Abstract

Microfinance institutions (MFIs) have attracted great attention, due to their significant role in poverty reduction. Given the features of MFIs, this paper proposes a novel hybrid model of soft set theory, and an improved order preference by similarity to ideal solution (HMSIT) to evaluate the sustainability of MFIs, considering accounting ratios, corporate governance factors, and macro-environmental factors, from a cross-country perspective. This setting enables the examination of the role of macro-environmental factors in the sustainability of MFIs. For this purpose, soft set theory is adopted to select optimal criteria. An improved order preference by similarity to ideal solution method, in which the weight of each criterion is determined by soft set theory, is proposed to rank the sustainability of MFIs. This algorithm enables HMSIT to make full use of various types of information. The case study uses cross-country samples. Results indicate that macro-environmental factors are significant in evaluating the sustainability of MFIs from a cross-country perspective. Particularly, they can play a key role in distinguishing MFIs with low sustainability. The results also indicate that HMSIT has strong robustness. Ranked results, produced from the proposed HMSIT are reliable enough to provide some managerial suggestions for MFIs and help stakeholders make decisions.

1. Introduction

According to the recent disclosure of the World Bank, the total volume of people who are still struggling to meet basic needs was 3.4 billion in 2018, which is almost half the world’s population. This demonstrates the magnitude of the challenge of worldwide poverty reduction and the significance of work in this field [1,2]. Various strategies and tools have been proposed to address this severe and serious issue [3]. Among these strategies and tools, the microfinance institution (MFI), which distinguishes itself from traditional financial institutions, such as the commercial bank, by operating small loans to “unbankable poor people and small businesses” [4], is not only considered an effective way for the poor to manage their finances and take advantage of economic opportunities while managing risks, but also an important way to promote economic development, employment and growth, through the financial support of small businesses. The MFI has attracted tremendous interest from both practitioners and academic researchers for its significant role in poverty reduction, by bridging the gap between formal financial institutions and low-income groups or individuals [5].

In order to make full use of MFIs in poverty reduction, various MFIs have been set up all over the world since the 1970s, especially in developing countries and regions. To date, in terms of amount of customers served, the MFI is poised to become the largest banking market in the world [6]. At the same time, MFIs are also suffering from fierce competition and rapid changes in the business environment. It is hard to sustain their success into the future in an increasingly complex business climate [7,8]. Given the significant role of MFIs in poverty reduction, it is important to operate MFIs effectively and efficiently to achieve sustainable financial development. It is generally believed that it is better not to have any MFIs than to have unsustainable ones [9]. Therefore, it is important to scientifically evaluate the sustainability of MFIs in the complex business environment.

Generally, sustainability is the ability to meet the needs of the present without compromising future generations [10]. It is composed of three pillars: environmental, economic, and social [11]. However, given the features of MFIs [7,8], the definition of sustainability is a little different in the early related literature [1]. The sustainability definition of MFIs has focused on two pillars [4,5]. One is financial (economic) sustainability. This emphasizes the financial self-sufficiency of MFIs, and a reduction in reliance on donor funds [6,12]. The other is social sustainability, which focuses on social outreach. In recent years, in addition to social and financial sustainability, more and more studies have paid attention to the environmental sustainability of MFIs [13,14], analyzing the green environment performance of MFIs. A financially sustainable MFI is required, in order to achieve social and environmental sustainability [15]. Therefore, this paper focuses on evaluating the financial sustainability of MFIs. In other words, we attempt to evaluate the financial self-sufficiency of MFIs.

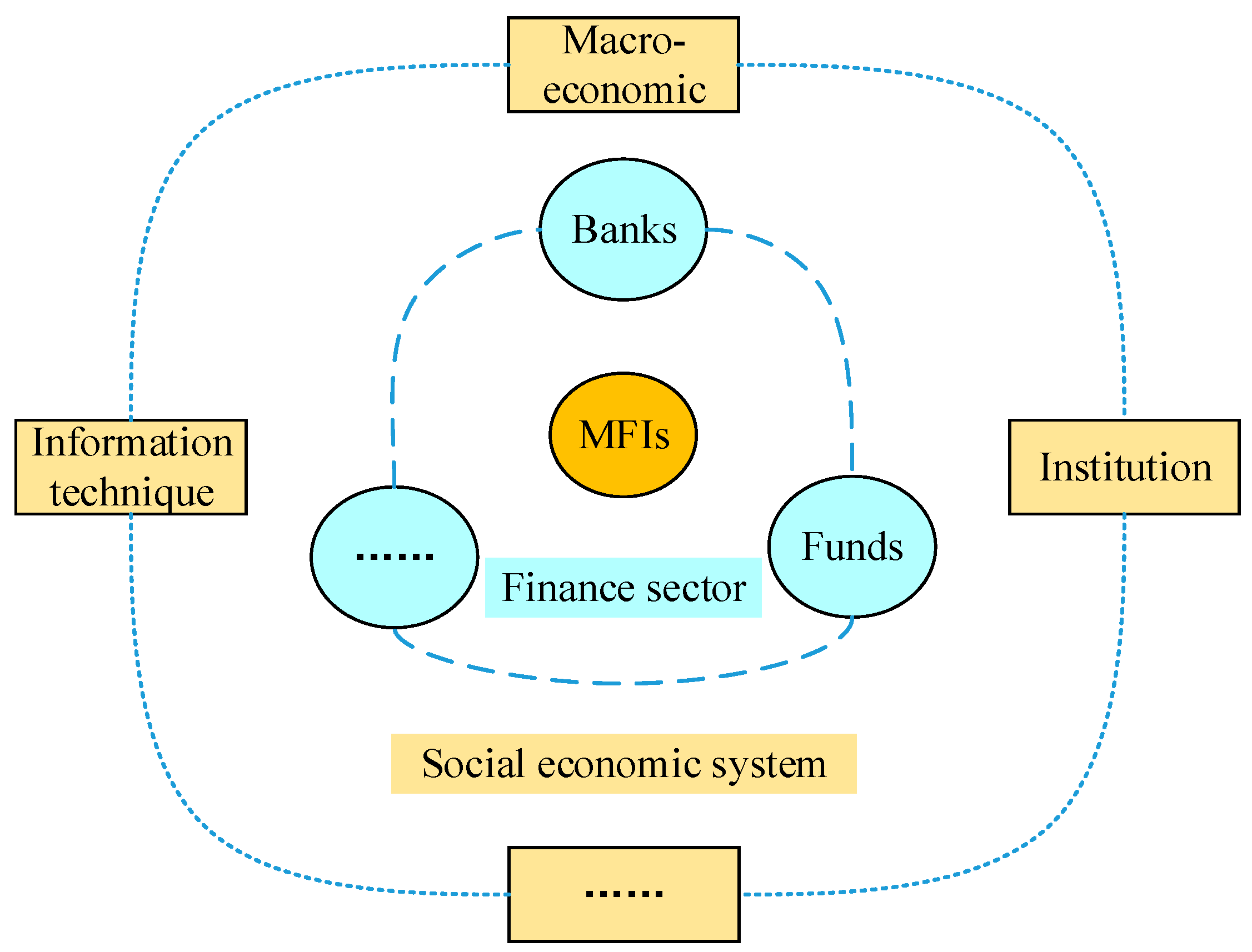

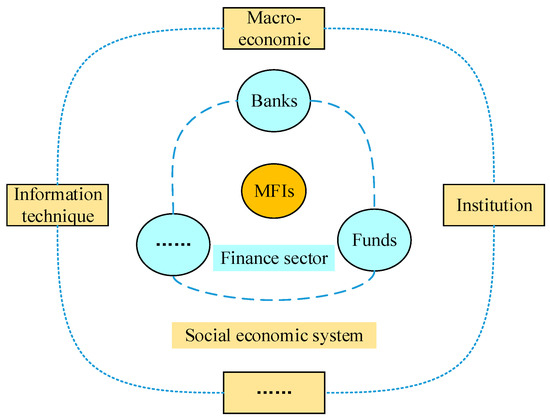

To evaluate the financial sustainability of MFIs, previous studies have adopted accounting ratios and corporate governance factors as criteria [16,17,18]. However, as well as the traditional financial system, MFIs are also a part of the social economy system [19,20], shown in Figure 1. More and more research has recognized that the performance of MFIs is not only influenced by internal factors, but also impacted by their external macro-environment, including the finance sector environment, macro-economic environment, and information technology environment [21,22,23]. Meanwhile, given the negative influence of failed MFIs, some mathematical models have been proposed for evaluating the financial sustainability of MFIs, such as the order preference by similarity to ideal solution (TOPSIS), and the data envelopment analysis operating frontiers model (DEA-OF), [16,24]. Prior studies have established a solid foundation for evaluating the financial sustainability of MFIs [25].

Figure 1.

MFIs and the social economic system.

However, to the best of our knowledge, the majority of prior studies evaluating the financial sustainability of MFIs adopted accounting ratios and corporate governance factors as criteria, in the context of one country. Macro-environmental factors have received little attention to date. There has been no study evaluating the financial sustainability of MFIs integrating this many factors as criteria, especially ones accounting for the interaction between MFIs and their external operating environment. In practical terms, this interaction includes the externality of MFIs to their environment and the influence of uncontrollable environmental factors on the financial sustainability of MFIs. It should be noted that neglect of macro-environmental factors may lead to an overestimation of the financial sustainability score of MFIs, and have implications for managerial decision making, which should contribute to effective MFI performance.

Here, we intend to fill this gap. Given the above context, it is challenging to evaluate the financial sustainability of MFIs while considering so many factors. Most evaluating models assume that criteria are independent [25]. This assumption is too great to be applicable to real situations. This paper aims to investigate the potential of constructing a cross-country financial sustainability evaluation model for MFIs. Such an analysis expands on previous studies evaluating the financial sustainability of MFIs, adding the new perspective of cross-country evaluation. We adopt a broad approach, covering more influencing factors of the financial sustainability of MFIs. Incorporating this information into the evaluation provides novel insight into how macro-environmental factors may influence the financial sustainability of MFIs. A case study is based on the cross-country samples from the microfinance information exchange market database (MIX).

Consequently, in this paper, the research questions can be summarized as follows: (1) How to evaluate the financial sustainability of MFIs from a cross-country perspective (2) Technically, how to select optimal criteria from accounting ratios, corporate governance factors, and macro-environmental factors (3) given the different features of selected criteria, how to construct a proper evaluating model from a comprehensive and applicable perspective (4) according to the case study, how to identify the operational deficiencies of MFIs and propose feasible managerial implementations in order to improve the performance of MFIs. In sum, this paper focuses on evaluating the financial sustainability of MFIs more comprehensively and applicably, from a cross-country perspective.

