1. Introduction

Housing has an important role in the socio-economic development of the country as a powerful source of a comprehensive effect on stimulating related industries, generating the resource-saving effect using eco-technologies, solving social problems, and expanding the investment opportunities of the population. The particularity of housing construction as a type of investment activity determines the features of its sources, forms, and methods of financing, among which mortgage lending occupies a central place.

The housing finance system is a diversified multi-level financial and credit relationship of its entities and an extensive instrumental apparatus [

1]. Housing financing is carried out in two directions based on the introduction of new technologies (for example, “green building”): (1) the construction of new housing and its restoration and (2) major repairs and reconstruction [

2,

3].

One of the reasons for the rapid increase in housing prices in recent years is the increase in the pace of economic activity. Joint movement in housing prices, especially in large cities with large and relatively liquid housing markets, may be driven by institutional investors looking for profitability in housing markets at low interest rates [

4].

Housing costs are usually greater than the annual income of potential homeowners in both developed and developing countries. Therefore, the capital-intensive nature of housing investment makes smoothing consumption necessary for home ownership to be affordable for many people [

5]. The development of mortgage financing contributes to economic growth. Despite its relevance, effectively functioning mortgage financing systems are practically nonexistent or underdeveloped in most developing countries [

6]. The underdevelopment of mortgage markets is a characteristic that is not limited only to developing countries, but also to some of the economically powerful countries [

7].

The dynamics of housing prices is of particular importance for the macroeconomy: although a boom in the housing market can have a significant positive effect on output in the short term, it tends to have a negative effect in the long run [

8]. At the same time, fluctuations in the financial market should be taken into account [

9]. Fluctuations in housing prices, which are concentrated in large cities, can have qualitatively similar effects. They can be significant for macroeconomic and financial stability if the city is closely integrated with the rest of the country’s economy [

10].

An abundance of capital and cash has found its way to housing markets through US securitization. In Spain, the banking channel was the most important: the Maastricht Treaty and accession to the European Union ensured the rapid convergence of prime rates, since Spanish banks could easily receive loans in safe currency on the European interbank market. Convergence of mortgage rates was sharp [

11,

12]. In major markets, such as the UK and the Scandinavian countries, there has been a tightening of returns and risk premiums, especially after the financial crisis: capital investors (some of them local) found it less attractive to invest in more exotic destinations [

13]. In China, housing price inflation is partly driven by domestic small investors. A significant share of national capital is not invested there and is controlled by state enterprises. Large savings of the population fall on the housing market due to direct investment in secondary housing [

14,

15]. In other countries, such as Kazakhstan, Georgia, Turkey, and Azerbaijan, the cycle of housing boom and recession has been linked to the Dutch disease phenomenon. Among the most important events in the financial market of Azerbaijan, it is worth highlighting the development of mortgage lending and a record level of gold and foreign exchange reserves. The latter laid the foundation for the influx of petrodollars and the activation of integration projects of the republic’s banking community leaders with international financial institutions [

16]. In several cities around the world (London, Dubai, New York, Vancouver, Sydney, Auckland), global capital has also found its way into the local housing market through direct purchases from foreign investors [

17].

Affordable housing is especially important in developing countries. It should be noted that the concept of “reasonable price” is presented differently in the experience of different countries of the world. Despite the fact that the number of apartments built in the Republic of Azerbaijan is growing rapidly in the residential real estate market, quite a significant purchase of housing for the low-income population is impossible, since prices are very high [

18]. Since consumer loans in Azerbaijan are classified as risky loans, in most cases mortgage loans or loans for reimbursement of losses are issued [

19].

However, despite the scientific value of numerous developments in the field of financial support for construction, in particular its mortgage-credit component, the influence of the following aspects is not fully studied:

- -

specifics of housing construction;

- -

high technology and innovation of housing construction; and

- -

the role of housing construction in the modern economic cycle and its use as a driving force for sustainable development and dissemination of innovative technologies in Azerbaijan.

The main reasons for this are the lack of statistical data for conducting in-depth studies taking into account the following:

- -

peculiarities of housing construction;

- -

economic efficiency of introducing innovative technologies; and

- -

the influence of fluctuations in mortgage market sustainable development on the level of risks for the population, construction companies, and the state as a whole.

Today, there is an objective need to improve state support for affordable housing financing for the population, minimize its risks, and develop green building technologies. At the same time, there are significant differences in the understanding and use of credit sources in the housing finance system. The need to solve these problems determined the goal of this study—to form a model for the sustainable development of the mortgage market in Azerbaijan, taking into account:

- -

commercial risks of housing construction;

- -

a strategy to diversify the risks of the construction industry;

- -

social visions of mortgages; and

- -

state pressure and support.

