Effectiveness and Sustainability of Grain Price Support Policies in China

Abstract

:1. Introduction

2. Brief Summary of the Grain Pricing Policies in China

2.1. Dual-Track Grain Pricing Polices

2.2. Grain Price Support Policies

3. Methodology

4. Empirical Analysis

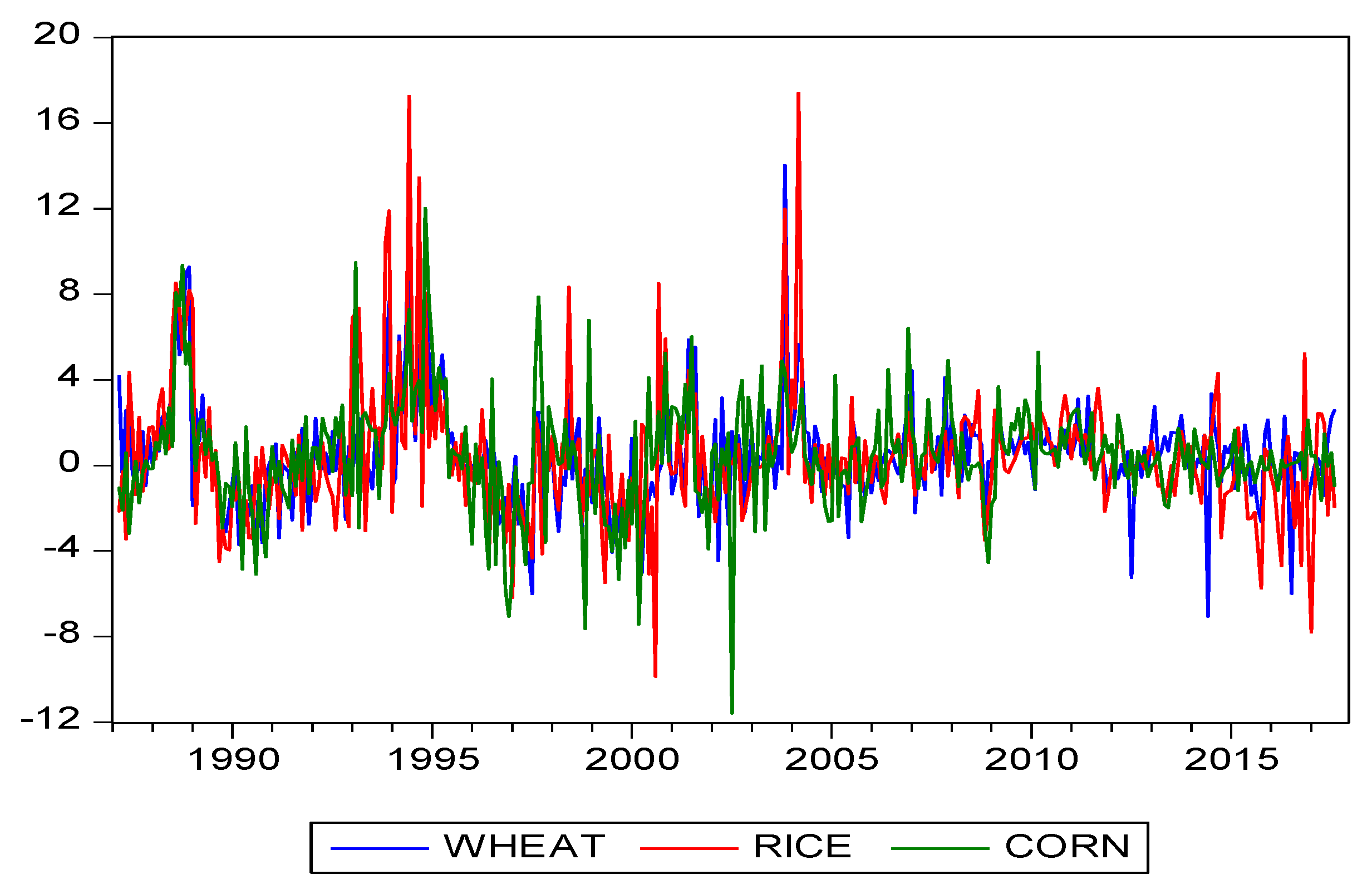

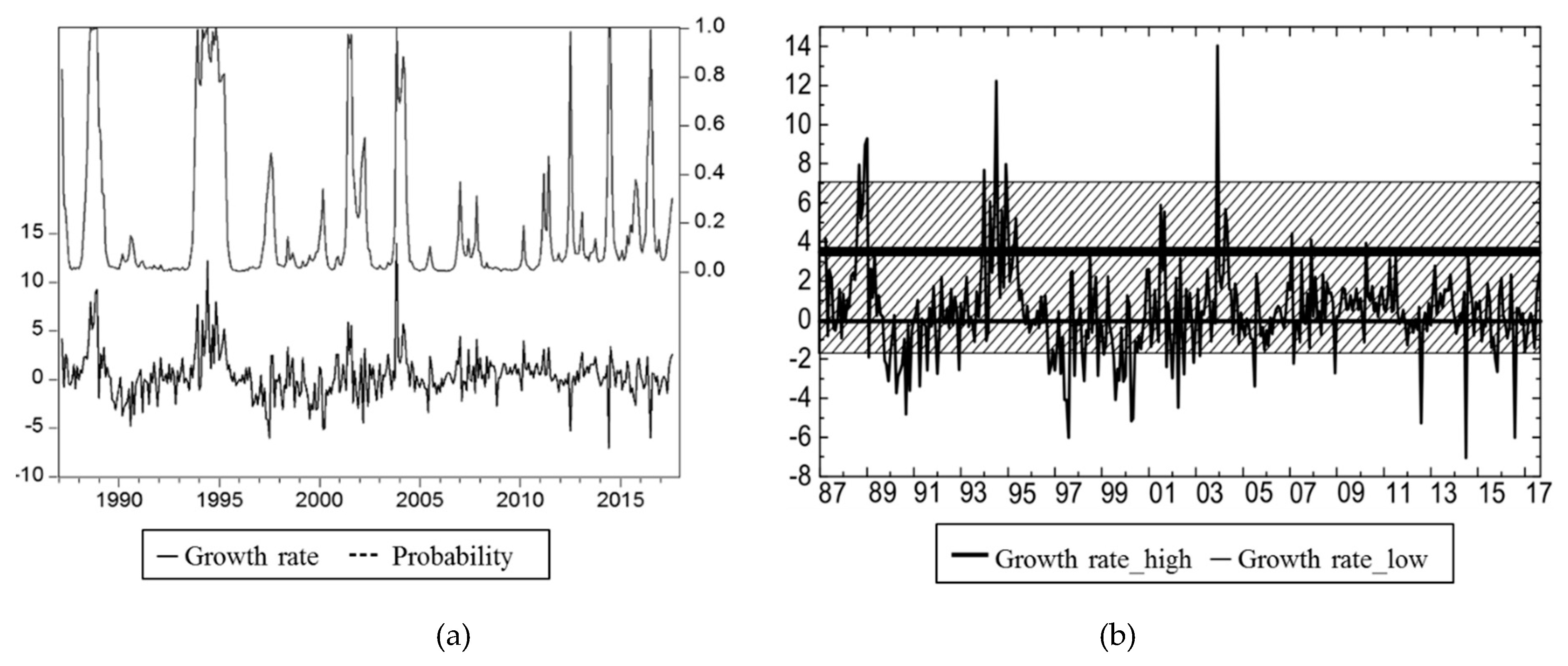

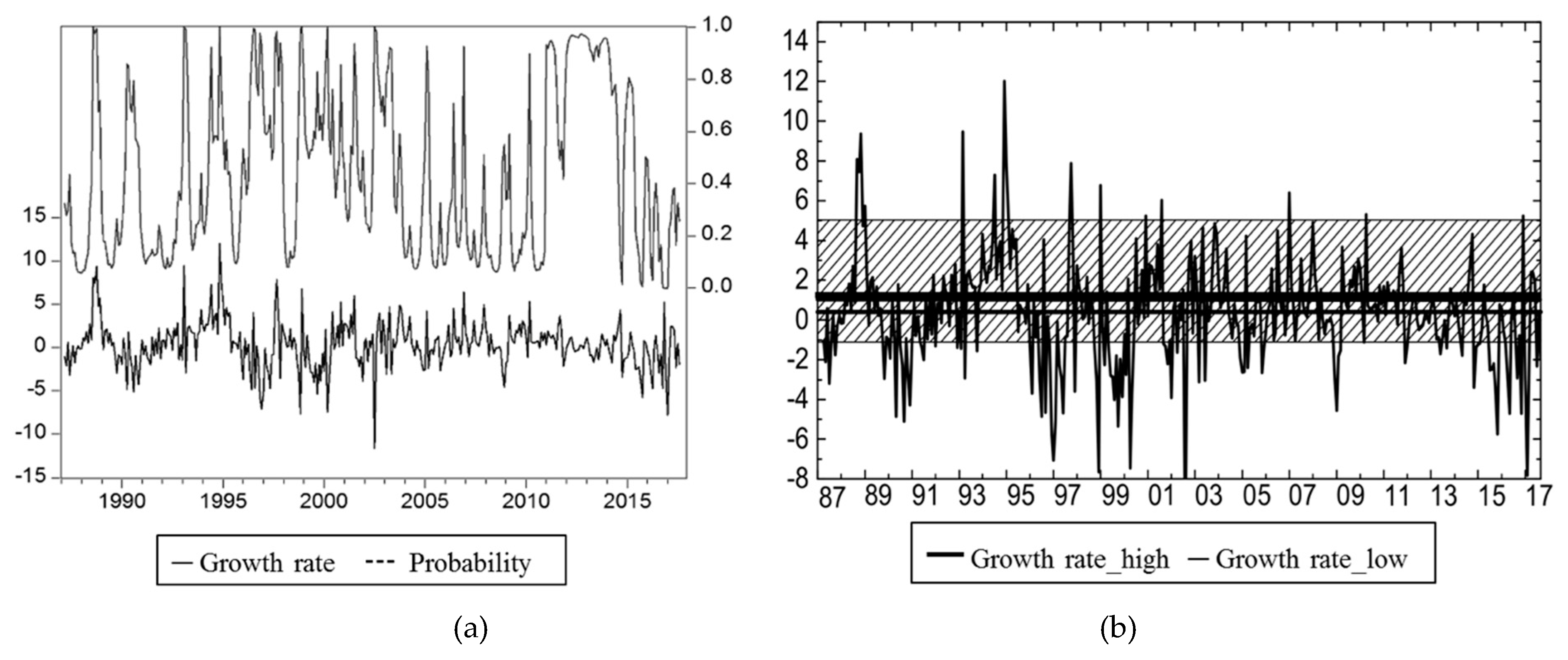

4.1. Estimation Results for Rice, Wheat, and Corn

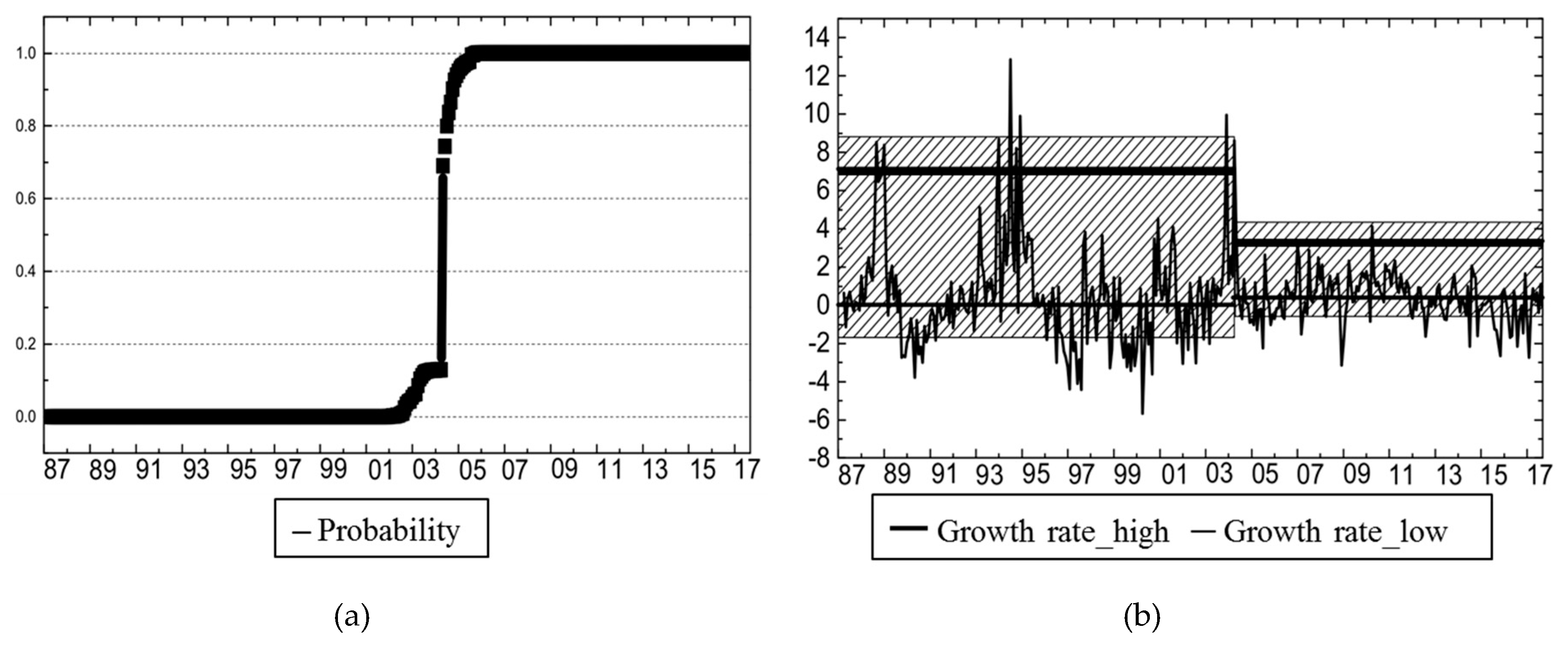

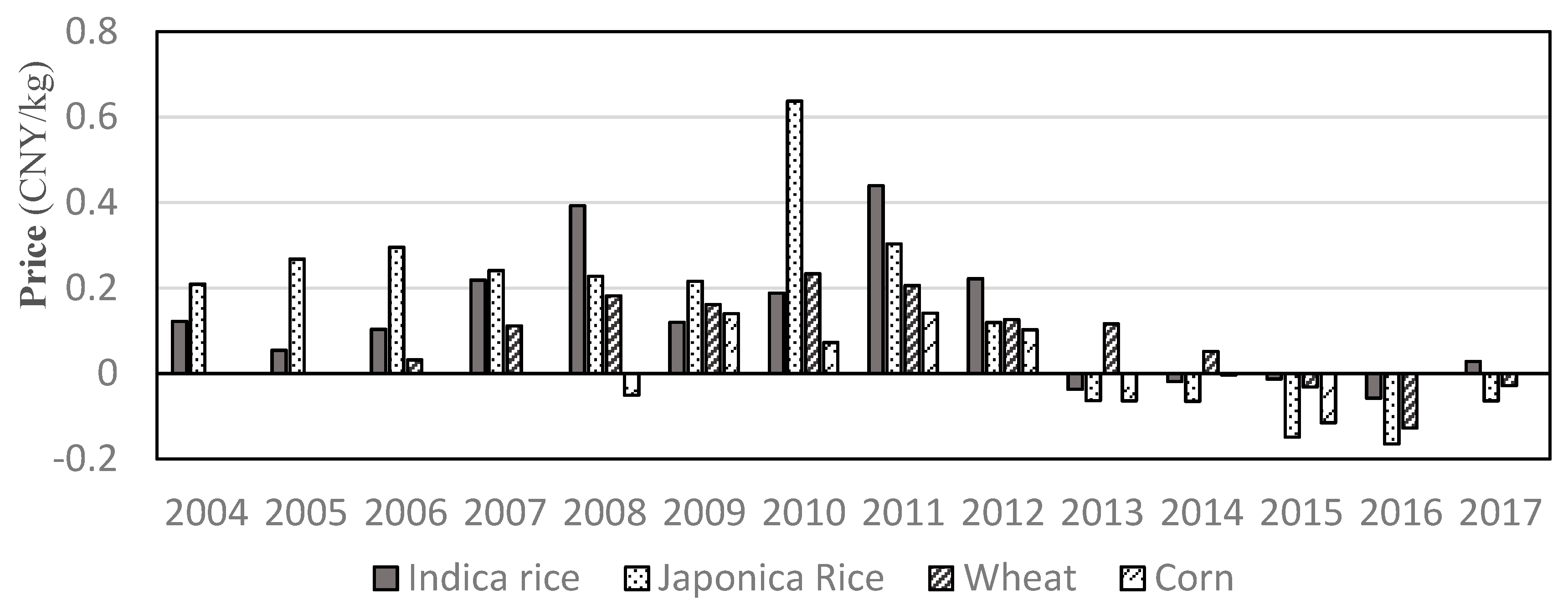

4.2. Policy Effectiveness on Grain Price Stabilization

