1. Introduction

A large part of our job as sustainability educators is to bring today’s students a healthy dose of reality while nurturing their ability to apply the scientific method to the details of their own lives. This is especially difficult in an age when the mythology of perpetual growth dominates popular discussion and the economics profession. Before the era of fossil fuels, no one spoke of self-perpetuating growth. The stationary state was the fate of an economy whose energy basis was one year’s solar flow. When British philosopher Thomas Carlyle surveyed the debate between David Ricardo and Thomas Malthus as to whether diminishing returns to land or rising population would be the cause of the stationary state, Carlyle dubbed economics as the “dismal science”. [

1] How can we avoid the impression that BioPhysical economics is merely the return of the dismal science? How then can we inform students of the potential biophysical and economic realities of their futures without depressing them into giving up? How can we get students to adopt a system-wide, big picture, vision of their futures when so many other sources lead them to focus on individual and personal issues?

This is especially difficult as regards energy, climate and jobs. As is clear from the historical literature [

2,

3,

4,

5], fossil fuels provided the driving force to mechanization, a vast expansion of consumer goods, and the growth in real wages that allowed those at the top of the income distribution to consume opulently and those in the middle to enjoy products such as televisions, climate controlled living spaces, computers and the internet, and cheap transportation and food. The thought of running short of the fuels that propel current lifestyles is nearly unthinkable to students who have grown up not having to consider energy issues and believing that energy should be delivered instantly in any quantity necessary. They believe that it is simply part of their birthright. The prospect of living without these comforts and conveniences is unpalatable to anyone other than the most diehard advocate of voluntary simplicity. If life without high-speed internet is considered unbearable, what about life without central heat or cheap transportation? As more heat waves grip even mild climates such as New England in the United States, people turn to air conditioning. However, this is a classic positive feedback loop. It gets hotter. People use more electricity to drive their air conditioning. This puts more carbon in the air. It gets hotter. People use more air conditioning. The mechanism continues. However, asking people to think about the energy behind climate control brings sighs of dismissal. Moreover, the prospect of spending up to 40% of one’s income on food alone, as was common in the economies dependent entirely upon the solar flow, is beyond the pale of rational thought. Yet fossil fuels are stock limited and, at some point, the energy cost of extracting them will exceed the energy obtained from them.

The concept of sustainability is not well integrated into economic theory, and neither is the role played by energy in economic activity. There are many complex interactions between humans and nature that must be understood in order to live well within the earth’s limits. Economics alone certainly cannot explain the difficult transitions we must make in order to live sustainably. Yet understanding the conflicts between economic activity and the planet’s thermodynamic and biological limits is crucial to understanding the urgency with which we must act. In order to understand the human–nature interaction, we need to think beyond the limited understanding of mainstream, neoclassical economics and explore the perspectives of history, psychology and the limits imposed by the earth’s biological and physical systems. While I advocate a synthesis of different analyses, as a United States economist reflecting on a career of teaching economics to undergraduate students, I advocate a multi-disciplinary perspective beyond economics that considers different theoretical perspectives within economics. My aim is to provide a starting point for other professors of economics to better address the sustainability challenges we face through their teaching and other professional work.

Additionally, this essay has several more specific purposes. It highlights the valuable efforts of Robert Carson and his colleagues who first produced a book titled Economic Issues Today in 1978 and kept revising it until 2005. Secondly, I argue that the inclusive approach to economic thought advocated by Economic Issues Today can be better adapted to the quest for sustainability by including the perspective of biophysical economics, itself a unity of natural sciences and heterodox political economy. Biophysical economics is built upon an understanding of the interaction of biophysical and economic limits to furthering economic growth of an earth system that is near, or in excess, of its planetary boundaries. Moreover, biophysical economics argues that economic activity is grounded in a flow of energy and is especially concerned with decline in resource quality. In the biophysical economics approach, different economic theories, especially those concerned with the environment, are presented in historical context. Sections below on “additions to Economic Issues Today” serve as a primer for those advocates of sustainability who are not economists themselves but who may address economic issues and challenges in their work. These sections highlight the primary conflict is between an earth system that is at or beyond its limits and an economic system that needs continual growth and accumulation in order to provide employment, opportunities, and profits. They also present the primary question posed by biophysical economics: to what degree do nature’s limits impose on current and future economic activity? Finally, the essay turns to the question of how sustainability educators can more effectively address today’s students: how do we help students think in systems and address big-picture issues? I suggest that perhaps we are approaching the issue of sustainability too abstractly and that we might focus on insights from psychology and behavioral economics as a more effective method of teaching and learning that supports sustainability.

Economic Issues Today

Since our journey towards the earth’s limits and the evolution of economic activity and theory took place in historical context, it is important to understand the environmental and economic transformations of earlier times. By the late 1970s, Keynesian theory was in decline, radical economics was becoming far more sophisticated, and neoclassical economics did not yet claim hegemony. Economics was a more theoretically diverse discipline than it is today and much less dominated by neoclassical orthodoxy. In this theoretically open period, Robert Carson, professor of economics at the State University of New York at Oneonta, published

Economic Issues Today in 1978. The book was meant to be an introduction to economics for those who wished to understand the economy without resorting to the formalism that generally characterizes economics teaching. Its purpose was to introduce students into thinking from various perspectives and to get students to think about big-picture, systemic issues. While the book did not address issues of sustainability directly, as few economics books did in 1978,

Economic Issues Today [

6] provided a method of inquiry that could be useful for sustainability studies in the present and future.

It was a wonderful and timely book, as it gave equal weight to liberal, radical and conservative thought. The book begins with an introduction that outlines the different ideological perspectives for the uninitiated. Carson borrows Thomas Kuhn’s idea of paradigms, which was in vogue for economic study at the time, especially amongst radical economists who believed they were in pursuit of an entirely new paradigm [

7]. Carson simply explicated each paradigm on its own grounds and left it to the student to decide for herself or himself which one made the most sense. The book provided straightforward, factual, synopses of each view, offering an introduction without being preachy or prejudging the correct vision of the economy. The style was to take the position of “first-person advocacy” for each of the views expressed [

6]. There are no equations, a handful of graphs and some accompanying charts.

The first chapter, which lays out the different paradigms, also traces the intellectual history of each position. The conservative position is attributed to Adam Smith, liberal thought is traced to John Maynard Keynes, and radical economics is grounded in the thought of Karl Marx, although Carson makes it clear that not all radical economists are Marxists.

The one nod to economic orthodoxy was to divide the book into the traditional split of microeconomics and macroeconomics. The microeconomics section covers issues such as competition or protection for agriculture, regulation vs. deregulation, income distribution, taxation, and externalities and the environment. Macroeconomic issues include cycles and instability, economic growth, budget deficits, unemployment and inflation, social security and international economics. It was a welcome book in the late 1970s. I would argue that

Economic Issues Today is a vital book for today as well. In an era where fewer people than ever interact with those who do not believe as they do, and dismiss easily ideas with which they do not agree, a book that leads students to look at various issues from different perspectives is as relevant today as it was in 1978. I believe economics would be a far more interesting field if it could return to a more diverse approach. In 1999, Carson added his SUNY Oneonta colleague, Wade Thomas, as well as Jason Hecht of Ramapo College as co-authors. The latest, 8th, edition appeared in 2005 [

8].

2. A Brief Economic History of the Late 20th Century

In order to understand the controversies in economic thought, it helps to understand the dramatic changes that were occurring at the end of the 20th century. The late 1970s, when the book first appeared, were turbulent times, and understanding the economic events of the time are vital to understanding the changes in economic analysis that were then occurring. Concerns over energy rose in a time when the prevailing economic orthodoxy was in flux. In 1970, the 1956 predictions of petroleum geologist M. King Hubbert were realized as conventional oil in the “lower 48” continental United States peaked [

9]. In 1970, oil prices stood at

$3.39 per barrel, up from a historical average of around 2 dollars per barrel. By 1975, oil prices nearly quadrupled to

$12.21 per barrel, driven up by the Saudi-led oil embargo [

10]. In April 1977, President Jimmy Carter addressed the nation calling the energy crisis “the moral equivalent of war.” Carter stated that, for economic growth to continue, Americans would need to make some sacrifices. Energy demand should be reduced through conservation measures and increased use of alternate energy sources such as nuclear power and coal. Also, Carter advocated the use of solar power and increased insulation [

11]. President Carter even installed solar panels on the roof of the White House and turned the thermostat down. However, things were soon to get worse. In March 1979, the nuclear reactor at Three Mile Island in Pennsylvania experienced a partial core meltdown, shaking the faith of many in nuclear power’s future and emboldening the burgeoning anti-nuclear movement.

