The Role of Local Finance in Overcoming Socioeconomic Inequalities in Polish Rural Areas

Abstract

1. Introduction

2. Materials and Methods

- very high intensity of characteristic k in class c; the characteristic is highly specific (in positive or negative terms);

- high intensity of characteristic k in class c; the characteristic is moderately specific (in positive or negative terms);

- average intensity of characteristic k in class c; the characteristic does not stand out and is not specific.

3. Role of Local Government in Promoting Development and Fighting Against Socioeconomic Inequalities: A Theoretical Background

4. Results and discussion

4.1. Results of Empirical Research, Part 1—Assessing the Socioeconomic Development Level of Polish Rural Municipalities Located in the Wielkopolskie Voivodeship

4.2. Results of Empirical Research, Part 2—Assessing the Quantitative Relationships Between the Socioeconomic Development Level and Financial Situation of Polish Rural Municipalities Located in the Wielkopolskie Voivodeship

4.3. Discussion and Political Implications

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Capello, R.; Nijkamp, P. Regional growth and development revisited. In Endogenous Regional Development, Perspectives, Measurement and Empirical Investigation; Stimson, R., Stough, R., Nijkamp, P., Eds.; Edward Elgar Publishing: Cheltenham, UK, 2011; pp. 301–324. [Google Scholar]

- Constitution of the Republic of Poland of 2 April 1997, Journal of Laws of 1997, No. 78, Item 483. Available online: http://prawo.sejm.gov.pl/isap.nsf/download.xsp/WDU19970780483/U/D19970483Lj.pdf (accessed on 16 January 2019). (In Polish)

- Municipal Government Act of 8 March 1990, Journal of Laws of 1990, No. 16, Item 95. Available online: http://prawo.sejm.gov.pl/isap.nsf/download.xsp/WDU19900160095/U/D19900095Lj.pdf (accessed on 16 January 2019). (In Polish)

- Hulbert, C.; Vammalle, C. Sub-National Perspektive on Financing Investment for Growth I–Measuring Fiscal Space for Public Investment: Influences, Evolution and Perspectives, No. 2; OECD Regional Development Working Papers: Paris, France, 2014. [Google Scholar]

- Allain-Dupre, D.; Hulbert, C.; Vammalle, C. Public Investement at Central and Sub-National Levels: An Adjustment Variable for OECD Countries in the Present Context of Austerity? OECD Workshop on Effective Public Investment and Sub-National Level in Times of Fiscal Constraints: Meeting in Coordination and Capacity Challenges; OECD: Paris, France, 2012. [Google Scholar]

- Gren, J. Reaching the Perpiheral Regional Growth Centres; Centre-periphery convergence through the structural funds’ transport infrastructure actions and the evolution of the centre-periphery paradigm. Eur. J. Spat. Dev. 2003, 3, 1–20. [Google Scholar]

- Wyszkowska, D. Samodzielność Finansowa Jako Determinanta Potencjału Inwestycyjnego Jednostek Samorządu Terytorialnego–Studium Empiryczne Gmin w Polsce (Financial Autonomy as a Determinant of Investment Potential of Local Government Units: An Empirical Study into Polish Municipalities); House of the Białystok University: Białystok, Poland, 2018. (In Polish) [Google Scholar]

- McCann, P. Urban and Regional Economics; Oxford University Press: New York, NY, USA, 2001; pp. 258–259. [Google Scholar]

- Standar, A. Differences in accessing Rural Development Programme (RDP) factors on the support level. The example of municipalities in the Wielkopolska region. In Innovation and Cooperation in Smart, Sustainable and Inclusive Rural Regions; Egartner, S., Niedermayr, J., Wagner, K., Eds.; Institute of Agriculture and Food Economics–National Research Institute: Warsaw, Poland; Vienna, Austria, 2018; Volume 15, pp. 93–105. [Google Scholar]

- Standar, A. Access to EU funds vs. financial risks faced by rural municipalities of the Wielkopolskie Voivodeship. In Proceedings of the 19th International Scientific Conference, Economic Science for Rural Development 2018, Jelgava, Latvia, 9–11 May 2018; Volume 49, pp. 169–177. [Google Scholar]

- Eurostat. Database. Available online: https://ec.europa.eu/eurostat/data/database (accessed on 16 July 2019).

- Stanny, M.; Rosner, A.; Komorowski, Ł. Monitoring Rozwoju Obszarów Wiejskich. Etap III Struktury Społeczno-Gospodarcze, Ich Przestrzenne Zróżnicowanie I Dynamika (Wersja Pełna) (Monitoring of Rural Development. Stage 3. Meaning of, Territorial Disparities and Changes in Socioeconomic Structures (Full Version)); The European Fund for the Development of Polish Villages Foundation (EFRWP), Institute of Rural and Agricultural Development, Polish Academy of Sciences (IRWIR PAN): Warsaw, Poland, 2018; p. 220. [Google Scholar]

- Rosner, A.; Stanny, M. Socio-Economic Development of Rural Areas in Poland; The European Fund for the Development of Polish Villages Foundation (EFRWP), Institute of Rural and Agricultural Development, Polish Academy of Sciences (IRWIR PAN): Warsaw, Poland, 2017. [Google Scholar]

- Kozera, A.; Głowicka-Wołoszyn, R. Identification of functional types of rural communes in Poland. In Proceedings of the 2018 International Scientific Conference Economic Sciences for Agribusiness and Rural Economy, Economic Sciences for Agribusiness and Rural Economy, Warsaw, Poland, 7–8 June 2018; Volume 1, pp. 109–115. [Google Scholar]

- Standar, A. Realizacja przedsięwzięć inwestycyjnych przez gminy–skala, zróżnicowanie i perspektywa (Investment project implementation by communes–scale, diversity and future possibilities). Probl. Zarządzania 2017, 2, 161–172. [Google Scholar] [CrossRef]

- Kierunki Rozwoju Obszarów Wiejskich. Założenia do Strategii Zrównoważonego Rozwoju wsi i Rolnictwa (Lines of Rural Development. Assumptions for the Strategy of Sustainable Development of Agriculture and Rural Areas); Ministry of Agriculture and Rural Development: Warsaw, Poland, 2010; Volume 50, p. 16. Available online: http://ksow.pl/fileadmin/user_upload/ksow.pl/pliki/rozne_agenda_itp_/2010.03-KROWaxc.pdf (accessed on 16 January 2019). (In Polish)