2. Materials and Methods

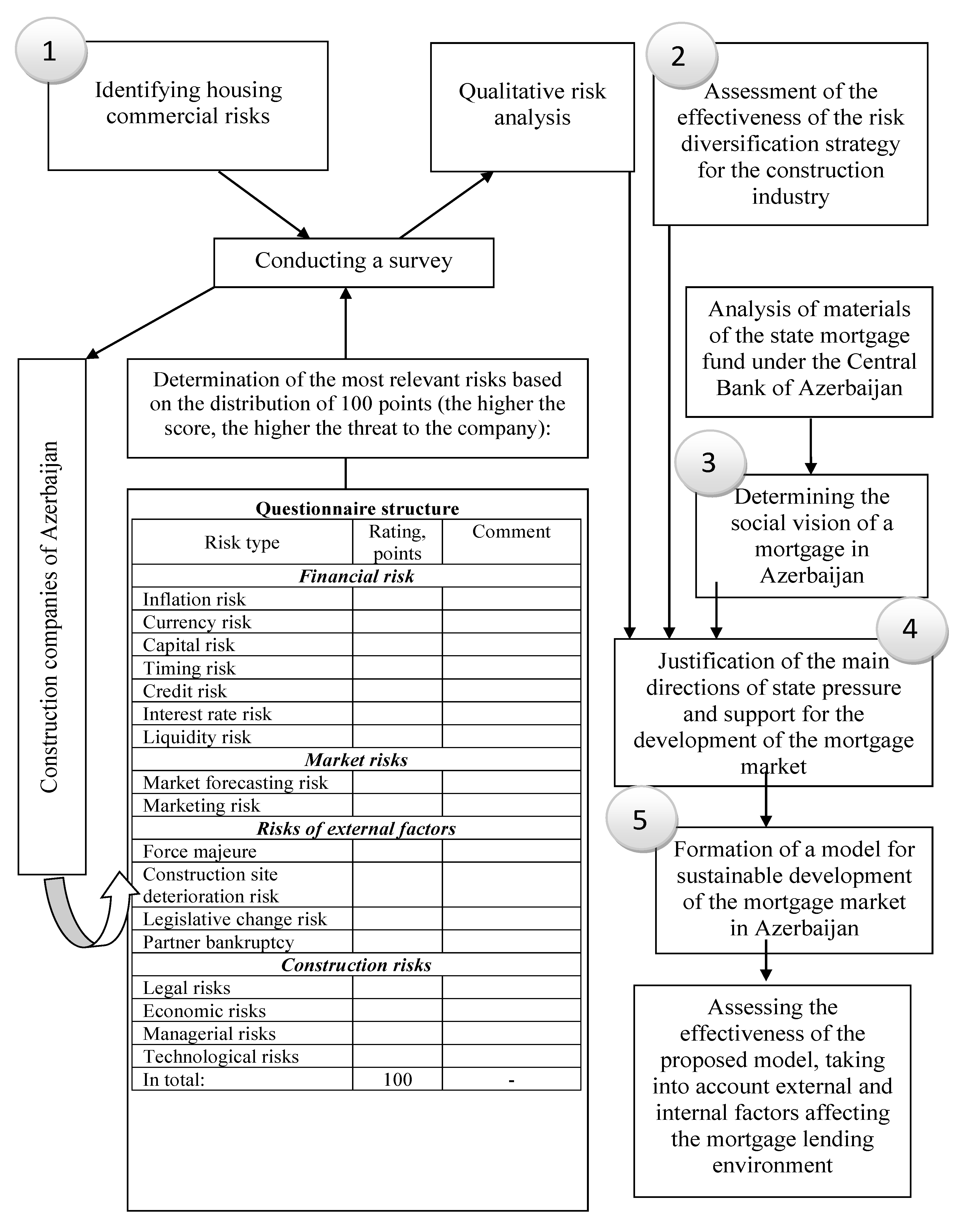

In the research process, five key stages can be distinguished:

Identification of commercial risks of housing based on a qualitative analysis of risks and identification of potential risk areas, as well as highlighting the likely benefits and negative consequences of the onset of identified risks. For the study, data were collected using questionnaires to identify current trends and possible risks of housing construction. The target group consisted of top management and administrative staff of construction companies. The survey was conducted anonymously and confidentially.

The procedure was as follows: the survey was conducted in electronic format using Google Forms, which were provided to respondents through corporate email addresses of real estate developers from January to February 2020. The received data were entered into computer programs (MS Excel, MS Word) and then processed. A questionnaire survey was conducted because today it is the most easily accessible method of conducting a survey for researchers and the most convenient for respondents, requiring a minimum of time. At the same time, the respondents were not tied to the time frame of the survey, and also had the opportunity to secure commercial information, taking into account the anonymity of the answers based on the Delphi method. Respondents were provided with a structured questionnaire of four risk groups (financial, market, external factors, and construction risks). Respondents noted the most relevant risks for their company, taking into account their ranking according to the degree of threat provided. They justified the threat to the company. The degree of influence of a certain type of risk was determined on the scale of relations. To get it, respondents distributed 100 points between the risks indicated in the questionnaire.

The survey included representatives from 15 Azerbaijani developer companies. A summary of the survey participants is given in

Table 1.

The margin of error was 4%; 2 questionnaires were filled out incorrectly (for example, some respondents did not answer all the questions).

- 2.

Assessment of the effectiveness of the risk diversification strategy for the construction industry by analyzing the development trends of the mortgage market.

- 3.

Determination of the social vision of a mortgage in Azerbaijan. The statistical information of the State Mortgage Fund created under the Central Bank of Azerbaijan was used because it is precisely this institution that forms the mortgage lending system to

- -

satisfy housing demand,

- -

improve housing conditions,

- -

create an effective mechanism for financing housing,

- -

ensure adaptation of the supply in this area to real purchasing power, and

- -

attract domestic and foreign investors in mortgage lending.

- 4.

Justification of the main directions of state pressure and support for the development of the mortgage market based on the results of the previous stages of the study.

- 5.

Formation of a model for sustainable development of the mortgage market in Azerbaijan. At the same time, it was proposed to use a methodological approach to assessing the effectiveness of the model, which involved the construction of a multivariate linear regression equation. It connected one dependent variable by a linear function of several independent variables. The main advantage of this feature is the minimization of the sum of standard deviations. The calculation was carried out according to the formula:

where, yi—a dependent variable (solvency of the borrower); xi—independent variables affecting the variable. These are the indicators by which the effectiveness of the model is evaluated; βj—parameters of the proposed inclusive model, indicating the significance of each independent variable. The essence of constructing multiple logarithmic regression is that it combines an unknown variable with several independent variables:

where, ρi = Prob (yi = yi/xi)—probability of a positive case; α—independent parameter of logarithmic regression; xi—independent variables; β—model parameters (weight). A feature of this logarithmic regression is that all estimates must be transformed into values from 0 to 1.

To determine the factors affecting the state of the mortgage market, taking into account their economic content, the following external factors were selected that affect the mortgage lending:

- -

average monthly wage of the population (X1),

- -

consumer price level (X2),

- -

direct investment (X3),

- -

discount rate of the Central Bank of Azerbaijan (X4),

- -

subsistence level (X5),

- -

volumes of housing commissioned for use (X6), and

- -

national currency rate (X7).

Internal factors were also taken into account:

- -

total assets of banks (X7),

- -

minimum contribution amount for mortgage lending (X8),

- -

investments in bank securities (X9),

- -

the share of overdue loans in the total amount of mortgage loans (X10),

- -

return on assets (X11), and

- -

the weighted average interest rate on long-term deposits in foreign currency (X12).

A diagram of the process of promotion and analysis of the study is shown in

Figure 1.

Despite the identification of internal and external factors that affect the mortgage market and the formation of forecast results, a limitation of the proposed methodological approach was the justification of the choice of these factors. A more detailed analysis of factors, which can affect the productive variable, could be considered appropriate, justifying the choice of each variable and revealing its economic content.

