Influence of Family Involvement on Family Firm Internationalization: The Moderating Effects of Industrial and Institutional Environments

Abstract

:1. Introduction

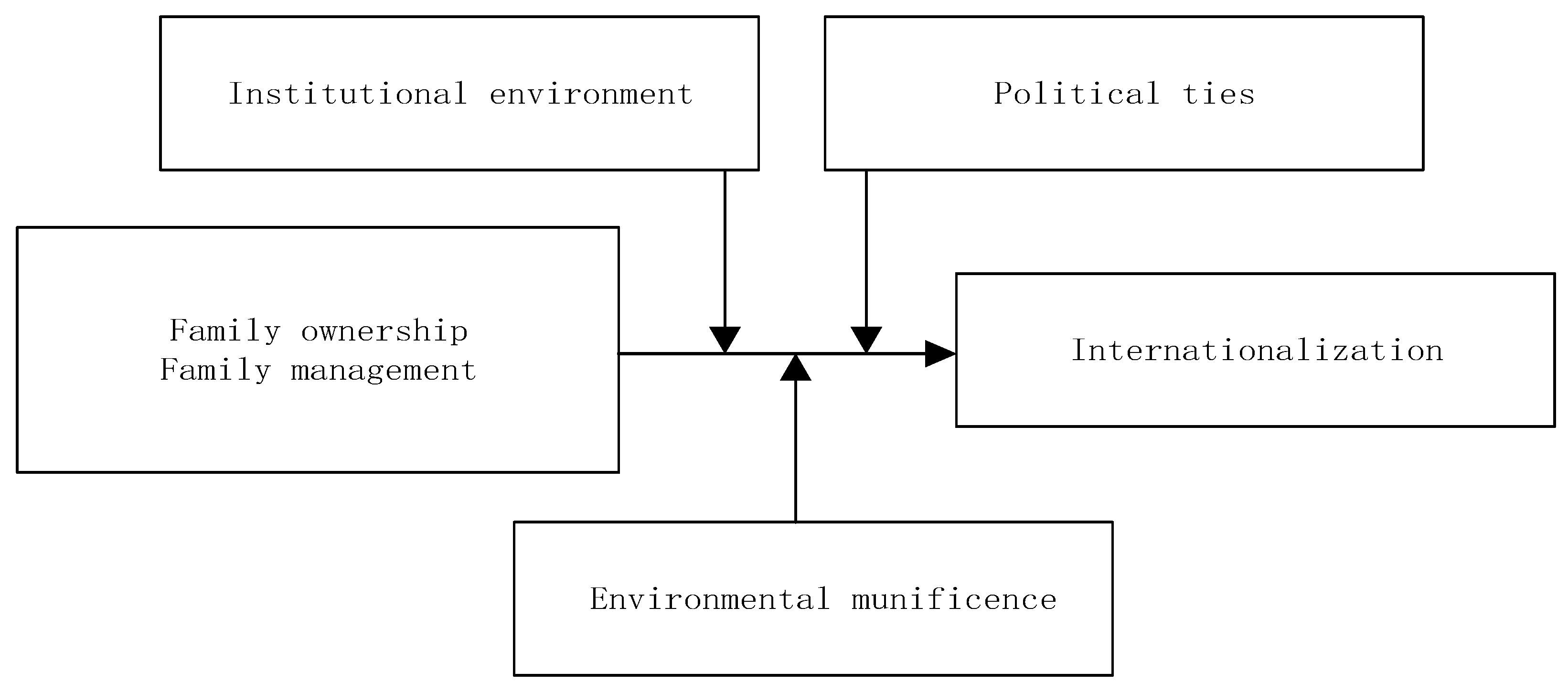

2. Hypotheses

2.1. The Effect of Family Involvement on Chinese Family Firm Internationalization

2.1.1. The Effect of Family Ownership on Chinese Family Firm Internationalization

2.1.2. The Effect of Family Management on Chinese Family Firm Internationalization

2.2. The Moderating Effect of Environmental Munificence

2.3. The Moderating Effect of Institutional Environment

2.4. The Moderating Effect of Political Ties

3. Methodology

3.1. Data and the Sample

3.2. Measures

3.2.1. Dependent Variable

3.2.2. Independent Variable

3.2.3. Moderating Variables

3.2.4. Control Variables

4. Results

4.1. Descriptive Statistics and Correlation Analysis

4.2. Test of Hypotheses

4.2.1. The Effect of Family Involvement on Chinese Family Firm Internationalization

4.2.2. The Moderating Effect of Environmental Munificence

4.2.3. The Moderating Effect of Institutional Environment

4.2.4. The Moderating Effect of Political Ties

5. Discussions and Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Pukall, T.J.; Calabrò, A. The internationalization of family firms: A critical review and integrative model. Fam. Bus. Rev. 2014, 27, 103–125. [Google Scholar] [CrossRef]

- Zahra, S.A. International expansion of US manufacturing family business: The effect of ownership and involvement. J. Bus. Venturing 2003, 18, 495–512. [Google Scholar] [CrossRef]

- Carr, C.; Bateman, S. International strategy configurations of the world’s top family firms. Manag. Int. Rev. 2009, 49, 733–758. [Google Scholar] [CrossRef]

- Fernández, Z.; Nieto, M.J. Internationalization strategy of small and medium-sized family business: Some influential factors. Fam. Bus. Rev. 2005, 18, 77–89. [Google Scholar] [CrossRef]

