1. Introduction

Sustainable finance, as a term, first appeared in a UNEP (The United Nations Environment Program) report to finance ministers. Literally, sustainable finance is a forward-looking development model that meets the needs of present generations without compromising the needs of future generations. Since the sustainable finance was put forward, many countries all over the world have taken action. The German government has given a certain discount and interest rate to the green project loan, the EU has stipulated that the green credit and securitization products can enjoy the tax concession, and the British government has adopted the loan guarantee scheme to support small and medium-sized enterprises, especially environmentally friendly ones. In China, since the 18th National Congress of the Communist Party of China, green development has been an important issue for China’s transformation and an important trend for future economic development. It can help to promote supply-side structural reforms and improve the quality of economic growth. The Fifth Plenary Session of the 18th CPC Central Committee of the Communist Party of China (CPC) stressed that the green development, as an important concept of the development of our country, is a basic idea of the economic and social development during the 13th Five-Year Plan period and even the longer period. As a key method for the comprehensive evaluation of financial institutions by financial regulatory authorities, the CAMELS rating system (CAMELS) [

1] was made by the Federal Reserve System and other regulators in November 1979 and revised by the Federal Financial Institutions Examination Council in 1996. Given its effectiveness, CAMELS has been adopted by most countries since its promulgation until today. However, as the financial industry’s influence on the environment grows, CAMELS’s age limitations are starting to become apparent. To overcome limitations and meet the requirements of China’s economic development, this study has added the green indicator based on the original CAMELS to form the G-CAMELS system. After considering the possible influence of banks on the environment, the G-CAMELS evaluation system can comprehensively measure the situation of financial institutions. Therefore, on the basis of the theoretical framework of G-CAMELS, this study constructs the competitiveness evaluation system of commercial banks and uses 16 listed banks in China to conduct an empirical analysis.

The G-CAMELS system is an extension and a development of the camel rating system. Taking environmental factors as a separate part of the system magnifies the impact of the financial industry on the environment, thereby stimulating banks to assume social responsibility and achieve sustainable development. It enriches the relevant research of CAMELS. The existing research mainly uses CAMELS for empirical analysis and has not considered innovating CAMELS. Although the green credit policy has already been proposed in China, commercial banks still lack deep understanding of the importance of relevant policies to achieve sustainable development. The imperfect incentive mechanism has made banks less active in implementing environmental policies. It is necessary to establish a bank competitiveness evaluation system considering environmental factors to raise awareness of social responsibility and evaluate competitiveness of banks from a new perspective.

Since the original camel rating system examines the comprehensive situation of the bank, the framework of the camel rating system can provide a comprehensive evaluation of the competitiveness of the bank. The G-CAMELS system has added an easy-to-quantify green indicator that reflects the bank’s environmental impact. While comprehensively examining the bank’s situation, it also emphasizes environmental factors and embodies the concept of green development. Therefore, the G-CAMELS system constructed in this paper promotes the research on bank competitiveness. It provides a new method for government and bank decision makers to measure the competitiveness. Moreover, this paper enriches the content of the camel rating system, adapts to the requirements of the times, and reaches the conclusion that green credit may not be able to enhance the competitiveness for different types of banks. We have also proposed different recommendations to different types of banks. The government should encourage state-owned banks to continue to implement green financial policies and green innovation, such as the development of green financial products to enhance profitability and moderately lower the standards of the green credit policy of joint-stock banks, especially local commercial banks. It is worth thinking that this article advances the understanding of sustainable development. In general, sustainability can be understood as philanthropy act, creating value that protects the welfare of local communities. But from the perspective of the bank’s point of view, sustainable development can not only bring environmental benefits, but also enables banks to increase their profit through the bank’s business operations or financial innovation. It is a win-win result.

The first part of the paper is the introduction, the second part is the literature review, the third part is the research method, the fourth part is the index system construction and data preprocessing, the fifth part is the empirical analysis, the sixth part is the result, and the seventh part is conclusion and outlook.

2. Literature Review

2.1. About Green Credit

In the early 1980s, the US Congress passed the “Super Fund Act”, which made the banking industry begin to take environmental risks into consideration. It also made the banking industry realize that finance is of great significance to environmental protection and human social development. Since then, developed countries have begun to study the relevant theories. White (1996) [

2] first proposed that green finance is to promote environmental protection by using various financial instruments and suggested that environmental risk factors should be included when making financing decisions. Jeucken (2002) [

3] provides a more comprehensive explanation of sustainable financing in

Sustainable Finance and Banking. He believed that commercial banks should take advantage of their huge advantages in resource allocation and guide the sustainable development of the economy and society through various credit policies and the means of deployment. For example, when banks provide loans to sustainable commercial projects, they can promote the development of sustainable projects by charging lower fees. To better implement sustainable finance theories, the International Finance Corporation (IFC) and ABN Amro (Algemene Bank Nederland and AMRO Bank agreed to merge to create the ABN AMRO.) introduced the Equator Principles in 2002, a set of voluntary financial industry benchmarks designed to manage environmental and social risks in project finance.

Industrial Ecology, published by Gradel and Allenby (2003) [

4], systematically expounded the important role of the financial industry in environmental protection and industrial structure adjustment and upgrading. The study of sustainable finance has been promoted to a new stage. Weber (2011) [

5] described the importance of adding sustainability assessments of projects to credit review mechanisms. Fatemi (2013) [

6] argued that companies cannot over-emphasize short-term benefits and need to establish a sustainable financing framework to quantify all environmental and social costs or benefits.

On the basis of the Western “sustainable financing” theory, combined with China’s development status, green financial policy came into being. Green financial policy refers to a series of institutional arrangements concerning financing conditions, financing processes, and incentive measures formulated by government departments for financial institutions and enterprises. For example, in terms of green credit, the China Banking Regulatory Commission formulated the Green Credit Guidelines in February 2012. It requires major commercial banks to control credits for enterprises and projects that do not meet industrial policies and environmental requirements. The document curbs the expansion of high-pollution and energy-intensive industries and conveys a signal of transforming development concepts and investing in green industries. It can be seen from Note 1 that the green credit balance of 21 major banks in China is increasing year by year. In terms of green bonds, the People’s Bank of China issued the Green Bond Support Project Catalogue in December 2015. Since then, it has issued Guidance on Building a Green Financial System, China Securities Regulatory Commission’s Guidance on Supporting the Development of Green Bonds, and Business Guidelines on Green Debt Financing Tools for Non-Financial Enterprises to support the development of China’s green bonds. Green bonds have developed rapidly in China. By the end of 2016, 205.231 billion yuan of green bonds had been issued in China. The issuance scale of green financial bonds amounted to 155.5 billion yuan, accounting for 75.52% of the total size of the green bonds issued. He et al. (2006) [

7] pointed out that the development of green finance can effectively promote the transformation and upgrading of the industrial structure. China’s green credit policy started late. In July 2007, the former State Environmental Protection Administration, the People’s Bank, and three departments of the China Banking Regulatory Commission jointly proposed a new credit policy in order to curb the blind expansion of high energy-consuming and high pollution industries. On January 2008, the former State Environmental Protection Administration signed a cooperation agreement with the World Bank and the IFC, deciding to jointly develop “green credit guidelines and environmental protection” in line with the actual conditions of China. It clarifies industry environmental standards in China and makes it possible for financial institutions to follow the rules when implementing green credit. In 2012, the China Banking Regulatory Commission formulated the “Green Credit Guide”, which conveys the clear policy direction of industrial structure adjustment. Green credit balances for 21 major banks in China are listed here: 4.85 trillion yuan in June 2013; 5.72 trillion yuan in June 2014; 6.64 trillion yuan in June 2015; 7.26 trillion yuan in June 2016; 8.3 trillion yuan in June 2017. China’s 21 major banks refer to China Development Bank, Export–Import Bank of China, Agricultural Development Bank of China, Industrial and Commercial Bank of China, Agricultural Bank of China, Bank of China, China Construction Bank, Bank of Communications, China CITIC Bank, China Everbright Bank, Hua Xia Bank, Guangdong Development Bank, Ping an Bank, China Merchants Bank, Pudong Development Bank, Industrial Bank, China Minsheng Bank, Hengfeng Bank, Zhejiang Commercial Bank, China Bohai Bank, and China Post Savings Bank. Qin (2012) [

8] analyzed the problems in the implementation of green credit in China. For example, the scale of credit business of commercial banks would shrink and the risk assessment standards and procedures of green credit business are not mature.