By November, in the wake of the Islamic Revolution in Iran, oil prices again soared, reaching

$37.42 per barrel [

10]. Gas lines were long, and tempers were short. Jimmy Carter’s presidency would also be short, as he was defeated by Ronald Reagan, who promised a new “morning in America” and a vastly more conservative economic policy known as “supply-side economics.” [

12]. In one of his first acts as president, Ronald Reagan removed the solar panels from the White House.

Both the 1973 and 1979 oil price spikes were followed by recessions. By 1974, the unemployment rate rose to 7.2 percent while the overall price level rose at 12.3% in the same year. After a brief respite in the late 1970s, and following the second oil price spike, by 1980, unemployment increased again to 7.2% and inflation ran at 12.5%. Draconian monetary policy of increased interest rates reduced the inflation rate to 3.8% by 1982, but American workers paid the price as unemployment soared to 10.8%, the highest level since the Great Depression [

10]. High oil prices encouraged the development of oil that had been found but was too costly to produce relative to the previously low prices. But, as new sources of supply emerged, oil prices began to fall again, and the economy recovered. By 1986, oil prices were below

$15 per barrel. This was perfect context for a book such as

Economic Issues Today that encouraged debates and knowledge of different ideological perspectives by asking probing questions. Was the “Reagan recovery” due to “the magic of the market,” deregulation, and tax cuts, or did falling oil prices and a renewal of debt infusion drive the new round of prosperity?

Another new issue was the phenomenon of simultaneous inflation and recession, or “stagflation,” that was inconsistent with prevailing Keynesian orthodoxy. For Keynes and his followers, recession and inflation were mutually exclusive events. Recessions occurred when spending for consumption, investment, and exports, along with government purchases of goods and services, were not large enough to absorb the goods and services that were produced. Inflation occurred when aggregate demand exceeded the economy’s ability to produce. If the economy was at full-employment and demand continued to increase, the only thing that could continue to rise would be prices. This is known as demand-pull inflation. If the degrees of unemployment and inflation were low and inverse, the tradeoff could be managed. However, Keynesian theory was not compatible with substantial unemployment occurring alongside high levels of inflation, making a coherent Keynesian approach to policy difficult to implement. If contractionary monetary and fiscal policies were implemented to control inflation, unemployment soared. If expansionary policies were enacted to reduce unemployment, prices increased. The inability of Keynesian policy to control stagflation sapped the credibility of this previously dominant liberal perspective. The inability of Keynesian policies to address stagflation created the conditions for the rise of a new and conservative economic orthodoxy. Few recognized that biophysical reality (the peaking of US oil production in 1970) might be a significant contributor to stagflation. Most sought understanding of economic challenges only within existing economic theory.

The 1980s variant of the conservative perspective presented in Economic Issues Today became known as supply-side economics. Supply-side economists rebelled against even the moderate version of Keynesianism that had come to dominate economic thought in the post-World War II United States. The 1950s and 1960s were the zenith of labor union power. Wages had risen faster than worker productivity, thereby increasing the cost of doing business. The early 1970s also saw a vast increase in protective legislation. Workplace safety was regulated by the Occupational Safety and Health Administration and environmental legislation flourished from the National Environmental Protection Act to the Clean Air and Clean Water Acts. A roughly progressive tax system made those at the top pay a higher proportion of their incomes to fund the agencies charged with rule making and the administration of the very acts that increased their costs and reduced their productivity growth. The era of U.S. hegemony in world production and trade began to ebb as Germany and Japan became serious industrial competitors. The new international monetary order, established at Bretton Woods, New Hampshire, in 1944 also began to crumble. By 1971 the Bretton Woods Accords simply fell apart as foreign holdings of U.S. dollars, redeemable in gold by the rules of the Accords, now exceeded the nation’s gold supply. After President Richard Nixon refused to honor exchanges of dollars for gold, the world monetary system was thrown into chaos. Moreover, resistance to the United States military in Asia, Africa, and Latin America was strong and expensive for the nation to address under current policy.

The supply-side agenda called for reversing these trends. The program called for breaking union power, deregulation, and substantial military rearmament. Focus shifted from the Keynesian approach of maintaining an adequate level of aggregate demand, mostly by means of consumption, to reducing costs to business, thereby increasing capital formation and aggregate supply of goods and services. Aggregate demand could be ignored. Supply-side economics was fundamentally anti-Keynesian at its core.

While Keynesian policies of government intervention to stabilize the economy had dominated mainstream economics since the 1930s, conservative thought had not altogether disappeared before the age of stagflation. In 1947, a group of economists, historians and philosophers called together by Austrian economist Frederick von Hayek met at a Swiss resort called Mont Pèlerin. There, they expressed grave concern that moral standards and economic freedoms were endangered by an activist state. They enunciated a Statement of Aims that included the idea that freedom could survive only in a competitive capitalist economy and that government should participate only mildly in a free economy, mainly to establish an institutional framework where private property and consumer and producer choice would be protected while government would be constrained by the rule of law. Moreover, this group declared that they should educate politicians and judges in free-market principles [

13].

The roots of supply-side economics can be traced to this gathering of conservative intellectuals. Politically, these supply-side economists found welcome allies in Ronald Reagan in the United States and Margaret Thatcher in the United Kingdom. Environmental and labor regulations were reduced, as were those of transportation and occupational safety. Reducing business costs by means of deregulation moved into full swing. At the same time, the nation’s central bank, The Federal Reserve, sought to wring inflation out of the economy by means of a severely contractionary monetary policy. The interest rates which banks pay to borrow money from one another on an overnight basis, known as the Federal Funds Rate, skyrocketed from 7.9% in 1978 to 16.4% in 1981. To put this in historical context, the rate fell to 0% in the aftermath of the great recession of 2008–2009, and the Federal Funds Rate stood at 2.13% as of August 2019 [

14]. This anti-inflationary approach made credit more difficult and expensive to acquire with especially devastating effects on credit-dependent industries such as construction and automobile production. Yet inflation persisted. The price of attempts to reduce inflation was paid mostly by working Americans in the form of increased unemployment and a slowing of wage growth. As it turns out, cost-push inflation, whereby increases in costs were passed on to consumers had replaced demand-pull inflation as the source of rising prices in the national economy. The ability of monopolized industries to mark up costs to achieve a higher target profit rate, in conjunction with the ability of organized labor to win wage concessions also combined with the increase in energy prices following the 1970 peak in U.S. domestic oil production to produce increases in costs that were passed on to the consumer. Attempts to control cost-push inflation by means of increasing interest rates were essentially futile as the increased interest costs were simply passed on to consumers in the form of higher prices [

15]. The supply side, agenda focused on reducing costs of doing business, especially labor and environmental costs.

In the early 1970s, the conservative view had yet to gain hegemony over the economics profession. Keynesian defenders, still prominent in the American Economic Association, still held some sway. Moreover, there was a challenge from the left. The Union for Radical Political Economy formed in 1968 and drew in critics of capitalism from many different viewpoints: orthodox Marxists, institutionalists, labor organizers, and non-Marxist radicals. Youthful radical scholars were united by their opposition to the war in Vietnam and their concerns over poverty in the nation’s urban centers, declining union power, and the role of women, especially related to unpaid labor in the home. They agreed that liberal economic policy had failed to provide “steady-state growth” but argued that the problem lay less in policy mistakes than in the inner workings of the capitalist system. A few, including my own undergraduate mentor, John Hardesty, began to write about the contradictions between economic growth and environmental quality, making the connection between environmental destruction and economic growth in the early 1970s [

16].

Sustainability remains an economic issue today. We are now on the verge of experiencing economic pressure resulting from declining energy availability and increased energy cost. Conventional oil production peaked globally around 2005. Production has also peaked in an increasing number of formerly exporting countries. The reduction in conventional oil supplies has been counteracted by the rise of petroleum production from hydraulic fracturing used to extract oil from shale formations. However, the end of the boom may be at hand. Shrinking global oil prices relative to an industry that prioritized rapid growth in drilling over profitability of production have led Wall Street financiers to question the continual provision of credit to fracking companies characterized by high production costs (relative to the price of oil) and excessive debt [

17]. In the not too distant future, the world may see a return to higher oil prices. Increases in oil prices make life difficult for cash-strapped working families. Furthermore, every oil price spike since the 1970 U.S. domestic conventional oil peak has been followed by a recession [

18].

