Abstract

In recent decades, the nuclear export market has observed a marked shift of demand from traditional customers in the Western world to Asia. The lack of projects in the United States, the delay in the French construction of advanced reactors, and the Fukushima accident in Japan have also led to the declining export capabilities of their companies. In contrast, Russia has gained numerous contracts, and China will likely become another major exporter. In this paper, the evolution of the market was examined from both the supply and demand sides with issues including the more concentrated and uncertain market, the lack of full participation by emerging suppliers to the nonproliferation regime, and the lesser governance capabilities of the newcomers. Addressing these issues, a range of policy suggestions was made, including the reinforcement of market shares of Western suppliers, the encouragement of newcomers to adhere to international norms, and a better safeguards contribution scheme.

1. Introduction

Although the demand for new nuclear power plants (NPPs) dropped significantly during the 1980s and 1990s, the number of potential customers of nuclear energy has since increased, especially in the 2000s, which led to the suggestion of a possible “nuclear renaissance” that was later deemed far-fetched after the Fukushima nuclear accident in 2011 and several years of low oil prices [1]. Nevertheless, the shift of demand for NPPs from traditional customers in the West to emerging countries in the East, especially China, has been observed since the end of the Cold War [2]. There have been concerns that such a nuclear spread to states having no prior experience can undermine the robustness of the nonproliferation regime [3]. Addressing such concerns, this paper examines the evolution of the nuclear export market from both the demand and supply sides, with focus on the characteristics of stakeholders in the market in terms of governance capabilities and nonproliferation compliance.

Although the construction time of a nuclear power unit can vary from several to ten years or more, in general a functional NPP can be operated for decades, thus the stability and governance capability of the host country throughout such a long lifetime of the plant are crucial to the safety, security, and nonproliferation of these complex industrial projects [4]. To assess the stability of a country and its governance capability, this paper uses the definition of governance quality proposed by Kaufmann et al. [5] and measured by the World Bank [6], which include “(a) the process by which governments are selected, monitored and replaced; (b) the capacity of the government to effectively formulate and implement sound policies; and (c) the respect of citizens and the state for the institutions that govern economic and social interactions among them”. For example, governments with low level of stability and governance capability have a high risk of losing control of their nuclear facilities to rogue factions in cases of coups d’état or a sudden take-over like the cases of South Vietnam, Iraq, Ukraine, or Syria. It is also significantly more difficult to maintain the safety of nuclear infrastructure when political disputes occur or low-intensity conflicts persist. On the exporting side, similarly the lack of good governance has been a matter of concern. For example, in the early 1990s the United States (U.S.) implemented numerous policies to reverse Russia’s nuclear export to Iran partly due to the concern that the lack of an effective export control system in Russia following the collapse of the Soviet Union might lead to the leakage of nuclear materials and sensitive technologies to potential proliferators. In addition, having a high level of corruption may expose a government to a greater risk of corrupted officials and scientists transferring knowledge, skills, and technologies to non-state actors like terrorist groups. This problem has been particularly highlighted since the proliferation activities of the A.Q. Khan network were uncovered in the early 2000s.

This paper also argues that membership to nonproliferation-related agreements and organizations also helps the evaluation of a country’s adherence to the nonproliferation and export control regime. This is due to the fact that in many situations, a country participates in such the international regime in order to either communicate their nonproliferation compliance to other treaty members, or call for support to strengthen such compliance. Besides, by admitting new members, international organizations provide a cooperative environment for them to improve their domestic nonproliferation infrastructure. The improvement of Brazil’s compliance to the nonproliferation and export control regimes after its participation in the Missile Technology Control Regime (MTCR), or the admission of former communist countries to the Wassenaar Arrangements that helped transform the export control practices of these countries are two examples for this argument about considering nonproliferation-related treaty membership as an indicator for treaty compliance. In another case, despite its robust export control system, Taiwan has been considered a target for illicit proliferation-related trades due to its isolation from international treaties and organizations related to the nonproliferation regime.

2. Overview of the Nuclear Export Market

The new landscape in the demand side of the market has also initiated the transformation of the supply side in all stages of the nuclear fuel cycle. Although the export of nuclear reactors is often considered synonymous with the nuclear export market [7], there are other types of services and technology transactions related to different stages of the nuclear fuel cycle, from uranium mining and milling, to conversion, enrichment, fuel fabrication, and nuclear reprocessing. Despite the lower total estimated value of these transactions in one year in comparison with NPP export contracts [8], the supply of nuclear fuel and other services is often in forms of long-term contracts with consistent revenues for nuclear companies. In fact, such sustainable profits have been considered as one of the reasons why nuclear suppliers are sometimes willing to export reactors at discounted prices [9].

At the front-end, the market for natural uranium, which was mostly shared among Western countries and the Soviet Union in the 1980s, is now dominated by Kazakhstan, Canada, Australia, and several African producers [8]. In terms of enrichment services, the dominance of the trio United States Enrichment Corporation (USEC), Tenex (Russia), and Areva (France) in the early 1990s has gradually transformed into a duopoly between Tenex and Areva, which was renamed Orano in January 2018, by the late 2000s [10]. The consolidation of market shares has also been observed in fuel fabrication, with almost three-quarters of the market belonging to Orano and two U.S.-Japan joint ventures. Finally, the lack of orders for new NPPs in the West has led to a situation where Rosatom gained ground while Chinese suppliers are catching up, whereas traditional suppliers from the U.S., European Union, and Japan have encountered diminishing commercial prospects [11]. As a result, the industry has observed the transfer of ownership of numerous American and European technology suppliers to conglomerates from East Asia [12].

