1. Introduction

With rapid urbanization and modernization of the economy, in developing countries like Pakistan, the consumption of modern electrical appliances has multiplied. According to the report, the Economic Survey of Pakistan [

1] stated that the share of households in electricity consumption comprises 50%, which is the highest among other users, such as 10% of the agriculture, 26% of the industry, and 8% of the commercial sector, respectively. Sustainability and economic prosperity can be achieved with ample power supply in the country. In Pakistan, the demand for electricity is increasing exponentially. This increase is due to household demand and the industry sector [

2,

3,

4]. Energy is the key ingredient and accelerating factor of production. Economic progress also refers to an increase in production, which is, ultimately, the symbol of progress [

5]. Dynamic relations of energy and economic progress have widely attracted the researchers and vast literature is available in this regard. Understanding the economic progression in the context of energy has drawn the attention of the scholars to estimate, analyze, and determine the short-run and long-run associations along with causality [

6,

7]. There are contradictory views or conclusions of the literature available on energy-growth relationships. Positive, negative, and neutral views have been identified in the literature.

Available literature can be further bifurcated to four different categories on the basis of the methodology used. The first category of methodologies used traditional Vector Autoregressive (VAR) models [

8] and Granger’s causality approach with the assumptions that the data series were stationary [

8,

9,

10]. The second category of research studies emphasized that co-integration is the applicable approach to inspect the energy-growth associations, by keeping in view the non-stationarity of the variables in use. Hence, the focus was on the basis of Granger [

11] two-stage procedure, tested pairs of variables for co-integrating connections, and error correction models (ECM) to test for Granger causality [

12,

13,

14]. In the third-category literature, researchers used multivariate analysis [

15], in which restricted estimations on co-integrating associations can be checked and information on the short-run as well as an adjustment may be identified. The multivariate procedure allows for estimation of two and more than two variables in the co-integration links [

6,

7,

16,

17,

18,

19,

20,

21,

22]. Then comes the fourth and recent category, in which studies use the panel co-integration and panel-based VECM to analyze the short-run and long-run associations. These tests are more powerful tests than time-series approaches [

23,

24]. Based on the available literature, it can be established that a connection among energy usage and economic growth exists, but it is still contradictory whether energy usage is a result of, or a prerequisite for, economic growth. Causality has also been controversial in terms of positive, negative, and neutral interactions between using energy and economic growth, based on the methodology used, the country, and the time span studied. This study is another attempt in light of the above discussion to establish a clear picture of the growth-energy nexus in Pakistan.

