The Relationships between Corporate Credibility, Service Convenience, and Consumers’ Use Intentions: Toward Ticketing Apps for Low-Cost Carriers

Abstract

:1. Introduction

2. Literature Review

2.1. Technology Readiness

2.2. Service Convenience

2.3. Corporate Credibility

2.4. Relationships among Technology Readiness for Mobile-Device Use, Service Convenience, Corporate Credibility, and Consumers’ App-Use Intentions

3. Methods

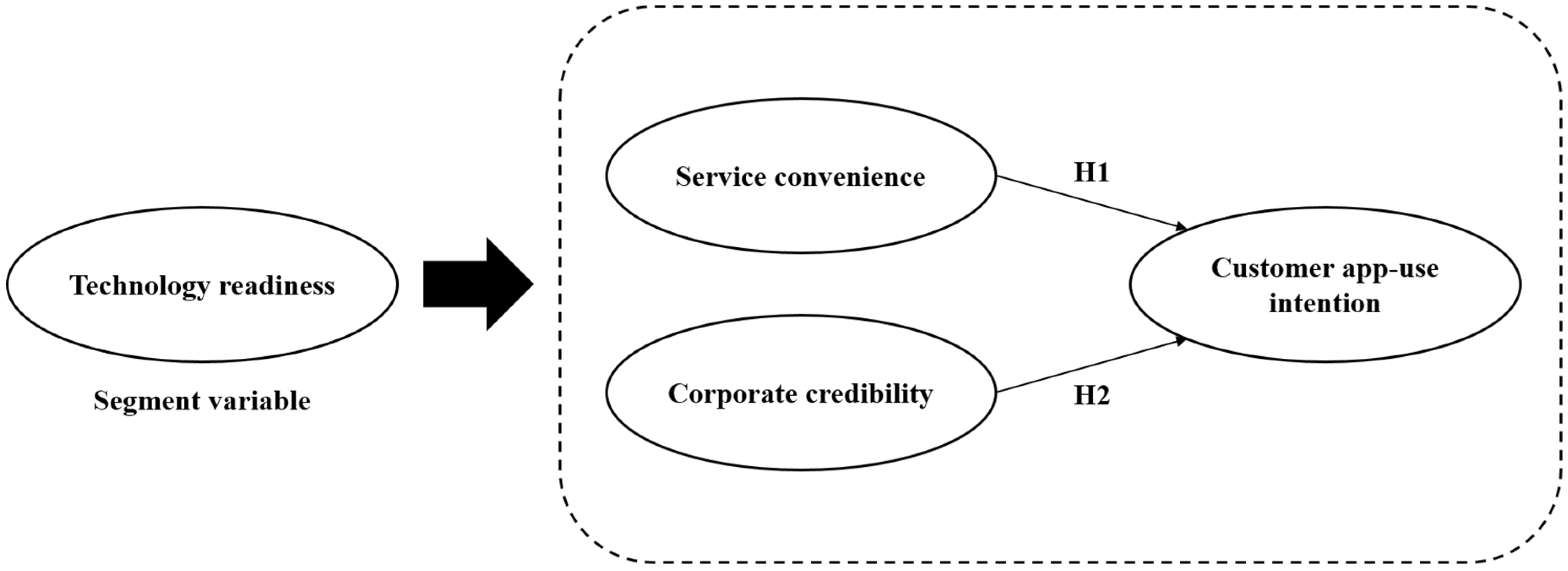

3.1. Research Framework

3.2. Questionnaire Design

3.3. Respondents and Sampling

4. Results and Analysis

