Local Economic Impact of Wind Energy Development: Analysis of the Regulatory Framework, Taxation, and Income for Galician Municipalities

Abstract

1. Introduction

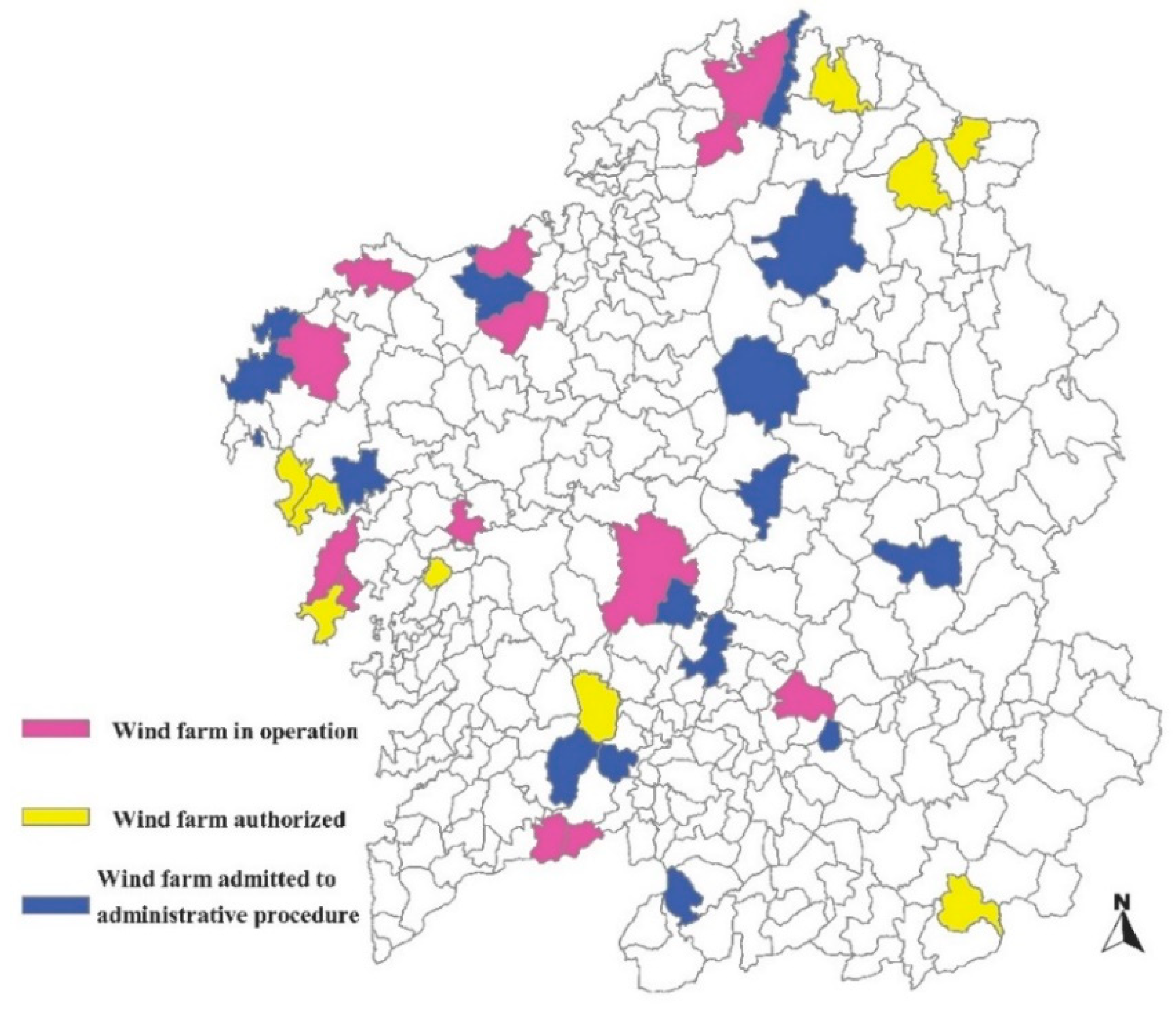

2. Local Economic Impacts, Regulatory Framework and Rural Development Associated with Wind Energy

3. Materials and Methods

3.1. Gathering and Selection of Information

3.2. Systematisation of the Information and Categories of Analysis

