Fighting Corruption and Enhancing Tax Compliance through Digitization: Achieving Sustainable Development in Romania

Abstract

1. Introduction

- Productive, evasive, and destructive entrepreneurship. Institutions influence the quality of entrepreneurship, the latency or explosion of entrepreneurship being the result of incentives in the economy [11,12]. The quality of institutional arrangements leads entrepreneurial initiatives towards productive, unproductive, or destructive efforts [13,14,15]. The institution of private property law has an important position within these entrepreneurial delimitations as it is the decisive source for undertaking productive entrepreneurial initiatives [16]. Tax institutions transfer resources from productive entrepreneurs to interest groups that have or want to have political power. This produces a brutal reallocation of wealth and change in entrepreneurial behavior. All these justify the importance of institutional arrangements for economic growth [17,18,19].

- Innovative entrepreneurship. It provides new products or services or it initiates and develops new methods to produce and distribute already existing goods at lower prices [20]. In addition, it takes responsibility, makes decisions based on judgments and changes the form and use of goods, resources, and institutions [21].

- Institutional entrepreneurship. The interaction between entrepreneurship and institutions is not one-way. Institutions influence the quality of the entrepreneurial environment; in its turn, entrepreneurship shapes the institutional environment. The influence of entrepreneurship on institutional arrangements is based on three major sources: market innovation, evasive actions, and political innovation [22]. Thus, the institutional process is continually evolving. Public policy decision makers cannot claim to have identified the definitive and lasting institutional arrangement without taking into account the reaction of the entrepreneurial environment. Entrepreneurs’ unexpected reactions require the re-evaluation of institutional choices. Institutional entrepreneurship is explained in terms of the actions of actors having interests in relation to certain institutional arrangements. These actors use resources to create new institutions or to improve the existing ones. In essence, the institutional entrepreneur is the individual who must take distance from the rules and practices associated with the dominant institutional arrangement and “institutionalize” new rules [23]. Productive entrepreneurship, viewed in terms of market initiatives whose role is to create wealth and improve living standards, is different from the one aimed to develop protective technologies. The latter refers to institutional entrepreneurship and seeks to provide the mechanisms that protect property rights, i.e., the essential institution required to involve entrepreneurs in productive activities [24].

- Political entrepreneurship. It is similar to the one occurring under market conditions, although the major difference between the voluntary nature of market exchanges and the coercive nature of those stemming from the political processes is emphasized. Political profit arises when decision makers can ensure resource allocation at lower costs or, in the form of votes won from wealth allocation among different interest groups [25]. This leads to the emergence of incentives conducive to corruption, the decrease and/or diversion of public funds resulting from taxation and, consequently, the endangering of the process of sustainable development [26,27].

