Consolidated Climate Markets Mechanism Analysis—Case Studies of China, Japan, and Taiwan

Abstract

:1. Introduction

2. Methodology

2.1. Synthesis of CCLIMMA Model

2.2. Regulatory Frameworks

2.2.1. China

2.2.2. Japan

2.2.3. Taiwan

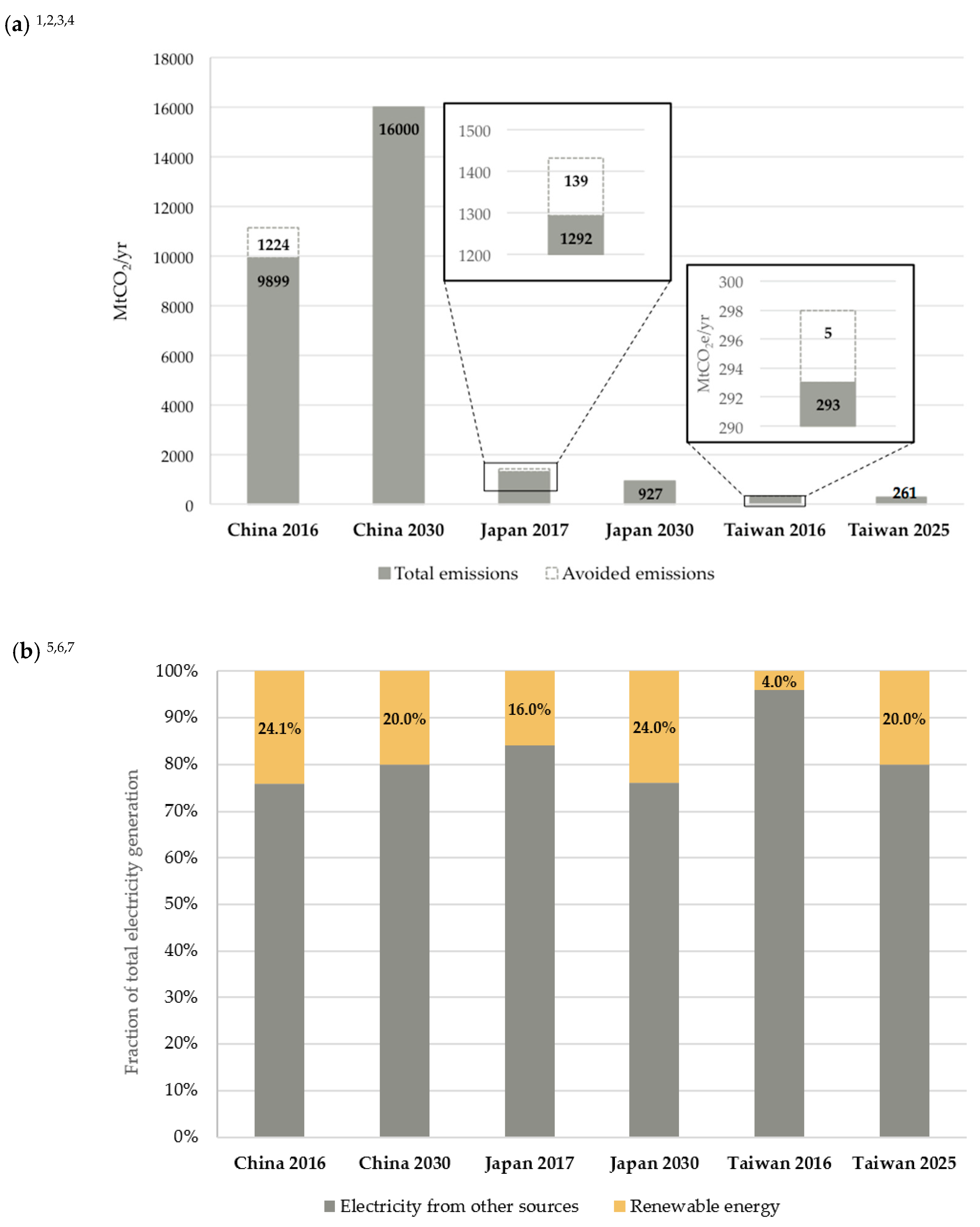

3. Results

3.1. China Case Study

3.1.1. A Stagnant Chinese Carbon Market

3.1.2. [Renewable] Energy Market Facing Development Hurdles

3.2. Japan Case Study

3.2.1. Carbon Market: Weak with Mandatory Cap Missing

3.2.2. Renewable Energy Market: Regaining Momentum with FIT but Lacking a Market Mechanism

3.3. Taiwan Case Study

3.3.1. Carbon Market: Imbalanced Supply and Demand, and Delayed Schedule

3.3.2. Renewable Energy Market: Phasing Out FIT in Favor of Market Liberalization Enhanced by RPS

4. Discussion

4.1. Predicament of FIT Schemes

4.2. Description of an Improved Model

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Roland, F.; Molina, M. Ozone Depletion-20 Years After the Alarm. Chem. Eng. News 1994, 72, 8–13. [Google Scholar]

- Velders, G.J.; Andersen, S.O.; Daniel, J.S.; Fahey, D.W.; McFarland, M. The importance of the Montreal Protocol in protecting climate. Proc. Natl. Acad. Sci. USA 2007, 104, 4814–4819. [Google Scholar] [CrossRef]

- Shin, S. Developing country’s perspective on COP3 development (Kyoto Protocol). Energy Policy 1998, 26, 519–526. [Google Scholar] [CrossRef]

- Iwata, H.; Okada, K. Greenhouse gas emissions and the role of the Kyoto Protocol. Environ. Econ. Policy Stud. 2014, 16, 325–342. [Google Scholar] [CrossRef]

- Lashof, D.A.; Ahuja, D.R. Relative contributions of greenhouse gas emissions to global warming. Nature 1990, 344, 529. [Google Scholar] [CrossRef]

- Price, L. Voluntary Agreements for Energy Efficiency or Ghg Emissions Reduction in Industry: An Assessment of Programs Around the World; Sage Publications: Thousand Oaks, CA, USA, 2005. [Google Scholar]

