The Non-Linear Effect of Financial Support on Energy Efficiency: Evidence from China

Abstract

1. Introduction

2. Methodology

2.1. Sample and Data Used

2.2. The PSTR Model

2.3. Energy Efficiency

2.4. Variables Definition

3. Empirical Analysis

3.1. Results of Pre-Tests

3.2. PSTR Estimates of Economic Development

3.3. PSTR Estimates of Financial Development

4. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Li, C.; Song, Y. Government response to climate change in China: A study of provincial and municipal plans. J. Environ. Plan. Manag. 2016, 59, 1679–1710. [Google Scholar] [CrossRef]

- Liu, Q.; Wang, Q. How China achieved its 11th Five-Year Plan emissions reduction target: A structural decomposition analysis of industrial SO2 and chemical oxygen demand. Sci. Total Environ. 2017, 574, 1104–1116. [Google Scholar] [CrossRef]

- Hou, J.; Teo, T.S.; Zhou, F.; Lim, M.K.; Chen, H. Does industrial green transformation successfully facilitate a decrease in carbon intensity in China? An environmental regulation perspective. J. Clean Prod. 2018, 184, 1060–1071. [Google Scholar] [CrossRef]

- Li, C. Essays on Climate Change Mitigation, Building Energy Efficiency, and Urban Form. Ph.D Dissertation, The University of North Carolina, Chapel Hill, NC, USA, 2018. [Google Scholar]

- Xu, C.; Wang, Y.; Li, L.; Wang, P. Spatiotemporal Trajectory of China’s Provincial Energy Efficiency and Implications on the Route of Economic Transformation. Sustainability 2018, 10, 4582. [Google Scholar] [CrossRef]

- Gökgöz, F.; Güvercin, M.T. Energy security and renewable energy efficiency in EU. Renew. Sustain. Energy Rev. 2018, 96, 226–239. [Google Scholar] [CrossRef]

- Jo, H.; Kim, H.; Park, K. Corporate Environmental Responsibility and Firm Performance in the Financial Services Sector. J. Bus. Ethic. 2015, 131, 257–284. [Google Scholar] [CrossRef]

- Ghisetti, C.; Rennings, K. Environmental innovations and profitability: How does it pay to be green? An empirical analysis on the German innovation survey. J. Clean. Prod. 2014, 75, 106–117. [Google Scholar] [CrossRef]

- Tong, X.; Li, X.; Tong, L.; Jiang, X. Spatial Spillover and the Influencing Factors Relating to Provincial Carbon Emissions in China Based on the Spatial Panel Data Model. Sustainability 2018, 10, 4739. [Google Scholar] [CrossRef]

- Li, Z.; Liao, G.; Wang, Z.; Huang, Z. Green loan and subsidy for promoting clean production innovation. J. Clean Prod. 2018, 187, 421–431. [Google Scholar] [CrossRef]

- Li, Z.; Wang, Z.; Huang, Z. Modeling Business Cycle with Financial Shocks Basing on Kaldor-Kalecki Model. Quant. Financ. Econ. 2017, 1, 44–66. [Google Scholar] [CrossRef]

- Qamruzzaman, M.; Jianguo, W. Investigation of the asymmetric relationship between financial innovation, banking sector development, and economic growth. Quant. Financ. Econ. 2018, 2, 952–980. [Google Scholar] [CrossRef]

- Gerarden, T.D.; Newell, R.G.; Stavins, R.N. Assessing the energy-efficiency gap. J. Econ. Lit. 2017, 55, 1486–1525. [Google Scholar] [CrossRef]

- Costantini, V.; Crespi, F.; Marin, G.; Paglialunga, E. Eco-innovation, sustainable supply chains and environmental performance in European industries. J. Clean Prod. 2017, 155, 141–154. [Google Scholar] [CrossRef]

- Benfratello, L.; Schiantarelli, F.; Sembenelli, A. Banks and Innovation: Microeconometric Evidence on Italian Firms. J. Financ. Econ. 2008, 90, 197–217. [Google Scholar] [CrossRef]

- Kenney, M. How Venture Capital Became a Component of the US National System of Innovation. Ind. Corp. Chang. 2011, 20, 1677–1723. [Google Scholar] [CrossRef]

- Brown, J.R.; Martinsson, G.; Petersen, B.C. Law, Stock Markets, and Innovation. J. Financ. 2013, 68, 1517–1549. [Google Scholar] [CrossRef]

- Hsu, P.H.; Tian, X.; Xu, Y. Financial Development and Innovation: Cross-Country Evidence. J. Financ. Econ. 2014, 112, 116–135. [Google Scholar] [CrossRef]

- King, R.G.; Levine, R. Finance and growth: Schumpeter might be right. Q. J. Econ. 1993, 108, 717–737. [Google Scholar] [CrossRef]

- Amore, M.D.; Schneider, C.; Zaldokas, A. Credit Supply and Corporate Innovation. J. Financ. Econ. 2013, 109, 835–855. [Google Scholar] [CrossRef]

- Kim, J.; Park, K. Financial development and deployment of renewable energy technologies. Energy Econ. 2016, 59, 238–250. [Google Scholar] [CrossRef]

- Katircioğlu, S.T.; Taşpinar, N. Testing the moderating role of financial development in an environmental Kuznets curve: Empirical evidence from Turkey. Renew. Sustain. Energy Rev. 2017, 68, 572–586. [Google Scholar] [CrossRef]

