In this section, a description of the key similarities and differences among the e-BSSs recorded in the database is attempted through exploratory data analysis and accompanying visualizations. It must be mentioned that determining the exact e-BSS adoption trends is hindered by its inherent rapid growth rate as well as the multiple data sources available. Moreover, the dataset refers to e-BSS launches, therefore capturing a single instance of the systems’ state, while ridership data were unavailable. Analyzing e-BSS launch data can be useful in understanding the strategic viewpoint of actors in the e-BSS market, thereupon explaining their operative decisions and how they tailor their initial fleet size depending on the intended installation.

The structure of the analysis was designed to trace the diffusion characteristics from a worldwide perspective to a breakdown per continent and further on the presentation of adoption leaders at the national level, in terms of cumulative number of deployed systems and respective size, as well as vehicle to population ratios and details on the largest systems reported in the data.

3.1. Global Outlook of E-BSS Deployment

A global outlook on the uptake of e-bikes in bikesharing is explored in the present section. An assessment of the temporal evolution of e-BSS is performed through an initial screening of the primary dataset, containing both conventional and electrified fleet systems. The annual shares of the number of system launches are distinguished upon their bikesharing system type, revealing the gradual penetration of e-BSS compared with the established conventional bikesharing.

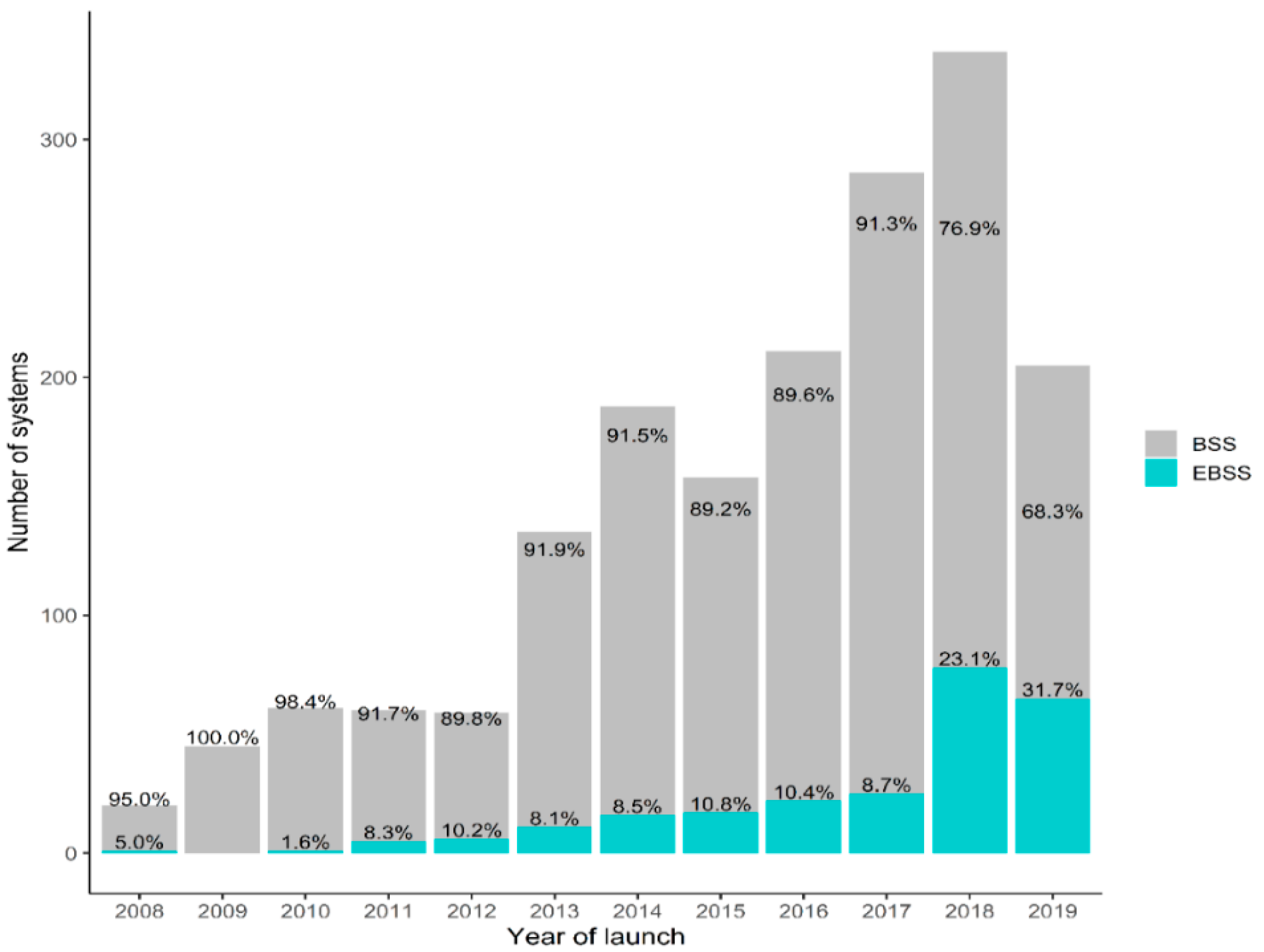

Observing the recorded annual worldwide system deployments—note that 2019 is not fully incorporated since entries are updated until November 2019 (

Figure 1)—demonstrates the rapid growth of bikesharing during the past decade, from a total of 20 new systems deployed in 2008 to 337 in 2018, equivalent to an average annual growth rate of 39.6%. In

Figure 1, BSSs offering both conventional and electric bikes are classified as e-BSSs, representing a partial or full electrification of the bike fleet. Focusing on the average annual growth rate of e-BSSs during the decade 2008–2018, it is estimated at 79.3%. Moreover, by the comparison of annual growth rates, three major milestones can be identified, reflecting different innovation maturity stages concerning bikesharing technology. An abrupt increase can be traced to the variation in figures from 2012 to 2013, with 59 systems (53 BSSs and 6 e-BSSs) launching in 2012 compared with 135 in 2013 (124 BSSs and 11 e-BSSs), translating to a 129% increase in deployment. Next, a deceleration can be observed from 2014 to 2015, reflecting the failure of third generation bikesharing technology to convince in terms of operability and scalability, equivalent to a 16% decrease. From 2015 till the peak observed in 2018, an increasing growth trend is recorded (139% over three years), with 2018 topping deployment rates with a total of 337 systems (259 BSSs and 78 e-BSSs) starting their operation during that year. More specifically, e-BSSs expanded from 17 launches in 2015 to 78 in 2018, corresponding to an almost 4-fold growth. The latter can be accounted to the introduction of massive systems in China and the USA, along with dockless bikesharing gaining acceptance and persuading investors as a reliable solution. Interestingly, figures for 2019 underline the potential of e-BSSs to scale-up and compete with conventional BSSs, since 31.7% of service launches (65 e-BSSs) were e-bike-based.

