1. Introduction

Financial technology (FinTech) consists of several technologies, such as blockchain, cloud computing, big data, and machine learning. Blockchain is an advanced technology extracted from the bitcoin, which was first promoted by Nakamoto [

1]. As one of the most innovative and important components of FinTech, it could now tackle challenges such as digital currency, asset securitization, cross-border payment and settlement, and insurance management. As part of FinTech, blockchain has produced a series of extremely promising applications because of its characteristics, such as decentralization, immutability, and anonymity. Blockchain can not only play a role in FinTech, but can also be applied to diverse industries, such as supply chain, intellectual property, estate, and the Internet of Things (IoT). Blockchain technology is highly valued in China. Even the People’s Bank of China (PBOC) began planning to issue CBDC (Central Bank Digital Currency) based on blockchain technology, and the excellent design has been basically completed [

2]. Mu et al. claim that the People’s Bank of China owns the most blockchain patents among central banks in the world [

3]. Due to the innovative nature of this technology and the high level of interest, the number of companies in this field is also increasing. It is necessary to detect the value of these firms to understand this industry better.

This paper will try to make use of the FFTFM (Fama-French Three-Factor Model) for the analysis of stocks of Chinese blockchain firms and to detect the existence of size effect and book-to-market ratio effect (BM effect) in this field. The capital asset pricing model is a popular topic attracting numerous researchers for a long time. Markowitz first proposed portfolio theory to balance the risk and return [

4]. Sharpe, Lintner, and Mossion built the capital asset pricing model in the 1960s, and this model considers the market return as the unique variable to explain the return. Fama and French proposed the FFTFM, that adding size factor and book-to-market ratio factor into the CAPM (Capital Asset Pricing Model) enhances the explanatory power [

5]. After the model was released, Chinese researchers began to utilize the FFTFM to analyze Chinese stock market performance and found it gains a better result than CAPM [

5,

6,

7,

8]. Some studies pay attention to the stock market, for instance, the stocks belonging to the A-shares’ market and Growth Enterprise Market [

9,

10]. Some Chinese researchers focus on a particular industry via the FFTFM, such as the real estate industry, the electric power industry, steel industry, and bank industry [

11,

12,

13,

14]. It could be noticed that many studies emphasize the traditional industry [

12,

14], whereas the blockchain industry is an innovation and the research of implementation of FFTFM in this field is lacking.

Blockchain owns its noticeable position, especially when it comes to concepts like FinTech. There is a saying that “one day in the blockchain industry, one year in real life”, which reveals the extremely rapid changes in this field. Blockchain technology was first applied in the financial field. Since it revolutionizes centralization and simplifies a series of the transaction process, it is recognized as a particularly useful tool of FinTech, which arouses a lot of interest. The rapid development also has an impact on investors’ expectations and sentiment to the blockchain companies including but not limited to the firms that take blockchain as FinTech, and the relationship between emotion and stock return is an indispensable topic of behavioral finance.

Behavioral finance researchers study the impact of capital market participants’ psychological and behavioral characteristics on capital markets based on the assumptions of limited arbitrage opportunities and bounded rationality. The “emotion” in psychology is the expression of external attitudes generated by individual cognitive processes. Investor sentiment in behavioral finance is caused by investors’ limited rationality and can be interpreted as investors’ expected bias, subjective preferences, investment beliefs, and speculative needs. When investor sentiment affects enough investment demand, it will cause the stock price to deviate from its value. According to empirical studies, investor sentiment has an essential impact on financial behaviors such as stock price and income fluctuations, stock market anomalies, and corporate investment decisions and earnings management [

15,

16]. Liu and Zhang summarize that the Chinese stock market is mainly composed of individual investors with relatively weak investment skills, keen subjective awareness, and low-risk perception ability [

17]. Investors are more inclined to pursue short-term capital gains and are keen on short-term investment projects to gain speculative profits. This determines that investor sentiment owns a more powerful influence in China than in mature capital markets.

Under this background, this paper tries to investigate the influence of Internet information related to the stock performance by mining and quantifying Internet public opinion information. Then the sentiment factor would be added into the traditional FFTFM for research.