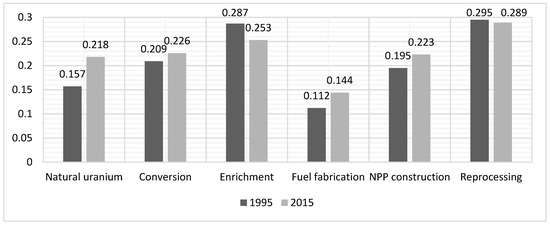

To measure the change in market share, and the level of concentration in different sections of the nuclear fuel cycle market [10], the Herfindahl-Hirschman Index (HHI) was calculated based on Equation (1) and market share data [8,13,14,15]. According to the U.S. Department of Justice, the market is considered highly concentrated when H ≥ 0.25, moderately concentrated when 0.15 ≤ H < 0.25, unconcentrated when 0.01 ≤ H < 0.15, and highly competitive when H < 0.01. Any merger that leads to such highly concentrated market would be considered a matter of concern, as it can disadvantage customers in due to the increasing market power [16].

where with si being the market share of producer i among N producers competing in the market; 0 ≤ si ≤ 1.

The comparison of estimated HHI in 1995 and 2015 of the six major sections of the nuclear export market is presented in Figure 1. Accordingly, the market has become more concentrated in almost all sectors, except for enrichment and reprocessing, which remain highly concentrated despite having lower HHI after 20 years. This finding, which is similar to the results of a report by the Nuclear Energy Agency [13], validates the longstanding concern of nuclear customers about the existence of a “nuclear cartel” that is a small group of powerful suppliers controlling the market [17], especially in sections like natural uranium supply, reactor construction, and fuel cycle services. Even in the case of a less-concentrated enrichment sector, end-users still have reason to worry, as enriched uranium can only be used in reactors after the fuel fabrication process, of which the market concentration has increased noticeably since the early 1990s. Furthermore, when a customer wants to diversify the fuel supply from its original producer, a new supplier needs years to acquire the necessary safety license to be able to produce such alternative fuel [18]. On the other hand, arguments have also been made that the supply surplus in natural uranium and nuclear fuel, and the uneventful history of uranium and fuel deliveries of the market can be considered reasons to assure nuclear customers about the long-term supply sustainability, and to render ideas like multinational reserves of fuel or enriched uranium like the Low-Enriched Uranium Bank owned and controlled by the International Atomic Energy Agency (IAEA) and hosted by Kazakhstan, impractical and uneconomical [19]. Such arguments can be refuted, however, by historical evidence such as the decision by the U.S. halting uranium export to Brazil during the 1970s [20].

Figure 1.

Estimated HHI of the nuclear market in 1995 and 2015. Here, market shares of different suppliers were assumed to be their production capacities, except for NPP construction, where the 1995 market share of a certain supplier equal the percentage of reactors built with its technology from 1951 to 1995, and the 2015 market share of that supplier equal the percentage of new builds since 1995 with its technology.

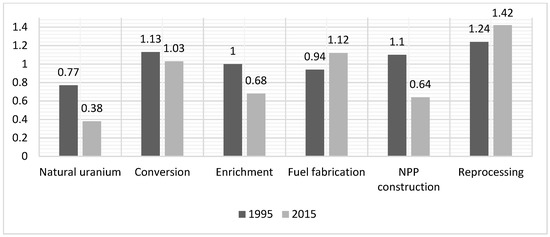

Given the reshuffle of suppliers in terms of market share, the total governance effectiveness of the market has also changed noticeably. Using the data provided by the World Bank, the overall governance effectiveness of the market (Eff) was calculated using Equation (2) for 1995 and 2015 [5,6]. As is shown in Figure 2, the estimated governance effectiveness of the nuclear market indicates a deterioration in almost all sections of the market, with the natural uranium supply and NPP construction having the biggest drops. Such lowered governance effectiveness can be explained by the shift of market shares in these sections from the well-developed Western countries to Eastern and African suppliers, which generally have lower governance capabilities. As new nuclear customers are also often developing countries with lesser governance capabilities, this deterioration may increase the risk of nuclear export to nuclear newcomers with lesser capabilities in safety (due to corruption in project management), security (due to sabotage and terrorism), and nonproliferation (due to domestic and regional instabilities).

where with Effi being the governance effectiveness score of exporter i; −2.5 (weakest effectiveness) ≤ Effi ≤ 2.5 (strongest).

Figure 2.

Estimated overall governance effectiveness of different parts of the nuclear market in 1995 and 2015. The global average of governance effectiveness in 1995 is approximately 0.01, this value for 2015 is approximately −0.01.

After reviewing the nuclear market in a whole, the next sections will address the specific situations of the demand and supply sides of the market. In most of the onward discussions, the term “nuclear exporter” or “nuclear supplier”, unless specified otherwise, are used to refer to the supplying country of nuclear reactor technology, as this section of the nuclear fuel cycle market is the most visible in term of commercial, political, and social values, and reactor exporters are often selected as suppliers of nuclear fuels and other services for safety and economic reasons.

