The Romanian Family Businesses Philosophy for Performance and Sustainability

Abstract

1. Introduction

2. Literature Review

3. Materials and Methods

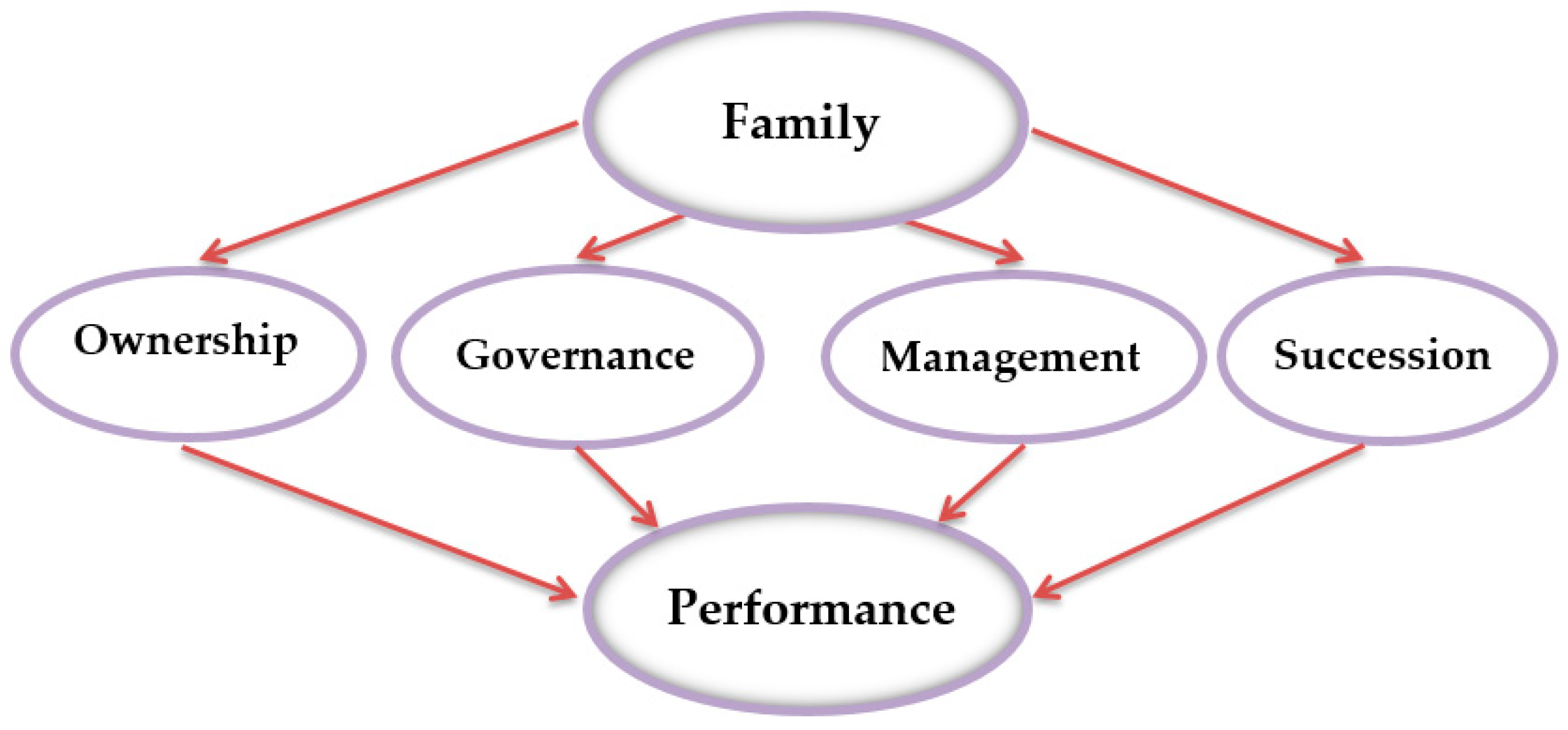

3.1. The Model

3.2. Sample

4. Results and Discussion

4.1. Characteristics of the Romanian Family Businesses

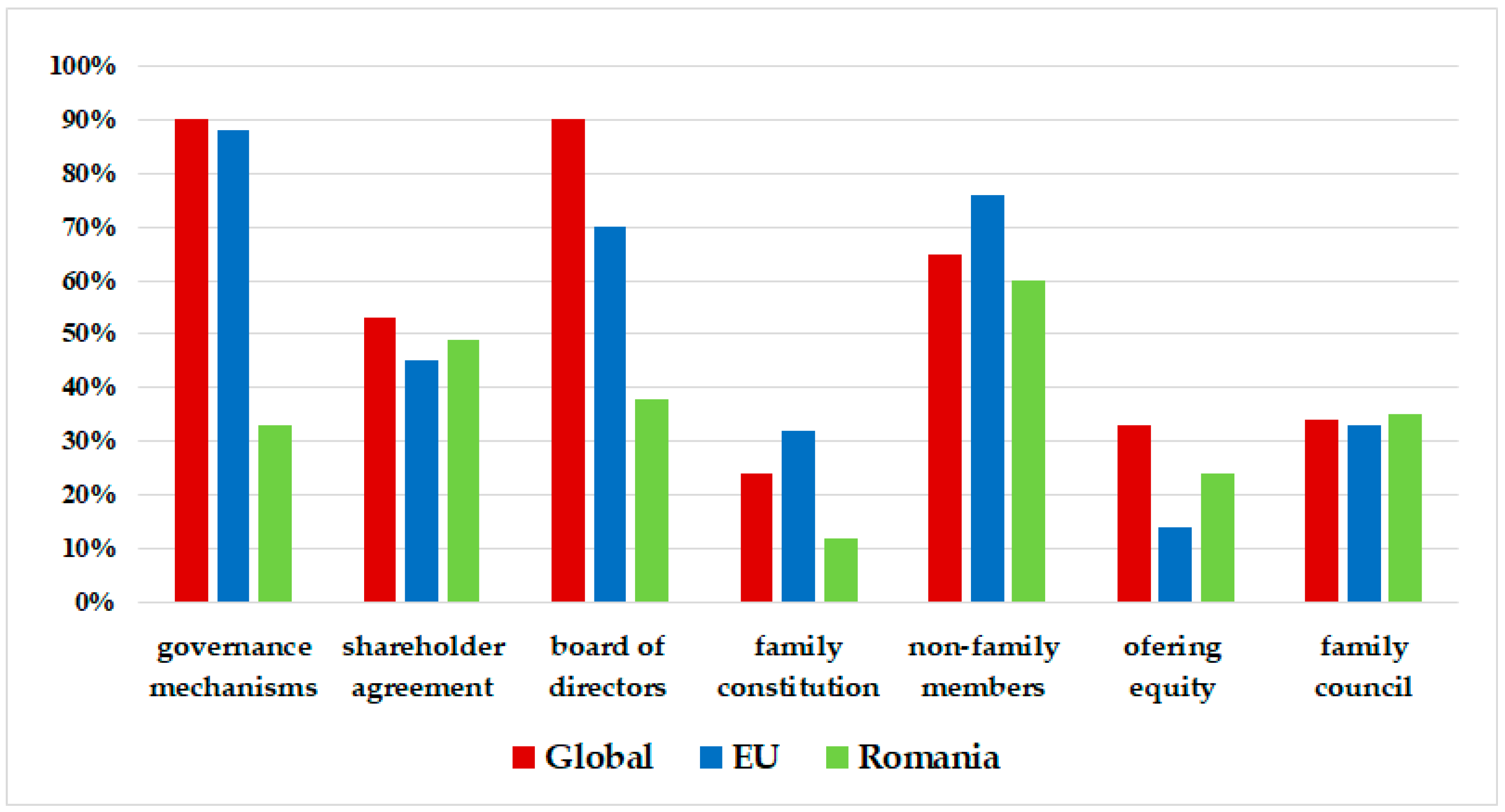