A decline in the availability and quality of fossil hydrocarbons is not the only problem that sustainability teachers face. Climate change, driven by the carbon dioxide released when burning the fossil fuels, is an equally important factor in the pursuit of living well within earth’s limits. The first effects of climate change in the U.S. are manifested primarily as storm damage. Since 1980, extreme weather has caused

$1.6 trillion worth of insured storm damage, not to mention uninsured damage, mostly among the poor. It has also caused significant loss of life. In addition to the more than

$900 billion worth of hurricane damage in the United States alone in the 2019 hurricane season, one must add damages produced by tornadoes, floods, droughts, and wildfires [

19]. Far greater damages have been borne of typhoons in Indonesia, Madagascar, and Mozambique. International damage is not limited to poor nations, as Japan was recently hit by a super typhoon while Australia is currently being devastated by wildfire.

In addition to the aggregated individual costs of property damage, nature’s limits have a profound effect on the overall economy. The rates of economic growth since the 1970 domestic oil peak have continually slowed, from an average of 3.3% per year in the 1970s to 1.9% in the third quarter of 2019 [

20]. To reduce the possible consequences of climate change and the abrupt, unplanned, end of the fossil fuel economy we must reduce our material impact upon the planet. The provision of jobs and opportunities within the present institutional context requires more growth. How are we, as sustainability educators to guide our students’ into embracing this dilemma, rather than avoiding it? Unless one believes that technological change will allow us to maintain the same energy-intensive lifestyles as we do now, then we will have to confront potentially uncomfortable reductions in today’s levels comfort, convenience, employment, and communication. Sustainability was not yet a well-known question when the first edition of

Economic Issues Today appeared. However, the approach of introducing students to diverse modes of thought, and getting them to think critically about difficult topics makes it possible to integrate new information into the book, and make it a better framework for addressing the many complex issues that comprise sustainability studies.

3. Topics I Would Add to Economic Issues Today

Approaching various issues from different perspectives is the hallmark of Economic Issues Today. The approach is a useful one in the era of theoretical and political polarization. A great deal has changed since the final, 2005, revision of the book, let alone since 1978. The inclusion of the perspective of biophysical economics (to be explained) will make the approach taken by the book’s authors even more useful in understanding ways to address the current conflict between living within nature’s limits and providing a decent life in human economy and society. Understanding the evolution of economic theory is valuable, even if the connection to sustainability is not immediate. An understanding of how actual economies work is also a crucial component in resolving the dilemma between a growing economy and a finite and non-growing nature. In order to study economic ideas and approaches that might contribute to sustainability, I would first expand the theoretical legacies of conservative, liberal, and radical economics as presented in Economic Issues Today. I hope that a greater understanding of the history of how the economy works will enhance the creative thinking that will be needed to live comfortably within nature’s limits.

3.1. The Theoretical Legacy of the Conservative View

The authors of

Economic Issues Today trace the theoretical roots of conservative economics to Adam Smith. Smith was certainly an advocate of liberty and free trade, yet some of his positions are in contradiction with present-day conservatism. Like all political economists of the pre-fossil fuel era, Smith believed that the accumulation process would end eventually in a non-growing stationary state, a situation Smith described as melancholy with its miserably low wages at close to biological subsistence and few, if any, opportunities for profitable investment [

21]. When access to energy is limited to annual solar flow, the ability to increase production and productivity is limited. Most incomes will be spent on food and shelter with few markets for comforts and amusements. Energy analyst Carey King found that from 1300 to 1750, 40% of economic activity was devoted to obtaining the food, fodder and wood to run the other 60% of the economy [

22]. Since Smith believed the division of labor (and therefore the augmentation of the wealth of a nation) was limited by the extent of the market, a lack of energy limited the accumulation of capital. The notion of self-perpetuating economic growth would have to wait for the industrial revolution, and access to the concentrated sunlight of geological periods long past, in the form of coal, and eventually oil and natural gas.

Smith’s English-speaking successors, David Ricardo and Thomas Malthus, added to the body of political economy the concept of diminishing marginal returns and the idea of exponential growth. I urge the interested reader to consult chapter 2 of

Energy and the Wealth of Nations [

18], in which one can find a more complete history of economic thought written from an energy perspective, or to read the works of Malthus and Ricardo in the original [

23,

24].

I would also augment the historical legacy of conservative economics by adding a section on neoclassical economics, as neoclassical economics is now the dominant ideology that most students encounter today. Neoclassical economics began with the marginal revolution of the 1870s. Conservative economists William Stanley Jevons, Leon Walras, and Karl Menger in England, Switzerland, and Austria simultaneously and independently arrived at a new and subjective theory of value and price known as marginal utility, replacing the objective classical cost of production theory. Value and price were seen as being based on subjective utility or a sense of well-being, constrained only by a limited amount of money. Furthermore, marginal, or extra, utility declined as more of any good was consumed. This became the basis of demand. In 1890, Alfred Marshall put supply and demand together in the now familiar graphs by which economics is introduced. The focus was on the process of market exchange with prices determined in competitive markets. Later in the 1890s, John Bates Clark in the United States and Philip Wicksteed in England placed the theory of production, known as marginal productivity, on a marginal utility basis and removed the classical cost of production approach. The theory of production became also a theory of distribution, as each factor, such as land, labor, or capital “earned” it marginal product in the form of rents, wages and profits. This is the neoclassical basis of supposed fairness, or equity.

While classical political economists focused on discovering the laws underlying the processes of accumulation and distribution among prevailing social classes, neoclassical economists focused on the individual and dismissed the importance of social class. Rather, the definition of economics became the study of the allocation of scarce resources among alternative uses. Allocative efficiency became the metric by which economic processes were judged, and markets were considered to attain allocative efficiency if undisturbed by government intervention. Classical political economists sought to influence policy decisions while neoclassical economists were in pursuit of a universal theory of an economy that could operate autonomously. Neoclassical economists consider humans to be rational, individualistic, hedonistic maximizers in all societies, from the first hunter gatherers to the modern day. While classical political economists began by analyzing the process of production, neoclassical economists believe that one can understand how the economy works simply by focusing on exchange, or the process of buying and selling [

25].

3.2. Additions to the Liberal Legacy

The theories of Lord Keynes, while pathbreaking, were essentially static, in that they did not predict or respond to changes in economic activity over time. Since I believe the fundamental dilemma of our time is to understand the conflict between an economic system that needs to grow and a biological and physical system that has exceeded its boundaries, a treatment of growth theory is essential. In 1939, Keynes’ Oxford colleague Sir Roy Harrod published “An Essay in Dynamic Theory,” and kept revising this work until the 1970s [

26,

27]. In the 1940s, American Economist Evsey Domar developed a similar dynamic theory independent from that of Harrod. Although the two economists wrote laudatory essays about each other’s work, they never, contrary to popular opinion, collaborated to produce a Harrod–Domar Model. Both economists, for slightly different reasons, concluded that the growth trajectory of a capitalist economy was highly unstable. Mainstream neoclassical (conservative) economic theory had also been static since its inception in the 1870s. A neoclassical growth theory did not emerge until the mid-1950s when Robert Solow produced two essays on economic growth. The first was a critique of Harrod and Domar, while the second was an econometric study that tested the influence of adding additional capital and labor to increase levels of overall output. Solow’s study, and subsequent work, produced large residuals, in which the equations did not explain economic growth well. The economy grew more rapidly than what could be explained merely by the addition of labor and capital. This “residual” was (rather arbitrarily) attributed to technological change or total factor productivity [

28,

29]. The authors of

Economic Issues Today do not delve into issues of technological change as a driver of economic growth, but rather focus on the supposedly stultifying effects of government regulation and liberal macroeconomic policy when explaining the conservative perspective. I believe that the perspectives of technology, economic growth, and sustainability are crucial in an era in which people interested in sustainability issues need to confront the role that technology plays in both ecology and economics.

Harrod and Solow were not the only economists to explore models of economic growth. Evsey Domar addressed the issue of jobs directly in a 1947 paper titled “Expansion and Employment” [

30]. His position was that employment depended upon the rate of growth of national income, not the level of income itself. If investment and capital formation were to increase, then final demand would have to increase at an increasing rate. If demand were to remain constant, so would investment. The problem of stagnant investment growth was based in the dual nature of investment. Investment is an important source of demand, but it also creates additional productive capacity. Unfortunately, the stimulus to demand is short-lived while the additional capacity is long-lived. The longevity of additional productive capacity raises the specters of excess capacity and overproduction, which serve as a disincentive for further investment. Domar believed that the government needed to assume the role of investment banker, assuring that enough funds were forthcoming to stimulate investment but not so many as to produce unused products [

30]. One can easily see why his theories were rejected by conservative economists who believe in minimal government intervention.