The remainder of this paper is arranged as follows: Section 2 reviews the pertinent literature evaluating the financial sustainability of MFIs; Section 3 provides the data, the new proposed hybrid model, and the case study, in detail; and, in Section 4, the case study results, as well as some useful discussions, are reported. Concluding remarks and possible future works are expounded on in Section 5.

2. Literature Reviews

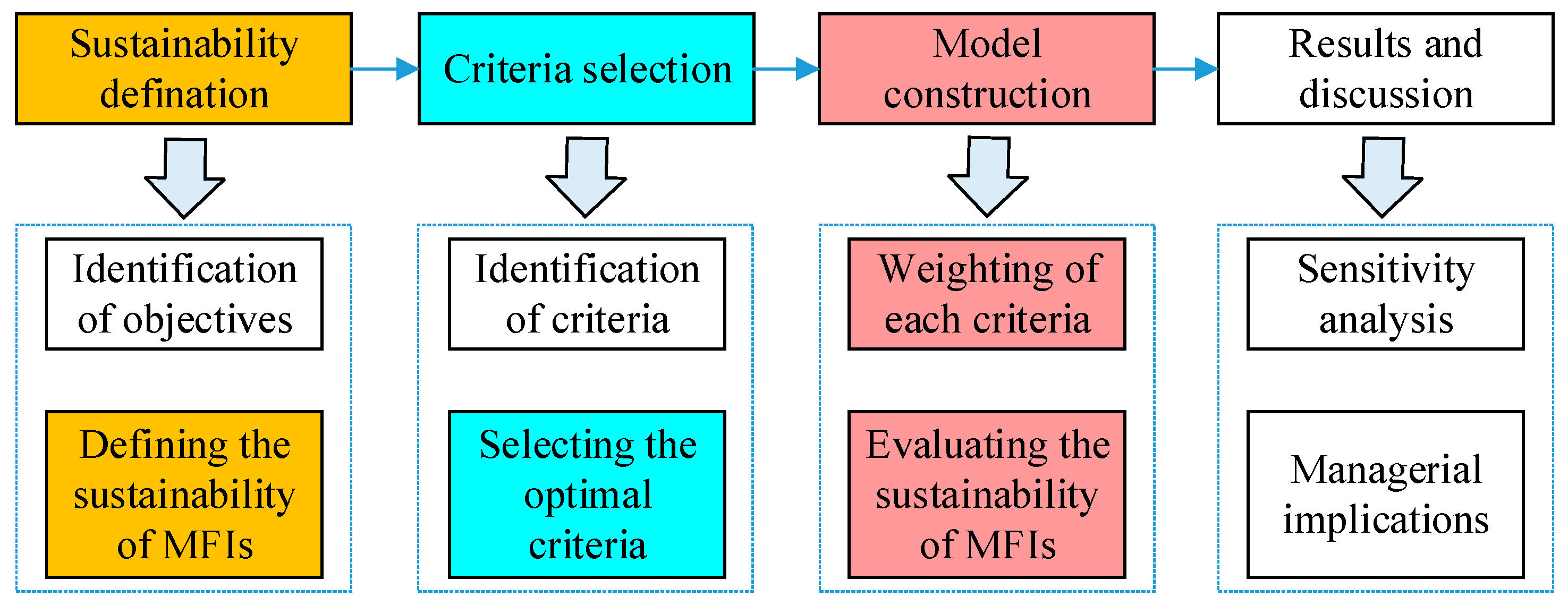

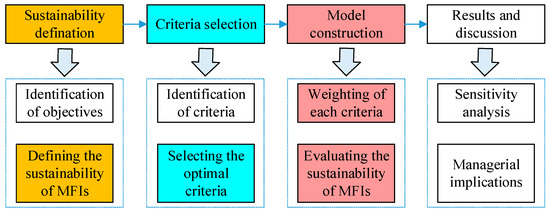

In recent decades, many researchers have evaluated the financial sustainability of MFIs [2,19]. Various criteria and mathematical models for doing so have been proposed in prior studies. According to the previous literature, there are three key points involved in evaluating the financial sustainability of MFIs: the sustainability definition of MFIs, the criteria, and the evaluating method, as shown in Figure 2.

Figure 2.

The process of evaluating the financial sustainability of MFIs.

2.1. The Sustainability Definition of MFIs

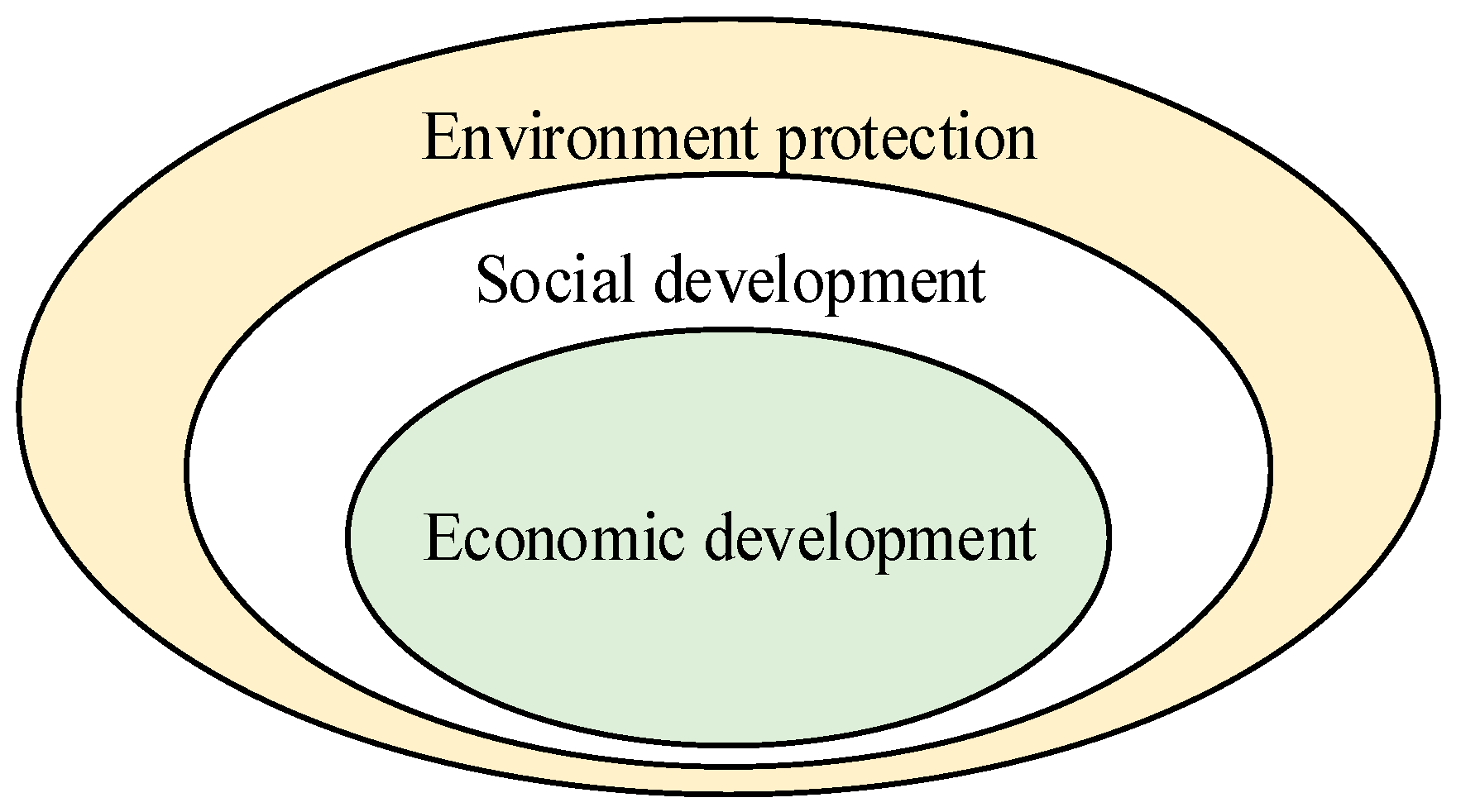

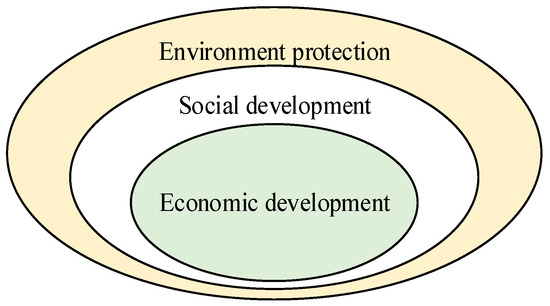

Sustainability, which is a complex, expansive and significant topic, is usually defined as the ability to exist constantly [26]. Specifically, it refers to the capacity for human civilization and the biosphere to coexist [27]. For many working in the field, sustainability is considered an objective which can strike a balance between socioeconomic activities and environmental concerns [19]. In fact, the definition of sustainability includes the following interconnected domains or pillars: environmental protection, economic development, and social development, as shown in Figure 3. This concept has been taken into consideration when evaluating socioeconomic activities from different perspectives. For example, Fu et al. [28] studied the risk–reward contract for the agri-food supply chain from the holistic sustainability perspective. The above suggests that a multifaceted perspective is needed to define sustainability.

Figure 3.

The three interconnected domains or pillars of the sustainability definition.

However, some researchers have highlighted that there can be “tension” between human activity, economic development, and protection of the natural environment. This tension can be analyzed through two perspectives: strong sustainability and weak sustainability [29]. The strong sustainability definition suggests that the substitutability of natural capital should be severely limited, whereas the weak sustainability believes that natural capital can be fully substituted. However, the concept of sustainability has slightly different meanings for different objectives [27].

Given the character of MFIs, in early studies, the sustainability definition regarding MFIs differs from the one mentioned above [1,4]. For example, Navajas et al. [30] defined the sustainability of MFIs as the permanence of ongoing financial services to “unbankable poor and small businesses”. Cull et al. [31] demonstrated that sustainable MFIs could concurrently maintain profitability and outreach. The sustainability definitions of MFIs above have focused their attention on two pillars: financial sustainability and social sustainability [4,5]. The former emphasizes the financial self-sufficiency of MFIs and the importance of reduced reliance on donor funds [6,12], the latter the social outreach of MFIs.

