A Life Cycle Analysis of Deploying Coking Technology to Utilize Low-Rank Coal in China

Abstract

:1. Introduction

2. Mathematic Modeling

2.1. Economic Benefit Analysis

2.2. Life Cycle Energy Consumption Analysis

2.3. Life Cycle CO2 Emissions Analysis

3. Results and Discussion

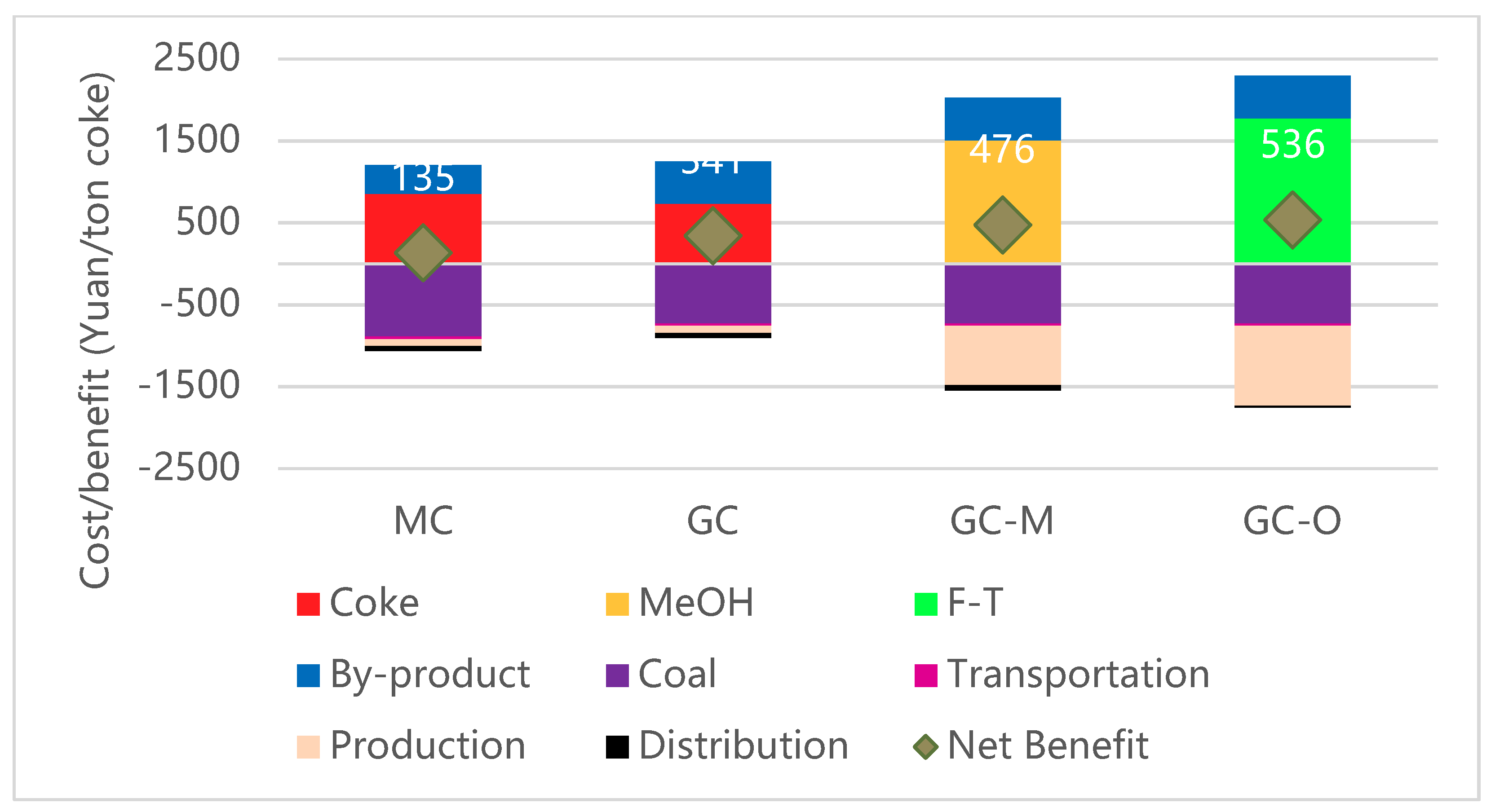

3.1. Economic Benefit Analysis

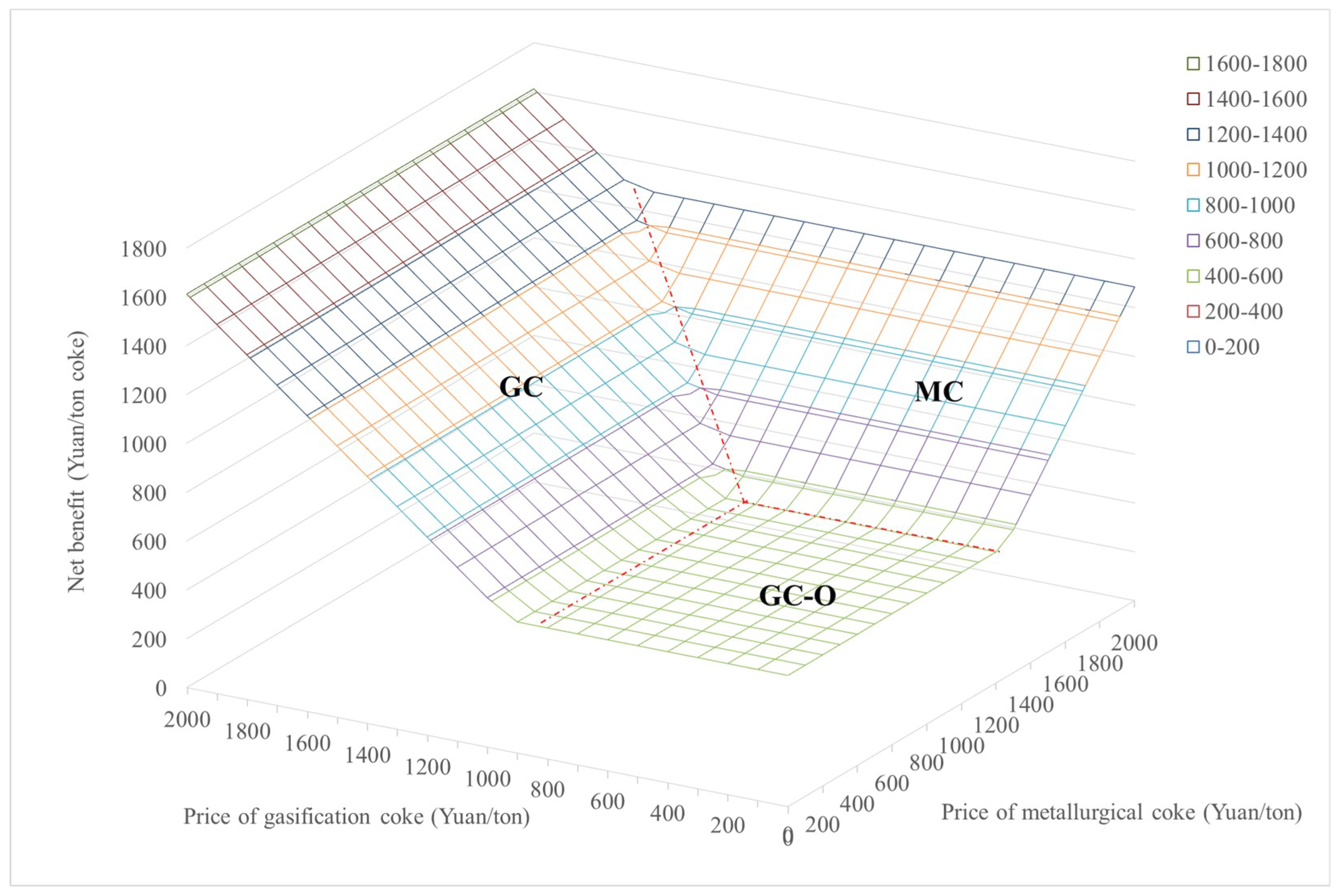

