Selecting Socially Responsible Portfolios: A Fuzzy Multicriteria Approach

Abstract

:1. Introduction

2. L-R Fuzzy Numbers and Credibility Theory

2.1. L-R Power Fuzzy Numbers

2.2. Credibility Theory

- Definition 1.Credibility measure [61]. Let ξ be a fuzzy variable with membership function µ and x a real number. The credibility measure of a fuzzy event, characterised by ξ ≤ x, is defined by Equation (1).The credibility measure of L-R power fuzzy numbers is expressed as:

- Definition 2.Expected value [61]. Let ξ be a fuzzy variable. Then the expected value of ξ is defined by Equation (2) provided that at least one of the two integrals is finite.The crisp equivalent expression for the credibilistic expected value of an L-R power fuzzy number is formulated by Equation (3) [67].

- Definition 3.Mean-absolute semi-deviation [64]. Let ξ be a fuzzy variable with finite expected value = . Its below-mean absolute semi-deviation is defined by Equation (4).where,Finally, following Vercher and Bermúdez [64], the crisp equivalent expression for the credibility-measure-based MASD of an L-R power fuzzy number is expressed as:

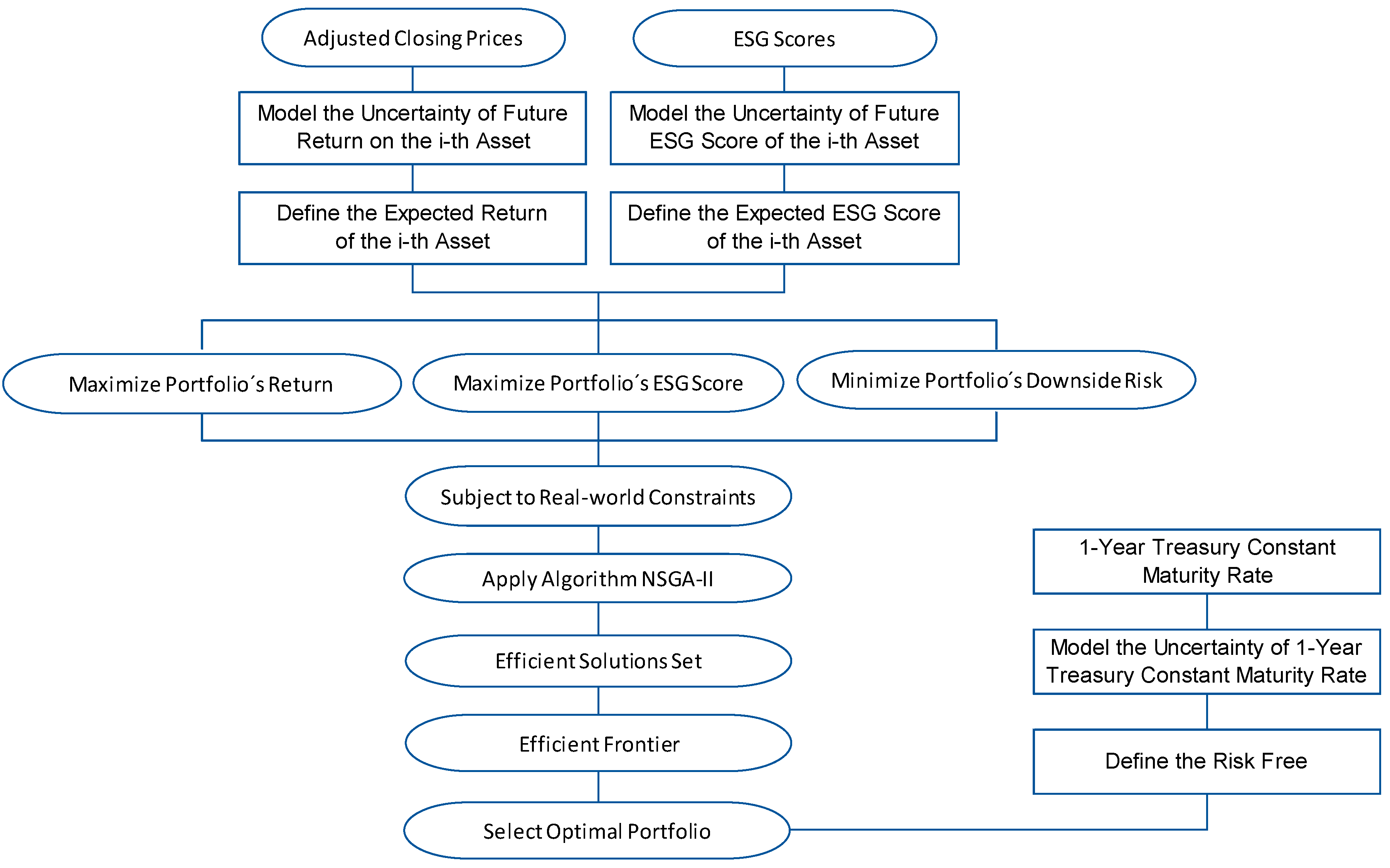

3. The Mean-Downside Risk-Socially Responsible Portfolio Selection Model

- : L-R fuzzy return of the i-th asset, that is, ,

- : L-R fuzzy ESG score of the i-th, that is, ,

- L-R fuzzy return of the portfolio, that is, ,

- expected return of the portfolio,

- : upper bound of the proportion invested in the i-th asset,

- : lower bound of the proportion invested in the i-th asset,

- k: the number of assets held in the portfolio,

- : the proportion of wealth invested in the i-th asset,

- : a binary variable indicating whether the i-th asset is contained in the portfolio. It takes value 1, if the i-th asset is included in the portfolio, otherwise it takes value 0.

3.1. Objective Functions

3.1.1. Return

3.1.2. ESG score

3.1.3. Risk

3.2. Real-World Constraints

- (i)

- Capital budget constraint on the assets is defined as

- (ii)

- Maximum number of assets held in the portfolio is defined as

- (iii)

- Maximal proportion of the capital that can be invested in a single asset is defined as

- (iv)

- Minimal proportion of the capital that can be invested in a single asset is defined as

- (v)

