Can Public-Private Partnerships Foster Investment Sustainability in Smart Hospitals?

Abstract

1. Introduction

- -

- improving health facilities performance through RBF;

- -

- enhancing financial accessibility to health services;

- -

- strengthening the institutional capacity of the Ministry of Health.

2. Literature Review

- -

- engaging the patient as a whole person [11];

- -

- recognizing and responding to emotions;

- -

- fostering a therapeutic alliance;

- -

- promoting an exchange of information;

- -

- sharing decision-making;

- -

- enabling continuity of care, self-management and patient navigation.

- -

- sustainability issues of infrastructural healthcare initiatives; health investments and expenses are influenced by public debt increase that backs universal healthcare coverage and can cause, in time of austerity, undesirable cuts to the health sector [16,17,18]; these social impact investments can so cover emerging social needs;

- -

- funding opportunities with PPP and PF schemes; global infrastructure reports suggest that, in the wake of the fiscal crisis, healthcare PPP are a growing area as governments switch attention to social welfare projects [19]; PF schemes have a levered financial structure where debt service is backed by cash-flow based expectations; the financial return for interested investors has to be consistent with a peculiar risk-return pattern;

- -

- -

- robust and innovative tools: SROI methodology has been proposed to systematically account for broader outcomes of interventions and the value for money of such interventions in health; in particular, some authors consider SROI a very relevant and applicable measure, especially as the global focus shifts from “output” to “impact” and from “generous giving” to “accountable giving” [24];

- -

- the long-termed horizon of these infrastructural investments, and the consequent importance of assuring not ephemeral sustainability, even in terms of resilience to exceptional occurrences.

- -

- projects operate under a concession obtained from the Government;

- -

- the sponsors provide a large portion of the equity for the project company and expertise in developing and running the project;

- -

- the Government may provide equity and running capital for the project company, facilitation for authorizations, and fiscal agreements;

- -

- the sponsors and Government may enter into contracts regarding the long-run ownership and operation of the project.

3. Research Question and Methodology

- -

- Problem: healthcare needs and costs are growing in Western countries with the ageing population and stronger public budget constraints; the public stakeholders typically lack enough knowledge to autonomously procure and manage technological (smart) solutions.

- -

- Target: technology improves the quality of cares and may create monetary value through savings (optimizing scarce resources); well-being can also be improved, enhancing the socio-economic sustainability of the healthcare system.

- -

- Solution: public players should cooperate with skilled private providers signing PPP agreements; being technology riskier than standard solutions the private actors must be compensated with higher returns; higher public-to-private rewards are however impeded by the budget constraints; additional resources may so be justified only with RBF/pay for performance patterns, where savings are first co-created and then shared; this may ensure much wanted long-term sustainability and support the bankability of the investments.

- -

- replacing public spending with private finance;

- -

- postponing public expenditure to the management phase through the availability and service fees payment;

- -

- with savings from traditional care systems and lower hospitalization able to make the availability and service fees sustainable.

4. The model: PPP Combination of Public Interest with Private Technology

- -

- medical equipment for tele-monitoring and tele-diagnosis in the form of wearable or implantable devices, etc.;

- -

- medical equipment for distribution of drugs (automated dosing equipment, e.g., for insulin) or to administer treatment;

- -

- telehealth equipment such as cameras, sensors, and telephone/internet connections; a telehealth computer system for patients to self-record core health parameters (e.g., blood pressure).

- -

- HIS;

- -

- LIS;

- -

- radiology, pharmacy, and pathology information systems;

- -

- blood bank system;

- -

- PACS;

- -

- research information system.

- -

- clinical and administrative patient data (e.g., health records, tests results, contact details);

- -

- financial, organizational, and other hospital data;

- -

- research data (e.g., clinical trial reports) and data intended for secondary use; staff data.

