Abstract

In most countries, small and medium-sized enterprises (SMEs) play a key role in driving sustainable economic growth and job creation; hence, the need to investigate factors (e.g., entrepreneurial factors) that influence SMEs’ sustainable growth (SMESG). This study provides an insight into entrepreneurs’ abilities (EAs) that affect SMESG in Côte d’Ivoire (a middle-income economy located in the West African region) and an assessment of the extent to which entrepreneurial orientation (EO) influences the EA–SMESG relationship. By using data from 320 Ivorian SMEs, the results of hypothesis testing confirm an association between SMESG and each EA dimension (creativity, risk control, relationship, and opportunity detection ability), learning ability excepted. As for the moderating effect of EO, the innovativeness in entrepreneurship positively and significantly regulates the EA–SMESG relationship; proactiveness positively regulates the relationship between almost all EA dimensions and SMESG; and risk tendency regulates the relationship EA–SMESG for creativity and risk-control ability. Based on major findings, management implications are formulated in relation to promoting SMEs’ sustainable growth. For example, in light of the impact of EA on SMESG, development actors can increase the efficiency of Ivorian SMEs through actions aiming at strengthening the abilities of entrepreneurs and managers.

1. Introduction

Since small and medium-sized enterprises (SMEs) are the catalysts for the economic growth of states [1], investigating factors that may affect their growth is not only a matter of improving their achievements, but also a national development concern. According to recent observations, SMEs generate more than 55% of the GDP and 65% of total employment in high-income countries; more than 60% of the GDP and 70% of total employment in low-income countries; and more than 95% of total employment and about 70% of the GDP in middle-income countries.

However, despite their acknowledged contributions to the economy, SMEs are faced with challenges and difficulties that seem to hinder their growth. According to numerous scholars [2,3,4,5,6], factors—such as firm characteristics, entrepreneur characteristics, entrepreneurial factors, managerial skills, external environment factors, technology, management issues, marketing management strategies, customers’ satisfaction, government policy, sociocultural factors and access to finance—may affect (positively or negatively) the growth of SMEs. In the African context, Diabate and Mingaine [7] investigated external environment factors affecting the performance of SMEs in Côte d’Ivoire. They found that several external factors ranging from political to economic, technological, socioeconomic and government policies affect the performance of SMEs to a large extent. Later, Diabate et al. [6], through statistical tests, found an association between most firm and entrepreneur characteristics and growth among Ivorian SMEs.

The concept of business growth is most often conjointly discussed with another key concept: Entrepreneurship. Entrepreneurship is a set of factors and actions that bring about development [8], which means positive growth, performance or stability. As an essential concept related to entrepreneurship, the term “entrepreneur” refers to the enterprise’s owner [9], whose abilities—such as creativity, risk control, learning, building relationships and detecting opportunity—can influence the growth of his/her business [10,11,12,13]. According to Lumpkin and Dess [14], the entrepreneur’s ability (EA) is most often captured and influenced by the entrepreneurial orientation (EO) that is the company’s posture on entrepreneurship. Studies in both developed and less developed countries concluded that EO generally has a positive effect on the growth of enterprises. Hence, one of the solutions to the problems of SMEs is the adoption of EO.

Since the recognition of entrepreneurial factors as growth determinants, practical studies on their impact on business growth have been welcomed everywhere; hence, several studies have been conducted about EA and SMEs’ sustainable growth (SMESG). These studies have, however, led to mixed results. For example, while Civelek et al. [15] revealed a positive relationship, Rauch et al. [16] found a negative relationship between EA and SMESG. As for the effect of EO on the relationship between EA and SMESG, the results of previous studies are also inconsistent from one author to another. For instance, a study by Aroyeun [17] showed a positive effect, while Matsuno et al. [18] stated that some EO dimensions had a negative or no impact on business growth.

Consequently, there is a need for further studies on the relationship between EA and EO, and SMESG. Besides, there is limited research dedicated to SMESG in developing economies like Côte d’Ivoire. This study therefore aimed at investigating the impact of EA on SMESG in Côte d’Ivoire by (1) identifying the most valuable EA dimensions that can contribute to SMESG; (2) assessing the extent to which each EA dimension leads to growth; and (3) examining the effects of EO on the EA–SMESG relationship. This study seeks to determine whether SMEs in Côte d’Ivoire will grow better and faster if—and only if—their owner-managers have good EAs and are entrepreneurially oriented.

The primary goal of this study is to investigate the abilities of entrepreneurs that affect the sustainable growth of SMEs operating in Côte d’Ivoire. To this end, three issues are considered in this study: Describing the most important EAs relating to SMEs’ sustainable growth (SMESG); demonstrating the existence of a relationship (or non-association) between each dimension of EA and SMESG; and assessing the effect of EO in enhancing SMESG through EA. Since the topics of EA and EO in regard to SMESG have not been explored in Côte d’Ivoire, the study seems to be pertinent.

The study is organized into five sections. Following the introduction section is the second section surveying the relevant literature. The concepts of SME, EA, EO and SMESG are described in this section. The third section is devoted to the hypothesis development (that led to the research model) and research methodology (that includes a description of the business environment in Côte d’Ivoire, the study population, the sampling procedure, the data collection and the statistical methods used in the data analysis). The fourth section is the analytical part. The last section covers the discussions of major findings, management implications arising from research findings, limitations, and directives for further research.

2. Literature Relating to SMEs, Entrepreneurship and Business Growth

2.1. Entrepreneurship and Its Key Concepts

Several factors could influence the success of enterprises. These factors include entrepreneurship, which is an individual’s ability to turn ideas into actions [19]. This individual is the entrepreneur [20]. The term entrepreneurship derives from the French verb “entreprendre” (i.e., to undertake). In business terms, entrepreneurship comprises a set of factors and continuous actions that bring about development, which leads to growth, performance, and stability [21]. Since Smith [9], EO and EA have been considered as important concepts related to entrepreneurship.

2.1.1. Entrepreneurs’ Ability and Its Components

Stevenson [10] implies that an entrepreneur needs some specific managerial skills (e.g., creativity, risk-control ability, learning ability, relationship ability and the ability to recognize and tap potential opportunities) to achieve growth [22]. Shane [23] further implies that an entrepreneur is an innovator who utilizes the opportunity to gain the benefits of the environment. In contrast, Whetten and Cameron [24] conclude that the relationship ability of the entrepreneur has an impact on the performance of an enterprise.

For the measurements of EA, although variables vary among scholars, the main dimensions include creativity and the ability to control risk, learn, conduct relationships, and detect opportunities.

Creativity ability (CA) refers to the development of new and appropriate solutions, goods and services [25] that can bring benefits to enterprises through innovation [26]. However, to achieve and strengthen innovation through creativity, innovative strategies should guide decisions on how resources are to be used to meet a business objective [27].

Risk-control ability (RCA) is about how the entrepreneur can successfully grasp high-risk opportunities, and manage and control risks in different stages of growth [28]. Since being entrepreneurial goes beyond the fear of risk [29], an entrepreneurial firm must focus on opening itself up to the risk and its effective management [30].

Learning ability (LA) refers to the ability to sum up experiences and to actively try to acquire new knowledge, new models, and new methods through various channels [31]. According to Voronov and Yorks [32], the willingness and ability to continuously learn are essential skills required to succeed as an entrepreneur.

Relationship ability (RA) refers to the ability to establish and maintain good relationships with business partners [33]. According to numerous scholars [34,35,36], entrepreneurs who are in good relationships with business partners (i.e., employees, shareholders, clients, suppliers, creditors, government, financial institutions, social partners, associations, chambers of commerce and the like) can easily succeed in business. Since the media and the government’s invisible hand affect companies’ activities [12], it is appropriate to establish and maintain good relationships with government-related organizations at all levels.

Opportunity detection ability (OA) refers to the ability to recognize and take advantage of potential market opportunities [37]. Opportunity—as a central element of the entrepreneurial process—is everywhere, but entrepreneurial founders should be able to recognize, size and tap them.

2.1.2. Entrepreneurial Orientation and Its Dimensions

If Smith’s [9] insight is applied, entrepreneurs are the owners, whose personal characteristics and orientation influence the growth of their enterprises. EO refers to a strategic posture reflecting how firms implicitly and explicitly choose to compete [38]. In other words, EO comprises the processes, practices and decision-making styles of the owner-managers or firms that engage in entrepreneurial activities [39]. Many studies [13,40,41] have established that EO is positively related to the performance of enterprises.

The topic of EO has been extensively discussed over the past decades. However, given the breadth of the concept, EO will be described in terms of dimensions [14]. Lumpkin and Dess [14] have defined five dimensions of EO, namely innovativeness, risk-taking, proactiveness, competitive aggressiveness, and autonomy. However, given the fact that the choice of dimensions for scrutiny depends on the objective of particular studies [42], the consideration of any EO dimension is accepted by research specialists [13]. Hence, numerous researchers [13,18,43] have restricted their studies to the most used EO dimensions, namely innovativeness, proactiveness, and risk trend.