- Graves, C.; Thomas, J. Internationalization of Australian family businesses: A managerial capabilities perspective. Fam. Bus. Rev. 2006, 19, 207–224. [Google Scholar] [CrossRef]

- Sciascia, S.; Mazzola, P.; Astrachan, J.H.; Pieper, T.M. The role of family ownership in international entrepreneurship: Exploring nonlinear effects. Small Bus. Econ. 2012, 38, 15–31. [Google Scholar] [CrossRef]

- Pinho, J.C. The impact of ownership: Location specific advantages and managerial characteristics on SME foreign entry mode choices. Int. Market. Rev. 2007, 24, 715–734. [Google Scholar] [CrossRef]

- Cerrato, D.; Piva, M. The internationalization of small and medium-sized enterprises: The effect of family management, human capital and foreign ownership. J. Manag. Govern. 2012, 16, 617–644. [Google Scholar] [CrossRef]

- Arregle, J.L.; Duran, P.; Hitt, M.A.; Essen, M. Why is family firms’ internationalization unique? A meta-analysis. Entrep. Theory Pract. 2017, 41, 801–831. [Google Scholar] [CrossRef]

- Liang, X.Y.; Wang, L.H.; Cui, Z.Y. Chinese private firms and internationalization: Family involvement in management and family ownership. Fam. Bu. Rev. 2014, 27, 126–141. [Google Scholar] [CrossRef]

- Dou, J.S.; Jacoby, G.; Li, J.L.; Su, Y.Y.; Wu, Z.Y. Family involvement and family firm internationalization: The moderating effects of board experience and geographical distance. J. Int. Financ. Mark. Inst. Money 2019, 59, 250–261. [Google Scholar] [CrossRef]

- Debicki, B.J. Socioemotional Wealth and Family Firm Internationalization: The Moderating Effect of Environmental Munificence. Ph.D. Thesis, Mississippi State University, Mississippi State, MS, USA, May 2012. [Google Scholar]

- Deng, P.; Wu, B. Institutional escapism and internationalization of SMEs: Evidence from Chinese private firms. Acad. Manag. Annu. Meet. Proc. 2016, 1, 12999. [Google Scholar]

- Li, F.G.; Ding, D. The dual effects of home country institutions on the internationalization of private firms in emerging markets: Evidence from China. Mult. Bus. Rev. 2017, 25, 128–149. [Google Scholar] [CrossRef]

