Green Co-Creation Strategies among Supply Chain Partners: A Value Co-Creation Perspective

Abstract

1. Introduction

2. Literature Review

2.1. Cooperation in a Green Supply Chain

2.2. Value Co-Creation

3. The Model

- p > c > s > 0. This condition indicates that all participants in the supply chain (including suppliers, manufacturers, and retailers) have positive profit margins in the production of raw materials, the manufacture of products, and the final sale. In addition, the production cost is greater than the discounted price, which means that some losses will occur if the product is not sold at full price;

- According to the purchase behavior of customers, the whole sales process is divided into two stages: normal sales stage and discount sales stage. Enterprises sell at regular prices in the normal sales stage and at discount prices in the discount sales stage. Assume that the remaining products that are not sold in the normal sales phase can always be sold in the discount sales phase;

- The product shortage costs of suppliers, manufacturers and retailers are not considered in this study, and all of the suppliers, manufacturers and retailers are risk-neutral and completely rational;

- This paper only considers the value co-creation under the carbon emission quota policy, and there is no carbon emission trading between enterprises in the supply chain;

- This paper only considers the carbon emissions of manufacturers and suppliers in the production of raw materials and products, because the carbon emissions in the production process are the main source of carbon emissions;

- This paper assumes that suppliers and manufacturers can reduce the carbon emission per unit product through investment in green technology, thus reducing the cost of carbon emission.

4. Analysis

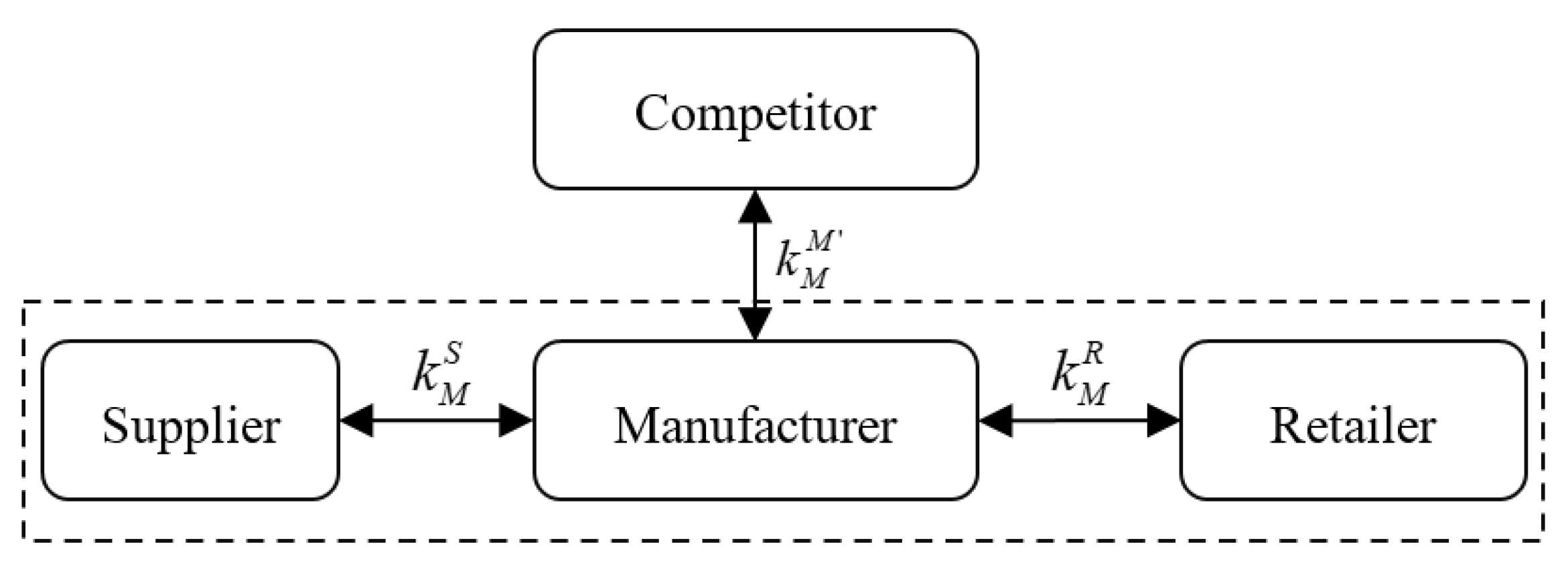

4.1. Value Co-Creation between Manufacturers

4.1.1. The Profit Function after Value Co-Creation (S, M)

4.1.2. Feasible Interval

4.1.3. Feasible Interval

- (1)

