Corporate Social Responsibility as an Antecedent of Innovation, Reputation, Performance, and Competitive Success: A Multiple Mediation Analysis

Abstract

1. Introduction

2. Literature Review

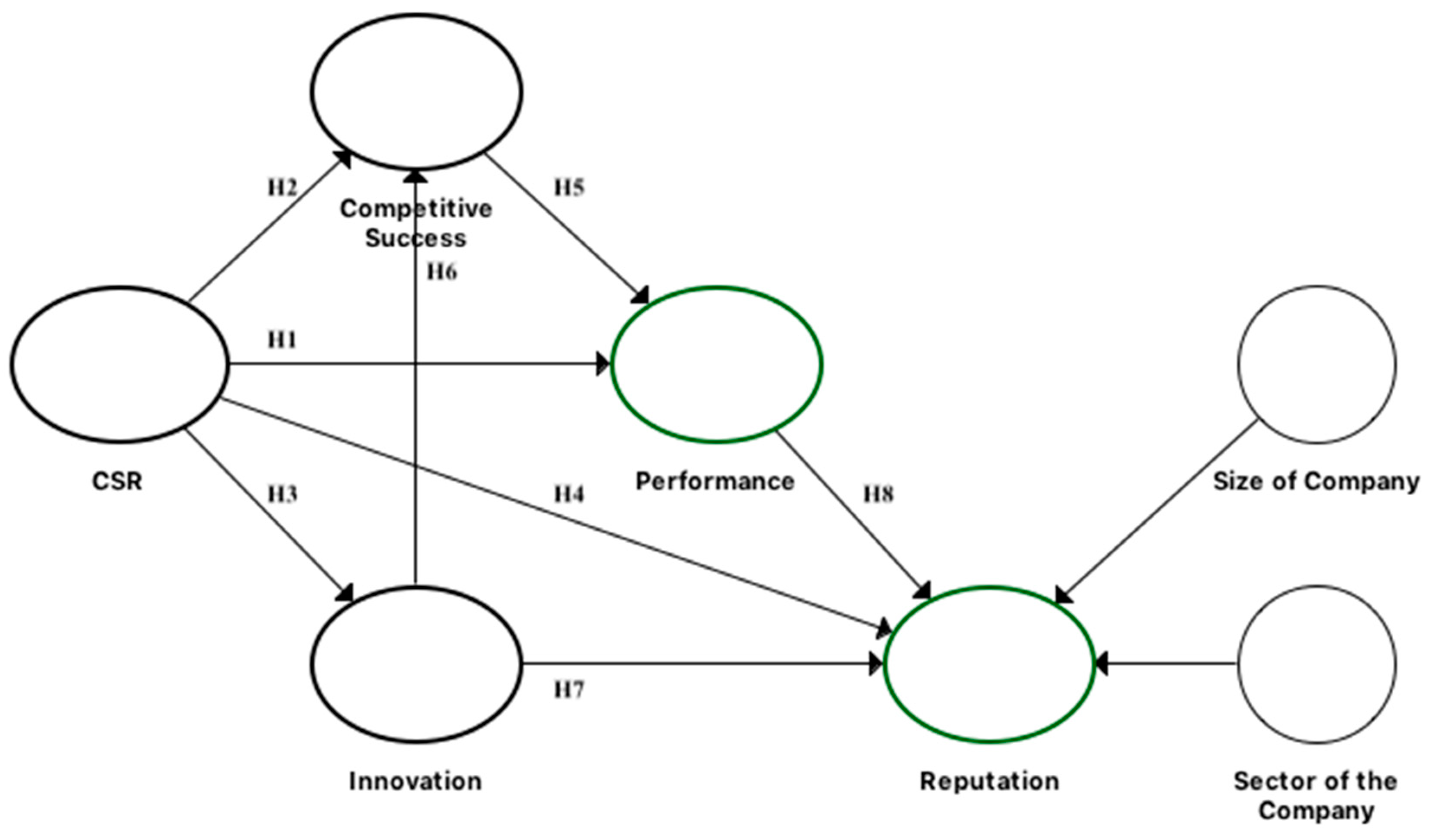

3. Development and Justification of Hypotheses

3.1. CSR and Performance

3.2. CSR and Competitive Success

3.3. CSR and Innovation

3.4. CSR and Reputation

3.5. Competitive Success and Performance

3.6. Innovation and Competitive Success

3.7. Innovation and Reputation

3.8. Performance and Reputation

4. Methodology

4.1. Population, Sample, and Data Collection Techniques

4.2. Creation and Measurement of Variables

4.2.1. CSR

4.2.2. Innovation

4.2.3. Competitive Success

4.2.4. Performance

4.2.5. Reputation

4.3. Control Variables

4.3.1. Company Size

4.3.2. Company Sector

5. Results

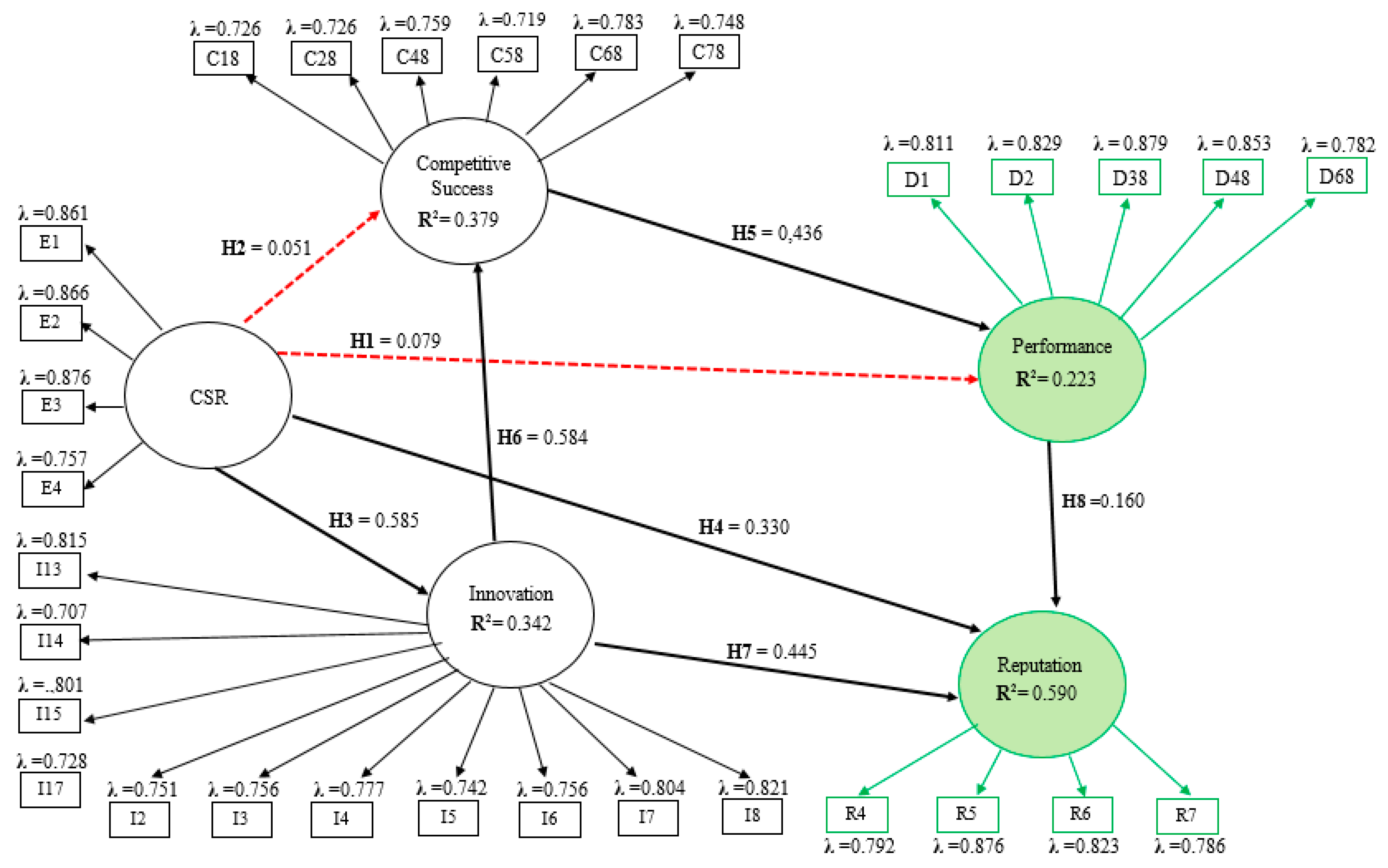

5.1. Measurement Model Evaluation

5.2. Structural Model Evaluation

5.3. Multiple Mediation Analysis

6. Discussion and Conclusions

7. Limitations and Future Lines of Research

Author Contributions

Acknowledgments

Conflicts of Interest

References and Notes

- Gallardo-Vázquez, D.; Sánchez-Hernández, M.I.; Corchuelo Martínez-Azúa, M.B. Validación de un instrumento de medida para la relación entre la orientación a la responsabilidad social corporativa y otras variables estratégicas de la empresa. Rev. Contab. 2013, 16, 11–23. [Google Scholar] [CrossRef]

- Boulouta, I.; Pitelis, C.N. Who needs CSR? The impact of corporate social responsibility on national competitiveness. J. Bus. Ethics 2014, 119, 349–364. [Google Scholar] [CrossRef]

- Carroll, A.B.; Shabana, K.M. The business case for corporate social responsibility: A review of concepts, research and practice. Int. J. Manag. Rev. 2010, 12, 85–105. [Google Scholar] [CrossRef]

- Oh, W.Y.; Chang, Y.K.; Martynov, A. The effect of ownership structure on corporate social responsibility: Empirical evidence from Korea. J. Bus. Ethics. 2011, 104, 283–297. [Google Scholar] [CrossRef]

- Erhemjamts, O.; Li, Q.; Venkateswaran, A. Corporate social responsibility and its impact on firms’ investment policy, organizational structure, and performance. J. Bus. Ethics. 2013, 118, 395–412. [Google Scholar] [CrossRef]

- Inoue, Y.; Lee, S. Effects of different dimensions of corporate social responsibility on corporate financial performance in tourism-related industries. Tour. Manag. 2011, 32, 790–804. [Google Scholar] [CrossRef]

- Baldarelli, M.G.; Gigli, S. Exploring the drivers of corporate reputation integrated with a corporate responsibility perspective: Some reflections in theory and in praxis. J. Manag. Gov. 2014, 18, 589–613. [Google Scholar] [CrossRef]

- Jo, H.; Kim, H.; Park, K. Corporate environmental responsibility and firm performance in the financial services sector. J. Bus. Ethics 2015, 131, 257–284. [Google Scholar] [CrossRef]

- Castilla-Polo, F.; Sánchez-Hernández, M.I.; Gallardo-Vázquez, D. Assessing the influence of social responsibility on reputation: an empirical Case-Study in agricultural cooperatives in Spain. J. Agric. Environ. Ethics 2017, 30, 99–120. [Google Scholar] [CrossRef]

- Yu, H.C.; Kuo, L.; Kao, M.F. The relationship between CSR disclosure and competitive advantage. Sustain. Account. Manag. Policy J. 2017, 8, 547–570. [Google Scholar] [CrossRef]

