Global Shale Revolution: Successes, Challenges, and Prospects

Abstract

:1. Introduction

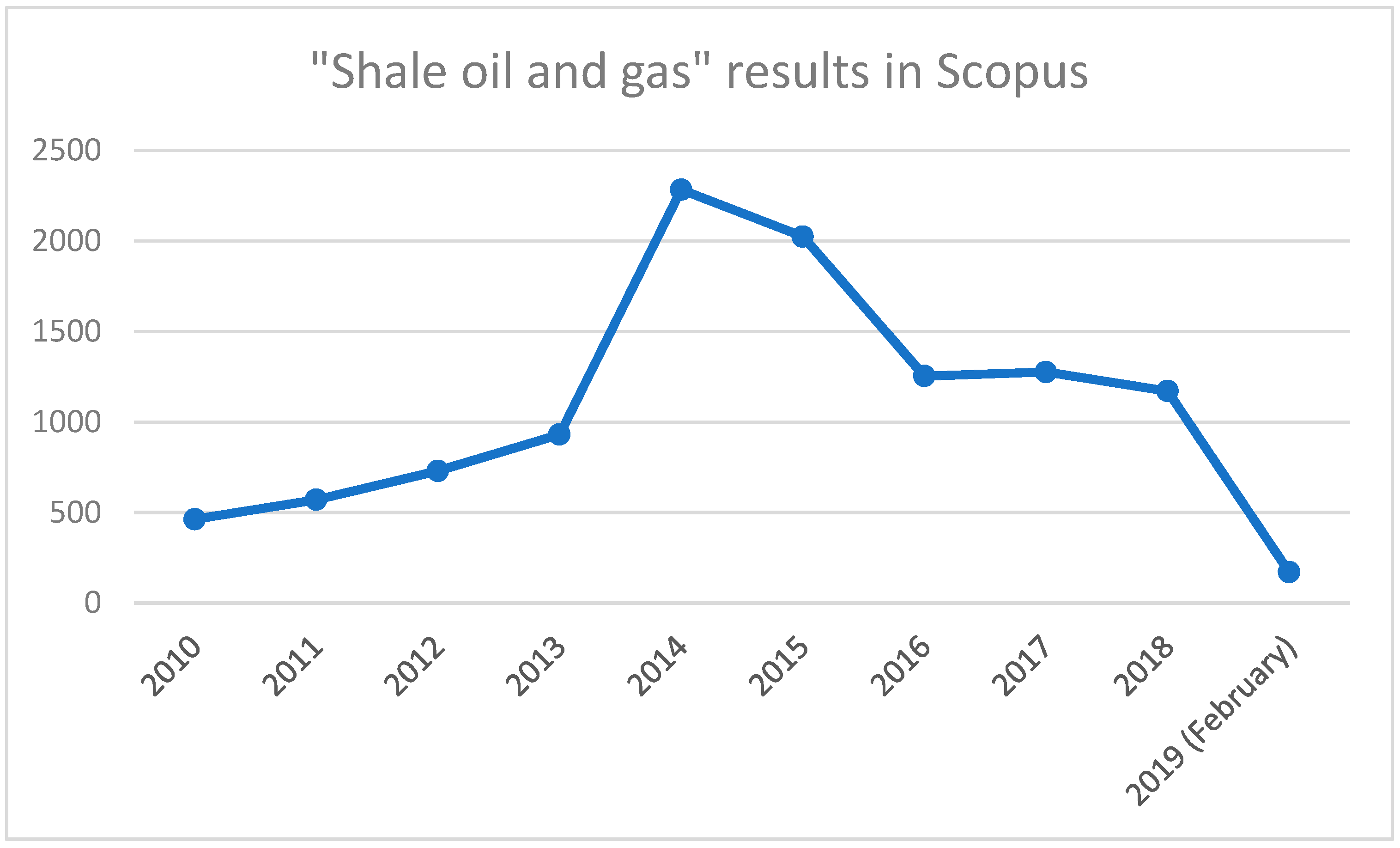

2. Literature Review and Methods

- We research the exports of shale oil and gas and give the developmental trends for the chosen countries. Our choice of countries is based on their readiness to conduct changes in their industry and economy, in order to develop shale oil and gas, and on their geographical position.

- After statistical analysis, we estimate the overall chance of further shale resource extraction growth—taking into account risks, the financial situation, and ecological constraints—forming a general vision of global shale oil and gas market conjuncture.

- On the basis of the retrieved data, we make forecasts for the future development of the shale oil industry in the studied countries, chosen for having sustainable shale oil and gas resources, and give recommendations on how to reach a better effect, with lower cost.

3. Results

3.1. The American Shale Revolution

- The prospects of the American shale revolution, according to EIA [18], are burgeoning; all the forecasts provided in the research demonstrate high growth rates and put shale oil in the center of the American oil and gas industry. Still, it is worth remembering that the rise of shale resource production was only achieved because of the massive financial support and investment; however, the financial flows in the industry are falling worldwide [19].

- 2.