- When the manufacturer’s share, the maximum of the sum of their profits after co-creation occurred;

- (2)

- When the allocation proportion is less than this value of extreme point, if the manufacturer increases the proportion of investment, the sum of their profits will increase;

- (3)

- When the allocation proportion is more than this value of extreme point, if the manufacturer increases the proportion of investment, the sum of their profits will decrease.

4.2. Value Co-Creation between Manufacturers

4.2.1. The Profit Function after Value Co-Creation (M, M′)

4.2.2. Feasible Interval

4.2.3. Extreme Point

- (1)

- When the manufacturer’s sharethe maximum of the sum of their profits after co-creation occurred;

- (2)

- When the allocation proportion is less than this value of extreme point, if the manufacturer M increases the proportion of investment, the sum of their profits will increase;

- (3)

- When the allocation proportion is more than this value of extreme point, if the manufacturer M increases the proportion of investment, the sum of their profits will decrease.

4.3. Value Co-Creation between Manufacturer and Retailer

4.3.1. The Profit Function after Value Co-Creation (M, R)

4.3.2. Feasible Interval

4.3.3. Extreme Point

- (1)

- When the manufacturer’s sharethe maximum of the sum of their profits after co-creation occurred;

- (2)

- When the allocation proportion is less than this value of extreme point, if the manufacturer M increases the proportion of investment, the sum of their profits will increase;

- (3)

- When the allocation proportion is more than this value of extreme point, if the manufacturer M increases the proportion of investment, the sum of their profits will decrease.

5. Numerical Study

5.1. Description of Scenario

5.2. Sample Selection

5.3. Results and Analysis

6. Discussions and Conclusions

6.1. Summary and Discussion

- Value co-creation between the manufacture and its supplierCombined with the actual operational, we assume that when the manufacturer M and its supplier S implement value co-creation, it may affect the output, price and carbon tax of both parties. They can share the green investment with a certain proportion of k (i.e., the function of the change index of sales volume ) to achieve the maximum value. In addition, we confirm that when k belongs to a certain range (i.e., determining by the total profit of selling q products without discount, the unit discount amount for each product in the case of discount, the total discount amount for selling q products in the case of discount and the fixed coefficients of M and S), value co-creation strategy has a positive impact on the interests of the supplier and the manufacturer;

- Value co-creation between the manufacture and its competitorIn addition to cooperation with upstream suppliers, it can also carry out technical cooperation with firms in the same industry to improve their competitive advantages. Therefore, we consider the situation that the manufacturer M and its competitor M′ co-create to share the green investment. Similarly, through value co-creation, the sales price, output and green investment cost of both firms could be affected. If the allocation ratio k (i.e., the function of the change index of sales volume ) is controlled within a reasonable range (i.e., determining by the total profit of selling q products without discount, the unit discount amount for each product in the case of discount, the total discount amount for selling q products in the case of discount and the fixed coefficients of M and M′), it can give full play to the advantages of value co-creation;

- Value co-creation between the manufacture and its retailerThe retailer is the company closest to the customer. The value co-creation between the manufacturer M and its retailer R can not only obtain consumer information, but also share the green cost with retailers, so as to meet the needs of customers to the greatest extent with minimum cost. Through mathematical derivation, we confirm the positive effect of value co-creation on the profits of manufacturers and retailers (i.e., the function of the change index of sales volume θM).

