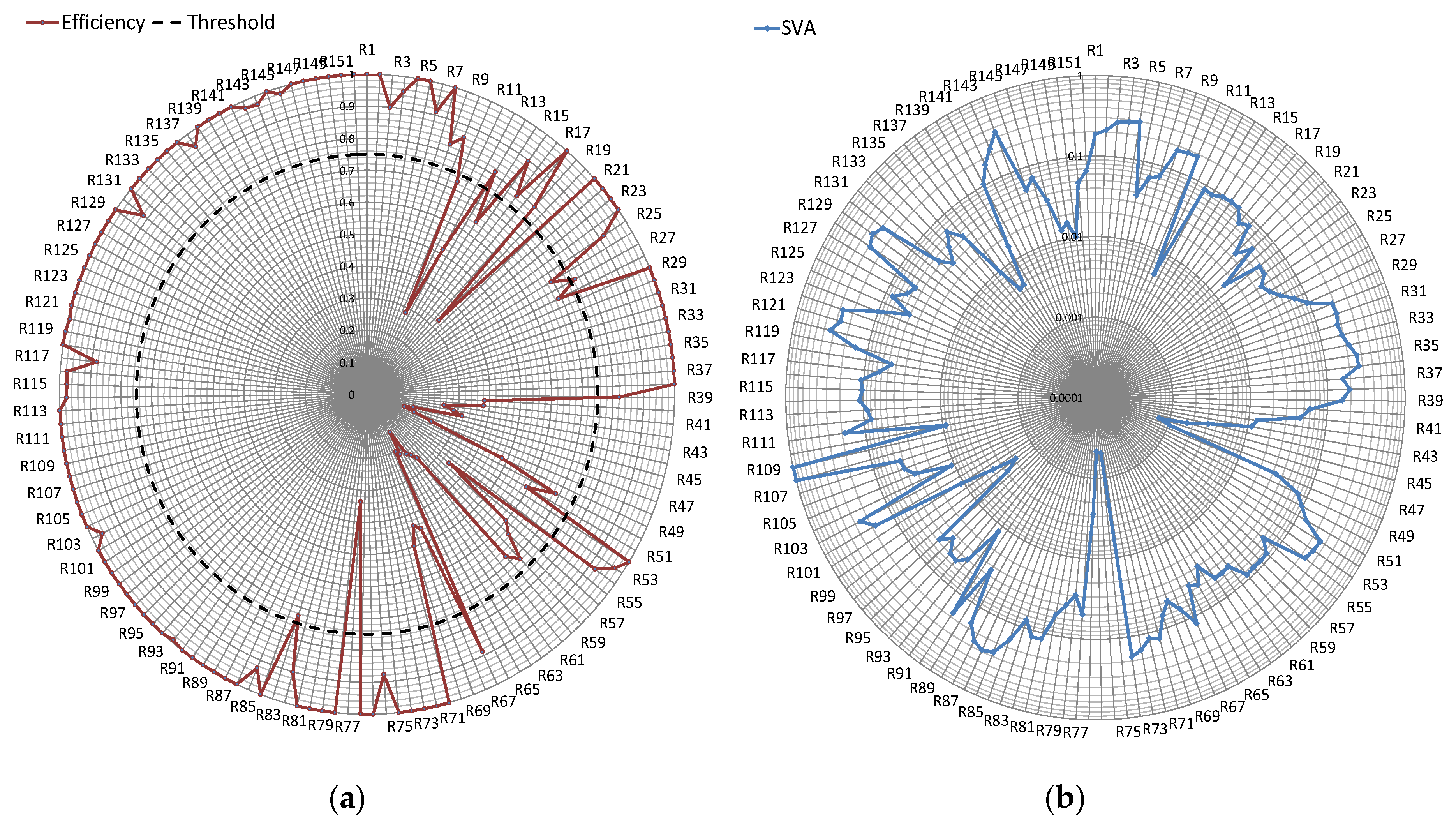

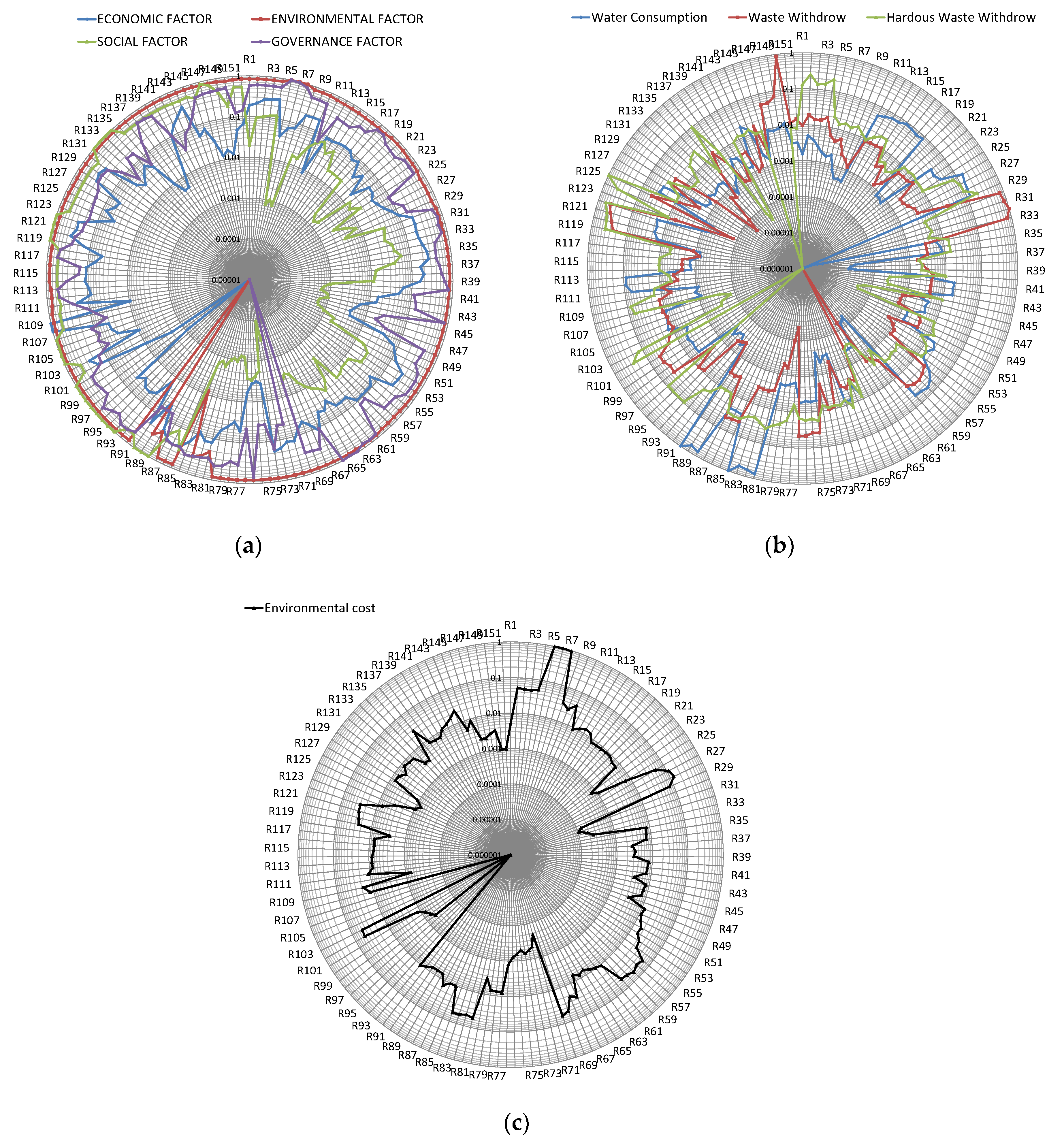

3.4.1. KPIs Weights and Efficiency Calculation

