1. Introduction

The concept of sustainability in the business world has numerous meanings. Indeed, some authors take the concepts of corporate social responsibility (CSR) and sustainability to be synonyms [

1,

2,

3], while others consider that epistemological ones can be found among them [

4,

5,

6,

7]. Consequently, a new term which now appears in the scientific literature, corporate sustainability, is used to specify its differences and similarities in the business domain. In any case, sustainability is understood from three areas of action or dimensions, namely the “triple bottom line” or “triple result”: the economic area, the social area, and the environmental area [

8,

9]. This article uses this “triple result” definition to homogeneously interpret the terms of CSR and corporate sustainability.

Currently, some proposals to measure the CSR or corporate sustainability of companies and countries exist, which have been prepared by private companies, such as the American agency KLD Research & Analytics, Inc. However, the fact that so many CSR-related standards have been reported in the world implies heterogeneity and difficulty in assessing and comparing results. Notwithstanding, it is becoming increasingly more important to measure aspects such as commitment to society and the environment, as well as the transparency of companies. This is because they are key factors of competitiveness, of creating tools of value and excellence in management, and of points of differentiation [

10]. As a result of the severe criticism and crisis that some of the world’s biggest and most recognized companies have gone through, groups of interest are seeking a new index of trust as a CSR reference.

This is why much importance is attached to the standards and guidelines that several world organizations prepare. The following is a list of some of the most outstanding ones, along with the year they were created: the Global Compact (a UN initiative created in 1999), the Green Book prepared by the European Commission (2001), the OECD guidelines (1976 and updates in 2011), the Global Reporting Initiative (GRI, 1997), the World Business Council for Sustainable Development (WBCSD, 1995), SA 8000 (1989), AA 1000 or Accountability 1000 (1996), ISO 26000 (2010), and the Ethos Indicators of CSR (1998).

Some studies [

11,

12] have analyzed the impact of CSR activities on the creation of companies’ value using the sustainability indices of private agencies like KLD, or the Chinese agency, Southern Weekend. Other studies have analyzed the influence of CSR on the value of brands and examined CSR in line with what this influence implies for interested stakeholders (customers, shareholders, employers, suppliers, and the community as a whole) [

13], or whether their information about CSR significantly improves consumer attitudes about the brand and how they perceive its singularity [

14]. Several other studies [

15,

16] have focused exclusively on analyzing the strong and weak points of sustainability indices by, for instance, empirically comparing private access indices in the USA (Dow Jones Sustainability Index (DJSI), Morgan Stanley Capital International and KLD Research & Analytics, Inc. Index (MSCI KLD 400 Social Index) and Financial Times Stock Exchange Index (FTSE4Good Index), and have obtained considerably different results [

17]. Similar results on the divergence among sustainability rankings can be found in the literature [

18,

19]. Other works have analyzed only the DSJI to study the impact of its use (e.g., by including its logo in reports and on websites) in 24 Canadian companies on the Stock Exchange [

20], or have evaluated the differences in the composition between DJSI Emerging markets and DJSI Developed markets (DJSI Europe and DJSI North America) [

21].

In today’s international context, having open access to sources of information via digital media is essential for investors, and is even more so for companies because they are capable of increasing the value of their brands by diffusing their strategic policies, actions, results, and achievements. The four most popular CSR open-access rankings are published by Newsweek, Forbes or Corporate Knights, the Reputation Institute, and the financial server Yahoo Finance. These four agencies annually evaluate companies’ levels of CSR from 1% to 100% (from worst to best).

The main objective of the present research was to study the degree of similarity in the sustainability valuation that might exist among the open-access CSR rankings in companies with the most globally valued brands. The secondary objective was to study whether these rankings incorporated the most de facto prestigious brands, and the third objective was to know of the influence of technological companies’ controversy levels on the CSR ranking of Finance Yahoo Sustainability.

In this way, the study’s premises are: (i) Smaller differences in the scores granted to companies between CSR rankings generate more confidence on financial markets in the “triple result”, and consequently, free-access indices are more widely used when making investment and financing decisions; (ii) smaller differences between CSR rankings and brand rankings also means greater commitment of large companies for sustainability. Thus, the present work contributes to the literature by analyzing the open-access sustainability rankings that have not been studied to date. Companies from the technology sector (IT) were chosen, for which no previous work exists despite it being the most incipient sector in the economy, and one that has been revolutionizing markets and society worldwide, particularly since the 1990s [

22]. It is also the sector that is growing the most in terms of both turnover and the number of companies.

This article is arranged as follows:

Section 2 offers a background for understanding the selected sample and the objective set in this research.