- Bocquet, R.; Le Bas, C.; Mothe, C.; Poussing, N. Are firms with different CSR profiles equally innovative? Empirical analysis with survey data. Eur. Manag. J. 2013, 31, 642–654. [Google Scholar] [CrossRef]

- Lindgreen, A.; Swaen, V.; Campbell, T.T. Corporate social responsibility practices in developing and transitional countries: Botswana and Malawi. J. Bus. Ethics 2009, 90, 429–440. [Google Scholar] [CrossRef]

- Tarus, D.K. Corporate social responsibility engagement in Kenya: bottom line or rhetoric? J. Afr. Bus. 2015, 16, 289–304. [Google Scholar] [CrossRef]

- Hu, J.N.; Wang, S.J.; Xie, F.X. Environmental responsibility, market valuation, and firm characteristics: Evidence from China. Corp. Soc. Responsib. Environ. Manag. 2018, 25, 1376–1387. [Google Scholar] [CrossRef]

- Wang, Q.; Junsheng, D.; Shenghua, J. A meta-analytic review of corporate social responsibility and corporate financial performance: The moderating effect of contextual factors. Bus. Soc. 2016, 55, 1083–1121. [Google Scholar] [CrossRef]

- Valdez-Juárez, L.E.; Gallardo-Vázquez, D.; Ramos-Escobar, E.A. CSR and the supply chain: Effects on the results of SMEs. Sustainability 2018, 10, 2356. [Google Scholar] [CrossRef]

- Wagner, M. Corporate social performance and innovation with high social benefits: a quantitative analysis. J. Bus. Ethics 2010, 94, 581–594. [Google Scholar] [CrossRef]

- Siegel, D.S.; Vitaliano, D.F. An empirical analysis of the strategic use of corporate social responsibility. J. Econ. Manag. Strategy 2007, 16, 773–792. [Google Scholar] [CrossRef]

- Turker, D. How corporate social responsibility influences organizational commitment. J. Bus. Ethics 2009, 89, 189–204. [Google Scholar] [CrossRef]

- Jenkins, H. Small business champions for corporate social responsibility. J. Bus. Ethics 2006, 67, 241–256. [Google Scholar] [CrossRef]

- Fassin, Y.; Van Rossem, A.; Buelens, M. Small-Business Owner-Managers´ Perceptions of Business Ethics and CSR-Related Concepts. J. Bus. Ethics 2011, 98, 425–453. [Google Scholar] [CrossRef]

- Pizzi, S. The Relationship between Non-financial Reporting, Environmental Strategies and Financial Performance. Empirical Evidence from Milano Stock Exchange. Adm. Sci. 2018, 8, 76. [Google Scholar] [CrossRef]

- Spence, L.J. Small business social responsibility: Expanding core CSR theory. Bus. Soc. 2016, 55, 23–55. [Google Scholar] [CrossRef]

- Del Baldo, M. Corporate social responsibility and corporate governance in Italian SMEs: the experience of some “spirited businesses”. J. Manag. Gov. 2012, 16, 1–36. [Google Scholar] [CrossRef]

- Pastrana, N.A.; Sriramesh, K. Corporate social responsibility: perceptions and practices among SMEs in Colombia. Public Relat. Rev. 2014, 40, 14–24. [Google Scholar] [CrossRef]

- Hamann, R.; Smith, J.; Tashman, P.; Scott Marshall, R. Why do SME go green? An analysis of wine firms in South Africa. Bus. Soc. 2017, 56, 23–56. [Google Scholar] [CrossRef]

- Russo, A.; Tencati, A. Formal vs. informal CSR strategies: Evidence from Italian micro, small, medium-sized, and large firms. J. Bus. Ethics 2009, 85, 339–353. [Google Scholar] [CrossRef]

- Gallardo-Vázquez, D.; Sánchez-Hernandez, M.I. Measuring corporate social responsibility for competitive success at a regional level. J. Clean. Prod. 2014, 72, 14–22. [Google Scholar] [CrossRef]

- Law 15/2010, of December 9, on Corporate Social Responsibility in Extremadura. DOE of December 15, 2010.