4.1.1. Governance in Family Business

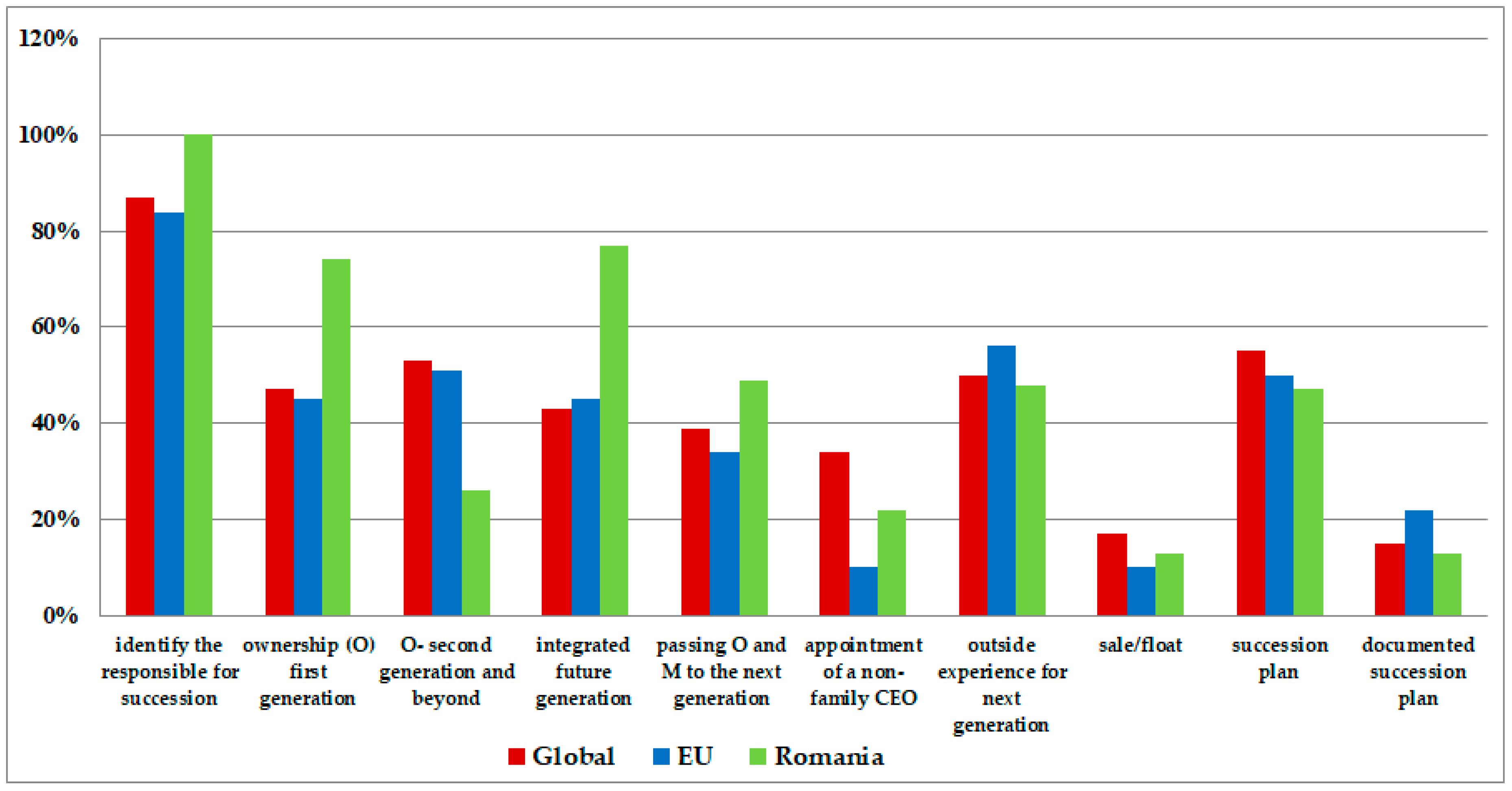

4.1.2. Succession Planning

4.2. Result of Regression Analysis

4.3. Discussion

5. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- European Family Business. Available online: www.europeanfamilybusinesses.eu/family-businesses/facts-figures (accessed on 1 February 2019).