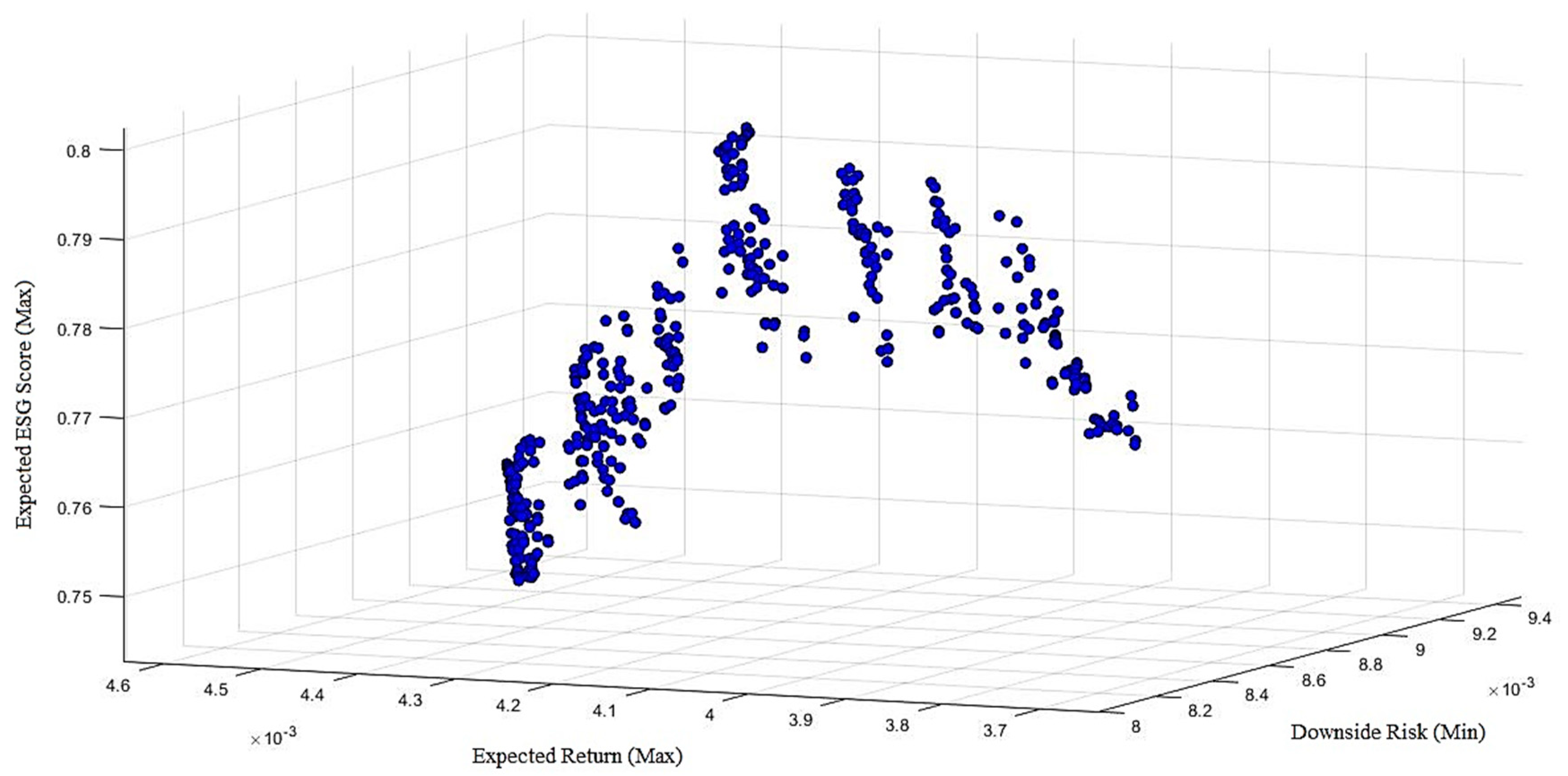

- No short selling of assets is defined asOn the basis of the aforementioned assumptions, the RRS portfolio selection model is formulated as:Here, an admissible portfolio is said to be Pareto-efficient if there is no other admissible portfolio such that , , and, with at least one strict inequality [76]. The efficient solutions set is the Pareto optimal set in the decision space and each of their three objective function values constitute the Pareto optimal frontier in the criterion space. The solutions of the Pareto optimal frontier are non-dominated.

4. Solution Methodology

5. Experimental Results

6. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Ballestero, E.; Pérez-Gladish, B.; Garcia-Bernabeu, A. The Ethical Financial Question and the MCDM Framework. In Socially Responsible Investment. International Series in Operations Research & Management Science; Ballestero, E., Pérez-Gladish, B., Garcia-Bernabeu, A., Eds.; Springer: Cham, Switzerland, 2015; Volume 219, pp. 3–22. [Google Scholar]

- Zopounidis, C.; Doumpos, M. Multicriteria classification and sorting methods: A literature review. Eur. J. Oper. Res. 2002, 138, 229–246. [Google Scholar] [CrossRef]

- Arribas, I.; García, F.; Guijarro, F.; Olive, J.; Tamošiūnienė, R. Mass appraisal of residential real estate using multilevel modelling. Int. J. Strateg. Prop. Manag. 2016, 20, 77–87. [Google Scholar] [CrossRef]

- Doumpos, M.; Zopounidis, C. Multicriteria Decision Aid Classification Methods; Springer US: Boston, MA, USA, 2002. [Google Scholar]

- García, F.; Guijarro, F.; Moya, I. A multi-objective model for passive portfolio management: an application on the S&P 100 index. J. Bus. Econ. Manag. 2013, 14, 758–775. [Google Scholar]

- Masood, O.; Tvaronavičienė, M.; Javaria, K. Impact of oil prices on stock return: evidence from G7 countries. Entrep. Sustain. Issues 2019, 1, 129–137. [Google Scholar]

