The Paradox of Value and Economic Bubbles: New Insights for Sustainable Economic Development

Abstract

:1. Introduction

- To study the question of paradoxicality of value in relation to the case of the water–diamond paradox.

- To review the historical solution to the paradox of value in economic theories.

- To provide exceptional insights on this matter by pioneer of the Austrian School of Economics—C. Menger.

- To discuss the gaps of the conception of marginal utility and possibilities to overcome them.

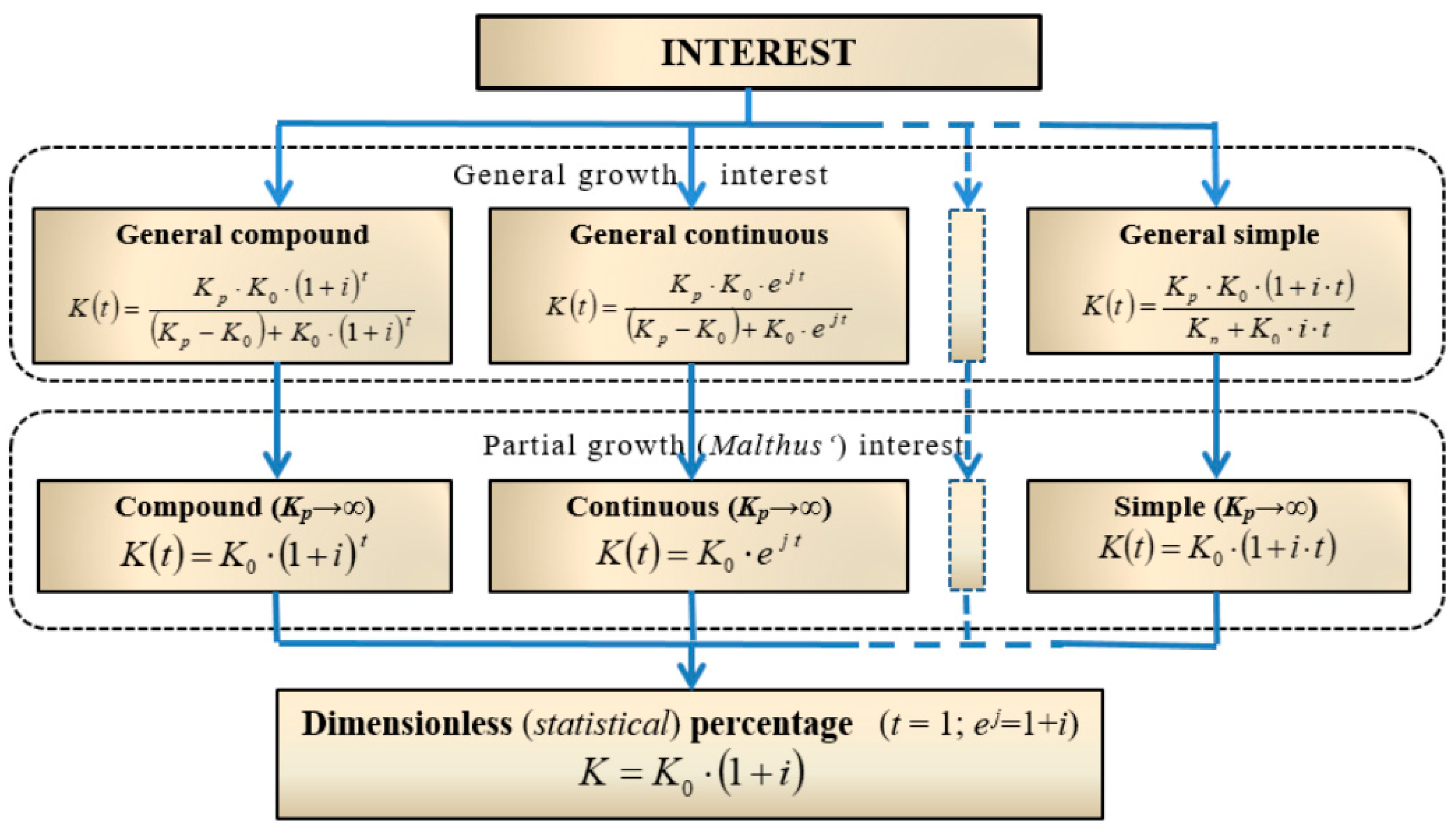

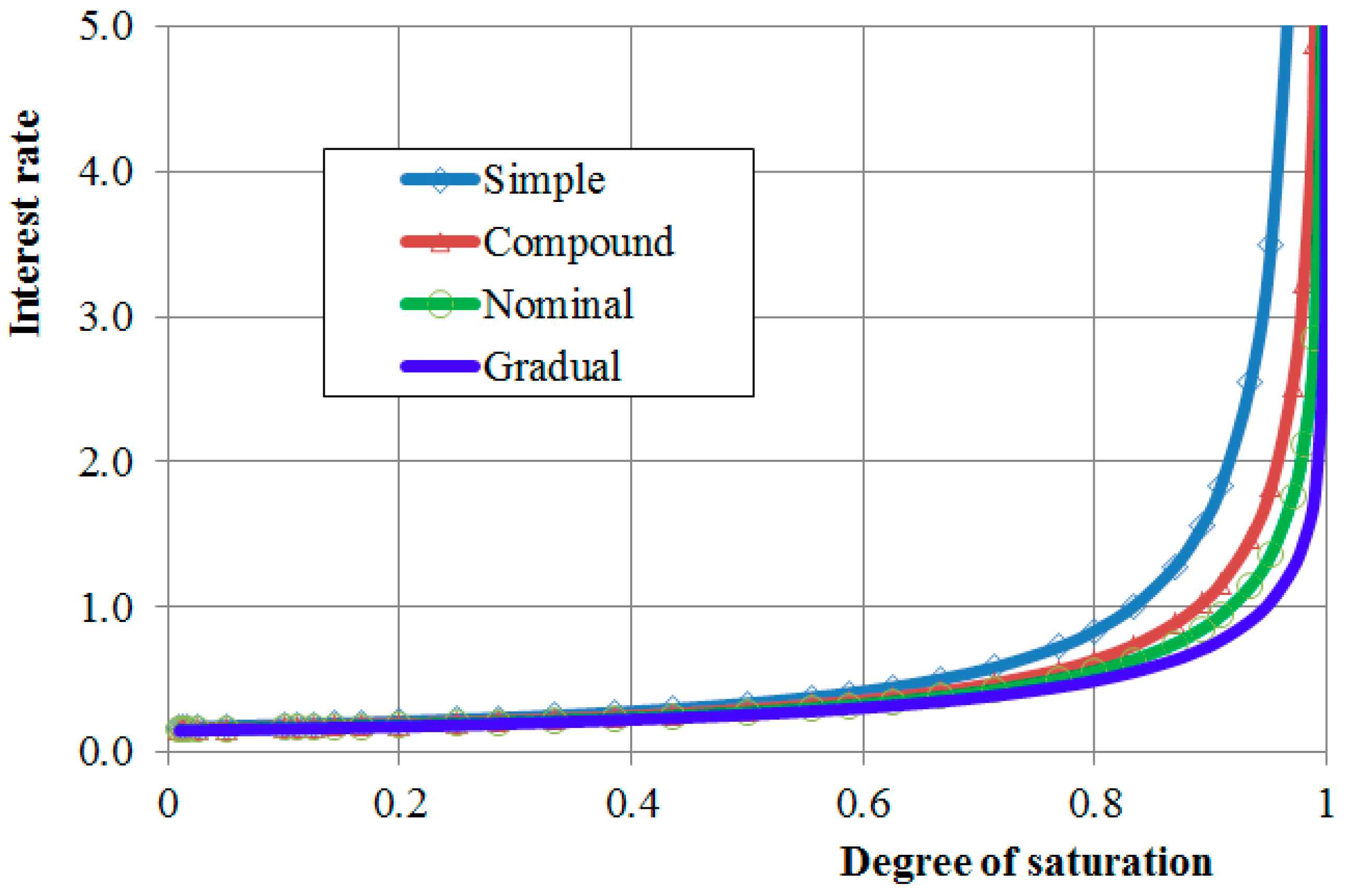

- To show the suitability of compound interests and the saturation phenomena in solving the problem of the paradox of value.