4.1. Descriptive Statistics

4.2. Exploratory Factor Analysis

4.3. Confirmatory Factor Analysis

4.4. Results of Cluster Analysis

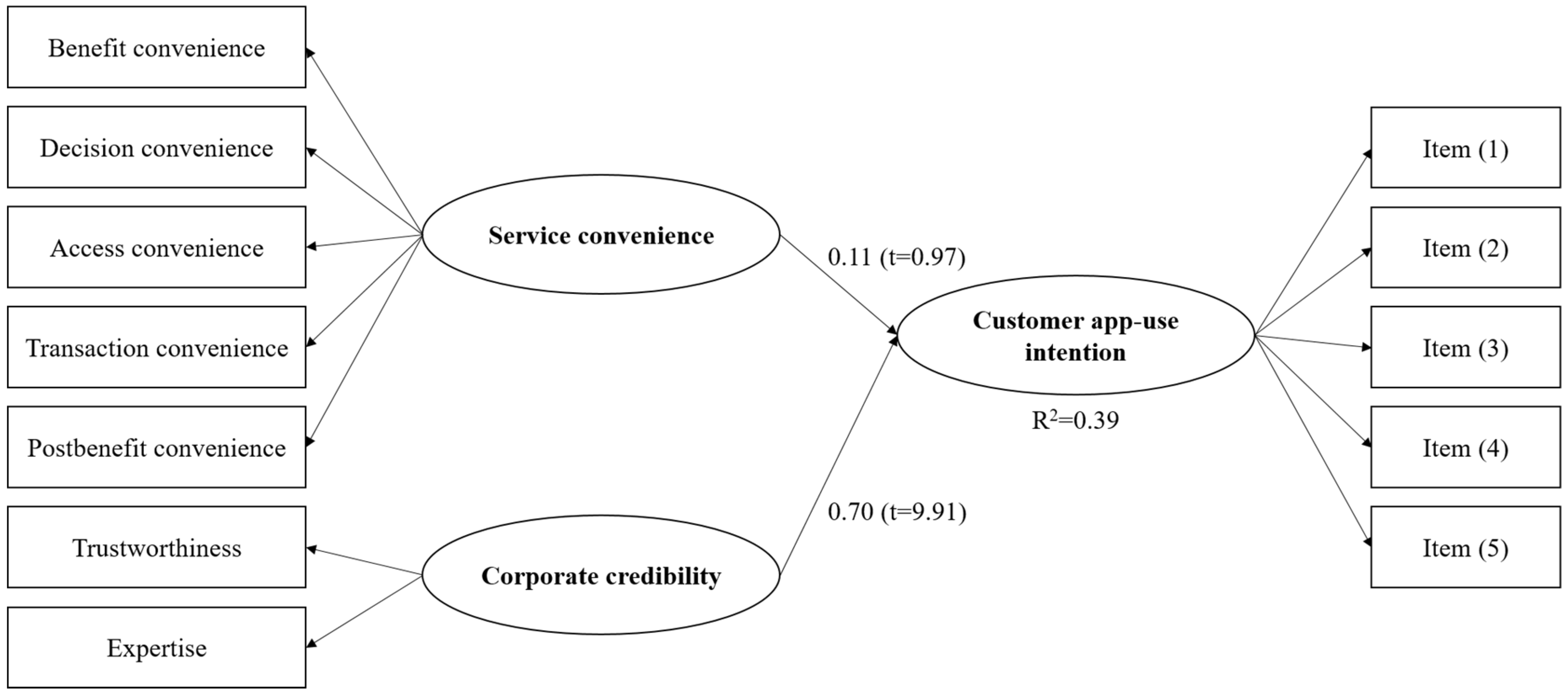

4.5. Verification of the Theoretical Model

5. Conclusions and Discussion

5.1. Conclusions

5.2. Management Implications

5.3. Limitations and Suggestions for Future Studies

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Stamford, C. Gartner Says Worldwide Mobile Payment Transaction Value to Surpass $235 Billion in 2013. Available online: http://www.gartner.com/newsroom/id/2504915 (accessed on 17 November 2015).

