Insufficient Consumption Demand of Chinese Urban Residents: An Explanation of the Consumption Structure Effect from Income Distribution Change

Abstract

1. Introduction

2. Review of Literature

3. Construction of the Model Used

3.1. The Duality Problem of the AIDS Model

3.2. Counterfactual Decomposition of Income Distribution

3.3. Dynamic Expansion of AIDS Model

4. Data Preparation and Regression Equation Setting

4.1. Data Preparation

4.2. Regression Equation Setting

5. Empirical Results and Discussion

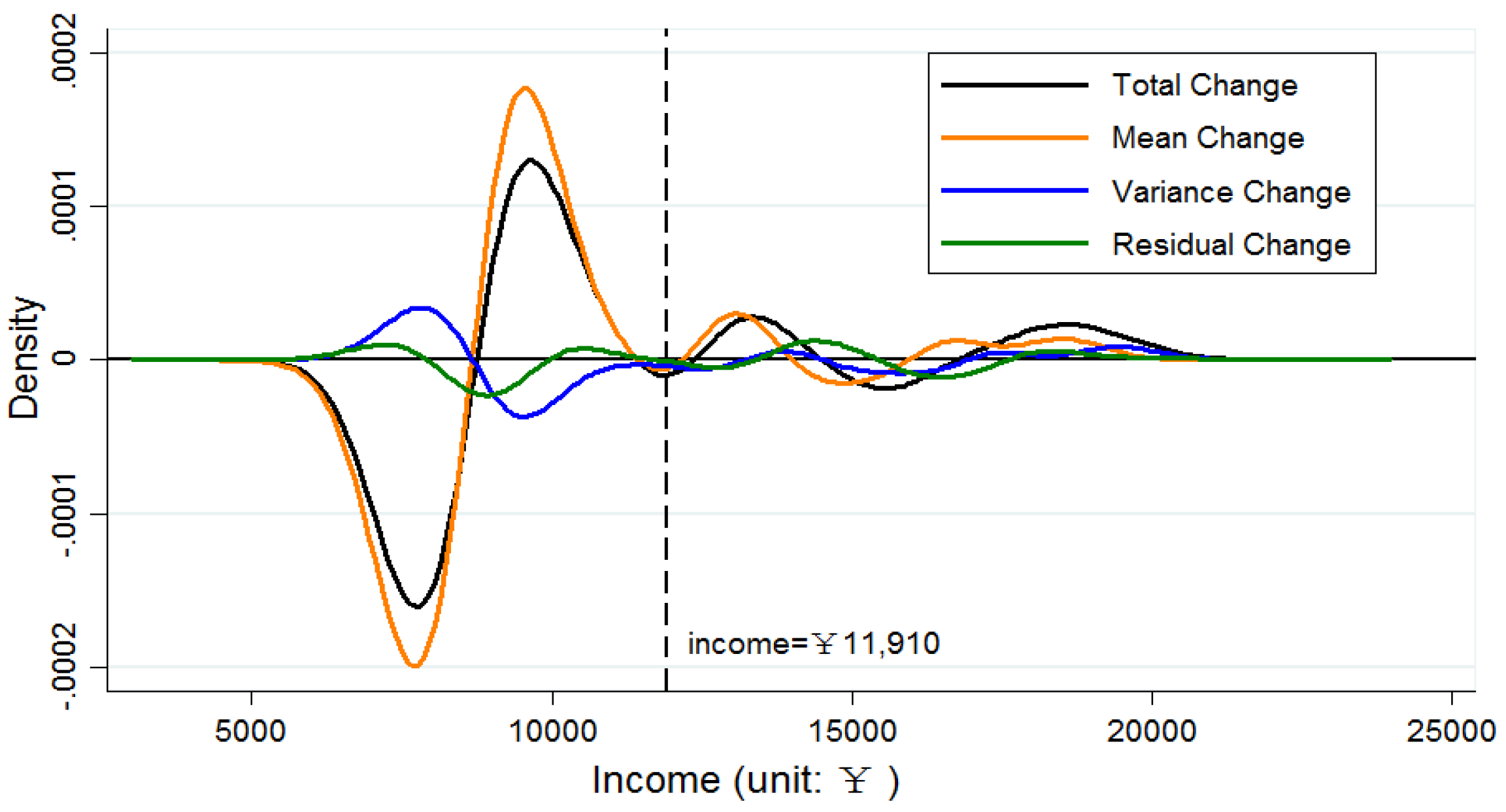

5.1. The Counter-factual Decomposition of Income Distribution

5.2. Model Estimation Results and Analysis

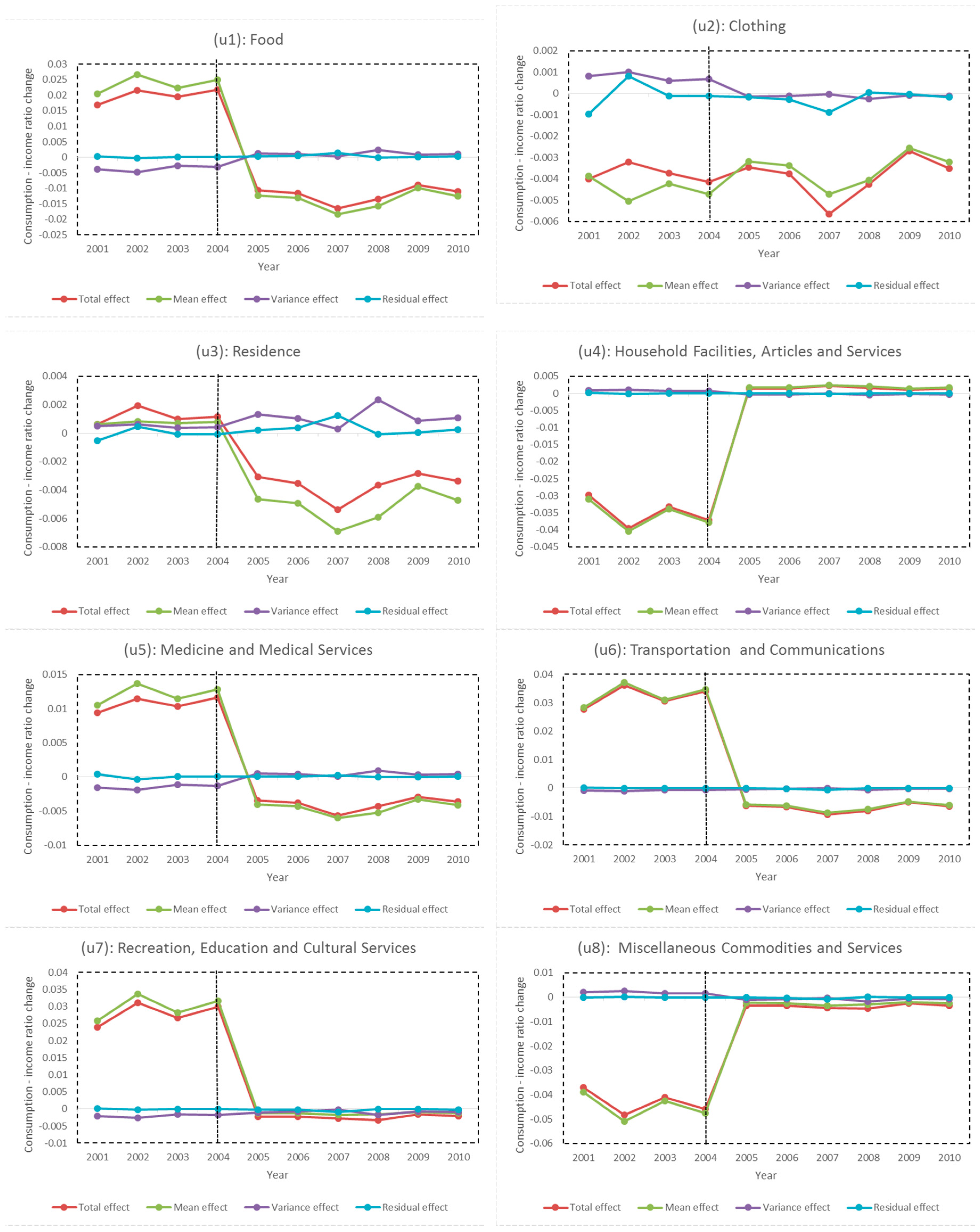

5.3. Quantitative Counterfactual Estimation of the Effects

- Total effect:

- Mean effect:

- Variance effect:

- Residual effect:

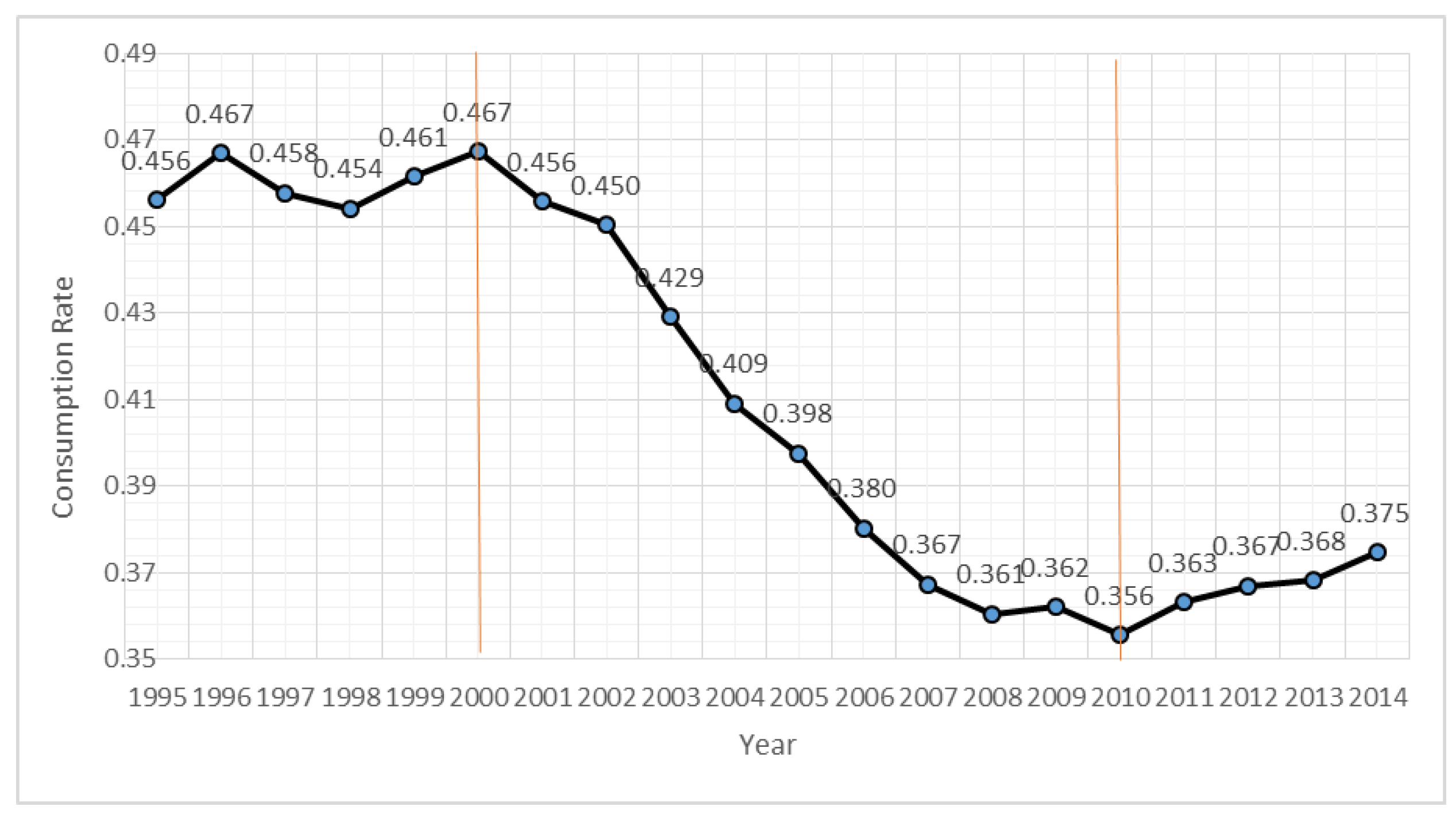

5.4. Discussion on China’s Insufficient Domestic Demand

- Case 1: Suppose this is a new commodity, and its price is relatively high, so its market initially is only the high-income families. It is easy to judge that the increase in income levels will promote its demand growth, while the widening income gap will make high-income residents enter the market faster, which will also increase the demand, so the two effects are both positive.