6.2. Implications

6.3. Limitations and Future Researches

Author Contributions

Funding

Conflicts of Interest

References

- Kusi-Sarpong, S.; Bai, C.; Sarkis, J.; Wang, X. Green Supply Chain Practices Evaluation in the Mining Industry Using a Joint Rough Sets and Fuzzy TOPSIS Methodology. Res. Policy 2015, 46, 86–100. [Google Scholar] [CrossRef]

- Kusi-Sarpong, S.; Gupta, H.; Sarkis, J. A supply chain sustainability innovation framework and evaluation methodology. Int. J. Prod. Res. 2019, 57, 1990–2008. [Google Scholar] [CrossRef]

- Hong, Z.; Guo, X. Green product supply chain contracts considering environmental responsibilities. Omega 2019, 83, 155–166. [Google Scholar] [CrossRef]

- Lacoste, S. Sustainable value co-creation in business networks. Ind. Mark. Manag. 2016, 52, 151–162. [Google Scholar] [CrossRef]

- Bai, C.; Kusi-Sarpong, S.; Sarkis, J. An Implementation Path for Green Information Technology Systems in the Ghanaian Mining Industry. J. Clean. Prod. 2017, 164, 1105–1123. [Google Scholar] [CrossRef]

- Linton, J.D.; Klassen, R.; Jayaraman, V. Sustainable supply chains: An introduction. J. Oper. Manag. 2007, 25, 1075–1082. [Google Scholar] [CrossRef]

- Cheng, J.H.; Sheu, J.B. Inter-organizational relationships and strategy quality in green supply chains—Moderated by opportunistic behavior and dysfunctional conflict. Ind. Mark. Manag. 2012, 41, 563–572. [Google Scholar] [CrossRef]

- MEP. Bulletin of China’s Ecological Environment. 2018. Available online: http://www.mee.gov.cn/hjzl/zghjzkgb/lnzghjzkgb/201905/P020190619587632630618.pdf (accessed on 12 May 2019).

- Isaksson, R.; Johansson, P.; Fischer, K. Detecting Supply Chain Innovation Potential for Sustainable Development. J. Bus. Ethics 2010, 97, 425–442. [Google Scholar] [CrossRef]

- Tariq, A.; Badir, Y.F.; Tariq, W.; Bhutta, U.S. Drivers and Consequences of Green Product and Process Innovation: A Systematic Review, Conceptual Framework, and Future Outlook. Technol. Soc. 2017, 51, 8–23. [Google Scholar] [CrossRef]

- Brockhaus, S.; Kersten, W.; Knemeyer, A.M. Where do we go from here? Progressing sustainability implementation efforts across supply chains. J. Bus. Logist. 2013, 34, 167–182. [Google Scholar] [CrossRef]

- Hsu, C.C.; Tan, K.C.; Zailani, S.H.M.; Jayaraman, V. Supply chain drivers that foster the development of green initiatives in an emerging economy. Int. J. Oper. Prod. Manag. 2013, 33, 656–688. [Google Scholar] [CrossRef]

- Carter, C.R.; Rogers, D.S. A framework of sustainable supply chain management: Moving toward new theory. Int. J. Phys. Distrib. Logist. Manag. 2008, 38, 360–387. [Google Scholar] [CrossRef]

- Carbon Trust China. Low Carbon Behaviour Change: The £300 Million Opportunity. 2019. Available online: https://cn.carbontrust.com/media/434481/ctc827-low-carbon-behaviour-change.pdf (accessed on 12 May 2019).

- Dai, R.; Zhang, J.; Tang, W. Cartelization or Cost-sharing? Comparison of cooperation modes in a green supply chain. J. Clean. Prod. 2017, 156, 159–173. [Google Scholar] [CrossRef]

- Bryson, J.; Sancino, A.; Benington, J.; Sørensen, E. Towards amulti-actor theory of public value co-creation. Public Manag. Rev. 2017, 19, 640–654. [Google Scholar] [CrossRef]

- Hazarika, N.; Zhang, X. Factors that drive and sustain eco-innovation in the construction industry: The case of Hong Kong. J. Clean. Prod. 2019, 238, 117816. [Google Scholar] [CrossRef]

- Zailani, S.; Govindan, K.; Iranmanesh, M.; Shaharudin, M.R.; Chong, Y.S. Green innovation adoption in automotive supply chain: The Malaysian case. J. Clean. Prod. 2015, 108, 1115–1122. [Google Scholar] [CrossRef]

- Hong, J.; Zheng, R.; Deng, H.; Zhou, Y. Green supply chain collaborative innovation, absorptive capacity and innovation performance: Evidence from China. J. Clean. Prod. 2019, 241, 118377. [Google Scholar] [CrossRef]