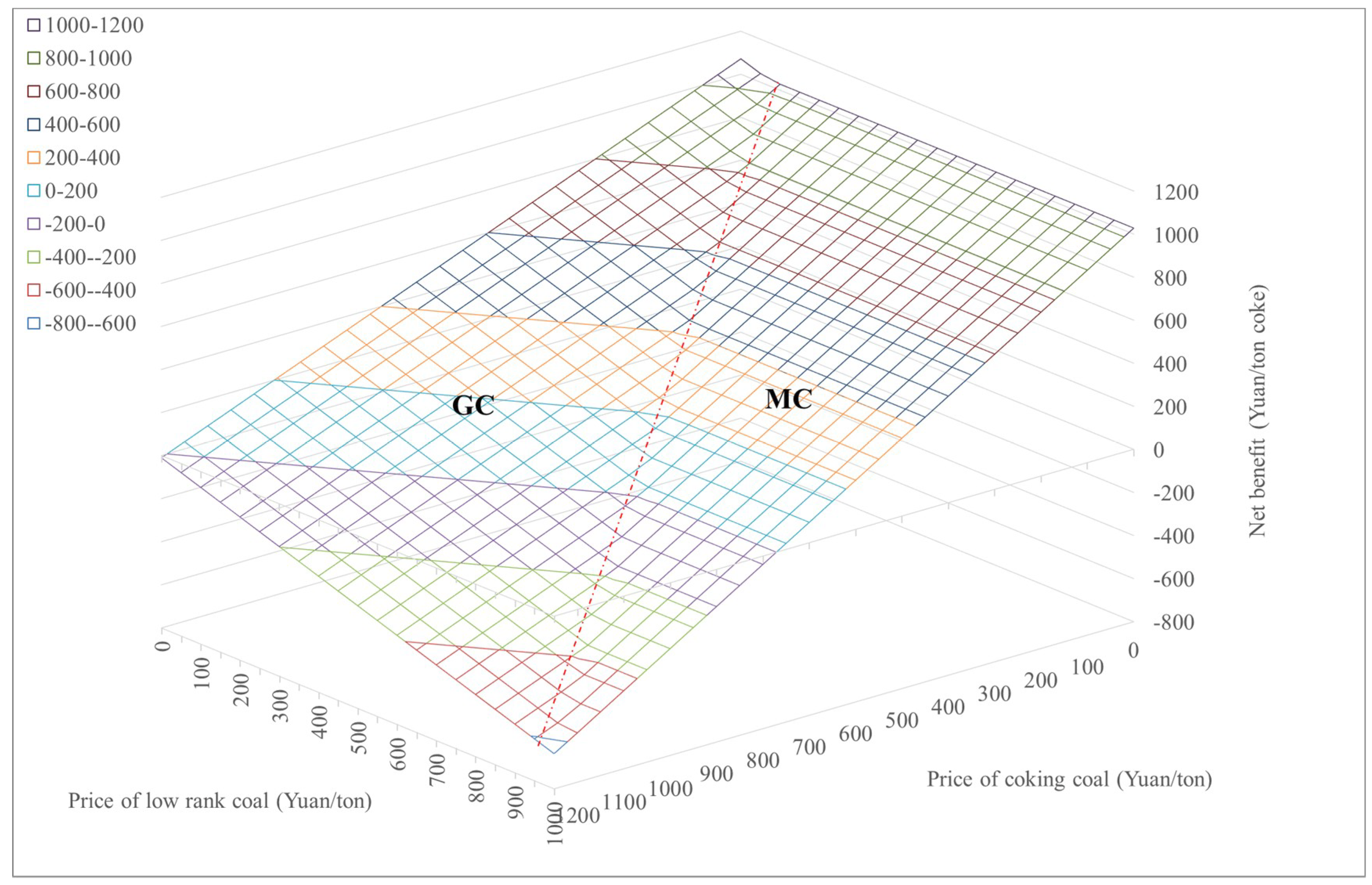

3.2. Sensitive Study of Economic Analysis

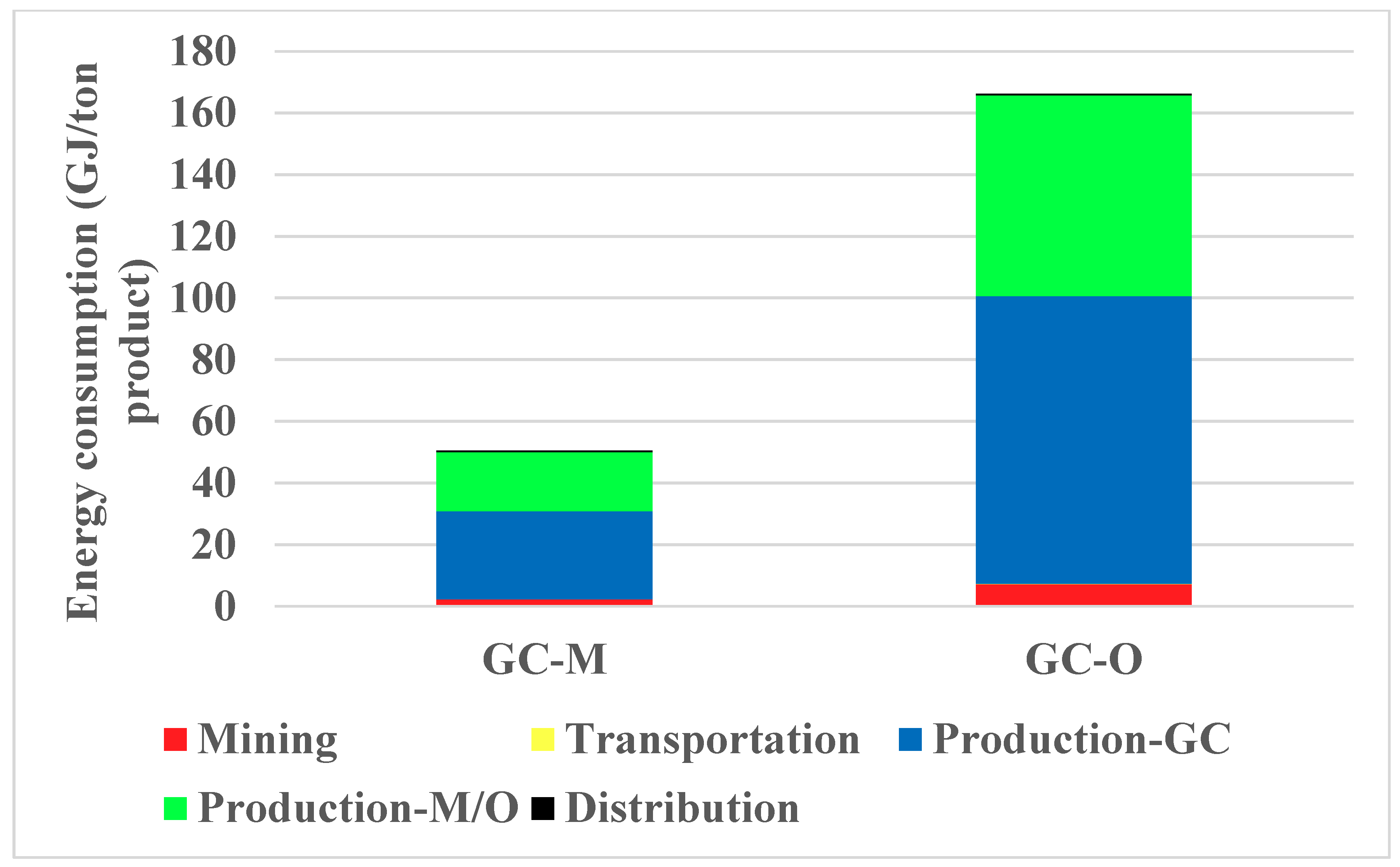

3.3. Life Cycle Energy Analysis

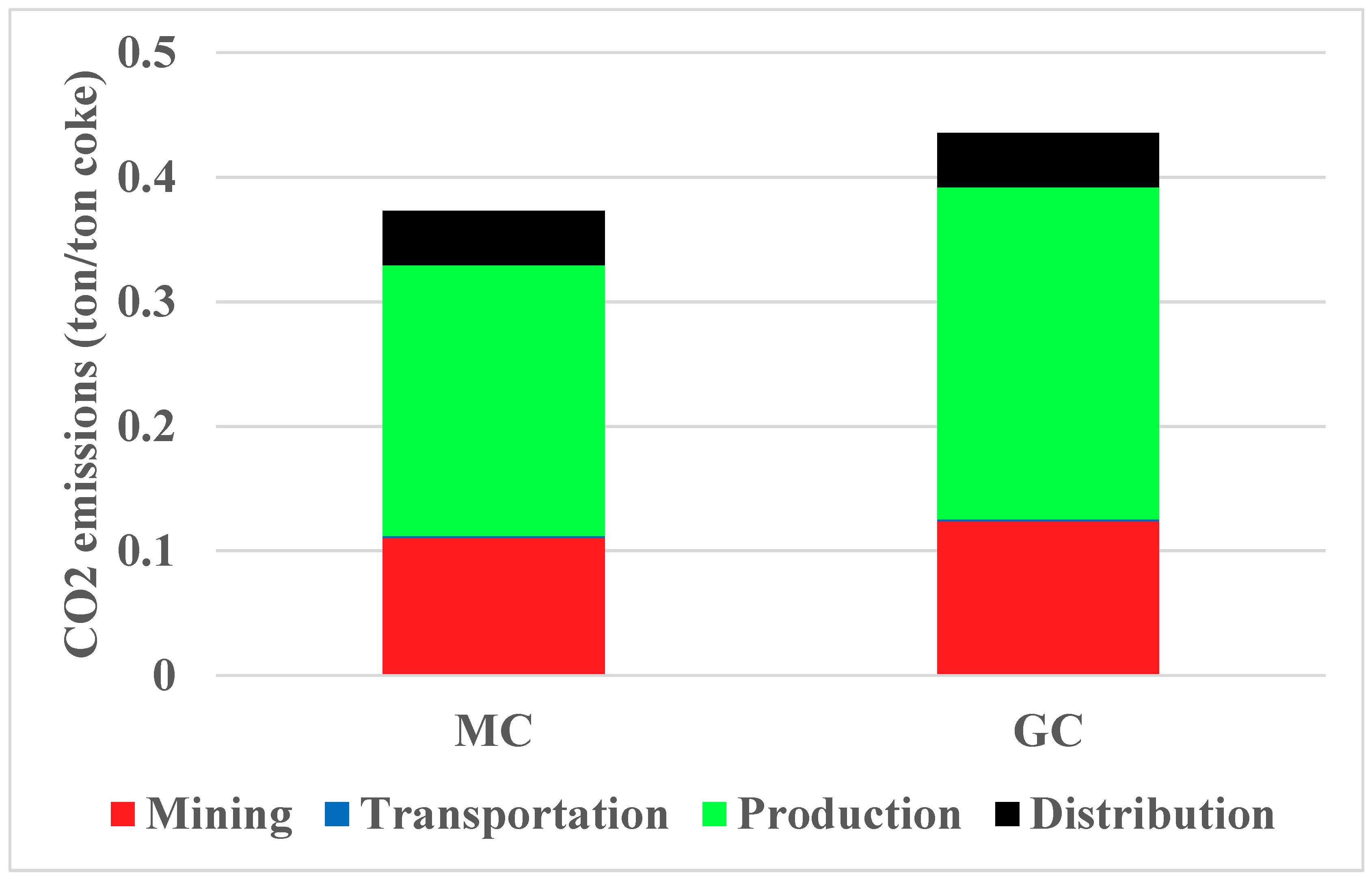

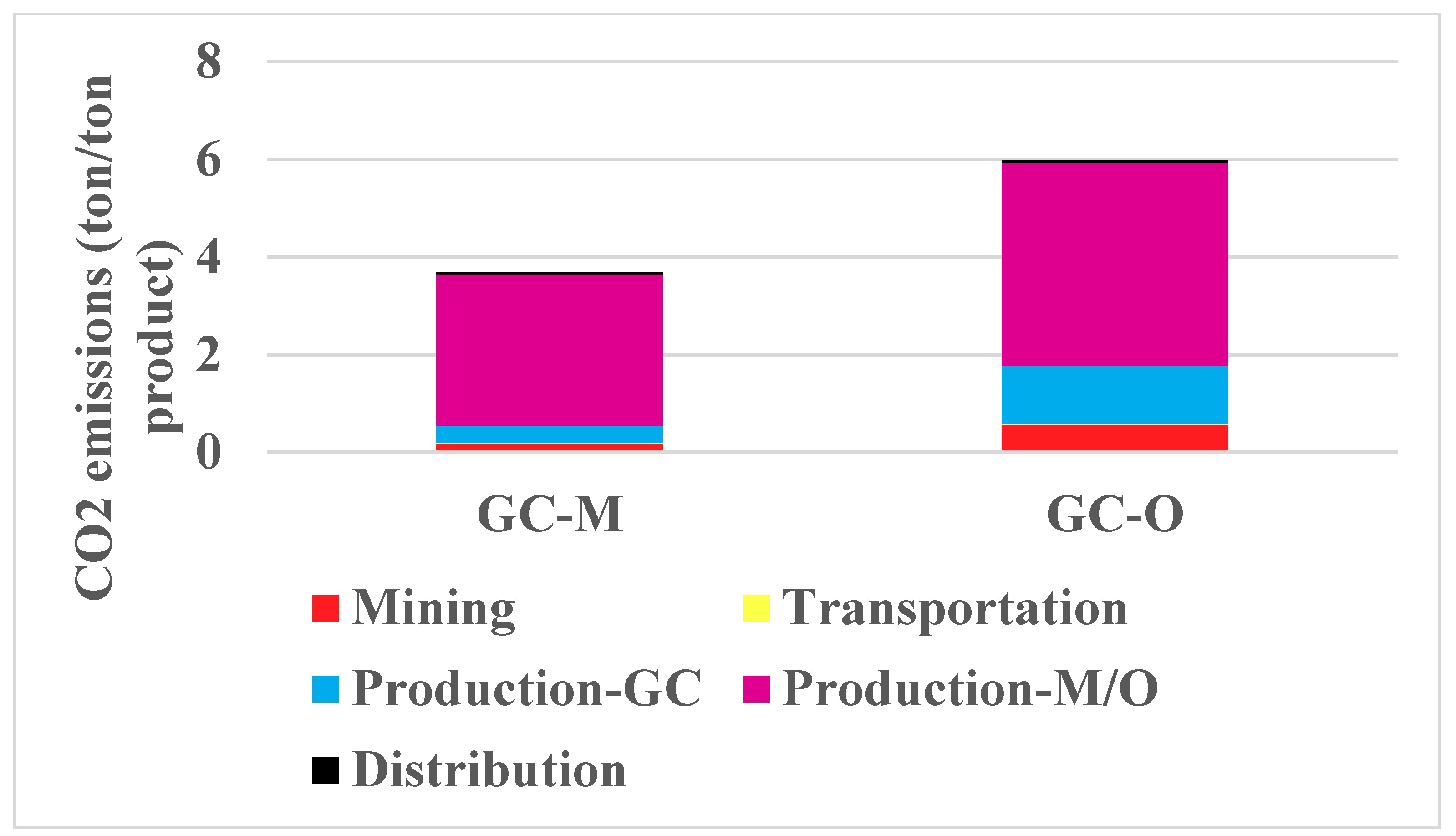

3.4. Life Cycle CO2 Emissions Analysis

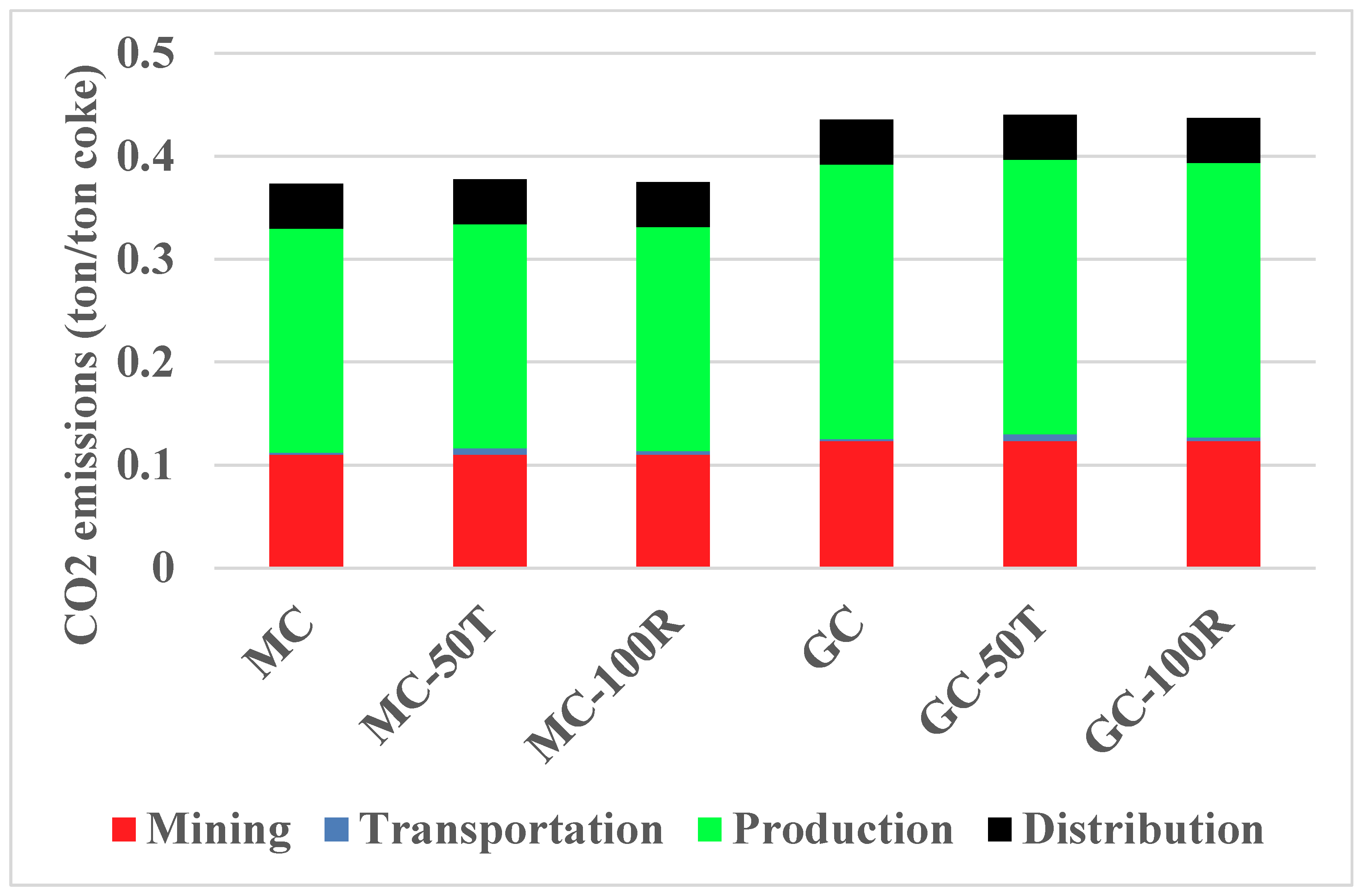

3.5. Comparative Analysis of Different Coal Transportation Modes and Distances

4. Conclusions

- (1)

- According to the economic benefit analysis, utilizing excess coke production capacity, replacing some high-quality coking coal with low-cost and low-rank coal, producing gasification coke, and using it in chemical production will have additional economic benefits.

- (2)

- The economic benefits of each technical pathway depend on the prices of cokes and coals, and this paper gives specific optimized price conditions.

- (3)

- Compared with metallurgical coke, gasification coke production would increase the energy consumption and CO2 emissions, because of the lower coke yield.

- (4)

- Generally speaking, using gasification coke to produce F-T oils has higher economic benefits than using it to produce methanol, but has low energy efficiency and high carbon emissions.

- (5)

- Different coal transportation modes (railway transportation or truck transportation) and transportation distances have little effect on economic benefits, energy consumption, and CO2 emissions throughout the life cycle.

Author Contributions

Funding

Conflicts of Interest

References

- National Bureau of Statistics of the Statistics of the People’s Republic of China. China Energy Statistics Yearbook of 2018; China Statistics Press: Beijing, China, 2019.