Innovativeness (innovative orientation) is the tendency to introduce new things by developing new products, services, processes, technologies, and models [14]. According to Berrone et al. [44], innovativeness can promote enterprise reform and accelerate the flow of new knowledge, which improves enterprise innovation performance.

Proactiveness (initiative orientation) is the tendency to anticipate and act on new opportunities related to future demand [11]. According to Zhai et al. [39], proactive enterprises tend to adopt an opportunity-seeking perspective for finding new market opportunities and take quick action on these opportunities ahead of competitors, which in turn bring innovative performance and financial growth.

Risk tendency (risk orientation) is the tendency to take bold actions rather than to be cautious [45]. It reflects the willingness of enterprises to invest resources in innovation projects, although the failure rate is high [46] or to enter a new market with high uncertainty of success.

2.2. SMEs and Sustainable Growth

2.2.1. Concept and Importance of SMEs

A small and medium-sized enterprise (SME) or business (SMB) is a business whose personnel number, annual turnover and balance sheet fall below certain levels. While SMEs’ reality and size change according to economies [47], companies are classified based on their legal recognition and tax payments, as well as their criteria of turnover and number of employees.

As for the importance of SMEs, it is widely accepted that SMEs are one of the pillars of the economies of states. In most countries, SMEs are the dominant form of business organization, accounting for over 90% of registered enterprises, and they play a key role in driving sustainable economic growth and job creation. In a nutshell, SMEs are the cornerstone of nations. Consequently, the more successful the SMEs, the wealthier the country [48].

2.2.2. Concept of Business Growth

Growth is a process of in-depth development and positive transformations [49] that is generally measured through quality [50] and/or profit [51] improvement. The business growth, according to Terziovski and Samson [52], refers to the growth of the profitability of the enterprise, on the one hand, and the improvement of the quality and ability of the enterprise, on the other hand.

Financial growth (as a profit improvement) and innovation growth (as a quality and ability improvement) formed the growth measurement in this research.

Financial Growth

Quantitative measures (e.g., financial indicators) are the best indicators of a business’s growth [53,54,55,56]. According to Delmar and Wiklund [54], if only one indicator has to be used to measure a business’s growth, then financial achievements should be the preferred choice. Since sales growth, annual turnover, average return on net assets, gross profit and market share are ‘financial achievements’, it seems logical to use them as good metrics in assessing the growth of enterprises.

Innovation Growth

Schumpeter [57] defined innovation as “the introduction of a new good or a new quality of a good” (i.e., product innovation) or “the introduction of a new method of production or a new way of handling a commodity commercially” (i.e., process innovation). Innovation growth, therefore, refers to the improvement in the method of production and quality of products [58]. Formulated otherwise, innovation growth refers to the marginal differences in the success of companies. According to Dimitar and Zornitsa [59], innovation metrics include R&D investments, the number of introduced new products and processes, and intellectual property rights (trademarks, copyright, patents, among others).

2.2.3. SME Sustainable Growth and Its Measurements

Sustainable growth literally refers to sustained success, which is the capacity of the business to accomplish its growth objective [60] within a specific period and given a particular context. Economists suggest that a company is considered capable of sustained growth if it grows at the average growth rate of the country’s economy [61]. This being so, given that Côte d’Ivoire’s GDP grew on average by 8–9% per year during the period 2012–2018 [62], any SME with an annual growth rate of 8% should be classified as growing sustainably. However, Flamholtz and Randle [61] consider 15% as the average growth rate for a healthy SME.

A synthesis of the three considerations in the previous paragraph (i.e., the growth definition, the economists’ suggestion and Flamholtz’s consideration) led to the following classification: 1 = Very low growth (less than 0% annually); 2 = Low growth (0–8% annually); 3 = Average growth (8–15% annually); 4 = High growth (15–99% annually); 5 = Very high growth (100% or greater). This was the basis of the five-point scale question about business growth.

3. Hypotheses Development, Research Model and Research Method

3.1. Hypotheses on the Relation between Entrepreneur Ability (EA), Entrepreneurial Orientation (EO) and SME Sustainable Growth (SMESG)

3.1.1. EA and SMESG

From previous studies, entrepreneurs can be considered as innovators with creative ability [10,51] and opportunity detection ability [8,63], who tap potential market opportunities with the certainty that their learning ability [32,64] and relationship ability [36,38] will help them to manage and control risks [39,65] in different stages of growth. These abilities are vital to promoting innovation and economic growth (that is, self-fulfilment, business growth and national development). Based on this consideration, the central hypothesis for this study is that EA may have major effects on the growth of Ivorian SMEs.

This study therefore measures the EA in terms of creativity, risk control, learning, relationships and opportunity discovery. For each hypothesis (e.g., EA predicts SMESG), the two sub-hypotheses are derived from the consideration of two growth measurements, namely innovation growth and financial growth.

Creativity Ability and SMESG

Creativity (or being creative) is the ability to create, articulate, or apply inventive ideas, techniques and perspectives [66]. Since we are now living in the age of modernity, entrepreneurs with excellent creative skills will more likely succeed in doing business [67]. Developing economies are characterized by instability and an ever-changing business environment. In such a business environment, SMEs with a lack of creativity cannot achieve sustained and healthy growth, and in the long run, may be eliminated by the market. Thus, successful entrepreneurs and enterprises need to be continuously creative to remain relevant to customers. Managers’ creativity, according to Coad et al. [66], will enable their companies to gain differentiated competitive advantages that generate financial resources and growth. This formed the basis of Hypothesis 1 (entrepreneurs’ ability to be creative predicts the sustainable growth of their enterprises) of this study. Since SMESG is assessed through innovation and financial achievements, the following specific hypotheses were formulated:

Hypothesis 1a (H1a).

An SME’s financial growth is positively related to the entrepreneur’s creative ability.

Hypothesis 1b (H1b).

An SME’s innovation growth is positively related to the entrepreneur’s creative ability.

Risk-Control Ability and SMESG

According to Robbins and Coulter [68], entrepreneurship is a process of identifying the profitable opportunities from the environment, exploiting those opportunities through the successful organization of business operations, handling the risks and uncertainties carefully and managing the operations systematically to help attain the objectives of a firm. Because SMEs tend to venture into high-risk projects in pursuing profit and innovation (to a certain extent), effective risk management skills are required. Risk-control abilities help entrepreneurs to identify and manage high-risk opportunities facing their businesses and in doing so, increase the likelihood of successfully achieving the business growth objective [28]. This trend prompted the formulation of study’s Hypothesis 2 (entrepreneurs’ risk-control ability predicts the sustainable growth of their enterprises). By considering these two specific dimensions of SMESG, the following specific hypotheses are proposed:

Hypothesis 2a (H2a).

The risk-control ability of entrepreneurs has a significant positive impact on the financial growth of their SMEs.

Hypothesis 2b (H2b).

The risk-control ability of entrepreneurs has a significant positive impact on the innovation growth of their SMEs.

Learning Ability and SMESG

Entrepreneurs’ learning ability refers to their ability to extract values from good experiences from the process of enterprise development [69], to sum up experiences from past failures [70] and actively to try to acquire new knowledge, new models and new methods through various channels [64]. According to Wolff et al. [71], the values above are crucial elements of competitiveness against the backdrop of globalization. In this vein, Lis and Sudolska [72] pointed out that the learning ability of entrepreneurs will help in solving the problems hindering the growth of SMEs (through knowledge acquisition and summing up experiences) and thus promoting the sustainable growth of enterprises. From this reality, the study’s Hypothesis 3 (entrepreneurs’ learning ability predicts the sustainable growth of their enterprises) was formulated. The evidence of this relationship led to the formulation of the following two specific hypotheses:

Hypothesis 3a (H3a).

The relationship ability of entrepreneurs positively impacts the innovation growth of SMEs.

Hypothesis 3b (H3b).

The learning ability of entrepreneurs significantly and positively affects the innovation growth of their SMEs.

Relationship Ability and SMESG

Relationship ability refers to the capability of the entrepreneur to establish and maintain good relationships with all relevant business partners [36]. Based on the analysis of Mehralizadeh and Sajady [73] of the profile of successful entrepreneurs, it can be argued that the ability to establish and maintain good relationships with workers, customers, suppliers, shareholders, creditors, financial institutions, government-related organizations and media offers several benefits to improve SMEs’ performance [74]. The relationship ability of managers, whether for instance, through political or business relations, is an important way for enterprises to obtain external resources, which in turn helps them to improve corporate performance. For instance, since government decisions and media visibility have a significant impact on the development of any company [75], SMEs can reach growth objectives by maintaining excellent and long-term relationships with them. These statements led to the formulation of Hypothesis 4 (entrepreneurs’ relationship ability predicts the sustainable growth of their enterprises). Based on the dimensions above, the following specific research hypotheses are proposed:

Hypothesis 4a (H4a).

