An Operation Benefit Analysis and Decision Model of Thermal Power Enterprises in China against the Background of Large-Scale New Energy Consumption

Abstract

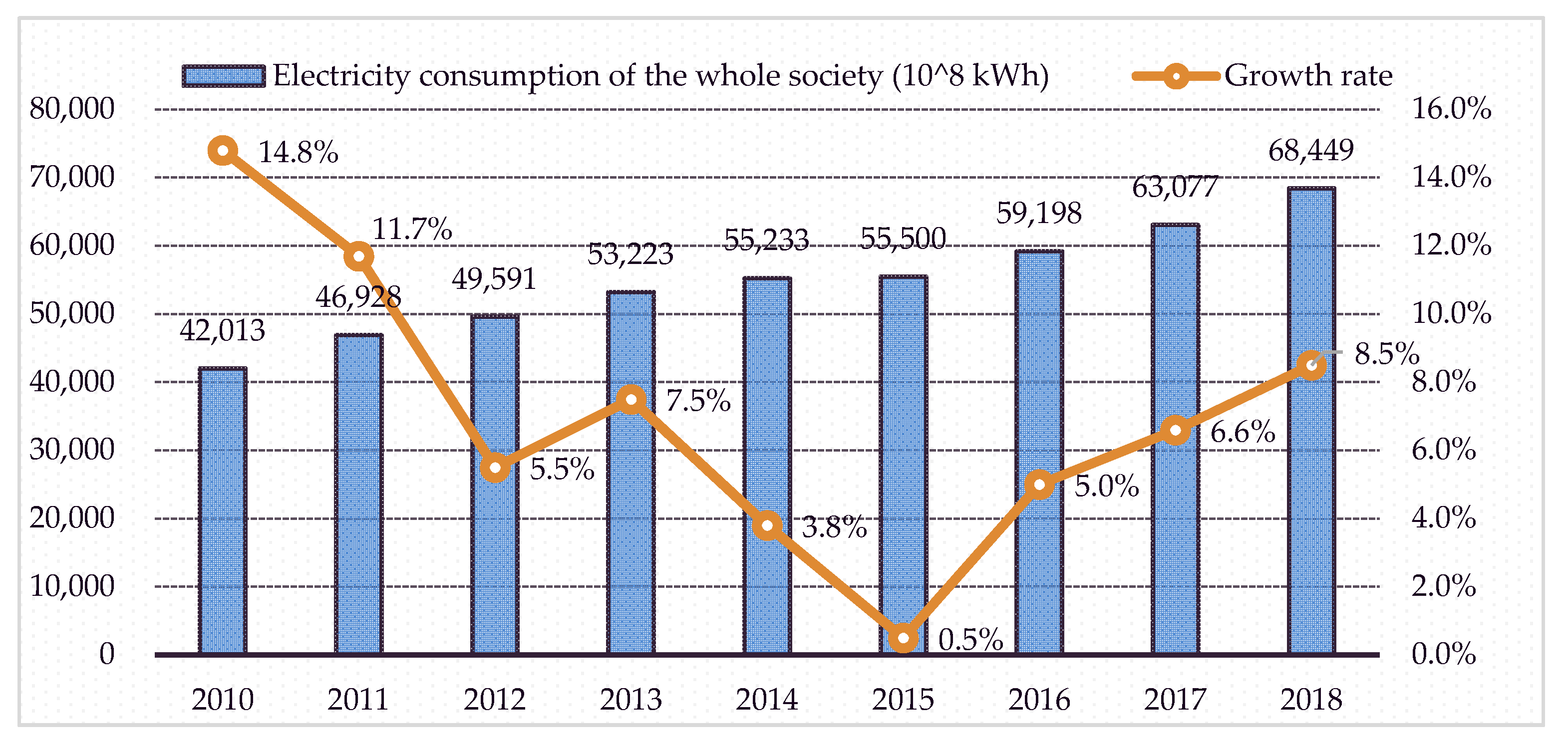

1. Introduction

2. Scenario Setting

3. Model Description

3.1. Income Analysis of Diversified Operation

3.1.1. Income of Power Sales

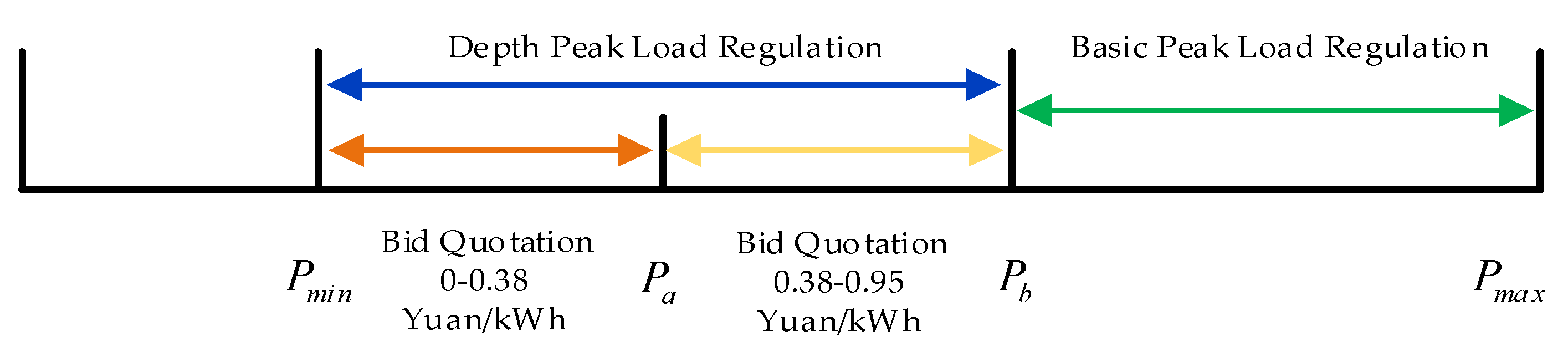