3. Status of Nuclear Exporters

As previously mentioned, Russia has been the dominating exporter in the global nuclear market since the 2000s. Despite some setbacks like Vietnam’s decision to indefinitely postpone the NPP contract under the agreement with Russia [21], the Russian state-owned corporation Rosatom has been able to win contracts in numerous countries, ranging from existing nuclear users like Finland or Hungary, to newcomers like Jordan or Bangladesh. The repeated successes of Russia’s nuclear export have been attributed to the favorable financial clauses of Rosatom’s bids with direct support from the Russian government, the corporation’s ability to provide full fuel cycle services, or the flexible contractual structure that Rosatom can employ [22]. Given the capital-intensive nature of NPP projects and Russia’s poor financial conditions due to the low oil price and sanctions by Western countries since 2014, experts have questioned Rosatom’s capabilities to deliver its signed contracts, and possibilities that the Russian government might use such projects as political leverage against its customers [23]. Nevertheless, Rosatom has continued to put new VVER reactors into commercial operation domestic and abroad, whereas the Russian government has been actively looking for opportunities in new markets in Asia or Africa [24].

Following Russia in expanding its portfolio in the nuclear market in recent years is China. Despite being a latecomer in the export market and being occupied with strong domestic demand, the Chinese nuclear industry has been able to gain a foothold abroad by taking over nuclear contracts of which suppliers and/or customers have struggled with financial issues, such as the NPP projects in Romania, Argentina, or the United Kingdom (UK) [25]. Backed with financial advantages, strong political support from the government, and technological advantages, as China already possesses licenses for most of the advanced reactor technologies, Chinese nuclear corporations have emerged as strong contenders in the nuclear market [26]. State ownership has also been cited as one of the advantages of the Republic of Korea (ROK) when they won contract to build four new reactors in the United Arab Emirates (UAE) over more experienced suppliers from the U.S. or France [27]. However, the lack of full fuel cycle capabilities, and recent government’s nuclear phase-out policy might hinder ROK efforts to compete in the export market [28].

Unlike the state-owned enterprises from Russia, China, and ROK, their private or partially state-owned counterparts from traditional nuclear suppliers like the U.S., France, Japan, and Canada have been struggling with completing delayed projects, or bidding in new markets with negligible financial supports from their governments. Furthermore, the lack of new orders back home has also greatly affected the manufacturing capabilities of these nuclear companies, and put them in an even more disadvantaged position [29].

Surveying the involvement of the major nuclear exporters to the nonproliferation and export control regimes, it can be concluded that except for China, which has participated in only a half of the major relevant agreements and is the last among them joining the Nuclear Suppliers Group (NSG), all other exporters have comprehensive memberships to the ten international instruments related to nuclear nonproliferation and export control, namely the Nonproliferation Treaty (NPT); Comprehensive Safeguards Agreement (CSA); Additional Protocol (AP); Nuclear Suppliers Group (NSG); Zangger Committee (ZC); Missile Technology Control Regime (MTCR); Hague Code of Conduct (HCOC); Australian Group (AG); Wassenaar Arrangement (WASS); and Proliferation Security Initiative (PSI). China has not participated in the last five instruments from this list, whereas Russia was not an AG member but has partly incorporated the AG’s export control list in its domestic legislation [30]. Even in the case of China’s non-participation, such absence has been partly due to legal disputes or the lack of consensus among existing participants about China’s bid for membership, while China has proven to be increasingly active in reinforcing its export control system [31]. Still, the country has been criticized for its reactor exports to Pakistan, and for its complacency implementing international sanctions against North Korea [32]. Here, it is necessary to mention that there have been other controversial export decisions made by suppliers with comprehensive nonproliferation membership, such as the nuclear cooperation agreement signed by the U.S. with India in 2005 despite the fact that India was not a member of the NPT and has not joined the regime since then. However, given the potential of China exporting technology to newcomer countries, China’s non-participation in international export control instruments might remain a matter of concern [33].

4. Status of Nuclear Importers

4.1. Overview

Aside from 30 states with operable NPPs [14], nuclear importers and prospective customers can be categorized into three groups based on their commitment to nuclear power development: having NPPs under construction; planning to build NPPs in the near future; and considering proposals for such construction. According World Nuclear Association statistics [34], there are 15 countries in the first group with 60 on-going new builds, 25 in the second group with 164 planned new builds, and 350 proposals from 35 countries of the third group. The list of countries based on the status of their nuclear commitments is presented in Table 1.

Table 1.

List of countries with commitments to nuclear energy development. Countries are ranked based on the combination of the current size and future development of their nuclear fleet. Category 1 (Cat1) indicates the number of operable NPPs (weighting factor 1 in the combination for ranking); Category 2 (Cat2) indicates the number of NPPs under construction (weighting factor 0.6); Category 3 (Cat3) indicates the number of NPPs in planned projects (weighting factor 0.3); Category 4 (Cat4) indicates the number of proposed NPPs (weighting factor 0.1).

Further corroborated by the forecast of the International Energy Agency [35], the projection made by the World Nuclear Association shows that, despite the loss of demands from traditional customers, future nuclear demand would be sustained by the rise of China and other nuclear newcomers. However, in the short term, the global nuclear industry has to rely on a relatively small group of customers from Asia like China, India, the Middle East, and Eastern Europe like Romania, Czech Republic, or Hungary. In some cases (i.e., in ROK or Russia), the sizeable market for new builds has been dominated by domestic suppliers and thus become almost impenetrable to international exporters. In addition, many newcomers had declared their intention to acquire NPP technology and later cancelled the projects due to political, economic, or social reasons like Thailand or Vietnam. The low oil and gas price, and the availability of cheaper renewable technologies have also affected the attractiveness of nuclear energy, especially in newcomer countries. Therefore, one may argue that to maintain nonproliferation and security of nuclear power development, the focal point should be this small group of significant customers so that the limited resources for nuclear security and safeguards can be maximally utilized. However, to prepare for a possible nuclear expansion to newcomers, not only committed users but also significant newcomers should be examined in term of stability, and governance capability [36].