3. Results

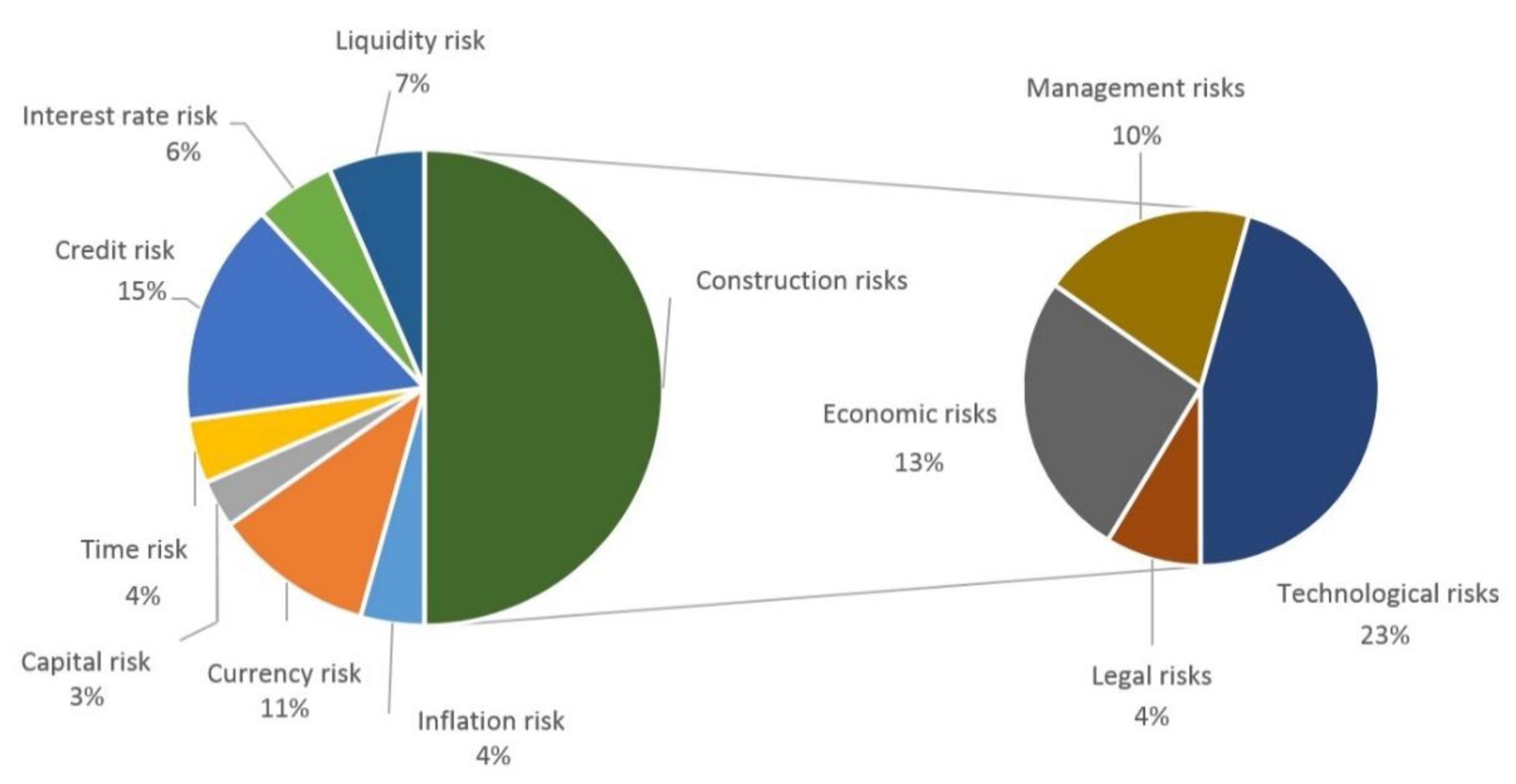

3.1. Commercial Risks of Housing Construction

In the development of housing construction, four blocks of risks can be identified, such as financial, construction, market, and external risks. As a result of the survey, representatives of construction companies identified financial and construction risks as the most dangerous for the functioning of their business. They are associated with unpredictable fluctuations in the value and volume of financial flows. The main ones included inflation and currency risks, capital and time risks, credit risk, and interest rate and liquidity risk (

Figure 2).

Credit risk, liquidity risk, and interest rate risk are typical for any type of lending. Therefore, the methods of their control and management in construction lending are identical to standard risk management procedures. For example, the liquidity risk may manifest itself in the insolvency of the developer in a timely manner to fulfill obligations to suppliers of building materials and contractors, in particular, due to delays or non-receipt of funds from other sources. The interest rate risk arises, for example, in a situation where the developer takes out a loan with a floating interest rate that may potentially increase.

Market risks of housing construction are associated with the features and quality of market research conducted both in the preparation of projects and in the process of their implementation. Miscalculations in the forecast estimate of demand may contribute to the impossibility of selling the property at planned prices. As a result, the payback period will increase and there will be difficulties with repaying the loan for the project. When analyzing market risks, in addition to forecasting demand, it is also necessary to assess the likelihood of competitors appearing with housing projects that have advantages over one’s development. A high-quality market analysis of current and future fluctuations in supply and demand can reduce market risks in lending to housing projects.

Actual external risks, in addition to force majeure, are the deterioration of the construction site (for example, subsidence); legislative changes affecting the business environment, in particular, housing construction; and bankruptcy of partners. Therefore, external risk management involves a thorough check of all technical and economic aspects associated with the preparation of a housing project.

Mortgage lending has special risks, such as economic, technological, managerial, and legal risks. Many different organizations participate in the housing construction process:

- -

contracting construction companies,

- -

development organizations that initiate the implementation of the project,

- -

state and municipal institutions that carry out expertise and issue various permits and approvals, and

- -

buyers or tenants of the constructed apartments.

A large number of participants in the construction process increase the likelihood of a disagreement of interests or legal risks; high-quality preparation of the regulatory component of the housing construction project is required to minimize risk. The main legal risks are a conflict of rights regarding the subject of the pledge, violation of contractual obligations, non-compliance with conciliation procedures, and environmental protection requirements.

In Azerbaijan, the concept of “real estate” is actually identified with the object of construction in progress. In this aspect, the authors consider it appropriate when using the real estate object as a mortgage subject to proceed from the following fact. Namely, the construction in progress prior to putting it into operation can be considered as a kind of encumbrance of property rights to the respective land plot or as an improvement (deterioration) in the cost and/or quality of this land plot. Therefore, it is necessary to consider the issue of transferring or pledging property rights to a land plot, rights to build on a land plot, lease rights to this plot, and the like. When using such an object, the mortgagor must submit documents confirming the right to acquire the corresponding immovable property in the future. To prevent any complications, it is advisable to consider the pledge of property rights to the object of construction in progress separately from the mortgage building, structure, and the like.

High legal risks of mortgage lending are associated with the imperfection of judicial practice and the executive service, which makes it difficult to implement the principle of protecting the rights of the lender. For example, banks face the threat that their requirements will not be satisfied with the value of the pledge in case of non-repayment of the debt.

Construction economic risks are associated with a bad-quality business case for a housing project. This can lead not only to underestimation of the level of expenses but also to unforeseen expenses. Therefore, obtaining a loan for housing construction depends, firstly, on the correctness of the borrower’s calculations, and secondly, on the result of the bank’s analysis of cash costs and revenues during the implementation of the project and after its completion.

A low level of management on the part of the bank and/or on the part of the project organizer (borrower) provokes managerial risks and leads to increased liquidity risks of the borrower; unauthorized and inappropriate spending of funds; and theft or damage to uninsured materials.

Specific risks of housing loans are “technological risks”. They arise as a result of poor-quality design, materials, and technologies. Moreover, the level of these risks is affected by the level of qualification of entrepreneurs or even their bankruptcy, as well as the lack of necessary equipment.

3.2. Diversification Strategies of Mortgage Housing Risks

Diversification is the most effective method associated with managing the risks of untimely profit in an unstable environment. By forming a loan portfolio using the widest variety of conditions on rates, terms, collateral, and repayment mechanisms, Azerbaijan can avoid excessive losses due to the negative impact of market factors in certain periods. Therefore, diversification is a priority method of managing liquidity risk and interest rate risk.

The use of risk reduction methods based on participants’ diversification in housing construction in Azerbaijan is quite problematic for the following reasons.

- -

Firstly, project risks are distributed between economic partners, according to their ability to neutralize these risks. Given the economic and political situation in the country, there are no guarantees of the sufficient financial stability of these partners.

