Abstract

Although the importance of external involvement has been recognized in product and technology innovation, whether research and development (R&D) internationalization stimulates green innovation and under what conditions it is more effective is still unclear. To address this research gap, this study uses knowledge-based theory to explore the effect of R&D internationalization on green innovation and the moderating roles of state ownership and international experience. We examine the research hypotheses using panel data of 19,273 Chinese resource enterprises (REs) and environmental enterprises (EEs) spanning three years. The results indicate that R&D internationalization has a negative effect on green innovation in REs and EEs. Additionally, we identified a negative moderating effect of state ownership and a positive moderating effect of internationalization experience on the relationship between R&D internationalization and green innovation, which suggests that the effect is contingent on the corporation’s ownership and capability in dealing with the complexities and uncertainties inherent in international business.

1. Introduction

The importance of green innovation has been highlighted as driving the sustainability of national and regional economic development [1]. Green innovation refers to innovations that can benefit the environment [2]. It includes the product and technology innovation involved in energy saving, pollution prevention, waste recycling, design for green products, environmental management, and so forth [3], and usually comes from resource enterprises (REs) and environmental enterprises (EEs) [4]. Adapting and implementing green innovation in products and technologies would relieve pressure on environmentally sensitive resources and capture sustainable development [5,6]. Therefore, governments usually enact more stringent environmental regulations to stimulate enterprises’ green innovations. However, few enterprises possess the technology, resources or knowledge required for green innovation [7]. Enterprises from emerging economies have the advantage of later development in terms of global advances in green innovation and can acquire advanced technology and knowledge through research and development (R&D) internalization. Therefore, more and more enterprises from emerging economies look beyond their own boundaries for technology, knowledge, and other resources to meet the demand for innovation [8,9,10,11,12], such as Huawei, ZTE, TCL, Haier, and SAIC. Companies like these try to stimulate green innovation through R&D internationalization activities, such as establishing a network with global R&D talents and acquiring and absorbing external advanced knowledge [13].

Some researchers have highlighted the importance of R&D internationalization for innovation [14] and investigated the effect of R&D internationalization on products and technology in R&D activities [15,16,17,18,19]. However, the impact on green innovation has been ignored. This is a relevant gap, considering that the effect of R&D internationalization on green innovation may be different from products and technology innovation. Since green innovations require more complex and diversified knowledge and skills [20,21], partnering with external actors to source new knowledge and problem-solving techniques is more important for enterprises conducting green innovation [21,22]. The importance of R&D internationalization is further exacerbated by the fact that returns of green innovations are more uncertain and riskier [23]. Moreover, the effect of R&D internationalization on green innovation is still uncertain and requires empirical testing. As R&D internationalization may have both positive effects on green innovation due to the integration of international R&D resources and the exchange of knowledge between R&D branches in the home country and abroad [6], and negative effects due to the cost that firms acquiring technologies have to face, such as cognitive costs, transaction costs, and organizational costs [24]. In addition, the effect of R&D internationalization may be contingent upon an enterprise’s knowledge stock as well as its capacity to absorb and integrate other knowledge [25]. An enterprise’s practices in this regard should be focused upon knowledge management in order to achieve superior green innovation performance [26,27,28] and should be aligned with its existing knowledge stock and knowledge integration capacity [26,29,30]. However, to the best of our knowledge, no research has investigated the contingency factors reflecting firm’s knowledge heterogeneity, which may contribute to explain differences across green innovations [21].

Therefore, based on knowledge-based theory (KBT), this study tries to uncover the mechanism that gives R&D internationalization its impact on green innovation. KBT identifies two essential concepts: knowledge stock and knowledge integration capacity [31,32]. In the context of green innovation, a state-owned enterprise’s knowledge stock may be affected by the limitations of state ownership [33], while its external knowledge integration ability may result from its international experience [29]. For non-state-owned enterprises, which usually have a limited ability to attract excellent local R&D talents and accumulate technical knowledge, R&D internationalization provides them with a channel to establish cooperative networks with international R&D talents and acquire advanced technical knowledge [16]. In addition, both non-state-owned enterprises and enterprises with high international experience would have a stronger external knowledge integration capability. Since acquisition or transfer of foreign advanced knowledge by state-owned enterprises is often more tightly restricted than for non-state-owned enterprises, international experience forces enterprises to deal with the liability that comes with foreignness and to handle the complexities of R&D internationalization well [34,35]. Thus, it is critical to consider state ownership and international experience in studying the impact of R&D internationalization on green innovation.

The remaining sections of this paper are arranged as follows: Section 2 presents the theoretical background and research hypotheses, followed by a description of data and methods in Section 3. Section 4 provides an empirical analysis and results. Last, the major findings, theoretical contributions and practice implications of the study are summarized, as well as its limitations and future research directions.

2. Theory and Hypotheses Development

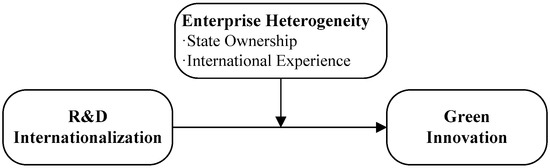

In this study, it is hypothesized that R&D internationalization will be positively related to green innovation. In addition, the relationship between R&D internationalization and green innovation will be moderated by state ownership and international experience. Figure 1 depicts the conceptual model.

Figure 1.

Research framework. R&D: research and development.

2.1. R&D Internationalization and Green Innovation

Conducting green innovation is a main objective as enterprises are facing increasing resource and environmental pressures [36,37]. Nevertheless, the success of green innovation depends largely on the inputs of knowledge and other R&D resources [4,25,36]. Several studies have highlighted the ways that a high degree of R&D internationalization is connected with good innovation performance [5,19,37,38]. First, due to knowledge’s tacitness and stickiness [39], REs and EEs need to go abroad to search out and absorb the knowledge connected with specific foreign geographic territories [19,40]. By means of R&D internationalization, REs and EEs have opportunities to acquire diversified and complementary knowledge as well as other R&D resources in the external space [41], which may lead to a high level of green innovation. Second, R&D internationalization helps REs and EEs participate in the richness of ties and networks maintained by other enterprises [42,43,44] and interact with a large number of organizations within those networks. Those ties and networks can serve as an importation source such that teams import ideas or relevant information from contacts outside of the team into the team domain [45,46,47]. Finally, cognitive benefits are more likely to be realized when nationality heterogeneity exists. The more unique perspectives or diverse viewpoints to which different team members are exposed, the more conducive their schemas will be to creatively solve problems [47]. R&D internationalization influences the way the focal actor views the world, in this case, the way he or she approaches problems. It is the member’s cognitive approaches to problems, or more formally the complexity and flexibility of his or her schemas (i.e., creative capacity), that can enhance an enterprise’s in-house innovation capability and ultimately benefit green innovation [47].