- European Council of Lisbon. Empleo, Reforma Económica y Cohesión Social. Available online: http://www.europarl.europa.eu/summits/lis1_es.htm (accessed on 22 September 2018).

- European, C. Green Book: Promote a European Framework for Corporate Social Responsibility; Office for Official Publications of the European Communities: Brussels, Belgium, 2001. [Google Scholar]

- Carroll, A.B. The pyramid of corporate social responsibility: toward the moral management of organizational stakeholders. Bus. Horiz. 1991, 34, 39–48. [Google Scholar] [CrossRef]

- Friedman, M. The social responsibility of business is to increase its profits. In Corporate Ethics and Corporate Governance; Zimmerli, W.C., Holzinger, M., Richter, K., Eds.; Springer: Berlin, Germany, 2007; pp. 173–178. [Google Scholar]

- Ludescher, J.C.; Mahsud, R.; Prussia, G.E. We are the corporation: Dispersive CSR. Bus. Soc. Rev. 2012, 117, 55–88. [Google Scholar] [CrossRef]

- Arendt, S.; Brettel, M. Understanding the influence of corporate social responsibility on corporate identity, image, and firm performance. Manag. Decis. 2010, 48, 1469–1492. [Google Scholar] [CrossRef]

- Porter, M.E.; Kramer, M.R. Creating shared value. Harv. Bus. Rev. 2011, 89, 62–77. [Google Scholar]

- Flammer, C. Does product market competition foster corporate social responsibility? Evidence from trade liberalization. Strateg. Manag. J. 2015, 36, 1469–1485. [Google Scholar] [CrossRef]

- Kramer, M.R.; Porter, M.E. Estrategia y sociedad: El vínculo entre ventaja competitiva y responsabilidad social corporativa. Harv. Bus. Rev. 2006, 84, 42–56. [Google Scholar]

- Carroll, A.B. Carroll’s pyramid of CSR: Taking another look. Int. J. Corp. Soc. Responsib. 2016, 1, 3. [Google Scholar] [CrossRef]

- Mishra, D.R. Post-innovation CSR performance and firm value. J. Bus. Ethics 2017, 140, 285–306. [Google Scholar] [CrossRef]

- Organization for Economic Cooperation and Development (OECD). Oslo Manual. Guidance on the Collection and Interpretation of Data on Innovation; OECD Publishing: Brussels, Belgium, 2005. [Google Scholar]

- Homfeldt, F.; Rese, A.; Simon, F. Suppliers versus start-ups: Where do better innovation ideas come from? Res. Policy 2019, 48, 1738–1757. [Google Scholar] [CrossRef]

- Larrieta-Rubín de Celis, I.; Velasco-Balmaseda, E.; Fernández de Bobadilla, S.; Alonso-Almeida, M.M.; Intxaurburu-Clemente, G. Does having women managers lead to increased gender equality practices in corporate social responsibility? Bus. Ethics 2015, 24, 91–110. [Google Scholar] [CrossRef]

- Gallardo-Vázquez, D.; Sánchez-Hernández, M.I. La Responsabilidad Social Empresarial en Extremadura; Fundación Obra Social la Caixa: Badajoz, Spain, 2012; ISBN 978-84-695-5177-6. [Google Scholar]

- Sánchez-Hernández, M.I.; Carvalho, L.C.; Paiva, I.S. Orientation towards social responsibility of North-West African firms. Sustain. Account. Manag. Policy J. 2019, 10, 365–394. [Google Scholar] [CrossRef]

- Rexhepi, G.; Kurtishi, S.; Bexheti, G. Corporate Social Responsibility (CSR) and innovation. The drivers of business growth? Procedia—Soc. Behav. Sci. 2013, 75, 532–541. [Google Scholar] [CrossRef]

- Andreeva, T.; Ritala, P. What are the sources of capability dynamism? Reconceptualizing dynamic capabilities from the perspective of organizational change. Balt. J. Manag. 2016, 11, 238–259. [Google Scholar] [CrossRef]

- Barney, J.B.; Ketchen, D.J.; Wright, M. The future of resource-based theory: Revitalization or decline? J. Manag. 2011, 37, 1299–1315. [Google Scholar] [CrossRef]

- Wójcik, P. Exploring links between dynamic capabilities perspective and resource-based view: A literature overview. Int. J. Manag. Econ. 2015, 45, 83–107. [Google Scholar] [CrossRef]

- Babbie, R. The Basics of Social Research, 7th ed.; Cengage Learning: Boston, UK, 2016. [Google Scholar]

- Bisbe, J.; Batista-Foguet, J.M.; Chenhall, R. Defining management accounting constructs: A methodological note on the risks of conceptual misspecification. Account. Organ. Soc. 2007, 32, 789–820. [Google Scholar] [CrossRef]

- Skouloudis, A.; Evangelinos, K. A research design for mapping national CSR terrains. Int. J. Sustain. Dev. World Ecol. 2012, 19, 130–143. [Google Scholar] [CrossRef]

- Cagliano, R.; Blackmon, K.; Voss, C. Small firms under microscope: International differences in production/operations management practices and performance. Integr. Manuf. Syst. 2001, 12, 469–482. [Google Scholar] [CrossRef]

- Prasad, D.S.; Pradhan, R.P. Analysing the critical success factors for implementation of sustainable supply chain management: an Indian case study. Deltamethrin 2018, 45, 3–25. [Google Scholar] [CrossRef]

- Weber, M. The business case for corporate social responsibility: A company-level measurement approach for CSR. Eur. Manag. J. 2008, 26, 247–261. [Google Scholar] [CrossRef]

- Carroll, C.E. Media relations and corporate social responsibility. In The Handbook of Communication and Corporate Social Responsibility; Ihlen, O., Bartlett, J., May, S., Eds.; Wiley-Blackwell, Hoboken: Hoboken, NJ, USA, 2011; pp. 423–444. [Google Scholar]

- Dell´Atti, S.; Trotta, A.; Iannuzzi, A.P.; Demaria, F. Corporate social responsibility engagement as a determinant of bank reputation: An empirical analysis. Corp. Soc. Responsib. Environ. Manag. 2017, 24, 589–605. [Google Scholar] [CrossRef]

- Husted, B.W.; Allen, D.B. Corporate Social Strategy: Stakeholder Engagement and Competitive Advantage; Cambridge University Press: Cambridge, UK, 2010. [Google Scholar]

- European Commission. EU Recommendation 2003/361/EC; European Commission: Brussels, Belgium, 2003; p. 4. [Google Scholar]

- Solberg Hjorth, S.; Brem, A.M. How to assess market readiness for an innovative solution: The case of heat recovery technologies for SMEs. Sustainability 2016, 8, 1152. [Google Scholar] [CrossRef]

- Business Economy—Size Class Analysis. Retrieved from Eurostat. Available online: https://ec.europa.eu/eurostat/statistics-explained/index.php/Archive:Business_economy_-_size_class_analysis (accessed on 3 August 2019).

- Eurostat. Statistics on Small and Medium-Sized Enterprises; Eurostat Publication Office: Luxemburg, 2012; Available online: http://ec.europa.eu/eurostat/statistics-explained/index.php/Statistics_on_small_and_medium-sized_enterprises#cite_note-7 (accessed on 3 August 2019).