- Xin, K.R.; Pearce, J.L. Guanxi: Connection as substitutes for formal institutional support. Acad. Manag. J. 1996, 39, 1641–1658. [Google Scholar]

- Peng, M.W.; Luo, Y. Managerial ties and firm performance in a transition economy: The nature of a micro-macro link. Acad. Manag. J. 2000, 43, 486–501. [Google Scholar]

- Kafouros, M.I.; Buckley, P.J.; Clegg, J. The effects of global knowledge reservoirs on the productivity of multinational enterprises: The role of international depth and breadth. Res. Policy 2012, 41, 848–861. [Google Scholar] [CrossRef]

- Chen, X.; Wu, J. Do differential guanxi types affect capability building differently? A contingency view. Ind. Market. Manag. 2011, 40, 581–592. [Google Scholar] [CrossRef]

- Li, H.; Zhang, Y. The role of managers’ political networking and functional experience in new venture performance: Evidence from China’s transition economy. Strategic Manag. J. 2007, 28, 791–804. [Google Scholar] [CrossRef]

- Calabrò, A.; Torchia, M.; Pukall, T.; Mussolino, D. The influence of ownership structure and board strategic involvement on international sales: The moderating effect of family involvement. Int. Bus. Rev. 2013, 22, 509–523. [Google Scholar] [CrossRef]

- Graves, C.; Thomas, J. Determinants of the internationalization pathways of family firms: An examination of family influence. Fam. Bus. Rev. 2008, 21, 151–167. [Google Scholar] [CrossRef]

- Miller, D.; Le Breton-Miller, I.; Scholnick, B. Stewardship vs. stagnation: An empirical comparison of small family and non-family businesses. J. Manag. Stud. 2008, 45, 51–78. [Google Scholar] [CrossRef]

- Claver, E.; Rienda, L.; Quer, D. Family firms risk perception: Empirical evidence on the internationalization process. J. Small Bus. Enterp. Dev. 2008, 15, 457–471. [Google Scholar] [CrossRef]

- Fernández, Z.; Nieto, M.J. Impact of ownership on the international involvement of SMEs. J. Int. Bus. Stud. 2006, 37, 340–351. [Google Scholar] [CrossRef]

- Ray, S.; Mondal, A.; Ramachandran, K. How does family involvement affect a firm’ internationalization? An investigation of Indian family firms. Glob. Strateg. J. 2018, 8, 73–105. [Google Scholar] [CrossRef]

- Fang, H.; Kotlar, J.; Memili, E.; Chrisman, J.J.; De Massis, A. The pursuit of international opportunities in family firms: Generational differences and the role of knowledge-based resources. Glob. Strateg. J. 2018, 8, 136–157. [Google Scholar] [CrossRef]

- Sirmon, D.G.; Hitt, M.A. Managing resources: Linking unique resources, management, and wealth creation in family firms. Entrep. Theory Pract. 2003, 27, 339–358. [Google Scholar] [CrossRef]

- Segaro, E. Internationalization of family SMEs: The impact of ownership, governance, and top management team. J. Manag. Govern. 2012, 16, 147–169. [Google Scholar] [CrossRef]

- Family Business Research Group of Chinese Private Economy Research Association. Chinese Family Business Report; China CITIC Press: Beijing, China, 2011. (In Chinese) [Google Scholar]

- Redding, G. Weak Organization and Strong Linkages: Managerial Ideology and Chinese Family Firm Networks. In Business Networks and Economic Development in East and Southeast Asian; Hamilton, G.G., Ed.; Centre of Asian Studies, University of Hong Kong: Hong Kong, China, 1991. [Google Scholar]

- Okoroafo, S.C. Internationalization of family businesses: Evidence from Northwest Ohio, U.S.A. Fam. Bus. Rev. 1999, 12, 147–158. [Google Scholar] [CrossRef]