- It seems that the trends of the shale oil industry are not as halcyon as the EIA supposes. Despite the efforts of the U.S. to turn its oil industry into a shale oil industry, investors are becoming less optimistic. Their main concerns are that the currently-productive oilfields will run out of oil soon (due to the short maximum profitability of shale well cycles and a low return rate [22]). Moreover, the American producers of shale have had zero, or close to zero, profits for the last four years, so the investors began to withdraw their finances from the industry, and it is expected that this trend will continue in the near future. The second concern is that the development of new fields is risky and needs venture capital, and a sustainable number of venture investors have found a new and more profitable industry—deep-water drilling, where operational costs have drastically fallen [23]. The third issue is the public attitude to fracking which has not changed since the first fracking bans in 2014. This makes investing in shale oil even more risky. At the same time, we cannot say that shale oil has a doubtful future in the USA. It is politically and economically profitable for the American economy. It is a logical conclusion, as the shale revolution allows the U.S. economy to have more maneuverability in trade politics; for instance, to cut the costs of the trade war with China for the budget. For now, it looks like America is going to be on the top of the shale revolution wave in the world. However, it is necessary to understand that the future of the American shale industry is not so bright as the EIA pictures it.

- 3.

- The American shale industry will continue to grow, but the more the growth, the further the negative consequences for society there will be. The American shale industry desperately needs new technological solutions, in order to get away from the dump water problems. In addition to that, the USA should be prepared for high volatility of oil and gas prices as competitors enter the market.

3.2. Canadian and Mexican Shale Industry

- Lack of infrastructure capacity

- High price spreads between WTI and Western Canadian Select (WCS)

- Oil price volatility caused by the global market supply and demand pursuit, if the conditions of unpredictable supply prevail (sanctions against Iran, feverish dynamics of Chinese imports, emerging new suppliers—China and India)

- Climate dependence on local demand

- Competition with the USA and Mexico for regional markets

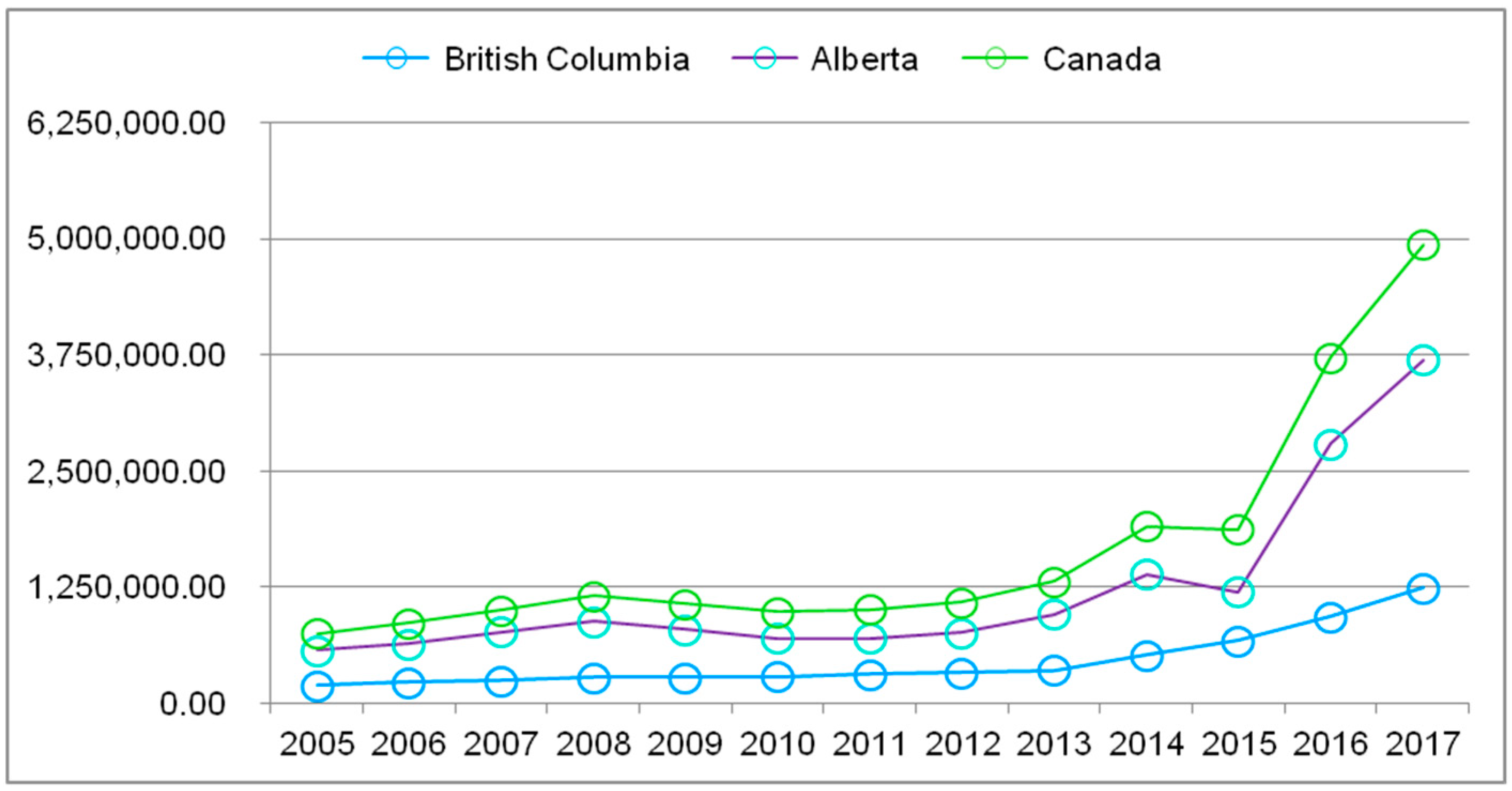

- The oil sands are one of the most important parts of the Canadian oil industry; they represent no less than 60% of Canadian crude oil extraction. This makes Canada a unique competitor to traditional oil exporting countries due to the sustainable growth of tight oil extraction (see Figure 2).