- Arvidsson, S. An exposé of the challenging practice development of sustainability reporting: From the first wave to the EU Directive (2014/95/EU). In Challengues in Managing Sustainable Business; Palgrave Macmillan: London, UK, 2019; pp. 3–24. [Google Scholar]

- Latif, K.F.; Sajjad, A. Measuring corporate social responsibility: A critical review of survey instruments. Corp. Soc. Responsib. Environ. Manag. 2018, 25, 1174–1197. [Google Scholar] [CrossRef]

- Melo, T.; Garrido-Morgado, A. Corporate reputation: A combination of social responsibility and industry. Corp. Soc. Responsib. Environ. Manag. 2012, 19, 11–31. [Google Scholar] [CrossRef]

- Olmedo-Cifuentes, I.; Martínez-León, I.M.; Davies, G. Managing internal stakeholders’ views of corporate reputation. Serv. Bus. 2014, 8, 83–111. [Google Scholar] [CrossRef]

- Roberts, P.W.; Dowling, G.R. Corporate reputation and sustained superior financial performance. Strateg. Manag. J. 2002, 23, 1077–1093. [Google Scholar] [CrossRef]

- Hillenbrand, C.; Money, K. Corporate responsibility and corporate reputation: Two separate concepts or two sides of the same coin? Corp. Reput. Rev. 2007, 10, 261–277. [Google Scholar] [CrossRef]

- Orlitzky, M.; Schmidt, F.L.; Rynes, S.L. Corporate social and financial performance: A meta-analysis. Organ. Stud. 2003, 24, 403–441. [Google Scholar] [CrossRef]

- Vishwanathan, P.; van Oosterhout, H.J.; Heugens, P.P.M.A.R.; Duran, P.; van Essen, M. Strategic CSR: A concept building meta-analysis. J. Manag. Stud. 2019, in press. [Google Scholar] [CrossRef]

- Hull, C.E.; Rothenberg, S. Firm performance: The interactions of corporate social performance with innovation and industry differentiation. Strateg. Manag. J. 2008, 29, 781–789. [Google Scholar] [CrossRef]

- Wood, D.J. Measuring corporate social performance: A review. Int. J. Manag. Rev. 2010, 12, 50–84. [Google Scholar] [CrossRef]

- Greening, D.; Turban, D.B. Corporate social performance as a competitive advantage in attracting a quality workforce. Bus. Soc. 2000, 39, 254–280. [Google Scholar] [CrossRef]

- Tang, Z.; Hull, C.E.; Rothenberg, S. How corporate social responsibility engagement strategy moderates the CSR-financial performance relationship. J. Manag. Stud. 2012, 49, 1274–1303. [Google Scholar] [CrossRef]

- Yasir Ali, H.; Qaiser Danish, R.; Asrar-ul-Haq, M. How corporate social responsibility boosts firm financial performance: The mediating role of corporate image and customer satisfaction. Corp. Soc. Responsib. Environ. Manag. 2019, in press. [Google Scholar] [CrossRef]

- Hammann, E.M.; Habisch, A.; Pechlaner, H. Values that create value: Socially responsible business practices in SMEs—empirical evidence from German companies. Bus. Ethics 2009, 18, 37–51. [Google Scholar] [CrossRef]

- Oliveira, R.; Zanella, A.; Camanho, A.S. The assessment of corporate social responsibility: The construction of an industry ranking and identification of potential for improvement. Eur. J. Oper. Res. 2019, 278, 498–513. [Google Scholar] [CrossRef]

- Halme, M.; Rintamäki, J.; Steen Knudsen, J.; Lankoski, L.; Kuisma, M. When is there a sustainability case for CSR? Pathways to environmental and social performance improvements. Bus. Soc. 2018. [Google Scholar] [CrossRef]

- Reverte, C.; Gómez-Melero, E.; Cegarra-Navarro, J.G. The influence of corporate social responsibility practices on organizational performance: Evidence from eco-responsible Spanish firms. J. Clean Prod. 2016, 112, 2870–2884. [Google Scholar] [CrossRef]

- Valdez-Juárez, L.E. Corporate social responsibility: Its effect on SMEs. J. Manag. Sustain. 2017, 7, 75–89. [Google Scholar] [CrossRef]

- Kechiche, A.; Soparnot, R. CSR within SMEs: Literature review. Int. Bus. Res. 2012, 5, 97. [Google Scholar] [CrossRef]

- Morata, F.; Vilà, B.; Suárez, C. La Responsabilidad Social de la Empresa a Debate: Lecciones de la Crisis. Una Perspectiva Europea; Instituto Universitario de Estudios Europeos: Barcelona, Spain, 2010. [Google Scholar]

- Lindgreen, A.; Swaen, W. Corporate social responsibility. Int. J. Manag. Rev. 2010, 12, 1–7. [Google Scholar] [CrossRef]

- López-Pérez, M.E.; Melero, I.; Sese, F.J. Management for sustainable development and its impact on firm value in the SME context: Does size matter? Bus. Strateg. Environ. 2017, 26, 985–999. [Google Scholar] [CrossRef]

- Yin, J. Institutional drivers for corporate social responsibility in an emerging economy: A mixed-method study of Chinese business executives. Bus. Soc. 2015, 56, 672–704. [Google Scholar] [CrossRef]

- Flammer, C. Competing for government procurement contracts: The role of corporate social responsibility. Strateg. Manag. J. 2018, 39, 1299–1324. [Google Scholar] [CrossRef]

- Bos-Brouwers, H.E.J. Corporate sustainability and innovation in SMEs: Evidence of themes and activities in practice. Bus. Strateg. Environ. 2010, 19, 417–435. [Google Scholar] [CrossRef]

- Sun, Z.; Li, Y.; Wang, M.; Wang, X.; Pan, Y.; Dong, F. How does vertical integration promote innovation corporate social responsibility (ICSR) in the coal industry? A multiple-step multiple mediator model. PLoS ONE 2019, 14, e0217250. [Google Scholar] [CrossRef]

- Lorenz, C.; Gentile, G.C.; Wehner, T. Exploring corporate community engagement in Switzerland: Activities, motivations, and processes. Bus. Soc. 2013, 55, 594–631. [Google Scholar] [CrossRef]

- Holmes, S.; Smart, P. Exploring open innovation practice in firm-nonprofit engagements: A corporate social responsibility perspective. R D Manag. 2009, 39, 394–409. [Google Scholar] [CrossRef]

- Luo, X.; Du, S. Exploring the relationship between corporate social responsibility and firm innovation. Mark. Lett. 2015, 26, 703–714. [Google Scholar] [CrossRef]

- Adams, R.; Jeanrenaud, S.; Bessant, J.; Denyer, D.; Overy, P. Sustainability-oriented innovation: A systematic review. Int. J. Manag. Rev. 2016, 18, 180–205. [Google Scholar] [CrossRef]

- Martínez-Conesa, I.; Soto-Acosta, P.; Palacios-Manzano, M. Corporate social responsibility and its effect on innovation and firm performance: An empirical research in SMEs. J. Clean. Prod. 2017, 142, 2374–2383. [Google Scholar] [CrossRef]

- Aho, E.; Cornu, J.; Georghiou, L.; Subirá, A. Creating an Innovative Europe. Report of the Independent Expert Group on R&D and Innovation Appointed Following the Hampton Court Summit. 2006. Available online: http://europa.eu.int/invest-in-research (accessed on 3 August 2019).

- European Commission. The European Union Explained: Research and Innovation; European Commission Publication Office: Brussels, Belgium, 2014; Available online: http://ec.europa.eu/newsroom/horizon2020/document.cfm?doc_id=6322 (accessed on 3 August 2019).

