5.1. Discussion

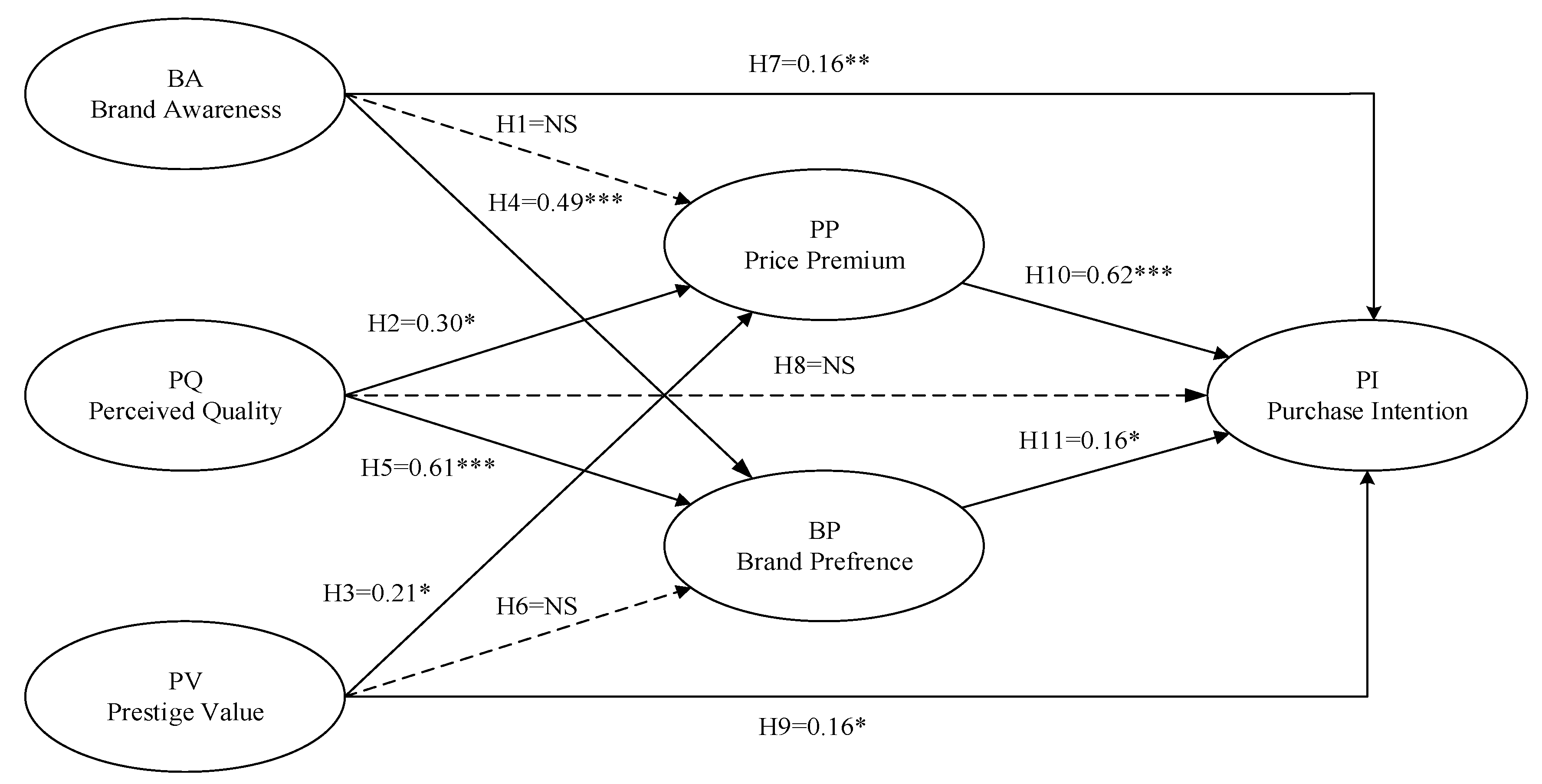

