Alleviating Financing Constraints of SMEs through Supply Chain

Abstract

1. Introduction

2. Literature Review

2.1. SMEs and Their Financial Constraints

2.2. Information Asymmetry

2.3. Supply Chain Finance and Sustainability

3. Theoretical Framework

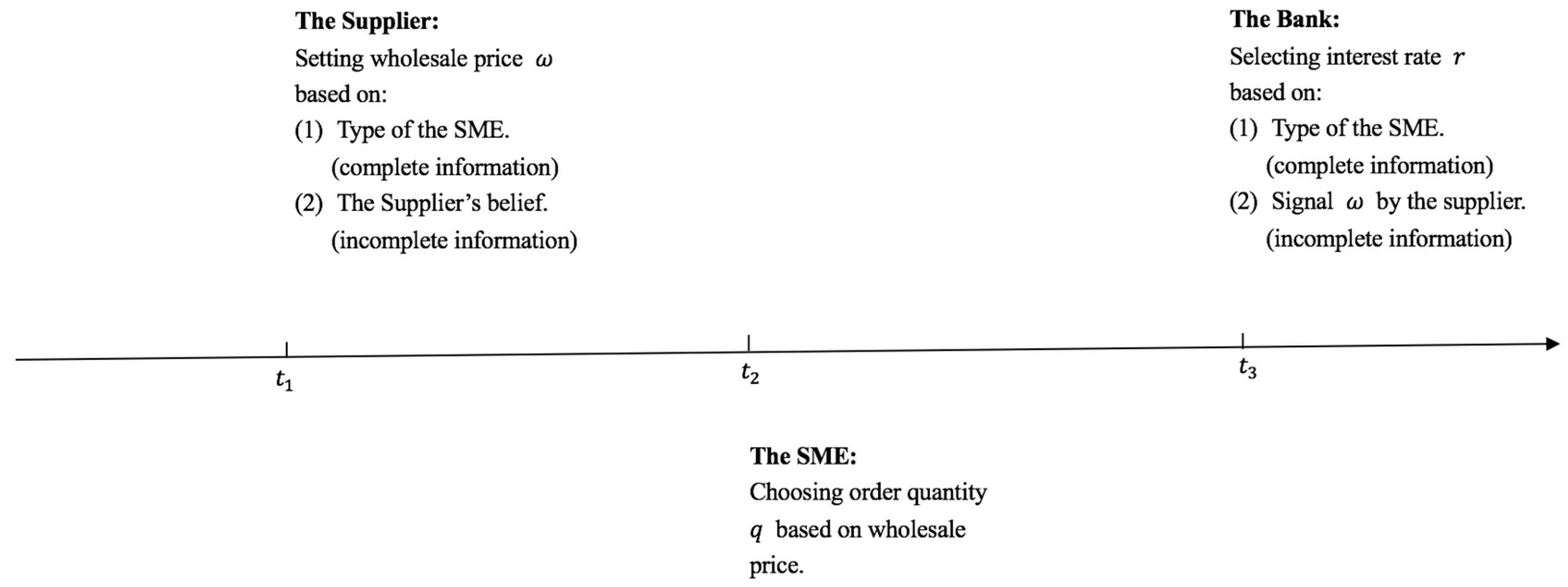

3.1. The Baisc Settings

3.2. Interactions under Complete Information

- Stage 1:

- Nature decides the type of the SME, either type or type .

- Stage 2:

- After observing the type of the SME, the supplier decides its wholesale price for the type SME, where .

- Stage 3:

- After observing , the type SME, where , decides its order quantity .

- Stage 4:

- After observing and the type of the SME, the bank selects for the type SME, where .

3.3. Interactions under Incomplete Information

- Stage 1:

- Nature decides the type of the SME, either type or type .

- Stage 2:

- After observing the type of the SME, the supplier decides its wholesale price for the type SME, where .

- Stage 3:

- After observing , the type SME, where , decides its order quantity .

- Stage 4:

- After observing , the bank selects for the SME.