In recent years, in addition to social and financial sustainability, more and more studies have paid attention to the environmental sustainability of MFIs [13,14], focusing on green environment performance [32]. For example, Garcia-Perez et al. [4] analyzed the sustainability definition of MFIs from economic, social, and environmental perspectives. However, a financially sustainable MFI is required in order to realize its social and environmental sustainability [15]. Therefore, this paper focuses on evaluating the financial sustainability of MFIs. In other words, we attempt to evaluate the financial self-sufficiency of MFIs in the complex business environment.

2.2. The Sustainability Evaluation of MFIs

Through the effective sustainability evaluation, which is a tool to distinguish normal MFIs from unsustainable ones, managers and stakeholders of MFIs can obtain timely warnings of their survival risk. It has been a subject of great interest to researchers and practitioners in recent decades. Various criteria, mainly including accounting ratios and corporate governance factors, have been proposed to evaluate the financial sustainability of MFIs [16,17,18]. Little attention has been paid to macro-environmental factors when evaluating the financial sustainability of MFIs.

However, more and more researchers have recognized that the performance of MFIs is not only influenced by internal factors, but also impacted by their external macro-environment [33,34,35]. For example, Goodspeed [21] studied the impact of macro-environmental shocks on the sustainability of MFIs. Churchill [36] found that MFIs depend on a poor economy to thrive, given their informal nature. Ahlin et al. [20] also confirmed the influence of macro-economic and institutional factors on the sustainability of MFIs. Besides the macro-economic factors mentioned above, Sainz-Fernandez et al. [22] found that the development of the financial sector influences the activity of MFIs. Kauffman and Riggins [23] verified the impact of information and communication technology on the sustainability of MFIs. Zegarra and Wilson [37] found that increases in the size of MFIs can effectively promote their growth. In addition, there are many other factors, such as institution [38], capital structure [39], choice of loan methods [40], age [41], cost [42], efficiency [24], financial inclusion [43], and information technology [23].

This paper intends to fill this gap. Evaluating the financial sustainability of MFIs, considering accounting ratios, corporate governance factors, and macro-environmental factors from a cross-country perspective, is challenging. As mentioned, evaluating the financial sustainability of MFIs is complicated. To address this issue, given the character of MFIs, many models have been proposed. Bhanot and Bapat [16] applied the TOPSIS method to evaluate the financial sustainability of MFIs in India, with three accounting ratios as the criteria. The weights of the three criteria were determined by the equal weight method (EWM), or assigned subjectively, according to their order of importance. Piot-Lepetit and Nzongang [24] proposed a new data envelopment analysis operating frontiers model (DEA-OF) to evaluate the performance of MFIs. Prior studies have established a solid foundation for evaluating the financial sustainability of MFIs [25].

Although these evaluation models above are not difficult to implement, they have several shortcomings. For example, the majority of prior studies evaluating the financial sustainability of MFIs focus on adopting accounting ratios and corporate governance factors as criteria, usually in the context of one country. They do not take macro-environmental factors into consideration. It should be noted that negligence of macro-environmental factors may result in overestimating the evaluation score, and no study has addressed this issue. In addition, these models assume that selected criteria are independent [25] and ignore a comprehensive derivation of weight for each criterion, in order to evaluate the financial sustainability of MFIs. This assumption is too great to be applicable in practice, especially when considering macro-environmental factors. Therefore, this paper aims to propose a novel hybrid model of the soft set theory, and an improved TOPSIS (HMSIT), to evaluate the financial sustainability of MFIs from a cross-country perspective, using accounting ratios, corporate governance factors and macro-environmental factors as criteria. HMSIT is applied to 20 MFIs from different countries.

Compared with prior studies, the main contributions of this paper can be summarized as follows. First, this work is the pioneering study evaluating the financial sustainability of MFIs from a cross-country perspective by considering accounting ratios, corporate governance factors, and macro-environmental factors simultaneously. Second, from the applicable perspective, this paper provides a novel mathematical model (HMSIT) to help the stakeholders of MFIs evaluate the financial sustainability of MFIs in a more comprehensive manner. HMSIT can make full use of accounting ratios, corporate governance factors, and macro-environmental factors to evaluate the financial sustainability of MFIs. To date, there has been no literature reporting the proposed evaluation approach. Third, some feasible managerial implementations have been proposed, based on the cross-county case study, to improve the financial sustainability of MFIs. This paper also contributes to soft set theory, introducing a new application field.

3. Materials and Methods

3.1. Sample and Data

A case study is provided in this paper to illustrate the influence of macro-environmental factors on the financial sustainability of MFIs. The data, adopted for the case study, are mainly collected from the microfinance information exchange market database (MIX) (https://www.themix.org/mixmarket). MIX, founded in June 2002, is an important, non-political private organization, with the goal of providing the exchange information of MFIs. To date, the MIX database has collected data from about 4577 microfinance institutions around the world. The geographic distribution of MFIs is presented in Table 1. Some macro-environmental data are also used here. They are collected from the World Development Indicators of the World Bank (WB) (https://data.worldbank.org) and the Heritage Foundation (https://www.heritage.org/).

Table 1.

The distribution of MFIs collected from the MIX database.

For the case study in this paper, we needed to select some real MFIs as samples randomly. At first, we discounted MFIs according to the following principles.

- To ensure quality of data, MFIs that have not been marked with four or five stars in the MIX database are removed.

- If MFI data concerning the required criteria are not available, they are deleted.

Then, a total of 20 cross-country MFIs were randomly adopted as samples from retained MFIs for the year 2016, according to the percentage of real distribution, and marked as . Table 2 provides the detailed information of MFIs employed in this work. No MFIs from the “Oceania” region and the “Unspecified” region have been selected as samples.

Table 2.

The abbreviated information of the 20 selected MFIs.

3.2. Criteria

The selection of criteria always plays a significant role in the process of evaluating the financial sustainability of MFIs [44]. The previous literature usually adopted accounting ratios and corporate governance factors as criteria, especially accounting ratios, such as the operational self-sufficiency ratio, average loan per borrower, and cost per borrower [16,18,37]. However, the performance of MFIs may be different if the operational environment has changed. Some studies have also confirmed that the financial sustainability of MFIs is influenced by macro-environmental factors, such as macro-economics, population, institutions, and information technique [2]. These factors, proposed in the recent literature [8,21,22,36,45,46,47], are briefly listed in Table 3. are accounting ratios, are corporate governance factors. is the institution factor, and are information technique factors, are macro-economic conditions, and are financial sector conditions. Those factors are adopted as the original criteria for evaluating the financial sustainability of MFIs from a cross-country perspective in this study.

Table 3.

The main criteria and factors adopted in prior literatures.