Nevertheless, some researchers have also pointed out that R&D internationalization is a double-edged sword; it can bring increased costs to enterprises [25] due to the emergence of geographic and cultural barriers across countries [48], such as cognitive costs (e.g., emerging due to the not-invented-here (NIH) syndrome and information overload), transaction costs (e.g., search costs and limited access to valuable external technologies), and organizational costs (e.g., caused by the need to integrate the acquired technology and to set up ad hoc routines) [25,49,50]. R&D internationalization increases operational complexity [51] and challenges coordination, communication, and monitoring [52,53]. Moreover, it can also expose REs and EEs to high levels of liability due to lack of familiarity with and the inherent risks of an international environment [54]. In addition, REs and EEs with broad R&D internationalization are likely to suffer knowledge leakages in their innovation processes [55]. Therefore, the research of Schmidt and Sofka [56] suggests that inter-institutional strangeness will be a barrier to enterprises when they approach valuable overseas innovation resources [57]. REs and EEs in developing countries stimulate green innovation via R&D internationalization to alleviate environmental pressures while pursuing sustainable development of their societies and economies, but there has been little research on what the advantages and disadvantages of R&D internationalization are under such circumstances [58]. One significant consideration is that the operational complexity and liability of foreignness can make the costs of R&D internationalization prohibitive for REs and EEs from emerging economies, which limits their R&D resource acquisition and integrating activities [14].

On the basis of arguments from the literature and considering the benefits and costs of R&D internationalization, we suggest a U-shaped relationship between R&D internationalization and green innovation performance of REs and EEs from emerging economies. Due to the liability of foreignness [54,59], dispersing R&D activities around the world negatively affects green innovation performance up to a certain degree. Then, after a certain threshold is reached, the benefits of R&D internationalization begin to outweigh the costs. This means that emerging-economy enterprises may not achieve the desired potential benefits from R&D internationalization instantly. Only after further improving the intensity of their R&D internationalization can enterprises enhance their green innovation performance deeply, which occurs as a result of their increasing familiarity with, and embeddedness in, local innovation systems. Hence, the following hypothesis is formulated:

Hypothesis 1.

There is a curvilinear relationship (U-shaped) between R&D internationalization and green innovation performance for REs and EEs from emerging economies.

2.2. Moderating Effect of State Ownership and International Experience

2.2.1. Moderating Effect of State Ownership

State-owned enterprises play an important role in the Chinese economy. State ownership, however, tends to negatively influence the relationship between R&D internationalization and green innovation. R&D internationalization and innovation activities of state-owned enterprises are highly defined and circumscribed by the government [60]. As a result, state-owned enterprises are often regarded as having political goals in addition to commercial goals [60,61,62,63]. Host governments will tend to strengthen regulations surrounding the tech and knowledge acquisition activities of state-owned REs and EEs, which increases knowledge integration costs, institutional constraints, and the pressure to legitimate state-owned REs and EEs carrying out R&D internationalization. In addition, state-owned REs and EEs can attract excellent local R&D talents and have a high technical knowledge stock [16]. Therefore, there is usually a lack of motivation to acquire and absorb knowledge via the process of R&D internationalization. Such enterprises are likely to seek natural resources rather than knowledge via internationalization [61,64]. As a result, state-owned REs and EEs clearly have both insufficient incentives and limited ability to acquire foreign advanced knowledge or stimulate green innovation by establishing R&D subsidiaries overseas or cooperating with leading technology enterprises around the world. Finally, top managers of state-owned REs and EEs also have a negative impact on the relation between R&D internationalization and green innovation. Most of the executives of state-owned REs and EEs are appointed by the government. They generally show strongly conservative tendencies and risk-aversion characteristics and tend to avoid risky decision-making [65]. It thus tends to be very difficult for these top managers to allocate their resources to green innovation activities, given the higher risk and uncertainty of them, in the process of R&D internationalization. At the same time, frequent changes of top managers in state-owned REs and EEs due to various “hidden” political reasons are not conducive to maintaining the consistent implementation of these enterprises’ R&D internationalization and green innovation strategies [66].

Hypothesis 2.

State ownership negatively moderates the relation between R&D internationalization and green innovation performance for REs and EEs from emerging economies.

2.2.2. Moderating Effect of International Experience

An enterprise’s international experience and its effect on performance has been extensively studied [67,68,69]. For example, scholars have pointed out that experienced enterprises are better able to deal with the liability of foreignness, they are more able to handle the problems of international business [34,35], and they have greater knowledge-based skill in discovering innovation opportunities [70]. Thus in the internationalization process, REs and EEs usually bear lower coordination and monitoring costs than enterprises without such experience. They would thus find it easier to adapt to and gain benefit from expansion into new international markets [34,71]. Some researchers have also highlighted the importance of international experience in overcoming the liability of foreignness [72] and have pointed out that enterprises able to develop knowledge-based capabilities with international experience may enjoy reduced costs in acquiring, transferring, and integrating R&D resources abroad [73]. Therefore, REs and EEs with fluent international experience should have the ability to commit to and conduct high-level resource commitment (i.e., achieve higher efficiency and wider diversity) contributing to R&D internationalization.

Overall, internationally experienced REs and EEs should be better at dealing with the complexities and uncertainties connected with R&D international expansion [70]. This may facilitate the enterprise’s overseas R&D activities and thereby support its innovation processes, particularly for REs and EEs from emerging economies. However, REs and EEs from emerging economies usually lack extensive experience in international business [74]. Thus, in the process of R&D internationalization, their lack of international experience results in latecomer disadvantages and accordingly limits their capability to resolve the complexities of international competition or overcome the liability of foreignness [75,76]. Therefore, we highlight the importance of international experience in supporting emerging-economy enterprises’ R&D internationalization and posit that international experience improves an enterprise’s ability to absorb and integrate R&D resources, thus lowering the costs of expanding R&D activities abroad [77]. This leads us to present the following hypothesis:

Hypothesis 3.

International experience positively moderates the relation of R&D internationalization and green innovation performance for REs and EEs from emerging economies.

3. Data and Methodology

The existing research about the relationship between R&D internationalization and innovation is mainly cross-sectional data collected via survey, which can cause two issues. The first is endogeneity problems, meaning estimates will be biased toward finding a more positive (or less negative) relationship between R&D internationalization and innovation. Second, the lagging effect of R&D internationalization on innovation cannot be considered using cross-sectional data. Therefore, this paper uses second-hand panel data to solve these two problems through an instrumental variable regression model.

3.1. Data Collection and Sample

Two data sources collected by the National Bureau of Statistics of China were used: the “China Industrial Enterprise Science and Technology Activity Database” and the “China Industrial Enterprise Database.” The former contains many indicators of the R&D activities from more than 60,000 enterprises, such as patents applied for and approved by the government in that year, government subsidies for R&D activities, R&D expenditures, and the number of R&D employees, etc. To gain information for control variables such as profit, firm size, and firm age, we merged the two databases.