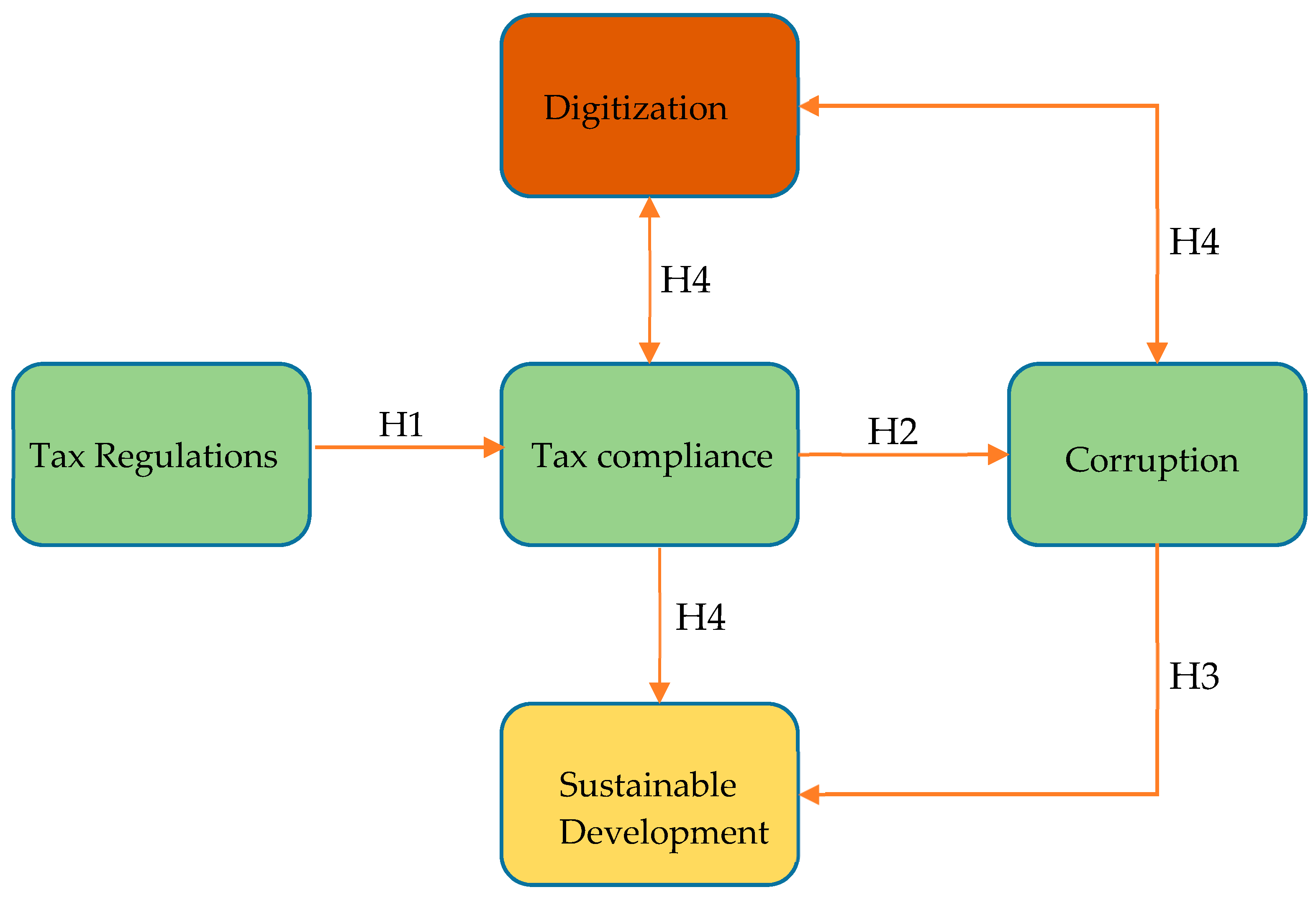

2. Materials and Methods

3. Results

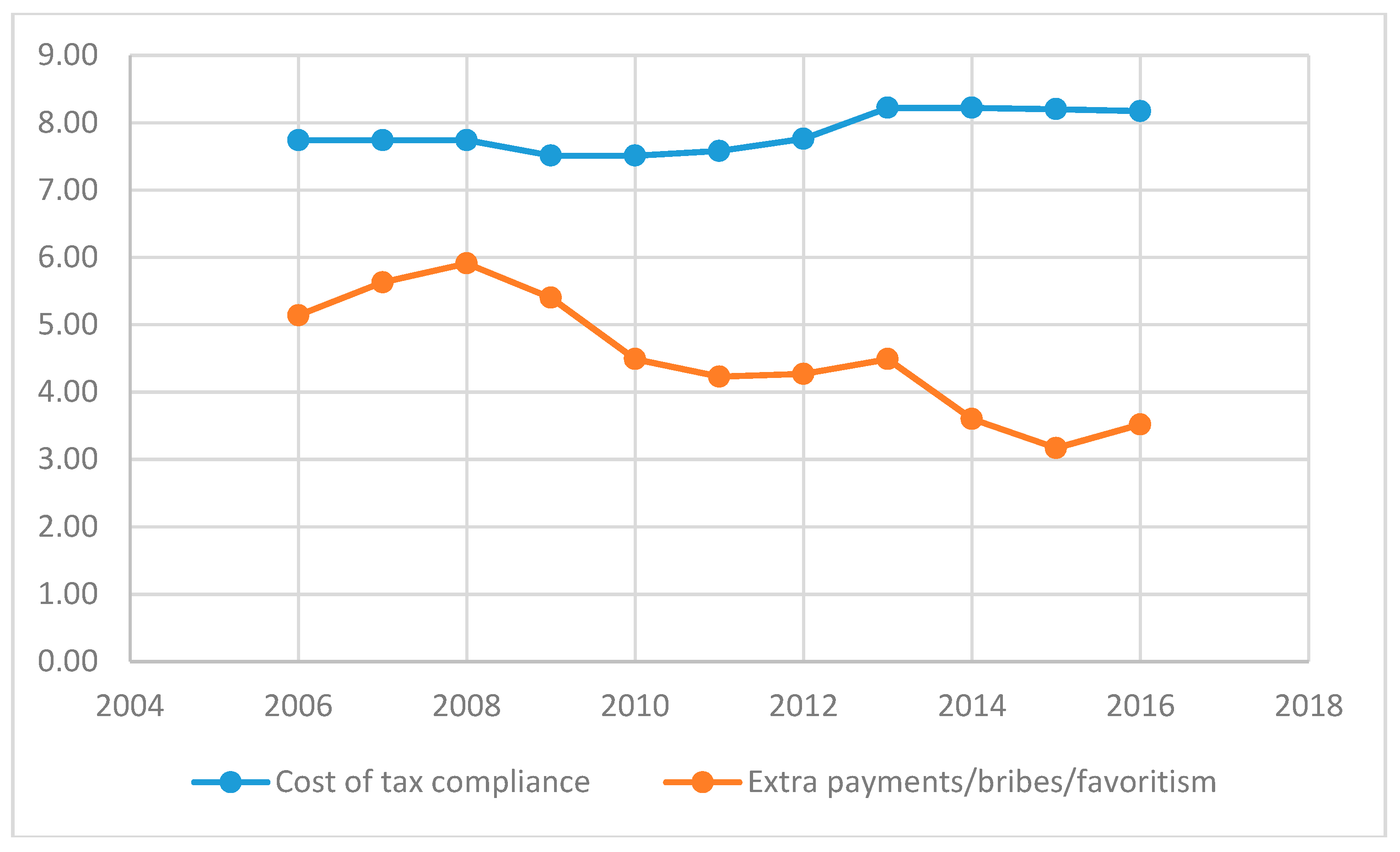

3.1. Hypothesis 1: Business Taxation Increases Entrepreneurs’ Costs of tax Compliance with Romanian tax Regulations

3.2. Hypothesis 2: Increasing Costs of tax Compliance Can be Correlated with Corruption Occurrence or Spread in Romania

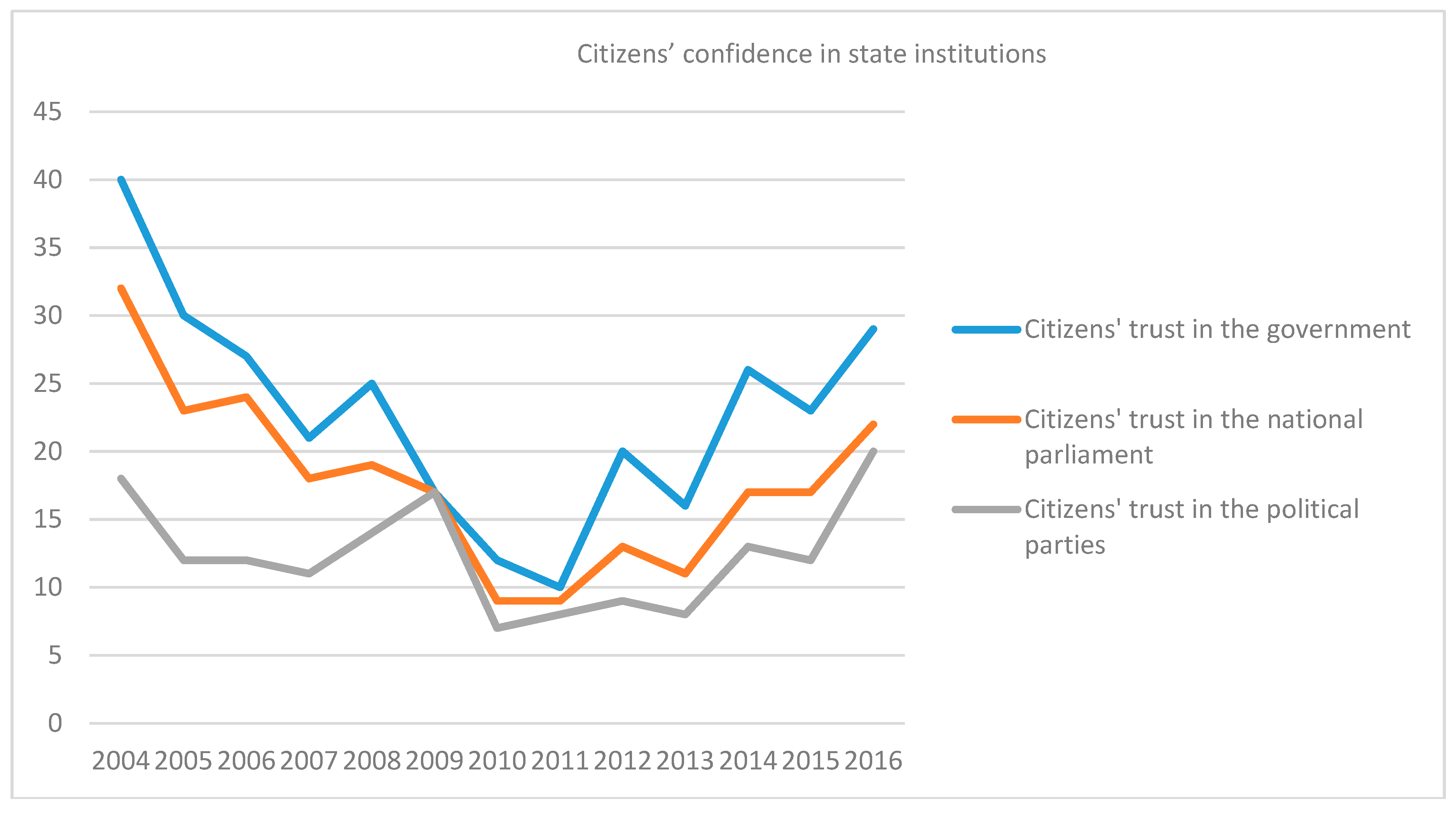

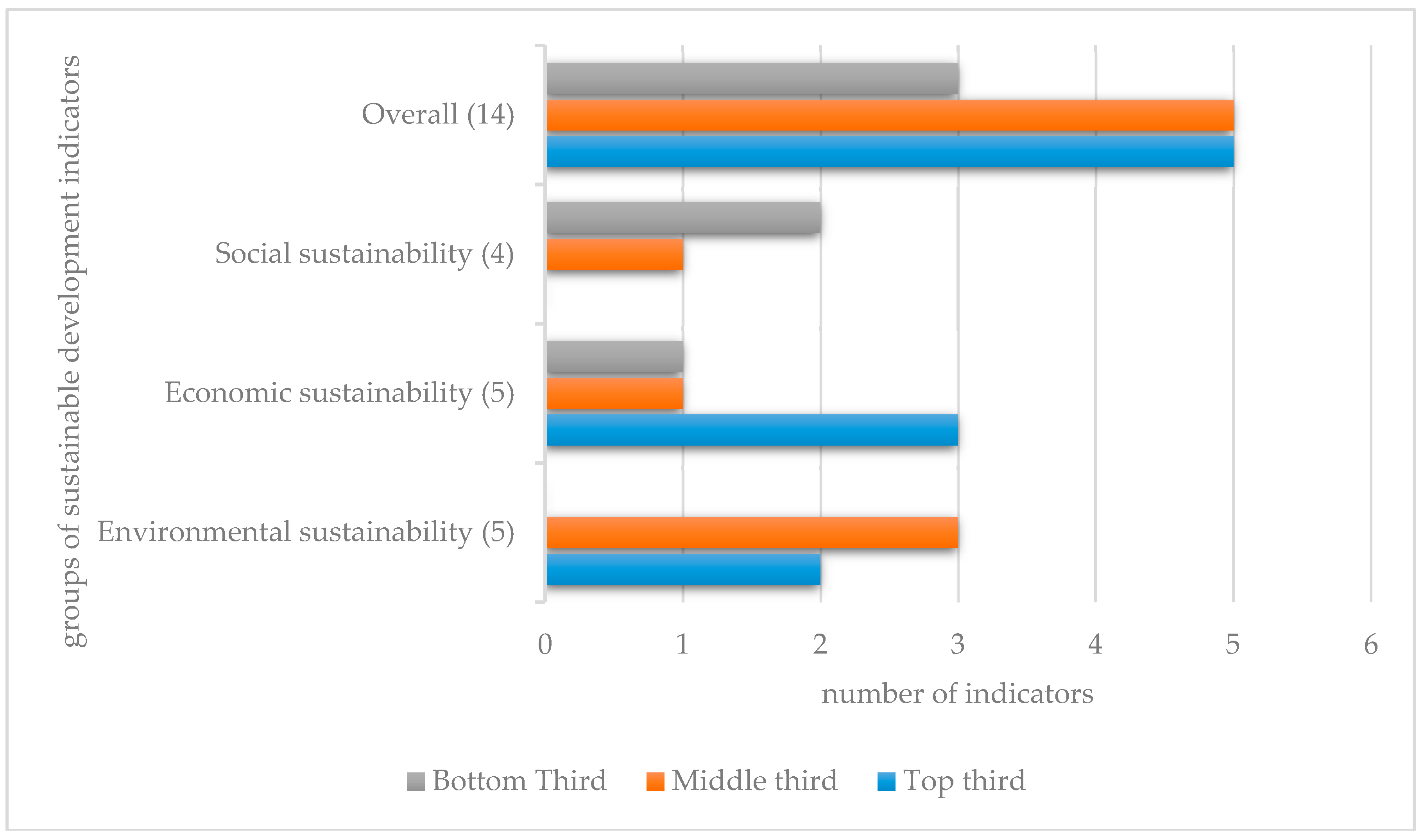

3.3. Hypothesis 3: The Spread of Corruption Endangers the Process of Sustainable Development in Romania

3.4. Hypothesis 4. Digitization Improves Tax Compliance and Reduces Corruption, Both of Which Leading to Increased Sustainable Development in Romania

- the year 2012 is the starting point when Romania made paying taxes easier for companies by introducing an electronic payment system and a unified return for social security contributions, while abolishing the annual minimum tax; in 2015, the process of simplifying paying taxes continued, with the majority using the electronic system for filing and paying taxes

- the trade register office electronically obtains the fiscal record certificates

- employers are to have an internal general register record of all their employees in electronic format, which is then transmitted to the Territorial Labor Inspectorate