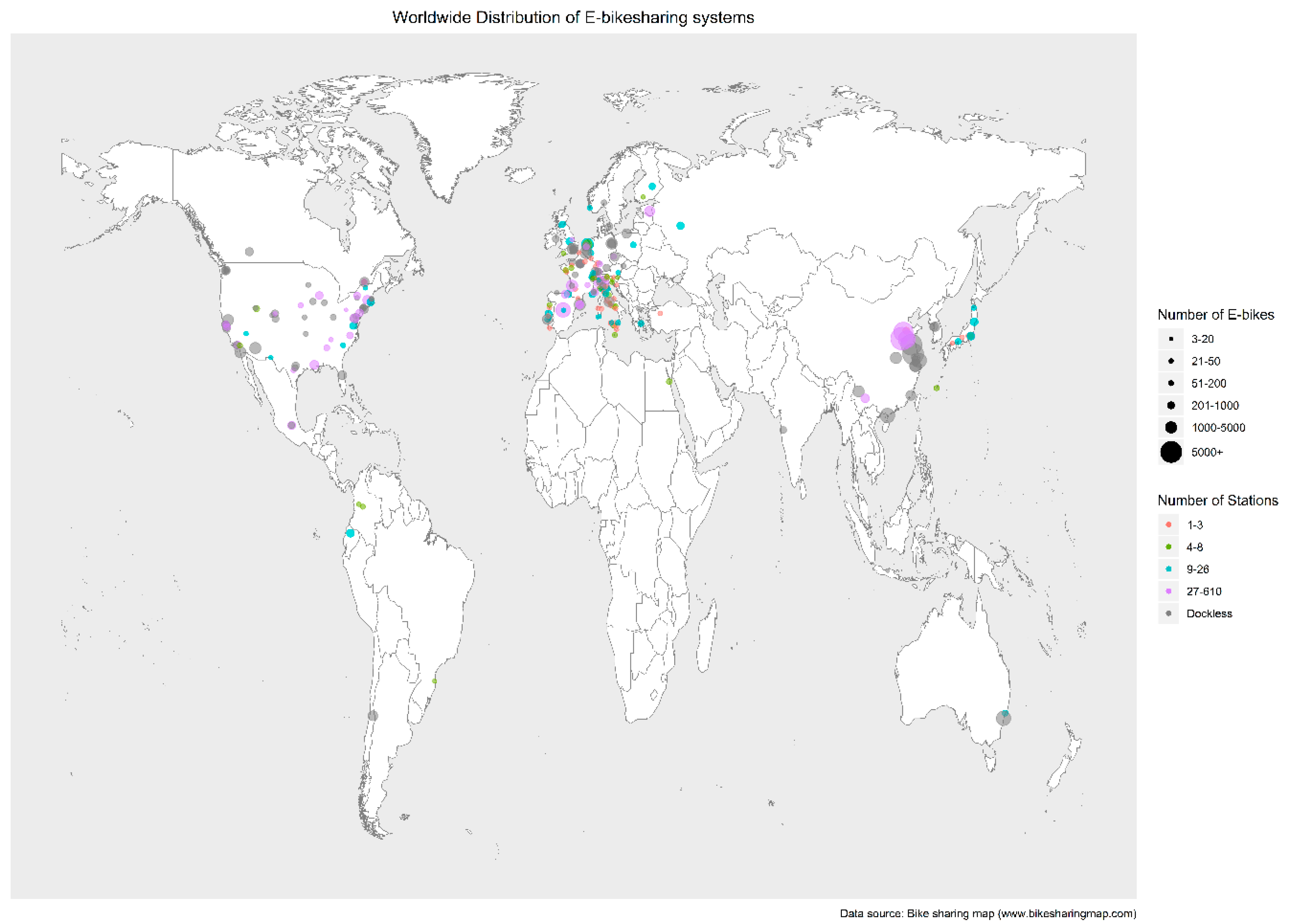

Figure 2 maps the global distribution of the e-BSS locations based on the geographical coordinates mined from the primary dataset. In accordance with the findings in [

4], the majority of e-BSSs are primarily located in Europe (59%) followed by the Americas (27%) and Asia (13.1%), while Egypt and Australia are the only countries from Africa and Oceania featured in the dataset. However, larger fleets are met in Asia (35,963 e-bikes), where the adoption of the technology occurred at a later stage, on which fourth generation bikesharing technologies were developed with geo-tracking integrated on the shared vehicles, allowing the operation and control of extended fleet coverage. Europe trails with 25,564 shared e-bikes, while North America registered 13,894 e-bikes, evidencing that e-BSSs are diffused mainly on the North Hemisphere (95% of worldwide shared e-bike fleet). In total, 231 cities were included in the dataset, with Europe leading in small station-based launches in contrast with North America and Asia, where larger scale launches were realized. The first record in the dataset is a station-based e-BSS located in Monaco, launching in 2008 with 10 e-bikes in four stations as a mixed fleet scheme and operated by the local bus company, and thus can be credited as the longest running e-BSS in Europe.

3.2. Analysis per Region

Since a global outlook on the uptake of e-BSSs has been provided in the previous section, it is yet essential to detail the spatio-temporal trends per region. It can be noted that the e-BSS is becoming a considerable alternative in bikesharing as proven by the respective shares of launches per system type worldwide, specifically during the past two years. Large-scale deployments infer higher initial capital investment costs when contrasted with conventional BSSs, and when considering the average market purchase value of an e-bike in relation to that of a regular bike.