REs’ and EEs’ innovations are usually focused on reduction of environmental risk, pollution, and other negative impacts on the environment, as well as improving the efficiency and efficacy of resource utilization [4], both of which are critical to sustainable development. Therefore, RE and EE samples from resource development, high pollution industries, or environment-protecting industries were selected. Specifically, REs are firms whose main industry involves natural resources, such as minerals, metallurgy, forests, oil, waste, energy (e.g., solar power and thermal power), etc. [78]. EEs are firms whose main business focus is on environmental pollution or protection, including papermaking, plastics, chemical materials, energy equipment manufacturing, waste materials recycling and processing, etc. [79].

We also screened for REs and EEs that continued to appear in 2011–2013 so as to avoid the influence caused by the emergence and collapse of enterprises. Thus, we got a time span of three years of panel data. We then deleted invalid or abnormal data, including samples with no patents or no sales income from 2011 to 2013; we finally got a sample of 19,273 REs and EEs. Table 1 illustrates the industry distribution of our sample. In addition to this, we carried out logarithmic calculation on variables such as innovation subsidy, tax deductions, and profits. We added the values of subsidies, tax deductions, and profits to 1 and then took the logarithm to avoid errors in calculation.

Table 1.

Industry distribution of sample.

3.2. Variables and Measurement

3.2.1. Dependent Variable

In this study, green innovation refers to innovations that can benefit the environment and includes the product and technology innovation involved in energy saving, pollution prevention, waste recycling, design for green products, environmental management, and so forth [3]. It can be reflected by the innovations of REs and EEs [4]. Therefore, we used the patent count of REs and EEs to measure green innovation output/performance [80]. Patent count is the most commonly used and widely recognized innovation measurement index in terms of new technologies and new products [19,81,82]. Its reliability and robustness have been verified in empirical research of green innovation [80,83]. Although patent-based measurement of green innovation may cause measurement error due to differences in patent systems [84] and enterprises’ patent application preferences [85], it is acceptable since our sample comes from one country and does not include patent system differences that could weaken the measurement. So, following previous literature, we measured green innovation with the logarithm value of patent counts newly granted each year for REs and EEs.

3.2.2. Independent and Moderating Variables

R&D internationalization: We used the variable of R&D internationalization intensity to measure R&D internationalization. Considering the lag of the effect of R&D internationalization on innovation, we created this variable by dividing total foreign R&D expenditure by the total R&D expenditure over the previous three years. This value indicated the intensity of an enterprise’s R&D activities in its international expansion. This concept was also used by several researchers to create relevant variables as measurements to reflect the relationship between geographic dispersion and enterprise performance [86,87].

International experience: This variable, which was calculated by percentage of exports in total sales, represented the enterprise’s experience in international business activities [69].

State ownership: When the state was the largest shareholder or the enterprise belonged to a state-owned enterprise, the value of state ownership was 1, otherwise 0.

3.2.3. Control Variables

We also controlled the following variables in the regression model to account for their potential impact on enterprise innovation performance. ① Enterprise size may have an impact on innovation, as it can reflect the heterogeneity of its knowledge stock, R&D accumulation, and market position among similar enterprises [43]. Therefore, in line with previous studies we controlled it in our model and measured it with the natural logarithm of the total number of employees. ② Enterprise age may influence all aspects of enterprise innovation activities [17], so we controlled it in our model. ③ R&D investment was used to control for its influence on enterprise innovation performance [87,88]. It was measured with the natural logarithm of the enterprise’s R&D expenditure. ④ The number of R&D employees may affect enterprises’ innovation ability, so we controlled it and measured it by the logarithm of the average annual number of R&D employees. ⑤ Financial leverage, which means the total debt divided by total assets for an enterprise, may influence the ability of the enterprise to fund innovation, so we controlled it in our model. ⑥ A government’s subsidy policy stimulates innovation activities [3], so we controlled it in the regression model. Government subsidy was measured by the logarithmic value of government subsidies for the enterprise’s scientific and technological activities. ⑦ Enterprise profits may have an impact on R&D activities as they may provide financial support. Therefore, we controlled it by using the logarithmic value of the enterprise’s after-tax profits to measure it. ⑧ Industrial and regional fixed effects were also controlled with a series of dummy variables of the two-digit industry and the province.

3.3. Methodology

We used the following regression model to identify the U-shape relationship between R&D internationalization and green innovation, denoting green innovation by , R&D internationalization by , R&D internationalization square by , and the vector of other controls by X. Just as some of the empirical results below demonstrate, the parameter estimates are generally more precise with second-hand objective data.

To test Hypotheses 2 and 3, we used the same model as the one used to test Hypothesis 1. However, we modified the specification of the conditional mean to allow interaction between competition and the technology gap. The conditional mean is now defined as

where is seen in the variables reflecting motivation or capability of innovation, including state ownership and international experience. is seen in the interactions between R&D internationalization and , and is the interactions between R&D internationalization square and . are control variables for enterprise i at year t. We also controlled industrial and regional fixed effects using a series of dummy variables of the two-digit industry () and provincial () dummy variables. denotes a random perturbation term. If state ownership and international experience positively moderate the relationship between R&D internationalization and green innovation, as implied by Hypotheses 2 and 3, then we would expect > 0 or > 0.

However, a few important identification issues need to be noted. First, if both green innovation and R&D internationalization are related to opportunities or other variables that change across the industry, we may overestimate the relationship between green innovation and R&D internationalization. For example, suppose that there is no causal relation between R&D internationalization and green innovation, but both are regulated by the government for a special industry. In this way, a spurious positive relationship between the two may be estimated, although in reality there is no causal relationship between them. Thus, industry fixed effects were adopted to overcome this problem.

Second, there is a heterogeneity of openness, policy, and resources for different provinces, which causes variation in innovation activity across provinces that may not be due to variation in R&D internationalization. This would lead to overestimation or underestimation of the relationship between green innovation and R&D internationalization. We used province fixed effects to control for this issue.

The third and most important is the problem of endogeneity of R&D internationalization, which may be the major obstacle to empirical research in similar areas [89]. If successful green innovations increase market power and hence stimulate R&D internationalization, the estimates will be biased toward finding a more positive (or less negative) relationship between R&D internationalization and green innovation. Using lagged endogenous variables and instrument variables (IV) are two widely used methods to address the issue of the endogeneity caused by causality running both ways. Considering that our sample is short panel data (three years) and the lag term will lose one year’s sample, an instrumental variable approach needed to be employed. Following Aiello [90] and Wooldridge [91], a fitted value of R&D internationalization decision-making was used as an instrument for R&D internationalization: First, we adopted the probit model to quantify R&D internationalization choice (when the R&D internationalization expenditure or overseas R&D institutions are greater than 0, the value is 1; otherwise, the value is 0). Second, following former research, we calculated the fitted value of R&D internationalization decision-making with the probit model and used the fitted value as an instrumental variable of R&D internationalization. This may help solve endogenous problems. For example, in Aiello’s study of R&D spillover effect and output performance [90], the fitted value of the probit model of R&D choice was used as the instrument of R&D input. In our study, the reason for taking the fitted value of R&D internationalization decision-making as an instrumental variable was: First, since R&D internationalization is the result of an enterprise’s choice, calculating the fitted value of R&D internationalization decision-making with the probit model is more convincing. Second, the fitted value of R&D internationalization is highly correlated with the real R&D internationalization expenditure of enterprises, which satisfies the basic requirement that instrumental variables must be related to endogenous variables. In the meantime, the explanatory variables of the probit model for R&D internationalization decision-making are exogenous variables. Therefore, the fitted value is exogenous variables, which also satisfies the assumption that instrumental variables are irrelevant with regard to error.