- Berry, L.L.; Seiders, K.; Grewal, D. Understanding service convenience. J. Mark. 2002, 66, 1–17. [Google Scholar] [CrossRef]

- Cheong, J.H.; Park, M.-C. Mobile internet acceptance in Korea. Internet Res. 2005, 15, 125–140. [Google Scholar] [CrossRef]

- Choi, J.; Seol, H.; Lee, S.; Cho, H.; Park, Y. Customer satisfaction factors of mobile commerce in Korea. Internet Res. 2008, 18, 313–335. [Google Scholar] [CrossRef]

- Wu, J.-H.; Wang, S.-C. What drives mobile commerce?: An empirical evaluation of the revised technology acceptance model. Inf. Manag. 2005, 42, 719–729. [Google Scholar] [CrossRef]

- Goldsmith, R.E.; Lafferty, B.A.; Newell, S.J. The impact of corporate credibility and celebrity credibility on consumer reaction to advertisements and brands. J. Advert. 2000, 29, 43–54. [Google Scholar] [CrossRef]

- Greyser, S.A. Advancing and enhancing corporate reputation. Corp. Commun. Int. J. 1999, 4, 177–181. [Google Scholar] [CrossRef]

- Verma, R.; Stock, D.; McCarthy, L. Customer preferences for online, social media, and mobile innovations in the hospitality industry. Cornell Hosp. Q. 2012, 53, 183–186. [Google Scholar] [CrossRef]

- Liljander, V.; Gillberg, F.; Gummerus, J.; Van Riel, A. Technology readiness and the evaluation and adoption of self-service technologies. J. Retail. Consum. Serv. 2006, 13, 177–191. [Google Scholar] [CrossRef]

- Becker, J.-M.; Rai, A.; Ringle, C.M.; Völckner, F. Discovering unobserved heterogeneity in structural equation models to avert validity threats. Mis Q. 2013, 37, 665–694. [Google Scholar] [CrossRef]

- Liau, B.Y.; Tan, P.P. Gaining customer knowledge in low cost airlines through text mining. Ind. Manag. Data Syst. 2014, 114, 1344–1359. [Google Scholar] [CrossRef]

- Lin, C.H.; Shih, H.Y.; Sher, P.J. Integrating technology readiness into technology acceptance: The TRAM model. Psychol. Mark. 2007, 24, 641–657. [Google Scholar] [CrossRef]

- Lin, J.-S.C.; Chang, H.-C. The role of technology readiness in self-service technology acceptance. Manag. Serv. Qual. Int. J. 2011, 21, 424–444. [Google Scholar] [CrossRef]

- Fu, X.; Lei, Z.; Wang, K.; Yan, J. Low cost carrier competition and route entry in an emerging but regulated aviation market—The case of China. Transp. Res. Part A Policy Pract. 2015, 79, 3–16. [Google Scholar] [CrossRef]

- Klaas, T.; Klein, J. Strategic airline positioning in the German low cost carrier (LCC) market. In Strategic Management in the Aviation Industry; Routledge: New York, NY, USA, 2017; pp. 119–142. [Google Scholar]

- O’Connell, J.F.; Connolly, D. The strategic evolution of Aer Lingus from a full-service airline to a low-cost carrier and finally positioning itself into a value hybrid airline. Tour. Econ. 2017, 23, 1296–1320. [Google Scholar] [CrossRef]

- Pearson, J.; O’Connell, J.F.; Pitfield, D.; Ryley, T. The strategic capability of Asian network airlines to compete with low-cost carriers. J. Air Transp. Manag. 2015, 47, 1–10. [Google Scholar] [CrossRef]

- Clavé, S.A.; Saladié, Ò.; Cortés-Jiménez, I.; Young, A.F.; Young, R. How different are tourists who decide to travel to a mature destination because of the existence of a low-cost carrier route? J. Air Transp. Manag. 2015, 42, 213–218. [Google Scholar] [CrossRef]

- De Wit, J.G.; Zuidberg, J. Route churn: An analysis of low-cost carrier route continuity in Europe. J. Transp. Geogr. 2016, 50, 57–67. [Google Scholar] [CrossRef]

- Tsui, K.W.H. Does a low-cost carrier lead the domestic tourism demand and growth of New Zealand? Tour. Manag. 2017, 60, 390–403. [Google Scholar] [CrossRef]

- Stern, S.E.; Kipnis, D. Technology in Everyday Life and Perceptions of Competence1. J. Appl. Soc. Psychol. 1993, 23, 1892–1902. [Google Scholar] [CrossRef]