3.3. A Novel Hybrid Model for Evaluating the Sustainability of MFIs

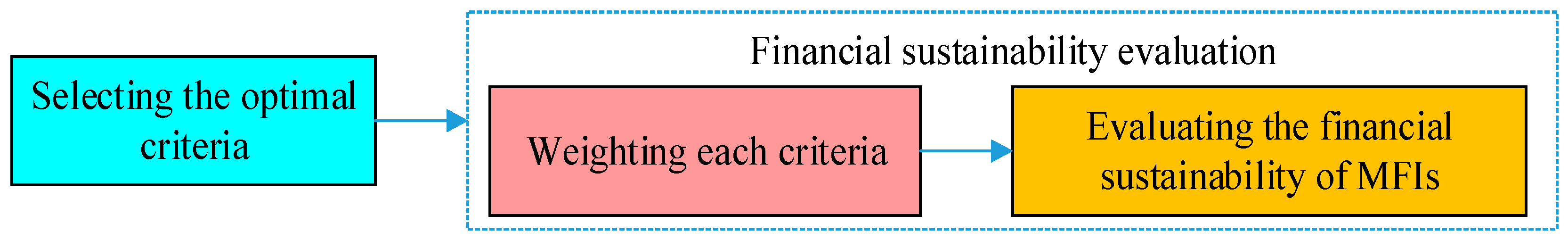

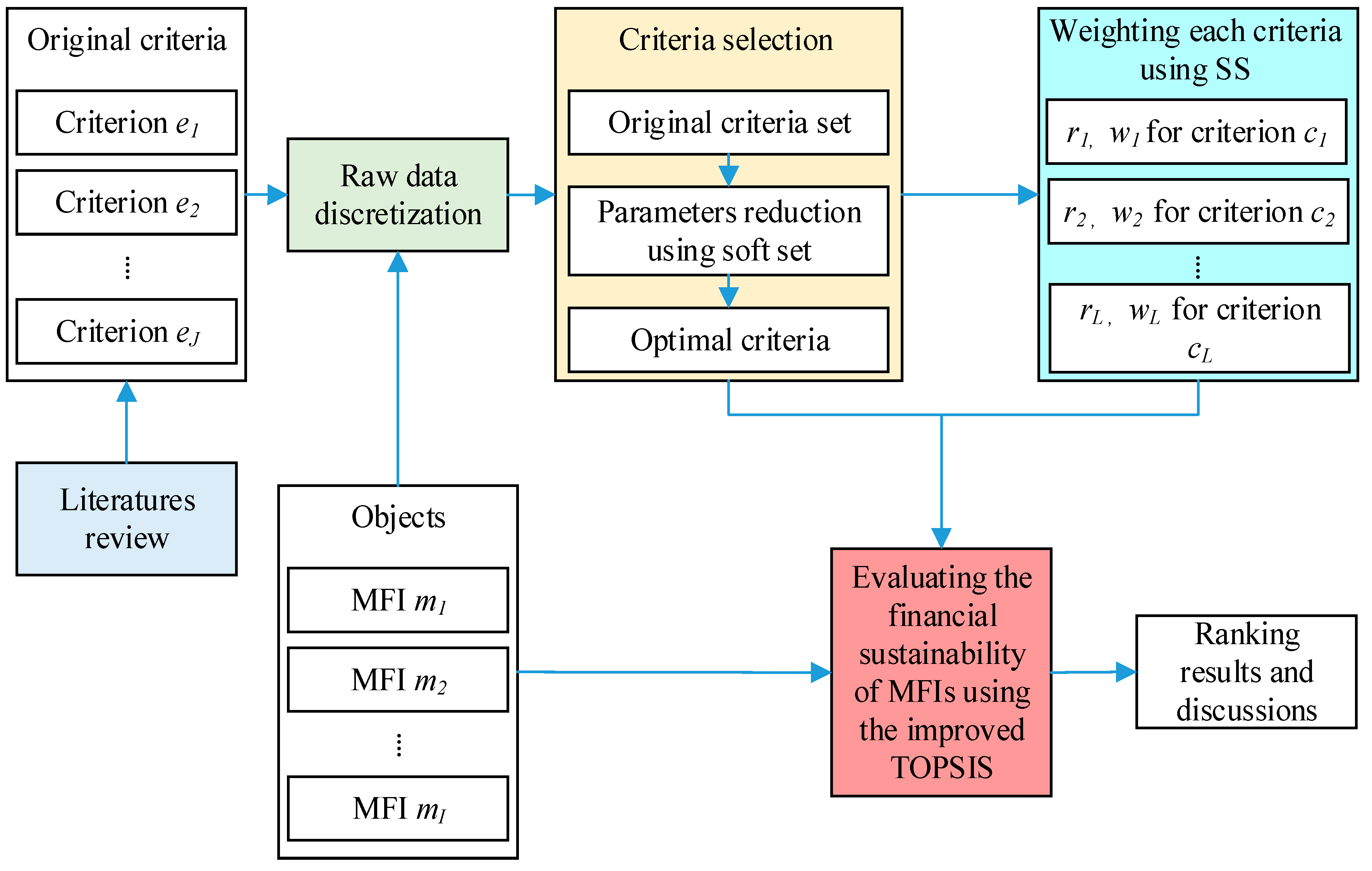

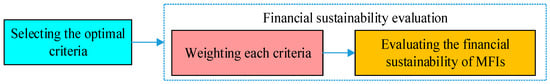

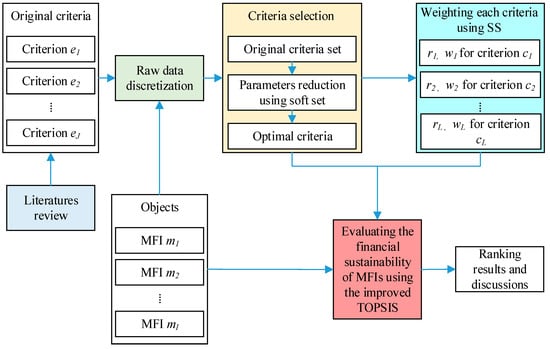

As mentioned above, it is a major challenge to evaluate the financial sustainability of MFIs whilst considering accounting ratios, corporate governance factors, and macro-environmental factors from a cross-country perspective. To address this issue, we introduce a novel hybrid model of soft set theory and an improved TOPSIS (HMSIT), to evaluate the financial sustainability of MFIs in detail. Assume that there are MFIs (), used as case study samples, and factors (), adopted as alternative criteria. To eliminate the redundant criteria, soft set theory (SS) is adopted, to select optimal criteria from alternative criteria. Subsequently, an improved TOPSIS is proposed, to rank the financial sustainability of MFIs. For the improved TOPSIS, the weight of each criterion is determined by soft set theory. The framework of HMSIT is shown in Figure 4. Details of each step are presented in the following work.

Figure 4.

The framework of the proposed HMSIT.

3.3.1. Optimal Criteria Selection Using the Soft Set Theory

Soft set theory, originated by Molodtsov [48], is a new, non-parameter mathematical approach to deal with uncertain and high-dimensional data. It has been theoretically proven to be an excellent mathematical tool for decision making and dimension reduction [49,50]. Here, we first briefly review the soft set theory, then give details about the classical reduction method of soft set theory.

In this paper, let be a non-empty universe of objects (MFIs), and be a set of parameters (criteria) to objects. A soft set over can be defined as a pair , where , and is the approximate function of soft set , . is the power set of . In other words, soft set is a parameterized family of subsets of the original universe .

Based on the above definition, many parameter reduction methods of soft set theory have been proposed to select optimal parameters under the uncertainty environment [51]. Each parameter reduction method of soft set theory has advantages and disadvantages [49]. Here, given the features of financial sustainability evaluation of MFIs, we adopt the parameter reduction method of soft set theory to select the optimal criteria from the original criteria. It can be briefly presented as follows; for details please refer to the literature of Kong et al. [51].

Specifically, suppose the universe , and the original parameter set . The soft set can be represented by a table , shown as Table 4. The soft set is represented as , , the . Obviously, . The universe can be partitioned to according to the values of , where , and any if, and only if, . In this way, objects of with the value of are divided into the same subset for the parameter set , if , which means has no effect on partition . In other words, the parameter set is dispensable and can be abandoned. is a normal reduction of if is dispensable, and the set is indispensable. The parameter set is the optimal parameter set that we need.

Table 4.

The tabular representation of soft set.

It is best to conduct parameter reduction as a jackknife (leaving one out). The algorithm of this parameter reduction method of soft set theory, shown above, can be presented as follows:

- Input the universe and the parameter set of soft set .

- Calculate the importance degree of parameter . We can measure the importance degree of by measuring the change between and , . The can be computed using Formula (1):where is the cardinality of a set and

- Find the maximal subset in , whose sum of is a nonnegative integer.

- Verify if is dispensable or not. If it is, the set is the normal parameter reduction. can be saved to the feasible parameter reduction set.

- Search for the set with the maximum cardinality in the feasible parameter reduction set.

- Calculate the set as the optimal parameter reduction.

3.3.2. Evaluating the Financial Sustainability of MFIs Using an Improved TOPSIS

Since accounting ratios, corporate governance factors, and macro-environmental factors should be adopted as criteria to evaluate the financial sustainability of MFIs from a cross-country perspective, the evaluation can be regarded as typical a multi-criteria decision making (MCDM) problem [16]. Many mathematical methods have been proposed for MCDM, such as weighted sum model, weighted product model, analytic hierarchy process method (AHP), revised AHP, elimination et choice translating reality method, and TOPSIS [52]. These models are suitable for handling MCDM problems. However, TOPSIS is one of the most well-known decision-making models, due to its advantages regarding sample size, and data distribution, etc. [53]. Therefore, given the character of MFIs, this paper proposes a novel, improved TOPSIS, by integrating soft set theory and TOPSIS to rank the financial sustainability of MFIs.

TOPSIS, developed by Ching-Lai Hwang and Yoon, in 1981, is a method of aggregation that evaluates a set of alternatives by determining the weight of each criterion, normalizing the score of each criterion and identifying the geometric distance between each alternative and the ideal alternative, which is the best score in each criterion [53]. In the traditional TOPSIS, the weight of each criterion is determined by the expert system method [54]. The expert system method relies heavily on expert knowledge and the ability to be widely employed [44,55]. To overcome the disadvantages of traditional TOPSIS, we implement a new TOPSIS approach by integrating soft set theory and traditional TOPSIS. For the new, improved TOPSIS, the expert system method is replaced by soft set theory to calculate the weight of each selected criterion. The algorithm of the improved TOPSIS approach can be carried out as follows:

- Input the universe and the parameter set of soft set . is the set of the selected criteria, with new labels.

- Calculate the importance degree of parameter using the Formula (1).

- Create the evaluation matrix based on the table of soft set .

- Create the weighted evaluation matrix , where so that .

- Determine the best alternative and the worst alternative :where is associated with criteria having positive impact, and is associated with criteria having negative impact.

- Calculate the distance between the alternative and the best alternative :and the distance between the alternative and the best alternative :

- Calculate the similarity of the alternative to the worst condition:where, . being closer to 1 means the alternative is better, and being closer to 0 means the alternative is worse.

- Rank alternatives according to the similarity .

3.3.3. The Algorithm of HMSIT

Based on the description of soft set theory and the improved TOPSIS, shown above, the algorithm of HMSIT, which is a key contribution to this work, is illustrated in Figure 5.

Figure 5.

The algorithm of HMSIT for evaluating the financial sustainability of MFIs.

- Collect influencing factors of the financial sustainability of MFIs through a review of the literature. These factors, covering accounting ratios, corporate governance factors, and macro-environmental factors, are adopted as original criteria in this paper.

- Raw data are discretized to be 0 or 1. Because soft set is developed based on the set theory, it is not suitable for continuous data. In this paper, we employ the entropy-based discretization technique (EBDT) to discretize the raw data. EBDT is one of the discretization methods using information entropy measure. Specifically, entropy is employed to evaluate the candidate cut points, which are treated as boundaries for discretization. For details, please refer to the literature [56].

- Select the optimal criteria from the original criteria, using the parameter reduction method of soft set theory.

- Recalculate the importance degree of each selected criterion () using the Formula (1). Here, we can obtain the weight of each selected criterion .

- Calculate the similarity score of alternatives to the worst condition, using the improved TOPSIS method, with the weights determined by soft set.

- Rank MFIs according to the similarity, calculated using the Formula (8).

In this way, HMSIT integrates soft set theory and the improved TOPSIS, and inherits the advantages, and avoids the disadvantages, of two methods simultaneously. We hope for an excellent HMSIT performance when evaluating the financial sustainability of MFIs from a cross-country perspective.