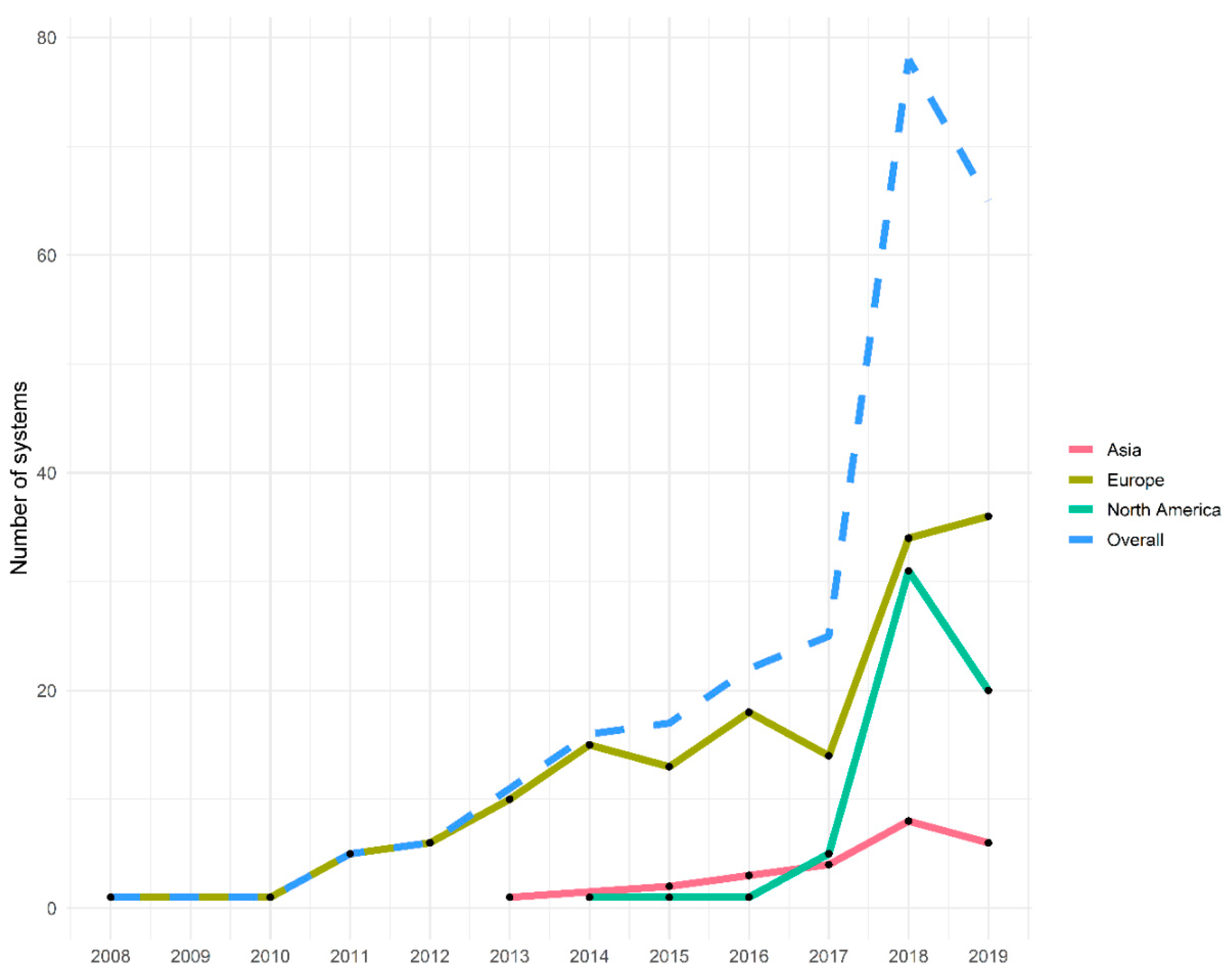

Investigating the rate of e-BSS diffusion, an initial step is to record the global overall trend in annual system launches. To this end,

Figure 3 details the number of new systems per year in Europe, North America and Asia, as well as the overall worldwide trend. All curves resemble a sigmoid curve, in accordance with the key feature of innovation diffusion theory [

5], and thus a delayed adoption during the first years, followed by a rapid growth. Breaking down the deployment rate per region, it can be observed that Europe held the initiative in adoption for the first five years till the concept was spread to Asia and one year later to North America. In fact, the overall trend coincides with the European market until 2013, although the uptake of electrified shared bike fleets was reluctant. The delayed entry of the two other key regions contributed to the global average annual growth rate of e-BSSs for the period 2014–2017, where the European market presented variations and instability. However, the level of system launches remained relatively low in both regions, characteristic of the delayed adoption of e-BSSs. Impressively, the increase in the cumulative number of system launches in North America traced the European trend in 2018, taking off e-BSSs to 23.1% of new bikesharing systems in that year. The differences in diffusion patterns per region can be summarized in the following statements: Europe led the adoption in the first years when bikesharing technology was still in the third generation and gradually transitioning to the fourth, with a stable diffusion pattern till 2018; Asia since 2015 is establishing the fourth generation bikesharing technology, remaining hesitant in the large-scale integration of e-bikes; meanwhile, North America is presenting a clear diffusion pattern, boosting the e-BSS uptake. Since 2019 is not fully included, all average annual growth rates are calculated till 2018, corresponding to 230% for North America, 58.3% for Asia and 75.8% for Europe.

An important contribution to the e-BSS expansion was marked by large actors in vehicle sharing schemes, for instance, Forever-Gonbike in Asia launched seven systems during 2017–2018, representing a high share of the innovation’s diffusion (average 56% of overall deployments in Asia) alongside public investment, while Uber, Jump and Lime in North America were responsible for the launch of 29 systems in the three-year period 2017–2019 (average 52% of overall deployments in North America), signifying the shift from the innovator stage to the early adoption phase of the technology and attempting to gain a pivotal placement in leading the e-BSS landscape. In Europe, the market appears more fragmented with the large multinationals playing a minor part in e-BSS diffusion along with smaller operators.

In terms of the number of e-bikes, large players dominated the annual percentage shares of e-BSS deployment during the past three years with massive roll-outs over the three examined regions. In detail, 72% of shared e-bikes deployed globally in 2017 were attributed to a large operator, mainly Forever-Gonbike with 62%. This is repeated in 2018, where 71% of shared e-bikes globally were rolled-out by a large operator, in this case with respective shares distributed more smoothly among operators, while in 2019, this percentage dropped to 30%.