- -

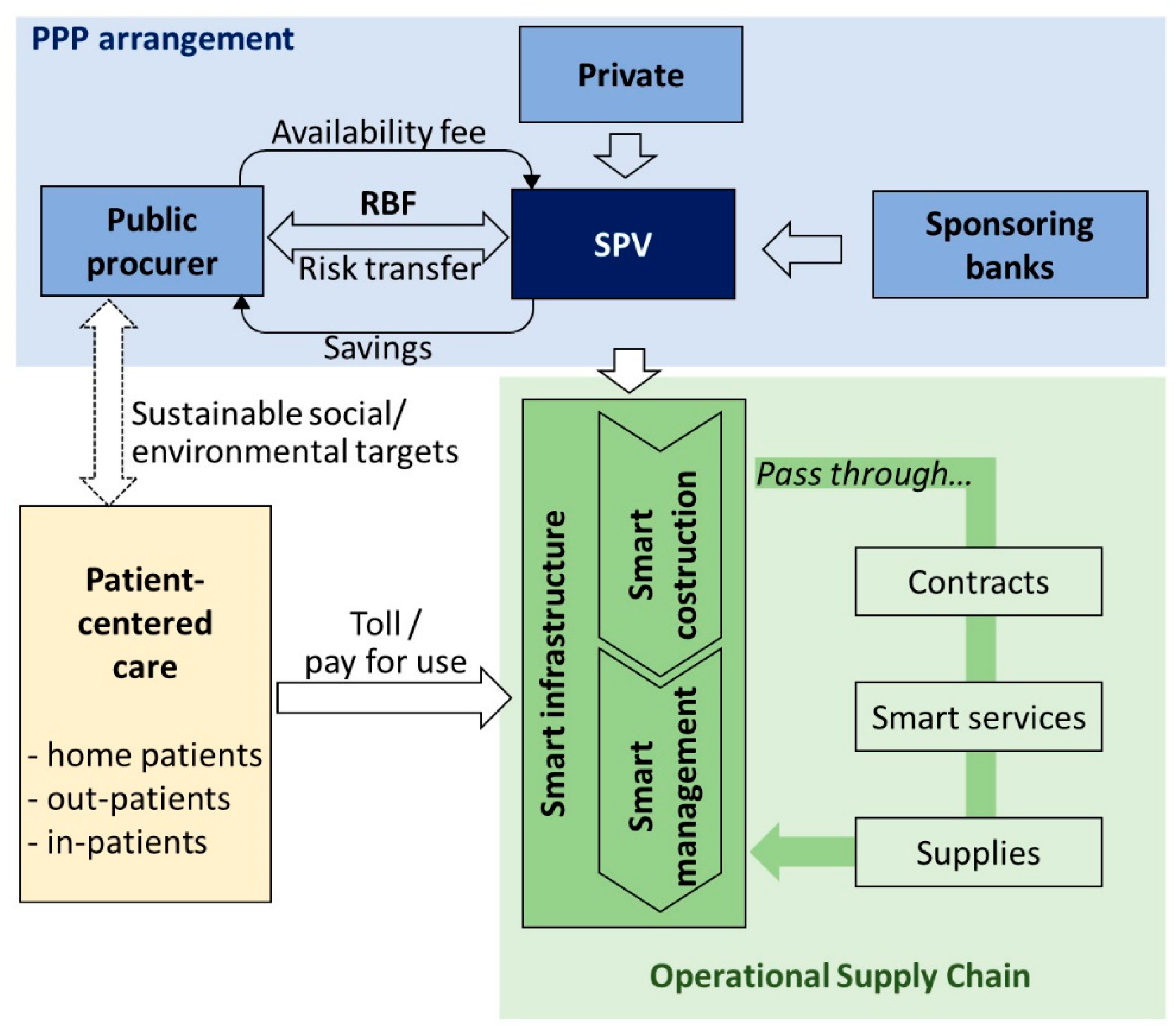

- the public procurer pays availability fees during the management phase;

- -

- the public procurer benefits from better risk transfer through RBF;

- -

- the sponsoring banks provide financial resources to the SPV that increases its risk/return profile.

- -

- the private SPV implements a new operational supply chain on the base of an agreed service contract;

- -

- the new services are paid through a “pay-per-use” mechanism consistent with RBF; the costs can either be charged to the national healthcare system or to the patients;

- -

- the SPV interacts with other technological suppliers.

4.1. Technology and Public-to-Private Risk Transfer

4.2. Technological Risk and Returns: Making the Availability Payment Sustainable with RBF

- -

- from the public side, there is a necessity to transfer a higher risk component to the private player, because of a stricter interpretation of Eurostat rules but also considering that innovative investments are riskier than standard ones;

- -

- from the private side, a higher risk may decrease profitability and raise bankability concerns.

- -

- defining the appropriate number of indicators that work as objectives;

- -

- choosing the correct principle to determine which indicators should be considered as high priorities.