- Standar, A.; Bartkowiak-Bakun, N. Ocena Oddziaływania Wybranych Działań PROW 2007-2013 na Zrównoważony Rozwój Obszarów Wiejskich Polski (Analiza Regionalna); (Assessing the impact of selected measures under the 2007–2013 RDP on sustainable rural development in Poland (a regional analysis)); Publishing House of the Poznań University of Life Sciences: Poznań, Poland, 2015. (In Polish) [Google Scholar]

- Hwang, C.L.; Yoon, K. Multiple Attribute Decision-Making: Methods and Applications; Springer: Berlin, Germany, 1981. [Google Scholar]

- Central Statistical Office. Local Data Bank. 2019; Database. Available online: http://www.stat.gov.pl/bdl (accessed on 16 January 2019). (In Polish)

- Rocznik Województwo Wielkopolskie–Podregiony, Powiaty, Gminy (Yearbook of the Wielkopolskie Voivodeship: Sub-Regions, Districts, Municipalities). Poznań Statistical Office: Poznań, Poland, 2018. Available online: https://poznan.stat.gov.pl/publikacje-i-foldery/roczniki-statystyczne/wojewodztwo-wielkopolskie-2018-podregiony-powiaty-gminy,1,15.html (accessed on 16 January 2019). (In Polish)

- Wskaźniki do Oceny Sytuacji Finansowej Jednostki Samorządu Terytorialnego (Indicators for Assessment of the Financial Situation of Local Government Units). Ministry of Finance: Warsaw, Poland, 2016. Available online: http://www.finanse.mf.gov.pl/budzet-panstwa/finanse-samorzadow/opracowania (accessed on 16 January 2019). (In Polish)

- Wysocki, F. Metody Taksonomiczne w Rozpoznawaniu Typów Ekonomicznych Rolnictwa i Obszarów Wiejskich (Taxonomic Methods in the Identification of Economic Types of Agriculture and Rural Areas); Publishing House of the Poznań University of Life Sciences: Poznań, Poland, 2010. (In Polish) [Google Scholar]

- Łuczak, A.; Wysocki, F. Zastosowanie mediany przestrzennej Webera i metody TOPSIS w ujęciu pozycyjnym do konstrukcji syntetycznego miernika poziomu życia (The application of spatial median of Weber and the method TOPSIS in positional formulation for the construction of synthetic measure of standard of living). Pr. Nauk. Uniw. Ekon. Wrocławiu 2013, 278, 63–73. (In Polish) [Google Scholar]

- Kozera, A.; Wysocki, F. Problem Ustalania Współrzędnych Obiektów Modelowych W Metodach Porządkowania Liniowego Obiektów (The Problem of Determining the Coordinates of Model Objects in Object Linear Ordering Methods). Research Papers of Wrocław University of Economics Taksonomia 27. 2016, Volume 427, pp. 131–142. Available online: http://www.dbc.wroc.pl/dlibra/docmetadata?id=33159&from=&dirids=1&ver_id=&lp=1&QI (accessed on 16 January 2019). (In Polish). [CrossRef]

- Kozera, A.; Łuczak, A.; Wysocki, F. The application of classical and positional TOPSIS methods to assessment financial self-sufficiency levels in local government units. In Data Science: Innovative Developments in Data Analysis and Clustering; Studies in Classification, Data Analysis and Knowledge Organization; Palumbo, F., Montanari, A., Vichi, M., Eds.; Cham Springer: Berlin, Germany, 2017; pp. 273–284. [Google Scholar]

- Głowicka-Wołoszyn, R.; Wysocki, F. Problem Identyfikacji Poziomów Rozwoju w Zagadnieniu Konstrukcji Cechy Syntetycznej (The Problem of Identifying Development Levels in Constructing Synthetic Characteristics). Research Papers of Wrocław University of Economics, Taksonomia 31. 2018, Volume 508, pp. 56–65. Available online: http://www.dbc.wroc.pl/dlibra/publication?id=64913&tab=3 (accessed on 16 January 2019). (In Polish). [CrossRef]

- Tukey, J.W. Exploratory Data Analysis; Addison-Wesley: Boston, MA, USA, 1977. [Google Scholar]

- Oliveira, E.C.; Faro, A.O.; Anderson, L.F. Comparison of Different Approaches for Detection and Treatment of Outliers in Meter Proving Factors Determination. Flow Meas. Instrum. 2016, 48, 29–35. [Google Scholar] [CrossRef]

- Lebart, L.; Morineau, A.; Piron, M. Statistigue Exploratorie Multidimensionalle; Donod: Paris, France, 1995. [Google Scholar]

- Lebart, L.; Salem, A.; Berry, L. Exploring Textual Data; Kluwer Academic Publishers: Dordrecht, The Netherlands, 1998. [Google Scholar]

- Potoczek, A. Polityka Regionalna i Gospodarka Przestrzenna (Regional Policy and Land Use Management); Publishing House of the Toruń University: Toruń, Poland, 2003. (In Polish) [Google Scholar]

- Toczyński, W.; Mikołajczyk, A. Polityka Regionalna (Regional Policy); College of Humanities: Gdańsk, Poland, 2001. (In Polish) [Google Scholar]

- Kosiedowski, W. Wprowadzenie do teorii i praktyki rozwoju regionalnego i lokalnego (An introduction to the theory and practice of regional local development). In Samorząd Terytorialny w Procesie Rozwoju Regionalnego i Lokalnego (Local Authorities in the Regional and Local Development Process); Kosiedowski, W., Ed.; Dom Organizatora: Toruń, Poland, 2005; pp. 11–58. (In Polish) [Google Scholar]

- Mau, S. Soziale Ungleichheit in der Europäischen Union (Social Inequality in the European Union). In Aus Politik und Zeitgeschichte (Noteson Politics and Contemporary History); 2004; Volume 38, pp. 38–46. Available online: http://www.bpb.de/apuz/28113/soziale-ungleichheit-in-der-europaeischen-union (accessed on 16 January 2019). (In German)

- Stiens, G. Region und Regionalismus (Regions and Regionalism). In Handwörterbuch zur Gesellschaft Deutschlands (Concise Dictionary of German Sociology); Schäfers, B., Zapf, W., Eds.; Bundeszentrale für politische Bildung: Bonn, Germany, 2001; pp. 538–550. [Google Scholar]

- Spellerberg, A.; Huschka, D.; Habich, R. Quality of life in rural area. Process of divergence and convergence. Soc. Indic. Res. 2007, 83, 283–307. [Google Scholar] [CrossRef]

- Solow, R.M. A Contribution to the Theory of Economic Growth. Q. J. Econ. 1956, 70, 65–94. [Google Scholar] [CrossRef]

- Afonasova, M. The Concept of Convergent Development of Rural Areas of the Russian Federation. Eur. Res. Stud. J. 2017, 20, 14–38. [Google Scholar]

- Quah, D. Convergence Determines Governance—Within and Without, Growth, Convergence and Income Distribution: The Road from the Brisbane G-20. Available online: http://www.dannyquah.com/Quilled/Output/2014.11-Danny.Quah-Convergence-Determines Governance-tt20-UK-Convergence-Governance-Quah.pdf (accessed on 16 January 2019).