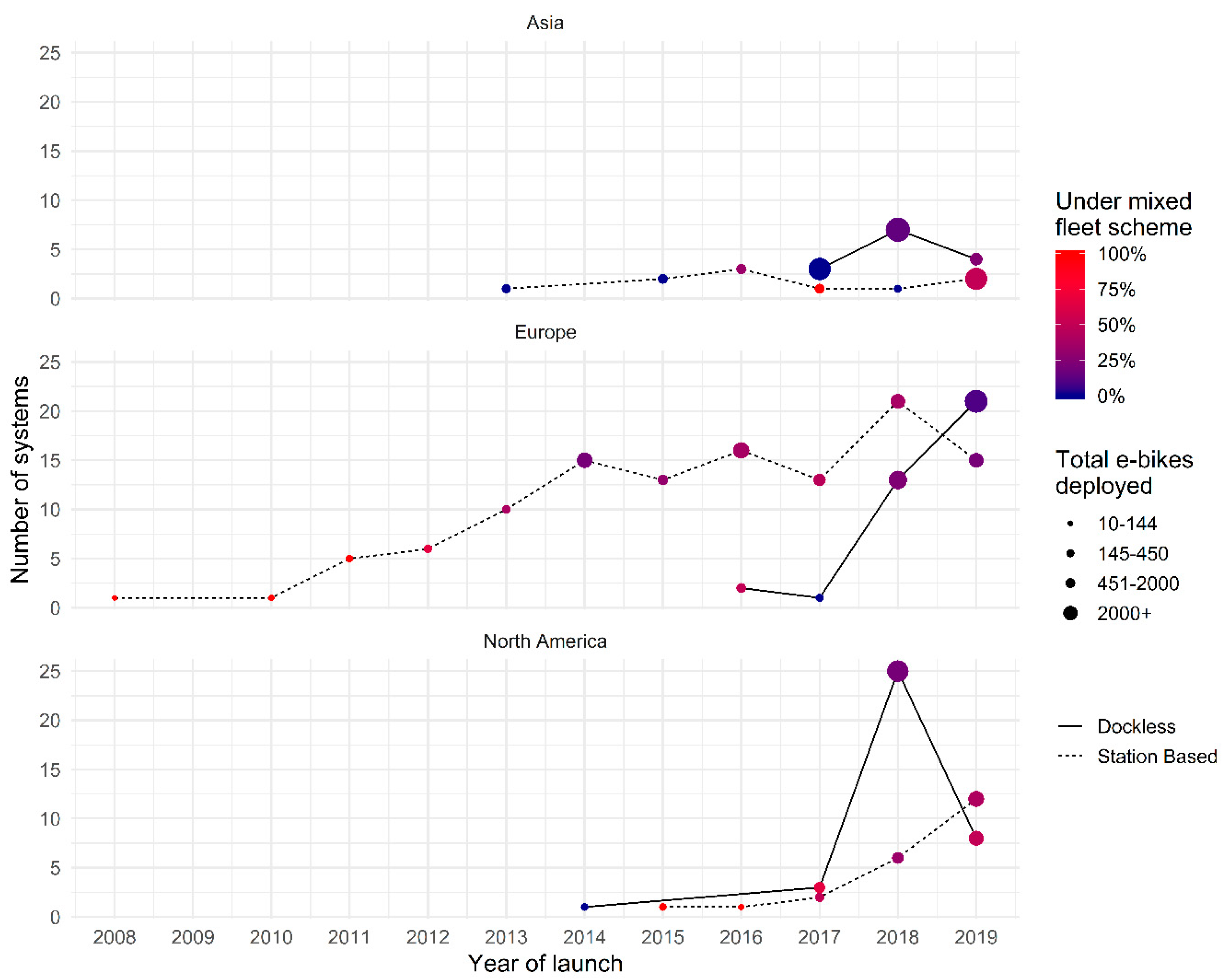

Aiming to examine in detail the technical characteristics of e-BSS deployments, a disaggregation of the diffusion curves presented above is pursued upon three exploratory variables (

Figure 4). Firstly, the total number of e-bikes deployed as an indicator of the system’s size, then a variable capturing whether a specific system is operating a mixed shared fleet and finally a variable indicating the type of vehicle sharing (dockless or station-based). The latter comprises the main technological attribute distinguishing the operating model followed by e-BSS operators, in the meantime providing a quantified comparative basis for the assessment of the innovation diffusion between the third generation bikesharing counterposed with the fourth generation technology.

As a general observation, it can be supported that the dockless e-BSS is more established in Asia and North America in comparison with Europe and launches with larger fleet sizes (mean 465) than station-based e-BSSs (mean 166). The first dockless e-BSS launched in Cincinnati, Ohio in 2014 with a fleet size of 102 e-bikes, prior to its wide establishment from 2016 and onwards. Cross-examining the evolution of fleet type annual percentage shares on the global scale, in the last two years, the dockless e-BSS has gained a significant share since its introduction. In particular, 47 out of 78 total e-BSS deployments were dockless in 2018, in contrast to 7 out of 25, in 2017. The pattern proceeds till November 2019, where 34 out of 67 e-BSSs were dockless bikeshares. Elaborating these findings per region and taking into account the respective fleet sizes for the period during which both types coincide (2016–2019), in Europe, dockless e-bikes deployed constituted 13% in 2016 and reached 78% of total e-bikes deployed in 2019, in Asia, e-BSS fleets were mainly composed (98%) of dockless e-bikes till 2019 when the trend reversed and the respective recorded shares were 15% dockless and 85% station-based, meanwhile in North America, a 70% fraction at the end of 2017 dropped to 45% in late 2019. What is notable in the case of the dockless e-BSS is its rapid integration to the overall technology diffusion trend, only within three years of competition with station-based implementations. Specifically, the recorded average annual growth rate from 2014 to 2019 for dockless e-BSSs was 200%, whereas for station-based e-BSSs, it was 18%. Nevertheless, the overall growth of station-based remains positive since from 2008 to 2019, it corresponded to a 60.7% annual growth rate.

Regarding the inclusion of e-bikes in mixed fleet sharing schemes, the data revealed that in Europe, where e-BSS adoption was engaged earlier than the other regions, e-bikes were initially offered as an additional vehicle option in conventional BSSs until 2012, when the first exclusively electrified e-BSS launched in Predazzo, Italy. The gradient scale in

Figure 4 describes the percentage of systems, regardless of docking type, operating under a mixed fleet scheme with their respective launch year. It can be derived from the first years of e-BSS launches in Europe, that the implementations were mainly foreseen as mixed fleet schemes, similar to North America. In addition, station-based schemes supplying a mixed fleet are more favorable than dockless schemes.