- Koestenbaum, P. The Philosophic Consultant. Revolutionizing Organizations with Ideas; Jossey-Bass/Pfeiffer: San Francisco, CA, USA, 2003. [Google Scholar]

- Hategan, V.P. Consilierea Filosofică: De la Practică la Profesie; Ars Docendi: Bucharest, Romania, 2018; ISBN 978-606-998-025-5. [Google Scholar]

- Iglesias, M.V. Does a Family-First Philosophy Affect Family Business Profitability? An Analysis of Family Businesses in the Midwest. Open Access Theses. 2015. Available online: https://docs.lib.purdue.edu/cgi/viewcontent.cgi?article=1517&context=open_access_theses (accessed on 23 January 2019).

- European Foundation for the Improvement of Living and Working Conditions. Family Businesses: Do They Perform Better? Literature Review by London Economics. 2011. Available online: https://londoneconomics.co.uk/wp-content/uploads/2011/09/101-Comparing-the-economic-performance-of-family-businesses-and-non-family-businesses.pdf (accessed on 23 January 2019).

- Neubauer, F.; Lank, A. The Family Business: Its Governance for Sustainability; Routledge: New York, NY, USA, 1998; Chapter 6; pp. 133–166. [Google Scholar]

- Harveston, P.D.; Davis, P.S.; Lyden, J.A. Succession planning in family business: The impact of owner gender. Fam. Bus. Rev. 1997, 10, 373–396. [Google Scholar] [CrossRef]

- Collins, J.D.; Worthington, W.J.; Schoen, J.E. Family business CEO succession: Examining personal retirement expectations. J. Small Bus. Strategy 2016, 26, 51–70. [Google Scholar]

- Miller, D.; Le Breton-Miller, I.; Scholnick, B. Stewardship vs. stagnation: An empirical comparison of small family and non-family businesses. J. Manag. Stud. 2008, 45, 51–78. [Google Scholar] [CrossRef]

- Hall, A.; Nordqvist, M. Professional management in family businesses: Toward an extended understanding. Fam. Bus. Rev. 2008, 21, 51–69. [Google Scholar] [CrossRef]

- Stewart, A.; Hitt, M.A. Why can’t a family business be more like a nonfamily business? Fam. Bus. Rev. 2012, 25, 58–86. [Google Scholar] [CrossRef]

- Rahman, H.; Galván, R.S.; Martínez, A.B. Impact of family business on economic development: A study of Spain’s family-owned supermarkets. J. Bus. Manag. Sci. 2017, 5, 129–138. [Google Scholar] [CrossRef]

- European Family Business—EFB & Deutsche Bank Report on Family Businesses in Europe. 2018. Available online: http://www.europeanfamilybusinesses.eu/uploads/Modules/Publications/efb-db-report.pdf (accessed on 12 January 2019).

- Family Business Network Romania. Available online: http://www.fbn-romania.ro/asociatia-fbn-romania/asociati-fbn-romania (accessed on 5 February 2019).

- Ceptureanu, E.G. Innovation and Change Management in Romanian SMEs Family Business. In Proceedings of the International Management Conference, Faculty of Management, Academy of Economic Studies, Bucharest, Romania, 25–28 August 2015. [Google Scholar]

- Fotea, I.; Fotea, S.; Vaduva, S.; Pop, I. Fostering entrepreneurial learning in family business through a community of practice approach—Case study of Romanian family business. Econ. Marche J. Appl. Econ. 2012, XXXI, 25–38. [Google Scholar]

- Fotea, S.; Pop, N.A.; Fotea, I. Developing an Understanding of Romanian Consumers’ Perception of Family Firms. In Proceedings of the ECMLG2017 13th European Conference on Management, Leadership and Governance: ECMLG 2017, London, UK, 11–12 December 2017. [Google Scholar]

- Schank, M.-J.; Murgea, A.; Enache, C. Family ownership and firm performance: Romania versus Germany. Timis. J. Econ. Bus. 2017, 10, 169–186. [Google Scholar] [CrossRef]

- Chua, J.H.; Chrisman, J.J.; Sharma, P. Defining the family business by behavior. Entrep. Theory Pract. 1999, 23, 19–39. [Google Scholar] [CrossRef]

- Habbershon, T.G.; Williams, M.; Macmillan, I.C. A unified systems perspective of family firm performance. J. Bus. Ventur. 2003, 18, 451–465. [Google Scholar] [CrossRef]

- Nicholson, N. Evolutionary psychology and family business: A new synthesis for theory, research, and practice. Fam. Bus. Rev. 2008, 21, 103–118. [Google Scholar] [CrossRef]

- Mandl, I. Overview of Family Business Relevant Issues—Final Report, Austrian Institute for SME Research. 2008. Available online: https://ec.europa.eu/growth/smes/promoting-entrepreneurship/we-work-for/family-business/index_en.htm (accessed on 15 April 2018).

- Romanian Government. Ordonanta de Urgenta nr. 44/.2008 Privind Desfasurarea Activitatilor economice de Catre Persoanele Fizice Autorizate, Intreprinderile Individuale si Intreprinderile Familiale. Monitorul Oficial nr. 328/2008. Available online: http://www.onrc.ro/documente/legislatie/OUG_Nr_44_2008.pdf (accessed on 5 July 2018).

- Shanker, M.C.; Astrachan, J.H. Myths and realities: Family businesses’ contribution to the US economy—A framework for assessing family business statistics. Fam. Bus. Rev. 1996, 9, 107–123. [Google Scholar] [CrossRef]

- Astrachan, J.H.; Klein, S.B.; Smyrnios, K.X. The F-PEC scale of family influence: A proposal for solving the family business definition problem. Fam. Bus. Rev. 2002, 15, 45–58. [Google Scholar] [CrossRef]

- Plato, A.B. The Republic of Plato; Basic Books: New York, NY, USA, 1991. [Google Scholar]

- Aristotle. Politics; Hackett: Indianapolis, IN, USA, 1998. [Google Scholar]

- Rousseau, J.J.; May, G. The Social Contract: And, the First and Second Discourses; Yale University Press: New Haven, CT, USA, 2002. [Google Scholar]

- Miller, D.; Le Breton-Miller, I. Family governance and firm performance: Agency, stewardship, and capabilities. Fam. Bus. Rev. 2006, 19, 73–87. [Google Scholar] [CrossRef]