- García, F.; Guijarro, F.; Oliver, J.; Tamošiūnienė, R. Hybrid fuzzy neural network to predict price direction in the german DAX-30 index. Technol. Econ. Dev. Econ. 2018, 24, 2161–2178. [Google Scholar] [CrossRef]

- Xidonas, P.; Doukas, H.; Mavrotas, G.; Pechak, O. Environmental corporate responsibility for investments evaluation: An Alternative Multi-objective programming model. Ann. Oper. Res. 2016, 247, 395–413. [Google Scholar] [CrossRef]

- Liern, V.; Méndez-Rodríguez, P.; Perez-Gladish, B. A Soft Computing Approach for Ranking Firms based on Experts’ Valuation of Corporate Social Responsibility. Appl. Math. Inf. Sci. 2015, 9, 1113–1122. [Google Scholar]

- Lin, S.-J.; Hsu, M.-F. Decision Making By Extracting Soft Information From Csr News Report. Technol. Econ. Dev. Econ. 2018, 24, 1344–1361. [Google Scholar] [CrossRef]

- Ou, Y.-C. Using a Hybrid Decision-Making Model to Evaluate the Sustainable Development Performance of High-Tech Listed Companies. J. Bus. Econ. Manag. 2016, 17, 331–346. [Google Scholar] [CrossRef]

- Del Mar Miralles-Quirós, M.; Miralles-Quirós, J.L. Improving Diversification Opportunities for Socially Responsible Investors. J. Bus. Ethics 2017, 140, 339–351. [Google Scholar]

- Silvestre, W.J.; Antunes, P.; Filho, W.L. The corporate sustainability typology: analysing sustainability drivers and fostering sustainability at enterprises. Technol. Econ. Dev. Econ. 2018, 24, 513–533. [Google Scholar] [CrossRef]

- Rahman, S.; Lee, C.-F.; Xiao, Y. The investment performance, attributes and investment behaviour of ethical equity mutual funds in the US: an empirical investigation. Rev. Quant. Financ. Account. 2017, 49, 91–116. [Google Scholar] [CrossRef]

- Bouslah, K.; Kryzanowski, L.; M’Zali, B. The impact of the dimensions of social performance on firm risk. J. Bank. Financ. 2013, 37, 1258–1273. [Google Scholar] [CrossRef]

- Petrillo, A.; De Felice, F.; García-Melón, M.; Pérez-Gladish, B. Investing in socially responsible mutual funds: Proposal of non-financial ranking in Italian market. Res. Int. Bus. Financ. 2016, 37, 541–555. [Google Scholar] [CrossRef]

- Fowler, S.J.; Hope, C. A Critical Review of Sustainable Business Indices and their Impact. J. Bus. Ethics 2007, 76, 243–252. [Google Scholar] [CrossRef]

- Jankalová, M.; Jankal, R. The assessment of corporate social responsibility: Approaches analysis. Entrep. Sustain. Issues 2017, 4, 441–459. [Google Scholar] [CrossRef]

- Smaliukienė, R.; Monni, S. A step-by-step approach to social marketing in energy transition. Insights Reg. Dev. 2019, 1, 19–32. [Google Scholar] [CrossRef]

- Anagnostopoulos, T.; Skouloudis, A.; Khan, N.; Evangelinos, K.; Anagnostopoulos, T.; Skouloudis, A.; Khan, N.; Evangelinos, K. Incorporating Sustainability Considerations into Lending Decisions and the Management of Bad Loans: Evidence from Greece. Sustainability 2018, 10, 4728. [Google Scholar] [CrossRef]

- Hasanudin, A.I.; Yuliansyah, Y.; Said, J.; Susilowati, C.; Muafi, M. Management control system, corporate social responsibility and firm performance. Entrep. Sustain. Issues 2019, 6, 1354–1368. [Google Scholar] [CrossRef]

- Charlo, M.J.; Moya, I.; Muñoz, A.M. Financial performance of socially responsible firms: The short- and long-term impact. Sustainability 2017, 9, 1622. [Google Scholar] [CrossRef]