- UNCTAD offers a SWOT analysis of the Canadian shale gas industry [28]. Canada does have the opportunities to become a major participant in the global gas market; still, the situation in Canada is highly dependent on the U.S. market and exports. The trends of Canadian shale oil and gas development are positive, but the industry growth rate will be far more moderate than that of America, due to the satellite position of the Canadian shale industry to the American one.

- Mexico is currently the least developed member country of the North American Free Trade Agreement (NAFTA), and this is obviously one of the reasons why, despite large shale reserves (which are part of Texas plays), the shale industry in the country is still not developed. The potential of the country is vast [29,30], but, as other countries that will follow, does not have a clear strategy of development. The problem lies deeper than a lack of financial resources—depressive tendencies have grasped the most powerful and prosperous industry of the country in the past, the oil and gas industry, not speaking about the Mexican economy. Today, oil production in Mexico is falling at a pace of 3–5% a year, and gas is imported from the USA. The reforms of 2013 have not changed much for the reasons mentioned in Reference [31]; moreover, the power in Mexico is not concentrated in governmental institutions and the country faces a high nepotism rate and, hence, crime.

- Mexico does not have the problems of a harsh climate, long transportation distances, or a high cost of labor force (as Canada does), but despite its potential for industrial development, Mexico’s oil and gas industry is stagnating and cannot attract new investment. The situation will not change unless American companies have no choice but to enter the Mexican market. The chances of this situation are small but, if the harmfulness of fracking is proved by numerous studies and several catastrophes with a high number of victims in America, fracking bans might be imposed, forcing oil and gas companies to move to Mexican plays.

- The future of the shale revolution in both Canada and Mexico strongly depends on the U.S. industry trends, but Canada is capable of developing an industry on its own, whereas Mexico is not. According to the current trends described above, we come to the conclusion that both countries need one of the key factors that allow the shale revolution to prosper, and both have the chance to acquire them. Still, their industries bear higher risks and investors will choose their national projects only in the case that no projects in the USA are available. Taking into account the fact that the shale industry in the USA constantly provides new investment opportunities, the chances for attracting new investors to Mexico and Canada are much lower than for the United States.