- To reveal the possibilities of the phenomenology of growth in studying the paradox of value.

- To discuss the relations between price bubbles and emotional consumer behavior: To provide a case analysis of collecting magic, investment, and gambling passion.

2. Literature Review

2.1. Recent Studies

2.2. Economic Paradoxes and Paradox of Value

- ○

- Opinion, reasoning, or conclusion that apparently does not match the globally accepted opinion and objects “reason” (often at first sight only);

- ○

- unexpected phenomenon or event that does not meet the usual idea;

- ○

- in set theory and logic, it is a contradiction arising from any digression from the truth.

2.3. The Gaps of the Conception of Marginal Utility in Solving Value Paradox

2.4. Integration of Emotional Consumer Behavior for Dealing with Paradox of Value

3. Methods

3.1. The Saturation Phenomena and Compound Interests

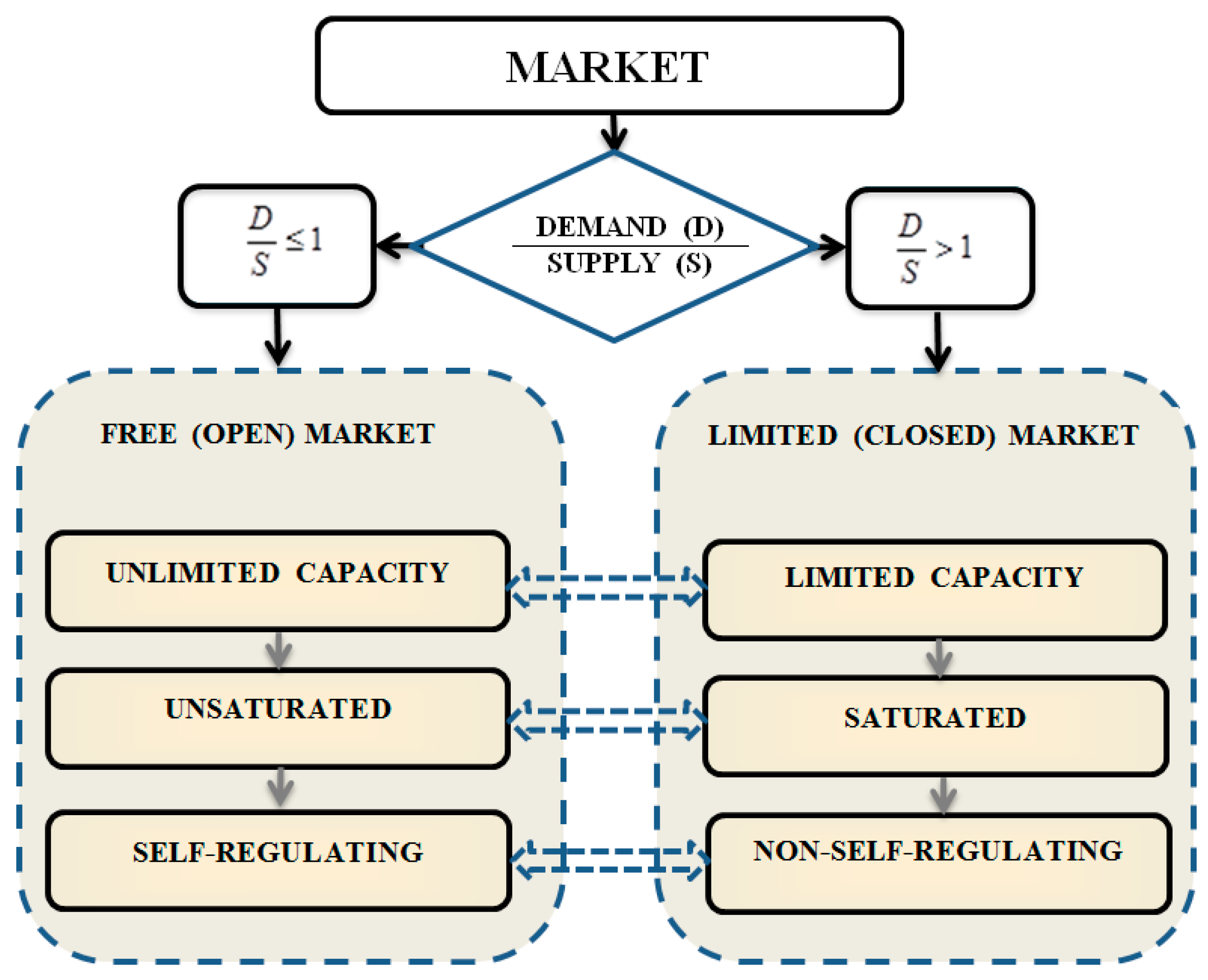

3.2. Closed and Open Markets and Saturation Phenomena

- Balancing market when demand (D) and supply (S) are more or less the same (S ≈ D);

- deficit market when demand exceeds supply (D > S);

- surplus (proficient) market when supply exceeds demand (S > D).