- Case 2: When the main body of the population, the middle-income group, begins to pay attention to the goods, the increase in the income levels will still drive demand growth. However, the larger variance will cause the income distribution to polarize and the distribution curve to become flat, so the size of the middle income groups will be reduced, which may inhibit the growth of demand. Therefore, the mean effect is positive and the variance effect is negative at this time.

- Case 3: When the middle income group leaves the market, only the demand from the low-income families is not met. The increase in income levels will lead to more people’s needs being met and cause them leave the market, but the expansion of the variance will increase the size of the low-income group and delay the decline in demand. Therefore, the mean effect is negative and the variance effect is positive.

- Case 4: When all the families have the ability to buy the goods, the goods become popular. This causes the upgraded goods to be effectively a new commodity, and at this point the increase in the mean and variance of the income will lead to a reduction in the demand for the commodity, so the two effects are both negative.

6. Conclusions and Policy Implications

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- National Bureau of Statistics of China. Consumption rate is calculated by the author. Available online: http://data.stats.gov.cn/ (accessed on 20 December 2018).

- Eichengreen, B.; Park, D.; Shin, K. When Fast Growing Economies Slow Down: International Evidence and Implications for China. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1883962 (accessed on 20 December 2018).

- Mofrad, M.A. The relationship between GDP, Export and Investment: Case Study Iran. Bus. Intel. J. 2012, 5, 401–405. [Google Scholar]

- Saito, M. The Japanese Economy. J. Asian Econ. 2000, 13, 569–570. [Google Scholar]

- Horioka, C.Y. The causes of Japan’s ‘lost decade’: The role of household consumption. JPN. World Econ. 2006, 18, 378–400. [Google Scholar] [CrossRef]

- Munir, Q.; Mansur, K. Others Non-linearity between inflation rate and GDP growth in Malaysia. Econ. Bull. 2009, 29, 1555–1569. [Google Scholar]

- Liu, J.; Wang, Q. The Nonlinear Relationship between Final Consumption Rate and Economic Growth: An International Experience Analysis based on PSTR Model. Int. Econ. Tr. Res. 2017, 33, 41–56. [Google Scholar]

- Su, P.; Jiang, X.; Sun, W. The Flexible Acceleration Mechanism of China’s Capital Adjustment with the Goal of Consumption-Driven Sustainable Growth. Sus. 2018, 10, 886. [Google Scholar] [CrossRef]

- World Development Indicators of World Bank. Available online: https://datacatalog.worldbank.org/dataset/world-development-indicators (accessed on 26 January 2019).

- Rhee, C. From Miracle to Maturity: The Growth of the Korean Economy. J. Econ. Lit. 2013, 51, 912–914. [Google Scholar]

- Modigliani, F.; Cao, S.L. The Chinese Saving Puzzle and the Life-Cycle Hypothesis. J. Econ. Lit. 2004, 42, 145–170. [Google Scholar] [CrossRef]

- Blanchard, O.J.; Giavazzi, F. Rebalancing Growth in China: A Three-Handed Approach. China World Econ. 2006, 4, 1–20. [Google Scholar] [CrossRef]

- Giles, J.; Yoo, K. Precautionary Behavior, Migrant Networks, and Household Consumption Decisions: An Empirical Analysis Using Household Panel Data from Rural China. Rev. Econ. Stat. 2007, 89, 534–551. [Google Scholar] [CrossRef]

- Aziz, J.; Cui, L. Explaining China’s Low Consumption: The Neglected Role of Household Income. Available online: https://www.imf.org/en/Publications/WP/Issues/2016/12/31/Explaining-Chinas-Low-Consumption-The-Neglected-Role-of-Household-Income-21026 (accessed on 20 December 2018).