3.1.2. Income of Peak Load Regulation

3.1.3. Income of Generation Rights Trading

3.2. Cost Analysis of Diversified Operation

3.2.1. Cost of Power Production

3.2.2. Loss Cost of Less Power Generation When Units Participate in Deep Peak Load Regulation

3.2.3. Apportioned Cost When the Units Do Not Participate in Peak Load Regulation

3.2.4. Loss Cost of Less Power Generation When the Generation Rights Are Traded

3.3. Objective Functions and Constraints

4. Empirical Study

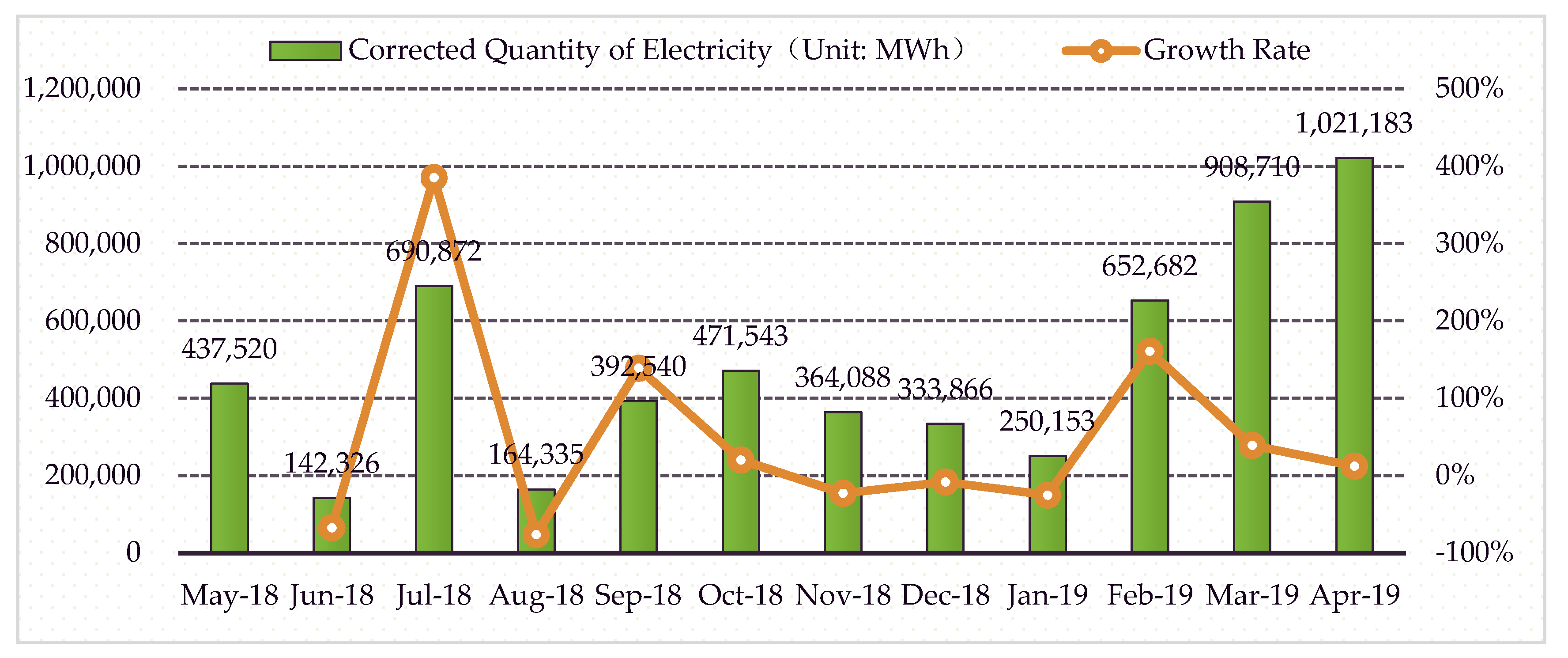

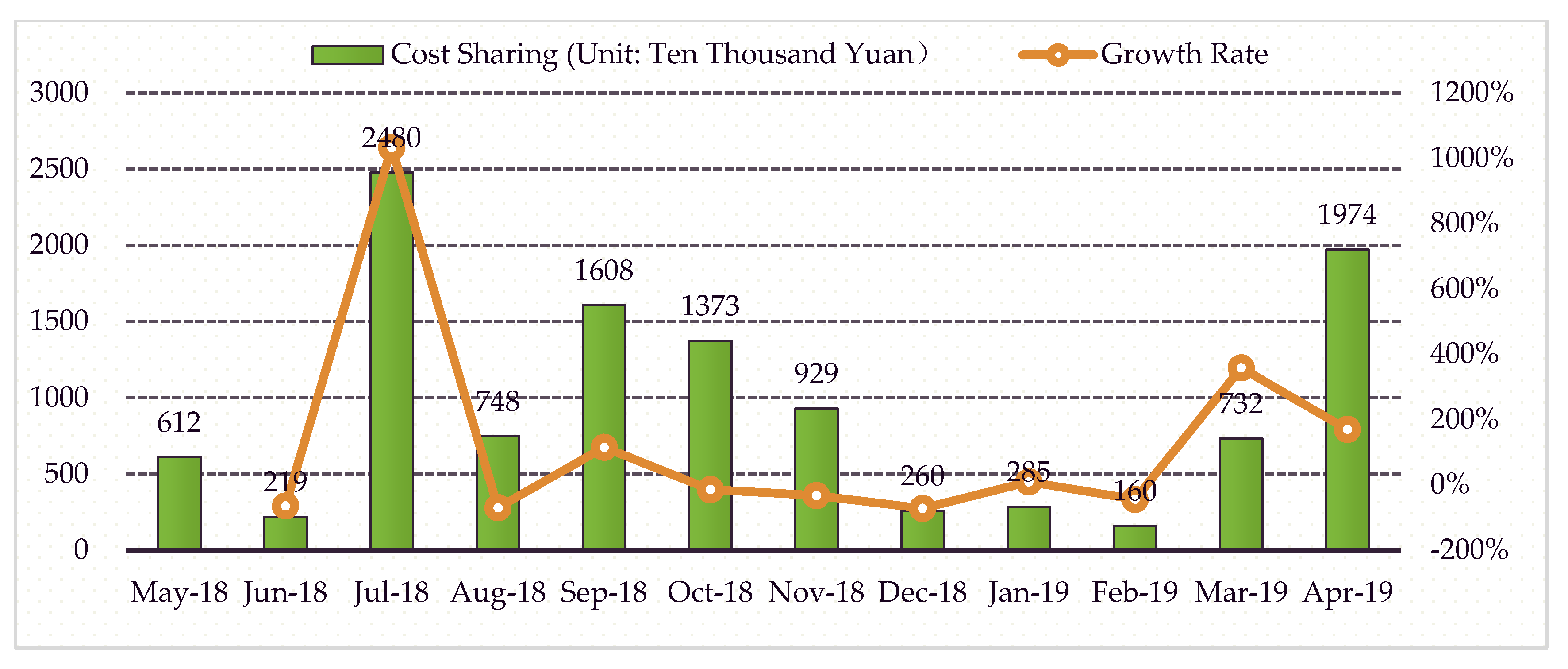

4.1. Background Introduction

4.2. Model Parameters

4.3. Simulation Results

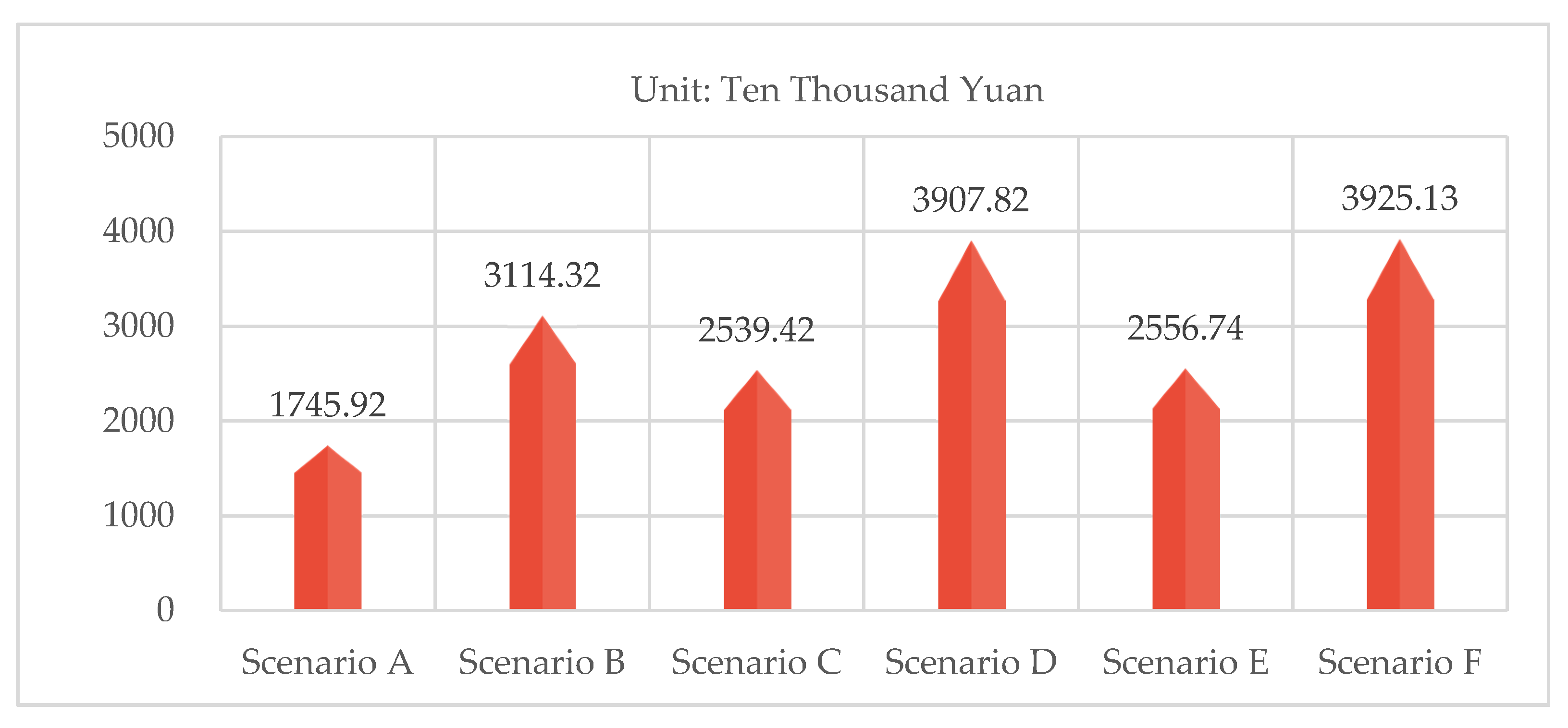

4.3.1. Scenario A

4.3.2. Scenario B