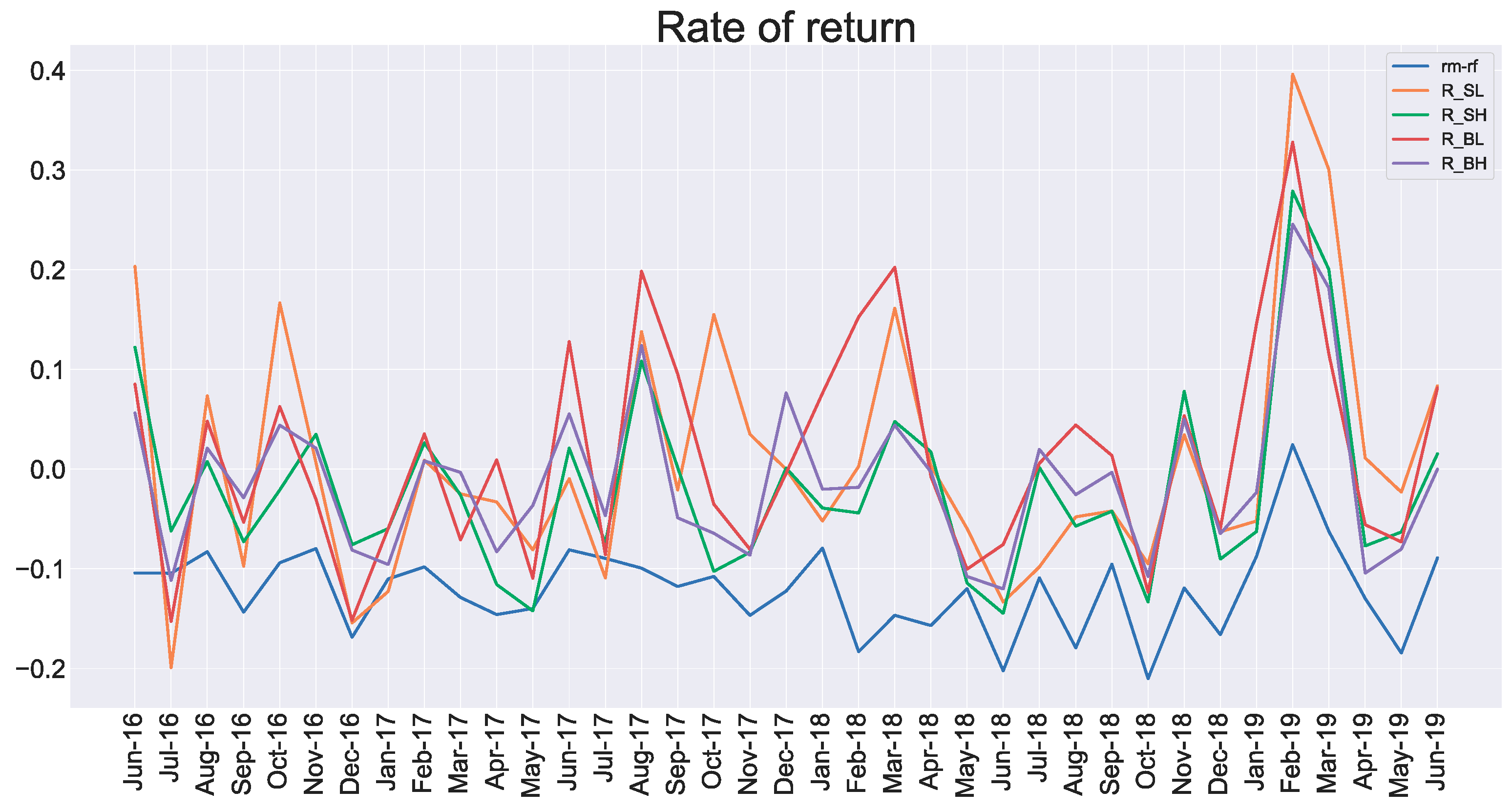

The data are collected from the China Stock Market Accounting Research platform and China Research Data Services platform. Sentiment factor results from the Guba public comments of each stock by online users. Stocks that related to blockchain technology, including but not limited to the listed firms that treat blockchain as FinTech, would be grouped to construct portfolios with different characteristics for the research. While comparing the results of the FFTFM and improved four-factor model, the sentiment factor could present a better explanation of the return of Chinese blockchain stocks. It also notices that size effect and BM effect could not be found in this industry, and the portfolios constructed by big-size companies and low book-to-market ratios companies gain the best return.