- Lau, L.C.; Lee, K.T.; Mohamed, A.R. Global warming mitigation and renewable energy policy development from the Kyoto Protocol to the Copenhagen Accord—A comment. Renew. Sustain. Energy Rev. 2012, 16, 5280–5284. [Google Scholar] [CrossRef]

- Teeter, P.; Sandberg, J. Constraining or enabling green capability development? How policy uncertainty affects organizational responses to flexible environmental regulations. Br. J. Manag. 2017, 28, 649–665. [Google Scholar] [CrossRef]

- Ecofys. Mapping Carbon Pricing Initiatives Developments and Prospects 2013; World Bank: Washington DC, USA, 2013; p. 94. [Google Scholar]

- Nejat, P.; Jomehzadeh, F.; Taheri, M.M.; Gohari, M.; Majid, M.Z.A. A global review of energy consumption, CO2 emissions and policy in the residential sector (with an overview of the top ten CO2 emitting countries). Renew. Sustain. Energy Rev. 2015, 43, 843–862. [Google Scholar] [CrossRef]

- Sorrell, S. Reducing energy demand: A review of issues, challenges and approaches. Renew. Sustain. Energy Rev. 2015, 47, 74–82. [Google Scholar] [CrossRef]

- Jacobson, M.Z.; Delucchi, M.A.; Cameron, M.A.; Frew, B.A. Low-cost solution to the grid reliability problem with 100% penetration of intermittent wind, water, and solar for all purposes. Proc. Natl. Acad. Sci. USA 2015, 112, 15060–15065. [Google Scholar] [CrossRef]

- Johnstone, N.; Haščič, I.; Popp, D. Renewable energy policies and technological innovation: Evidence based on patent counts. Environ. Resour. Econ. 2010, 45, 133–155. [Google Scholar] [CrossRef]

- Falconett, I.; Nagasaka, K. Comparative analysis of support mechanisms for renewable energy technologies using probability distributions. Renew. Energy 2010, 35, 1135–1144. [Google Scholar] [CrossRef]

- Cox, S.; Esterly, S. Renewable Electricity Standards: Good Practices and Design Considerations; National Renewable Energy Lab (NREL): Golden, CO, USA, 2016.