- -

- fee-for-service: Providers are paid a fee for each service that they render to a patient;

- -

- case-based payments: Providers are paid a fee for each treated case, independently of the type or intensity of services that are required and rendered;

- -

- capitation: Providers are paid a fixed amount for each person enrolled in their care and are expected to provide all the services needed by that individual during the term of enrollment.

- -

- align objectives between the grantor and IT providers;

- -

- collecting reliable information on results;

- -

- give both private operators and medical staff a stake in the outcome of their efforts, and higher discretion to carry out their tasks.

5. An Example of Telehealth Application to Chronic Diseases

- -

- only the non-acute hospitalization (18.8%) potentially linked to chronical diseases;

- -

- we estimate only 23.7% of the previous hospitalization due to chronical disease in line with the reported percentage in 2015 of Italian population suffering Chronical disease [52];

- -

- consequently, we estimate a total of 5079 hospitalization days due to chronic disease in Policlinico S.S. Annunziata (about 4.5% of hospitalizations).

- -

- the coverage of a technological investment of about 9 million euros through private resources without any preliminary public spending;

- -

- an internal rate of return of about 8.8% for the private partner, showing its level of profitability; this return is currently higher than the cost of collected capital, so bringing to a positive Net Present Value of the investment;

- -

- a public-to-private transfer of technological and managerial risks;

- -

- a repayment linked to the expected savings through RBF mechanisms.

6. Discussion

- -

- the price of the investment, in the form of the public grant contribution for the building and, sometimes, the biomedical equipment;

- -

- the availability payment, represented by the annual rent paid to the private concessionaire; due to the Eurostat risk transfer rules, part of the availability payment (up to 50% or more) is conditionally subordinated to effective management and working of the hospital and is so subject to fines if the service provided is inadequate;

- -

- the economic margin of the no-core services, within the investment perimeter, with a proper blending of revenues and costs;

- -

- the duration of the whole concession (project + construction + operation/management).

- -

- increasing labor productivity and process efficiency;

- -

- reducing several categories of costs;

- -

- reducing the duration of hospital stays while preserving the occupancy rate and the quality of health services.

- -

- optimization of admissions, scheduling, and other processes, resulting in seamless patient flow; the new, more automated processes increase labor productivity and reduce personnel and management costs;

- -

- optimization of assets maintenance (with warning IoT sensors) that diminishes yearly assets costs with quantifiable savings and reduced errors.

- -

- computerized medical record and interconnected clinical information, which ensures a more efficient healthcare thanks to the availability of patient information at all stages; together with networked medical devices, these systems increase the quality of medical treatments reducing the duration of hospital stays, with an impact on daily cost for the patient.

7. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Acronyms

| BOT | Build Operate Transfer |

| CHF | Congestive Heart Failure |

| COPD | Chronic Obstructive Pulmonary Disease and diabetes |

| EMHC | Eastern Maine HomeCare |

| ENISA | European Union Agency for Network and Information Security |

| GIIN | Global Impact Investing Network |

| HIS | Hospital Information Systems |

| HIT | Health Information Technologies |

| ICT | Information and Communication Technologies |

| IoT | Internet of Things |

| IT | Information Technology |

| LIS | Laboratory Information Systems |

| MedTech | Medical Technology |

| OECD | Organization for Economic Co-operation and Development |

| PACS | Picture Archiving and Communication Systems |

| PF | Project Financing |

| PPP | Public Private Partnership |

| RBF | Result Based Financing |

| SPV | Special Purpose Vehicle |

| SROI | Social Return on Investment |

| UK | United Kingdom |

| U.S. | United States |

References

- Hueskes, M.; Verhoest, K.; Block, T. Governing public–private partnerships for sustainability: An analysis of procurement and governance practices of PPP infrastructure projects. Int. J. Proj. Manag. 2017, 35, 1184–1195. [Google Scholar] [CrossRef]

- Wang, T.; Wang, Y.; McLeod, A. Do health information technology investments impact hospital financial performance and productivity? Int. J. Account. Inf. Syst. 2011, 28, 1–13. [Google Scholar] [CrossRef]

- Lee, M.; Adbi, A.; Singh, J. Outcome Efficiency in Impact Investing Decisions; INSAED Working Paper Series; SSRN: New York, NY, USA, 2018; Volume 32. [Google Scholar]

- European Union Agency for Network and Information Security “ENISA”. Smart Hospitals. Available online: http://www.enisa.europa.eu (accessed on 7 March 2019).