Section 3 describes the research objective, the methodology, and the sample and data employed herein.

Section 4 presents the results. Finally, the discussion of the results and a few final remarks are provided.

3. Materials and Methods

3.1. Methods

To study the degree of similarity in the sustainability valuations that open-access CSR rankings make of technology companies with the most valued brands over time, a descriptive and graphical statistical analysis was done of the scores that each company obtained in the four open-access CSR ranking agencies.

Linear regression by Ordinary Least Squares (OLS) was applied, where the dependent variable was the companies’ score in each ranking and year, and the explanatory variables were the four rankings, defined as dummy variables (with 1 being if the ranking scored a company within this year, and 0 being otherwise). In addition, indicators of the company’s size and performance were included as control variables. Size was measured by total asset (millions in $) and the number of employees in each tax year (these two variables were obtained from companies’ annual accounts for the years 2010–2018). Performance was measured by market capitalization (market capitalization = share market price x number of shares).

The equation of the model is expressed as follows:

where:

Yij: Score of company i (i = 1 to 13) in the year j (j = 2010 to 2018).

α: Constant term.

βm: Coefficients of the explanatory variables.

ε: Random disturbance term.

Different regression models were obtained for all the companies as a whole, for each separate company and for each individual year.

Finally, in order to know the influence of the controversy level in the technological sector on the ranking scores of Finance Yahoo Sustainability, another model was obtained by OLS regression. This third objective was applied only to the Finance Yahoo ranking for 2018, as it is the only one that provides this indicator among the four rankings studied herein. The indicator’s five levels were transformed into five dummy variables (with 1 being if the company has that level of controversy, and 0 otherwise). The equation of this model is expressed as follows:

where:

Yi: Score of company i (i = 1 to 13) in Finance Yahoo Sustainability.

α: Constant term.

βm: Coefficients of the explanatory dummy variables.

ε: Random disturbance term

The models’ goodness of fit was measured with the adjusted R2 and the Student’s t. The error considered levels were 0.5%, 1%, and 5%. Multicollinearity was measured with the condition index (CI) and the variance inflation factor (VIF).

3.2. Sources of Information

For our study, the selection of companies belonging to the IT sector was based on the brand value criterion, using the ratings of the rankings published by Intebrand, Millward Brown, and Brand Finance. These three consultancy firms only analyze companies whose brands are global, visible, growing, and relatively transparent with financial results. These companies only publish the top 100 brands according to their rankings. Given their relevance, these brand valuation rankings have been previously used in other studies [

68].

It is notable that these three consultancy companies employ mixed valuation methods. Interbrand uses a mixed model of discounted cash flows, along with marketing methods. Millward Brown publishes the ranking Brand Z and uses a mixed model between marketing variables and the Millward Brown Optimor. Brand Finance combines market approaches (royalty-based methods) with the brand strength associated with these approaches. Therefore, these three agencies combine economic-financial information with qualitative variables. These qualitative variables measure the strength of the brand and how consumers perceive it, which is what Interbrand calls “brand strength” (a measure of the ability of a brand to create loyalty), and what Millward Brown calls “brand contribution” (which assesses the ability of brand associations in consumers’ minds). However, neither of these agencies include environmental or social performance variables, which constitute the other two CSR dimensions, along with the economic-financial dimension. Only the company Brand Finance was found to calculate the “Brand Strength Index” using a balanced scorecard of a number of relevant attributes, such as emotional connection, financial performance, and sustainability, among others. The weight of “sustainability” is diluted among the other variables used to calculate this index, which is then multiplied by the royalties tax.

The brand value criterion for selecting the companies in the sample are companies that have been in the top 100 in at least two rankings published by Interbrand, Millward Brown, and Brand Finance between 2000 and 2018 (inclusive). This requirement was met by 13 companies, which made up our study object sample—namely: Accenture, Apple, Cisco, Facebook, Google, HP, IBM, Intel, Microsoft, Oracle, Samsung, SAP, and Sony.

To facilitate understanding of the importance attached to the value that brands take in companies, especially in the companies selected for the present work,

Table 1 shows the evolution of the mean brand values of all 13 of the studied companies. The mean brand value was obtained as the means of the valuations made by Interbrand, Millward Brown, and Brand Finance for each year from 2010 to 2018.

Table 1 shows how all 13 companies obtained very high values and whose values increased with time, except for Sony, IBM, and HP. Apple leads the Interbrand, Millward Brown, and Brand Finance rankings in all the sectors by occupying either first or second position between 2012 and 2018. It is followed by brands Google, Microsoft, and Facebook, which have also appeared in the top 10 of these rankings in recent years, and were higher up than the most prestigious brands in other economy sectors.