2.2. About Bank Competitiveness

Foreign research on the competitiveness of commercial banks is based on the discussion of the connotation of commercial banks’ competitiveness and the rating of commercial banks by rating agencies. About the study of competitiveness, there is Porter’s value chain theory (1990) [

9]. He believed that enterprises constitute the value of enterprises through a series of activities, which can be divided into basic activities and auxiliary activities. In addition, authoritative rating agencies rate major international commercial banks with influence each year. Lausanne International Management Development Institute (IMD) and the World Economic Forum (WEF) conduct an assessment of the competitiveness of countries around the world, which involves the international competitiveness of all commercial banks throughout the evaluated country. However, it fails to reflect the competitiveness of individual commercial banks.

The Banker (2018) [

10] magazine regularly publishes the rankings of the top 1000 banks in the world every year. The ranking is mainly based on the bank’s Tier 1 capital, total assets and asset growth rate, profitability, return on assets, and return on capital. Some scholars have used various models to evaluate the competitiveness of banks in various countries. For example, Shin and Kim (2013) [

11] used the Panzar and Rosse models and the data from 1992 to 2007 to analyze the competitiveness.

On the one hand, domestic research on the competitiveness of commercial banks is based on the construction of evaluation models and empirical research. Huang and Liu (2007) [

12] used the factor analysis method and the analytic hierarchy process to obtain the bank competitiveness system. Qing (2009) [

13] designed five first-level evaluation indicators: Uniqueness, strategic value, system integration, extensibility, and dynamics. Yue (2010) [

14] used the structural equation model to analyze the liquidity, safety, profitability, and growth ability of commercial banks and believed that supplemental capital could improve the competitiveness of commercial banks. Yang et al. (2012) [

15] used the factor analysis method to obtain the measurement model of the core competitiveness of listed banks in China. Liu and Zhang (2018) [

16] selected 16 A-share listed commercial banks of China and the data of 2017 is analyzed by factor analysis. The comprehensive ranking of each bank is calculated through the indexes, so the advantages of the state-owned commercial banks are analyzed. They also discussed how to improve banks’ own core competitiveness and put forward some suggestions from different dimensions. Deng (2010) [

17] and Fang et al. (2014) [

18] respectively believed that the core competitiveness could be improved through the development of strategic and business aspects.

2.3. About CAMELS Rating System

The domestic research on CAMELS focuses on using the system for credit evaluation or business performance evaluation and comparing the competitiveness of banks. Bao (2018) [

19] used CAMELS to analyze the credit situation of the Agricultural Bank of China in 2016 and made targeted recommendations. Tao (2017) [

20] used it to quantitatively analyze the operating performance of the Bank of Beijing from 2012 to 2016, gave reasons, and made relevant recommendations. On the basis of the CAMELS framework, Zhou (2016) [

21] used eight joint-stock commercial banks as samples to evaluate business performance, analyzed the reasons, and proposed targeted measures. Li and Song (2014) [

22] used this system to compare the operating performance of state-owned commercial banks and joint-stock banks. Li and Ma (2013) [

23] innovated CAMELS, added new indicators, obtained management levels by quantitative methods, calculated total scores by factor analysis, and then compared the scores of China and the United States, thereby gaining inspiration. Xie (2013) [

24] used CAMELS as the basis for calculating the competitiveness score of banks and compared the score rankings of 13 banks. Banks can enhance their competitiveness by enhancing management level and profitability and Xie (2013) [

24] made recommendations on the basis of this finding.

There are three main aspects in the study abroad of camel rating system. First, predict bankruptcy for the company. Barr et al. [

25] used the CAMELS system to identify the bankrupt company in 1994. Christopoulos et al. (2011) [

26] used the CAMELS rating system as a basis to explain the signs of Lehman Brothers before bankruptcy and proved that the incident should have been foreseen. CAMELS is also used by banks to evaluate bank performance. Vousinas (2018) [

27] used the CAMELS rating model to evaluate the performance of Greek systemic banks in the sovereign debt crisis. Bastan et al. (2016) [

28] used to evaluate the robustness of the Iranian banking system. Hasan et al. (2011) [

29] applied the CAMELS framework to the Turkish banking industry and discussed the performance trends of the pre-crisis and post-crisis situations. Later, the researchers tried to combine other methods based on the CAMELS evaluation system. Dincer et al. (2015) [

30] used the annual data from 2004 to 2014 to analyze 20 deposit banks in Turkey and built a CAMELS rating system with 21 different indicators. Based on this, multiple nominal Logistic regression analysis was established. It found that asset quality, management quality, and market risk sensitivity had an impact on credit ratings, while the ratios related to capital adequacy ratio and returns were not significantly related. Shaddady and Moore (2018) [

31] applied the camel scoring system to quantile regression and found that stricter capital regulation is positively correlated with bank stability, while stricter restrictions, deposit insurance, and over-regulation seem to have a negative impact on bank stability.

With regard to the selection of indicators of the CAMELS rating system, capital adequacy is used to measure the bank’s final liquidity, in order to ensure that commercial banks can withstand the risk of bad debt losses, and is an important criterion for measuring the bank’s operational stability. Fang (2011) [

32] selected the indicator of capital adequacy ratio, while Lu (2009) [

33] selected four indicators: Core capital adequacy ratio, shareholder equity ratio, equity-to-loan ratio, and weighted risk assets to total assets. The quality of assets determines the stability and security of commercial banks. Hasan (2011) [

29] selected financial assets (Net)/Total Assets, Total Loans and Receivables/Total Assets, and Permanent Assets/Total Assets to measure asset quality. Chen (2014) [

34] chose non-performing loan ratio and provision coverage ratio. Dash and Das (2009) [

35] chose return on net assets, operating profit and average working fund ratio, after-tax profit, and total assets ratio to measure profitability. Chen (2014) [

34] selected weighted average return on assets and net profit growth. In addition, sensitivity to market risk can be divided into sensitivity to interest rate risk and sensitivity to exchange rate risk. Two methods are used to measure the level of management quality. One is to use the BSS model (An envelopment-analysis approach to measuring the managerial efficiency of banks) proposed by Barr et al. [

36] in 1993 and the other is to select some indexes which can reflect the quality of management, for instance, Christopoulos et al. [

26] used management expenses/sales to measure the quality of management and Chen (2014) [

34] selected the cost-to-income ratio and brand value. Because the selection of indicators varies from country to country, the literature on the selection of indicators is mainly used in China based on the assurance that the meaning of CAMELS can be correctly reflected.

2.4. About the Influence Path of Green Credit on the Bank’s Competitiveness

Few researchers study the effect of green credit on the bank’s competitiveness. Most research is about the related concepts of green credit and competitiveness, such as the relationship between social responsibility and operation performance or the relationship between the green credit and the development of the bank.

Regarding studies about the relationship between the green credit and the development of the bank, Seifert et al. (2004) [

37] and Brammer et al. (2005) [

38] held that there is no correlation between the social responsibility of banks and their operating performance by means of empirical tests. Liu (2009) [

39] showed that the fulfillment of social responsibility is significantly related to their core competitiveness under the 95% confidence level. Lei (2013) [

40] concludes that the behavior of our commercial banks in the performance of social responsibility has a positive impact on its core competitiveness and this effect is significant both in the short term and in the long term. Zhou (2014) [

41] set up an empirical model through the theoretical analysis results and selected the relevant data of China’s commercial bank in 2008–2012 as a sample. The result showed that there is a significant negative correlation between the green credit and the profit. Chen (2014) [

42] focused on the sustainable development of commercial banks and linked them with the implementation of environmental responsibility. It was shown that there was a significant positive correlation between the implementation of the green credit and the sustainable development of the future. Some scholars have also analyzed the effect of the performance of social responsibility on the competitiveness of the bank. He et al. (2019) [

43] examined the nonlinear relationship between renewable energy investment and green economy development from the perspective of green credit. Gazzola et al. (2019) [

44] showed that combining policy and intelligence into the blueprint for environmental protection was more conducive to achieving sustainable development concepts, thereby promoting sustainable development decisions.