The relationship ability of entrepreneurs has a positive impact on the financial growth of SMEs.

Hypothesis 4b (H4b).

The learning ability of entrepreneurs significantly and positively affects the financial growth of their SMEs.

Opportunity Detection Ability and SMESG

Nowadays, economic liberalism has bred market imperfections which provide the potential for entrepreneurs to create economic returns by organizing the necessary resources to respond to opportunities. Opportunity discovery skill is, according to Penrose [8], the capability to discover new opportunities even in unfamiliar areas. Based on Penrose’s view, the entrepreneurs’ opportunity detection ability refers to the ability of the entrepreneur to recognize and take advantage of potential market opportunities. As a visionary, Penrose [8] pointed out that opportunity detection ability—as the heart of entrepreneurship—is a scarce resource that can have a direct impact on business growth. Recently, George et al. [76], suggested that the opportunity detection ability of an entrepreneur will help in recognizing new opportunities, and in evaluating and exploiting them in ways that generate business growth; hence, the formulation of Hypothesis 5 (entrepreneurs’ opportunity detection ability predicts the sustainable growth of their enterprises). This trend prompted the proposal of the following two specifics hypotheses:

Hypothesis 5a (H5a).

The financial growth of SMEs is positively related to the opportunity detection ability of their owner-managers.

Hypothesis 5b (H5b).

The innovation growth of SMEs is positively related to the opportunity detection ability of their owner-managers.

3.1.2. EO and EA–SMESG Linkage

EO is the overall strategic posture of entrepreneurship [13]. From a growth perspective, EO will (1) guide entrepreneurs towards early deployment of their operations in light of future environmental changes (proactiveness); (2) enable entrepreneurs and managers to take the initiative to innovate by dealing with the challenge of uncertainty (innovativeness); and (3) enable SMEs to take advantage of some high-risk opportunities (risk tendency). This will result in promoting SMESG [16,77]. One can, therefore, consider that fact as proof of the existence of a relationship between EO dimensions and SMESG.

Research findings have shown that EO generally has a positive effect on business growth in emerging economies [39] and developing countries [78]. Anlesinya et al. [78] found a significant positive effect of proactiveness and risk-taking on the profitability of microenterprises that operate in the retail sector in Ghana (a developing country located in the West African region, sharing a border with Côte d’Ivoire). Moreover, in a recent survey of 324 SMEs of the Yangtze River Delta in China, Zhai et al. [39] found that the relationship between EO and the innovation growth of SMEs was significantly positive.

While EA affects business growth, excellent abilities of the owner-managers do not systematically result in growth. Valuable EO must support EA in pursuing growth. It means that EA can lead to success if—and only if—businesses adopt a strategic posture (EO) that also promotes the growth of the enterprise; hence, the formulation of a hypothesis about the moderating role of EO in EA–SMESG relationships.

Though EO has five dimensions [14], this study focuses on three of them as identified and considered by other researchers [13,43,78], namely innovativeness (i.e., the willingness to innovate), proactiveness (i.e., the willingness to be more proactive) and risk tendency (i.e., the willingness to take risks). In considering these EO dimensions, the following three suppositions are hypothesized:

Hypothesis 6 (H6).

The innovative orientation (innovativeness) positively regulates the relationship between the entrepreneurs’ ability and SME growth.

Hypothesis 7 (H7).

The initiative orientation (proactiveness) positively regulates the relationship between the entrepreneurs’ ability and SME growth.

Hypothesis 8 (H8).

The risk orientation (risk tendency) positively regulates the relationship between entrepreneurs’ ability and SME growth.

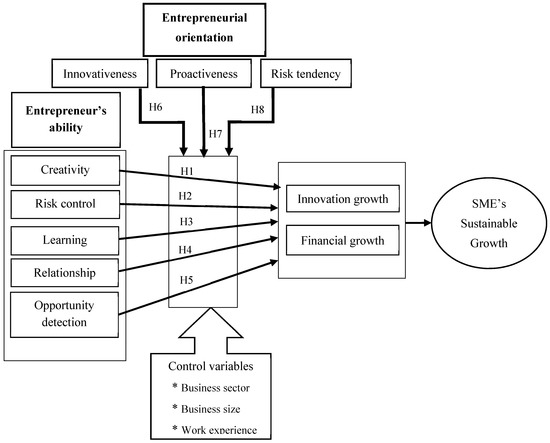

3.2. Conceptual Model

Since numerous researchers have demonstrated that EA may affect the growth of SMEs, the theory of growth determinism can be applied to express the relationship between EA and SMESG. However, EA must be sufficiently stimulated by EO to achieve SMESG [79]. That is, EO has a regulating effect on the relationship between EA and SMESG in Côte d’Ivoire.

Since it is evidenced that SME growth may be influenced by the business sector [80], business size [6] and entrepreneurs’ work experience [81], these characteristics could be considered as control variables (CV).

Figure 1 represents a concise conceptualization of EA and EO, leading to SMESG.

Figure 1.

Conceptual model of the moderating role of entrepreneurial orientation (EO) in the relationship between entrepreneurs’ ability (EA) and small and medium-sized enterprise (SME) growth.

The conceptual framework is presented in a way that clearly shows EA as the IV, SMESG as the DV, and EO as the moderating variable, while the business sector, business size and entrepreneurs’ work experience are CVs. These considerations are indicated in Table 1.

Table 1.

Variable specifications.

To elucidate the rational choice of study variables, the sources of variables and hypotheses (i.e., the relationship between factors and SMESG) are synthesized in Table 2.

Table 2.

Sources of hypotheses on the relationship between entrepreneurial factors and SMEs’ sustainable growth (SMESG).

3.3. Research Method

3.3.1. Questionnaire Design and Validity

The questionnaire—as the primary research instrument—was developed and pre-tested by experts in the field of the present study. It was designed following the requirements of research specialists such as Curwin and Slater [82] and Neuman [83].

Validity—the extent to which an instrument measures what it is supposed to measure [84] and performs as it is designed to perform [85]—has two important dimensions, namely face validity and content-related validity. According to Hair et al. [84], face and content validities are established by the judgment of experts. In order to establish face and content validity of the research instrument, a draft of the questionnaire was examined by a panel of experts (including the researcher’s supervisor, some lecturers in the management field and leaders of SMEs in Côte d’Ivoire) in the field of study. Some modifications were made to the first version of the questionnaire based on suggestions concerning the items which were not properly reflecting what they set out to measure. Additionally, the clarity of the questionnaire was confirmed during a pilot study, since none of the 10 participants found ambiguities in the questionnaire. Based on the feedback from the pilot test, slight changes were however made to improve the quality of the questionnaire.

3.3.2. Population, Sampling and Data Collection

This research occurred on a national scale where the target population consisted of SMEs operating in Côte d’Ivoire, a member country of the Economic Community of West African States (ECOWAS), which is made up of 15 countries. Côte d’Ivoire experienced inclusive growth since its independence in 1960 until 1999 (1999 is the beginning of a period of political instability). With the return of peace and political stability from 2011, the government implemented economic reforms which have contributed to improving the macroeconomic environment and set the stage for both SMESG and country development. These developmental reforms included tax deduction policies and the establishment of the Investment Promotion Centre. Consequently, the country’s GDP grew, on average, 9% per year during the period 2012–2018, making Côte d’Ivoire the fastest-growing economy in the West African region, and one of Africa’s fastest-growing economies in recent years. Apart from the sociopolitical crisis experienced by Côte d’Ivoire, the entrepreneurial imbalance between men and women [86], the inaccessibility of finance [86] and the low purchasing power of customers [87] are major factors that can explain the weak performance of most Ivorian SMEs in recent years. The two main parameters defining SMEs in Côte d’Ivoire are (1) the number of employees (microenterprise < 10; small enterprise < 50; medium-sized enterprise < 200) and (2) the amount of annual turnover (microenterprise ≤ €45,735; small enterprise ≤ €228,674; medium-sized enterprise ≤ €1,524,490). Whilethey represent about 90–98% of the registered companies and 23% of jobs, most Ivorian SMEs are defined by a low level of an organization [86].

The researcher gained access to the Ivorian SMEs database through the Ivorian Movement of SMEs (MPME-CI), an official union for Ivorian SMEs. In order to have a representative sample, including SMEs of all business sectors, stratified sampling was used as the primary random sampling technique. Given the fact that the contribution of the significant business sectors to the national GDP in 2015 was 28% for agriculture (stratum 1#), 25% for industry (stratum 2#) and 47% for services (stratum 3#), SMEs were selected randomly with the same proportion given to each stratum. These considerations resulted in the selection of 320 SMEs (among the thousands in operation) of which 80 (25%) operating in industry, 90 (28%) in agriculture and 150 (45%) in services.