- Dabholkar, P.A. Consumer evaluations of new technology-based self-service options: An investigation of alternative models of service quality. Int. J. Res. Mark. 1996, 13, 29–51. [Google Scholar] [CrossRef]

- Dabholkar, P.A.; Bagozzi, R.P. An attitudinal model of technology-based self-service: Moderating effects of consumer traits and situational factors. J. Acad. Mark. Sci. 2002, 30, 184–201. [Google Scholar] [CrossRef]

- Kleijnen, M.; Wetzels, M.; De Ruyter, K. Consumer acceptance of wireless finance. J. Financ. Serv. Mark. 2004, 8, 206–217. [Google Scholar] [CrossRef]

- Ferreira, J.B.; da Rocha, A.; da Silva, J.F. Impacts of technology readiness on emotions and cognition in Brazil. J. Bus. Res. 2014, 67, 865–873. [Google Scholar] [CrossRef]

- BAŞGÖZE, P. Integration of Technology Readiness (TR) into the Technology Acceptance Model (TAM) for m-shopping. Int. J. Sci. Res. Innov. Technol. 2015, 2, 26–35. [Google Scholar]

- Parasuraman, A. Technology Readiness Index (TRI) a multiple-item scale to measure readiness to embrace new technologies. J. Serv. Res. 2000, 2, 307–320. [Google Scholar] [CrossRef]

- Parasuraman, A.; Colby, C.L. An updated and streamlined technology readiness index TRI 2.0. J. Serv. Res. 2015, 18, 59–74. [Google Scholar] [CrossRef]

- Parasuraman, A.; Colby, C.L. Techno-Ready Marketing; The Free Press: New York, NY, USA, 2001. [Google Scholar]

- Copeland, M.T. Relation of consumers’ buying habits to marketing methods. Harv. Bus. Rev. 1923, 1, 282–289. [Google Scholar]

- Brown, L.G. Convenience in services marketing. J. Serv. Mark. 1990, 4, 53–59. [Google Scholar] [CrossRef]

- Davis, M.M.; Vollmann, T.E. A framework for relating waiting time and customer satisfaction in a service operation. J. Serv. Mark. 1990, 4, 61–69. [Google Scholar] [CrossRef]

- Berry, L.L. Time-buying consumer. J. Retail. 1979, 55, 58–69. [Google Scholar]

- Yale, L.; Venkatesh, A. Toward the construct of convenience in consumer research. Na-Adv. Consum. Res. 1986, 13, 403–408. [Google Scholar]

- Roy, S.K.; Shekhar, V.; Lassar, W.M.; Chen, T. Customer engagement behaviors: The role of service convenience, fairness and quality. J. Retail. Consum. Serv. 2018, 44, 293–304. [Google Scholar] [CrossRef]

- Chang, M.-Y.; Chen, K.; Pang, C.; Chen, C.-M.; Yen, D.C. A study on the effects of service convenience and service quality on maintenance revisit intentions. Comput. Stand. Interfaces 2013, 35, 187–194. [Google Scholar] [CrossRef]

- Gehrt, K.C.; Yale, L.J. The dimensionality of the convenience phenomenon: A qualitative reexamination. J. Bus. Psychol. 1993, 8, 163–180. [Google Scholar] [CrossRef]

- Craig, C.S.; McCann, J.M. Assessing communication effects on energy conservation. J. Consum. Res. 1978, 5, 82–88. [Google Scholar] [CrossRef]

- Ohanian, R. Construction and validation of a scale to measure celebrity endorsers’ perceived expertise, trustworthiness, and attractiveness. J. Advert. 1990, 19, 39–52. [Google Scholar] [CrossRef]

- Idris, A.; Hati, S.R.H. Corporate Credibility, Religion and Customer Support Intention toward Social Enterprises. In Social Enterprise-Context-Dependent Dynamics in A Global Perspective; IntechOpen: London, UK, 2016. [Google Scholar]

