An Empirical Analysis of Bitcoin Price Jump Risk

Abstract

1. Introduction

2. Related Literature Review

3. Data and Methodology

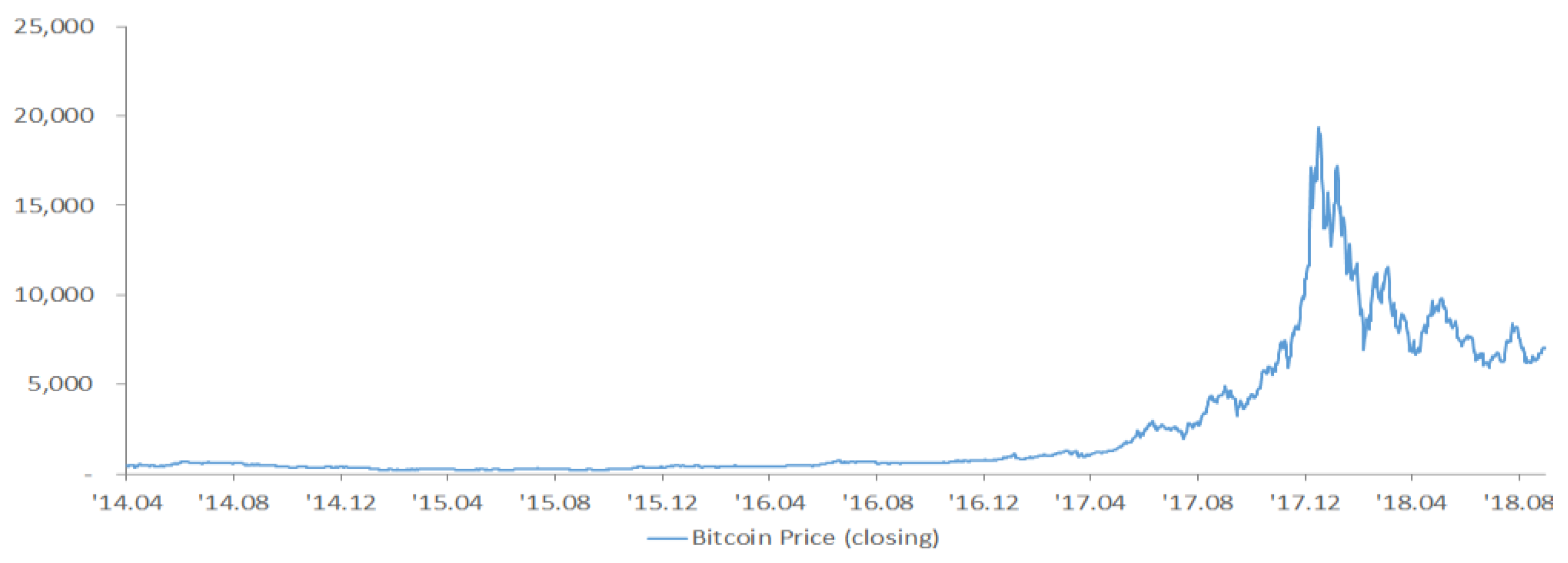

3.1. Data Description

3.2. Methodology

4. Empirical Results

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Sahoo, P.K. Bitcoin as digital money: Its growth and future sustainability. Theor. Appl. Econ. 2017, 53–64. [Google Scholar]

- Aït-Sahalia, Y.; Matthys, F. Robust consumption and portfolio policies when asset prices can jump. J. Econ. Theory 2019, 179, 1–56. [Google Scholar] [CrossRef]

- Cao, W.; Guernsey, S.B.; Linn, S.C. Evidence of infinite and finite jump processes in commodity futures prices: Crude oil and natural gas. Phys. A 2018, 502, 629–641. [Google Scholar] [CrossRef]

- Jiang, G.J.; Oomen, R.C.A. Testing for jumps when asset prices are observed with noise—A “swap variance” approach. J. Econ. 2008, 144, 352–370. [Google Scholar] [CrossRef]

- Hanousek, J.; Kočenda, E.; Novotný, J. Price jumps on European stock markets. Borsa Istanb. Rev. 2014, 14, 10–22. [Google Scholar] [CrossRef]

