Improving Financial Service Innovation Strategies for Enhancing China’s Banking Industry Competitive Advantage during the Fintech Revolution: A Hybrid MCDM Model

Abstract

1. Introduction

2. Evaluation Attributions Development for Banking Sector

2.1. New Service Concpet

2.2. New Coustomer Interaction

2.3. New Business Partners

2.4. New Revenue Models

2.5. Organizational Innovation

2.6. Technnological Innovation

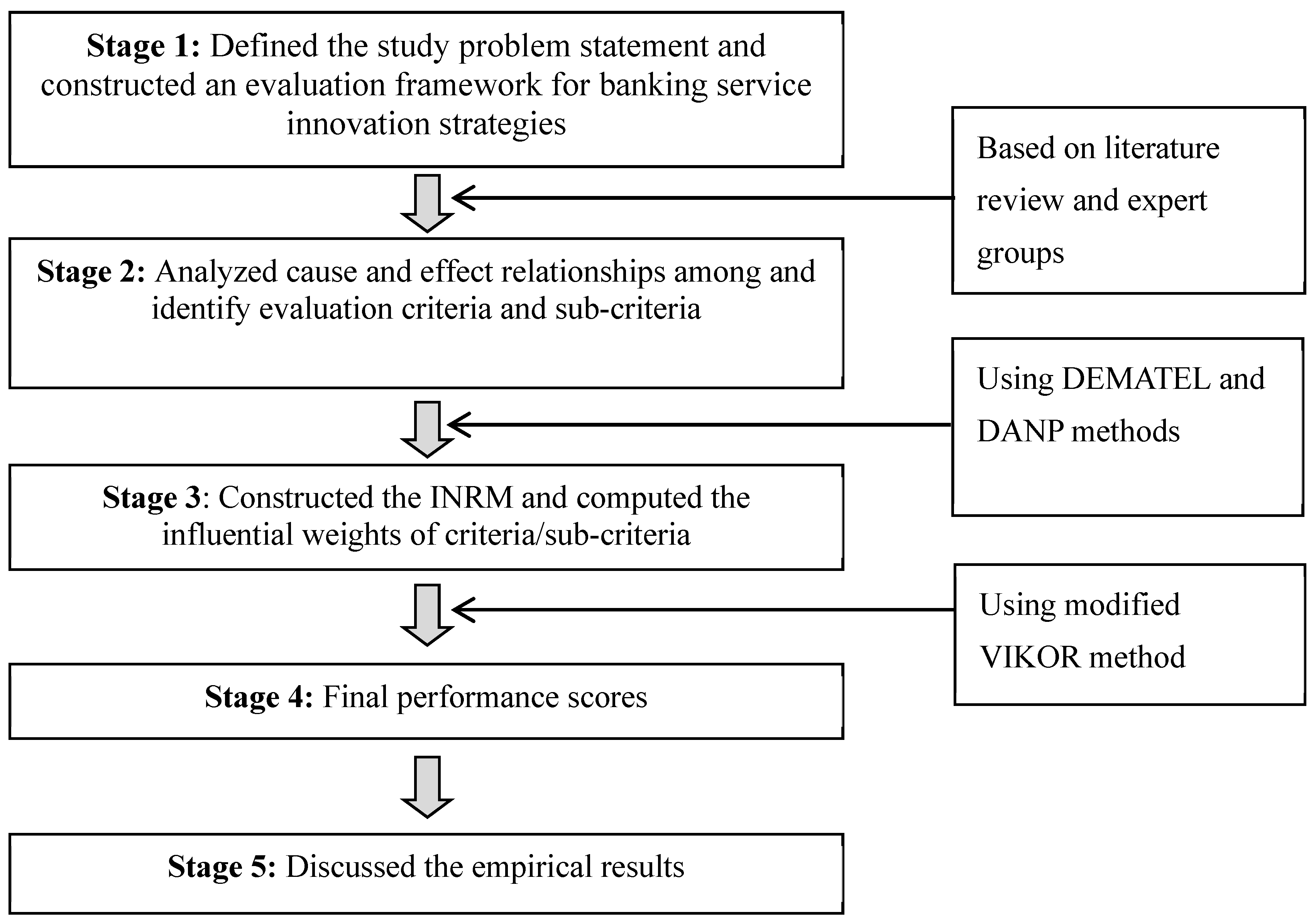

3. Research Design and Methodology

3.1. Establishment of an Influential Network Relationship Map Based on the DEMATEL

3.2. Obtain the Influential Weights by DANP

3.3. Analysis of Banking Service Innovation Strategies and Evaluation of the Gaps by Using Modified VIKOR Method

4. Empirical Cases from the Banking Service Innovation Following Fintech Revolution

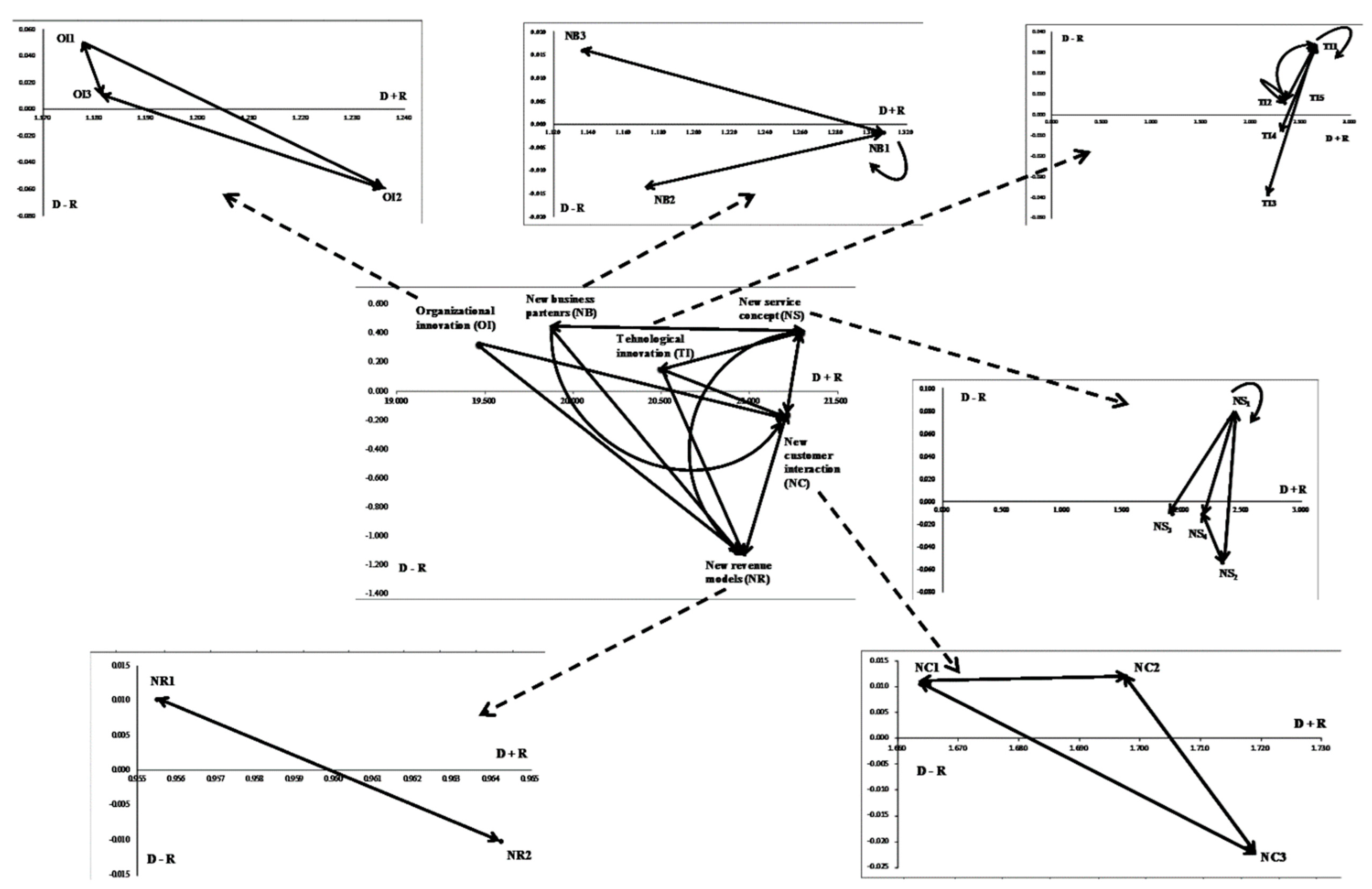

4.1. Collection of Data and Information from the DEMATEL Technique

4.2. Analyze Influential Weights Using the DANP Technique

4.3. Evaluating the Strategies of Banking Service Innovation Using the Modified VIKOR

4.4. Discussions and Managerial Implications

5. Conclusions and Remarks

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A. DEMATEL Method

Appendix B. DANP Method

Appendix C. Modified VIKOR Method

Appendix D

| NS1 | NS2 | NS3 | NS4 | NC1 | NC2 | NC3 | NB1 | NB2 | NB3 | NR1 | NR2 | OI1 | OI2 | OI3 | TI1 | TI2 | TI3 | TI4 | TI5 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| NS1 | 0.000 | 3.407 | 2.037 | 2.889 | 3.370 | 3.333 | 3.444 | 2.481 | 2.481 | 2.222 | 2.556 | 2.815 | 2.556 | 2.778 | 2.407 | 3.111 | 2.741 | 2.667 | 2.852 | 2.926 |