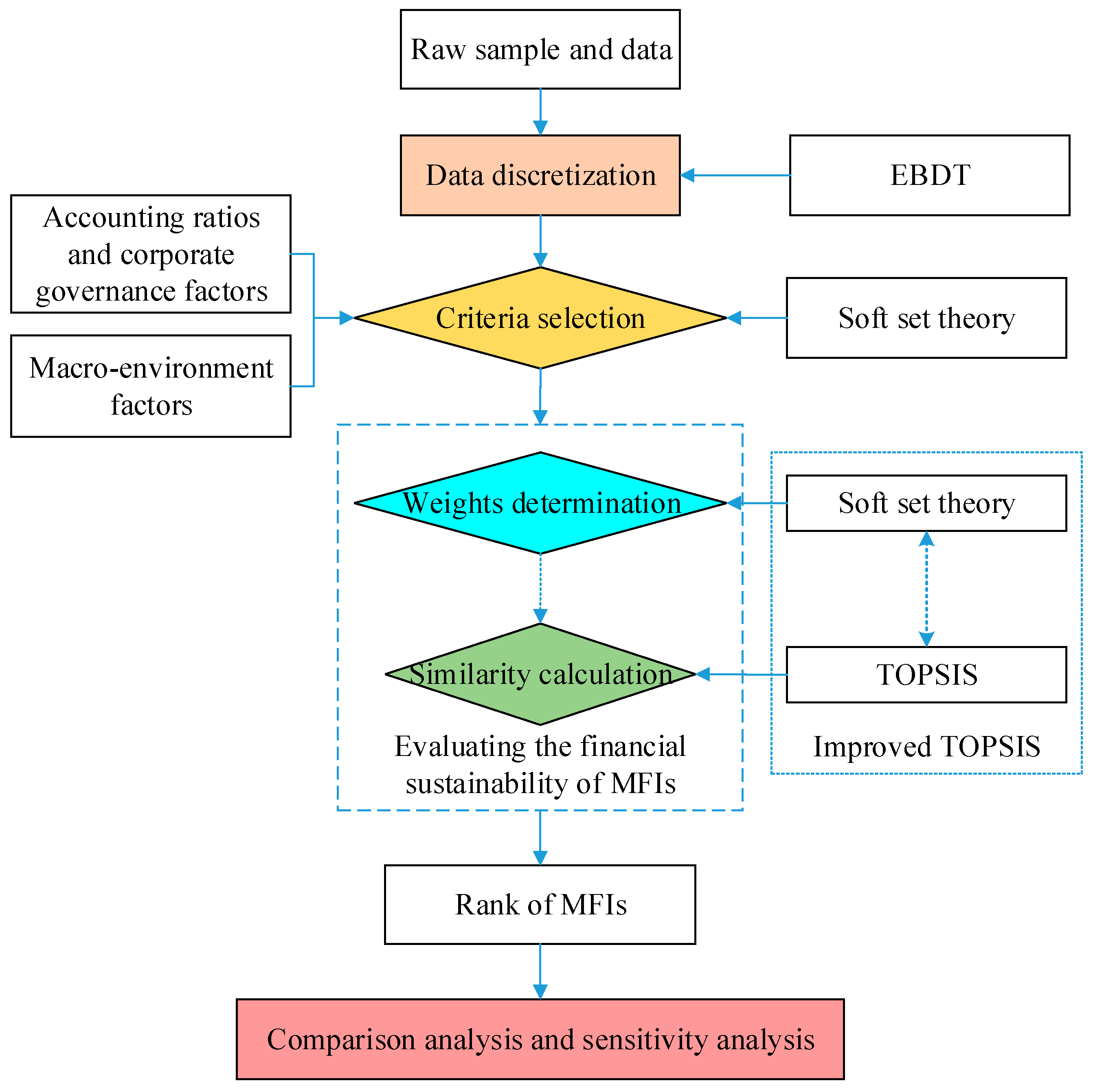

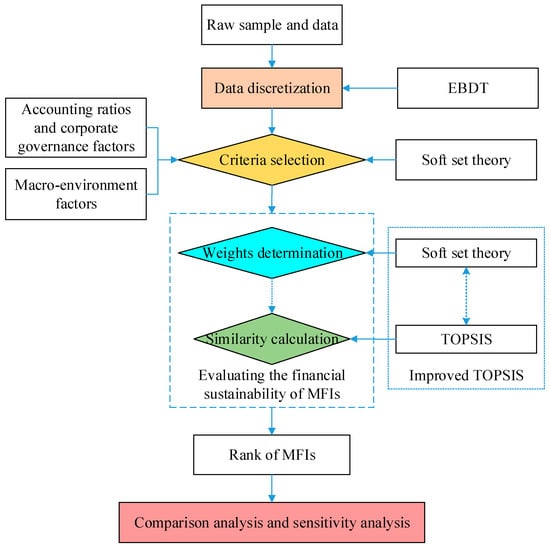

3.4. Framework of the Case Study

To investigate the efficiency of the proposed HMSIT, when evaluating the financial sustainability of MFIs from a cross-country perspective, a case study with 20 MFIs is conducted. The framework of the case study is shown in Figure 6. Details are illustrated in the following.

Figure 6.

The framework of the case study.

- Discretization of raw data using EBDT. Then, the raw sample and data can be converted to the tabular presentation of soft set.

- Criteria selection and reduction for evaluating the financial sustainability of MFIs, using the parameter reduction method of soft set theory from accounting ratios, corporate governance factors, and macro-environmental factors.

- Determination of the weight of each criterion, using soft set. This is the key innovation of the improved TOPSIS approach.

- Calculations of the similarity of MFIs, using the improved TOPSIS.

- Ranking of MFIs according to the similarity.

- Comparison analysis. To investigate the influence of macro-environmental criteria on evaluating the financial sustainability of MFIs, we make a comparison between the ranked results with all criteria, and the ranked results, without the external criteria.

- Sensitivity analysis. The sensitivity analysis is conducted to verify the stability of the novel HMSIT.

4. Results and Discussion

In this section, we display the case study results, as well as some useful discussions. In accordance with the two important issues that are addressed, this section is divided into two subsections. In the first subsection, we present the case study results, followed by some discussion, and the marginal implications on the results of comparison and sensitivity analysis. This work is executed with the Matlab software (2016b).

4.1. Results

4.1.1. Results with All Selected Criteria

Since accounting ratios, corporate governance factors, and macro-environmental factors are adopted as criteria when evaluating the financial sustainability of MFIs from a cross-country perspective, the number of criteria is too huge to evaluate efficiently. We adopt the parameter reduction approach of soft set theory to select the optimal criteria, from influencing factors of the MFIs listed in Table 3. At last, seven factors, marked as , are selected as the optimal criteria for evaluating the financial sustainability of MFIs, shown in Table 5.

Table 5.

Optimal criteria for evaluating the financial sustainability of MFIs.

Then, based on Table 5, using the Formulas (1) and (3), we can obtain the importance degree (), and also get the weight () of each selected criteria for evaluation of the financial sustainability of MFIs from a cross-country perspective. The importance degree and weights are listed in Table 6.

Table 6.

The importance degree and weight of selected criteria.

Using the improved TOPSIS, the similarity () of the financial sustainability of MFIs are calculated through Formula (8). The ranked results, determined by the similarity scores, are shown in Table 7. According to the final case study result, we can clearly observe the similarity scores of each MFI, and their ranking.

Table 7.

The similarity scores and the ranked results of MFIs.

4.1.2. Results without Macro-Environmental Criteria

To verify the influence of macro-environmental factors when evaluating the financial sustainability of MFIs from a cross-country perspective, according to the prior literature [16,24], we conduct the case study again, but with the accounting ratios and corporate governance factors only. First, we use the parameter reduction method of soft set theory to select optimal criteria for evaluating the financial sustainability of MFIs from listed in Table 3. Their weights are allocated by soft set theory, through Formulas (1) and (3). Both are shown in Table 8.

Table 8.

The new importance degree and weight of selected criteria, without macro-environmental factors.

Then, the ranked results of the financial sustainability of MFIs are listed in Table 9, according to the similarity score of the improved TOPSIS.

Table 9.

New similarity scores and the ranked results of MFIs, without macro-environmental factors.

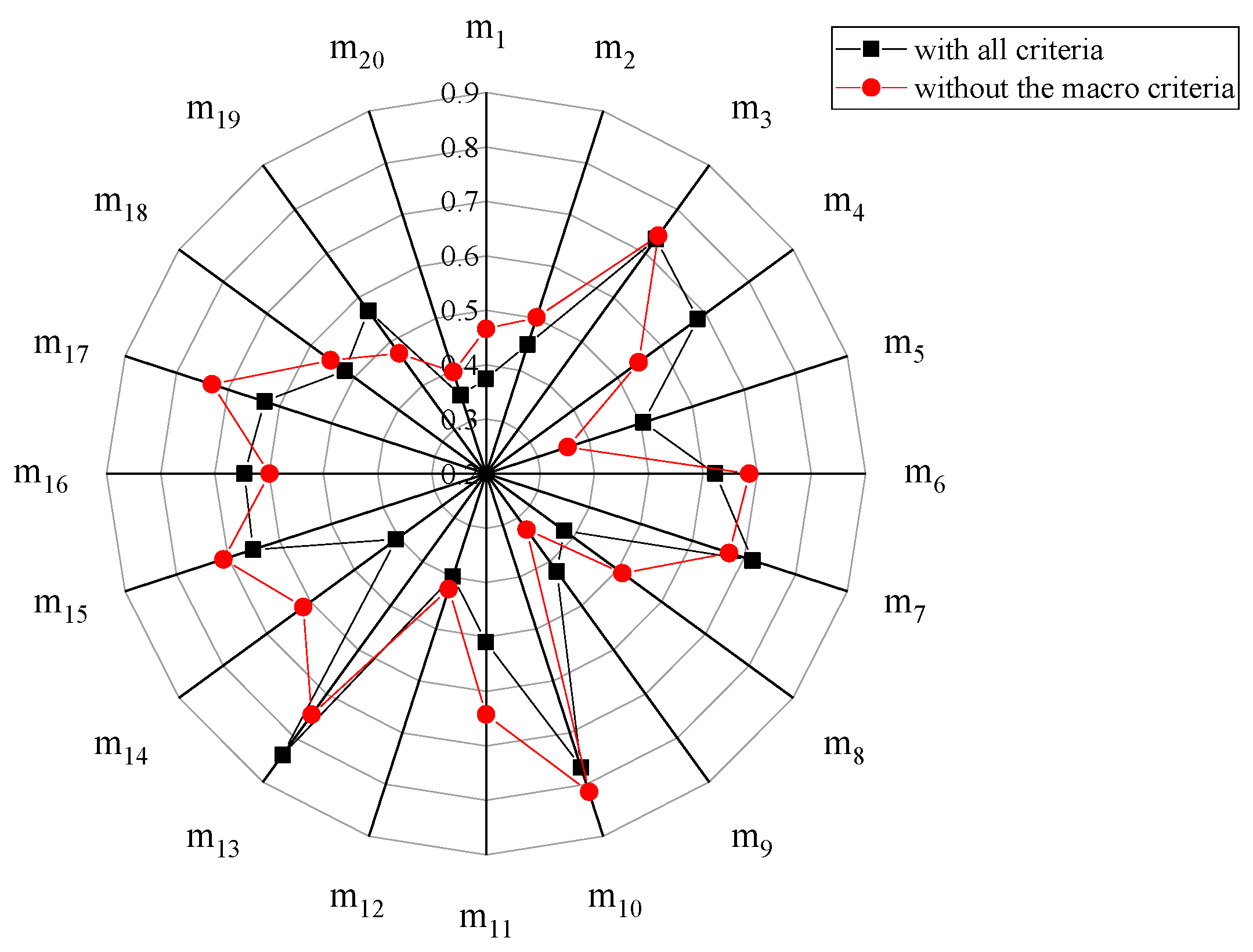

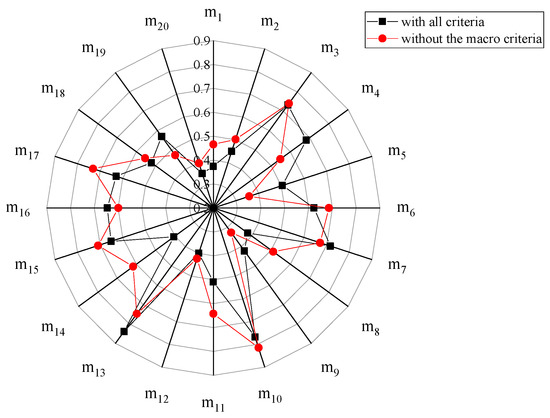

4.1.3. Comparison Analysis Results

In order to observe the influence of macro-environmental factors on the financial sustainability of MFIs, we conduct a comparison analysis between the ranked results with all selected criteria and the ranked results without macro-environmental factors. Based on Table 7 and Table 9, a radar chart is employed to clearly present the changes in evaluation results when macro-environmental factors are included as criteria.