However, I believe that understanding theories of economic growth is vital to resolve the future of sustainability. If the government behaves as an investment banker and funds projects such as roads and bridges to provide employment, then the improved infrastructure will merely facilitate the longevity of the fossil fuel economy. If the government does not act and lets the market decide, stagnation and unemployment may soon follow. An improved discussion of sustainable development can be enhanced by an understanding of economic growth theory.

3.3. Additions to the Radical Legacy

Since advocating a non-growing, steady-state, economy is a very radical idea, it would help to augment one’s knowledge of radical economics in the 20th and 21st centuries. Karl Marx was also interested in not only the causes of economic volatility and social change, but in the metabolism between humans and nature as well. In the third volume of

Capital, Marx presented his most complete theory of capital accumulation. There, he enunciated two “laws of motion” of the capitalist system. These were a tendency for the rate of profit to fall, and a tendency towards monopoly or, as Marx put it, concentration and centralization. Marx believed that the battle of competition was fought by the cheapening of commodities. In order to sell at a lower price there was pressure to use less human labor. This could be accomplished by utilizing machinery driven by the tremendous energy found in the bonds of hydrogen and carbon, namely in coal. If a capitalist were to mechanize and reduce his cost of production, he could either undersell his competitors or use the excess profits to purchase even more advanced technology, further driving down his costs. Those who invested first in mechanization reaped the rewards as labor productivity increased at a faster pace than did capital intensity. Consequently, profits increased. However, as more capitalists competed by investing to keep up, the increase in labor productivity slowed and the capital/labor ratio increased. This made profits fall and touched of a period of crisis or depression. In the depression, the capital/labor ratio fell as machines were laid idle and bad debts were written off. At the same time, labor productivity rose as the desperate unemployed had few options other than to work harder for less. This restored the rate of profit and set the stage for the next round of prosperity [

31].

Marx also believed that, in a depression, some of the stronger, lower cost firms would survive and even prosper. They would purchase the weaker, now bankrupt, businesses at bargain basement prices. The average company got larger (concentration) and was owned by fewer people (centralization). For Marx, this was a prediction of the future [

31]. The British economy of the mid-to-late 1800s when Marx was writing was still basically competitive.

In 1966, Paul Sweezy and Paul Baran produced the classic radical essay on the American economic and social order entitled

Monopoly Capital. Their argument was: given the dominance of the giant corporation, and I might add the power of fossil fuels, the economy could produce a large economic surplus. For the economy to remain prosperous, the surplus had to be absorbed or spent. Failure to spend the surplus for consumption, investment, civilian government or the military would result in a slowly growing, stagnant economy and a periodic depression [

32]. Mary Wrenn pointed out the fundamental difference between the neoclassical and radical version of economics when she said: “The central problem in advanced monopoly capitalism is not one of scarce resources clashing against innate, insatiable wants. Rather, it is one of an abundance of production clashing against saturated consumption and investment markets” [

33]. As in Marx’s era of competitive capitalism, a firm must grow or die. In the monopoly era, this is accomplished by a constant effort to expand market share and cut costs. As Baran and Sweezy argued, unabsorbed surplus leaves its statistical trace as unemployment and excess capacity. Despite a huge sales effort of advertising, branding and planned obsolescence, consumption expenditures were in the 1950s, and continue to be, insufficient to absorb this surplus [

32]. This yields an economic system that must grow, but at the same time has difficulty growing because of unabsorbed surplus.

If the normal state of monopoly capitalism is stagnation, what could be responsible for periods of prosperity? Baran and Sweezy attributed these to epoch-making innovations. An epoch-making innovation would absorb inordinate amounts of economic surplus and investment capital, create many additional subsidiary industries, and geographically reorder spatial patterns of production and consumption. Epoch-making innovations are few and far between. Baran and Sweezy list only three: The steam engine, the railroad, and the automobile. The steam engine changed the pattern of manufacturing in England, freeing industry from the rural waterfalls where procuring an adequate labor force willing to submit to the discipline of factory work was always problematic. This dramatically increased the output of cloth in the new industrial cities such as Manchester [

3]. In the post-civil war United States, the railroad not only revolutionized transportation and cut the cost of shipping goods but it also provided the rights of way and demand for electronic communication (the telegraph), absorbed more than 10% of all investment capital, and provided the impetus for the development of American securities markets. Without the automobile, we would have neither suburban housing, nor fast-food restaurants, nor soccer moms. Note that all epoch-making innovations depended upon cheap fossil energy. Baran and Sweezy also considered war and its aftermath to be a force that would lift the economy out of its normal situation of stagnation. World War II rekindled the American economy from the doldrums of the depression. As mentioned previously, the unemployment rate fell to 1.2% in 1944. Industrial production skyrocketed more than fourfold from March 1933 to the war’s end in August 1944 [

14].

In the absence of epoch-making innovations or the simulative effects of war, economic surplus can be absorbed only by means of consumption, investment or waste. For Baran and Sweezy, waste was to be found in the resources procured by the military and by sales effort (advertising) needed to drive ever-higher levels of consumption. Today we must include among our factors of waste generating, surplus absorbing activities our system of energy generation and transmission, as well as our proclivity for large houses and automobiles. The function of waste in our economy begs the question: how we can live within nature’s limits when macroeconomic sustainability depends upon copious waste and conspicuous consumption? This should be a question of great import for today’s students. The tradeoff between stagnation and environmental destruction is a difficult one to grasp, but it is our moral responsibility to use our experience as teachers and our knowledge of theory to inform students of the economic changes they will likely see.

I discuss these matters in more detail in my 2013

Sustainability paper titled “Heterodox Political Economy and the Degrowth Perspective” and refer the interested reader to this past work, rather than repeating it here [

34].

4. Beyond Externalities

As was the convention at the time of the original 1978 publication of

Economy Issues Today, environmental issues were considered to be microeconomic in nature. Pollution of all types fell under the category of externalities. An externality is defined as a change in the utility of someone who is not a party to the transaction. Externalities come in four types: positive; negative; local; and pervasive. Externalities are not reflected in the prices one pays for goods and services that produce them. The greatest concern is for negative, pervasive externalities. Paper is a vital component of the modern information economy. Unfortunately, the low temperature combustion of carbon (from the wood pulp) and chlorine (from the bleach) also produces a whole family of dioxins [

35]. They are among the deadliest chemicals on the planet. Dioxin was the active ingredient in Agent Orange, a defoliant used in the Vietnam War and was responsible for the poisoning of Times Beach, Missouri and Love Canal in Western New York. How should the cost of the poisoning of air and groundwater be internalized, accounted for in the economic system?

Externalities also distort the market as the equilibrium solution does not produce allocative efficiency. Allocative efficiency occurs theoretically when the market price covers fully all the incremental costs of production, in other words when price = marginal cost. This, according to conservative doctrine, means that resources flow to their best use. In the presence of negative externalities, there are unpaid social costs. Therefore, the equilibrium solution is not allocatively efficient. Pioneering welfare economist A.C. Pigou advocated the use of taxes to solve the problem. He advocated, first, estimating the marginal social costs of the externality and, next, imposing a tax on the offending polluter equal to the marginal social cost and add that to the market price which measures only marginal private cost of production. The resulting sum equals marginal total cost, and the solution would be allocatively efficient. This is the theoretical framework behind the discussion of carbon taxes, which are regularly discussed when one talks about mitigating the effects of climate change.

The concept of externalities is accepted among the ranks of most economists but has also been subject to serious criticism. Conservative economists tend to take a dim view of taxes and regulation in general. Their preferred solution to externalities was individual bargaining between perpetrator and victim. In a 1960 paper titled “The Problem of Social Cost,” Ronald Coase stated that, if property rights were well specified, and transactions costs were low, individuals could arrive at an allocatively efficient solution, even in the presence of externalities [

36]. One assigns either the right to pollute or the right to be free of pollution to one of the parties and they bargain until the payment from the other is Pareto optimal, or the point where no one party can be made better without making another worse off. Volumes of papers have been produced over the years debating the merits of the “Coase Theorem”.