| NS2 | 3.000 | 0.000 | 1.852 | 2.407 | 2.963 | 2.926 | 2.852 | 2.370 | 1.963 | 2.333 | 2.222 | 2.778 | 2.370 | 2.704 | 2.333 | 2.852 | 2.889 | 2.481 | 2.667 | 2.407 |

| NS3 | 2.000 | 2.148 | 0.000 | 2.111 | 1.963 | 2.148 | 1.815 | 2.407 | 1.593 | 2.000 | 1.778 | 2.259 | 2.148 | 2.556 | 1.963 | 2.815 | 2.000 | 2.593 | 1.852 | 1.926 |

| NS4 | 2.778 | 2.556 | 1.926 | 0.000 | 2.667 | 2.667 | 2.519 | 2.593 | 2.741 | 2.148 | 2.481 | 2.222 | 2.111 | 2.148 | 2.074 | 2.778 | 2.037 | 2.000 | 2.481 | 2.259 |

| NC1 | 3.333 | 3.148 | 2.111 | 2.556 | 0.000 | 2.963 | 2.926 | 2.481 | 2.444 | 2.111 | 2.667 | 2.074 | 2.111 | 2.222 | 2.000 | 2.593 | 2.148 | 2.074 | 2.296 | 2.185 |

| NC2 | 3.333 | 3.259 | 2.519 | 2.630 | 2.704 | 0.000 | 3.111 | 2.667 | 2.407 | 1.926 | 2.259 | 2.370 | 2.000 | 2.296 | 2.037 | 2.667 | 2.519 | 2.074 | 2.481 | 2.481 |

| NC3 | 3.370 | 3.074 | 2.185 | 2.630 | 2.778 | 2.667 | 0.000 | 2.519 | 2.370 | 2.296 | 2.111 | 2.667 | 2.111 | 2.333 | 2.296 | 3.037 | 2.630 | 2.074 | 2.259 | 2.333 |

| NB1 | 2.333 | 2.630 | 2.407 | 2.852 | 2.519 | 2.444 | 2.889 | 0.000 | 1.556 | 1.444 | 2.630 | 2.333 | 2.148 | 2.037 | 2.037 | 2.852 | 2.481 | 2.370 | 2.593 | 2.444 |

| NB2 | 2.444 | 2.259 | 1.852 | 2.926 | 2.667 | 2.037 | 2.407 | 1.630 | 0.000 | 1.407 | 2.519 | 2.148 | 1.704 | 1.926 | 1.667 | 2.148 | 1.593 | 1.704 | 2.296 | 1.852 |

| NB3 | 2.333 | 2.519 | 2.296 | 2.630 | 2.259 | 1.963 | 2.296 | 1.407 | 1.444 | 0.000 | 2.222 | 2.074 | 1.630 | 1.926 | 1.667 | 2.296 | 2.074 | 2.037 | 2.111 | 2.111 |

| NR1 | 2.519 | 2.148 | 2.296 | 2.741 | 2.741 | 2.704 | 2.667 | 2.630 | 2.667 | 2.370 | 0.000 | 1.963 | 2.444 | 2.407 | 2.333 | 2.667 | 2.222 | 2.259 | 2.407 | 2.444 |

| NR2 | 2.741 | 3.185 | 2.519 | 2.185 | 2.296 | 2.593 | 2.704 | 2.593 | 2.370 | 2.111 | 1.926 | 0.000 | 2.370 | 2.667 | 2.111 | 2.407 | 2.630 | 2.148 | 2.259 | 2.148 |

| OI1 | 2.222 | 2.593 | 1.963 | 2.000 | 1.889 | 1.852 | 2.148 | 2.074 | 1.852 | 1.778 | 2.148 | 2.148 | 0.000 | 2.556 | 2.519 | 2.111 | 1.889 | 1.889 | 1.741 | 1.926 |

| OI2 | 2.630 | 2.963 | 2.667 | 2.222 | 2.000 | 2.296 | 2.370 | 1.444 | 1.556 | 1.778 | 1.889 | 2.370 | 1.741 | 0.000 | 2.222 | 1.778 | 1.667 | 1.444 | 1.667 | 1.852 |

| OI3 | 2.519 | 2.481 | 2.222 | 2.074 | 1.778 | 1.963 | 2.111 | 1.889 | 1.741 | 1.741 | 2.259 | 2.037 | 2.000 | 2.556 | 0.000 | 1.852 | 1.741 | 1.815 | 1.926 | 1.889 |

| TI1 | 2.889 | 2.852 | 3.148 | 2.815 | 2.481 | 3.333 | 3.111 | 2.667 | 2.185 | 1.963 | 2.778 | 2.926 | 2.148 | 2.185 | 2.074 | 0.000 | 2.667 | 2.222 | 2.333 | 2.778 |

| TI2 | 2.741 | 2.704 | 2.259 | 2.481 | 2.407 | 2.704 | 2.963 | 2.630 | 1.704 | 1.815 | 2.370 | 2.741 | 1.852 | 2.185 | 1.926 | 2.481 | 0.000 | 1.778 | 1.667 | 2.259 |

| TI3 | 2.481 | 2.370 | 2.556 | 2.333 | 2.074 | 2.185 | 2.074 | 2.333 | 1.630 | 1.889 | 2.074 | 2.259 | 1.741 | 1.963 | 1.815 | 1.963 | 1.778 | 0.000 | 2.185 | 1.778 |

| TI4 | 3.037 | 3.074 | 1.815 | 2.481 | 2.556 | 2.296 | 2.296 | 2.741 | 2.630 | 2.000 | 2.407 | 2.296 | 1.593 | 1.926 | 1.704 | 2.074 | 1.852 | 2.222 | 0.000 | 1.889 |

| TI5 | 2.667 | 2.704 | 1.741 | 2.407 | 2.741 | 2.593 | 2.444 | 2.444 | 2.000 | 1.815 | 2.333 | 2.407 | 1.852 | 2.222 | 1.815 | 2.741 | 2.296 | 1.889 | 1.963 | 0.000 |

Appendix E

| NS1 | NS2 | NS3 | NS4 | NC1 | NC2 | NC3 | NB1 | NB2 | NB3 | NR1 | NR2 | OI1 | OI2 | OI3 | TI1 | TI2 | TI3 | TI4 | TI5 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| NS1 | 0.000 | 0.064 | 0.038 | 0.054 | 0.064 | 0.063 | 0.065 | 0.047 | 0.047 | 0.042 | 0.048 | 0.053 | 0.048 | 0.052 | 0.045 | 0.059 | 0.052 | 0.050 | 0.054 | 0.055 |

| NS2 | 0.057 | 0.000 | 0.035 | 0.045 | 0.056 | 0.055 | 0.054 | 0.045 | 0.037 | 0.044 | 0.042 | 0.052 | 0.045 | 0.051 | 0.044 | 0.054 | 0.054 | 0.047 | 0.050 | 0.045 |

| NS3 | 0.038 | 0.040 | 0.000 | 0.040 | 0.037 | 0.040 | 0.034 | 0.045 | 0.030 | 0.038 | 0.033 | 0.043 | 0.040 | 0.048 | 0.037 | 0.053 | 0.038 | 0.049 | 0.035 | 0.036 |

| NS4 | 0.052 | 0.048 | 0.036 | 0.000 | 0.050 | 0.050 | 0.047 | 0.049 | 0.052 | 0.040 | 0.047 | 0.042 | 0.040 | 0.040 | 0.039 | 0.052 | 0.038 | 0.038 | 0.047 | 0.043 |

| NC1 | 0.063 | 0.059 | 0.040 | 0.048 | 0.000 | 0.056 | 0.055 | 0.047 | 0.046 | 0.040 | 0.050 | 0.039 | 0.040 | 0.042 | 0.038 | 0.049 | 0.040 | 0.039 | 0.043 | 0.041 |

| NC2 | 0.063 | 0.061 | 0.047 | 0.050 | 0.051 | 0.000 | 0.059 | 0.050 | 0.045 | 0.036 | 0.043 | 0.045 | 0.038 | 0.043 | 0.038 | 0.050 | 0.047 | 0.039 | 0.047 | 0.047 |

| NC3 | 0.064 | 0.058 | 0.041 | 0.050 | 0.052 | 0.050 | 0.000 | 0.047 | 0.045 | 0.043 | 0.040 | 0.050 | 0.040 | 0.044 | 0.043 | 0.057 | 0.050 | 0.039 | 0.043 | 0.044 |

| NB1 | 0.044 | 0.050 | 0.045 | 0.054 | 0.047 | 0.046 | 0.054 | 0.000 | 0.029 | 0.027 | 0.050 | 0.044 | 0.040 | 0.038 | 0.038 | 0.054 | 0.047 | 0.045 | 0.049 | 0.046 |

| NB2 | 0.046 | 0.043 | 0.035 | 0.055 | 0.050 | 0.038 | 0.045 | 0.031 | 0.000 | 0.027 | 0.047 | 0.040 | 0.032 | 0.036 | 0.031 | 0.040 | 0.030 | 0.032 | 0.043 | 0.035 |

| NB3 | 0.044 | 0.047 | 0.043 | 0.050 | 0.043 | 0.037 | 0.043 | 0.027 | 0.027 | 0.000 | 0.042 | 0.039 | 0.031 | 0.036 | 0.031 | 0.043 | 0.039 | 0.038 | 0.040 | 0.040 |

