Multi-Criteria Decision Making of Contractor Selection in Mass Rapid Transit Station Development Using Bayesian Fuzzy Prospect Model

Abstract

1. Introduction

2. Literature Review

2.1. Method of Selecting Multi-Criteria Decision Making for Contractor Selection

2.2. Preference Relationships Theory

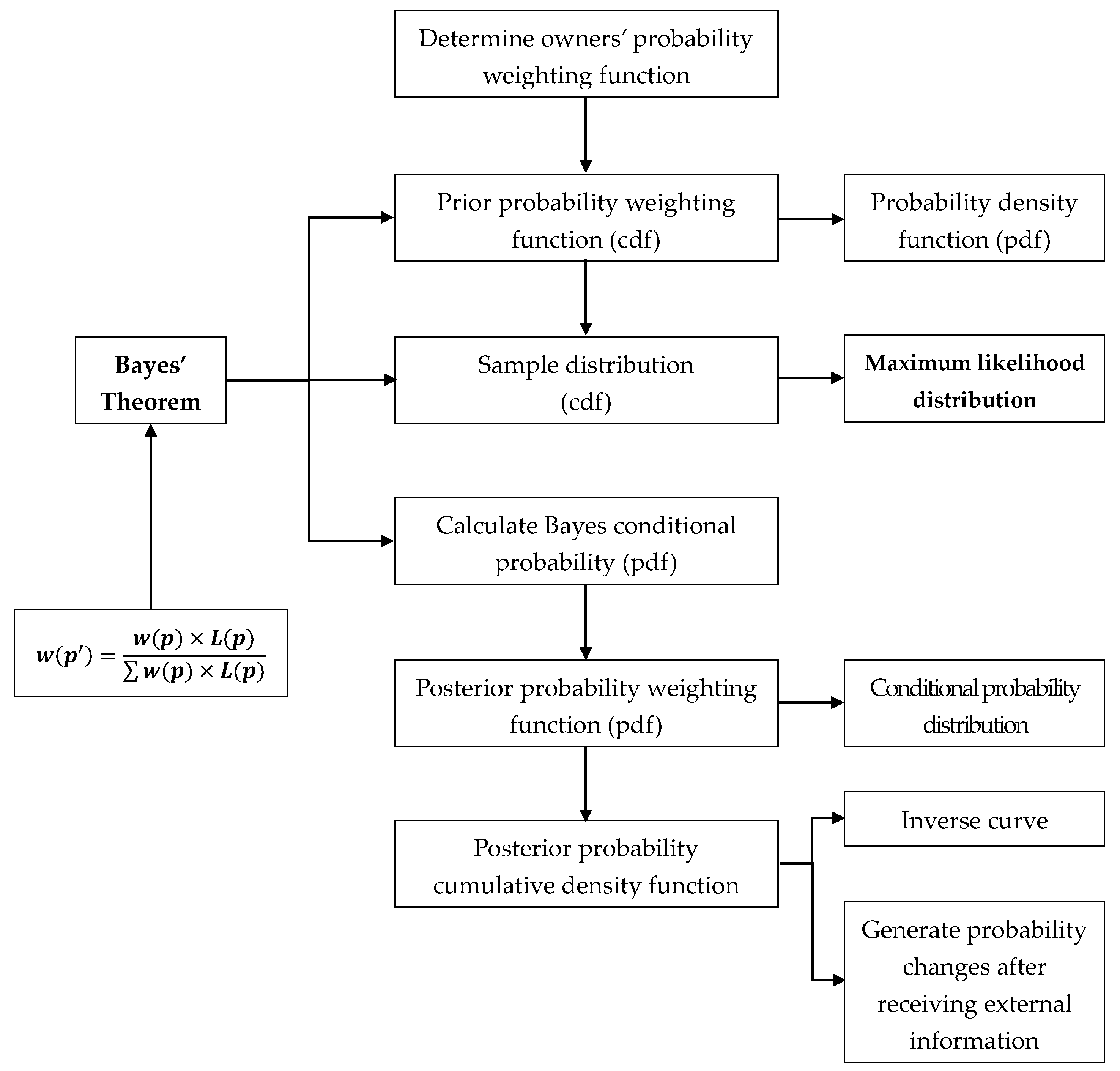

2.3. Bayes’ Theorem

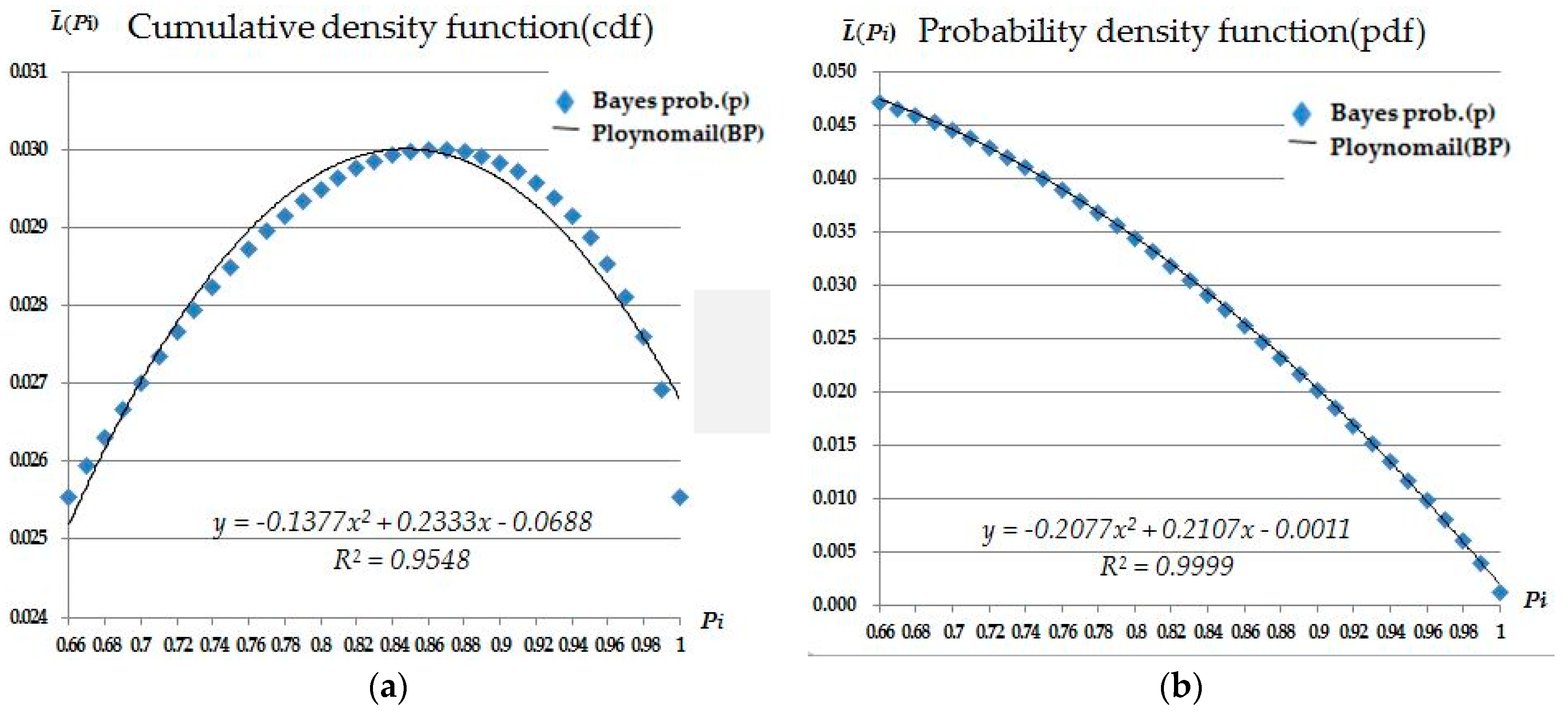

- The prior probability is expressed as a cumulative distribution function (CDF) as follows:where is prior probability density function; α and β are the parameters of Equation (2).

- The maximum likelihood distribution depends on additional information.

- The posterior probability ( is given as follows:

- Posterior probability = prior probability × likelihood function. The posterior probability is expressed as a probability density function (PDF) as follows:

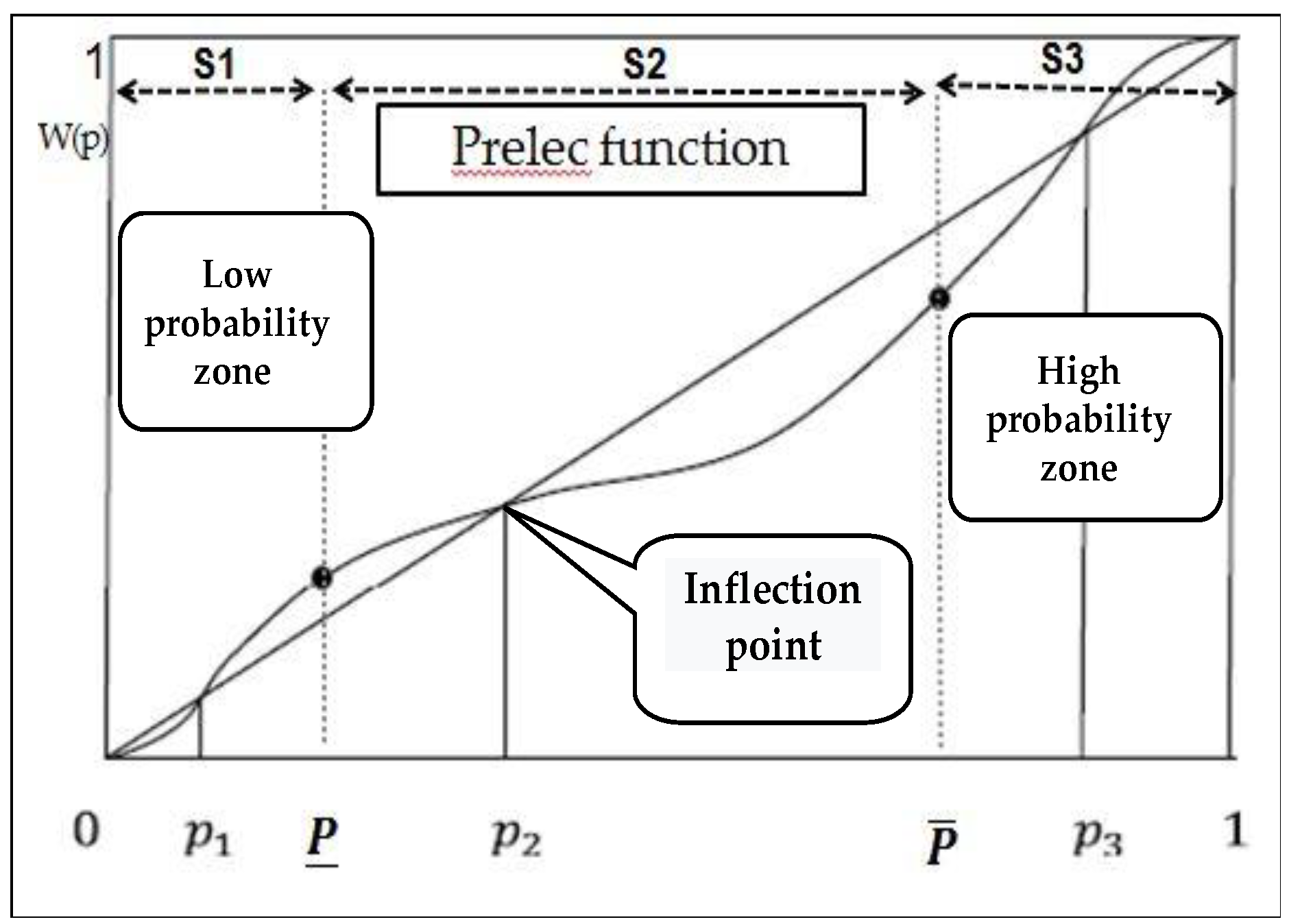

2.4. Prospect Theory

- PT and investment psychology (a four-level model): Kahneman and Smith [13] proposed the S-shaped utility function in Foundations of Behavioral and Experimental Economics. It has experimentally indicated that people have non-linear preferences when evaluating probabilities [35]. This preference is characterized by (1) a tendency for “loss aversion,” in which a unit loss is perceived to be of a greater magnitude than a unit gain; (2) a tendency for “risk aversion” in gain situations; (3) a tendency for “risk seeking” in loss situations; and (4) a tendency to make decisions based on a “reference point” to determine gain or loss situation.

- CCPT: Ali and Dhami [15] (pp. 14–16) proposed a probability weighting function which uses the composite Prelec probability weighting function (CPF) [49] to correct the curve function of high- and low-probability zones. Due to this correction, changes in subjective decision-making probabilities after the provision of external information can be better reflected.