- Acquaah, M. Social networking relationships, firm-specific managerial experience and firm performance in a transition economy: A comparative analysis of family owned and nonfamily firms. Strategic Manag. J. 2012, 33, 1215–1228. [Google Scholar] [CrossRef]

- Graves, C.; Shan, Y.G. An empirical analysis of the effect of internationalization on the performance of unlisted family and nonfamily firms in Australia. Fam. Bus. Rev. 2014, 27, 142–160. [Google Scholar] [CrossRef]

- Chang, S.J.; Shim, J. When does transitioning from family to professional management improve firm performance? Strategic Manag. J. 2015, 36, 1297–1316. [Google Scholar] [CrossRef]

- Dess, G.; Beard, D. Dimensions of organizational task environments. Admin. Sci. Quart. 1984, 29, 52–78. [Google Scholar] [CrossRef]

- North, D.C. Institutions, Institutional Change, and Economic Performance; Cambridge University Press: Cambridge, UK, 1990. [Google Scholar]

- Yamakawa, Y.; Peng, M.W.; Deeds, D.L. What drives new ventures to internationalize from emerging to developed economies? Entrep. Theory Pract. 2008, 32, 59–82. [Google Scholar] [CrossRef]

- Holmes, R.M.; Miller, T.; Hitt, M.A.; Salmador, M.P. The interrelationships among informal institutions, formal institutions, and inward foreign direct investment. J. Manag. 2013, 39, 531–566. [Google Scholar] [CrossRef]

- Boisot, M.; Meyer, M.W. Which way through the open door? Reflections on the internationalization of Chinese firms. Manag. Organ. Rev. 2008, 4, 349–365. [Google Scholar] [CrossRef]

- Sheng, S.; Zhou, K.Z.; Li, J.J. The effects of business and political ties on firm performance: Evidence from China. J. Mark. 2011, 75, 1–15. [Google Scholar] [CrossRef]

- Peng, M.W.; Heath, P.S. The growth of the firm in planned economies in transition: Institutions, organizations and strategic choice. Acad. Manag. Rev. 1996, 21, 492–528. [Google Scholar] [CrossRef]

- Napshin, S.A.; Azadegan, A. Partner attachment to institutional logics: The influence of congruence and divergence. J. Manag. Organ. 2012, 18, 481–498. [Google Scholar] [CrossRef]

- Wang, C.; Yi, J.; Kafouros, M.; Yan, Y. Under what institutional conditions do business groups enhance innovation performance. J. Bus. Res. 2015, 68, 694–702. [Google Scholar] [CrossRef]

- Yuan, J.G.; Hou, Q.S.; Cheng, C. The curse effect of enterprise political resources: Based on the investigation of political association and firms’ technological innovation. Manag. Word 2015, 1, 139–155. (In Chinese) [Google Scholar]

- Westhead, P.; Howorth, C. Ownership and management issues associated with family firm performance and company objectives. Fam. Bus. Rev. 2006, 19, 301–316. [Google Scholar] [CrossRef]

- Wang, X.L.; Fan, G.; Yu, J.W. Marketization Index of China’s Provinces: NERI Report 2016; Social Sciences Academic Press: Beijing, China, 2017. (In Chinese) [Google Scholar]

- Du, X.; Luo, J. Political connections, home formal institutions and internationalization: Evidence from China. Manag. Organ. Rev. 2016, 12, 103–133. [Google Scholar] [CrossRef]

- Gómez-Mejía, L.R.; Makri, M.; Larraza-Kintana, M. Diversification decisions in family-controlled firms. J. Manag. Stud. 2010, 47, 223–252. [Google Scholar] [CrossRef]

- Aiken, L.S.; West, S.G. Multiple Regression: Testing an Interpreting Interactions; Sage Publications: Newbury Park, CA, USA, 1991. [Google Scholar]