To collect data, structured questionnaires (i.e., the primary data collection instrument) were provided to the participants together with the research permit (i.e., an official document in which owner-managers are invited to acquaint themselves with the researcher) and the letter of introduction (i.e., a document explaining the purpose of the study, while also giving the assurance that the information would be strictly confidential). Questionnaires were collected on the agreed-upon dates, and some managers were interviewed through both open-ended questions and closed-ended questions. The response rate was 99% (318 responses out of 320 questionnaires).

The document analysis—a secondary source of information for this study—was performed on relevant documents such as developmental policy documents of SMEs, companies’ financial statements, internet, academic papers and national development plans.

3.3.3. Statistic Methods of Data Analysis

First and foremost, an SPSS dataset was established based on the data collected from 318 entrepreneurs. In order to examine the relationship between EA and SMESG, the multiple regression analysis methods were adopted. As required by research specialists, thorough factor analyses were a prerequisite for running regression analyses; hence, the data analysis methods of this study included the exploratory factor analysis (EFA), confirmatory factor analysis (CFA) and regression analysis (RA).

EFA—a reliable instrument used to check whether the factor being examined needs all its items to be measured effectively [88]—was run to clear the dataset of the items that did not contribute to the reliability of each dimension of EA, EO and SMESG. Since the questionnaire used was the Likert scale, EFA consisted of assessing the reliability of questions and factor analysis. By considering previous studies [89,90,91], this study admitted Kaiser–Meyer–Olkin (KMO) > 0.5 and significance (p-value < 0.05) of Bartlett’s Test of Sphericity as a criterion of the suitability of factor analysis. Based on the principal component analysis (PCA) approach, 50–60% [92] and 1 [90] were considered as the minimum acceptable cumulative percentage of variance and eigenvalue, respectively.

CFA—an analysis method that aims at confirming the structure of the factor extracted in the EFA—consists in establishing composite reliability (CR) and convergent validity (CV), as well as discriminant validity (DV). In this study, the threshold of CV was the average variance extracted (AVE) > 0.5 [93], and the minimum acceptable value of CR was 0.7 [84]. According to the Fornell–Larcker [94] criterion, the discriminant validity of the construct is established only if the square root of each construct’s AVE is higher than its correlation with other latent constructs.

After inspecting the reliability of each question (based on Cronbach’s Alpha coefficients) and factor analysis (construct validity, PCA and rotated component analysis), dependent and independent variables were created by obtaining simple averages of the measures (using the cleaned dataset).

Hierarchical regression analysis (HRA) was used to evaluate the impact of EA on SMESG. The hypothesis (i.e., the IV predicts the DV) is confirmed if the regression coefficient (β) of the added variable is positive and statistically significant (p < 0.05). Besides, a model is declared to be a good fit for the data if the F-statistic is significant (p < 0.05). Multiple regression analysis (MRA) consisted in evaluating the moderating effect of each of the three dimensions of EO on the relationship between EA and Ivorian SMESG. The moderating effect of EO exists if—and only if—(1) R2 obtained by adding interaction terms is higher than the model fitting coefficient obtained without interaction terms and (2) β of interaction term between IV and moderator is positive (β > 0) and statistically significant (p < 0.05).

4. Analysis

4.1. Statistics on SMEs, Entrepreneurs and Study Variables

Table 3 contains a summary of information relating to SMEs and entrepreneurs operating in Côte d’Ivoire.

Table 3.

Statistical landscape of SMEs and entrepreneurs in Côte d’Ivoire.

Gender, age, the highest level of education and work experience form the entrepreneurs’ personal characteristics. In general, data reveal that Ivorian SMEs are managed by men or women whose ages range from 31 to over 50 years, with different levels of education. The majority of the respondents (71.2%) were above 40 years, meaning that most Ivorians set up their businesses when they reach the mature age of 40 years. Regarding the gender of entrepreneurs, women represent only about 16% of entrepreneurs in Côte d’Ivoire, while 84% of entrepreneurs are male, which is in line with the official figures published by the government of Côte d’Ivoire. In terms of work experience, a deduction can be made regarding the diversity of entrepreneurs’ work experience, ranging from beginners (15% of the Ivorian entrepreneur population) to seniors (41% of the Ivorian entrepreneur population). Furthermore, the data show that the majority (72%) of the owner-managers are holders of master’s or higher degrees. Of the 28% of entrepreneurs who fall outside the master’s or higher degree holders’ category, only 9% hold a secondary or lower level of education.

Business size, business sector and business age were the characteristics of firms that were measured. In general, data revealed that SMEs from all business categories (micro, small and medium) and all business sectors (agriculture, services and industry) were represented in this sample, although none of the SMEs had a lifespan of above 15 years. Ivorian SMEs were classified into microenterprises (about 50% of SMEs), small enterprises (about 25% of SMEs) and medium-sized enterprises (about 25% of SMEs). The statistics produced a plausible result since the proportion of SMEs belonging to each business sector was very close to the country’s GDP by sector, namely 47% for services, 28% for agriculture and 25% for industry. The reason why there were “no SMEs which had been in operation for more than 15 years” is that after so many years of existence, either the SME had become a large enterprise (because of its success and growth) or it had disappeared (because of failure or bankruptcy).

By inspecting the means of study variables, the responses were around the average value of 3, indicating that the average level of performance of Ivorian SMEs is moderately good.

4.2. Suitability of Sample Size and Scale Question and Normal Distribution of Variables

One of the assumptions underlying the factor analysis is “sufficient sample size (n > 100) and n > 5 times the number of items”. Based on Comrey’s rule of thumb [95], the sample size was classified as good (n = 318 > 300). In addition, n = 318 > 5 times the number of items (5 × 35 = 175).

The assumption of scale question was also met since the questionnaires for this study consisted of eight questions and 35 items with responses recorded on a five-point Likert scale, with options ranging from very unfavourable (score = 1) to very favourable (score = 5).

The results indicate that all the variables in the dataset are in accordance with the rule of thumb for skewness (−2 < skewness < 2) [96] and with the rule of thumb for kurtosis (kurtosis ≤ 3) [97]. This finding suggests that the study variables (or dataset) globally satisfy the conditions for normal distribution; hence, data are suitable for further statistical analysis.

4.3. Impact of EA on SME Growth

By assessing the impact of EA on SMESG, the EFA was first performed. EFA consists of inspecting the reliability of questions (for each dimension) and factor analysis (for each factor or variable). Reliability of questions was assessed by analyzing Cronbach’s Alpha coefficients and corrected item-total correlation for each dimension of EA, EO and SMESG. Table 4 presents a summary of question reliability results. Based on Hinton’s [98] criteria, the measures used to assess the effect of EA on the growth of Ivorian SMEs are of excellent internal consistency (Cronbach’salphavalues ≥ 0.9).

Table 4.

Summary of results of question reliability and factor validity tests.

Factor analysis consists of assessing construct validity, inspecting and interpreting scree plot, principal component analysis (PCA) and rotated component analysis (PCA). Overall, the validity of data is illustrated since all the factors are valid (Bartlett’s test p < 0.05; KMO > 0.5; eigenvalue > 1.0; cumulative contribution rate > 60%; prime component > 20%). This confirmed that the data on EA affecting the growth of Ivorian SMEs are suitable for further analysis. Four specific analyses could be done from these results. Firstly, it can be concluded that the data on EA affecting the growth of Ivorian SMEs are suitable for factor analysis because KMO > 0.5 and Bartlett’s test of sphericity is statistically significant (p = 0.0001 < 0.05) for all variables. Secondly, by looking at the results of PCA, it can be concluded that the three criteria, namely Kaiser’s criteria (all eigenvalue > 1.0), cumulative percentage of variance (cumulative % > 60%) and percentage of prime component (% of variance of the first component > 20%) were met for each dimension of EA, EO and SMESG. Hence, the dimensions of each study variable (EA, EO and SMESG), as indicated in Table 1, correctly express their related factor. Thirdly, for each factor (i.e., EA, EO and SMESG), the inspection of the scree plot and eigenvalues confirms the dimensions expressing the factor. Lastly, the main objective of factor analysis (i.e., data summarization and data reduction) was met since some questions (relating to some EA dimensions) were rejected because of their weak contribution to data reliability.

After the EFA, the CFA was performed to confirm the reliability (i.e., composite reliability) and validity (i.e., convergent and discriminant validity) of the factor structure extracted in the EFA. Referring to the results, the validity of the constructs was adequate, because (1) the factor loadings of the indicators respective fields were significant; (2) CR of all dimensions was higher than 0.7 and (3) AVE was higher than 0.5. Based on Fornell–Larcker [94] criterion, the constructs’ discriminant validity was also established because the square root of each construct’s AVE was higher than its correlation with another latent construct (i.e., inter-construct correlations). Moreover, multicollinearity problems were absent because of lower correlation coefficients (between variables).