2.5. Influence Factors Considered

2.6. Summary

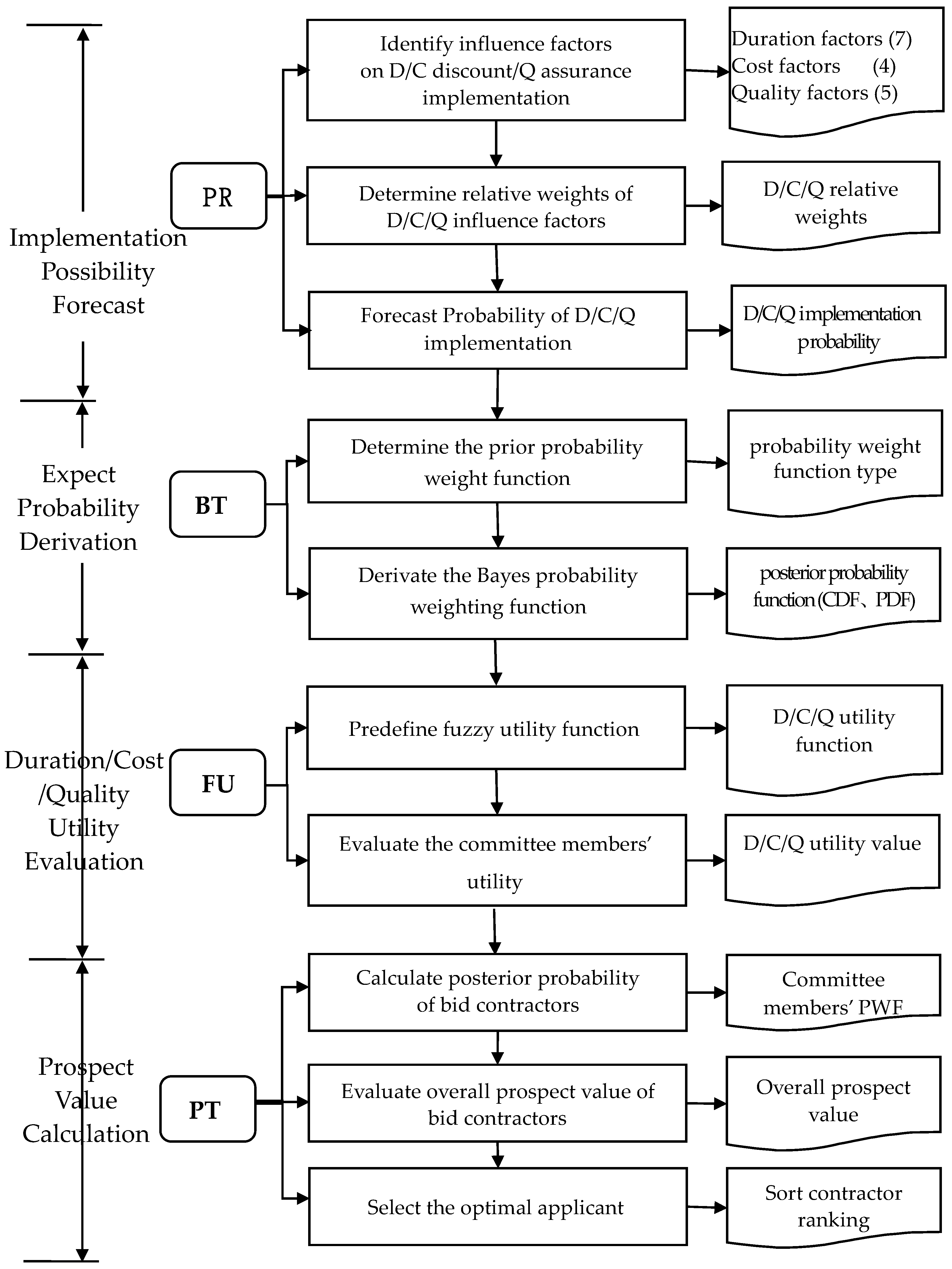

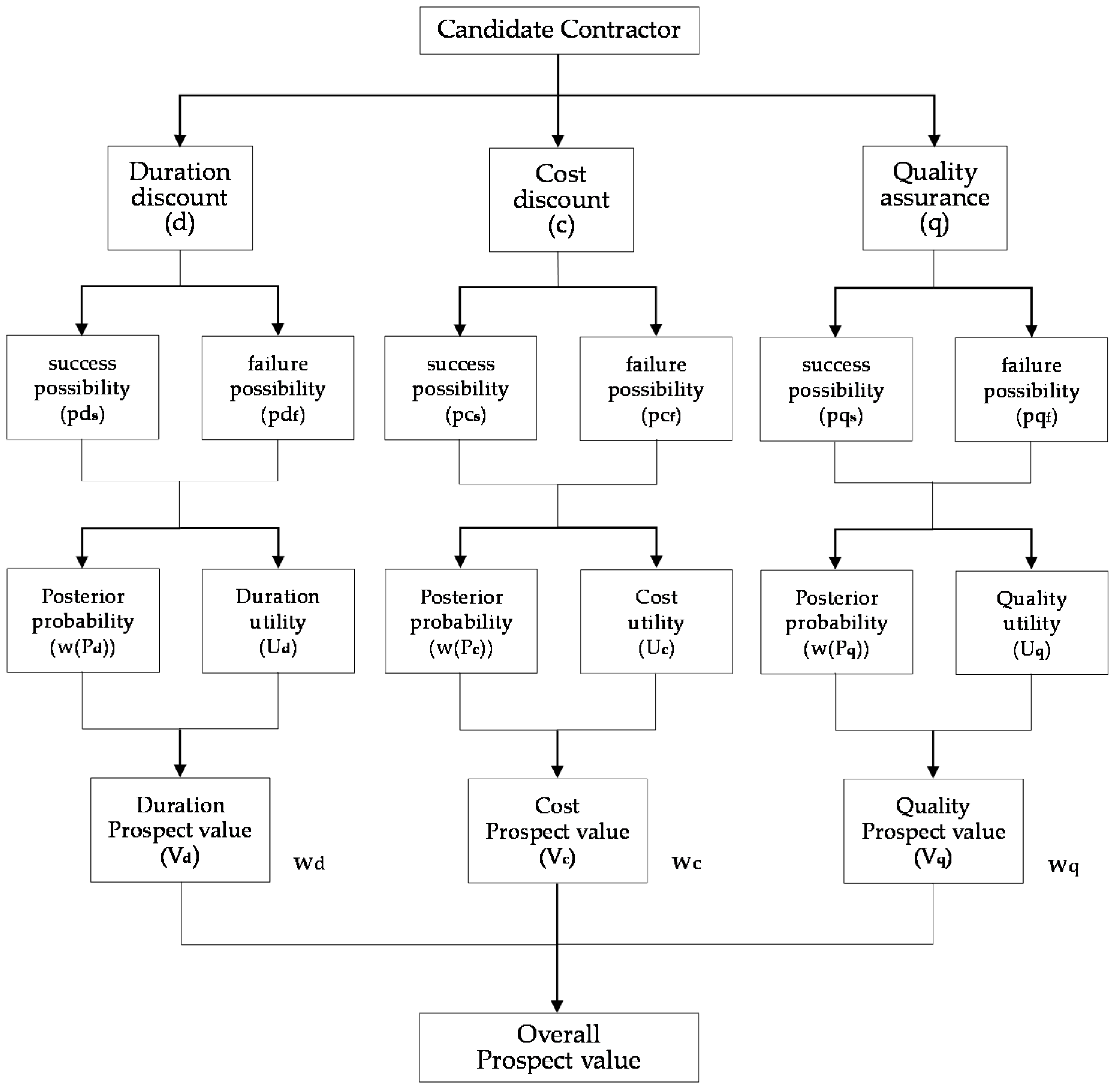

3. Constructing the Bayesian Fuzzy Prospect Model

3.1. Asssessment for Implementation Possibility

3.2. Derivation of Expected Probability

3.3. Evaluation of Utilities for Duration, Cost and Quality

3.4. Overall Prospect Evaluation of Candidate Contractors

4. Assessment Implementation Possibility for Bid Commitment

4.1. Identifying Influence Factors of Duration, Cost and Quality Implementation

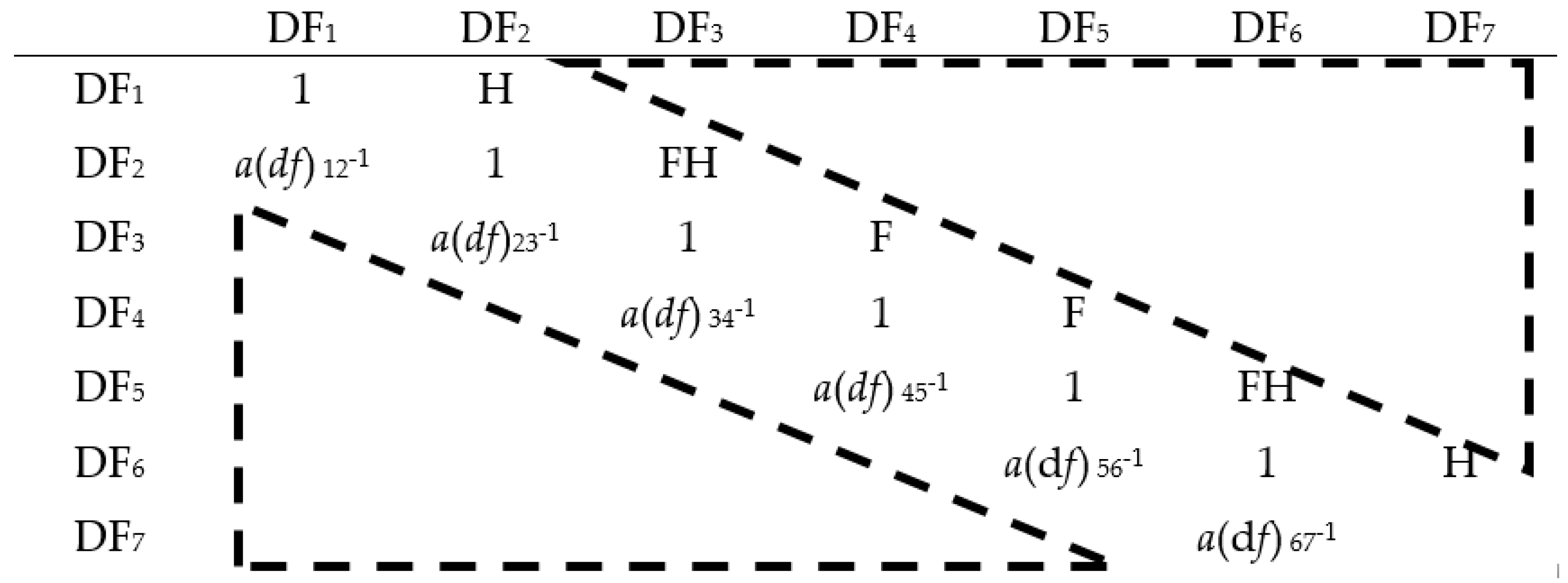

4.2. Determining Relative Weights between Influence Factors

4.3. Assessing the Probability of Fulfilling the Bid Commitment

5. Assessment of the Committee Members’ Expected Probability

5.1. Determination of the Prior Probability Weight Function

5.2. Derivation of the Bayesian Probability Weight Function

- Solve .Let .Take ln on both sides; .Take exp on both sides; = .

- Similarly, obtain = and = .

- Let the prior probability function [17] (pp. 45–48) beLet , = 0.2, and .Using the equations = and = , calculations were conducted.

- Using the equations = and in the calculation, the following result was obtained:

6. Assessment of the Utility of Bid Commitment

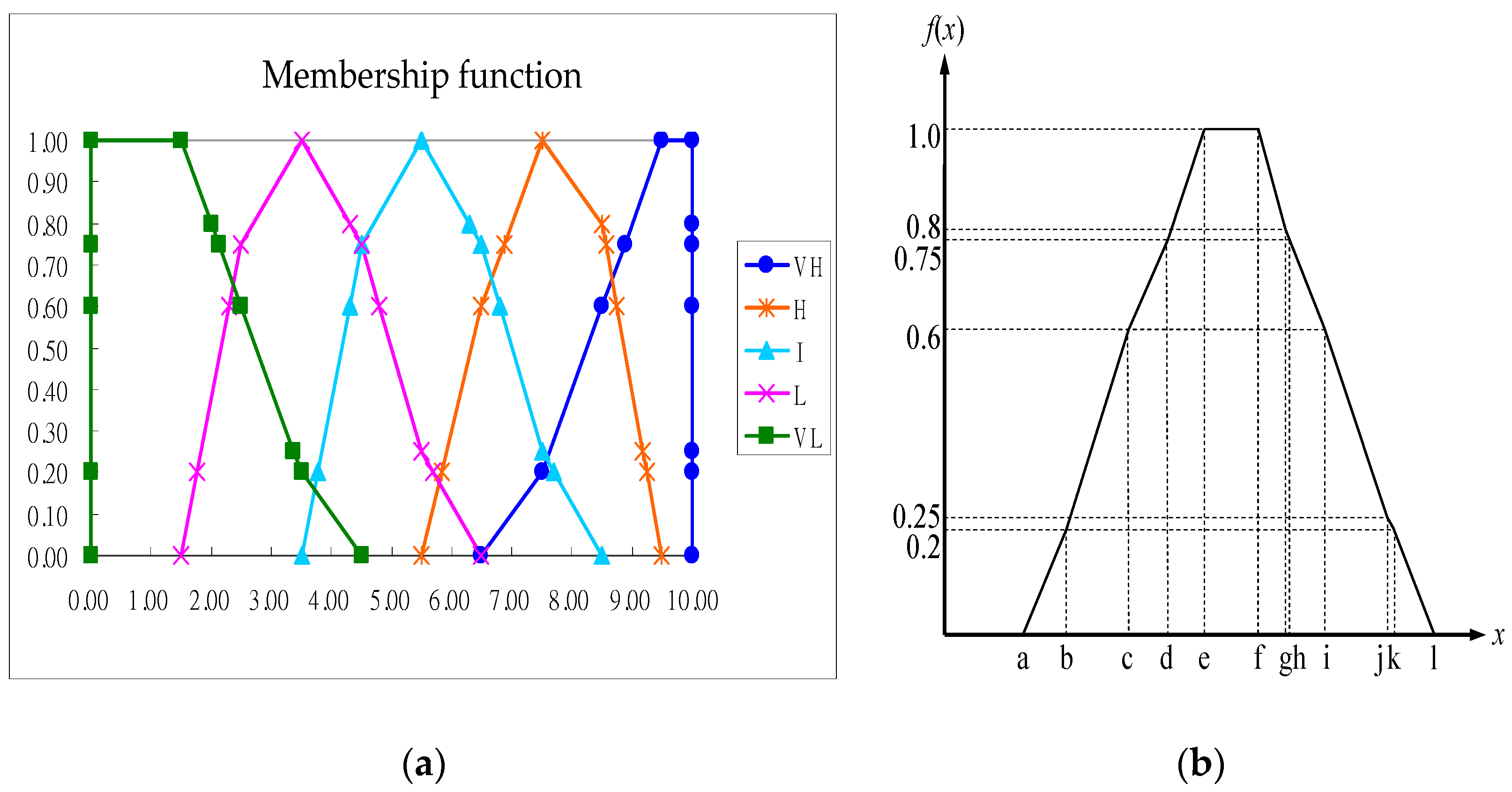

6.1. Determining the Fuzzy Utility Functions

- (1)

- ρ ≥ 0 Conservative (risk-averse nature)

- (2)

- ρ < 0 Adventurous (risk-seeking nature)

- Cost utility function: , where ρ = 0.06.