- Yan, Q.; Zhang, Q.; Yang, L.; Wang, X. Overall review of feed-in tariff and renewable portfolio standard policy: A perspective of China. In Proceedings of the IOP Conference Series: Earth and Environmental Science, Banda Aceh, Indonesia, 21–22 August 2019. [Google Scholar]

- Fang, D.; Zhao, C.; Yu, Q. Government regulation of renewable energy generation and transmission in China’s electricity market. Renew. Sustain. Energy Rev. 2018, 93, 775–793. [Google Scholar] [CrossRef]

- China Steps Up Its Push Into Clean Energy. Available online: https://www.bloombergquint.com/china/china-sets-out-new-clean-energy-goals-penalties-in-revised-plan (accessed on 24 November 2018).

- Renewable Energy Development Act. Available online: https://law.moj.gov.tw/ENG/LawClass/LawAll.aspx?pcode=J0130032 (accessed on 24 November 2018).

- Sotos, M. GHG Protocol Scope 2 Guidance. An Amendment to the GHG Protocol Corporate Standard; World Resources Institute (WRI), in association with the World Business Council for Sustainable Development (WBCSD): Washington DC, USA, 2015; p. 120. Available online: https://ghgprotocol.org/sites/default/files/standards/Scope%202%20Guidance_Final_Sept26.pdf (accessed on 14 November 2019).

- Myllyvirta, L. Guest Post: Why China’s CO2 Emissions Grew 4% during First Half of 2019. Available online: https://www.carbonbrief.org/guest-post-why-chinas-co2-emissions-grew-4-during-first-half-of-2019 (accessed on 23 October 2019).

- Yang, X.J.; Hu, H.; Tan, T.; Li, J. China’s renewable energy goals by 2050. Environ. Dev. 2016, 20, 83–90. [Google Scholar] [CrossRef]

- Vaughan, A. China is on Track to Meet Its Climate Change Goals Nine Years Early. Available online: https://www.newscientist.com/article/2211366-china-is-on-track-to-meet-its-climate-change-goals-nine-years-early/ (accessed on 23 October 2019).

- China Country Summary. Available online: https://climateactiontracker.org/countries/china/ (accessed on 23 October 2019).

- China 14th FY Development Plan for Renewable Energy. Available online: http://www.cresp.org.cn/index.php?m=content&c=index&a=show&catid=20&id=380 (accessed on 28 September 2019).

- Progress of China‘s Power Industry Carbon Emissions Trading Market—China’s Power Industry‘s 2018 Emission Reduction Officially Released. Available online: http://www.tanjiaoyi.com/article-26959-1.html (accessed on 23 October 2019).

- Japan‘s Energy 2018, 10 Questions for Understanding the Current Energy Situation. Available online: https://www.enecho.meti.go.jp/en/category/brochures/pdf/japan_energy_2018.pdf (accessed on 15 September 2019).

- Japan‘s Energy Plan 2015. Available online: https://www.enecho.meti.go.jp/en/category/brochures/pdf/energy_plan_2015.pdf (accessed on 14 September 2019).

- 2018 Taiwan National Greenhouse Gas Emissions Inventory Report. Available online: http://unfccc.saveoursky.org.tw/2018nir/uploads/00_nir_full.pdf (accessed on 23 October 2019).

- Greenhouse Gas Phase Control Target. Available online: https://ghgrule.epa.gov.tw/greenhouse_control/greenhouse_control (accessed on 26 October 2019).

- Power Generation Report (By Year). Available online: https://www.moeaboe.gov.tw/ECW/populace/web_book/WebReports.aspx?book=M_CH&menu_id=142 (accessed on 25 September 2019).

- 2018 Electricity Emission Factor. Available online: https://www.moeaboe.gov.tw/ecw/populace/content/ContentDesc.aspx?menu_id=6989 (accessed on 23 September 2019).

- Data List of 2016 National Electric Industry. Available online: http://www.cec.org.cn/guihuayutongji/tongjxinxi/niandushuju/2018-03-21/178791.html (accessed on 23 September 2019).

- China 13th Renewable Energy Development Five Year Plan (2016–2020). Available online: https://www.iea.org/policiesandmeasures/pams/china/name-161254-en.php? (accessed on 26 September 2019).

- Energy Policy Plan Report. Available online: https://www.ey.gov.tw/File/FA89BE915504DBD8/311ed920-9788-499d-87ff-7d665b870a77?A=C (accessed on 23 September 2019).