- The World Bank. Benin—Health System Performance Project. Available online: http://documents.worldbank.org/curated/en/610531528123982706/Benin-Health-System-Performance-Project (accessed on 8 March 2019).

- Bullen, M.; Hughes, T.; Marshall, J.D. The Evolution of Nice Med Tech Innovation Briefings and Their Associated Technologies. Value Health 2017, 20, A595. [Google Scholar] [CrossRef]

- Munksgaard, K.B.; Majbritt, R.; Evald Clarke, A.H.; Nielsen, L.S. Open Innovation in Public-Private Partnerships? Ledelse Erhv. 2012, 77, 41–51. [Google Scholar]

- Meissner, D. Public-Private Partenerships Models for Science, Technology and Innovation Cooperation. J. Knowl. Econ. 2015. [Google Scholar] [CrossRef]

- Moro Visconti, R.; Martiniello, L. Smart Hospitals and Patient-Centered Governance. Corp. Ownersh. Control 2019, 16, 83–96. [Google Scholar] [CrossRef]

- Clarke, S.; Ells, C.; Thombs, B.D.; Clarke, D. Defining elements of patient-centered care for therapeutic relationships: A literature review of common themes. Eur. J. Pers. Cent. Healthc. 2017, 5, 362–372. [Google Scholar] [CrossRef]

- Barello, S.; Triberti, S.; Graffigna, G.; Libreri, C.; Serino, S.; Hibbard, J.; Riva, G. eHealth for Patient Engagement: A Systematic Review. Front. Psychol. 2016, 6, 2013. [Google Scholar] [CrossRef]

- Australian Commission of Safety and Quality in Healthcare. Patient-Centered Care: Improving Quality and Safety by Focusing Care on Patients and Consumers. Available online: https://safetyandquality.gov.au/wp-content/uploads/2012/01/PCCC-DiscussPaper.pdf (accessed on 8 March 2019).

- Rantala, K.; Karjialuoto, H. Value co-creation in healthcare: Insights into the transformation from value creation to value co-creation through digitization. In Proceedings of the 20th International Academic MindTrek Conference, Tampere, Finland, 17–18 October 2016. [Google Scholar]

- Larocca, A.; Moro Visconti, R.; Marconi, M. First-Mile Accessibility to Health Services: A m-Health Model for Rural Uganda; Working Paper; SSRN: New York, NY, USA, 2016. [Google Scholar]

- David, G.; Saynisch, P.A.; Smith-McLallen, A. The Economics of Patient-Centered Care. J. Health Econ. 2018, 59, 60–77. [Google Scholar] [CrossRef]

- Reeves, A.; McKee, M.; Basu, S.; Stuckler, D. The political economy of austerity and healthcare: Cross-national analysis of expenditure changes in 27 European nations 1995–2011. Health Policy 2014, 115, 1–8. [Google Scholar] [CrossRef]

- Sanyal, R.; Banerjee, S. Effects of State Level Government Spending in Health Sector: Some Econometric Evidences. Rev. Manag. 2018, 8, 17–25. [Google Scholar]

- De Rosis, S. Public strategies for improving eHealth integration and long-term sustainability in public health care system: Finding from an Italian case study. Int. J. Health Plan. Manag. 2018, 33, e131–e152. [Google Scholar] [CrossRef] [PubMed]

- Acerete, B.; Stafford, A.; Stapleton, P. Spanish healthcare Public Private Partnerships: The ‘Alzira model’. Crit. Perspect. Account. 2011, 22, 533–549. [Google Scholar] [CrossRef]

- Amy, S.; Brisbois, B.; Zerger, S.; Hwang, S.W. Social impacts bonds as a funding method for Health and social programs: Potential area of concerns. Am. J. Public Health 2018, 108, 210–215. [Google Scholar]

- Laing, C.M.; Moules, N.J. Social return on investment: A new approach to understanding and advocating for value in Health. J. Nurs. Adm. 2017, 47, 623–628. [Google Scholar] [CrossRef] [PubMed]

- La Torre, M.; Calderini, M. Social Impact Investing beyond the SIB; Palgrave Macmillan: London, UK, 2018. [Google Scholar]

- Deloitte. Volume—To Value-Based Care: Physicians Are Willing to Manage Cost but Lack Data and Tools. Available online: https://www2.deloitte.com/content/dam/insights/us/articles/4628_Volume-to-value-based-care/DI_Volume-to-value-based-care.pdf (accessed on 8 March 2019).