With the deepening of the research, a few scholars have studied the effect of green credit on the bank’s competitiveness. He et al. (2018) [

45] used the systematic GMM (A statistic method referring to generalized method of moments.) regression method to demonstrate that green credit policies can enhance the competitiveness of banks. Some scholars have proposed the path of green credit to the competitiveness of banks. Wang (2016) [

46] believed that the performance of green credit through environmental risk management and social responsibility had an impact on the bank’s management ability and the reputation of the bank, which in turn had an impact on the core competitiveness of the bank. On the basis of Wang, Chai (2017) [

47] also proposed that green credit will influence its domestic competitiveness through the influence of the international competitiveness of commercial banks. Gao (2018) [

48] mentioned three influencing mechanisms, one more path than Wang, and the theory of financial sustainable development first proposed by Bai (2003) [

49].

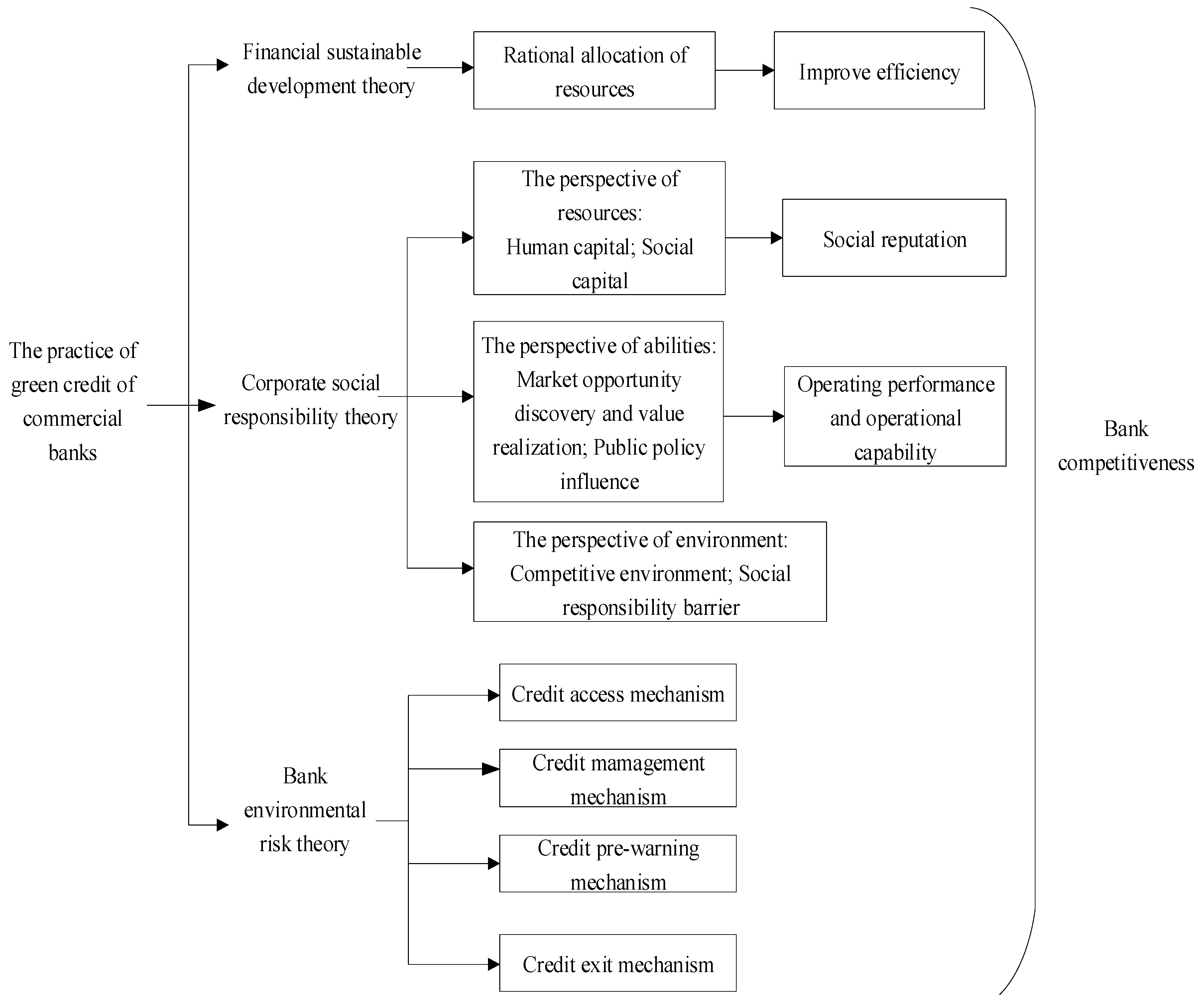

In this paper, the three effects mentioned by Gao (2018) [

48] and Wang (2016) [

46], namely, the theory of financial sustainable development, the theory of corporate social responsibility and the theory of bank environmental risk. The theory of sustainable development of finance is to regard finance as a kind of special resource or strategic resource of a country. Therefore, the irrationality of the economic structure can be solved through rational allocation of financial resources, thereby improving economic efficiency. Green credit policies can increase efficiency and reduce vulnerability to achieve sustainable financial and economic development. The theory of corporate social responsibility has also affected the competitiveness of banks through three channels. (1) Green credit can bring reputational effects to commercial banks and help them establish a positive social image. (2) The implementation of green credit can have a positive impact on the business capacity and performance and the boosting effect on the long-term development is more effective. There are many theories about the implementation of corporate social responsibility, management ability, and the performance of the enterprise. The relevant research finds that there is a certain positive correlation among them. For example, Peng (2018) [

50], Huang (2018) [

51], Zeng (2016) [

52], and Cilliers et al. (2012) [

53] have demonstrated a significant positive correlation between the green credit scale and the performance of the bank. The implementation of green credit can help banks to find their market opportunity and improve value realization ability. The implementation of green credit can help commercial banks to take the lead in entering the market. Fund rationing is tilted towards green industry, environmental protection industry, and new energy industry so that the responsibility opportunities can be converted into market opportunities. It will help the enterprises to improve their core competitiveness. (3) The implementation of green credit can set up a social responsibility barrier, which helps bring positive externalities to the bank and win a high level of confidence. These banks will create a more durable, more sustainable competitive advantage and promote competitiveness. The last path is the bank’s environmental risk path. The environmental risk management is a series of measures taken by the bankers to avoid the losses caused by environmental risks such as credit and reputation. The green credit policy is to encourage commercial banks to invest in environmentally friendly enterprises and projects. The government’s green credit policy is the source and power of the commercial bank to carry out the environmental risk management. There is no strict green credit policy. The commercial bank cannot gain higher income than its cost without strict green credit policy. Therefore, the commercial banks will also actively introduce and adopt the technology of environmental risk management to improve the competitiveness under the strict green credit policy. The impact mechanism of commercial banks’ green credit on competitiveness is shown in

Figure 1.

Therefore, most of the literature only stays in the study of social responsibility and sustainable development and cannot give specific advice to the government and banks. However, a few researchers conducted the research between green credit and bank competitiveness and further research can be carried out. This article is based on the ranking of bank competitiveness and gives specific policy recommendations, which is of great reference value to the government and the bank.

3. Research Methods

The CAMELS system is primarily used for financial institution ratings. Institutions with low ratings indicate that they are in poor business or have serious potential crises. These institutions are less sustainable and less competitive. Institutions with better ratings indicate that they have sustainable development capabilities and are more competitive. Just because of the positive relationship between the level of rating and the competitiveness of banks, it is feasible to use the rating system to evaluate the competitiveness of banks. Among many rating systems, CAMELS is generally accepted by countries all over the world because of its high emphasis on safety and risk, comprehensive perspective, availability of indicator data, and the high priority of the Federal Bank. Therefore, this paper uses this framework to determine the competitiveness of banks.

In the original CAMELS system, green credit was not specifically mentioned as part of bank credit. With the national attention to environmental protection, green credit, as an indicator of green development, is independent from the original bank credit, which constitutes a new system. This actually magnifies the impact of the environment on economic development and reflects the country’s policy orientation.