In Figure 7, the red line and the black line does not overlap. This means that the ranked results of MFIs are different when macro-environmental factors are excluded from the proposed criteria. In other words, macro-environmental factors can provide extra information when evaluating the financial sustainability of MFIs from a cross-country perspective. It can be treated as a complement to traditional accounting ratios and corporate governance factors. Incorporating such macro-environmental information into the evaluation, especially the interaction between the externality of MFIs and the external environment, and the influence of uncontrollable environmental factors on the financial sustainability of MFIs, provides much more comprehensive information for evaluating the sustainability of MFIs.

Figure 7.

Results of the comparison analysis.

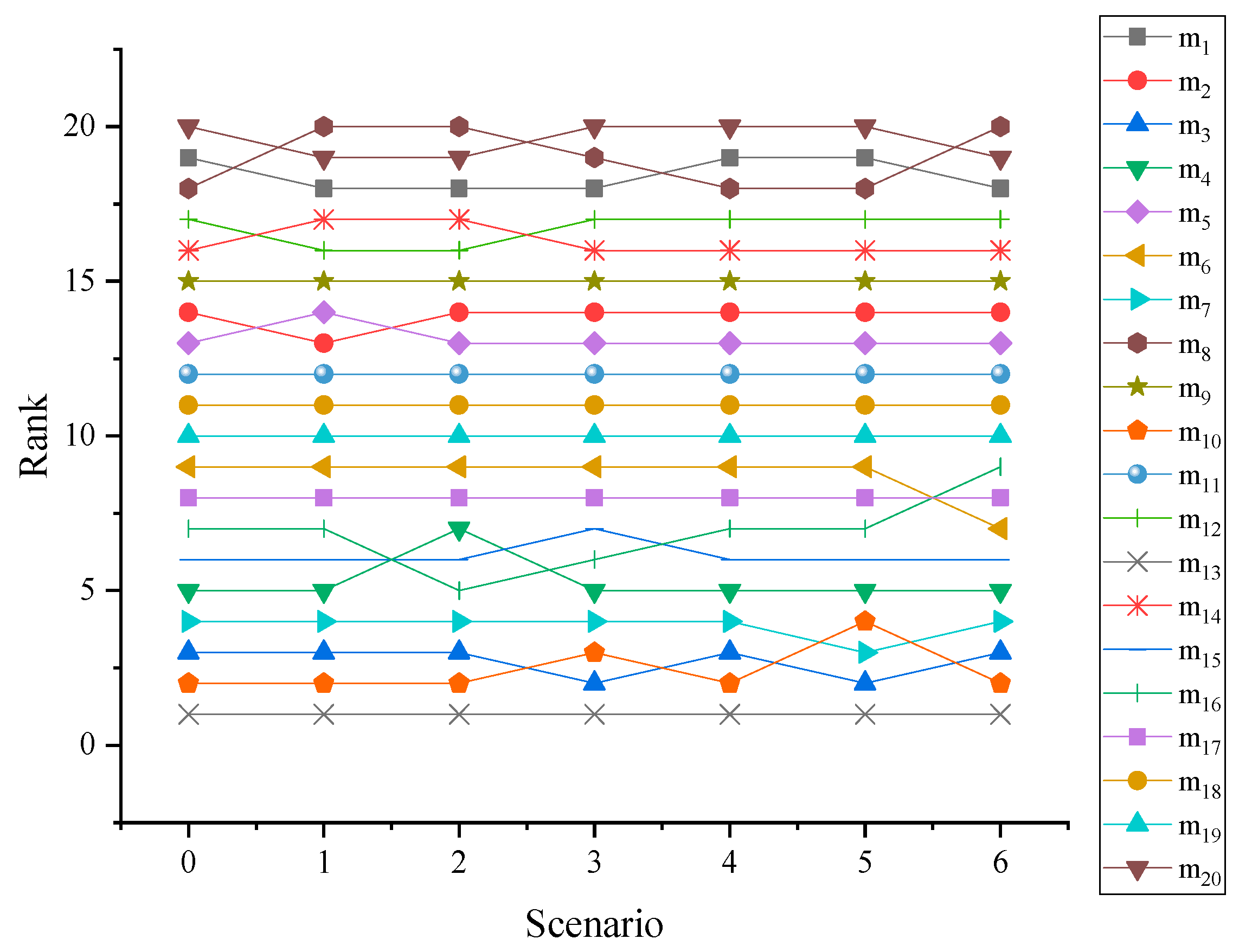

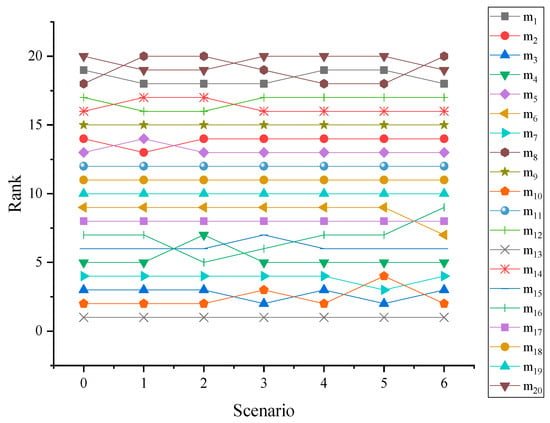

4.1.4. Sensitivity Analysis Results

To verify the stability of HMSIT when evaluating the financial sustainability of MFIs from a cross-country perspective, a number of sensitivity analyses are conducted in this subsection. According to Wang et al. [57], the modified weight of each criterion can be calculated through:

where is the new weight of , () is the changing ratio of the original weight . Six scenarios are presented in Table 10.

Table 10.

Six scenarios of the weights.

Then, with the improved TOPSIS, the similarity of MFIs can be calculated. The similarity and ranked results are listed in Table 11. It is easy to find out that the proposed HMSIT model is stable when evaluating the financial sustainability of MFIs from a cross-country perspective. The HMSIT can be widely adopted, to make decisions in many different fields.

Table 11.

The similarity and ranked results of MFIs for six scenarios.

4.2. Discussions

4.2.1. Analyses of the Optimal Criteria

As mentioned above, choice of criteria plays a significant role in evaluating the financial sustainability of MFIs. From Table 6, it is easy to find out that weight of the criterion (operational self-sufficiency ratio) is the biggest, 0.203. In other words, the criterion has the most information for determining the financial sustainability of MFIs. This is why the prior literature used to adopt this criterion to measure the financial sustainability of MFIs [2,19]. (profit orientation) has the second biggest weight value, 0.176. This explains why an increasing number of profit-oriented MFIs have been developed in recent years. The weight of the criterion (regulate state) is the third biggest, 0.162. This means that effective regulation of MFIs by the government or other authorities is beneficial in improving their financial sustainability. This result is of great significance for the future development of MFIs. The Chinese practice has also clearly demonstrated that an under-regulated MFI can play a more significant role in poverty reduction.

Besides, , , and also play a significant role in measuring the financial sustainability of MFIs. The criterion (portfolio at risk), which is the load structure of MFIs, decides the quality of assets. Many previous studies have presented the negative relationship between and the financial sustainability of MFIs [47]. (index of economic freedom) not only impacts the financial innovation and business of MFIs, but also influences the development of their clients. Generally, high economic freedom is beneficial to the financial sustainability of MFIs. The bigger the criterion (depth of credit information index), the greater the financial sustainability of MFIs. For most financial institutions, assessing the default probability of their clients is key when reducing their non-performing assets. For MFIs, if available credit information is greater, the probability of suffering loss is smaller. However, it is noticeable that the criterion (scale) ranked at the bottom. This demonstrates a big difference between MFIs and the traditional commercial bank [16].

4.2.2. Comments on the Comparison Results

From the results displayed in Table 7 and Table 9, it can be concluded that macro-environmental factors are useful in evaluating the financial sustainability of MFIs from a cross-country perspective. The ranking of MFIs is quite different when macro-environmental factors are excluded from the proposed criteria, as shown in Figure 7. Therefore, it can be concluded that not only accounting ratios and corporate governance factors, but also macro-environmental factors, should be considered as criteria when the financial sustainability of MFIs is evaluated. In fact, macro-environmental factors can provide information that the accounting ratios and corporate governance factors do not have, especially taking into account the interaction between MFIs and their external operating environment. It should be noted that MFIs may change when their operational environment is different. This becomes particularly important when evaluating the financial sustainability of MFIs in a cross-country context.

Specifically, from Table 7 and Table 9, and Figure 7, it is clear that the ranked results, excepting the top three, are different if macro-environmental factors are not taken into consideration. This demonstrates that macro-environmental factors play a significant role in distinguishing the MFIs with low financial sustainability. This is because the management of MFIs with low financial sustainability do not always have an advantage when coping with changes in the complex business environment. In other words, those MFIs are not good at making full use of environmental opportunities and dealing with environmental threats. Meanwhile the macro-environmental factors are useless in distinguishing MFIs with high financial sustainability. This conclusion coincides with our comparison results, which suggests that, whether or not macro-environmental factors are adopted for evaluating the financial sustainability of MFIs, the three highest ranked results are always , and . This is normal, because MFIs with high financial sustainability usually have excellent operational teams. Their managers and other employers can respond effectively to changes in the complex business environment.