- Kutner, M.H.; Nachtsheim, C.J.; Neter, J. Applied Linear Regression, 4th ed.; McGraw-Hill Irwin: New York, NY, USA, 2004. [Google Scholar]

| Items | Frequency | Percentage (%) | Items | Frequency | Percentage (%) |

|---|---|---|---|---|---|

| Location | Entrepreneur’s gender | ||||

| Zhejiang | 106 | 38.7 | Male | 229 | 83.9 |

| Shanghai | 15 | 5.5 | Female | 44 | 16.1 |

| Fujian | 6 | 2.2 | Entrepreneur’s age | ||

| Guangdong | 4 | 1.5 | Less than 35 years | 37 | 13.5 |

| Chongqing | 100 | 36.5 | 36–45 years | 128 | 46.7 |

| Qinghai | 22 | 8.0 | 46–55 years | 83 | 30.3 |

| Shaanxi | 13 | 4.7 | Over 55 years | 26 | 9.5 |

| Yunnan | 8 | 2.9 | People’s Congress Member, or Member of Chinese People’s Political Consultative Conference | ||

| Industry | Yes | 53 | 19.4 | ||

| Manufacturing | 212 | 77.4 | No | 220 | 80.6 |

| Service | 46 | 16.8 | Family ownership | ||

| Agriculture, farming | 12 | 4.4 | 50%–70% | 72 | 26.3 |

| Construction | 4 | 1.5 | 71%–99% | 61 | 22.3 |

| Total staff | 100% | 141 | 51.5 | ||

| Less than 50 | 134 | 48.9 | Family management | ||

| 51–200 | 80 | 29.2 | 0% | 21 | 7.7 |

| 201–300 | 18 | 6.6 | 0%–20% | 112 | 41.2 |

| More than 301 | 42 | 15.3 | 21%–50% | 44 | 16.2 |

| Firm age | 51%–80% | 43 | 15.8 | ||

| Less than 5 years | 50 | 18.2 | More than 80% | 52 | 19.1 |

| 6–10 years | 89 | 32.5 | International experience | ||

| 11–19 years | 101 | 36.9 | Yes | 200 | 73.5 |

| More than 20 years | 34 | 12.4 | No | 72 | 26.5 |

| Variables | Mean | SD | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1.DEPT | 0.459 | 0.385 | 1 | ||||||||||

| 2.BREA | 1.243 | 0.977 | 0.304 *** | 1 | |||||||||

| 3.FO | 0.851 | 0.185 | 0.239 *** | 0.163 ** | 1 | ||||||||

| 4.FM | 2.974 | 1.284 | 0.379 *** | 0.193 *** | 0.206 ** | 1 | |||||||

| 5.EM | 2.736 | 0.827 | 0.123 * | −0.078 | 0.030 | 0.031 | 1 | ||||||

| 6.IE | 8.120 | 2.061 | 0.356 *** | 0.142 * | 0.090 | 0.394 *** | 0.017 | 1 | |||||

| 7.POL | 0.194 | 0.396 | −0.184 ** | 0.050 | −0.107 + | −0.160 ** | −0.014 | −0.346 *** | 1 | ||||

| 8. SIZE | 4.163 | 1.575 | −0.339 *** | 0.075 | −0.256 *** | −0.248 *** | −0.029 | −0.259 *** | 0.370 *** | 1 | |||

| 9.AGE | 2.259 | 0.694 | −0.047 | 0.220 *** | 0.057 | −0.090 | 0.030 | −0.045 | 0.164 ** | 0.376 *** | 1 | ||

| 10.INDU | 0.774 | 0.419 | 0.021 | 0.122 * | −0.099 | 0.044 | −0.053 | 0.187 ** | −0.043 | 0.239 *** | 0.070 | 1 | |

| 11.EIE | 0.735 | 0.442 | 0.031 | 0.137 * | −0.067 | −0.146 * | −0.120 * | −0.041 | 0.081 | 0.071 | 0.129 * | 0.007 | 1 |

| 12.PERF | 3.295 | 0.749 | 0.104 + | 0.164 ** | 0.009 | 0.018 | 0.144 * | 0.088 | 0.128 * | 0.105 + | −0.043 | 0.026 | 0.144 ** |