- Blinder, A.S. A Model of Inherited Wealth. Quart. J. Econ. 1973, 87, 608–626. [Google Scholar] [CrossRef]

- Musgrove, P. Income Distribution and the Aggregate Consumption Function. J. Polit. Econ. 1980, 88, 504–525. [Google Scholar] [CrossRef]

- Chen, L. The Expansion of Income Gap and the Inadequacy of China’s Domestic Demand: Theoretical Mechanism and Empirical Test. Econ. Sci. 2011, 1, 11–24. [Google Scholar]

- Zhang, Y.S.; Chen, M. Theil Index and Its Suitability Test in China––the Relationship between Income Distribution and Expanding Domestic Demand. Res. Econ. Manag. 2012, 12, 5–14. [Google Scholar]

- Zhu, G.L.; Fan, J.Y.; Yan, Y. On China’s Consumption Sag and Income Distribution. Econ. Res. J. 2002, 5, 72–80. [Google Scholar]

- Li, J. Quantitative Analysis of Influence of Relative Income Gaps on the Consumption Demand. J. Quant. Tech. Econ. 2003, 20, 5–11. [Google Scholar]

- Qiao, W.G.; Kong, X.X. Impact of Household Income Inequality on Tendency of Propensity to Consume in China. Mod. Econ. Sci. 2005, 27, 1–5. [Google Scholar]

- Su, P.; Sun, W. Income Inequality and Insufficient Domestic Demand: Nonlinear Feature of Consumer Demand. Com’l. Res. 2013, 55, 47–53. [Google Scholar]

- Keynes, J.M. The General Theory of Employment, Interest and Money; Palgrave Macmillan: New York, NY, USA, 1936. [Google Scholar]

- Modigliani, F.; Brumberg, R. Utility Analysis and the Consumption Function: An Interpretation of the Cross-Section Data. In Post-Keynesian Economics; Kenneth, K.K., Ed.; Rutgers University Press: New Jersey, NJ, USA, 1954. [Google Scholar]

- Kalecki, M. Selected Essays on the Dynamics of the Capitalist Economy 1933–1970; Cambridge University Press: Cambridge, UK, 1971. [Google Scholar]

- Weintraub, S. Effective Demand and Income Distribution. In Distribution, Effective Demand and International Economic Relations; Kregel, J.A., Ed.; Palgrave Macmillan: London, UK, 1983. [Google Scholar]

- Stoker, T.M. Simple Tests of Distributional Effects on Macroeconomic Equations. J. Polit. Econ. 1986, 94, 763–795. [Google Scholar] [CrossRef]

- Campbell, J.Y.; Mankiw, N.G. The Response of Consumption to Income: A Cross-Country Investigation. Eur. Econ. Rev. 1991, 35, 723–756. [Google Scholar] [CrossRef]

- Lin, Y.F. Strengthen the Construction of Rural Infrastructure and Start the Rural Market. Iss. Agric. Econ. 2000, 21, 2–3. [Google Scholar]

- Hock, H.; Weil, D.N. On the Dynamics of the Age Structure, Dependency, and Consumption. J. Popul. Econ. 2012, 25, 1019–1043. [Google Scholar] [CrossRef]

- Sun, W.; Su, P. On the Transition of Income Distribution in China’s Urban Areas. Jilin Univ. J. Soc. Sci. Ed. 2013, 53, 23–31. [Google Scholar]

- Pittau, M.G.; Zelli, R. Testing for Changing Shapes of Income Distribution: Italian Evidence in the 1990S from Kernel Density Estimates. Empir. Econ. 2004, 29, 415–430. [Google Scholar] [CrossRef]

- Jenkins, S.P.; Van Kerm, P. Accounting for Income Distribution Trends: A Density Function Decomposition Approach. J. Econ. Inequal. 2005, 3, 43–61. [Google Scholar] [CrossRef]

- Fogel, R.W. A Quantitative Approach to the Study of Railroads in American Economic Growth: A Report of some Preliminary Findings. J. Econ. Hist. 1962, 22, 163–197. [Google Scholar] [CrossRef]

- Yin, H.; Du, Z.; Zhang, L. Assessing the Gains and Vulnerability of Free Trade: A Counterfactual Analysis of Macau. Econ. Model. 2018, 70, 147–158. [Google Scholar] [CrossRef]

- Stone, R. Linear Expenditure Systems and Demand Analysis: An Application to the Pattern of British Demand. Econ. J. 1954, 64, 511–527. [Google Scholar] [CrossRef]