- Quality utility function: , where ρ = 0.12.

6.2. Evaluating a Committee Members’ Utility of the Bid Commitment

- Solve fuzzy weights relative to the D/C/Q factors

- 2.

- The steps used to determine the difference between the candidate contractors with respect to the D/C/Q fuzzy utility are as follows:

7. Evaluation of Overall Prospect Value of Candidate Contractors

7.1. Calculation of the Posterior Probability of Candidate Contractors

7.2. Evaluation of the Overall Prospect Value of Candidate Contractors

7.3. Selection of the Optimal Contractor

8. Conclusions

Author Contributions

Funding

Conflicts of Interest

Appendix A

| Authors | Weber (1991) [52] | Dickson (1966) [53] | Choi (1996) [54] | Hsu et al. (1998–2012) [55] | Alzober 2014 [56] | Ebrahi-Mi 2016 [57] | Oyatoye 2016 [58] | Chiang 2017 [59] | Hasnain 2018 [27] | Turskis 2019 [20] | Morkunaite 2019 | Maha-Madu 2020 [10] | Koc 2020 [35] | Zhang 2020 [36] | Adoption Factors | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Factors | [26] | [60] | ||||||||||||||

| 1. Plan Management (DF4) | √ | √ | √ | (7) | √ | √ | √ | √ | √ | √ | √ | √ | 18 | |||

| 2. Green Building | (2) | √ | √ | 4 | ||||||||||||

| 3. Building Materials (Capacity)/Equipment Resources QF1) | √ | √ | √ | (3) | √ | √ | √ | √ | √ | √ | √ | √ | √ | 19 | ||

| 4. Comfort and Environment | (2) | √ | √ | 4 | ||||||||||||

| 5. Migration Compensation | (1) | 1 | ||||||||||||||

| 6. Land Equity Conversion | √ | (1) | √ | 3 | ||||||||||||

| 7. Trust Management | (1) | 1 | ||||||||||||||

| 8. Contract Execution Volume (CF1) | √ | √ | √ | (3) | √ | √ | √ | √ | √ | √ | √ | √ | 18 | |||

| 9. Goodwill and Industry’s Greatest Position (CF2) | √ | √ | √ | (1) | √ | √ | √ | √ | √ | √ | √ | 10 | ||||

| 10. Financial Status (Capacity) (DF5) | √ | √ | √ | (6) | √ | √ | √ | √ | √ | √ | √ | √ | √ | 17 | ||

| 11. Historical Performance (CF3) | √ | √ | √ | (4) | √ | √ | √ | √ | √ | √ | √ | √ | √ | √ | √ | 16 |

| 12. After-Sales Service (Service Attitude) (QF2) | √ | √ | √ | (3) | √ | √ | √ | √ | √ | √ | √ | 12 | ||||

| 13. Warranty Period (QF3) | √ | √ | (2) | √ | √ | √ | √ | 8 | ||||||||

| 14. Communication and Coordination with Residents | √ | (1) | 2 | |||||||||||||

| 15. Construction Period or Delivery Capacity (DF6) | √ | √ | √ | (5) | √ | √ | √ | √ | √ | √ | √ | √ | √ | 17 | ||

| 16. Price (Cost) (CF4) | √ | √ | √ | (5) | √ | √ | √ | √ | √ | √ | √ | √ | √ | √ | 18 | |

| 17. Technical Ability (DF1) | √ | √ | (6) | √ | √ | √ | √ | √ | √ | √ | √ | √ | √ | 18 | ||

| 18. Management Organization (Control)(QF4) | √ | √ | √ | √ | √ | √ | √ | √ | √ | √ | √ | 11 | ||||

| 19. Communication Cooperation/Subcontracting Situation (QF5) | √ | √ | √ | (3) | √ | √ | √ | √ | √ | √ | √ | 13 | ||||

| 20. Manufacturer Qualification Manpower (DF2) | √ | √ | √ | (2) | √ | √ | √ | √ | √ | √ | √ | √ | 13 | |||

| 21 Distance (Location) | √ | √ | (1) | 3 | ||||||||||||

| 22. Customer Complaint Procedure | √ | √ | √ | 3 | ||||||||||||

| 23. Past Impressions | √ | √ | √ | √ | √ | 5 | ||||||||||

| 24. Labor Relations (Resolving Conflicts) (DF7) | √ | √ | √ | (1) | √ | √ | √ | √ | 8 | |||||||

| 25. Planning and Control (DF3) | √ | √ | √ | (2) | √ | √ | √ | √ | √ | √ | √ | 12 | ||||

| 26. Performance Record/Project Claim | (2) | √ | √ | √ | 5 | |||||||||||

| 27. Failed Projects | (1) | √ | 2 | |||||||||||||

| 28. Training/Security Management Capabilities | (3) | √ | √ | 5 | ||||||||||||

| 29. Creation/Development Potential | √ | √ | √ | √ | √ | 5 | ||||||||||

| 30. Health and Safety | √ | √ | √ | √ | √ | 5 | ||||||||||

| Number of Items | 19 | 17 | 14 | 6–15 | 18 | 13 | 13 | 12 | 12 | 13 | 12 | 10 | 13 | 18 | 18 | |

Appendix B

| p | Cumulative Density Function (CDF) | Probability Density Function (PDF) | Bayes Relation | Bayes Probability | |||||

|---|---|---|---|---|---|---|---|---|---|

| w(p) | w1(p) | B(p) Weight Effect | w(p) | w1(p) | B(p) Weight Effect | ||||

| 0.66 | 0.5697 | 0.5697 | 1.0001 | 0.0072 | 0.0161 | 2.2354 | 0.9893 | 1 | 0.0473 |

| 0.67 | 0.5769 | 0.5858 | 1.0153 | 0.0073 | 0.0161 | 2.2086 | 0.9880 | 0.9880 | 0.0467 |

| 0.68 | 0.5843 | 0.6019 | 1.0300 | 0.0074 | 0.0161 | 2.1790 | 0.9866 | 0.9747 | 0.0461 |

| 0.69 | 0.5918 | 0.6179 | 1.0441 | 0.0075 | 0.0160 | 2.1467 | 0.9852 | 0.9603 | 0.0454 |

| 0.7 | 0.5994 | 0.6339 | 1.0576 | 0.0076 | 0.0160 | 2.1117 | 0.9837 | 0.9447 | 0.0447 |

| 0.71 | 0.6070 | 0.6498 | 1.0704 | 0.0077 | 0.0159 | 2.0743 | 0.9822 | 0.9279 | 0.0439 |

| 0.72 | 0.6148 | 0.6656 | 1.0826 | 0.0078 | 0.0158 | 2.0343 | 0.9807 | 0.9100 | 0.0430 |

| 0.73 | 0.6227 | 0.6814 | 1.0942 | 0.0079 | 0.0157 | 1.9918 | 0.9791 | 0.8910 | 0.0421 |

| 0.74 | 0.6307 | 0.6970 | 1.1050 | 0.0080 | 0.0156 | 1.9470 | 0.9775 | 0.8710 | 0.0412 |

| 0.75 | 0.6389 | 0.7125 | 1.1152 | 0.0082 | 0.0155 | 1.8998 | 0.9758 | 0.8499 | 0.0402 |

| 0.76 | 0.6472 | 0.7278 | 1.1246 | 0.0083 | 0.0154 | 1.8504 | 0.9740 | 0.8277 | 0.0391 |

| 0.77 | 0.6556 | 0.7430 | 1.1333 | 0.0084 | 0.0152 | 1.7987 | 0.9721 | 0.8046 | 0.0381 |

| 0.78 | 0.6642 | 0.7580 | 1.1412 | 0.0086 | 0.0150 | 1.7450 | 0.9701 | 0.7806 | 0.0369 |

| 0.79 | 0.6730 | 0.7729 | 1.1484 | 0.0088 | 0.0148 | 1.6892 | 0.9680 | 0.7556 | 0.0357 |

| 0.8 | 0.6820 | 0.7875 | 1.1547 | 0.0090 | 0.0146 | 1.6313 | 0.9658 | 0.7298 | 0.0345 |

| 0.81 | 0.6912 | 0.8019 | 1.1602 | 0.0092 | 0.0144 | 1.5715 | 0.9634 | 0.7030 | 0.0332 |

| 0.82 | 0.7005 | 0.8161 | 1.1649 | 0.0094 | 0.0142 | 1.5099 | 0.9608 | 0.6754 | 0.0319 |

| 0.83 | 0.7102 | 0.8300 | 1.1687 | 0.0096 | 0.0139 | 1.4464 | 0.9580 | 0.6470 | 0.0306 |

| 0.84 | 0.7200 | 0.8436 | 1.1716 | 0.0099 | 0.0136 | 1.3812 | 0.9549 | 0.6178 | 0.0292 |

| 0.85 | 0.7302 | 0.8570 | 1.1736 | 0.0102 | 0.0133 | 1.3142 | 0.9515 | 0.5879 | 0.0278 |

| 0.86 | 0.7407 | 0.8700 | 1.1746 | 0.0105 | 0.0130 | 1.2456 | 0.9478 | 0.5572 | 0.0264 |

| 0.87 | 0.7515 | 0.8827 | 1.1747 | 0.0108 | 0.0127 | 1.1753 | 0.9436 | 0.5258 | 0.0249 |

| 0.88 | 0.7627 | 0.8951 | 1.1736 | 0.0112 | 0.0123 | 1.1035 | 0.9389 | 0.4936 | 0.0233 |