- Saidi, K.; Mbarek, M.B. The impact of income, trade, urbanization, and financial development on CO2 emissions in 19 emerging economies. Environ. Sci. Pollut. Res. 2017, 24, 12748–12757. [Google Scholar] [CrossRef] [PubMed]

- Shahzad, S.J.H.; Kumar, R.R.; Zakaria, M.; Hurr, M. Carbon emission, energy consumption, trade openness and financial development in Pakistan: A revisit. Renew. Sustain. Energy Rev. 2017, 70, 185–192. [Google Scholar] [CrossRef]

- Pata, U.K. Renewable energy consumption, urbanization, financial development, income and CO2 emissions in Turkey: Testing EKC hypothesis with structural breaks. J. Clean Prod. 2018, 187, 770–779. [Google Scholar] [CrossRef]

- Huang, Y.; Kou, G.; Peng, Y. Nonlinear manifold learning for early warnings in financial markets. Eur. J. Oper. Res. 2017, 258, 692–702. [Google Scholar] [CrossRef]

- Dahlhaus, T. Conventional monetary policy transmission during financial crises: An empirical analysis. J. Appl. Econ. 2017, 32, 401–421. [Google Scholar] [CrossRef]

- Li, Z.; Hao, D.; Huang, Z.; Failler, P. Asymmetric Effects on Risks of Virtual Financial Assets (VFAs) in different regimes: A Case of Bitcoin. Quant. Financ. Econ. 2018, 2, 860–883. [Google Scholar] [CrossRef]

- Shahbaz, M.; Van Hoang, T.H.; Mahalik, M.K.; Roubaud, D. Energy consumption, financial development and economic growth in India: New evidence from a nonlinear and asymmetric analysis. Energy Econ. 2017, 63, 199–212. [Google Scholar] [CrossRef]

- Fouquau, J.; Hurlin, C.; Rabaud, I. The Feldstein–Horioka puzzle: A panel smooth transition regression approach. Econ. Model. 2008, 25, 284–299. [Google Scholar] [CrossRef]

- Wang, K.; Wei, Y.M.; Zhang, X. Energy and emissions efficiency patterns of Chinese regions: A multi-directional efficiency analysis. Appl. Energy 2013, 104, 105–116. [Google Scholar] [CrossRef]

- Shahbaz, M.; Bhattacharya, M.; Mahalik, M.K. Financial development, industrialization, the role of institutions and government: A comparative analysis between India and China. Appl. Econ. 2018, 50, 1952–1977. [Google Scholar] [CrossRef]

- Meng, Y.; Yang, Y.; Chung, H.; Lee, P.-H.; Shao, C. Enhancing Sustainability and Energy Efficiency in Smart Factories: A Review. Sustainability 2018, 10, 4779. [Google Scholar] [CrossRef]

- Wen, J.; Yang, D.; Feng, G.F.; Dong, M.; Chang, C.P. Venture capital and innovation in China: The non-linear evidence. Struct. Chang. Econ. Dyn. 2018, 46, 148–162. [Google Scholar] [CrossRef]

- Yao, X.; Zhou, H.; Zhang, A.; Li, A. Regional energy efficiency, carbon emission performance and technology gaps in China: A meta-frontier non-radial directional distance function analysis. Energy Policy 2015, 84, 142–154. [Google Scholar] [CrossRef]

- Ouyang, X.; Wei, X.; Sun, C.; Du, G. Impact of factor price distortions on energy efficiency: Evidence from provincial-level panel data in China. Energy Policy 2018, 118, 573–583. [Google Scholar] [CrossRef]

- Chen, Y.; Cook, W.D.; Du, J.; Hu, H.; Zhu, J. Bounded and discrete data and Likert scales in data envelopment analysis: Application to regional energy efficiency in China. Ann. Oper. Res. 2017, 255, 347–366. [Google Scholar] [CrossRef]

- Li, M.J.; Tao, W.Q. Review of methodologies and polices for evaluation of energy efficiency in high energy-consuming industry. Appl. Energy 2017, 187, 203–215. [Google Scholar] [CrossRef]

- Zhang, M.; Liu, X.; Wang, W.; Zhou, M. Decomposition analysis of CO2 emissions from electricity generation in China. Energy Policy 2013, 52, 159–165. [Google Scholar] [CrossRef]

- Filippini, M.; Zhang, L. Estimation of the energy efficiency in Chinese provinces. Energy Effic. 2016, 9, 1315–1328. [Google Scholar] [CrossRef]

- Al-Refaie, A.; Hammad, M.; Li, M.H. DEA window analysis and Malmquist index to assess energy efficiency and productivity in Jordanian industrial sector. Energy Effic. 2016, 9, 1299–1313. [Google Scholar] [CrossRef]

- Li, Z.; Chen, S.; Chen, S. Statistical Measure of Validity of Financial Resources Allocation. EURASIA J. Math. Sci. Tech. Ed. 2017, 13, 7731–7741. [Google Scholar] [CrossRef]

- Cheng, G. Data Envelopment Analysis: Methods and MaxDEA Software; Intellectual Property Pub: Beijing, China, 2014. [Google Scholar]

- Levin, A.; Lin, C.F.; Chu, C. Unit root tests in panel data: Asymptotic and finite-sample properties. J. Econ. 2002, 108, 1–24. [Google Scholar] [CrossRef]