- Brenes, E.R.; Madrigal, K.; Requena, B. Corporate governance and family business performance. J. Bus. Res. 2011, 64, 280–285. [Google Scholar] [CrossRef]

- Pindado, J.; Requejo, I. Family business performance from a Governance perspective: A review of empirical research. Int. J. Manag. Rev. 2015, 17, 279–311. [Google Scholar] [CrossRef]

- Eisenhardt, K.M. Making fast strategic decisions in high-velocity environments. Acad. Manag. J. 1989, 32, 543–576. [Google Scholar]

- Jensen, M.; Meckling, W. Theory of the firm: Managerial behavior, agency costs and ownership structure. J. Financ. Econ. 1976, 3, 305–360. [Google Scholar] [CrossRef]

- Demsetz, H. Ownership, Control, and the Firm: The Organization of Economic Activity; Blackwell: New York, NY, USA, 1988; Volume 1. [Google Scholar]

- Ang, J.S.; Cole, R.A.; Lin, J.W. Agency costs and ownership structure. J. Financ. 2000, 55, 81–106. [Google Scholar] [CrossRef]

- Fama, E.F.; Jensen, M.C. Separation of ownership and control. J. Law Econ. 1983, 26, 301–325. [Google Scholar] [CrossRef]

- Chang, H.J.; Lin, S.J.; Hou, J.J. An investigation of family business from the perspective of dynamic capabilities. J. Chin. Manag. Rev. 2014, 17. Available online: http://cmr.ba.ouhk.edu.hk/cmr/webjournal/v17n1/CMR401E13.pdf. (accessed on 5 July 2018).

- Donaldson, L.; Davis, J.H. Stewardship theory or agency theory: CEO governance and shareholder returns. Aust. J. Manag. 1991, 16, 49–64. [Google Scholar] [CrossRef]

- Davis, J.H.; Schoorman, F.D.; Donaldson, L. Toward a stewardship theory of management. Acad. Manag. Rev. 1997, 22, 20–47. [Google Scholar] [CrossRef]

- Fox, M.; Hamilton, R. Ownership and diversification: Agency theory or stewardship theory. J. Manag. Stud. 1994, 31, 69–81. [Google Scholar] [CrossRef]

- Hegel, G.W.F. Hegel: Elements of the Philosophy of Right; Cambridge University Press: Cambridge, UK, 1991. [Google Scholar]

- Gomez-Mejia, L.R.; Takacs-Haynes, K.; Nunez-Nickel, M.; Jacobson, K.J.L.; Moyano-Fuentes, J. Socioemotional wealth and business risks in family controlled firms: Evidence from Spanish olive oil mills. Adm. Sci. Q. 2007, 52, 106–137. [Google Scholar] [CrossRef]

- Berrone, P.; Cruz, C.; Gomez-Meija, L. Socioemotional wealth in family firms: Theoretical dimensions, assessment approaches, and agenda for future research. Fam. Bus. Rev. 2012, 25, 258–279. [Google Scholar] [CrossRef]

- Gottardo, P.; Moisello, A.M. The impact of socioemotional wealth on family firms’ financial performance. Probl. Perspect. Manag. 2015, 13, 67–77. [Google Scholar]

- Gavana, G.; Gottardo, P.; Moisello, A.M. The effect of equity and bond issues on sustainability disclosure. Family vs non-family Italian firms. Soc. Responsib. J. 2017, 13, 126–142. [Google Scholar] [CrossRef]

- Stafford, K.; Duncan, K.; Dane, S.; Winter, M. A research model of sustainable family businesses. Fam. Bus. Rev. 1999, 12, 197–208. [Google Scholar] [CrossRef]

- Núñez-Cacho, P.; Molina-Moreno, V.; Corpas-Iglesias, F.A.; Cortés-García, F.J. Family businesses transitioning to a circular economy model: The case of “Mercadona”. Sustainability 2018, 10, 538. [Google Scholar] [CrossRef]

- Oudah, M.; Jabeen, F.; Dixon, C. Determinants linked to family business sustainability in the UAE: An AHP approach. Sustainability 2018, 10, 246. [Google Scholar] [CrossRef]

- Le Breton-Miller, I.; Miller, D. Why do some family businesses out-compete? Governance, long-term orientations, and sustainable capacity. Entrep. Theory Pract. 2006, 30, 731–746. [Google Scholar] [CrossRef]

- Rutherford, M.W.; Kuratko, D.F.; Holt, D.T. Examining the link between familiness and performance: Can the F-PEC untangle the family business theory jungle? Entrep. Theory Pract. 2008, 32, 1089–1109. [Google Scholar] [CrossRef]

- Mazzi, C. Family business and financial performance: Current state of knowledge and future research challenges. J. Family Bus. Strategy 2011, 2, 166–181. [Google Scholar] [CrossRef]

- Basco, R. Family Business in Emerging Markets. In The Oxford Handbook of Management in Emerging Markets; Oxford University Press: Oxford, UK, 2018; pp. 1–22. [Google Scholar]

- Garcia-Castro, R.; Aguilera, R.V. Family involvement in business and financial performance: A set-theoretic cross-national inquiry. J. Fam. Bus. Strategy 2014, 5, 85–96. [Google Scholar] [CrossRef]

- Block, J. Family management, family ownership, and downsizing: Evidence from S&P 500 firms. Fam. Bus. Rev. 2010, 23, 109–130. [Google Scholar]

- Anderson, R.C.; Reeb, D.M. Founding-family ownership and firm performance: Evidence from the S&P 500. J. Financ. 2003, 58, 130–132. [Google Scholar]

- Carney, M.; Gedajlovic, E. Corporate governance and firm capabilities: A comparison of managerial, alliance, and personal capitalisms. Asia Pac. J. Manag. 2001, 18, 335–354. [Google Scholar] [CrossRef]

- Grosu, C.; Almasan, A. Management Control: Between Global Performance and Social Responsibility. In Proceedings of the 8th International Conference Accounting and Management Information Systems, The Bucharest University of Economic Studies AMIS 2013, Bucharest, Romania, 12–13 June 2013. [Google Scholar]

- Barney, J.B. Firm resources and sustained competitive advantage. J. Manag. 1991, 17, 99–120. [Google Scholar] [CrossRef]