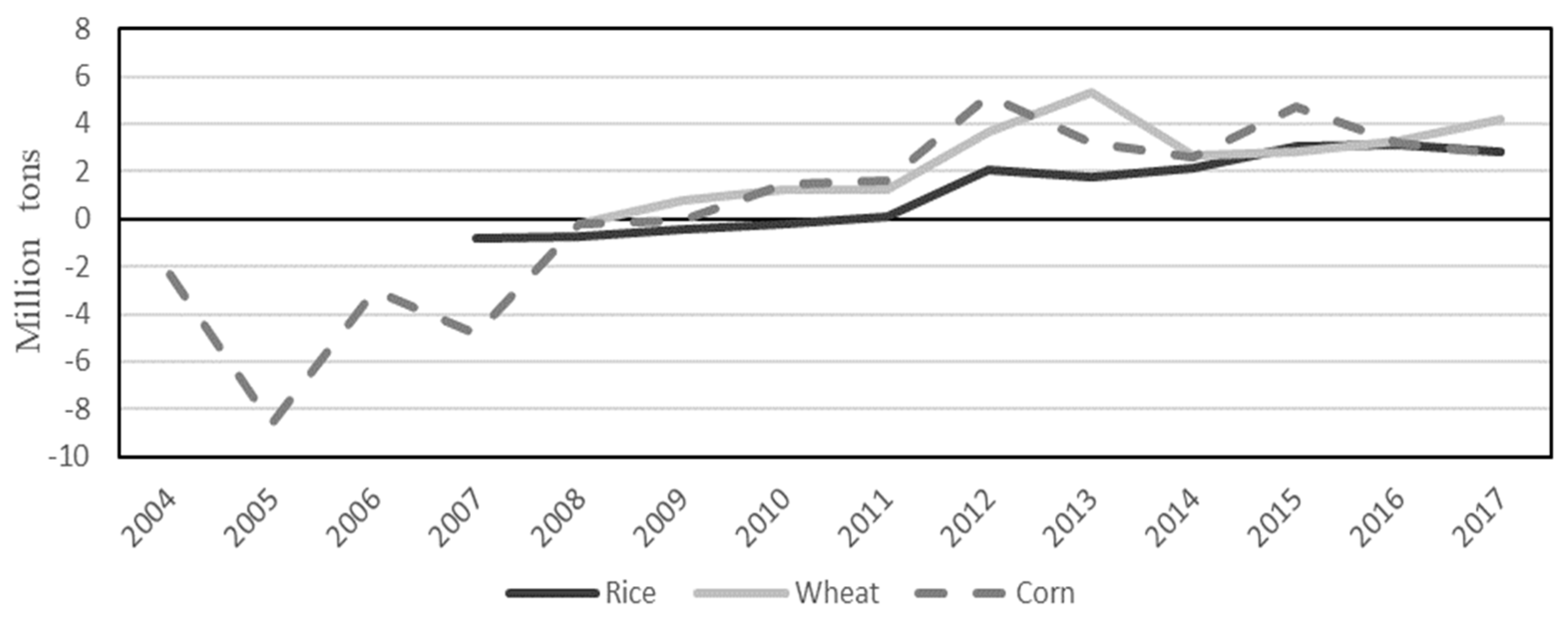

5. Sustainability Analysis of Grain Price Support Policies

6. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Tomek, W.G.; Kaiser, H.M. Agricultural Product Prices, 5th ed.; Cornell University Press: Ithaca, NY, USA, 2014. [Google Scholar]

- Gupta, N. Government Intervention in Grain Markets in India: Rethinking the Procurement Policy; Working Paper No. 231; Department of Economics, Delhi School of Economics: New Delhi, India, 2013. [Google Scholar]