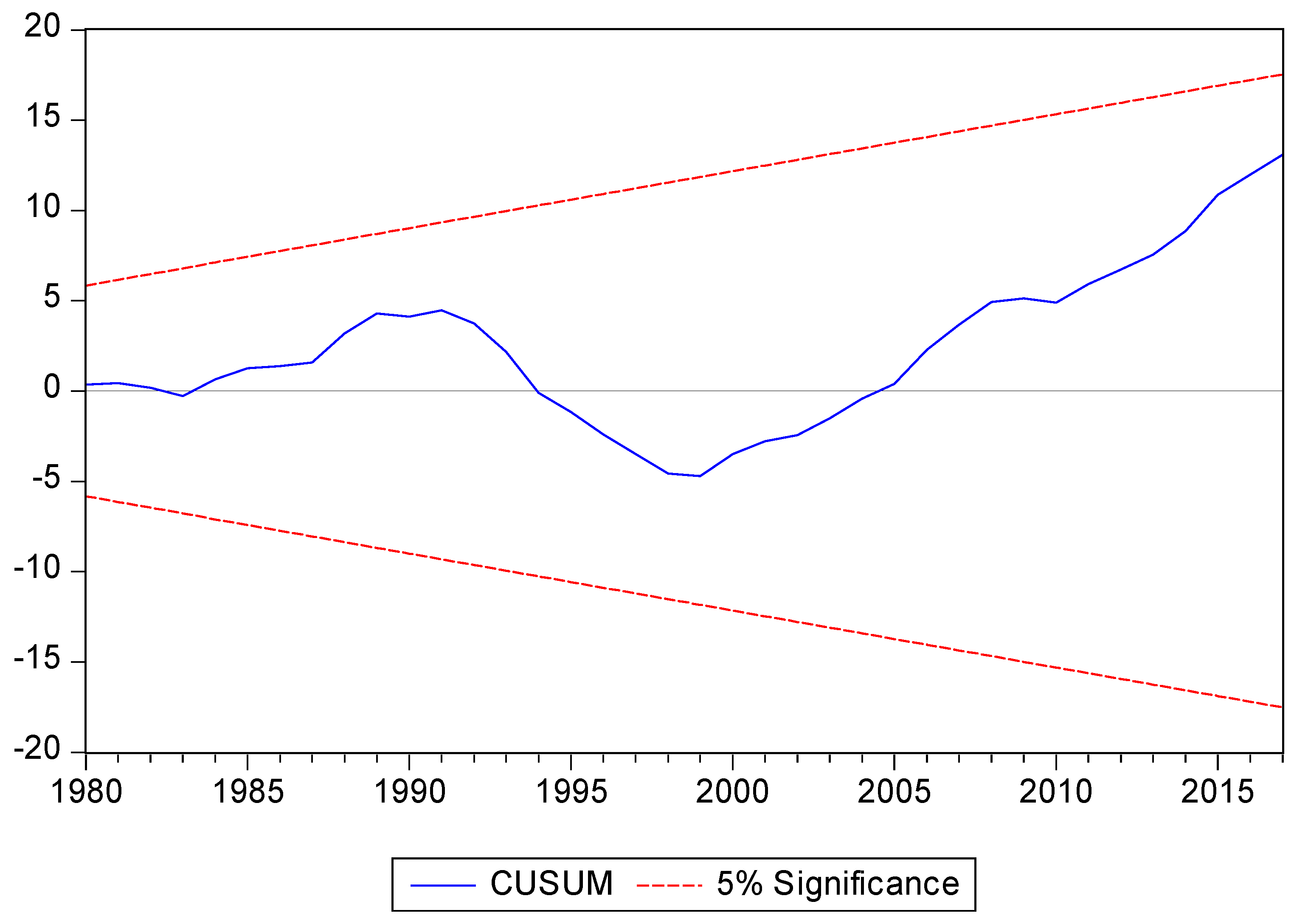

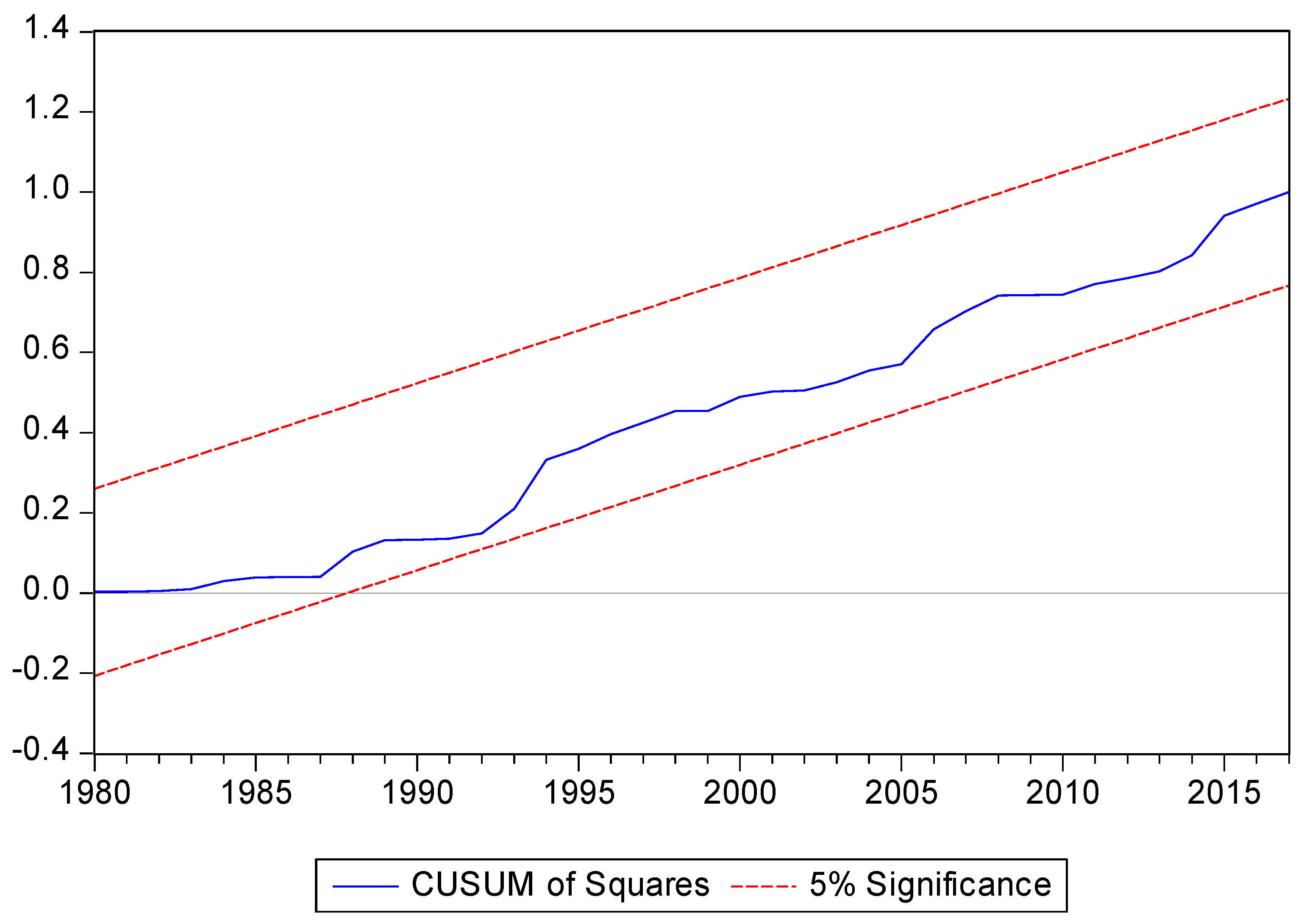

This empirical study offers a five-fold contribution to existing literature in the following ways: (1) we apply several unit root tests such as the augmented Dickey-Fuller (ADF), the Phillip-Perron (PP), and the Zivot and Andrews (Z&A) to check the order of the integration of the study variables, (2) we use annual time series data over the period from 1972–2017, (3) we employ the ARDL bounds testing approach to cointegrate and to inspect the long-run association between the variables, (4) we apply the ARDL-ECM procedure to investigate the short-run and long-run impacts of household energy consumption (electricity and gas), and population growth on economic development, and, (5) in order to check the robustness, we apply the Johansen cointegration technique, the VECM-specified Granger causality test, and the variance decomposition (VDM) method.

The organization of the remaining parts is as follows:

Section 2 presents the electricity scenario of Pakistan and

Section 3 states the literature review.

Section 4 describes data and methods. The results are discussed in

Section 5, and

Section 6 offers concluding remarks.

2. Electricity Scenario of Pakistan

Pakistan has been generating electricity from different energy sources such as hydropower, thermal, and nuclear power plants. More than 30% of electricity is generated from hydroelectric systems, 64% is generated from thermal systems, and the remaining 6% is produced through nuclear power in the country [

25]. The total population of Pakistan is 207.77 million. Out of this total, 75.58 million people live in urban areas while 132.18 million people live in rural areas.

According to the World Bank [

26] report, 80% of Pakistan’s population has access to electricity whereas 20% of the population is still lacking electricity access. Currently, the demand of electricity in the country is 25,000 MW and is projected to increase to 40,000 MW by 2030 [