- Standar, A.; Puślecki, Z.W. Ocena Zastosowania Środków Polityki Regionalnej Unii Europejskiej Przez Samorządy Gminne Województwa Wielkopolskiego (Assessing the Use of Funds under the European Union Regional Policy by Municipal Government Units in the Wielkopolskie Voivodeship); Publishing House of the Poznań University of Life Sciences: Poznań, Poland, 2011. (In Polish) [Google Scholar]

- Adamowicz, M. Dyfuzja innowacji jako czynnik rozwoju regionów peryferyjnych (Diffusion of innovations as a development factor for peripheral regions). In Zarządzanie Wiedzą w Agrobiznesie w Warunkach Polskiego Członkostwa w Unii Europejskiej (Agribusiness Knowledge Management in Poland as a Member of the European Union); Adamowicz, M., Ed.; Publishing House of the Warsaw University of Life Sciences: Warsaw, Poland, 2005; pp. 581–592. (In Polish) [Google Scholar]

- Churski, P. Czynniki rozwoju regionalnego w świetle koncepcji teoretycznych (Regional development factors in the light of theoretical concepts). Sci. J. Humanit. Econ. Coll. Włocławek 2005, 19, 3. (In Polish) [Google Scholar]

- Fuest, C.; Huber, B. Can regional policy in a federation improve economic efficiency? J. Public Econ. 2005, 90, 499–511. [Google Scholar] [CrossRef]

- Woś, B. Rozwój Regionów i Polityka Regionalna w Unii Europejskiej Oraz w Polsce (Regional Development and Regional Policy in the European Union and Poland); Publishing House of the Wrocław University of Technology: Wrocław, Poland, 2005. (In Polish) [Google Scholar]

- Heller, J. Dochody budżetowe samorządów gmin wiejskich w ujęciu regionalnym (Budgetary income of rural municipal government units). Rocz. Stwowarzyszenia Ekon. Rol. Agrobiz. 2008, 10, 74–79. (In Polish) [Google Scholar]

- Henckel, G. Dorf und Gemeinde (Village and Community). In Handwörterbuch zur Ländlichen Gesellschaft in Deutschland (Concise Dictionary of Social Conditions in Rural Germany); Beetz, S., Brauer, K., Neu, C., Eds.; Springer: Wiesbaden, Germany, 2005; pp. 41–54. [Google Scholar]

- Barro, R.J.; Sala-i-Martin, X. Economic Growth, 2nd ed.; The MIT Press: Cambridge, MA, USA, 2004. [Google Scholar]

- Dervish, K. Convergence, interdependence and divergences. Financ. Dev. 2012, 9, 11–14. [Google Scholar]

- Korotayev, A.; Zinkina, J.; Bogevolnov, J.; Malkov, A. Global unconditional convergence among larger economies after 1998. J. Glob. Stud. 2011, 2, 25–62. [Google Scholar]

- Dobson, S.; Ramlogan, C. Economic growth and convergence in Latin America. J. Dev. Stud. 2002, 38, 83–104. [Google Scholar] [CrossRef]

- Herrerias, M.J.; Ordonez, J. New evidence on the role of regional clusters and convergence in China (1952–2008). China Econ. Rev. 2012, 23, 1120–1133. [Google Scholar] [CrossRef]

- Ghosh, M.; Ghoshray, A.; Malki, I. Regional divergence and club convergence in India. Econ. Model. 2013, 30, 733–742. [Google Scholar] [CrossRef]

- Andrés, J.; Doménech, R.; Molinas, C. Macroeconomic performance and convergence in OECD countries. Eur. Econ. Rev. 1996, 40, 1683–1704. [Google Scholar] [CrossRef]

- Arnold, J.; Bassanini, A.; Scarpetta, S. Solow or Lucas? Testing speed of convergence on a panel of OECD countries. Res. Econ. 2010, 65, 110–123. [Google Scholar] [CrossRef]

- Elhorst, J.P. The mystery of regional unemployment differentials: Theoretical and empirical explanations. J. Econ. Surv. 2003, 17, 709–748. [Google Scholar] [CrossRef]

- Aumayr, C.M. European region types in EU-25. Eur. J. Comp. Econ. 2007, 4, 109–147. [Google Scholar]

- Marelli, E.; Signorelli, M. Transition, regional features, growth and labour market dynamics. In The Labour Market Impact of the EU Enlargement; Caroleo, F.E., Pastore, F., Eds.; Springer Physica-Verlag: Berlin/Heidelberg, Germany, 2010; pp. 99–147. [Google Scholar]

- Le Pen, Y. A pair-wise approach to output convergence between European regions. Econ. Model. 2011, 28, 955–964. [Google Scholar] [CrossRef]

- Bartkowska, M.; Riedl, A. Regional convergence clubs in Europe: Identification and conditioning factors. Econ. Model. 2012, 29, 22–31. [Google Scholar] [CrossRef]

- Nell, G.; Signorelli, M. Convergence and divergence. Palgrave Dictionary of Emerging Markets and Transition Economics; Hölscher, J., Tomann, H., Eds.; Macmillan Palgrave: London, UK, 2015; pp. 437–457. [Google Scholar]

- Grafton, R.Q.; Knowles, S.; Owen, P.D. Social Divergence and Economic Performance; Department of economics Working Paper 0103E, University of Ottawa: Ottawa, ON, Canada, 2002. [Google Scholar]

- Gałązka, A. Teoretyczne podstawy rozwoju regionalnego–wybrane teorie, czynniki i bariery rozwoju regionalnego. Studia BAS 2017, 1, 9–61. [Google Scholar]

- Sieverts, T. Zwischenstadt. Zwischen Ort und Welt, Raum und Zeit, Stadt und Land (Intermediate City. Between Location and the World, Place and Time, Town and Country); Birkhäuser: Braunschweig, Germany; Wiesbaden, Germany, 1998. (In German) [Google Scholar]