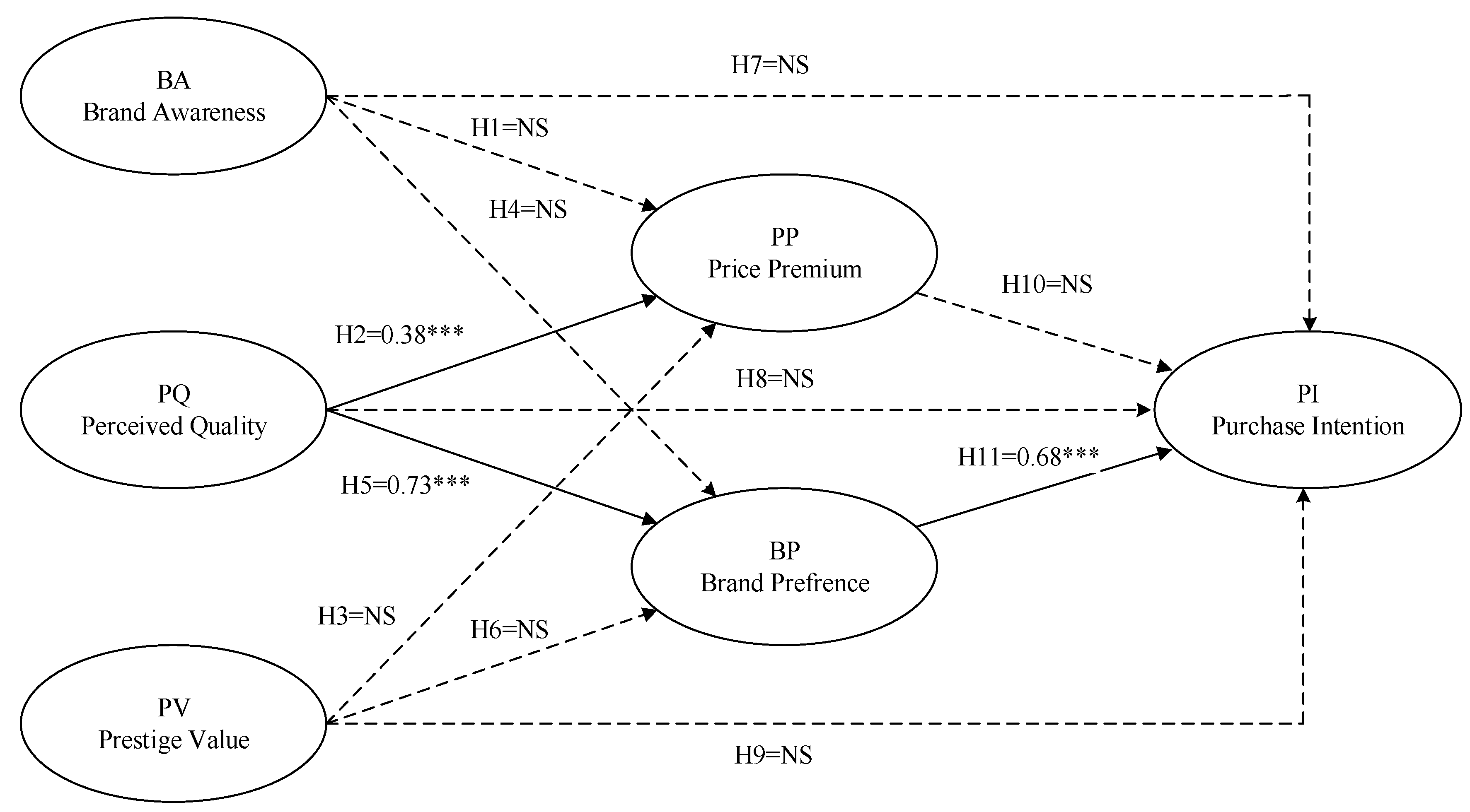

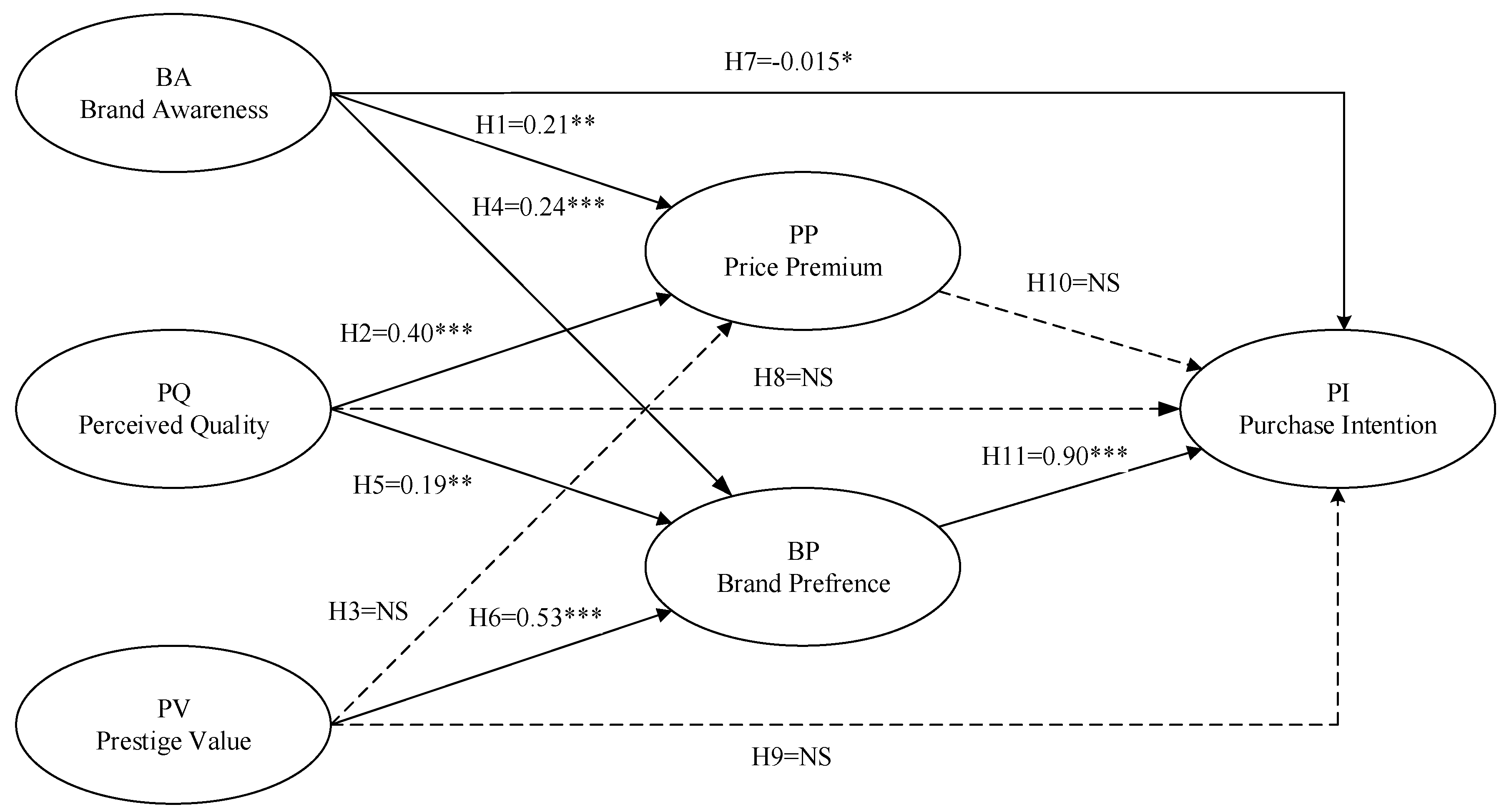

Hypothesis 1 (H1): BA has a statistically significant influence on PP.

