The Effects of Infrastructure Service Disruptions and Socio-Economic Vulnerability on Hurricane Recovery

Abstract

1. Introduction

2. Literature Review

2.1. Infrastructure Disruptions from Hurricanes: A Focus on Electric Power Outages

2.2. Socio-Economic Vulnerability

2.3. Insurance Coverage

2.4. Disaster Assistance

3. Methods and Measurements

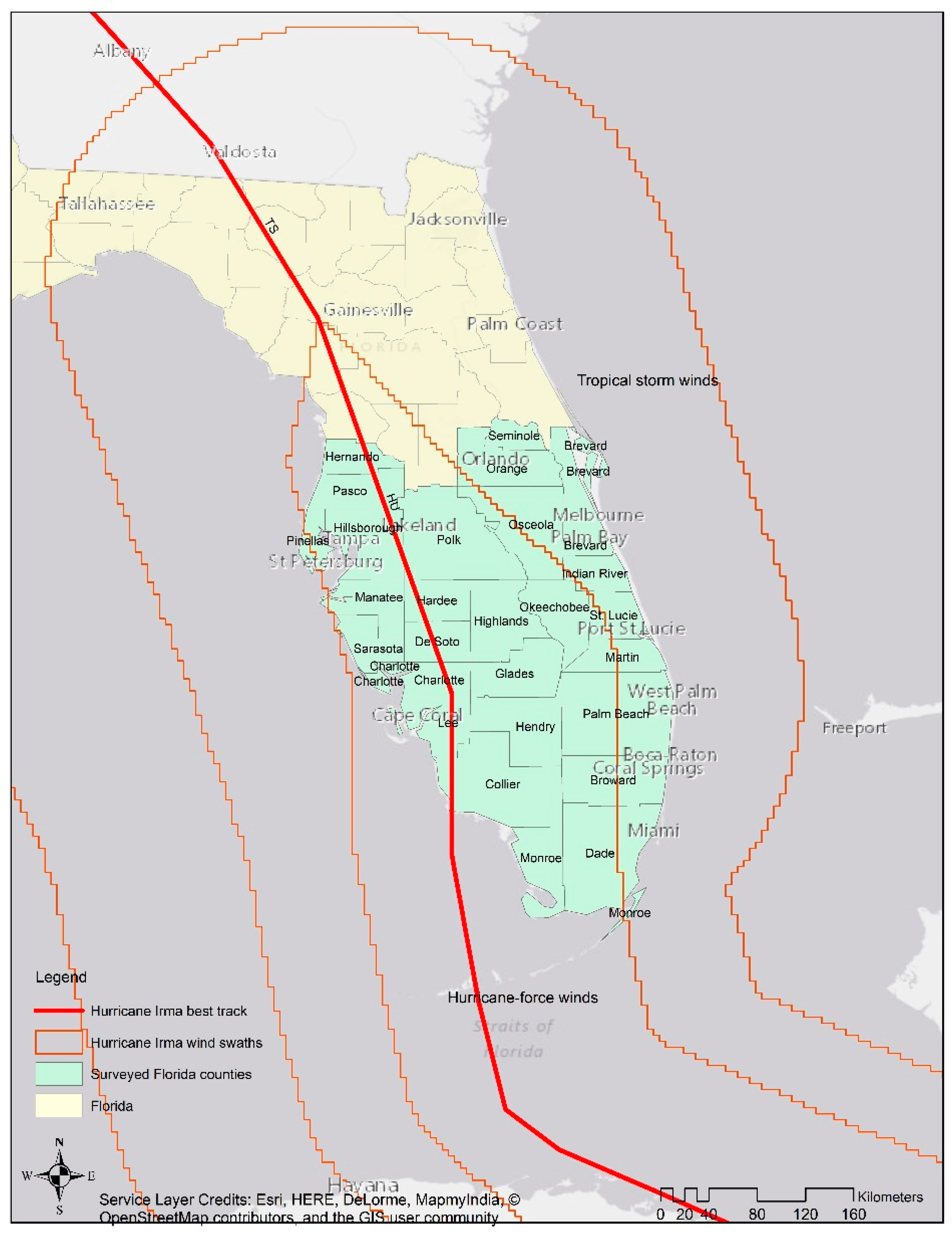

3.1. Study Area

3.2. Data Collection

3.3. Statistical Modeling

3.4. Dependent Variable

3.5. Independent Variables

4. Results

4.1. Characteristics of the Survey Participants

4.2. Infrastructure Disruptions Following Hurricane Irma

4.3. Insurance and Disaster Assistance

4.4. Logistic Regression Analysis

5. Discussion

6. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Cutter, S.L.; Boruff, B.J.; Shirley, W.L. Social Vulnerability to Environmental Hazards. Soc. Sci. Q. 2003, 84, 242–261. [Google Scholar] [CrossRef]