- Sobczyk, A. Instrumenty rozwoju lokalnego (Local development instruments). In Polityka Regionalna i Lokalna w Aspekcie Wejścia Polski do Unii Europejskiej (Regional and Local Policy in the Context of Poland’s Accession to the European Union); Fic, M., Ed.; Sulechów Vocational College: Sulechów, Poland, 2004; p. 39. (In Polish) [Google Scholar]

- Woś, A.; Zegar, J.S. Rolnictwo Społecznie Zrównoważone (A Socially Sustainable Agriculture); Institute of Agricultural and Food Economics: Warsaw, Poland, 2002; p. 51. (In Polish) [Google Scholar]

- Standar, A.; Bartkowiak-Bakun, N. Zmiany poziomu rozwoju gminnej infrastruktury technicznej w województwie wielkopolskim (Changes in the level of development of technical infrastructure in communes of the Wielkopolska voivodeship). J. Agribus. Rural Dev. 2014, 4, 147–157. [Google Scholar]

- Bański, J. Przemiany Polskiej wsi (Transformation of Polish Rural Areas); Institute of Geography and Spatial Organization of the Polish Academy of Sciences: Warsaw, Poland, 2010. [Google Scholar]

- Foundation for Development of Polish Agriculture. Rural Poland 2016. The Report on the State of Rural Areas; Scholar Publishing House: Warsaw, Poland, 2016. [Google Scholar]

- Kaczmarek, T. Obszar metropolitalny jako przedmiot badania i narzędzie działania (Metropolitan area as a subject matter of studies and an actionable tool). In Delimitacja Poznańskiego Obszaru Metropolitalnego (Delimitation of the Poznań Metropolitan Area); Kaczmarek, T., Kaczmarek, U., Mikuła, Ł., Bul, R., Walaszek, M., Eds.; Metropolitan Research Center of the Adam Mickiewicz University, Library of the Poznań Agglomeration: Poznań, Poland, 2014. [Google Scholar]

- Kopczewska, K. Rola Sektora Publicznego w Przestrzennym Rozwoju Państwa (Role of the Public Sector in the Territorial Development of a Country); CeDeWu.pl: Warsaw, Poland, 2011. (In Polish) [Google Scholar]

- European Charter of Local Self-Government Signed 15 October 1985, Strasbourg, France, ETS No.122. Available online: https://www.coe.int/en/web/conventions/full-list/-/conventions/treaty/122 (accessed on 18 April 2019).

- Act on Incomes of Local Government Units of November 13, 2003, Journal of Laws of 2010, No. 80, Item 526. Available online: http://prawo.sejm.gov.pl/isap.nsf/download.xsp/WDU20032031966/U/D20031966Lj.pdf (accessed on 18 April 2019).

- Dafflon, B.; Beer-Toth, K. Managing Local Public Debt in Transition Countries: An Issue of Self-Control. Paper Prepared at the 14th Annual Conference of the Network of Institutions and Schools of Public Administration in Central and Eastern Europe (NISPAcee). Available online: https://www.researchgate.net/publication/227821199_Managing_local_public_debt_in_transition_countries_an_issue_of_self-control (accessed on 18 April 2019).

- Kata, R. Ryzyko finansowe w działalności jednostek samorządu terytorialnego-metody oceny (Financial risk in the activities of local government units–the method of assessment). Zesz. Nauk. Sggw Eiogż 2012, 97, 129–141. [Google Scholar]

- Public Finance Act of June 30, 2005, Journal of Laws of 2005, No. 249, Item 2104. Available online: http://prawo.sejm.gov.pl/isap.nsf/download.xsp/WDU20052492104/U/D20052104Lj.pdf (accessed on 18 April 2019).

- European Commission, History of the Policy. Available online: https://ec.europa.eu/regional_policy/en/policy/what/history/ (accessed on 1 October 2019).

- Barcz, J. Przewodnik po Traktacie z Lizbony. Traktaty Stanowiące Unię Europejską. Stan Obecny Oraz Teksty Skonsolidowane w Brzmieniu Traktatu z Lizbony (Guide to the Treaty of Lisbon. Treaties Constituting the European Union. Current Status and Consolidated Texts as Amended by the Treaty of Lisbon); Wyd. Prawnicze LexisNexis: Warszawa, Poland, 2008. (In Polish) [Google Scholar]

- European Commission. Investing in Europe’s Future. Fifth Report on Economic, Social and Territorial Cohesion; Publications Office of the European Union: Luxembourg, 2010. [Google Scholar]

- European Commission. Investment for Jobs and Growth. Promoting Development and Good Governance in EU Regions and Cities; Sixth Report on Economic, Social and Territorial Cohesion; Publications Office of the European Union: Luxembourg, 2014. [Google Scholar]

- European Commission. My Region, My Europe, Our Future. Seventh Report on Economic, Social and Territorial Cohesion; Publications Office of the European Union: Luxembourg, 2017. [Google Scholar]

- Rodriguez-Pose, A.; Fratesi, U. Between development and social polities: The impact of European structural funds in Objective 1 regions. Reg. Stud. 2004, 38, 97–113. [Google Scholar] [CrossRef]

- Gorzelak, G. Polska polityka regionalna wobec zróżnicowań polskiej przestrzeni (Polish regional policy towards the diversity of Polish space). Studia Reg. Lokalne 2004, 4, 37–72. (In Polish) [Google Scholar]

- Filipiak, B.; Kogut, M.; Szewczuk, A.; Zioło, M. Rozwój Lokalny i Regionalny. Uwarunkowania, Finanse, Procedury (Local and Regional Development. Conditions, Finance, Procedures); Fundacja na rzecz Uniwersytetu Szczecińskiego: Szczecin, Poland, 2005. (In Polish) [Google Scholar]

- Strategia Rozwoju Kraju na Lata 2007–2015 (National Development Strategy for 2007–2015). Ministry of Regional Development. Available online: http://pkpplewiatan.pl/upload/File/plik/Strategia_Rozwoju_Kraju.pdf (accessed on 1 October 2019). (In Polish).

- Narodowe Strategiczne Ramy Odniesienia 2007–2013 (National Strategic Reference Framework 2007–2013). Ministry of Regional Development. Available online: https://www.funduszeeuropejskie.2007-2013.gov.pl/WstepDoFunduszyEuropejskich/Documents/NSRO_maj2007.pdf (accessed on 1 October 2019). (In Polish)

- Strategia Rozwoju Województwa Wielkopolskiego do 2020 (Development Strategy of Wielkopolska Province until 2020). Wielkopolska Voivodship Regional Assembly. Available online: http://www.wrot.umww.pl/wp-content/uploads/2014/07/Strategia-rozwoju-wojew%C3%B3dztwa-wielkopolskiego-do-2020-r_2005.pdf (accessed on 1 October 2019). (In Polish).