This article refers to the predecessor’s construction of CAMELS and initially establishes the index system. The factor analysis method was used to determine the indicators included in the index system. On the basis of the study of the internal correlation of variables, factor analysis is a multivariate statistical analysis of research. The method of dimensionality reduction is used to synthesize the factors with higher correlation to reduce more variables to several factors. It uses the properties of high correlation of similar variables and low correlation of different classes of variables to classify variables, so each class of variables is a common factor. Through the analysis of common factors, the purpose of research on complex subjects is achieved.

The scientific nature of the comprehensive ranking of the competitiveness of commercial banks depends largely on the reasonableness of the empowerment of each index. As an objective weighting method, the entropy weight method has a theoretical basis. Compared with the subjective weighting method, it has a relatively high degree of credibility and precision. It can also profoundly reflect different abilities of indicators and the calculation is very simple. Thus, the entropy weight method and the equal difference series weighting method are adopted as indicators and time weights, in which the entropy method divides the indexes into positive, negative, and moderate indexes. In addition, the proportion of the value of the j item of the first year to the total sample value of the index is calculated after standardizing the data, respectively.

Calculate the information entropy of the indicator:

Calculate the redundancy of information entropy:

Calculate the indicator weights:

where

m is the year when the indicator is evaluated,

n is the number of indicators, and

k = 1/

lnm. A dynamic evaluation model is constructed after determining the weights of the indicators. Suppose the comprehensive scores of the research objects in each year form a matrix A, which is as follows:

where

aij represents the comprehensive score of the

ith study object in the

jth year. Dynamic analysis and evaluation must consider the growth of indicators, hence, matrix B is used to indicate the changes in the scores of the research subjects.

By weighting matrices A and B, dynamic evaluation matrix C can be obtained as follows:

where the value of

α and

β may be determined by the problem of the research. Thereafter, the ideal time series matrix

Ci+ and the negative ideal time series matrix

Ci− can be constructed respectively for matrix C:

According to the ideal point algorithm, distance is measured by the European norm. The distance from the dynamic comprehensive score of the research object at a specific time point to the ideal point

Ci+ and the negative ideal point

Ci− can be expressed respectively as

di+ and

di−:

where

j = 1, 2, 3, ……,

b and

wi denotes the weight given to the time.

Therefore, the relative distance between the evaluation object and the ideal point can be expressed by the following formula:

Because 0 ≤ d ≤ 1, the larger the value is, the closer the distance is between the evaluation object and the ideal point, making the dynamic evaluation score higher. Finally, according to the dynamic evaluation model scores to rank, and on the basis of ranking, cluster analysis is carried out. Moreover, to learn from one another to improve their operations, commercial banks with similar competitiveness are taken as one category to compare the advantages and disadvantages.

4. Index System Construction and Data Preprocessing

4.1. Index System Construction

Since the reform and opening-up, China’s economy is developing at an astonishing speed, accompanied by the continuous deterioration of the environment. In order to improve the environmental problems, the Chinese government has also made great efforts. In 2007, the green credit policy was officially launched. In 2015, the “Belt and Road” policy put special emphasis on severe environmental governance issues. The concept of “green development” was proposed in the 13th five-year Plan in 2016, and the G20 Summit that held in Hangzhou in September 2016 included “green finance” for the first time. From the current situation, it is very necessary to introduce “green index” into the CAMELS system.

Consequently, this paper builds the G-CAMELS system based on the related literature shown in

Table 1. In terms of green indicators, in order to reflect the concept of green development, this paper chooses the green credit ratio as an indicator to reflect the bank’s tendency to conduct green business operations. It reflects the bank’s ability to sustain development. Capital adequacy ratio is one of the indicators that can intuitively reflect capital adequacy. The shareholder equity ratio reflects how much the company’s assets are invested by the owner. If the value is too small, the company is over-indebted. If too large, the company does not actively use financial leverage to expand the scale. The capital ratio reflects the capital structure. A reasonable capital ratio is to find a balance between the funds raised from the outside and the self-owned funds, which can promote the healthy and rapid development of the company. The ratio of capital to assets shows the proportion of the bank’s own capital to the total assets and the ability to take risks. In terms of asset quality, the reserve for doubtful accounts is the fund to be prepared as a loss of the write-off loan, which shows the expected losses. Interest-bearing assets refers to assets formed by the financial institution to melt or deposit funds. It aims to charge interest, so the higher the interest-bearing asset ratio is, the higher the quality of the asset is. Therefore, the higher the ratio of interest-earning assets is, the higher the asset quality is. The loan-to-deposit ratio can enhance the ability to defend against bad debt risks. The higher the ratio of weighted risk assets is, the greater the risk is and the worse the asset quality is. The loan provision rate mainly embodies the ability to make up for loan losses and the ability to prevent loan risks. Regarding the measurement of management quality level, most of the literature selects the indexes that can reflect the management level. However, most of these indexes are qualitative and subjective. In this paper, the BSS model is combined with the Data Envelopment Analysis method to determine the management efficiency. Among the profitability, the net interest margin is the rate of return on interest-bearing assets. The weighted risky return on assets and the return on net assets are common indicators that reflect the bank’s operating performance. Among the liquidity indicators, the liquidity ratio and the liquidity gap rate are the core indicators of risk supervision, which measures the liquidity status and their volatility of commercial banks. Sensitivity to market risk can be divided into sensitivity to exchange risk and sensitivity to interest rate risk. The former can be observed by the cumulative exchange exposure ratio and the latter is observed by the rate-sensitive ratio disclosed by the banks.

In order to make the system more comprehensive and provide ideas for follow-up research, several points are provided here.

It is worth noting that, in the relevant research on the competitiveness of banks, the scale of bank operations is a variable that needs to be paid attention to. For example, The Banker, the authoritative magazine that ranks the competitiveness of banks around the world every year, takes into account the size of its operations. Only banks with high profitability, good security and no serious liquidity crisis will expand their scale and obtain economies of scale from it. So, for most countries, the scale of the bank’s operation is actually a comprehensive reflection of the profitability, safety, and liquidity of the bank. However, the objects of this paper are China’s listed banks. The size of the banks depends not only on the above three factors, but also on the bank’s governance structure in China. For example, the size of state-owned banks is generally larger than joint-stock banks. Therefore, in order to measure the profitability, security, and liquidity reasonably and avoid duplication of metrics, the system constructed no longer introduces the variable that can represent the size of the banks. It is regarded as the classification basis of the conclusion, so the system can be used to evaluate the competitiveness of banks of all sizes.

The political ties between business and government will also affect the competitiveness of banks. Banks provide loans and conduct business to non-political ties companies in accordance with market principles [

54,

55]. For politically-tied companies, government officials have greater control or influence on bank credit decisions [

56,

57]. These companies can obtain loans through non-marketing political ties rather than their own strength, which has changed the efficiency of the financial resources allocation; the efficiency may increase. When banks pursue short-term benefits, they will offer more loans to companies with a lot of environmental pollution rather than to environmentally friendly companies. Then, good policy guidance may force banks to increase the loans to enterprises that contribute to sustainable development. Therefore, political ties may bring about an increase in the resource allocation efficiency. On the other hand, if banks lack post-supervision of bank loans to political relations companies [

58,

59], those companies will have the incentive to make use of the lack of supervision and regard banks as “cash machines”. In this case, it reduces the efficiency of resource allocation and lowers the competitiveness of banks.