- Wisner, B. Vulnerability as Concept, Model, Metric and Tool. Available online: http://naturalhazardscience.oxfordre.com/view/10.1093/acrefore/9780199389407.001.0001/acrefore-9780199389407-e-25 (accessed on 25 October 2018).

- Lindell, M.K. Recovery and Reconstruction after Disaster. In Encyclopedia of Natural Hazards; Bobrowsky, P.T., Ed.; Springer: New York, NY, USA, 2013; pp. 812–824. [Google Scholar]

- Shan, X.; Felder, F.A.; Coit, D.W. Game-theoretic Model for Electric Distribution Resiliency/Reliability from a Multiple Stakeholder Perspective. IISE Trans. 2017, 49, 159–177. [Google Scholar] [CrossRef]

- Peng, J.; Shan, X.G.; Kesete, Y.; Gao, Y.; Davidson, R.; Nozick, L.K.; Kruse, J. Modeling the Integrated Roles of Insurance and Retrofit in Managing Natural Disaster Risk: A Multi-stakeholder Perspective. J. Nat. Hazards 2014, 74, 1043–1068. [Google Scholar] [CrossRef]

- Kesete, Y.; Peng, J.; Shan, X.G.; Gao, Y.; Davidson, R.; Nozick, L.K.; Kruse, J. Modeling Insurer-homeowner Interactions in Managing Natural Disaster Risk. Risk Anal. 2014, 34, 1040–1055. [Google Scholar] [CrossRef] [PubMed]

- O’Rourke, T. Critical infrastructure, interdependencies, and resilience. Natl. Acad. Eng. Bridge 2007, 37, 22–29. [Google Scholar]

- Wang, Y. Security of Electric Power Systems: Cascading Outage Analysis, Interdiction Model and Resilience to Natural Disasters. Ph.D. Thesis, The University of Texas at Austin, Austin, TX, USA, 2015. [Google Scholar]

- NERC. Reliability Standards for the Bulk Electric Systems of North America; North American Electric Reliability Corporation: Atlanta, GA, USA, 2017. [Google Scholar]

- Allen, E.; Stuart, R.; Wiedman, T. No light in August: Power system restoration following the 2003 North American blackout. IEEE Power Energy Mag. 2014, 12, 24–33. [Google Scholar] [CrossRef]

- Ma, S.; Chen, B.; Wang, Z. Resilience enhancement strategy for distribution systems under extreme weather events. IEEE Trans. Smart Grid 2018, 9, 1442–1451. [Google Scholar] [CrossRef]

- Guikema, S.D.; Davidson, R.A.; Liu, H. Statistical models of the effects of tree trimming on power system outages. IEEE Trans. Power Deliv. 2006, 21, 1549–1557. [Google Scholar] [CrossRef]

- Nateghi, R.; Guikema, S.D.; Quiring, S.M. Comparison and validation of statistical methods for predicting power outage durations in the event of hurricanes. Risk Anal. 2011, 31, 1897–1906. [Google Scholar] [CrossRef]

- Eskandarpour, R.; Khodaei, A. Machine learning based power grid outage prediction in response to extreme events. IEEE Trans. Power Syst. 2017, 32, 3315–3316. [Google Scholar] [CrossRef]

- Ganger, D.; Zhang, J.; Vittal, V. Forecast-based anticipatory frequency control in power systems. IEEE Trans. Power Syst. 2018, 33, 1004–1012. [Google Scholar] [CrossRef]

- Mitsova, D.; Esnard, A.-M.; Sapat, A.; Lai, B.S. Socioeconomic vulnerability and electric power restoration timelines in Florida: The case of Hurricane Irma. Nat. Hazards 2018, 94, 689–709. [Google Scholar] [CrossRef]