4.3.3. Scenario C

4.3.4. Scenario D

4.3.5. Scenario E

4.3.6. Scenario F

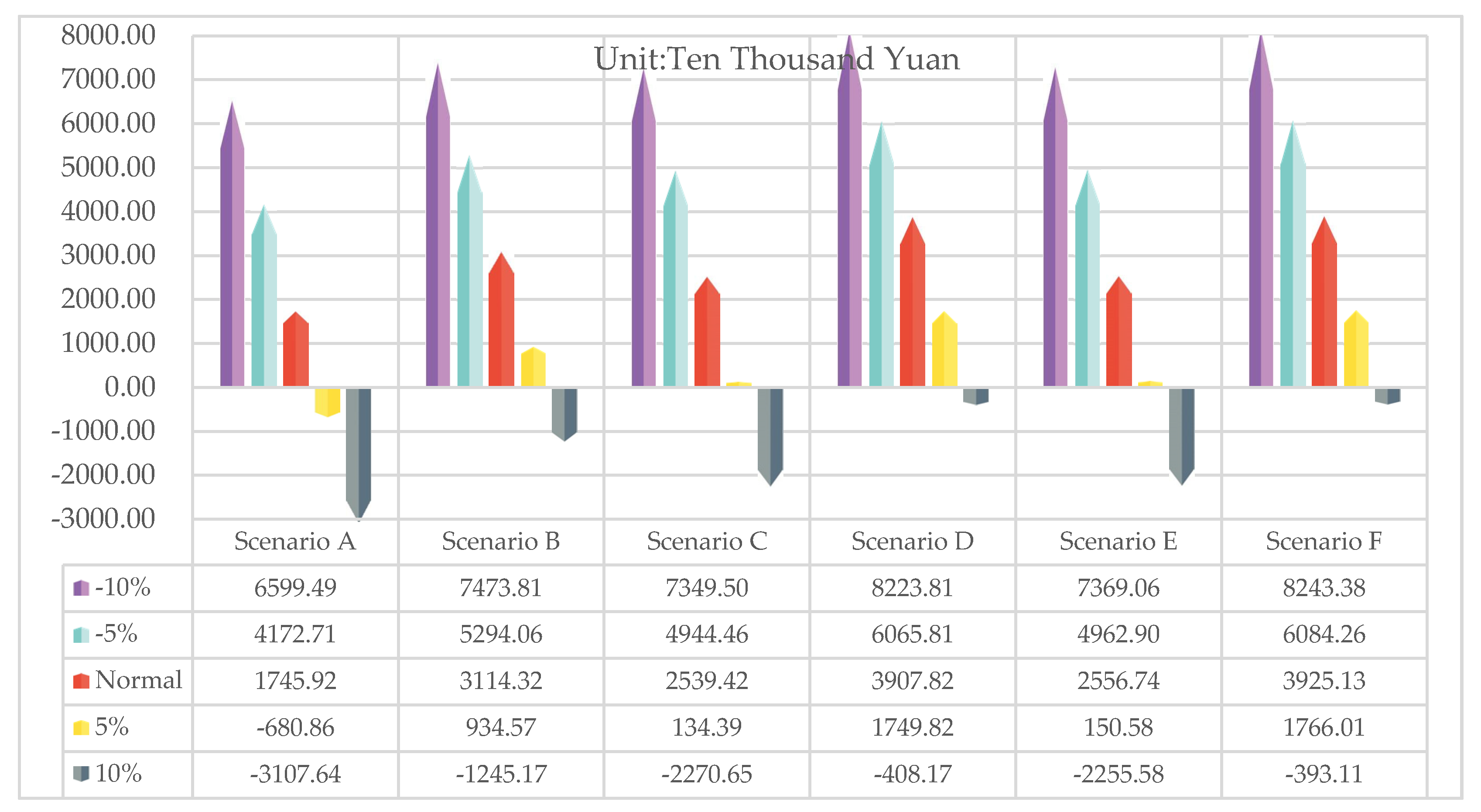

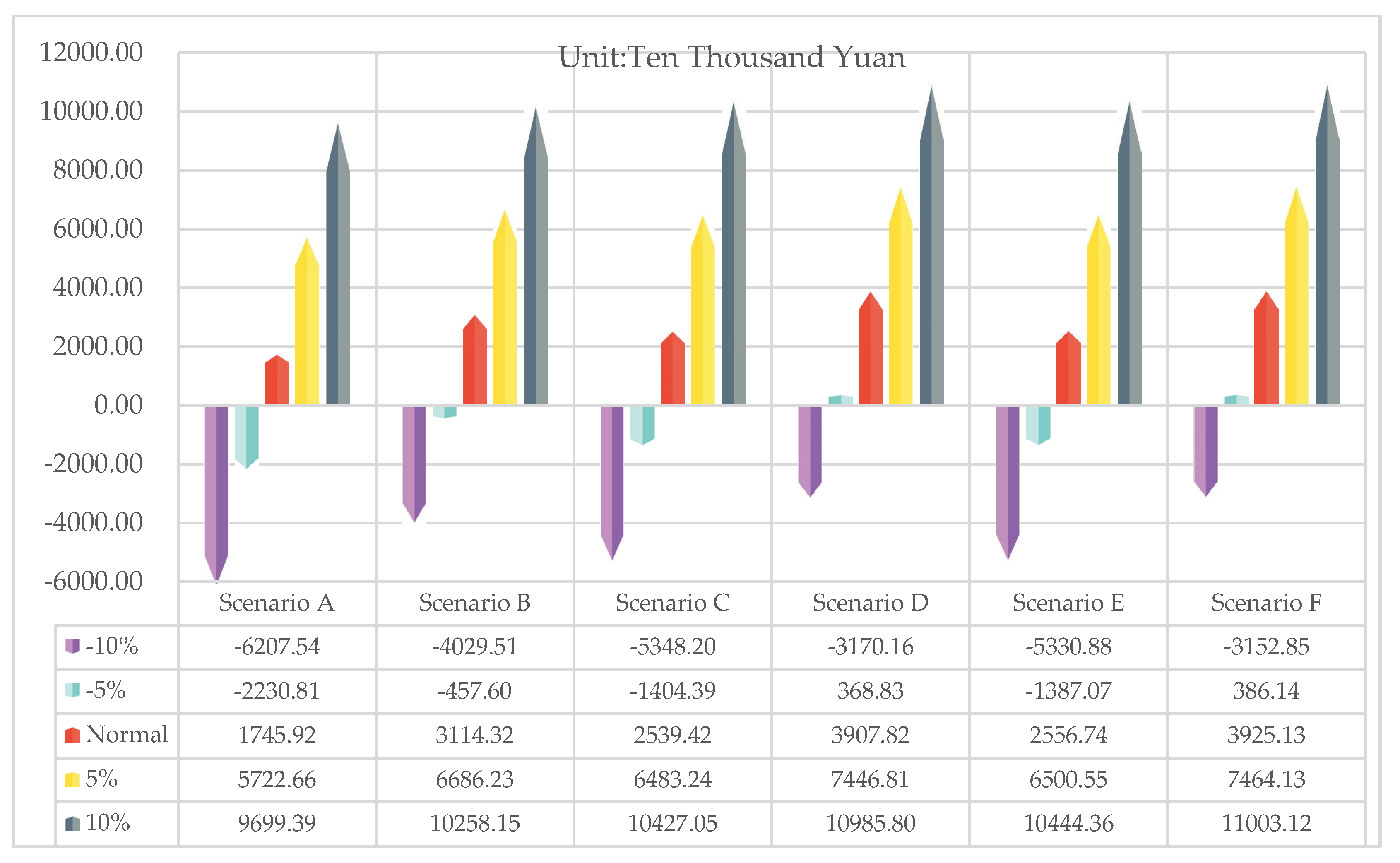

5. Discussion and Scenario Analysis

6. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

| Parameter | Value | Details |

|---|---|---|

| 0.000169 | Citing references [43] | |

| 0.27601 | ||

| 11.46196 | ||

| 1.2 | ||

| 1.2 | ||

| Unit price of standard coal | 514.15 yuan/ton | Market price in 2018 |

| On-grid electricity tariff of Thermal power | 259.5 yuan/MWh | Market price in 2018 |

| Price of oil | 6130 yuan/ton | Market price in 2018 |

| The average price difference of Power generation rights trading | 50 yuan/MWh | Unit operation data |