Another critique was launched by the ecological economist Herman Daly. While Daly believes that the theory of externalities is perhaps superior to theory that does not recognize the problem of pollution at all, he considers the externalities approach to be little more than a modern-day version of Ptolemaic epicycles. Ptolemy hypothesized that the earth was the center of the universe. If one viewed the motion of the inner planets, it appeared that the planets were going backwards (retrograde motion) from time to time. To correct this uncomfortable, but empirically verified, observation, Ptolemy hit upon the idea of epicycles. Planets such a Venus not only revolved around the earth but orbited on their own separate epicycles. When viewed from the earth, this explained retrograde motion. In short, epicycles allowed for the maintenance of the dominant ideology while explaining the uncomfortable empirical anomaly. The problem was finally solved by Nicolas Copernicus when he put the sun at the center of the solar system and the planets in its orbit. Since the laws of angular velocity dictate that an object with a smaller orbit moves faster than one with a larger orbit the problem was resolved for science.

For Daly, externalities are just epicycles. The approach is designed to protect the prevailing orthodoxy that unregulated markets produce allocatively efficient equilibria while at the same time accounting for environmental degradation and providing some avenue for policy solutions. Applying the externalities approach to environmental problems as severe as climate change, the disruption of biogeochemical cycles, and biodiversity loss is likely to be ineffective when dealing with issues of this magnitude. Daly put the matter well when he said:

In recent years, environmental concerns have been taken up by traditional economists, and their general theme of “internalization of externalities” certainly has its place. However, as a general solution to environmental problems it is proving inadequate. The increasing frequency of appeal to externalities is the clearest possible evidence that more and more relevant facts do not fit within the existing theoretical framework. When increasingly vital facts, including the very capacity of the earth to support life, have to be treated as “externalities,” then it is past time to change the basic framework of our thinking so that we can treat these critical issues internally and centrally.

The problem with the standard treatment of environmental problems as externalities is that they are treated solely as microeconomic issues, rectifiable by the price system itself, with or without government intervention, depending upon one’s ideological perspective. However, from a biophysical perspective, problems of environment and energy are macroeconomic problems, essentially problems of economic growth within a finite earth system. A new framework must include treatment of the environment within the contexts of growth and accumulation as well as including the limits imposed by the laws of nature. In short, the biophysical economics framework considers environmental destruction as a function of economic growth itself, rather than merely a breakdown in market processes and an inefficient allocation of resources.

In summary, I would add several topic areas to Economic Issues Today in order to bring the book up to the theoretical advances developed in the past fifteen years, and to make it more focused towards issues of sustainability. I would add a section on neoclassical economics to the conservative paradigm, as this theoretical approach has dominated economics since the 1970s. Furthermore, the basic premises of neoclassical economics are often different than those of Adam Smith and other classical political economists. I would augment the liberal paradigm based in the theoretical legacy of John Maynard Keynes by adding dynamic theories that explain the volatility of investment, income, and employment. I would also include Marx’s theory of accumulation and crisis in the radical legacy, and more explicitly address the theory of monopoly capitalism and stagnation in the 20th and 21st centuries. Most of my additions address the conditions of the capital accumulation process, as I believe an understanding the tendency of a capitalist economy to grow is essential to understanding sustainability. Finally, I would treat environmental destruction as a large-scale systemic problem that requires a fundamental economic transformation, not just a marginal change in tax policy. I call this new approach to theory BioPhysical Economics.

4.1. BioPhysical Economics as a New Framework

BioPhysical economics is largely a unity of natural (biological and physical) sciences and heterodox political economy. It was born as a collaboration of natural scientists who rejected the lack of energy flow analysis and the narrow behavioral postulates of neoclassical economics and heterodox political economists who believed that the proper starting point of economics was a study of how human labor transformed nature to meet social needs. Such a perspective is important to teachers of sustainability because it integrates the effect upon the environment of both economic limits to further expansion, as well as natural ones. Most mainstream economics treats these limits separately, if at all.

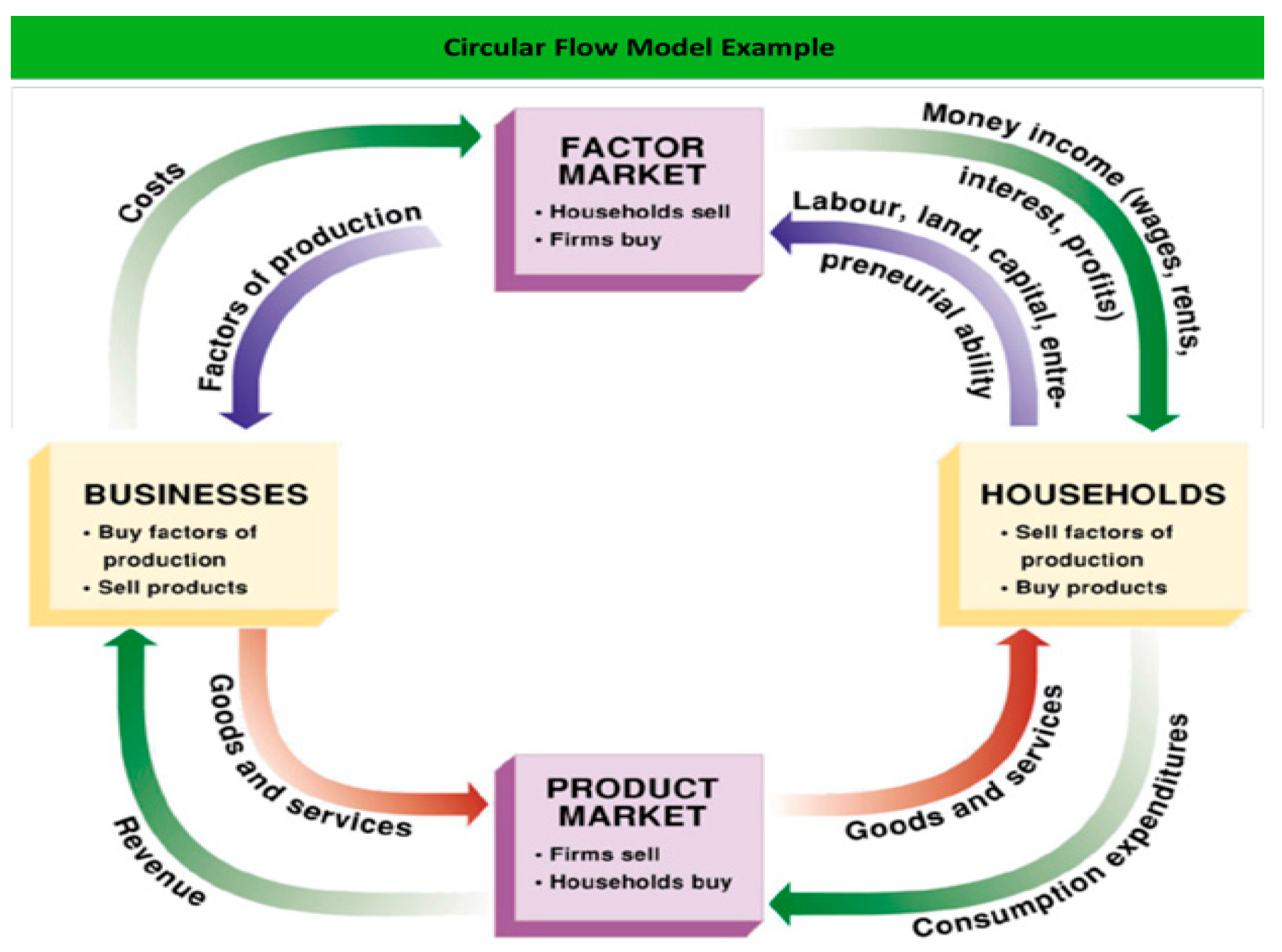

BioPhysical economics began with a critique of the pre-analytical vision of neoclassical economics embodied in the conceptual model called the circular flow with which nearly all students of economics commence their studies. As can be seen in

Figure 1 that depicts this flow, the economy is divided between firms and households, product markets and factor markets. Households have property rights to land, labor and capital while firms own goods and services. Money flows between the sectors via the markets. Households exchange the money they earned from selling their factors of production while firms spend all the income they receive from households in the process of producing goods and services. Every purchase is a sale, and the money in the top flow (national income) equals the sum of factor payments (bottom flow). This equality of income flows shows the most basic macroeconomic equilibrium.

Unfortunately, this model violates some basic laws of nature. The economy is depicted as an isolated system that exchanges neither matter nor energy with an outside system. According to the laws of physics, entropy or disorder in the form of waste heat always increases in an isolated system. However, if there were material waste or energy degradation, the money on the top loop could not equal the money on the bottom loop. Moreover, there are no inputs of low-entropy energy into the system or waste heat out of the system, nor throughput of energy and materials within the system. One cannot deny the second law of thermodynamics and consider one’s work science. Hall and Klitgaard [

18] contend that neoclassical economics is built more on a series of self-serving myths than upon scientific principles.