The result of SEM analyses indicates that for Apple, brand awareness does not have a significant sustainable influence on the price premium in the Taiwan smartphone market. This result is not consistent with the findings from Huang and Sarigöllü [

112], claiming that a positive relationship exists between brand awareness and price premium. Meanwhile, in the Indonesian smartphone market, brand awareness has a significant influence on the price premium (β = 0.32,

p < 0.001). Similarly, for HTC smartphones, brand awareness has no significant sustainable impact on the price premium for Taiwanese smartphone users. Nevertheless, brand awareness significantly influences price premium in the Indonesia smartphone market.

Hypothesis 2 (H2): PQ has a statistically significant influence on PP.

The results indicate that perceived quality significantly influences consumers’ purchase intention for both Apple (TW: β = 0.30,

p < 0.001; IND: β = 0.53,

p < 0.001) and HTC (TW: β = 0.38,

p < 0.001; IND: β = 0.40,

p < 0.001). Perceived quality in the proposed model is one of the important factors that influence both Taiwanese and Indonesian smartphone consumer willingness to pay a premium price for Apple and HTC smartphones. Therefore, no matter what product, and no matter where the product is sold, quality is always on consumers’ minds [

69,

73,

74,

75,

76,

113].

Hypothesis 3 (H3): PV has a statistically significant influence on PP.

Results show that the relationship between perceived prestige value and price premium for Apple is significant in Taiwan (β = 0.21,

p < 0.05) and Indonesia (β = −0.25,

p < 0.01). This finding is also supported by several researchers in previous studies [

75,

114]. However, in Indonesia, prestige value negatively influences price premium as consumers are not willing to pay for prestige. Not only are they not willing to pay for it, but they are against it. This may be due to respondents’ economic and financial background, as previously mentioned.

For HTC, however, the results are dissimilar to Apple. Perceived prestige value failed to influence price premium both in Taiwan and Indonesia markets significantly. Thus, Taiwanese and Indonesian consumers do not think of HTC as a prestigious brand and, therefore, not worth to pay more than what they should for it. This has important implications for HTC in terms of pricing their products.

Hypothesis 4 (H4): BA has a statistically significant influence on BP.

In a previous study, Buil et al. [

83] stated that companies with higher brand awareness are able to generate a larger impact on consumers’ brand preferences. In line with that, researchers also found that in Indonesia, consumers’ brand preferences are significantly influenced by brand awareness both for Apple (β = 0.50,

p < 0.001) and HTC (β = 0.24,

p < 0.001). However, Taiwanese consumers have shown a different perspective. Their brand preference is not significantly impacted by brand awareness, both for Apple and HTC. It can be noted that Indonesian consumers are more likely to prefer a smartphone brand (Apple/HTC) with a famous name, while Taiwanese consumers tend to think that a famous name (Apple/HTC) is not the main reason for their brand preference.

Hypothesis 5 (H5): PQ has a statistically significant influence on BP.

Results indicate that in Indonesia and Taiwan markets, perceived quality strongly impacts consumers’ brand preferences for each of the compared smartphone brands, Apple (TW: β = 0.61,

p < 0.001; IND: β = 0.54,

p < 0.001) and HTC (TW: β = 0.73,

p < 0.001; IND: β = 0.19,

p < 0.01). Findings from previous research also support these results [

78,

84]. Therefore, as mentioned before, for both Indonesian and Taiwanese consumers of smartphones, perceived quality is an important factor when it comes to preferring a brand and paying a premium price for it.

Hypothesis 6 (H6): PV has a statistically significant influence on BP.