| Variables | Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 |

|---|---|---|---|---|---|---|

| −CONS | −0.064(0.161) | −0.385 *(0.188) | −0.336 +(0.188) | −0.482 *(0.189) | −0.340 +(0.188) | −0.379 *(0.192) |

| SIZE | −0.077 *** (0.016) | −0.061 ***(0.016) | −0.065 ***(0.017) | −0.059 ***(0.016) | −0.058 **(0.017) | −0.062 ***(0.016) |

| AGE | 0.041(0.033) | 0.032(0.033) | 0.033(0.033) | 0.034(0.033) | 0.031(0.033) | 0.034(0.032) |

| INDU | 0.044(0.054) | 0.052(0.053) | 0.051(0.053) | 0.042(0.053) | 0.044(0.053) | 0.040(0.052) |

| EIE | 0.045(0.049) | 0.071(0.048) | 0.065(0.049) | 0.075(0.048) | 0.080(0.049) | 0.069(0.048) |

| PERF | 0.051 +(0.030) | 0.043(0.029) | 0.059 *(0.029) | 0.036(0.029) | 0.035(0.029) | 0.046(0.029) |

| EM | 0.047 +(0.026) | 0.047 +(0.025) | 0.046 +(0.025) | 0.042 +(0.025) | 0.048 +(0.025) | 0.042 +(0.025) |

| IE | 0.048 ***(0.011) | 0.031 *(0.012) | 0.025 *(0.012) | 0.047 ***(0.013) | 0.031 *(0.012) | 0.040 **(0.014) |

| POL | 0.001(0.060) | −0.005(0.059) | −0.014(0.058) | 0.020(0.059) | −0.040(0.062) | −0.006(0.064) |

| FO | 0.243 *(0.118) | 0.211 +(0.119) | 0.264 *(0.118) | 0.226 +(0.119) | 0.206 +(0.119) | |

| FM | 0.069 ***(0.018) | 0.069 ***(0.018) | 0.049 *(0.019) | 0.065 ***(0.018) | 0.050 **(0.019) | |

| FO × EM | −0.292 *(0.142) | −0.309 *(0.141) | ||||

| FM × EM | 0.041 *(0.020) | 0.035 +(0.020) | ||||

| FO × IE | 0.039(0.054) | 0.040(0.056) | ||||

| FM × IE | 0.027 *(0.011) | 0.023 *(0.011) | ||||

| FO × POL | 0.053(0.268) | 0.243(0.277) | ||||

| FM × POL | −0.098 *(0.049) | −0.067 +(0.051) | ||||

| R2 | 0.219 | 0.277 | 0.296 | 0.299 | 0.288 | 0.322 |

| Adjusted R2 | 0.196 | 0.249 | 0.263 | 0.266 | 0.255 | 0.279 |

| F | 9.174 *** | 9.849 *** | 8.945 *** | 9.047 *** | 8.606 *** | 7.453 *** |

| N | 270 | 268 | 268 | 268 | 268 | 268 |