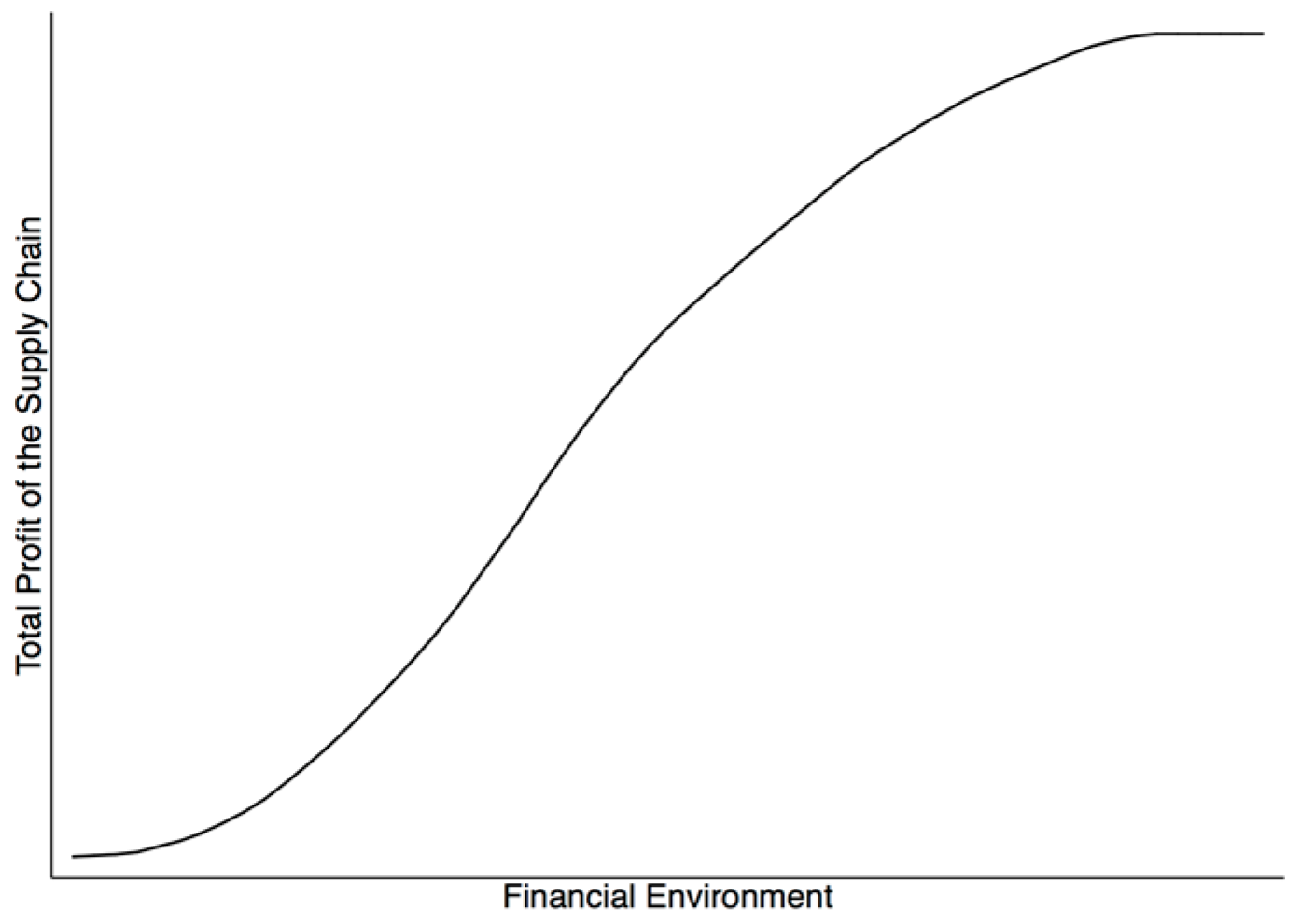

4. Discussion and Conclusions

Author Contributions

Acknowledgments

Conflicts of Interest

References

- Seo, J. A Study of Effective Financial Support for SMEs to Improve Economic and Employment Conditions: Evidence from OECD Countries. Manag. Decis. Econ. 2017, 38, 432–442. [Google Scholar] [CrossRef]

- Maksimov, V.; Wang, S.L.; Luo, Y. Reducing Poverty in the Least Developed Countries: The Role of Small and Medium Enterprises. J. World Bus. 2017, 52, 244–257. [Google Scholar] [CrossRef]

- Kongolo, M. Job Creation Versus Job Shedding and the Role of SMEs in Economic Development. Afr. J. Bus. Manag. 2010, 4, 2288–2295. [Google Scholar]