| NR1 | 0.047 | 0.040 | 0.043 | 0.052 | 0.052 | 0.051 | 0.050 | 0.050 | 0.050 | 0.045 | 0.000 | 0.037 | 0.046 | 0.045 | 0.044 | 0.050 | 0.042 | 0.043 | 0.045 | 0.046 |

| NR2 | 0.052 | 0.060 | 0.047 | 0.041 | 0.043 | 0.049 | 0.051 | 0.049 | 0.045 | 0.040 | 0.036 | 0.000 | 0.045 | 0.050 | 0.040 | 0.045 | 0.050 | 0.040 | 0.043 | 0.040 |

| OI1 | 0.042 | 0.049 | 0.037 | 0.038 | 0.036 | 0.035 | 0.040 | 0.039 | 0.035 | 0.033 | 0.040 | 0.040 | 0.000 | 0.048 | 0.047 | 0.040 | 0.036 | 0.036 | 0.033 | 0.036 |

| OI2 | 0.050 | 0.056 | 0.050 | 0.042 | 0.038 | 0.043 | 0.045 | 0.027 | 0.029 | 0.033 | 0.036 | 0.045 | 0.033 | 0.000 | 0.042 | 0.033 | 0.031 | 0.027 | 0.031 | 0.035 |

| OI3 | 0.047 | 0.047 | 0.042 | 0.039 | 0.033 | 0.037 | 0.040 | 0.036 | 0.033 | 0.033 | 0.043 | 0.038 | 0.038 | 0.048 | 0.000 | 0.035 | 0.033 | 0.034 | 0.036 | 0.036 |

| TI1 | 0.054 | 0.054 | 0.059 | 0.053 | 0.047 | 0.063 | 0.059 | 0.050 | 0.041 | 0.037 | 0.052 | 0.055 | 0.040 | 0.041 | 0.039 | 0.000 | 0.050 | 0.042 | 0.044 | 0.052 |

| TI2 | 0.052 | 0.051 | 0.043 | 0.047 | 0.045 | 0.051 | 0.056 | 0.050 | 0.032 | 0.034 | 0.045 | 0.052 | 0.035 | 0.041 | 0.036 | 0.047 | 0.000 | 0.033 | 0.031 | 0.043 |

| TI3 | 0.047 | 0.045 | 0.048 | 0.044 | 0.039 | 0.041 | 0.039 | 0.044 | 0.031 | 0.036 | 0.039 | 0.043 | 0.033 | 0.037 | 0.034 | 0.037 | 0.033 | 0.000 | 0.041 | 0.033 |

| TI4 | 0.057 | 0.058 | 0.034 | 0.047 | 0.048 | 0.043 | 0.043 | 0.052 | 0.050 | 0.038 | 0.045 | 0.043 | 0.030 | 0.036 | 0.032 | 0.039 | 0.035 | 0.042 | 0.000 | 0.036 |

| TI5 | 0.050 | 0.051 | 0.033 | 0.045 | 0.052 | 0.049 | 0.046 | 0.046 | 0.038 | 0.034 | 0.044 | 0.045 | 0.035 | 0.042 | 0.034 | 0.052 | 0.043 | 0.036 | 0.037 | 0.000 |

Appendix F

| NS1 | NS2 | NS3 | NS4 | NC1 | NC2 | NC3 | NB1 | NB2 | NB3 | NR1 | NR2 | OI1 | OI2 | OI3 | TI1 | TI2 | TI3 | TI4 | TI5 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| NS1 | 0.295 | 0.358 | 0.280 | 0.323 | 0.330 | 0.334 | 0.344 | 0.299 | 0.273 | 0.256 | 0.296 | 0.309 | 0.270 | 0.300 | 0.269 | 0.327 | 0.292 | 0.277 | 0.294 | 0.295 |

| NS2 | 0.323 | 0.273 | 0.256 | 0.291 | 0.300 | 0.304 | 0.310 | 0.275 | 0.244 | 0.239 | 0.269 | 0.286 | 0.247 | 0.278 | 0.248 | 0.300 | 0.274 | 0.255 | 0.270 | 0.265 |

| NS3 | 0.259 | 0.265 | 0.185 | 0.244 | 0.240 | 0.248 | 0.248 | 0.236 | 0.202 | 0.200 | 0.222 | 0.237 | 0.209 | 0.236 | 0.207 | 0.257 | 0.220 | 0.221 | 0.218 | 0.219 |

| NS4 | 0.302 | 0.301 | 0.243 | 0.233 | 0.279 | 0.284 | 0.288 | 0.264 | 0.245 | 0.223 | 0.259 | 0.262 | 0.230 | 0.254 | 0.231 | 0.283 | 0.245 | 0.233 | 0.253 | 0.249 |

| NC1 | 0.319 | 0.319 | 0.253 | 0.286 | 0.239 | 0.296 | 0.302 | 0.269 | 0.246 | 0.229 | 0.269 | 0.266 | 0.236 | 0.262 | 0.235 | 0.287 | 0.254 | 0.241 | 0.256 | 0.254 |

| NC2 | 0.326 | 0.328 | 0.265 | 0.293 | 0.293 | 0.250 | 0.312 | 0.278 | 0.250 | 0.230 | 0.268 | 0.277 | 0.239 | 0.269 | 0.241 | 0.295 | 0.266 | 0.246 | 0.265 | 0.264 |

| NC3 | 0.326 | 0.325 | 0.260 | 0.293 | 0.294 | 0.297 | 0.256 | 0.275 | 0.249 | 0.236 | 0.265 | 0.282 | 0.241 | 0.269 | 0.246 | 0.301 | 0.267 | 0.246 | 0.261 | 0.262 |

| NB1 | 0.294 | 0.302 | 0.251 | 0.283 | 0.276 | 0.279 | 0.293 | 0.218 | 0.224 | 0.211 | 0.261 | 0.263 | 0.230 | 0.251 | 0.230 | 0.284 | 0.252 | 0.239 | 0.254 | 0.251 |

| NB2 | 0.265 | 0.264 | 0.216 | 0.256 | 0.250 | 0.243 | 0.255 | 0.220 | 0.172 | 0.188 | 0.233 | 0.232 | 0.199 | 0.223 | 0.199 | 0.243 | 0.211 | 0.203 | 0.224 | 0.215 |

| NB3 | 0.263 | 0.268 | 0.224 | 0.250 | 0.243 | 0.242 | 0.253 | 0.216 | 0.198 | 0.162 | 0.228 | 0.231 | 0.198 | 0.223 | 0.199 | 0.245 | 0.220 | 0.209 | 0.220 | 0.220 |

| NR1 | 0.304 | 0.301 | 0.255 | 0.288 | 0.286 | 0.290 | 0.296 | 0.270 | 0.248 | 0.232 | 0.220 | 0.263 | 0.241 | 0.263 | 0.240 | 0.287 | 0.253 | 0.243 | 0.257 | 0.257 |

| NR2 | 0.305 | 0.315 | 0.256 | 0.275 | 0.276 | 0.285 | 0.294 | 0.267 | 0.241 | 0.225 | 0.252 | 0.225 | 0.237 | 0.266 | 0.234 | 0.280 | 0.258 | 0.238 | 0.252 | 0.249 |

| OI1 | 0.259 | 0.268 | 0.217 | 0.238 | 0.235 | 0.239 | 0.249 | 0.226 | 0.204 | 0.193 | 0.225 | 0.231 | 0.167 | 0.233 | 0.214 | 0.241 | 0.215 | 0.205 | 0.213 | 0.216 |

| OI2 | 0.264 | 0.272 | 0.227 | 0.239 | 0.235 | 0.244 | 0.251 | 0.213 | 0.197 | 0.191 | 0.218 | 0.233 | 0.197 | 0.185 | 0.206 | 0.233 | 0.209 | 0.196 | 0.209 | 0.212 |

| OI3 | 0.261 | 0.263 | 0.218 | 0.236 | 0.230 | 0.237 | 0.245 | 0.220 | 0.199 | 0.190 | 0.224 | 0.226 | 0.201 | 0.230 | 0.166 | 0.233 | 0.210 | 0.202 | 0.213 | 0.212 |

| TI1 | 0.327 | 0.330 | 0.284 | 0.304 | 0.298 | 0.317 | 0.320 | 0.286 | 0.254 | 0.238 | 0.284 | 0.294 | 0.249 | 0.275 | 0.249 | 0.255 | 0.276 | 0.256 | 0.270 | 0.277 |

| TI2 | 0.294 | 0.297 | 0.243 | 0.270 | 0.268 | 0.278 | 0.289 | 0.259 | 0.221 | 0.213 | 0.251 | 0.264 | 0.220 | 0.248 | 0.223 | 0.272 | 0.203 | 0.224 | 0.233 | 0.243 |

| TI3 | 0.266 | 0.266 | 0.229 | 0.246 | 0.240 | 0.246 | 0.250 | 0.233 | 0.201 | 0.196 | 0.226 | 0.235 | 0.200 | 0.224 | 0.202 | 0.240 | 0.215 | 0.173 | 0.222 | 0.215 |

| TI4 | 0.295 | 0.298 | 0.231 | 0.267 | 0.267 | 0.267 | 0.273 | 0.257 | 0.234 | 0.212 | 0.248 | 0.253 | 0.212 | 0.240 | 0.215 | 0.260 | 0.232 | 0.228 | 0.199 | 0.233 |

| TI5 | 0.290 | 0.293 | 0.232 | 0.266 | 0.271 | 0.273 | 0.277 | 0.253 | 0.224 | 0.210 | 0.248 | 0.256 | 0.218 | 0.246 | 0.218 | 0.273 | 0.241 | 0.223 | 0.236 | 0.199 |