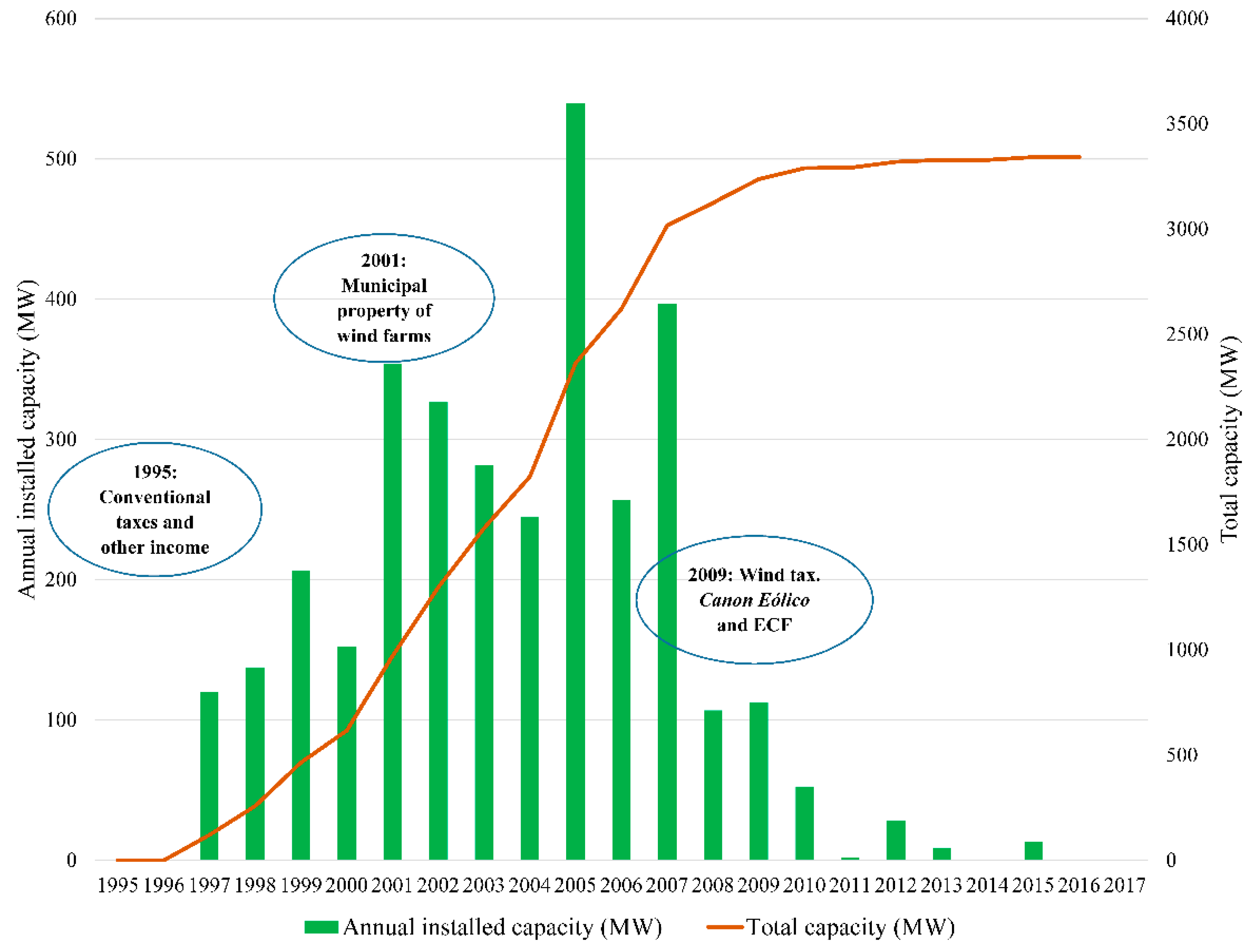

4. Results

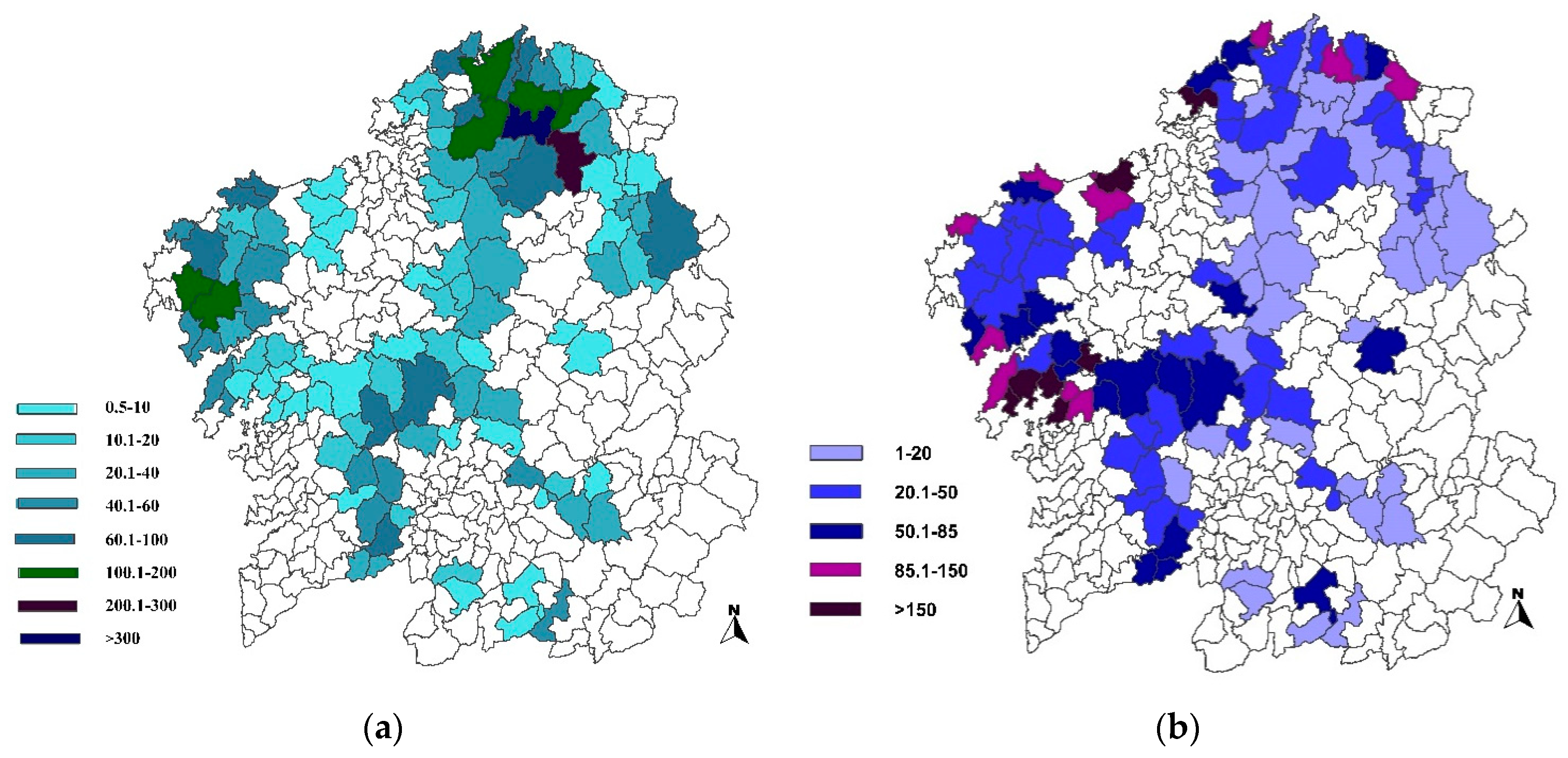

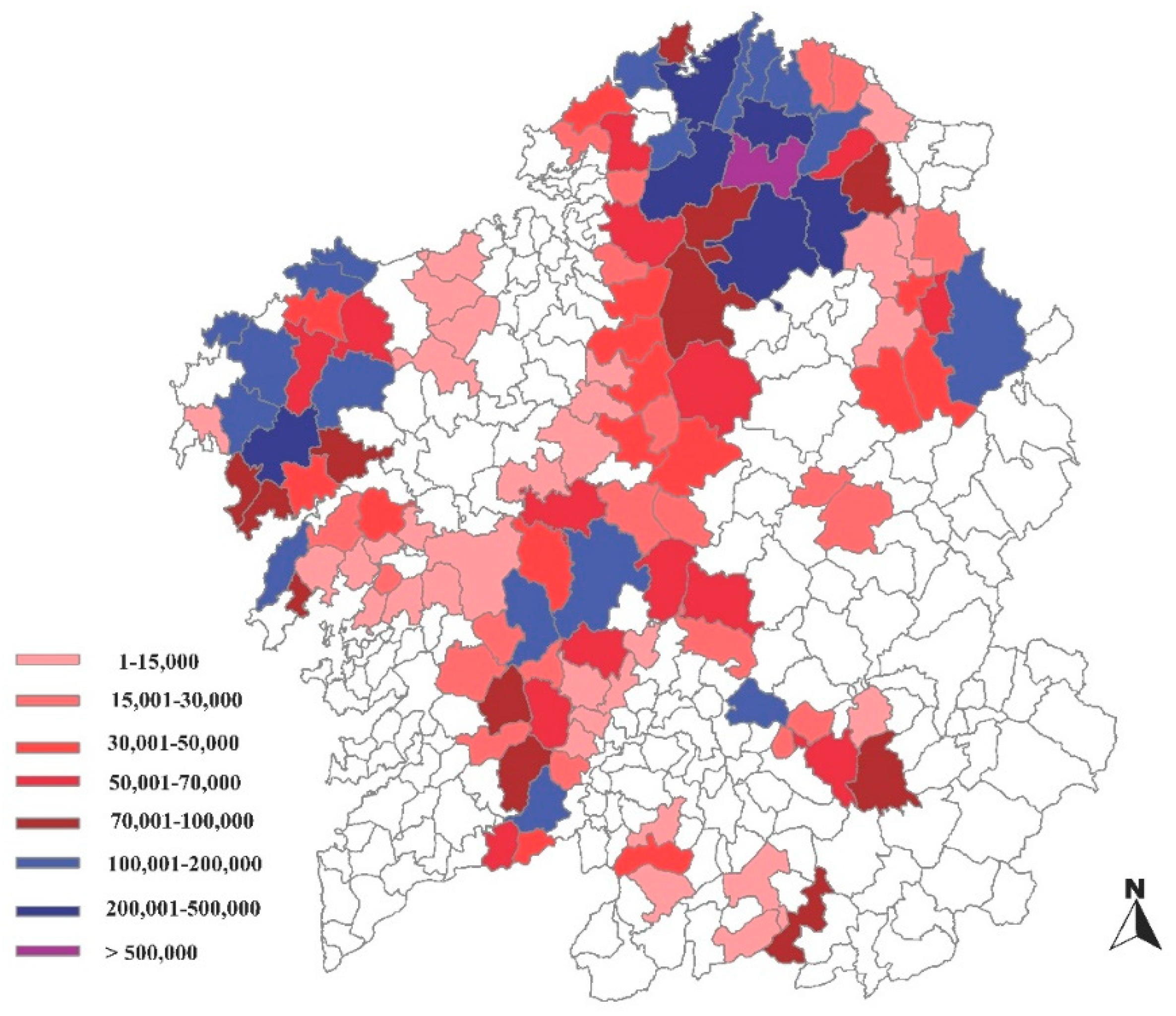

4.1. Municipal Tax Revenues

4.1.1. Conventional Taxes

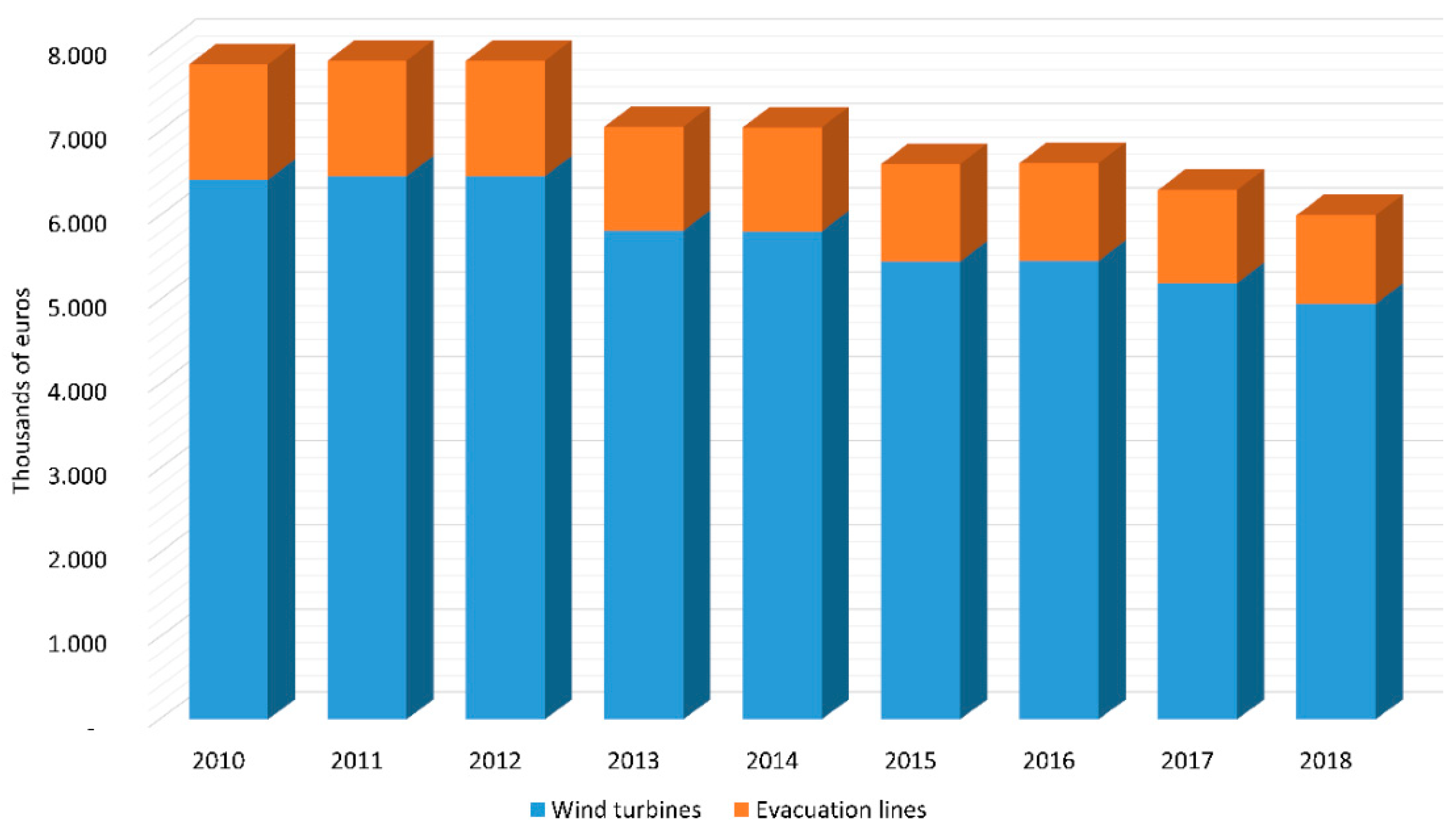

4.1.2. Specific Taxes: the canon eólico and the Environmental Compensation Fund

4.2. Municipal Ownership of Wind Farms: Singular Wind Farms

4.3. Other Incomes

5. Discussion

5.1. Wind Revenues and Rural Development in Galicia

5.2. Regulatory Limitations to the Access, Control, and Generation of Wind Revenues

5.3. Limitations and Future Research Prospects

6. Conclusions and Policy Recommendations

Author Contributions

Funding

Conflicts of Interest

References and Notes

- Intergovernmental Panel on Climate Change (IPCC). Summary for Policymakers; Edenhofer, O., Pichs-Madruga, R., Sokona, Y., Eds.; IPCC Special Report on Renewable Energy Sources and Climate Change Mitigation; Cambridge University Press: Cambridge, UK, 2011. [Google Scholar]

- European Parliament. Directive 2009/28/EC of the European Parliament and of the Council, of 23 April 2009, on the Promotion of the Use of Energy from Renewable Sources and Amending and Subsequently Repealing Directives 2001/77/EC and 2003/30/EC. 2009. Available online: http://eur-lex.europa.eu/legal-content/EN/ALL/?uri=CELEX:32009L0028 (accessed on 20 November 2018).