- Vachon, S.; Klassen, R.D. Environmental management and manufacturing performance: The role of collaboration in the supply chain. Int. J. Prod. Econ. 2008, 111, 299–315. [Google Scholar] [CrossRef]

- Grekova, K.; Bremmers, H.J.; Trienekens, J.H.; Kemp, R.G.M.; Omta, S.W.F. Extending environmental management beyond the firm boundaries: An empirical study of Dutch food and beverage firms. Int. J. Prod. Econ. 2014, 152, 174–187. [Google Scholar] [CrossRef]

- Hafezalkotob, A. Competition, cooperation, and coopetition of green supply chains under regulations on energy saving levels. Transp. Res. Part E 2017, 97, 228–250. [Google Scholar] [CrossRef]

- Klassen, R.; Vachon, S. Collaboration and evaluation in the supply chain: The impact on plant-level environmental investment. Prod. Oper. Manag. 2003, 12, 336–352. [Google Scholar] [CrossRef]

- Zhu, Q.; Geng, Y.; Lai, K. Circular economy practices among Chinese manufacturers varying in environmental-oriented supply chain cooperation and the performance implications. J. Environ. Manag. 2010, 91, 1324–1331. [Google Scholar] [CrossRef] [PubMed]

- Green, J.; Zelbst, P.; Bhadauria, V.; Meacham, J. Do environmental collaboration and monitoring enhance organizational performance. Ind. Manag. Data Syst. 2012, 112, 186–205. [Google Scholar] [CrossRef]

- Sarkar, S.; Bhadouriya, A. Manufacturer competition and collusion in a two-echelon green supply chain with production trade-off between non-green and green quality. J. Clean. Prod. 2020, 253, 119904. [Google Scholar] [CrossRef]

- Ji, J.; Zhang, Z.; Yang, L. Comparisons of initial carbon allowance allocation rules in an O2O retail supply chain with the cap-and-trade regulation. Int. J. Prod. Econ. 2017, 187, 68–84. [Google Scholar] [CrossRef]

- Yang, Z.; Lin, Y. The effects of supply chain collaboration on green innovation performance: An interpretive structural modeling analysis. Sustain. Prod. Consum. 2020, 23, 1–10. [Google Scholar] [CrossRef]

- Rahim, S.; Fernando, Y.; Rohaizah, S.A. Sustainable green supply chain management and impact on organisations. J. Emerg. Trends Econ. Manag. Sci. 2016, 7, 147–155. [Google Scholar]

- Ghosh, D.; Shah, J. A comparative analysis of greening policies across supply chain structures. Int. J. Prod. Econ. 2012, 135, 568–583. [Google Scholar] [CrossRef]

- Yenipazarli, A. To collaborate or not to collaborate: Prompting upstream eco-efficient innovation in a supply chain. Eur. J. Oper. Res. 2017, 260, 571–587. [Google Scholar] [CrossRef]

- Shi, R.; Zhang, J.; Ru, J. Impacts of power structure on supply chains with uncertain demand. Prod. Oper. Manag. 2013, 22, 1232–1249. [Google Scholar] [CrossRef]

- Benton, W.; Maloni, M. The influence of power driven buyer/seller relationships on supply chain satisfaction. J. Oper. Manag. 2005, 23, 1–22. [Google Scholar] [CrossRef]

- Chen, X.; Wang, X. Free or bundled: Channel selection decisions under different power structures. Omega 2015, 53, 11–20. [Google Scholar] [CrossRef]

- Chen, X.; Luo, Z.; Wang, X. Impact of efficiency, investment, and competition on low carbon manufacturing. J. Clean. Prod. 2017, 143, 388–400. [Google Scholar] [CrossRef]

- Prahalad, C.K.; Ramaswamy, V. Co-creation experiences: The next practice in value creation. J. Interact. Mark. 2004, 18, 5–14. [Google Scholar] [CrossRef]

- Vargo, S.L.; Lusch, R.F. Evolving to a new dominant logic for marketing. J. Mark. 2004, 68, 1–17. [Google Scholar] [CrossRef]