4.2. Issues

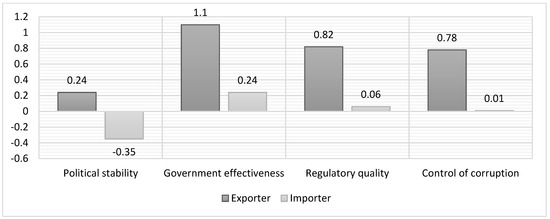

To compare the suitable conditions for nuclear power development in term of nuclear nonproliferation, security, and safety between suppliers and potential customers, the 2016 Worldwide Governance Indicators by World Bank were used [17,36]. Accordingly, the average 2015 scores in political stability, government effectiveness, regulatory quality, and control of corruptions of the aforementioned seven major exporters (U.S., Russia, China, France, Japan, ROK, Canada), and 25 prospective importers (Algeria, Argentina, Bangladesh, Belarus, Bulgaria, China, Czech, Egypt, Finland, Hungary, India, Iran, Jordan, Malaysia, Nigeria, Pakistan, Romania, Saudi Arabia, Slovakia, South Africa, Thailand, Turkey, UAE, UK, and Vietnam) were calculated with the results presented in Figure 3.

Figure 3.

Average 2015 governance-related scores of major exporters and importers [17]. According to the scale of the previously-mentioned Worldwide Governance Indicators, the value of −2.5 represents the weakest conditions for each category, the 2.5 the strongest.

The results indicated that, on average, prospective importers of NPPs have significantly lower governance capabilities than the major suppliers. Such a disparity may lead to the mismanagement of nuclear projects, and create risks in the three major aspects of nuclear governance: safeguards, security, and safety (3S) risks. For example, ineffective or corrupted safety regulators would not be able to ensure that NPP operators apply the highest standards for the safe operation of their plants, whereas national instability in a country would increase the security risks of the NPPs and nuclear materials, or make it more difficult for the IAEA to ensure its safeguards responsibility in that country. This is especially the case when exporters are willing to sacrifice their high standard in order to win contracts in nuclear newcomers [37]. Moreover, the rate of participation by potential customers in the nonproliferation and export control regimes is also noticeably lower [30]. For example, Pakistan has joined only one in ten major instruments, whereas this number for Egypt is two in ten. Even Bangladesh, whose first NPP has been already under construction by Russia, or Saudi Arabia, which has been active in implementing its ambitious program, only has memberships in four out of ten instruments, while Saudi Arabia still refuses to sign the AP, which is, aside from the NPT and CSA, considered the most important instrument in minimizing the proliferation risk in newcomer countries [38].

As a simple count of participation to international agreement may not truly reflect the capabilities of the importing governments in implementing necessary measures to ensure the 3S conditions of their nuclear projects, additional metrics were considered including the Nuclear Threat Initiative (NTI) Nuclear Security Index, and the completion of the export control-related matrix provided by the UNSCR1540 Committee [39]. Results of the 2016 NTI Nuclear Security Index show that the average score of these prospective importers is 66.12, which is significantly lower than the corresponding score estimated for major exporters, which is 77.14 [40]. Following the risk-based framework proposed by reference [41], a detailed examination of the UNSCR1540 matrices reported by exporters and importers indicated similar disparity, according to which the average percentage of completion of the UNSCR1540 requirements by the seven major nuclear suppliers is 91.79%, whereas this average percentage for the 25 potential importers is 67.03%. This disparity is especially worrying given the fact that even in countries with generally high export control standards like Germany or Switzerland, the lack of authority awareness, and the profit-driven behaviors of nuclear-related companies have led to risky exports to potential proliferators or non-compliant countries [3]. However, it should also be noted that the completion percentage would generally increase with time, as was shown through the comparison between reference [41] and our calculation for 2015 data [39], for it may take years for countries to implement necessary infrastructure for export control. Also, the membership of a state in an international treaty does not always entail its effective compliance with all requirements laid out by such a treaty. For example, investigations conducted in Japan following the Fukushima nuclear accident (2011) indicated that, despite being a party to the Convention on Nuclear Safety, numerous safety recommendations in accordance with the convention had been neglected by Japan before the occurrence of the accident [42]. In the absence of an in-depth and country-specific review of the state-level adherence to the nonproliferation and export control regimes, however, the accuracy of the compliance assessment conducted in this paper was strengthened by the use of multiple surveys carried out by the UNSCR1540 Committee and the NTI. The comparison between reference [41] and our calculation for 2015 data is presented in Table 2.

Table 2.

Comparison of completion percentage of the 1540 Resolution of different countries in 2006 [41] and 2015 (our study) as was reflected through the 1540 Committee approved matrices [39]. The same ranking of countries from Table 1 was used to indicate the size of each country’s current and future nuclear fleet.