Due to the creativity and the bright prospect of blockchain technology, this paper focused on Chinese listed firms related to blockchain technology and demonstrated the valuation via the FFTFM, which is supposed to describe the risk yield characteristics of the blockchain industry in China. Many scholars have studied China‘s asset pricing based on FFTFM. This paper also drew on the FFTFM to empirically research the Chinese A-share market, to try to explain the stock performance of the Chinese A-share blockchain firms and verify whether the industry has scale effects, value premium effects, and profitability effects. We concluded that the BM effect does not exist in the Chinese blockchain industry. We also built a sentiment factor using data mining to improve the traditional FFTFM in order to present a better explanatory power for this industry.

6. Conclusions

This paper is relevant to the topic of regression for FinTech, to demonstrate the effective valuation theory conducted in companies embracing FinTech. It focused on the blockchain companies in China, including those which treat blockchain as FinTech, and used the FFTFM to find these firms. It also contained a new sentiment factor collecting from public comments for better explanatory power. After the above descriptive analysis and regression analysis, it could lead to some conclusions.

6.1. Feasibility of FFTFM and an Improved Four-Factor Model

The FFTFM and the improved Fama-French model that added a new sentiment factor both passed the F test. The market factor, size factor, and book-to-market ratio factor in FFTFM owned the explanatory power to describe and review portfolios’ returns. In the improved model, the sentiment factor could also explain the return of portfolios effectively.

It was noticeable that the explanatory power of four portfolios in FFTFM increased when adding sentiment factor, rising from 0.77, 0.509, 0.653, and 0.458 to 0.771, 0.529, 0.689, 0.514, respectively. It revealed that the sentiment factor had a positive effect on the model. All coefficients of sentiment factors in different portfolios were positive, indicating more optimism brings a higher return.

However, there are still some minor flaws that caused the eight portfolios’ R-square to be not as good as the expectation: The best goodness-of-fit value was 77.1%, and there could be more explanatory variables to review the return of portfolios.

Additionally, to guarantee the reliability of the regression results, it was indispensable to test if there were autocorrelation, multicollinearity, and heteroscedasticity, and we proved that all regressions were acceptable.

Subsequently, although all portfolios passed the F test, the independent variables in each portfolio should also be checked for the significance. There were two portfolios (S/L and B/L) under the FFTFM and one portfolio (B/L) under the four-factor model’s own independent variables that all passed the significance test.

6.2. Influence of Market Risk Premium Factor

The blockchain industry in China, including, but not limited to, the firms that take blockchain as FinTech, owns a positive relationship with the whole market environment. The coefficients of the independent variable market risk premium factor of all eight portfolios were more significant than 1, which implied that the investment portfolio could release the nonsystematic risk and contribute to the return of portfolios. The blockchain industry is an emerging market in China, and several update companies have begun to brace this technology recently, including the companies which use blockchain as FinTech. Along with the development of the blockchain industry, numerous investors are attracted by this industry and plan their investment in this as well. It causes higher volatility in return than the whole market.

6.3. The Non-Existence of Size Effect and Book-to-Market Ratio Effect in the Chinese Blockchain Industry

The size effect is that the return of small listed firms have significantly higher average returns than the large. Banz first found this effect and Fama and French verified the existence [

5,

55]. However, several researchers own opposite views about the size effect. Goyal and Welch concluded that this effect is caused by the deviation of sample selection rather than the size of the companies [

56]. Dimon and Marsh believe that big companies could achieve a higher return than small firms [

57]. Schwert claimed that the size effect is disappearing gradually. In this empirical research, the conclusion could be drawn that there is no size effect in the Chinese blockchain industry, which includes the firms using this technology as FinTech; portfolios with big companies bring a higher return [