- Chirico, F.; Bau, M. Is the family an ‘asset’ or ‘liability’ for firm performance? The moderating role of environmental dynamism. J. Small Bus. Manag. 2014, 52, 210–225. [Google Scholar] [CrossRef]

- Maury, B. Family ownership and firm performance: Empirical evidence from Western European corporations. J. Corp. Financ. 2006, 12, 321–341. [Google Scholar] [CrossRef]

- Barontini, R.; Caprio, L. The effect of family control on firm value and performance: Evidence from continental Europe. Eur. Financ. Manag. 2006, 12, 689–723. [Google Scholar] [CrossRef]

- Sacristán-Navarro, M.; Gómez-Ansón, S.; Cabeza-García, L. Family ownership and control, the presence of other large shareholders, and firm performance: Further evidence. Fam. Bus. Rev. 2011, 24, 71–93. [Google Scholar] [CrossRef]

- Sciascia, S.; Mazzola, P. Family involvement in ownership and management: Exploring nonlinear effects on performance. Fam. Bus. Rev. 2008, 21, 331–345. [Google Scholar] [CrossRef]

- García-Ramos, R.; García-Olalla, M. Board characteristics and firm performance in public founder-and non-founder-led family businesses. J. Fam. Bus. Strategy 2011, 2, 220–231. [Google Scholar] [CrossRef]

- Miralles-Marcelo, J.L.; del Mar Miralles-Quirós, M.; Lisboa, I. The impact of family control on firm performance: Evidence from Portugal and Spain. J. Fam. Bus. Strategy 2014, 5, 156–168. [Google Scholar] [CrossRef]

- Vieira, E.F.S. The effect on the performance of listed family and non-family firms. Manag. Financ. 2014, 40, 234–253. [Google Scholar]

- Kowalewski, O.; Talavera, O.; Stetsyuk, I. Influence of family involvement in management and ownership on firm performance: Evidence from Poland. Fam. Bus. Rev. 2010, 23, 45–59. [Google Scholar] [CrossRef]

- Preslmayer, C.; Kuttner, M.; Feldbauer-Durstmüller, B. Uncovering the research field of corporate social responsibility in family firms: A citation analysis. J. Fam. Bus. Manag. 2018, 8, 169–195. [Google Scholar] [CrossRef]

- Van Gils, A.; Dibrell, C.; Neubaum, D.O.; Craig, J.B. Social issues in the family enterprise. Fam. Bus. Rev. 2014, 27, 193–205. [Google Scholar] [CrossRef]

- Leotta, A.; Rizza, C.; Ruggeri, D. The role of management accounting in the construction of the new generation leadership in family firms: An Actor-Reality perspective. Proc. Pragmatic Constr. 2016, 6, 34–48. [Google Scholar]

- Bisogno, M.; Vaia, G. The role of management accounting in family business succession. Afr. J. Bus. Manag. 2017, 11, 619–629. [Google Scholar] [CrossRef]

- Prencipe, A.; Bar-Yosef, S.; Dekker, H.C. Accounting research in family firms: Theoretical and empirical challenges. Eur. Account. Rev. 2014, 23, 361–385. [Google Scholar] [CrossRef]

- Ernst & Young. Barometrul Afacerilor de Familie din Romania. 2017. Available online: https://eyromania.ro/wp-content/uploads/2017/07/Barometrul-afacerilor-de-familie_Romania-2017_FINAL_pdf (accessed on 29 March 2018).

- PricewaterhouseCoopers. PwC Global Family Business Survey 2016/2017. Afacerile de Familie din România Strategia Antreprenorială și Planificarea Succesiunii. Available online: https://www.pwc.ro/en/publications/fbs/afacerile-de-familie-din-romania-editia-2017.pdf (accessed on 9 June 2018).

- KPMG. European Family Business Barometer, 6th ed. 2017. Available online: https://home.kpmg.com/xx/en/home/insights/2017/11/european-family-business-barometer-confidence-in-unity-sixth-edition.html (accessed on 29 March 2018).

- Siddik, M.; Kabiraj, S. Family-owned firms between agency conflicts and stewardship: Corporate governance factors driving firm performance. J. Bus. Manag. Res. 2016, 1, 33–47. [Google Scholar] [CrossRef]

- Imbrescu, C.M. Specific aspects regarding the prevention of insolvency based on the financial and economic analysis. Lucrări Științifice Management Agricol 2014, 16, 26–33. [Google Scholar]

- Hategan, C.D.; Sirghi, N.; Ioana, C.R. The Financial Indicators Influencing the Market Value of Romanian Listed Companies at the Regional Level. In Proceedings of the 26th International Scientific Conference on Economic and Social Development—“Building Resilient Society”, Zagreb, Croatia, 8–9 December 2017; pp. 160–171. [Google Scholar]

- Liu, W.; Wei, Q.; Huang, S.-Q.; Tsai, S.-B. Doing good again? A multilevel institutional perspective on corporate environmental responsibility and philanthropic strategy. Int. J. Env. Res. Public Health 2017, 14, 1283. [Google Scholar] [CrossRef]

- Weng, P.S.; Chen, W.Y. Doing good or choosing well? Corporate reputation, CEO reputation, and corporate financial performance. North Am. J. Econ. Financ. 2017, 39, 223–240. [Google Scholar]

- Chrisman, J.J.; Chua, J.H.; Sharma, P. Trends and directions in the development of a strategic management theory of the family firm. Entrep. Theory Pract. 2005, 29, 555–575. [Google Scholar] [CrossRef]

- Allouche, J.; Amann, B.; Jaussaud, J.; Kurashina, T. The impact of family control on the performance and financial characteristics of family versus nonfamily businesses in Japan: A matched-pair investigation. Fam. Bus. Rev. 2008, 21, 315–329. [Google Scholar] [CrossRef]

- Dyer, W.G. Examining the ‘family effect’ on firm performance. Family Bus. Rev. 2006, 1994, 253–273. [Google Scholar] [CrossRef]

- Lemmon, M.L.; Roberts, M.R.; Zender, J.F. Back to the beginning: Persistence and the cross-section of corporate capital structure. J. Financ. 2008, 63, 1575–1608. [Google Scholar] [CrossRef]

- Data Selection Report. Available online: www.listafirme.ro (accessed on 7 December 2018).