Appendix G

| NS1 | NS2 | NS3 | NS4 | NC1 | NC2 | NC3 | NB1 | NB2 | NB3 | NR1 | NR2 | OI1 | OI2 | OI3 | TI1 | TI2 | TI3 | TI4 | TI5 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| NS1 | 0.235 | 0.282 | 0.272 | 0.280 | 0.271 | 0.269 | 0.271 | 0.260 | 0.265 | 0.261 | 0.265 | 0.265 | 0.264 | 0.263 | 0.267 | 0.263 | 0.266 | 0.264 | 0.270 | 0.268 |

| NS2 | 0.285 | 0.239 | 0.278 | 0.279 | 0.271 | 0.271 | 0.270 | 0.267 | 0.264 | 0.267 | 0.262 | 0.274 | 0.273 | 0.272 | 0.269 | 0.265 | 0.269 | 0.265 | 0.273 | 0.271 |

| NS3 | 0.223 | 0.224 | 0.194 | 0.225 | 0.215 | 0.219 | 0.216 | 0.222 | 0.216 | 0.222 | 0.222 | 0.223 | 0.221 | 0.226 | 0.223 | 0.228 | 0.220 | 0.227 | 0.212 | 0.214 |

| NS4 | 0.257 | 0.255 | 0.256 | 0.216 | 0.243 | 0.242 | 0.243 | 0.250 | 0.256 | 0.249 | 0.251 | 0.239 | 0.242 | 0.239 | 0.241 | 0.244 | 0.245 | 0.244 | 0.244 | 0.246 |

| NC1 | 0.327 | 0.328 | 0.327 | 0.328 | 0.285 | 0.343 | 0.347 | 0.325 | 0.334 | 0.329 | 0.328 | 0.323 | 0.325 | 0.322 | 0.323 | 0.318 | 0.321 | 0.326 | 0.331 | 0.330 |

| NC2 | 0.332 | 0.333 | 0.337 | 0.333 | 0.354 | 0.292 | 0.351 | 0.329 | 0.325 | 0.328 | 0.332 | 0.334 | 0.330 | 0.334 | 0.333 | 0.339 | 0.333 | 0.334 | 0.331 | 0.333 |

| NC3 | 0.341 | 0.339 | 0.337 | 0.338 | 0.361 | 0.365 | 0.302 | 0.346 | 0.341 | 0.343 | 0.339 | 0.344 | 0.345 | 0.344 | 0.344 | 0.343 | 0.346 | 0.339 | 0.338 | 0.337 |

| NB1 | 0.361 | 0.363 | 0.370 | 0.361 | 0.362 | 0.366 | 0.362 | 0.333 | 0.380 | 0.376 | 0.360 | 0.364 | 0.364 | 0.355 | 0.362 | 0.368 | 0.374 | 0.369 | 0.365 | 0.368 |

| NB2 | 0.330 | 0.322 | 0.317 | 0.334 | 0.331 | 0.330 | 0.328 | 0.343 | 0.296 | 0.343 | 0.331 | 0.328 | 0.327 | 0.327 | 0.327 | 0.326 | 0.319 | 0.319 | 0.333 | 0.326 |

| NB3 | 0.309 | 0.315 | 0.313 | 0.305 | 0.308 | 0.304 | 0.311 | 0.323 | 0.324 | 0.281 | 0.309 | 0.307 | 0.310 | 0.318 | 0.312 | 0.306 | 0.307 | 0.311 | 0.302 | 0.306 |

| NR1 | 0.490 | 0.485 | 0.484 | 0.498 | 0.503 | 0.491 | 0.485 | 0.498 | 0.501 | 0.496 | 0.456 | 0.529 | 0.493 | 0.484 | 0.498 | 0.491 | 0.487 | 0.490 | 0.496 | 0.492 |

| NR2 | 0.510 | 0.515 | 0.516 | 0.502 | 0.497 | 0.509 | 0.515 | 0.502 | 0.499 | 0.504 | 0.544 | 0.471 | 0.507 | 0.516 | 0.502 | 0.509 | 0.513 | 0.510 | 0.504 | 0.508 |

| OI1 | 0.322 | 0.320 | 0.320 | 0.322 | 0.322 | 0.319 | 0.319 | 0.324 | 0.320 | 0.319 | 0.323 | 0.322 | 0.272 | 0.335 | 0.337 | 0.322 | 0.319 | 0.319 | 0.318 | 0.319 |

| OI2 | 0.358 | 0.359 | 0.362 | 0.355 | 0.357 | 0.359 | 0.356 | 0.353 | 0.359 | 0.360 | 0.354 | 0.360 | 0.380 | 0.314 | 0.386 | 0.356 | 0.359 | 0.358 | 0.359 | 0.361 |

| OI3 | 0.320 | 0.321 | 0.317 | 0.323 | 0.321 | 0.322 | 0.325 | 0.323 | 0.321 | 0.322 | 0.323 | 0.318 | 0.348 | 0.351 | 0.278 | 0.322 | 0.322 | 0.323 | 0.323 | 0.320 |

| TI1 | 0.220 | 0.220 | 0.226 | 0.224 | 0.222 | 0.221 | 0.225 | 0.221 | 0.221 | 0.220 | 0.221 | 0.219 | 0.221 | 0.220 | 0.218 | 0.191 | 0.231 | 0.226 | 0.226 | 0.233 |

| TI2 | 0.197 | 0.201 | 0.194 | 0.194 | 0.196 | 0.199 | 0.200 | 0.197 | 0.193 | 0.197 | 0.195 | 0.202 | 0.198 | 0.198 | 0.196 | 0.207 | 0.173 | 0.202 | 0.202 | 0.206 |

| TI3 | 0.187 | 0.187 | 0.195 | 0.185 | 0.186 | 0.184 | 0.184 | 0.187 | 0.185 | 0.188 | 0.187 | 0.187 | 0.189 | 0.185 | 0.188 | 0.192 | 0.191 | 0.162 | 0.198 | 0.190 |

| TI4 | 0.198 | 0.198 | 0.192 | 0.200 | 0.199 | 0.198 | 0.195 | 0.199 | 0.204 | 0.198 | 0.198 | 0.197 | 0.195 | 0.198 | 0.199 | 0.202 | 0.199 | 0.209 | 0.173 | 0.201 |

| TI5 | 0.198 | 0.194 | 0.193 | 0.197 | 0.197 | 0.198 | 0.196 | 0.196 | 0.196 | 0.197 | 0.198 | 0.195 | 0.198 | 0.200 | 0.198 | 0.208 | 0.207 | 0.201 | 0.202 | 0.170 |

Appendix H

| NS1 | NS2 | NS3 | NS4 | NC1 | NC2 | NC3 | NB1 | NB2 | NB3 | NR1 | NR2 | OI1 | OI2 | OI3 | TI1 | TI2 | TI3 | TI4 | TI5 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| NS1 | 0.037 | 0.044 | 0.043 | 0.044 | 0.047 | 0.047 | 0.047 | 0.044 | 0.045 | 0.045 | 0.045 | 0.045 | 0.046 | 0.046 | 0.046 | 0.045 | 0.046 | 0.045 | 0.046 | 0.046 |

| NS2 | 0.045 | 0.037 | 0.044 | 0.044 | 0.047 | 0.047 | 0.047 | 0.046 | 0.045 | 0.046 | 0.045 | 0.047 | 0.047 | 0.047 | 0.046 | 0.045 | 0.046 | 0.045 | 0.047 | 0.047 |

| NS3 | 0.035 | 0.035 | 0.030 | 0.035 | 0.037 | 0.038 | 0.037 | 0.038 | 0.037 | 0.038 | 0.038 | 0.038 | 0.038 | 0.039 | 0.039 | 0.039 | 0.038 | 0.039 | 0.036 | 0.037 |

| NS4 | 0.040 | 0.040 | 0.040 | 0.034 | 0.042 | 0.042 | 0.042 | 0.043 | 0.044 | 0.042 | 0.043 | 0.041 | 0.042 | 0.041 | 0.042 | 0.042 | 0.042 | 0.042 | 0.042 | 0.042 |

| NC1 | 0.058 | 0.058 | 0.058 | 0.058 | 0.046 | 0.055 | 0.056 | 0.057 | 0.049 | 0.061 | 0.058 | 0.057 | 0.057 | 0.056 | 0.057 | 0.056 | 0.056 | 0.057 | 0.058 | 0.058 |

| NC2 | 0.059 | 0.059 | 0.060 | 0.059 | 0.057 | 0.047 | 0.056 | 0.058 | 0.052 | 0.055 | 0.058 | 0.059 | 0.058 | 0.059 | 0.058 | 0.060 | 0.058 | 0.059 | 0.058 | 0.058 |

| NC3 | 0.060 | 0.060 | 0.060 | 0.060 | 0.058 | 0.058 | 0.048 | 0.061 | 0.054 | 0.062 | 0.060 | 0.060 | 0.060 | 0.060 | 0.060 | 0.060 | 0.061 | 0.060 | 0.059 | 0.059 |

| NB1 | 0.058 | 0.058 | 0.059 | 0.057 | 0.058 | 0.058 | 0.058 | 0.049 | 0.055 | 0.055 | 0.058 | 0.058 | 0.058 | 0.057 | 0.058 | 0.059 | 0.060 | 0.059 | 0.059 | 0.059 |

