1. Introduction

Along with the changing of a global era, investments are transforming in many forms to be financially, socially, and environmentally sustainable. Sustainable investment as an investment procedure potentially affects sustainable development through the coordination of monetary concerns, as well as long haul environmental, social, and governance (ESG) criteria while making investment decisions [

1,

2]. Sustainable investment is an ethical and green investment that uses ESG investment, or socially responsible investment (SRI) [

3]. The recent increase in the volume of SRI has stirred the enthusiasm of scholastic professionals and policymakers in assessing the connection between corporate social benefits, environmental impacts, and financial performance (triple-bottom-line (TBL)) [

4]. For instance, [

5] applied panel data and statistical methods to analyze the integration of ESG policies for green production into the investment strategy on pensions for sustainable investment. Integrate sustainable investment to ESG preferences of investors using fuzzy techniques for trader preferences by similarity to the ideal situation. They presented the perspective of establishing the association between social, economic, and environmental benefits of the sustainable supply chain finance [

6]. Nevertheless, they mentioned corporate governance or market risks [

7].

Thus, the previous studies failed to address the interrelationships among the social aspects, environmental aspects, economic benefits, market conditions, and corporate governance issues on sustainable investment [

8,

9]. Therefore, to deliver sustainable growth and the long-term goals in building a sustainable investment there is a need to develop a set of measures that integrate the ESG with the economic benefits and market risks to access sustainable investment. The determination of portfolio investment is a decision of best choice which ought to be made considering a set of measures. Socially capable utilization practices and the aim to invest resources in a socially mindful way affirms that investors have socially dependable utilization, and obtaining these propensities is the most alluring aspect to financial institutions that attract socially capable venture investment. A model to which the intention to invest in an SRI is explained by the investor’s perception, the perception of the personal gain, and the effectiveness of the action on decision-making [

10]. However, investor perception of SRI is always on qualitative information. Therefore, the qualitative information of the SRI needs to be properly addressed.

The aforementioned qualitative information is defined as the subjective assessment of the investors focusing on the advantages and disadvantages for the ESG on sustainable investment. The absence of prerequisites and clearness regarding the viability of ESG integration with the market risk being never far away. This pattern of ESG incorporation with SRI may prompt confusion and misrepresentative marketing of practices. SRI, as discussed, could be green and profitable; indeed, this is subject to being taken advantage of and the emergence of ESG performance. They referred to the firms’ ESG performance and indicated its exposure to non-sustainability risk attributes [

11], such as corporate governance, economic performance, and market risks might incorporate product and commercial-practical risks [

12,

13]. They investigated whether investors support good ESG practices, by selectively providing the equity to assure their growth, or potentially deprive poor ESG practices. Investors that follow socially responsible and green investments should have guidelines for screening market conditions for practitioners [

14]. The practitioner that provides the evidence for screening considerably impacts on the economic performance of a sustainable investment [

15,

16,

17].

The ESG criteria are quite subjective and assessing factors accurately might be challenging. Investor judgment is based on subjective preferences and relates to investors’ preferences. The qualitative information and analyses that integrated a set of measures among the ESG are important for the SRI as a sustainable investment. The fuzzy set theory deals with qualitative information and transforms the linguistic preference into the comparable crisp value [

6,

18]. Moreover, this study proposes to apply decision-making trial and evaluation laboratory (DEMATEL) to handle the interrelationships among the attributes [

19,

20,

21]. The attributes are always with the interrelationships. This study aims to present a set of measures that integrate social impact, environmental management, economic performance, market conditions, and corporate governance on sustainable investments using an investor’s preferences approach.

The contribution of the current study is as follows: (1) propose a set of integrated ESG criteria and sustainable investment measures; (2) use investor’s preferences to approach the ESG qualitative information; (3) present the causal interrelationships among the aspects and indicate the improvement criteria in practices. The data for this study were collected by questionnaire. The questionnaires were delivered to 15 VIP investors on stock market industry in Indonesia. The rest of the study is organized as follows. The

Section 2 analyses the previous literature and the proposed measures. The

Section 3 describes the industrial background and method in this study. The results are provided in the

Section 4. Further implications, conclusions, and future study opportunities appear in the

Section 5.

3. Proposed Method

This section includes the industrial background and the proposed analytical fuzzy DEMATEL method.