- Medium and Long-Term Development Plan for Renewable Energy. Available online: http://www.martinot.info/China_RE_Plan_to_2020_Sep-2007.pdf (accessed on 10 September 2018).

- Ming, Z.; Ximei, L.; Na, L.; Song, X. Overall review of renewable energy tariff policy in China: Evolution, implementation, problems and countermeasures. Renew. Sustain. Energy Rev. 2013, 25, 260–271. [Google Scholar] [CrossRef]

- Ng, E. Why China’s Costly Green Energy Certificate Has Not Helped Cash-Strapped Renewable Energy Firms. South China Morning. Available online: https://www.scmp.com/business/commodities/article/2116131/why-chinas-costly-green-energy-certificate-has-not-helped-cash (accessed on 10 September 2018).

- Umeda, S. Japan: Renewable Energy Special Measures Act Amended. Available online: https://www.loc.gov/search/?in=PartOf%3Alaw+library+of+congress&q=Japan+renewable+energy (accessed on 14 November 2019).

- Japan’s Energy, 20 Questions to Understand the Current Energy Situation (2017 Edition). Available online: https://www.enecho.meti.go.jp/en/category/brochures/pdf/japan_energy_2017.pdf (accessed on 23 October 2019).

- Ito, Y. A Brief History of Measures to Support Renewable Energy; The Institute of Energy Economics: Tokyo, Japan, 2015. [Google Scholar]

- Chan, D.Y.-L.; Yang, K.-H.; Hsu, C.-H.; Chien, M.-H.; Hong, G.-B. Current situation of energy conservation in high energy-consuming industries in Taiwan. Energy Policy 2007, 35, 202–209. [Google Scholar] [CrossRef]

- Greenhouse Gas Reduction and Management Act. Available online: https://law.moj.gov.tw/ENG/LawClass/LawAll.aspx?pcode=O0020098 (accessed on 3 October 2019).

- Installed Capacity. Available online: https://www.moeaboe.gov.tw/ECW/english/content/ContentLink.aspx?menu_id=1540 (accessed on 26 October 2019).

- Power Generation. Available online: https://www.moeaboe.gov.tw/ECW/english/content/ContentLink.aspx?menu_id=1540 (accessed on 26 October 2019).

- Chang, C.-T.; Lee, H.-C. Taiwan‘s renewable energy strategy and energy-intensive industrial policy. Renew. Sustain. Energy Rev. 2016, 64, 456–465. [Google Scholar] [CrossRef]

- The Electricity Act. Available online: https://law.moj.gov.tw/ENG/LawClass/LawAll.aspx?pcode=J0030011 (accessed on 26 October 2019).

- T-REC E-paper, September 2019. Available online: https://www.trec.org.tw/epaper/download/2019-09 (accessed on 26 October 2019).

- Chinese NDRC and BOE Jointly Issued a Renewable Energy Power Consumption Guarantee Mechanism! Tibet Was Not Assessed! Individual Provinces have Defined Renewable Energy Consumption Obligations! Available online: https://www.in-en.com/article/html/energy-2279877.shtml (accessed on 22 October 2019).

- Non-Fossil Value Trading Market. Available online: https://www.renewable-ei.org/pdfdownload/activities/4-2_ManabuNabeshima_JP.pdf (accessed on 22 October 2019).

- Yin, Y.-H. Big Power Users Subject to Renewable Energy Regulations. Taiwan’s 500 Large Power Users Should Use 10% of Renewable Energy in the Next 5 Years. Available online: https://www.storm.mg/article/1794785 (accessed on 22 October 2019).

- D’Adamo, I. The profitability of residential photovoltaic systems. A new scheme of subsidies based on the price of CO2 in a developed PV market. Soc. Sci. 2018, 7, 148. [Google Scholar] [CrossRef]

- Gerbeti, A. Mercati Ambientali. Available online: http://www.treccani.it/enciclopedia/mercati-ambientali_%28Enciclopedia-Italiana%29/ (accessed on 17 September 2019).

- Revised 1996 IPCC Guidelines for National Greenhouse Gas Inventories. Available online: https://www.ipcc-nggip.iges.or.jp/public/gl/invs4.html (accessed on 3 October 2019).