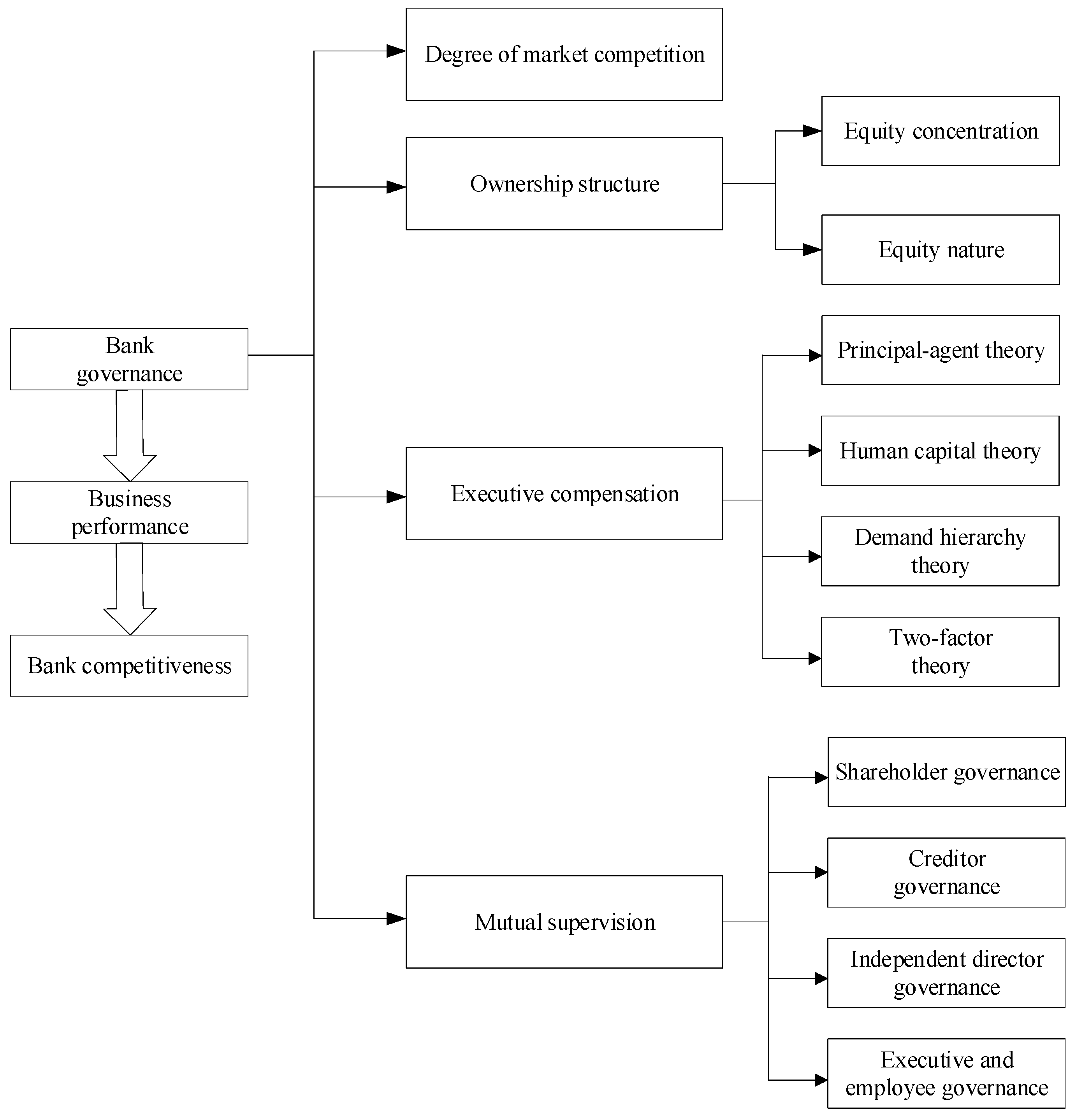

Bank governance can also have an impact on competitiveness by affecting the bank’s business performance. However, the data is incomplete, therefore only a few channels are discussed here, as shown in

Figure 2. Firstly, the market competition mechanism is discussed (Giroud and Mueller (2011) [

60]). China’s state-owned banks are less competitive, while joint-stock banks are more competitive. State-owned banks are backed by the government, with less risk of bankruptcy. This will leave state-owned banks with insufficient incentives to improve corporate governance, inefficient employees, high investment costs and poor profitability. On the contrary, in order to survive and profit in a competitive environment, joint-stock banks must strengthen corporate governance to be more competitive. Second, the shareholding structure is discussed (Du, J. 2016 [

61]). The shareholding structure affects the competitiveness of banks through the nature of equity and the concentration of ownership. From the perspective of the equity nature, when the nature of the largest shareholder is state-owned in the smaller banks, it will have a significant positive impact on business performance. While the larger banks have a positive correlation with business performance, the effect is not good. The reason why the state holds more shares of large commercial banks is to promote economic development, maintain social stability, and facilitate the use of macro-control functions. The state’s shareholding in small and medium-sized commercial banks is to participate in and improve the internal governance of banks. From the perspective of equity concentration, the largest shareholder’s shareholding ratio of state-owned commercial banks is negatively correlated with business performance, while the shareholding ratio of the top five shareholders is positively related to business performance and the joint-stock banks are just the opposite. While pursuing profits, state-owned banks must consider the country’s policy intentions, so these steps will have a certain impact on the improvement of banks’ business performance. If the bank’s equity is concentrated in several shareholders, it is not conducive to the improvement of the bank’s internal management system and thus the operating efficiency will decline. In small and medium-sized banks, the gap between state-owned shares and the major shareholders is small. The distribution of such shares is beneficial to mutual supervision and mutual checks and balances, which contributes to the improvement of banks’ business performance. Thirdly, executive compensation incentives are discussed [

62,

63]. Executive compensation incentives can improve the bank’s business performance in four ways. Firstly, the goal of the principal is to pursue the increase in shareholders’ wealth and maximize the value of the company, while the goal of the agent is to pursue the maximization of self-reward and the realization of its own value. To avoid the inconformity between the two goals, the link between the executive compensation and the enterprise performance will be established, then the performance of the enterprise will be maximized while maximizing the utility of the agents [

64]. Secondly, the acquisition of high human capital stock requires a higher level of investment, and the executives of high quality are in short supply. Therefore, executives with high human capital should receive higher compensation. In addition, the senior management is basically a person with a higher social status and their demands are generally of a higher level. Therefore, the focus of executive compensation incentives should be different based on their needs. Finally, it is known from the two-factor theory that only incentives can bring satisfaction to people and generate incentives. If the company simply increases the basic salary, but ignores the role of incentive compensation and spiritual incentives, it is difficult for executives to create wealth for shareholders. Therefore, the basic salary should be specified at a level that is relatively satisfactory to an executive. More emphasis should be placed on the compensation paid in the form of rewards and the spiritual incentives for executives. Last but not least, mutual supervision is discussed [

65,

66]. This paper expounds it from the perspective of stakeholders. (A) Mutual supervision between major shareholders and minor shareholders in shareholder governance. In the case of excessive equity concentration, if the interests of the major shareholders and minor shareholders are inconsistent, the major shareholders may damage the interests of the minor shareholders for their own interests, thereby reducing the bank’s operating performance. On the contrary, if the ownership structure is extremely dispersed, the interests of bank managers and shareholders cannot be consistent. The minor shareholders have no ability and no incentive to supervise the agents, which means that senior management is inclined to make risky decisions that are not conducive to bank development, thereby reducing the bank’s operating performance. (B) In creditor governance, there are “free riders” in the supervision of banks by small and medium-sized depositors. The creditors lack sufficient motivation to directly participate in bank governance. To compensate for this shortcoming, independent bank directors and government regulatory authorities replace the creditors to exercise the functions of supervising commercial banks. It improves the governance of commercial banks and business performance. (C) The independent director does not have any significant interest relationship with the company and the major shareholders. When the major shareholder or the senior manager has a conflict with the company, the independent director can solve the conflict through coordination. It can help realize the maximum of the bank’s benefits. (D) The senior managers are the ultimate agents. They can directly affect the bank’s business performance. However, for the employees of banks, their participation in corporate governance is to join in the board of supervisors through the election, which indirectly affects the bank’s operating performance.

On the basis of the CAMELS rating system, in order to better evaluate the competitiveness of banks, this paper adds green indicators so that banks can help society to achieve sustainable development; these green indicators are related to the operation of banking business. The green indicators related to banking also include green financial products and green financial instruments, except for the green credit. However, the standards of these indicators have not yet been unified and the data disclosure is less. Therefore, this paper does not introduce these indicators.