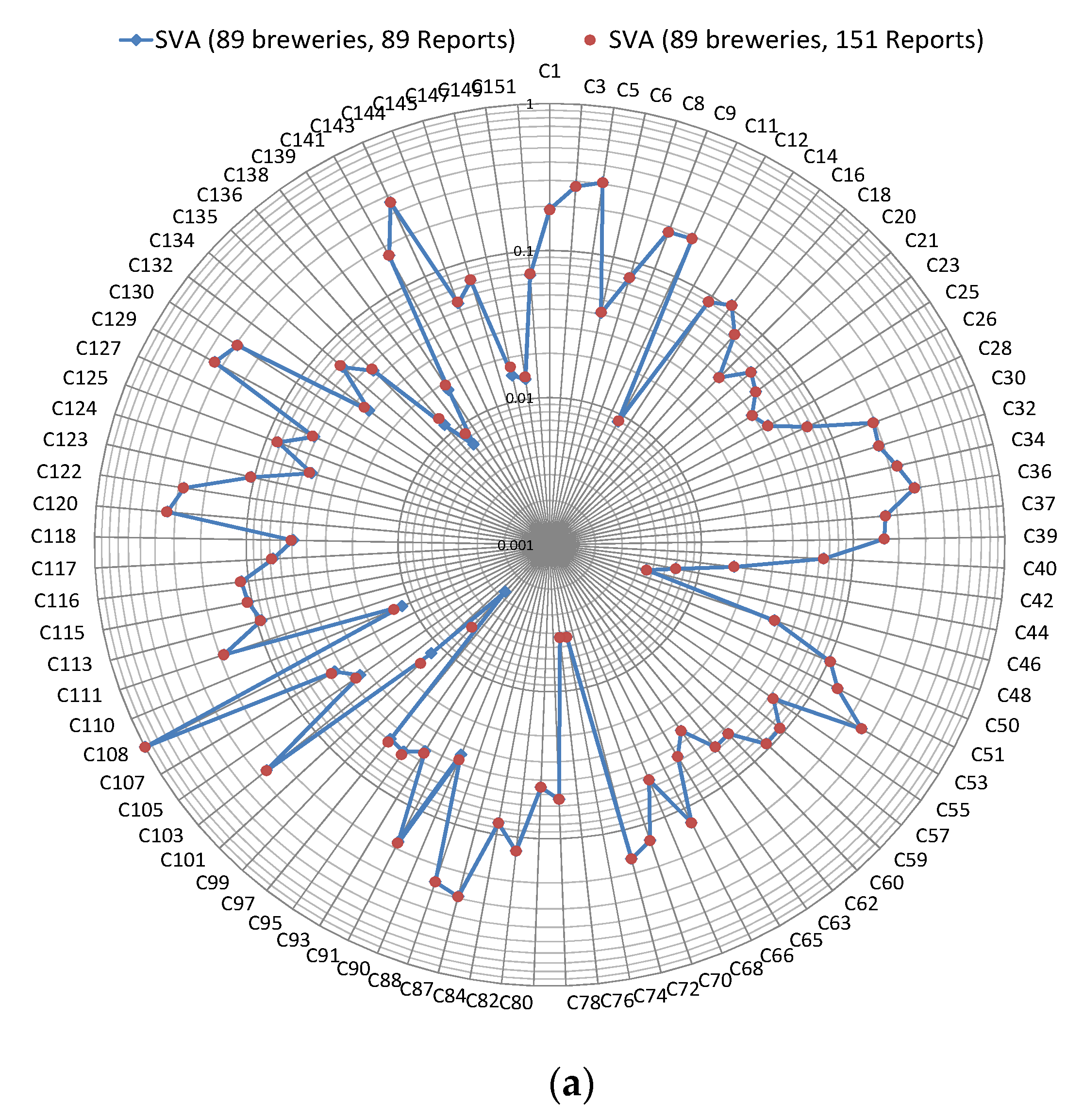

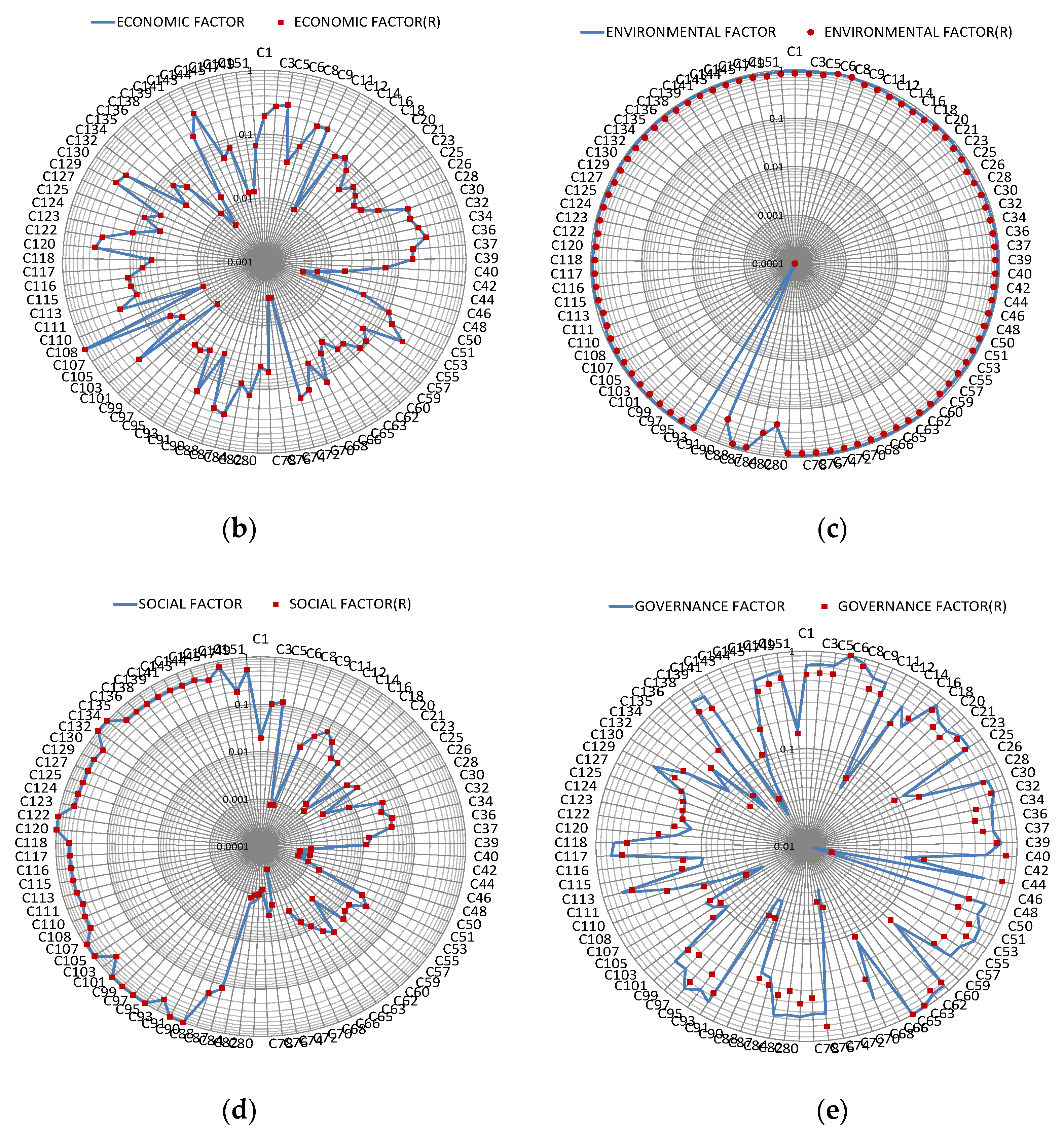

3.4.2. Sustainable Value Added Calculation

- Proposition 0: Sustainability assessment depends on the report itself. More than one report for one company can be involved in sustainability assessment.