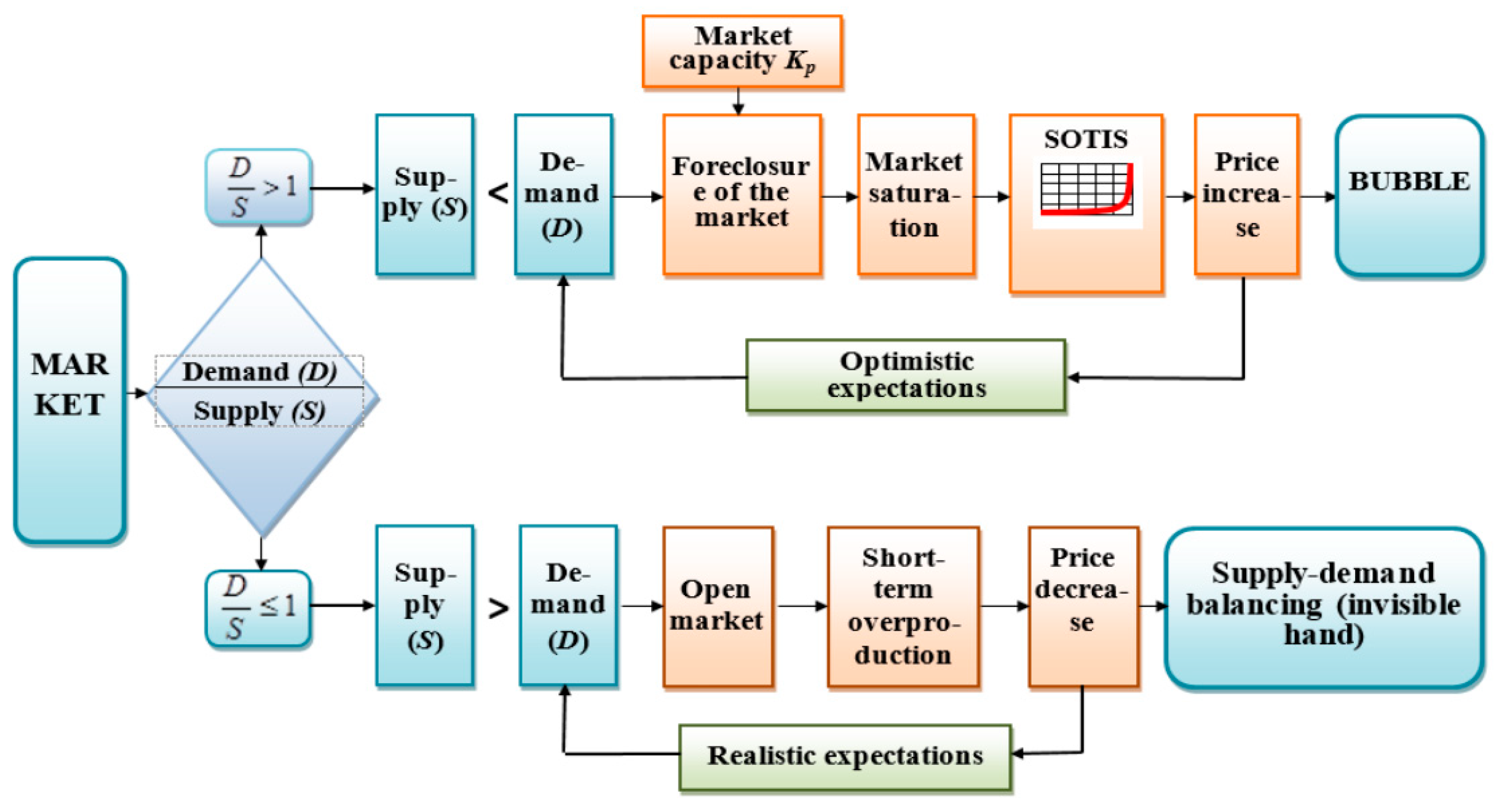

4. Economic Bubbles and Market Saturation Phenomena

5. Generalization and Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Skousen, M.; Taylor, K.C. Puzzles and Paradoxes in Economics; Edward Elgar Pub: Cheltenham, UK, 1997. [Google Scholar]

- Wolf, C., Jr. Puzzles, Paradoxes, Controversies, and the Global Economy; Hoover Press: Washington, DC, USA, 2015. [Google Scholar]

- Da Costa, P.; Attias, D. (Eds.) Towards a Sustainable Economy. In Paradoxes and Trends in Energy and Transportation; Springer: Berlin, Germany, 2018. [Google Scholar]

- Lisin, E.; Shuvalova, D.; Volkova, I.; Strielkowski, W. Sustainable development of regional power systems and the consumption of electric energy. Sustainability 2018, 10, 1111. [Google Scholar] [CrossRef] [Green Version]

- Giarini, O.; Jacobs, G. The Evolution of Wealth & Human Security: The Paradox of Value and Uncertainty. Cadmus 2011, 1, 29–59. [Google Scholar]