- National Trade Register Office Romania. Statistics. Available online: http://www.onrc.ro/index.php/ro/statistici?id=243 (accessed on 5 February 2019).

- European Commission. Overview of Family-Business-Relevant Issues: Research, Networks, Policy Measures and Existing Studies. 2009. Available online: http://ec.europa.eu/growth/smes/promoting-entrepreneurship/we-work-for/family-business/index_en.htm. (accessed on 23 May 2018).

- Romanian Government—Hotararea nr. 859 Privind Aprobarea Strategiei Guvernamentale Pentru Dezvoltarea Sectorului Intreprinderilor Mici si Mijlocii si Imbunatatirea Mediului de Afaceri din Romania—Orizont 2020 (Governmental Strategy for the Development of SME Sector and Improving the Business Environment in Romania. Horison 2020). Available online: https://static.anaf.ro/static/10/Anaf/legislatie/HG_859_2014.pdf (accessed on 23 July 2018).

- Lee, J. The effects of family ownership and management on firm performance. Adv. Manag. J. 2004, 69, 46–53. [Google Scholar]

- Lee, J. Family firm performance: Further evidence. Fam. Bus. Rev. 2006, 19, 103–115. [Google Scholar] [CrossRef]

- Madison, K.; Holt, D.T.; Kellermanns, F.W.; Ranft, A.L. Viewing family firm behavior and governance through the lens of agency and stewardship theories. Fam. Bus. Rev. 2016, 29, 65–93. [Google Scholar] [CrossRef]

- CSR Media & Ernst & Young. Tendinte si Realitati CSR in Romania 2016. Available online: https://www.stiri.ong/library/files/ey_studiu_tendin%C8%9Be_%C8%99i_realit%C4%83%C8%9Bi_csr_%C3%AEn_rom%C3%A2nia%E2%80%932016_ro.pdf (accessed on 23 January 2019).

- Memili, E.; Fang, H.C.; Chrisman, J.J.; de Massis, A. The Impact of Small- and Medium-Sized Family Firms on Economic Growth. Small Bus. Econ. 2015, 45, 771–785. [Google Scholar] [CrossRef]

- Audretsch, D.B.; Heger, D.; Veith, T. Infrastructure and entrepreneurship. Small Bus. Econ. 2015, 44, 219–230. [Google Scholar] [CrossRef]

| Variable | Code | Description |

|---|---|---|

| Dependent Variables (DV) | ||

| Financial Indicators | ||

| Return on Assets | ROA | Net profit/Total assets |

| Return on Equity | ROE | Net profit/Equity |

| Profit margin | PM | Net profit/Turnover |

| Turnover total assets ratio | TAT | Turnover/Total assets |

| Non-financial indicator | ||

| Social responsibility | SR | Dummy variable taking value “1” if the company is involved in social responsibility activities, otherwise taking value “0” |

| Independent Variables (IV) | ||

| Ownership | O | Percentage of share owned by family members |

| Governance | G | Percentage of family members in total number of Supervisory Board |

| Management | M | Percentage of family members in total members in board of directors (executive) |

| Succession | S | Dummy variable taking value “1” if the next generation is involved in ownership, governance or management, otherwise taking value “0” |

| Control Variables (CV) | ||

| Debt ratio | DR | Total liabilities/Total assets |

| Size | Size | total assets expressed in natural logarithm |

| Age | Age | Number of activity years |

| Industry | Ind | NACE Rev. 2—Statistical classification of economic activities—2 digits |

| Activities According NACE Rev 2 | Number of Companies | Number of Employees | Turnover (Eur) | Turnover (Eur) | |||

|---|---|---|---|---|---|---|---|

| No. | % | <250 | >250 | <10 mil | >10 mil | ||

| 1 | Wholesale | 77 | 38.31 | 67 | 10 | 6 | 71 |

| 2 | Manufacturing | 56 | 27.86 | 24 | 32 | 9 | 47 |

| 3 | Retail | 20 | 9.95 | 17 | 3 | 2 | 18 |

| 4 | Transportation | 17 | 8.46 | 12 | 5 | 4 | 13 |

| 5 | Construction | 12 | 5.97 | 4 | 8 | 1 | 11 |

| 6 | Agriculture | 6 | 2.99 | 5 | 1 | 1 | 5 |

| 7 | Rental and leasing activities | 3 | 1.49 | 2 | 1 | 2 | 1 |

| 8 | Waste collection | 2 | 1.00 | 2 | 0 | 0 | 2 |

| 9 | Computer programming, consultancy and related activities | 2 | 1.00 | 2 | 0 | 1 | 1 |

| 10 | Travel agency and tour operator activities | 2 | 1.00 | 2 | 0 | 2 | 0 |

| 11 | Postal and courier activities | 1 | 0.50 | 0 | 1 | 0 | 1 |

| 12 | Engineering activities and related technical consultancy | 1 | 0.50 | 0 | 1 | 0 | 1 |