- Ertay, T.; Kahraman, C.; Kaya, İ. Evaluation of renewable energy alternatives using MACBETH and fuzzy AHP multicriteria methods: The case of Turkey. Technol. Econ. Dev. Econ. 2013, 19, 38–62. [Google Scholar] [CrossRef]

- Kaplan, Y.A. Overview of wind energy in the world and assessment of current wind energy policies in Turkey. Renew. Sustain. Energy Rev. 2015, 43, 562–568. [Google Scholar] [CrossRef]

- Michalak, P.; Zimny, J. Wind energy development in the world, Europe and Poland from 1995 to 2009. Current status and future perspectives. Renew. Sustain. Energy Rev. 2011, 15, 2330–2341. [Google Scholar] [CrossRef]

- Kemmoku, Y.; Keiko, N.; Kawamoto, T.; Sakakibara, T. Life cycle CO2 emissions of a photovoltaic/wind/diesel generating system. Electr. Eng. Jpn. 2002, 138, 14–23. [Google Scholar] [CrossRef]

- Kayser, B. The future of the countryside. In Beyond Modernization: The Impact of Endogenous Development; van der Ploeg, J.D., Van Dijk, G., Eds.; Van Gorcum: Assen, Holland, 1995; pp. 179–190. [Google Scholar]

- Ryser, L.; Halseth, G. Rural Economic Development: A Review of the Literature from Industrialized Economies. Geogr. Compass 2010, 4, 510–531. [Google Scholar] [CrossRef]

- Varela-Vázquez, P.; Sánchez-Carreira, M.C. Socioeconomic impact of wind energy on peripheral regions. Renew. Sustain. Energy Rev. 2015, 50, 982–990. [Google Scholar] [CrossRef]

- Slattery, M.C.; Lantz, E.; Johnson, B.L. State and local economic impacts from wind energy projects: Texas case study. Energy Policy 2011, 39, 7930–7940. [Google Scholar] [CrossRef]

- Aceleanu, M.I.; Șerban, A.C.; Țîrcă, D.M.; Badea, L. The rural sustainable development through renewable energy. The case of Romania. Technol. Econ. Dev. Econ. 2018, 24, 1408–1434. [Google Scholar] [CrossRef]

- Fouché, E.; Brent, A. Journey towards Renewable Energy for Sustainable Development at the Local Government Level: The Case of Hessequa Municipality in South Africa. Sustainability 2019, 11, 755. [Google Scholar] [CrossRef]

- Benedek, J.; Sebestyén, T.; Bartók, B. Evaluation of renewable energy sources in peripheral areas and renewable energy-based rural development. Renew. Sustain. Energy Rev. 2018, 90, 516–535. [Google Scholar] [CrossRef]

- Instituto Nacional de Estadística-INE. Indicadores de Estructura de la Población. Madrid. 2018. Available online: http://www.ine.es (accessed on 20 November 2018).

- Instituto Galego de Estatística-IGE. Nomenclator. Santiago de Compostela. 2018. Available online: https://www.ige.eu (accessed on 20 November 2018).

- Corbelle, E.; Crecente, R.O. Abandono de terras: Concepto teórico e consecuencias. Revista Galega de Economía 2008, 17, 47–62. [Google Scholar]

- Fuentes-Santos, I.; Marey-Pérez, M.F.; González-Manteiga, W. Forest fire spatial pattern analysis in Galicia (NW Spain). J. Environ. Manag. 2013, 128, 30–42. [Google Scholar] [CrossRef] [PubMed]

- Copena, D. Enerxía Eólica e Medio Rural: Unha Análise Aplicada dos Impactos Socioeconómicos dos Parques Eólicos no Mundo Rural Galego. Ph.D. Thesis, Universidade de Vigo, Vigo, Spain, 17 December 2015. Available online: http://www.investigo.biblioteca.uvigo.es/xmlui/handle/11093/658 (accessed on 16 April 2017).

- Instituto Galego de Estatística-IGE. Poboación, Entidades e Densidade. Santiago de Compostela. 2017. Available online: https://www.ige.eu (accessed on 12 April 2018).

- Copena, D.; Simón, X. Wind farms and payments to landowners: Opportunities for rural development for the case of Galicia. Renew. Sustain. Energy Rev. 2018, 95, 38–47. [Google Scholar] [CrossRef]

- Delicado, A.; Figueiredo, E.; Silva, L. Community perceptions of renewable energies in Portugal: Impacts on environment, landscape and local development. Energy Res. Soc. Sci. 2016, 13, 84–93. [Google Scholar] [CrossRef]

- Rand, J.; Hoen, B. Thirty years of North American wind energy acceptance research: What have we learned? Energy Res. Soc. Sci. 2017, 29, 135–148. [Google Scholar] [CrossRef]

- Baxter, J.; Morzaria, R.; Hirsch, R. A case-control study of support/opposition to wind turbines: Perceptions of health risk, economic benefits, and community conflict. Energy Policy 2013, 61, 931–943. [Google Scholar] [CrossRef]

- Dimitropoulos, A.; Kontoleon, A. Assessing the determinants of local acceptability of wind-farm investment: A choice experiment in the Greek Aegean Islands. Energy Policy 2009, 37, 1842–1854. [Google Scholar] [CrossRef]