| 0.89 | 0.7743 | 0.9070 | 1.1715 | 0.0116 | 0.0120 | 1.0301 | 0.9335 | 0.4608 | 0.0218 |

| 0.9 | 0.7864 | 0.9186 | 1.1681 | 0.0121 | 0.0116 | 0.9552 | 0.9273 | 0.4273 | 0.0202 |

| 0.91 | 0.7990 | 0.9297 | 1.1636 | 0.0126 | 0.0111 | 0.8787 | 0.9199 | 0.3931 | 0.0186 |

| 0.92 | 0.8123 | 0.9403 | 1.1576 | 0.0133 | 0.0106 | 0.8007 | 0.9112 | 0.3582 | 0.0169 |

| 0.93 | 0.8263 | 0.9505 | 1.1502 | 0.0141 | 0.0101 | 0.7210 | 0.9005 | 0.3225 | 0.0153 |

| 0.94 | 0.8413 | 0.9600 | 1.1411 | 0.0150 | 0.0096 | 0.6396 | 0.8870 | 0.2861 | 0.0135 |

| 0.95 | 0.8574 | 0.9690 | 1.1301 | 0.0161 | 0.0090 | 0.5562 | 0.8696 | 0.2488 | 0.0118 |

| 0.96 | 0.8750 | 0.9773 | 1.1169 | 0.0176 | 0.0083 | 0.4705 | 0.8459 | 0.2105 | 0.0100 |

| 0.97 | 0.8946 | 0.9848 | 1.1007 | 0.0196 | 0.0075 | 0.3819 | 0.8117 | 0.1708 | 0.0081 |

| 0.98 | 0.9173 | 0.9913 | 1.0807 | 0.0227 | 0.0066 | 0.2893 | 0.7574 | 0.1294 | 0.0061 |

| 0.99 | 0.9455 | 0.9967 | 1.0541 | 0.0282 | 0.0054 | 0.1897 | 0.6557 | 0.0848 | 0.0040 |

| 1 | 1.0000 | 1.0000 | 1.0000 | 0.0545 | 0.0033 | 0.0611 | 0.3222 | 0.0273 | 0.0013 |

| Overall | 0.4082 | 0.3821 | 21.1433 | 1.0000 | |||||

References

- Mardani, A.; Jusoh, A.; Nor, K.M.; Khalifah, Z.; Zakwan, N.; Valipour, A. Multiple criteria decision-making techniques and their applications—A review of the literature from 2000 to 2014. Econ. Res. Ekonomska Istrazivanja 2015, 28, 510–571. [Google Scholar] [CrossRef]

- Vinogradova, I.; Podvezko, V.; Zavadskas, E.K. The Recalculation of the Weights of Criteria in MCDM Methods Using the Bayes Approach. Symmetry 2018, 10, 205. [Google Scholar] [CrossRef]

- Topcu, V.I. A decision model proposal for construction contractor selection in Turkey. Build. Environ. 2004, 39, 469–481. [Google Scholar] [CrossRef]

- Sergios, L. The use of time and cost utility for construction contract award under European Union Legislation. Build. Environ. 2007, 42, 452–463. [Google Scholar]

- Herrera-Viedma, E.; Herrera, F.; Chiclana, F.; Luque, M. Some issues on consistency of fuzzy preference relations. Eur. J. Oper. Res. 2004, 154, 98–109. [Google Scholar] [CrossRef]

- Cheng, M.Y.; Tsai, H.C.; Chuang, K.H. Supporting international entry decisions for construction firms using fuzzy preference relations and cumulative prospect theory. Expert Syst. Appl. 2011, 38, 15151–15158. [Google Scholar] [CrossRef]

- Aladag, H.; Isik, Z. The Effect of Stakeholder-Associated Risks in Mega-Engineering Projects: A Case Study of a PPP Airport Project. IEEE Trans. Eng. Manag. 2020, 67, 174–186. [Google Scholar] [CrossRef]

- Ulubeyli, S.; Kazaz, A. Fuzzy Multi-criteria Mecision Making Model for Subcontractor Selection in International Construction Projects. TEDE 2016, 22, 210–234. [Google Scholar]

- Pashaei, R.; Moghadam, A.S. Fuzzy AHP Method for Selection of a Suitable Seismic Retrofitting Alternative in Low-Rise Buildings. Civ. Eng. J. 2018, 4, 1074–1086. [Google Scholar] [CrossRef]

- Mahamadu, A.M.; Manu, P.; Mahdjoubi, L.; Booth, C.; Aigbavboa, C.; Abanda, F.H. The importance of BIM capability assessment: An evaluation of post-selection performance of organizations on construction projects. ECAM 2020, 27, 24–48. [Google Scholar] [CrossRef]

- Alpay, S.; Iphar, M. Equipment selection based on two different fuzzy multi criteria decision making methods Fuzzy TOPSIS and fuzzy VIKOR. Open Geosci. 2018, 10, 661–677. [Google Scholar] [CrossRef]

- Revie, M.; Bedford, T.; Walls, L. Supporting Reliability Decisions During Defense Procurement Using a Bayes Linear Methodology. IEEE Trans. Eng. Manag. 2011, 58, 602–673. [Google Scholar] [CrossRef]

- Kahneman, D.; Smith, V. Foundations of Behavioral and Experimental Economics. In Advanced Information on the Prize in Economic Science; The Royal Swedish Academy: Stockholm, Sweden, 2002; pp. 1–25. [Google Scholar]

- Kahneman, D.; Tversky, A. On the psychology of prediction. Am. Psychol. Assoc. 1973, 80, 237–251. [Google Scholar] [CrossRef]

- Al-Nowaihi, A.; Dhami, S. Probability weighting functions. In Encyclopaedia of Operations Research and Management Science; Wiley: Hoboken, NJ, USA, 2011; pp. 1–42. [Google Scholar]

- Kirkwood, C.W. Notes on Attitude toward Risk Taking and the Exponential Utility Function; Department of Management Arizona State University: Tempe, AZ, USA, 1997; pp. 1–23. [Google Scholar]

- Cheng, M.Y.; Kang, S.T. Integrated fuzzy preference relations with decision utilities for construction contractor selection. J. Chin. Inst. Eng. 2012, 35, 1051–1063. [Google Scholar] [CrossRef]

- Antoniou, F.; Aretoulis, G.N. A multi-criteria decision-making support system for choice of method of compensation for highway construction contractors in Greece. Int. J. Constr. Manag. 2019, 19, 492–508. [Google Scholar] [CrossRef]

- Mardani, A.; Jusoh, A.; Halicka, K.; Ejdys, J.; Magruk, A.; Ahmad, U.N.U. Determining the utility in management by using multi-criteria decision support tools: A review. Econ. Res. Ekonomska Istrazivanja 2018, 31, 1666–1716. [Google Scholar] [CrossRef]

- Turskis, Z.; Goranin, N.; Nurusheva, A.; Boranbayev, S. A Fuzzy WASPAS-Based Approach to Determine Critical Information Infrastructures of EU Sustainable Development. Sustainability 2019, 11, 424. [Google Scholar] [CrossRef]

- Liang, R.; Zhang, J.; Wu, C.Z.; Sheng, Z.H.; Wang, X.Y. Joint-Venture Contractor Selection Using Competitive and Collaborative Criteria with Uncertainty. J. Constr. Eng. Manag. 2018, 145, 04018123. [Google Scholar] [CrossRef]

- Keshavarz-Ghorabaee, M.; Amiri, M.; Zavadskas, E.K.; Turskis, Z.; Antucheviciene, J. A Dynamic Fuzzy Approach Based on the EDAS Method for Multi-Criteria Subcontractor Evaluation. Information 2018, 9, 68. [Google Scholar] [CrossRef]

- Davoudabadi, R.; Mousavi, S.M.; Saparauskas, J.; Gitinavard, H. Solving construction project selection problem by a new uncertain weighting and ranking based on compromise solution with linear assignment approach. JCEM 2019, 25, 241–251. [Google Scholar] [CrossRef]

- Jato-Espino, D.; Castillo-Lopez, E.; Rodriguez-Hernandez, J.; Canteras-Jordana, J.C. A review of application of multi-criteria decision making methods in construction. Autom. Constr. 2014, 45, 151–152. [Google Scholar] [CrossRef]

- Ilce, A.C.; Ozkaya, K. An integrated intelligent system for construction industry: A case study of raised floor material. Technol. Econ. Dev. Econ. 2018, 24, 1866–1884. [Google Scholar] [CrossRef]

- Morkunaite, Z.; Bausys, R.; Zavadskas, E.K. Contractor Selection for Sgraffito Decoration of Cultural Heritage Buildings Using the WASPAS-SVNS Method. Sustainability 2019, 11, 6444. [Google Scholar] [CrossRef]

- Hasnain, M.; Thaheem, M.J.; Ullah, F. Best Value Contractor Selection in Road Construction Projects: ANP-Based Decision Support System. Int. J. Civ. Eng. 2018, 16, 695–714. [Google Scholar] [CrossRef]

- Stanujkic, D.; Zavadskas, E.K.; Liu, S.; Karabasevic, D.; Popovic, G. Improved OCRA Method Based on the Use of Interval Grey Numbers. J. Grey Syst. 2017, 29, 49–60. [Google Scholar]

- Khanzadi, M.; Turskis, Z.; Amiri, G.G.; Chalekaee, A. A model of discrete zero-sum two-person matrix games with grey numbers to solve dispute resolution problems in construction. J. Civ. Eng. Manag. 2017, 23, 824–835. [Google Scholar] [CrossRef]