- Strielkowski, W. Social and economic implications for the smart grids of the future. Econ. Soc. 2017, 10, 310–318. [Google Scholar] [CrossRef] [Green Version]

- Ekelund, R.B., Jr.; Thornton, M. Galileo, smith and the paradox of value: The ‘connection’ of art and science. Hist. Econ. Ideas 2011, 19, 85–101. [Google Scholar]

- Schmidt, R.H.; Cannon, F. Why Water Markets are Good for California Agriculture. In Achieving Consensus on Water Policy in California; California State University: Los Angeles, CA, USA, 1992; pp. 59–69. [Google Scholar]

- Vaux, H.J., Jr.; Howitt, R.E. Managing Water Scarcity: An Evaluation of Interregional Transfers. Water Resour. Res. 1984, 20, 785–792. [Google Scholar] [CrossRef]

- Menger, C. Grundsätze der Volkswirtschaftslehre; Wilhelm Braumüller: Vienna, Austria, 1871. [Google Scholar]

- Schoenmaker, D. Investing for the Common Good: A Sustainable Finance Framework; Bruegel: Brussels, Belgium, 2017; Available online: https://bruegel.org/wp-content/uploads/2017/07/From-traditional-to-sustainable-finance_ONLINE.pdf (accessed on 15 June 2019).