- Peacock, W.G.; Van Zandt, S.; Zhang, Y.; Highfield, W.E. Inequities in long-term housing recovery after disasters. J. Am. Plan. Assoc. 2014, 80, 356–371. [Google Scholar] [CrossRef]

- Van Zandt, S.; Sloan, M. The Texas Experience with 2008’s Hurricanes Dolly and Ike. In Coming Home after Disaster: Multiple Dimensions of Housing Recovery; Sapat, A., Esnard, A.-M., Eds.; CRC Press: Boca Raton, FL, USA, 2017; pp. 83–98. [Google Scholar]

- Bolin, B.; Kurtz, L.C. Race, Class, Ethnicity and Disaster Vulnerability. In Handbook of Disaster Research; Rodriguez, H., Donner, W., Trainor, J.E., Eds.; Springer International Publishing: Basel, Switzerland, 2018; pp. 181–204. [Google Scholar]

- Wisner, B.; Blaikie, P.; Cannon, T.; Davis, I. At Risk: Natural Hazards, People’s Vulnerability, and Disaster, 2nd ed.; Routledge: London, UK, 2004; pp. 3–48. [Google Scholar]

- Dash, N.; Peacock, W.G.; Morrw, B.H. Hurricane Andrew: Ethnicity, Gender, and the Sociology of Disasters; Peacock, W.G., Morrow, B.M., Gladwin, H., Eds.; Routledge: New York, NY, USA, 1997; pp. 206–225. [Google Scholar]

- Dash, N.; Morrow, B.; Mainster, J.; Cunningham, L. Lasting Effects of Hurricane Andrew on a Working-Class Community. Nat. Hazards Rev. 2007, 8, 13–21. [Google Scholar] [CrossRef]

- Insurance Information Institute. Facts + Statistics: Flood Insurance. 2018. Available online: https://www.iii.org/fact-statistic/facts-statistics-flood-insurance (accessed on 29 September 2018).

- Long, H. Where Harvey Is Hitting Hardest, 80 Percent Lack Flood Insurance. The Washington Post. 29 August 2017. Available online: https://www.washingtonpost.com/news/wonk/wp/2017/08/29/where-harvey-is-hitting-hardest-four-out-of-five-homeowners-lack-flood-insurance/?noredirect=on&utm_term=.c16d47843bc9 (accessed on 1 November 2018).

- Michel-Kerjan, E.O.; Kousky, C. Come rain or shine: Evidence on flood insurance purchases in Florida. J. Risk Insur. 2010, 77, 369–397. [Google Scholar] [CrossRef]

- Kousky, C. Disasters as Learning Experiences or Disasters as Policy Opportunities? Examining Flood Insurance Purchases after Hurricanes. Risk Anal. 2017, 37, 517–530. [Google Scholar] [CrossRef] [PubMed]

- Michel-Kerjan, E.; Lemoyne de Forges, S.; Kunreuther, H. Policy tenure under the U.S. national flood insurance program (NFIP). Risk Anal. 2012, 32, 644–658. [Google Scholar] [CrossRef]

- Sylves, R.; Buzas, Z.I. Presidential Disaster Declaration Decisions, 1953-2003: What Influences Odds of Approval. State Local Gov. Rev. 2007, 39, 3–15. [Google Scholar] [CrossRef]

- Garrett, T.; Sobel, R. The Political Economy of FEMA Disaster Payments. Econ. Inquiry 2003, 41, 496–509. [Google Scholar] [CrossRef]

- Salkowe, R.; Chakraborty, J. Federal disaster relief in the US: The role of political partisanship and preference in presidential disaster declarations and turndowns. J. Homeland Secur. Emerg. Manag. 2009, 6, 28. [Google Scholar]

- Downton, M.W.; Pielke, R.A., Jr. Discretion without accountability: Politics, flood damage, and climate. Nat. Hazards Rev. 2001, 2, 157–166. [Google Scholar] [CrossRef]

- Kousky, C.; Michel-Kerjan, E.O.; Raschky, P.A. Does federal disaster assistance crowd out flood insurance? J. Environ. Econ. Manag. 2018, 87, 150–164. [Google Scholar] [CrossRef]

- Kousky, C. Facts about FEMA household disaster aid: Examining the 2008 floods and tornadoes in Missouri. Weather Clim. Soc. 2013, 5, 332–344. [Google Scholar] [CrossRef]