3.3. The European Shale Industry

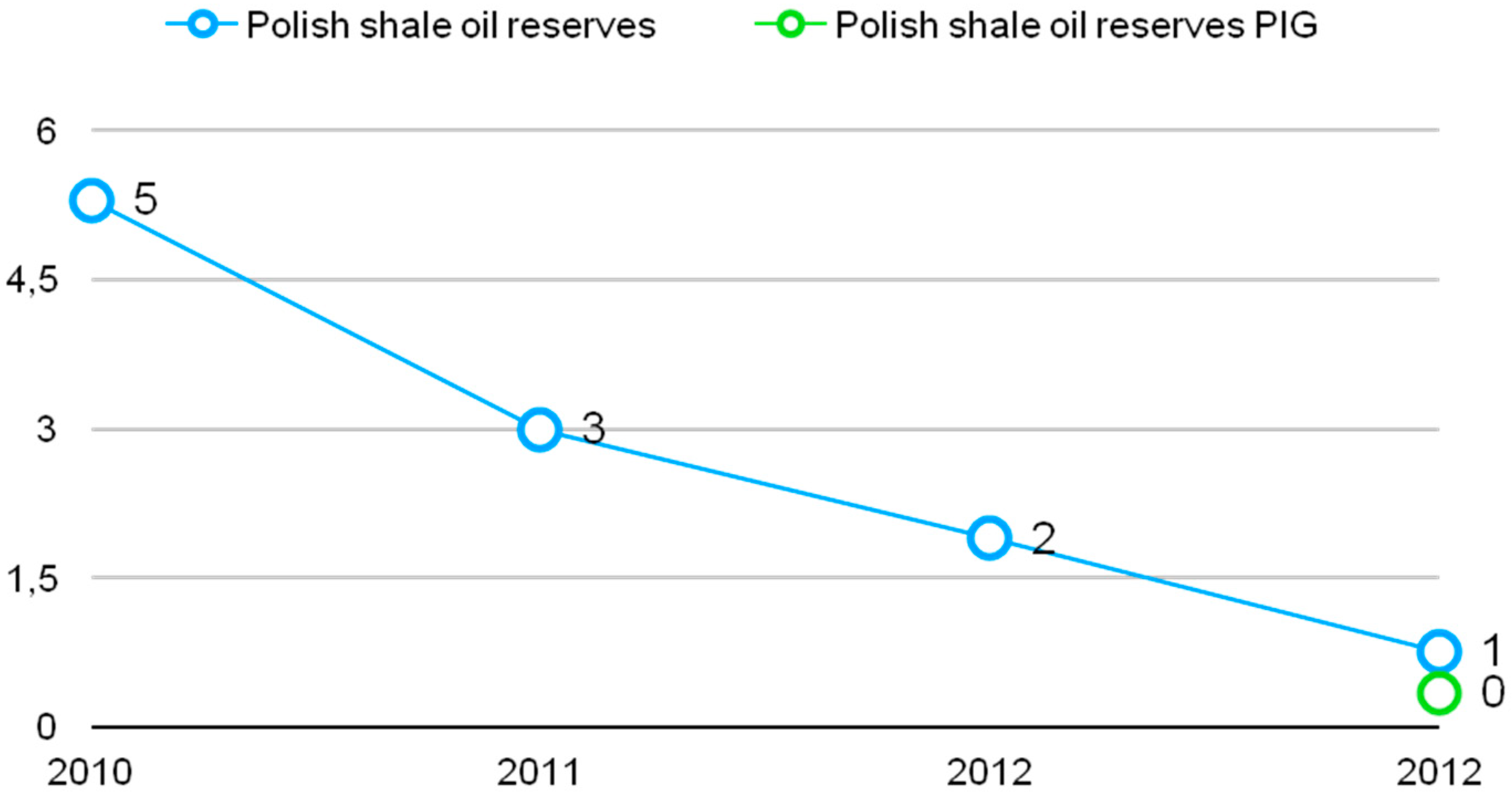

- As the ruckus around the shale revolution began in 2011, Poland started to actively participate in the promotion of this new technology and attracted investment from many transnational giants, such as Chevron [36]. However, the further development of the industry was blocked by a complex of obstacles. Optimism faded away in 2017, when the future of Polish shale industry became clear—there was no future for it [37]. Still, Poland hosts shale gas terminals and U.S. shale gas gets to Europe, for the biggest part, through Poland. While conducting this research, it was noticed that the effect of anticipations on the forecasts in the oil and gas industry is strong. The more economically prospective the play seems to be, the higher the estimations of the potential reserves are. Geological data is exploited to give the projection, but the economic potential corrects the data. One of the illustrations is the situation around the Monterey Shale formation, overestimated by 96% in 2013 [38], but Poland is a far better illustration. According to the most trusted institutes (EIA, National Geological Institute (PIG)), the extractable reserves of the Polish shale resources were significantly bigger in 2010, when the wave of excitement arose, than in 2012 and onwards, when the industry stumbled and faced severe problems, including legal issues (see Figure 3).

- 2.

- The shale revolution in Europe is postponed up to the situation where Russia and the Middle Eastern countries run out of their reserves of conventional hydrocarbons. This situation is complemented by the import of shale gas from the USA, so Europe becomes one of the arenas of competition between shale and conventional gas.

- 3.

- As was already mentioned, there will be no massive shale oil and gas extraction in Europe; thus, it will become one of the main importers of energy from other countries. Whether it will be conventional or unconventional oil is a matter of global energy market conjuncture, but European countries will not push the shale industry forward.

3.4. The Asian Shale Revolution

- Australia is another country in the Australasian region that has very interesting prospects for shale oil and gas development. The EIA estimated that the Australian shale gas extractable reserves are around 396 trillion cubic feet—a figure highly distributed in many sources [54]—with the overall reserves accounting for 437 trillion cubic feet, with the main basins lying in the center of the continent. It is a region with low population density, desert landscapes, and low quality and transitional infrastructure capacity. All the mentioned points give Australia several benefits; first of all, in the spheres of ecology and infrastructure development. The Northern Territory implied a long-lasting two-year ban on fracking, lifted in 2018 [55]. It seems that the considerations on budget effects and energy development outweighed the doubtfulness of environmental impacts and, now, shale oil and gas extraction is being actively developed in Australia.

- Even though Australia has significant reserves of conventional gas and exports it, its oil reserves are relatively low, with a consumption higher than the amount of production [56]. Development of shale oil can prove to be a step forward for the Australian oil market; as the continent is separated from any other country by the ocean, importing oil is an expensive practice.

- Still, there are several difficulties in developing a shale oil industry in Australia—first and foremost, the infrastructure. In the Northern Territory and Queensland, the shale plays are situated far from the shoreline, where the main cities lie. Therefore, the development of the industry needs an expensive infrastructure. The second problem is water supply. As has been mentioned in the overview of the technology of fracking, it requires a lot of fresh water—a scarce resource in Australia. The last, but not the least, is ecology. Australia is a unique natural region with many endemic species, the protection of which is one of the main goals that the Australian ecological policy pursues. The negative impact of fracking on the environment is underestimated, in our opinion, in order to preserve the unique biocenosis of Australia, shale oil and gas extraction should be banned or only proceeded with the uttermost precision and caution and with respect to the conservation of wild nature. The contemporary technologies of shale play development cannot reach the necessary standards of ecological consciousness, so it is vital to doublecheck the possibility of their implementation in Australia.