- -

Secondly, the deficit of own funds of most large enterprises–developers, as well as the mismatch of the inflow of foreign investments to their needs complicates the reservation of funds to cover unforeseen expenses.

- -

Thirdly, in the construction sector, the legal framework for ensuring insurance of foreign investment has not been created.

- -

Fourthly, there is a need for high-quality development of a ranking model for investment projects due to a shortage of investment resources.

One of the approaches to risk diversification in the mortgage market of Azerbaijan is to simplify the process of assessing mortgage borrowers. The requirement on the ratio of the monthly mortgage payment to the monthly gross income is canceled if the amount of the down payment is more than 40% of the cost of living space. A mortgage restructuring mechanism has been created to protect the rights of borrowers whose solvency is deteriorating due to changes in economic and legal conditions.

Risk diversification is also evident in the full automation of mortgage loans. Electronic systems allowed authorized banks to monitor the stages of mortgage lending and increase the transparency of the mortgage lending process in general. At the same time, the population has the opportunity to make mortgage payments in an electronic form using various payment instruments.

Recently, as elements of a strategy to diversify mortgage risks, large-scale automation processes related to the provision of electronic services have been introduced in the country. Risk diversification through the creation of a new electronic system makes the following possible:

- -

mortgage market growth in the coming years;

- -

expanding the credit and client base;

- -

new loan products and management functions; and

- -

providing the system with a broad base, speed, and flexibility, as well as support for all modern web browsers.

In addition to this, it became possible to integrate various subsystems into a new system on one platform.

The introduction of the new system increased the transparency of business processes, significantly reduced clearing time and operating costs, as well as increased the efficiency of financial risk management by authorized banks and by the MCGF (Mortgage and Credit Guarantee Fund).

Of particular note is the MCGF risk diversification strategy, as it is not involved in direct mortgage lending as part of the mortgage system. Mortgages are provided by authorized MCGF banks. Then the MCGF refinances these loans, that is, withdraws credit claims from authorized banks. MCGF-authorized insurance companies and authorized appraisers enter into appropriate mortgage agreements and mortgages. Currently, the MCGF is working with 24 authorized banks, 18 authorized insurance companies, and 17 authorized appraisers.

It should be noted that the financing of mortgage loans from the MCGF began in 2006, and this system plays an important role in supporting the state social policy in the field of housing. As of 2019, the volume of mortgages issued by the MCGF amounted to

$1.2 billion. More than 26,000 families improved their housing conditions through mortgages. A total of 67.9% of the mortgage loans provided by the MCGF in 2006–2019 were for young people and young families, and 19.5% of loans were issued in the regions. Looking at mortgages at the expense of the MCGF, one can trace the positive dynamics in this area in recent years. Thus, in 2018, through the MCGF, 3109 families received 203 million manats, and in 2019, 3960 families received 273 million manats [

20].

All this confirms the effectiveness of the MCGF risk diversification strategy since the MCGF has not incurred financial losses as a result of creating a highly reliable risk management system in its activities. Adequate risk allocation at the legislative and institutional levels and accurate forecasting led the MCGF to fulfill its obligations and recognition as a reliable and solvent partner in relation to third parties in a timely manner.

The high quality of the mortgage loan portfolio was ensured due to the fact that the MCGF allocated mortgages in accordance with strict standards based on best practices in this field. The condition of the loan portfolio made it possible to immediately transfer it to other banks without any financial losses in case of cancellation of some authorized banks issuing these loans.

In addition, a credit rating model has been created in Azerbaijan to ensure an adequate distribution of risks between the MCGF and lenders in order to minimize credit risks, and the actual application of guarantee has been launched.

In addition, in order to improve the quality of services provided to the public, ensure transparency and efficiency, and reduce the use of paper documentation, an electronic system was created. Integrated advanced technologies allow one to effectively manage the financial and other risks of the MCGF, significantly increasing the efficiency of management processes.

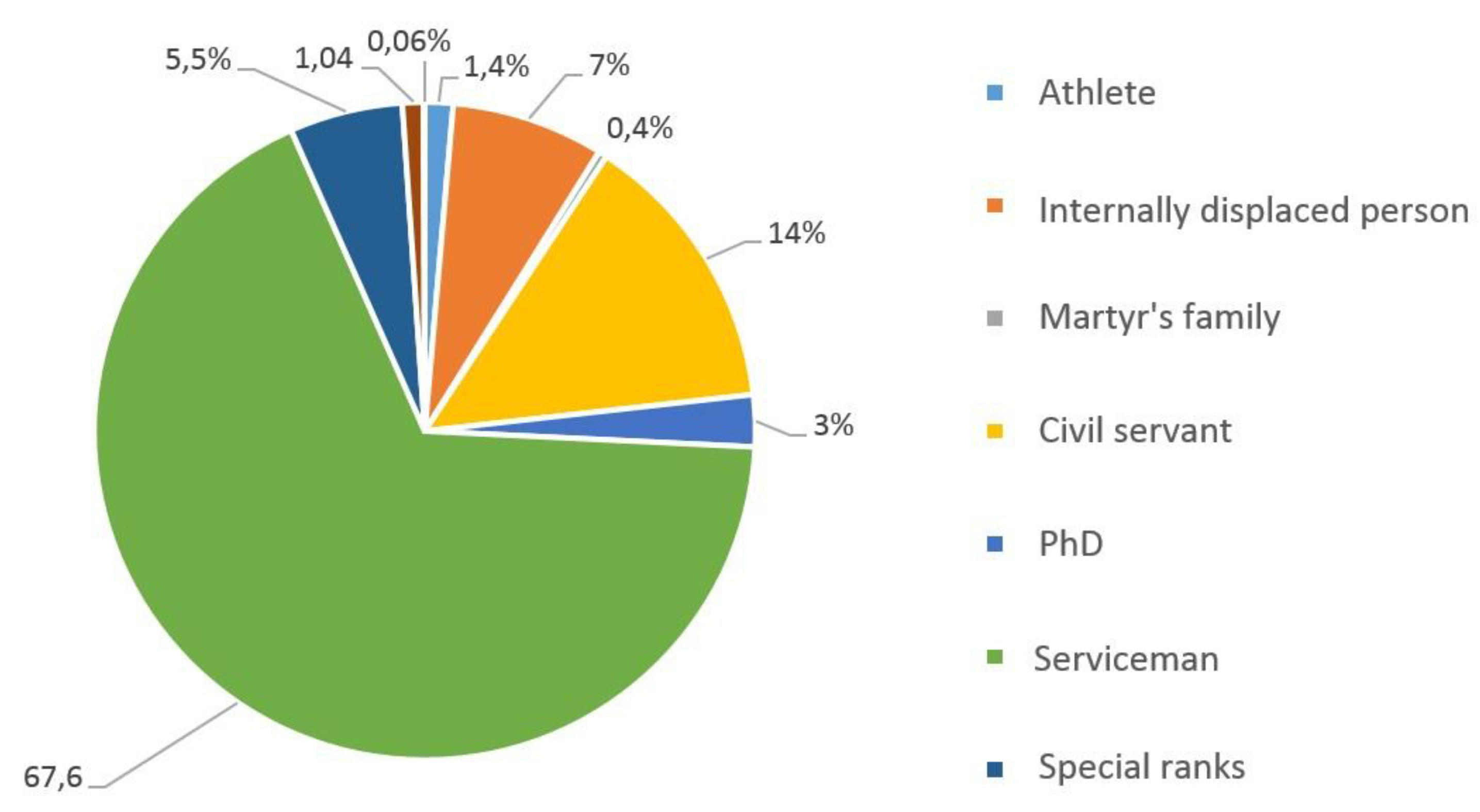

3.3. Social Vision of Mortgages in Azerbaijan

Reforms in Azerbaijan in 2019 led to fundamental changes in the political and socio-economic development of the country. Since the bulk of the reforms is aimed at improving the living standards and social conditions of the population, activities in this area are reflected in the formation of a social vision for mortgage and credit support. In this regard, important decisions were made in Azerbaijan to improve the living conditions of the population and expand access to finance for business.