Since numerous potential customers are developing countries without prior experience in operating NPPs, there have been concerns that they do not have enough institutional, financial, and human resources to fully implement the requirements of the UNSCR1540 Committee [33]. However, as pointed out by the Panel of Experts on the UNSCR1874, the reasons behind the incomplete implementation of Security Council resolutions also include the lack of political willingness or understanding about the resolutions, and low prioritization [43]. To verify this observation in the case of the UNSCR1540 implementation, a linear regression analysis was conducted with the dependent variable being the number of the planned and proposed NPPs by a country, and independent variables including the completion percentage of the UNSCR1540 matrix by the same country, and its scientific output in nuclear-related subjects [44]. Results of the analysis showed that there is a statistically-significant correlation between the scientific output and the scale of the nuclear fleet that a country plans to build (p-value < 0.01), whereas there is no such correlation between the latter and the 1540 matrix completion percentage. Such lack of compliance might create favorable conditions for nuclear smuggling, as strict export control has been considered essential in preventing the illicit trafficking of nuclear materials and technologies from these countries to state or non-state actors [45].

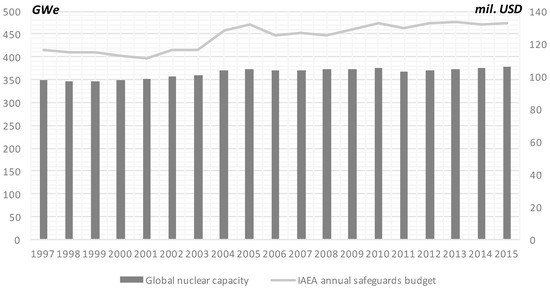

Finally, the possible expansion of nuclear energy to newcomer countries has not only created new 3S risks due to the generally lower governance capabilities of these countries, but also brought additional financial burdens on the IAEA. This is due to the fact that new nuclear installations in these countries will require the Agency to dedicate resources to monitor nuclear-related facilities and activities. In many cases, these newcomers also benefit from the “shielding system”, according to which the poorer countries in term of income per capita would pay less than their full share of the cost for safeguards by the IAEA. Instead, the most prosperous IAEA Member States would pay more to compensate for such a deficit to the operational budget of the Agency [46]. Therefore, the funding situation for the IAEA safeguards system will face additional challenges with the nuclear expansion to newcomers, unless the major nuclear suppliers can share the financial safeguards burden rising from such new NPP projects with the IAEA, as they are responsible for introducing additional proliferation risks to their customers by supplying them with nuclear technology [47]. This is especially the case when major contributors to the IAEA like the U.S. have emphasized a “zero-real-growth” policy that restricts any increase in the Agency’s budget beyond inflation. As illustrated in Figure 4, the zero-real-growth policy might be considered beneficial to enhance the Agency’s effectiveness, especially in the context of no significant increase in global nuclear capacities, and of advanced inspection technologies and experiences. However, if the global nuclear industry has a noticeable rise in total nuclear capacities in the next few decades, without a substantial change in the safeguards budget, the IAEA will face difficulties in implementing the Agency’s responsibilities.

Figure 4.

Changes in Agency’s annual safeguards budgets (line, in millions of USD), adjusted for inflation to 2015 USD, in comparison with changes in global nuclear capacities (column, in GWe).

5. Conclusions and Policy Recommendations

Based on the analysis in this paper, several conclusions can be made regarding the nuclear export market in general, and the situations of nuclear exporters and importers in particular, along with recommendations to improve the security and nonproliferation robustness of the market. Firstly, the nuclear export market has become more concentrated and uncertain. Such concentration and uncertainty will likely cause concerns among nuclear importers about the stable supply of technologies, materials, and services. Given the decline of traditional exporters and the emergence of new exporters with lesser governance capabilities, the average governance effectiveness of exporters has generally deteriorated, which could lead to the mismanagement of nuclear exports to newcomers.

Secondly, with respect to the evolution of nuclear suppliers, it is evident that Russia has been be dominating the market along with China, and will dominate the market in the future. Given Russia’s tendency to use energy supplies as a political leverage tool [23], and China’s history of resorting to economic retaliation to address political disputes [48], it would be desirable that traditional suppliers from the Western world retain certain shares in the market, especially in technology export related to the nuclear steam supply system, enrichment, and fuel fabrication in order to keep the market in healthy competition, and to maintain global standards. In particular, the foothold in uranium enrichment and fuel fabrication seems to be more feasible for the Western companies, as the markets for enrichment and fuel fabrication are less capital intensive while providing more long-term contracts, especially when customers need to diversify their fuel supply from Russian and Chinese suppliers. Such a foothold can be in the form of multilateral cooperation with new suppliers, in which technologies would be provided by traditional suppliers, whereas new suppliers are in charge of funding and financing [49]. It should be noted, though, that safety regulations for alternative fuel fabrication will be a challenge, as was exemplified by the difficulties that Westinghouse faced in acquiring regulatory approval for their VVER-type fuel fabricated for Ukraine. Thus, state support in testing and licensing is essential.

Although regaining the technology market might be difficult for Western and Japanese suppliers due to their precarious domestic situations, a strategy to maintain their partial control in this sector still needs to be considered given the link between technology supply and fuel/services supply. When state-sponsored financial packages are unavailable, other incentives should be considered like state bilateral agreements on arms trade, direct investment, or technology transfer that are coupled with the bid for the nuclear contract. In this aspect, traditional nuclear exporters should also focus on the retransfer of Western-origin technologies to a third party through tightening the criteria for technological transfer/indigenization, as well as encouraging the NSG guideline implementation by its new Member States. The AP should also be made a prerequisite for any technology import in order to enhance the transparency by the importers in utilizing nuclear technology, to demonstrate the adherence of the exporters to export control regimes, and to supplement the ad-hoc nature of the control list. In fact, as there has not existed a full-scope framework for civil nuclear export control, in 2008 the Carnegie Endowment for International Peace has initiated the development and promotion of the Nuclear Power Plant Exporters’ Principles of Conduct [50]. Despite containing innovative features such as the independence from state involvement, or the flexible adaptation of the safety requirements by the IAEA, this initiative has not been mentioned recently when its participants like Areva (now Orano) or KEPCO encountered safety-related issues with their supply chains. In addition, traditional suppliers should secure the market for spent fuel management, including dry storage and final disposal solutions, as back-end fuel cycle has become an issue to many nuclear users. To facilitate commercial opportunities in this part of the fuel cycle, geological disposal should be successfully implemented in Sweden, Finland, France, and the U.S., whereas disposal in a third and non-nuclear party like Mongolia or Australia should be explored.