According to the Global Industry Classification Standard (GICS), the 13 selected companies came from different industries, but appeared more (with four companies) in “consumer electronics” (

Table 2). According to their location, nine had their headquarters in the USA, two in Europe, and two in Asia. Differences in their ages also appeared (the oldest was created in 1911, the youngest in 2004), as they did in economic results. Their size was measured as their amount of assets and number of employees. It is noteworthy that the companies belonging to the “IT services” industry required more employees, such as Accenture or IBM, while, conversely, the “internet, content, & services” industry employed fewer workers, such as Facebook. Some companies stood out for several reasons: Apple for its amount of assets, net income, and market capitalization; Microsoft for its total number of outstanding shares; and Google for its price to earning ratio (PER) and earnings per share ratio. (EPS). All this information was valid on 31 December 2017.

The four open-access CSR rankings employed (2018) herein are described in order of age:

Newsweek classifies the biggest companies in corporate sustainability or environmental impact terms as a ranking. This list is known as the “Green Ranking” and has been published continuously ever year since 2010, except for 2013. The “Green Ranking, Global 500” assesses the sustainable performance (measured in environmental terms) of the 500 biggest companies worldwide, according to their income and whether they were on the Stock Exchange on December 31 of each year. This ranking exclusively employs environmental indicators [

69].

Reputation Institute classifies those companies with the best reputation in CSR matters worldwide. Its ranking, known as “CSR RepTrak”, has been published since 2012 and lists the top 100 companies with the best reputation [

70].

The financial Finance Yahoo portal includes Environment, Social, and Governance (or ESG) scores of more than 2000 companies on the Stock Exchange [

71]. Such information provides a given company’s numerical score for all three ESG categories, as well as its overall score. It also graphically presents information, which is compared with the averages of either their category or industry over time, and indicates their level of controversy. The level of controversy is measured by identifying the companies involved in incidents and events that may have a negative impact on the interested parties, the environment, or a company’s operations. This is scored on a scale from 1 to 5, where 1 indicates a low level, 2 a moderate level, 3 is significant, 4 is high, and 5 indicates the gravest or most serious controversy, with the strongest potential impact. The Yahoo Finance Sustainability ranking was published for the first time on 1 February 2018, but has included data of each company since 2014. However, the level of controversy is available only for the current year. The methodology that it employs was developed by Sustainalytics, a leading independent world supplier of corporate governance and ESG research works and scores. This is further proof that investors at all levels look beyond the conventional financial risk, and consider the risk of investing in ESG to better assess companies’ performance from many angles.

Forbes has published the “Global 100 most sustainable corporations”, also known as “Global 100” [

72], from 2015 to 2018. This ranking was named one of the best CSR rankings in 2017 and 2018, and has been prepared by the company Corporate Knights since 2005. The objective of creating this index was to design a methodology to quantitatively compare and classify the largest public companies in the world (with a minimum income of 1000 million US dollars). In 2018, it employed 15 indicators, of which five are environmental and 10 are corporate.

The 13 brands selected for our sample were not equally present in the four open-access CSR rankings, and the years that the four rankings have been available also differed. This provided 266 data for the series of scores obtained by the four rankings for our selected sample of 13 companies. The values of the rankings to be analyzed corresponded to the period between 2010, which was when the first ranking was published (“Green Ranking”) and 2018. The data distribution is shown below in

Table 3 and

Table 4 for years and companies, respectively.

The years with the most information were the more recent ones, except for 2018, as some rankings had still not published their classification when the present study was conducted. The first years provided less information because most public rankings still did not exist at that time. The presence of different technology companies was similar, with a mean of 8.2%. The least present companies were SAP and Facebook because they were included in fewer rankings (Facebook appeared in only two) and in fewer years.

4. Results

4.1. Descriptive Analysis

A descriptive analysis was firstly carried out (

Table 5) of the scores obtained jointly by the 13 companies from the technology sector in the four open-access CSR rankings.

The mean scores were similar: “Green Ranking” and “RepTrack” came close to 60%, and “Global 100” and “Finance Yahoo Sustainability” came close to 70%. Thus, it can be stated that the technology sector companies have a mean RSC index of 60–70. However, none of these four CSR indices coincided in terms of maximum and minimum scores. This is due to the methodology used, the number of companies studied, and the years analyzed (

Table 6). The “Green Ranking” is the oldest and, therefore, includes more years—and as seen below, there have been differences over time, as well as the inclusion of more companies (top 500), meaning that its range is wider. Finance Yahoo Sustainability follows in terms of the number of valid cases and rank, with it being 63 and 45, respectively. This is because, despite being quite recent (since 2014), it analyzes more than 2000 companies and, thus, the sample included the 13 companies. The smallest number of analyzed valid cases, 20, corresponds to “Global 100”, and its range is 25.42 because it includes the fewest companies in our sample in its Top 100 ranking, as it has been publishing for a fewer number of years. Finally, the narrowest range corresponds to RepTrak, which, despite having published its ranking since 2012, employs a completely different methodology to the other rankings, and obtains values through surveys with a panel of experts, who could make more subjective and homogeneous assessments.