- Maddala, G.S.; Wu, S.A. Comparative study of unit root tests with panel data and a new simple test. Oxf. Bull. Econ. Stat. 1999, 108, 1–24. [Google Scholar] [CrossRef]

| Data Sources | Carbon emission Factor for Coal Consumption (t(C)/t) | Carbon Emission Factor for Oil Consumption (t(C)/t) | Carbon Emission Factor for Natural Gas Consumption (t(C)/t) |

|---|---|---|---|

| Energy Information Administration—EIA | 0.702 | 0.478 | 0.389 |

| The Institute of Energy Economics, Japan | 0.756 | 0.586 | 0.449 |

| Chinese Committee for WCRP | 0.726 | 0.583 | 0.409 |

| Energy Research Institute National Development and Reform Commission | 0.7476 | 0.5825 | 0.4435 |

| Average | 0.7329 | 0.5574 | 0.4426 |

| Sample | Input | Desirable Output | Undesirable Output | |||

|---|---|---|---|---|---|---|

| Total Number of Employees (Ten Thousand) | Total Energy consumption (10,000 Tons of Standard Coal) | Total Investment in Fixed Assets of Industry (Billion Yuan) | Gross Domestic Product in the Region (Billion Yuan) | Carbon Dioxide Emissions (Tons) | ||