The variables involved in this HRA were IVs (EA dimensions), DV (SMESG) and CVs. These variables are specified in Table 1. Since the DV has two dimensions, two different regressions were run separately: One regression for “financial growth”; another regression for “innovation growth”. Table 5 shows the regression analysis results for financial and innovation growth. First and foremost, the diagnostic of assumptions resulted in “no autocorrelation in the data” since all the IVs had VIF < 5 [99], and “no multicollinearity between the IVs” since all the IVs had Durbin–Watson (DW) between the two critical values of 1.5 and 2.5 (1.5 < DW < 2.5).

Table 5.

Impact of entrepreneurs’ ability on SME growth.

4.3.1. Impact of EA on SME Financial Growth

About the impact of EA on SME financial growth, the results indicate that, except for learning ability, all EA dimensions explained the SME financial growth (ΔR2 is positive) above and beyond the control variable (i.e., work experience, business size, business sector). Also, the regression coefficient (β) of each of these EA dimensions was positive and statistically significant (p < 0.01), which offers evidence to confirm Hypothesis H1a (i.e., creativity ability predicts SME financial growth), H2a (i.e., risk-control ability predicts SME financial growth), H4a (i.e., relationship ability predicts SME financial growth) and H5a (i.e., opportunity detection ability predicts SME financial growth). There was, however, evidence to reject Hypothesis H3a (i.e., learning ability predicts SME financial growth) because the regression coefficient of learning ability was not statistically significant (p > 0.1). Since F-statistics are significant (p < 0.01), the obtained models were good fits for the data relating to the SMEs’ financial growth.

To identify the most effective predictors (EAs), a hierarchical regression—aimed at confirming or rejecting the hypotheses when all IVs are included—was performed for the financial dimension of SMESG. The results of the regression (in the full model) were in line with the findings from each standard regression (in single models). For the DV “financial growth”, the regression coefficient (β) of creative ability, opportunity detection ability, risk-control ability and relationship ability was positive and statistically significant (p < 0.05); hence, these abilities are effective predictors. However, β of “learning ability” was not significant, meaning that the learning ability of entrepreneurs does not affect the SME financial growth. Moreover, according to the p-value of F-statistic, the full model is a good fit for the data (p < 0.01).

4.3.2. Impact of EA on SME Innovation Growth

Concerning the impact of EA on SME innovation growth, the results indicate a non-relationship between “creativity and SME innovation growth” and between “learning ability and SME innovation growth” (regression coefficient β is not significant). The predictive power of creativity was indeed contradicted since the F-statistic was not significant, even though β is significant at 10% level. Consequently, Hypothesis H1b (i.e., creativity predicts SME innovation growth) and H3b (i.e., learning ability predicts SME innovation growth) were rejected. The other EA dimensions (i.e., risk control, relationship and opportunity detection ability) predict the Ivorian SME innovation growth, because the regression coefficients were statistically significant (p < 0.1).

To identify the most effective predictors (EAs), a hierarchical regression—aimed at confirming or rejecting the hypotheses when all IVs are included—was performed for the innovation dimension of SMESG. The results of the regression (in the full model) were in line with the findings from each standard regression (in single models). For the DV “innovation growth”, the regression coefficient (β) of opportunity detection ability, risk-control ability and relationship ability was positive and statistically significant (p < 0.05); hence, these abilities are effective predictors. However, β of “learning” and “creativity” were not significant in the final full model, meaning that neither the learning ability nor creativity ability of entrepreneurs affect the SME innovation growth. Moreover, according to the p-value of F-statistic, the full model is a good fit for the data (p < 0.01).

4.4. Moderating Effect of EO on the Linkage between EA and SME Growth

Multiple regression analyses were made to estimate the predictive power of each EO dimension on the linkage between each EA dimension and SMESG. The results of regression analysis (in assessing the moderating effect of EO on EA–SMESG linkage) are reported in Table 6.

Table 6.

Moderating effect of entrepreneurial orientation (EO) on the linkage between entrepreneurs’ ability (EA) and SME sustainable growth (SMESG) in Côte d’Ivoire.

Overall, the outputs of regressions do not indicate any autocorrelation issue, because Durbin–Watson values are within the 1.5 and 2.5 recommended values for independent observations. Besides, all models fit the data well as the F-statistic was statistically significant (p < 0.01) for all variables.

Specifically, three conclusions can be drawn from the regression analysis results.

Firstly, from the obtained models, Hypothesis H6 (i.e., the moderating effect of innovativeness exists) can be fully confirmed for creativity, risk control, relationship and opportunity detection ability. The justification is that the model fitting coefficient (R2) obtained by adding the interaction term was higher (ΔR2 > 0) than the model fitting coefficient obtained without interaction terms and the regression coefficient (β) of interaction of EA and innovativeness was positive (β > 0) and statistically significant (p < 0.01) for these dimensions of EA.

Secondly, Hypothesis H7 (i.e., the moderating effect of proactiveness exists) is confirmed for relationship and opportunity detection ability because ΔR2 (obtained by adding the interaction term) was positive; and EA–proactiveness interaction was positive (β > 0) and statistically significant (p < 0.01) for these EA dimensions. This was not the case for creativity and risk control ability; hence, Hypothesis H7 was rejected for these two dimensions of EA.

Thirdly, Hypothesis H8 (i.e., the moderating effect of risk tendency exists) is confirmed for creativity and risk control ability because ΔR2 (obtained by adding the interaction term) was positive; and EA–risk tendency interaction was positive (β > 0) and statistically significant (p < 0.01) for these EA dimensions. This was not the case for relationship and opportunity detection ability; hence, Hypothesis H8 could not be confirmed for these two dimensions of EA.

In line with the research objectives, the results of the hypotheses testing are summarized in Table 7.

Table 7.

Summary of relationships between entrepreneurs’ ability (EA) and Ivorian SMEs’ sustainable growth (SMESG).

5. Conclusions

5.1. Discussion

The study was aimed at examining the relationship between entrepreneurs’ ability (EA) and growth among SMEs in Côte d’Ivoire while assessing the influence of entrepreneurial orientation (EO) in this link. This study was motivated by the fact that none of the previous studies dealing with EA–SMESG relationships have been carried out in environments and contexts of the Ivorian economy. The business environment is so unfavourable that conducting such research in Côte d’Ivoire proves to be a great challenge. Previous studies [100,101,102] have focused on only a few factors (e.g., lack of financing, gender disparities and political instability), hindering the development of SMEs operating in Côte d’Ivoire. Besides, because SMEs in Côte d’Ivoire have long faced many challenges hindering their sustainable growth, studies on any factor that may positively affect the performance and growth of SMEs in the country are of great importance.

To achieve this primary objective, three research questions were addressed. The first research question concerns the literature relating to the impact of EA on SMEs’ sustainable growth (SMESG), the second research question deals with hypotheses on the relationship between EA and SMESG, and the third research question deals with the moderating effect of EO on the EA–SMESG linkage. The research findings are therefore discussed in so far as they have bearing on the research questions, and in relation to the existing literature.

5.1.1. Which Entrepreneurs’ Abilities Can Affect the Growth of Ivorian SMEs?

Since the growth of enterprise results from a combination of factors, including entrepreneurial skills [103], the examination of EAs seems logical in assessing the growth of SMEs [14]. The existing literature was explored to establish the list of EAs that usually affect the growth of SMEs in most countries and regions. While several factors may be the reason for the success of enterprises [19], successful entrepreneurs share certain traits, such as creativity, relationship capability, continuous learning, an ability to seize opportunities and an ability to control risks. These traits make up the EAs that mostly have a positive effect on the growth of enterprises [24,36,51] in any country. Therefore, creativity, learning, relationship, risk control and opportunity detection are five dimensions of EA that can have an advantageous effect on the growth of Ivorian SMEs.

5.1.2. Which Entrepreneurs’ Abilities Are Affecting the Growth of Ivorian SMEs?

By considering the five most frequently studied dimensions of EA, this study aimed at confirming their positive influence on the growth of Ivorian SMEs. While the findings of this study reveal an association between most EA dimensions (i.e., entrepreneur’s creativity, risk control, relationship and opportunity detection ability) and SMESG, some cases of non-association (i.e., learning ability and SME financial growth; and learning ability and SME innovation growth) are especially notable. This finding challenges many standpoints [8,64,71,72], which support the significance of learning ability in SME growth.