- Leiponen, A. Managing knowledge for innovation: The case of business-to-business services. J. Prod. Innov. Manag. 2006, 23, 238–258. [Google Scholar] [CrossRef]

- Vargo, S.L.; Lusch, R.F. Service-dominant logic: Continuing the evolution. J. Acad. Mark. Sci. 2008, 36, 1–10. [Google Scholar] [CrossRef]

- Kohtamäki, M.; Partanen, J.; Möller, K. Making a profit with R&D services—The critical role of relational capital. Ind. Mark. Manag. 2013, 42, 71–81. [Google Scholar]

- Sugathan, P.; Ranjan, K.R.; Mulky, A.G. Atypical shifts postfailure: Influence of co-creation on attribution and future motivation to co-create. J. Interact. Mark. 2017, 38, 64–81. [Google Scholar] [CrossRef]

- Malshe, A.; Friend, S.B. Initiating value co-creation: Dealingwith non-receptive customers. J. Acad. Mark. Sci. 2018, 46, 895–920. [Google Scholar] [CrossRef]

- Black, I.; Veloutsou, C. Working consumers: Co-creation of brand identity, consumer identity, and brand community identity. J. Bus. Res. 2017, 70, 416–429. [Google Scholar] [CrossRef]

- Grönroos, C.; Voima, P. Critical service logic: Making sense of value creation and cocreation. J. Acad. Mark. Sci. 2012, 41, 133–150. [Google Scholar] [CrossRef]

- Kohtamäki, M.; Partanen. J. Co-creating value from knowledge-intensive business services in manufacturing firms: The moderating role of relationship learning in supplier–customer interactions. J. Bus. Res. 2016, 69, 2498–2506. [Google Scholar] [CrossRef]

- Vargo, S.L.; Lusch, R.F. Institutions and axioms: An extension and update of service-dominant logic. J. Acad. Mark. Sci. 2016, 44, 5–23. [Google Scholar] [CrossRef]

- Xie, C.; Bagozzi, R.P.; Troye, S.V. Trying to prosume: Toward a theory of consumers as co-creators of value. J. Acad. Mark. Sci. 2008, 36, 109–122. [Google Scholar] [CrossRef]

- Tuan, L.T.; Rajendran, D.; Rowley, C.; Khaic, D.C. Customer value co-creation in the business-to-business tourism context: The roles of corporate social responsibility and customer empowering behaviors. J. Hosp. Tour. Manag. 2019, 39, 137–149. [Google Scholar] [CrossRef]

- Donaldson, T.; Preston, L.E. The stakeholder theory of the corporation: Concepts, evidence, and implications. Acad. Manag. Rev. 1995, 20, 65–91. [Google Scholar] [CrossRef]

- Suginouchi, S.; Kokuryo, D.; Kaihara, T. Value co-creative manufacturing system for mass customization: Concept of smart factory and operation method using autonomous negotiation mechanism. Procedia Cirp 2017, 63, 727–732. [Google Scholar] [CrossRef]

- Luu, T.T. CSR and customer value co-creation behavior: The moderation mechanisms of servant leadership and relationship marketing orientation. J. Bus. Ethics 2017, 155, 379–398. [Google Scholar] [CrossRef]

- Stubbs, W.; Cocklin, C. An ecological modernist interpretation of sustainability. Case Interface Inc. Bus. Strategy Environ. 2008, 17, 512–523. [Google Scholar] [CrossRef]

- Kurucz, E.C.; Barry, A.; Colbert, F.L. Relational Leadership for Strategic Sustainability: Practices and Capabilities to Advance the Design and Assessment of Sustainable Business Models. J. Clean. Prod. 2017, 140, 189–204. [Google Scholar] [CrossRef]

- Teece, D.J. Business Models, Business Strategy and Innovation. Long Range Plan. 2010, 43, 172–194. [Google Scholar] [CrossRef]

- Freudenreich, B.; Lüdeke-Freund, F.; Schaltegger, S. A Stakeholder Theory Perspective on Business Models: Value Creation for Sustainability. J. Bus. Ethics 2019, 2019, 1–16. [Google Scholar] [CrossRef]