- Proposition 1: Sustainability assessment depends on the company. More than one report for one company cannot be involved in sustainability assessment. In addition, all the reports should have the same reporting period.

4. Discussion

5. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Ferrero-Ferrero, I.; Fernández-Izquierdo, M.; Muñoz-Torres, M. The effect of environmental, social and governance consistency on economic results. Sustainability 2016, 8, 1005. [Google Scholar] [CrossRef]

- Hřebiček, J.; Faldik, O.; Chvatalova, Z.; Kasem, E.; Trenz, O. Sustainability assessment of biogas plants. In Proceedings of the 6th International Symposium on Energy from Biomass and Waste (Venice 2016), Venice, Italy, 14–17 November 2016; ISBN 978-88-6265-007-6. [Google Scholar]

- Heemskerk, B.; Pistorio, P.; Scicluna, M. Sustainable Development Reporting: Striking the Balance; World Business Council for Sustainable Development: Geneva, Switzerland, 2002; ISBN 2-940240-45-0. [Google Scholar]

- The Green New Deal. 2017. Available online: https://gpus.org/organizing-tools/the-green-new-deal/ (accessed on 17 December 2019).

- Hahn, R.; Kühnen, M. Determinants of sustainability reporting: A review of results, trends, theory, and opportunities in an expanding field of research. J. Clean. Prod. 2013, 59, 5–21. [Google Scholar] [CrossRef]

- Lozano, R. Sustainability inter-linkages in reporting vindicated: A study of European companies. J. Clean. Prod. 2013, 51, 57–65. [Google Scholar] [CrossRef]

- Engida, T.G.; Rao, X.; Berentsen, P.B.; Lansink, A.G.O. Measuring corporate sustainability performance–the case of European food and beverage companies. J. Clean. Prod. 2018, 195, 734–743. [Google Scholar] [CrossRef]

- Kwatra, S.; Kumar, A.; Sharma, P.; Sharma, S.; Singhal, S. Benchmarking sustainability using indicators: An Indian case study. Ecol. Indic. 2016, 61, 928–940. [Google Scholar] [CrossRef]

- Ocetkiewicz, I.; Tomaszewska, B.; Mróz, A. Renewable energy in education for sustainable development. The Polish experience. Renew. Sustain. Energy Rev. 2017, 80, 92–97. [Google Scholar] [CrossRef]

- Forbes. Socially-Responsible Investing: Earn Better Returns from Good Companies. 2017. Available online: https://www.forbes.com/sites/moneyshow/2017/08/16/socially-responsible-investing-earn-better-returns-from-good-companies/#5542a29623d0 (accessed on 17 December 2019).

- Song, Y.; Wang, H.; Zhu, M. Sustainable strategy for corporate governance based on the sentiment analysis of financial reports with CSR. Financ. Innov. 2018, 4, 2. [Google Scholar] [CrossRef]

- Duuren, E.; Plantinga, A.; Scholtens, B. ESG Integration and the Investment Management Process: Fundamental Investing Reinvented. J. Bus. Ethic 2016, 138, 525–533. [Google Scholar] [CrossRef]

- Kunz, V. Corporate Social Responsibility; Grada Publishing: Prague, Czech Republic, 2012; p. 201. ISBN 978-80-247-3983-0. [Google Scholar]

- Pícha, K. Social Responsibolity of the Company in the Present Trends and in Contexts (Czech); Alfa Nakladatelství: Prague, Czech Republic, 2012; p. 103. ISBN 978-80-87197-55-4. [Google Scholar]

- Darcy, C.; Hill, J.; McCabe, T.J.; McGovern, P. A consideration of organisational sustainability in the SME context: A resource-based view and composite model. Eur. J. Train. Dev. 2014, 38, 398–414. [Google Scholar] [CrossRef]

- Hsu, C.H.; Chang, A.Y.; Luo, W. Identifying key performance factors for sustainability development of SMEs–integrating QFD and fuzzy MADM methods. J. Clean. Prod. 2017, 161, 629–645. [Google Scholar] [CrossRef]

- Kubíčková, L.; Tuzová, M.; Toulová, M. The Internationalisation of Small and Medium-Sized Enterprises as a Path to Competitiveness. In Competitiveness, Social Inclusion and Sustainability in a Diverse European Union; Springer: Cham, Switzerland, 2016; pp. 99–120. ISBN 978-3-319-17298-9. [Google Scholar]

- Lu, J.W.; Beamish, P.W. The internationalization and performance of SMEs. Strateg. Manag. J. 2001, 22, 565–586. [Google Scholar] [CrossRef]

- Pechmann, A.; Shrouf, F.; Chonin, M.; Steenhusen, N. Load-shifting potential at SMEs manufacturing sites: A methodology and case study. Renew. Sustain. Energy Rev. 2017, 78, 431–438. [Google Scholar] [CrossRef]