The main direction of the reforms was providing the population with housing through long-term mortgage lending. Significant simplification and full automation of the mortgage lending process created a high demand for these loans. Thus, during 2019, the total amount of loans to authorized MCGF banks amounted to 503 million manats; 2652 mortgage loans were issued. In 2019, 1390 preferential mortgage loans were granted (

Figure 3). Conventional mortgages are attracted by the MCGF from domestic financial markets, and soft mortgages are provided by funds allocated from the state budget (226.5 million manats) [

20].

The total amount of mortgages provided by the MCGF in 2006–2019 amounted to 1.391 billion dollars. The number of families that improved their housing conditions through these loans was 27,883. Of these, 436 million manats (8839 loans) were issued to preferential categories. About 70% of the beneficiaries of mortgage loans were young people and young families, and about 20% of loans were issued in the regions [

20].

The apartments held by the State Housing Construction Agency (MIDA), approved by the relevant Decree of the President of the Republic of Azerbaijan, are transferred to the full ownership of the citizen from the date of conclusion of the relevant agreement. However, the relevant agreement provides for a 3-year alienation of the apartment, as well as restrictions on renting. The sale of discounted apartments is one of the steps taken towards the implementation of a unified social policy of the state and is aimed at providing social support to the population. It is no secret that apartments that are offered at lower prices than the average market price will have a negative impact on the real estate market if they are put up for sale immediately. The above limitation is intended to prevent abuse. Owners of discounted apartments acquire the right to sell or rent their property only after the expiration of the specified period.

It is also provided for the rental of premises with the obligation to sell them within the framework of the social vision of a mortgage in Azerbaijan with the aim of:

- -

improving the mechanisms for providing the population with housing,

- -

meeting the needs of citizens with insufficient personal means, and

- -

developing rental relations in the framework of socio-economic reforms.

In accordance with this, the MCGF provides for the creation of an appropriate mechanism for the rental of residential premises with an obligation to sell. To date, preparatory work has been carried out in Azerbaijan to ensure the implementation of the housing rental mechanism. A housing fund has been created, the necessary procedures and internal rules have been established to ensure the operation of the mechanism, and the requirements for residents and housing have been identified. At the same time, the mechanism is fully automated. ASAN (Azerbaijan Service and Assessment Network) service centers have been provided to Azerbaijani citizens to ensure transparency and efficiency.

In addition, the Azerbaijani government is working on the following:

- -

development of mortgage lending mechanisms in the country,

- -

improving the level of service for mortgage loans,

- -

introducing widespread use of information technology,

- -

mortgage annuity, and

- -

insurance and repayment of mortgage loans at the expense of the MCGF.

In the process of achieving a social mortgage vision during the course of 2019, MCGF invested

$150 million with an annual interest rate of 3% in the amount of mortgage bonds for 1 million manats. In general, financial resources raised by placing securities on the domestic capital market since 2009 amounted to

$1.005 billion. These funds are used to finance ordinary mortgage loans (for up to 25 years, at 8% per annum). Bonds in the amount of 281.1 million manats were fully sold. Currently, the volume of placed bonds of the fund is 723.9 million manats [

20]. This constitutes a significant part of the domestic securities market.

Another step towards a social vision is to increase the charter capital of the Mortgage and Credit Facility Fund up to 637 million manats based on the Decree of the President of Azerbaijan. This increase in capital was provided by 71 million manats allocated for preferential mortgage lending in the state budget for 2020 [

20].

3.4. State Pressure and Support

In recent years, Azerbaijan has been successfully working in accordance with the priorities of the concept of socio-economic development implemented by the state to ensure a decent standard of living and improve social security and achieve balanced and sustainable economic growth. The main objectives are to strengthen social protection and meet the needs of the population, improve housing and financial conditions for low-income families. The effectiveness of the MCGF’s activity should be noted, which is reflected in the evaluation of the international rating agency Fitch Ratings [

21]. The agency affirmed the long-term default rating of the MCGF in foreign and national currency at “BB+” level (“stable”). The international credit rating at the level of “BB+” is an indicator of the strategic importance of the fund in the country’s economic policy.

Today, for the registration of a mortgage in Azerbaijan, it is necessary to prepare many documents. This complicates the process of mortgage lending, and in some cases creates unofficial payments and additional costs. The authors offer mortgage proof of ownership (“extract”) from the State Real Estate Register, a document confirming that the subject of the pledge is not responsible for any other obligations and that there are no restrictions to a mortgage agreement and lending.

Interest rates on mortgage lending in Azerbaijan are very high amid studies of world practice and real incomes of the population. Macroeconomic stability in the country’s economy, fluctuations in inflation between 1% and 2%, and the size of state reserves contribute to more moderate interest rates. It can also open access for low-income families. It is necessary to provide the opportunity to use SOFAZ (State Oil Fund of the Republic of Azerbaijan) funds to reduce interest rates.

The maximum size of mortgage loans in previous years was lower than real market prices, and this amount was not enough to solve the housing problem for long-term borrowers. A citizen had to buy an apartment for 25 years. This means that if he/she wants to buy a home with a mortgage, he/she must foresee 25 years in advance that this housing meets future family conditions. However, the maximum size of a mortgage loan of 50,000 manats did not allow this to be planned. Today, the size of the mortgage loan corresponds to the possibilities of solving the housing problem in the long term (

Figure 4).

A mortgage of over 120,000 manats is one-fifth in the IKZF portfolio. In the future, the maximum limit should be indexed in accordance with changes in the real estate market once every two years. It is more advisable to remove the maximum limit in the future in order to ensure sustainable development of the construction sector and strengthen government support for the real estate market.

The requirement that a borrower should be registered as a mortgagor in the state register of property rights in most cases excludes the primary housing market in this process, since delays in the state registration of many new buildings impede the availability of these assets in mortgage markets. There is a problem for citizens wishing to purchase housing in a more expensive market, which is significantly limited.

The financial resources of the MCGF are limited. Therefore, the fund is not able to provide a wider range of loans. In order to diversify financial resources and increase opportunities, insurance funds should be involved in mortgage lending, and private capital in the securities market. In addition, construction savings banks should be created, and passive savings of the population should be attracted to the mortgage market.