4. Discussion

- Resource availability;

- Significant financial investment in the industry;

- High demand for oil or gas on the national market, not matched with the national supply;

- High energy resource prices; and

- A light-minded attitude towards environmental impacts.

- To implement a stricter environmental policy for chosen industries (shale industry included);

- To begin extraction in the least populated areas, to cut down the possible effects of technogeneous accidents that are more probable during the pilot projects;

- Form a list of shale oil and gas plays and point out the order in which they are to be developed; and

- In partnership with Russian and Australian (if it becomes politically possible) companies, develop new technologies that will have smaller negative external effects.

- High and fast development of shale industries in the countries where the shale revolution succeeded; other countries do not implement these technologies in oil and gas extraction. The global energy balance reformats and shifts to the USA and China; traditional exporters face new competitors and act in accordance with the market laws—they cut down the prices. The supply from shale oil and gas exporters shrinks, the prices grow, and so on until the new balance is found. This balance will tend to give more preferences to the countries which export unconventional oil. The oil market will be divided into two sectors: conventional and unconventional oil and gas, where oil and gas prices will be different. The market of long-term gas contracts will face decline. The process will be painful for all the participants, except for the consumers, who will enjoy low prices. This scenario is possible if new, more ecological extraction technologies are developed.

- The development of the shale industry leads to harsh competition with the traditional exporters, forcing the newcomers to leave the market or fencing in a statistically neglectable niche on the global market. Still, the traditional exporters will lose Asian and American markets, which will lead to a sharp drop in prices. Russia, Venezuela, and other countries with high oil and gas production costs will lose their positions on the global market and will have to transform their industries in order to cut costs or enhance productivity. The newcomers will probably not conquer new markets, where the traditional exporters will lose their positions, as the supply of unconventional oil and gas to these markets is problematic and expensive. Additionally, countries where the shale revolution succeeded will have to endure low prices, which will have a far more devastating effect on unconventional oil extraction than on conventional oil extraction.

- The shale industry will be proved to be harmful for nature and its effects will be too negative to bear, so the development of shale plays will decline. The market will face a moderate growth of prices, and its conjuncture will resemble that of the early 2000s.

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

Appendix A

References

- Yergin, D. The Quest: Energy, Security, and the Remaking of the Modern World; Updated, Revised, Reprint edition; Penguin Books: London, UK, 2012; 832p, ISBN 978-0143121947. [Google Scholar]

- Rosneft. Official Website. Available online: https://www.rosneft.com/press/news/item/188679/ (accessed on 25 December 2018).

- Syed, A. Horizontal Well Length Optimization Considering Well Bore Hydraulics. Master’s Thesis, Norwegian University of Science and Technology, Trondheim, Norway, 2014. Available online: https://daim.idi.ntnu.no/masteroppgaver/011/11471/masteroppgave.pdf (accessed on 25 December 2018).

- Crawford, P.; Biglarbigi, K.; Dammer, A.; Knaus, E. Advances in World Oil-Shale Production Technologies. In Proceedings of the SPE Annual Technical Conference and Exhibition (ATCE 2008), Denver, CO, USA, 21–24 September 2008; Volume 6, SPE 116570. pp. 4101–4111. [Google Scholar]

- Azar, A. Reserve Base Lending and the Outlook for Shale Oil and Gas Finance. Available online: https://energypolicy.columbia.edu/sites/default/files/CGEPReserveBaseLendingAndTheOutlookForShaleOilAndGasFinance.pdf (accessed on 25 December 2018).

- Salameh, M.G. Impact of U.S. Shale Oil Revolution on the Global Oil Market, the Price of Oil & Peak Oil. Available online: https://www.iaee.org/en/publications/newsletterdl.aspx?id=202 (accessed on 20 December 2018).

- Roncaglia, A. La rivoluzionedello shale oil e imercatifinanziari (The Shale Oil Revolution and Financial Markets). Moneta e Credito 2017, 70, 173–193. [Google Scholar] [CrossRef]

- IEA. World Energy Investment 2018. Available online: https://webstore.iea.org/world-energy-investment-2018 (accessed on 21 December 2018).

- Ansari, D. OPEC, Saudi Arabia, and the shale revolution: Insights from equilibrium modelling and oil politics. Energy Policy 2017, 111, 166–178. [Google Scholar] [CrossRef] [Green Version]

- Yang, Z.; Zou, C.; Wu, S.; Lin, S.; Pan, S.; Niu, X.; Men, G.; Tang, Z.; Li, G.; Zhao, J.; et al. Formation, distribution and resource potential of the “sweet areas (sections)” of continental shale oil in China. Mar. Pet. Geol. 2019, 102, 48–60. [Google Scholar] [CrossRef]

- De Silva, P.N.K.; Simons, S.J.R.; Stevens, P.; Philip, L.M. A comparison of North American shale plays with emerging non-marine shale plays in Australia. Mar. Pet. Geol. 2015, 67, 16–29. [Google Scholar] [CrossRef] [Green Version]

- Shale Gas: Ecology, Politics, Economy, 1st ed.; Zhiltsov, S.S. (Ed.) Springer: Berlin/Heidelberg, Germany, 2017; ISBN 978-3-319-50273-1. [Google Scholar] [CrossRef]

- Howarth, R.W. Methane emissions and climatic warming risk from hydraulic fracturing and shale gas development: Implications for policy. Energy Emiss. Control Technol. 2015, 3, 45–54. [Google Scholar] [CrossRef]

- Webster, J. Going Global: Tight Oil Production; U.S. Energy Information Administration (EIA): Washington, DC, USA. Available online: https://www.eia.gov/conference/2014/pdf/presentations/webster.pdf (accessed on 20 December 2018).