With the panel data of Chinese REs and EEs, the probit model was used to fit the decision-making of R&D internationalization. D means the decision-making of R&D internationalization, defining 0–1 variable as Equation (3):

Equation (4) is the model-of-choice for determining whether or not REs and EEs implement R&D internationalization. From Equation (4), represents the explanatory and controlled variables, represents the heterogeneity of industries, reflects the heterogeneity of provinces, and represents the error term and obeys independent and identically distribution (i.i.d.).

4. Empirical Analysis and Results

Table 2 provides descriptive statistics for all variables. Standard deviations of R&D internationalization, state ownership, and international experience show enough variation, which is helpful in identifying the relationship of interest. The correlation coefficient of each variable is less than 0.8, which suggests that variables can be effectively discriminated from each other. In addition, the correlation coefficient between R&D internationalization and innovation is positive (r = 0.205, p < 0.05).

Table 2.

Descriptive statistics and correlation matrix a.

4.1. Probit Model Estimation of R&D Internationalization Decision-Making

Table 3 reports the estimation results of the probit model of R&D internationalization decision-making. The result shows that the decision-making involved in R&D internationalization is significantly negatively correlated with financial leverage. This means that with the increase of financial leverage, fewer funds will be used for R&D investment. The result also shows that government subsidy is positively correlated, which is mainly due to the requirement that government subsidy should stimulate an enterprise’s R&D activities [3]. In addition, with the increase of enterprise size, international experience, R&D expenditure, and number of R&D employees, enterprises have a high innovation performance. This may be due to these factors increasing the innovation ability of the enterprises. According to the correlation analysis, the fitted value of R&D internationalization decision-making based on the probit model significantly correlated with the actual R&D internationalization (r = 0.363, p < 0.001).

Table 3.

Regression results of R&D internationalization choice model.

4.2. Test of Hypotheses

We used two-stage least squares (2SLS) regression, which is the most common approach of instrument variable (IV), to test our hypotheses [81]. In stage one, we regressed R&D internationalization on all the control variables and the IV (fitted R&D internationalization choice) and predicted the value of R&D internationalization (). Then we replaced R&D internationalization with its predicted value in the regression of stage two. The first step of IV regression shows a positive relationship (γ = 11.611, p < 0.01) between IV and R&D internationalization. The Cragg–Donald Wald F statistic is 148.202, indicating our IV is valid and strong (see M1 in Table 4).

Table 4.

Results of regression analysis on green innovation.

To confirm our argument in Hypothesis 1, the variable of the predicted value of R&D internationalization () and its squared term () in our regression model were first added to test their effects on enterprise green innovation performance. As illustrated in Model 3 from Table 4, the result revealed a negative linear effect of R&D internationalization intensity (M3: = −3.082, p < 0.01 and = 0.002, p > 0.1), which does not support the U-shaped relationship in Hypothesis 1.

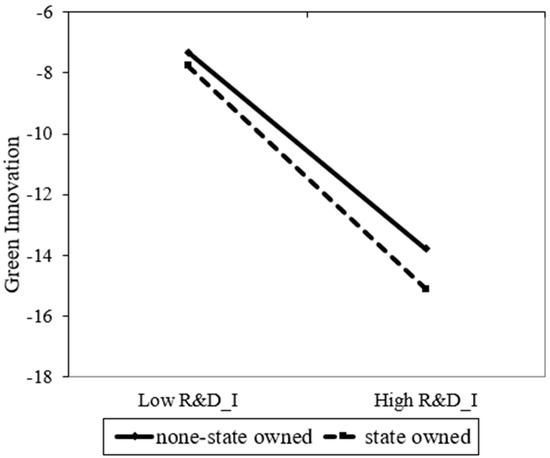

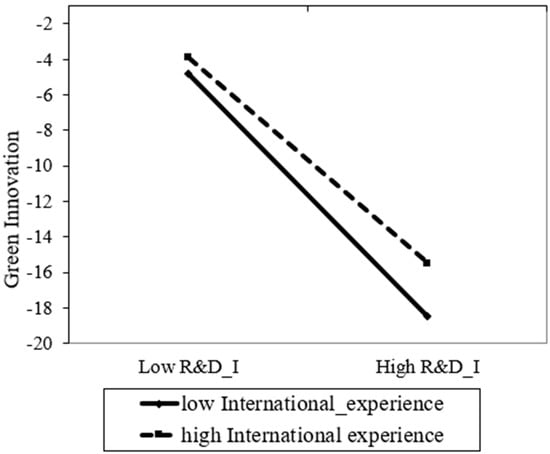

Next, we analyzed the moderating effects of state ownership and international experience on the relationship between R&D internationalization and innovation performance. Specifically, the interactions of state ownership with R&D internationalization were incorporated in Model 4. We then found the interaction was negatively related to green innovation (M4: = −0.378, p < 0.01), which means that state-ownership negatively moderated the relationship of R&D internationalization on innovation performance. The result supports Hypothesis 2. Likewise, the interactions of international experience with R&D internationalization were incorporated in Model 5, where we found the interaction was positively related to norm internalization (M5: = −0.478, p < 0.01), suggesting that an enterprise’s international experience positively moderated the relationship of R&D internationalization on innovation performance, supporting Hypothesis 3.

In addition, we followed the procedure recommended by Aiken and West [92]. According to two levels of moderating variable—that is, one standard deviation above and below the mean—we plotted the relationship between R&D internationalization and innovation to visually interpret the pattern of the moderating effect of state-ownership and international experience. As illustrated in Figure 2, the predicted negative relationship between R&D internationalization and innovation is more negative for state-owned enterprises. Figure 3 illustrates that the predicted negative relationship between R&D internationalization and innovation is more negative for enterprises with low international experience.

Figure 2.

An illustration of moderating effects of state ownership.

Figure 3.

An illustration of moderating effects of international experience.