- Aduragbemi Oluwabusayo, B.T.; Barbara, M.; Ameh, C.; Nynke, V.D.B. Social Return on Investment (SROI) methodology to account for value for money of public health interventions: A systematic review. BMC Public Health 2015, 15, 582. [Google Scholar]

- Shaoul, J.; Stafford, A.; Stapleton, P. The cost of using Private Finance to Build Finance and Operate Hospitals. Public Money Manag. 2008, 28, 101–108. [Google Scholar] [CrossRef]

- Acerete, B.; Stafford, A.; Stapleton, P. New development: New Global health care PPP developments—A critique of the success story. Public Money Manag. 2012, 32, 311–314. [Google Scholar] [CrossRef]

- Moro Visconti, R. Healthcare Public-Private Partnerships in Italy: Assessing Risk Sharing and Governance Issues with Pestle and Swot Analysis. Corp. Ownersh. Control 2016, 13, 122–131. [Google Scholar] [CrossRef]

- Moro Visconti, R.; Doś, A.; Pelin Gurgun, A. Public-Private Partnerships for Sustainable Healthcare in Emerging Economies. In The Emerald Handbook of Public-Private Partnerships in Developing and Emerging Economies: Perspectives on Public Policy, Entrepreneurship and Poverty; Leitão, J., Sarmento, E.M., Aleluia, J., Eds.; Emerald Group Publishing: Bingley, UK, 2017; Chapter 15; pp. 407–437. [Google Scholar]

- Moro Visconti, R. Multidimensional principal–agent value for money in healthcare project financing. Public Money Manag. 2014, 34, 259–269. [Google Scholar] [CrossRef]

- Esty, B.C.; Chavich, C.; Sesia, A. An Overview of Project Finance and Infrastructure Finance-2014 Update; Harvard Business School Industry Background Note; SSRN: New York, NY, USA, 2014; p. 214083. [Google Scholar]

- Pinto, J.M.; Alves, P.P. The Choice between Project Financing and Corporate Financing: Evidence from the Corporate Syndicated Loan Market. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2876524 (accessed on 8 March 2019).

- Bayar, O.; Chemmanur, T.J.; Banerji, S. Optimal Financial and Contractual Structure for Building Infrastructure Using Limited-Recourse Project Financing. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2795889 (accessed on 8 March 2019).

- Moro Visconti, R. Evaluating a Project Finance SPV: Combining Operating Leverage with Debt Service, Shadow Dividends and Discounted Cash Flows. Int. J. Econ. Financ. Manag. Sci. 2013, 1, 9–20. [Google Scholar] [CrossRef]

- Gatti, S. Project Finance in Theory and Practice—Designing, Structuring, and Financing Private and Public Projects, 2nd ed.; Academic Press Advanced Finance—Elsevier: Amsterdam, The Netherlands, 2013. [Google Scholar]

- Brealey, R.A.; Cooper, I.A.; Habib, M.A. Using Project Finance to Fund Infrastructure Investments. J. Appl. Corp. Financ. 1996, 9, 25–39. [Google Scholar] [CrossRef]

- Esty, B.C. The Economic Motivations for Using Project Finance; Mimeo: New York, NY, USA, 2003. [Google Scholar]

- Esty, B.C. Modern Project Finance, a Case Book; John Wiley & Sons: Hoboken, NJ, USA, 2004. [Google Scholar]

- Esty, B.C. Why Study Large Projects? An Introduction to Research on Project Finance. Eur. Financ. Manag. 2004, 10, 213–224. [Google Scholar] [CrossRef]

- Corielli, F.; Gatti, S.; Steffanoni, A. Risk Shifting through Nonfinancial Contracts: Effects on Loan Spreads and Capital Structure of Project Finance Deals. J. Money Credit Bank. 2008, 42, 1295–1320. [Google Scholar] [CrossRef]

- Eurostat Manuals and Guidelines. Manual on Government Deficit and Debt, Implementation of ESA 2010. Available online: http://ec.europa.eu/eurostat/documents/3859598/7203647/KS-GQ-16-001-EN-N.pdf/5cfae6dd-29d8-4487-80ac-37f76cd1f012 (accessed on 8 March 2019).