4.2. Data Source and Preprocessing

In 1995, the State Environmental Protection Agency issued a document regarding the protection of ecological resources and pollution prevention as one of the factors considered for bank loans. In 2007, the green credit policy was formally put forward. However, at this time, the domestic standards are different from international standards and the standards among the departments are not uniform, so there is a “waste of resources”. Data disclosure related to the sustainable development is very rare. In 2013, the China Banking Regulatory Commission unified the statistics caliber of green credit. In order to ensure consistency of statistical caliber and availability of data, the years selected in this paper are 2013–2017, for a total of 5 years.

Due to the late listing of Chinese banks, the sample selected consists of commercial banks that were listed before 2013, in order to ensure the integrity of the data. The sample includes five state-owned commercial banks, eight joint-stock commercial banks, and three local commercial banks. These three types are the main types of commercial banks in China. State-owned banks refer to Industrial and Commercial Bank of China, China Construction Bank, Agricultural Bank of China, Bank of China, and China Bank of Communications; joint-stock commercial banks refer to China CITIC Bank, China Merchants Bank, Shanghai Pudong Development Bank, China Minsheng Bank, Industrial Bank, China Everbright Bank, Ping An Bank, and Hua Xia Bank; local commercial banks refer to Bank of Beijing, Bank of Nanjing, and Bank of Ningbo. These 16 listed banks have strong indications and representations for the entire banking and financial industry in China. It is worth noting that Industrial Bank is the first and only bank in China to announce the adoption of the Equator Principles in project financing. Therefore, the green credit business in Industrial Bank has developed rapidly and accounted for a relatively large proportion.

The original data used in this article came from the 2013–2017 annual report and social responsibility report of each listed bank and from Wind database (A financial database provided by Wind Information Company). The preprocessing of data refers to the non-dimensionalization of data. In this study, the most commonly used the Z-score standardization method to avoid the influence of different dimensions on the results.

where

x is the raw data,

μ is the sample mean,

σ is the sample standard deviation, and

X′ is the normalized value.

5. Empirical Analysis

5.1. Quantification of Management Quality Levels

The quality level of management was quantified by the BSS model and the data envelope method proposed by Barr et al. [

36] in 1993. This paper changes some of the input variables in the BSS model the availability of data and, adapting to the current situation of commercial banks in China, this study converts the fund investment in the input variable into investment, which corresponds to the sum of investments held to maturity, long-term equity investments, accounts receivable investments, and real estate investments in the balance sheet of commercial banks. The improved BSS model has six input variables, including the number of employees, compensation expenses, fixed assets and depreciation, non-interest expenses, interest expenses, and investment. Three output variables are included, which are deposits, interest-earning assets, and total interest income.

Among them, the number of employees refers to the number of all employees employed by a company; the salary expenses correspond to the employee benefits payable on the balance sheet; fixed assets and depreciation can be understood as the original value of fixed assets; non-interest expenses include salaries and welfare expenditures, asset expenses and other expenses; interest expenses include interest expenses on loans and interest on deposits; investment corresponds to held-to-maturity investments, long-term equity investments, accounts receivable investments, and real estate investments in the balance sheets of commercial banks; deposits refer to the monetary funds deposited in the bank; interest-earning assets refer to assets in the form of loans, investments, etc., which can bring income to the bank; total interest income refers to the fact that the enterprise provides funds for others to use but does not constitute an equity investment, or refers to the income from the use of funds from others.

On the basis of the theoretical BSS model, we obtain the technical efficiency (crste), pure technical efficiency (vrste), and scale efficiency (scale) of 16 banks in 2013–2017, in which the three relationships satisfy crste = vrste × scale. Therefore, this paper regards technical efficiency (crste) as the quantitative index of management quality level.

5.2. Factor Analysis

For capital adequacy, this paper selects the four factors of shareholder equity ratio, capital ratio, capital-to-asset ratio, and capital adequacy ratio to analyze the capital adequacy of commercial banks. The Bartlett spherical test probability is 0.0001 < 0.05, indicating suitability for factor analysis. The KMO (Kaiser-Meyer-Olkin) test value is 0.7575 > 0.7, which indicates that the factor analysis effect is good. According to the principle that the factor characteristic value is greater than 1, the number of factors is determined. The variable with the greatest influence on the main factor, the shareholder equity ratio, and the capital ratio are selected.

Similarly, for asset quality, the adjoint probability of the Bartlett spherical test is 0.0001 < 0.05, whereas the KMO test value is 0.7010 > 0.7. The two variables of the loan-to-deposit ratio and the weighted risk assets/total assets are selected. The profitability part selects the weighted risk asset return rate, the weighted average return on equity, and the basic earnings per share. The indexes measuring liquidity leaves the liquidity gap rate, the ratio of the 90-day current liabilities to the total liabilities. The indexes measuring sensitivity to market risk select both the cumulative foreign exchange exposure and the interest rate sensitivity ratio.

This method finally determines the G-CAMELS evaluation system, as shown in

Table 2.

5.3. Calculating the Comprehensive Scores

In this paper, we used entropy weight method to determine the weight of each indicator, as shown in

Table 2. From the weight distribution results, we can see that the impact of green credit is very large, second only to profitability. The large weight of green credit shows the necessity of independence of green credit, which makes the index system more reasonable and reflects the concept of green development in China. The results of normalization of the indicators of 16 banks in 2013–2017 were used as the scores of each indicator. The final score was calculated using the formula below as listed in

Table 3.

5.4. Dynamic Evaluation Model

The equivalence was used to weight the time dimension, the trend of indicators was considered, then a dynamic evaluation model was established to obtain the average competitiveness of the sample banks in 2013–2017.

5.4.1. Time Weighting

We used

t1 for 2013,

t2 for 2014, and so on. We weighted the time with the principle of arithmetic progression and calculated the time weights,

ti, for each year according to the following formula (

i = 1, 2, 3, 4, 5):

5.4.2. Dynamic Evaluation Score Calculation

First, the matrix provided in

Table 3 was formed by the 16 × 5 matrix A, then matrix A was used to calculate the increase in score. It was assumed that the growth of scores in 2013 of all banks is 0. Hence, the growth figures result in a 16 × 5 matrix B. The two matrices respectively weighed a = b = 0.5, considering the comprehensive score of the sample bank in five years and the trend of their scores. The two matrices were weighted, so that the dynamic evaluation matrix C can be calculated. Thereafter, the ideal time series matrix C

+ = (0.282270346, 0.325527625, 0.316182703, 0.266398506, 0.355689139) and the negative ideal time series matrix C

− = (0.154455628, 0.138563557, 0.127997291, 0.056375563, 0.144482524) were obtained. By weighting the time, we could calculate

ti = (0.1, 0.15, 0.2, 0.25, 0.3) and obtain the dynamic evaluation scores and ranking of the sample banks by means of the ideal point algorithm, as shown in

Table 4.

5.4.3. Dynamic Evaluation Score under the Original CAMELS Evaluation System

According to the steps as above, the time and index were weighted by the arithmetic equation and the entropy weight method and the dynamic evaluation model was established. The results of the dynamic evaluation based on the CAMELS evaluation system are shown in

Table 5.