| Whole | Mean | 468.31 | 11,960.99 | 9245.97 | 14,447.14 | 7455.07 |

| Std. Dev. | 316.14 | 7883.32 | 9195.82 | 13,919.62 | 5234.63 | |

| Min | 42.67 | 683.74 | 255.62 | 390.2 | 390.41 | |

| Max | 1973.28 | 38,899.25 | 53,322.94 | 80,854.91 | 25,050.65 | |

| East | Mean | 669.09 | 16,163.55 | 12,535.14 | 23,023.99 | 8144.79 |

| Std. Dev. | 368.51 | 9505.17 | 11,056.87 | 17,405.11 | 5564.97 | |

| Min | 191.20 | 3214.97 | 921.30 | 2578.03 | 1397.52 | |

| Max | 1973.28 | 38,899.25 | 53,322.94 | 80,854.91 | 22,522.79 | |

| Central | Mean | 426.57 | 10,870.06 | 8862.14 | 11,773.34 | 8549.60 |

| Std. Dev. | 110.13 | 4207.13 | 7190.20 | 7196.08 | 3838.82 | |

| Min | 262.02 | 3426.00 | 969.03 | 2662.08 | 3379.71 | |

| Max | 719.32 | 19,863.00 | 30,011.65 | 32,665.38 | 20,263.36 | |

| West | Mean | 281.67 | 8323.46 | 6032.74 | 7523.11 | 5815.66 |

| Std. Dev. | 160.71 | 4730.50 | 5856.48 | 6475.57 | 5026.05 | |

| Min | 42.67 | 1122.70 | 255.62 | 390.20 | 431.34 | |

| Max | 846.25 | 20,575.00 | 28,811.95 | 32,934.54 | 25,050.65 | |

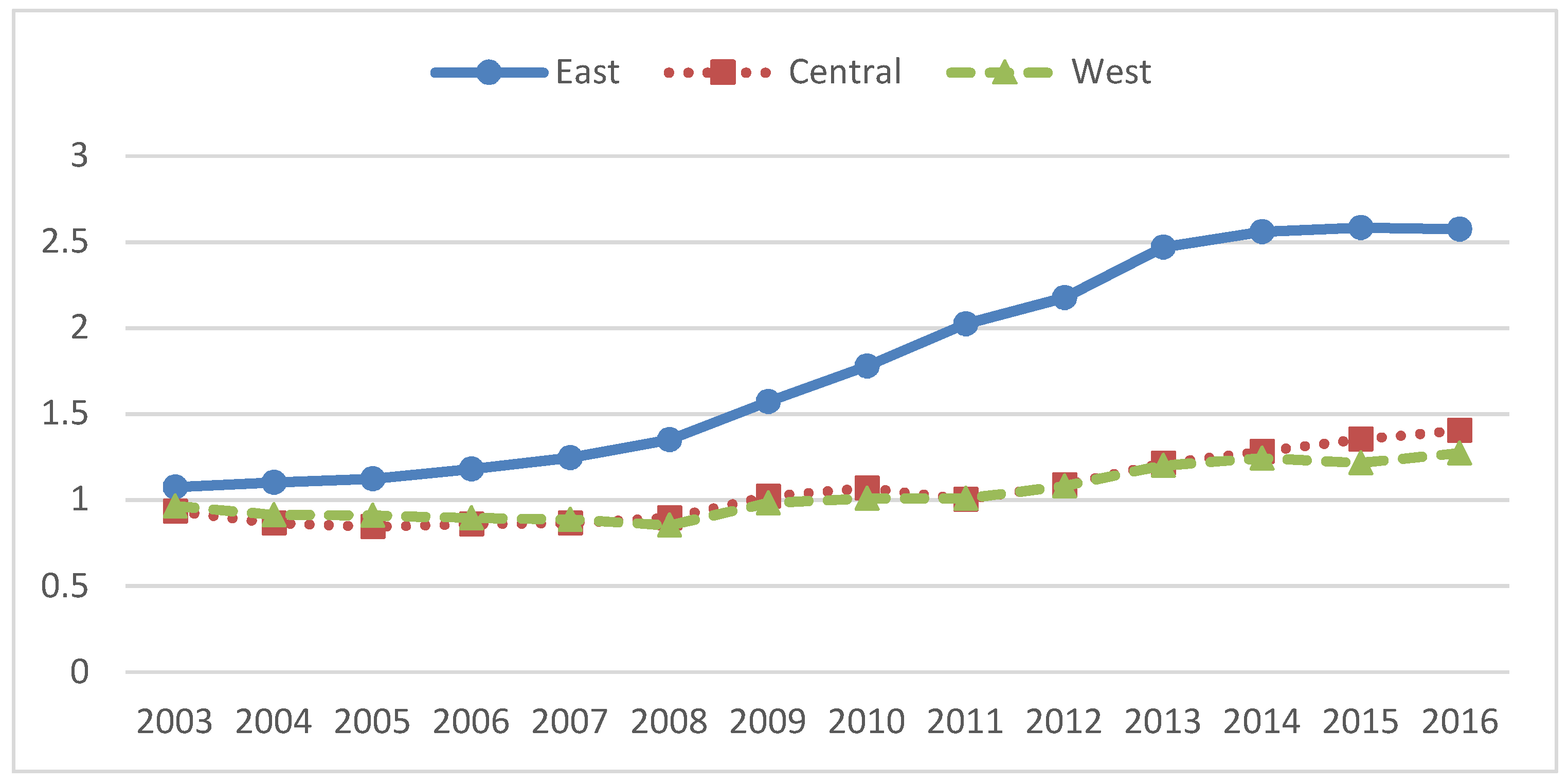

| 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Beijing (E) | 1.047 | 1.108 | 1.122 | 1.149 | 1.215 | 1.222 | 1.354 | 1.363 | 1.343 | 1.344 | 1.383 | 1.365 | 1.362 | 1.315 |

| Tianjin (E) | 1.077 | 1.046 | 0.987 | 1.018 | 1.078 | 1.272 | 1.624 | 2.059 | 2.191 | 2.229 | 2.569 | 2.744 | 2.964 | 3.059 |

| Hebei (E) | 0.968 | 0.974 | 1.027 | 1.141 | 1.171 | 1.226 | 1.501 | 1.550 | 1.451 | 1.617 | 1.801 | 2.011 | 2.197 | 2.229 |

| Liaoning (E) | 0.981 | 1.073 | 1.163 | 1.305 | 1.408 | 1.548 | 1.727 | 1.871 | 1.781 | 2.000 | 2.190 | 2.072 | 1.682 | 1.793 |

| Shanghai (E) | 0.986 | 1.024 | 1.041 | 1.047 | 1.086 | 1.117 | 1.150 | 1.099 | 1.172 | 1.240 | 1.282 | 1.248 | 1.155 | 1.027 |

| Jiangsu (E) | 1.294 | 1.295 | 1.278 | 1.394 | 1.536 | 1.786 | 2.136 | 2.574 | 2.999 | 3.349 | 3.952 | 4.265 | 4.465 | 4.492 |

| Zhejiang (E) | 1.165 | 1.241 | 1.277 | 1.378 | 1.493 | 1.560 | 1.813 | 1.967 | 2.247 | 2.530 | 2.613 | 2.723 | 2.680 | 2.596 |

| Fujian (E) | 1.010 | 1.034 | 1.044 | 1.073 | 1.158 | 1.233 | 1.424 | 1.619 | 2.169 | 2.375 | 2.563 | 2.684 | 2.802 | 2.813 |

| Shandong (E) | 1.277 | 1.337 | 1.485 | 1.580 | 1.645 | 1.882 | 2.225 | 2.490 | 2.621 | 2.834 | 3.114 | 3.245 | 3.420 | 3.496 |

| Guangdong (E) | 1.077 | 1.125 | 1.137 | 1.163 | 1.252 | 1.418 | 1.730 | 2.363 | 3.724 | 3.828 | 5.018 | 5.078 | 4.931 | 4.734 |

| Hainan (E) | 0.946 | 0.871 | 0.806 | 0.734 | 0.661 | 0.610 | 0.629 | 0.597 | 0.560 | 0.599 | 0.668 | 0.725 | 0.765 | 0.755 |

| Shanxi (C) | 0.826 | 0.686 | 0.605 | 0.573 | 0.522 | 0.462 | 0.521 | 0.455 | 0.396 | 0.407 | 0.423 | 0.420 | 0.421 | 0.403 |

| Jilin (C) | 0.878 | 0.788 | 0.803 | 0.871 | 0.926 | 0.991 | 1.107 | 1.137 | 0.922 | 1.019 | 1.046 | 1.079 | 1.157 | 1.200 |

| Heilongjiang (C) | 0.897 | 0.781 | 0.683 | 0.630 | 0.583 | 0.504 | 0.499 | 0.441 | 0.385 | 0.390 | 0.405 | 0.366 | 0.353 | 0.344 |

| Anhui (C) | 0.978 | 0.981 | 1.047 | 1.192 | 1.369 | 1.518 | 1.824 | 2.058 | 1.965 | 2.223 | 2.549 | 2.876 | 3.057 | 3.201 |

| Jiangxi (C) | 1.099 | 1.121 | 1.148 | 1.178 | 1.230 | 1.412 | 1.671 | 1.835 | 1.725 | 1.899 | 2.121 | 2.266 | 2.402 | 2.524 |