- Hřebíček, J.; Soukopová, J.; Štencl, M.; Trenz, O. Integration of economic, environmental, social and corporate governance performance and reporting in enterprises. Acta Univ. Agric. Silvic. Mendel. Brun. 2014, 59, 157–166. [Google Scholar] [CrossRef]

- Gallego-Álvarez, I.; Galindo-Villardón, M.P.; Rodríguez-Rosa, M. Evolution of sustainability indicator worldwide: A study from the economic perspective based on the X-STATICO method. Ecol. Indic. 2015, 58, 139–151. [Google Scholar] [CrossRef]

- Kocmanová, A.; Hřebíček, J.; Dočekalová, M.; Hodinka, M.; Hornungová, J.; Chvátalová, Z.; Trenz, O. Measuring Business Performance (Měření Podnikové Výkonnosti); Littera: Brno, Czech Republic, 2013. [Google Scholar]

- Hřebíček, J.; Trenz, O.; Vernerová, E. Optimal set of agri-environmental indicators for the agricultural sector of Czech Republic. Acta Univ. Agric. Silvic. Mendel. Brun. 2013, 61, 2171–2181. [Google Scholar] [CrossRef]

- Holden, M. Sustainability indicator systems within urban governance: Usability analysis of sustainability indicator systems as boundary objects. Ecol. Indic. 2013, 32, 89–96. [Google Scholar] [CrossRef]

- Karnauskaite, D.; Schernewski, G.; Støttrup, J.G.; Kataržytė, M. Indicator-Based Sustainability Assessment Tool to Support Coastal and Marine Management. Sustainability 2019, 11, 3175. [Google Scholar] [CrossRef]

- Shakya, B.; Shrestha, A.; Sharma, G.; Gurung, T.; Mihin, D.; Yang, S.; Choudhury, D. Visualizing Sustainability of Selective Mountain Farming Systems from Far-eastern Himalayas to Support Decision Making. Sustainability 2019, 11, 1714. [Google Scholar] [CrossRef]

- Global Reporting Initiative. G4 Guidelines–Reporting Principles and Standard Disclosures/Implementation Manual; GRI: Amsterdam, The Netherlands, 2013. [Google Scholar]

- Scialabba, N. SAFA Guidelines: Sustainability Assessment of Food and Agriculture Systems. Food and Agriculture Organization of the United Nations. 2014. Available online: http://www.fao.org/nr/sustainability/sustainability-assessments-safa/en/ (accessed on 15 December 2019).

- DVFA. DVFA Key Performance Indicators for Environment, Social and Governance Issues: (ESG 3.0), Society of Investment Professionals in Germany in Conjunction with EFFAS European Federation of Financial Analysts Societies; DVFA: Frankfurt am Main, Germany, 2010. [Google Scholar]

- ISO. ISO 14031: 2013. Environmental Management, Environmental Performance Evaluation, Guidelines. 2013. Available online: https://www.iso.org/standard/52297.html (accessed on 15 December 2019).

- ISO. ISO 9000, ISO 14000, ISO 18000 Documentation. 2015. Available online: http://integrated-standards.com/compare-managementsystem-structure/compare-iso-9001-ohsas18001-iso-14001/ (accessed on 15 December 2019).

- ISO. ISO 26000:2010. Social Responsibility. 2010. Available online: http://www.iso.org/iso/iso26000 (accessed on 15 December 2019).

- EMAS. EU Eco-Management and Audit Scheme (EMAS). 2011. Available online: http://ec.europa.eu/environment/emas/pdf/leaflets/emasleaflet_en.pdf (accessed on 15 December 2019).

- Jesover, F.; Kirkpatrick, G. The revised OECD principles of corporate governance and their relevance to non-OECD countries. Corp. Gov. Int. Rev. 2005, 13, 127–136. [Google Scholar] [CrossRef]

- Křen, J. Methodology for Assessing the Sustainability of Crop Production Systems for CR Conditions; Mendel University in Brno: Brno, Czech Republic, 2011. [Google Scholar]

- Dočekalová, M.P.; Kocmanová, A. Composite indicator for measuring corporate sustainability. Ecol. Indic. 2016, 61, 612–623. [Google Scholar] [CrossRef]

- Pask, F.; Lake, P.; Yang, A.; Tokos, H.; Sadhukhan, J. Sustainability indicators for industrial ovens and assessment using Fuzzy set theory and Monte Carlo simulation. J. Clean. Prod. 2017, 140, 1217–1225. [Google Scholar] [CrossRef]

- Skorpil, V.; Stastny, J. Back-Propagation and K-Means Algorithms Comparison. In Proceedings of the 8th International Conference on Signal Processing, Beijing, China, 16–20 November 2006; pp. 1871–1874, ISBN 0-7803-9736-3. [Google Scholar]

- Dodd, J.L.; Chen, S. Economic value added (EVA). Ark. Bus. Econ. Rev. 1997, 30, 1–8. [Google Scholar]

- Jin, S.; Jeong, S.; Kim, K. A linkage model of supply chain operation and financial performance for economic sustainability of firm. Sustainability 2017, 9, 139. [Google Scholar] [CrossRef]