- Cutter, S.L. The perilous nature of food supplies: Natural hazards, social vulnerability, and disaster resilience. Environ. Sci. Policy Sustain. Dev. 2017, 59, 4–15. [Google Scholar] [CrossRef]

- Welsh, M.G.; Esnard, A.M. Closing gaps in local housing recovery planning for disadvantaged displaced households. Cityscape 2009, 195–212. [Google Scholar]

- Sapat, A. Politics of Recovery: Policy and Governance Challenges in Post-Disaster Housing. In Coming Home after Disaster: Multiple Dimensions of Housing Recovery; Sapat, A., Esnard, A.-M., Eds.; CRC Press: Boca Raton, FL, USA, 2017; pp. 67–79. [Google Scholar]

- Peacock, W.G.; Dash, N.; Zhang, Y.; Van Zandt, S. Post-Disaster Sheltering, Temporary Housing, and Permanent Housing Recover. In Handbook of Disaster Research, 2nd ed.; Rodriguez, H., Donner, W., Trainor, J.E., Eds.; Springer International Publishing: Basel, Switzerland, 2018; pp. 569–594. [Google Scholar]

- Esnard, A.M.; Sapat, A.; Mitsova, D. An index of relative displacement risk to hurricanes. Nat. Hazards 2011, 59, 833–859. [Google Scholar] [CrossRef]

- Cangialosi, J.P.; Latto, A.S.; Berg, R. Hurricane Irma. National Hurricane Center Tropical Cyclone Report. Available online: https://www.nhc.noaa.gov/data/tcr/AL112017_Irma.pdf (accessed on 23 October 2018).

- U.S. Census Bureau. Available online: http://www.census.gov (accessed on 10 October 2018).

- Agresti, A. Categorical Data Analysis, 3rd ed.; John Wiley & Sons: Hoboken, NJ, USA, 2013; p. 182. [Google Scholar]

- IBM Corp. IBM SPSS Statistics for Windows; Version 25.0, released 2017; IBM Corp.: Armonk, NY, USA, 2017. [Google Scholar]

- Kousky, C. Understanding the demand for flood insurance. Nat. Hazards Rev. 2011, 12, 96–110. [Google Scholar] [CrossRef]

- Bolin, R.C. Household and Community Recovery after Earthquakes; University of Colorado Institute of Behavioral Science: Boulder, CO, USA, 1993. [Google Scholar]

- Atreya, A.; Ferreira, S.; Michel-Kerjan, E. What drives households to buy flood insurance? New evidence from Georgia. Ecol. Econ. 2015, 117, 153–161. [Google Scholar] [CrossRef]

- Browne, M.; Hoyt, R. The demand for flood insurance: Empirical evidence. J. Risk Uncertain. 2000, 20, 291–306. [Google Scholar] [CrossRef]

- Landry, C.; Jahan-Parvar, M. Flood insurance coverage in the coastal zone. J. Risk Insur. 2011, 78, 361–388. [Google Scholar] [CrossRef]

- Kriesel, W.; Landry, C. Participation in the National Flood Insurance Program: An empirical analysis for coastal properties. J. Risk Insur. 2004, 71, 405–420. [Google Scholar] [CrossRef]

- Wang, D.; Davidson, R.; Trainor, J.; Nozick, L.; Kruse, J. Homeowner purchase of insurance for hurricane-induced wind and flood damage. Nat. Hazards 2017, 88, 221–245. [Google Scholar] [CrossRef]

- Lindell, M.K.; Brody, S.D.; Highfield, W.E. Financing Housing Recovery through Hazard Insurance: The case of the National Flood Insurance Program. In Coming Home after Disaster: Multiple Dimensions of Housing Recovery; Sapat, A., Esnard, A.-M., Eds.; CRC Press: Boca Raton, FL, USA, 2017; pp. 49–66. [Google Scholar]

- Eskandarpour, R.; Lotfi, H.; Khodaei, A. Optimal micro-grid placement for enhancing power system resilience in response to weather events. In Proceedings of the 2016 North American Power Symposium, Denver, CO, USA, 18–20 September 2016; pp. 1–6. [Google Scholar]

- Pham, T.T.H.; Besanger, Y.; Hadjsaid, N. New challenges in power system restoration with large scale of dispersed generation insertion. IEEE Trans. Power Syst. 2009, 24, 398–406. [Google Scholar] [CrossRef]