27,

28,

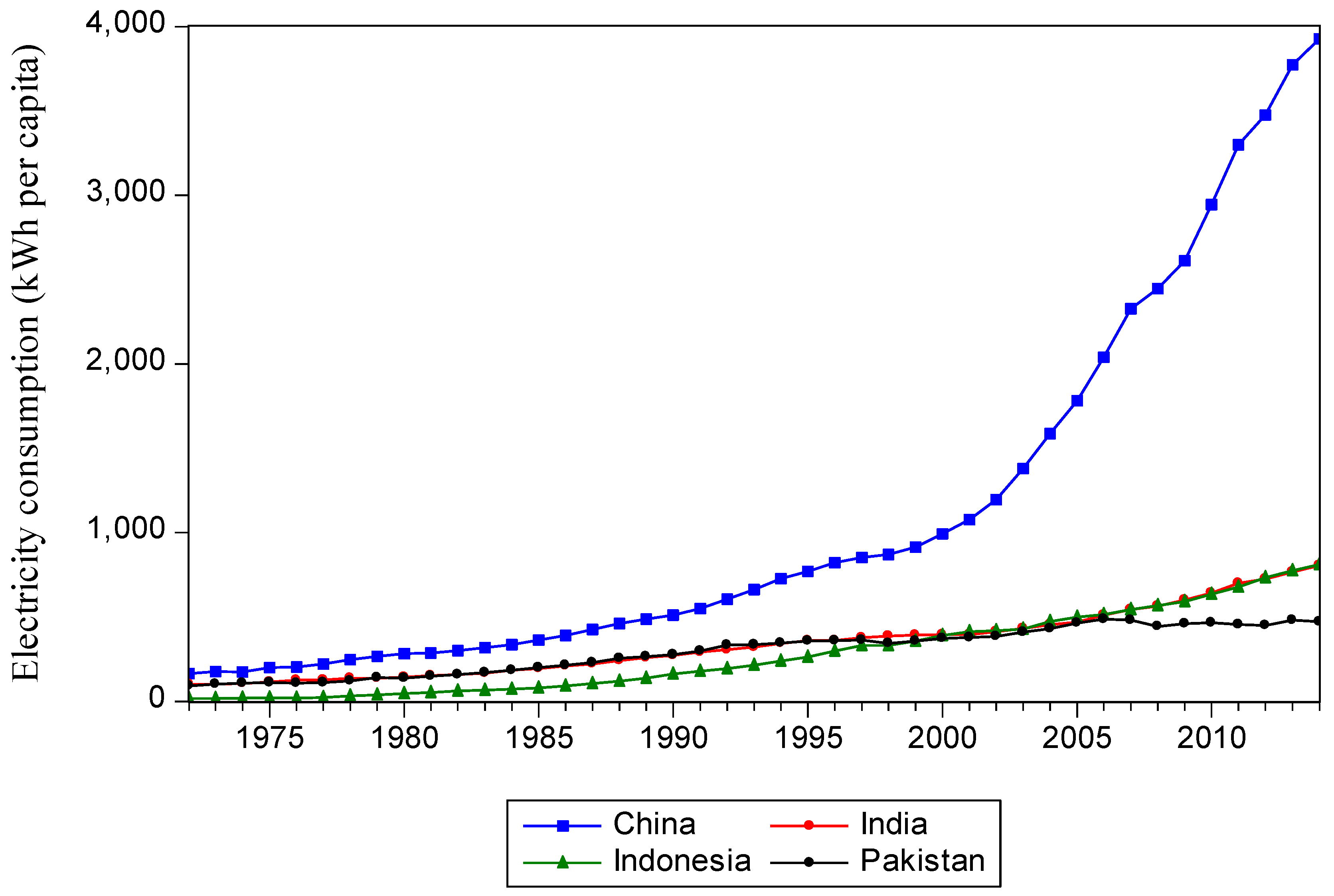

29]. Pakistan’s energy infrastructure is under developed and insufficient. For most of the economic activities, electricity is the most widely demanded and used form of energy and Pakistan is the lowest per capita electricity-consuming country in Asia (i.e.,

Figure 1).

The Economic Survey of Pakistan [

25] reported that the installed power generation capacity was 25,878 MW in 2015 and 2016.The demand of electricity has significantly increased in the country during the past few years. The reason for this increased demand is the progress of economic activities with changes in trade and investment policies. Therefore, the installed capacity and maximum power generation increased significantly from 17,498 (MW), 68,117 (GW/h) to 26,188 (MW), 117,326 (GW/h) [

25] from 2000–2001 to 2016–2017. However, the country has been struggling to meet the demand of electricity for its population.

3. Literature Review

Electricity is a major source of energy and it is a prime policy issue for sustainable expansion. The accessibility of electricity helps meet household and domestic needs, stimulates export potentials of the country to create employment, reduces poverty, and, ultimately, improves socio-economic development [

4,

30,

31,

32]. Electricity, therefore, plays a key role for the economic progression of a country, which brings much more assistance to all dynamic sectors of an economy [

2,

33]. Due to these facts, empirical research has been previously conducted to inspect the impact of electricity usage on economic development in developing and developed countries.

Kraft and Kraft [

9], in their pioneering research work, examined the relationship among consumption of electricity and economic progression. Other researchers examined this in several other countries. Several researchers [

34,

35,

36,

37,

38,

39,

40,

41,

42,

43,

44,

45,

46] have worked in several parts of the world on the effects of electricity usage and economic progression and provided mixed outcomes. Zhang [

47] aimed to identify the association between the use of energy and economic development in Russia by using time-varying methodology. The empirical findings revealed that the use of energy causes economic progression and resulting economic progression leads to energy consumption.

Damette and Seghir [

48] used panel cointegration and causality approaches to inspect the connection among energy use and economic progress in oil-exporting countries such as Brazil, Canada, Mexico, Norway, and Russia, respectively. Findings showed that economic progress has a positive influence on energy consumption. Das et al. [

49] empirically studied the relationship among use of electricity and economic progress in 45 developing countries. The study used data from the time period of 1971–2009 and applied a generalized method of the moments approach. Das et al. [

49] documented that consumption of electricity has a positive relationship with economic progression in a full panel. Further results show a positive growth electricity connection for Asia, the Pacific, and for the sub-Saharan African region. Using the ARDL model [

50], the long term link between growth and electricity consumption in Malaysia was investigated. The results confirm the long-run association of both variables, and the negative impact of energy consumption on the environment.