- Lluch, C. The Extended Linear Expenditure System. Eur. Econ. Rev. 1973, 4, 21–32. [Google Scholar] [CrossRef]

- Deaton, A.; Muellbauer, J. An Almost Ideal Demand System. Am. Econ. Rev. 1980, 70, 312–326. [Google Scholar]

- Ray, R. The Testing and Estimation of Complete Demand Systems on Household Budget Surveys: An Application of AIDS. Eur. Econ. Rev. 1982, 17, 349–369. [Google Scholar] [CrossRef]

- Blanciforti, L.; Green, R. An Almost Ideal Demand System Incorporating Habits: An Analysis of Expenditures on Food and Aggregate Commodity Groups. Rev. Econ. Stat. 1983, 65, 511–515. [Google Scholar] [CrossRef]

- Chesher, A.; Rees, H. Income Elasticities of Demand for Foods in Great Britain. J. Agri. Econ. 1987, 38, 435–448. [Google Scholar] [CrossRef]

- Filippini, M. Electricity Demand by Time of Use: An Application of the Household AIDS Model. Energ. Econ. 1995, 17, 197–204. [Google Scholar] [CrossRef]

- Thong, N.T. An Inverse Almost Ideal Demand System for Mussels in Europe. Mar. Resour Econ. 2012, 27, 149–164. [Google Scholar] [CrossRef]

- Pollak, R.A.; Wales, T.J. Estimation of Complete Demand Systems from Household Budget Data: The Linear and Quadratic Expenditure Systems. Am. Econ. Rev. 1978, 68, 348–359. [Google Scholar]

- Blundell, R.; Pashardes, P.; Weber, G. What do we learn about Consumer Demand Patterns from Micro Data? Am. Econ. Rev. 1993, 83, 570–597. [Google Scholar]

- Fan, S.; Wailes, E.J.; Cramer, G.L. Household Demand in Rural China: A Two-Stage LES-AIDS Model. Am. J. Agr. Econ. 1995, 77, 54–62. [Google Scholar] [CrossRef]

- Menezes, T.A.; Azzoni, C.R.; Silveira, F.G. Demand Elasticities for Food Products in Brazil: A Two-Stage Budgeting System. Appl. Econ. 2008, 40, 2557–2572. [Google Scholar] [CrossRef]

- Dey, M.M.; Alam, M.F.; Paraguas, F.J. A Multistage Budgeting Approach to the Analysis of Demand for Fish: An Application to Inland Areas of Bangladesh. Mar. Resour. Econ. 2011, 26, 35–58. [Google Scholar] [CrossRef]

- Moschini, G.; Meilke, K.D. Modeling the Pattern of Structural Change in U.S. Meat Demand. Amer. J. Agr. Econ. 1989, 71, 253–261. [Google Scholar] [CrossRef]

- Hansen, B.E. Inference When a Nuisance Parameter is Not Identified under the Null Hypothesis. Econ. 1996, 64, 413–430. [Google Scholar] [CrossRef]

- Hansen, B.E. Threshold Effects in Non-dynamic Panels: Estimation, Testing, and Inference. J. Econ. 1999, 93, 345–368. [Google Scholar] [CrossRef]

- Hansen, B.E. Sample Splitting and Threshold Estimation. Econ. 2000, 68, 575–603. [Google Scholar] [CrossRef]

- Campbell, J.Y.; Cocco, J.F. How do House Prices Affect Consumption? Evidence from Micro Data. J. Monetary Econ. 2007, 54, 591–621. [Google Scholar] [CrossRef]

- Lin, Y.F.; Wu, H.M.; Xing, Y.Q. “Wave Phenomena” and Formation of Excess Capacity. Econ. Res. J. 2010, 10, 4–19. [Google Scholar]

| Year | Per Capita Income | Lowest | Low | Lower Middle | Middle | Upper Middle | High | Highest | Standard Deviation |

|---|---|---|---|---|---|---|---|---|---|

| 2000 | 6280.0 | 2653.0 | 3633.5 | 4623.5 | 5897.9 | 7487.4 | 9434.2 | 13,311.0 | 1122.7 |

| 2001 | 6859.6 | 2802.8 | 3319.7 | 4946.6 | 6366.2 | 8164.2 | 12,662.6 | 15,114.9 | 1424.4 |