| 13 | Business support service activities | 1 | 0.50 | 1 | 0 | 0 | 1 |

| 14 | Gambling and betting activities | 1 | 0.50 | 0 | 1 | 0 | 1 |

| Total | 201 | 100.00 | 138 | 63 | 28 | 173 | |

| The Age of the Associates/Shareholders | Number | Percentage |

|---|---|---|

| Up to 29 years | 124,502 | 9.16% |

| 30–39 years | 361,246 | 26.58% |

| 40–49 years | 392,880 | 28.90% |

| 50–59 years | 257,898 | 18.97% |

| over 60 years | 222,836 | 16.39% |

| Total number of associates/shareholders | 1,359,362 | 100% |

| Number of active companies owned by individuals | 927,373 | |

| Average number of associates | 1.47 |

| Variable | Obs. | Mean | Std. Dev. | Min | Max | HT Unit Root Test (z) |

|---|---|---|---|---|---|---|

| Ownership | 1206 | 0.968 | 0.097 | 0.4 | 1 | −19.198 *** |

| Governance | 1206 | 0.939 | 0.199 | 0 | 1 | −4.499 *** |

| Management | 1206 | 0.856 | 0.268 | 0 | 1 | −23.772 *** |

| Succession | 1206 | 0.345 | 0.475 | 0 | 1 | −4.984 *** |

| ROA | 1206 | 0.095 | 0.077 | −0.099 | 0.549 | −8.913 *** |

| ROE | 1206 | 0.226 | 0.225 | −0.399 | 2.784 | −10.248 *** |

| PM | 1206 | 0.055 | 0.064 | −0.566 | 0.531 | −18.666 *** |

| TAT | 1206 | 2.267 | 1.635 | 0.088 | 11.204 | −4.207 *** |

| SR | 1206 | 0.898 | 0.301 | 0 | 1 | −18.398 *** |

| Debt ratio | 1206 | 0.495 | 0.218 | 0.027 | 0.974 | −4.260 *** |

| Age | 1206 | 20.549 | 3.280 | 2 | 27 | −1.794 ** |

| Size | 1206 | 17.493 | 1.070 | 13.280 | 22.221 | −3.942 *** |

| Ind | 1206 | 38.164 | 16.743 | 1 | 32 | −19.198 *** |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | O | 1 | ||||||||||||

| 2 | G | 0.120 *** | 1 | |||||||||||

| 3 | M | 0.020 | 0.364 *** | 1 | ||||||||||

| 4 | S | 0.002 | −0.049 * | 0.050 * | 1 | |||||||||

| 5 | ROA | −0.025 | 0.054 * | 0.019 | 0.005 | 1 | ||||||||

| 6 | ROE | −0.010 | 0.016 | 0.047* | −0.013 | 0.597 *** | 1 | |||||||

| 7 | PM | −0.069 ** | −0.128 *** | −0.144 *** | 0.053 * | 0.526 *** | 0.285 *** | 1 | ||||||

| 8 | TAT | 0.046 | 0.050 * | 0.182 *** | −0.127 *** | 0.225 *** | 0.233 *** | −0.299 *** | 1 | |||||

| 9 | CSR | −0.098 *** | 0.022 | −0.042 | 0.082 *** | 0.074 *** | −0.040 | 0.123 *** | −0.073 ** | 1 | ||||

| 10 | DR | 0.099 *** | −0.013 | 0.108 *** | −0.015 | −0.302 *** | 0.292 *** | −0.302 *** | 0.155 *** | −0.096 *** | 1 | |||

| 11 | Age | −0.005 | 0.019 | 0.004 | 0.045 | 0.125 *** | −0.070 ** | 0.016 | 0.050 * | 0.069 ** | −0.191 *** | 1 | ||

| 12 | Size | 0.026 | −0.256 *** | −0.403 *** | 0.050 * | −0.142 *** | −0.194 *** | 0.183 *** | −0.490 *** | 0.184 *** | −0.138 *** | 0.089 *** | 1 | |

| 13 | Ind | −0.034 | −0.076 *** | −0.014 | −0.163 *** | −0.024 | 0.021 | −0.048 * | 0.164 *** | −0.015 | 0.145 *** | −0.188 *** | −0.151 *** | 1 |

| Mean VIF | Breusch-Pagan/Cook-Weisberg | Hausman Test | Pesaran’s Test | Wooldridge Test | |

|---|---|---|---|---|---|

| DV:ROA | 1.15 | Chi2 (1) = 126.29 | Chi2 (6) = 15.37 | 12.940 | F (1200) = 55.674 |

| Prob > chi2 = 0.0000 | Prob > chi2 = 0.0176 | Pr = 0.0000 | Prob > F = 0.0000 | ||

| DV:ROE | 1.15 | Chi2 (1) = 660.32 | Chi2 (6) = 17.97 | 10.888 | F (1200) = 9.009 |

| Prob > chi2 = 0.0000 | Prob > chi2 = 0.0063 | Pr = 0.0000 | Prob > F = 0.0030 | ||

| DV:PM | 1.15 | Chi2 (1) = 310.30 | Chi2 (3) = 15.67 | 16.193 | F (1.39) = 29.281 |

| Prob > chi2 = 0.0000 | Prob > chi2 = 0.0157 | Pr = 0.0000 | Prob > F = 0.0000 | ||

| DV:TAT | 1.15 | Chi2 (1) = 224.33 | Chi2 (3) = 18.82 | 5.550 | F (1.39) = 63.222 |

| Prob > chi2 = 0.0000 | Prob > chi2 = 0.0045 | Pr = 0.0000 | Prob > F = 0.0000 | ||

| DV:SR | 1.15 | Chi2 (1) = 246.52 | Chi2 (3) = 3.72 | 162.471 | F (1.39) = 1.568 |

| Prob > chi2 = 0.0000 | Prob > chi2 = 0.7143 | Pr = 0.0000 | Prob > F = 0.2120 |

| ROA | ROE | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| O | 0.0651 (3.68) *** | 0.0954 (5.19) *** | 0.0217 (0.47) | 0.0600 (1.36) | ||||||

| G | 0.0309 (3.56) *** | 0.0485 (5.30) *** | 0.0620 (2.08) *** | 0.0574 (2.44) ** | ||||||

| M | 0.0149 (2.09) ** | 0.0326 (3.90) *** | –0.0160 (–0.86) | 0.0088 (0.51) | ||||||

| S | 0.0097 (3.09) *** | 0.0101 (3.26) *** | 0.0071 (0.43) | 0.0072 (0.40) | ||||||

| Debt ratio | –0.1094 (–7.08) *** | –0.1058 (–6.67) *** | –0.1018 (–6.61) *** | –0.1037 (–7.19) *** | –0.0991 (–6.66) *** | 0.3749 (6.60) *** | 0.3765 (6.81) *** | 0.3747 (6.97) *** | 0.3816 (7.04) *** | 0.3796 (6.80) *** |

| Age | 0.0030 (4.73) ** | 0.0034 (4.58) *** | 0.0033 (4.45) *** | 0.0034 (4.36) *** | 0.0038 (4.18) *** | 0.0036 (1.17) | 0.0044 (1.45) | 0.0035 (1.16) | 0.0045 (1.47) | 0.0046 (1.51) |