- Moro Visconti, R. Big Data-Driven Healthcare Project Financing; Working Paper; SSRN: New York, NY, USA, 2017. [Google Scholar]

- Barlow, K.G. Delivering Innovation in Hospital Construction: Contracts and Collaboration in the UK’s Private Finance Initiative Hospitals Program. Calif. Manag. Rev. 2009, 51, 126–143. [Google Scholar] [CrossRef]

- Chirkunova, E.K.; Kornilova, D.A.; Pschenichnikova, J.S. Research of Instruments for Financing of Innovation and Investment Construction Projects. Procedia Eng. 2016, 153, 112–117. [Google Scholar] [CrossRef]

- Campbell, S.; Reeves, D.; Kontopantelis, E.; Middleton, E.; Sibbald, B.; Roland, M. Quality of Primary Care in England with the Introduction of Pay for Performance. N. Engl. J. Med. 2007, 357, 181–190. [Google Scholar] [CrossRef]

- Strategic Finance. Managing Healthcare Cost and Value. Available online: https://sfmagazine.com/post-entry/january-2017-managing-healthcare-costs-and-value/ (accessed on 8 March 2019).

- Henjewele, C.; Sun, M.; Fewings, P. Critical parameters influencing value for money variations in PFI projects in the healthcare and transport sectors. Constr. Manag. Econ. 2011, 29, 825–839. [Google Scholar] [CrossRef]

- Savedoff, D.W. Basic Economics of Results-Based Financing in Health; Social Insight: Bath, ME, USA, 2010. [Google Scholar]

- Nasira, J.A.; Hussainb, S.; Danga, C. An Integrated Planning Approach towards Home Health Care, Telehealth and Patients Group Based Care. J. Netw. Comput. Appl. 2018, 117, 30–41. [Google Scholar] [CrossRef]

- Pan, E.; Cusack, C.; Hook, J.; Vincent, A.; Kaelber, D.C.; Bates, D.W.; Middleton, B. The value of provider-to-provider telehealth. Telemed J. Health 2008, 14, 446–453. [Google Scholar] [CrossRef]

- Osservatori.net—Digital Innovation. Digital Innovation in Healthcare Observatory 2017–2018 (Italy). Available online: https://www.osservatori.net (accessed on 8 March 2019).

- Darmanin, A.; Gaur, C. Benefits of Telehealth: Reducing Hospitalization for Older Adults. In Proceedings of the Student-Faculty Research Day, Seidenberg School of CSIS, White Plains, NY, USA, 1 May 2015. [Google Scholar]

- Osservatorio Nazionale Sulla Salute Nelle Regioni Italiane. Rapporto Osservasalute. 2017. Available online: http//www.osservatoriosullasalute.it (accessed on 8 March 2019).

- U.S. Department of Health & Human Services. Long-Term and Post-Acute Care Providers Engaged in Health Information Exchange: Final Report. Telehealth Cost Considerations; Report 2013; U.S. Department of Health & Human Services: Washington, DC, USA, 2013. Available online: https://aspe.hhs.gov/report/ (accessed on 8 March 2019).

- Società di Telemedicina. Telemonitoraggio Medico e la Teleassistenza Domiciliare Contro il Fenomeno Crescente Della Cronicità. Available online: http://www.panoramasanita.it/2014/06/18/elemonitoraggio-medico-e-la-teleassistenza-domiciliare-contro-il-fenomeno-crescente-della-cronicita/ (accessed on 8 March 2019).

- Chen, Y.; Yang, L.; Hu, H.; Chen, J.; Shen, B. How to Become a Smart Patient in the Era of Precision Medicine? In Healthcare and Big Data Management; Shen, B., Ed.; Springer: Singapore, 2017; Volume 1028, pp. 1–16. [Google Scholar]

- Van Thiel, S.; Leeuw, F.L. The Performance Paradox in the Public Sector. Public Perform. Manag. Rev. 2002, 25, 267–281. [Google Scholar] [CrossRef]

- Kumar, R.K. Technology and Healthcare Costs. Ann. Pediatr. Cardiol. 2011, 4, 84–86. [Google Scholar] [CrossRef] [PubMed]

- Moro Visconti, R. Public Private Partnerships, Big Data Networks and Mitigation of Information Asymmetries. Corp. Ownersh. Control 2017, 14, 205–215. [Google Scholar] [CrossRef]

- Social Impact Investment Task Force Report Impact Investment: The Invisible Heart of Market. 2014. Available online: https://impactinvestingaustralia.com (accessed on 8 March 2019).