- Von Schomberg, R.A. Vision of Responsible Research and Innovation. In Responsible Innovation: Managing the Responsible Emergence of Science and Innovation in Society; Owen, R., Bessant, J., Heintz, M., Eds.; John Wiley & Sons, Ltd.: Chinchester, UK, 2013; pp. 51–74. [Google Scholar]

- Auer, A.; Jarmai, K. Implementing responsable research and innovation practices in SMEs: Insights into drivers and barriers from the Austrian Medical Device Sector. Sustainability 2018, 10, 17. [Google Scholar] [CrossRef]

- Voegtlin, C.; Scherer, A.G. Responsible innovation and the innovation of responsibility: Governing sustainable development in a globalized world. J. Bus. Ethics 2017, 143, 227–243. [Google Scholar] [CrossRef]

- Baumann-Pauly, D.; Wickert, C.; Spence, L.J.; Scherer, A.G. Organizing Corporate Social Responsibility in Small and Large Firms: Size Matters. J. Bus. Ethics 2013, 115, 693–705. [Google Scholar] [CrossRef]

- Pavie, X.; Scholten, V.; Carthy, D. Responsible Innovation: From Concept to Practice; World Scientific Publishing Company: Singapore, 2014. [Google Scholar]

- Chatfield, K.; Iatridis, K.; Stahl, B.C.; Paspallis, N. Innovating responsibly in ICT for ageing: Drivers, obstacles and implementation. Sustainability 2017, 9, 971. [Google Scholar] [CrossRef]

- Van de Poel, I.; Asveld, L.; Flipse, S.; Klaassen, P.; Scholten, V.; Yaghmaei, E. Company strategies for responsable research and innovation (RRI): A conceptual model. Sustainability 2017, 9, 2045. [Google Scholar] [CrossRef]

- Freeman, R.E.; Velamuri, S.R. A new approach to CSR: Company stakeholder responsibility. In Corporate Social Responsibility; In Kakabadse, A., Morsing, M., Eds.; Palgrave Macmillan: London, UK, 2008; pp. 9–23. [Google Scholar]

- Cegarra-Navarro, J.G.; Reverte, C.; Gómez-Melero, E.; Wensley, A.K.P. Linking social and economic responsibilities with financial performance: The role of innovation. Eur. Manag. J. 2016, 34, 530–539. [Google Scholar] [CrossRef]

- Saadaoui, K.; Soobaroyen, T. An analysis of the methodologies adopted by CSR rating agencies. Sustain. Account. Manag. Policy J. 2018, 9, 43–62. [Google Scholar] [CrossRef]

- Lloyd-Smith, P.; An, H. Are corporate social responsibility and advertising complements or substitutes in producing firm reputation? Appl. Econ. 2019, 51, 2275–2288. [Google Scholar] [CrossRef]

- Martín de Castro, G.; Verde-Delgado, M.; Sáez-López, P.; López-Navas, J.E. Technological Innovation; Springer: Heidelberg, Germany, 2010. [Google Scholar]

- Li, D.; Xin, L.; Chen, X.; Ren, S. Corporate social responsibility, media attention and firm value: empirical research on Chinese manufacturing firms. Qual. Quant. 2017, 51, 1563–1577. [Google Scholar] [CrossRef]

- Maldonado-Guzmán, G.; Pinzón-Castro, S.Y.; Leana Morales, C. Corporate social responsibility and firm reputation in Mexican small business. Adv. Manag. Appl. Econ. 2017, 7, 29. [Google Scholar] [CrossRef]

- Porter, M.E. The competitive advantage of nations, states and regions. In Proceedings of the National Council of Professors, Kuala Lumpur, Malaysia, 7 July 2011. [Google Scholar]

- Rivière-Giordano, G.; Giordano-Spring, S.; Cho, C.H. Does the level of assurance statement on environmental disclosure affect investor assessment? Sustain. Account. Manag. Policy J. 2018, 9, 336–360. [Google Scholar] [CrossRef]

- Madrid-Guijarro, A.; García-Pérez de Lema, D.; Van Auken, H. An investigation of Spanish SME innovation during different economic conditions. J. Small Bus. Manag. 2013, 51, 578–601. [Google Scholar] [CrossRef]

- Marín, L.; Rubio, A.; Ruiz de Maya, S. Competitiveness as a strategic outcome of corporate social responsibility. Corp. Soc. Responsib. Environ. Manag. 2012, 19, 364–376. [Google Scholar] [CrossRef]

- Schaltegger, S.; Wagner, M. Managing the Business Case for Sustainability: The Integration of Social, Environmental and Economic Performance; Routledge: Abingdon, UK, 2017. [Google Scholar]

- Acquaah, M.; Yasai-Ardekani, M. Does the implementation of a combination competitive strategy yield incremental performance benefits? A new perspective from a transition economy in Sub-Saharan Africa. J. Bus. Res. 2008, 61, 346–354. [Google Scholar] [CrossRef]

- Kropp, F.; Lindsay, N.J.; Shoham, A. Entrepreneurial, market, and learning orientations and international entrepreneurial business venture performance in South African firms. Int. Market. Rev. 2006, 23, 504–523. [Google Scholar] [CrossRef]

- Lengnick-Hall, C.A. Innovation and competitive advantage: What we know and what we need to learn. J. Manag. 1992, 18, 399–429. [Google Scholar] [CrossRef]

- Brem, A.; Maier, M.; Wimschneider, C. Competitive advantage through innovation: The case of Nespresso. Eur. J. Innov. Manag. 2016, 19, 133–148. [Google Scholar] [CrossRef]

- Chesbrough, H. Business model innovation: Opportunities and barriers. Long Range Plan. 2010, 43, 354–363. [Google Scholar] [CrossRef]

- Porter, M.E. Competitive Advantage: Creating and Sustaining Superior Performance; Free Press: New York, NY, USA, 2004. [Google Scholar]

- Terziovski, M. Innovation practice and its performance implications in small and medium enterprises (SMEs) in the manufacturing sector: a resource-based view. Strateg. Manag. J. 2010, 31, 892–902. [Google Scholar] [CrossRef]

- Damanpour, F.; Walker, R.M.; Avellaneda, C.N. Combinative effects of innovation types and organizational performance: A Longitudinal study of service organizations. J. Manag. Stud. 2009, 46, 650–675. [Google Scholar] [CrossRef]

- Chesbrough, H.W.; Vanhaverbeke, W.; West, J. New Frontiers in Open Innovation; Oxford University Press: Oxford, UK, 2014. [Google Scholar]

- Chiu, C.N.; Yang, C.L. Competitive advantage and simultaneous mutual influences between information technology adoption and service innovation: Moderating effects of environmental factors. Struct. Chang. Econ. Dyn. 2019, 49, 192–205. [Google Scholar] [CrossRef]

- Love, J.H.; Roper, S. SME innovation, exporting and growth: A review of existing evidence. Int. Small Bus. J. 2015, 33, 28–48. [Google Scholar] [CrossRef]

- Jahanshahi, A.A.; Brem, A. Sustainability in SMEs: Top management teams behavioral integration as source of innovativeness. Sustainability 2017, 9, 1899. [Google Scholar] [CrossRef]

- Spanish Corporate Reputation Monitor. Proceso y valoración de reputación, RSE en España. Available online: http://C:/Users/apple/Downloads/metodologia-e-informe-de-verificacion-merco-empresas-es-2017.pdf (accessed on 1 October 2018).