- Fičura, M. Modelling Jump Clustering in the Four Major Foreign Exchange Rates Using High-Frequency Returns and Cross-exciting Jump Processes. Procedia Econ. Financ. 2015, 25, 208–219. [Google Scholar] [CrossRef]

- Aït-Sahalia, Y.; Laeven, R.J.A.; Pelizzon, L. Mutual excitation in Eurozone sovereign CDS. J. Econ. 2014, 183, 151–167. [Google Scholar] [CrossRef]

- Novotný, J.; Petrov, D.; Urga, G. Trading price jump clusters in foreign exchange markets. J. Financ. Mark. 2015, 24, 66–92. [Google Scholar] [CrossRef]

- Ross, S.A. Information and Volatility: The No-Arbitrage Martingale Approach to Timing and Resolution Irrelevancy. J. Financ. 1989, 44, 1–17. [Google Scholar] [CrossRef]

- Maheu, J.M.; McCurdy, T.H. News Arrival, Jump Dynamics, and Volatility Components for Individual Stock Returns. J. Financ. 2004, 59, 755–793. [Google Scholar] [CrossRef]

- Andersen, T.G.; Bollerslev, T.; Diebold, F.X.; Vega, C. Real-time price discovery in global stock, bond and foreign exchange markets. J. Int. Econ. 2007, 73, 251–277. [Google Scholar] [CrossRef]

- Lahaye, J.; Laurent, S.; Neely, C.J. Jumps, cojumps and macro announcements. J. Appl. Econ. 2011, 26, 893–921. [Google Scholar] [CrossRef]

- Lee, S.S.; Mykland, P.A. Jumps in financial markets: A new nonparametric test and jump dynamics. Rev. Financ. Stud. 2008, 21, 2535–2563. [Google Scholar] [CrossRef]

- Bouchaud, J.-P.; Kockelkoren, J.; Potters, M. Random walks, liquidity molasses and critical response in financial markets. Quant. Financ. 2006, 6, 115–123. [Google Scholar] [CrossRef]

- Będowska-Sójka, B. Liquidity Dynamics Around Jumps: The Evidence from the Warsaw Stock Exchange. Emerg. Mark. Financ. Trade 2016, 52, 2740–2755. [Google Scholar] [CrossRef]

- Madhavan, A. Market microstructure: A survey. J. Financ. Mark. 2000, 3, 205–258. [Google Scholar] [CrossRef]

- Zhou, C. The term structure of credit spreads with jump risk. J. Bank. Financ. 2001, 25, 2015–2040. [Google Scholar] [CrossRef]

- Duan, J.-C.; Yeh, C.-Y. Jump and volatility risk premiums implied by VIX. JEDC 2010, 34, 2232–2244. [Google Scholar] [CrossRef]

- Eraker, B.; Johannes, M.; Polson, N. The Impact of Jumps in Volatility and Returns. J. Financ. 2003, 58, 1269–1300. [Google Scholar] [CrossRef]

- Black, B.; Kim, W. The effect of board structure on firm value: A multiple identification strategies approach using Korean data. JFE 2012, 104, 203–226. [Google Scholar] [CrossRef]

- Sharpe, W.F. Capital asset prices: A theory of market equilibrium under conditions of risk*. J. Financ. 1964, 19, 425–442. [Google Scholar]

- Li, Z.; Zhang, W.-G.; Liu, Y.-J.; Zhang, Y. Pricing discrete barrier options under jump-diffusion model with liquidity risk. IREF 2019, 59, 347–368. [Google Scholar] [CrossRef]

- Broadie, M.; Jain, A. The effect of jumps and discrete sampling on volatility and variance swaps. IJTAF 2008, 11, 761–797. [Google Scholar] [CrossRef]

- Arshanapalli, B.; Fabozzi, F.J.; Nelson, W. The role of jump dynamics in the risk–return relationship. IRFA 2013, 29, 212–218. [Google Scholar] [CrossRef]

- Pan, J. The jump-risk premia implicit in options: Evidence from an integrated time-series study. JFE 2002, 63, 3–50. [Google Scholar] [CrossRef]

- Yan, S. Jump risk, stock returns, and slope of implied volatility smile. JFE 2011, 99, 216–233. [Google Scholar] [CrossRef]

- Chang, B.Y.; Christoffersen, P.; Jacobs, K. Market skewness risk and the cross section of stock returns. JFE 2013, 107, 46–68. [Google Scholar] [CrossRef]