Why does the learning ability of Ivorian entrepreneurs not predict SMESG? Entrepreneurs’ learning ability refers to their ability (1) to summarize good experiences, (2) to sum up experiences from past failures and (3) to actively try to acquire knowledge, models and methods through various channels (e.g., school, readings, training, workshops and apprenticeships). However, it is not just any knowledge, models and methods that should be drawn from, but the right ones [31]. So, the question is: Are Ivorian managers learning the right knowledge, models and methods through the productive channels? It is known that the principal learning channel is the school, which forms part of the education system. A previous study by Diabate et al. [6] revealed that the level of education (known to be a fundamental developmental factor) does not play an invaluable role in SMESG in Côte d’Ivoire. This is the inevitable consequence of the weak education system (compared to education systems in developed countries). The best illustration of the weakness of the education system is the difference in know-how between an Ivorian IT engineer (graduated from an Ivorian school) and a German engineer (graduated from a German school). While both are IT engineers, the German engineer is superior in respect of know-how. While Ivorian IT engineers claim to have good skills (e.g., high educational background, ability to manage IT enterprises, ability to summarize good experiences, ability to learn and develop new methods), these abilities do not positively affect the growth of their enterprises.

While this finding contradicts the results of a number of earlier researchers, it is aligned with the findings of some studies. For example, Yeboah [104], in a study in Ghana (a developing African country), concluded that entrepreneurs with high learning ability did not report the highest sales growth. Furthermore, even if entrepreneurs can succeed through their capabilities such as learning, proactiveness and personality, these factors do not always bring sustainable growth [105].

5.1.3. Does EO Moderate the Link Between EA and SME Growth in Côte d’Ivoire?

EO indeed moderates the link between EA and Ivorian SMESG. Innovativeness (innovative orientation), proactiveness (initiative orientation) and risk tendency (risk orientation) are all associated with business growth among SMEs operating in Côte d’Ivoire. Through regression analyses, the hypotheses of the moderating effects of EO in the EA–SMESG relationship are supported. These results are consistent with the findings of earlier scholars [11,14,78]. In the African context, this result is particularly in line with the conclusion of Musaana [106], who discovered a significant positive effect of innovativeness on the entrepreneur’s opportunity detection ability and enterprise growth relationship of SMEs in Zambia. By examining the influence of EO on the growth of SMEs in Ghana, Alembummah [107] found that successful SMEs in the food processing sector often exhibit high levels of proactiveness and entrepreneurial ability. LeRoux and Bengesi [108] also found a significant positive effect of risk-taking on the profitability of enterprises operating in Tanzania. The present study seems to fill a gap (to some extent) in literature because no previous study has focused on the importance of entrepreneurship with the aim of estimating the effect of EA and EO on the growth of SMEs in Côte d’Ivoire. Moreover, the conclusions and implications of this study have reference value for the development of SMEs in Côte d’Ivoire.

5.2. Management Implications

The goal of management implications is to guide management decisions by recommending clear management actions based on the results of hypothesis testing. In light of the predictive power of EA and EO in respect of SMEs achievements, this study provides suggestions on how to promote the sustainable growth of Ivorian SMEs, which will, in turn, foster sustainable development in the country.

By revealing the critical EA dimensions affecting the growth of SMEs, this study seems to be a useful reference for development actors in their growth-oriented planning. For example, a bank manager can decide to grant a bank loan to an entrepreneur when his or her career profile, personal characteristics and managerial abilities seem right for succeeding in entrepreneurial activities. The overall implication of the findings is that government and decision makers can increase the efficiency of SMEs through actions aiming at strengthening the abilities of entrepreneurs and managers. As for entrepreneurs and managers, they should continuously display their managerial skills because EA can increase the likelihood of SMEs growing faster.

If the learning ability of Ivorian entrepreneurs does not affect the growth of their SMEs, this may be owing to the fact that they are not good at extracting good experiences from the process of business development, and are not able to apply their managerial experiences in work practice. As a practical implication, this study suggests that entrepreneurs should “continuously learn the latest management knowledge” to “acquire new knowledge, new models and new methods” and to “reinforce their learning capability”.

Given the positive impact of EO on the growth of SMEs, EO should be seen as a developmental factor. This study, therefore, recommends that the government, policymakers and SME leaders should consider EO in the formulation and implementation of the Côte d‘Ivoire’s National Development Plan. Such entrepreneurial-oriented policies could enhance SMESG, which would lead to the country’s progress. Moreover, the government of Côte d’Ivoire should organize workshops for entrepreneurs to educate them on the importance of EO and its implication for SMESG, and to consolidate their strategic orientation toward entrepreneurship. A specific implication of the study findings is that entrepreneurs and business partners must (1) maintain a posture that continuously pursues novel ideas, new products, new services, new processes, new technologies and new models related to business development; (2) maintain an opportunity-seeking perspective; and (3) control risks associated with high-risk ventures that bring financial achievements.

5.3. Research Gaps and Direction of Further Studies

The limitations of this study are all linked to its limited scope. First and foremost, the study is restricted to only one aspect of entrepreneurship (i.e., EA dimensions) as an independent variable. It does not consider the many other factors that may affect the growth of SMEs. As such, the findings cannot be seen as an all-encompassing conclusion relating to managerial success. Future researches may focus on other factors that are likely to affect the growth of SMEs. Secondly, since the primary objective of the study (i.e., the recognition of EAs that significantly affect SMESG in a middle-income economy like Cote d’Ivoire) was achieved through commonly known methods, future researchers may wish to employ advanced methods and techniques in assessing these EAs. For instance, each EA dimension could be investigated in order to estimate the extent to which, and how, each of its measurements affects SMESG in Cote d’Ivoire. Thirdly, since the field of SMEs is vast and diverse, many issues remain unresolved. Upcoming researchers could venture into working on other variables affecting the growth of SMEs in the greater African context and that have not been examined in this study set in Côte d’Ivoire. The methodology, the approach and the context of this study can serve as a practical model for future researchers. Factors affecting the growth of SMEs in Côte d’Ivoire (as a middle-income economy) may be investigated and compared with situations in other developed countries to reveal similarities and differences. This appears to be the right direction for future research and the findings of such studies would be of significance.

Author Contributions

Authors worked together in the process of planning and designing the paper. A.D. carried out the data collection. A.D., H.S., L.W. and L.Y. contributed equally to writing the paper, analysing the data and drawing conclusions.

Funding

This research was funded by Shanghai Soft Science Research Project, “Research on the Influencing Factors of Collaborative Innovation Performance in Colleges and Universities Based on Value Co-creation” (funding No. 18692107500).

Acknowledgments

The authors acknowledge the Ivorian authorities for their support; the SME managers for their participation in interviews and surveys; and academic experts for their suggestions. Their joint contributions were indispensable to this study.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Paul, S.; Whittam, G.; Wyper, J. The pecking order hypothesis: Does it apply to start-up firms? J. Small Bus. Enterp. Dev. 2007, 14, 8–21. [Google Scholar] [CrossRef]

- Van, S.A.J.; Storey, D.J. The link between firm births and job creation: Is there a up as tree effect? Reg. Stud. 2004, 38, 893–909. [Google Scholar]

- Haase, H.; Franco, M. What factors drive performance of small and medium-sized enterprises? Eur. J. Int. Manag. 2016, 10, 678–697. [Google Scholar] [CrossRef]

- Ceptureanu, S.I.; Ceptureanu, E.G.; Marin, I. Assessing the role of strategic choice on organizational performance by Jacquemin-Berry entropy index. Entropy 2017, 19, 448. [Google Scholar] [CrossRef]

- Windapo, A. Entrepreneurial factors affecting the sustainable growth and success of a South African construction company. Sustainability 2018, 10, 1276. [Google Scholar] [CrossRef]

- Diabate, A.; Allate, B.M.; Wei, D.; Yu, L. Do firm and entrepreneur characteristics play a role in SMEs’ sustainable growth in a middle-income economy like Côte d’Ivoire? Sustainability 2019, 11, 1557. [Google Scholar] [CrossRef]

- Diabate, A.; Mingaine, L. An investigation into external environmental factors affecting performance of small and medium enterprise in Cote d’Ivoire. In Proceedings of the International Conference on Business and Information Management (ICBIM), Beijing, China, 23–25 July 2017. [Google Scholar]

- Penrose, E.T. The Theory of the Growth of the Firm; Oxford University Press: Oxford, UK, 1959. [Google Scholar]

- Smith, A. The Wealth of Nations; Knopf: New York, NY, USA, 1910. [Google Scholar]

- Stevenson, H. The nature of entrepreneurship. In Dynamic Entrepreneurship in Central and Eastern Europe, 2nd ed.; Abell, D., Köllermeier, T., Eds.; Delwel Publishers: The Hague, The Netherlands, 1993. [Google Scholar]

- Wiklund, J.; Sepherd, D. Entrepreneurial orientation and small business performance: A configurational approach. J. Bus. Ventur. 2005, 20, 71–91. [Google Scholar] [CrossRef]

- Guo, G.C.; Jiang, C.X.; Yang, Q. The effect of government involvement on Chinese firms’ corporate entrepreneurial activities: The case of Chinese automobile industry. N. Engl. J. Entrep. 2017, 20, 6–16. [Google Scholar] [CrossRef]