Mortgages in Azerbaijan often lead to higher prices in the real estate market, since market inflows generate additional demand. If the pace of development of the construction sector is contradictory, an undesirable increase in prices is observed. According to the current legislation, new buildings in the mortgage market are scarce and the main demand is remarketing for old buildings, while the problem becomes more obvious.

Every citizen of Azerbaijan has the right to use a mortgage once in a lifetime, as provided for by the Law on Mortgage, and the presence of a house does not limit the mortgage. This means that everyone who has an apartment and at the same time the right to a mortgage loan can turn to the limited resources of the MCGF, reducing the likelihood of citizens really needing loans from this fund. This is a flaw of mortgages financed by the state. That is, when a resident uses the limited capabilities of the MCGF, the principle of social justice is violated. The authors propose restricting the use of conventional and preferential mortgage loans provided by the state. People in this category should use commercial mortgages or other options offered by construction companies.

In practice, authorized banks sometimes provide citizens with inaccurate information. In many cases, a citizen may misunderstand the information received. To prevent such incidents and increase accountability and transparency, the MCGF publishes a new monthly program at the beginning of each period along with the results of the previous one. At the same time, it is necessary that each of the authorized banks reflect the amount of soft and ordinary mortgage loans in the new period. Thus, it is possible to manipulate or eliminate the subjective approach in the process of mortgage lending.

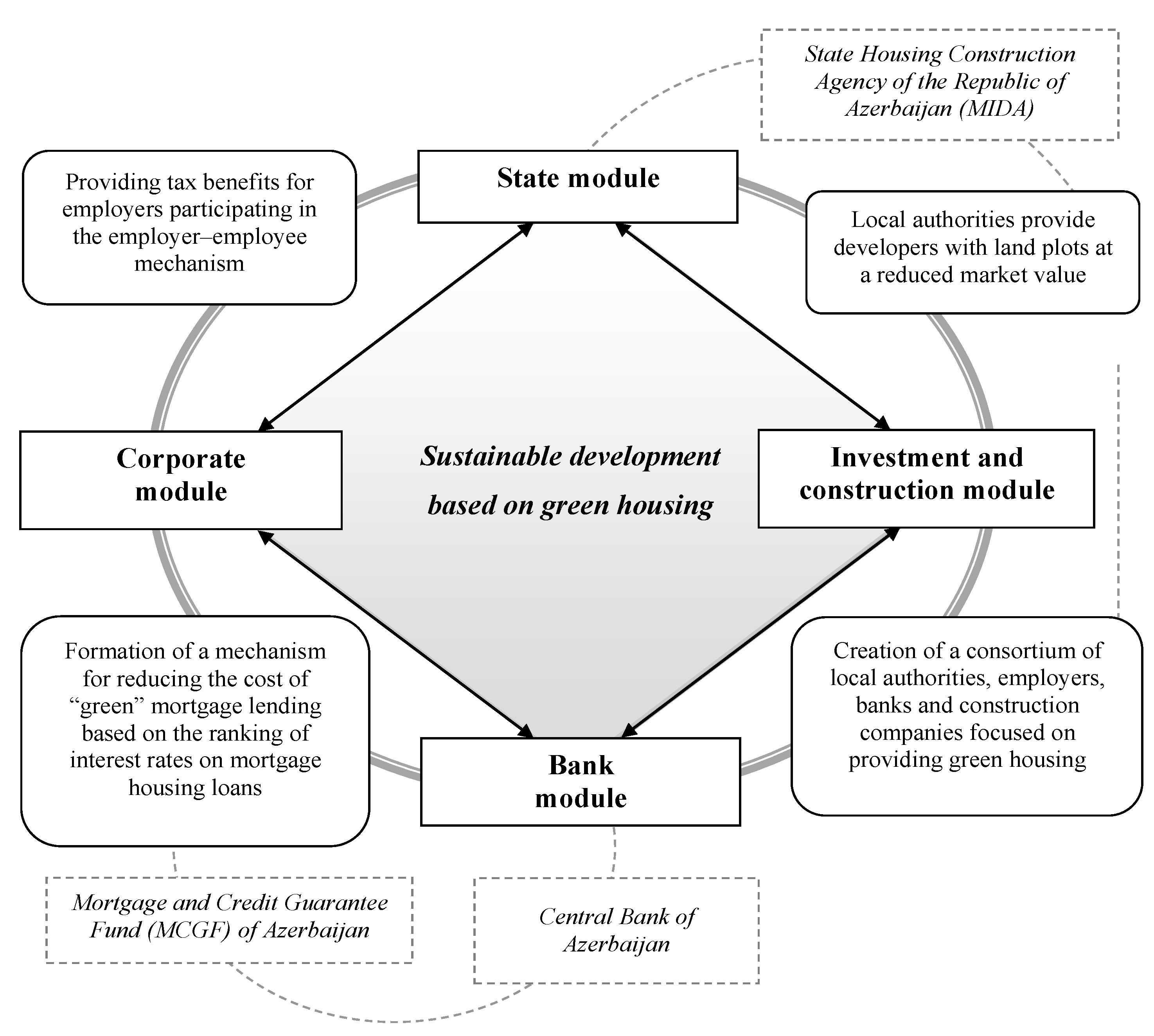

3.5. A Model of Sustainable Development of the Mortgage Market in Azerbaijan

Taking into account the identified commercial risks of housing construction, the effectiveness of the risk diversification strategy for the construction industry, social visions, and state pressure and support for mortgages, a model for the sustainable development of the mortgage market in Azerbaijan was proposed (

Figure 5). This model provides for the formation of a favorable institutional environment by mitigating the negative impact of various risks and developing institutions that form the structural institutional framework for improving housing, financial, and credit policy of the state, with the focus on green building and environmentally friendly technologies.

The proposed inclusive model was based on enhancing the effectiveness of the state housing support module, taking into account the main trends and changes in the housing sector, defining new requirements for the technical characteristics of housing construction. As consumer qualities, functional amenities, and comfortable living, as well as the relatively low cost of housing coming to the fore today, a contradiction arises between the need to reduce the cost of constructing affordable housing and introducing new economic building technologies and materials. At the same time, rising energy prices and electricity and transport tariffs require an increase in the heat-shielding qualities of residential buildings. This significantly affects the cost of operating housing and requires the introduction of green building technologies.

The investment and construction module provides for the following:

- -

construction of economical and energy-efficient buildings with the development of autonomous systems for engineering, heating, water supply, sewage, and various capacities, including the use of renewable energy sources;

- -

restructuring of the production base of housing construction; and

- -

restructuring the industry of building materials and structures.

In accordance with this, the state module should be formed on the basis of segmentation of the housing market, taking into account the solvency of all categories of citizens. The state module provides for the use of special mechanisms for regulating both demand and supply in each segment of the housing market. Special state programs should be focused on the following:

- -

solving the problem of low solvency of citizens and the high cost of credit resources;

- -

creating favorable conditions for accumulating funds for the purchase of housing;

- -

developing rental housing, which the population needs during the accumulation of savings for property acquisition;

- -

reducing inflationary risk and the risk of price increase for housing by fixing the last and interest-free repayment of the residual value of the loan provided with the support of the state;

- -

stimulating the process of crediting of housing construction by supplementing the shortage of funds in different layers of the population; and

- -

eliminating existing disparities between predicted performance and the actual needs and capabilities of citizens, who are potential participants in such programs, given their focus on families with relatively high incomes.