- Nadaï, A.; Krauss, W.; Afonso, A.I.; Dracklé, D.; Hinkelbein, O.; Labussière, O.; Mendes, C. El paisaje y la transición energética: Comparando el surgimiento de paisajes de energía eólica en Francia, Alemania y Portugal. Nimbus 2010, 25–26, 155–173. [Google Scholar]

- Nolden, C. Governing community energy—Feed-in tariffs and the development of community wind energy schemes in the United Kingdom and Germany. Energy Policy 2013, 63, 543–552. [Google Scholar] [CrossRef]

- Yin, Y. An analysis of empirical cases of community wind in Oregon. Renew. Sustain. Energy Rev. 2013, 17, 54–73. [Google Scholar] [CrossRef][Green Version]

- Bauwens, T.; Gotchev, B.; Holstenkamp, L. What drives the development of community energy in Europe? The case of wind power cooperatives. Energy Res. Soc. Sci. 2016, 13, 136–147. [Google Scholar] [CrossRef]

- Del Río, P.; Burguillo, M. An empirical analysis of the impact of renewable energy deployment on local sustainability. Renew. Sustain. Energy Rev. 2009, 13, 1314–1325. [Google Scholar] [CrossRef]

- Paolo De Pascali, P.; Bagaini, A. Energy Transition and Urban Planning for Local Development. A Critical Review of the Evolution of Integrated Spatial and Energy Planning. Energies 2019, 12, 35. [Google Scholar] [CrossRef]

- Munday, M.; Bristow, G.; Cowell, R. Wind farms in rural areas: How far do community benefits from wind farms represent a local economic development opportunity? J. Rural Stud. 2011, 27, 1–12. [Google Scholar] [CrossRef]

- Castleberry, B.; Greene, J.S. Impacts of wind power development on Oklahoma’s public schools. Energy Sustain. Soc. 2017, 7. [Google Scholar] [CrossRef]

- Okkonen, L.; Lehtonen, O. Socio-economic impacts of community wind power projects in Northern Scotland. Renew. Energy 2016, 85, 826–833. [Google Scholar] [CrossRef]

- Liebe, U.; Bartczak, A.; Meyerhoff, J. A turbine is not only a turbine: The role of social context and fairness characteristics for the local acceptance of wind power. Energy Policy 2017, 107, 300–308. [Google Scholar] [CrossRef]

- Slattery, M.C.; Johnson, B.L.; Swofford, J.A.; Pasqualetti, M.J. The predominance of economic development in the support for large-scale wind farms in the U.S. Great Plains. Renew. Sustain. Energy Rev. 2012, 16, 3690–3701. [Google Scholar] [CrossRef]

- Jami, A.A.N.; Walsh, P.R. The role of public participation in identifying stakeholder synergies in wind power project development: The case study of Ontario, Canada. Renew. Energy 2014, 68, 194–202. [Google Scholar] [CrossRef]

- Mundaca, L.; Busch, H.; Schwer, S. ‘Successful’ low-carbon energy transitions at the community level? An energy justice perspective. Appl. Energy 2018, 218, 292–303. [Google Scholar] [CrossRef]

- Upham, P.; García, J. A cognitive mapping approach to understanding public objection to energy infrastructure: The case of wind power in Galicia, Spain. Renew. Energy 2015, 83, 587–596. [Google Scholar] [CrossRef]

- Breukers, S.; Wolsink, M. Wind power implementation in changing institutional landscapes: An international comparison. Energy Policy 2007, 35, 2737–2750. [Google Scholar] [CrossRef]

- Johansen, K.; Emborg, J. Wind farm acceptance for sale? Evidence from the Danish wind farm co-ownership scheme. Energy Policy 2018, 117, 413–422. [Google Scholar] [CrossRef]

- Krog, L.; Sperling, K.; Lund, H. Barriers and Recommendations to Innovative Ownership Models for Wind Power. Energies 2018, 11, 2602. [Google Scholar] [CrossRef]

- Nadaï, A. ‘‘Planning’’, ‘‘siting’’ and the local acceptance of wind power: Some lessons from the French case. Energy Policy 2007, 35, 2715–2726. [Google Scholar] [CrossRef]

- Jacquet, J.B. Landowner attitudes toward natural gas and wind farm development in northern Pennsylvania. Energy Policy 2012, 50, 677–688. [Google Scholar] [CrossRef]

- Söderholm, P.; Ek, K.; Pettersson, M. Wind power development in Sweden: Global policies and local obstacles. Renew. Sustain. Energy Rev. 2007, 11, 365–400. [Google Scholar] [CrossRef]

- Smith, A. Emerging in between: The multi-level governance of renewable energy in the English regions. Energy Policy 2007, 35, 6266–6280. [Google Scholar] [CrossRef]

- Cassell, C.; Symon, G. Essential Guide to Qualitative Methods in Organizational Research; Sage Publications: London, UK, 2004; pp. 154–164. [Google Scholar]

- McKim, C.A. The value of mixed methods research: A mixed methods study. J. Mix Methods Res. 2015, 11, 202–222. [Google Scholar] [CrossRef]

- Presidencia. Lei 8/2009, do 22 de Decembro, pola que se Regula o Aproveitamento Eólico en Galicia e se Crean o canon Eólico e o Fondo de Compensación Ambiental; Diario Oficial de Galicia de 29 de decembro de 2009; Xunta de Galicia: Santiago de Compostela, España, 2009.