5. Discussion, Contribution, and Implications

5.1. Discussion

This paper represents one of the first attempts to uncover how R&D internationalization affects green innovation from emerging economies. As distinct from previous literature using data collected by questionnaire, we mainly used second-hand big data, which helped us to solve the problem of endogeneity. Our empirical analysis found a negative linear relationship between R&D internationalization and green innovation, which suggests that the benefits of cross-national integration as it happens in reality generally is not large enough to overcome the costs of acquiring, transferring, and integrating this knowledge through cross-nationally dispersed R&D facilities for REs and EEs from emerging economies. This result is different from earlier conclusions of positive-linear relationships [2], U-shaped relationships [25], and S-shaped relationships [17] between R&D internationalization and innovation. This may be due to REs and EEs having a lack of motivation for green innovation in the areas of energy efficiency and environmental protection, which have obvious qualities of externalities and characteristic public goods, such that other enterprises or social members could benefit freely from the innovation of REs and EEs (e.g., cleaner air and water), while REs and EEs could not get all the benefits of innovation; or it may indicate that the technology and knowledge acquired abroad is not useful for REs and EEs in their home countries, which face different pollution, environmental protection, and resource problems from the host countries.

From the perspective of KBT, which suggests that enterprises’ knowledge stock and external knowledge acquisition and integration are contingency factors, these results are consistent. They show that state-owned enterprises or enterprises with international experience would have a higher knowledge stock or higher knowledge iteration capability than non-state-owned enterprises or enterprises without international experience. Consistent with previous research findings [25], we found that REs and EEs with international experience provide green innovations of significantly greater value than enterprises without international experience. In addition, we also found a negative moderation effect of state-ownership. This result is different from earlier conclusions that the state-owned organizations have the responsibility to intervene to compensate for misalignment caused by positive externalities, and ultimately have a greater green innovation than private enterprises [36]. This may be due to REs and EEs state-owned enterprises’ inefficient knowledge acquisition and iteration caused by stricter regulation by foreign governments. If a state-owned enterprise overcomes those deficiencies via a new R&D internationalization path, such as distribution of the R&D of private enterprises through a backdoor route and introduction of global R&D talents, the negative average effect of R&D internationalization on innovations of REs and EEs from emerging economies may be weakened—and possibly even get reversed. The conclusions echo the suggestion that state-owned enterprises are highly constrained by the government [60] and are inefficient operations [54], whereas experienced enterprises are better equipped to deal with the liability of foreignness and the complexities of international management [34,35].

5.2. Contribution to Theory

From a theoretical standpoint, research on the determinants of green innovations has mainly focused on environmental-level factors (e.g., public policy, stakeholder impacts, and market demands) [21]. Instead, we narrowed the attention on knowledge acquiring, which is also a critical driver of green innovation performance [13]. More in detail, the need to rely on international distributed R&D to develop green innovations of a higher value has been widely debated. Despite this, very few studies have delved into R&D internationalization leading to more green innovations [21]. Therefore, by unveiling that R&D internationalization affects green innovation value, we may contend that our understanding of this issue has been moved one step further. Indeed, this paper represents one of the few attempts to analyze how to choose R&D nationalization strategy, in terms of enterprise types, to achieve better green innovation performance.

Specifically, to the best of our knowledge, the role of an enterprise’s heterogeneity has never been examined, nor the new set of studies that lies at the intersection of R&D nationalization and green innovation theory. Our study is a beneficial supplement in this research area from the perspective of knowledge base theory, which allows us to consider state ownership or a firm’s international experience as contingency factors that might influence the relationship between R&D internationalization and green innovation. That is, we have expanded the use of knowledge as a theoretical lens to articulate its linkage to R&D nationalization strategy aimed at creating green innovations.

Broadly speaking, our findings also add to the more general research about R&D internationalization and their impact on innovation output. Prior studies have examined the influence of R&D nationalization on innovation, and found positive-linear relationships [2], U-shaped relationships [25], and S-shaped relationships [17]. However, this study provided opposing results, in that negative effects were revealed. These contrasting effects may be symptomatic of inadequate consideration of endogenous problems. As distinct from previous literature using data collected by questionnaire, we mainly used second-hand big data, which helped us to overcome issues of endogeneity.

5.3. Implications

From a practical standpoint, our results have implications for business strategy and policy decisions because we provide more detailed directions to managers and policymakers in respect to the peculiarities of R&D internationalization aimed at developing green innovations. That is, REs and EEs from emerging economies should reconstruct their green innovation strategies. Instead of decentralizing R&D activities by reaching out to the international market, REs and EEs should pay more attention to setting up R&D branches in their home countries and making good use of knowledge and other R&D resources that already exist in their internal environments. Decentralized R&D activities around the world are a complicated and challenging situation for managers of REs and EEs, whose talents and corporate efforts may be more effectively used closer to home. Moreover, our findings show a positive moderation effect of international experience. Therefore, REs and EEs, which have to conduct internationalized R&D to gain key technology or resources, should hire managers from, or cooperate with, enterprises with rich international experience. This could help to overcome the liability of foreignness and the complexities of international management [93]. In addition, we highlight that state-owned enterprises may face stricter regulation by foreign governments that limit the ability of knowledge acquisition and iteration and hinder greener innovation. This can guide policy makers enterprise selection in the process of pushing Chinese enterprises to establish transnational R&D network collaborations. Eventually, state-owned REs and EEs have to overcome deficiencies caused by restrictive foreign regulations via new R&D internationalization paths, such as acquiring the distributed R&D of private enterprises via a backdoor method and the introduction of global R&D talents.

6. Limitations and Future Research

While we believe that our study is an important contribution to understanding the association of R&D internationalization and green innovation of REs and EEs, it also has some limitations. First, R&D internationalization has two dimensions [25]: intensity and diversity. This study just tested R&D internationalization in terms of intensity; its diversity needs to be further examined [88]. Second, this study did not consider the quality of green innovation; it just evaluated R&D internationalization in terms of patent numbers for REs and EEs. Future studies could more closely examine the effect of R&D internationalization on the quality of green innovation, which can be measured by the number of inventions or the number of forward citations [94]. Third, data limitations also prevented us from exploring why R&D internationalization has a negative effect on green innovation for REs and EEs. Future studies could extend the current research by testing the influence of various mechanisms of R&D internationalization on REs’ and EEs’ innovation through more in-depth study of individual firms. Fourth, we just considered the moderating effect of state ownership and international experience. Future studies could continue our research by examining other contingency factors that might influence REs’ and EEs’ R&D internationalization and its impact on innovation performance. Finally, this research also suffers from the limitations associated with single-country analysis. In the future, researchers could extend this study to other emerging countries, which would provide further insights for policy makers and enterprise managers interested in this issue.

Author Contributions

Conceptualization, X.Z. and B.X.; methodology, B.X.; software, B.X.; validation, X.Z. and B.X.; formal analysis, B.X.; resources, X.Z.; data curation, B.X.; writing—original draft preparation, X.Z.; writing—review and editing, B.X.