| 25,374 MWh | Unit operation data | |

| 312,000 MWh | Unit operation data | |

| 0–0.38 yuan/kWh | Notice on operation rules (Trial) of Ningxia electric power auxiliary service market | |

| 0.38–0.95 yuan/kWh | Notice on operation rules (Trial) of Ningxia electric power auxiliary service market | |

| 40% | Notice on operation rules (Trial) of Ningxia electric power auxiliary service market | |

| 50% | Notice on operation rules (Trial) of Ningxia electric power auxiliary service market | |

| The corrected quantity of electricity | 5,829,820 MWh | Northwest China Energy Regulatory Bureau of National Energy Administrator of the People’s Republic of China. http://xbj.nea.gov.cn/website/Aastatic/news-list-100300-100301.html |

| The total apportioned cost | 113.79 million yuan |

References

- Rosnes, O. The Impact of Climate Policies on the Operation of a Thermal Power Plant. Energy J. 2008, 29, 1–22. [Google Scholar] [CrossRef]

- ECCEPY (Editorial Committee of China Electric Power Yearbook). China Electric Power Yearbook; China Electric Power Press: Beijing, China, 2018. [Google Scholar]

- SGERI (State Grid Energy Research Institute CO., LTD.). China New Energy Power Generation Analysis Report; China Electric Power Press: Beijing, China, 2019. [Google Scholar]

- Zeng, M.; Zhang, X.; Zhang, P.; Dong, J. Overall review of China’s thermal power development with emphatic analysis on thermal powers’ cost and benefit. Renew. Sustain. Energy Rev. 2016, 63, 152–157. [Google Scholar] [CrossRef]

- Ma, X.; Wang, Y.; Wang, C. Low-carbon development of China’s thermal power industry based on an international comparison: Review, analysis and forecast. Renew. Sustain. Energy Rev. 2017, 80, 942–970. [Google Scholar] [CrossRef]

- Huang, H.; Liang, D.; Liang, L.; Tong, Z. Research on China’s Power Sustainable Transition Under Progressively Levelized Power Generation Cost Based on a Dynamic Integrated Generation–Transmission Planning Model. Sustainability 2019, 11, 2288. [Google Scholar] [CrossRef]

- Song, X.; Jiang, X.; Zhang, X.; Liu, J. Analysis, Evaluation and Optimization Strategy of China Thermal Power Enterprises’ Business Performance Considering Environmental Costs under the Background of Carbon Trading. Sustainability 2018, 10, 2006. [Google Scholar] [CrossRef]

- Wu, J.; Xiong, B.; An, Q.; Zhu, Q.; Liang, L. Measuring the performance of thermal power firms in China via fuzzy Enhanced Russell measure model with undesirable outputs. J. Clean. Prod. 2015, 102, 237–245. [Google Scholar] [CrossRef]

- Tang, B.; Li, R.; Li, X.-Y.; Chen, H. An optimal production planning model of coal-fired power industry in China: Considering the process of closing down inefficient units and developing CCS technologies. Appl. Energy 2017, 206, 519–530. [Google Scholar] [CrossRef]

- Zhao, J.; Yang, K. Allocating Output Electricity in a Solar-Aided Coal-Fired Power Generation System and Assessing Its CO2 Emission Reductions in China. Sustainability 2020, 12, 673. [Google Scholar] [CrossRef]

- Reutov, B.F.; Ryabov, G.A. Coal Utilization in Thermal Power Plants. Influence of Coal Quality on Technical-economical and Ecological Indices. In Proceedings of the XVIII International Coal Preparation Congress, Saint-Petersburg, Russia, 28 June–1 July 2016; pp. 327–332. [Google Scholar]

- Tumanovskii, A.G.; Olkhovsky, G.G. Thermal power plants: Ways to improve russian coal-fired power plants. Power Technol. Eng. 2015, 49, 119–123. [Google Scholar] [CrossRef]

- Na, C.; Yuan, J.; Zhu, Y.; Xue, L. Economic Decision-Making for Coal Power Flexibility Retrofitting and Compensation in China. Sustainability 2018, 10, 348. [Google Scholar] [CrossRef]

- Mohammadi, K.; Saghafifar, M.; McGowan, J.G.; Powell, K. Thermo-economic analysis of a novel hybrid multigeneration system based on an integrated triple effect refrigeration system for production of power and refrigeration. J. Clean. Prod. 2019, 238. [Google Scholar] [CrossRef]

- Duan, X. The evaluation of thermal power enterprise coal suppliers based on analytical hierarchy process. In Proceedings of the 2013 6th International Conference on Information Management, Innovation Management and Industrial Engineering, Xi’an, China, 23–24 November 2013; Volume 1, pp. 197–200. [Google Scholar]

- Zhao, H.; Guo, S. Selecting Green Supplier of Thermal Power Equipment by Using a Hybrid MCDM Method for Sustainability. Sustainability 2014, 6, 217–235. [Google Scholar] [CrossRef]