- Charnes, A.; Cooper, W.W.; Rhodes, E. Measuring the efficiency of decision making units. Eur. J. Oper. Res. 1978, 2, 429–444. [Google Scholar] [CrossRef]

- Doyle, J.; Green, R. Efficiency and cross-efficiency in DEA: Derivations, meanings and uses. J. Oper. Res. Soc. 1994, 45, 567–578. [Google Scholar] [CrossRef]

- Liang, L.; Wu, J.; Cook, W.D.; Zhu, J. The DEA game cross-efficiency model and its Nash equilibrium. Oper. Res. 2008, 56, 1278–1288. [Google Scholar] [CrossRef]

- Azoulay-Schwartz, R.; Kraus, S.; Wilkenfeld, J. Exploitation vs. exploration: Choosing a supplier in an environment of incomplete information. Decis. Support Syst. 2004, 38, 1–18. [Google Scholar] [CrossRef]

- Kumar, M.; Vrat, P.; Shankar, R. A fuzzy goal programming approach for vendor selection problem in a supply chain. Comput. Ind. Eng. 2004, 46, 69–85. [Google Scholar] [CrossRef]

- Xu, J.; Li, B.; Wu, D. Rough data envelopment analysis and its application to supply chain performance evaluation. Int. J. Prod. Econ. 2009, 122, 628–638. [Google Scholar] [CrossRef]

- Cisneros, J.M.; Grau, J.B.; Antón, J.M.; De Prada, J.D.; Cantero, A.; Degioanni, A.J. Assessing multi-criteria approaches with environmental, economic and social attributes, weights and procedures: A case study in the Pampas, Argentina. Agric. Water Manag. 2011, 98, 1545–1556. [Google Scholar] [CrossRef]

- Adler, N.; Friedman, L.; Sinuany-Stern, Z. Review of ranking methods in the data envelopment analysis context. Eur. J. Oper. Res. 2002, 140, 249–265. [Google Scholar] [CrossRef]

- Figge, F.; Hahn, T. Sustainable value added measuring corporate contributions to sustainability beyond eco-efficiency. Ecol. Econ. 2004, 48, 173–187. [Google Scholar] [CrossRef]

- Faulkner, W.; Templeton, W.; Gullett, D.; Badurdeen, F. Visualizing sustainability performance of manufacturing systems using sustainable value stream mapping (Sus-VSM). In Proceedings of the 2012 International Conference on Industrial Engineering and Operations Management, Istanbul, Turkey, 3 July 2012; pp. 815–824. [Google Scholar]

- Kratena, K. Ecological value added’in an integrated ecosystem–economy model—an indicator for sustainability. Ecol. Econ. 2004, 48, 189–200. [Google Scholar] [CrossRef]

- Zahm, F.; Viaux, P.; Girardin, P.; Vilain, L.; Mouchet, C.; Environnement, F. Farm Sustainability Assessment using the IDEA Method From the concept of farm sustainability to case studies on French farms. Common Princ. Common Pract. 2007, 77, 77–110. [Google Scholar]

- Hallstedt, S.I.; Bertoni, M.; Isaksson, O. Assessing sustainability and value of manufacturing processes: A case in the aerospace industry. J. Clean. Prod. 2015, 108, 169–182. [Google Scholar] [CrossRef]

- Villeneuve, C.; Tremblay, D.; Riffon, O.; Lanmafankpotin, G.Y.; Bouchard, S. A systemic tool and process for sustainability assessment. Sustainability 2017, 9, 1909. [Google Scholar] [CrossRef]

- Finnveden, G. On the limitations of life cycle assessment and environmental systems analysis tools in general. Int. J. Life Cycle Assess. 2000, 5, 229–238. [Google Scholar] [CrossRef]

- Norris, C.B. Social life cycle assessment: A technique providing a new wealth of information to inform sustainability-related decision making. In Life Cycle Assessment Handbook: A Guide for Environmentally Sustainable Products; Scrivener Publishing LLC: Cincinnati, OH, USA, 2012; pp. 433–451. [Google Scholar]

- Gerrard, C.L.; Smith, L.; Padel, S.; Pearce, B.; Hitchings, R.; Cooper, N. Ocis Public Goods Tool Development. 2011. Available online: https://orgprints.org/18518/2/OCIS_PG_report_April_ORC_2011V1.0.pdf (accessed on 15 December 2019).

- Narodoslawsky, M.; Krotscheck, C. The sustainable process index (SPI): Evaluating processes according to environmental compatibility. J. Hazard. Mater. 1995, 41, 383–397. [Google Scholar] [CrossRef]

- Van der Werf, H.M.; Tzilivakis, J.; Lewis, K.; Basset-Mens, C. Environmental impacts of farm scenarios according to five assessment methods. Agric. Ecosyst. Environ. 2007, 118, 327–338. [Google Scholar] [CrossRef]

- Toensmeier, E. The Carbon Farming Solution: A Global Toolkit of Perennial Crops and Regenerative Agriculture Practices for Climate Change Mitigation and Food Security; Chelsea Green Publishing: Hartford, VT, USA, 2016; ISBN 978-1603585712. [Google Scholar]

- Huang, I.B.; Keisler, J.; Linkov, I. Multi-criteria decision analysis in environmental sciences: Ten years of applications and trends. Sci. Total Environ. 2011, 409, 3578–3594. [Google Scholar] [CrossRef]