In summary, prior studies mainly emphasized adopting accounting ratios and corporate governance factors as criteria when evaluating the financial sustainability of MFIs [16,17,18]. This may be suitable in the context of one country, because the business environment is almost the same for all the MFIs included. However, this is not the case when we evaluate the financial sustainability of MFIs from a cross-country perspective. The business environment is different for MFIs in different countries or regions. To complement to the previous literature, this paper finds that the macro-environmental factors of MFIs should be considered as a significant component of the criteria for evaluating the financial sustainability of MFIs from a cross-country perspective, especially when the operational level and management level of MFIs are different. Furthermore, in practice, MFIs should pay close attention to improving the ability of their operation teams. It is important to realize the positive impact of MFIs on poverty reduction and social development.

4.2.3. Discussions on the Sensitive Analysis

To verify the stability of HMSIT, the sensitivity analysis is adopted. In order to give readers a clear visual sense of the change in ranked results, with respect to small changes in the criteria, we plot Figure 8, based on the data of Table 11. Scenario 0 is the first column of Table 11, scenario 1 is the second column of Table 11, scenario 2 is the third column of Table 11, and so on.

Figure 8.

Results of the sensitive analysis.

From Table 11 and Figure 8, it is obvious that the ranked results of MFIs are dominated by the original ranking sequence (Scenario 0). The ranked results remain the same, unless the value of each criterion in one scenario changes significantly. The sensitive analysis results suggest that the proposed HMSIT approach is sufficient for evaluating the financial sustainability of MFIs from a cross-country perspective. , and are always in the top three MFIs. HMSIT is stable enough to provide some managerial implementations for MFIs and help stakeholders make decisions. Differing from prior related studies, HMSIT can evaluate the financial sustainability of MFIs from a cross-country perspective, by integrating accounting ratios, corporate governance factors, and macro-environmental factors simultaneously. Hence, in practice, the HMSIT can not only be applied to evaluate the financial sustainability of MFIs in a complex environment, but can also be widely adopted to drive decision making in many different fields.

4.2.4. Managerial Implementations

According to the above case study results, we suggest some specific managerial implementations to improve the financial sustainability of MFIs, as follows.

First, MFIs can learn their weaknesses, strengths, opportunities, and threats through the financial sustainability evaluation, and can also recognize the gap between themselves and the best MFIs. Therefore, they should establish or optimize the financial sustainability management system for MFIs. Relevant departments of MFIs need to be improved, and the rules need to be clarified. Moreover, the rules should be executed with especial supervision, and should be improved in a timely manner. MFIs can also improve their financial sustainability by improving the abilities of their operation teams. By doing this, MFIs can make use of environmental opportunities and better resolve environmental threats. The case study results also demonstrated that financial sustainability could be improved if the MFI focuses on its operational self-sufficiency ratio and becomes a profit-orientated organization. Furthermore, the MFI can improve its financial sustainability through other methods, such as the human resource revolution, and application of the big data technique.

Second, governmental administrative departments need to establish a special organization to regulate MFIs and regularly evaluate the financial sustainability of MFIs. In this way, the government can know recent developments regarding MFIs, and adopt efficient measures to promote the financial sustainability of MFIs. For example, the government can provide preferential treatment for MFIs with high financial sustainability, such as financial subsidies or rewards, while the government should uncover the reasons for, and weaknesses and threats of, MFIs with low financial sustainability, so that pertinent preventive measures can be adopted, such as special education and supervision. The government should focus on developing economic freedom, particularly by promoting the financial innovation of MFIs and encouraging self-employment of impoverished people. Moreover, the government can also promote the financial sustainability of MFIs by constructing a sound credit system.

Third, for donators to and stockholders of MFIs worldwide, the ranking of MFIs, according to the similarity score of HMSIT, is important in order to discover which MFIs are most suitable to donate to and cooperate with. In this way, more impoverished people and small businesses can obtain help with depletable resources.

5. Conclusion and Future Research

The significant role of MFIs in poverty reduction has led to extensive research on their financial sustainability. Prior studies have focused on the adoption of accounting ratios and corporate governance factors as criteria to evaluate the financial sustainability of MFIs. However, as an economic subject, the financial sustainability of MFIs is not only influenced by internal factors, but also by their operational environment. It should be noted that the neglect of macro-environmental factors may lead to an overestimation of the financial sustainability of MFIs, and result in misleading managerial implementations, which should contribute to the performance of MFIs. Given the above context, it is appropriate to evaluate the financial sustainability of MFIs from a cross-country perspective. To the best of our knowledge, there has been no study to date which evaluates the financial sustainability of MFIs from a cross-country perspective, by integrating accounting ratios, corporate governance factors, and macro-environmental factors as criteria, especially focusing on the interaction between MFIs and the exogenous environment.

Using this framework, the main aim of this paper is to investigate the potential to construct a financial sustainability evaluation model for MFIs from a cross-country perspective. Such an analysis extends prior studies evaluating the financial sustainability of MFIs, adding a new cross-country perspective. Furthermore, it adopts a broad approach, covering many influencing factors on the financial sustainability of MFIs, instead of focusing only on accounting ratios and corporate governance factors. The cross-country focus enables the examination of the role of macro-environmental factors. Incorporating such information into the evaluation provides novel insights on how macro-environmental factors may influence the financial sustainability of MFIs. To address this issue, we also extend the research on MFIs by proposing a novel hybrid model of soft set theory and an improved TOPSIS (HMSIT). Soft set theory is adopted to select optimal criteria. The improved TOPSIS is proposed to evaluate and rank MFIs. For the improved TOPSIS, the weight of each criterion is allocated by soft set theory. This algorithm enables HMSIT to make full use of accounting ratios, corporate governance factors, and macro-environmental factors. The case study is based on the cross-country samples of 20 MFIs from the MIX.

Case study results indicate that macro-environmental factors are significant when evaluating the financial sustainability of MFIs from a cross-country perspective. Notably, macro-environmental factors can play a key role in distinguishing MFIs with low financial sustainability. The results also indicate that the proposed HMSIT has a strong robustness. The ranked results produced from the proposed HMSIT are reliable enough to provide managerial suggestions for MFIs and help stakeholders make decisions.

Though the case study result is satisfactory, future work is needed to improve the financial sustainability of MFIs. First, as a key point for evaluation, the considered criteria should be more comprehensive. For example, the character and behavioral factors of MFI leaders should also be included, whereas, due to the data being unavailable, we do not adopt it as criteria in this paper. Second, for the success of HMSIT, a more efficient parameter reduction method should be studied, considering its complexity and cost. Third, this paper is limited to a case study evaluating financial sustainability, based on data from a one-year cross-section of 20 MFIs. A bigger sample size should be considered in future works, for a more comprehensive analysis. Also, future works could focus on predicting financial sustainability.

Author Contributions

Conceptualization, W.X. and H.F.; Methodology, W.X.; Software, W.X.; Validation, W.X., H.F. and H.L.; Formal Analysis, H.F.; Investigation, W.X.; Resources, W.X.; Data Curation, W.X.; Writing—Original Draft Preparation, W.X.; Writing—Review & Editing, W.X., H.F. and H.L.; Visualization, W.X., H.F. and H.L.; Supervision, H.F.; Project Administration, W.X.; Funding Acquisition, W.X.

Funding

This work was supported by the National Natural Science Foundation of China (No. 71801113). We also acknowledge the MOE (Ministry of Education in China) Project of Humanities and Social Sciences (No. 18YJC630212) and the Fundamental Research Funds for the Central Universities (No. 2019JDZD16).

Acknowledgments

We sincerely thank the anonymous reviewers for their helpful and constructive suggestions and the editors for their careful and patient work.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Meyer, J. Outreach and performance of microfinance institutions: The importance of portfolio yield. Appl. Econ. 2019, 51, 2945–2962. [Google Scholar] [CrossRef]

- García-Pérez, I.; Muñoz-Torres, M.-J.; Fernández-Izquierdo, M.-Á. Microfinance literature: A sustainability level perspective survey. J. Clean. Prod. 2017, 142, 3382–3395. [Google Scholar] [CrossRef]

- Leventi, C.; Sutherland, H.; Tasseva, I.V. Improving poverty reduction in Europe: What works best where? J. Eur. Soc. Policy 2018, 29, 29–43. [Google Scholar] [CrossRef]

- Garcia-Perez, I.; Munoz-Torres, M.J.; Fernandez-Izquierdo, M.A. Microfinance institutions fostering sustainable development. Sustain. Dev. 2018, 26, 606–619. [Google Scholar] [CrossRef]

- Cull, R.; Demirgüç-Kunt, A.; Morduch, J. The Microfinance Business Model: Enduring Subsidy and Modest Profit. World Bank Econ. Rev. 2018, 32, 221–244. [Google Scholar] [CrossRef]

- Duguma, G.; Han, J. Effect of Deposit Mobilization on the Financial Sustainability of Rural Saving and Credit Cooperatives: Evidence from Ethiopia. Sustainability 2018, 10, 3387. [Google Scholar] [CrossRef]

- Churchill, S.A. Sustainability and depth of outreach: Evidence from microfinance institutions in sub-Saharan Africa. Dev. Policy Rev. 2018, 36, O676–O695. [Google Scholar] [CrossRef]

- Inekwe, J.N. Lending Risk in MFIs: The Extreme Bounds of Microeconomic and Macroeconomic Factors. J. Small Bus. Manag. 2019, 57, 538–558. [Google Scholar] [CrossRef]

- Ben Abdelkader, I.; Mansouri, F. Performance of microfinance institutions in the MENA region: A comparative analysis. Int. J. Soc. Econ. 2019, 46, 47–65. [Google Scholar] [CrossRef]

- Schaltegger, S.; Burritt, R. Business Cases and Corporate Engagement with Sustainability: Differentiating Ethical Motivations. J. Bus. Ethics 2018, 147, 241–259. [Google Scholar] [CrossRef]

- Olawumi, T.O.; Chan, D.W.M. A scientometric review of global research on sustainability and sustainable development. J. Clean. Prod. 2018, 183, 231–250. [Google Scholar] [CrossRef]

- Quayes, S. Depth of outreach and financial sustainability of microfinance institutions. Appl. Econ. 2012, 44, 3421–3433. [Google Scholar] [CrossRef]