- Lusch, R.; Vargo, S.; Tanniru, M. Service, value networks and learning. J. Acad. Mark. Sci. 2010, 38, 19–31. [Google Scholar] [CrossRef]

- Payne, A.F.; Storbacka, K.; Frow, P. Managing the co-creation of value. J. Acad. Mark. Sci. 2008, 36, 83–96. [Google Scholar] [CrossRef]

- Storbacka, K.; Brodie, R.J.; Böhmann, T.; Maglio, P.P.; Nenonen, S. Actor engagement as a microfoundation for value co-crea-tion. J. Bus. Res. 2016, 69, 3008–3017. [Google Scholar] [CrossRef]

- Jang, S.H.; Grandzol, C. Value co-creation in emerging economies: Planting and harvesting innovation perspectives. Int. J. Serv. Sci. 2015, 5, 171–181. [Google Scholar] [CrossRef]

- Elion Think Tank, Research Report on China’s Manufacturing Transformation Trend 2019–2020; EO Intelligence, China, 11 November 2019.

- Burniaux, J.M.; Chateau, J. Greenhouse gases mitigation potential and economic efficiency of phasing-out fossil fuel subsidies. Int. Econ. 2014, 140, 71–88. [Google Scholar] [CrossRef]

- Lin, B.; Li, A. Impacts of removing fossil fuel subsidies on china: How large and how to mitigate. Energy 2012, 44, 741–749. [Google Scholar] [CrossRef]

| D | the stochastic demand |

| q | the quantity of production/purchase |

| c | the production/wholesale costs |

| s | the product scrap value |

| I | the investment cost of green technology, while we assume that the investment cost of green technology is a quadratic function of emission reduction rate η, then I(η) = 1/2tη2, t is the coefficient of green technology investment cost function |

| T | the carbon tax, while we assume that the carbon tax is a linear function of the carbon emission of unit product e, then T = de, d is the cost of unit carbon emission |

| L | the compensation cost for physical accidents of employees, while we assume that the compensation cost is a linear function of the probability of production accident λ, then L(λ) = λF0, F0 is the average compensation cost for accidents of employees |

| Π | the profit of a firm, or the sum of the profits of the co-creators |

| k | the cost allocation proportion of green technology investment. For example, when M and its supplier S co-create value together, it means that the M needs to undertake while belongs to the S |

| θ | the change index of sales volume. For example, after co-creation, the sales volume of M will change from to |

| p(RMB) | c(RMB) | s(RMB) | q(107 units) | |

|---|---|---|---|---|

| S | 36 | 31 | 27 | 45 |

| M | 50 | 40 | 32 | 25 |

| M′ | 52 | 40 | 32 | 20 |

| R | 75 | 60 | 53 | 45 |

| θ1 | θ2 | |

|---|---|---|

| (S, M) | 1.0124 | 1.0153 |

| (M, M′) | 1.026 | 1.0175 |

| (M, R) | 1.0348 | 1.003 |

| Π | k | ||

|---|---|---|---|

| (S, M) | 560 | 687.7 | = 0.31 |

| (M, M′) | 693.4 | 769.7 | = 0.65 |

| (M, R) | 586 | 980.5 | = 0.87 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Li, G.; Shi, X.; Yang, Y.; Lee, P.K.C. Green Co-Creation Strategies among Supply Chain Partners: A Value Co-Creation Perspective. Sustainability 2020, 12, 4305. https://doi.org/10.3390/su12104305

Li G, Shi X, Yang Y, Lee PKC. Green Co-Creation Strategies among Supply Chain Partners: A Value Co-Creation Perspective. Sustainability. 2020; 12(10):4305. https://doi.org/10.3390/su12104305

Chicago/Turabian StyleLi, Genzhu, Xianliang Shi, Yefei Yang, and Peter K. C. Lee. 2020. "Green Co-Creation Strategies among Supply Chain Partners: A Value Co-Creation Perspective" Sustainability 12, no. 10: 4305. https://doi.org/10.3390/su12104305

APA StyleLi, G., Shi, X., Yang, Y., & Lee, P. K. C. (2020). Green Co-Creation Strategies among Supply Chain Partners: A Value Co-Creation Perspective. Sustainability, 12(10), 4305. https://doi.org/10.3390/su12104305