An investigation conducted by Narayan and Smyth [

51] applied panel cointegration, Granger causality, and long-run structural estimation to explore the association between electricity usage, economic growth, and exports for a group of Middle Eastern states. This research used data based on time series from 1974–2002. The empirical findings revealed that, for the panel as a whole, there are statistically significant feedback effects between these selected study variables. With respect to Pakistan-specific studies, Aqeel and Butt [

52] applied co-integration and Hsiao’s version of Granger causality to inspect the causal linkage between energy usage and economic progression, and employment in Pakistan, which covers the time period from 1956–1996. Their results revealed that usage of electricity leads to economic progression without feedback. Assessing the electricity access impact on economic progress for Pakistan, Reference [

30] suggested the long-run positive association among variables. Furthermore, the growth-enhancing impact of electricity access has been confirmed for the urban population. Likewise, Chaudhry et al. [

53] used annual data for the period from 1972 to 2012 and found that consumption of electricity is significantly stimulating economic development whereas the consumption of oil is adversely affecting the economic development. On a similar note, electricity production from solar energy has a significant impact on the environment and several economic benefits are also associated with this production for Pakistan [

54]. Household consumption has been increasing in Pakistan and, with this environmental problem, has also been increasing. The estimations of the demand side scenario show that efficient water heating can save more electricity than cooling. Moreover, renewable energy use in electricity production can mitigate CO

2 emission significantly [

55].

Another investigation conducted by Shahbaz and Feridun [

41] examined the association of electricity consumption and economic progression in Pakistan. The study used the data for Pakistan over the period from 1971 to 2008. Applying several techniques such as the ARDL, the Toda Yamamoto causality, and the Wald-test, the outcomes of the study reported that the two variables are in a long-run equilibrium association. In addition, economic progression leads to electricity consumption in Pakistan and not vice versa. The consumption pattern varies among households. The ultimate consumption depends on end use and household gender. The investment and strict regulations can protect the loss of electricity to promote growth in Pakistan [

4]. In Pakistan, a study conducted by Shahbaz et al. [

56] inspected the association of natural gas usage and economic development. In doing so, the study applied the ARDL procedure and the Innovative Accounting Approach (IAA). The estimated outcomes of the study reported that consumption of natural gas is positively affecting the economic progression in Pakistan.

However, there is no study that has been conducted in Pakistan to inspect the linkage between households’ consumption of energy and economic progression. This is where our study contributes to the literature. Hence, it is important and timely to explore the association of households’ energy usage and economic progression in the country by applying the technique of ARDL bounds testing and the Error Correction Model (ECM). Therefore, this study provides further evidence regarding energy and growth connection with the ARDL method. Additionally, the Granger causality and variance decomposition are used for checking the robustness of outcomes.