| Henan (C) | 0.917 | 0.809 | 0.784 | 0.795 | 0.807 | 0.849 | 0.984 | 1.039 | 1.013 | 1.053 | 1.235 | 1.247 | 1.271 | 1.263 |

| Hubei (C) | 0.931 | 0.865 | 0.797 | 0.771 | 0.659 | 0.627 | 0.660 | 0.679 | 0.695 | 0.739 | 0.816 | 0.832 | 0.854 | 0.862 |

| Hunan (C) | 0.945 | 0.891 | 0.894 | 0.863 | 0.829 | 0.816 | 0.902 | 0.924 | 0.922 | 0.971 | 1.103 | 1.178 | 1.316 | 1.446 |

| Inner Mongolia (W) | 0.970 | 1.054 | 1.159 | 1.196 | 1.214 | 1.131 | 1.302 | 1.319 | 1.249 | 1.299 | 1.490 | 1.758 | 1.356 | 1.465 |

| Guangxi (W) | 0.932 | 0.835 | 0.826 | 0.804 | 0.817 | 0.849 | 1.083 | 1.339 | 1.673 | 2.021 | 2.257 | 2.338 | 2.437 | 2.900 |

| Chongqing (W) | 1.098 | 1.159 | 1.214 | 1.316 | 1.446 | 1.562 | 1.906 | 2.148 | 2.272 | 2.333 | 2.546 | 2.597 | 2.563 | 2.463 |

| Sichuan (W) | 1.010 | 0.965 | 1.007 | 0.993 | 1.023 | 1.079 | 1.502 | 1.598 | 1.461 | 1.554 | 1.807 | 1.735 | 1.615 | 1.551 |

| Guizhou (W) | 0.935 | 0.849 | 0.776 | 0.708 | 0.630 | 0.532 | 0.529 | 0.479 | 0.433 | 0.424 | 0.413 | 0.405 | 0.416 | 0.451 |

| Yunnan (W) | 0.973 | 0.904 | 1.001 | 1.019 | 1.034 | 0.982 | 1.055 | 1.014 | 0.956 | 0.971 | 1.004 | 0.948 | 0.905 | 0.915 |

| Shaanxi (W) | 0.940 | 0.847 | 0.772 | 0.732 | 0.712 | 0.667 | 0.690 | 0.652 | 0.615 | 0.654 | 0.753 | 0.792 | 0.816 | 0.858 |

| Gansu (W) | 0.915 | 0.794 | 0.730 | 0.660 | 0.598 | 0.533 | 0.539 | 0.493 | 0.459 | 0.481 | 0.536 | 0.555 | 0.580 | 0.581 |

| Qinghai (W) | 0.981 | 0.934 | 0.921 | 0.937 | 0.888 | 0.789 | 0.902 | 0.849 | 0.896 | 1.018 | 1.181 | 1.217 | 1.247 | 1.402 |

| Ningxia (W) | 0.944 | 0.868 | 0.848 | 0.786 | 0.716 | 0.674 | 0.707 | 0.697 | 0.630 | 0.705 | 0.797 | 0.887 | 0.942 | 0.910 |

| Xinjiang (W) | 0.934 | 0.842 | 0.778 | 0.720 | 0.670 | 0.595 | 0.608 | 0.511 | 0.468 | 0.449 | 0.441 | 0.443 | 0.493 | 0.517 |

| Variables | Descriptive | Mean | Std. Dev | Min | Max |

|---|---|---|---|---|---|

| EE | Energy efficiency | 1.3085 | 0.0973 | 0.3435 | 5.0785 |

| TP | Technical progress | 1.0356 | 0.0962 | 0.6730 | 1.3410 |

| LOAN | Total loans/GDP | 1.1517 | 0.3992 | 0.5372 | 2.5847 |

| STOCK | Total market capitalization/GDP | 0.5875 | 1.4016 | 0.0578 | 18.6363 |

| INSURE | Insurance penetration | 2.7021 | 1.0134 | 0.4467 | 7.3900 |

| GOV | Local government expenditure on science and technology | 0.2043 | 0.0921 | 0.0792 | 0.6274 |

| FDI | Foreign direct investment | 0.3637 | 0.2823 | 0.0058 | 1.2999 |

| ESC | Coal consumption/energy consumption | 0.6847 | 0.2618 | 0.0870 | 1.4495 |