- Lack, S. America’s Path to Energy Independence: The Shale Revolution. Available online: https://www.forbes.com/sites/simonlack/2018/06/04/americas-path-to-energy-independence-the-shale-revolution/#2e1dfda97554 (accessed on 21 December 2018).

- Hartnett White, K. The Shale Revolution is a Uniquely American Story. Available online: https://www.washingtonexaminer.com/opinion/the-natural-gas-revolution-is-a-uniquely-american-story (accessed on 21 December 2018).

- ASMAA. List of Worldwide Fracking Country Bans. Available online: http://www.asmaa-algarve.org/en/blog/fracking/list-of-worldwide-fracking-country-bans (accessed on 21 December 2018).

- EIA. Tight Oil Remains the Leading Source of Future U.S. Crude Oil Production; U.S. Energy Information Administration (EIA): Washington, DC, USA. Available online: https://www.eia.gov/todayinenergy/detail.php?id=35052 (accessed on 21 December 2018).

- EIA. Investment in Tight Oil, Oil Sands, and Deepwater Drives Long-Term Oil Production Growth; U.S. Energy Information Administration (EIA): Washington, DC, USA. Available online: https://www.eia.gov/todayinenergy/detail.php?id=35272 (accessed on 21 December 2018).

- BP. Statistical Review of World Energy. Available online: https://www.bp.com/en/global/corporate/energy-economics/statistical-review-of-world-energy.html (accessed on 21 December 2018).

- EIA. Shale Gas Production; U.S. Energy Information Administration (EIA): Washington, DC, USA. Available online: www.eia.gov/dnav/ng/ng_prod_shalegas_s1_a.htm (accessed on 21 December 2018).

- Cunningham, N. Profitability is Finally Within Reach for U.S. Shale. Available online: https://oilprice.com/Energy/Crude-Oil/Profitability-Is-Finally-Within-Reach-For-US-Shale.html (accessed on 22 December 2018).

- Cunningham, N. Is Deepwater Drilling More Profitable Than Shale? Available online: https://oilprice.com/Energy/Energy-General/Is-Deepwater-Drilling-More-Profitable-Than-Shale.html (accessed on 22 December 2018).

- Advanced Resources International. EIA/ARI World Shale Gas and Shale Oil Resource Assessment. Available online: http://adv-res-hou.com/pdf/01_I_EIA_ARI_Canada_June_2013_FINAL.pdf (accessed on 22 December 2018).

- European Parliament. The Shale Gas ‘Revolution’ in the United States: Global Implications, Options for the EU. Official Website. Available online: http://www.europarl.europa.eu/RegData/etudes/briefing_note/join/2013/491498/EXPO-AFET_SP%282013%29491498_EN.pdf (accessed on 23 December 2018).

- Paraskova, T. Canadian Shale Is Hitting the Wall. Available online: https://oilprice.com/Energy/Crude-Oil/Canadian-Shale-Is-Hitting-The-Wall.html (accessed on 21 December 2018).

- Canadian Association of Petroleum Producers. Statistical Handbook. Available online: https://www.capp.ca/publications-and-statistics/statistics/statistical-handbook (accessed on 23 December 2018).

- UNCTAD. Commodities at a Glance. Special Issue on Shale Gas. 2018, 9, UNCTAD/SUC/2017/10, eISBN: 978-92-1-363266-6. Available online: https://unctad.org/en/PublicationsLibrary/suc2017d10_en.pdf (accessed on 21 December 2018).

- EIA. Technically Recoverable Shale Oil and Shale Gas Resources: Mexico. Available online: https://www.eia.gov/analysis/studies/worldshalegas/pdf/Mexico_2013.pdf (accessed on 21 December 2018).

- Coyne, D. Mexico Oil Reserves and Production. Available online: peakoilbarrel.com/mexico-oil-reserves-and-production/ (accessed on 21 December 2018).

- Burgess, J. Mexico Shale Gas Industry and Energy Reform. Available online: https://oilprice.com/Energy/Energy-General/Mexico-Shale-Gas-Industry-and-Energy-Reform.html (accessed on 21 December 2018).

- Directive 2009/73/EC of the European Parliament and of the Council of 13 July 2009 Concerning Common Rules for the Internal Market in Natural Gas and Repealing Directive 2003/55/EC (Text with EEA relevance). OJ L 211, 14.8.2009. pp. 94–136. Available online: https://eur-lex.europa.eu/eli/dir/2009/73/oj (accessed on 21 December 2018).

- Wozniak, P. Shale Gas in Poland. Available online: https://www.iea.org/media/weowebsite/workshops/goldenrules/Piotr_Wozniak.pdf (accessed on 23 December 2018).