This will reduce the number of program participants and the amount of funding, restore full funding for programs, and expand the circle of program participants by removing restrictions on the participation of families with the necessary income level. In the authors’ opinion, it is advisable to change the principle of providing funds for the purchase of affordable housing. Namely, instead of financing the purchase of housing, apartments might be provided for rent with tenant’s ability to redeem an apartment after a certain period of time at a residual value or to resell his/her right to purchase it.

The corporate module is included in the model using the employer–employee mechanism. This mechanism assumes that the employer, at the expense of tax benefits provided by the state, receives an annual income from the placement of free working capital in deposit accounts and directs them to housing mortgage lending.

Unlike the market mechanism for accumulating funds and using them for housing financing, the banking module of the proposed model does not have high requirements for:

- -

the level of development of the financial market, and its institutional and infrastructural organization;

- -

the quality of institutions, instruments and financial assets; and

- -

information about assets.

However, taking into account the development of the market foundations of the financial system of Azerbaijan, a gradual reduction in budget financing and a reorientation to the domestic supply of financial resources, including through bank lending, are necessary [

22]. Therefore, the banking module is necessary to help solve the housing problem of the state by using various sources of financing not prohibited by law. It is also necessary to integrate the banking module into the relationship between the developer and the future home buyer (investor) on the basis of a legislative ban on the sale of apartments from unfinished houses, whose readiness is less than 80%. On the one hand, this will reduce the funds of developers at the initial stages of construction and increase their need for loans, and on the other, it will minimize the risks of fraud.

The inclusiveness of the proposed model emphasizes a move away from over-focusing on state support in the long term, which may lead to:

- -

a decrease in the effectiveness of mortgage and housing lending mechanisms;

- -

the formation of insufficiently clear strategic indicators of such mechanisms’ functioning; and

- -

deformation of organizational structures and institutional forms of financing.

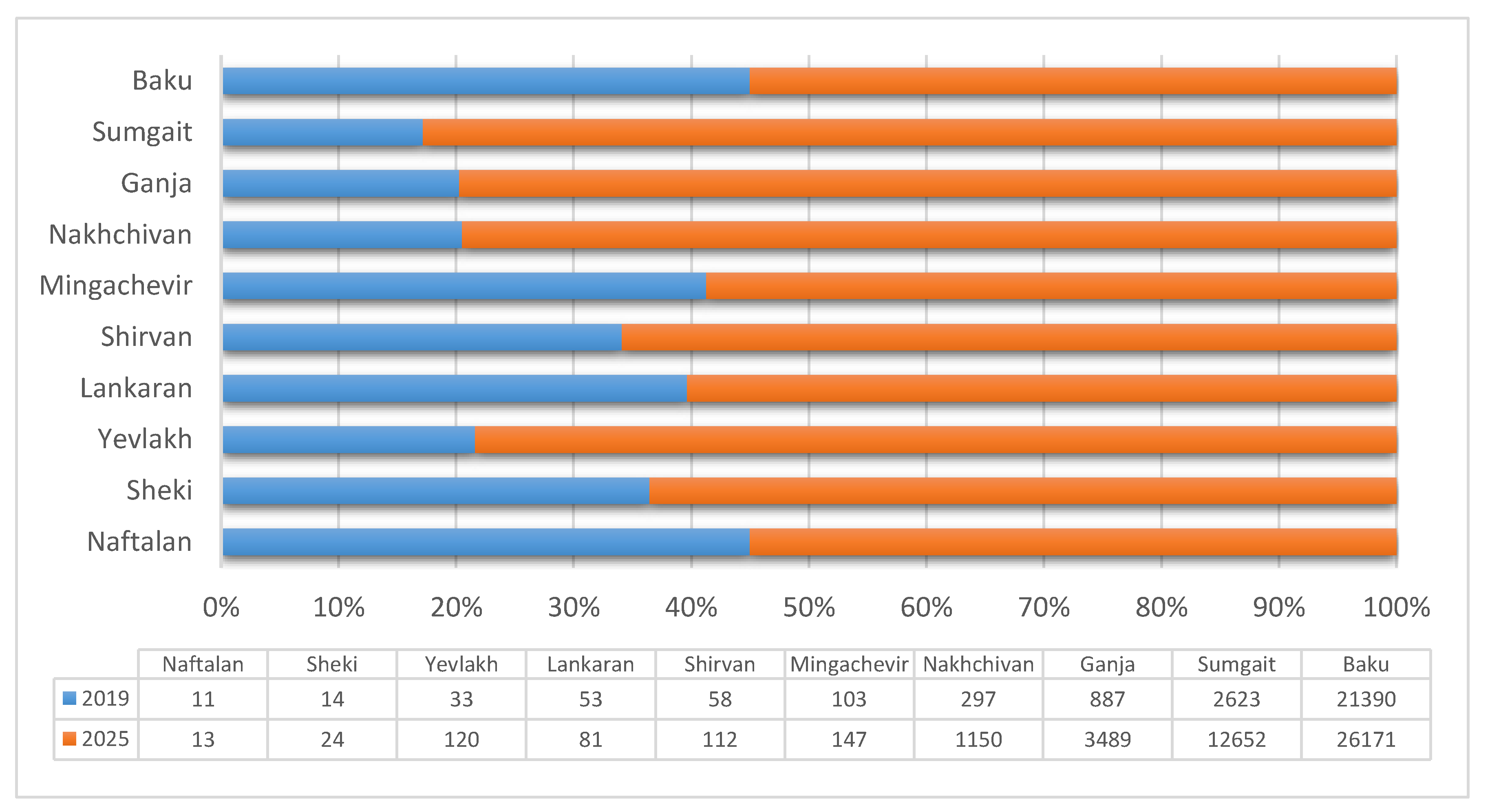

Taking into account the selected modules and checking them for multicollinearity, the effectiveness of the proposed inclusive model of mortgage market sustainable development in the main cities of the republican subordination of Azerbaijan was forecasted (

Figure 6).

The evaluation of the effectiveness of the proposed model takes into account a number of factors (variables) that can be attributed to:

- -

state module (average monthly wage of the population (X1), consumer price level (X2), cost of living (X5));

- -

banking module (discount rate of the Central Bank of Azerbaijan (X4), national currency rate (X7), total assets of banks (X8), weighted average interest rate on long-term deposits in foreign currency (X13));

- -

corporate module (volumes of housing commissioned (X6), minimum contribution for mortgage lending (X9), return on assets (X12)); and

- -

investment and construction module (direct investment (X3), investments in bank securities (X10), the share of overdue loans for the total amount of mortgage loans (X11)).