| NB2 | 0.053 | 0.051 | 0.051 | 0.053 | 0.053 | 0.053 | 0.052 | 0.050 | 0.043 | 0.050 | 0.053 | 0.053 | 0.052 | 0.052 | 0.052 | 0.052 | 0.051 | 0.051 | 0.053 | 0.052 |

| NB3 | 0.049 | 0.050 | 0.050 | 0.049 | 0.049 | 0.048 | 0.049 | 0.047 | 0.047 | 0.041 | 0.050 | 0.049 | 0.049 | 0.051 | 0.050 | 0.049 | 0.049 | 0.050 | 0.048 | 0.049 |

| NR1 | 0.089 | 0.088 | 0.088 | 0.091 | 0.092 | 0.090 | 0.088 | 0.092 | 0.092 | 0.091 | 0.076 | 0.088 | 0.090 | 0.088 | 0.091 | 0.090 | 0.089 | 0.090 | 0.091 | 0.090 |

| NR2 | 0.093 | 0.094 | 0.094 | 0.092 | 0.091 | 0.093 | 0.094 | 0.092 | 0.092 | 0.093 | 0.091 | 0.079 | 0.092 | 0.094 | 0.092 | 0.093 | 0.094 | 0.093 | 0.092 | 0.093 |

| OI1 | 0.051 | 0.050 | 0.050 | 0.051 | 0.051 | 0.050 | 0.050 | 0.051 | 0.050 | 0.050 | 0.051 | 0.051 | 0.039 | 0.048 | 0.048 | 0.050 | 0.050 | 0.050 | 0.050 | 0.050 |

| OI2 | 0.056 | 0.057 | 0.057 | 0.056 | 0.056 | 0.056 | 0.056 | 0.056 | 0.056 | 0.057 | 0.056 | 0.057 | 0.054 | 0.045 | 0.055 | 0.056 | 0.056 | 0.056 | 0.056 | 0.056 |

| OI3 | 0.050 | 0.051 | 0.050 | 0.051 | 0.051 | 0.051 | 0.051 | 0.051 | 0.051 | 0.051 | 0.051 | 0.050 | 0.050 | 0.050 | 0.040 | 0.050 | 0.050 | 0.051 | 0.050 | 0.050 |

| TI1 | 0.037 | 0.037 | 0.038 | 0.037 | 0.037 | 0.037 | 0.038 | 0.037 | 0.037 | 0.037 | 0.037 | 0.037 | 0.037 | 0.037 | 0.036 | 0.029 | 0.035 | 0.034 | 0.034 | 0.035 |

| TI2 | 0.033 | 0.034 | 0.032 | 0.032 | 0.033 | 0.033 | 0.034 | 0.033 | 0.032 | 0.033 | 0.033 | 0.034 | 0.033 | 0.033 | 0.033 | 0.032 | 0.026 | 0.031 | 0.031 | 0.031 |

| TI3 | 0.031 | 0.031 | 0.032 | 0.031 | 0.031 | 0.031 | 0.031 | 0.031 | 0.031 | 0.031 | 0.031 | 0.031 | 0.031 | 0.031 | 0.031 | 0.029 | 0.029 | 0.025 | 0.030 | 0.029 |

| TI4 | 0.033 | 0.033 | 0.032 | 0.033 | 0.033 | 0.033 | 0.033 | 0.033 | 0.034 | 0.033 | 0.033 | 0.033 | 0.032 | 0.033 | 0.033 | 0.031 | 0.030 | 0.032 | 0.026 | 0.031 |

| TI5 | 0.033 | 0.032 | 0.032 | 0.033 | 0.033 | 0.033 | 0.033 | 0.033 | 0.033 | 0.033 | 0.033 | 0.033 | 0.033 | 0.033 | 0.033 | 0.032 | 0.032 | 0.031 | 0.031 | 0.026 |

Appendix I

| NS1 | NS2 | NS3 | NS4 | NC1 | NC2 | NC3 | NB1 | NB2 | NB3 | NR1 | NR2 | OI1 | OI2 | OI3 | TI1 | TI2 | TI3 | TI4 | TI5 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| NS1 | 0.045 | 0.045 | 0.045 | 0.045 | 0.045 | 0.045 | 0.045 | 0.045 | 0.044 | 0.045 | 0.045 | 0.045 | 0.045 | 0.045 | 0.045 | 0.045 | 0.045 | 0.045 | 0.045 | 0.045 |

| NS2 | 0.045 | 0.045 | 0.045 | 0.045 | 0.045 | 0.045 | 0.045 | 0.045 | 0.045 | 0.046 | 0.045 | 0.045 | 0.045 | 0.045 | 0.045 | 0.045 | 0.045 | 0.045 | 0.045 | 0.045 |

| NS3 | 0.037 | 0.037 | 0.037 | 0.037 | 0.037 | 0.037 | 0.037 | 0.037 | 0.036 | 0.037 | 0.037 | 0.037 | 0.037 | 0.037 | 0.037 | 0.037 | 0.037 | 0.037 | 0.037 | 0.037 |

| NS4 | 0.041 | 0.041 | 0.041 | 0.041 | 0.041 | 0.041 | 0.041 | 0.041 | 0.041 | 0.042 | 0.041 | 0.041 | 0.041 | 0.041 | 0.041 | 0.041 | 0.041 | 0.041 | 0.041 | 0.041 |

| NC1 | 0.056 | 0.056 | 0.056 | 0.056 | 0.056 | 0.056 | 0.056 | 0.056 | 0.055 | 0.056 | 0.056 | 0.056 | 0.056 | 0.056 | 0.056 | 0.056 | 0.056 | 0.056 | 0.056 | 0.056 |

| NC2 | 0.057 | 0.057 | 0.057 | 0.057 | 0.057 | 0.057 | 0.057 | 0.057 | 0.056 | 0.057 | 0.057 | 0.057 | 0.057 | 0.057 | 0.057 | 0.057 | 0.057 | 0.057 | 0.057 | 0.057 |

| NC3 | 0.059 | 0.059 | 0.059 | 0.059 | 0.059 | 0.059 | 0.059 | 0.059 | 0.058 | 0.059 | 0.059 | 0.059 | 0.059 | 0.059 | 0.059 | 0.059 | 0.059 | 0.059 | 0.059 | 0.059 |

| NB1 | 0.057 | 0.057 | 0.057 | 0.057 | 0.057 | 0.057 | 0.057 | 0.057 | 0.056 | 0.057 | 0.057 | 0.057 | 0.057 | 0.057 | 0.057 | 0.057 | 0.057 | 0.057 | 0.057 | 0.057 |

| NB2 | 0.052 | 0.052 | 0.052 | 0.052 | 0.052 | 0.052 | 0.052 | 0.052 | 0.051 | 0.052 | 0.052 | 0.052 | 0.052 | 0.052 | 0.052 | 0.052 | 0.052 | 0.052 | 0.052 | 0.052 |

| NB3 | 0.049 | 0.049 | 0.049 | 0.049 | 0.049 | 0.049 | 0.049 | 0.049 | 0.048 | 0.049 | 0.049 | 0.049 | 0.049 | 0.049 | 0.049 | 0.049 | 0.049 | 0.049 | 0.049 | 0.049 |

| NR1 | 0.089 | 0.089 | 0.089 | 0.089 | 0.089 | 0.089 | 0.089 | 0.089 | 0.087 | 0.089 | 0.089 | 0.089 | 0.089 | 0.089 | 0.089 | 0.089 | 0.089 | 0.089 | 0.089 | 0.089 |

| NR2 | 0.091 | 0.091 | 0.091 | 0.091 | 0.091 | 0.091 | 0.091 | 0.091 | 0.089 | 0.091 | 0.091 | 0.091 | 0.091 | 0.091 | 0.091 | 0.091 | 0.091 | 0.091 | 0.091 | 0.091 |

| OI1 | 0.050 | 0.050 | 0.050 | 0.050 | 0.050 | 0.050 | 0.050 | 0.050 | 0.049 | 0.050 | 0.050 | 0.050 | 0.050 | 0.050 | 0.050 | 0.050 | 0.050 | 0.050 | 0.050 | 0.050 |

| OI2 | 0.055 | 0.055 | 0.055 | 0.055 | 0.055 | 0.055 | 0.055 | 0.055 | 0.054 | 0.056 | 0.055 | 0.055 | 0.055 | 0.055 | 0.055 | 0.055 | 0.055 | 0.055 | 0.055 | 0.055 |

| OI3 | 0.050 | 0.050 | 0.050 | 0.050 | 0.050 | 0.050 | 0.050 | 0.050 | 0.049 | 0.050 | 0.050 | 0.050 | 0.050 | 0.050 | 0.050 | 0.050 | 0.050 | 0.050 | 0.050 | 0.050 |

| TI1 | 0.036 | 0.036 | 0.036 | 0.036 | 0.036 | 0.036 | 0.036 | 0.036 | 0.036 | 0.036 | 0.036 | 0.036 | 0.036 | 0.036 | 0.036 | 0.036 | 0.036 | 0.036 | 0.036 | 0.036 |

| TI2 | 0.032 | 0.032 | 0.032 | 0.032 | 0.032 | 0.032 | 0.032 | 0.032 | 0.032 | 0.033 | 0.032 | 0.032 | 0.032 | 0.032 | 0.032 | 0.032 | 0.032 | 0.032 | 0.032 | 0.032 |

| TI3 | 0.031 | 0.031 | 0.031 | 0.031 | 0.031 | 0.031 | 0.031 | 0.031 | 0.030 | 0.031 | 0.031 | 0.031 | 0.031 | 0.031 | 0.031 | 0.031 | 0.031 | 0.031 | 0.031 | 0.031 |

| TI4 | 0.033 | 0.033 | 0.033 | 0.033 | 0.033 | 0.033 | 0.033 | 0.033 | 0.032 | 0.033 | 0.033 | 0.033 | 0.033 | 0.033 | 0.033 | 0.033 | 0.033 | 0.033 | 0.033 | 0.033 |

| TI5 | 0.032 | 0.032 | 0.032 | 0.032 | 0.032 | 0.032 | 0.032 | 0.032 | 0.032 | 0.032 | 0.032 | 0.032 | 0.032 | 0.032 | 0.032 | 0.032 | 0.032 | 0.032 | 0.032 | 0.032 |