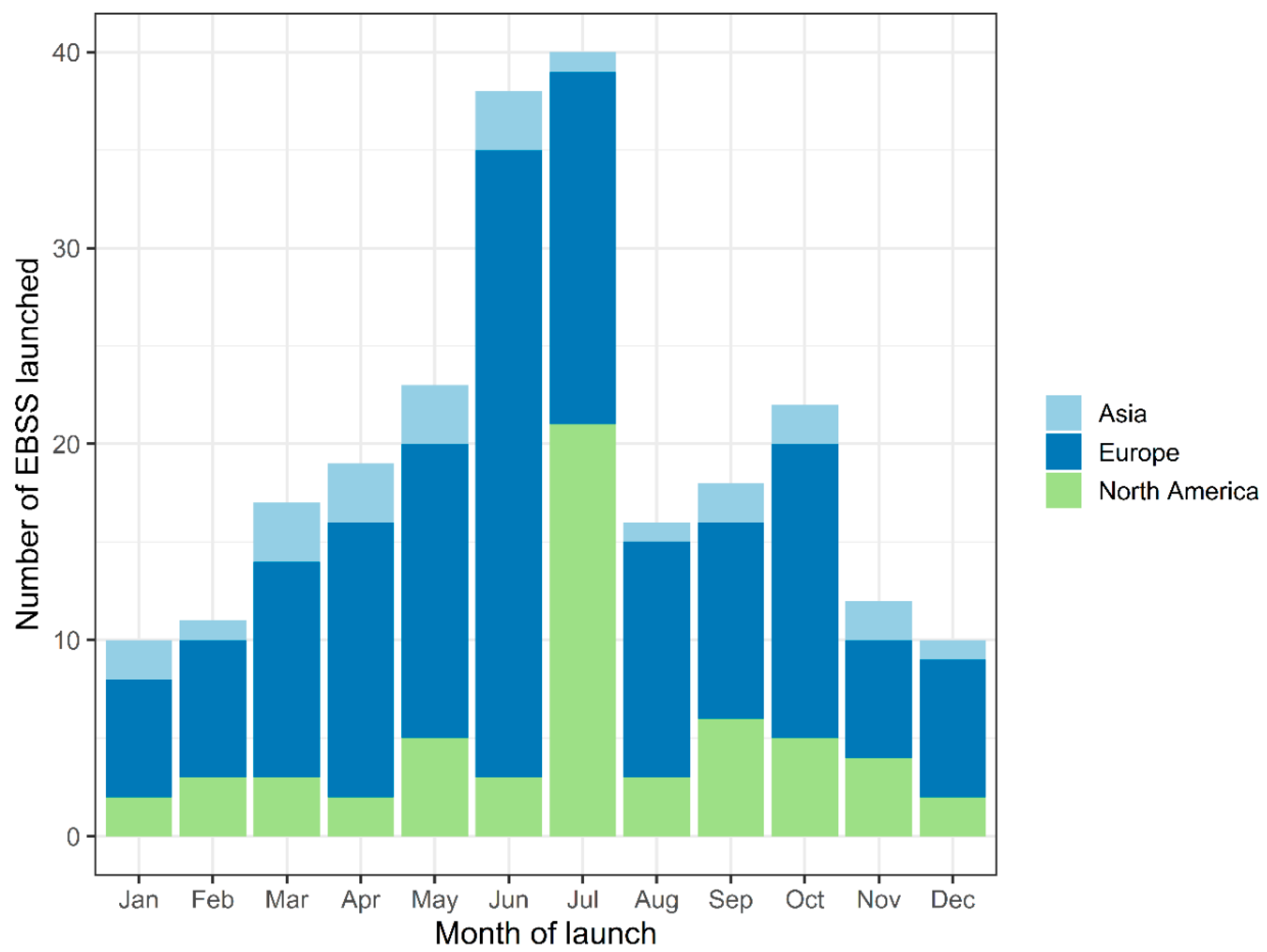

Another factor for e-BSS deployment unraveling further details on the temporal characteristics of the diffusion was the monthly seasonality of launches per region.

Figure 5 presents the number of e-BSS deployments per region by month of launch. It is evident that summer months are the most preferred for the launch of an e-BSS (40%). This can be accounted to certain aspects, such as the seasonal character of bikesharing due to the dependence of ridership from weather conditions, the fact that the studied regions are located in the Northern Hemisphere and the aim of operators to attract also tourists in order to accelerate their service roll-out plan. In detail, July holds a 17% share, trailed by June at 16% and May at 10%. The distribution for Asia is uniform with a peak from March to June, however, the number of entries is only 24, in Europe, the peak is recorded in June with 32 entries out of 153 resembling a normal distribution, while for North America, an abrupt peak (21 e-BSSs out of 59) appears in July, with the remaining months trailing, therefore concentrating a lower preference for deployment.