| Size | –0.001 (–1.48) | –0.0014 (–1.10) | 0.0011 (0.90) | 0.0020 (1.61) | 0.0027 (2.15) ** | –0.0043 (–0.88) | –0.004 (–0.84) | –0.0033 (–0.77) | –0.0020 (–0.46) | –0.0019 (–0.44) |

| Ind | 0.0002 (1.57) | 0.0002 (1.43) | 0.0002 (1.63) | 0.0003 (1.74) | 0.0003 (2.07) ** | –0.0005 (–1.21) | –0.0006 (–1.38) | –0.0005 (–1.12) | –0.0006 (–1.29) | –0.0005 (–1.20) |

| Obs | 1206 | 1206 | 1206 | 1206 | 1206 | 1206 | 1206 | 1206 | 1206 | 1206 |

| R2 | 0.625 | 0.619 | 0.621 | 0.620 | 0.619 | 0.488 | 0.484 | 0.490 | 0.487 | 0.487 |

| Wald chi2 | 2565.19 *** | 543.54 *** | 695.79 *** | 713.5 *** | 537.36 *** | 1539.22 *** | 471.97 *** | 658.78 *** | 703.47 *** | 459.27 *** |

| PM | TAT | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| O | –0.0367 (–2.56) ** | –0.0550 (–4.26) *** | 3.5704 (6.46) *** | 4.3685 (6.37) *** | ||||||

| G | –0.0334 (–1.56) | –0.0383 (–3.82) *** | 0.1410 (0.66) | 1.5259 (8.15) *** | ||||||

| M | 0.0153 (0.50) | 0.0025 (0.09) | 0.8513 (3.48) *** | 1.2708 (5.82) *** | ||||||

| S | 0.0145 (7.10) *** | 0.0142 (6.80) *** | –0.2745 (–6.19) *** | –0.2815 (–7.03) *** | ||||||

| Debt ratio | –0.0550 (–3.11) *** | –0.0510 (–2.19) *** | –0.0538 (–2.37) ** | –0.0597 (–3.47) *** | –0.0558 (–2.37) ** | 0.0930 (0.31) | 0.1345 (0.40) | 0.3421 (0.95) | 0.2776 (0.83) | 0.4079 (1.07) |

| Age | –0.0006 (–1.31) | –0.0006 (–1.24) | –0.0004 (–1.01) | –0.0008 (–1.36) | –0.0009 (–1.81) * | 0.0875 (4.40) *** | 0.0976 (4.48) *** | 0.1042 (4.55) *** | 0.09555 (4.22) *** | 0.1135 (4.34) *** |

| Size | 0.0087 (10.95) *** | 0.0090 (11.40) *** | 0.0078 (9.70) *** | 0.0062 (5.38) *** | 0.0060 (7.21) *** | –0.2667 (–13.77) *** | –0.2863 (–11.1) *** | –0.1427 (–5.7) *** | –0.1070 (–3.76) *** | –0.0681 (–1.85) * |

| Ind | –0.0002 (–0.89) | –0.0003 (–1.03) | –0.0002 (–1.14) | –0.0003 (–1.16) | –0.0002 (–0.88) | 0.0230 (7.24) *** | 0.0256 (8.10) *** | 0.0262 (8.05) *** | 0.0247 (7.63) *** | 0.0259 (6.79) *** |

| Obs | 1206 | 1206 | 1206 | 1206 | 1206 | 1206 | 1206 | 1206 | 1206 | 1206 |

| R2 | 0.3728 | 0.355 | 0.357 | 0.356 | 0.356 | 0.722 | 0.725 | 0.721 | 0.720 | 0.703 |

| Wald chi2 | 1131.42 *** | 551.18 *** | 506.06 *** | 881.63 *** | 524.76 *** | 6177.52 *** | 4587.16 *** | 862.32 *** | 779.21 *** | 488.44 *** |

| SR | |||||

|---|---|---|---|---|---|

| O | –11.8053 (–5.98) *** | –9.6857 (–5.86) *** | |||

| G | 1.4234 (2.78) *** | 0.0599 (–3.82) *** | |||

| M | 0.1137 (0.21) | –0.4852 (–1.08) | |||

| S | 0.5933 (2.72) *** | 0.5746 (2.66) *** | |||

| Debt ratio | –1.0208 (–1.76) * | –0.9444 (–1.60) | –1.6741 (–2.93) *** | –1.5589 (–2.81) *** | –1.6980 (–2.92) *** |

| Age | 0.0317 (1.15) | 0.0417 (1.52) | –0.0043 (–0.16) | 0.0029 (0.11) | –0.0047 (–0.17) |

| Size | 0.6789 (7.15) *** | 0.6443 (7.11) *** | 0.1833 (3.86) *** | 0.1976 (4.51) *** | 0.1726 (4.31) *** |

| Ind | 0.01166 (1.86) * | 0.0079 (1.21) | –0.0015 (–0.27) | –0.0009 (–0.15) | 0.0008 (0.14) |

| Obs | 1206 | 1206 | 1206 | 1206 | 1206 |

| Wald chi2 | 442.19 *** | 445.86 *** | 515.11 *** | 505.03 *** | 507.90 *** |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hategan, C.-D.; Curea-Pitorac, R.-I.; Hategan, V.-P. The Romanian Family Businesses Philosophy for Performance and Sustainability. Sustainability 2019, 11, 1715. https://doi.org/10.3390/su11061715

Hategan C-D, Curea-Pitorac R-I, Hategan V-P. The Romanian Family Businesses Philosophy for Performance and Sustainability. Sustainability. 2019; 11(6):1715. https://doi.org/10.3390/su11061715

Chicago/Turabian StyleHategan, Camelia-Daniela, Ruxandra-Ioana Curea-Pitorac, and Vasile-Petru Hategan. 2019. "The Romanian Family Businesses Philosophy for Performance and Sustainability" Sustainability 11, no. 6: 1715. https://doi.org/10.3390/su11061715

APA StyleHategan, C.-D., Curea-Pitorac, R.-I., & Hategan, V.-P. (2019). The Romanian Family Businesses Philosophy for Performance and Sustainability. Sustainability, 11(6), 1715. https://doi.org/10.3390/su11061715