| Variables | Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 |

|---|---|---|---|---|---|---|

| −CONS | −0.575(0.442) | −1.393 **(0.517) | −1.331 *(0.519) | −1.456 **(0.525) | −1.310 *(0.515) | −1.449 **(0.527) |

| SIZE | −0.025(0.045) | 0.019(0.046) | 0.012(0.046) | 0.025(0.046) | 0.012(0.046) | 0.008(0.046) |

| AGE | 0.333 **(0.096) | 0.288 **(0.096) | 0.305 **(0.096) | 0.276 **(0.096) | 0.272 **(0.095) | 0.289 **(0.095) |

| INDU | 0.177(0.150) | 0.199(0.148) | 0.219(0.147) | 0.194(0.148) | 0.222(0.146) | 0.230(0.145) |

| EIE | 0.155(0.134) | 0.209(0.134) | 0.170(0.135) | 0.211(0.133) | 0.174(0.133) | 0.128(0.133) |

| PERF | 0.215 *(0.081) | 0.197 *(0.079) | 0.184 *(0.081) | 0.184 *(0.079) | 0.180 *(0.079) | 0.153 +(0.080) |

| EM | −0.118(0.071) | −0.124 +(0.069) | −0.126 +(0.069) | −0.144 *(0.070) | −0.117 +(0.068) | −0.136 *(0.069) |

| IE | 0.062 +(0.031) | 0.026(0.033) | 0.027(0.034) | 0.052(0.037) | 0.039(0.033) | 0.081 *(0.038) |

| POL | 0.121(0.167) | 0.116(0.165) | 0.115(0.164) | 0.140(0.167) | 0.242(0.172) | 0.332 +(0.179) |

| FO | 0.731 *(0.332) | 0.688 *(0.333) | 0.739 *(0.332) | 0.610 +(0.331) | 0.593 +(0.331) | |

| FM | 0.142 **(0.050) | 0.148 **(0.049) | 0.107 *(0.054) | 0.151 **(0.049) | 0.109 *(0.053) | |

| FO × EM | −0.220(0.392) | −0.272(0.386) | ||||

| FM × EM | −0.114 *(0.056) | −0.112 *(0.055) | ||||

| FO × IE | −0.158(0.150) | 0.005(0.153) | ||||

| FM × IE | 0.053 +(0.031) | 0.070 *(0.031) | ||||

| FO × POL | 2.148 **(0.733) | 2.375 **(0.762) | ||||

| FM × POL | 0.067(0.136) | 0.124(0.141) | ||||

| R2 | 0.119 | 0.173 | 0.190 | 0.184 | 0.202 | 0.235 |

| Adjusted R2 | 0.095 | 0.139 | 0.149 | 0.143 | 0.162 | 0.183 |

| F | 4.361 *** | 5.073 *** | 4.702 *** | 4.527 *** | 5.090 *** | |

| N | 256 | 254 | 254 | 254 | 254 | 254 |

| Variables | Environmental Munificence | Institutional Environment | Political Ties | |||