- Nicoletta, F. The effects of entrepreneurial orientation dimensions on performance in the tourism sector. N. Engl. J. Entrep. 2018, 21, 22–44. [Google Scholar]

- Lumpkin, G.T.; Dess, G.G. Clarifying the entrepreneurial orientation construct and linking it performance. Acad. Manag. Rev. 1996, 21, 135–172. [Google Scholar] [CrossRef]

- Civelek, M.; Rahman, A.; Kozubikova, L. Entrepreneurial orientation in the segment of Micro-Enterprises: Evidence from Czech Republic. Int. J. Entrep. Knowl. 2016, 33, 72–89. [Google Scholar] [CrossRef]

- Rauch, A.; Wiklund, J.; Lumpkin, G.T.; Frese, M. Entrepreneurial orientation and business performance: An assessment and past research and suggestions for the future. Entrep. Theory Pract. 2009, 33, 761–787. [Google Scholar] [CrossRef]

- Aroyeun, T.F. Effect of entrepreneurial orientation on performance of selected small and medium scale enterprises in Ogun State Nigeria. Int. J. Bus. Manag. Invent. 2019, 8, 16–27. [Google Scholar]

- Matsuno, K.; Zhu, Z.; Rice, M.P. Innovation process and outcomes for large Japanese firms: Roles of entrepreneurial proclivity and customer equity. J. Prod. Innov. Manag. 2014, 31, 1106–1124. [Google Scholar] [CrossRef]

- Al-Mahrouq, M. Success factors of small and medium enterprises: The case of Jordan. Zagreb Int. Rev. Econ. Bus. 2010, 13, 89–106. [Google Scholar]

- Schumpeter, J.A. Economic theory and entrepreneurial history. In Essays on Entrepreneurs, Innovations, Business Cycles and the Evolution of Capitalism; Clemence, R.V., Ed.; Transaction Publishers: London, UK, 1949. [Google Scholar]

- Steven, C.M. Entrepreneurship, growth, and Adam Smith. Strateg. Entrep. J. 2007, 1, 287–289. [Google Scholar]

- Coric, G.; Katavic, I.; Kopecki, D. Sustainable growth of SMEs in Croatia through development of entrepreneurial skills. In Proceedings of the 9th International Conference: “Challenges of Europe: Growth and Competitiveness-Reversing the Trends”, Split, Croatia, 26–28 May 2011; pp. 207–242. [Google Scholar]

- Shane, S. Prior knowledge and the discovery of entrepreneurial opportunities. Organ. Sci. 2000, 11, 448–469. [Google Scholar] [CrossRef]

- Whetten, D.A.; Cameron, K.S. Developing Management Skills, 6th ed.; Pearson Education Inc.: Upper Saddle River, NJ, USA, 2005. [Google Scholar]

- Haque, A.U.; Faizan, R.; Cockrill, A. The relationship between female representation at strategic level and firm’s competitiveness: Evidences from cargo logistic firms of Pakistan and Canada. Pol. J. Manag. Stud. 2017, 15, 69–81. [Google Scholar] [CrossRef]

- Lubart, T.I.; Sternberg, R.J. An investment approach to creativity: Theory and data. In The Creative Cognition Approach; Smith, S.M., Ward, T.B., Finke, R.A., Eds.; MIT Press: Cambridge, MA, USA, 1995. [Google Scholar]

- Shalley, C.E.; Zhou, J. Organizational creativity research: A historical overview. In Handbook of Organizational Creativity; Shalley, C.E., Zhou, J., Eds.; Lawrence Erlbaum: Hillsdale, NJ, USA, 2008. [Google Scholar]

- Caliendo, M.; Fossen, F.M.; Kritikos, A.S. Personality characteristics and the decision to become and stay self-employed. Small Bus. Econ. 2014, 42, 787–814. [Google Scholar] [CrossRef]

- McMullen, J.S.; Shepherd, D.A. Entrepreneurial action and the role of uncertainty in the theory of entrepreneur. Acad. Manag. Rev. 2006, 31, 132–152. [Google Scholar] [CrossRef]

- Miller, D.; Friesen, P. Strategy-making and environment: The third link. Strateg. Manag. J. 1983, 4, 221–235. [Google Scholar] [CrossRef]

- Njoroge, C.W.; Gathungu, J.M. The effect of entrepreneurial education and training on development of small and medium size enterprises in Githunguri District-Kenya. Int. J. Educ. Res. 2013, 1, 1–22. [Google Scholar]

- Voronov, M.; Yorks, L. Taking power seriously in strategic organizational learning. Learn. Organ. 2005, 12, 9–25. [Google Scholar] [CrossRef]

- Vesper, K.H. New Venture Strategy; Prentice-Hall: Englewood Cliffs, NJ, USA, 1990. [Google Scholar]

- Cooper, A.C. Challenges in predicting new firm performance. J. Bus. Ventur. 1993, 8, 241–254. [Google Scholar] [CrossRef]

- Ahghar, G.; Mohammadi, T. A study on the relationship between entrepreneur skills and psychological well-beings among medical students in Islamic Azad University. Eur. Online J. Nat. Soc. Sci. 2013, 2, 3329–3336. [Google Scholar]

- Kotabe, M.; Jiang, C.; Murray, J. Examining complementary effects of political networking capability with absorptive capacity on EMFs’ innovative performance. J. Manag. 2017, 43, 1131–1156. [Google Scholar]

- Foss, L.; Henry, C.; Ahl, H.; Mikalsen, G.H. Women’s entrepreneurship policy research: A 30-year review of the evidence. Small Bus Econ. 2019, 53, 409–429. [Google Scholar] [CrossRef]

- Covin, J.G.; Slevin, D. A conceptual model of entrepreneurship as firm behavior. Entrep. Theory Pract. 1991, 16, 7–26. [Google Scholar] [CrossRef]

- Zhai, Y.M.; Sun, W.Q.; Tsai, S.B.; Zhen, W.; Zhao, Y.; Chen, Q. An empirical study on entrepreneurial orientation, absorptive capacity, and SMEs’ innovation performance: A sustainable perspective. Sustainability 2018, 10, 314. [Google Scholar] [CrossRef]

- Wales, W.; Wiklund, J.; McKelvie, A. What about new entry? Examining the theorized role of new entry in the entrepreneurial orientation-performance relationship. Int. Small Bus. J. 2013, 33, 351–373. [Google Scholar] [CrossRef]

- Gupta, V.K.; Dutta, D.K. Inquiring into entrepreneurial orientation: Making progress, one step at a time. N. Engl. J. Entrep. 2016, 19, 7–12. [Google Scholar] [CrossRef]

- Welter, F.; Smallborne, D. Institutional perspective on entrepreneurial behavior in challenging environments. J. Small Bus. Manag. 2011, 49, 107–125. [Google Scholar] [CrossRef]

- Miller, D. The correlates of entrepreneurship in three types of firms. J. Manag. Sci. 1983, 29, 770–791. [Google Scholar] [CrossRef]

- Berrone, P.; Surroca, J.; Tribó, J.A. The Influence of Blockholders on R&D Investments Intensity: Evidence from Spain; Working Paper; Departamento de Economia de la Empresa, Universidad Carlos III de Madrid: Madrid, Spain, 2005. [Google Scholar]

- Slocum, J.W.; McGill, M.; Lei, D.T. The new learning strategy: Anytime, anything, anywhere. Organ. Dyn. 1994, 23, 33–47. [Google Scholar] [CrossRef]

- Wickham, P. Strategic Entrepreneurship, 4th ed.; Financial Times Prentice-Hall: London, UK, 2006. [Google Scholar]

- Diabate, A. Factors influencing small and medium enterprises (SMEs) in adoption and use of technology in Côte d’Ivoire. Int. J. Bus. Manag. 2014, 9, 179–190. [Google Scholar]

- Menon, A.; Varadarajan, P.R. A model of marketing knowledge use within firms. J. Mark. 1992, 56, 53–71. [Google Scholar] [CrossRef]

- Dziallas, M.; Blind, K. Innovation indicators throughout the innovation process: An extensive literature analysis. Technovation 2019, 80, 3–29. [Google Scholar] [CrossRef]

- Pearce, J.A.; Robinson, R.B. Strategic Management: Formulation and Implementation of Competitive Strategy, 8th ed.; McGraw-Hill Inc.: Boston, MA, USA, 2007. [Google Scholar]

- Wiklund, J. The sustainability of the entrepreneurial orientation-performance relationship. Entrep. Theory Pract. 1999, 24, 37–48. [Google Scholar] [CrossRef]

- Terziovski, M.; Samson, D. The effect of company size on the relationship between TQM strategy and organizational performance. TQM Mag. 2010, 12, 144–159. [Google Scholar] [CrossRef]