- Krajowa Strategia Rozwoju Regionalnego 2010–2020–Regiony, Miasta, Obszary Wiejskie (National Strategy for Regional Development 2010–2020–Regions, Cities, Rural Areas). Ministry of Regional Development. Available online: http://prawo.sejm.gov.pl/isap.nsf/download.xsp/WMP20110360423/O/M20110423.pdf (accessed on 1 October 2019). (In Polish)

- Gaczek, M.W. Zróżnicowanie wewnętrzne województwa wielkopolskiego (Internal diversity of the Wielkopolskie voivodship). Biul. KPZK PAN 2001, 197, 37–58. (In Polish) [Google Scholar]

- Motek, P. Gospodarka Finansowa Samorządu Terytorialnego w Województwie Wielkopolskim (Financial Economy of Local Government in the Wielkopolska Voivodeship); Bogucki Wydawnictwo Naukowe: Poznań, Poland, 2006. (In Polish) [Google Scholar]

- Dolata, M. Wewnętrzne zróżnicowanie poziomu rozwoju gospodarczego województwa wielkopolskiego (Internal differentiation of the level of economic development of Wielkopolska voivodeship). In Charakter Regionalny Województwa Wielkopolskiego (Regional Character of the Wielkopolska Voivodeship); Czyż, T., Ed.; Biuletyn Instytutu Geografii Społeczno-Ekonomicznej i Gospodarki Przestrzennej UAM: Poznań, Poland, 2009; Volume 9, pp. 63–76. (In Polish) [Google Scholar]

- Satoła, Ł.; Standar, A.; Kozera, A. Financial autonomy of local government units: Evidence from Polish rural municipalities. Lex Localis–J. Local Self-Gov. 2019, 17, 321–342. [Google Scholar]

- Gardini, S.; Grossi, G. What is known and what should be known about factors affecting financial sustainability in the public sector, Aliterature review. In Financial Sustainability and Intergenerational Equity in Local Goverments; Rodriguez Bolivar, M.P., Loprez Subires, M.D., Eds.; IGI Global: Hershey, PA, USA, 2018; pp. 179–205. [Google Scholar] [CrossRef]

- Wibbels, E.; Rodden, J. Business Cycles and Political Economy od Decentralized Finance: Lessons for Fiscal Federalism in the EU. In Fiscal Policy Surveillance in Europe; Wierts, P., Ed.; Macmillan: London, UK, 2006; pp. 1–43. [Google Scholar]

- Wolman, H. National Fiscal Policy and Local Government During the Economic Crisis Urban Policy Paper Series; The German Marshall Fund of the United States: Washington, DC, USA, 2014. [Google Scholar]

- Blochliger, H.; Charbit, C.; Pinero Campos, J.M.; Vammalle, C. Sub-Central Governments and Economic Crisis: Impact and Policy Responses; Economics Department Working Papers 752; OECD: Paris, France, 2010. [Google Scholar]

- Smutek, J. Change of municipal finances due to suburbanization as a development challenge on the example of Poland. Bull. Geogr. Soc.-Econ. Ser. 2017, 37, 139–149. [Google Scholar] [CrossRef]

- Hendrick, R. Managing the Fiscal Metropolis: The Financial Policies; Practices, and Health of Suburban Municipalities; Georgetown University Press: Washington, DC, USA, 2011. [Google Scholar]

- Wixforth, J. Kommunalfinanzen in Suburbia. Das Beispiel der Regionen (Municipal Finances in Suburbia. The Example of the Regions); VS Verlag für Sozialwissenschaften: Wiesbaden, Germany; Berlin/Heidelberg, Germany, 2009. (In German) [Google Scholar]

| Item | Designation | Secondary Criterion | Name of the Characteristic |

|---|---|---|---|

| 1 | x1 | Demographic situation | Population density (per km2) |

| 2 | x2 | Population growth rate per 1000 population | |

| 3 | x3 | Net migration rate per 1000 population | |

| 4 | x4 | Social situation | Percentage of unemployed people in the total working-age population (%) |

| 5 | x5 | Share of councilors at tertiary education levels (%) | |

| 6 | x6 | Number of foundations, associations and social organizations per 1000 population | |

| 7 | x7 | People employed in the industrial, construction and service sectors per 100 working-age population | |

| 8 | x8 | Share of social assistance beneficiaries in the total population (%) | |

| 9 | x9 | Local economy | Number of operators entered into the REGON register per 10,000 population |

| 10 | x10 | Number of natural persons engaged in a business per 1000 population | |

| 11 | x11 | Number of operators with 50 or more employees per 10,000 working-age population | |

| 12 | x12 | Number of beds in accommodation facilities per 1000 population | |

| 13 | x13 | Agriculture | Share of farms with an area of 15 ha or more in the total number of farms (%) |

| 14 | x14 | Housing conditions | Average usable floor area per person (m2) |

| 15 | x15 | Share of apartments equipped with central heating (%) | |

| 16 | x16 | Infrastructure | Share of population served by a sewerage network (%) |

| 17 | x17 | Share of population served by a gas network (%) |

| Main Types of Development Theories | Groups of Development Theories | Development Theories | Selected Authors |

|---|---|---|---|

| Top-down development (1) Classical approach | Neoclassical economics | Basic neoclassical model | Smith A. (1776) |

| Theory of comparative advantage | Ricardo D. (1817) | ||

| Hecksher–Ohlin theory of factor proportions | Heckscher E. (1919); Ohlin B. (1930) | ||

| Keynesian model | Basic Keynesian model | Keynes J. M. (1936) | |

| Theory of economic base | North D. C. (1955); Rittenbruch K. (1968) | ||

| Stage models | Rostow’s stages of growth | RostowW. W.(1960) | |

| Kondratiev waves | Kondratiew N. D. (1926) | ||

| Product lifecycle theories | Vernon R. (1966) | ||

| Sustainable and unsustainable development theories | Sustainable development | Nurkse R. (1953); Rosenstein-Rodan P.N. (1961) | |

| Unsustainable development | Hirschman A.O. (1958); Streeten P. (1964) | ||

| Top-down development (2) Polarization theories | Growth poles | Sectoral polarization | Schumpeter J. A. (1964); Peroux F. (1964) |