- Cravens, K.; Oliver, E.G.; Ramamoorti, S. The reputation index: Measuring and managing corporate reputation. Eur. Manag. J. 2003, 1, 201–212. [Google Scholar] [CrossRef]

- Halme, M.; Korpela, M. Responsible innovation toward sustainable development in small and medium-sized enterprises: A resource perspective. Bus. Strateg. Environ. 2014, 23, 547–566. [Google Scholar] [CrossRef]

- Usman, M.; Vanhaverbeke, W. How start-ups successfully organize and manage open innovation with large companies. Eur. J. Innov. Manag. 2017, 20, 171–186. [Google Scholar] [CrossRef]

- Varadarajan, R. Innovating for sustainability: A framework for sustainable innovations and a model of sustainable innovations orientation. J. Acad. Mark. Sci. 2017, 45, 14–36. [Google Scholar] [CrossRef]

- Tetrault Sirsly, C.A.; Lvina, E. From doing good to looking even better: the dynamics of CSR and reputation. Bus. Soc. 2016, 58, 1234–1266. [Google Scholar] [CrossRef]

- Cahan, S.F.; Chen, C.; Chen, L.; Nguyen, N.H. Corporate social responsibility and media coverage. J. Bank Financ. 2015, 59, 409–422. [Google Scholar] [CrossRef]

- Ghosh, A. Corporate governance and corporate social responsibility. In Essays on Sustainability and Management; Sarkar, R., Shawa, A., Eds.; Springer: Berlin, Germany, 2017; pp. 153–175. [Google Scholar]

- Fanasch, P. Survival of the fittest: The impact of eco-certification and reputation on firm performance. Bus. Strateg. Environ. 2019, 28, 611–628. [Google Scholar] [CrossRef]

- Kucharska, W.; Kowalczyk, R. How to achieve sustainability? Employee´s point of vie won company´s culture and CSR practice. Corp. Soc. Responsib. Environ. Manag. 2019, 26, 453–467. [Google Scholar] [CrossRef]

- Agostini, L.; Nosella, A. The central role of a company’s technological reputation in enhancing customer performance in the B2B context of SMEs. J. Eng. Technol. Manag. 2016, 42, 1–14. [Google Scholar] [CrossRef]

- Menaka, R.; Ranganathan, V.; Sowmya, B. Improving performance through reputation based routing protocol for Manet. Wirel. Pers. Commun. 2017, 94, 2275–2290. [Google Scholar] [CrossRef]

- Cohen, J. Statistical Power Analysis for the Behavioral Sciences; Lawrence Erlbaum Associates: Hillsdale, NJ, USA, 1988. [Google Scholar]

- Roldán, J.L.; Sánchez-Franco, M.J. Variance-based structural equation modeling: Guidelines for using partial least squares. In Research Methodologies, Innovations and Philosophies in Software Systems Engineering and Information Systems; Mora, M., Gelman, O., Steenkamp, A.L., Raisinghani, M., Eds.; Information Science Reference: Hershey, PA, USA, 2012; pp. 193–221. [Google Scholar]

- Esposito Vinzi, V.; Chin, W.W.; Henseler, J.; Wang, H. (Eds.) Handbook of Partial Least Squares: Concepts, Methods and Applications; Springer: Heidelberg, Germany, 2010. [Google Scholar]

- Hair, J.F.; Sarstedt, M.; Ringle, C.M.; Mena, J.A. An assessment of the use of partial least squares structural equation modeling in marketing research. J. Acad. Mark. Sci. 2012, 40, 414–433. [Google Scholar] [CrossRef]

- Jarvis, C.B.; MacKenzie, S.B.; Podsakoff, P.M. A critical review of construct indicators and measurement model misspecification in marketing and consumer research. J. Consum. Res. 2003, 30, 199–218. [Google Scholar] [CrossRef]

- Wetzels, M.; Odekerken-Schröder, G.; Van Oppen, C. Using PLS path modeling for assessing hierarchical construct models: Guidelines and empirical illustration. Manag. Inf. Syst. Q. 2009, 33, 177–195. [Google Scholar] [CrossRef]

- Carroll, A.; Buchholtz, A. Business and Society: Ethics, Sustainability, and Stakeholder Management; Nelson Education: Scarborough, ON, Canada, 2014. [Google Scholar]

- Avendaño, C.; William, R. Innovación: Un proceso necesario para las pequeñas y medianas empresas del municipio de San José de Cúcuta, norte de Santander (Colombia). Semest. Econ. 2012, 15, 187–208. [Google Scholar] [CrossRef]

- Organization for Economic Cooperation and Development (OECD). OECD Environmental Performance Reviews: Slovak Republic; OECD Publishing: Paris, France, 2011. [Google Scholar]

- Tomlinson, P.R.; Fai, F.M. The nature of SME co-operation and innovation: A multi-scalar and multi-dimensional analysis. Int. J. Prod. Econ. 2013, 141, 316–326. [Google Scholar] [CrossRef]

- Osterwalder, A.; Pigneur, Y. Business Model Generation: A Handbook for Visionaries, Game Changers, and Challengers; John Wiley & Sons: Hoboken, NJ, USA, 2013. [Google Scholar]

- Rostek, K. The reference model of competitiveness factors for SME medical sector. Econ. Model. 2012, 29, 2039–2048. [Google Scholar] [CrossRef]

- Smith, M.H.; Smith, D. Implementing strategically aligned performance measurement in small firms. Int. J. Prod. Econ. 2007, 106, 393–408. [Google Scholar] [CrossRef]

- Parmar, B.L.; Freeman, R.E.; Harrison, J.S.; Wicks, A.C.; Purnell, L.; De Colle, S. Stakeholder theory: The state of the art. Acad. Manag. Ann. 2010, 4, 403–445. [Google Scholar] [CrossRef]

- Money, K.; Hillenbrand, C. Using reputation measurement to create value: An analysis and integration of existing measures. J. Gen. Manag. 2006, 32, 1–12. [Google Scholar] [CrossRef]

- Dang, C.; Zhichuan, F.L.; Yang, C. Measuring firm size in empirical corporate finance. J. Bank Financ. 2018, 86, 159–176. [Google Scholar] [CrossRef]

- Cepeda-Carrión, I.; Leal-Millán, A.G.; Martelo-Landroguez, S.; Leal-Rodriguez, A.L. Absorptive capacity and value in the banking industry: A multiple mediation model. J. Bus. Res. 2016, 69, 1644–1650. [Google Scholar] [CrossRef]

- Nelson, R.R. An Evolutionary Theory of Economic Change; Harvard University Press: Cambridge, MA, USA, 2009. [Google Scholar]

- Li, F. Endogeneity in CEO power: A survey and experiment. Invest. Anal. J. 2016, 45, 149–162. [Google Scholar] [CrossRef]

- Bagnoli, C.; Vedovato, M. The impact of knowledge management and strategy configuration coherence on SME performance. J. Manag. Gov. 2014, 18, 615–647. [Google Scholar] [CrossRef]

- Carmines, E.G.; Zeller, R.A. Reliability and Viability Assessment; Newbury Park Sage Publications: Thousand Oaks, CA, USA, 1991. [Google Scholar]

- Chin, W.W.; Dibbern, J. An introduction to a permutation based procedure for multi-group PLS analysis: results of tests of differences on simulated data and a cross cultural analysis of the sourcing of information system services between Germany and the USA. In Handbook of Partial Least Squares: Concepts, Methods and Applications in Marketing and Related Fields; Esposito, V., Chin, W.W., Henseler, J., Wang, H., Eds.; Springer: Berlin, Germany, 2010; pp. 171–193. [Google Scholar]

- Roberts, P.; Priest, H.; Traynor, M. Reliability and validity in research. Nurs. Stand. 2006, 20, 41–45. [Google Scholar] [CrossRef] [PubMed]

- Nunnally, J. Psychometric Methods; McGraw-Hill: New York, NY, USA, 1978. [Google Scholar]

- Vandenberg, R.J.; Lance, C.E. A review and synthesis of the measurement invariance literature: Suggestions, practices, and recommendations for organizational research. Organ. Res. Methods 2000, 3, 4–70. [Google Scholar] [CrossRef]

- Hair, J.F.; Black, W.C.; Babin, B.J.; Anderson, R.E.; Tatham, R.L. Multivariate Data Analysis; Pearson Prentice Hall: Upper Saddle River, NJ, USA, 2006; p. 6. [Google Scholar]