Thirdly, most of the prospective nuclear customers have significantly lower governance capabilities than major nuclear exporters in term of nuclear safety, security, and project managements. Also, there is a discrepancy regarding the adherence of prospective importers to international nonproliferation norms. In contrast to their efforts to build up the scientific and technological capabilities to develop nuclear energy, new customers have not paid enough attention to reinforcing their export control and nonproliferation commitments. Such lack of governance capabilities in nuclear newcomers indicates not only the risk of mismanagement by state actors, but also the risk of the state system bypassed or exploited by non-state actors. As most newcomers are looking for full-scale reactors for the purpose of energy security, financing has been the most difficult barrier for nuclear newcomers [51]. This creates enough incentive for the newcomer countries to seek active external support in building governance capabilities, especially in nuclear security and export control. In particular, these countries should be persuaded that a higher priority for nonproliferation and export control would facilitate the flow of nuclear trade in and out of their territories, and not affect the benefits from nuclear cooperation [52]. Moreover, given the lack of economic viability and the diversity of suppliers, a stable and diverse supply of uranium should be maintained from Canada, Australia, and Africa. In addition, Western countries should retain the conversion, enrichment, and fuel fabrication capabilities to prevent the total control of these markets by Russia and China.

Finally, the zero-growth policy and reliance of safeguards funding on extra budgetary contributions should be replaced by demand-based budget planning and adequate regular funding. Safeguards contribution of a Member State to the IAEA should be commensurate with the size or potential of its nuclear program, and not based on the shielding program. In particular, emerging nuclear exporters like Russia, ROK, and China should financially support the safeguards system proportionally to the benefits they acquire from the market. Transparency and openness for areas such as the public distribution of reports related to IAEA safeguards funding, are also necessary in order to mobilize third-party support for such a reform of the funding mechanism for the Agency. In addition, newcomers looking for an acquisition of research reactor require equal attention to other constructing nuclear power plants, as the financial demands for safeguarding these two types of facilities are comparable. It is easier for states to provide legitimate rationales for these types of projects, which are also less demanding nature in terms of technology and funding, whereas a small reactor can still be directly used for proliferation purposes, or indirectly for increasing nuclear latent capabilities through manpower development. Therefore, the nonproliferation and security of the civil nuclear market can only be ensured if the export of research reactors, especially to developing countries with no prior nuclear experiences, is properly addressed with necessary scrutiny of the implication of such projects.

In terms of nuclear nonproliferation and security policies over the past two decades, the attention of the international community has mostly focused on a number of specific and prominent cases like the North Korea and Iran nuclear crises. However, as this paper illustrated, the evolution of the civil nuclear export market during the same period has fundamentally changed the market shares of, and the dynamics between nuclear exporters and their potential customers. These changes, which are exemplified by the rise of new nuclear suppliers and importers from the East, may lead to new nuclear risks into the future due to their lesser governance capabilities and lower priority for nonproliferation and export control policies. Therefore, a range of policies, as discussed above, should be carefully examined and systematically implemented in order to reinforce the nonproliferation and security characteristics of the global nuclear industry for the responsible use of nuclear energy.

Lastly, it is necessary to note the limitations of current compliance measurements like the UNSCR1540 matrices or the NTI Nuclear Security Index. For example, the NTI Index was partly developed through expert judgement, thus specific conditions of countries will create discrepancies in the assessment by reviewers from different countries, as was the case with China [53]. Neither checklist-form of the UNSCR1540 matrices can assure that the final score of a state matrix would truly reflect its compliance to nonproliferation and export control. In addition, these metrics are not sufficient to address the synergy between nuclear safety, security, and safeguards, which have played an increasingly important role in the safe and secured development of nuclear power in any country [54]. However, due to the lack of alternative metrics, these datasets were used in this paper as an attempt to provide a holistic picture of nonproliferation compliance worldwide. Although this approach may not be suitable to point out the different weaknesses and disadvantages of different newcomers that have distinctive socio-political conditions and nuclear energy ambitions, the comprehensive perspective it provided about the state of countries’ compliance to the nonproliferation and export control regime is a useful contribution to the nonproliferation literature, and may encourage reconsideration of the distribution of international resources for safeguards and export control, as well as general policies that can be applied to improve the market situation.

Author Contributions

Conceptualization, V.P.N.; Data curation, V.P.N.; Funding acquisition, M.S.Y.; Investigation, M.S.Y.; Methodology, V.P.N.; Project administration, M.S.Y.; Writing—original draft, V.P.N.; Review & editing, M.S.Y.

Funding

This research was supported by Basic Science Research Program through the National Research Foundation of Korea (NRF) funded by the Ministry of Science, ICT & Future Planning (NRF-2016R1A5A1013919) and also in part by the Brain Korea 21 Plus Project of Nuclear and Quantum Engineering Department, KAIST in 2017. This article is made open access thanks to the financial support from the Managing the Atom Project at the Belfer Center, Harvard Kennedy School.