- Todaro, M.P.; Smith, S.C. Economic Development, 12th ed.; Pearson Publishing Ltd.: London, UK, 2014; pp. 337–349. ISBN 0133406784. [Google Scholar]

- Elmagrhi, M.H.; Ntim, C.G.; Crossley, R.; Malagila, J.K. Corporate Governance and Dividend Pay-Out Policy in UK Listed SMEs: The Effect of Corporate Board Characteristics. Int. J. Account. Inf. Manag. 2017, 3, 1–33. [Google Scholar] [CrossRef]

- Ayyagari, M.; Beck, T.; Demirguc-Kunt, A. Small and Medium Enterprises across the Globe. Small Bus. Econ. 2007, 4, 415–434. [Google Scholar] [CrossRef]

- Memili, E.; Fang, H.; Chrisman, J.J.; Massis, A. The Impact of Small and Medium Sized Family Firms on Economic Growth. Small Bus. Econ. 2015, 4, 771–785. [Google Scholar] [CrossRef]

- Yazdanfar, D.; Ohman, P. Firm-Level Determinants of Job Creation by SMEs: Swedish Empirical Evidence. J. Small Bus. Enterp. Dev. 2015, 4, 666–679. [Google Scholar] [CrossRef]

- McPherson, M.A. Growth of Mirco and Small Enterprises in Southern Africa. J. Dev. Econ. 1996, 48, 253–277. [Google Scholar] [CrossRef]

- Asikhia, O.U. SMEs and Poverty alleviation in Nigeria: Marketing Resources and Capabilities Constraint. N. Engl. J. Entrep. 2010, 13, 57–70. [Google Scholar]

- Beck, T.; Demirguc-Kunt, A.; Levine, R. SMEs, Growth, and Poverty: Cross-Country Evidence. J. Econ. Growth 2005, 3, 199–229. [Google Scholar] [CrossRef]

- Rossi, M. SMEs’ Access to Finance: An Overview from Southern Italy. Eur. J. Bus. Social Sci. 2014, 11, 155–164. [Google Scholar]

- Sleuwaegen, L.; Goedhuysa, M. Growth of firms in developing countries: Evidence from Côte d’Ivoire. J. Dev. Econ. 2002, 68, 117–135. [Google Scholar] [CrossRef]

- Saito, K.; Tsuruta, D. Information Asymmetry in Small and Medium Enterprise Credit Guarantee Schemes: Evidence from Japan. Appl. Econ. 2018, 50, 2469–2485. [Google Scholar] [CrossRef]

- Tagoe, N.; Amarh, E.A.; Nyarko, E. SME Access to Bank Finance in an Emerging Economy: The Role of Information Management Practices. Int. J. Financ. Serv. Manag. 2008, 3, 148–170. [Google Scholar] [CrossRef]

- Berger, A.N.; Udell, G.F. The Economics of Small Business Finance: The Role of Private Equity and Debt Markets in the Financial Growth Cycle. J. Bank. Financ. 1998, 22, 613–673. [Google Scholar] [CrossRef]

- Wang, R. Blockchain, Bank Credit and SME Financing. Qual. Quant. 2018, 1, 1–14. [Google Scholar] [CrossRef]

- Reid, G.C. Mature Micro-Firms and Their Experience of Funding Shortage. Small Bus. Econ. 1996, 1, 27–37. [Google Scholar] [CrossRef]

- Ayyagari, M.; Demirguc-Kunt, A.; Maksimovic, V. Formal Versus Informal Finance: Eveidence from China. Rev. Financ. Stud. 2010, 8, 3038–3097. [Google Scholar] [CrossRef]

- Apoga, R.R.; Saksonova, S. SMEs’ Alternative Financing: The Case of Latvia. Eur. Res. Stud. 2018, 21, 43–52. [Google Scholar]

- Degryse, H.; Matthews, K.; Zhao, T. SMEs and Access to Bank Credit: Evidence on the Reginal Propagation of Financial Crisis in the UK. J. Financ. Stabil. 2018, 38, 53–70. [Google Scholar] [CrossRef]

- Beck, T.; Lu, L.; Yang, R. Finance and Growth for Microenterprises: Evidence from Rural China. World Dev. 2015, 67, 38–56. [Google Scholar] [CrossRef]