References

- Gomber, P.; Kauffman, R.J.; Parker, C.; Weber, B.W. On the Fintech revolution: Interpreting the forces of innovation, disruption and transformation in financial services. J. Manag. Inf. Syst. 2018, 35, 220–265. [Google Scholar] [CrossRef]

- Barberis, J. The Rise of Fintech: Getting Hong Kong to Lead the Digital financial Transition in APAC; Fintech Report; Fintech HK: Hong Kong, 2014. [Google Scholar]

- Lee, I.; Shin, Y.J. Fintech: Ecosystem, business models, investment decisions, and challenges. Bus. Horiz. 2018, 61, 35–46. [Google Scholar] [CrossRef]

- Leong, C.; Tan, B.; Xiao, X.; Tan, F.T.C.; Sun, Y. Nurturing a FinTech ecosystem: The case of a youth microloan startup in China. Int. J. Inf. Manag. 2017, 37, 92–97. [Google Scholar] [CrossRef]

- Ryu, H.S. Understanding benefit and risk framework of Fintech adoption: Comparison of early adopters and late adopters. In Proceedings of the 51st Hawaii International Conference on System Sciences, Waikoloa Village, HI, USA, 2–6 January 2018. [Google Scholar]

- Chen, L. From Fintech to Finlife: The case of Fintech development in China. China Econ. J. 2016, 9, 225–239. [Google Scholar] [CrossRef]

- Shim, Y.; Shin, D.H. Analyzing China’s fintech industry from the perspective of actor-network theory. Telecommun. Policy 2016, 40, 168–181. [Google Scholar] [CrossRef]

- KPMG, and H2 Ventures. The FinTech 100 Leading Global Fintech Innovators for 2015. Available online: https://assets.kpmg.com/content/dam/kpmg/pdf/2015//12/Fintech-100-leading-innovators-2015.pdf (accessed on 10 February 2019).

- Crowdfund Insider. KPMG:Ranking of 50 top Fintech Companies in China for 2017 Kicks Off. Available online: https://www.crowdfundinsider.com/2017/06/101525-kpmg-ranking-50-top-fintech-companies-china-2017-kicks-off/ (accessed on 5 February 2019).

- Citigroup. Digital Disruption: How FinTech Is Forcing Banking to a Tipping Point; Citigroup: Warszawa, Poland, 2016. [Google Scholar]

- Kong, Y.S.; Masud, I. Service innovation, service delivery and customer satisfaction and loyalty in the banking sector of Ghana. Int. J. Bank Mark. 2019, in press. [Google Scholar]

- Lusch, R.F.; Nambisan, S. Service innovation: A service-dominant logic perspective. MIS Q. 2015, 39, 155–175. [Google Scholar] [CrossRef]

- Tan, L.H.; Chew, B.C.; Rizal, H.S. Service innovation in Malaysian banking system towards sustainable competitive advantage through environmentally and socially practices. Procedia Soc. Behav. Sci. 2016, 224, 52–59. [Google Scholar]

- Den Hertog, P.; Van Der Aa, W.; De Jong, M.W. Capabilities for managing service innovation: Towards a conceptual framework. J. Serv. Manag. 2010, 21, 490–514. [Google Scholar] [CrossRef]

- Tseng, M.L.; Lin, Y.H.; Lim, M.K.; Teehankee, B.L. Using a hybrid method to evaluate service innovation in the hotel industry. Appl. Soft Comput. 2015, 28, 411–421. [Google Scholar] [CrossRef]

- Chang, S.C.; Tsai, P.H. A hybrid financial performance evaluation model for wealth management banks following the global financial crisis. Technol. Econ. Dev. Econ. 2016, 22, 21–46. [Google Scholar] [CrossRef]

- Mardani, A.; Jusoh, A.; Nor, K.M.D.; Khalifah, Z.; Zakwan, N.; Valipour, A. Multiple criteria decision-making techniques and their applications—A review of the literature from 2000 to 2014. Econ. Res. 2015, 28, 516–571. [Google Scholar] [CrossRef]

- Zavadskas, E.K.; Govindan, K.; Antucheviciene, J.; Turskis, Z. Hybrid multiple criteria decision-making methods: A review of applications for sustainability issues. Econ. Res. 2016, 29, 857–887. [Google Scholar] [CrossRef]

- Chen, S.H.; Lin, W.T. Analyzing determinants for promoting emerging technology through intermediaries by using a DANP-based MCDA framework. Technol. Forecast. Soc. Chang. 2018, 131, 94–110. [Google Scholar] [CrossRef]

- Carayannis, E.G.; Ferreira, J.J.M.; Jalali, M.S.; Ferreira, F.A.F. MCDA in knowledge-based economies: Methodological developments and real world applications. Technol. Forecast. Soc. Chang. 2018, 131, 1–3. [Google Scholar] [CrossRef]

- Tsai, P.H.; Lin, C.T. Creating a business strategy evaluation model for national museums based on the views of curators. Curator Mus. J. 2016, 59, 287–303. [Google Scholar] [CrossRef]

- Tsai, P.H.; Lin, C.T. How should national museums create competitive advantage following changes in the global economic environment? Sustainability 2018, 10, 3749. [Google Scholar] [CrossRef]

- Pineda, P.J.G.; Liou, J.J.H.; Hsu, C.C.; Chuang, Y.C. An integrated MCDM model for improving airline operational and financial performance. J. Air Transp. Manag. 2018, 68, 103–117. [Google Scholar] [CrossRef]

- Akdag, H.; Kalayci, T.; Karagöz, S.; Zülfikar, H.; Giz, D. The evaluation of hospital service quality by fuzzy MCDM. Appl. Soft Comput. 2014, 23, 239–248. [Google Scholar] [CrossRef]

- Sarkar, S.; Pratihar, D.K.; Sarkar, B. An integrated fuzzy multiple criteria supplier selection approach and its application in a welding company. J. Manuf. Syst. 2018, 466, 163–178. [Google Scholar] [CrossRef]

- Foster, C.; Heeks, R. Innovation and scaling of ICT for the bottom-of-the-pyramid. J. Inf. Technol. 2013, 28, 296–315. [Google Scholar] [CrossRef]

- Burtch, G.; Ghose, A.; Wattal, S. An empirical examination of the antecedents and consequences of contribution patterns in crowdfunded markets. Inf. Syst. Res. 2013, 24, 499–519. [Google Scholar] [CrossRef]

- Burtch, G.; Ghose, A.; Wattal, S. Cultural differences and geography as determinants of online prosocial lending. MIS Q. 2014, 38, 773–794. [Google Scholar] [CrossRef]

- De Reuver, M.; Verschuur, E.; Nikayin, F.; Cerpa, N.; Bouwman, H. Collective action for mobile payment platforms: A case study on collaboration issues between banks and telecom operators. Electron. Commer. Res. Appl. 2015, 14, 331–344. [Google Scholar] [CrossRef]

- Schumpeter, J.A. The Theory of Economic Development: An Inquiry into Profits, Capital, Credit, Interest, and the Business Cycle; Transaction Publishers: Piscataway, NJ, USA, 1934. [Google Scholar]

- Drucker, P.F. Innovations and Entrepreneurship; Haper and Row: New York, NY, USA, 1985. [Google Scholar]

- Panesar, S.S.; Markeset, T. Development of a framework for industrial service innovation management and coordination. J. Qual. Maint. Eng. 2008, 14, 177–193. [Google Scholar] [CrossRef]

- Miles, I. Services Innovation: Statistical and Conceptual Issues; Doc DSTI/EAS/STP/NESTI (95); Working Group on Innovation and Technology Policy, OECD: Paris, France, 1995. [Google Scholar]

- Djellal, F.; Gallouj, F. Services and the search for relevant innovation indicators: A review of national and international surveys. Sci. Public Policy 1999, 26, 218–232. [Google Scholar] [CrossRef]

- Bilderbeek, R.; den Hertog, P.; Marklund, G.; Miles, I. Services in Innovation: Knowledge Intensive Business Services (KIBS) as Co-Producers of Innovation; SI4S Synthesis Paper No. 3; STEP: Oslo, Norway, 1998. [Google Scholar]

- Vargo, S.L.; Lusch, R.F. Evolving to a new dominant logic for marketing. J. Mark. 2004, 68, 1–17. [Google Scholar] [CrossRef]

- Lusch, R.F.; Vargo, S.L.; Wessels, G. Towards a conceptual foundation for service science: Contributions from service dominant logic. IBM Syst. J. 2008, 47, 5–14. [Google Scholar] [CrossRef]

- Frei, F.X. The four things a service business must get right. Harv. Bus. Rev. 2008, 86, 70–80. [Google Scholar] [PubMed]