5.5. Cluster Analysis

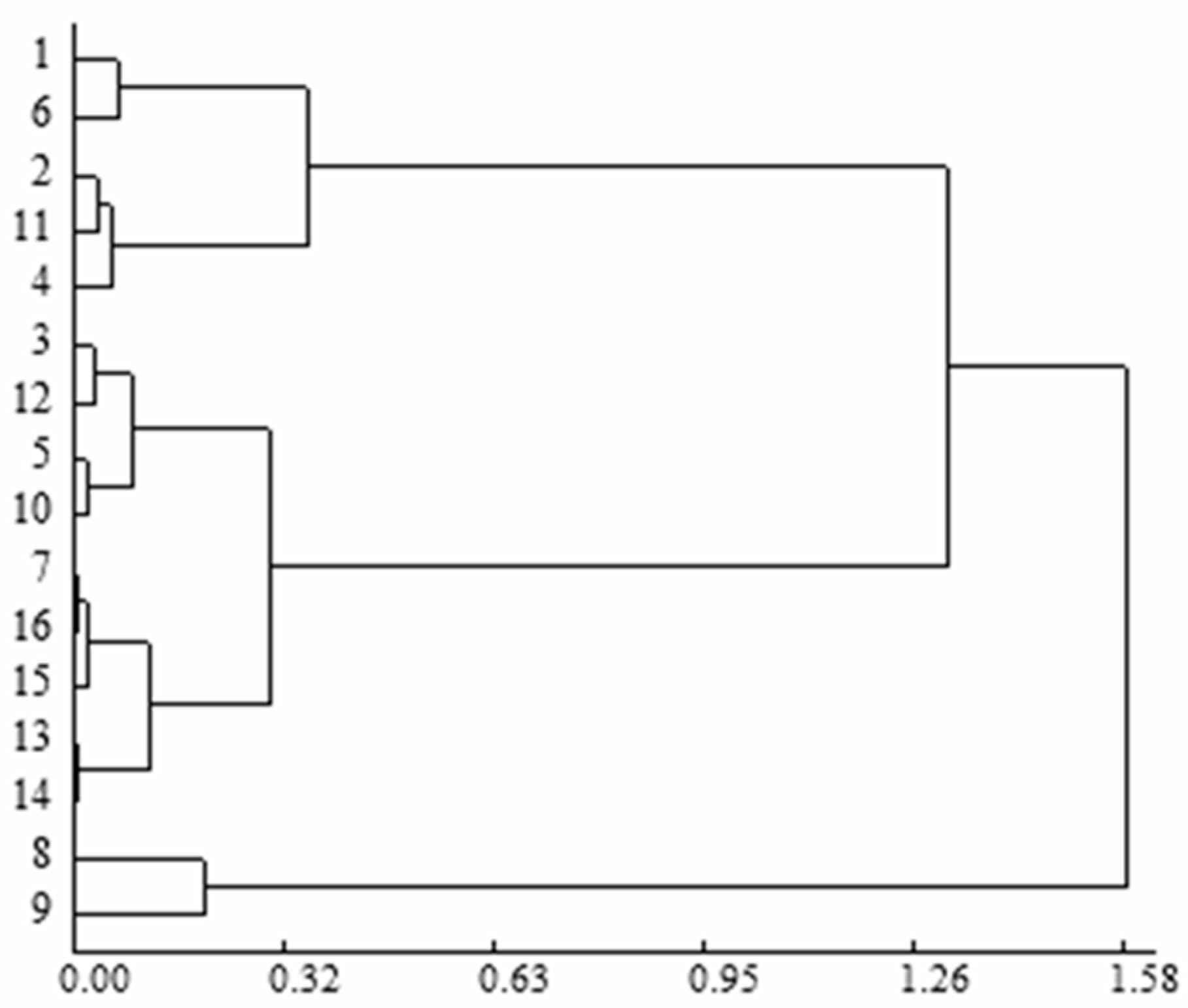

In this paper, the sample banks were classified by cluster analysis. The dynamic evaluation scores of sample banks based on G-CAMELS system was processed and the distance was measured using the Euclidean distance formula. Moreover, the deviation square sum minimization method was used to cluster systematically. The average competitiveness clustering results of the sample banks for 2013–2017 are shown in

Figure 3.

From the system clustering tree, we can divide the sample banks into five categories:

Most competitive: Industrial Bank and China Merchants Bank.

Highly competitive: China Construction Bank, Shanghai Pudong Development Bank, Ningbo Bank, and Agricultural Bank of China.

Medium Competitive: Bank of Nanjing, Bank of Communications, Hua Xia Bank, Bank of Beijing, and Industrial and Commercial Bank of China.

Less competitive: Bank of China, Minsheng Bank, and Ping An Bank.

Least competitive: China Everbright Bank and CITIC Bank.

5.6. Comparative Analysis of Dynamic Evaluation Results between the G-CAMELS and CAMELS Systems

In view of the small dynamic evaluation scores and the different indicators and weights included in the two evaluation systems, the effect of the system change may be masked by testing the score. Therefore, this paper chose to test the competitiveness ranking to intuitively see the effect of the change on the evaluation system of the competitiveness.

First, the Shapiro–Wilk test was used to determine whether the difference between the rankings of state-owned banks obeyed the normal distribution. The test results were that the probability was 0.3254 > 0.05, which means that the original hypothesis that the ranking of state-owned banks is based on normal distribution cannot be rejected under the 5% confidence level. Thereafter, a paired t-test was performed, in which the results confirmed a probability of 0.03411 < 0.05. The result indicates that under the 5% confidence level, the original hypothesis was rejected. It shows that the competitiveness ranking of state-owned banks has changed significantly after the CAMELS system joined the green index. It can be visually found that, except for the fact that the Industrial and Commercial Bank of China remains unchanged, the rankings of other state-owned banks have risen. This growth shows that China’s state-owned banks attach importance to the implementation of green financial policies. Moreover, the effect of implementation is relatively good, gradually realizing the transformation to sustainable-development-oriented state-owned banks and fulfilling social responsibility.

As the difference in the ranking of joint-stock banks does not follow the normal distribution, the paired t-test could not be used. In this paper, the Wilcoxon signed rank test in the paired sample non-parametric test was selected. The test results showed that, under the 5% confidence level, the original assumption cannot be rejected because the probability was 0.1675 > 0.05. No significant difference occurred in the competitiveness ranking of joint-stock banks when comparing the G-CAMELS evaluation system with the CAMELS evaluation system. Given their relatively small asset size, narrow business scope, and poor anti-risk ability, the original business situation is more difficult. In this situation, green financial policy is both an opportunity and a challenge for joint-stock banks. On the one hand, joint-stock banks start with the innate advantages of location and policy and information. With the aid of green financial policies, joint-stock banks find new profit growth points and combine profit with social responsibility organically. On the other hand, the transformation of banks may be accompanied by reduced capital scale, mismatched maturity, and insufficient reserve of professional talents, thus creating a “crowding-out effect” on the original business. Thus, the operating conditions may deteriorate in the short term. However, considering the prospects for sustainable development, the operating conditions of joint-stock banks will still improve in the long run.

6. Result Analysis

On the basis of the above results of dynamic evaluation score, the top five commercial banks ranked in the average competitiveness of commercial banks in 2013–2017 were Industrial Bank, China Merchants Bank, Shanghai Pudong Development Bank, China Construction Bank, and Agricultural Bank of China. The bottom five banks were Bank of China, Ping An Bank, China Minsheng Bank, China Everbright Bank, and CITIC Bank. Industrial Bank scored highest in 2013–2016 and declined slightly in 2017, pulling it one level lower, so the dynamic score was still ranked first. The scores of China Merchants Bank came second only to Industrial Bank each year. In addition to falling to seventh place in 2016, Pudong Development Bank outperformed China Merchants Bank in other years, so their dynamic ranking was also very high. In contrast, CITIC Bank and China Everbright Bank scored lower in each year, so they ranked lower in the dynamic evaluation. Other banks fluctuated in their rankings. The dynamic evaluation results excluded fortuitousness and combined the development trend to give their stable average competitiveness ranking. From the above results, the dynamic analysis method used in this paper reflects the true competitiveness of commercial banks than the static analysis method that compares the scores of a certain year. To some extent, the influence of one-sidedness and contingency on the result is alleviated.

Among the state-owned banks, the best performer was China Construction Bank, followed by the Agricultural Bank of China. The capital adequacy of state-owned banks was excellent, but the overall competitiveness was not as good as some non-state banks. For instance, the profitability of Industrial Bank was higher than that of China Construction Bank. The high growth of non-interest income was the key driver of the improved profitability of Industrial Bank. In addition, the proportion of green credit of China Construction Bank was also not as good as Industrial Bank. Therefore, the two types of indicators with the heaviest weights have lowered the competitiveness of state-owned banks. Among the state-owned banks, the profitability of China Construction Bank and Industrial and Commercial Bank of China was comparable. However, the profitability of China Construction Bank was more stable and had a gradual growth trend, whereas Construction Bank’s implementation of the green credit policy was even greater, thus making China Construction Bank stand out. On the contrary, the Bank of China had poor performance in all indicators, thus ranking behind.

Among the joint-stock commercial banks, Industrial Bank, China Merchants Bank, and Shanghai Pudong Development Bank were the three best performing banks. Industrial Bank, as the leader of green finance, fully enjoyed the economic benefits brought by green finance. China Merchants Bank’s profit score ranked in the top two in 2013–2017, but its scores on asset quality and green indicators were lower than those of Industrial Bank. Thus, the overall ranking was lower than Industrial Bank. Pudong Development Bank’s scores ranked second or third. Contrary to the ranking, CITIC Bank and China Everbright Bank performed relatively poorly in various indicators in each year, so they ranked lower.