4. Data and Methodology

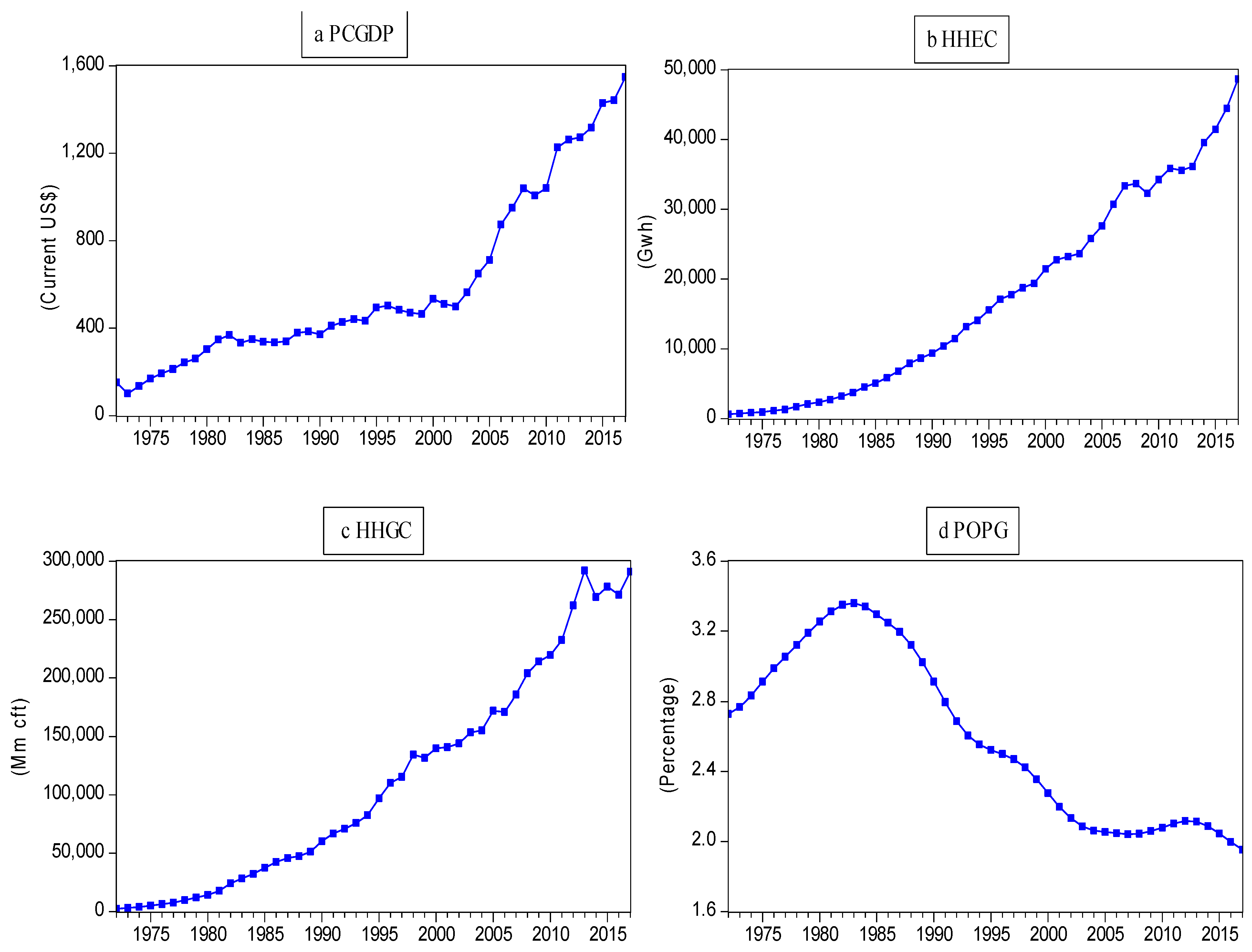

The present empirical study uses the annual time series data for Pakistan over the time span from 1972–2017 and were sourced from both international and domestic institutions, such as World Development Indicators and the Economic Survey of Pakistan [

1] (

Table 1). The GDP in per capita terms is the dependent variable, and household electricity and gas use are the main independent variables. Furthermore, the influence of population growth is also considered for GDP growth. The annual data of these variables are used for statistical estimations. The details are given in

Table 1. The GDP is taken in current US dollars. The annual growth of population is used to check the impact on the population. The data for household electricity and gas use is collected from the official website of the Pakistan government.

4.1. Model Specification

The present empirical study inspects the short-run and long-run linkage between electricity and gas consumption at households’ level, population growth, and economic progress in Pakistan. We used the multivariate regression model indicated below.

where

represents the per capita GDP in (Current US

$),

represents households electricity consumption in (Gwh),

represents households gas consumption in (mm cft), and

represents population growth as a percentage.

By applying the natural logarithm to Equation (2), a log-linear model is given by the equation below.

Equation (3) is specified for the log-linear form of the selected study variables. denotes for the natural logarithm of per capita GDP, shows the natural logarithm of households usage of electricity, stands for the natural logarithm of households’ usage of gas, represents the natural logarithm of populating growth, t denotes the time dimension, represents the error term, denotes the constant intercept, and , denotes parameters of the model to be estimated, respectively.

4.2. Unit Root Tests for Stationarity

The present empirical study examines the effects of households’ electricity and gas consumption, and population growth on economic development. Employing the unit root tests to check the stationarity among the study variables, several unit root tests including the ADF [

57], P-P [

58], DF-GLS [

59], and Ng-Perron [

60] exist in the applied economics literature. This study uses two renowned unit root methods that are ADF and P-P unit root tests to determine that none of the study variables considered is integrated of order

I(2). The ARDL method is invalidated in cases where the

I(2) variable is used [

61]. The ADF unit root test, therefore, is performed using Equation (4).

where

denotes the first difference,

t refers to the time, Z symbolizes the variables being tested for a unit root,

indicates a linear trend,

is the error term, and

denotes the achievement of white noise residuals.