- Keller, K.L. Strategic Brand Management; Prentice Hall: Upper Saddle River, NJ, USA, 1998. [Google Scholar]

- Kim, S.; Choi, S.M. Credibility cues in online shopping: An examination of corporate credibility, retailer reputation, and product review credibility. Int. J. Internet Mark. Advert. 2012, 7, 217–236. [Google Scholar] [CrossRef]

- Tseng, S.; Fogg, B. Credibility and computing technology. Commun. ACM 1999, 42, 39–44. [Google Scholar] [CrossRef]

- Melo, T.; Garrido-Morgado, A. Corporate reputation: A combination of social responsibility and industry. Corp. Soc. Responsib. Environ. Manag. 2012, 19, 11–31. [Google Scholar] [CrossRef]

- Musgrove, C.F.; Choi, P.; Chris Cox, K. Consumer Perceptions of Green Marketing Claims: An Examination of the Relationships with Type of Claim and Corporate Credibility. Serv. Mark. Q. 2018, 1–16. [Google Scholar] [CrossRef]

- Soesilo, P.K.; Gunadi, W.; Arimbi, I.R. The effect of endorser and corporate credibility on perceived risk and consumer confidence: The case of technologically complex products. J. Mark. Commun. 2018, 1–21. [Google Scholar] [CrossRef]

- Zhang, B.; Ritchie, B.; Mair, J.; Driml, S. Is the Airline Trustworthy? The Impact of Source Credibility on Voluntary Carbon Offsetting. J. Travel Res. 2018. [Google Scholar] [CrossRef]

- Rust, R.T.; Verhoef, P.C. Optimizing the marketing interventions mix in intermediate-term CRM. Mark. Sci. 2005, 24, 477–489. [Google Scholar] [CrossRef]

- Spina, C. Finding, evaluating, and sharing new technology. Ref. User Serv. Q. 2014, 53, 217–220. [Google Scholar]

- Hurley, R.F. Customer service behavior in retail settings: A study of the effect of service provider personality. J. Acad. Mark. Sci. 1998, 26, 115–127. [Google Scholar] [CrossRef]

- Khalifa, M.; Ning Shen, K. Explaining the adoption of transactional B2C mobile commerce. J. Enterp. Inf. Manag. 2008, 21, 110–124. [Google Scholar] [CrossRef]

- Song, K.; Fiore, A.M.; Park, J. Telepresence and fantasy in online apparel shopping experience. J. Fash. Mark. Manag. Int. J. 2007, 11, 553–570. [Google Scholar] [CrossRef]

- Featherman, M.S.; Miyazaki, A.D.; Sprott, D.E. Reducing online privacy risk to facilitate e-service adoption: The influence of perceived ease of use and corporate credibility. J. Serv. Mark. 2010, 24, 219–229. [Google Scholar] [CrossRef]

- Jarvenpaa, S.L.; Tractinsky, N.; Vitale, M. Consumer trust in an Internet store. Inf. Technol. Manag. 2000, 1, 45–71. [Google Scholar] [CrossRef]

- Walker, M.; Kent, A. The roles of credibility and social consciousness in the corporate philanthropy-consumer behavior relationship. J. Bus. Ethics 2013, 116, 341–353. [Google Scholar] [CrossRef]

- Keller, K.L. Strategic Brand Management: Building, Measuring, and Managing Brand Equity; Prentice Hall: Upper Saddle River, NJ, USA, 2012. [Google Scholar]

- Chen, K.-H.; Yang, C.-H. The Service Factors and Market Segmentation for Mobile Commerce Customers: An Empirical Study on T Express of Taiwan High Speed Rail. J. Tour. Leis. Stud. 2013, 19, 279–306. [Google Scholar]

- Mallat, N.; Rossi, M.; Tuunainen, V.K.; Öörni, A. The impact of use context on mobile services acceptance: The case of mobile ticketing. Inf. Manag. 2009, 46, 190–195. [Google Scholar] [CrossRef]