- Tidd, J.; Hull, F. Service Innovation: Organizational Responses to Technological Opportunities & Market Imperatives; Imperial College Press: London, UK, 2003. [Google Scholar]

- Leong, K.; Sung, A. FinTech (Financial Technology): What is It and How to Use Technologies to Create Business Value in Fintech Way? Int. J. Innov. Manag. Technol. 2018, 9, 74–78. [Google Scholar]

- Shi, L. Big data: From traditional risk control to FinTech. Mod. Bank. 2016, 7, 44–48. [Google Scholar]

- Gallouj, F. Innovation in services and the attendant old and new myths. J. Socio-Econ. 2002, 31, 137–154. [Google Scholar] [CrossRef]

- Foss, N.J.; Laursen, K.; Pedersen, T. Linking customer interaction and innovation: The mediating role of new organizational practices. Organ. Sci. 2011, 22, 980–999. [Google Scholar] [CrossRef]

- Acar, A.Z.; Zehir, C.; Özgenel, N.; Özşahin, M. The effects of customer and entrepreneurial orientations on individual service performance in banking sector. Procedia Soc. Behav. Sci. 2013, 99, 526–535. [Google Scholar] [CrossRef]

- Brandenburger, A.M.; Nalebuff, B.J. Co-Opetition; Harper Collins Business: New York, NY, USA, 1996. [Google Scholar]

- Brentani, U.D. Innovative versus incremental new business services: Different keys for achieving success. J. Prod. Innov. Manag. 2001, 18, 169–187. [Google Scholar] [CrossRef]

- Tee, R.; Gawer, A. Industry architecture as a determinant of successful platform strategies: A case study of the i-mode mobile internet service. Eur. Manag. Rev. 2009, 6, 217–232. [Google Scholar] [CrossRef]

- Wu, X. The development status and its influence of commercial Banks in China. Wuhan Financ. 2012, 11, 67–69. [Google Scholar]

- Xing, Q.D.; Bai, Y.J. Inspirations for online banking from financial service innovation of the Internet enterprises. Account. Financ. 2016, 3, 1–6. [Google Scholar]

- Dubois, M.; Bobillier-Chaumon, M.E.; Retour, D. The impact of development of customer online banking skills on customer adviser skills. New Technol. Work Employ. 2011, 26, 156–173. [Google Scholar] [CrossRef]

- Rajan, R.G.; Zingales, L. The influence of the financial revolution on the nature of firms. Am. Econ. Rev. 2001, 91, 206–212. [Google Scholar] [CrossRef]

- Khafri, N.; Budhwar, P. Measuring charisma and vision and their effect on followers in the UK manufacturing companies. Manag. Res. News 2002, 25, 108–111. [Google Scholar]

- Ponsignon, F.; Smart, P.A.; Maull, R.S. Service delivery system design: Characteristics and contingencies. Int. J. Oper. Prod. Manag. 2011, 31, 324–349. [Google Scholar] [CrossRef]

- Blazevic, V.; Lievens, A. Managing innovation through customer conproduced knowledge in electronic services: An exploratory study. J. Acad. Mark. Sci. 2008, 36, 138–151. [Google Scholar] [CrossRef]

- Griffin, A. PDMA research on new product development practices: Updating trends and benchmarking best practices. J. Prod. Innov. Manag. 1997, 14, 429–458. [Google Scholar] [CrossRef]

- Sing’oei, L.; Wang, J. Data mining framework for direct marketing: A case study of bank marketing. Int. J. Comput. Sci. Issues 2013, 10, 198–203. [Google Scholar]

- Shen, K.Y.; Hu, S.K.; Tzeng, G.H. Financial modeling and improvement planning for the life insurance industry by using a rough knowledge based hybrid MCDM model. Inf. Sci. 2017, 375, 296–313. [Google Scholar] [CrossRef]

- Gabus, A.; Fontela, E. Perceptions of the World Problematique: Communication Procedure, Communicating with Those Bearing Collective Responsibility; DEMATEL Report No. 1; Battelle Geneva Research Center: Geneva, Swizerland, 1973. [Google Scholar]

- Fontela, E.; Gabus, A. The DEMATEL Observer; DEMATEL 1976 Report; Battelle Geneva Research Center: Geneva, Swizerland, 1976. [Google Scholar]

- Gölcük, I.; Baykasoğlu, A. An analysis of DEMATEL approaches for criteria interaction handling within ANP. Expert Syst. Appl. 2016, 46, 346–366. [Google Scholar] [CrossRef]

- Lin, K.P.; Tseng, M.L.; Pai, P.F. Sustainable supply chain management using approximate fuzzy DEMATEL method. Resour. Conserv. Recycl. 2018, 128, 134–142. [Google Scholar] [CrossRef]

- Liu, Y.; Chen, Y.; Tzeng, G.H. Identification of key factors in consumers’ adoption behavior of intelligent medical terminals based on a hybrid modified MADM model for product improvement. Int. J. Med. Inform. 2017, 105, 68–82. [Google Scholar] [CrossRef] [PubMed]

- Liu, C.H.S.; Chou, S.F. Tourism strategy development and facilitation of integrative processes among brand equity, marketing and motivation. Tour. Manag. 2016, 54, 298–308. [Google Scholar] [CrossRef]

- Opricovic, S. Multicriteria Optimization of Civil Engineering Systems; Faculty of Civil Engineering: Belgrade, Serbian, 1998. [Google Scholar]

- Opricovic, S.; Tzeng, G.H. Compromise solution by MCDM methods: A comparative analysis of VIKOR and TOPSIS. Eur. J. Oper. Res. 2004, 156, 445–455. [Google Scholar] [CrossRef]

- Opricovic, S.; Tzeng, G.H. Extended VIKOR method in comparison with outranking methods. Eur. J. Oper. Res. 2007, 178, 514–529. [Google Scholar] [CrossRef]

- Yu, P.L. A class of solutions for group decision problems. Manag. Sci. 1973, 19, 936–946. [Google Scholar] [CrossRef]

| Criteria | Sub-Criteria | Definition |

|---|---|---|

| New service concept (NS) | Customer-centric (NS1) | Focus on customer needs to provide personalized and customized services. |

| Service efficiency enhancement (NS2) | Mobilize new technologies to expedite transaction speed and improve service efficiency. | |

| Reduced credit risk (NS3) | Mobilize new technologies to collect consumer behavior data to lower credit risk. | |

| Development of scenario finance (NS4) | Combine financial services with new commercial scenarios to develop new services. | |

| New customer interaction (NC) | Increased communication channels with customers (NC1) | Mobilize new technologies to launch more service channels such as mobile banking, WeChat banking, and Weibo banking. |

| Active identification of customer needs (NC2) | Mobilize new technologies to actively analyze the potential needs of target customers, undertake initiatives to care for consumer needs, and provide precise financial services. | |

| Provision of customized services (NC3) | Provide personalized services as per customer needs such as private banking. | |

| New business partners (NB) | Alliance with Fintech (NB1) | Share data with Fintech and e-commerce companies to explore potential customers’ financial needs to enhance customer satisfaction. |

| Alliance with offline merchants (NB2) | Partner with offline businesses to install ATM machines in business premises, provide free parking for credit card holders, and offer other convenient services. | |

| Alliance with financial peers (NB3) | Form an alliance with domestic and overseas financial peers to develop service content and scope. | |

| New revenue models (NR) | Multi-faceted business strategies (NR1) | Operate cross-border banking businesses to develop diversified products or markets such as in-house e-commerce platforms and mobilize business data collected through e-commerce transactions to provide financing services that are convenient. |

| Professional business strategies (NR2) | Focus on specific groups to provide more professional products and services. | |

| Organizational innovation (OI) | Organizational structure reform (OI1) | Set up online financial centers and process reform departments to expedite financial innovation, promptly adapt to external changes, and improve decision-making efficiency. |

| Employee training and learning (OI2) | Train service personnel to enhance their professional knowledge and skills to ensure smooth implementation of new services. | |

| Organizational innovation culture (OI3) | Establish incentive mechanisms to motivate employees to participate in innovation and develop an innovative organizational culture. | |

| Technological innovation (TI) | Development of big data analysis (TI1) | Utilize big data analytics to construct customer behavior patterns to explore new customer demands. |

| Development of smart investment management (TI2) | Employ new technologies to provide customers with effective investment portfolio recommendations (e.g., Capricorn Smart Investment by China Merchants Bank). | |

| Blockchain application (TI3) | Apply blockchain technology to improve transaction security. | |

| New payment methods (TI4) | Adopt Internet-of-Things and biometric identification technology to provide innovative payment methods using, for example, face recognition and voice control. | |

| Digital marketing enhancements (TI5) | Use digital media, content marketing, and database marketing to enhance the publicity of new services and accelerate customer understanding of these services. |