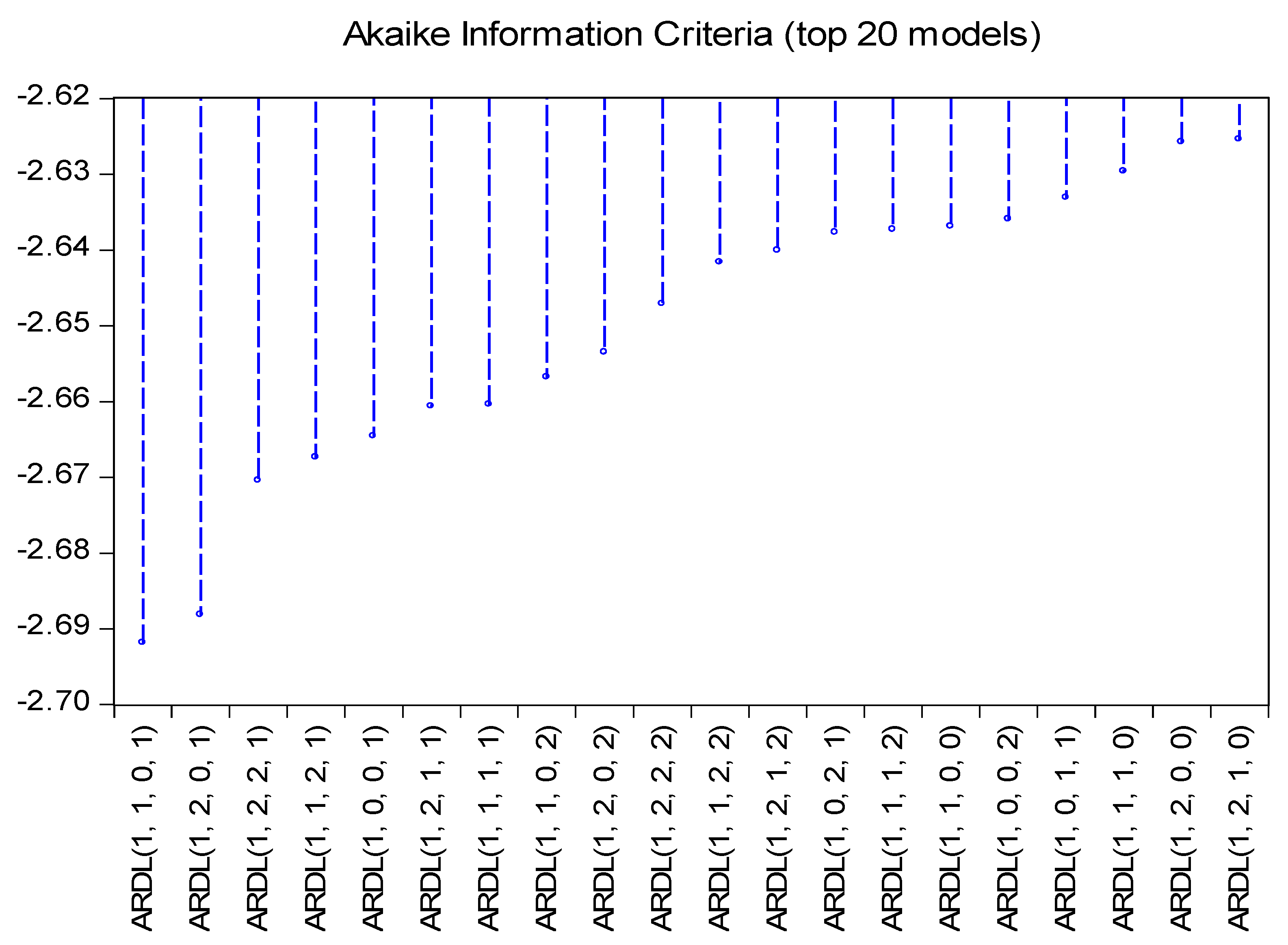

4.3. Co-Integration with the ARDL Approach

The applied economics literature provides several approaches of co-integration including J-J cointegration [

62], Phillips and Hansen [

63], Engle and Yoo [

64], and Engle and Granger [

65] in order to inspect the co-integration between electricity and gas consumption at the households’ level, the population growth, and economic progress variables. We prefer to employ the ARDL approach to avoid the criticism of employing conventional techniques of co-integration that may have serious shortcomings. It also captures short-run and long-run run linkages. The ARDL approach is very appropriate for the order of cointegration of the variables. This approach was introduced by References [

66,

67]. We may use the ARDL method to co-integrate if the study variables are stationary or integrated at the first difference

I(1) or at the level

I(0). The linkage of the long-run and short-run is inspected using the ARDL bounds testing method representation of the dynamic unrestricted error-correction model of Equation (3), as represented in Equation (5).