| IS | Share of service sector/GDP | 0.4160 | 0.0861 | 0.2860 | 0.8023 |

| EDL | GDP per capita | 3.3431 | 2.2906 | 0.3701 | 11.8198 |

| FIN | LOAN + STOCK + INSURE | 4.4412 | 2.3808 | 1.4358 | 26.1564 |

| Variables | LLC | Fisher-ADF |

|---|---|---|

| EE | −3.6816 (0.000) | 155.95 (0.000) |

| TP | −3.8328 (0.000) | 155.73 (0.000) |

| LOAN | −7.0140 (0.000) | 144.40 (0.000) |

| STOCK | −13.6992 (0.000) | 197.67 (0.000) |

| INSURE | −4.3744 (0.000) | 128.53 (0.000) |

| GOV | −5.893 (0.000) | 106.10 (0.000) |

| FDI | −5.0639 (0.000) | 128.06 (0.000) |

| ESC | −9.5078 (0.000) | 153.92 (0.000) |

| IS | −3.4194 (0.000) | 68.64 (0.208) |

| EDL | −5.6636 (0.000) | 100.85 (0.001) |

| FIN | −4.3613 (0.000) | 112.99 (0.000) |

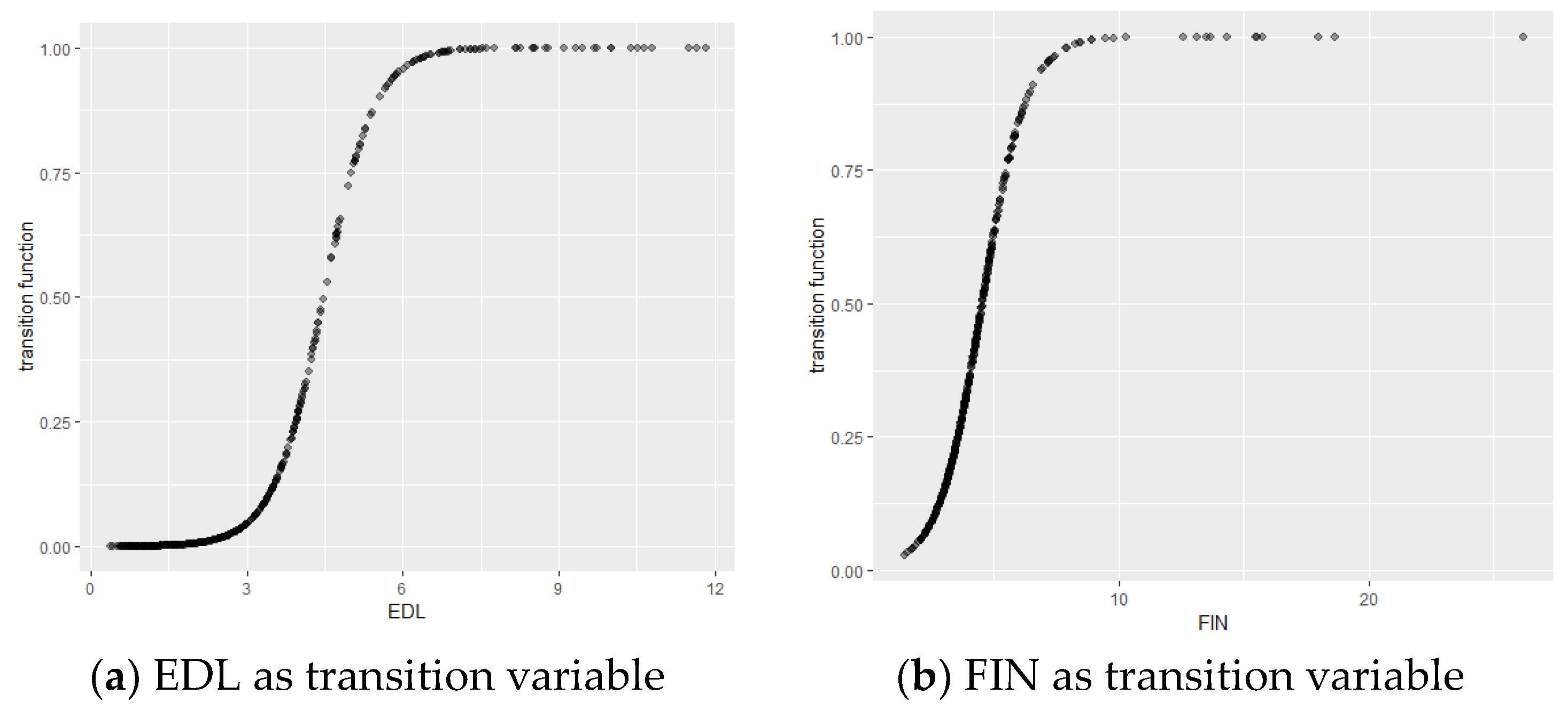

| Transition Variable | Sample | H0: r = 0; H1: r = 1 | H0: r = 1; H1: r = 2 | ||||

|---|---|---|---|---|---|---|---|

| LM | LMF | LRT | LM | LMF | LRT | ||

| EDL | Whole | 82.619 (0.000) | 11.827 (0.000) | 92.843 (0.000) | 11.261 (0.187) | 1.219 (0.287) | 11.426 (0.179) |

| East | 30.145 (0.000) | 4.107 (0.000) | 33.548 (0.000) | 11.580 (0.171) | 1.128 (0.350) | 12.038 (0.150) | |

| Central | 28.605 (0.000) | 4.116 (0.000) | 33.030 (0.000) | 5.410 (0.248) | 1.233 (0.296) | 5.445 (0.245) | |

| West | 103.182 (0.000) | 34.263 (0.000) | 170.739 (0.000) | 11.305 (0.255) | 1.021 (0.427) | 11.741 (0.228) | |

| FIN | Whole | 117.072 (0.000) | 18.454 (0.000) | 137.238 (0.000) | 17.614 (0.244) | 2.003 (0.456) | 17.994 (0.214) |

| East | 43.632 (0.000) | 6.671 (0.000) | 51.302 (0.000) | 10.738 (0.217) | 1.115 (0.358) | 11.130 (0.194) | |

| Central | 16.279 (0.039) | 2.041 (0.049) | 17.591 (0.025) | 15.953 (0.043) | 1.661 (0.121) | 17.210 (0.121) | |

| West | 44.804 (0.000) | 6.924 (0.000) | 52.947 (0.000) | 11.243 (0.211) | 1.051 (0.403) | 10.842 (0.188) | |