- Li, J.; Li, C.; Chavas, J.P. Food price bubbles and government intervention: Is China different? Can. J. Agric. Econ. 2017, 65, 135–157. [Google Scholar] [CrossRef]

- Zilbermann, D.; Hochman, G.; Rajagopal, D.; Sexton, S.; Timilsina, G. The impact of biofuels on commodity food prices: Assessment of findings. Am. J. Agric. Econ. 2013, 95, 275–281. [Google Scholar] [CrossRef]

- Hamilton, J.D. A new approach to the economic analysis of nonstationary time series and the business cycle. Econometrica 1989, 57, 357–384. [Google Scholar] [CrossRef]

- Simpson, P.W.; Denise, R.O.; Marianne, S. Modeling business cycle movements in the UK economy. Economica 2001, 68, 243–267. [Google Scholar] [CrossRef]

- Mills, T.C.; Wang, P. Have output growth rates stabilized? evidence from the G-7 economies. Scott. J. Polit. Econ. 2003, 50, 232–246. [Google Scholar] [CrossRef]

- Gale, F.H. Growth and Evolution in China’s Agricultural Support Policies; USDA-ERS Economic Research Report 153; USDA: Washington, DC, USA, 2013.

- Rivera-Ferre, M.; Ortega-Cerdà, M.; Baumgärtner, J. Rethinking study and management of agricultural systems for policy design. Sustainability 2013, 5, 3858–3875. [Google Scholar] [CrossRef]

- Park, A.; Jin, H.; Rozelle, S.; Huang, J. Market emergence and transition: Arbitrage, transaction costs and autarky in China’s grain markets. Am. J. Agric. Econ. 2002, 84, 67–82. [Google Scholar] [CrossRef]

- Putterman, L. Dualism and reform in China. Econ. Dev. Cult. Chang. 1992, 40, 467–493. [Google Scholar] [CrossRef]

- Huang, J.; Rozelle, S. The emergence of agricultural commodity markets in China. China Econ. Rev. 2006, 17, 266–280. [Google Scholar] [CrossRef]

- Heerink, N.; Kuiper, M.; Shi, X. China’s new rural income support policy: Impacts on grain production and rural income inequality. China World Econ. 2006, 14, 58–69. [Google Scholar] [CrossRef]

- Food and Agriculture Organization of the United Nations (FAO). The State of Food Insecurity in the World; FAO: Rome, Italy, 2011. [Google Scholar]

- Food and Agriculture Organization of the United Nations (FAO). The State of Agricultural Commodity Markets; FAO: Rome, Italy, 2018. [Google Scholar]

- The National Development and Reform Commission of China. Available online: http://www.ndrc.gov.cn/ (accessed on 31 January 2019).