- Ci, T.; Liu, X. The Study of Selection of Coal-Fired Supplier in Thermal Power Enterprise Based on the Extension Analysis Method. Telkomnika Indones. J. Electr. Eng. 2013, 11, 15. [Google Scholar] [CrossRef]

- Fang, D.; Zhang, M.; Wang, X. Power coal transportation and storage: A programming analysis of road and rail options. Wuhan Univ. J. Nat. Sci. 2011, 16, 469–474. [Google Scholar] [CrossRef]

- Aditya, I.; Simaremare, A.A.; Hudaya, C. Study of Coal Inventory Planning Analysis in a Coal-Fired Power Plant Using Continuous and Periodic Review. In Proceedings of the 2019 IEEE 2nd International Conference on Power and Energy Applications (ICPEA), Singapore, 27–30 April 2019; pp. 33–36. [Google Scholar]

- Kopiske, J.; Spieker, S.; Tsatsaronis, G. Value of power plant flexibility in power systems with high shares of variable renewables: A scenario outlook for Germany 2035. Energy 2017, 137, 823–833. [Google Scholar] [CrossRef]

- Alizadeh, M.; Moghaddam, M.P.; Amjady, N.; Siano, P.; Eslami-Kalantari, M. Flexibility in future power systems with high renewable penetration: A review. Renew. Sustain. Energy Rev. 2016, 57, 1186–1193. [Google Scholar] [CrossRef]

- Qi, L.; Chen, B.; Jiang, P.; Zhao, R.; Gao, X.J. Cost and benefit analysis of peak regulation auxiliary services for coal-fired thermal power units. Power Syst. Big Data 2019, 22, 23–29. [Google Scholar]

- Yang, Y.; Qin, C.; Zeng, Y.; Wang, C. Interval Optimization-Based Unit Commitment for Deep Peak Regulation of Thermal Units. Energies 2019, 12, 922. [Google Scholar] [CrossRef]

- Zhang, H.T.; Wu, C.; Wu, J.; Liu, Y. Economic Benefit Analysis of Thermal Power Units Deep Peak Load Regulation in Northeast China. Northeast Electr. Power Technol. 2019, 40, 15–17, 21. [Google Scholar]

- Mo, C.H.; Liu, Y.G.; Wang, D.P.; Yang, H.C.; Pan, S.; Yi, G.Z. Discussion on Critical Technologies of Double-Reheat Ultra-supercritical Boiler with Higher Steam Parameters. Electr. Power 2018, 51, 151–157. [Google Scholar]

- Zhou, Y.F.; Hu, W.; Min, Y.; Gao, K.; Jin, X.M. Peak Regulation Compensation Price Decision for Combined Heat and Power Unit and Profit Allocation Method. Proc. CSEE 2019, 39, 5325–5335, 5579. [Google Scholar]

- Xue, B.-K.; Qi, T.-X.; Zhang, W.; Li, Y.; Wang, X.-L. Research on market bidding mechanism of generation rights trade for promoting new energy consumption. J. Eng. 2017, 2017, 1378–1382. [Google Scholar] [CrossRef]

- Xia, T.; He, Y.X.; Song, D.; Guang, F.T. Research on the Mode of Generation Rights Trade between Renewable Energy and Self-generation Power Plants Based on Cooperative Game Theory. In Proceedings of the 2016 International Seminar on Education Innovation and Economic Management (SEIEM 2016), Chongqing, China, 23–25 December 2016; pp. 269–272. [Google Scholar]

- Liu, R.; Chen, A.; Chen, Z.G. Research of Generation Rights Trade Mechanism inside Power Plant Based on Energy saving and Emission Reduction. In Proceedings of the 2010 Asia-Pacific Power and Energy Engineering Conference (APPEEC), Chengdu, China, 28–31 March 2010. [Google Scholar]

- Li, X.; Bin Li, C.; Lu, G.S. Analysis of Risk Transmission from Generation Right Trading to Generation Company Profit. Adv. Mater. Res. 2011, 403, 2856–2860. [Google Scholar] [CrossRef]

- Zhang, X.; Geng, J.; Pang, B.; Xue, B.K.; LIi, Z. Application and Analysis of Generation Right Trade in Energy-saving and Emission Reduction in China. Autom. Electr. Power Syst. 2014, 38, 87–90. [Google Scholar]

- Jiang, Z.T. Multi-objective Optimization of Generation Right Transaction Based on Security and Economy. Master’s Thesis, Nanchang University, Jiangxi, China, 2018. [Google Scholar]

- Wu, D.; Yang, Z.; Wang, N.; Li, C.; Yang, Y. An Integrated Multi-Criteria Decision Making Model and AHP Weighting Uncertainty Analysis for Sustainability Assessment of Coal-Fired Power Units. Sustainability 2018, 10, 1700. [Google Scholar] [CrossRef]

- Li, Z.H.; Chen, M.Z. Multi-Objective Evaluation Method of Thermal Power Enterprise Cost Effective Research. Adv. Mater. Res. 2013, 734, 1693–1696. [Google Scholar] [CrossRef]