- Atari, S.; Bakkar, Y.; Olaniyi, E.O.; Prause, G. Real options analysis of abatement investments for sulphur emission control compliance. Entrep. Sustain. Issues 2019, 6, 1062–1087. [Google Scholar] [CrossRef]

- De Colle, S.; York, J.G. Why Wine is not Glue? The Unresolved Problem of Negative Screening in Socially Responsible Investing. J. Bus. Ethics 2009, 85, 83–95. [Google Scholar] [CrossRef]

- Hermawan, A.; Gunardi, A. Motivation for disclosure of corporate social responsibility: evidence from banking industry in Indonesia. Entrep. Sustain. Issues 2019, 6, 1297–1306. [Google Scholar] [CrossRef]

- Li, F.; Patel, S.; Ramani, S. The Role of Mutual Funds in Corporate Social Responsibility. ResearchGate. 2019; Available online: https://www.researchgate.net/publication/332448888_The_Role_of_Mutual_Funds_in_Corporate_Social_Responsibility/download (accessed on 28 April 2019).

- Arribas, I.; Espinós-Vañó, M.D.; García, F.; Tamosiuniene, R. Negative screening and sustainable portfolio diversification. Entrep. Sustain. Issues 2019, 6, 1566–1586. [Google Scholar]

- Derwall, J.; Koedijk, K. Socially Responsible Fixed-Income Funds. J. Bus. Financ. Account. 2009, 36, 210–229. [Google Scholar] [CrossRef]

- Gil-Bazo, J.; Ruiz-Verdú, P.; Santos, A.A.P. The Performance of Socially Responsible Mutual Funds: The Role of Fees and Management Companies. J. Bus. Ethics 2010, 94, 243–263. [Google Scholar] [CrossRef]

- Ortas, E.; Moneva, J.M.; Burritt, R.; Tingey-Holyoak, J. Does Sustainability Investment Provide Adaptive Resilience to Ethical Investors? Evidence from Spain. J. Bus. Ethics 2014, 124, 297–309. [Google Scholar] [CrossRef]

- Wu, J.; Lodorfos, G.; Dean, A.; Gioulmpaxiotis, G. The Market Performance of Socially Responsible Investment during Periods of the Economic Cycle - Illustrated Using the Case of FTSE. Manag. Decis. Econ. 2017, 38, 238–251. [Google Scholar] [CrossRef]

- Yu, L. Performance of Socially Responsible Mutual Funds. J. Bus. Res. 2014, 6, 9–17. [Google Scholar]

- Chang, C.E.; Witte, H.D. American Journal of Business Performance Evaluation of U.S. Socially Responsible Mutual Funds: Revisiting Doing Good and Doing Well Article information. Am. J. Bus. 2010, 25, 9–24. [Google Scholar] [CrossRef]

- Cortez, M.C.; Silva, F.; Areal, N. The Performance of European Socially Responsible Funds. J. Bus. Ethics 2009, 87, 573–588. [Google Scholar] [CrossRef]

- Geczy, C.C.; Stambaugh, R.F.; Levin, D. Investing in Socially Responsible Mutual Funds. Scholarly Commons. 2005. Available online: https://repository.upenn.edu/cgi/viewcontent.cgi?article=1444&context=fnce_papers (accessed on 28 April 2019).

- Jones, S.; van der Laan, S.; Frost, G.; Loftus, J. The Investment Performance of Socially Responsible Investment Funds in Australia. J. Bus. Ethics 2008, 80, 181–203. [Google Scholar] [CrossRef]

- Renneboog, L.; Ter Horst, J.; Zhang, C. Socially responsible investments: Institutional aspects, performance and investor behaviour. J. Bank. Financ. 2008, 32, 1723–1742. [Google Scholar] [CrossRef]

- Bauer, R.; Koedijk, K.; Otten, R. International evidence on ethical mutual fund performance and investment style. J. Bank. Financ. 2005, 29, 1751–1767. [Google Scholar] [CrossRef]