Among the local commercial banks, Ningbo Bank had better profitability, whereas Beijing Bank had poor asset quality. Nanjing Bank had better implemented green credit policy so its green credit ratio was higher. However, in terms of comprehensive competitiveness, Ningbo Bank was outstanding compared to the rest.

7. Conclusions and Prospect

By the entropy weight method, the results showed that profitability accounted for 34.79%, green index 18.34%, liquidity 16.82%, capital adequacy 14.22%, and asset quality 10.87%. The sensitivity to market risk was 3.6% and the level of management quality was 1.37%. We can see that the profitability accounted for the largest proportion, which is in line with reality. People often use financial statements to understand the business status of banks and the financial statements can directly reflect the profitability of banks. The better the banks operate performance, the stronger the bank competitiveness is. The green index is second only to profitability in the empowerment, which shows the policy orientation, the enhancement of the implementation of green financial policy, and the realization of sustainable development. The weight of this paper is in line with China’s national conditions. The sample selection covers all types of domestic listed banks, so it can be used for the comparison of domestic banks’ competitiveness. However, for other countries, the weight of each indicator may be different due to the change of environment. Specific analysis should be made on a case-by-case basis. The public can choose banks to save or invest in according to the ranking of bank competitiveness. The public may be more inclined to choose the top banks because they perform well in terms of security, profitability, liquidity, and sustainability. For banks, the public choice has an incentive effect. Therefore, it promotes the sustainable development of the entire banking industry. There are many local banks in China and local banks are rushing into other areas in order to expand their size. So, local governments can selectively accept or reject banks to establish branches to expand their scale, according to their rankings. This ranking also provides a realistic basis for regulators to formulate financial policies.

So, how do commercial banks improve their competitiveness? Under the premise of ensuring safety, state-owned banks should innovate their profit models and find new profit growth points. Compared with the intermediate business of some joint-stock banks, state-owned banks have poor product innovation, fewer types of products, and worse profitability. Therefore, the state-owned commercial banks should substantially increase the proportion of intermediary business income to total revenue, improve the intermediate business organization system and mechanism, strengthen the management of the intermediary business, make full use of all resources and advantages to strengthen technological innovation and process integration, and promote the research and development of new products and the upgrading of old products. They should also strengthen marketing and perfect marketing mode, make full use of the advantages of state-owned banks in capital, institutions, networks, information, technology, and brands, implement an integrated marketing strategy, implement a marketing model of customer managers, product managers, and counter-marketing, and promote the development of various intermediary business linkages. The positive interaction between the intermediary business and the asset-liability business should be considered the integrated business objectives of the intermediary business should be achieved. At the same time as implementing salary incentives, we must further organize business competitions, formulate a reasonable reward and punishment mechanism, and mobilize employees’ work enthusiasm and commercial banks should maintain moderate asset expansion speed. Banks need to appropriately control the scale of assets, improve the efficiency of capital operation, and avoid value-damaging acquisitions to blindly expand the scale. In order to strengthen the internal governance and control of the bank, the proportion of shares held by the state should be appropriately reduced. It is beneficial to professional managers to play a management role in the daily activities and improve the business performance. Internal governance structures should be optimized, power structures should be changed, and creditors and employees should be incorporated. Banks should distribute the voting rights among shareholders, creditors, and employees to weaken the principal-agent relationship among other stakeholders and shareholders, and protect all stakeholders’ interests. For example, the power of commercial banks can be dispersed among various stakeholders and peers to improve service levels and quality and improve customer satisfaction. Establishing a good salary incentive mechanism requires employees and senior executives to be linked to performance. It is also necessary to combine short-term incentives with long-term incentives to minimize the short-sighted behavior of bank decisions. Bank members are vulnerable to salary incentives and simply pursue high bank returns. Therefore, banks should link compensation to risks and performance. The banks can try to delay payment of executive compensation according to risk exposure time and risk type. It not only makes the compensation system reflect the current profits and risks, but also reflects the potential losses and risks in the future. It is important to optimize the salary performance assessment method and listen widely to different opinions on salary arrangements and improve the transparency of the salary arrangement. In addition, the G-CAMELS system, which has joined the green indicator, has improved the competitiveness of state-owned banks as a whole. The reason for the improvement of the competitiveness of state-owned banks is that they can meet the policy requirements of bank transformation, shorten the transition period, adjust the business structure in time, control potential risk, and enrich the original business, with the whole target of banks by virtue of their good reputation, strong capital strength, and ability to resist risks. Therefore, state-owned banks should continue to implement the green credit policy respond to the call of national policies, accelerate economic transformation, and promote sustainable development.

Joint-stock commercial banks should continue to expand their advantages in asset quality and profitability, as well as improve the supervision of capital adequacy and market risk. Capital adequacy is determined by the proportion of the bank’s own capital and risk assets. Clearing up non-performing loans can reduce the ratio of non-performing assets and improve the quality of assets. Reducing the total amount of risky assets can moderately reduce the proportion of credit assets and constantly improve the proportion of investment and financing assets. It aims to increase their own capital and reduce risk assets to increase the capital adequacy of banks. Banks can also improve capital adequacy by restructuring risky assets. The equity of small and medium-sized commercial banks should be properly concentrated. Since the equity structure of smaller banks is relatively dispersed, equity concentration ensures that the largest shareholder has a controlling stake and that the legal rights and interests of other shareholders in the bank are protected. To strengthen the supervisory function of the board of supervisors, we must first increase the entry threshold of the members of supervisors; secondly, we must strengthen supervision over the board of supervisors and achieve effective combination of pre-supervision, in-process supervision, and post-supervision supervision. We must promote the reform of the banks’ property rights systems and form a diversified property rights structure. The introduction of foreign capital and private capital cannot only expand the banks’ capital, but also achieve the effect of optimizing the shareholding structure and corporate governance structure. On the other hand, with the globalization process and the increasing degree of marketization in China, the risks faced by banks are also increasing. Joint-stock banks should strengthen risk management and the training of professionals involved in risk control to ensure the stability of China’s financial system. They should also actively cooperate with the financial supervision department and prepare for risk prevention.

Given the late start-up, small asset scale, and strong regional dependence, the city commercial banks have been facing a severe test. For most city commercial banks, the green financial policy undoubtedly increases their operational pressure. Therefore, to ensure their good operation under the premise of gradual transformation, the state can moderately reduce the implementation standards for green financial policies of city commercial banks. Additionally, urban commercial banks should be encouraged to develop innovative businesses and to practice social responsibility while making profits. Related measures can be found in the recommendations given to state-owned banks and joint-stock banks.

In this paper, we need to further explore and study the following aspects. First, this paper uses the framework of the CAMELS rating system to comprehensively evaluate the competitiveness of banks, but the camel rating system has certain limitations. The main limitations are as follows: False accounting by financial institutions leads to errors in assessment, management personnel quality assessment is subjective and complex, CAMELS cannot calculate expected risks, and some indicators can only be used for post-mortem analysis and cannot be predicted. Second, combined with China’s national conditions, this article selects indicators based on literature. However, the variables may not fully reflect the bank’s information. For example, in most of the literature, capital indicators include capital adequacy ratios or core Tier 1 capital adequacy ratio indicators. However, capital has an indicator of capital adequacy ratio in the initial established indicator system and it is deleted after factor analysis. The cause needs further discussion. Third, although the linear ordering method used in this paper is easy to operate, it does not have stability. Further discussion can try to use other sorting methods to correct the results. This article is limited to length and this is not covered. Fourth, the paper uses the objective weighting method. Further research can try to use the expert scoring method to weight and observe how the score results change. Fifth, in the BSS model, it will be better to select more samples, but in view of the late listing time of Chinese banks and the small number of listed banks, this paper only selected 16 banks. In addition, the BSS model has its own limitations. For example, whether the selection of variables is comprehensive will also affect the efficiency of bank management. Therefore, how to more accurately quantify the quality of management needs further research.