Acknowledgments

The authors would like to thank the current and former members of the Managing the Atom Project and International Security Program at the Belfer Center, especially Matthew Bunn, Martin Malin, Steven Miller, and Lami Kim for their helpful discussions and suggestions. This article and its previous drafts also benefited from the detailed and constructive comments made by the three reviewers of Sustainability and other anonymous reviewers.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Hibbs, M. The Nuclear Renaissance? Carnegie Endowment for International Peace: Washington, DC, USA, 2016. [Google Scholar]

- Nguyen, V.P.; Yim, M.S. Post-Cold War civilian nuclear cooperation and implications for nuclear nonproliferation. Prog. Nucl. Energy 2016, 93, 246–259. [Google Scholar] [CrossRef]

- Potter, W.C. The New Nuclear Producers: The Main Threat to Supply-Side Restraints? In Limiting the Proliferation of Weapons: The Role of Supply-Side Strategies; Rioux, J.F., Ed.; Carleton University Press: Ottawa, ON, Canada, 1992; ISBN 978-0886291938. [Google Scholar]

- Bleek, P.C. Project Vinca: Lessons for securing civil nuclear material stockpiles. Nonprolif. Rev. 2003, 10, 1–23. [Google Scholar] [CrossRef]

- Kaufmann, D.; Kraay, A.; Mastruzzi, M. The Worldwide Governance Indicators—Methodology and Analytical Issues. Available online: https://openknowledge.worldbank.org/bitstream/handle/10986/3913/WPS5430.pdf?sequence=1&isAllowed=y (accessed on 25 March 2019).

- World Bank. The Worldwide Governance Indicators, 2016 Update; World Bank Group: Washington, DC, USA, 2016. [Google Scholar]

- Ramberg, B. Destruction of Nuclear Energy Facilities in War; Lexington Books: Lexington, MA, USA, 1980; ISBN 978-0669037678. [Google Scholar]

- NEA. Forty Years of Uranium Resources, Production and Demand in Perspective; Nuclear Energy Agency, Organisation for Economic Co-operation and Development: Paris, France, 2006.

- Thomas, S.D. The Realities of Nuclear Power—International Economic and Regulatory Experience; Cambridge University Press: Cambridge, MA, USA, 1988; ISBN 978-0521126038. [Google Scholar]

- Rothwell, G. Market Power in Uranium Enrichment. Sci. Glob. Secur. 2009, 17, 132–154. [Google Scholar] [CrossRef]

- Inagaki, K.; Lewis, L.; Crooks, E. Downfall of Toshiba, a nuclear industry titan. The Financial Times, 14 February 2017. [Google Scholar]

- IAEA. Nuclear Technology Review; International Atomic Energy Agency: Vienna, Austria, 2008. [Google Scholar]

- NEA. Market Competition in the Nuclear Industry; Nuclear Energy Agency, Organisation for Economic Co-operation and Development: Paris, France, 2008.

- IAEA. The Database on Nuclear Power Reactors; International Atomic Energy Agency: Vienna, Austria, 2017. [Google Scholar]

- WNA. Nuclear Fuel Cycle; World Nuclear Association: London, UK, 2017. [Google Scholar]

- DoJ. Horizontal Merger Guidelines (08/19/2010); U.S. Department of Justice: Washington, DC, USA, 2010.

- Stewart, L.R. Canada’s Role in the International Uranium Cartel. Int. Organ. 1981, 35, 657–689. [Google Scholar] [CrossRef]

- Standish, R. Can the IAEA’s New Nuclear Fuel Bank Prevent a Future Iran Crisis? Foreign Policy, 28 August 2015. [Google Scholar]

- Wood, T.; Seward, A.; Otto, R. Market-based policies for nuclear nonproliferation. Nonprolif. Rev. 2016, 23, 409–423. [Google Scholar] [CrossRef]

- Debs, A.; Monteiro, N.P. Nuclear Politics: The Strategic Causes of Proliferation; Cambridge University Press: New York, NY, USA, 2017; ISBN 978-1107518575. [Google Scholar]

- Nguyen, V.P. The fate of nuclear power in Vietnam. Bulletin of the Atomic Scientists, 5 December 2016. [Google Scholar]

- Saha, S. Russia’s Nuclear Diplomacy: How Washington Should Respond. Foreign Affairs, 2 April 2017. [Google Scholar]

- Lecavalier, E. Russian nuclear power: Convenience at what cost? Bulletin of the Atomic Scientists, 16 October 2015. [Google Scholar]

- Roelf, W. Russia’s Rosatom seeks cooperation agreements for African nuclear expansion. Reuters. 19 May 2016. Available online: https://af.reuters.com/article/investingNews/idAFKCN0YA1CH (accessed on 26 March 2019).

- Thomas, S. China’s nuclear export drive: Trojan Horse or Marshall Plan? Energy Policy 2017, 101, 683–691. [Google Scholar] [CrossRef]

- Stanway, D. China’s Premier urges nuclear firms to boost overseas presence. Reuters, 16 January 2015. [Google Scholar]

- Kane, C.; Pomper, M.A. Reactor Race: South Korea’s Nuclear Export Successes and Challenges; Korea Economic Institute of America: Washington, DC, USA, 2013. [Google Scholar]

- Nguyen, V.P. An Analysis of Moon Jae-in’s Nuclear Phase-out Policy: The Past, Present, and Future of Nuclear Energy in South Korea. Georget. J. Asian Aff. 2019, 4, 2. [Google Scholar]

- GAO. Nuclear Commerce: Government-Wide Strategy Could Help Increase Commercial Benefits from U.S. Nuclear Cooperation Agreements with Other Countries; Report No. GAO-11-36 to the Committee on Foreign Affairs; United States Government Accountability Office, House of Representative: Washington, DC, USA, 2010.