- Brzeszczyński, J.; McIntosh, G. Performance of Portfolios Composed of British SRI Stocks. J. Bus. Ethics 2014, 120, 335–362. [Google Scholar] [CrossRef]

- Goldreyer, E.F.; Diltz, J.D. The performance of socially responsible mutual funds: Incorporating sociopolitical information in portfolio selection. Manag. Financ. 1999, 25, 5. [Google Scholar] [CrossRef]

- Hamilton, S.; Jo, H.; Statman, M. Doing Well While Doing Good? The Investment Performance of Socially Responsible Mutual Funds. Financ. Anal. J. 1993, 49, 62–66. [Google Scholar] [CrossRef]

- Kreander, N.; Gray, R.H.; Power, D.M.; Sinclair, C.D. The Financial Performance of European Ethical Funds 1996-1998. J. Account. Financ. 2002, 1, 3–22. [Google Scholar]

- Revelli, C.; Viviani, J.-L. Financial performance of socially responsible investing (SRI): What have we learned? A meta-analysis. Bus. Ethics A Eur. Rev. 2015, 24, 158–185. [Google Scholar] [CrossRef]

- McWilliams, A.; Siegel, D. Corporate Social Responsibility: a Theory of the Firm Perspective. Acad. Manag. Rev. 2001, 26, 117–127. [Google Scholar] [CrossRef]

- Ghoul, S.E.; Guedhami, O.; Kwok, C.C.Y.; Mishra, D.R. Does Corporate Social Responsibility Affect the Cost of Capital? J. Bank. Financ. 2011, 35, 2388–2406. [Google Scholar] [CrossRef]

- Attig, N.; El Ghoul, S.; Guedhami, O.; Suh, J. Corporate Social Responsibility and Credit Ratings. J. Bus. Ethics 2013, 117, 679–694. [Google Scholar] [CrossRef]

- Cheng, B.; Ioannou, I.; Serafeim, G. Corporate social responsibility and access to finance. Strateg. Manag. J. 2014, 35, 1–23. [Google Scholar] [CrossRef]

- Markowitz, H. Portfolio Selection. J. Financ. 1952, 7, 77–91. [Google Scholar]

- Hallerbach, W.; Ning, H.; Soppe, A.; Spronk, J. A framework for managing a portfolio of socially responsible investments. Eur. J. Oper. Res. 2004, 153, 517–529. [Google Scholar] [CrossRef]

- Steuer, R.E.; Qi, Y.; Hirschberger, M. Suitable-portfolio investors, nondominated frontier sensitivity and the effect of multiple objectives on standard portfolio selection. Ann. Oper. Res. 2007, 152, 297–317. [Google Scholar] [CrossRef]

- Bilbao-Terol, A.; Arenas-Parra, M.; Cañal-Fernández, V. A fuzzy multi-objective approach for sustainable investments. Expert Syst. Appl. 2012, 39, 10904–10915. [Google Scholar] [CrossRef]

- Utz, S.; Wimmer, M.; Hirschberger, M.; Steuer, R.E. Tri-criterion inverse portfolio optimization with application to socially responsible mutual funds. Eur. J. Oper. Res. 2014, 234, 491–498. [Google Scholar] [CrossRef]

- Calvo, C.; Ivorra, C.; Liern, V. Fuzzy portfolio selection with non-financial goals: exploring the efficient frontier. Ann. Oper. Res. 2016, 245, 31–46. [Google Scholar] [CrossRef]

- Li, Z.F.; Minor, D.; Wang, J.; Yu, C. A Learning Curve of the Market: Chasing Alpha of Socially Responsible Firms. SSRN Electron. J. 2018. [Google Scholar] [CrossRef]

- Bilbao-Terol, A.; Arenas-Parra, M.; Cañal-Fernández, V.; Obam-Eyang, P.N. Multi-criteria analysis of the GRI sustainability reports: an application to Socially Responsible Investment. J. Oper. Res. Soc. 2018, 69, 1576–1598. [Google Scholar] [CrossRef]