Funding

“This research was funded by NATIONAL NATURAL SCIENCE FOUNDATION OF CHINA, grant number 71473116”, “NATIONAL NATURAL SCIENCE FOUNDATION OF CHINA, grant number 71874080” and “NATIONAL NATURAL SCIENCE FOUNDATION OF CHINA, grant number 71802070”.

Acknowledgments

Thanks go to Brenda Denzler for her editorial assistance.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Noailly, J.; Ryfisch, D. Multinational firms and the internationalization of green R&D: A review of the evidence and policy implications. Energy Policy 2015, 83, 218–228. [Google Scholar]

- Driessen, P.H.; Hillebrand, B. Adoption and diffusion of green innovations. In Marketing for Sustainability: Towards Transactional Policy-Making; Ios Press Inc.: Amsterdam, The Netherlands, 2002; pp. 343–355. [Google Scholar]

- Huang, Z.; Liao, G.; Li, Z. Loaning scale and government subsidy for promoting green innovation. Technol. Forecast. Soc. 2019, 144, 148–156. [Google Scholar] [CrossRef]

- Cantwell, J.; Zhang, Y. Why is R&D internationalization in Japanese firms so low? A path-dependent explanation. Asian Bus. Manag. 2006, 5, 249–269. [Google Scholar]

- El-Kassar, A.N.; Singh, S.K. Green innovation and organizational performance: The influence of big data and the moderating role of management commitment and HR practices. Technol. Forecast. Soc. Chang. 2019, 144, 483–498. [Google Scholar] [CrossRef]

- Tariq, A.; Badir, Y.; Chonglerttham, S. Green innovation and performance: Moderation analyses from Thailand. Eur. J. Innov. Manag. 2019, 22, 446–467. [Google Scholar] [CrossRef]

- Huang, J.W.; Li, Y.H. Green innovation and performance: The view of organizational capability and social reciprocity. J. Bus. Ethics 2017, 145, 309–324. [Google Scholar] [CrossRef]

- Melander, L. Achieving sustainable development by collaborating in green product innovation. Bus. Strategy Environ. 2017, 26, 1095–1109. [Google Scholar] [CrossRef]

- Zhao, Y.; Feng, T.; Shi, H. External involvement and green product innovation: The moderating role of environmental uncertainty. Bus. Strategy Environ. 2018, 27, 1167–1180. [Google Scholar] [CrossRef]

- Shu, C.; Zhao, M.; Liu, J.; Lindsay, W. Why firms go green and how green impacts financial and innovation performance differently: An awareness-motivation-capability perspective. Asia Pac. J. Manag. 2019, 1–27. [Google Scholar] [CrossRef]

- Di Minin, A.; Zhang, J.; Gammeltoft, P. Chinese foreign direct investment in R&D in Europe: A new model of R&D internationalization. Eur. Manag. J. 2012, 30, 189–203. [Google Scholar]

- Reddy, P. The Globalization of Corporate R & D: Implications for Innovation Systems in Host Countries; Routledge: London, UK, 2000. [Google Scholar]

- Arfi, W.B.; Hikkerova, L.; Sahut, J.M. External knowledge sources, green innovation and performance. Technol. Forecast Soc. 2018, 129, 210–220. [Google Scholar] [CrossRef]

- Cantwell, J.; Mudambi, R. The location of MNE R&D activity: The role of investment incentives. MIR Manag. Int. Rev. 2000, 40, 127–148. [Google Scholar]

- Lahiri, N. Geographic distribution of R&D activity: How does it affect innovation quality? Acad. Manag. J. 2010, 53, 1194–1209. [Google Scholar]

- Xiao, S.S.; Jeong, I.; Moon, J.J.; Chung, C.C.; Chung, J. Internationalization and performance of firms in China: Moderating effects of governance structure and the degree of centralized control. J. Int. Manag. 2013, 19, 118–137. [Google Scholar] [CrossRef]

- Chen, C.J.; Huang, Y.F.; Lin, B.W. How firms innovate through R&D internationalization? An S-curve hypothesis. Res. Policy 2012, 41, 1544–1554. [Google Scholar]

- Grevesen, C.W.; Damanpour, F. Performance implications of organisational structure and knowledge sharing in multinational R&D networks. Int. J. Technol. Manag. 2007, 38, 113–136. [Google Scholar]

- Penner-Hahn, J.; Shaver, J.M. Does international research and development increase patent output? An analysis of Japanese pharmaceutical firms. Strateg. Manag. J. 2005, 26, 121–140. [Google Scholar] [CrossRef]

- Hojnik, J.; Ruzzier, M. What drives eco-innovation? A review of an emerging literature. Environ. Innov. Soc. Transit. 2016, 19, 31–41. [Google Scholar] [CrossRef]

- Ardito, L.; Messeni Petruzzelli, A.; Pascucci, F.; Peruffo, E. Inter-firm R&D collaborations and green innovation value: The role of family firms’ involvement and the moderating effects of proximity dimensions. Bus. Strategy Environ. 2019, 28, 185–197. [Google Scholar]

- Horbach, J.; Oltra, V.; Belin, J. Determinants and specificities of eco-innovations compared to other innovations—An econometric analysis for the French and German Industry based on the Community Innovation Survey. Ind. Innov. 2013, 20, 523–543. [Google Scholar] [CrossRef]

- De Marchi, V. Environmental innovation and R&D cooperation: Empirical evidence from Spanish manufacturing firms. Res. Policy 2012, 41, 614–623. [Google Scholar]

- Lee, C.Y. A theory of firm growth: Learning capability, knowledge threshold, and patterns of growth. Res. Policy 2010, 39, 278–289. [Google Scholar] [CrossRef]

- Hsu, C.W.; Lien, Y.C.; Chen, H. R&D internationalization and innovation performance. Int. Bus. Rev. 2015, 24, 187–195. [Google Scholar]

- Martin-de Castro, G.; Lopez-Saez, P.; Delgado-Verde, M. Towards a knowledge-based view of firm innovation. Theory and empirical research. J. Knowl. Manag. 2011, 15, 871–874. [Google Scholar] [CrossRef]

- Birkinshaw, J.; Bresman, H.; Nobel, R. Knowledge transfer in international acquisitions: A retrospective. J. Int. Bus. Stud. 2010, 41, 21–26. [Google Scholar] [CrossRef]

- Chen, J.; Jiao, H.; Zhao, X. A knowledge-based theory of the firm: Managing innovation in biotechnology. Chin. Manag. Stud. 2016, 10, 41–58. [Google Scholar] [CrossRef]

- Kotabe, M.; Dunlap-Hinkler, D.; Parente, R.; Mishra, H.A. Determinants of cross-national knowledge transfer and its effect on firm innovation. J. Int. Bus. Stud. 2007, 38, 259–282. [Google Scholar] [CrossRef]

- Awate, S.; Larsen, M.M.; Mudambi, R. Accessing vs sourcing knowledge: A comparative study of R&D internationalization between emerging and advanced economy firms. J. Int. Bus. Stud. 2015, 46, 63–86. [Google Scholar]