Hoeffler and Keller [

41] suggest that brands with strong brand equity tend to get preferential evaluations and higher preference from consumers than those that do not. Indonesian customers seem to agree with this finding. The researchers discovered that in Indonesia, perceived prestige value has a statistically significant impact on brand preference for Apple (β = 0.65,

p < 0.001) and HTC (β = 0.53,

p < 0.001) products.

However, this finding does not apply to Taiwan. Our research reveals that in Taiwan, perceived value failed to significantly influence brand preferences both in the case of Apple and HTC products. In the Indonesia market, consumers value prestige and prefer to have a prestigious smartphone, however, they are not willing to pay for it. That is a clue for prestigious brands marking in Indonesia to keep the prices reasonably low. However, Taiwanese do not consider the perceived prestige value when preferring a smartphone to another.

Hypothesis 7 (H7): BA has a statistically significant influence on PI.

Hypothesis 8 (H8): PQ has a statistically significant influence on PI.

Hypothesis 9 (H9): PV has a statistically significant influence on PI.

There are a few studies discovering the relationship between brand awareness and purchase intention. In this vein, Chang and Liu [

78], as well as San Martín et al. [

45], state that brand awareness significantly influences purchase intention. In this study, researchers also discovered that for Apple products, purchase intention is an influential factor that can influence consumers’ purchase both in Taiwan (β = 0.16,

p < 0.01) and Indonesia (β = 0.23,

p < 0.05). In the case of HTC products, Indonesian smartphone consumers very weakly agree that brand awareness could increase their purchase intention to buy an HTC product (β = −0.015,

p < 0.05). However, for Taiwanese, the total influence of BA on PI is insignificant. In this model, there are two mediating variables. Therefore, there may be an indirect influence.

Perceived quality failed to significantly influence purchase intention for Apple and HTC in both countries (Taiwan and Indonesia). For both Taiwanese and Indonesian consumers, quality is important. However, in this proposed model with the presence of the mediating variables, the indirect influence of PQ on PI should be studied.

Results of statistical analyses indicate that for Apple, Taiwanese consumers believe that PV is an influential factor that could increase their intention to purchase Apple (β = 0.16,

p < 0.05). Conversely, Indonesian consumers do not think that the PV of Apple or HTC products is an important factor that can affect their purchase intention. Taiwanese and Indonesian consumers agree that their purchase intention cannot be affected by PV, verifying the previous results of a similar study on the same product [

87].

Hypothesis 10 (H10): PP has a statistically significant influence on PI.

Hypothesis 11 (H11): BP has a statistically significant influence on PI.

Prior studies assume that consumers are more likely to purchase a particular product and are even willing to pay a price premium because its benefits meet their needs [

5,

95]. This study also found that for Apple, the price premium has an influential impact on purchase intention both in Taiwanese (β = 0.62,

p < 0.001) and Indonesian (β = 0.20,

p < 0.05) consumers’ minds.

However, Indonesian and Taiwanese consumers think that the price premium of the HTC smartphone product does not have an essential role in influencing their purchase intention. Thus, researchers conclude that Taiwanese and Indonesian perceive that a premium price tag put on HTC is not going to influence their purchase intention.

Comparing smartphone brands, Apple and HTC, brand preference has a strong influence on purchase intention in Taiwan (Apple: β = 0.16,

p < 0.05; HTC: β = 0.68,

p < 0.001) and Indonesia (Apple: β = 0.37,

p < 0.001; HTC: β = 0.900,

p < 0.001). Hellier et al. [

98] state that brand preference is one essential factor that could influence consumers’ purchase intention. When consumers have a favorable preference for a smartphone brand, they will be more likely to purchase it. Similarly, the present findings are consistent with previous work that supports the significant role of brand preference in predicting consumer purchase intention.