- European Commission. Unconventional Shale Gas and Oil: Overview of Ecological Impacts. Official Website. Available online: http://ec.europa.eu/environment/integration/research/newsalert/pdf/overview_of_environmental_impacts_of_shale_gas_and_oil_398na1_en.pdf (accessed on 21 December 2018).

- Neslen, A. The Rise and Fall of Fracking in Europe. Available online: https://www.theguardian.com/sustainable-business/2016/sep/29/fracking-shale-gas-europe-opposition-ban (accessed on 23 December 2018).

- Gefira. Is the Polish Shale Gas Industry Set for a Comeback? Available online: https://oilprice.com/Energy/Energy-General/Is-The-Polish-Shale-Gas-Industry-Set-For-A-Comeback.html (accessed on 23 December 2018).

- Emerging Europe. The End of Poland’s Shale Gas Eldorado. Available online: https://emerging-europe.com/news/the-end-of-polands-shale-gas-eldorado/ (accessed on 23 December 2018).

- Farnham, A. California Shale Oil Bonanza Suffers Major Setback. Available online: https://abcnews.go.com/Business/california-shale-oil-estimate-off-96-percent/story?id=23828490 (accessed on 23 December 2018).

- Bault, O. What Happened to Polish Shale Gas? Available online: https://visegradpost.com/en/2018/03/29/what-happened-to-polish-shale-gas/ (accessed on 25 December 2018).

- Neslen, A. What Happened to Polish Shale Gas? Available online: https://www.theguardian.com/environment/2015/jan/12/polands-shale-gas-revolution-evaporates-in-face-of-environmental-protests (accessed on 25 December 2018).

- EIA. Technically Recoverable Shale Oil and Shale Gas Resources: Russia; U.S. Energy Information Administration (EIA): Washington, DC, USA. Available online: https://www.eia.gov/analysis/studies/worldshalegas/pdf/Russia_2013.pdf (accessed on 21 December 2018).

- Chelyabinsk Pipe Plant. Russian Shale Oil: Foreign Experience for Siberian Fields. Available online: http://chelpipe-globalsales.com/analytics/russian-shale-oil-foreign-experience-for-siberian-fields/ (accessed on 21 December 2018).

- OSEA2018. China ‘Set for Shale Gas Revolution’. Available online: https://www.osea-asia.com/media-centre/industry-insights/china-set-for-shale-gas-revolution/ (accessed on 21 December 2018).

- Harjani, A. Is a US-style Shale Revolution Coming for Australia? Available online: https://www.cnbc.com/2014/04/14/is-a-us-style-shale-revolution-coming-for-australia.html (accessed on 25 December 2018).

- Public Energy Website. Credit Suisse Securities Research & Analytics. The Shale Revolution. Available online: https://www.saudienergy.net/Unconventional/The%20Shale%20Revolution.pdf (accessed on 25 December 2018).

- Fortune 500. Available online: http://fortune.com/fortune500/ (accessed on 25 December 2018).

- EIA; INTEK. Secure Fuels from Domestic Resources, 5th ed.; U.S. Energy Information Administration (EIA): Washington, DC, USA. Available online: https://www.energy.gov/sites/prod/files/2013/04/f0/SecureFuelsReport2011.pdf (accessed on 25 December 2018).

- WorldData. Population Growth in China. Available online: https://www.worlddata.info/asia/china/populationgrowth.php (accessed on 25 December 2018).

- API. Oil & Natural Gas Transportation & Storage Infrastructure: Status, Trends & Economic Benefits. Available online: https://www.api.org/~/media/Files/Policy/SOAE-2014/API-Infrastructure-Investment-Study.pdf (accessed on 25 December 2018).

- Fan, G. Will There be a Shale Gas Revolution in China by 2020? Available online: https://www.oxfordenergy.org/publications/will-there-be-a-shale-gas-revolution-in-china-by-2020-2 (accessed on 25 December 2018).

- Chen, J. Shale Gas Exploration and Development Progress in China and the Way Forward. IOP Conf. Ser. Earth Environ. Sci. 2018, 113, 012178. [Google Scholar] [CrossRef] [Green Version]

- Lingke, Z.; Kirton, D. China’s Shale Gas Dreams Run Out of Steam. Available online: https://www.caixinglobal.com/2018-12-03/chinas-shale-gas-dreams-run-out-of-steam-101354965.html (accessed on 25 December 2018).

- Ernst & Young. Shale Gas: Key Considerations for India. Available online: https://www.ey.com/Publication/vwLUAssets/Shale_Gas_-_Key_considerations_for_India/%24FILE/EYIN1210-084-Shale-gas.pdf (accessed on 25 December 2018).

- APPEA. The Shale Gas Opportunity. Available online: https://www.appea.com.au/oil-gas-explained/benefits/the-shale-gas-opportunity/ (accessed on 25 December 2018).

- Westbrook, T. Australia’s Northern Territory Lifts Fracking Ban. Available online: https://www.reuters.com/article/us-australia-gas-idUSKBN1HN360 (accessed on 27 December 2018).

- Energy Consulting Group. Australia Oil and Gas Overview. Available online: http://www.energy-cg.com/Australia/Australia_OilGasOverview_EIA.html (accessed on 21 December 2018).