- Degryse, H.; Lu, L.; Ongena, S. Informal or formal Financing? Evidence on the Co-Funding of Chinese Firms. J. Financ. Intermed. 2016, 27, 31–50. [Google Scholar] [CrossRef]

- Soufani, K. On the Determinants of Factoring as a Financing Choice: Evidence from the UK. J. Econ. Bus. 2002, 2, 239–252. [Google Scholar] [CrossRef]

- Duqi, A.; Tomaselli, A.; Torluccio, G. Is Relationship Lending Still a Mixed Blessing? A Review of Advantages and Disadvantages for Lenders and Borrowers. J. Econ. Surv. 2018, 32, 1446–1482. [Google Scholar] [CrossRef]

- Kouvelis, P.; Zhao, W. Who Should Finance the Supply Chain? Impact of Credit Ratings on Supply Chain Decisions. Manuf. Serv. Oper. Manag. 2018, 20, 19–35. [Google Scholar] [CrossRef]

- Martin, J. Suppliers’ Participation in Supply Chain Finance Practices: Predictors and Outcomes. Int. J. Integr. Supply Manag. 2017, 11, 193–216. [Google Scholar] [CrossRef]

- Abdulsaleh, M.A.; Worthington, A.C. Small and Medium-Sized Enterprises Financing: A Review of Literautre. Int. J. Bus. Manag. 2013, 8, 36–54. [Google Scholar] [CrossRef]

- Gupta, J.; Gregoriou, A. Impact of Market-Based Finance on SMEs Failure. Econ. Model. 2018, 69, 13–25. [Google Scholar] [CrossRef]

- Hanedar, E.Y.; Broccardo, E.; Bazzana, F. Collateral Requirements of SMEs: The Evidence from Less-Developed Countries. J. Bank. Financ. 2014, 38, 106–121. [Google Scholar] [CrossRef]

- Ibe, S.O.; Moemena, I.C.; Alozie, S.T. Financing Options for Small and Medium Enterprises (SMEs): Exploring Non-Bank Financial Institutions as an Alternative Means of Financing. J. Educ. Policy Entrep. Res. 2015, 2, 28–37. [Google Scholar]

- Chowdhury, S.A.; Azam, K.G.; Islam, S. Problems and Prospects of SME Financing in Bangladesh. Asian Bus. Rev. 2013, 4, 51–58. [Google Scholar] [CrossRef]

- Stiglitz, J.E.; Weiss, A. Credit Rationing in Markets with Imperfect Information. Am. Econ. Rev. 1981, 71, 393–410. [Google Scholar]

- Bester, H. The role of collateral in credit markets with imperfect information. Eur. Econ. Rev. 1987, 31, 887–899. [Google Scholar] [CrossRef]

- Akerlof, G.A. The Market for ‘Lemons’: Quality Uncertainty and the Market Mechanism. Q. J. Econ. 1970, 84, 488–500. [Google Scholar] [CrossRef]

- Spence, M. Information Aspects of Market Structure: An Introduction. Q. J. Econ. 1976, 90, 591–597. [Google Scholar] [CrossRef]

- Shavell, S. Moral Hazard and Insurance. Q. J. Econ. 1979, 93, 541–562. [Google Scholar] [CrossRef]

- Spence, M. Competitive and Optimal Responses to Signals: An Analysis of Efficiency and Distribution. J. Econ. Theory 1974, 7, 296–332. [Google Scholar] [CrossRef]

- Wilson, R.B. Competitive Bidding with Disparate Information. Manag. Sci. 1968, 7, 446–448. [Google Scholar]

- Spence, M.; Zeckhauser, R. Insurance, Information and Individual Action. Am. Econ. Rev. 1971, 61, 380–385. [Google Scholar]

- Ross, S.A. The Economic Theory of Agency: The Principal’s Problem. Am. Econ. Rev. 1973, 2, 134–139. [Google Scholar]

- Mirrlees, J. The Optimal Structure of Authority and Incentives within an Organization. Bell J. Econ. 1976, 7, 105–131. [Google Scholar] [CrossRef]

- Holmstrom, B. Moral Hazard and Observability. Bell J. Econ. 1979, 10, 74–91. [Google Scholar] [CrossRef]