- there is a collateral registry in operation for both incorporated and non-incorporated entities, which is unified geographically and by asset type with an electronic database indexed in the debtor’s name

- a score of 2 out of 8 regarding the format in which the majority of title or deed records are kept in the largest business city

- a score of 1 out of 4 for paying court fees electronically within the competent court

- a score of 1 out of 8 for the electronic database for recording boundaries, checking plans, and providing cadastral information (geographic information system)

- a score of 0 out of 8 regarding the format in which the majority of maps of land plots are kept in the largest business city—this means they are entirely kept on paper

- there is no electronic database for checking encumbrances (liens, mortgages, restrictions)

4. Discussion

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Popescu, G.H.; Davidescu, A.A.M.; Huidumac, C. Researching the Main Causes of the Romanian Shadow Economy at the Micro and Macro Levels: Implications for Sustainable Development. Sustainability 2018, 10, 3518. [Google Scholar] [CrossRef]

- Li, Z.F. Endogeneity in CEO Power: A Survey and Experiment. Invest. Anal. J. 2016, 45, 149–162. [Google Scholar] [CrossRef]

- Kim, E.; Ha, Y.; Kim, S. Public Debt, Corruption and Sustainable Economic Growth. Sustainability 2017, 9, 433. [Google Scholar] [CrossRef]

- Buchanan, J.M.; Gordon, T. The Collected Works of James M. Buchanan, Volume 3, The Calculus of Consent. Logical Foundations of Constitutional Democracy; Liberty Fund: Indianapolis, IN, USA, 1999. [Google Scholar]

- North, D.C. Institutions. J. Econ. Perspect. 1991, 5, 97–112. [Google Scholar] [CrossRef]

- North, D.C. Understanding the Process of Economic Change; Princeton University Press: Princeton, NJ, USA, 2005; pp. 103–115. ISBN 0-691-11805-1. [Google Scholar]

- North, D.C. Instituţii, Schimbare Instituţională şi Performanţă Economică; Î.E.P. Ştiinţa: Chişinău, Moldova, 2003; pp. 11–12. ISBN 9975-67-370-8. (In Romanian) [Google Scholar]

- Williamson, O.E. The New Institutional Economics: Taking Stock, Looking Ahead. J. Econ. Lit. 2000, 38, 595–613. [Google Scholar] [CrossRef]

- Fudulu, P. Teoria Culturilor şi Instituţiilor: Determinarea Culturală a Performanţelor Economice; Editura Universitară: București, Romania, 2007; pp. 139–142. ISBN 978-973-749-132-9. (In Romanian) [Google Scholar]