- Gladstone, R. Iran Sanctions Explained: U.S. Goals, and the View from Tehran. Available online: https://www.nytimes.com/2018/11/05/world/middleeast/iran-sanctions-explained.html (accessed on 21 December 2018).

- Polson, J.; Loh, T.U.S. Vastly Overstates Oil Output Forecasts, MIT Study Suggests. Available online: https://www.bloomberg.com/news/articles/2017-12-01/mit-study-suggests-u-s-vastly-overstates-oil-output-forecasts (accessed on 26 February 2019).

- Kallanish Energy News. EIA Overestimating Oil Production by 100%: Continental’s Hamm. Available online: http://www.kallanishenergy.com/2017/09/22/eia-overestimating-oil-production-by-100-continentals-hamm/ (accessed on 26 February 2019).

- Durden, T. The Truth Emerges: EIA Admits It “Overestimated” Crude, Gasoline Demand in the First Half By 16%. Available online: https://www.zerohedge.com/news/2016-08-31/truth-emerges-eia-admits-it-overestimated-crude-gasoline-demand-first-half (accessed on 26 February 2019).

- Stern, J.; Yafimava, K.; Rogers, H.; Pirani, S.; El-Katiri, L.; Honoré, A.; Henderson, J.; Hassanzadeh, E.; Dickel, R. Reducing European Dependence on Russian Gas—Distinguishing Natural Gas Security from Geopolitics. Available online: https://www.oxfordenergy.org/wpcms/wp-content/uploads/2014/10/NG-92.pdf (accessed on 25 December 2018).

- Chyong, C.; Slavkova, L.; Tcherneva, V. Europe’s Alternatives to Russian Gas. Available online: https://www.ecfr.eu/article/commentary_europes_alternatives_to_russian_gas311666 (accessed on 27 December 2018).

- Fortune. Israel’s Government Approves Leviathan Natural Gas Deal. Available online: http://fortune.com/2016/05/22/israel-leviathan-natural-gas/ (accessed on 21 December 2018).

- Zou, C.; Yang, Z.; He, D.; Wei, Y.; Li, J.; Jia, A.; Chen, J.; Zhao, Q.; Li, Y.; Li, J.; et al. Theory, technology and prospects of conventional and unconventional natural gas. Pet. Explor. Dev. 2018, 45, 604–618. [Google Scholar] [CrossRef]

| Year | Shale Gas Exports, Billion Cubic Metres (bcm) | Global Gas Demand, bcm | Percentage of American Exports |

|---|---|---|---|

| 2007 | 36.62 | 2958.35 | 1 |

| 2008 | 59.93 | 3024.19 | 2 |

| 2009 | 88.08 | 2948.12 | 3 |

| 2010 | 151.12 | 3176.27 | 5 |

| 2011 | 226.39 | 3241.41 | 7 |

| 2012 | 293.71 | 3318.33 | 9 |

| 2013 | 323.27 | 3371.87 | 10 |

| 2014 | 380.,82 | 3399.06 | 11 |

| 2015 | 430.83 | 3474.57 | 12 |

| 2016 | 482.35 | 3564.,81 | 14 |

| 2017 | 526.44 | 3670.80 | 14 |

| 2018 | 584.78 | Forecast | |

| 2018 | 636.80 | ||

| 2019 | 688.83 | ||

| 2020 | 740.85 | ||

| The USA | China |

|---|---|

| High proved reserves 1 | High proved reserves 2 |

| Many multinational companies (MNCs) and entrepreneurs | Many MNCs and nearly no entrepreneurs |

| Deep financial market | High governmental financial support |

| High import of energy resources before shale revolution | High import of energy resources |

| High development of drilling technology | High potential for technological development 3 |

| High productiveness rate | High population and labor force resources |

| Developed system of gas and oil transportation | Fast development of gas and oil transportation system |

| Low respect for environmental standards | Low environmental standards |

| Managed to Transform | Did not Manage the Transformation |

|---|---|

| The USA | Mexico |

| Canada | India |

| China | Russia |

| Australia | Poland |

| Other EU economies |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Salygin, V.; Guliev, I.; Chernysheva, N.; Sokolova, E.; Toropova, N.; Egorova, L. Global Shale Revolution: Successes, Challenges, and Prospects. Sustainability 2019, 11, 1627. https://doi.org/10.3390/su11061627

Salygin V, Guliev I, Chernysheva N, Sokolova E, Toropova N, Egorova L. Global Shale Revolution: Successes, Challenges, and Prospects. Sustainability. 2019; 11(6):1627. https://doi.org/10.3390/su11061627

Chicago/Turabian StyleSalygin, Valery, Igbal Guliev, Natalia Chernysheva, Elizaveta Sokolova, Natalya Toropova, and Larisa Egorova. 2019. "Global Shale Revolution: Successes, Challenges, and Prospects" Sustainability 11, no. 6: 1627. https://doi.org/10.3390/su11061627

APA StyleSalygin, V., Guliev, I., Chernysheva, N., Sokolova, E., Toropova, N., & Egorova, L. (2019). Global Shale Revolution: Successes, Challenges, and Prospects. Sustainability, 11(6), 1627. https://doi.org/10.3390/su11061627