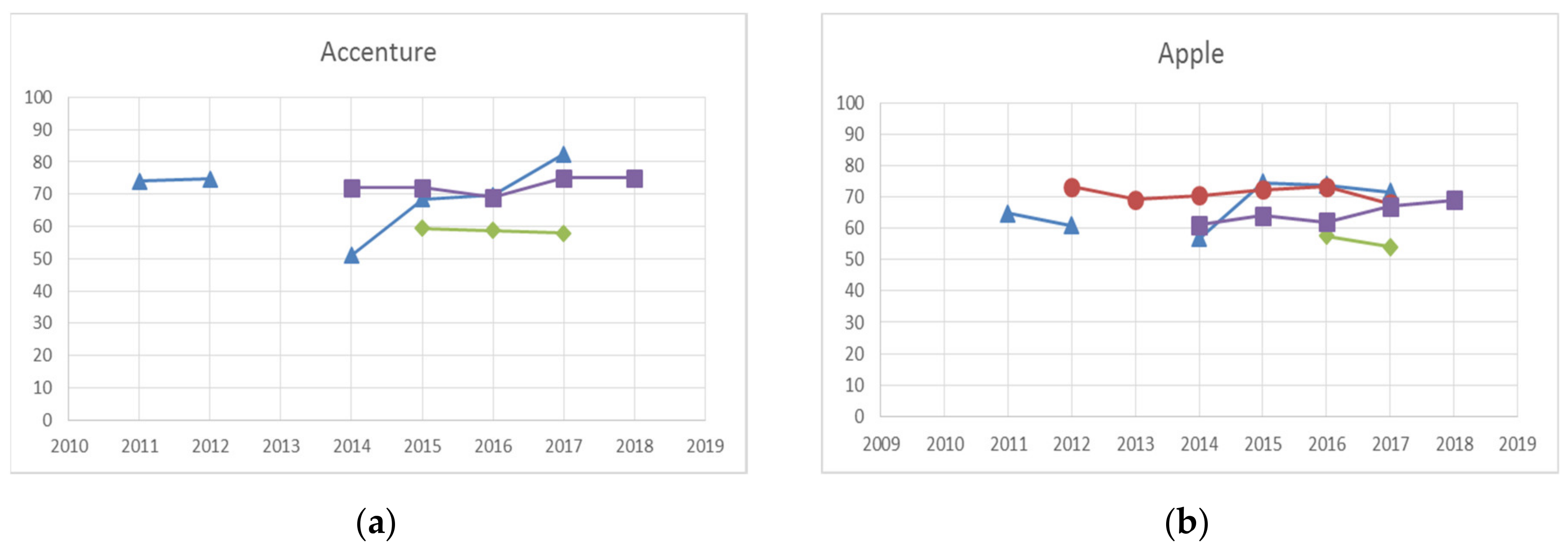

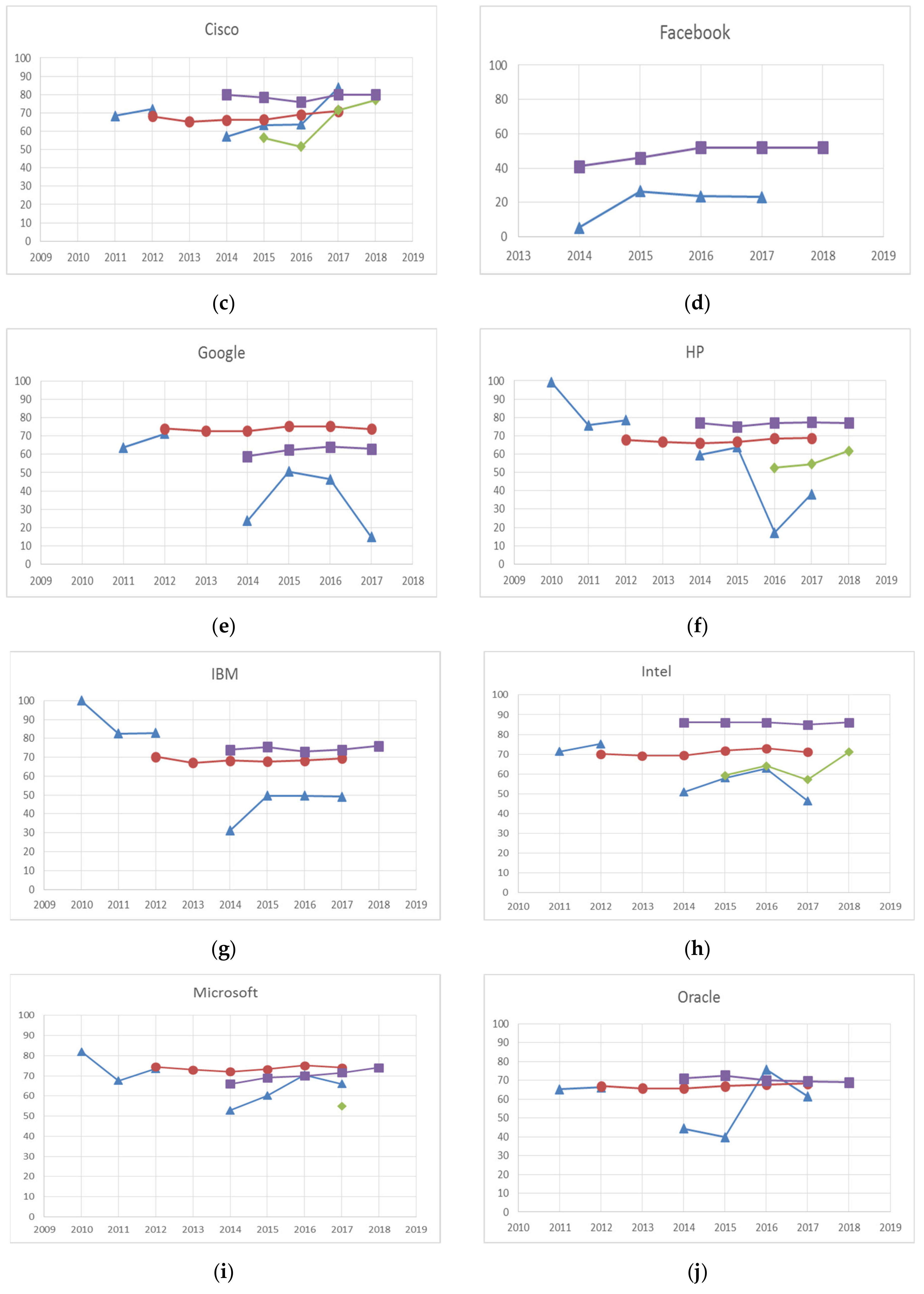

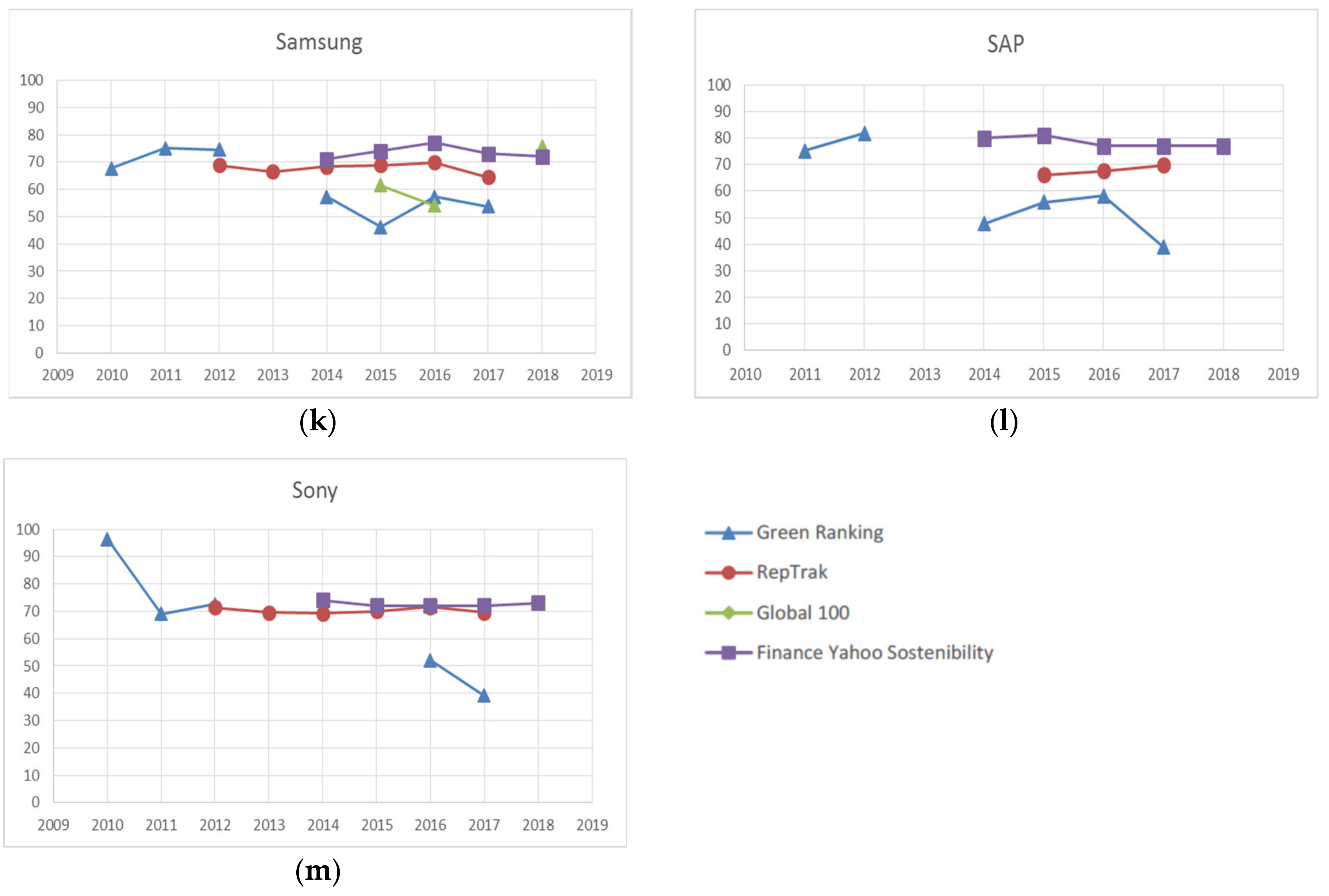

Some companies did not appear in any ranking for any studied year. This was the case for Accenture and Facebook, because they did not appear in “RepTrack” (

Figure 1). The “Global 100” index did not include six of the 13 companies in any studied year—namely, Facebook, Google, IBM, Oracle, Sap, and Sony. Therefore, the number of companies assessed in the four rankings in any study year was 53.84%.

Marked discrepancies also appeared in the maximum and minimum scores that each ranking gave to companies. The maximum value given by “Green Ranking” was 100% to IBM in 2010, and its minimum one was 5.40%, which went to Facebook in 2014 and coincided with position 478 in this ranking. However, the best value given by the Reputation Institute was 75.40% for Google in 2015, which repeated this value in 2016 and occupied first place in both years. The worst score that it gave went to Samsung in 2017 with 64.50%, which occupied post 84. This