- Hair, J.F., Jr.; Black, W.C.; Babin, B.J.; Anderson, R.E.; Tatham, R.L. SEM: an introduction. In Multivariate Data Analysis: A Global Perspective; Hair, J.F., Jr., Black, W.C., Babin, B.J., Anderson, R.E., Eds.; Pearson Prentice Hall: Upper Saddle River, NJ, USA, 2010; pp. 629–686. [Google Scholar]

- Henseler, J.; Ringle, C.M.; Sarstedt, M. A new criterion for assessing discriminant validity in variance-based structural equation modeling. J. Acad. Mark. Sci. 2015, 43, 115–135. [Google Scholar] [CrossRef]

- Ringle, C.M.; Wende, S.; Becker, J.M. SmartPLS 3; SmartPLS: Hamburg, Germany, 2014. [Google Scholar]

- Chin, W.W. How to write up and report PLS analyses. In Handbook of Partial Least Squares: Concepts, Methods and Applications in Marketing and Related Fields; Esposito, V., Chin, W.W., Henseler, J., Wang, H., Eds.; Springer: Berlin, Germany, 2010; pp. 655–690. [Google Scholar]

- Urbach, N.; Ahlemann, F. Structural equation modeling in information systems research using partial least squares. J. Inf. Technol. Theory Appl. 2010, 11, 5–40. [Google Scholar]

- Chin, W.W. The partial least squares approach to structural equation modeling. Mod. Methods Bus. Res. 1998, 295, 295–336. [Google Scholar]

- Braojos-Gómez, J.; Benitez-Amado, J.; Llorens-Montes, F. How do small firms learn to develop a social media competence? Int. J. Inf. Manage. 2015, 35, 443–458. [Google Scholar] [CrossRef]

- Falk, R.F.; Miller, N.B. A Primer for Soft Modeling; University of Akron Press: Akron, OH, USA, 1992. [Google Scholar]

- Leal-Rodríguez, A.L.; Ariza-Montes, J.A.; Roldán, J.L.; Leal-Millán, A.G. Absorptive capacity, innovation and cultural barriers: a conditional mediation model. J. Bus. Res. 2014, 67, 763–768. [Google Scholar] [CrossRef]

- Hair, J.F.; Ringle, C.M.; Sarstedt, M. Editorial—partial least squares structural equation modeling: rigorous applications, better results and higher acceptance. Long Range Plan. 2013, 46, 1–12. [Google Scholar] [CrossRef]

- Henseler, J.; Dijkstra, T.K.; Sarstedt, M.; Ringle, C.M.; Diamantopoulos, A.; Straub, D.W.; Ketchen, D.J., Jr.; Hair, J.F.; Hult, G.T.M.; Calantone, R.J. Common beliefs and reality about PLS comments on Rönkkö and Evermann. Organ. Res. Methods 2014, 17, 182–209. [Google Scholar] [CrossRef]

- Baron, R.M.; Kenny, D.A. The moderator-mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. J. Pers. Soc. Psychol. 1986, 51, 1173–1182. [Google Scholar] [CrossRef] [PubMed]

- Preacher, K.J.; Hayes, A.F. Asymptotic and resampling strategies for assessing and comparing indirect effects in multiple mediator models. Behav. Res. Methods 2008, 40, 879–891. [Google Scholar] [CrossRef]

- Roldán, J.L.; Cepeda, G. Seminario Modelos de Ecuaciones Estructurales Basados en la Varianza: Partial Least Squares (PLS) para Investigadores en Ciencias Sociales, 3rd ed.; Universidad de Sevilla: Seville, Spain, 2016. [Google Scholar]

- Williams, J.; MacKinnon, D. Resampling and distribution of the product methods for testing indirect effects in complex models. Struct. Equ. Model. 2008, 15, 23–51. [Google Scholar] [CrossRef]

- Nitzl, C.; Roldan, J.L.; Cepeda, G. Mediation analyses in partial least squares path modeling: Helping researchers discuss more sophisticated models. Ind. Manag. Data Syst. 2016, 116, 1849–1864. [Google Scholar] [CrossRef]

- Hair, J.F.; Hult, G.T.M.; Ringle, C.M.; Sarstedt, M. A Primer on Partial Least Squares Structural Equation Modeling (PLS- SEM), 2nd ed.; Sage: Newcastle upon Tyne, UK, 2017. [Google Scholar]

- Hair, J.F.; Sarstedt, M.; Hopkins, L.; Kuppelwieser, V.G. Partial least squares structural equation modeling (PLS-SEM): an emerging tool in business research. Eur. Bus. Rev. 2014, 26, 106–121. [Google Scholar] [CrossRef]

- Badulescu, A.; Badulescu, D.; Saveanu, T.; Hatos, R. The relationship between firm size and age, and its social Responsibility actions—Focus on a developing country (Romania). Sustainability 2018, 10, 605. [Google Scholar] [CrossRef]

- Choi, J.H.; Kim, S.K.; Yang, D.H. Small and medium enterprises and the relation between social performance and financial performance: Empirical evidence from Korea. Sustainability 2018, 10, 1816. [Google Scholar] [CrossRef]

- Teece, D.J. Business models, business strategy and innovation. Long Range Plan. 2010, 43, 172–194. [Google Scholar] [CrossRef]

- McWilliams, A.; Siegel, D.S.; Wright, P.M. Corporate social responsibility: strategic implications. J. Manage. Stud. 2006, 43, 1–18. [Google Scholar] [CrossRef]

- McWilliams, A.; Parhankangas, A.; Coupet, J.; Welch, E.; Barnum, D.T. Strategic Decision Making for the Triple Bottom Line. Bus. Strateg. Environ. 2016, 25, 193–204. [Google Scholar] [CrossRef]

- Porter, M.E.; Kramer, M.R. Creating Shared Value. In Managing Sustainable Business; Springer: Dordrecht, The Netherlands, 2019; pp. 323–346. [Google Scholar] [CrossRef]

- Galbreath, J. The impact of board structure on corporate social responsibility: A temporal view. Bus. Strateg. Environ. 2017, 26, 358–370. [Google Scholar] [CrossRef]

- Caldera, H.; Desha, C.; Production, L.D. Evaluating the enablers and barriers for successful implementation of sustainable business practice in ’lean’ SMEs. J. Clean Prod. 2019, 218, 575–590. Available online: https://www.sciencedirect.com/science/article/pii/S0959652619302586 (accessed on 3 August 2019). [CrossRef]

- Freeman, R.E. Strategic Management: A Stakeholder Approach; Cambridge University Press: Cambridge, MA, USA, 2010. [Google Scholar]

- Postma, T.; Zwart, P.S. Strategic research and performance of SMEs. J. Small Bus. Strateg. 2015, 12, 52–64. [Google Scholar]

- Wright, M.; Roper, S.; Hart, M.; Carter, S. Joining the dots: building the evidence base for SME growth policy. Int. Small Bus. J. 2015, 33, 3–11. [Google Scholar] [CrossRef]

- Carayannis, E.G.; Grigoroudis, E.; Sindakis, S.; Walter, C. Business Model Innovation as Antecedent of Sustainable Enterprise Excellence and Resilience. J. Knowl. Econ. 2014, 5, 440–463. [Google Scholar] [CrossRef]

- Carayannis, E.G.; Barth, T.D.; Campbell, D.F. The Quintuple Helix innovation model: global warming as a challenge and driver for innovation. J. Innov. Entrep. 2012, 1, 2. [Google Scholar] [CrossRef]