- Saladié, S. Impacte econòmic de les centrals eòliques en els pressupostos municipals a Catalunya; Associació de Municipis Eòlics de Catalunya: La Granadella, Spain, 2014. [Google Scholar]

- Iglesias, G.; del Río, P.; Dopico, J.A. Policy analysis of authorization procedures for wind energy deployment in Spain. Energy Policy 2011, 39, 4067–4076. [Google Scholar] [CrossRef]

- The compensation for the generation of MWh by wind farms has changed during the expansion of the wind power industry. These changes have been implemented through various regulations. At the beginning of the wind power boom, the selling price of wind energy was fixed in relation to the electricity tariffs and the capacity installed, in addition to other complements. Later on, in 1998, a premium was introduced, the amount of which depended on various factors. After 2004, an incentive was created, in addition to the premium, for participation in the market; both were defined as a percentage of the baseline average electricity tariff. Three years later, two options were established for the sale of wind-generated electricity: (a) to transfer the electricity in exchange for a regulated tariff, which is expressed in euro cents per kWh, for all programming periods; (b) to sell the electricity in the electric energy production market. In the last case, the selling price of the electricity would be the one fixed at the regulated market or freely negotiated, which is later complemented by a premium in euro cents per kWh.

- Flores, J.; Esteve, J. Una visión general de la fiscalidad de la actividad eléctrica en España. In Los Tributos del Sector Eléctrico; Becker, F., Cazorla, L.M., Martínez-Simancas, J., Eds.; Aranzadi Thomson Reuters: Cizur Menor, Spain, 2013; pp. 145–170. [Google Scholar]

- Pérez de Ayala, M.A. La doctrina del Tribunal Supremo sobre la base del ICIO en la construcción de parques eólicos. Estrateg. Financ. 2010, 276, 70–74. [Google Scholar]

- Blanco, M.I. The economics of wind energy. Renew. Sustain. Energy Rev. 2009, 13, 1372–1382. [Google Scholar] [CrossRef]

- Santos-Alamillos, F.J.; Thomaidis, N.S.; Usaola-García, J.; Ruiz-Arias, J.A.; Pozo-Vazquez, D. Exploring the mean-variance portfolio optimization approach for planning wind repowering actions in Spain. Renew. Energy 2017, 106, 335–342. [Google Scholar] [CrossRef]

- Copena, D.; Simón, X. Enerxía eólica e desenvolvemento local en Galicia: Os parques eólicos singulares municipais. Revista Galega de Economía 2018, 27, 31–48. [Google Scholar]

- Ellis, G.; Cowell, R.; Warren, C.; Strachan, P.; Szarka, J.; Hadwin, R.; Miner, P.; Wolsink, M.; Nadaï, A. Wind Power: Is There A “Planning Problem”? Expanding Wind Power: A Problem of Planning, or of Perception? Plan. Theory Pract. 2009, 10, 521–547. [Google Scholar] [CrossRef]

- Ministerio de Medio Ambiente y Medio Rural y Marino. Tercer Inventario Forestal Nacional. Madrid. 2008. Available online: https://www.miteco.gob.es/es/biodiversidad/servicios/banco-datos-naturaleza/informacion-disponible/ifn3.aspx (accessed on 25 June 2018).

- Rodríguez-Pose, A.; Palavicini-Corona, E.I. Does local economic development really work? Assessing LED across Mexican municipalities. Geoforum 2013, 44, 303–315. [Google Scholar] [CrossRef]

- Fast, S.; Mabee, W. Place-making and trust-building: The influence of policy on host community responses to wind farms. Energy Policy 2015, 81, 27–37. [Google Scholar] [CrossRef]

- Del Río, P.; Burguillo, M. Assessing the impact of renewable energy deployment on local sustainability: Towards a theoretical framework. Renew. Sustain. Energy Rev. 2008, 12, 1325–1344. [Google Scholar] [CrossRef]

- Wang, S.; Wang, S. Impacts of wind energy on environment: A review. Renew. Sustain. Energy Rev. 2015, 49, 437–443. [Google Scholar] [CrossRef]

- Wolsink, M. Planning of renewables schemes: Deliberative and fair decision-making on landscape issues instead of reproachful accusations of non-cooperation. Energy Policy 2007, 35, 2692–2704. [Google Scholar] [CrossRef]

- Villena-Ruiz, R.; Ramirez, F.J.; Honrubia-Escribano, A.; Gómez-Lázaro, E. A techno-economic analysis of a real wind farm repowering experience: The Malpica case. Energy Convers. Manag. 2018, 172, 182–199. [Google Scholar] [CrossRef]

- Elola, A.; Parrilli, M.D.; Rabellotti, R. The Resilience of Clusters in the Context of Increasing Globalization. Eur. Plan. Stud. 2013, 21, 989–1006. [Google Scholar] [CrossRef]

- Varela-Vázquez, P.; Sánchez-Carreira, M.C. Upgrading Peripheral wind sectors. Technol. Anal. Strateg. Manag. 2016, 28, 1152–1166. [Google Scholar] [CrossRef]