agency provided less variability in the studied data (its range was only 10.90%). The maximum “Global 100” ranking score corresponded to Cisco in 2018 (77.02%), which occupied post 7, while the minimum score went to the same company in 2015 (51.6%), which occupied position 57 of this ranking. Finally, the best “Finance Yahoo Sustainability” score went to Intel in years 2014, 2015, 2016, and 2018, with the score being 86% in all four years. The worst score was for Facebook in 2014, with only 41%. Only “Green Ranking” and “Finance Yahoo Sustainability” coincided in placing Facebook in the worst position in 2014, but with very different scores of 5.40% and 41%, respectively.

When examining the time course of each company’s CSR score (

Figure 1), we observed that, just as the descriptive statistics pointed out, the scores of the four indices revealed differences in most of the observations made throughout the study period. It is worth stressing that “RepTrack” proved the best stability given its variability or range, which has been previously indicated with only 10.90%. However, “Green Ranking” and “Global 100” indicated more volatility over the study period, where the quantity of the “Global 100” data was too minimal to draw any significant conclusions. In general, “Green Ranking” displayed a trend for giving the lowest scores.

To measure the consistency of the rankings on the selected companies’ sustainability valuations, the coefficient of variation was calculated for each company and year (mean scores/standard deviation) of their score in all four rankings.

Table 7 shows that the coefficients of variation lie between 0.92 (Facebook in 2014) and 136.59 (Oracle in 2012). The vast majority obtained low values, which indicated a high degree of variability among rankings. The highest coefficients were obtained in 2012 for Microsoft and Oracle, which indicated that the degree of variability between rankings was lower for that particular year. These coefficients lowered in the following years, but rose again in 2018, which implies fewer discrepancies among the scores that the four CSR rankings provided.