- Jesen, M.C.; Meckling, W.H. Theory of the Firm: Managerial Behavior, Agency Costs and Ownership Structure; Springer: Dordrecht, The Netherlands, 1976; Volume 4, pp. 305–360. [Google Scholar]

- Feldman, T.; Liu, S. A New Perspective Measure Using Agent-Based Behavioral Finance. Comput. Econ. 2018, 51, 941–959. [Google Scholar] [CrossRef]

- Marquez, C.M.; Vazquez, F.J. How Information and Communication Technology Affects Decision-Making on Innovation Diffusion: An Agent-Based Modeling Approach. Intell. Syst. Account. Financ. Manag. 2018, 25, 124–133. [Google Scholar] [CrossRef]

- Maggetti, M.; Papadopoulos, Y. The Principal-Agent Framework and Independent Regulatory Agencies. Polit. Stud. Rev. 2018, 16, 172–183. [Google Scholar] [CrossRef]

- Connolly, J.M. The Impact of Local Politics on the Principal-Agent Relationship Between Council and Manager in Municipal Government. J. Public Adm. Res. Theory 2017, 27, 253–269. [Google Scholar] [CrossRef]

- Dai, S.; Nie, G.; Xiao, N. The Study of the Two-Way Principal-Agent Model Based on Asymmetric Information. Wirel. Pers. Commun. 2018, 102, 629–639. [Google Scholar] [CrossRef]

- Forkuoh, S.K.; Affumosei, E.; Quaye, I. Informal Financial Services, a Panacea for SMEs Financing? A Case Study of SMEs in the Ashanti Region of Ghana. Am. J. Ind. Bus. Manag. 2015, 5, 779–793. [Google Scholar]

- Minard, P. Signaling Through the Noise: Private Certification, Information Asymmetry and Chinese SMEs’ Access to Finance. J. Asian Public Policy 2016, 9, 243–256. [Google Scholar] [CrossRef]

- Nanyondo, M.; Tauringana, V.; Kamukama, N.; Nkundabanyanga, S. Quality of Financial Statements, Information Asymmetry, Perceived Risk and Access to Finance by Uganda SMEs. Int. J. Manag. Pract. 2014, 7, 324–340. [Google Scholar] [CrossRef]

- Berger, A.N.; Udell, G.F. A More Complete Conceptual Framework for SME Finance. J. Bank. Financ. 2006, 11, 2945–2966. [Google Scholar] [CrossRef]

- Rezaei, J.; Ortt, R.; Trott, P. How SMEs Can Benefit from Supply Chain Partnerships. Int. J. Prod. Res. 2015, 5, 1527–1543. [Google Scholar] [CrossRef]

- Yan, N.; Sun, B.; Zhang, H.; Liu, C. A Partial Credit Guarantee Contract in a Capital Constrained Supply Chain: Financing Equilibrium and coordinating strategy. Int. J. Prod. Econ. 2016, 173, 122–133. [Google Scholar] [CrossRef]

- Budin, M.; Eapen, A.T. Cash Generation in Business Operations: Some Simulation Models. J. Financ. 1970, 25, 1091–1107. [Google Scholar] [CrossRef]

- Stemmler, L. Cost Management in Supply Chain; Physica Heidelberg Press: Heidelberg, Germany, 2002; pp. 165–176. ISBN 978-3-7908-2515-2. [Google Scholar]

- Pfohl, H.C.; Gomm, M. Supply Chain Finance: Optimizing Financial Flows in Supply Chains. Logist. Res. 2009, 1, 149–161. [Google Scholar] [CrossRef]

- Gelsomino, L.M.; Mangiaracina, R.; Perego, A.; Tumino, A. Supply Chain Finance: A Literature Review. Int. J. Phys. Distrib. Logist. Manag. 2016, 4, 348–366. [Google Scholar] [CrossRef]

- Liao, J. An EOQ Model with Noninstantaneous Receipt and Exponentially Deteriorating Items under Two-Level Trade Credit. Int. J. Prod. Econ. 2008, 2, 852–861. [Google Scholar] [CrossRef]

- Wong, A.; Holmes, S.; Schaper, M.T. How Do Small Business Owners Actually Make Their Financial Decisions? Understanding SME Financial Behavior Using a Case-Based Approach. Small Enterp. Res. 2018, 25, 36–51. [Google Scholar] [CrossRef]