- Pană, C.M. Economia Instituțională a Mediului Educațional și Antreprenorial din România; Editura ASE: București, Romania, 2018; pp. 53–54. ISBN 978-606-34-0247-0. (In Romanian) [Google Scholar]

- Boettke, P.J.; Coyne, C.J. Entrepreneurship and development: Cause or consequence? In Advances in Austrian Economics; Koppl, R., Birner, J., Kurrild-Klitgaard, P., Eds.; Emerald Group Publishing Limited: Bingley, UK, 2003; Volume 6, pp. 67–87. ISBN 978-0-76231-041-8. [Google Scholar]

- Boettke, P.J.; Coyne, C.J.; Leeson, P.T. Institutional Stickiness and the New Development Economics. Am. J. Econ. Sociol. 2008, 67, 331–358. [Google Scholar] [CrossRef]

- Baumol, W.J. Entrepreneurship: Productive, Unproductive, and Distructive. J. Polit. Econ. 1990, 98, 893–921. [Google Scholar] [CrossRef]

- Sautet, F.E. The Role of Institutions in Entrepreneurship: Implications for Development Policy. In Mercatus Policy Series; Policy Primer no. 1; Mercatus Center: Arlington, VA, USA, 2005; pp. 1–18. [Google Scholar]

- Sobel, R.S. Testing Baumol: Institutional quality and the productivity of entrepreneurship. J. Bus. Ventur. 2008, 23, 641–655. [Google Scholar] [CrossRef]

- Boettke, P.J.; Fink, A. Institutions first. J. Econ. 2011, 7, 499–504. [Google Scholar] [CrossRef]

- Acemoglu, D.; Johnson, S.; Robinson, J. Institutions as a fundamental cause of long-run growth. In Handbook of Economic Growth; Aghion, P., Durlauf, S.N., Eds.; North Holland Publishing Co.: Amsterdam, The Netherlands, 2005; Volume 1A, pp. 386–464. ISBN 9780444520418. [Google Scholar]

- Acemoglu, D. Institutions, Factor Prices, and Taxation: Virtues of Strong States? Am. Econ. Rev. 2010, 100, 115–119. [Google Scholar] [CrossRef]

- Acemoglu, D.; Robinson, J.A. De ce Eșuează Națiunile; Litera: Bucuresti, Romania, 2012; pp. 409–447. ISBN 978-606-33-0025-07. (In Romanian) [Google Scholar]

- Baumol, W.J.; Litan, R.E.; Schramm, C.J. Capitalismul Bun, Capitalismul Rău şi Economia Dezvoltării şi a Prosperităţii; Polirom: Iaşi, Romania, 2009; p. 12. ISBN 978-973-46-1104-1. (In Romanian) [Google Scholar]

- Hébert, R.F.; Link, A.N. In Search of the Meaning of Entrepreneurship. Small Bus. Econ. 1989, 39–49. [Google Scholar] [CrossRef]

- Henrekson, M.; Sanandaji, T. The interaction of entrepreneurship and institutions. J. Econ. 2011, 7, 47–75. [Google Scholar] [CrossRef]

- Garud, R.; Hardy, C.; Maguire, S. Institutional Entrepreneurship as Embedded Agency: An Introduction to the Special Issue. Organ. Stud. 2007, 28, 957–969. [Google Scholar] [CrossRef]

- Leeson, P.T.; Boettke, P.J. Two-Tiered Entrepreneurship and Economic Development. Int. Rev. Law Econ. 2009, 29, 252–259. [Google Scholar] [CrossRef]

- Holcombe, R.G. Political Entrepreneurship and the Democratic Allocation of Economic Resources. Rev. Austrian Econ. 2002, 15, 143–159. [Google Scholar] [CrossRef]

- Buchanan, J.M.; Tullock, G. Calculul Consimțământului: Fundamentele Logice ale Democrației Constiuționale; Publica: București, Romania, 2010; pp. 356–372. ISBN 978-973-1931-27-2. (In Romanian) [Google Scholar]

- Buchanan, J.M. Limitele Libertăţii: Între Anarhie şi Leviathan; Institutul European: Iași, Romania, 1997; pp. 219–226. ISBN 973-586-038-4. (In Romanian) [Google Scholar]

- Selke, S.; Mallick, B.; Holzbach, A. e-Honesty: Technical Potentials and Social Risks of Local e-Government Strategies in Bangladesh for Supporting the Fight against Corruption. In Proceedings of the 8th European Conference on eGovernment, Lausanne, Switzerland, 10–11 July 2008; Remenyi, D., Ed.; Acad. Conferences Ltd.: Reading, UK, 2008; pp. 475–482. [Google Scholar]

- Foley, J.; Galllery, K. An Investigative Study of Promoting Awareness and Increasing Registration of PAYE Anytime in the Border Midlands West Region. In Proceedings of the 12th European Conference on eGovernment, Barcelona, Spain, 14–15 June 2012; Gasco, M., Ed.; Acad. Conferences Ltd.: Reading, UK, 2012; pp. 227–233. [Google Scholar]

- Klun, M. Does eTaxation Reduce Taxation Compliance Costs. In Proceedings of the 11th European Conference on eGovernment, Ljubljana, Slovenia, 16–17 June 2011; Klun, M., Decman, M., Jukic, T., Eds.; Acad. Conferences Ltd.: Reading, UK, 2011; pp. 335–338. [Google Scholar]