- Arthur D Little. Building the Smart Hospital Agenda. Available online: http://www.adlittle.com/sites/default/files/viewpoints/ADL_Smart%20Hospital.pdf (accessed on 8 March 2019).

- Tsasis, P.; Agrawal, N.; Guriel, N. An Embedded Systems Perspective in Conceptualizing Canada’s Healthcare Sustainability. Sustainability 2019, 11, 531. [Google Scholar] [CrossRef]

- Lo Presti, L.; Testa, M.; Marino, V.; Singer, P. Engagement in Healthcare Systems: Adopting Digital Tools for a Sustainable Approach. Sustainability 2019, 11, 220. [Google Scholar] [CrossRef]

- Faggini, M.; Cosimato, S.; Nota, F.D.; Nota, G. Pursuing Sustainability for Healthcare through Digital Platforms. Sustainability 2019, 11, 165. [Google Scholar] [CrossRef]

| Risks | Traditional PF | Smart PF |

|---|---|---|

| Construction risk | -SPV is mainly a construction company. -The contract allocates construction risks on the base of a standard risk matrix. | -SPV includes partners with expertise in smart technologies and IoT (e.g., MedTech companies). -A Public/Private coordination committee ensures joint management in design, and construction phases. A new risk matrix is provided. |

| Availability risk | Transfer of the following risks: -availability of the infrastructural assets (rooms, operational rooms, etc.); -maintenance costs of the buildings; -maintenance costs of the Equipment. | Transfer of the following additional risks: -reservation services on mobile and electronic payments; -data management and dematerialization; -hospital equipment maintenance; -computerized management of medical records for an interconnected Clinical Information Systems; -hospital equipment maintenance software to optimize technical control; -networked medical devices; -remote care system management; -cybersecurity. |

| Demand risk/commercial services | Management by one or more traditional operators | Integrated and automated management of newsstands, vending machines for drinks and food, advertising inside the hospital, rental of televisions and other devices for patients, supplementary services to improve the hospitality. |

| Pathology | Patients (Number) | Hospitalization Prior Telemedicine (%) | Hospitalization Post Telemedicine (%) | Visits Prior Telemedicine (%) | Visits Post Telemedicine (%) | Savings (dollars) |

|---|---|---|---|---|---|---|

| CHF | 57 | 86 | 14 | 84 | 14 | 490,040 |

| COPD | 36 | 83 | 6 | 83 | 6 | 373,365 |

| Diabetes | 15 | 53 | 9 | 53 | 9 | 118,386 |

| Cardiac | 54 | 56 | 4 | 56 | 4 | 992,267 |

| Other | 5 | 80 | 0 | 80 | 0 | 84,482 |

| Total | 167 | 2,058,550 |

| Ospedale S.S. Annuziata di Chieti | Hospitalization (days) |

|---|---|

| Hospitalization 2016 (days) | 113,998 |

| Non-acute care (%) | 18.8 |

| Non-acute care hospitalization (days) | 21,432 |

| For chronical disease (average population) (%) | 23.7 |

| Estimation average days of hospitalization for chronical disease | 5079 |

| Reduced hospitalization (%) | 30 |

| Home patient estimation | 1524 |

| Reduced Hospitalization Patients/Day | 1524 |

|---|---|

| Saving for day for patient (euros) | 724 |

| Total saving (euros) | 1,103,130 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Moro Visconti, R.; Martiniello, L.; Morea, D.; Gebennini, E. Can Public-Private Partnerships Foster Investment Sustainability in Smart Hospitals? Sustainability 2019, 11, 1704. https://doi.org/10.3390/su11061704

Moro Visconti R, Martiniello L, Morea D, Gebennini E. Can Public-Private Partnerships Foster Investment Sustainability in Smart Hospitals? Sustainability. 2019; 11(6):1704. https://doi.org/10.3390/su11061704

Chicago/Turabian StyleMoro Visconti, Roberto, Laura Martiniello, Donato Morea, and Elisa Gebennini. 2019. "Can Public-Private Partnerships Foster Investment Sustainability in Smart Hospitals?" Sustainability 11, no. 6: 1704. https://doi.org/10.3390/su11061704

APA StyleMoro Visconti, R., Martiniello, L., Morea, D., & Gebennini, E. (2019). Can Public-Private Partnerships Foster Investment Sustainability in Smart Hospitals? Sustainability, 11(6), 1704. https://doi.org/10.3390/su11061704