- Ho, C.; Ouyang, L.; Su, C. Optimal Pricing, Shipment and Payment Policy for an Integrated Supplier-Buyer Inventory Model with Two-Part Trade Credit. Eur. J. Oper. Res. 2008, 2, 496–510. [Google Scholar] [CrossRef]

- Marchim, B.; Ries, J.M.; Zanoni, S.; Glock, C.H. A Joint Economic Lot Size Model with Financial Collaboration and Uncertain Investment Opportunity. Int. J. Prod. Econ. 2016, 176, 170–182. [Google Scholar] [CrossRef]

- Sarkar, B.; Saren, S.; Barron, L.E. An Inventory Model with Trade Credit Policy and Variable Deterioration for Fixed Lifetime Products. Ann. Oper. Res. 2015, 229, 677–702. [Google Scholar] [CrossRef]

- Mahata, G.C. Analysis of Partial Trade Credit Financing in a Supply Chain by EOQ-Based Inventory Model for Exponentially Deteriorating Items. Int. J. Oper. Res. 2012, 15, 94–124. [Google Scholar] [CrossRef]

- Zhou, Y.; Zhong, Y.; Wahab, M. How to Make the Replenishment and Payment Strategy under Flexible Two-Part Trade Credit. Comput. Oper. Res. 2013, 40, 1328–1338. [Google Scholar] [CrossRef]

- Mahata, G.C.; Goswami, A. An EOQ Model for Deteriorating Items under Trade Credit Financing in the Fuzzy Sense. Prod. Plan. Control 2007, 8, 681–692. [Google Scholar] [CrossRef]

- Chang, C.; Teng, J.T.; Chern, M.S. Optimal Manufacturer’s Replenishment Policies for Deteriorating Items in a Supply Chain with Up-Stream and Down-Stream Trade Credits. Int. J. Prod. Econ. 2010, 127, 197–202. [Google Scholar] [CrossRef]

- Van der Vliet, K.; Reindorp, M.J.; Fransoco, J.C. The Price of Reverse Factoring: Financing Rates vs. Payment Delays. Eur. J. Oper. Res. 2015, 242, 842–853. [Google Scholar] [CrossRef]

- Lee, C.H.; Rhee, B.D. Coordination Contract in the Presence of Positive Inventory Financing Costs. Int. J. Prod. Econ. 2010, 124, 331–339. [Google Scholar]

- Chen, X. A Model of Trade Credit in a Capital-Constrained Distribution Channel. Int. J. Prod. Econ. 2015, 159, 347–357. [Google Scholar] [CrossRef]

- Andrieu, G.; Stagliano, R.; Van Zwan, P. Bank Debt and Trade Credit for SMEs in Europe: Firm, Industry, and Country Level Determinants. Small Bus. Econ. 2018, 51, 245–264. [Google Scholar] [CrossRef]

- Fabbri, D.; Klapper, L.F. Bargaining Power and Trade Credit. J. Corp. Financ. 2016, 41, 66–80. [Google Scholar] [CrossRef]

- Caniato, F.; Gelsomino, L.M.; Perego, A.; Ronchi, S. Does Finance Solve the Supply Chain Financing Problem. Supply Chain Manag. Int. J. 2016, 21, 534–549. [Google Scholar] [CrossRef]

- Tseng, M.; Wu, K.; Hu, J.; Wang, C. Decision-Making Model for Sustainable Supply Chain Finance under Uncertainties. Int. J. Prod. Econ. 2018, 205, 30–36. [Google Scholar] [CrossRef]

- Lozano, R. Towards Better Embedding Sustainability into Companies’ Systems: An Analysis of Voluntary Corporate Initiatives. J. Clean. Prod. 2012, 25, 14–26. [Google Scholar] [CrossRef]

- Hofmann, E.; Kotzad, H. A Supply Chain-Oriented Approach of Working Capital Management. J. Bus. Logist. 2010, 31, 305–330. [Google Scholar] [CrossRef]

- Gosman, M.; Kohlbeck, M. The Relationship Between Supply-Chain Economies and Large Retailers’ Working Capital. Commer. Lend. Rev. 2005, 1, 9–17. [Google Scholar]

- Afrifa, G.A.; Tingbani, I. Working Capital Management, Cash Flow, and SMEs’ Performance. Int. J. Bank. Account. Financ. 2018, 9, 19–43. [Google Scholar] [CrossRef]