- Cao, Q.; Esangbedo, M.O.; Bai, S.; Esangbed, C.O. Grey SWARA-FUCOM Weighting Method for Contractor Selection MCDM Problem: A Case Study of Floating Solar Panel Energy System Installation. Energies 2019, 12, 2481. [Google Scholar] [CrossRef]

- Morkunaite, Z.; Podvezko, V.; Zavadskas, E.K.; Bausys, R. Contractor selection for renovation of cultural heritage buildings by PROMETHEE method. Arch. Civ. Mech. Eng. 2019, 19, 1056–1071. [Google Scholar] [CrossRef]

- Gunduz, M.; Alfar, M. Integration of Innovation through Analytical Hierarchy Process (AHP) in Project Management and Planning. Technol. Econ. Dev. Econ. 2019, 25, 258–276. [Google Scholar] [CrossRef]

- Mokhtariani, M.; Sebt, M.H.; Davoudpour, H. Construction Marketing: Developing a Reference Framework. Adv. Civ. Eng. 2017, 2017, 7548905. [Google Scholar] [CrossRef]

- Ferrieia, J.; Pinheiro, M.D.; Brito, J.D. Refurbishment decision support tools: A review from a Portuguese user’s perspective. Constr. Build. Technol. 2013, 49, 425–447. [Google Scholar] [CrossRef]

- Koc, K.; Gurgun, A.P. Contractor prequalification for green buildings—Evidence from Turkey. Eng. Constr. Archit. Manag. 2020. [Google Scholar] [CrossRef]

- Zhang, Y. Construction of Bid Evaluation Index System in Government Public Project Green Procurement in China Based on D-S Evidence Theory. Sustainability 2020, 12, 651. [Google Scholar] [CrossRef]

- Ye, K.H.; Zeng, D.; Wong, J. Competition rule of the multi-criteria approach: What contractors in China really want? J. Civ. Eng. Manag. 2018, 24, 155–166. [Google Scholar] [CrossRef]

- Ortiz, O.I.; Pellicer, E.; Molenaar, K.R. Management of time and cost contingencies in construction projects: A contractor perspective. J. Civ. Eng. Manag. 2018, 24, 254–264. [Google Scholar] [CrossRef]

- Saaty, T.L. Fundamentals of Decision Making and Priority Theory with the AHP; RWS Publications: Pittsburgh, PA, USA, 2000; pp. 15–35. [Google Scholar]

- Tanino, T. Fuzzy preference orderings in group decision making. Fuzzy Sets Syst. 1984, 12, 117–131. [Google Scholar] [CrossRef]

- Triantaphyllou, E. Multi-Criteria Decision Making Methods: A Comparative Study; Kluwer Academic Publishers: Dordrecht, The Netherlands, 2000; pp. 5–21. [Google Scholar]

- Chiclana, F.; Herrera, F.; Herrera-Viedma, E. Integrating three representation models in fuzzy multipurpose decision making based on fuzzy preference relations. Fuzzy Sets Syst. 1998, 97, 33–48. [Google Scholar] [CrossRef]

- Tanino, T. Fuzzy preference relations in group decision making. In Non-Conventional Preference Relations in Decision Making; Kacprzyk, J., Roubens, M., Eds.; Springer: Berlin/Heidelberg, Germany, 1988; pp. 54–71. [Google Scholar]

- Ng, S.T.; Skitmore, R.M. Client and consultant perspectives of prequalification criteria. Build. Environ. 1999, 34, 607–621. [Google Scholar] [CrossRef]

- Bayes, T. An Essay towards solving a Problem in the Doctrine of Changes. Philos. Trans. R. Soc. Lond. 1763, 53, 370–418. [Google Scholar]

- Leśniak, A.; Janowiec, F. Risk Assessment of Additional Works in Railway Construction Investments Using the Bayes Network. Sustainability 2019, 11, 5388. [Google Scholar] [CrossRef]

- Kahneman, D.; Tversky, A. Prospect theory: An analysis of decision under risk. Econometrica 1979, 47, 263–291. [Google Scholar] [CrossRef]

- Tversky, A.; Kahneman, D. Advances in Prospect Theory: Cumulative Representation of Uncertainty. J. Risk Uncertain. 1992, 5, 297–323. [Google Scholar] [CrossRef]

- Prelec, D. The probability weighting function. Econometrica 1998, 66, 497–527. [Google Scholar] [CrossRef]

- Ling, F.Y.Y. Key determinants of performance of design-bid-build projects in Singapore. Build. Res. Inf. 2004, 32, 128–139. [Google Scholar] [CrossRef]

- Best, R.; Langston, C. Evaluation of construction contractor performance: A critical analysis of some recent research. Constr. Manag. Econ. 2006, 24, 439–445. [Google Scholar] [CrossRef]

- Weber, C.A.; Current, J.R.; Benton, W.C. Vendor selection criteria and methods. Eur. J. Oper. Res. 1991, 50, 2–18. [Google Scholar] [CrossRef]

- Dickson, G.W. An Analysis Of Vendor Selection Systems And Decisions. J. Supply Chain Manag. 1966, 2, 5–17. [Google Scholar] [CrossRef]

- Choi, T.; Hartley, J.L. An exploration of supplier selection practices across the supply chain. J. Oper. Manag. 1996, 14, 333–343. [Google Scholar] [CrossRef]

- Hsu, C.H.; Liang, G.S. Constructing Performance Evaluation Model of Suppliers’ Purchase in Green Supply Chain. Marit. Q. 2011, 20, 71–84. [Google Scholar]

- Alzober, W.; Yaakub, A.R. Integrated Model for Selection the Prequalification Criteria of Contractor. Lect. Notes Softw. Eng. 2014, 2, 233–237. [Google Scholar] [CrossRef]

- Ebrahimi, A.; Alimohammadlou, M.; Mohammadi, S. Identification and prioritization of effective factors in assessment and ranking of contractors using fuzzy multi-criteria techniques. Decis. Sci. Lett. 2016, 5, 95–108. [Google Scholar] [CrossRef]

- Oyatoye, E.O.; Odulana, A.A. A Prototype AHP System for Contractor Selection Decision; Data Analytics for Audit; IntechOpen: London, UK, 2016. [Google Scholar]

- Chiang, F.Y.; Yu, V.F.; Luarn, P. Construction Contractor Selection in Taiwan Using AHP. Int. J. Eng. Technol. 2017, 9, 211–215. [Google Scholar] [CrossRef][Green Version]

- Morkunaite, Z.; Podvezko, V. Criteria Evaluation for Contractor Selection in Cultural Heritage Projects Using Multiple Criteria Approach. In Proceedings of the 17th International Colloquium on Sustainable Decisions in Built Environment, Vilnius, Lithuania, 15–16 May 2019. [Google Scholar]

- Chiclana, F.; Herrera, F.; Herrera, V.E. Integrating multiplicative preference relations in a multipurpose decision making model based on fuzzy preference relations. Fuzzy Sets Syst. 2001, 112, 277–291. [Google Scholar] [CrossRef]

- Wang, T.H.; Chang, T.H. Forecasting the Probability of Successful Knowledge Management by Consistent Fuzzy Preference Relations. Expert Syst. Appl. 2007, 32, 801–813. [Google Scholar] [CrossRef]

- Patiniotakis, I.; Apostolou, D.; Mentzas, G. Fuzzy UTASTAR: A method for discovering utility functions from fuzzy data. Expert Syst. Appl. 2011, 38, 15463–15474. [Google Scholar] [CrossRef]

- Cheng, M.Y.; Ko, C.H. Automated Safety Monitoring and Diagnosis System for Unstable Slopes. Comput. Aided Civ. Infrastruct. Eng. 2003, 18, 64–77. [Google Scholar] [CrossRef]

- Laarhoven, P.J.; Pedrycz, M. A fuzzy extension of Saaty’s priority theory. Fuzzy Sets Syst. 1983, 2, 229–241. [Google Scholar] [CrossRef]

- Cheng, M.Y.; Hsiang, C.L. Bidding Decision Model Based on Prospect Theory and Game Theory. Adv. Mater. Res. 2013, 723, 951–959. [Google Scholar] [CrossRef]

| No | Authors | Year | Methods and Approaches |

|---|---|---|---|

| 1 | Revie and Bedford [12] | 2011 | DM and Bayes linear method (defense procuring) |

| 2 | Ferrieia, Pinheiro and Brito [34] | 2011 | Refurbishment decision support tools: A review from a Portuguese user’s perspective |

| 3 | Jato-Espino, Castillo-Lopez, Rodriguez-Hernandez and Canteras-Jordana [24] | 2014 | A Review —AHP, TOPSIS … 22 methods (Construction) |

| 4 | Mardani, Jusoh, Nor, Khalifah, Zakwan and Valipour [1] | 2015 | A Review —AHP (32.57%), Hybrid MCDM (16.28%) Aggregation DM method (11.7%) —4.TOPIS, 5.ELECTRE, 6.ANP, 7.PROMETHEE |

| 5 | Ulubeyli and Kazaz [8] | 2016 | Fuzzy MCDM and CoSMo (subcontractor selection in international construction) |

| 6 | Stanujkic, Zavadskas, Liu, Karabasevic and Popovic [28] | 2017 | OCRA and Grey (ranking order) (investment in the most appropriate type of hotels) |

| 7 | Khanzadi, Turskis, Amiri and Chalekaee [29] | 2017 | Game theory, ADR, grey number (solve dispute resolution problems in construction) |