- CNS. Membership of Nonproliferation Export Control Regimes, HCOC and PSI; Updated October 26; Center for Nonproliferation Studies—Inventory of International Nonproliferation Organizations and Regimes: Monterey, CA, USA, 2015; Available online: http://www.nti.org/documents/540/apmnecr_sCQhT3r.pdf (accessed on 26 March 2019).

- Schell, T.P. Governing Uranium in China; DIIS Report No. 2014:03; DIIS—Danish Institute for International Studies: Copenhagen, Denmark, 2014. [Google Scholar]

- Plant, T.; Rhode, B. China, North Korea and the Spread of Nuclear Weapons. Surviv. Glob. Politics Strateg. 2013, 55, 61–80. [Google Scholar] [CrossRef]

- Davis, Z.S. China’s Nonproliferation and Export Control Policies: Boom or Bust for the NPT Regime? Asian Surv. 1995, 35, 587–603. [Google Scholar] [CrossRef]

- WNA. World Nuclear Power Reactors & Uranium Requirements; World Nuclear Association: London, UK, 2017. [Google Scholar]

- IEA. World Energy Outlook 2016; International Energy Agency: Paris, France, 2016. [Google Scholar]

- Miller, S.E.; Sagan, S.D. Nuclear power without nuclear proliferation? Daedalus Fall 2009. [Google Scholar] [CrossRef]

- Countryman, T. CSIS Seminar on U.S. Policy Directions in Limiting Enrichment and Reprocessing; Center for Strategic & International Studies: Washington, DC, USA, 2016. [Google Scholar]

- Burkhard, S.; Wenig, E.; Albright, D.; Stricker, A. Saudi Arabia’s Nuclear Ambitions and Proliferation Risks; Institute for Science and International Security: Washington, DC, USA, 2017. [Google Scholar]

- UNSCR1540. 1540 Matrices; Security Council Committee Established Pursuant to Resolution 1540 (1540 Committee): New York, NY, USA. Available online: https://www.un.org/en/sc/1540/national-implementation/1540-matrices.shtml (accessed on 26 March 2019).

- NTI. NTI Nuclear Security Index: Building a Framework for Assurance, Accountability, and Action, 3rd ed.; Nuclear Threat Initiative: Washington, DC, USA, 2016. [Google Scholar]

- Crail, P. Report: Implementing UN Security Council Resolution 1540—A Risk-Based Approach. Nonprolif. Rev. 2006, 13, 355–399. [Google Scholar] [CrossRef]

- Cavoski, A. Revisiting the Convetion on Nuclear Safety: Lessons Learned from the Fukushima Accident. Asian J. Int. Law 2013, 3, 365–391. [Google Scholar] [CrossRef]

- UNSCR1874. Report of the Panel of Experts (S/2017/150); Security Council Committee Established Pursuant to Resolution 1874 (1874 Committee): New York, NY, USA. Available online: https://www.securitycouncilreport.org/un-documents/document/s2017150.php (accessed on 26 March 2019).

- SCImago. Country Rankings. Scimago J. Country Rank 2017. Available online: https://www.scimagojr.com/countryrank.php (accessed on 26 March 2019).

- Murauskaite, E. The Trust Paradox in Nuclear Smuggling. Nonprolif. Rev. 2015, 22, 321–339. [Google Scholar] [CrossRef]

- Findlay, T. What Price Nuclear Governance? Funding the International Atomic Energy Agency; Project on Managing the Atom Report No. 2016-01; Belfer Center for Science and International Affairs: Cambridge, MA, USA, 2016. [Google Scholar]

- Toomey, C.M.; Kurzrok, A.J.; Wyse, E.T.; Swarthout, J.M. Alternative Funding Sources for the International Atomic Energy Agency; Pacific Northwest National Laboratory: Richland, WA, USA, 2012.

- Jennings, R. These Are 4 Other Countries China Boycotted Before South Korea. Forbes, 17 March 2017. [Google Scholar]

- Kaynak, E.; Wells, R.D. Exporting Large Capital Equipment: A Case Study of Nuclear Technology Transfer. Ind. Mark. Manag. 1990, 19, 173–190. [Google Scholar] [CrossRef]

- Perkovich, G.; Radzinsky, B. A common high standard for nuclear power plant exports: Overview and analysis of the Nuclear Power Plant Exporters’ Principles of Conduct. Nucl. Law Bull. 2012, 90, 7–22. [Google Scholar] [CrossRef]

- Goldemberg, J. Nuclear energy in developing countries. Daedalus Fall 2009. [Google Scholar] [CrossRef]

- Jones, S.; Karreth, J. Assessing the Economic Impact of Adopting Strategic Trade Controls; U.S. Department of State, Bureau of International Security and Nonproliferation, Office of Export Cooperation: Washington, DC, USA, 2010.

- Shen, D.L. China’s Nuclear Security Status is Underestimated. Glob. Asia 2016, 11, 112–117. [Google Scholar]

- Cipollaro, A.; Lomonaco, G. Contributing to the nuclear 3S’s via a methodology aiming at enhancing the synergies between nuclear security and safety. Prog. Nucl. Energy 2016, 86, 31–39. [Google Scholar] [CrossRef]

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).