- Kot, S. Sustainable Supply Chain Management in Small and Medium Enterprises. Sustainability 2018, 4, 1143. [Google Scholar] [CrossRef]

- Randall, W.; Farris, T. Supply Chain Financing: Using Cash-to-Cashing Variables to Strengthen the Supply Chain. Int. J. Phys. Distrib. Logist. Manag. 2009, 39, 669–689. [Google Scholar] [CrossRef]

- Niehuis, J.J.; Cortet, M.; Lycklama, D. Real-Time Financing: Extending E-Invoicing to Real-Time SME Financing. J. Paym. Strategy Syst. 2013, 7, 232–245. [Google Scholar]

- Wuttke, D.A.; Blome, C.; Heese, H.S.; Sieke, M.P. Supply Chain Finance: Optimal Introduction and Adoption Decisions. Int. J. Prod. Econ. 2016, 178, 72–81. [Google Scholar] [CrossRef]

- Zhu, Y.; Xie, C.; Sun, B.; Wang, G.; Yan, X. Predicting China’s SME Credit Risk in Supply Chain Financing by Logistic Regression, Artificial Neural Network and Hybrid Models. Sustainability 2016, 8, 433. [Google Scholar] [CrossRef]

- Li, Y.; Zhen, X.; Cai, X. Trade Credit Insurance, Capital Constraint, and the Behavior of Manufactures and Banks. Ann. Oper. Res. 2016, 240, 395–414. [Google Scholar] [CrossRef]

- Hadar, J.; Russel, W.R. Rules for Ordering Uncertain Prospects. Am. Econ. Rev. 1969, 59, 25–34. [Google Scholar]

- Lee, K.; Go, D.; Park, I.; Yoon, B. Exploring Suitable Technology for Small and Medium Enterprises (SMEs) Based on a Hidden Markov Model Using Patent Information and Value Chain Analysis. Sustainability 2017, 9, 1100. [Google Scholar] [CrossRef]

- Gungoraydinoglu, A.; Colak, G.; Oztekin, O. Political Environment, Financial Intermediation Costs, and Financial Patterns. J. Corp. Financ. 2017, 44, 167–192. [Google Scholar] [CrossRef]

- Li, W.; Chen, J. Backward Integration Strategy in a Retailer Stackelberg Supply Chain. Omega 2018, 75, 118–130. [Google Scholar] [CrossRef]

- Tang, O.; Musa, S.N. Identifying Risk Issues and Research Advancements in Supply Chain Risk Management. Int. J. Prod. Econ. 2011, 133, 25–34. [Google Scholar] [CrossRef]

- Beck, T.; Demirguc-Kunt, A.; Scoledad, M. Bank Financing for SMEs: Evidence Across Countries and Bank Ownership Types. J. Financ. Serv. Res. 2011, 29, 35–54. [Google Scholar] [CrossRef]

- Lafferty, B.A.; Goldsmith, R.E. How Influential Are Corporate Credibility and Endorser Attractiveness When Innovators React to Advertisements for a New High-Technology Product. Corp. Reput. Rev. 2004, 7, 24–36. [Google Scholar] [CrossRef]

- Cho, I.K.; Kreps, D.M. Signaling Games and Stable Equilibria. Q. J. Econ. 1987, 12, 179–221. [Google Scholar] [CrossRef]

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yang, Y.; Chen, X.; Gu, J.; Fujita, H. Alleviating Financing Constraints of SMEs through Supply Chain. Sustainability 2019, 11, 673. https://doi.org/10.3390/su11030673

Yang Y, Chen X, Gu J, Fujita H. Alleviating Financing Constraints of SMEs through Supply Chain. Sustainability. 2019; 11(3):673. https://doi.org/10.3390/su11030673

Chicago/Turabian StyleYang, Yang, Xuezheng Chen, Jing Gu, and Hamido Fujita. 2019. "Alleviating Financing Constraints of SMEs through Supply Chain" Sustainability 11, no. 3: 673. https://doi.org/10.3390/su11030673

APA StyleYang, Y., Chen, X., Gu, J., & Fujita, H. (2019). Alleviating Financing Constraints of SMEs through Supply Chain. Sustainability, 11(3), 673. https://doi.org/10.3390/su11030673