- Black, K. Business Statistics: For Contemporary Decision Making: For Contemporary Decision Making; Wiley Global Education: Hoboken, NJ, USA, 2010; ISBN 978-1-119-32089-0. [Google Scholar]

- Kassem, E.; Trenz, O.; Hřebíček, J.; Faldík, O. Sustainability Assessment Using Sustainable Value Added. Procedia-Soc. Behav. Sci. 2016, 220, 177–183. [Google Scholar] [CrossRef]

- Qureshi, M.; Sabir, F. A comparison of model view controller and model view presenter. Sci. Int. 2014, 25, 7–9. [Google Scholar]

- BR. Public Business Register of Documents in the Czech Republic. Available online: https://or.justice.cz/ias/ui/rejstrik (accessed on 17 December 2019).

- Balach, V. Czech Beer and Malt Association (CBMA). Available online: http://www.cspas.cz (accessed on 17 December 2019).

- Mavlikaeva, L.; Ryglova, K. Using exploratory factor analysis for determination of tourist satisfaction factors in the Czech Republic. In Proceedings of the Conference Proceedings Mathematical Methods in Economics, Cheb, Czech Republic, 9–11 September 2015; pp. 513–518. [Google Scholar]

- Vacl, J. Microbreweries as attractive tourist destinations in the Czech Republic. In Proceedings of the International Conference on Business Strategy and Organizational Behaviour (BizStrategy); Global Science and Technology Forum, Fort Canning Downtown Core, Singapore, 21–22 July 2014; p. 51. [Google Scholar]

- Economics, Europe The Contribution Made by Beer to the European Economy. 2013. Available online: https://brewersofeurope.org/uploads/mycms-files/documents/publications/2016/EU_economic_report_2016_web.pdf (accessed on 17 December 2019).

- Elith, J.; HGraham, C.; PAnderson, R.; Dudík, M.; Ferrier, S.; Guisan, A.; JHijmans, R.; Huettmann, F.; RLeathwick, J.; Lehmann, A.; et al. Novel methods improve prediction of species’ distributions from occurrence data. Ecography 2006, 29, 129–151. [Google Scholar] [CrossRef]

- GACR. Project GACR P403/11/2085: Construction of Methods for Multifactor Assessment of Company Complex Performance in Selected Sector. 2011. Available online: http://gacr.pefka.mendelu.cz/gacr403/cs/ (accessed on 15 May 2019).

| Institution | Manuals | Description |

|---|---|---|

| Global Reporting Initiative (GRI) | Reporting Principles, Standard Disclosures and Implementation Manual [27] | The manuals contain the requirements of reporting against the framework, ’what’ must be reported, and provides further guidance on ’how’ organizations can report against G4 criteria. |

| Food and Agriculture Organization (FAO) of the United Nations | Sustainability Assessment of Food and Agriculture Systems (SAFA) guidelines, SAFA indicators, and SAFA tool [28]. | It is a holistic global framework for sustainability assessment along food and agriculture value chains. |

| European Federation of Financial Analysts Societies (EFFAS) | DVFA framework Issues 3.0 [29] | It proposes the basis for the integration of ESG indicators into corporate performance reporting. |

| International Organization for Standardization (ISO) | ISO 14031:2013 [30] | It contains several environmental aspects which determine the Environmental Performance (EP). |

| ISO 9000 [31] | Standard for quality aspects implementation. | |

| ISO 14000 [31] | Environmental aspects. | |

| ISO 18000 [31] | Occupational health and safety aspects. | |

| ISO 26000 [32] | Corporate social responsibility aspects. | |

| European Commission | Eco-Management and Audit Scheme (EMAS) [33] | It improves the environmental performance of the organization (reduces its environmental impacts, strengthens legal compliance and employee involvement, and saves resources and money). |

| Organization for Economic Cooperation and Development (OECD) | OECD Greening Guidelines [34] | It improves the economic and social well-being of people around the world. |

| Indicator | Description | Unit | Sig. (p Value) |

|---|---|---|---|

| EC1 | Economic value added (EVA) | CZK | 0.004148 |

| EN1 | Water consumption | m3 | 0.000007 |

| EN2 | The amount of waste production | Tons | 0.000015 |

| EN3 | The amount of hazardous waste production | Tons | 0.000410 |

| EN4 | Environmental investments | CZK | 0.000004 |

| SO1 | Employee turnover rate | % | 0.000410 |

| SO2 | Donations | CZK | 0.009322 |

| SO3 | Number of Employees | Number | 0.000004 |

| SO4 | Education and training | CZK | 0.001728 |

| GO1 | Liability Corporate Governance (CG) collective report | yes/no | 0.000007 |

| GO2 | CG report on environmental and social activities | yes/no | 0.000004 |

| GO3 | Ethical Behavior | yes/no | 0.000015 |

| GO4 | Women in management | yes/no | 0.038777 |

| EC1 | EN1 | EN2 | EN3 | EN4 | SO2 | SO3 | SO1 | SO4 | GO1 | GO2 | GO3 | GO4 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| EC1 | 1 | ||||||||||||