| 2002 | 7702.8 | 2408.6 | 3032.1 | 4932.0 | 6656.8 | 8869.5 | 15,459.5 | 18,995.9 | 1919.1 |

| 2003 | 8472.2 | 2590.2 | 3295.4 | 5377.3 | 7278.8 | 9763.4 | 17,471.8 | 21,837.3 | 2224.4 |

| 2004 | 9421.6 | 2862.4 | 3642.2 | 6024.1 | 8166.5 | 11,050.9 | 20,101.6 | 25,377.2 | 2609.4 |

| 2005 | 10,493.0 | 3134.9 | 4017.3 | 6710.6 | 9190.1 | 12,603.4 | 22,902.3 | 28,773.1 | 2988.4 |

| 2006 | 11,759.5 | 3568.7 | 4567.1 | 7554.2 | 10,269.7 | 14,049.2 | 25,410.8 | 31,967.3 | 3303.3 |

| 2007 | 13,785.8 | 4210.1 | 6504.6 | 8900.5 | 12,042.3 | 16,385.8 | 22,233.6 | 36,784.5 | 3406.6 |

| 2008 | 15,780.8 | 4753.6 | 7363.3 | 10,195.6 | 13,984.2 | 19,254.1 | 26,250.1 | 43,613.8 | 4087.8 |

| 2009 | 17,174.7 | 5253.2 | 8162.1 | 11,243.6 | 15,399.9 | 21,018.0 | 28,386.5 | 46,826.1 | 4366.2 |

| 2010 | 19,109.4 | 5948.1 | 9285.3 | 12,702.1 | 17,224.0 | 23,188.9 | 31,044.0 | 51,431.6 | 4750.0 |

| (a) | ||||||

| Mutation Point | 2003 | 2004 | 2005 | 2006 | 2007 | |

| Likelihood Value | 9033.876 | 9035.975 * | 9035.189 | 9001.732 | 8980.904 | |

| (b) | ||||||

| Likelihood-ratio Test | Test Statistic | df | Probability | Critical value | ||

| 1% | 5% | 10% | ||||

| Assumption: No Structural Change | 250.20 | 32 | 0.000 | 53.486 | 46.194 | 42.585 |

| Period | Effects | (u1) | (u2) | (u3) | (u4) | (u5) | (u6) | (u7) | (u8) |

|---|---|---|---|---|---|---|---|---|---|

| 2000–2004 | Mean | 0.219** (2.52) | −0.00415 (−0.80) | 0.00676 (0.11) | −0.333*** (−6.75) | 0.113*** (2.76) | 0.306*** (3.90) | 0.278*** (4.56) | −0.418*** (−11.68) |

| Variance | 0.266*** (4.02) | −0.0576 (−1.46) | −0.0357 (−0.73) | -0.0626* (−1.66) | 0.108*** (3.43) | 0.0536 (0.89) | 0.142*** (3.00) | −0.138*** (−5.23) | |

| Residual | −0.0321 (0.90) | −0.0838*** (−3.92) | −0.0465* (−1.76) | 0.0166 (0.83) | 0.0380** (2.25) | 0.0101 (0.31) | 0.0135 (0.53) | −0.00973 (−0.66) | |

| 2005–2010 | Mean | −0.106*** (−3.28) | −0.0274 (−1.37) | −0.0400 (−1.59) | −0.0142 (0.74) | −0.0350** (−2.17) | −0.0504* (−1.65) | −0.0100 (−0.42) | 0.0203 (−1.55) |

| Variance | −0.125** (−1.98) | 0.0128 (0.35) | −0.125*** (−2.67) | 0.0318 (0.91) | −0.0508* (−1.70) | 0.0308 (0.55) | 0.0946** (2.14) | 0.0966*** (3.94) | |

| Residual | −0.0626* (−1.76) | 0.0378* (1.79) | −0.0522** (−2.00) | 0.00428 (0.22) | −0.0111 (−0.66) | 0.0234 (0.73) | 0.0353 (1.41) | 0.0319** (2.17) | |