- Schoenmaker, D.; Schramade, W. Principles of Sustainable Finance; Oxford University Press: Oxford, UK, 2019. [Google Scholar]

- Sang-Bing, T.; Chung-Hua, S.; Hua, S.; Baozhuang, N. Green Finance for Sustainable Global Growth. In Advances in Environmental Engineering and Green Technologies, 1st ed.; IGI Global: Hershey, PA, USA, 2019. [Google Scholar]

- Popescu, C.R.G.; Popescu, G.N. An Exploratory Study Based on a Questionnaire Concerning Green and Sustainable Finance, Corporate Social Responsibility, and Performance: Evidence from the Romanian Business Environment. J. Risk Financ. Manag. 2019, 12, 162. Available online: https://www.mdpi.com/1911-8074/12/4/162 (accessed on 15 June 2019). [CrossRef] [Green Version]

- Asquith, P.; Weiss, L.A. Lessons in Corporate Finance: A Case Studies Approach to Financial Tools, Financial Policies, and Valuation, 2nd ed.; Wiley: Hoboken, NJ, USA, 2019. [Google Scholar]

- Bulai, V.-C.; Horobet, A.; Belascu, L. Improving Local Governments’ Financial Sustainability by Using Open Government Data: An Application of High-Granularity Estimates of Personal Income Levels in Romania. Sustainability 2019, 11, 5632. [Google Scholar] [CrossRef] [Green Version]

- Chollet, P.; Sandwidi, B.W. CSR engagement and financial risk: A virtuous circle? International evidence. Glob. Financ. J. 2018, 38, 65–81. [Google Scholar] [CrossRef]

- Popescu, C.R.G. Analyzing the Impact of Green Marketing Strategies on the Financial and Non-Financial Performance of Organizations: The Intellectual Capital Factor. In Green Marketing as a Positive Driver Toward Business Sustainability; Naidoo, V., Verma, R., Eds.; IGI Global: Hershey, PA, USA, 2019; pp. 186–218. [Google Scholar]

- Popescu, C.R.G. Addressing Intellectual Capital in the Context of Integrated Strategy and Performance: Emphasizing the Role of Companies’ Unique Value Creation Mechanism, While Targeting Better Organizational Reporting in Romania: The Case of Green Marketing and Green Marketing Strategies. J. Market. Res. Case Stud. 2019. [Google Scholar] [CrossRef]

- Anderson, N.; Potoˇcnik, K.; Zhou, J. Innovation and Creativity in Organizations: A State-of-the-Science Review, Prospective Commentary, and Guiding Framework. J. Manag. 2014, 40, 1297–1333. [Google Scholar] [CrossRef] [Green Version]

- Dang, C.; Li, Z.F.; Yang, C. Measuring Firm Size in Empirical Corporate Finance. J. Bank. Financ. 2013, 86, 159–176. [Google Scholar] [CrossRef]

- Evgenidis, A.; Tsagkanos, A. Asymmetric effects on the international transmission of US financial stress. A Threshold VAR approach. Int. Rev. Financ. Anal. 2017, 51, 69–81. [Google Scholar] [CrossRef]

- Girdzijauskas, S.; Streimikiene, D.; Mialik, A. Economic Growth, Capitalism and Unknown Economic Paradoxes. Sustainability 2012, 4, 2818–2837. [Google Scholar] [CrossRef] [Green Version]

- Akerlof, G.A.; Shiller, R.J. Phishing for Phools: The Economics of Manipulation and Deception; Princeton University Press: Princeton, NJ, USA, 2015. [Google Scholar]

- Gerding, E. Law, Bubbles, and Financial Regulation; Routledge: London, UK, 2016. [Google Scholar]

- Aliber, R.Z.; Kindleberger, C.P. Manias, Panics, and Crashes: A History of Financial Crises, 7th ed.; Palgrave Maccmilan: New York, NY, USA, 2005. [Google Scholar]

- Shiller, R.J. Irrational Exuberance; Princeton University Press: Princeton, NJ, USA, 2000. [Google Scholar]

- Sornette, D. Why Stock Markets Crash: Critical Events in Complex. Financial Systems; Princeton University Press: Princeton, NJ, USA, 2003. [Google Scholar]

- Schumpeter, J.A. Business Cycles. A Theoretical, Historical and Statistical Analysis of the Capitalist Process; McGraw-Hill Book Company: New York, NY, USA, 2008. [Google Scholar]