- Barndorff-Nielsen, O.E.; Shephard, N. Power and Bipower Variation with Stochastic Volatility and Jumps. J. Financ. Econom. 2004, 2, 1–37. [Google Scholar] [CrossRef]

- Barndorff-Nielsen, O.E. Econometrics of Testing for Jumps in Financial Economics Using Bipower Variation. J. Financ. Econom. 2005, 4, 1–30. [Google Scholar] [CrossRef]

- Jiang, G.J.; Yao, T. Stock Price Jumps and Cross-Sectional Return Predictability. J. Financ. Quant. Anal. 2013, 48, 1519–1544. [Google Scholar] [CrossRef]

- Jiang, G.J.; Zhu, K.X. Information Shocks and Short-Term Market Underreaction. JFE 2017, 124, 43–64. [Google Scholar] [CrossRef]

- Branger, N.; Schlag, C.; Schneider, E. Optimal portfolios when volatility can jump. J. Bank. Financ. 2008, 32, 1087–1097. [Google Scholar] [CrossRef]

- Buckley, W.; Long, H.; Perera, S. A jump model for fads in asset prices under asymmetric information. Eur. J. Oper. Res. 2014, 236, 200–208. [Google Scholar] [CrossRef]

| Bitcoin Price | World MSCI Index | WTI Price | Gold Price | US Dollar Index | |