- Sumner, D.A. Recent Commodity Price Movements in Historical Perspective. Am. J. Agric. Econ. 2009, 91, 1250–1256. [Google Scholar] [CrossRef]

- Sanjuan, A.I.; Dawson, P.J. Price transmission, BSE and structural breaks in the UK meat sector. Eur. Rev. Agric. Econ. 2003, 30, 155–172. [Google Scholar] [CrossRef]

- Salisu, A.A.; Fasanya, I.O. Modelling oil price volatility with structural breaks. Energy Policy 2013, 52, 554–562. [Google Scholar] [CrossRef]

- Wang, X.; Hui, E.; Sun, J. Population aging, mobility and real estate price: Evidence from cities in China. Sustainability 2018, 10, 3140. [Google Scholar] [CrossRef]

- Pesaran, M.H.; Pettenuzzo, D.; Timmermann, A. Forecasting time series subject to multiple structural breaks. Rev. Econ. Stud. 2006, 73, 1057–1084. [Google Scholar] [CrossRef]

- The Department of Market and Economic Information, Ministry and Rural Affairs of Agriculture of China. Available online: http://www.moa.gov.cn/zj2017/sj_styj/ (accessed on 31 January 2019).

- The Website of the State Council of China. Available online: http://www.ce.cn/cysc/sp/info/201601/05/t20160105_8073502.shtml (accessed on 31 January 2019).

- Anderson, K. (Ed.) Distortions to Agricultural Incentives: A Global Perspective, 1955–2007; The World Bank: Washington, DC, USA, 2009. [Google Scholar]

- Newbery, D.M.; Stiglitz, J.E. The Theory of Commodity Price Stabilization: A Study in the Economics of Risk; Clarendon Press: Oxford, UK, 1981. [Google Scholar]

- Lichtenberg, E.; Zilberman, D. The Econometrics of Damage Control: Why Specification Matters. Am. J. Agric. Econ. 1986, 68, 261–273. [Google Scholar] [CrossRef]

- Gardner, B.L. The Economics of Agricultural Policies; Macmillan: New York, NY, USA, 1987. [Google Scholar]

- Yu, W. How China’s Farm Policy Reforms Could Affect Trade and Markets: A Focus on Grains and Cotton; Issue Paper; International Centre for Trade and Sustainable Development: Geneva, Switzerland, 2017. [Google Scholar]

- Orden, D.; Brink, L. China’s Price Support for Wheat, Rice and Corn under Dispute at the WTO: Compliance and Economic Issues. In Proceedings of the 2018 Agricultural & Applied Economics Association Annual Meeting, Washington, DC, USA, 5–7 August 2018. [Google Scholar]

- Brink, L.; Orden, D.; Zulauf, C. WTO Dispute Panel Report on China’s Agricultural Support; Farmdoc Daily (9): 40; Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign: Champaign, IL, USA, 6 March 2019. [Google Scholar]

- Yu, W.; Jensen, H.G. Trade policy responses to food price crisis and implications for existing domestic support measures: The case of China in 2008. World Trade Rev. 2014, 13, 651–683. [Google Scholar] [CrossRef]

- Konandreas, P.A.; Schmitz, A. Welfare implications of grain price stabilization: Some empirical evidence for the United States. Am. J. Agric. Econ. 1978, 60, 74–84. [Google Scholar] [CrossRef]

- Cochrane, W.W. Some nonconformist thoughts on welfare economics and commodity stabilization policy. Am. J. Agric Econ. 1980, 62, 508–511. [Google Scholar] [CrossRef]

- Gardner, B.L. Optimal Stockpiling of Grain; Lexington Books: Lanham, MD, USA, 1980. [Google Scholar]

- Spriggs, J. Economic analysis of the western grain stabilization program. Can. J. Agric. Econ. 1985, 33, 209–229. [Google Scholar] [CrossRef]

| Year | Rice | Wheat | Corn | ||||

|---|---|---|---|---|---|---|---|

| Early Indica Rice | Mid-Late Indica Rice | Late Japonica Rice | White Wheat | Red Wheat | Mixed Wheat | Corn | |