- Li, Y.; Du, W.; Huisingh, D. Challenges in developing an inventory of greenhouse gas emissions of Chinese cities: A case study of Beijing. J. Clean. Prod. 2017, 161, 1051–1063. [Google Scholar] [CrossRef]

- D’Avignon, A.; Carloni, F.A.; La Rovere, E.L.; Dubeux, C.B.S. Emission inventory: An urban public policy instrument and benchmark. Energy Policy 2010, 38, 4838–4847. [Google Scholar] [CrossRef]

- Marchi, M.; Pulselli, F.M.; Mangiavacchi, S.; Menghetti, F.; Marchettini, N.; Bastianoni, S. The greenhouse gas inventory as a tool for planning integrated waste management systems: A case study in central Italy. J. Clean. Prod. 2017, 142, 351–359. [Google Scholar] [CrossRef]

- Leonard, R.L. Best Available Control Technology. In Air Quality Permitting; Routledge: Abingdon, UK, 2018; pp. 65–80. [Google Scholar]

| Study Cases | Carbon Market | Renewable Energy Market |

|---|---|---|

| China |

|

|

| Japan |

|

|

| Taiwan |

|

|

| Cases. | REC | RPS | BACT | |

|---|---|---|---|---|

| Certificate System | Type of Projects | |||

| China | Chinese Green Electricity Certificate, C-GEC | Onshore wind and solar PV |

| Individual specifications for BACT in thermal power generation, pulp and paper, steel, cement, textile, pharmaceutical, leather tanning, fertilizers, petrochemical, and coking industries, are available in guidelines. These guidelines provide details about technical and management requirements for compliance based on emission standards. |

| International Renewable Energy Certificate, I-REC | Onshore wind, solar PV, hydro | |||

| Japan | Japanese Green Electricity Certificate, J-GEC | Solar, wind, hydro, geothermal, and biomass |

| In Japan, BAT specifications are available for key industries such as iron and steel, chemical, pulp and paper, cement, energy generation, oil, gas, among others. |

| J-Credits | Projects that reduce or increase absorption of GHG emissions | |||

| Non-fossil Value Certificates, NFCs | Renewable energy projects receiving and not receiving FITs | |||

| Taiwan | Taiwan Renewable Energy Certificate, T-REC | Wind, solar, and biomass |

| The BACT stipulated in the Air Pollution Prevention Law includes the following:

|

| I-REC | Hydro | |||

| Factors | China | Japan | Taiwan |

|---|---|---|---|

| I. RE measures | |||

| 1. FIT mission accomplishment | +++ | + | + |

| 2. Market readiness | + | + | + |

| 3. Introduction of market instruments | ++ | ++ | + |

| 4. Effectiveness of market instruments | --- | + | --- |

| II. GHG measures | |||

| 5. Cap formulation readiness | +++ | +++ | +++ |

| 6. Introduction of market instruments | +++ | ++ | --- |

| 7. Effectiveness of market instruments | ++ | -- | --- |

| III. RE & GHG policy synergies | |||

| 8. Existence of interactions between RE & GHG market instruments | --- | + | --- |

| 9. Connectivity to international markets | + | + | --- |

| Overall effectiveness | |||

| 10. Effective markets | ++ | -- | + |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chuang, J.; Lien, H.-L.; Roche, A.K.; Liao, P.-H.; Den, W. Consolidated Climate Markets Mechanism Analysis—Case Studies of China, Japan, and Taiwan. Sustainability 2019, 11, 6478. https://doi.org/10.3390/su11226478

Chuang J, Lien H-L, Roche AK, Liao P-H, Den W. Consolidated Climate Markets Mechanism Analysis—Case Studies of China, Japan, and Taiwan. Sustainability. 2019; 11(22):6478. https://doi.org/10.3390/su11226478

Chicago/Turabian StyleChuang, Jules, Hsing-Lung Lien, Akemi Kokubo Roche, Pei-Hsuan Liao, and Walter Den. 2019. "Consolidated Climate Markets Mechanism Analysis—Case Studies of China, Japan, and Taiwan" Sustainability 11, no. 22: 6478. https://doi.org/10.3390/su11226478

APA StyleChuang, J., Lien, H.-L., Roche, A. K., Liao, P.-H., & Den, W. (2019). Consolidated Climate Markets Mechanism Analysis—Case Studies of China, Japan, and Taiwan. Sustainability, 11(22), 6478. https://doi.org/10.3390/su11226478