3.1. Industrial Background

Sustainable investment has a screening that is strict in the environment, social, and governance criteria. In this case, the firm is included in the SRI index through the screening process. The pursuit of achieving sustainability is to drive the capital from investors to the impact of investment. SRI is the sustainable investment in the stock market which leads the investor to create more value and positive impact on the environment and society. This SRI presents the firm’s management on the ESG. Usually, the ESG attributes include a qualitative information approach. The investor preferences are built upon the assessment of firms ESG management. This study collected investor preferences from 15 VIP investors in the stock market industry in Indonesia. The investors have 10 years’ experience of the investment. This study is conducted with face-to-face interviews to enhance expert validity. Hence, the measures are satisfied with the content, and expert validity from the literature review and experts view on the sustainable investment.

3.2. Fuzzy DEMATEL

The fuzzy DEMATEL is an effective fuzzy aggregation method to transfer human judgments into fuzzy linguistic variables. The qualitative information is always imprecise and subjective to the nature of human judgments. The linguistics preferences are converted into triangular fuzzy numbers. The defuzzification converts fuzzy numbers into crisp values [

36] and develops the conversion of fuzzy data into crisp values, which uses the fuzzy minimum and maximum to determine the left and right values. The total weighted values are computed from a weighted average employing fuzzy membership functions

. The triangular fuzzy numbers are converted into crisp values and applied into the DEMATEL total direct relation matrix the crisp value are utilized as shown in

Table 2.

DEMATEL enables analysis and solves problems using a visualization method. The DEMATEL depicts the interrelationships and the influential effects between cause and effect groups to dram the causal and effect diagram. The attributes are divided into cause and effect groups. A visual relationship among the attributes provides a better understanding of the structural relationship among aspect and criteria groups [

37,

38,

39]. The DEMATEL method is applied to construct a causal network structure among the sustainable investment attributes based on investor preferences. The interrelationships between cause and effect attributes are converted. A set of attributes

= {

} and particular pairwise interrelationships are for modelling in a mathematical relation. The procedure is described as follows.

The interrelationship scale is designed into a five-point scale in linguistic preferences ranging between 0 stands for no influence, 1 for very low influence, 2 for low influence), 3 for high influence, and 4 for very high influence. If a decision group has n members; take to present the fuzzy weight of ith attribute affects the jth attribute assessed by fth evaluators.

Normalization:

where

.

Compute left (

lt) and right (

rt) normalized value:

Total normalized crisp value

The subjective judgment for n evaluators is aggregated the synthetic value using the equation below:

Define an initial direct relation matrix (IDRM), a matrix obtained by pair-wise comparisons. In matrix IDRM, has been denoted as the degree to which the criterion i affects the criterion j, i.e., .

Standardizing the direct relation matrix IDRM—Using matrix

F to obtain matrix

X by multiplying matrix

Z with

.

where

.

The total relation matrix (

X) is obtained and uses matrix

X to calculate the total relation matrix

Y.