- Yang, X.; Li, Y.; Niu, D.; Sun, L. Research on the Economic Benefit Evaluation of Combined Heat and Power (CHP) Technical Renovation Projects Based on the Improved Factor Analysis and Incremental Method in China. Sustainability 2019, 11, 5162. [Google Scholar] [CrossRef]

- Zou, B.; Zhao, Y.; Li, X.G.; Yang, L.B. Market Mechanism Research on Trans-Provincial and Trans-Regional Clean Energy Consumption and Compensation. Power Syst. Technol. 2016, 40, 595–601. [Google Scholar]

- Gou, X.K.; Cui, L.L.; Ju, Y.Y.; Guo, T.; Zhang, S. Study on curve fitting algorithm for thermal power plant units coal consumption. Power Syst. Prot. Control 2014, 42, 84–89. [Google Scholar]

- Zhang, G.Z.; Zhang, J.T.; Li, Y.W.; Liu, M. Energy Consumption Characteristics Analysis on a Coal-Fired Power Plant Operating in Deep Peaking Mode. Electr. Power Constr. 2017, 38, 56–61. [Google Scholar]

- Lin, L.; Zou, L.Q.; Peng, Z.; Yu, T.X. Multi-angle Economic Analysis on Deep Peak Regulation of Thermal Power Units with Large-scale Wind Power Integration. Autom. Electr. Power Syst. 2017, 07, 21–27. [Google Scholar]

- Fu, Q. Study on Depth and Economic Benefits of Thermal Power Flexibility Transformation to Promote Wind Power Consumption. Master’s Thesis, Beijing Jiaotong University, Beijing, China, 2018. [Google Scholar]

- Zhao, W.H.; Lin, M.X.; Gao, J.Q.; Song, Y.J.; Yu, J.L. Combined Transaction Model of Generation Right and Carbon Emission Right under the Power Market Mechanism with Renewable Energy Considered. Power Syst. Clean Energy 2016, 32, 1–8. [Google Scholar]

- NCERB (Northwest China Energy Regulatory Bureau of the National Energy Administration of the People’ Republic of China). Notice on Operation Rules (Trial) of Ningxia Electric Power Auxiliary Service Market. 2018. Available online: http://xbj.nea.gov.cn/website/Aastatic/news-175486.html (accessed on 18 December 2019). (In Chinese)

- Li, J.H.; Zhang, J.H.; Mu, G.; Ge, Y.F.; Yan, G.G.; Shi, S.J. Hierarchical Optimization Scheduling of Deep Peak Shaving for Energy-storage Auxiliary Thermal Power Generating Units. Power Syst. Technol. 2019, 43, 3961–3970. [Google Scholar]

- NCERB (Northwest China Energy Regulatory Bureau of the National Energy Administration of the People’s Republic of China). Notice on Announcing the Compensation Allocation of Ningxia Electric Power Auxiliary Service Market. 2019. Available online: http://xbj.nea.gov.cn/website/Aastatic/news-list-100300-100301.html (accessed on 11 December 2019). (In Chinese)

| Scenario | Business Model |

|---|---|

| A | power sales |

| B | power sales + generation rights trading |

| C | power sales + peak load regulation (without oil) |

| D | power sales + generation rights trading + peak load regulation (without oil) |

| E | power sales + peak load regulation (without oil) + peak load regulation (with oil) |

| F | power sales + generation rights trading + peak load regulation (without oil) + peak load regulation (with oil) |

| Scenario | Sensitivity Coefficient of Profit to Coal Price | Sensitivity Coefficient of Profit to On-Grid Electricity Price |

|---|---|---|

| A | 27.80 | 45.55 |

| B | 14.00 | 22.94 |

| C | 18.94 | 31.06 |

| D | 11.04 | 18.11 |

| E | 18.82 | 30.85 |

| F | 11.00 | 18.03 |

| Average | 16.93 | 27.76 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yang, X.; Niu, D.; Chen, M.; Wang, K.; Wang, Q.; Xu, X. An Operation Benefit Analysis and Decision Model of Thermal Power Enterprises in China against the Background of Large-Scale New Energy Consumption. Sustainability 2020, 12, 4642. https://doi.org/10.3390/su12114642

Yang X, Niu D, Chen M, Wang K, Wang Q, Xu X. An Operation Benefit Analysis and Decision Model of Thermal Power Enterprises in China against the Background of Large-Scale New Energy Consumption. Sustainability. 2020; 12(11):4642. https://doi.org/10.3390/su12114642

Chicago/Turabian StyleYang, Xiaolong, Dongxiao Niu, Meng Chen, Keke Wang, Qian Wang, and Xiaomin Xu. 2020. "An Operation Benefit Analysis and Decision Model of Thermal Power Enterprises in China against the Background of Large-Scale New Energy Consumption" Sustainability 12, no. 11: 4642. https://doi.org/10.3390/su12114642

APA StyleYang, X., Niu, D., Chen, M., Wang, K., Wang, Q., & Xu, X. (2020). An Operation Benefit Analysis and Decision Model of Thermal Power Enterprises in China against the Background of Large-Scale New Energy Consumption. Sustainability, 12(11), 4642. https://doi.org/10.3390/su12114642