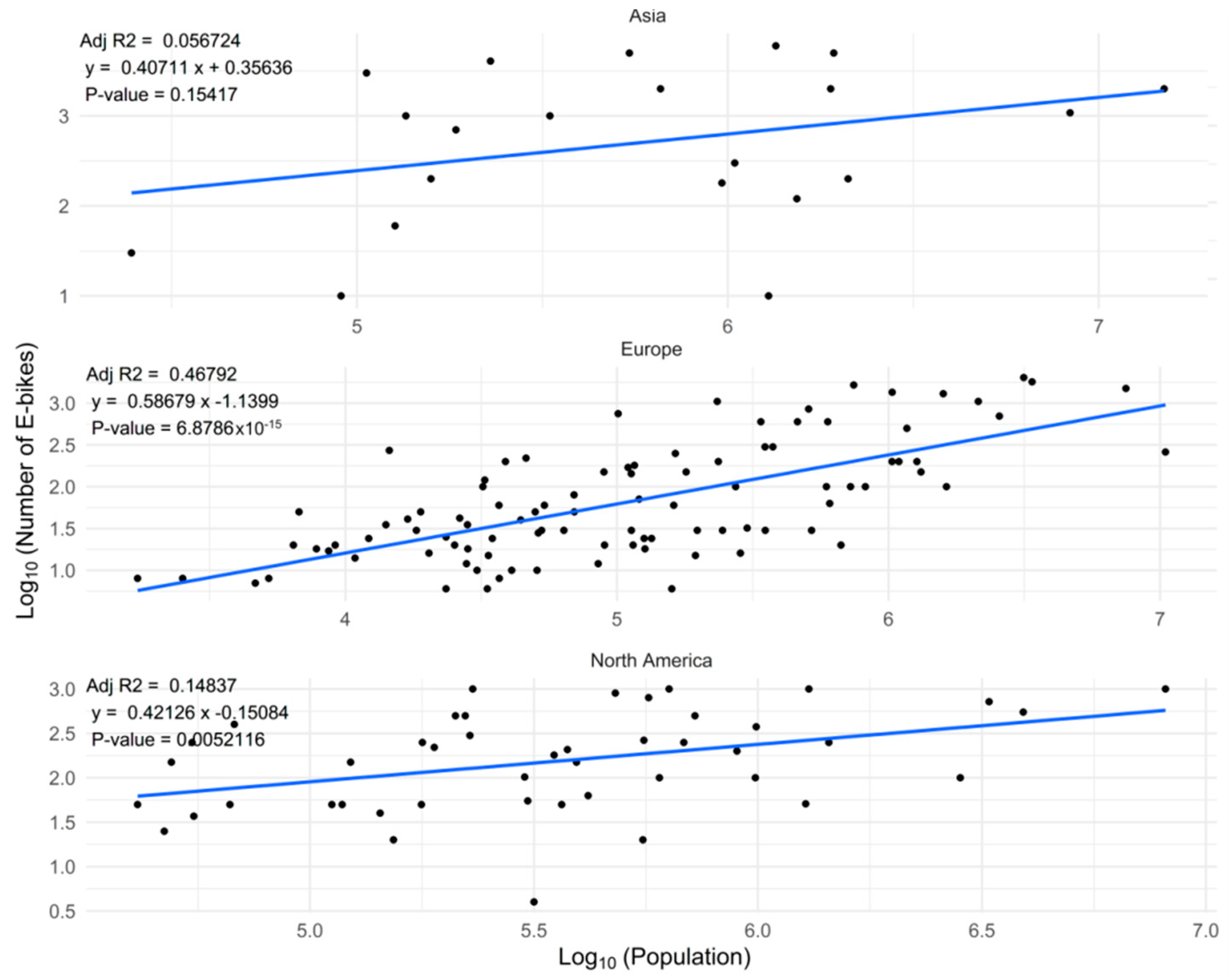

Within the context of discovering the underlying motives for e-BSS diffusion and launch fleet sizing as a function of population, a linear regression model is applied on each region between the logarithms of population size and the logarithm of the number of e-bikes deployed. This log transformation is motivated from assuming a non-linear relationship for the compared variables. Additionally, capturing the correlation between these variables can provide useful arguments for validating the assumption that cities with larger populations will necessarily require larger fleet coverage. In this direction,

Figure 6 demonstrates the resulting plots with their respective fitted linear regression curves. Clearly, a low correlation (0.0567) pinpoints the inadequacy of the fitted curve to describe the relationship between the data points from Asia, suggesting that a polynomial relationship could improve the regression model’s accuracy. By comparing the strengths of correlation, attempting to model the relationship between population and fleet size fails to score a reasonable adjusted R squared value for Asia, therefore contradicting the initial hypothesis. Nevertheless, the assumption is confirmed for the remaining two regions with calculated correlations higher than the results presented for the early stages of the bikesharing technology diffusion in [

4].

Specifically, the previous study focusing on the diffusion of public BSSs over a 15-year timespan (1998–2012) presented a 0.1994 R2 value for 55 BSSs in Europe and 0.1315 for 19 BSSs in North America. The respective values estimated in this study were 0.4679 for 97 e-BSSs in Europe and 0.1484 on 45 e-BSSs in North America. Although these coefficients are relatively low to suggest a strong correlation between the examined variables, it has to be mentioned that cities recording more than one system were aggregated on a common population value.

3.3. Deployment on Country Scale

Deployment trends at the continental level revealed differences in average annual growth rates between the three regions with the highest incorporation in the dataset, nonetheless, an exploration of the magnitude of the trends on a country scale allows the inference of the contribution of specific e-bike markets. It is expected that major drivers in the adoption of e-BSSs will be the largest bikesharing markets with an established cycling tradition. A normalization on population size serves as the weighted comparative standard for the appeal of e-BSS technology, as well as the growth potential in the studied location. Furthermore, this analysis can highlight specific deployment features in finer resolution.

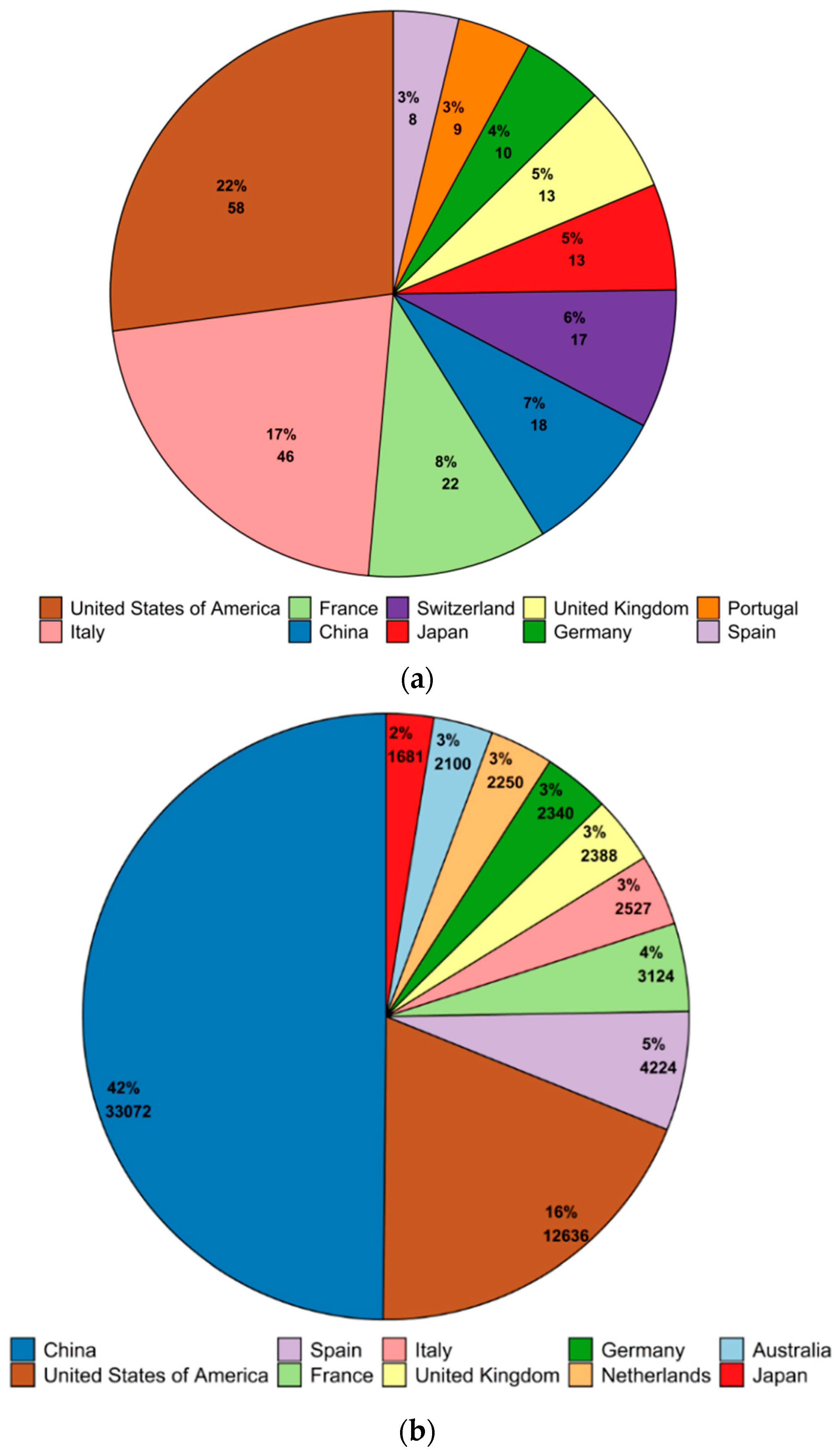

Aiming to explore the characteristics of the innovation diffusion at the national level,