| RMSE | 0.0105 | 0.0061 | 0.0075 | 0.0057 | 0.0047 | 0.0094 | 0.0071 | 0.0042 | |

| “R-sq.” | 0.9986 | 0.9946 | 0.9905 | 0.9858 | 0.9928 | 0.9887 | 0.9948 | 0.9795 | |

| Breusch-Pagan test of independence: chi2(28) = 174.237, Pr = 0.0000 | |||||||||

| Period | Effects | (u1) | (u2) | (u3) | (u4) | (u5) | (u6) | (u7) | (u8) |

|---|---|---|---|---|---|---|---|---|---|

| 2000–2004 | Total | 0.01995 | −0.00378 | 0.00116 | −0.03490 | 0.01070 | 0.03216 | 0.02795 | −0.04304 |

| (100) | (100) | (100) | (100) | (100) | (100) | (100) | (100) | ||

| Mean | 0.02355 | −0.00447 | 0.00073 | −0.03578 | 0.01213 | 0.03288 | 0.02987 | −0.04492 | |

| (118.04) | (118.25) | (62.51) | (102.52) | (113.36) | (102.25) | (106.90) | (104.37) | ||

| Variance | −0.00364 | 0.00079 | 0.00049 | 0.00086 | −0.00147 | −0.00073 | −0.00194 | 0.00189 | |

| (−18.25) | (−20.82) | (41.96) | (−2.46) | (−13.74) | (−2.27) | (−6.94) | (−4.39) | ||

| Residual | 0.00004 | −0.00010 | −0.00005 | 0.00002 | 0.00004 | 0.00001 | 0.00002 | −0.00001 | |

| (0.18) | (2.51) | (−4.56) | (−0.05) | (0.40) | (0.04) | (0.05) | (0.03) | ||

| 2005–2010 | Total | −0.01205 | −0.00389 | −0.00364 | 0.00150 | −0.00396 | −0.00691 | −0.00239 | −0.00370 |

| (100) | (100) | (100) | (100) | (100) | (100) | (100) | (100) | ||

| Mean | −0.01362 | −0.00352 | −0.00514 | 0.00182 | −0.00450 | −0.00648 | −0.00129 | −0.00261 | |

| (113.03) | (90.49) | (141.21) | (121.32) | (113.64) | (93.78) | (53.97) | (70.39) | ||

| Variance | 0.00115 | −0.00012 | 0.00115 | −0.00029 | 0.00047 | −0.00028 | −0.00087 | −0.00088 | |

| (−9.54) | (3.08) | (−31.54) | (−19.32) | (−11.74) | (4.05) | (36.40) | (23.88) | ||

| Residual | 0.00042 | −0.00025 | 0.00035 | −0.00003 | 0.00007 | −0.00016 | −0.00023 | −0.00021 | |

| (−3.46) | (6.43) | (−9.56) | (−1.87) | (−1.87) | (2.32) | (9.62) | (5.73) |

| Effects | Case 1 | Case 2 | Case 3 | Case 4 | |

|---|---|---|---|---|---|

| Income Distribution Change | Mean | + | + | − | − |

| Variance | + | − | + | − |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Su, P.; Jiang, X.; Yang, C.; Wang, T.; Feng, X. Insufficient Consumption Demand of Chinese Urban Residents: An Explanation of the Consumption Structure Effect from Income Distribution Change. Sustainability 2019, 11, 984. https://doi.org/10.3390/su11040984

Su P, Jiang X, Yang C, Wang T, Feng X. Insufficient Consumption Demand of Chinese Urban Residents: An Explanation of the Consumption Structure Effect from Income Distribution Change. Sustainability. 2019; 11(4):984. https://doi.org/10.3390/su11040984

Chicago/Turabian StyleSu, Peng, Xiaochun Jiang, Chengbo Yang, Ting Wang, and Xing Feng. 2019. "Insufficient Consumption Demand of Chinese Urban Residents: An Explanation of the Consumption Structure Effect from Income Distribution Change" Sustainability 11, no. 4: 984. https://doi.org/10.3390/su11040984

APA StyleSu, P., Jiang, X., Yang, C., Wang, T., & Feng, X. (2019). Insufficient Consumption Demand of Chinese Urban Residents: An Explanation of the Consumption Structure Effect from Income Distribution Change. Sustainability, 11(4), 984. https://doi.org/10.3390/su11040984