- Sovacool, B.K.; Dworkin, M.H. Energy justice: Conceptual insights and practical applications. Appl. Energy 2015, 142, 435–444. [Google Scholar] [CrossRef]

| Database | Sources of Information | Content | Relevance for This Article |

|---|---|---|---|

| 1. Socio-administrative | - Official Journal of Galicia - Official State Gazette - Register of special regime installations - Register of pre-allocation of remuneration - Administrative record of electric energy production - Regulatory documents, especially those issued by the Galician regional administration | - Temporary dynamics concerning the installation of wind farms and MW - Information on the developers - Information classified according to the second administrative phase | - To understand the dynamics of wind energy development in relation to the legal framework - To understand the future prospects for the installation of new wind farms and the creation of new economic opportunities at the local level |

| 2. Economic | - Statistical information on the electric energy industry - Statistical information on special-regime energy sales - Specialised reports published by public and private entities | - Wind farm turnover | - To measure the importance of this new industrial activity in rural areas - To estimate the turnover of wind farms in order to compare it with local revenues |

| 3. Public income | - Public statistical databases - Official Journal of Galicia - Official Journal of each Galician province - Specialised scientific literature on the object of study - Public registers related to renewable energy activities - Geographic Information System tools - Websites of the different municipalities - Semi-structured interviews | - Revenues obtained at a local level, disaggregated by categories (canon eólico and ECF, conventional taxes, and municipal ownership of wind farms) - Destination of public wind revenues (only available in certain cases) | - Identification, characterisation, and estimation of the new income flows earned by municipalities with wind farms in their territories for each of the categories identified (canon eólico and the Environmental Compensation Fund (ECF), conventional taxes, and municipal ownership of wind farms) - To discuss wind revenues for the municipalities and their destination, as well as their impact on local public income |

| 4. Landowner income | - Statistical information on the electric energy industry - Statistical information on special-regime energy sales - Geographic Information System tools - Semi-structured interviews | - Renting contracts and collaboration agreements between companies and municipalities | - To have access to the renting contracts of municipally-owned land signed by wind power companies - To have access to the collaboration agreements drawn up between municipalities and wind power firms |

| Category | Subcategory | Tax or Taxing Figure | Year of First Possible Revenues | Specific of Galician Legislation | Limitations for the Use of Revenues | Characteristics of the Income |

|---|---|---|---|---|---|---|

| i. Taxes | Conventional taxes | IAE (Tax on economic activities) | 1995 | No | No | Annual income |

| IBI (Property tax) | 1995 | No | No | Annual income | ||

| ICIO (Tax on Constructions, Installations, and Works) | 1995 | No | No | One-time income | ||

| b. Wind taxes | Canon eólico and ECF | 2010 | Yes | Yes | Income depending on the number of wind turbines and the number of meters of power evacuation lines | |

| ii. Municipal ownership of wind farms | Singular wind farm | 2001 | Yes | No | Percentage of the turnover and/or annual fix amount | |

| iii. Other incomes | Renting of municipal land | 1995 | No | No | Annual income/One-time income | |

| Collaboration agreements | 1995 | No | No | Annual income/One-time income | ||

| Category | Subcategory | Tax/Mechanism | Number of Municipalities | Income (1000 €) | Income (%) |

|---|---|---|---|---|---|

| i. Taxes | a. Conventional taxes (*) | IBI | 107 | 6719 | 37.7 |

| IAE | 103 | 3499 | 19.6 | ||

| b. Wind taxes | Canon eólico and ECF | 117 (**) | 6307 | 35.4 | |

| ii. Municipal ownership of wind farms | Singular wind farm | 13 | 1255 | 7.0 | |

| iii. Other incomes | Renting of municipal land | 5 | <20 | 0.1 | |

| Collaboration agreements | 3 | <20 | 0.1 | ||

| Total income estimation | 17,820 | 100 | |||

| Canon eólico Tax Bracket (No. of Wind Turbines) | € per Wind Turbine-Year | No. of Wind Farms | No. of Wind Turbines | Income (1000 euros) | Income (%) |

|---|---|---|---|---|---|

| Between 1–3 | 0 | 19 | 33 | 0 | 0 |

| Between 4–7 | 2300 | 11 | 58 | 133 | 0.6 |

| Between 8–15 | 4100 | 23 | 275 | 1128 | 4.9 |

| More than 15 | 5900 | 101 | 3721 | 21,954 | 94.6 |

| Total | 154 | 4087 | 23,215 | 100 | |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Copena, D.; Pérez-Neira, D.; Simón, X. Local Economic Impact of Wind Energy Development: Analysis of the Regulatory Framework, Taxation, and Income for Galician Municipalities. Sustainability 2019, 11, 2403. https://doi.org/10.3390/su11082403

Copena D, Pérez-Neira D, Simón X. Local Economic Impact of Wind Energy Development: Analysis of the Regulatory Framework, Taxation, and Income for Galician Municipalities. Sustainability. 2019; 11(8):2403. https://doi.org/10.3390/su11082403

Chicago/Turabian StyleCopena, Damián, David Pérez-Neira, and Xavier Simón. 2019. "Local Economic Impact of Wind Energy Development: Analysis of the Regulatory Framework, Taxation, and Income for Galician Municipalities" Sustainability 11, no. 8: 2403. https://doi.org/10.3390/su11082403

APA StyleCopena, D., Pérez-Neira, D., & Simón, X. (2019). Local Economic Impact of Wind Energy Development: Analysis of the Regulatory Framework, Taxation, and Income for Galician Municipalities. Sustainability, 11(8), 2403. https://doi.org/10.3390/su11082403