- Allet, M.; Hudon, M. Green Microfinance: Characteristics of Microfinance Institutions Involved in Environmental Management. J. Bus. Ethics 2015, 126, 395–414. [Google Scholar] [CrossRef]

- Mia, M.A.; Zhang, M.; Zhang, C.; Kim, Y. Are microfinance institutions in South-East Asia pursuing objectives of greening the environment? J. Asia Pac. Econ. 2018, 23, 229–245. [Google Scholar] [CrossRef]

- Tanin, T.I.; Mobin, M.A.; Ng, A.; Dewandaru, G.; Salim, K.; Nkoba, M.A.; Razak, L.A. How does microfinance prosper? An analysis of environmental, social, and governance context. Sustain. Dev. 2019. [Google Scholar] [CrossRef]

- Bapat, V.; Bhanot, D. Sustainability index of micro finance institutions (MFIs) and contributory factors. Int. J. Soc. Econ. 2015, 42, 387–403. [Google Scholar]

- Koveos, P.; Randhawa, D. Financial services for the poor: Assessing microfinance institutions. Manag. Finance 2004, 30, 70–95. [Google Scholar] [CrossRef]

- Reiter, B.; Peprah, J.A. Assessing African Microfinance: An Exploratory Case Study of Ghana’s Central Region. J. Int. Dev. 2015, 27, 1337–1342. [Google Scholar] [CrossRef]

- Iqbal, S.; Nawaz, A.; Ehsan, S. Financial performance and corporate governance in microfinance: Evidence from Asia. J. Asian Econ. 2019, 60, 1–13. [Google Scholar] [CrossRef]

- Ahlin, C.; Lin, J.; Maio, M. Where does microfinance flourish? Microfinance institution performance in macroeconomic context. J. Dev. Econ. 2011, 95, 105–120. [Google Scholar] [CrossRef]

- Goodspeed, T.B. Environmental Shocks and Sustainability in Microfinance: Evidence from the Great Famine of Ireland. World Bank Econ. Rev. 2018, 32, 456–481. [Google Scholar] [CrossRef]

- Sainz-Fernandez, I.; Torre-Olmo, B.; Lopez-Gutierrez, C.; Sanfilippo-Azofra, S. Development of the Financial Sector and Growth of Microfinance Institutions: The Moderating Effect of Economic Growth. Sustainability 2018, 10, 3930. [Google Scholar] [CrossRef]

- Kauffman, R.J.; Riggins, F.J. Information and communication technology and the sustainability of microfinance. Electron. Commer. Res. Appl. 2012, 11, 450–468. [Google Scholar] [CrossRef]

- Piot-Lepetit, I.; Nzongang, J. Performance assessment and definition of improvement paths for microfinance institutions: An application to a network of village banks in Cameroon. Int. Trans. Oper. Res. 2018, 26, 1188–1210. [Google Scholar] [CrossRef]

- Bibi, U.; Balli, H.O.; Matthews, C.D.; Tripe, D.W.L. New approaches to measure the social performance of microfinance institutions (MFIs). Int. Rev. Econ. Finance 2018, 53, 88–97. [Google Scholar] [CrossRef]

- Wilkinson, A.; Hill, M.; Gollan, P. The sustainability debate. Int. J. Oper. Prod. Manag. 2001, 21, 1492–1502. [Google Scholar] [CrossRef]

- Williams, C.C.; Millington, A.C. The Diverse and Contested Meanings of Sustainable Development. Geogr. J. 2004, 170, 99–104. [Google Scholar] [CrossRef]

- Fu, H.; Teo, K.L.; Li, Y.; Wang, L. Weather Risk–Reward Contract for Sustainable Agri-Food Supply Chain with Loss-Averse Farmer. Sustainability 2018, 10, 4540. [Google Scholar] [CrossRef]

- Ahi, P.; Searcy, C.; Jaber, M.Y. A Quantitative Approach for Assessing Sustainability Performance of Corporations. Ecol. Econ. 2018, 152, 336–346. [Google Scholar] [CrossRef]

- Navajas, S.; Schreiner, M.; Meyer, R.L.; Gonzalez-vega, C.; Rodriguez-meza, J. Microcredit and the Poorest of the Poor: Theory and Evidence from Bolivia. World Dev. 2000, 28, 333–346. [Google Scholar] [CrossRef]

- Cull, R.; Demirgüç-Kunt, A.; Morduch, J. Financial performance and outreach: A global analysis of leading microbanks*. Econ. J. 2007, 117, F107–F133. [Google Scholar] [CrossRef]

- Forcella, D.; Hudon, M. Green Microfinance in Europe. J. Bus. Ethics 2016, 135, 445–459. [Google Scholar] [CrossRef]

- Gonzalez, A. Resilience of Microfinance Institutions to National Macroeconomic Events: An Econometric Analysis of MFI Asset Quality. SSRN Electron. J. 2007, 1, 1–25. [Google Scholar] [CrossRef]

- Vanroose, A.; D’Espallier, B. Do microfinance institutions accomplish their mission? Evidence from the relationship between traditional financial sector development and microfinance institutions’ outreach and performance. Appl. Econ. 2013, 45, 1965–1982. [Google Scholar] [CrossRef]

- Sainz-Fernandez, I.; Torre-Olmo, B.; Lopez-Gutierrez, C.; Sanfilippo-Azofra, S. Crisis in Microfinance Institutions: Identifying Problems. J. Int. Dev. 2015, 27, 1058–1073. [Google Scholar] [CrossRef]

- Churchill, S.A. The macroeconomy and microfinance outreach: A panel data analysis. Appl. Econ. 2019, 51, 2266–2274. [Google Scholar] [CrossRef]

- Liñares-Zegarra, J.; Wilson, J.O.S. The size and growth of microfinance institutions. Br. Account. Rev. 2018, 50, 199–213. [Google Scholar] [CrossRef]

- Gupta, N.; Mirchandani, A. Corporate governance and performance of microfinance institutions: Recent global evidences. J. Manag. Gov. 2019. [Google Scholar] [CrossRef]

- Bogan, V.L. Capital Structure and Sustainability: An Empirical Study of Microfinance Institutions. Rev. Econ. Stat. 2011, 94, 1045–1058. [Google Scholar] [CrossRef]

- Widiarto, I.; Emrouznejad, A.; Anastasakis, L. Observing choice of loan methods in not-for-profit microfinance using data envelopment analysis. Expert Syst. Appl. 2017, 82, 278–290. [Google Scholar] [CrossRef]

- Nurmakhanova, M.; Kretzschmar, G.; Fedhila, H. Trade-off between financial sustainability and outreach of microfinance institutions. Eurasian Econ. Rev. 2015, 5, 231–250. [Google Scholar] [CrossRef]

- Caserta, M.; Monteleone, S.; Reito, F. The trade-off between profitability and outreach in microfinance. Econ. Model. 2018, 72, 31–41. [Google Scholar] [CrossRef]

- Schönerwald, C.; Vernengo, M. Microfinance, Financial Inclusion, and the Rhetoric of Reaction: The Evolution and Limitations of Microfinance in Brazil. Lat. Am. Policy 2016, 7, 356–376. [Google Scholar] [CrossRef]

- Xu, W.; Xiao, Z.; Dang, X.; Yang, D.L.; Yang, X.L. Financial ratio selection for business failure prediction using soft set theory. Knowl. Based Syst. 2014, 63, 59–67. [Google Scholar] [CrossRef]

- Tadele, H.; Roberts, H.; Whiting, R.H. Microfinance institutions’ website accessibility. Pac.-Basin Financ. J. 2018, 50, 279–293. [Google Scholar] [CrossRef]

- Gui, F.A.; Fodder, J.; Shahriar, A.Z.M. Performance of Microfinance Institutions: Does Government Ideology Matter? World Dev. 2017, 100, 1–15. [Google Scholar]

- Wijesiri, M.; Yaron, J.; Meoli, M. Assessing the financial and outreach efficiency of microfinance institutions: Do age and size matter? J. Multinatl. Financ. Manag. 2017, 40, 63–76. [Google Scholar] [CrossRef]

- Molodtsov, D. Soft set theory—First results. Comput. Math. Appl. 1999, 37, 19–31. [Google Scholar] [CrossRef]

- Gong, K.; Wang, Y.; Xu, M.; Xiao, Z. BSSReduce an O(|U|) Incremental Feature Selection Approach for Large-Scale and High-Dimensional Data. IEEE Trans. Fuzzy Syst. 2018, 26, 3356–3367. [Google Scholar] [CrossRef]

- Chang, K.-H. A novel supplier selection method that integrates the intuitionistic fuzzy weighted averaging method and a soft set with imprecise data. Ann. Oper. Res. 2019, 272, 139–157. [Google Scholar] [CrossRef]

- Kong, Z.; Gao, L.; Wang, L.; Li, S. The normal parameter reduction of soft sets and its algorithm. Comput. Math. Appl. 2008, 56, 3029–3037. [Google Scholar] [CrossRef]

- Sassanelli, C.; Rosa, P.; Rocca, R.; Terzi, S. Circular economy performance assessment methods: A systematic literature review. J. Clean. Prod. 2019, 229, 440–453. [Google Scholar] [CrossRef]

- Hwang, C.-L.; Yoon, K. Multiple Attribute Decision Making: Methods and Applications a State-of-the-Art Survey; Springer Science & Business Media: Berlin, Germany, 2012; ISBN 978-3-642-48318-9. [Google Scholar]

- Yu, S.; Wang, J.; Wang, J.; Li, L. A multi-criteria decision-making model for hotel selection with linguistic distribution assessments. Appl. Soft Comput. 2018, 67, 741–755. [Google Scholar] [CrossRef]

- Xu, W.; Pan, Y.; Chen, W.; Fu, H. Forecasting Corporate Failure in the Chinese Energy Sector: A Novel Integrated Model of Deep Learning and Support Vector Machine. Energies 2019, 12, 2251. [Google Scholar] [CrossRef]

- Grzymala-Busse, J.W.; Mroczek, T. Merging of Numerical Intervals in Entropy-Based Discretization. Entropy 2018, 20, 880. [Google Scholar] [CrossRef]

- Wang, H.; Jiang, Z.; Zhang, H.; Wang, Y.; Yang, Y.; Li, Y. An integrated MCDM approach considering demands-matching for reverse logistics. J. Clean. Prod. 2019, 208, 199–210. [Google Scholar] [CrossRef]

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).