- Bilbao-Terol, A.; Jiménez-López, M.; Arenas-Parra, M.; Rodríguez-Uría, M.V. Fuzzy Multi-criteria Support for Sustainable and Social Responsible Investments: The Case of Investors with Loss Aversion. In The Mathematics of the Uncertain. Studies in Systems, Decision and Control; Gil, E., Gil, E., Gil, J., Gil, M., Eds.; Springer: Berlin, Germany, 2018; Volume 142, pp. 555–564. [Google Scholar]

- Gasser, S.M.; Rammerstorfer, M.; Weinmayer, K. Markowitz revisited: Social portfolio engineering. Eur. J. Oper. Res. 2017, 258, 1181–1190. [Google Scholar] [CrossRef]

- Zadeh, L.A. Fuzzy sets. Inf. Control 1965, 8, 338–353. [Google Scholar] [CrossRef]

- Gupta, P.; Mehlawat, M.K.; Saxena, A. Hybrid optimization models of portfolio selection involving financial and ethical considerations. Knowl.-Based Syst. 2013, 37, 318–337. [Google Scholar] [CrossRef]

- Pérez-Gladish, B.M.; del Arenas-Parra, M.; Bilbao-Terol, C.; Rodríguez-Uría, M.V. Socially Responsible Investment: Mutual Funds Portfolio Selection Using Fuzzy Multiobjective Pro-Gramming; FUNCAS: Madrid, Spain, 2007; Volume 350. [Google Scholar]

- Liu, B.; Liu, Y.K. Expected value of fuzzy variable and fuzzy expected value models. IEEE Trans. Fuzzy Syst. 2002, 10, 445–450. [Google Scholar]

- Barak, S.; Abessi, M.; Modarres, M. Fuzzy turnover rate chance constraints portfolio model. Eur. J. Oper. Res. 2013, 228, 141–147. [Google Scholar] [CrossRef]

- Huang, X. Fuzzy chance-constrained portfolio selection. Appl. Math. Comput. 2006, 177, 500–507. [Google Scholar] [CrossRef]

- Vercher, E.; Bermúdez, J.D. Portfolio optimization using a credibility mean-absolute semi-deviation model. Expert Syst. Appl. 2015, 42, 7121–7131. [Google Scholar] [CrossRef]

- Gupta, P.; Mittal, G.; Mehlawat, M.K. Expected value multiobjective portfolio rebalancing model with fuzzy parameters. Insur. Math. Econ. 2013, 52, 190–203. [Google Scholar] [CrossRef]

- Mohebbi, N.; Najafi, A.A. Credibilistic multi-period portfolio optimization based on scenario tree. Phys. A Stat. Mech. its Appl. 2018, 492, 1302–1316. [Google Scholar] [CrossRef]

- Jalota, H.; Thakur, M.; Mittal, G. Modelling and constructing membership function for uncertain portfolio parameters: A credibilistic framework. Expert Syst. Appl. 2017, 71, 40–56. [Google Scholar] [CrossRef]

- García, F.; González-Bueno, J.; Oliver, J.; Tamošiūnienė, R. A credibilistic mean-semivariance-PER portfolio selection model for Latin America. J. Bus. Econ. Manag. 2019, 20, 225–243. [Google Scholar] [CrossRef]

- Markowitz, H.; Todd, P.; Xu, G.; Yamane, Y. Computation of mean-semivariance efficient sets by the Critical Line Algorithm. Ann. Oper. Res. 1993, 45, 307–317. [Google Scholar] [CrossRef]

- Speranza, M. Linear programming models for portfolio optimization. Finance 1993, 14, 107–123. [Google Scholar]

- Sortino, F.A.; Van Der Meer, R. Downside risk. J. Portf. Manag. 1991, 17, 27–31. [Google Scholar] [CrossRef]

- Dubois, D.J.; Prade, H. Fuzzy Sets and Systems: Theory and Applications; Academic Press: New York, NY, USA, 1980; Volume 144. [Google Scholar]