- Hanzaee, K.H.; Taghipourian, M.J. The effects of brand credibility and prestige on consumers purchase intention in low and high product involvement. J. Basic Appl. Sci. Res. 2012, 2, 1281–1291. [Google Scholar]

- Escobar-Rodríguez, T.; Carvajal-Trujillo, E. Online purchasing tickets for low cost carriers: An application of the unified theory of acceptance and use of technology (UTAUT) model. Tour. Manag. 2014, 43, 70–88. [Google Scholar] [CrossRef]

- Inoue, Y.; Kent, A. Investigating the role of corporate credibility in corporate social marketing: A case study of environmental initiatives by professional sport organizations. Sport Manag. Rev. 2012, 15, 330–344. [Google Scholar] [CrossRef]

- Gorondutse, A.; Hilman, H.; Nasidi, M. Relationship between corporate reputation and customer loyalty on Nigerian food and beverages industry: PLS approach. Int. J. Manag. Bus. Res. 2014, 4, 125–136. [Google Scholar]

- Walsh, G.; Dinnie, K.; Wiedmann, K.-P. How do corporate reputation and customer satisfaction impact customer defection? A study of private energy customers in Germany. J. Serv. Mark. 2006, 20, 412–420. [Google Scholar] [CrossRef]

| Variable | Sample Size | Percentage (%) | |

|---|---|---|---|

| Gender | Male | 356 | 43.7 |

| Female | 459 | 56.3 | |

| Age | ≤20 years | 52 | 6.4 |

| 21–30 years | 414 | 50.8 | |

| 31–40 years | 197 | 24.2 | |

| 41–50 years | 92 | 11.3 | |

| ≥51 years | 60 | 7.4 | |

| Occupation | Student | 188 | 23.1 |

| Military, police, civil servant, and teacher | 114 | 14.0 | |

| Business person | 90 | 11.0 | |

| Service worker | 104 | 12.8 | |

| Freelancer | 147 | 18.0 | |

| Laborer | 34 | 4.2 | |

| Housekeeper | 51 | 6.3 | |

| Retired | 11 | 1.3 | |

| Other | 75 | 9.2 | |

| Education | Junior high school graduate (or below) | 3 | 0.4 |

| Senior high school/vocational school graduate | 56 | 6.9 | |

| Bachelor’s degree | 556 | 68.2 | |

| Graduate degree | 197 | 24.2 | |

| Income per month (NTD) | ≤20,000 | 188 | 23.1 |

| 20,000–40,000 | 210 | 25.8 | |

| 40,000–60,000 | 180 | 22.1 | |

| 60,000–80,000 | 92 | 11.3 | |

| 80,000–100,000 | 66 | 8.1 | |

| ≥100,000 | 64 | 7.9 | |

| Annual air travel frequency | ≤3 trips | 470 | 57.7 |

| 4–6 trips | 250 | 30.7 | |

| 7–9 trips | 49 | 6.0 | |

| ≥10 trips | 44 | 5.4 | |

| Most frequent channel used for buying Tigerair Taiwan flight tickets | Online booking | 676 | 82.9 |

| Customer service center | 81 | 9.9 | |

| app | 48 | 5.9 | |

| Travel agency | 10 | 1.2 | |

| Experience buying tickets on the Tigerair Taiwan app | Yes | 207 | 25.4 |

| No | 608 | 74.6 | |

| Travel purpose(s) when taking Tigerair Taiwan flights (multiple answers) | Leisure | 711 | 87.2 |

| Business | 76 | 9.3 | |

| Visiting relatives and friends | 96 | 11.8 | |

| Education | 40 | 4.9 | |

| Business events | 23 | 2.8 | |

| Factor | Observational Variable | Item | Factor Loading | Cronbach’s Alpha |

|---|---|---|---|---|

| Benefit convenience | SA1 | Purchase of extra baggage (checked and carry-on baggage) is available. | 0.728 | 0.764 |

| SA2 | Service inquiry for passengers with special requirements is available. | 0.669 | ||