| Regional polarization | Myrdal G. (1957) | ||

| Sectoral and regional polarization | Hirschman A. O. (1958); Kaldor N. (1970) | ||

| Growth poles concept | Peroux F. (1964); | ||

| Paelinck J. (1965); | |||

| Boudeville J. R. (1956); | |||

| Pottier P. (1963) | |||

| Growth poles and hierarchical diffusion | Theory of innovation and of innovation process phases | Schumpeter J. A. (1964) | |

| Theory of sectoral and regional growth poles | Lausen J. M. (1969) | ||

| Core-periphery theory | Core-periphery theory (Prebisch) | Prebisch R. (1959) | |

| Core-periphery theory (Friedmann) | Friedmann J. (1973) | ||

| Bottom-up development | Historical perspective of development processes | Theory of long-term alternation between development phases | Walter P. P. (1980); Stohr W. B. (1981) |

| Theory of basic needs | Redistribution and growth strategy | Chenery H. H. S. (1974); ILO/MOP (1979); Tinbergen J. (1976) | |

| Strategy of alternative development | Report from Cocoyoc (1974); Hammarskjold Fundation (1975); Roman Club Report (1975); Stohr W. B. (1974) | ||

| Self-centered development theory and selective separation | Theory of dependency | Frank A. G. (1978) | |

| Theory of self-centered development and selective separation | Senghaas D. (1977) | ||

| Theory of independent regional development | Regional policy concept | Stohr W. B. (1981); Uhahne (1985); Maier G. (1987) | |

| Concept of independent regional development | Scheer G. (1981); Glatz H. (1981) | ||

| Concept of regional development through activation of sub-sectoral potential | Hahne U. (1992) | ||

| Theory of use of endogenous potential | Regional self-fulfillment concept of intraregional flows of an innovative regional environment | Maier G. (1987) |