| 2004 | 1.40 | 1.44 | 1.50 | - | - | - | - |

| 2005 | 1.40 | 1.44 | 1.50 | - | - | - | - |

| 2006 | 1.40 | 1.44 | 1.50 | 1.44 | 1.38 | 1.38 | - |

| 2007 | 1.40 | 1.44 | 1.50 | 1.44 | 1.38 | 1.38 | - |

| 2008 | 1.54 | 1.58 | 1.64 | 1.54 | 1.44 | 1.44 | 1.50 |

| 2009 | 1.80 | 1.84 | 1.90 | 1.74 | 1.66 | 1.66 | 1.50 |

| 2010 | 1.86 | 1.94 | 2.10 | 1.80 | 1.72 | 1.72 | 1.80 |

| 2011 | 2.04 | 2.14 | 2.56 | 1.90 | 1.86 | 1.86 | 1.98 |

| 2012 | 2.40 | 2.50 | 2.8 | 2.04 | 2.04 | 2.04 | 2.12 |

| 2013 | 2.64 | 2.70 | 3.00 | 2.24 | 2.24 | 2.24 | 2.24 |

| 2014 | 2.70 | 2.76 | 3.10 | 2.36 | 2.36 | 2.36 | 2.24 |

| 2015 | 2.70 | 2.76 | 3.10 | 2.36 | 2.36 | 2.36 | 2.00 |

| 2016 | 2.66 | 2.76 | 3.10 | 2.36 | 2.36 | 2.36 | - |

| 2017 | 2.60 | 2.72 | 3.00 | 2.36 | 2.36 | 2.36 | - |

| Commodity | Parameter | Average | Median | 5% Quantile | 95% Quantile | SD |

|---|---|---|---|---|---|---|

| rice | −0.134 | −0.140 | −0.407 | 0.137 | 0.201 | |

| 3.728 ** | 3.648 | 1.402 | 6.248 | 1.475 | ||

| 1.701 *** | 1.701 | 1.520 | 1.877 | 0.109 | ||

| 6.126 *** | 6.037 | 5.006 | 7.558 | 0.795 | ||

| wheat | 0.064 | 0.069 | −0.323 | 0.225 | 0.163 | |

| 3.478 *** | 3.548 | 1.189 | 5.570 | 1.337 | ||

| 1.643 *** | 1.658 | 1.361 | 1.851 | 0.142 | ||

| 3.585 *** | 3.555 | 2.824 | 4.427 | 0.490 | ||

| corn | 0.401 * | 0.406 | 0.017 | 0.773 | 0.227 | |

| 1.039 ** | 0.926 | 0.386 | 2.038 | 0.523 | ||

| 1.523 *** | 1.520 | 1.156 | 1.910 | 0.233 | ||

| 3.980 *** | 3.869 | 3.290 | 5.010 | 0.556 |

| Parameter | Average | Median | 5% Quartile | 95% Quartile | SD |

|---|---|---|---|---|---|

| 0.008 | 0.006 | −0.452 | 0.477 | 0.274 | |

| 7.173 *** | 7.171 | 6.186 | 8.161 | 0.597 | |

| 0.361 | 0.358 | −0.068 | 0.834 | 0.268 | |

| 3.365 *** | 3.376 | 2.474 | 5.829 | 0.590 | |

| 1.700 *** | 1.695 | 1.546 | 1.860 | 0.094 | |

| 0.976 *** | 0.965 | 0.823 | 1.345 | 0.107 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lyu, J.; Li, X. Effectiveness and Sustainability of Grain Price Support Policies in China. Sustainability 2019, 11, 2478. https://doi.org/10.3390/su11092478

Lyu J, Li X. Effectiveness and Sustainability of Grain Price Support Policies in China. Sustainability. 2019; 11(9):2478. https://doi.org/10.3390/su11092478

Chicago/Turabian StyleLyu, Jie, and Xiaolei Li. 2019. "Effectiveness and Sustainability of Grain Price Support Policies in China" Sustainability 11, no. 9: 2478. https://doi.org/10.3390/su11092478

APA StyleLyu, J., & Li, X. (2019). Effectiveness and Sustainability of Grain Price Support Policies in China. Sustainability, 11(9), 2478. https://doi.org/10.3390/su11092478