- Leake, S. Risk Analysis, or How to Avoid Contact with Most of Your Customers. In Proceedings of the 8th European Conference on eGovernment, Lausanne, Switzerland, 10–11 July 2008; Remenyi, D., Ed.; Acad. Conferences Ltd.: Reading, UK, 2008; pp. 347–352. [Google Scholar]

- Xia, H.; Tan, Q.; Bai, J. Corruption and Technological Innovation in Private Small-Medium Scale Companies: Does Female Top Management Play a Role? Sustainability 2018, 10, 2252. [Google Scholar] [CrossRef]

- Johnstone, M. Corupţia şi Formele Sale. Bogăţie, Putere şi Democraţie; Editura Polirom: Bucharest, Romania, 2007; p. 31. ISBN 978-973-46-0446-3. (In Romanian) [Google Scholar]

- World Bank. Data Bank. Data Catalog, doing Business. Available online: http://databank.worldbank.org/data/reports.aspx?source=doing-business (accessed on 27 November 2018).

- World Bank, Doing Business. Measuring Business Regulations. Methodology. Available online: http://www.doingbusiness.org/en/methodology/paying-taxes (accessed on 27 November 2018).

- World Economic Forum. The Global Competitiveness Report 2018. Downloads. Data Set. Available online: http://reports.weforum.org/global-competitiveness-report-2018/downloads/ (accessed on 3 December 2018).

- World Bank, Doing Business 2012. Economy Profile: Romania. Available online: https://openknowledge.worldbank.org/bitstream/handle/10986/26999/654500Romania00BOX0365768B00PUBLIC0.pdf?sequence=1&isAllowed=y (accessed on 3 December 2018).

- Pană, M.C.; Staicu, G.S. Institutional Framework, Transaction Costs and Entrepreneurship. An Analysis of the Romanian Business Environment. In The International Conference in Economics and Administration, Proceedings of the International Conference in Economics and Administration, Bucharest, Romania, 5–6 June 2015; Druică, E., Ed.; Editura Universității din București: București, Romania, 2015; pp. 299–309. [Google Scholar]

- Coase, R.H. The Nature of the Firm. Econ.-New Ser. 1937, 4, 386–405. [Google Scholar] [CrossRef]

- Allen, D.W. Transaction Costs. In Encyclopedia of Law and Economics; Bouckaert, B., De Geest, G., Eds.; Edward Elgar: Cheltenham, UK, 2000; Volume 1, pp. 893–926. ISBN 1-85898-984-1. [Google Scholar]

- Alchian, A.A. Some Implications of Recognition of Property Right Transaction Costs. In Economics and Social Institutions; Brunner, K., Ed.; Springer: Dordrecht, The Netherlands, 1979; Volume 1, pp. 233–254. ISBN 978-94-009-9259-7. [Google Scholar]

- Dang, C.; Li, Z.F.; Yang, C. Measuring firm size in empirical corporate finance. J. Bank. Financ. 2018, 86, 159–176. [Google Scholar] [CrossRef]

- Fraser Institute. Economic Freedom of the World: 2018 Annual Report. View the Data Set-Data for Researchers. Available online: https://www.fraserinstitute.org/resource-file?nid=12378&fid=10644 (accessed on 11 December 2018).

- Gwartney, J.; Lawson, R.; Hall, J.; Murphy, R. Economic Freedom of the World: 2018 Annual Report, 2018 ed.; Fraser Institute: Vancouver, BC, Canada, 2018; pp. 224–225. ISBN 978-0-88975-505-5. [Google Scholar]

- World Economic Forum. Global Competitiveness Index 2017–2018. Appendix A: Methodology and Computation of the GCI 2017–2018. Available online: http://reports.weforum.org/global-competitiveness-index-2017-2018/appendix-a-methodology-and-computation-of-the-global-competitiveness-index-2017-2018/ (accessed on 11 December 2018).

- World Economic Forum. Global Competitiveness Index 2017–2018. Appendix D: Technical Notes and Sources. Available online: http://reports.weforum.org/global-competitiveness-index-2017-2018/appendix-d-technical-notes-and-sources/ (accessed on 11 December 2018).

- Sustainable Development Goals. 17 Goals to Transform Our World. Available online: https://www.un.org/sustainabledevelopment/sustainable-development-goals/ (accessed on 18 December 2018).

- Sustainable Development Goals. Knowledge Platform: Progress of Goal 16 in 2018. Available online: https://sustainabledevelopment.un.org/sdg16 (accessed on 18 December 2018).

- European Commission. Public Opinion in the European Union. Standard Eurobarometer 90. November 2018. Available online: http://ec.europa.eu/commfrontoffice/publicopinion/index.cfm/Survey/index#p=1&instruments=STANDARD (accessed on 22 January 2019).

- European Commission. Public Opinion in the European Union. Eurobarometer A-Z. Special Eurobarometer 470. Corruption. Summary. October 2017. Available online: http://ec.europa.eu/commfrontoffice/publicopinion/index.cfm/Survey/getSurveyDetail/instruments/SPECIAL/surveyKy/2176 (accessed on 23 January 2019).

- Sustainable Development Goals. Knowledge Platform: Progress of Goal 17 in 2018. Available online: https://sustainabledevelopment.un.org/sdg17 (accessed on 18 December 2018).