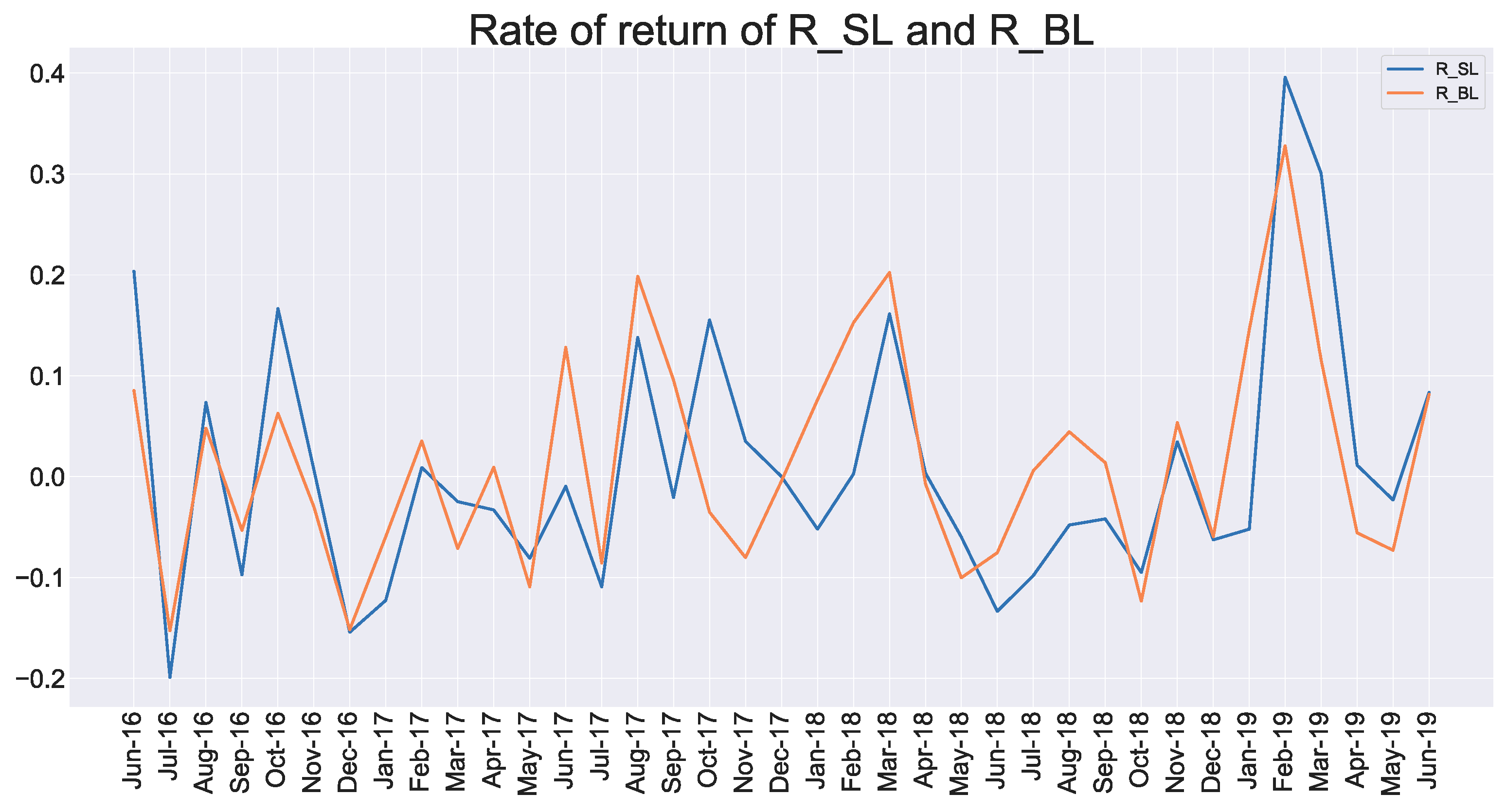

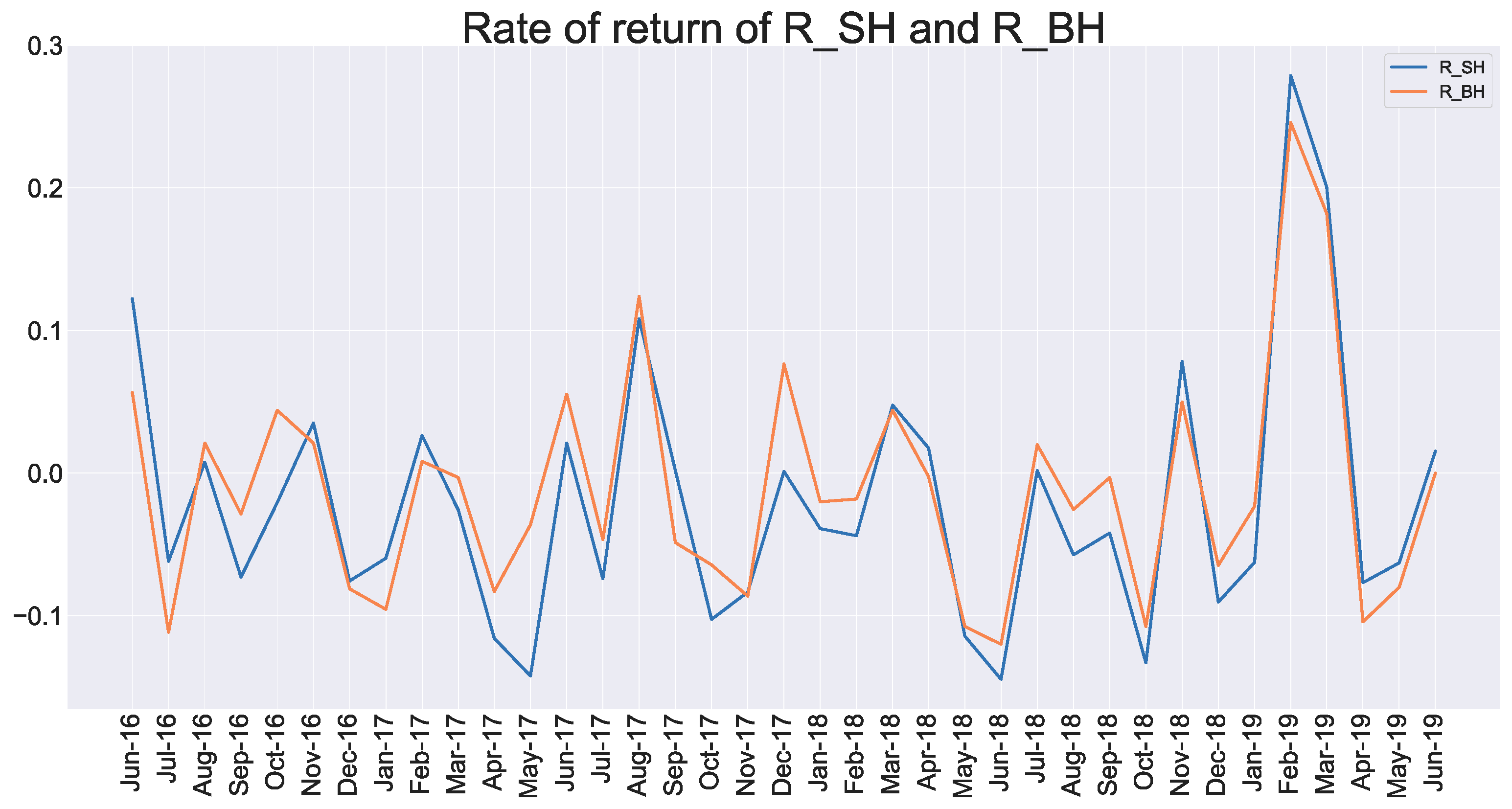

58].

The BM effect indicates that the return of the stocks has a positive relationship with the company’s market-to-book ratio. A higher book-to-market rate could bring out a higher stock return. Fama and French also believe the existence of the BM effect [

5]. Chinese researchers drew a different conclusion about the BM effect in the Chinese securities market. Xu argued that there is a significant BM effect in the Chinese stock market [

59]. Gu and Ding conducted an empirical study of the growth effect of China’s securities’ market and proved that the BM effect is non-existent [

60]. According to the analysis of the Fama-French model above, the BM effect does not exist in the Chinese blockchain industry. Portfolios built by the low book-to-market ratio companies earn more returns than others.

There are various factors that affect the investment in the stock market and investors have been trying to obtain higher investment returns. Many scholars have also studied the effective factors in this filed and have proved that FFTFM can be applied to Western developed securities’ markets. Compared with these mature stock markets, the Chinese stock market has developed late. Therefore, whether the Chinese market can effectively meet the conditions for using the three-factor model has been under discussion. In recent years, with the continuous development of technologies, such as big data, methods for measuring investor sentiment have also advanced. The online forum is an important window for investors to express their sentiments. This article also took this factor into account to improve the model’s explanatory power. The empirical analysis of this article showed that there is no size effect in the Chinese blockchain industry, but there is a BM effect. Companies with more positive and optimistic concerns can bring higher returns to investors. These can help investors choose high-return companies in this field. We also need to admit that the method of sentiment analysis is still relatively simple, and the accuracy of text sentiment measurement needs to be improved. The extent to which the information in the online forum can affect investors’ decisions needs further research.