| SA3 | Seat selection is available. | 0.614 | ||

| SA4 | Instant booking is available on app before departure. | 0.601 | ||

| SA5 | Live flight status (departures and arrivals) is available. | 0.584 | ||

| SA6 | Weather forecast is provided. | 0.520 | ||

| Decision convenience | SB1 | The app is instantaneously updated. | 0.773 | 0.76 |

| SB2 | The app is easy to use. | 0.761 | ||

| SB3 | Tickets and up-to-date flight schedule are available on the app at all times. | 0.651 | ||

| SB4 | 24-h ticketing service is provided. | 0.640 | ||

| Access convenience | SC1 | The app stores and maintains complete ticketing-related information. | 0.754 | 0.753 |

| SC2 | A passenger’s seat is automatically arranged next to that of the accompanying passenger(s) (if any). | 0.705 | ||

| SC3 | The app is available for different mobile device operating systems. | 0.642 | ||

| SC4 | Passengers are free to go back and forth when booking a flight on the app. | 0.631 | ||

| Transaction convenience | SD1 | Travel history can be tracked using the app. | 0.735 | 0.733 |

| SD2 | A transaction management system is attached. | 0.679 | ||

| SD3 | Changes of flight schedule trigger alerts. | 0.660 | ||

| SD4 | Multiple methods of payment are available. | 0.613 | ||

| Post-benefit convenience | SE1 | In-flight meals and duty-free goods can be reserved through the app. | 0.817 | 0.765 |

| SE2 | Hotel bookings for the destination are available on the app. | 0.807 | ||

| SE3 | Traffic information between the airport and downtown area of the destination is provided through the app. | 0.647 |

| Latent Variable | Item | Factor Loading | Error Variance | Average Variance Extracted | Composite Reliability |

|---|---|---|---|---|---|

| Technology readiness | |||||

| Optimism (M = 4.09) | TRO1 | 0.52 | 0.24 | 0.57 | 0.84 |

| TRO2 | 0.62 | 0.22 | |||

| TRO3 | 0.59 | 0.22 | |||

| TRO4 | 0.58 | 0.32 | |||

| Innovativeness (M = 3.43) | TRI1 | 0.65 | 0.41 | 0.54 | 0.82 |

| TRI2 | 0.93 | 0.49 | |||

| TRI3 | 0.56 | 0.62 | |||

| TRI4 | 0.80 | 0.42 | |||

| Discomfort (M = 3.12) | TRD1 | 0.84 | 0.31 | 0.51 | 0.80 |

| TRD2 | 0.57 | 0.53 | |||

| TRD3 | 0.59 | 0.70 | |||

| TRD4 | 0.82 | 0.45 | |||

| Insecurity (M = 3.57) | TRS1 | 0.50 | 0.54 | 0.53 | 0.81 |

| TRS2 | 0.87 | 0.37 | |||

| TRS3 | 0.83 | 0.42 | |||

| TRS4 | 0.69 | 0.61 | |||

| Corporate credibility | |||||

| Trustworthiness (M = 3.66) | reliable | 0.60 | 0.16 | 0.72 | 0.91 |

| honest | 0.59 | 0.13 | |||

| trustworthy | 0.64 | 0.10 | |||

| sincere | 0.60 | 0.19 | |||

| Expertise (M = 3.60) | an expert | 0.64 | 0.13 | 0.63 | 0.90 |

| experienced | 0.58 | 0.25 | |||

| knowledgeable | 0.59 | 0.17 | |||

| qualified | 0.55 | 0.22 | |||

| skilled | 0.56 | 0.23 | |||

| Customers’ app-use intentions (M = 3.42) | (I1) I will encourage my friends to use the Tigerair Taiwan app | 0.65 | 0.25 | 0.64 | 0.90 |

| (I2) I will frequently use the Tigerair Taiwan app | 0.75 | 0.30 | |||

| (I3) I will recommend the Tigerair Taiwan app to others | 0.76 | 0.15 | |||

| (I4) I will not reduce the frequency of my use of the Tigerair Taiwan app | 0.61 | 0.30 | |||