| 8 | Mokhtariani, Sebt and Davoudpour [33] | 2017 | Cultural heritage Building renovation —Construction marketing —Attribute Analysis: Service attributes versus construction |

| 9 | Pashaei and Moghadam [9] | 2018 | Fuzzy AHP Method (Alternative in Low-Rise Buildings) |

| 10 | Ilce and Ozkaya [25] | 2018 | AHP and MOORA methods (the raised floor choice practice consists) |

| 11 | Mardani, Jusoh, Halicka, Ejdys, Magruk and Ahmad [19] | 2018 | A review MCDM —MOORA, COPRAS, ARAS, WASPAS, SWARA —classified into 10 areas: (1) energy source, (2) buildings, (3) material, (4) project management, (5) construction management, … |

| 12 | Hasnain, Thaheem and Ullah [27] | 2018 | ANP-Based Decision Support System —Analytical network process (ANP) (Contractor Selection in Road Construction) |

| 13 | Liang, Zhang, Wu, Sheng and Wang, [21] | 2018 | Using Competitive and Collaborative Criteria with Uncertainty (Joint-Venture Contractor Selection) |

| 14 | Alpay and Iphar [11] | 2018 | fuzzy multi-criteria decision-making methods —Fuzzy TOPSIS and fuzzy VIKOR (Equipment selection) |

| 15 | Keshavarz-Ghorabaee, Amiri, Zavadskas, Turskis and Antucheviciene [22] | 2018 | A Dynamic Fuzzy Approach Based on the EDAS Method for Multi-Criteria Subcontractor Evaluation —Fuzzy EDAS (MCDM Subcontractor Evaluation) |

| 16 | Ye, Zeng and Wong [37] | 2018 | Competition rule of the multi-criteria approach —34 tender evaluation factors are proposed to compose the competition rule in China —The composition varies slightly between public and private sectors |

| 17 | Ortiz, Pellicer and Molenaar [38] | 2018 | Management of time and cost contingencies in construction projects: a contractor perspective (a case study of two large Spanish construction companies) |

| 18 | Cao, Esangbedo, Bai and Esangbed [30] | 2019 | Contractor Selection MCDM Problem Grey —SWARA-FUCOM Weighting Method (Floating Solar Panel Energy System Installation) |

| 19 | Turskis, Goranin, Nurusheva and Boranbayev [20] | 2019 | Fuzzy WASPAS and AHP methods (Determine Critical Information Infrastructures of EU Sustainable Development) |

| 20 | Antoniou and Aretoulis [18] | 2019 | TOPSIS and utility theory (highway construction contractors) |

| 21 | Morkunaite, Bausys and Zavadskas [26] | 2019 | WASPAS-SVNS Method (Contractor Selection for Sgraffito Decoration of Cultural Heritage Buildings) |

| 22 | Gunduz and Alfar [32] | 2019 | AHP Method (Innovation in project management) |

| 23 | Morkunaite, Podvezko, Zavadskas and Bausys [31] | 2019 | AHP, PROMETHEE(Ranking) (Contractor selection by Cultural heritage buildings) |

| 24 | Davoudabadi, Mousavi, Shaparauskas and Gitinavard [23] | 2019 | a new uncertain weighting and ranking based on compromise solution with linear assignment approach —Interval-valued intuitionistic fuzzy sets (IVIFSs) —Ranking (in energy projects—A case study about the construction project selection problem) |

| 25 | Aladag and Isik [7] | 2020 | Fuzzy AHP Method (BOT project—A case study of a PPP airport project) |

| 26 | Mahamadu, Manu, Mahdjoubi, Booth, Aigbavboa and Abanda [10] | 2020 | Fuzzy TOPSIS (BIM capability assessment: Post-selection performance of organizations on construction projects) |

| 27 | Koc and Gurgun [35] | 2020 | AH P, MCDM (Contractor prequalification for green buildings—Evidence from Turkey) |

| 28 | Zhang [36] | 2020 | AHP, D-S Evidence Theory (Construction in Government public project green procurement in China) |

| Item | Influence Factors | No. |

|---|---|---|

| Duration |

| DF1 DF2 DF3 DF4 DF5 DF6 DF7 |

| Cost |

| CF1 CF2 CF3 CF4 |

| Quality |

| QF1 QF2 QF3 QF4 QF5 |

| Linguist Variables | Very Low | Low to Very Low | Low | Fair to Low | Fair | Fair to High | High | High to Very High | Very High |

|---|---|---|---|---|---|---|---|---|---|

| Symbol | VL | LVL | L | FL | F | FH | H | HVH | VH |

| Quantitative value | 1/5 | 1/4 | 1/3 | 1/2 | 1 | 2 | 3 | 4 | 5 |

| q(df)ij | DF1 | DF2 | DF3 | DF4 | DF5 | DF6 | DF7 | Sum Σq(df)ij | Relative Weights r(df)i |

|---|---|---|---|---|---|---|---|---|---|

| DF1 | 0.20 | 0.18 | 0.17 | 0.18 | 0.19 | 0.19 | 0.17 | 1.29 | 0.18 |

| DF2 | 0.12 | 0.13 | 0.13 | 0.13 | 0.12 | 0.13 | 0.13 | 0.89 | 0.13 |

| DF3 | 0.10 | 0.11 | 0.12 | 0.11 | 0.10 | 0.11 | 0.12 | 0.77 | 0.11 |

| DF4 | 0.15 | 0.15 | 0.15 | 0.15 | 0.15 | 0.15 | 0.15 | 1.03 | 0.15 |

| DF5 | 0.18 | 0.16 | 0.16 | 0.17 | 0.17 | 0.17 | 0.16 | 1.18 | 0.16 |

| DF6 | 0.16 | 0.16 | 0.16 | 0.16 | 0.16 | 0.16 | 0.15 | 1.11 | 0.16 |

| DF7 | 0.09 | 0.11 | 0.11 | 0.11 | 0.10 | 0.10 | 0.11 | 0.74 | 0.11 |

| Overall | 7.00 | 1.00 |

| Duration Factor | S | Linguist Variables | F | E1 | E2 | E3 | E4 | E5 | E6 | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| VH | HVH | H | FH | F | FL | L | LVL | VL | F | F | F | F | F | F | |||||

| DF1 | Success Implementation | v | Failure Implementation | DF1 | S | 5 | 4 | 4 | 3 | 3 | 4 | ||||||||

| DF2 | v | DF2 | S | 4 | 5 | 4 | 4 | 3 | 3 | ||||||||||

| DF3 | v | DF3 | S | 3 | 3 | 3 | 3 | 3 | 3 | ||||||||||

| DF4 | v | DF4 | S | 5 | 4 | 5 | 4 | 5 | 3 | ||||||||||

| DF5 | v | DF5 | S | 3 | 5 | 3 | 3 | 5 | 3 | ||||||||||

| DF6 | v | DF6 | S | 4 | 3 | 5 | 4 | 4 | 3 | ||||||||||

| DF7 | v | DF7 | S | 3 | 5 | 4 | 5 | 4 | 4 | ||||||||||

| E1 | E2 | E3 | E4 | E5 | E6 | Average | ||

|---|---|---|---|---|---|---|---|---|

| F | F | F | F | F | F | cdsk | ||

| DF1 | S | 1.00 | 0.93 | 0.93 | 0.84 | 0.84 | 0.93 | 0.91 |

| DF2 | S | 0.93 | 1.00 | 0.93 | 0.93 | 0.84 | 0.84 | 0.91 |

| DF3 | S | 0.84 | 0.84 | 0.84 | 0.84 | 0.84 | 0.84 | 0.84 |

| DF4 | S | 1.00 | 0.93 | 1.00 | 0.93 | 1.00 | 0.84 | 0.95 |

| DF5 | S | 0.84 | 1.00 | 0.84 | 0.84 | 1.00 | 0.84 | 0.89 |

| DF6 | S | 0.93 | 0.84 | 1.00 | 0.93 | 0.93 | 0.84 | 0.91 |

| DF7 | S | 0.84 | 1.00 | 0.93 | 1.00 | 0.93 | 0.93 | 0.94 |

| Success | Failure | S | F | Sum | Evaluating Value | ||||

|---|---|---|---|---|---|---|---|---|---|

| DF1 | Success | 0.50 | 0.91 | DF1 | S | 0.91 | 0.65 | 1.55 | 0.78 |

| Failure | 0.05 | 0.50 | F | 0.09 | 0.35 | 0.45 | 0.22 | ||

| Overall | 0.55 | 1.41 | Overall | 2.0 | |||||

| DF2 | Success | 0.50 | 0.91 | DF2 | S | 0.91 | 0.65 | 1.55 | 0.78 |

| Failure | 0.05 | 0.50 | F | 0.09 | 0.35 | 0.45 | 0.22 | ||

| Overall | 0.55 | 1.41 | Overall | 2.00 | |||||

| DF3 | Success | 0.50 | 0.84 | DF3 | S | 0.76 | 0.63 | 1.38 | 0.69 |

| Failure | 0.16 | 0.50 | F | 0.24 | 0.37 | 0.62 | 0.31 | ||

| Overall | 0.66 | 1.34 | Overall | 2.00 | |||||

| DF4 | Success | 0.50 | 0.95 | DF4 | S | 0.96 | 0.66 | 1.62 | 0.81 |

| Failure | 0.02 | 0.50 | F | 0.04 | 0.34 | 0.38 | 0.19 | ||

| Overall | 0.52 | 1.45 | Overall | 2.00 | 1.00 | ||||

| DF5 | Success | 0.50 | 0.89 | DF5 | S | 0.82 | 0.64 | 1.46 | 0.73 |

| Failure | 0.11 | 0.50 | F | 0.18 | 0.36 | 0.54 | 0.27 | ||

| Overall | 0.61 | 1.39 | Overall | 2.00 | 1.00 | ||||

| DF6 | Success | 0.50 | 0.91 | DF6 | S | 0.86 | 0.65 | 1.51 | 0.75 |

| Failure | 0.08 | 0.50 | F | 0.14 | 0.35 | 0.49 | 0.25 | ||

| Overall | 0.58 | 1.41 | Overall | 2.00 | 1.00 | ||||

| DF7 | Success | 0.50 | 0.94 | DF7 | S | 0.79 | 0.65 | 1.45 | 0.72 |

| Failure | 0.13 | 0.50 | F | 0.21 | 0.35 | 0.55 | 0.28 | ||

| Overall | 0.63 | 1.44 | Overall | 2.00 | 1.00 | ||||

| Duration Commitment Section | Cost Commitment Section | Quality Commitment Section | ||||||