Furthermore, rather than testing behavioral hypotheses statistically, neoclassical economics considers the postulates concerning human behavior to be “maintained hypotheses” that also do not require testing. When behavioral economists have subjected the behavior of rational economic men (self-interested, rational, maximizing, self-regarding preference structures) to testing by means of controlled laboratory experiments and field studies, the neoclassical vision of idealized human behavior has not been confirmed. Rather, they find that humans are as likely to be vindictive or altruistic as they are rational. Moreover, the combination of game theory and positron emissions tomography yield the results that humans have fairness-specific receptors in our brains. These studies produce results that are a far cry from the maintained hypotheses of behavior for homo economicus. Critiquing the behavioral postulates of neoclassical economics is not just a theoretical academic exercise. If human beings really are individualistic, maximizing, and insatiable, then humanity and many other species do not have a chance of living in balance with nature. If we are, as many scientific studies indicate, at the planet’s limits, then continued growth will be unsustainable. Teachers of sustainability should be able to address this dilemma, but the approach of mainstream economics makes this very difficult.

Energy is an essential input to economic activity and neoclassical economics fails to address sufficiently the role of energy in its theories and models. When humans discovered fire and the ability to cook food, the world changed. When we discovered large quantities of fossil fuels and used them to provide heat and mechanical power, the world changed again. Aggregate incomes rose, although poverty was still the condition of most of the world’s people. Greater access to energy fueled further technological change, enabled vast increases in labor productivity, and provided products unimaginable even a few generations ago. However, energy is not free. It must either be extracted from the earth’s crust or large-scale investments must be made to capture and store the solar flux. When the energy costs of extracting energy exceed the energy obtained (measured by the Energy Return on Investment or EROI), we have essentially run out of that form of energy, even if large quantities remain in the ground. BioPhysical economics focuses on energy availability, energy quality and energy cost. The fundamental unit of measurement is Energy Return on Investment (EROI), which is a ratio of the energy available to society and the energy needed to obtain that energy.

At the turn of the 19th to the 20th century, when vast quantities of oil were discovered and put into production the Energy Return on Investment may have been as high as 100:1. Global EROI as of 2006 has fallen to 18:1 [

18]. EROI is a measure of energy quality and cost. Drillers tend to extract the best quality deposits first and exploit lower quality deposits later, much as low fertility land was put into production after more fertile land. As we become left with only low-quality fossil fuel deposits—deep water, oil sands, polar deposits, heavy sour (or high in Sulphur and highly viscous)—the energy needed to extract energy resources rises, and the EROI falls. Examples today include the use of high-quality hydrocarbons to extract low-quality fuels such as using diesel and explosives to extract sub-bituminous coal. The “alternative” fuel of corn-based ethanol has, in the low estimates, an EROI of less than 1. It takes more fossil fuels to produce corn ethanol than the energy content embodied in it. Few renewable sources have Energy Returns on Investment that approach those of fossil fuels. This makes it hard to accept the idea that we could simply replace fossil fuels with renewables and live the same high-energy lifestyle at the same low cost. Because of this, access to energy forms a limit to continued economic growth. As discussed in the next section, so too, do the emissions resulting from the use of fossil fuels and other limits that characterize earth systems. As discussed in more depth in the next section, developing an understanding of these limits is essential to teaching and learning for sustainability both within and beyond economics classrooms.

4.2. Earth Systems and the Great Acceleration: Where Biophysical Science Meets Heterodox Political Economy

The Great Acceleration is the time period, beginning around 1750 with the industrial revolution when the human impact upon earth systems began to accelerate, exponentially in some cases, thereby compromising the stability of the Holocene period. The Holocene geological period in which we are living, or perhaps just left, is characterized by unprecedented climate stability. Atmospheric concentrations of carbon dioxide began to rise some 12,000 years ago from an ice age baseline of around 180 parts per million (ppm). Carbon concentrations, which stood at about 280 parts per million at the dawn of the industrial revolution in 1750, now exceed 415 parts per million. The physics department at Oxford University calculates that if humans emit 1 trillion metric tons (or tonnes) of carbon into the atmosphere the global temperature will increase by 2° Celsius, initiating potentially catastrophic climate change, and creating a hothouse earth that our species has never seen. Current levels of atmospheric carbon exceed 633 billion tonnes, and at the present rate of emissions growth the trillion tonne threshold will be exceeded by 2035. To avoid this dire situation, emissions will have to fall by 3% per year [

38].

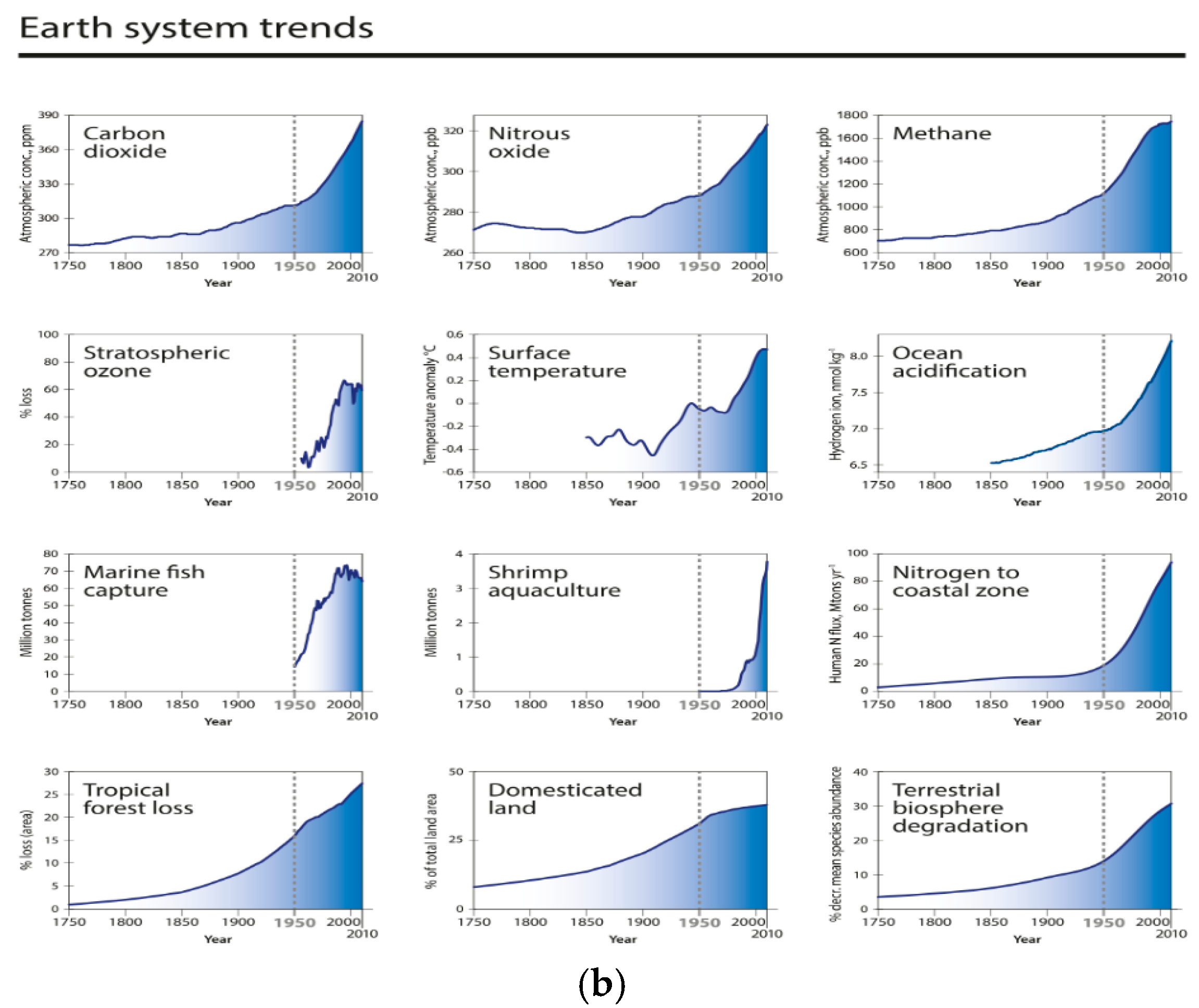

Additional studies of other planetary boundaries show an economic system in overshoot in terms of biodiversity loss and disruption of biogeochemical cycles [

39]. Work by a team of scientists headed by Will Steffan of the International Geosphere-Biosphere Programme (IGBP), and including Nobel Laureate in Chemistry Paul Crutzen, chronicled the pressure put on earth systems by the advance of human activity [

40].