| (I5) I trust the quality of the Tigerair Taiwan app | 0.61 | 0.27 | |||

| Optimism | Innovativeness | Discomfort | Insecurity | Trustworthiness | Expertise | Customers’ App-Use Intentions | |

|---|---|---|---|---|---|---|---|

| Optimism | 1 | ||||||

| Innovativeness | 0.451 | 1 | |||||

| Discomfort | 0.023 | 0.311 | 1 | ||||

| Insecurity | −0.042 | −0.024 | 0.324 | 1 | |||

| Trustworthiness | 0.285 | 0.210 | 0.020 | 0.053 | 1 | ||

| Expertise | 0.298 | 0.207 | 0.035 | 0.055 | 0.777 | 1 | |

| Customers’ app-use intentions | 0.353 | 0.319 | 0.144 | 0.065 | 0.593 | 0.548 | 1 |

| Technology Readiness Factor | Groups | p-Value | Post-Hoc Comparison | ||

|---|---|---|---|---|---|

| Technology Exploration (n = 226) (1) | Technology Contradiction (n = 265) (2) | Technology Insecurity (n = 322) (3) | |||

| Optimism | 4.28 | 4.37 | 3.61 | 0.000 *** | 2,1 > 3 |

| Innovativeness | 3.55 | 3.94 | 2.93 | 0.000 *** | 2 > 1 > 3 |

| Discomfort | 2.65 | 3.77 | 2.92 | 0.000 *** | 2 > 3 > 1 |

| Insecurity | 2.65 | 4.00 | 3.87 | 0.000 *** | 2 > 3 > 1 |

| Model Fit Index | Optimal Value | Actual Value | |||

|---|---|---|---|---|---|

| Model I (n = 815) | Model II (n = 226) | Model III (n = 265) | Model IV (n = 322) | ||

| χ2 | Low values are optimal | 120.54 | 71.77 | 92.89 | 112.27 |

| χ2/df | <3 | 2.74 | 1.59 | 1.94 | 2.91 |

| GFI | >0.9 | 0.98 | 0.95 | 0.94 | 0.94 |

| AGFI | >0.9 | 0.96 | 0.91 | 0.91 | 0.91 |

| NFI | >0.9 | 0.98 | 0.94 | 0.94 | 0.94 |

| CFI | >0.9 | 0.98 | 0.98 | 0.97 | 0.97 |

| PGFI | >0.5 | 0.55 | 0.55 | 0.58 | 0.59 |

| RMSEA | <0.08 | 0.046 | 0.051 | 0.06 | 0.063 |

| RMR | <0.05 | 0.024 | 0.025 | 0.023 | 0.027 |

| Critical N | >200 | 458.77 | 213.85 | 201.59 | 213.19 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chen, K.-H.; Chang, F.-H.; Chen, Y.-L.; Chen, P.-M. The Relationships between Corporate Credibility, Service Convenience, and Consumers’ Use Intentions: Toward Ticketing Apps for Low-Cost Carriers. Sustainability 2019, 11, 810. https://doi.org/10.3390/su11030810

Chen K-H, Chang F-H, Chen Y-L, Chen P-M. The Relationships between Corporate Credibility, Service Convenience, and Consumers’ Use Intentions: Toward Ticketing Apps for Low-Cost Carriers. Sustainability. 2019; 11(3):810. https://doi.org/10.3390/su11030810

Chicago/Turabian StyleChen, Kaung-Hwa, Feng-Hsiang Chang, Yu-Ling Chen, and Pei-Ming Chen. 2019. "The Relationships between Corporate Credibility, Service Convenience, and Consumers’ Use Intentions: Toward Ticketing Apps for Low-Cost Carriers" Sustainability 11, no. 3: 810. https://doi.org/10.3390/su11030810

APA StyleChen, K.-H., Chang, F.-H., Chen, Y.-L., & Chen, P.-M. (2019). The Relationships between Corporate Credibility, Service Convenience, and Consumers’ Use Intentions: Toward Ticketing Apps for Low-Cost Carriers. Sustainability, 11(3), 810. https://doi.org/10.3390/su11030810