- Wiklund, J. Small Firm Growth and Performance: Entrepreneurship and Beyond. Ph.D. Thesis, Jönköping International Business School, Jönköping, Sweden, 1998. [Google Scholar]

- Delmar, F.; Wiklund, J. The effect of small business managers of growth motivation on firm growth: A longitudinal study. Entrep. Theory Pract. 2008, 32, 437–457. [Google Scholar] [CrossRef]

- Achtenhagen, L.; Naldi, L.; Melin, L. Business Growth Do: Practitioners and Scholars Really Talk About the Same Thing? Entrep. Theory Pract. 2010, 34, 289–316. [Google Scholar] [CrossRef]

- Sidika, I.G. Conceptual framework of factors affecting SME development: Mediating factors on the relationship of entrepreneur traits and SME performance. Procedia Econ. Financ. 2012, 4, 373–383. [Google Scholar] [CrossRef]

- Schumpeter, J.A. The Theory of Economic Development: An Inquiry into Profits, Capital, Credit, Interest, and the Business Cycle; Harvard University Press: Cambridge, MA, USA, 1934. [Google Scholar]

- Perrott, B.E. Managing strategy in turbulent environments. J. Gen. Manag. 2008, 3, 127–139. [Google Scholar] [CrossRef]

- Dimitar, B.; Zornitsa, Y. Company Innovative Leadership Model. Econ. Altern. 2015, 2, 5–16. [Google Scholar]

- Yoo, W.J.; Choo, H.H.; Lee, S.J. A study on the sustainable growth of SMEs: The mediating role of organizational metacognition. Sustainability 2018, 10, 2829. [Google Scholar] [CrossRef]

- Flamholtz, E.G.; Randle, Y. Growing Pains: Transforming from an Entrepreneurship to a Professionally Managed Firm, 4th ed.; Jossey-Bass: San Francisco, CA, USA, 2007. [Google Scholar]

- Oxford Business Group. Cote d’Ivoire’s Sustained Rapid Growth Bucks Regional Economic Trend. 2017. Available online: https://oxfordbusinessgroup.com/overview/ivory-towers-sustained-rapid-growth-bucking-regional-tren (accessed on 18 January 2019).

- O’Hara, B. Entrepreneurship in Ireland; Gill and MacMillan: Dublin, Ireland, 2011. [Google Scholar]

- Mintzberg, H.; Waters, J.A. Of strategies, deliberate and emergent. Strateg. Manag. J. 1985, 6, 257–272. [Google Scholar] [CrossRef]

- Lumpkin, G.T.; Dess, G.G. Linking two dimensions of entrepreneurial orientation to firm performance: The moderating role of environment and industry life cycle. J. Bus. Ventur. 2001, 16, 429–451. [Google Scholar] [CrossRef]

- Coad, A.; Segarra, A.; Teruel, M. Innovation and firm growth: Does firm age play a role. Res. Policy 2016, 45, 387–400. [Google Scholar] [CrossRef]

- Pink, D. A Whole New Mind: Why Right-Brainers Will Rule the Future; The Berkley Publishing Group: New York, NY, USA, 2006. [Google Scholar]

- Robbins, S.P.; Coulter, M. Management, 7th ed.; Pearson Prentice Hall: Upper Saddle River, NJ, USA, 1998. [Google Scholar]

- Pietersen, W. Reinventing Strategy: Using Strategic Learning to Create and Sustain Breakthrough Performance; John Wiley & Sons: Hoboken, NJ, USA, 2002. [Google Scholar]

- Jerez-Gómez, P.; Céspedes-Lorente, J.; Valle-Cabrera, R. Organizational learning capability: A proposal of measurement. J. Bus. Res. 2005, 58, 715–725. [Google Scholar] [CrossRef]

- Wolf, J.A.; Pett, T.L.; Ring, J.K. Small firm growth as a function of both learning orientation and entrepreneurial orientation: An empirical analysis. Int. J. Entrep. Behav. Res. 2015, 21, 709–730. [Google Scholar] [CrossRef]

- Lis, A.; Sudolska, A. Absorptive capacity and its role for the company growth and competitive advantage: The case of Frauenthal Automotive Toruń Company. J. Entrep. Manag. Innov. 2015, 11, 63–91. [Google Scholar] [CrossRef]

- Mehralizadeh, Y.; Sajady, S.H. A study of factors related to successful and failure of entrepreneurs of small industrial business with emphasis on their level of education and training. In Proceedings of the European Conference on Educational Research, Dublin, Ireland, 7–10 September 2005. [Google Scholar]

- Li, H.; Meng, L.; Wang, Q.; Zhou, L. Political connections, financing and firm performance: Evidence from Chinese private firms. J. Dev. Econ. 2008, 87, 283–299. [Google Scholar] [CrossRef]

- Capriotti, P. Economic and social roles of companies in the mass media: The impact media visibility has on businesses’ being recognized as economic and social actors. Bus. Soc. 2009, 48, 225–242. [Google Scholar] [CrossRef]

- George, N.M.; Parida, V.; Lahti, T.; Wincent, J. A systematic literature review of entrepreneurial opportunity recognition: Insights on influencing factors. Int. Entrep. Manag. J. 2016, 12, 309–350. [Google Scholar] [CrossRef]

- Moreno, A.M. Entrepreneurial orientation and growth of SMEs: A causal model. Entrep. Theory Pract. 2008, 32, 507–528. [Google Scholar] [CrossRef]

- Anlesinya, A.; Eshun, P.; Bonuedi, A.F. Entrepreneurial orientation dimensions and profitability nexus: Evidence from micro enterprises in the retail sector in a developing country. Int. J. Small Bus. Entrep. Res. 2015, 3, 79–87. [Google Scholar]

- Sok, P.; Snell, L.; Lee, W.J.; Sok, K.M. Linking entrepreneurial orientation and small service firm performance through marketing resources and marketing capability: A moderated mediation model. J. Serv. Theory Pract. 2017, 27, 231–249. [Google Scholar] [CrossRef]

- Barbosa, E.G.; Moraes, C.C. Determinants of the Firm’s Capital Structure: The Case of the very Small Enterprises. 2018. Available online: http://econpa.wustl.edu.8089/eps/fin/papers0302/0302001.pdf (accessed on 20 January 2018).

- Nor, H.O.; Afifah, H.M.P.; Siti, A.A.; Sit, Z.M.Z.; Chuk, W.J.; Nur, F.D.M. Influence of work experience and education towards business performance among entrepreneurs. Int. Bus. Educ. J. 2016, 9, 78–87. [Google Scholar]

- Curwin, J.; Slater, J. Quantitative Methods for Business Decisions, 6th ed.; Cengage Brain: Boston, MA, USA, 2008. [Google Scholar]

- Neuman, W.L. Basics of Social Research: Qualitative and Quantitative Approaches, 2nd ed.; Pearson Education: London, UK, 2011. [Google Scholar]

- Hair, F.; Hult, M.T.; Ringle, C.M.; Sarstedt, M. A Primer on Partial Least Squares Structural Equation Modeling (PLS-SEM); Sage: Thousand Oaks, CA, USA, 2014. [Google Scholar]

- Bryman, A. Social Research Methods; Oxford University Press Inc.: NewYork, NY, USA, 2004. [Google Scholar]

- Thiam, I. Unlocking the Potential of Small and Medium Size Enterprises in West Africa: A Path for Reform and Action. Master’s Thesis, Russian Friendship University, Moscow, Russia, 2009. [Google Scholar]

- Alila, O.; Ove, P. Negotiating Social Space: East African Micro Enterprises; Africa world press: Trenton, Africa, 2005; Volume 75, pp. 261–273. [Google Scholar]

- Child, J.; Lu, Y. Industrial decision-making under China’s reform, 1985–1988. Organ. Stud. 1990, 11, 321–351. [Google Scholar] [CrossRef]

- Bartlett, M.S. Tests of significance in factor analysis. Br. J. Psychol. 1950, 3, 77–85. [Google Scholar] [CrossRef]

- Kaiser, H.F. An index of factorial simplicity. Psychometrika 1974, 39, 31–36. [Google Scholar] [CrossRef]

- Hair, J.F.; Anderson, R.E.; Tatham, R.L.; Black, W.C. Multivariate Data Analysis, 3rd ed.; Macmillan: New York, NY, USA, 1995. [Google Scholar]

- Pett, M.A.; Lackey, N.R.; Sullivan, J.J. Making Sense of Factor Analysis: The Use of Factor Analysis for Instrument Development in Health Care Research; Sage Publications Inc.: Thousand Oaks, CA, USA, 2003. [Google Scholar]

- Johnson, M.D.; Home, F.D.R. Attribute abstraction, feature-dimensionality, and the scaling of product similarities. Int. J. Res. Mark. 1992, 9, 131–147. [Google Scholar] [CrossRef][Green Version]