- United Nations Development Programme. Human Development Reports. Human Development Indicators. Human Development for Everyone. Briefing Note for Countries on the 2016 Human Development Report: Romania. Available online: http://hdr.undp.org/en/countries/profiles/ROU. (accessed on 4 January 2019).

- Voicu, C. Îndreptar de Economie Subterană. Abordare Multidimensională a Eşecului Raţionalităţii Economice; Editura ASE: Bucharest, Romania, 2015; p. 112. ISBN 978-606-505-882-8. (In Romanian) [Google Scholar]

- Klitgaard, R. International Cooperation against Corruption. Financ. Dev. 1998, 1998, 3–6. [Google Scholar]

- Transparency International. Surveys, Corruption Perceptions Index 2017, 21 February 2018. Available online: https://www.transparency.org/news/feature/corruption_perceptions_index_2017 (accessed on 4 January 2019).

- Mungiu-Pippidi, A.; Dadasov, R.; Kukutschka, R.M.B.; Alvarado, N.; Dykes, V.; Kossow, N.; Khaghaghordyan, K.; Index of Public Integrity. European Research Centre for Anti-Corruption and State-Building (ERCAS). 2017. Available online: https://integrity-index.org/country-profile/?id=ROM&yr=2017 (accessed on 19 November 2018).

- Smith, A. An Inquiry into the Nature and Causes of the Wealth of Nations; Edwin Cannan: London, UK, 1776; ISBN 0865970068. [Google Scholar]

- Laffer, A.B. The Laffer Curve: Past, Present, and Future, The Heritage Foundation. Available online: https://www.heritage.org/research/taxes/bg1765.cfm (accessed on 18 February 2019).

- European Commission. Digital Economy and Society Index (DESI) 2018. Country Report Romania. 2018. Available online: http://ec.europa.eu/information_society/newsroom/image/document/2018-20/ro-desi_2018-country-profile_eng_199394CB-B93B-4B85-C789C5D6A54B83FC_52230.pdf (accessed on 17 November 2018).

- European Commission. Digital Economy and Society Index (DESI). Romania. Available online: https://ec.europa.eu/digital-single-market/en/scoreboard/romania (accessed on 8 December 2018).

- INSSE. eGovernment Online Availability. Available online: http://www.insse.ro/cms/files/Web_IDD_BD_ro/O13/O13_4-Disponibilitatea%20guvernarii.xls (accessed on 17 November 2018).

- INSSE. Share of Individuals Aged 16 to 74 in the Last Three Months for Interaction with Public Authorities in the Total Individuals Aged 16–74. Available online: http://www.insse.ro/cms/files/Web_IDD_BD_ro/O13/O13_5-Utilizarea%20guvernarii%20electronice.xls (accessed on 17 November 2018).

- Ernst & Young. Global Tax Alert. Romania Introduces Mandatory E-Filing of Certain Tax Statements. 2017. Available online: https://www.google.ro/search?q=romania+tax+filing+ey&spell=1&sa=X&ved=0ahUKEwis6IjttNveAhVMkSwKHZouDZoQBQgoKAA&biw=1242&bih=597 (accessed on 17 November 2018).

- Ernst & Young. Digital Tax Administration Trends—Timeline. Available online: http://cdn.instantmagazine.com/upload/6014/ey-000053126_indirect_tax_thought_leadership_1.ac4869b7e5a8.pdf (accessed on 17 November 2018).

- European Commission. eGovernment in Romania. 2015. Available online: https://joinup.ec.europa.eu/sites/default/files/inline-files/eGovernment%20in%20Romania%20-%20February%202016%20-%20v1_00.pdf (accessed on 17 November 2018).

- World Bank, Doing Business 2019. Romania. 16th Edition. 2018. Available online: http://www.doingbusiness.org/content/dam/doingBusiness/country/r/romania/ROM.pdf (accessed on 17 November 2018).

| Year | Paying Taxes | ||

|---|---|---|---|

| Payments (Number Per Year) | Time (Hours Per Year) | Total Tax Rate (Percentage of Profit) | |

| 2006 | 108 | 192 | 55.8 |

| 2007 | 108 | 195 | 48.2 |

| 2008 | 108 | 204 | 45.6 |

| 2009 | 113 | 204 | 45.4 |

| 2010 | 113 | 204 | 45.5 |

| 2011 | 113 | 230 | 44 |

| 2012 | 113 | 224 | 43.5 |

| 2013 | 41 | 218 | 43.3 |

| 2014 | 39 | 202 | 43.2 |

| 2015 | 14 | 161 | 43.2 |

| 2016 | 14 | 161 | 42 |

| 2017 | 14 | 161 | 40 |

| 2018 | 14 | 163 | 40 |

| 2019 | 14 | 163 | 40 |

| Entrepreneurial Behaviors | Transaction Costs Level (Compliance Costs and Non-Compliance Costs) | Costs and Benefits of State Capture (Official and Unofficial) |

|---|---|---|

| Productive | Low level Compliance costs are lower than non-compliance costs | Benefits are lower than costs |

| Elusive | High level Compliance costs are higher than non-compliance costs | Benefits are lower than costs |

| Destructive | Low level Compliance costs are higher than non-compliance costs | Benefits are higher than costs |

| Year | Irregular Payments and Bribes | Favoritism in Decisions of Government Officials | Diversion of Public Funds |