- Peng, S.P.; Zhang, B.; Wang, T. Coal Resources and Water Resources; Science Press: Beijing, China, 2014. [Google Scholar]

- Inner Mongolia Meifang Coal Coking Co., Ltd. Final Science and Technology Report on the New Technology Development of Gasification Coke Preparation from High Proportion Low Rank Coal High Temperature Pyrolysis; Ministry of Science and Technology: Wuhai, China, 2019.

- Athaley, A.; Annam, P.; Saha, B.; Ierapetritou, M. Techno-economic and life cycle analysis of different types of hydrolysis process for the production of p-Xylene. Comput. Chem. Eng. 2019, 121, 685–695. [Google Scholar] [CrossRef]

- Agarski, B.; Nikolić, V.; Kamberović, Ž.; Anđić, Z.; Kosec, B.; Budak, I. Comparative life cycle assessment of Ni-based catalyst synthesis processes. J. Clean. Prod. 2017, 162, 7–15. [Google Scholar] [CrossRef]

- Zhang, Y.; Cao, C.; Zhang, C.; Zhang, Z.; Liu, X.; Yang, Z.; Zhu, M.; Meng, B.; Xu, J.; Han, Y.-F. The study of structure-performance relationship of iron catalyst during a full life cycle for CO2 hydrogenation. J. Catal. 2019, 378, 51–62. [Google Scholar] [CrossRef]

- Collotta, M.; Champagne, P.; Tomasoni, G.; Alberti, M.; Busi, L.; Mabee, W. Critical indicators of sustainability for biofuels: An analysis through a life cycle sustainabilty assessment perspective. Renew. Sustain. Energy Rev. 2019, 115, 109358. [Google Scholar] [CrossRef]

- Dasan, Y.K.; Lam, M.-K.; Yusup, S.; Lim, J.W.; Lee, K.T. Life cycle evaluation of microalgae biofuels production: Effect of cultivation system on energy, carbon emission and cost balance analysis. Sci. Total Environ. 2019, 688, 112–128. [Google Scholar] [CrossRef] [PubMed]

- Mayer, F.D.; Brondani, M.; Carrillo, M.C.V.; Hoffmann, R.; Lora, E.E.S. Revisiting energy efficiency, renewability, and sustainability indicators in biofuels life cycle: Analysis and standardization proposal. J. Clean. Prod. 2020, 252, 119850. [Google Scholar] [CrossRef]

- Li, R.; Zhang, H.; Wang, H.; Tu, Q.; Wang, X. Integrated hybrid life cycle assessment and contribution analysis for CO2 emission and energy consumption of a concentrated solar power plant in China. Energy 2019, 174, 310–322. [Google Scholar] [CrossRef]

- Mateus, R.; Silva, S.M.; Almeida, M. Environmental and cost life cycle analysis of the impact of using solar systems in energy renovation of Southern European single-family buildings. Renew. Energy 2019, 137, 82–92. [Google Scholar] [CrossRef]

- Huang, Y.-F.; Gan, X.-J.; Chiueh, P.-T. Life cycle assessment and net energy analysis of offshore wind power systems. Renew. Energy 2017, 102, 98–106. [Google Scholar] [CrossRef]

- Nian, V.; Liu, Y.; Zhong, S. Life cycle cost-benefit analysis of offshore wind energy under the climatic conditions in Southeast Asia–Setting the bottom-line for deployment. Appl. Energy 2019, 233, 1003–1014. [Google Scholar] [CrossRef]

- Chai, L.; Liao, X.; Yang, L.; Yan, X. Assessing life cycle water use and pollution of coal-fired power generation in China using input-output analysis. Appl. Energy 2018, 231, 951–958. [Google Scholar] [CrossRef]

- Zhu, Y.; Liang, J.; Yang, Q.; Zhou, H.; Peng, K. Water use of a biomass direct-combustion power generation system in China: A combination of life cycle assessment and water footprint analysis. Renew. Sustain. Energy Rev. 2019, 115. [Google Scholar] [CrossRef]

- Korre, A.; Durucan, S.; Nie, Z. Life cycle environmental impact assessment of coupled underground coal gasification and CO2 capture and storage: Alternative end uses for the UCG product gases. Int. J. Greenh. Gas Control. 2019, 91, 102836. [Google Scholar] [CrossRef]

- Tang, Y.; You, F. Life cycle environmental and economic analysis of pulverized coal oxy-fuel combustion combining with calcium looping process or chemical looping air separation. J. Clean. Prod. 2018, 181, 271–292. [Google Scholar] [CrossRef]

- Wang, N.; Shen, R.; Wen, Z.; De Clercq, D. Life cycle energy efficiency evaluation for coal development and utilization. Energy 2019, 179, 1–11. [Google Scholar] [CrossRef]

- Gao, D.; Qiu, X.; Zheng, X.; Zhang, Y. Life cycle analysis of coal-based synthetic natural gas for heat supply and electricity generation in China. Chem. Eng. Res. Des. 2018, 131, 709–722. [Google Scholar] [CrossRef]

- Man, Y.; Han, Y.; Hu, Y.; Yang, S.; Yang, S. Synthetic natural gas as an alternative to coal for power generation in China: Life cycle analysis of haze pollution, greenhouse gas emission, and resource consumption. J. Clean. Prod. 2018, 172, 2503–2512. [Google Scholar] [CrossRef]

- Gao, D.; Qiu, X.; Zhang, Y.; Liu, P. Life cycle analysis of coal based methanol-to-olefins processes in China. Comput. Chem. Eng. 2018, 109, 112–118. [Google Scholar] [CrossRef]

- Li, C.; Bai, H.; Lu, Y.; Bian, J.; Dong, Y.; Xu, H. Life-cycle assessment for coal-based methanol production in China. J. Clean. Prod. 2018, 188, 1004–1017. [Google Scholar] [CrossRef]