Figure 7a illustrates the top 10 countries in the adoption of e-BSS based on the number of entries per countries in the dataset registering at least six launched systems, and

Figure 7b depicts the top 10 ranking of countries based on the percentage breakdown of e-bikes deployed during the examined period. Indicatively, Italy which holds the second biggest share of deployed e-BSSs (17% with 46 entries) would have been overrepresented if the analysis was performed solely on the absolute number of systems as in the results presented in [

10]. The corresponding share is attributed to an extensive deployment of mostly third generation systems which were small-scale station-based (up to 20 bikes fleet) and operating in small cities, in contrast with the large fourth generation deployments met in Chinese large cities or the US [

16]. When the ranking is based on the percentage breakdown of e-bikes deployed during the examined period (

Figure 7b), China records the largest share of available e-bikes on e-BSS launches (42%) followed by the USA (16%). Combining the above, an average e-BSS launch fleet size per country can be estimated with the values of 1837 e-bikes per system for China and 218 for the USA. However, this number hinders the extraction of a rigid conclusion on the diffusion of the technology due to the omission of important historical parameters concerning the stages of bikesharing technology’s evolution (more reluctant and small-scale deployments preferred during the first years of the diffusion) and spatio-demographic traits such as tailoring the launch fleet size to the intended location’s metropolitan area and population.

A common trend can be attributed to the USA and China regarding adoption patterns, specifically, both enter the e-BSS landscape after fourth generation products reach the market and from 2017 onwards show a tendency in launching large-scale (>1000 bikes fleet) dockless systems. This temporal pattern is reflected in almost every facet of

Figure 5, where at least one large-scale dockless e-BSS appears on the map after 2017. Italy and Switzerland comprise the main leaders in the early adoption stages since 2012 and 2010, respectively [

17], while China and the USA are the main areas of e-BSS deployment in recent years. The latter reflects the shift in the e-bikesharing technology innovation, from an early period when the Italian company Bicincitta engaged a wide deployment campaign throughout rural areas, offering a demo third generation system for small-scale applications [

18], to the emergence of key innovation leaders (it cannot be considered as an exaggeration to coin the term fifth generation for the ongoing service schemes offered from Chinese bikesharing companies [

9]) in the form of private funded initiatives combined with governmental subsidies enacted later in the implementation phase.

Driven by the roll-out strategy experienced in the Chinese e-bike sharing market and in line with the latest demands of the fourth generation of bikesharing, companies in the USA decided to engage on aggressive roll-outs of dockless e-BSSs with free floating e-bikes accessible at major densely populated cities, with each stakeholder offering his own built-in technology and pricing policy [

19]. This transition can be linked with the market placement of large mobility-on-demand providers (i.e., Uber) through the purchase of bike tech companies (Jump Bikes), therefore permitting larger-scale campaigns and higher initial capital investments.

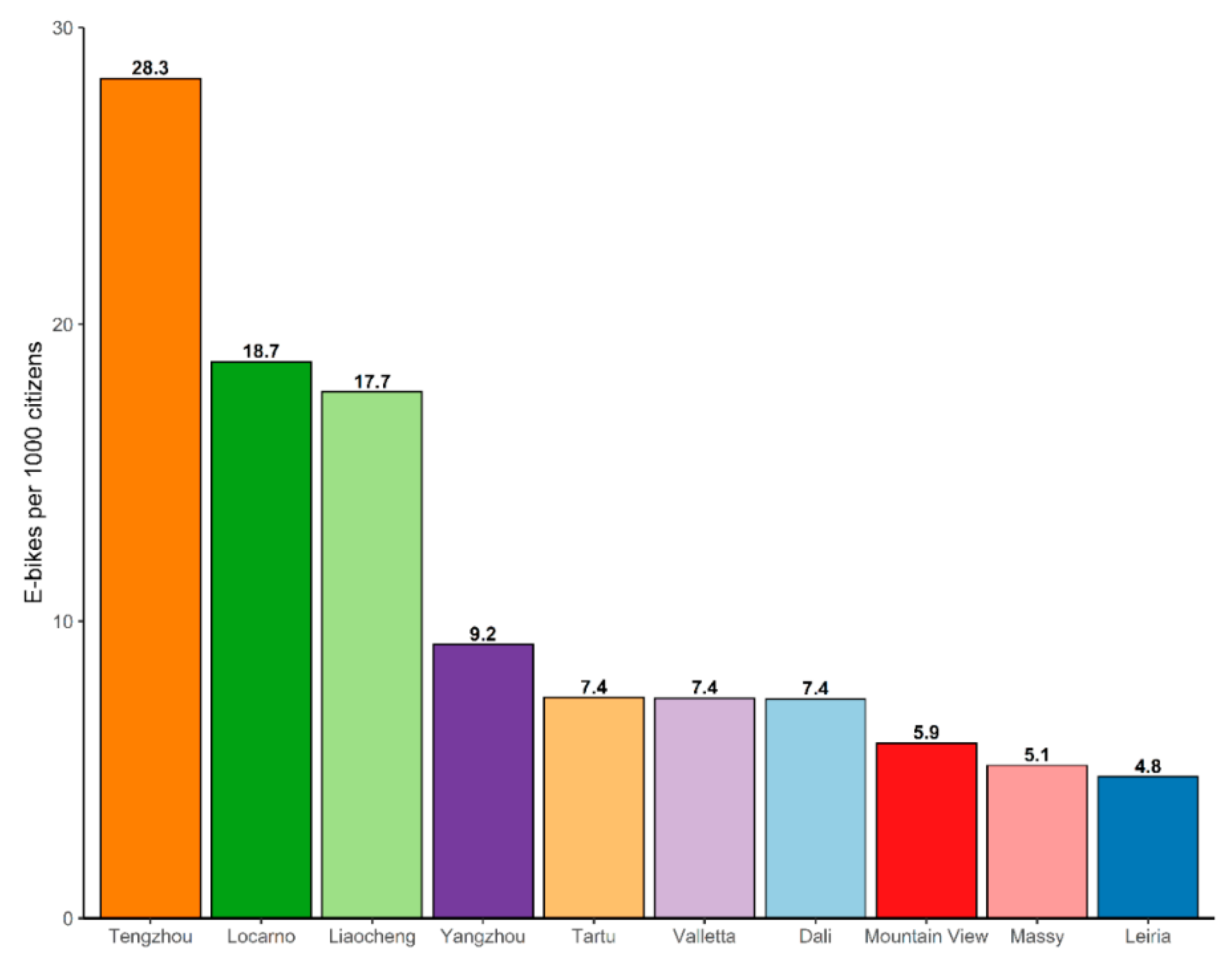

Ranking the top 10 performing cities on the e-BSS fleet size to population ratio was performed solely on city populations cross-validated with the city population dataset. Importantly, the results (