- Ardito, L.; Natalicchio, A.; Messeni Petruzzelli, A.; Garavelli, A.C. Organizing for continuous technology acquisition: The role of R&D geographic dispersion. RD Manag. 2017, 48, 165–176. [Google Scholar]

- Kraaijenbrink, J.; Wijnhoven, F. Managing heterogeneous knowledge: A theory of external knowledge integration. Knowl. Manag. Res. Pract. 2008, 6, 274–286. [Google Scholar] [CrossRef]

- Benassi, M.; Landoni, M. State-owned enterprises as knowledge-explorer agents. Ind. Innov. 2019, 26, 218–241. [Google Scholar] [CrossRef]

- Brouthers, K.D.; Hennart, J.F. Boundaries of the firm: Insights from international entry mode Research. J. Manag. 2007, 33, 395–425. [Google Scholar] [CrossRef]

- Li, P.Y.; Meyer, K.E. Contextualizing experience effects in international business: A study of ownership strategies. J. World Bus. 2009, 44, 370–382. [Google Scholar] [CrossRef]

- Ardito, L.; Petruzzelli, A.M.; Ghisetti, C. The impact of public research on the technological development of industry in the green energy field. Technol. Forecast. Soc. Chang. 2019, 144, 25–35. [Google Scholar] [CrossRef]

- Phene, A.; Almeida, P. Innovation in multinational subsidiaries: The role of knowledge assimilation and subsidiary capabilities. J. Int. Bus. Stud. 2008, 39, 901–919. [Google Scholar] [CrossRef]

- Iwasa, T.; Odagiri, H. Overseas R&D, knowledge sourcing, and patenting: An empirical study of Japanese R&D investment in the US. Res. Policy 2004, 33, 807–828. [Google Scholar]

- Szulanski, G. Exploring internal stickiness: Impediments to the transfer of best practice within the firm. Strateg. Manag. J. 1996, 17, 27–43. [Google Scholar] [CrossRef]

- Kogut, B. Country capabilities and the permeability of borders. Strateg. Manag. J. 1991, 12, 33–47. [Google Scholar] [CrossRef]

- Laursen, K.; Salter, A. Open for innovation: The role of openness in explaining innovation performance among UK manufacturing firms. Strateg. Manag. J. 2006, 27, 131–150. [Google Scholar] [CrossRef]

- Feng, T.; Sun, L.; Zhang, Y. The effects of customer and supplier involvement on competitive advantage: An empirical study in China. Ind. Mark. Manag. 2010, 39, 1384–1394. [Google Scholar] [CrossRef]

- Un, C.A.; Cuervo-Cazurra, A.; Asakawa, K. R&D collaborations and product innovation. J. Prod. Innov. Manag. 2010, 27, 673–689. [Google Scholar]

- Brunswicker, S.; Hutschek, U. Crossing horizons: Leveraging cross-industry innovation search in the front-end of the innovation process. Int. J. Innov. Manag. 2010, 14, 683–702. [Google Scholar] [CrossRef]

- Hansen, M.T. The search-transfer problem: The role of weak ties in sharing knowledge across organizational subunits. Adm. Sci. Q. 1999, 37, 422–447. [Google Scholar] [CrossRef]

- Murray, F. The role of academic inventors in entrepreneurial firms: Sharing the laboratory life. Res. Policy 2004, 33, 643–659. [Google Scholar] [CrossRef]

- Perry-Smith, J.E.; Shalley, C.E. A Social Composition View of Team Creativity: The Role of Member Nationality-Heterogeneous Ties Outside of the Team. Organ. Sci. 2014, 25, 1434–1452. [Google Scholar] [CrossRef]

- Contractor, F.J. Is International Business Good for Companies? The Evolutionary or Multistage Theory of Internationalization vs. the Transaction Cost Perspective. MIR Manag. Int. Rev. 2007, 47, 453–475. [Google Scholar] [CrossRef]

- Arora, A.; Gambardella, A. Ideas for rent: An overview of markets for technology. Ind. Corp. Chang. 2010, 19, 775–803. [Google Scholar] [CrossRef]

- Cassiman, B.; Valentini, G. Open innovation: Are inbound and outbound knowledge flows really complementary? Strateg. Manag. J. 2016, 37, 1034–1046. [Google Scholar] [CrossRef]

- Sofka, W. Innovation Activities Abroad and the Effects of Liability of Foreignness: Where it Hurts. Center for European Economic Research (ZEW) Discussion Paper No. 06–029. Available online: http://dx.doi.org/10.2139/ssrn.901212 (accessed on 20 November 2019).

- Lien, Y.C.; Piesse, J.; Strange, R.; Filatotchev, I. The role of corporate governance in FDI decisions: Evidence from Taiwan. Int. Bus. Rev. 2005, 14, 739–763. [Google Scholar] [CrossRef]

- Argyres, N.S.; Silverman, B.S. R&D, organization structure, and the development of corporate technological knowledge. Strateg. Manag. J. 2004, 25, 929–958. [Google Scholar]

- Zaheer, S. Overcoming the liability of foreignness. Acad. Manag. J. 1995, 38, 341–363. [Google Scholar]

- Sanna-Randaccio, F.; Veugelers, R. Multinational knowledge spillovers with decentralised R&D: A game-theoretic approach. J. Int. Bus. Stud. 2007, 38, 47–63. [Google Scholar]

- Schmidt, T.; Sofka, W. Lost in Translation Empirical Evidence for Liability of Foreignness as Barriers to Knowledge Spillovers. ZEW-Centre for European Economic Research Discussion Paper No. 06–001. Available online: http://dx.doi.org/10.2139/ssrn.874972 (accessed on 10 November 2019).

- Al-Laham, A.; Amburgey, T.L. Knowledge sourcing in foreign direct investments: An empirical examination of target profiles. Manag. Int. Rev. 2005, 45, 247–275. [Google Scholar]

- Lu, L.Y.Y.; Liu, J.S. R&D in China: An empirical study of Taiwanese IT companies. RD Manag. 2004, 34, 453–465. [Google Scholar]

- Thomas, D.E. International diversification and firm performance in Mexican firms: A curvilinear relationship. J. Bus. Res. 2006, 59, 501–507. [Google Scholar] [CrossRef]

- Ramamurti, R. A multilevel model of privatization in emerging economies. Acad. Manag. Rev. 2000, 25, 525–550. [Google Scholar] [CrossRef]

- Cui, L.; Jiang, F. State ownership effect on firms’ FDI ownership decisions under institutional pressure: A study of Chinese outward-investing firms. J. Int. Bus. Stud. 2012, 43, 264–284. [Google Scholar] [CrossRef]

- Buckley, P.J.; Clegg, L.J.; Cross, A.R.; Liu, X. The determinants of Chinese outward foreign direct investment. J. Int. Bus. Stud. 2009, 40, 499–518. [Google Scholar] [CrossRef]