In relation to the third objective about the influence of the level of controversy on the Finance Yahoo Sustainability ranking in 2018, according to this ranking, the average level of controversy of the technology sector was around 1.3, which indicates that it is a sector with a low level of controversy. However, the average level of controversy obtained by the 13 companies in the sample was somewhat higher with a score of 2.69, which lies between the moderate (2) and significant (3) levels. The companies Apple, Facebook, Google, and Samsung reached a higher level of controversy of level 4, possibly because they have been involved in 2018 in some type of event with either a negative impact on the environment, the interested parties, or the company. On the contrary, Accenture was the only company to obtain a low level of controversy, level 1, in that particular year.

4.2. Regression Analysis

The linear regression results corresponding to mathematical Equation (1) are offered in

Table 8 and

Table 9, and several models are presented.

Table 8 presents ten models: one for the data (226) and nine individual models for each company, except for HP, IBM, Oracle, and Sony, for which no significant results were obtained.

A model was also obtained for the years 2014, 2015, and 2016 (

Table 9). No significant results were found for 2018, 2017, and 2012, and this was not possible for 2013, 2011, and 2010 because only one of the four rankings gave scores in these years.

Of all the obtained models (

Table 8 and

Table 9), “Green Ranking” was selected as the reference variable. It is noteworthy that none of the economic-financial control variables (total assets, no. of employees, and market capitalization) were statistically significant in any model.

The constant in all the models was extremely similar, being between 44.83 and 71.18, except for Facebook. In contrast, the coefficient for the Finance Yahoo ranking was the highest (28.85), because Facebook was valued by only two rankings (Green Ranking and Finance Yahoo Sustainability), with large differences between them of 28.85 points on average. These differences were due to the fact that Green Ranking measures only the environmental dimension, while Finance Yahoo Sustainability measures the three ESG dimensions. This corroborates the low coefficients of variability obtained by Facebook in

Table 7, especially in 2014. Indeed, Facebook was fully expanding and building an important datacenter in 2014, which allowed its environmental footprint to considerably increase [

73], a fact that was much criticized by organizations like Greenpeace. As a result, Facebook took energy efficiency measures to improve its score in the rankings, especially in the Green Ranking.

We also found that the obtained CSR scores lay between 14.10% (for the sample as a whole) and 79.80% (for Facebook) for the company that prepared the ranking.

The scores given by “Finance Yahoo Sustainability” for all the companies were above those given by “Green Ranking” (a positive coefficient), except for Apple, which was lower (a negative coefficient), and no difference was found for the companies Accenture, Google, and Microsoft. Indeed, for these three companies, “Global 100” scored below the “Green Ranking” (for Accenture and Microsoft), and “RepTrak” scored above it (for Google).

In the joint model (1) for the years 2014–2016 (13, 12, and 11), the “Finance Yahoo Sustainability” coefficient was always above that which corresponded to RepTraK. “Global 100” did not appear, which meant that no significant differences were found between its valuations and those of the control variable “Green Ranking”.

Thus, we concluded that the “Finance Yahoo Sustainability” ranking tends to score above the other rankings in most cases, while “Green Ranking” and “Global 100” tends to score below.

The linear regression result corresponding to mathematical Equation (2) is offered in

Table 10 to analyze the influence of the level of controversy in the Finance Yahoo Sustainability scores in 2018.

The obtained results (

Table 10) reveal that only the level of controversy explains 45.90% variability of the score of the Finance Yahoo ranking for technology companies in 2018. In addition, there were only differences in the Finance Yahoo Sustainability scores between a level of controversy of 4 (high) and the other levels (1, 2, and 3), which did not appear in the model because they were not statistically significant. Companies with a level of controversy of 4 had a mean score in the ranking of 12.33 points less (negative coefficient) than those with levels 1, 2, and 3 (76.33 points). Therefore, there were no differences in score due to the level of controversy among levels 1, 2, and 3. A level of controversy of 5 (gravest level) did not appear in the model because none of the 13 companies that we analyzed obtained this level in 2018 and, therefore, its impact on the ranking score could not be determined.