|---|---|---|---|---|---|---|

| High | Low | Good | Bad | Yes | No | |

| −CONS | −0.411(0.258) | −0.071(0.252) | −0.105(0.282) | −0.062(0.228) | 0.056(0.406) | −0.402 +(0.211) |

| SIZE | −0.050 *(0.023) | −0.079 **(0.024) | −0.045(0.027) | −0.041 +(0.022) | 0.010(0.035) | −0.066 **(0.019) |

| AGE | 0.026(0.051) | 0.036(0.045) | 0.019(0.051) | −0.009(0.044) | −0.045(0.095) | 0.022(0.035) |

| INDU | 0.004(0.074) | 0.082(0.078) | 0.114(0.073) | 0.004(0.072) | −0.159(0.131) | 0.100 +(0.057) |

| EIE | 0.130 *(0.064) | −0.018(0.074) | 0.019(0.064) | 0.175 *(0.070) | 0.070(0.132) | 0.099 +(0.051) |

| PERF | 0.043(0.041) | 0.069(0.042) | −0.004(0.045) | 0.076 *(0.037) | 0.168 *(0.062) | −0.001(0.033) |

| EM | 0.068 +(0.037) | 0.003(0.035) | −0.061(0.057) | 0.069 *(0.027) | ||

| IE | 0.054 **(0.017) | 0.006(0.018) | −0.019(0.026) | 0.043 **(0.014) | ||

| POL | −0.049(0.088) | 0.028(0.082) | −0.006(0.174) | 0.022(0.060) | ||

| FO | 0.172(0.187) | 0.331 *(0.158) | 0.388 *(0.188) | 0.190(0.152) | 0.084(0.243) | 0.206(0.134) |

| FM | 0.082 **(0.024) | 0.048 +(0.026) | 0.069 **(0.024) | 0.005(0.028) | 0.011(0.046) | 0.076 ***(0.019) |

| R2 | 0.394 | 0.210 | 0.221 | 0.136 | 0.242 | 0.333 |

| Adjusted R2 | 0.338 | 0.157 | 0.162 | 0.076 | 0.075 | 0.304 |

| F | 8.042 *** | 3.908 *** | 3.776 *** | 2.245 * | 1.452 | 11.471 *** |

| N | 126 | 142 | 130 | 138 | 51 | 217 |

| Variables | Environmental Munificence | Institutional Environment | Political Ties | |||

|---|---|---|---|---|---|---|

| High | Low | Good | Bad | Yes | No | |

| −CONS | −1.319 +(0.705) | −1.951 **(0.703) | −0.625(0.637) | −1.108(0.778) | −2.764 *(1.258) | −0.726(0.559) |

| SIZE | −0.065(0.063) | 0.094(0.069) | 0.028(0.062) | 0.010(0.075) | −0.140(0.105) | 0.074(0.052) |

| AGE | 0.372 **(0.139) | 0.213(0.138) | 0.121(0.120) | 0.354(0.164) | 0.711 *(0.342) | 0.117(0.098) |

| INDU | 0.104(0.203) | 0.204(0.222) | 0.366 *(0.164) | 0.091(0.250) | −0.239(0.396) | 0.374 *(0.154) |

| EIE | 0.055(0.174) | 0.400 +(0.207) | 0.206(0.144) | 0.204(0.238) | 0.407(0.412) | 0.128(0.136) |

| PERF | 0.329 **(0.111) | 0.068(0.118) | −0.015(0.100) | 0.357 **(0.125) | 0.441 *(0.188) | 0.035(0.87) |

| EM | −0.110(0.082) | −0.162(0.119) | −0.326 +(0.174) | −0.098(0.073) | ||

| IE | 0.044(0.046) | 0.023(0.050) | 0.081(0.080) | 0.050(0.037) | ||

| POL | 0.029(0.240) | 0.078(0.236) | 0.195(0.391) | 0.041(0.208) | ||

| FO | 0.258(0.508) | 0.859 +(0.453) | 0.891 *(0.420) | 0.348(0.537) | 1.473 +(0.746) | 0.349(0.361) |

| FM | 0.032(0.067) | 0.260 **(0.075) | 0.200 ***(0.055) | 0.059(0.099) | 0.207(0.145) | 0.141 **(0.051) |

| R2 | 0.167 | 0.226 | 0.235 | 0.179 | 0.512 | 0.152 |

| Adjusted R2 | 0.101 | 0.168 | 0.176 | 0.116 | 0.400 | 0.113 |

| F | 2.537 * | 3.893 *** | 3.995 *** | 2.829 ** | 4.554 *** | 3.884 ** |

| N | 124 | 130 | 127 | 127 | 49 | 205 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhou, L.; Han, Y.; Gou, C. Influence of Family Involvement on Family Firm Internationalization: The Moderating Effects of Industrial and Institutional Environments. Sustainability 2019, 11, 5721. https://doi.org/10.3390/su11205721

Zhou L, Han Y, Gou C. Influence of Family Involvement on Family Firm Internationalization: The Moderating Effects of Industrial and Institutional Environments. Sustainability. 2019; 11(20):5721. https://doi.org/10.3390/su11205721

Chicago/Turabian StyleZhou, Lixin, Yan Han, and Chaoli Gou. 2019. "Influence of Family Involvement on Family Firm Internationalization: The Moderating Effects of Industrial and Institutional Environments" Sustainability 11, no. 20: 5721. https://doi.org/10.3390/su11205721

APA StyleZhou, L., Han, Y., & Gou, C. (2019). Influence of Family Involvement on Family Firm Internationalization: The Moderating Effects of Industrial and Institutional Environments. Sustainability, 11(20), 5721. https://doi.org/10.3390/su11205721