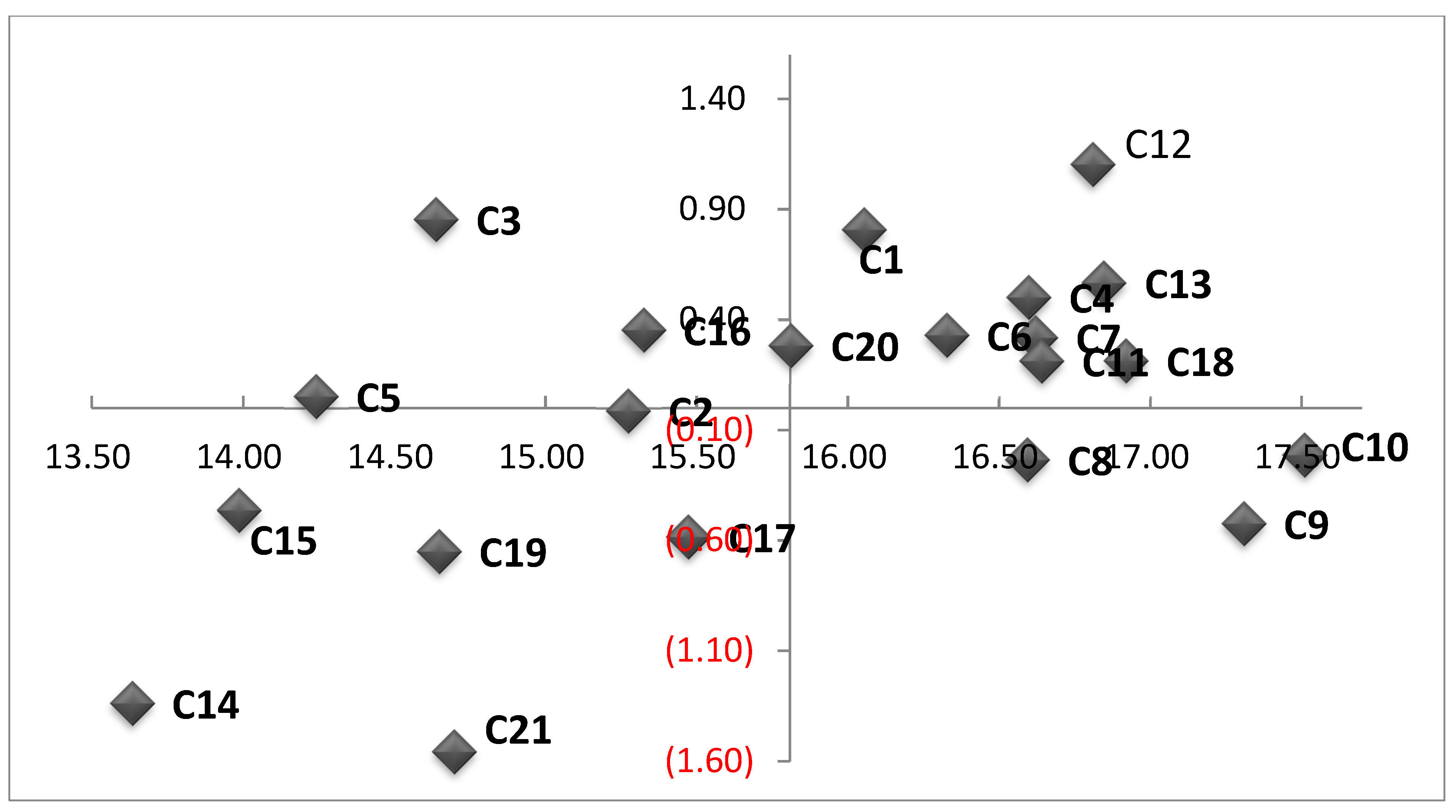

A causal diagram- the vector D represents the sum of rows and vector R represents the sum of columns within the total relation matrix U. A causal and effect group can be designed by mapping with (D + R, D − R). The horizontal axis vector (D + R) has been given the name “Prominence.” The vertical axis (D − R) has been given the name “Relation.” When the sum of (D − R) is negative, the criterion is grouped into the effect group, and when the sum of (D − R) is positive, the criterion falls into the effect group

5. Implications

This section presents the theoretical and practical implications.

5.1. Theoretical Implications

This study presented the interrelationship among aspects. The aspect causal result presented the interrelated among corporate governance, economic performance, and market risks, especially, the cause group are related to their influence on the effect group. Corporate governance (A5) is the highest relation to influence the economic performance, market risks and others in sustainable investment. Corporate governance is the main attribute to develop and improve sustainable investment. Previous studies argued that the corporate governance had a positive effect on financial performance [

3,

33]. This attracts investors of sustainable investments. Corporate governance impacts upon economic performance and reduces market risks.

Economic performance (A3) covers the investor preferences on the firm’s sustainable investment and has a strong influence on corporate governance and market risks. The firms can maintain and increase their economic performance simultaneously. The causal effect improves corporate governance and mitigates market risks. Economic performance makes firms obtain more capital from investment. The sustainable investor fund’s asset allocation decisions are driven by economic performance and corporate governance [

4,

40]. Lastly, market risks and economic performance are interrelated. The higher market risks and higher economic performance are for higher returns. The market risks might affect the investor decision that concerns the high risks for their investment. Nevertheless, low market risks will also make the market sluggish. Hence, the stability of market risks is important for sustainable investment performance in the long-term [

29,

40].

5.2. Practical Implications

The investor’s preferences on sustainable investment are for the firms to improve their ESG in practices. Transparency and anti-corruption (C18) drive investors to choose sustainable investment as their portfolio investment. Transparency and anti-corruption have the highest influence on others, as the investor highly regard the firm that is free of corruption and demonstrates transparency in the financial, policy, and management dimensions. Non-transparency and corruption problems cause management conflict, generate unstable profit margin, devaluate market value and degrading shareholder loyalty. These are criteria that lead to high investor turnover from sustainable investment. Such turnover can be prevented by reporting financial statements, new firm policies, and managerial reports to investors regularly. Furthermore, financial auditing from a credible institution and an anti-corruption campaign can strengthen the firm’s control and mitigate corruption.