| Criteria/Sub-Criteria | Di | Rj | Di + Rj | Di − Rj |

|---|---|---|---|---|

| New service concept (NS) | 10.850 | 10.445 | 21.295 | 0.405 |

| (NS1) | 1.256 | 1.179 | 2.434 | 0.077 |

| (NS2) | 1.143 | 1.197 | 2.340 | −0.054 |

| (NS3) | 0.953 | 0.964 | 1.917 | −0.011 |

| (NS4) | 1.079 | 1.090 | 2.169 | −0.011 |

| New customer interaction (NC) | 10.526 | 10.689 | 21.215 | −0.614 |

| (NC1) | 0.837 | 0.827 | 1.664 | 0.010 |

| (NC2) | 0.855 | 0.843 | 1.698 | 0.012 |

| (NC3) | 0.848 | 0.870 | 1.718 | −0.022 |

| New business partners (NB) | 10.166 | 9.722 | 19.888 | 0.444 |

| (NB1) | 0.652 | 0.654 | 1.307 | −0.002 |

| (NB2) | 0.580 | 0.593 | 1.173 | −0.014 |

| (NB3) | 0.576 | 0.560 | 1.136 | 0.016 |

| New revenue models (NR) | 9.965 | 11.127 | 21.092 | −1.163 |

| (NR1) | 0.483 | 0.473 | 0.955 | 0.010 |

| (NR2) | 0.477 | 0.487 | 0.964 | −0.010 |

| Organizational innovation (OI) | 9.895 | 9.573 | 19.468 | 0.322 |

| (OI1) | 0.613 | 0.564 | 1.178 | 0.049 |

| (OI2) | 0.588 | 0.648 | 1.236 | −0.060 |

| (OI3) | 0.596 | 0.585 | 1.182 | 0.011 |

| Technological innovation (TI) | 10.326 | 10.171 | 20.497 | 0.156 |

| (TI1) | 1.334 | 1.300 | 2.633 | 0.034 |

| (TI2) | 1.174 | 1.167 | 2.341 | 0.007 |

| (TI3) | 1.065 | 1.104 | 2.168 | −0.039 |

| (TI4) | 1.152 | 1.160 | 2.312 | −0.008 |

| (TI5) | 1.172 | 1.166 | 2.339 | 0.006 |

| Criteria/Sub-Criteria | Original Weights | Overall Weights (by DANP) | Bank A | Bank B | Bank C | Bank D | ||||

|---|---|---|---|---|---|---|---|---|---|---|

| Scores | Gap | Scores | Gap | Scores | Gap | Scores | Gap | |||

| New service concept (NS) | 0.169 | 8.034 | 0.197 | 8.931 | 0.107 | 8.862 | 0.114 | 7.931 | 0.207 | |

| NS1 | 0.267 | 0.045 | 8.414 | 0.159 | 9.069 | 0.093 | 8.724 | 0.128 | 8.345 | 0.166 |

| NS2 | 0.270 | 0.045 | 8.621 | 0.138 | 9.103 | 0.090 | 8.966 | 0.103 | 8.310 | 0.169 |

| NS3 | 0.218 | 0.037 | 8.379 | 0.162 | 8.897 | 0.110 | 8.483 | 0.152 | 8.034 | 0.197 |

| NS4 | 0.246 | 0.041 | 8.172 | 0.183 | 8.690 | 0.131 | 8.241 | 0.176 | 7.414 | 0.259 |

| New customer interaction (NC) | 0.173 | 8.000 | 0.200 | 8.724 | 0.128 | 8.103 | 0.190 | 7.759 | 0.224 | |

| NC1 | 0.326 | 0.056 | 8.069 | 0.193 | 8.655 | 0.134 | 8.207 | 0.179 | 7.517 | 0.248 |

| NC2 | 0.332 | 0.057 | 8.000 | 0.200 | 8.966 | 0.103 | 8.586 | 0.141 | 7.552 | 0.245 |

| NC3 | 0.342 | 0.059 | 8.000 | 0.200 | 9.069 | 0.093 | 8.414 | 0.159 | 7.552 | 0.245 |

| New business partners (NB) | 0.158 | 7.655 | 0.234 | 8.552 | 0.145 | 8.241 | 0.176 | 7.517 | 0.248 | |

| NB1 | 0.362 | 0.057 | 7.483 | 0.252 | 8.103 | 0.190 | 8.172 | 0.183 | 7.414 | 0.259 |

| NB2 | 0.328 | 0.052 | 7.379 | 0.262 | 8.172 | 0.183 | 8.034 | 0.197 | 7.207 | 0.279 |

| NB3 | 0.310 | 0.049 | 7.276 | 0.272 | 7.897 | 0.210 | 7.690 | 0.231 | 7.034 | 0.297 |

| New revenue models (NR) | 0.180 | 7.724 | 0.228 | 8.310 | 0.169 | 8.379 | 0.162 | 7.690 | 0.231 | |

| NR1 | 0.493 | 0.089 | 8.034 | 0.197 | 8.483 | 0.152 | 7.931 | 0.207 | 6.931 | 0.307 |

| NR2 | 0.507 | 0.091 | 8.000 | 0.200 | 8.586 | 0.141 | 7.897 | 0.210 | 7.379 | 0.262 |

| Organizational innovation (OI) | 0.155 | 7.621 | 0.238 | 7.828 | 0.217 | 7.724 | 0.228 | 7.414 | 0.259 | |

| OI1 | 0.316 | 0.050 | 8.069 | 0.193 | 8.000 | 0.200 | 7.690 | 0.231 | 7.138 | 0.286 |

| OI2 | 0.358 | 0.055 | 8.207 | 0.179 | 8.414 | 0.159 | 8.379 | 0.162 | 7.828 | 0.217 |

| OI3 | 0.326 | 0.050 | 7.931 | 0.207 | 7.966 | 0.203 | 8.000 | 0.200 | 7.310 | 0.269 |

| Technological innovation (TI) | 0.165 | 8.345 | 0.166 | 8.759 | 0.124 | 8.276 | 0.172 | 7.724 | 0.228 | |

| TI1 | 0.221 | 0.036 | 8.759 | 0.124 | 8.690 | 0.131 | 8.034 | 0.197 | 7.000 | 0.300 |

| TI2 | 0.198 | 0.032 | 7.690 | 0.231 | 8.379 | 0.162 | 7.172 | 0.283 | 6.069 | 0.393 |

| TI3 | 0.187 | 0.031 | 8.103 | 0.190 | 7.966 | 0.203 | 7.034 | 0.297 | 5.931 | 0.407 |

| TI4 | 0.197 | 0.033 | 8.241 | 0.176 | 8.621 | 0.138 | 7.552 | 0.245 | 6.586 | 0.341 |

| TI5 | 0.198 | 0.032 | 7.862 | 0.214 | 8.621 | 0.138 | 8.103 | 0.190 | 6.793 | 0.321 |

| Formula | Strategies (Sequence of Improvement Priorities) |

|---|---|

| F1: influential network of criteria | (NB), (NS), (OI), (TI), (NC), (NR) |

| F2: influential network of sub-criteria | (NB): (NB3), (NB1), (NB2) (NS): (NS1), (NS3), (NS4), (NS2) (OI): (OI1), (OI3), (OI2) (TI): (TI1), (TI5), (TI2), (TI4), (TI5) (NC): (NC2), (NC1), (NC3) (NR): (NR1), (NR2) |

| F3: Bank A (state-owned commercial banks) (by gap value, from high to low) | (NB): (NB3), (NB2), (NB1) (NS): (NS4), (NS3), (NS1), (NS2) (OI): (OI3), (OI1), (OI2) (TI): (TI2), (TI5), (TI3), (TI4), (T1) (NC): (NC2), (NC3), (NC1) (NR): (NR2), (NR1) |

| F4: Bank B (joint-equity commercial banks) (by gap value, from high to low) | (NB): (NB3), (NB1), (NB2) (NS): (NS4), (NS3), (NS1), (NS2) (OI): (OI3), (OI1), (OI2) (TI): (TI3), (TI2), (TI4), (TI5), (T1) (NC): (NC2), (NC3), (NC1) (NR): (NR2), (NR1) |

| F5: Bank C (urban commercial banks) (by gap value, from high to low) | (NB): (NB3), (NB2), (NB1) (NS): (NS4), (NS3), (NS1), (NS2) (OI): (OI1), (OI3), (OI2) (TI): (TI3), (TI2), (TI4), (TI1), (T5) (NC): (NC1), (NC3), (NC2) (NR): (NR2), (NR1) |

| F6: Bank D (others) (by gap value, from high to low) | (NB): (NB3), (NB2), (NB1) (NS): (NS4), (NS3), (NS2), (NS1) (OI): (OI1), (OI3), (OI2) (TI): (TI3), (TI2), (TI4), (TI5), (T1) (NC): (NC1), (NC2), (NC3) (NR): (NR1), (NR2) |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhao, Q.; Tsai, P.-H.; Wang, J.-L. Improving Financial Service Innovation Strategies for Enhancing China’s Banking Industry Competitive Advantage during the Fintech Revolution: A Hybrid MCDM Model. Sustainability 2019, 11, 1419. https://doi.org/10.3390/su11051419

Zhao Q, Tsai P-H, Wang J-L. Improving Financial Service Innovation Strategies for Enhancing China’s Banking Industry Competitive Advantage during the Fintech Revolution: A Hybrid MCDM Model. Sustainability. 2019; 11(5):1419. https://doi.org/10.3390/su11051419

Chicago/Turabian StyleZhao, Qun, Pei-Hsuan Tsai, and Jin-Long Wang. 2019. "Improving Financial Service Innovation Strategies for Enhancing China’s Banking Industry Competitive Advantage during the Fintech Revolution: A Hybrid MCDM Model" Sustainability 11, no. 5: 1419. https://doi.org/10.3390/su11051419

APA StyleZhao, Q., Tsai, P.-H., & Wang, J.-L. (2019). Improving Financial Service Innovation Strategies for Enhancing China’s Banking Industry Competitive Advantage during the Fintech Revolution: A Hybrid MCDM Model. Sustainability, 11(5), 1419. https://doi.org/10.3390/su11051419