For Apple, Taiwanese smartphone consumers stated that the key factors that influence their intention to purchase the brand are its high brand awareness, certain value they perceive when owning or using Apple, its price premium that makes them feel more prestigious and luxurious, and their personal preferences for the Apple brand. Meanwhile, Indonesian consumers have a slightly different opinion. Indonesian consumers perceive that brand awareness, price premium, and brand preference could have an impact on their purchasing intention. However, they disagree that perceived value is an important and influential factor when purchasing Apple products.

Notwithstanding, in terms of HTC, the findings suggest that brand awareness is the only independent variable that can influence both Indonesian and Taiwanese consumers. Perceived quality is the only variable that failed to influence both Taiwanese and Indonesian consumers’ purchase intentions for Apple or HTC. The researchers conclude that nowadays, Taiwanese and Indonesian consumers would prefer a smartphone that has higher brand awareness and their personal brand preferences rather than quality when purchasing smartphones. They feel more up-to-date, stylish, and trendy when owning a smartphone that has a higher brand awareness regardless of its quality, rather than a smartphone advertising good quality but with low brand awareness. The decline of worldwide sales for HTC is possibly due to its decreasing brand awareness. HTC needs to redefine its branding and marketing strategy to increase its brand awareness in order to increase sales among Taiwanese and Indonesian consumers. According to the present study’s findings, Taiwanese and Indonesian consumers still have a favorable purchase intention for HTC due to their personal brand preferences and loyalty towards this brand and its products.

5.2. Conclusions and Implications

The results of the study provide a deeper understanding of the sustainable relationships among brand equity subsets, price premium, brand preference, brand awareness, and purchase intention. In a general sense, our study recommends essential guidelines to international smartphone marketers who are planning to introduce or expand a sustainable marketing strategy. The proposed model focused on testing the brand sustainability relationships among the study constructs. The findings provide useful information to predict consumer tendencies to buy specific brands that would assist marketers in developing strategies in the Indonesian and Taiwanese markets to increase purchase intention for the brands. The results of this study point out several valuable conclusions regarding brand sustainability and marketing sustainability [

1].

The first finding indicates a lack of sustainable support for the influence of brand awareness on price premium in Taiwan for both HTC and Apple smartphones. Our conclusion of this finding is that for Taiwanese, despite their awareness of different brands, the price they are willing to pay off a smartphone product (HTC or Apple) does not rely on their brand awareness. In Taiwan, consumers are well-aware of the products and may be willing to pay the higher price, but perhaps due to other variables such as prestige and quality. Meanwhile, Indonesian smartphone consumers’ awareness of the product is an important factor in determining the price they are willing to pay for that product. Indonesian consumers are more selective and more careful when it comes to paying premium prices. This also could be explained by the GDP (nominal) per capita for each country. In 2019, the GDP (nominal) per capita for Taiwan and Indonesia was

$25,447 and

$4120, respectively [

115]. There is a significant (6:1) ratio difference between the GDP (nominal) per capita for Taiwan and Indonesia. However, there is no significant difference in the average price of genuine HTC and Apple in Taiwan and Indonesia [

116]. Indonesian consumers are more careful about paying higher prices.

Perceived quality is an influential sustainable factor on the price premium. Indonesian and Taiwanese consumers are aware of HTC and Apple smartphone qualities and are willing to pay a price premium for those brands. There is no surprise element in this finding as it supports previous finding vis-à-vis different products in different countries [

69,

73,

75,

76,

113].

Neither Taiwanese nor Indonesian consumers perceive HTC as a prestigious brand. For the Taiwanese population, this finding is consistent with a similar previous study of HTC in Taiwan [

117]. The results, however, are different for Apple smartphones. Apple smartphones are perceived as prestigious in both Taiwan and Indonesia. The influence of prestige value on the price premium is, however, very different. Taiwanese consumers, perhaps due to a higher standard of living, are willing to pay a premium price for a prestigious product. In other words, for Taiwanese, it is worth to pay more for luxury. It is a matter of social status and feeling unique. For Indonesian consumers, if a product is perceived as prestigious, then it has to be more expensive for no good reason rather than prestige. Indonesian consumers pay for the quality of the smartphone, but not for the brand name. The perception is that if a smartphone is a prestigious global brand, it carries higher prices. This is not a surprising finding for countries with low GDP per capita [

118,

119].