|---|---|---|---|

| 2006 | * | 2.34 | 2.91 |

| 2007 | * | 2.34 | 3.17 |

| 2008 | * | 2.42 | 3.27 |

| 2009 | * | 2.34 | 3.25 |

| 2010 | 4.36 | 2.39 | 3.08 |

| 2011 | 3.97 | 2.47 | 2.79 |

| 2012 | 3.73 | 2.38 | 2.55 |

| 2013 | 3.79 | 2.24 | 2.51 |

| 2014 | 3.89 | 2.55 | 3.01 |

| 2015 | 3.63 | 2.43 | 2.92 |

| 2016 | 3.59 | 2.21 | 2.81 |

| 2017 | 3.98 | 2.25 | 3.12 |

| Types of Corruption | Political Opportunities | Economic Opportunities | Capacity of State and Society | Economic Institutions |

|---|---|---|---|---|

| Influential markets | Mature democracies

| Mature Markets

| Strong | High |

| Cartels of elites | Reforming democracies

| Reforming Markets

| Moderate | Medium |

| Oligarchs and clans | Transition regimes

| New Markets

| Low | Weak |

| Official moguls | Undemocratic

| New Markets

| Low | Weak |

| Components | Component Score | World Rank (N = 109) | Regional Rank (N = 30) | Income Group Rank (N = 28) |

|---|---|---|---|---|

| Judicial Independence | 5.49 | 52 | 23 | 10 |

| Administrative Burden | 8.96 | 35 | 21 | 5 |

| Trade Openness | 10 | 1 | 1 | 1 |

| Budget Transparency | 8.71 | 20 | 10 | 6 |

| E-Citizenship | 6.05 | 48 | 30 | 10 |

| Freedom of the Press | 6.74 | 40 | 26 | 5 |

| Digital Public Services | Romania | EU Score | |

|---|---|---|---|

| Rank | Score | ||

| DESI 2018 | 26 | 41.4 | 57.5 |

| DESI 2017 | 26 | 37.1 | 53.7 |

| DESI 2016 | 28 | 0.21 | 0.51 |

| DESI 2015 | 28 | 0.27 | 0.54 |

| DESI 2014 | 25 | 0.27 | 0.45 |

| Component | Romania | EU DESI 2018 | |||

|---|---|---|---|---|---|

| DESI 2018 | DESI 2017 | ||||

| Value | Rank | Value | Rank | ||

| 5a1 eGovernment Users (%internet users needing to submit forms) | 80% | 7 | 84% | 4 | 58% |

| 5a2 Pre-filled Forms (Score: 0 to 100) | 12 | 28 | 12 | 27 | 53 |

| 5a3 Online Service Completion (Score: 0 to 100) | 61 | 28 | 55 | 28 | 84 |

| 5a4 Digital Public Services for Businesses (Score: 0 to 100, including domestic and cross-border) | 51 | 28 | 48 | 28 | 83 |

| 5a5 Open Data (% of maximum score) | 79% | 10 | 63% | 11 | 73% |

| 5a6 eHealth Services (% individuals) | 11% | 21 | N/A | - | 18% |

| Tax Statement Code | Tax Statement Denomination |

|---|---|

| Form 100 | Statement regarding the liabilities due to the State Budget |

| Form 101 | Statement regarding corporate income tax |

| Form 120 | Excise duties return |

| Form 205 | Informative statement regarding the withheld tax, income derived from gambling and gains/losses derived from investments for income beneficiaries |

| Form 207 | Informative statement regarding the withheld tax/exempt incomes for non-resident income beneficiaries |

| Form 208 | Informative statement regarding the tax on the income derived from the transfer of the real estate property from the personal property |

| Form 300 | Value added tax return |

| Form 301 | Special value added tax return |

| Form 307 | Statement regarding the amounts resulting from the adjustment/correction of the adjustment/VAT regularization |

| Form 311 | Statement regarding output VAT due by taxable persons whose VAT registration number has been cancelled as per art. 316 para. (11) letters (a)–(e), letter (g) or letter (h) of Law no. 227/2015 regarding the Tax Code |

| Form 390 | Recapitulative statement regarding the intra-Community supplies/acquisitions of goods/services |

| Form 394 | Informative statement for local supplies of goods/services and acquisitions performed within the national territory by taxable persons registered for VAT purposes |

| Form 710 | Rectifying statement |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Fanea-Ivanovici, M.; Muşetescu, R.-C.; Pană, M.-C.; Voicu, C. Fighting Corruption and Enhancing Tax Compliance through Digitization: Achieving Sustainable Development in Romania. Sustainability 2019, 11, 1480. https://doi.org/10.3390/su11051480

Fanea-Ivanovici M, Muşetescu R-C, Pană M-C, Voicu C. Fighting Corruption and Enhancing Tax Compliance through Digitization: Achieving Sustainable Development in Romania. Sustainability. 2019; 11(5):1480. https://doi.org/10.3390/su11051480

Chicago/Turabian StyleFanea-Ivanovici, Mina, Radu-Cristian Muşetescu, Marius-Cristian Pană, and Cristina Voicu. 2019. "Fighting Corruption and Enhancing Tax Compliance through Digitization: Achieving Sustainable Development in Romania" Sustainability 11, no. 5: 1480. https://doi.org/10.3390/su11051480

APA StyleFanea-Ivanovici, M., Muşetescu, R.-C., Pană, M.-C., & Voicu, C. (2019). Fighting Corruption and Enhancing Tax Compliance through Digitization: Achieving Sustainable Development in Romania. Sustainability, 11(5), 1480. https://doi.org/10.3390/su11051480