| EN1 | 0.054 | 1 | |||||||||||

| EN2 | 0.012 | 0.057 | 1 | ||||||||||

| EN3 | 0.077 | 0.053 | 0.131 | 1 | |||||||||

| EN4 | 0.016 | 0.003 | 0.044 | 0.021 | 1 | ||||||||

| SO2 | 0.035 | 0.105 | 0.043 | 0.214 | 0.164 | 1 | |||||||

| SO3 | 0.402 | 0.013 | 0.331 | 0.313 | 0.028 | 0.106 | 1 | ||||||

| SO1 | 0.191 | 0.013 | 0.166 | 0.024 | 0.119 | 0.162 | 0.214 | 1 | |||||

| SO4 | 0.091 | 0.054 | 0.041 | 0.182 | 0.202 | 0.779 | 0.079 | 0.034 | 1 | ||||

| GO1 | 0.135 | 0.006 | 0.244 | 0.093 | 0.137 | 0.031 | 0.098 | 0.147 | 0.057 | 1 | |||

| GO2 | 0.131 | 0.029 | 0.024 | 0.073 | 0.122 | 0.052 | 0.011 | 0.044 | 0.063 | 0.241 | 1 | ||

| GO3 | 0.137 | 0.004 | 0.114 | 0.247 | 0.138 | 0.317 | 0.102 | 0.085 | 0.396 | 0.037 | 0.433 | 1 | |

| GO4 | 0.090 | 0.179 | 0.245 | 0.065 | 0.300 | 0.276 | 0.118 | 0.169 | 0.291 | 0.070 | 0.066 | 0.427 | 1 |

| Component | Initial Eigenvalues | ||

|---|---|---|---|

| Total | % of Variance | Cumulative % | |

| 1 | 2.638 | 20.295 | 20.295 |

| 2 | 1.824 | 14.033 | 34.328 |

| 3 | 1.450 | 11.155 | 45.483 |

| 4 | 1.183 | 9.103 | 54.586 |

| 5 | 1.174 | 9.030 | 63.617 |

| 6 | 0.989 | 7.604 | 71.221 |

| 7 | 0.886 | 6.815 | 78.035 |

| 8 | 0.778 | 5.984 | 84.019 |

| 9 | 0.642 | 4.936 | 88.955 |

| 10 | 0.496 | 3.816 | 92.771 |

| 11 | 0.459 | 3.530 | 96.301 |

| 12 | 0.319 | 2.454 | 98.755 |

| 13 | 0.162 | 1.245 | 100.000 |

| Report | Efficiency | wEN1 | wEN2 | wEN3 | wEN4 | wSO1 | wSO2 | wSO3 | wSO4 | wGO1 | wGO2 | wGO3 | wGO4 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| : | : | : | : | : | : | : | : | : | : | : | : | : | : |

| R20 | 0.437 | 0.000 | 0.012 | 0.386 | 0.378 | 0.032 | 2.2528 | 0.000 | 0.006 | 0.003 | 0.000 | 0.000 | 0.000 |

| R21 | 1.000 | 0.000 | 0.000 | 0.456 | 0.000 | 0.219 | 16.851 | 0.000 | 0.026 | 0.000 | 0.000 | 0.000 | 0.000 |

| R22 | 1.000 | 0.125 | 0.020 | 0.145 | 0.321 | 0.340 | 0.000 | 0.072 | 0.113 | 0.000 | 0.000 | 0.000 | 0.000 |

| R23 | 1.000 | 0.123 | 0.000 | 0.214 | 0.000 | 0.410 | 0.000 | 0.085 | 0.309 | 0.000 | 0.000 | 0.000 | 0.000 |

| : | : | : | : | : | : | : | : | : | : | : | : | : | : |

| R148 | 0.980 | 0.000 | 0.000 | 0.001 | 0.000 | 0.000 | 0.001 | 0.000 | 0.010 | 0.011 | 0.000 | 0.000 | 0.001 |

| R149 | 1.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.001 | 0.001 | 0.010 | 0.011 | 0.000 | 0.000 | 0.000 |

| R150 | 1.000 | 0.000 | 0.007 | 0.000 | 0.000 | 0.000 | 0.003 | 0.000 | 0.004 | 0.000 | 0.000 | 0.010 | 0.000 |

| R151 | 1.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.003 | 0.000 | 0.010 | 0.001 | 0.000 | 0.019 | 0.001 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kassem, E.; Trenz, O. Automated Sustainability Assessment System for Small and Medium Enterprises Reporting. Sustainability 2020, 12, 5687. https://doi.org/10.3390/su12145687

Kassem E, Trenz O. Automated Sustainability Assessment System for Small and Medium Enterprises Reporting. Sustainability. 2020; 12(14):5687. https://doi.org/10.3390/su12145687

Chicago/Turabian StyleKassem, Edward, and Oldrich Trenz. 2020. "Automated Sustainability Assessment System for Small and Medium Enterprises Reporting" Sustainability 12, no. 14: 5687. https://doi.org/10.3390/su12145687

APA StyleKassem, E., & Trenz, O. (2020). Automated Sustainability Assessment System for Small and Medium Enterprises Reporting. Sustainability, 12(14), 5687. https://doi.org/10.3390/su12145687