Taiwanese consumers perceived awareness and perceived prestige of HTC and Apple smartphones do no influence their brand preference. For Taiwanese consumers, quality plays the only role in influencing their brand preference of HTC and Apple. For Indonesian consumers, brand awareness, perceived quality, and prestige value are all influential factors in their preference of HTC and Apple smartphones. From the results of this study, we can also conclude that the direct influence of brand awareness, perceived quality, and prestige value on purchase intention is not sustainable. The influence of the price premium of Apple smartphones on the decision to buy this brand is sustainable both in Taiwan ad Indonesia. For HTC, however, the significance of the price premium on purchase intention is non-significant. Indonesian and Taiwanese consumers will purchase the brand they prefer the most. This variable is highly influential for the HTC brand in Taiwan and Indonesia.

The findings of this study highlight the sustainable role of perceived quality as a valuable parameter regarding consumer brand preferences and price premium for both brands in both countries. Thus, brand managers should emphasize raising consumer’s awareness of the quality of the product, perhaps through planned advertising programs or developing applications that raise consumer perceived quality. Emphasis on product quality through the company’s website, retailer’s site, or even through social media will enhance consumer awareness preference, and purchase intention. Creating and strengthening brand equity is a critical approach for companies that generate high value for consumers, resulting in purchase intention, and conclusively improving brand market position for the company.

5.3. Limitation and Future Research

In the current study, some aspects define the limitations and provide new directions for future research. First of all, this study is limited to only Taiwanese and Indonesian smartphone consumers. Therefore, the representativeness of the sample might contain unexpected bias. Future research should expand the demographic diversity of the samples to verify the results.

Secondly, this study is limited to only three aspects, which are brand equity (brand awareness, perceived value, and perceived quality), price premium, and brand preferences. However, when it comes to forecasting purchase intention, several other factors may be influential. For instance, external factors relevant to consumer’s purchase intention can be included in the model, such as brand reputation or advertising. Besides, as the direct effect of brand preference and price was analyzed, the mediation analysis would be interesting to study further. Considering the comparative notion of our research in two different countries with diverse cultural backgrounds, moderating variables are recommended to be employed, such as cultural beliefs or attitudes. Moreover, this study only compared two smartphone brands, Apple and HTC, while future studies may consider other popular smartphone brands, such as Samsung, Huawei, Oppo, and Xiaomi, to see the differences between these brands when forecasting consumer purchase likelihood. Finally, our model did not deal with control variables, and it is suggested to take into account the role of possible elements, such as sociodemographic variables that may affect the results.

One suggestion for a future study is to take into consideration the significant differences between Indonesians and Taiwanese in their perception of each variable. We believe that it will be beneficial to additionally attempt multi-group analysis for the groupings presented in this study. As such, it will provide better insights on the significant or non-significant relationships established in this study. It will be interesting to see how different brands perform in each country. The future study can explore and compare the model further. More importantly, the role of the mediator can be explored in each country and for each brand. The unsustainable direct influences of brand awareness, perceived quality, and prestige value on purchase intention are hinting toward the possibility of sustainable indirect results thought price premium and brand preferences.

This paper studies the sustainability of brand survival. Extension of our paper could expand to investigate other sustainable issues. For example, one could extend Moslehpour et al. [

87,

120,

121] to study the sustainability of e-business and consumer behavior. Academics and practitioners could also extend Pham et al. [

122] and Mou et al. [

123] to study the sustainability of outsourcing and supply chains or extend the sustainability studies of funds, futures markets Wong et al. [

124,

125], and stock market Batmunkh et al. [

126].