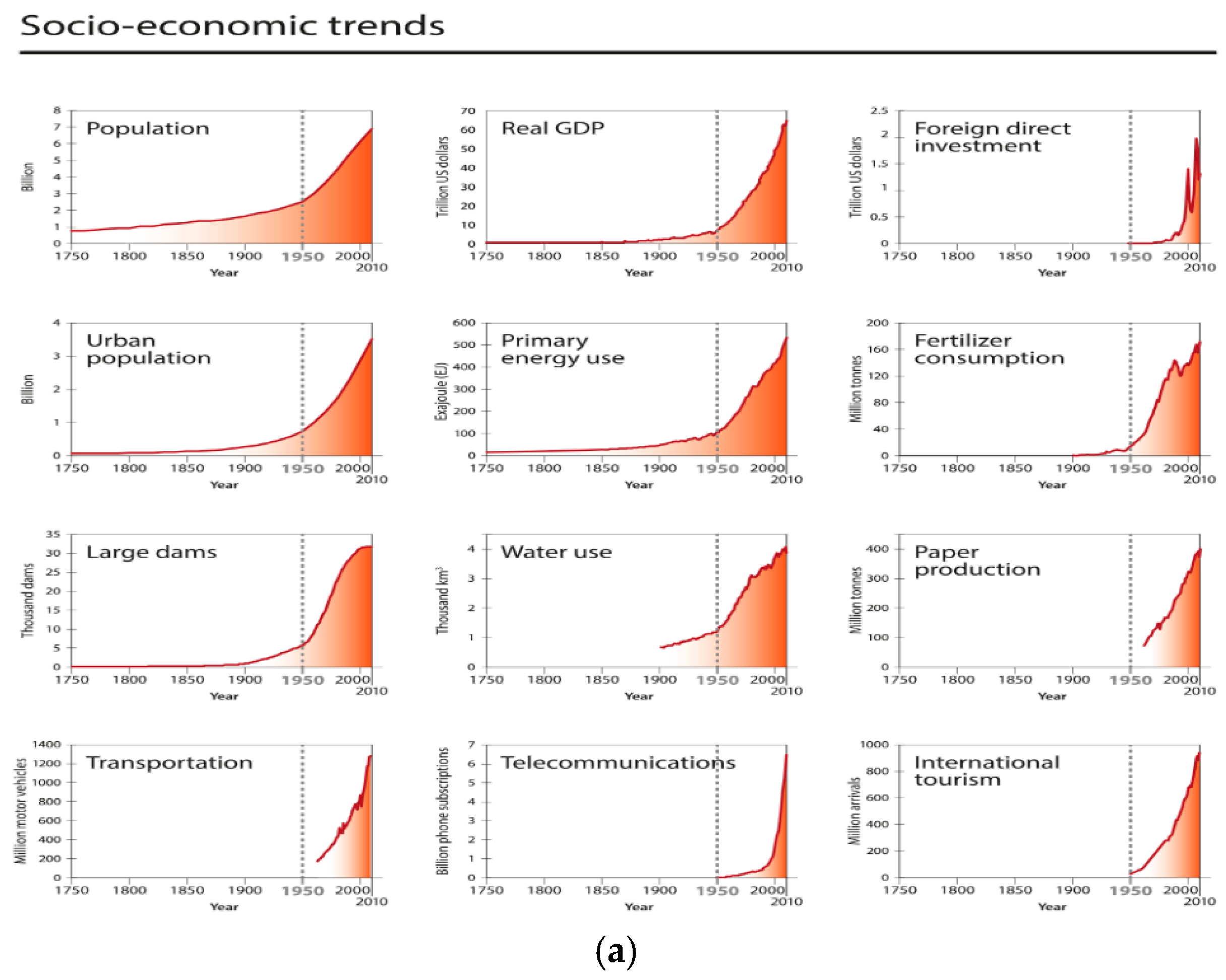

Figure 1 shows the exponential growth of human activity and effects on the earth systems. Will Steffan and his colleagues ask a powerful question that I hope students consider as they live their daily lives: how compatible are the exponential growth in human activity and the resulting effects upon earth systems with regard to Holocene stability? Steffan and the IGBP are leading the efforts to have a new geological period declared called the Anthropocene [

40]. On pages 132–133 of

Global Change and the Earth System, Steffan and his colleagues present the following series of graphs showing expanding trends of both socio-economic and natural systems. These graphs are reproduced herein as

Figure 2a (socioeconomic trends) and

Figure 2b (earth systems trends).

A system in overshoot cannot grow its way into sustainability, yet a non-growing capitalist system is not economically sustainable because the accumulation of capital is the theoretical essence of the system. A non-growing capitalist system finds itself perpetually mired in stagnation and depression. An understanding of this dilemma requires an understanding of the internal dynamics of the capital accumulation process. This is where the heterodox political economy, or radical economics, meets biophysical science.

In order to understand how the economy works, one needs to understand how the earth systems work to provide resources and assimilate wastes. In order to understand how earth systems work, one needs to understand how the economy works, as it is the growing resource depletion and proliferation of waste driven by economic activity that are disrupting the proper functioning of the earth’s biophysical systems. BioPhysical economics recognizes the limits to the continued growth of the economy found in biological and physical processes such as the depletion of high-quality petroleum and the declining ability of the atmosphere to absorb further loading of carbon waste into the atmosphere. However, there are internal, social limits to economic growth as well. If economic stability depends upon avoiding stagnation by conspicuous consumption, fossil-fuel intensive investment, and outright waste, how can we sustain the proper function of our biophysical systems if the economy depends upon ever greater levels of resource use and increasing waste?