- Li, J.; Ma, X.; Liu, H.; Zhang, X. Life cycle assessment and economic analysis of methanol production from coke oven gas compared with coal and natural gas routes. J. Clean. Prod. 2018, 185, 299–308. [Google Scholar] [CrossRef]

- Shen, Q.; Song, X.H.; Mao, F.; Sun, N.; Wen, X.; Wei, W. Carbon reduction potential and cost evaluation of different mitigation approaches in China’s coal to olefin Industry. J. Environ. Sci. 2020, 90, 352–363. [Google Scholar] [CrossRef]

- Ye, L.; Xie, F.; Hong, J.; Yang, D.; Ma, X.; Li, X.-Z. Environmental burden mitigation potential of oil field gas-assisted coal-to-olefin production. Energy 2018, 157, 1015–1024. [Google Scholar] [CrossRef]

- Ou, X.; Xiaoyu, Y.; Zhang, X. Life-cycle energy consumption and greenhouse gas emissions for electricity generation and supply in China. Appl. Energy 2011, 88, 289–297. [Google Scholar] [CrossRef]

- Ou, X.; Yan, X.; Zhang, X.; Liu, Z. Life-cycle analysis on energy consumption and GHG emission intensities of alternative vehicle fuels in China. Appl. Energy 2012, 90, 218–224. [Google Scholar] [CrossRef]

- Qin, Z.; Zhai, G.; Wu, X.; Yu, Y.; Zhang, Z. Carbon footprint evaluation of coal-to-methanol chain with the hierarchical attribution management and life cycle assessment. Energy Convers. Manag. 2016, 124, 168–179. [Google Scholar] [CrossRef]

- Li, S.; Gao, L.; Jin, H. Life cycle energy use and GHG emission assessment of coal-based SNG and power cogeneration technology in China. Energy Convers. Manag. 2016, 112, 91–100. [Google Scholar] [CrossRef]

- Bai, X.Y.; Pei, X.F.; Wang, Y. Technical and economic analysis of coking enterprise’s transformation and production of gasification coke. Coal Qual. Technol. 2016, 8, 16–20. [Google Scholar]

- Li, D.S. Analysis of the Adjustment the Product Structure of the Independent Coking Enterprises to Turn Losses into Gains. Coal Chem. Ind. 2015, 43, 1–6. (In Chinese) [Google Scholar]

- National Bureau of Statistics. Methanol Prices in Late October Fell 8.6% Month-On-Month. 2019. Available online: http://www.meitanwang.com/meitan/bd/1237347.html/ (accessed on 18 December 2019).

- National Development and Reform Commission of the People’s Republic of China. Domestic Refined Oil Prices Are Raised in Accordance with the Mechanism. 2019. Available online: https://www.ndrc.gov.cn/xwdt/xwfb/201912/t20191202_1207337.html/ (accessed on 18 December 2019). (In Chinese)

- Inner Mongolia Development and reform commission. Notice on Reducing General Industrial and Commercial Electricity Prices in Western Inner Mongolia. 2019. Available online: http://fgw.nmg.gov.cn/fggz/jggl_14670/201906/t20190611_152552.html/ (accessed on 18 December 2019). (In Chinese)

- National Development and Reform Commission of the People’s Republic of China. The Railway Transporting Price for the Goods of All Types. 2019. Available online: http://www.ndrc.gov.cn/xxgk/zcfb/tz/201712/t20171226_962626.html/ (accessed on 18 December 2019). (In Chinese)

- Taiyuan Engineering Consulting Company. Feasibility Study Report of 600000 Tons/Year Coking Project in Inner Mongolia; Taiyuan Engineering Consulting Company: Taiyuan, China, 2005. [Google Scholar]

- Tang, H. New Technology of Modern Coal Chemical Industry; Chemical Industry Press: Beijing, China, 2016. [Google Scholar]

- Gao, D.; Ye, C.; Ren, X.; Zhang, Y. Life cycle analysis of direct and indirect coal liquefaction for vehicle power in China. Fuel Process. Technol. 2018, 169, 42–49. [Google Scholar] [CrossRef]

- The People’s Bank of China. The Central Parity of the RMB Exchange Rate against the US dollar. Available online: http://www.pbc.gov.cn/rmyh/108976/109428/index.html (accessed on 7 June 2020).

- Wang, Q.Y. 2018 Energy Data; Energy Foundation: Beijing, China, 2019. [Google Scholar]

- China State Railway Group Co., Ltd. Statistical Bulletin 2018. 2019. Available online: http://www.ndrc.gov.cn/xxgk/zcfb/tz/201712/t20171226_962626.html/ (accessed on 18 December 2019). (In Chinese)

- China Electricity Council. 2018 National Power Industry Statistics. 2019. Available online: http://www.cec.org.cn/guihuayutongji/tongjxinxi/niandushuju/2019-01-22/188396.html/ (accessed on 18 December 2019). (In Chinese).

- The First National Pollution Source Census: Leading Group Office. Sewage Discharge Handbook of Industrial Pollution Source Production in the First National Census of Pollution Sources; The First National Pollution Source Census: Leading Group Office: Beijing, China, 2009. [Google Scholar]