where

represents the constant intercept, the coefficients (

of the approach reflect the short-run linkage, and the coefficients (

denote the short-run dynamics. The next step of the present study is to calculate the F-test for comparing the (a) upper and (b) lower critical values introduced by Reference [

67], which are more appropriate for large samples. For small samples like in this study, it is suggested to use critical values introduced by Reference [

68]. The ARDL bound test will favor the presence of a long-term co-integration among the study variables. If the calculated value of the F-test is greater than the value of the upper critical bound, a long-term cointegration exists. However, if the computed value of the F-test is lower than the value of the upper critical bound, no long-term cointegration exists. However, if the computed value of the F-test is between the upper and lower bounds critical values, the outcomes of the estimation are inconclusive. This study explores the long-run elasticity and short-run adjustment parameters in Equation (5).

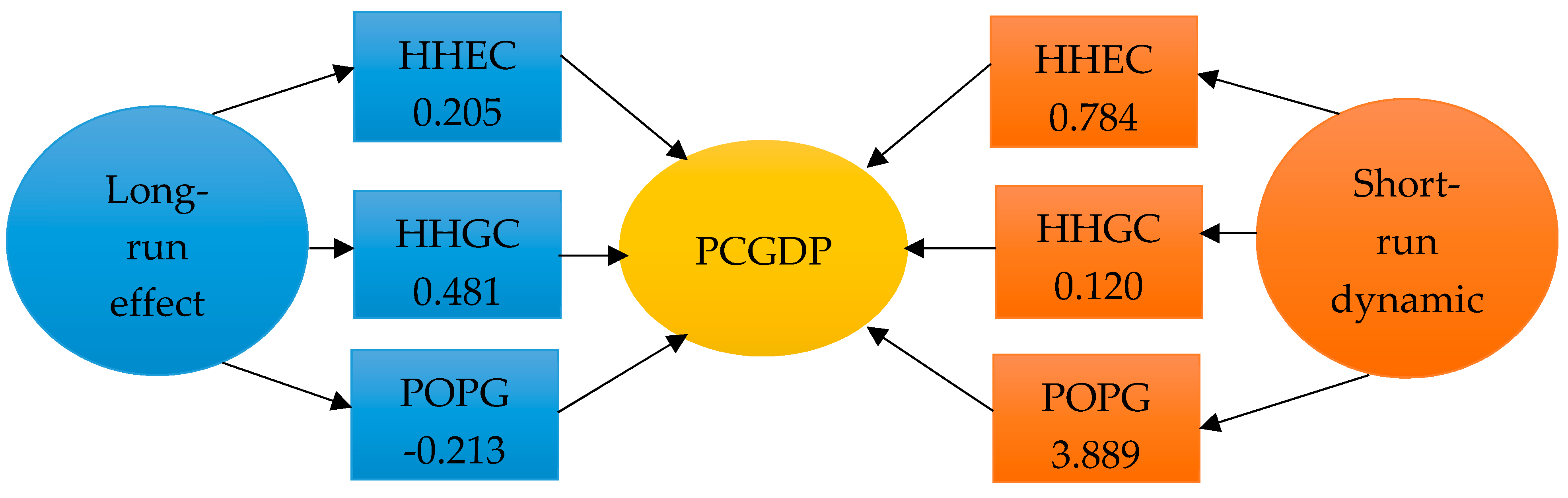

6. Conclusions

Energy plays a leading role in a country’s economic progression, and electricity plays a central role as a multi-functional form of energy. The main aim of the empirical study is to inspect the long-run and short-run connection among households’ electricity consumption, households’ gas consumption, population growth, and economic progression in Pakistan from 1972 to 2017. This empirical study applied the ARDL bounds testing for the cointegration approach as an analytical tool together with the Johansen co-integration method. The findings of the work exhibited that households’ electricity consumption and households’ gas consumption have a positive influence on economic progress in both long-run and short-run associations. However, the population growth in the long-run assessment has a negative influence while, in the short-run analysis, it has a positive influence on the economic development in Pakistan. The estimated outcomes of the VECM causality test also specify that there is a long-run connection among all variables, and a unidirectional causality from all variables to GDP growth in the short run assessment. Furthermore, the results of VDM confirm the robustness of the findings. Pakistan is a rich country in terms of energy sources including oil, coal, and gas. However, more than 20% of the population does not have access to electricity. To meet the increasing modern energy demand of its population, the government should enhance its energy policies and invest more in the energy sector to boost modern energy production. In addition, the government should place greater emphasis on producing electricity from alternative sources such as wind, solar, and nuclear power. Oil and natural gas are the country’s two main sources of energy. Economical electricity can also be generated from natural gas.