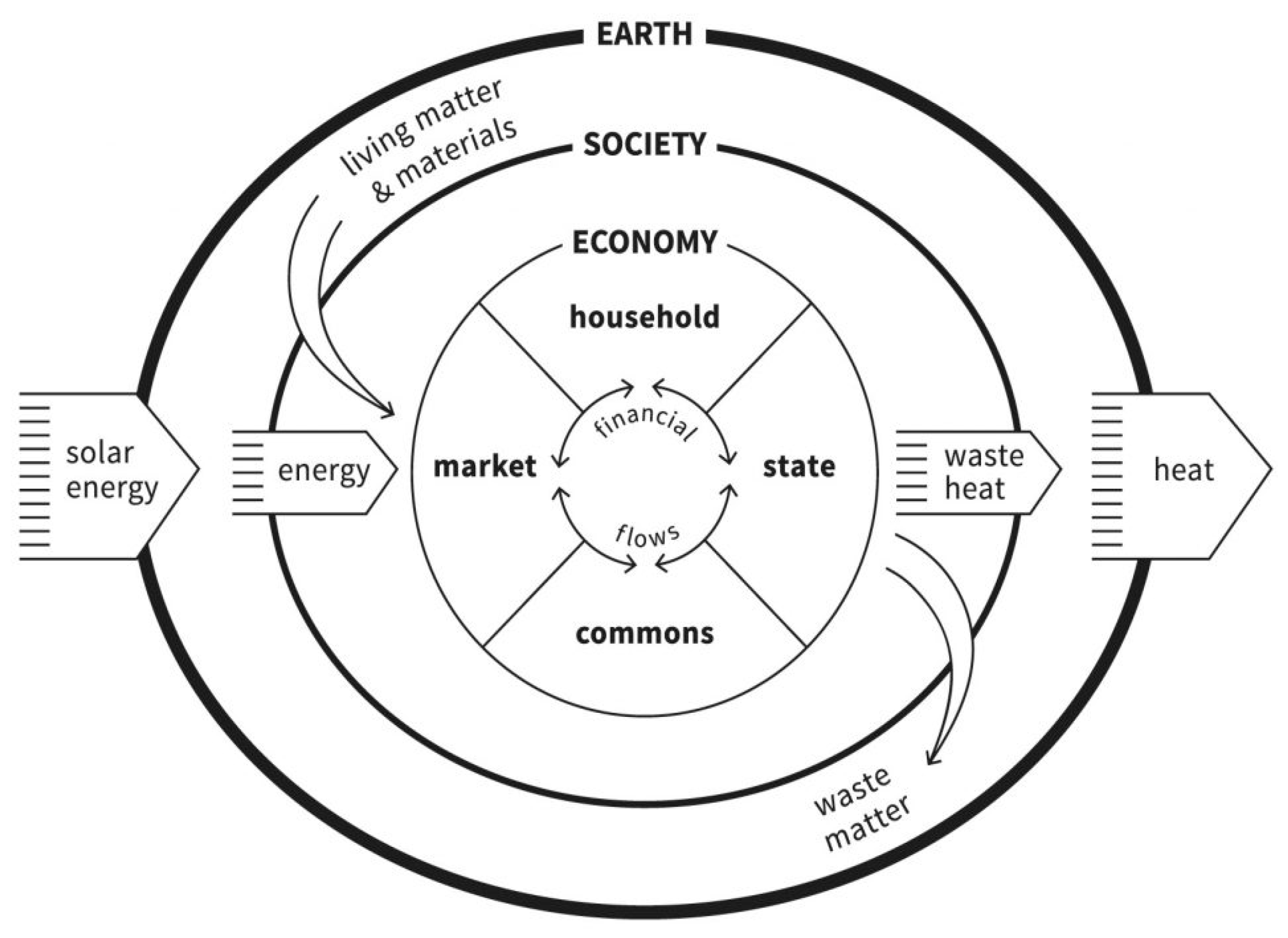

4.3. The Embedded Economy Model

In order to accomplish a new understanding based on a synthesis of biophysical science and economics, ecological and biophysical economists advance a new conceptual model in place of the mainstream circular flow. It is based on the idea of the embedded economy and energy flow. In the circular flow model, the economy is an isolated entity that looks solely at exchange between sectors via markets. But, as previously mentioned, in any isolated system, entropy or disorder must increase as useful energy is degraded into waste heat in the process of doing work. The only way to have an economic model that is consistent with the laws of physics is not to pose it as an isolated system existing without inputs or outputs of matter and energy.

In a biophysical model, the economy is a subsystem of society, and society is a subsystem of nature. As a subsystem, the economy must obey nature’s rules and be subject to nature’s limits. Since the primary system (planet earth) is finite and non-growing, the subsystem cannot grow forever without approaching or transcending nature’s boundaries. In terms of systems theory, the economy is an open system, exchanging matter and energy with the closed system of planet earth, which exchanges energy, but not matter with the surrounding universe. An open subsystem can forestall the buildup of entropy by adding energy. However, the decrease in entropy in one part of the system is possible only by an increase in entropic disorder in another part of the system. Depletion of minerals and fossil hydrocarbons, disruptions of biogeochemical cycles, loss of biodiversity, and climate change are examples of the problems that occur when a subsystem approaches the boundaries of the primary system.

The new conceptual model therefore begins with an embedded economy and an energy flow. High quality energy in the form of visible light flows in from the sun which performs work such as driving the motion of fluids (air and water currents), plant respiration, and photosynthesis. In the process of performing this work, the useful energy degrades into diffuse waste heat, which can no longer perform useful work, and eventually flows out of the system into space.

Before the hydrocarbon revolution associated with the large-scale use of coal to provide mechanical energy (and not just heat) humans had access to only one year’s solar flow in the form of food and fiber (carbohydrates). However, some of the products of photosynthesis were buried and reduced to form hydrocarbons. Access to these hydrocarbons provided great increases in energy availability and labor productivity. The industrial revolution was a hydrocarbon revolution, in conjunction with a fundamental change in the labor process (the detailed division of labor), by which humans transformed the products of nature into useful goods and services.

There are many examples of embedded economy models. The anthropologist Karl Polanyi developed such a conceptual model in the 1950s [

41]. Nicholas Georgescu-Roegen critiqued neoclassical economics for lack of attention to energy and entropy and built models that included them [

42,

43]. Georgescu-Roegen’s Ph.D. student Herman Daly drew one of the first visual models of the embedded economy, placing the economy within the ecosystem [

37]. A group from the Global Development and Environment Institute developed such a model by placing the economy within society as well as the ecosystem [

44]. The model chosen for this essay, and reproduced as

Figure 3, is that of Kate Raworth. It presents all the elements of energy flow and the embodied economy and adds the financial sector, government, and the commons [

45].

From the standpoint of political economy, we need to go beyond a critique of neoclassical economics. BioPhysical economics needs to incorporate economic reality into economics if we are to understand how economic processes affect the earth systems. Most mainstream economic models are built upon faulty models of industrial structure and human behavior. In order to construct an economic theory that emphasizes living within nature’s limits, we need a more realistic set of assumptions and empirically verifiable theories.

The world is dominated by large-scale multinational corporations that maximize profits in the long run by minimizing costs and expanding market share. More than 90% of US Gross Domestic Product is generated in Finance, Insurance, and Real Estate (FIRE) not in manufacturing [

46]. It is a straightforward endeavor to observe the connections between fossil-fuel use, economic cycles and economic growth. BioPhysical economics needs to transcend observation and analyze the causal mechanisms as to how and why increased amounts of energy spur economic growth, but more importantly in the second half of the age of oil, how and why decreases in the availability and quality of fuels, and increases in cost, lead to declining labor productivity and slower rates of economic growth. BioPhysical economics is built upon the idea that the limits to growth are found in nature, but also in the internal dynamics of the economy itself. It needs to address how interruptions in the supply of high-quality fuels disrupt the accumulation of capital and affect investment trajectories. Long before we physically run out of fossil fuels the economies of the world will feel the economic effects, and the potential disruption of economic growth is the prime factor advanced in opposition to efforts at sustainability. This focus on the interaction of natural and economic limits to growth is unique to biophysical economics, and I believe it should be an important part of the study of sustainability [

18]. Understanding the complex interaction of energy, economy, and environment will allow us to craft economic institutions and policies that will allow us to live within nature’s limits.

6. Some Insights from Psychology and Behavioral Economics Relevant to Sustainability Education

In 2002, Daniel Kahneman received the Nobel Prize in Economics for his work with fellow psychologist Amos Tversky. They challenged the idea that the possessive individualism of the rational economic man explained actual human behavior. These breakthroughs, learned from controlled laboratory experiments, provide some insights into sustainability education. Human behavior is divided into two systems: an automatic system (System I) and an analytical system (System II). System I is unconscious, effortless, intuitive, and fast. System II is intentional, controlled, in need of a great deal of effort, and slow [

48,

49].

Kahneman and Tversky also found that humans are subject to loss aversion, with the loss of something you already possess creating a greater discomfort (or disutility) than acquiring something new gives you pleasure. This means that the behavior you observe depends largely on how the question is framed. The perception of loss results in a different outcome than the chance of a gain. Moreover, humans are often subject to high levels of time discounting. We tend not to respond analytically (through System II) to problems we perceive to be distant in time. In addition, people tend to engage in risky behavior when all the potential outcomes are bad [

49].

I fear, as scientists, economists, and sustainability educators, we tend to address only the analytical System II, being trained to believe that the study of intuition and emotion is unworthy of our effort, and that appealing to them simply exhibits a lack of rigor. Thankfully, there are psychologists from whom we can learn. Are we losing half our audience before we begin? Do we really believe that the results of an empirical study published in a prestigious journal will motivate enough people to take the action needed to allow humanity to live comfortably within nature’s limits? We need to appeal to System I as well as System II. We need to reframe the issues as to include the possibility of living on a planet somewhat similar to that on which our species evolved rather than framing it as the loss of your air conditioning and your truck. We need to learn how to not demoralize people while, at the same time, not putting a smiley face on mass extinction or showing blind faith in technologies that do not exist. We should foster the idea that living within nature’s limits is not deprivation. People have long lived happy lives without the levels of income and consumption that many in the United States take for granted. We need to open our minds, stop thinking about “threats to our way of life,” and start exploring the concept that an economic system that meets peoples’ needs without destroying our planet is possible. If all the outcomes are potentially bad, how do we lead the young to take the positive risks of attaining a sustainable society, rather than engage in the type of risky behaviors that may harm themselves and the planet? Evans and Greenwood speak clearly to this issue in a 2015 article on “Hope and Agency in Education and Life” [

50]. They assert that not only the natural world can give us hope, but also people, communities, and social movements, and that change occurs when people exercise hope and agency. Hope and agency can result when we are participants in a web of knowing and doing, not just being problem solvers. The movement towards sustainability is a collective one and, although the time for action is approaching rapidly, sustaining one’s optimism takes both patience and participation. Certainly, given the need for the economy to expand, those who strive for sustainability will certainly encounter setbacks. We need to address questions of what makes us human, not just questions about atmospheric concentrations of carbon dioxide, energy returns on investment, and rates of capital accumulation. When asked whether he was an optimist or a pessimist, David Greenwood replied: “If you look at the science about what is happening on the earth and aren’t pessimistic, you don’t understand the data. But if you meet the people who are working to restore this earth and the lives of the poor, and you aren’t optimistic, you haven’t got a pulse”.