Investors consider earning a high profit and a high excess return (C13) from their investment and increase the market value (C12). However, firm profit affects shareholder loyalty (C11). The increasing profit leads the firm to create more investment in production and human resources. In contrast, decreasing profit affects employee efficiency, executive pay, and corporate responsibility programs. However, the investment which has a high return always has a high risk. Most investors tend to gain high returns, and rationally the investors consider the risks. The firm listed in the SRI must be able to mitigate the risks while having good returns for their investors. Moreover, market value affects the willingness of investors to invest their money in the firms. As the market value is the firm value rated by the market itself, the investors tend to buy the firm’s stocks which have a high valuation in the market. Investors consider the ESG firm that performs well and who has good loyalty. When the shareholder of a firm is loyal that means the investors gain the dividends from their stocks. However, not all the firms which earn profits want to share the dividend, and therefore, shareholder loyalty becomes the most important aspect for the sustainable investors.

Corporate governance affects environmental management. Emission reduction (C7) and resource reduction (C6) are under environmental management. Reducing emissions (C7) leads to the improvement of the firm’s quality and it significantly affects the market value and excess return. However, reducing emissions requires both additional and high investment. The results suggest that another way to increase the market value and excess return is through resource reduction (C6) as resource reduction means efficiency in raw material input and operational costs. This efficiency decreases the production cost and increases the profit margin of the firm. The increasing profit margin positively affects the increasing excess return and enhances the market value of a firm listed in SRI.

Products and services produced by the listed firms are a large concern for sustainable investors. To maintain sustainable investors, the firms should produce the products and services on the ESG. The product responsibility (C4) covers the whole life cycle from the use of raw materials, product development, production, distribution, product use to the recycling system. The employment quality (C1) is important to firms’ ESG management activities. However, the employment quality raises productivity, and the firms should improve the executive pay/compensation policy and healthcare facilities. This improvement also requires the firm’s investment if the practice becomes a dilemma due to limited investments and resources. However, sufficient health and living conditions create more productivity and generate dynamic creativity for responding to the sustainable investor’s feedback in the long-term firm period.

6. Conclusions

The sustainable investment attributes are analyzed using fuzzy set theory and DEMATEL methods to explain the interrelationships among aspects and criteria based on investor preferences. Sustainable investment is rapidly growing due to the improvement of investor awareness on sustainability issues. Sustainable investment has been released to identify aspects that affect sustainable investment. This study examined the attributes with interrelationships and ESG qualitative information for sustainable investment using investor preferences. The ESG is used interchangeably to cover a wide spectrum of firms’ strategies toward sustainable investment. Ethical screens eliminate firms engaged in controversial operational activities and reflects the firm’s values and this, therefore, improved investment returns. Sustainable investment is approached thoughtfully and integrated with traditional analysis, and improves insights and enhances performance.

This study fulfills the investor’s approach in which a set of ESG related attributes are considered, in addition to traditional financial analysis. This study leads to the understanding of investor preferences on the ESG that firms’ operates with and their performance in attracting stakeholders. In addition, this study provides a more complete understanding of ESG attribute to traditional statistical analysis. In practice, the results show how this attribute integration is approached and can be implemented. The findings show that corporate governance drives social impact and environmental management to improve the sustainable investment in investor preferences. The examination of firms’ environmental, social, and governance performances are designed in this proposed approach in linguistic preferences. The result indicates that the improvement criteria lead to a better performance due to those attributes that are performed in sustainable ESG investment. The results are an important contribution to investors and firms’ ESG activities, especially if the firm has transparency and anti-corruption issues. The ESG performed firm is the best choice for investors and the portfolio manager in allocating assets on sustainable investments and reduces the market risks. Investors must consider the sustainable investment that gives high excess returns, high market value, and excellent shareholder loyalty.

There are several limitations. For instance, ESG firms are measured in qualitative information. There are still quantitative data to be included in the assessment although the interrelationships among the attributes are addressed. Still, the hierarchical structure is ignored in this assessment due to the method limitations. This study adopts the content validity, but perhaps the reliability and construct validity need to be enhanced in future studies. The sample size is limited in the current study. Future studies could enlarge the sample size or analyses of the cross-sector study.