This approach allows the state and banks to intensify mortgage lending based on interest rate regulation, taking into account the benefits of “green” housing. Of all the selected variables, the weighted average interest rate on long-term deposits in foreign currency (X12) affects the volume of housing mortgage lending in the financial market.

In Sumgait, Ganja, and Nakhchivan, it is expected that by 2025 the volume of lending will triple, and in Yevlakh, 2.5 times. The smallest growth is projected in Naftalan. This is due primarily to the fact that Naftalan is a small city, which is located near Baku and the second largest city in the country-Ganja. Therefore, the young able-bodied part of the population migrates to large cities, which reduces the average monthly salary of the population. At the same time, in 2019, Naftalan recorded the lowest level of mortgage lending. The city is not attractive for investment in the context of housing; most of the investments are attracted to the recreational sector, as Naftalan is a place for a spa holiday. Despite the fact that the bulk of mortgage loans was issued in Baku, the largest increase in mortgage lending for housing construction based on the proposed inclusive model is projected in the periphery.

The developed inclusive model helps minimize the most relevant building risks, namely, the economic ones—based on banking, investment, and building module—with the help of creating a consortium of local authorities, employers, banks, and construction companies focused on providing green housing construction. It also minimizes technological risks—based on corporate module—in the context of a mechanism for reducing the cost of “green” mortgage lending based on the ranking of interest rates on mortgage housing loans. The MCGF and MIDA contribute to increasing the effectiveness of the strategy for diversifying risks of mortgage housing construction. At the same time, the state module provides control and support for the development of mortgage housing construction.

4. Discussion

The functioning of the proposed inclusive model of sustainable development of the mortgage market in Azerbaijan should, first of all, be correlated with the development goals of both the construction industry and the state as a whole. Therefore, the development of the construction industry involves the inclusion of “green technologies” in the model of sustainable development of the mortgage market for:

- -

reducing the level of consumption of energy and material resources throughout the entire life cycle of buildings;

- -

improving the quality of buildings and the comfort of their internal environment;

- -

the reduction of the negative impact of the structure on the environment; and

- -

including waste processing [

23], etc.

This is especially important with an ever-increasing energy cost [

24]. In banking module, given the high cost-effectiveness of “green” construction, investing in green technologies can help reduce the cost of maintaining a home, as well as the development of lending to green construction [

25,

26]. At the same time, there is a connection with a state module, since the government should deal with green building loans by introducing subsidies to part of the interest rate, as well as to prevent the risks of liquidity and economic inefficiency of banks [

27]. In conditions of limited budgetary funds, it is advisable to renew financing of affordable housing programs and others only if energy-saving technologies are used [

28]. Thus, the state will simultaneously solve the social problem of providing housing and preserving the environment, saving resources [

29]. This will significantly increase the effectiveness of the use of budget funds based on the functioning of an inclusive model of sustainable development of the mortgage market. The relationship between the state and the corporate module is determined by the driving factors affecting labor productivity in the construction industry [

30,

31]. The interconnection of the state and investment-building modules is confirmed by the need to support lending to green building with tax levers for the state purchase of environmental products and materials, the introduction of environmental taxes on building materials, and the regulation of environmental labeling [

32]. Another confirmation of the need for the state module in an inclusive model is that the state plays a significant role in financing housing construction, including the provision of land for developers at a reduced market price [

33].

In foreign countries, financing is provided through both market-based financing mechanisms and credit institutions, as well as various mechanisms for accumulating people’s savings in the form of non-governmental institutions and organizations. The American model is built on market-based mechanisms for accumulating and placing savings [

34], German—uses a mutual lending mechanism with banks [

35], and Chinese—uses mechanisms for the accumulation of funds through their transfer by enterprises to residential joint-stock companies, housing savings funds [

36]. The different institutional structure of financing models reflects the essential features of the housing finance system, i.e., the specifics of the mechanism of accumulation of savings, such as American—savings through investment and issuance of securities, German—the use of credit and savings institutions, which are banks and mutual lending cash registers, and Chinese—the mechanism for the formation of special funds at the expense of the population with the participation of primary link (enterprises) under state control.

The authors cannot agree with the assertion that in order to ensure access to mortgage loans for a wide segment of the population in Azerbaijan, it is advisable to apply the German model [

37]. It represents the following system: a citizen makes certain deposits in the bank; when the amount of these deposits reaches a certain figure, the bank gives him/her a loan. However, the modern Azerbaijan system of housing mortgage lending includes elements of both the German model of the financial mechanism and the American one. At the same time, the functioning model for the development of financial mechanisms of the mortgage lending system in Azerbaijan is mainly focused on the American experience in connection with the dynamism and a two-level model in the overall development of the state financial system.

A suitable option for future research would be the identification and quantification of external effects linking cities to the rest of the country, as well as consideration of how regulation can take into account the specific risks arising from regional fluctuations in house prices [

17]. Therefore, the following studies should focus on the formation of recommendations on expanding government support for lending the reconstruction of housing for low-income apartment owners in the context of green construction.

5. Conclusions

Representatives of construction companies that took part in the survey identified financial and construction risks as the most dangerous for the functioning of their business. Diversification is a priority method for managing liquidity risk and interest rate risk. One of the approaches to risk diversification in the mortgage market of Azerbaijan is to simplify the process of assessing mortgage borrowers. A mortgage restructuring mechanism has been created to protect the rights of borrowers whose solvency is deteriorating due to changes in economic and legal conditions. In addition to everything else, in order to improve the quality of services, an electronic system has been created that is fully integrated into the e-government portal. Integrated advanced technologies allow one to effectively manage financial and other risks, significantly increasing the efficiency of management processes.

Within the framework of the social vision of mortgages in Azerbaijan and socio-economic reforms, it is planned to rent residential premises with an obligation to sell them. The aim of the latter is to improve the mechanisms for providing the population with housing and meeting the needs of citizens with insufficient personal funds.

In the process of achieving a social mortgage vision during the course of 2019, the MCGF invested

$150 million with an annual interest rate of 3% in the number of mortgage bonds for 1 million manats. Overall, financial resources raised through the placement of securities on the domestic capital market since 2009 amounted to

$1.005 billion [

20]. These funds are used to finance ordinary mortgage loans (for up to 25 years, at 8% per annum).

The inclusive model of sustainable development of the mortgage market in Azerbaijan provides for the following. Namely, it provides for the formation of a favorable institutional environment by mitigating the negative impact of various risks and developing institutions that form the structural institutional framework for improving housing, financial and credit policy of the state, with the focus on green building and environmentally friendly technologies. The model includes four modules: state, investment and construction, banking, and corporate. Given the selected modules, forecasting the effectiveness of the proposed inclusive model for sustainable development of the mortgage market in the main cities of Azerbaijan demonstrates that, namely, the model’s effectiveness in the direction of enhancing mortgage lending is based on the regulation of the interest rate and benefits of “green” housing construction.

Future research should focus on forming a set of recommendations for expanding government support for housing reconstruction lending in the context of green construction. At the same time, it is necessary to resume financing state programs of providing affordable housing exclusively on the principles of “green” construction. This will increase the effectiveness of government support measures not only for mortgage lending of new residential premises, but also for housing reconstruction.