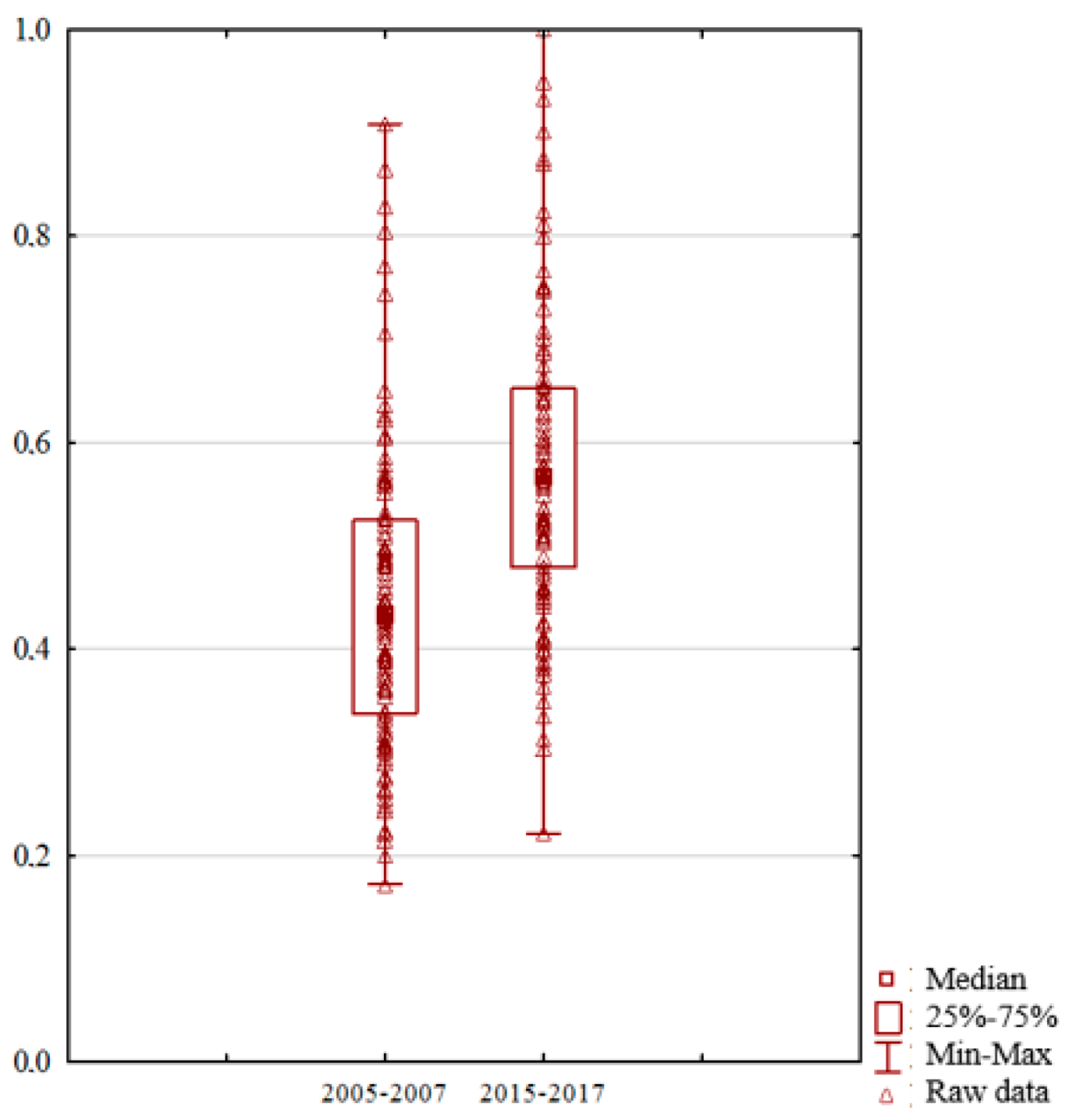

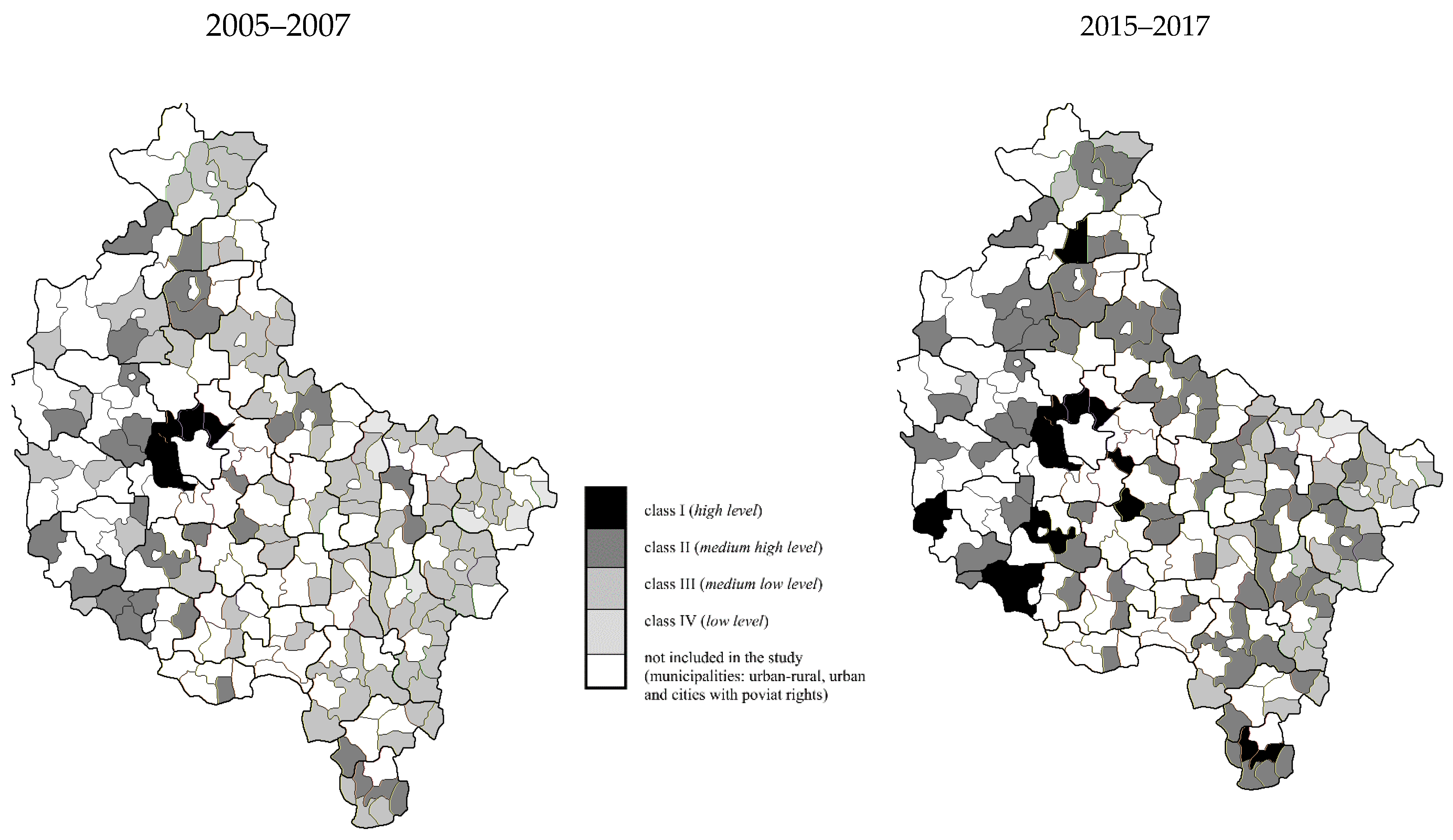

| Typological Class | Development Level | Thresholds for the Synthetic Indicator | Number of Municipalities | Percentage of Municipalities (%) | Change (Percentage Points) | ||

|---|---|---|---|---|---|---|---|

| I | high | <0.75, 1.00 | 6 | 16 | 5.3 | 14.2 | 8.8 |

| II | medium-high | <0.5, 0.75 | 29 | 67 | 25.7 | 59.3 | 33.6 |

| III | medium-low | <0.25, 0.5 | 72 | 29 | 63.7 | 25.7 | −38.1 |

| IV | low | <0.0, 0.25 | 6 | 1 | 5.3 | 0.9 | −4.4 |

| Specification | Typological Class/Socioeconomic Development Level | Total | ||||

|---|---|---|---|---|---|---|

| I High | II Medium-High | III Medium-Low | IV Low | |||

| Distance from the region’s central city of Poznań (km) | 2005–2007 | 15.1 | 76.4 | 112.0 | 137.0 | 91.3 |

| 2015–2017 | 42.2 | 85.4 | 137.0 | 125.0 | 91.0 | |

| Population density (per km2) | 2005–2007 | 160.1 | 56.7 | 52.6 | 49.0 | 56.9 |

| 2015–2017 | 91.6 | 56.4 | 53.5 | 50.5 | 59.7 | |

| Net migration rate per 1000 population | 2005–2007 | 42.3 | 2.3 | −1.0 | −2.3 | 0.1 |

| 2015–2017 | 4.3 | −0.4 | −1.0 | −4.8 | −0.4 | |

| Share of unemployed people in the total working-age population | 2005–2007 | 3.2 | 6.2 | 10.4 | 12.8 | 8.9 |

| 2015–2017 | 1.8 | 3.7 | 4.9 | 8.4 | 3.3 | |

| Share of councilors at tertiary education levels in the total number of councilors (%) | 2005–2007 | 48.9 | 23.3 | 17.8 | 6.7 | 20.0 |

| 2015–2017 | 46.7 | 26.7 | 13.3 | 0.0 | 4.7 | |

| People employed in the industrial, construction and service sectors per 100 working-age population | 2005–2007 | 41.4 | 17.6 | 11.3 | 8.3 | 13.8 |

| 2015–2017 | 35.7 | 14.3 | 8.2 | 12.5 | 14.0 | |

| Share of social assistance beneficiaries in the total population (%) | 2005–2007 | 4.4 | 8.8 | 12.0 | 11.4 | 10.7 |

| 2015–2017 | 4.7 | 6.0 | 8.7 | 12.2 | 6.4 | |

| Operators entered to the REGON register per 10,000 population | 2005–2007 | 1212.3 | 723.4 | 578.4 | 469.6 | 626.1 |

| 2015–2017 | 1203.7 | 811.2 | 645.7 | 434.4 | 784.2 | |

| Operators with 50 or more employees per 10,000 working-age population | 2005–2007 | 19.9 | 13.2 | 3.9 | 0.0 | 5.3 |

| 2015–2017 | 14.9 | 6.50 | 2.36 | 6.4 | 6.4 | |

| Share of people served by a sewerage network in the total population (%) | 2005–2007 | 45.6 | 34.4 | 25.4 | 13.0 | 27.3 |

| 2015–2017 | 70.4 | 52.2 | 27.1 | 3.5 | 49.4 | |

| Share of people served by a gas network in the total population (%) | 2005–2007 | 61.4 | 6.4 | 0.0 | 0.0 | 0.0 |