|---|---|---|---|---|---|

| Panel A | |||||

| Mean | 2461.08 | 1814.09 | 57.96 | 1239.20 | 93.68 |

| Std.Dev | 3613.26 | 176.24 | 18.44 | 70.68 | 5.66 |

| Min | 178.35 | 1468.90 | 26.21 | 1051.10 | 79.09 |

| Max | 19,394.76 | 2248.93 | 107.26 | 1366.33 | 103.30 |

| Skew | 1.93 | 0.71 | 1.23 | −0.56 | −1.05 |

| Kurt | 3.31 | −0.65 | 0.76 | −0.31 | 0.53 |

| obs | 1614 | 1154 | 1115 | 1148 | 1154 |

| Panel B | |||||

| Bitcoin price | 1 | ||||

| World MSCI Index | 0.86 | 1 | |||

| WTI price | 0.10 | 0.15 | 1 | ||

| Gold price | 0.41 | 0.42 | 0.34 | 1 | |

| US Dollar Index | −0.08 | −0.02 | −0.86 | −0.43 | 1 |

| Significance Level | Alpha = 1% | Alpha = 5% | Alpha = 10% | |

|---|---|---|---|---|

| The number of jump days | 69 | 97 | 122 | |

| Monthly CR | N | 53 | 53 | 53 |

| Mean | 0.057 | 0.059 | 0.061 | |

| Std.Dev | 0.205 | 0.189 | 0.184 | |

| Min | −0.327 | −0.185 | −0.185 | |

| Max | 0.676 | 0.676 | 0.676 | |

| Skew | 1.154 | 1.610 | 1.684 | |

| Kurt | 1.793 | 2.925 | 3.397 | |

| Monthly JR | N | 53 | 53 | 53 |

| Mean | 0.017 | 0.015 | 0.014 | |

| Std.Dev | 0.097 | 0.123 | 0.137 | |

| Min | −0.271 | −0.271 | −0.353 | |

| Max | 0.409 | 0.409 | 0.409 | |

| Skew | 1.093 | 0.534 | 0.070 | |

| Kurt | 6.053 | 1.927 | 1.929 | |

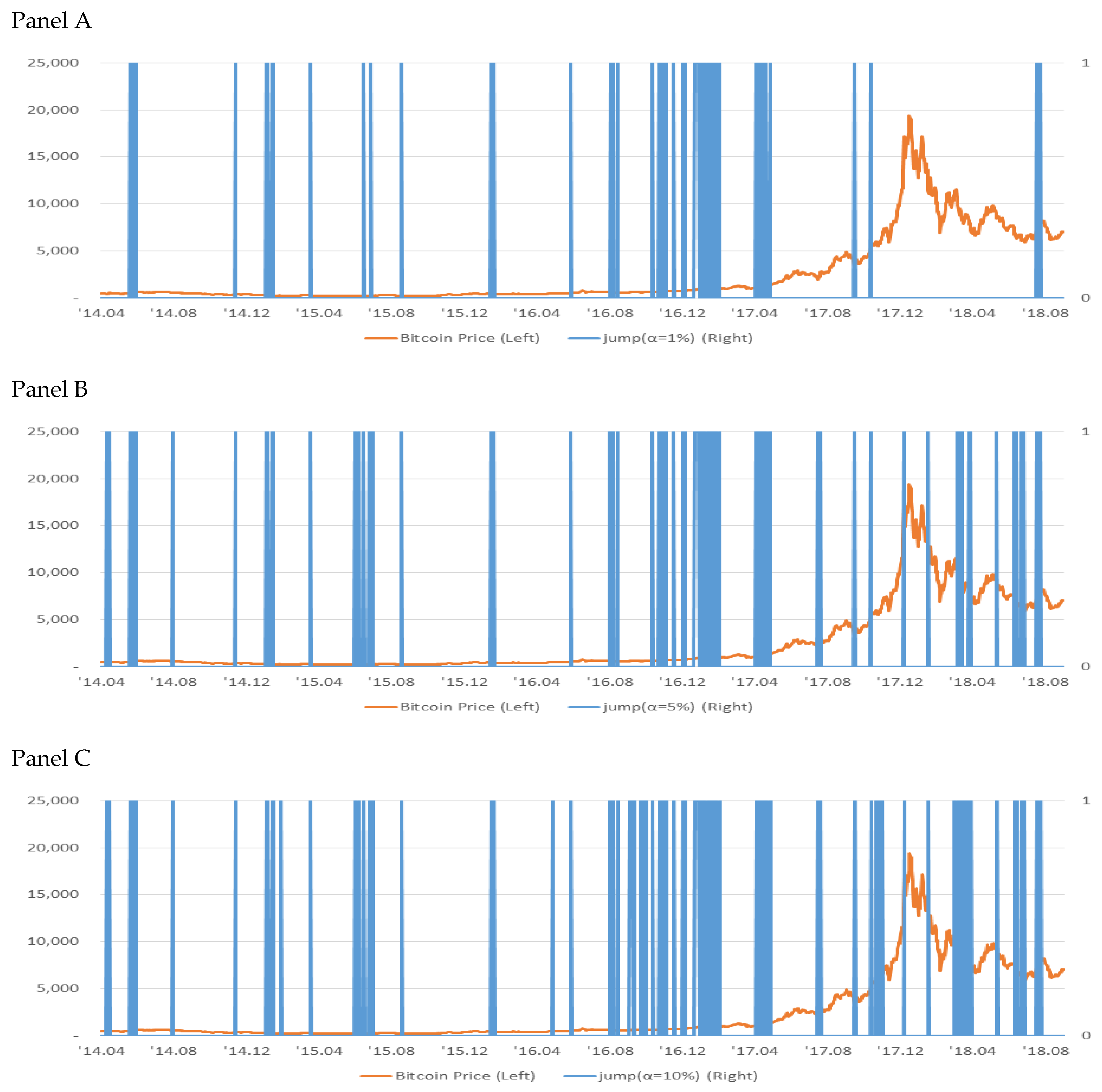

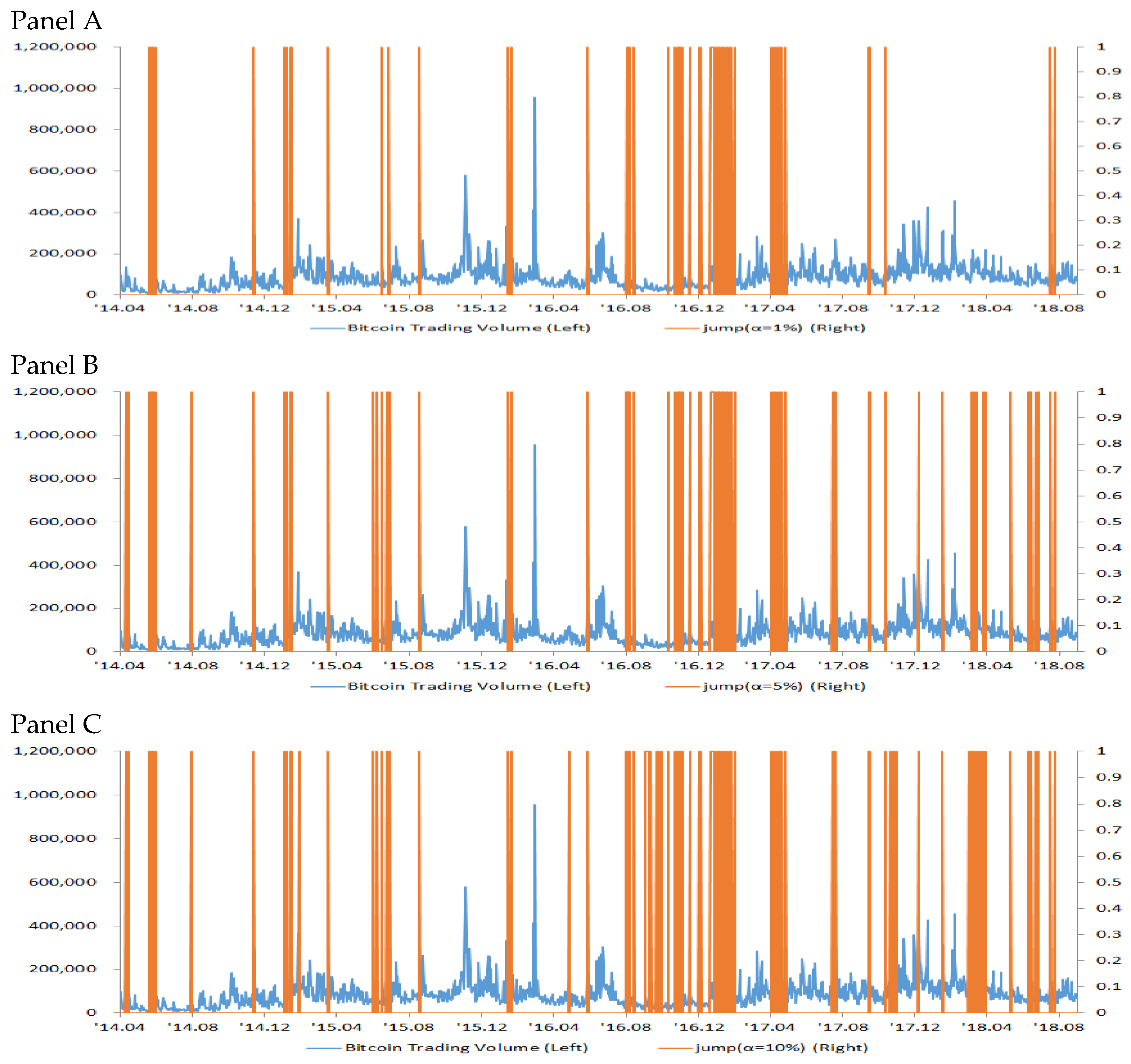

| Year | Total Trading Day | Jump (Alpha = 1%) | Jump (Alpha = 5%) | Jump (Alpha = 10%) |