- Girdzijauskas, S. The Logistic Theory of Capital Management: Deterministic Methods. Monograph No 1, published a peer-reviewed Supplement A. Transform. Bus. Econ. 2008, 7, 163. [Google Scholar]

- Girdzijauskas, S.; Ciegis, R.; Simanskiene, L.; Griesiene, I. Analysis of the Austrian School of Economics Business Cycles within the Framework of General Percentages as the New Paradigm of Economic Theory. Transform. Bus. Econ. 2018, 17, 21–37. [Google Scholar]

- Čiegis, R.; Girdzijauskas, S. Retų prekių kainų burbulai, arba vertės paradoksas (Rare Goods Prices Bubbles or Value Paradox). Reg. Format. Dev. Stud. 2018, 26, 36–43. (In Lithuanian) [Google Scholar]

- Čiegis, R.; Girdzijauskas, S. Austrų ekonomikos mokyklos verslo ciklų teorija bendrųjų palūkanų požiūriu (Austrian School Business Cycle Theory and the Common Interest Rates). Reg. Format. Dev. Stud. 2018, 25, 38–47. (In Lithuanian) [Google Scholar]

- Kahneman, D. Thinking, Fast and Slow; Farrar, Straus and Giroux: New York, NY, USA, 2011. [Google Scholar]

- Kahneman, D.; Tversky, A. Prospect Theory: An Analysis of Decision under Risk. Econometrica 1979, 47, 263–291. [Google Scholar] [CrossRef] [Green Version]

- Girdzijauskas, S.A.; Moskaliova, V.; Streimikiene, D. Economic Bubbles and Financial Pyramids: Logistic Analysis and Management. In Economic Issues, Problems and Perspectives; Nova Science Pub Inc.: Hauppauge, NY, USA, 2014. [Google Scholar]

- Verhulst, Pierre-François. Notice sur la loi que la population poursuit dans son accroissement. Correspondance Mathématique Physique 1838, 10, 113–121. [Google Scholar]

- Tsoularis, A. Analysis of Logistic Growth Models. Res. Lett. Inf. Math. Sci. 2001, 2, 23–46. [Google Scholar] [CrossRef] [Green Version]

- Kotler, P.; Armstrong, G.; Saunders, J.; Wong, V. Rinkodaros Principai; Poligrafija ir Informatika: Kaunas, Lithuania, 2003. [Google Scholar]

- Moskaliova, V.; Girdzijauskas, S.; Čiegis, R. Rinkos transformacija, arba klasikinės ir keinsistinės teorijų suderinamumas (Market Transformation or Compatibility of Classical and Keynesian Theories). Reg. Format. Dev. Stud. 2018, 24, 85–96. Available online: http://journals.ku.lt/index.php/RFDS/article/view/1685 (accessed on 15 June 2019).

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gryshova, I.; Shabatura, T.; Girdzijauskas, S.; Streimikiene, D.; Ciegis, R.; Griesiene, I. The Paradox of Value and Economic Bubbles: New Insights for Sustainable Economic Development. Sustainability 2019, 11, 6888. https://doi.org/10.3390/su11246888

Gryshova I, Shabatura T, Girdzijauskas S, Streimikiene D, Ciegis R, Griesiene I. The Paradox of Value and Economic Bubbles: New Insights for Sustainable Economic Development. Sustainability. 2019; 11(24):6888. https://doi.org/10.3390/su11246888

Chicago/Turabian StyleGryshova, Inna, Tatyana Shabatura, Stasys Girdzijauskas, Dalia Streimikiene, Remigijus Ciegis, and Ingrida Griesiene. 2019. "The Paradox of Value and Economic Bubbles: New Insights for Sustainable Economic Development" Sustainability 11, no. 24: 6888. https://doi.org/10.3390/su11246888

APA StyleGryshova, I., Shabatura, T., Girdzijauskas, S., Streimikiene, D., Ciegis, R., & Griesiene, I. (2019). The Paradox of Value and Economic Bubbles: New Insights for Sustainable Economic Development. Sustainability, 11(24), 6888. https://doi.org/10.3390/su11246888