| Variable | Whole | East | Central | West | ||||

|---|---|---|---|---|---|---|---|---|

| Linear | Nonlinear | Linear | Nonlinear | Linear | Nonlinear | Linear | Nonlinear | |

| TP | 0.6526 *** (9.3042) | 0.1206 ** (2.187) | 0.4478 *** (7.1) | 0.3906 *** (2.6215) | 0.7021 *** (7.0485) | 0.3373 ** (2.3422) | 0.3716 ** (2.5383) | 0.4768 ** (2.3581) |

| LOAN | 0.4956 ** (2.5157) | −0.2354 * (−1.6724) | 1.056 *** (2.9797) | −1.004 ** (−2.1066) | 0.23 * (1.6674) | 1.213 ** (2.5537) | 0.3462 *** (3.7704) | 0.5185 *** (3.0198) |

| STOCK | −0.019 * (−1.7546) | 0.0132 (0.3286) | 0.2153 *** (2.8722) | −0.2385 *** (−3.3157) | 0.0603 * (1.6917) | 0.1152 (0.2934) | −0.0157 (−0.3667) | 0.7325 *** (3.1051) |

| INSURE | 0.0039 (0.1222) | −0.0293 (−0.5393) | 0.0869 (1.6029) | −0.0961 * (−1.8055) | −0.0972 *** (−3.4406) | 0.0937 (1.2115) | 0.0316 (0.7412) | −0.1549 ** (−2.415) |

| GOV | −0.5069 ** (−2.4283) | 1.002 (0.9882) | 2.216 * (1.8956) | −1.546 (−0.9923) | 2.591 *** (3.2943) | −3.34 * (−1.7387) | −1.176 *** (−3.2158) | 0.0974 (0.1662) |

| FDI | 0.0034 (0.0322) | −0.2101 (−1.129) | −0.0488 (−0.2797) | −0.0066 (−0.0298) | −0.1248 (−0.5799) | 0.5978 (1.0486) | 0.2128 (1.1206) | −0.1388 (−0.3777) |

| ESC | 0.342 (0.9735) | −0.6467 (−1.3532) | 1.63 ** (1.9893) | −2.902 *** (−3.4049) | 0.1439 (0.5599) | −0.3267 (−1.0335) | 0.2238 (1.3401) | 0.2519 * (1.8387) |

| IS | −0.0223 ** (−2.085) | 0.0167 (0.8497) | −0.0985 *** (−3.9903) | 0.072 *** (2.8876) | 0.0001 (0.0138) | −0.0346 ** (−2.3093) | −0.0061 (−0.7404) | −0.0278 * (−1.9536) |

| c | 4.495 | 4.394 | 4.31 | 2.966 | ||||

| γ | 2.533 | 3.0460 | 1.533 | 3.004 | ||||

| Number of observations | 420 | 154 | 112 | 154 | ||||

| Variable | Whole | East | Central | West | ||||

|---|---|---|---|---|---|---|---|---|

| Linear | Nonlinear | Linear | Nonlinear | Linear | Nonlinear | Linear | Nonlinear | |

| TP × LOAN | 0.5787 *** (12.7383) | −0.1489 ** (−2.117) | 0.5304 *** (4.1405) | −0.086 * (−1.7156) | 0.7167 *** (9.9404) | −0.0351 (−0.1185) | 0.42 *** (6.422) | 0.2846 *** (3.3267) |

| TP × STOCK | −0.0624 * (−1.9388) | 0.0671 * (1.8495) | −0.1199 ** (−1.9611) | 0.1205 * (1.7579) | −0.0258 (−0.61) | −0.2638 ** (−2.297) | 0.0024 (1.0802) | −0.2281 (−1.0565) |

| TP × INSURE | 0.0076 (0.1766) | 0.0735 (0.718) | 0.0095 (0.4418) | 0.077 (1.5599) | 0.0058 (0.2431) | −0.0306 (−0.3852) | 0.0248 (1.1058) | −0.0747 *** (−3.619) |

| GOV | −0.2139 * (−1.6578) | - | 3.316 * (1.8756) | - | 1.034 (1.5655) | - | −1.059 *** (−4.3207) | - |

| FDI | −0.1761 (−0.9442) | - | −0.237 (−1.6177) | - | 0.1178 (0.5036) | - | −0.1824 (−1.2071) | - |

| ESC | 0.2299 (1.0963) | - | 1.001 * (1.817) | - | −0.0811 (−0.3704) | - | 0.1011 (0.6822) | - |

| IS | −0.0201 *** (−3.0403) | - | −0.0592 ** (−2.5057) | - | −0.0111 *** (-4.0862) | - | −0.0079 (−1.4921) | - |

| c | 4.868 | 4.7810 | 4.31 | 2.964 | ||||

| γ | 1.608 | 2.705 | 1.327 | 5.909 | ||||

| Number of observations | 420 | 154 | 112 | 154 | ||||

| Variable | Whole | East | Central | West | ||||

|---|---|---|---|---|---|---|---|---|

| Linear | Nonlinear | Linear | Nonlinear | Linear | Nonlinear | Linear | Nonlinear | |

| TP | 0.6989 *** (7.7785) | 0.2462 * (1.7867) | 0.6711 * (1.8899) | 0.4405 * (1.8649) | 0.3434 * (1.8071) | 0.9524 ** (2.2993) | 0.3014 ** (2.4286) | 0.723 * (1.9166) |