- Xie, K.C. Clean and Efficient Coal Conversion; Science Press: Beijing, China, 2014. [Google Scholar]

| Abbreviation | Mining | Transportation | Production | Distribution |

|---|---|---|---|---|

| MC | Coking coal mining | Railway transportation | Coal coking | Truck long delivery to Steelmaking |

| GC | Coking coal and Low-rank coal mining | Railway transportation | Coal coking | Truck long delivery to chemical |

| GC-M | Coking coal and Low-rank coal mining | Railway transportation | Coal coking and methanol synthesis | Tanker Truck long delivery to chemical |

| GC-O | Coking coal and Low-rank coal mining | Railway transportation | Coal coking and F-T synthesis | Tanker Truck long delivery to fuel station |

| Type | Metallurgical Coking | Gasification Coking |

|---|---|---|

| Coal as fire | 100% coking coal | 58% coking coal + 42% low-rank coal |

| Coke yield | 75% | 67% |

| Tar yield | 3.15% | 4.07% |

| Crude benzene yield | 0.95% | 1.24% |

| Coke oven gas production | 340 m3/t | 451 m3/t |

| Parameter | Value | Unit | Source |

|---|---|---|---|

| Price of coking coal | 670 | Yuan/ton | Ref. [31] |

| Price of low-rank coal (Long flame coal) | 240 | Yuan/ton | Ref. [31] |

| Price of metallurgical coke | 850 | Yuan/ton | Ref. [30] |

| Price of gasification coke | 730 | Yuan/ton | Ref. [30] |

| Price of tar | 1800 | Yuan/ton | Ref. [30] |

| Price of crude benzene | 4000 | Yuan/ton | Ref. [30] |

| Price of coke oven gas | 0.5 | Yuan/Nm3 | Ref. [30] |

| Average price of methanol | 2080 | Yuan/ton | Ref. [32] |

| Average diesel price | 7500 | Yuan/ton | Ref. [33] |

| Average gasoline price | 8500 | Yuan/ton | Ref. [33] |

| Industrial electricity price | 0.4744 | Yuan/kWh | Ref. [34] |

| Railway transport price a (coal) | 16.3 | Yuan/ton | Ref. [35] |

| Railway transport price b (coal) | 0.098 | Yuan/ton/km | Ref. [35] |

| One-off total capital cost of coal coking | 224 | Yuan/(ton/year) | Ref. [36] |

| One-off total capital cost of methanol synthesis | 5500 | Yuan/(ton/year) | Ref. [37] |

| One-off total capital cost of F-T synthesis | 15,800 | Yuan/(ton/year) | Ref. [38] |

| Exchange rate between Yuan and US dollar | 7.05 | Yuan/USD | Ref. [39] |

| Item | Value | Unit | Reference |

|---|---|---|---|

| Average power consumption of coal mining and washing | 25.8 | kWh/ton | Ref. [40] |

| Average energy consumption in the process of coal mining and washing | 30.5 | kgce/ton | Ref. [40] |

| Average energy consumption in the process of steel production | 890 | kgce/ton | Ref. [40] |

| Average energy consumption in the process of cement production | 135 | kgce/ton | Ref. [40] |

| Average energy consumption for railway transportation | 4.11 | gce/ton/km | Ref. [41] |

| Average loss ratio of power transmission and distribution | 6.21% | - | Ref. [42] |

| Average coal consumption of coal-fired power generation industry | 308 | gce/kWh | Ref. [42] |

| Electricity consumption for coke production | 43 | kWh/ton | Ref. [37] |

| Energy consumption of methanol synthesis | 1.4 | GJ/ton | Ref. [21] |

| Energy efficiency of F-T synthesis | 42% | - | Ref. [38] |

| Parameter | Value | Unit | Source |

|---|---|---|---|

| Average CO2 emissions from coal mining and washing | 64 | kg/ton | Ref. [21] |

| Average CO2 emissions from electric industry | 627 | g/kWh | Ref. [21] |

| Average CO2 emissions from coal combustion | 2.71 | ton/tce | Ref. [38] |

| Average CO2 emissions from diesel production | 0.51 | kg/L | Ref. [43] |

| Average CO2 emissions from diesel combustion | 2.57 | kg/L | Ref. [43] |

| CO2 emissions from metallurgical coke production | 0.15 | ton/ton | Ref. [44] |

| CO2 emissions from methanol synthesis | 3 | ton/ton | Ref. [21] |

| CO2 emissions from F-T synthesis | 4.79 | ton/ton | Ref. [38] |

| Abbreviation | Mining | Transportation | Production | Distribution |

|---|---|---|---|---|

| MC | Coking coal mining | 50 km railway transportation | Coal coking | Truck long delivery to Steelmaking |

| MC-50T | Coking coal mining | 50 km truck transportation | Coal coking | Truck long delivery to Steelmaking |

| MC-100R | Coking coal mining | 100 km railway transportation | Coal coking | Truck long delivery to Steelmaking |

| GC | Coking coal and Low-rank coal mining | 50 km railway transportation | Coal coking | Truck long delivery to chemical |

| GC-50T | Coking coal and Low-rank coal mining | 50 km Truck transportation | Coal coking | Truck long delivery to chemical |

| GC-100R | Coking coal and Low-rank coal mining | 100 km railway transportation | Coal coking | Truck long delivery to chemical |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Li, Y.; Wang, G.; Li, Z.; Yuan, J.; Gao, D.; Zhang, H. A Life Cycle Analysis of Deploying Coking Technology to Utilize Low-Rank Coal in China. Sustainability 2020, 12, 4884. https://doi.org/10.3390/su12124884

Li Y, Wang G, Li Z, Yuan J, Gao D, Zhang H. A Life Cycle Analysis of Deploying Coking Technology to Utilize Low-Rank Coal in China. Sustainability. 2020; 12(12):4884. https://doi.org/10.3390/su12124884

Chicago/Turabian StyleLi, Yan, Guoshun Wang, Zhaohao Li, Jiahai Yuan, Dan Gao, and Heng Zhang. 2020. "A Life Cycle Analysis of Deploying Coking Technology to Utilize Low-Rank Coal in China" Sustainability 12, no. 12: 4884. https://doi.org/10.3390/su12124884

APA StyleLi, Y., Wang, G., Li, Z., Yuan, J., Gao, D., & Zhang, H. (2020). A Life Cycle Analysis of Deploying Coking Technology to Utilize Low-Rank Coal in China. Sustainability, 12(12), 4884. https://doi.org/10.3390/su12124884