|---|---|---|---|---|---|---|---|---|

| Influence Factor | Relative Weights | Success Implementation (s) | Influence Factor | Relative Weights | Success Implementation (s) | Influence Factor | Relative Weights | Success Implementation (s) |

| DF1 | 0.18 | 0.78 | CF1 | 0.30 | 0.70 | QF1 | 0.27 | 0.72 |

| DF2 | 0.13 | 0.78 | CF2 | 0.24 | 0.67 | QF2 | 0.17 | 0.74 |

| DF3 | 0.11 | 0.69 | CF3 | 0.23 | 0.63 | QF3 | 0.14 | 0.74 |

| DF4 | 0.15 | 0.81 | CF4 | 0.23 | 0.73 | QF4 | 0.20 | 0.74 |

| DF5 | 0.16 | 0.73 | QF5 | 0.22 | 0.69 | |||

| DF6 | 0.16 | 0.76 | ||||||

| DF7 | 0.11 | 0.72 | ||||||

| Success robability (pds) | 0.76 | Success probability (pcs) | 0.68 | Success probability (pqs) | 0.72 | |||

| Factors | Duration | Cost | Quality |

|---|---|---|---|

| Duration (W1j) | (1,1,1) | (1.2,1.3,1.4) | (1.1,1.2,1.3) |

| Cost (W2j) | (0.5,0.6,0.7) | (1,1,1) | (0.67,1,1.49) |

| Quality (W3j) | (0.45,0.55,0.65) | (0.67,1,1.5) | (1,1,1) |

| Linguistic Variables | The Fuzzy Number (X) | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| a | b | c | d | e | f | g | h | i | j | k | l | |

| VH | 6.50 | 7.50 | 8.50 | 8.88 | 9.50 | 10.00 | 10.00 | 10.00 | 10.00 | 10.00 | 10.00 | 10.00 |

| H | 5.50 | 5.83 | 6.50 | 6.88 | 7.50 | 7.50 | 8.50 | 8.56 | 8.75 | 9.19 | 9.25 | 9.50 |

| I | 3.50 | 3.77 | 4.30 | 4.50 | 5.50 | 5.50 | 6.30 | 6.50 | 6.80 | 7.50 | 7.70 | 8.50 |

| L | 1.50 | 1.77 | 2.30 | 2.50 | 3.50 | 3.50 | 4.30 | 4.50 | 4.80 | 5.50 | 5.70 | 6.50 |

| VL | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 1.50 | 2.00 | 2.13 | 2.50 | 3.38 | 3.50 | 4.50 |

| The Experts Filled in Linguistic Variables [VH, L, VH, I, H] | ||||||||||||

| SUM | 23.50 | 26.37 | 30.10 | 31.63 | 35.50 | 36.50 | 39.10 | 39.56 | 40.35 | 42.19 | 42.65 | 44.50 |

| Aggregated | 4.70 | 5.27 | 6.02 | 6.33 | 7.10 | 7.30 | 7.82 | 7.91 | 8.07 | 8.44 | 8.53 | 8.90 |

| Candidate Contractor | Bid Duration (months) | Bid Cost (TWD) | Duration Discount (dj) (%) | Cost Discount (cj) (%) | Quality Assurance (qj) (%) |

|---|---|---|---|---|---|

| A | 37 | 177,072,000 | - | - | - |

| B | 36 | 173,121,000 | 7.83 | 15.69 | 10.95 |

| C | 40 | 170,884,000 | −5.49 | 15.69 | 5.68 |

| D | 34 | 178,937,000 | 9.43 | −10.43 | 4.16 |

| E | 37 | 175,393,000 | 4.16 | 9.43 | 5.68 |

| Candidate Contractor | Duration Discount (dj) (%) | Duration Utility (Ud) | Cost Discount (cj) (%) | Cost Utility (UC) | Quality Assurance (qj) (%) | Quality Utility (Uq) | Overall Utility Value (TU) |

|---|---|---|---|---|---|---|---|

| A | 26.20 | 735 | 11.30 | 848 | 18.80 | 791 | 785.7 |

| B | 28.25 | 762 | 13.07 | 887 | 20.86 | 824 | 818.1 |

| C | 24.76 | 715 | 13.07 | 887 | 19.87 | 809 | 794.8 |

| D | 28.67 | 767 | 10.12 | 815 | 19.58 | 791 | 788.6 |

| E | 27.29 | 750 | 12.37 | 873 | 19.87 | 791 | 799.3 |

| Candidate Contractor | Duration | Cost | Quality | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Success Possibility (pds) | Prior Probability (1) | Posterior Probability (2) | Success Possibility (pcs) | Prior Probability (1) | Posterior Probability (2) | Success Possibility (pqs) | Prior Probability (1) | Posterior Probability (2) | |

| A | 0.76 | 0.65 | 0.76 | 0.68 | 0.58 | 0.60 | 0.72 | 0.61 | 0.66 |

| B | 0.61 | 0.53 | 0.53 | 0.60 | 0.53 | 0.53 | 0.61 | 0.53 | 0.53 |

| C | 0.83 | 0.71 | 0.83 | 0.50 | 0.46 | 0.46 | 0.67 | 0.58 | 0.60 |

| D | 0.50 | 0.46 | 0.46 | 0.83 | 0.71 | 0.83 | 0.67 | 0.58 | 0.60 |

| E | 0.76 | 0.65 | 0.76 | 0.69 | 0.59 | 0.62 | 0.67 | 0.58 | 0.60 |

| Candidate Contractor | Duration | Cost | Quality | ||||||

|---|---|---|---|---|---|---|---|---|---|

| A | 735 | 0.76 | 558.6 | 848 | 0.60 | 508.8 | 791 | 0.66 | 522.1 |

| B | 762 | 0.53 | 403.9 | 887 | 0.53 | 470.1 | 824 | 0.53 | 436.7 |

| C | 715 | 0.83 | 593.4 | 887 | 0.46 | 408.0 | 887 | 0.59 | 477.3 |

| D | 767 | 0.46 | 352.8 | 815 | 0.83 | 676.4 | 815 | 0.59 | 466.7 |

| E | 750 | 0.76 | 570.0 | 873 | 0.62 | 541.3 | 873 | 0.59 | 466.7 |

| Candidate Contractor | The Lowest Bid | MCDM | MCPM | BFPM | ||||

|---|---|---|---|---|---|---|---|---|

| Overall Utility | ||||||||

| Cost Discount | Rank | UtilityValue | Rank | Prospect Value | Rank | Prospect Value | Rank | |

| A | 11.30% | 4 | 785.7 | 5 | 483.4 | 2 | 532.8 | 1 |

| B | 13.07% | 1 | 818.1 | 1 | 433.6 | 5 | 433.6 | 5 |

| C | 13.07% | 1 | 794.8 | 3 | 466.2 | 3 | 503.0 | 3 |

| D | 10.12% | 5 | 788.6 | 4 | 452.4 | 4 | 484.2 | 4 |

| E | 12.37% | 3 | 799.3 | 2 | 487.3 | 1 | 530.8 | 2 |

| Gap (%) | 2.95% | 32.4 (4.12%) | 53.7 (12.38%) | 99.2 (22.87%) | ||||

| (%) | - | 71.9% | 39.3% | 30.04% | ||||

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Cheng, M.-Y.; Yeh, S.-H.; Chang, W.-C. Multi-Criteria Decision Making of Contractor Selection in Mass Rapid Transit Station Development Using Bayesian Fuzzy Prospect Model. Sustainability 2020, 12, 4606. https://doi.org/10.3390/su12114606

Cheng M-Y, Yeh S-H, Chang W-C. Multi-Criteria Decision Making of Contractor Selection in Mass Rapid Transit Station Development Using Bayesian Fuzzy Prospect Model. Sustainability. 2020; 12(11):4606. https://doi.org/10.3390/su12114606

Chicago/Turabian StyleCheng, Min-Yuan, Shu-Hua Yeh, and Woei-Chyi Chang. 2020. "Multi-Criteria Decision Making of Contractor Selection in Mass Rapid Transit Station Development Using Bayesian Fuzzy Prospect Model" Sustainability 12, no. 11: 4606. https://doi.org/10.3390/su12114606

APA StyleCheng, M.-Y., Yeh, S.-H., & Chang, W.-C. (2020). Multi-Criteria Decision Making of Contractor Selection in Mass Rapid Transit Station Development Using Bayesian Fuzzy Prospect Model. Sustainability, 12(11), 4606. https://doi.org/10.3390/su12114606