5. Concluding Remarks

This study confirms that, like private CSR rankings, which have been the study object of previous research works [

17,

18,

19], the degree of variability between different open-access CSR rankings is high. In other words, the scores that these rankings give to technology companies do not coincide to assess their level of sustainability throughout our study period (2010–2018). These differences between rankings are due to the methodology used by each one. Green Ranking, Global 100, and Finance Yahoo use quantitative indicators, which is why they are more objective than Rep Track, which is based on expert surveys. Green Ranking only measures the environmental aspect of CSR; thus, any variation in only this aspect will more strongly influence the final score of the ranking, and will lead to wider temporal variability in the same company. On the contrary, Finance Yahoo Sustainability measures the three aspects (ESG), so the same environmental variation will have a much lower impact on the final score. Therefore, Finance Yahoo Sustainability is much stabler over time. The same can be stated of private access rankings, where differences have been observed for the methodologies they use, and also for other aspects such as lack of standardization, transparency, bias, tradeoffs, and the credibility of both information and the independence between rating organizations and companies [

17,

19]. These differences are corroborated empirically in the study conducted by Delmas and Blass [

18] in the chemical sector, where 15 companies in that sector were analyzed during the 2000–2005 period. Hence, it can be stated that these differences are not specific to a given sector, but exist in different sectors of the economy.

It has been verified that these differences in scores between rankings are due solely to the different forms of their performance, regardless of the differences that may exist between companies for economic-financial aspects, such as total assets, number of employees, and market capitalization.

Hence, nowadays, these rankings do not provide investors and shareholders with reliability, so they can be used as further information with which to assess companies’ performance. A trend is stressed for the “Finance Yahoo Sustainability” ranking—that of scoring above the rest. “RepTrack” can be considered the stablest, or that its variability is narrower. The results indicate wide variability among open-access CSR rankings depending on the analyzed companies and years. The widest variability was obtained for Facebook in 2014, and the smallest differences went to Oracle in 2012. In general, 2012 was the year with the smallest differences among rankings.

Rankings are useful for companies themselves because they help them to know their position compared to other companies in the sector, which can be useful for making improvements in the future and, with it, to increase their reputation in the market. However, this study shows that, depending on the pursued investment-financing object, some sustainability indicators are more useful than others. For example, if a company chooses to finance itself by issuing green bonds, which entails its environmental performance being monitored, the Green Ranking will be used as a reference. On the contrary, if investors wish to buy stocks of technology companies, they will look more at Finance Yahoo Sustainability, which encompasses the three dimensions (ESG), where it is also one of the stablest rankings that incurs a lower risk.

All this evidences the need for both financial agents and society to define a regulation or homogeneous standard for measuring and diffusing companies’ CSR actions, as well as standards for reporting financial information (e.g., International Financial Report Standards). This is because investors and shareholders particularly need increasingly stabler and more reliable indices to measure companies’ non-financial aspects.

Moreover, the companies studied herein have brands that have been more economically valued (the top 100) since 2000, which indicates that the highest economic value is no synonym of sustainability according to the agencies that measure CSR, because the companies in our sample have not always been included in the top 100 of open-access CSR rankings. In other words, there is no correspondence between CSR rankings and brands rankings. This is because the methodologies used to value brands and those that value CSR differ as the consultancy firms that value brands do not include any variables to contemplate the three sustainability dimensions in their methodologies, but only the economic-financial dimension. Likewise, no CSR measurement agency explicitly includes the economic-financial dimension in its methodology. However, some companies like Newsweek or Forbes implicitly consider them in order to include sales in productivity indicators.

Probably in the future, international consultancy firms of brands valuations will include variables of socio-environmental dimensions because non-financial information is becoming increasingly more relevant for investors and creditors and could also affect the value of brands. If a regulation or standard existed to measure CSR actions, it would help the agencies that value brands to include these results in their methodologies.

This work has demonstrated that levels of controversy is an important aspect in the CSR score of companies, but it is only measured explicitly by the Finance Yahoo ranking. According to this ranking, the technology sector generally has a low level of controversy [

65], but some analyzed companies have a high level of controversy, which is possibly due to them having performed some specific act with a negative impact on both their own operations and the environment. It would be desirable for all sustainability and brand valuation rankings to explicitly include this measure in order to compare them, although, implicitly, some rankings are already considering this by completely excluding companies from certain highly controversial sectors from their presence in rankings, which is the case for companies in the tobacco or armament sectors in the Global 100.

This study has two main limitations. One is its small sample size, which means that its results cannot be extrapolated to other technological brands and sectors because only 13 companies were selected, given the interest in knowing what effect CSR had on the best-valued brands. Future research could be extended to all companies in the technology sector on the Stock Exchange and to other sectors. The second limitation is the different time availability of the open-access CSR ranking scores, specifically for the years 2010, 2012, 2014, and 2015 for the rankings by Newsweek, the Reputation Institute, Finance Yahoo, and Forbes, respectively.

Finally, it would be relevant to perform a cost–benefit analysis in the future, and what it means for companies to provide CSR information, by comparing the cost of collecting information with the benefit that it confers their reputation, their position in rankings, and their market value.