- Liu, B. Uncertainty Theory: An Introduction to Its Axiomatic Foundations; Springer-Verlag: Berlin/Heidelberg, Germany, 2004. [Google Scholar]

- Liu, B. Uncertainty Theory an Introduction to Its Axiomatic Foundations, 2nd ed.; Springer-Verlag: Berlin/Heidelberg, Germany, 2007; Volume 154. [Google Scholar]

- Vercher, E.; Bermúdez, J.D. Fuzzy Portfolio Selection Models: A Numerical Study. In Springer Optimization and Its Applications; Doumpos, M., Zopounidis, C., Pardalos, P.M., Eds.; Springer: Boston, MA, USA, 2012; pp. 253–280. [Google Scholar]

- Vercher, E.; Bermúdez, J.D. A Possibilistic Mean-Downside Risk-Skewness Model for Efficient Portfolio Selection. IEEE Trans. Fuzzy Syst. 2013, 21, 585–595. [Google Scholar] [CrossRef]

- Liagkouras, K.; Metaxiotis, K. Efficient Portfolio Construction with the Use of Multiobjective Evolutionary Algorithms: Best Practices and Performance Metrics. Int. J. Inf. Technol. Decis. Mak. 2015, 14, 535–564. [Google Scholar] [CrossRef]

- Deb, K. Multi-Objective Optimization Using Evolutionary Algorithms; John Wiley & Sons: Hoboken, NJ, USA, 2001; ISBN 047187339X. [Google Scholar]

- Deb, K.; Agrawal, K.; Pratap, A.; Meyarivan, T. A Fast Elitist Non-dominated Sorting Genetic Algorithm for Multi-objective Optimization: NSGA-II. IEEE Trans. Evol. Comput. 2002, 6, 182–197. [Google Scholar] [CrossRef]

- Gupta, P.; Mehlawat, M.K.; Inuiguchi, M.; Chandra, S. Portfolio Optimization with Interval Coefficients. In Fuzzy Portfolio Optimization. Studies in Fuzziness and Soft Computing; Springer: Berlin/Heidelberg, Germany, 2014; pp. 33–59. [Google Scholar]

- Skolpadungket, P.; Dahal, K.; Harnpornchai, N. Portfolio optimization using multi-obj ective genetic algorithms. In Proceedings of the 2007 IEEE Congress on Evolutionary Computation, Singapore, 25–28 September 2007; pp. 516–523. [Google Scholar]

- Sharpe, W.F. Mutual Fund Performance. J. Bus. 1966, 39, 119–138. [Google Scholar] [CrossRef]

| Return | Risk | ESG Score | |

|---|---|---|---|

| Return | 1.000 | ||

| Risk | 0.957 ** | 1.000 | |

| ESG score | −0.614 ** | 0.449 ** | 1.000 |

| VaR | Return | ESG Score | |

|---|---|---|---|

| SPDR Dow Jones ETF (DIA) | 0.0157 | 0.0426 | 0.6381 |

| SR Optimal Portfolio | 0.0182 | 0.1433 | 0.7110 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

García, F.; González-Bueno, J.; Oliver, J.; Riley, N. Selecting Socially Responsible Portfolios: A Fuzzy Multicriteria Approach. Sustainability 2019, 11, 2496. https://doi.org/10.3390/su11092496

García F, González-Bueno J, Oliver J, Riley N. Selecting Socially Responsible Portfolios: A Fuzzy Multicriteria Approach. Sustainability. 2019; 11(9):2496. https://doi.org/10.3390/su11092496

Chicago/Turabian StyleGarcía, Fernando, Jairo González-Bueno, Javier Oliver, and Nicola Riley. 2019. "Selecting Socially Responsible Portfolios: A Fuzzy Multicriteria Approach" Sustainability 11, no. 9: 2496. https://doi.org/10.3390/su11092496

APA StyleGarcía, F., González-Bueno, J., Oliver, J., & Riley, N. (2019). Selecting Socially Responsible Portfolios: A Fuzzy Multicriteria Approach. Sustainability, 11(9), 2496. https://doi.org/10.3390/su11092496