Figure 8) were scaled on e-bike availability per 1000 citizens for the purposes of comparability with previous studies. It can be noted that Tengzhou, China ranks in first place with 28.3 e-bikes per 1000 citizens, along with four other Chinese cities (i.e., Liaocheng third, Yangzhou fourth and Dali seventh), followed by Locarno, Italy with 18.7 e-bikes per 1000 citizens. Highly performing European cities are also Tartu, Estonia and Valetta, Malta, with their rate computed from only one system serving small populations in both cities, i.e., 750 e-bikes deployed in Tartu and 50 e-bikes in Valetta, whereas Chinese cities with 15 entries tallying 32,340 e-bikes present a more reliable figure. For example, the US market, which is highly incorporated in the population quota dataset with 43 entries, recorded two top-ranking cities with 5.9 and 5.1 e-bikes per 1000 citizens over an average country level of 1. In contrast, Italy, the second most represented country in terms of the number of systems (i.e., 28 in

Figure 7a) in the population quota database, ranked 20th in country averages, at a 0.5 ratio. Hence, in contrast with the rankings in

Figure 7, the analysis from the population coverage suggests that leaders in number of deployed systems would not necessarily land a position in the highest ranks of population coverage due to the rate’s sensitivity to low population values.

Table 1 lists the largest e-BSSs included in the dataset, describing their launch date, number of e-bikes, number of docking stations, operator, population in millions and total BSS fleet size of all systems available within the studied location. Values for the last data field were extracted from an online source with live data on bikesharing from 300+ cities [

20]. The largest recorded roll-out was 5000 e-bikes in two Chinese cities, namely Yangzhou and Shunyang, while in Europe, the largest roll-outs are recorded for Madrid (BiciMAD around 2000 e-bikes, launched 2014), Amsterdam (Urbee 1150 e-bikes, launched 2016), Brussels (Uber 1200 dockless e-bikes, started in 2019) and Milan (BikeMi, 1000 e-bikes, launched 2016). A dockless e-BSS in San Diego was the largest roll-out for North America, where the most frequent value for initial fleet size was 500. Evidently, larger systems launch in Chinese cities, while flexible access to shared e-bikes (dockless shared fleet) is more favored for large-scale deployments.

In Hangzhou, a Chinese city that alone accounts for almost one million shared bicycles, a new system launched in January 2018 which introduced 1000 e-bikes in the district of Binjiang that run on a large removable battery. The difference is that these batteries are stored and charged in a separate solar-powered vending machine at each station. As an effect, users can still choose between a conventional or e-bike, but without the responsibility of carrying and maintaining the battery [

21]. The opposite principle applies in the case of the envisioned e-BSS for Stockholm, where a fleet of “hybrid bikes” will be rolled out with members carrying the responsibility for charging a battery that is compatible with the vehicle and receiving it upon subscription. Aiming to lower the cost of the membership fees, the city authorities reached an agreement with the system operator for allocation of advertising space in privileged locations [

22].

3.4. Discussion

The results in the previous sub-sections revealed the diversity of e-BSS adoption patterns depending on the examined scale. Mainly, the technology has spread to three regions, namely Europe, North America and Asia, being initiated in Europe and with short delays arriving in the other continents. The temporal evolution of e-BSSs compared to conventional BSSs demonstrates the gradual penetration of electrified fleet deployments throughout three stages, firstly as a pure innovation followed by an early adoption period (stabilized on 9% of total bikesharing launches) and lately as an established transportation solution. In fact, in the last two years, e-BSSs comprise almost one quarter on average of all BSS roll-outs worldwide.

In terms of system fleet size, China and USA constitute the key market leaders in e-BSS deployment. Other cases of large-scale systems have been launched also in large cities in Europe and Australia with dockless e-BSSs gaining popularity in contrast to station-based implementations. City population presents a positive correlation with launch fleet size, validating the hypothesis that deployment decisions vary depending on scale. According to the findings presented in

Figure 6, Europe demonstrates a statistically significant relationship between initial fleet size and targeted city population, whereas in Asia and North America, large-scale systems are launched in cities with a population over 100,000 citizens.

The dynamics of the deployment trends observed point that the peak in the e-BSS diffusion curve has not yet been reached. Bikesharing remains a considerable micro-mobility solution with e-bikes bearing the potential to extend the technology’s scalability, also confirmed by the rapid diffusion rate presented in the analysis. The maturity of BSS adoption in a city’s transportation plan facilitates and motivates the transition or the integration of e-BSSs. It becomes clear that fully characterizing the diffusion patterns of the e-BSS technology requires the inclusion of key categorical predictors and quantitative variables, for example, utilization patterns, budget considerations, mobility plans, level of established cycling culture, public or private operator model, selected payment system (impeding or not flexible vehicle acquisition) and trip costs. However, the purpose of implementing a BSS on each of the cities recorded in the database was beyond the scope of this study.

Tracing the deployment characteristics at the country level, multiple aspects were explored, such as top adopters according to percentage breakdown of the number of e-BSSs, total fleet size compared with the global fleet size, system size to population ratio and the largest systems recorded in the database. After a close examination of the results presented in

Figure 7 and

Figure 8, as well as in

Table 1, China undoubtedly drives e-BSS adoption followed by the USA, in alignment with the rapid diffusion rate of the BSS technology. In addition, e-BSS deployment in these countries is also influenced from the presence of an innovation competition that attracts more operators into planning future implementations or pursuing to introduce the technology to new locations in order to achieve a market advantage. At this point, it is noted that a permit is necessary for an operator to deploy a system in a city, thus deployment trends are subject to local transport policy and regulation.

Importantly, the degree of e-BSS expansion on an urban scale is impacted by the competition with other vehicle sharing technologies apart from conventional BSSs, such as e-scooter rental/sharing systems or ridesharing depending on the service level of micro-mobility demand. Especially, in cities where alternative micro-mobility schemes have established their presence within the transportation landscape, this hinders the appeal of an e-BSS roll-out for a prospective operator. Recent studies comparing ridership patterns between scooter sharing schemes and BSSs in cities where both are offered revealed that shared bikes were mostly used for commuting while shared scooters for recreation in Washington D.C. [

23], and that scooter sharing exhibits an increased utilization rate on a smaller fleet size than BSSs in Singapore, although over a significantly lower total daily usage [

24]. Notwithstanding this, the large-scale integration of micro-mobility schemes is beneficial for transport systems, such as alleviating rush-hour congestion, and therefore this competition may lead to a broader positive outcome [

25,

26].