| LOAN | 0.3552 ** (1.9944) | −0.3525 ** (−2.1237) | 0.8923 ** (1.7918) | −0.7632 * (−1.6518) | 1.095 (1.4793) | −2.862 ** (−1.9971) | −0.0323 (−0.0449) | 1.551 ** (2.1715) |

| STOCK | −0.184 * (−1.8394) | 0.1972 * (1.8879) | −0.3205 * (−1.6964) | 0.3252 * (1.7073) | −1.133 *** (−3.1648) | 1.207 * (1.8244) | 0.1149 (0.1529) | 0.6069 (0.6355) |

| INSURE | −0.0629 (−0.9782) | −0.0776 (−0.796) | −0.0776 (−0.4759) | −0.0134 (−0.0698) | −0.4207 ** (−2.0492) | −0.0922 (−0.2519) | 0.6948 (0.6122) | −0.3434 (−0.3246) |

| GOV | −0.025 (−0.0716) | −0.0566 (−0.0784) | 3.064 * (1.7321) | −1.19 (−0.365) | −13.78 (−1.5325) | 27.27 (1.545) | −0.4789 (−0.2) | 0.2189 (0.0563) |

| FDI | −0.0924 (−0.6375) | −0.634 ** (−2.0146) | 0.5982 (0.5433) | −1.177 (−0.9124) | −1.793 *** (−3.1966) | 2.989 ** (2.1675) | −0.5564 (−0.7527) | 0.2436 (0.1974) |

| ESC | 0.05 (0.2269) | −0.1516 (−0.5181) | 3.032 (0.9434) | −4.29 * (−1.6559) | −2.332 *** (−3.0721) | 4.028 *** (3.2484) | −0.5276 (−0.7376) | 0.8585 (1.0738) |

| IS | −0.0139 * (−1.847) | 0.0224 (1.3088) | −0.1121 * (−1.7138) | 0.0895 (1.4234) | −0.0144 (−0.7736) | 0.0224 (0.6116) | 0.1308 (0.7832) | −0.228 (−1.3793) |

| c | 4.989 | 3.9067 | 3.65 | 3.162 | ||||

| γ | 1.82 | 0.8968 | 0.6236 | 0.3328 | ||||

| Number of observations | 420 | 154 | 112 | 154 | ||||

| Variable | Whole | East | Central | West | ||||

|---|---|---|---|---|---|---|---|---|

| Linear | Nonlinear | Linear | Nonlinear | Linear | Nonlinear | Linear | Nonlinear | |

| TP × LOAN | 0.6144 *** (8.7721) | −0.1238 * (−1.7288) | 0.7474 *** (5.83) | −0.2358 ** (−2.3323) | 1.301 *** (3.587) | −1.21 *** (−3.975) | 0.4933 *** (7.23) | −0.0186 (−0.0922) |

| TP × STOCK | −0.2791 * (−1.8022) | 0.2959 * (1.833) | −0.657 ** (−1.9121) | 0.677 * (1.9113) | −0.8006 *** (−2.754) | 1.353 *** (3.6099) | −0.1145 *** (−3.7321) | 0.4725 (1.0477) |

| TP × INSURE | 0.039 ** (2.5397) | 0.0075 (0.3036) | 0.0477 ** (2.1855) | 0.0158 (0.5003) | 0.0502 (0.4976) | 0.0249 (0.2171) | 0.0458 (1.0566) | −0.0903 *** (−3.142) |

| GOV | −0.4026 * (−1.6609) | - | 1.654 * (1.934) | - | 0.6179 (0.9393) | - | −0.7115 *** (−4.6443) | - |

| FDI | −0.3057 ** (−2.2813) | - | −0.3722 ** (−2.3497) | - | 0.1 (0.3526) | - | −0.3519 (−1.5267) | - |

| ESC | 0.2453 (1.2586) | - | 0.4885 (0.8321) | - | 0.0708 (0.3969) | - | 0.1211 (1.1339) | - |

| IS | −0.0156 ** (−2.6652) | - | −0.0494 ** (−2.3452) | - | −0.0068 ** (−2.5013) | - | −0.0071 (−0.878) | - |

| c | 4.213 | 4.035 | 3.251 | 5.858 | ||||

| γ | 1.354 | 1.973 | 0.5452 | 1.377 | ||||

| Number of observations | 420 | 154 | 112 | 154 | ||||

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chen, S.; Liao, G.; Drakeford, B.M.; Failler, P. The Non-Linear Effect of Financial Support on Energy Efficiency: Evidence from China. Sustainability 2019, 11, 1959. https://doi.org/10.3390/su11071959

Chen S, Liao G, Drakeford BM, Failler P. The Non-Linear Effect of Financial Support on Energy Efficiency: Evidence from China. Sustainability. 2019; 11(7):1959. https://doi.org/10.3390/su11071959

Chicago/Turabian StyleChen, Shuanglian, Gaoke Liao, Benjamin M. Drakeford, and Pierre Failler. 2019. "The Non-Linear Effect of Financial Support on Energy Efficiency: Evidence from China" Sustainability 11, no. 7: 1959. https://doi.org/10.3390/su11071959

APA StyleChen, S., Liao, G., Drakeford, B. M., & Failler, P. (2019). The Non-Linear Effect of Financial Support on Energy Efficiency: Evidence from China. Sustainability, 11(7), 1959. https://doi.org/10.3390/su11071959