- Carayannis, E.G.; Grigoroudis, E.; Campbell, D.F.J.; Meissner, D.; Stamati, D. The ecosystem as helix: an exploratory theory-building study of regional co-opetitive entrepreneurial ecosystems as Quadruple/Quintuple Helix Innovation Models. R D Manag. 2018, 48, 148–162. [Google Scholar] [CrossRef]

| Study Universe | 180 Companies Contacted |

|---|---|

| Geographical Scope | Extremadura (Spain) |

| Data Collection Method | Structured questionnaire distributed to managers (in person or online) |

| Sample Unit | Managers |

| Sample | 109 companies |

| Participation Rate | 60.55% |

| Measurement Error | 5.9% |

| Confidence Level | 95%; z = 1.96; p = q = 0.5 |

| Sampling Procedure | Simple random sampling |

| Type of Population | Finite sample |

| Company Size | ||||||

|---|---|---|---|---|---|---|

| Autonomous (0 Employees) | Microenterprises (<10 Employees) | Small (10–49 Employees) | Medium (50–249 Employees) | Total | ||

| Company Sector | Primary | 3.70% | 3.70% | 0.90% | 0.00% | 8.30% |

| Secondary | 0.90% | 7.30% | 4.60% | 0.90% | 13.70% | |

| Tertiary | 12.80% | 50.50% | 11.00% | 3.70% | 78.00% | |

| Total | 17.40% | 61.50% | 16.50% | 4.60% | 100.00% | |

| Item Number | Indicators | Loads (λ) | CA | CR |

|---|---|---|---|---|

| CSR | 0.862 | 0.906 | ||

| 1 | E1 | 0.861 | ||

| 2 | E2 | 0.866 | ||

| 3 | E3 | 0.876 | ||

| 4 | E4 | 0.757 | ||

| Competitive Success | 0.840 | 0.881 | ||

| 5 | C1 | 0.726 | ||

| 6 | C2 | 0.726 | ||

| 7 | C4 | 0.759 | ||

| 8 | C5 | 0.719 | ||

| 9 | C6 | 0.783 | ||

| Performance | 0.891 | 0.918 | ||

| 11 | D1 | 0.811 | ||

| 12 | D2 | 0.829 | ||

| 13 | D3 | 0.879 | ||

| 14 | D4 | 0.853 | ||

| 15 | D6 | 0.782 | ||

| Innovation | 0.941 | 0.931 | ||

| 16 | I13 | 0.815 | ||

| 17 | I14 | 0.707 | ||

| 18 | I15 | 0.801 | ||

| 19 | I17 | 0.728 | ||

| 20 | I2 | 0.751 | ||

| 21 | I3 | 0.756 | ||

| 22 | I4 | 0.777 | ||

| 23 | I5 | 0.742 | ||

| 24 | I6 | 0.756 | ||

| 25 | I7 | 0.804 | ||

| 26 | I8 | 0.821 | ||

| Reputation | 0.837 | 0.891 | ||

| 27 | R4 | 0.792 | ||

| 28 | R5 | 0.876 | ||

| 29 | R6 | 0.823 | ||

| 30 | R7 | 0.786 |

| Constructs | AVE | Performance | Innovation | Reputation | CSR | Competitive Success |

|---|---|---|---|---|---|---|

| Performance | 0.691 | 0.831 | ||||

| Innovation | 0.592 | 0.424 | 0.770 | |||

| Reputation | 0.672 | 0.431 | 0.705 | 0.820 | ||

| CSR | 0.708 | 0.250 | 0.585 | 0.630 | 0.841 | |

| Competitive Success | 0.553 | 0.467 | 0.614 | 0.443 | 0.392 | 0.744 |

| Hypothesis | Path Coefficients (β) | T Value | F2 | Correlation | Explained Variance (%) | Supported |

|---|---|---|---|---|---|---|

| H1: CSR → Performance | 0.079 | 1.148 | 0.018 | 0.250 | 1.975% | No |

| H2: CSR → Competitive success | 0.051 | 0.838 | 0.007 | 0.392 | 1.99% | No |

| H3: CSR → Innovation | 0.585 *** | 8.706 | 0.563 | 0.585 | 34.22% | Yes |

| H4: CSR → Reputation | 0.330 *** | 4.469 | 0.329 | 0.630 | 20.79% | Yes |

| H5: Competitive success → Performance | 0.436 *** | 3.153 | 0.220 | 0.467 | 20.36% | Yes |

| H6: Innovation → Competitive success | 0.584 *** | 6.710 | 0.398 | 0.614 | 35.86% | Yes |

| H7: Innovation → Reputation | 0.445 *** | 4.600 | 0.194 | 0.705 | 31.37% | Yes |

| H8: Performance → Reputation | 0.160 * | 2.013 | 0.050 | 0.431 | 6.9% | Yes |

| Constructs | R2 (Explained Variance) |

|---|---|

| Performance | 0.223 |

| Innovation | 0.342 |

| Reputation | 0.590 |

| Competitive Success | 0.379 |

| Constructs | Q2 (1-SSE/SSO) | Model Goodness of Fit SRMR |

|---|---|---|

| Performance | 0.131 | 0.08 |

| Innovation | 0.157 | |

| Reputation | 0.298 | |

| Competitive Success | 0.176 |

| Direct Effects | Coefficient | Bootstrap 0.95 Confidence Interval | ||||

|---|---|---|---|---|---|---|

| Percentile | BC | |||||

| c | 0.292sig | 0.106 | 0.47 | 0.104 | 0.467 | |

| a1 | 0.348sig | 0.262 | 0.492 | 0.234 | 0.464 | |

| a2 | 0.576sig | 0.494 | 0.684 | 0.478 | 0.668 | |

| a3 | 0.266sig | 0.162 | 0.412 | 0.138 | 0.388 | |

| b1 | 0.000 | −0.121 | 0.139 | −0.125 | 0.135 | |

| b2 | 0.485sig | 0.327 | 0.621 | 0.335 | 0.628 | |

| b3 | 0.161sig | 0.044 | 0.285 | 0.040 | 0.281 | |

| Indirect Effects | Point Estimate | Percentile | BC | VAF | ||

| a1 × b1 | 0.000 | −0.046 | 0.054 | −0.047 | 0.0527 | 0.00% |

| a2 × b2 | 0.279sig | 0.183 | 0.386 | 0.179 | 0.382 | 45.48% |

| a3 × b3 | 0.043sig | 0.013 | 0.084 | 0.009 | 0.081 | 6.97% |

| Total indirect effect | 0.322 | −0.031 | 0.066 | 0.276 | 0.373 | 52.45% |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gallardo-Vázquez, D.; Valdez-Juárez, L.E.; Castuera-Díaz, Á.M. Corporate Social Responsibility as an Antecedent of Innovation, Reputation, Performance, and Competitive Success: A Multiple Mediation Analysis. Sustainability 2019, 11, 5614. https://doi.org/10.3390/su11205614

Gallardo-Vázquez D, Valdez-Juárez LE, Castuera-Díaz ÁM. Corporate Social Responsibility as an Antecedent of Innovation, Reputation, Performance, and Competitive Success: A Multiple Mediation Analysis. Sustainability. 2019; 11(20):5614. https://doi.org/10.3390/su11205614

Chicago/Turabian StyleGallardo-Vázquez, Dolores, Luis Enrique Valdez-Juárez, and Ángela María Castuera-Díaz. 2019. "Corporate Social Responsibility as an Antecedent of Innovation, Reputation, Performance, and Competitive Success: A Multiple Mediation Analysis" Sustainability 11, no. 20: 5614. https://doi.org/10.3390/su11205614

APA StyleGallardo-Vázquez, D., Valdez-Juárez, L. E., & Castuera-Díaz, Á. M. (2019). Corporate Social Responsibility as an Antecedent of Innovation, Reputation, Performance, and Competitive Success: A Multiple Mediation Analysis. Sustainability, 11(20), 5614. https://doi.org/10.3390/su11205614