| 2015–2017 | 60.3 | 2.3 | 0.03 | 0.1 | 1.5 | |

| Specification | Typological Classes/Socioeconomic Development Level | Total | ||||

|---|---|---|---|---|---|---|

| I High | II Medium-High | III Medium-Low | IV Low | |||

| Own incomes per capita (PLN) | 2005–2007 | 0.61 | 0.33 * | 0.07 | 0.47 | 0.35 ** |

| 2015–2017 | 0.62 ** | 0.09 | 0.01 | × | 0.51 ** | |

| Share of own incomes in total incomes (%) | 2005–2007 | 0.72 * | 0.01 | 0.35 ** | 0.64 | 0.73 ** |

| 2015–2017 | 0.80 ** | 0.26 ** | 0.00 | × | 0.66 ** | |

| Per capita income derived from income taxes which are state budget revenue (PLN) | 2005–2007 | 0.32 | 0.22 | 0.28 ** | 0.37 | 0.69 ** |

| 2015–2017 | 0.80 ** | 0.30 ** | 0.13 | × | 0.69 ** | |

| Per capita income derived from local taxes (PLN) | 2005–2007 | 0.66 | −0.28 | 0.14 | 0.20 | 0.46 ** |

| 2015–2017 | 0.52 ** | 0.07 | −0.05 | × | 0.41 ** | |

| Operating surplus per capita (PLN) | 2005–2007 | 0.57 | −0.03 | 0.07 | −0.59 | 0.49 ** |

| 2015–2017 | 0.64 ** | −0.07 | −0.17 | × | 0.42 ** | |

| Investment expenditure per capita (PLN) | 2005–2007 | 0.62 | 0.17 | 0.12 ** | −0.83 | 0.54 ** |

| 2015–2017 | 0.72 ** | 0.05 | −0.44 ** | × | 0.45 ** | |

| Total liabilities per capita (PLN) | 2005–2007 | 0.44 | −0.23 | −0.07 | -0.10 | 0.25 ** |

| 2015–2017 | 0.48 * | 0.22 * | −0.13 | × | 0.36 ** | |

| Specification | Typological Class/Socioeconomic Development Level | Total | ||||

|---|---|---|---|---|---|---|

| I High | II Medium-High | III Medium-Low | IV Low | |||

| Own incomes per capita (PLN) | 2005–2007 | 3007.3 | 2107.0 | 2091.3 | 2033.6 | 2140.9 |

| 2015–2017 | 2508.7 ** | 1550.1 | 1194.3 * | 1745.1 | 1596.3 | |

| Share of own incomes in total incomes (%) | 2005–2007 | 74.1 ** | 41.9 ** | 30.6 * | 25.3 * | 35.5 |

| 2015–2017 | 53.9 ** | 37.8 | 29.5 * | 38.0 | 37.9 | |

| Per capita income derived from income taxes which are state budget revenue (PLN) | 2005–2007 | 725.2 ** | 291.5 ** | 178.8 * | 146.8 * | 235.0 |

| 2015–2017 | 1069.8 ** | 539.3 * | 405.8 * | 269.4 | 577.8 | |

| Per capita income derived from local taxes and fees (PLN) | 2005–2007 | 1066.1 ** | 394.8 | 310.8 * | 243.4 * | 368.9 |

| 2015–2017 | 997.4 ** | 600.5 | 463.2 * | 715.3 | 622.5 | |

| Share of operating surplus in total incomes (%) | 2005–2007 | 30.5 ** | 12.0 | 9.9 * | 10.6 | 11.6 |

| 2015–2017 | 17.1 ** | 10.9 * | 9.9 * | 8.6 | 11.5 | |

| Operating surplus per capita (PLN) | 2005–2007 | 961.2 ** | 247.2 | 208.5 * | 208.0 | 258.4 |

| 2015–2017 | 766.4 ** | 443.0 * | 399.2 * | 374.2 | 476.9 | |

| Property investment expenditure per capita (PLN) | 2005–2007 | 1239.9 ** | 406.2 | 276.6 * | 290.6 | 361.8 |

| 2015–2017 | 790.9 ** | 443.8 * | 387.1 * | 484.3 | 478.7 | |

| Share of property investment expenditure in total expenditure (%) | 2005–2007 | 37.4 ** | 19.0 ** | 13.0 * | 14.9 | 16.0 |

| 2015–2017 | 18.3 ** | 11.7 * | 10.9 * | 14.4 | 12.4 | |

| Per capita income derived from the general subsidy (without the educational part) (PLN) | 2005–2007 | 4.3 * | 159.9 * | 292.9 ** | 358.2 | 246.9 |

| 2015–2017 | 91.3 * | 366.0 | 564.6 ** | 304.4 | 377.5 | |

| Total liabilities per capita (PLN) | 2005–2007 | 505.1 | 409.4 ** | 283.6 * | 270.6 | 327.0 |

| 2015–2017 | 1028.7 ** | 681.2 | 514.8 * | 1050.6 | 691.0 | |

| Share of total liabilities in total incomes (%) | 2005–2007 | 18.3 | 19.6 ** | 13.6 * | 13.6 | 15.4 |

| 2015–2017 | 22.7 | 17.4 | 13.1 * | 23.3 | 17.1 | |

| Share of capital and interest repayments in total incomes (%) | 2005–2007 | 6.0 | 6.6 | 5.3 | 4.2 | 5.6 |

| 2015–2017 | 22.0 ** | 14.8 | 12.7 * | 22.7 | 15.3 | |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Standar, A.; Kozera, A. The Role of Local Finance in Overcoming Socioeconomic Inequalities in Polish Rural Areas. Sustainability 2019, 11, 5848. https://doi.org/10.3390/su11205848

Standar A, Kozera A. The Role of Local Finance in Overcoming Socioeconomic Inequalities in Polish Rural Areas. Sustainability. 2019; 11(20):5848. https://doi.org/10.3390/su11205848

Chicago/Turabian StyleStandar, Aldona, and Agnieszka Kozera. 2019. "The Role of Local Finance in Overcoming Socioeconomic Inequalities in Polish Rural Areas" Sustainability 11, no. 20: 5848. https://doi.org/10.3390/su11205848

APA StyleStandar, A., & Kozera, A. (2019). The Role of Local Finance in Overcoming Socioeconomic Inequalities in Polish Rural Areas. Sustainability, 11(20), 5848. https://doi.org/10.3390/su11205848