- Zhang, J.; Zhou, C.; Ebbers, H. Completion of Chinese overseas acquisitions: Institutional perspectives and evidence. Int. Bus. Rev. 2011, 20, 226–238. [Google Scholar] [CrossRef]

- Wang, C.; Hong, J.; Kafouros, M.; Wright, M. Exploring the role of government involvement in outward FDI from emerging economies. J. Int. Bus. Stud. 2012, 43, 655–676. [Google Scholar] [CrossRef]

- Justin Tan, J.; Litsschert, R.J. Environment-strategy relationship and its performance implications: An empirical study of the Chinese electronics industry. Strateg. Manag. J. 1994, 15, 1–20. [Google Scholar] [CrossRef]

- Li, Y.; Liu, Y.; Ren, F. Product innovation and process innovation in SOEs: Evidence from the Chinese transition. J. Technol. Transf. 2007, 32, 63–85. [Google Scholar] [CrossRef]

- Emden, Z.; Yaprak, A.; Cavusgil, S.T. Learning from experience in international alliances: Antecedents and firm performance implications. J. Bus. Res. 2005, 58, 883–892. [Google Scholar] [CrossRef]

- Hultman, M.; Katsikeas, C.S.; Robson, M.J. Export promotion strategy and performance: The role of international experience. J. Int. Mark. 2011, 19, 17–39. [Google Scholar] [CrossRef]

- Johnson, J.; Yin, E.; Tsai, H. Persistence and learning: Success factors of Taiwanese firms in international markets. J. Int. Mark. 2009, 17, 39–54. [Google Scholar] [CrossRef]

- Chetty, S.; Eriksson, K.; Lindbergh, J. The effect of specificity of experience on a firm’s perceived importance of institutional knowledge in an ongoing business. J. Int. Bus. Stud. 2006, 37, 699–712. [Google Scholar] [CrossRef]

- Brouthers, K.D. Institutional, cultural and transaction cost influences on entry mode choice and performance. J. Int. Bus. Stud. 2002, 33, 203–221. [Google Scholar] [CrossRef]

- Barkema, H.G.; Bell, J.H.J.; Pennings, J.M. Foreign entry, cultural barriers, and learning. Strateg. Manag. J. 1996, 17, 151–166. [Google Scholar] [CrossRef]

- Pennings, J.M.; Barkema, H.; Douma, S. Organizational learning and diversification. Acad. Manag. J. 1994, 37, 608–640. [Google Scholar]

- Luo, Y.; Tung, R.L. International expansion of emerging market enterprises: A springboard perspective. J. Int. Bus. Stud. 2007, 38, 481–498. [Google Scholar] [CrossRef]

- Hoskisson, R.E.; Eden, L.; Lau, C.M.; Wright, M. Strategy in emerging economies. Acad. Manag. J. 2000, 43, 249–267. [Google Scholar]

- Wright, M.; Filatotchev, I.; Hoskisson, R.E.; Peng, M.W. Strategy research in emerging economies: Challenging the conventional wisdom. J. Manag. Stud. 2005, 42, 1–33. [Google Scholar] [CrossRef]

- Mohr, A.; Fastoso, F.; Wang, C.; Shirodkar, V. Testing the regional performance of multinational enterprises in the retail sector: The moderating effects of timing, speed and experience. Br. J. Manag. 2014, 25, S100–S115. [Google Scholar] [CrossRef]

- Oltra, V.; Saint Jean, M. Sectoral systems of environmental innovation: An application to the French automotive industry. Technol. Forecast. Soc. Chang. 2009, 76, 567–583. [Google Scholar] [CrossRef]

- Uhlaner Hendrickson, L.; Tuttle, D.B. Dynamic management of the environmental enterprise: A qualitative analysis. J. Organ. Chang. Manag. 1997, 10, 363–382. [Google Scholar] [CrossRef]

- Gunarathne, N. Sustainable Innovation Measurement: Approaches and Challenges. In Innovation for Sustainability: Business Transformations Towards a Better World, 1st ed.; Bocken, N., Paavo, R., Laura, A., Robert, V., Eds.; Palgrave Macmillan: Basingstoke, UK, 2019; pp. 233–251. [Google Scholar]

- Calik, E.; Bardudeen, F. A measurement scale to evaluate sustainable innovation performance in manufacturing organizations. Procedia CIRP 2016, 40, 449–454. [Google Scholar] [CrossRef]

- Yu, G.; Rhee, S.Y. Effect of R&D collaboration with research organizations on innovation: The mediation effect of environmental performance. Sustainability 2015, 7, 11998–12016. [Google Scholar]

- Hagedoorn, J.; Cloodt, M. Measuring innovative performance: Is there an advantage in using multiple indicators? Res. Policy 2003, 32, 1365–1379. [Google Scholar] [CrossRef]

- Bakker, J.; Verhoeven, D.; Zhang, L.; Van Looy, B. Patent citation indicators: One size fits all? Scientometrics 2016, 106, 187–211. [Google Scholar] [CrossRef]

- Arundel, A. The relative effectiveness of patents and secrecy for appropriation. Res. Policy 2001, 30, 611–624. [Google Scholar] [CrossRef]

- Delios, A.; Beamish, P.W. Geographic scope, product diversification, and the corporate performance of Japanese firms. Strateg. Manag. J. 1999, 20, 711–727. [Google Scholar] [CrossRef]

- Lu, J.W.; Beamish, P.W. International diversification and firm performance: The S-curve hypothesis. Acad. Manag. J. 2004, 47, 598–609. [Google Scholar]

- Hitt, M.A.; Hoskisson, R.E.; Kim, H. International diversification: Effects on innovation and firm performance in product-diversified firms. Acad. Manag. J. 1997, 40, 767–798. [Google Scholar]

- Jean, R.J.B.; Deng, Z.; Kim, D.; Yuan, X. Assessing endogeneity issues in international marketing research. Int. Market. Rev. 2016, 33, 483–512. [Google Scholar] [CrossRef]

- Aiello, F.; Cardamone, P. R&D spillovers and firms’ performance in Italy. Empir. Econ. 2008, 34, 143–166. [Google Scholar]

- Wooldridge, J.M. Econometric Analysis of Cross Section and Panel Data, 2nd ed.; MIT Press: Cambridge, MA, USA, 2010; pp. 83–107. [Google Scholar]

- Aiken, L.S.; West, S.G. Multiple Regression: Testing and Interpreting Interactions; Sage: Newbury Park, CA, USA, 1991; pp. 116–137. [Google Scholar]

- Hansen, M.T.; Nohria, N. How to build collaborative advantage. MIT Sloan Manag. Rev. 2004, 46, 22–30. [Google Scholar]

- Dang, J.; Motohashi, K. Patent statistics: A good indicator for innovation in China? Patent subsidy program impacts on patent quality. China Econ. Rev. 2015, 35, 137–155. [Google Scholar] [CrossRef]

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).