|---|---|---|---|---|

| Total period (2014.04–2018.08) | 1614 | 69 | 97 | 122 |

| 2014.04–2014.12 | 275 | 6 | 10 | 10 |

| 2015 | 365 | 9 | 14 | 15 |

| 2016 | 366 | 27 | 28 | 41 |

| 2017 | 365 | 25 | 30 | 34 |

| 2018.01–2018.08 | 243 | 2 | 15 | 22 |

| Significance (α) | Pearson Chi-Squared Statistics |

|---|---|

| 1% | 326.58 |

| 5% | 268.54 |

| 10% | 297.66 |

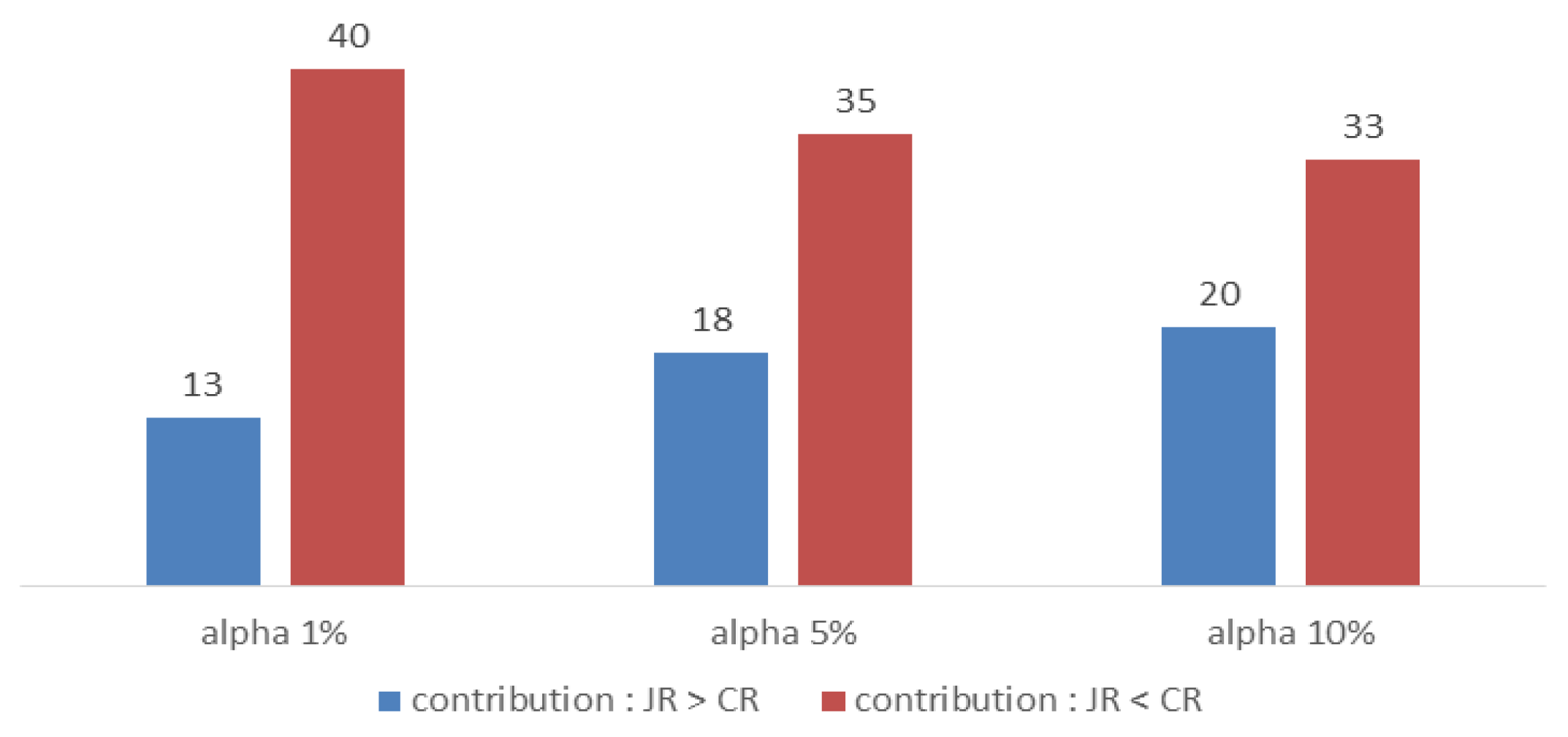

| Contribution of Jump Return to Total Return (%) | |||

|---|---|---|---|

| Alpha = 1% | Alpha = 5% | Alpha = 10% | |

| MEAN | 20.30 | 31.01 | 34.12 |

| Std.Dev | 63.52 | 72.07 | 75.44 |

| Min | −276.83 | −276.83 | −276.83 |

| Max | 248.55 | 248.56 | 248.56 |

| Skew | −0.82 | −0.71 | −0.71 |

| Kurt | 11.20 | 6.73 | 5.35 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kang, N.; Kim, J. An Empirical Analysis of Bitcoin Price Jump Risk. Sustainability 2019, 11, 2012. https://doi.org/10.3390/su11072012

Kang N, Kim J. An Empirical Analysis of Bitcoin Price Jump Risk. Sustainability. 2019; 11(7):2012. https://doi.org/10.3390/su11072012

Chicago/Turabian StyleKang, Naeyoung, and Jungmu Kim. 2019. "An Empirical Analysis of Bitcoin Price Jump Risk" Sustainability 11, no. 7: 2012. https://doi.org/10.3390/su11072012

APA StyleKang, N., & Kim, J. (2019). An Empirical Analysis of Bitcoin Price Jump Risk. Sustainability, 11(7), 2012. https://doi.org/10.3390/su11072012