- Stefanov, A.; Liu, C.; Sforna, M.; Eremia, M.; Balaurescu, R. Decision support for restoration of interconnected power systems using tie lines. IET Gener. Transm. Distrib. 2015, 9, 1006–1018. [Google Scholar] [CrossRef]

- Toya, H.; Skidmore, M. Cellular telephones and natural disaster vulnerability. Sustainability 2018, 10, 2970. [Google Scholar] [CrossRef]

- Samarajiva, R.; Waidyanathan, N. Two complementary mobile technologies for disaster warning. Info 2009, 11, 58–65. [Google Scholar] [CrossRef]

- Jatman, H.M. Design for safety: A new service for alarming and informing the population in case of emergency. Infranomics Sustain. Eng. Des. Gov. 2014, 24, 103–124. [Google Scholar]

- Quarantelli, E.L. Problematical aspects of the information/communication revolution for disaster planning and research: Ten non-technical issues and questions. Disaster Prev. Manag. 1997, 6, 94–106. [Google Scholar] [CrossRef]

- Michel-Kerjan, E.; Kunreuther, H. Redesigning flood insurance. Science 2011, 333, 408–409. [Google Scholar] [CrossRef]

- Fernandez, M.; Alvarez, L.; Nixon, R. Still Waiting for FEMA in Texas and Florida After Hurricanes. New York Times. 22 October 2017. Available online: https://www.nytimes.com/2017/10/22/us/fema-texas-florida-delays-.html (accessed on 13 October 2018).

| Variable | Categories | Percent | Variable | Categories | Percent |

|---|---|---|---|---|---|

| Gender | Housing tenure | ||||

| Male | 48.3 | Own | 69.3 | ||

| Female | 51.7 | Rent | 30.7 | ||

| Age | Education | ||||

| 18–24 | 10.1 | Less than high school | 13.4 | ||

| 25–39 | 24.2 | High school graduate | 27.7 | ||

| 40–64 | 42.0 | Some college/trade school | 20.0 | ||

| 65 or older | 23.7 | College/postgraduate degree | 39.0 | ||

| Race/Ethnicity | Income | ||||

| White/Caucasian | 49.0 | $0–$25,999 | 26.3 | ||

| Hispanic/Latino | 30.8 | $26,000-$49,999 | 25.3 | ||

| Black/African American | 15.4 | $50,000 to $99,999 | 26.2 | ||

| Other * | 4.6 | $100,000 to $149,999 | 11.5 | ||

| More than $150,000 | 8.9 |

| Covariates | Categories | Odds Ratio | Std. Error | Estimate | Sig. | Odds Ratio | Std. Error | Estimate | Sig. | |

|---|---|---|---|---|---|---|---|---|---|---|

| Model 1 | Model 2 | |||||||||

| Damage | 1 | Not at all | ||||||||

| 2 | Minor | 0.764 | 0.274 | −0.75 | 0.695 | 0.250 | −1.01 | |||

| 3 | Some | 0.292 | 0.103 | −3.49 | *** | 0.229 | 0.080 | −4.20 | *** | |

| 4 | Severe | 0.052 | 0.021 | −7.49 | *** | 0.047 | 0.018 | −7.84 | *** | |

| How long w/o power? | 1 | No loss of power | ||||||||

| 2 | A few hours | 0.784 | 0.457 | −0.42 | ||||||

| 3 | 1 day or less | 0.358 | 0.174 | −2.11 | ** | |||||

| 4 | 2–3 days | 0.354 | 0.163 | −2.26 | ** | |||||

| 5 | 4–7 days | 0.271 | 0.120 | −2.95 | ** | |||||

| 6 | More than 7 days | 0.188 | 0.086 | −3.65 | *** | |||||

| How long w/o cell/internet? | 1 | No loss of service | ||||||||

| 2 | A few hours | 0.413 | 0.166 | −2.20 | ** | |||||

| 3 | 1 day or less | 1.118 | 0.510 | 0.25 | ||||||

| 4 | 2–3 days | 0.457 | 0.172 | −2.08 | ** | |||||

| 5 | 4–7 days | 0.313 | 0.115 | −3.15 | ** | |||||

| 6 | More than 7 days | 0.232 | 0.090 | −3.76 | *** | |||||

| Homeowners’/renters’ insurance | 1 | Yes | 1.555 | 0.400 | 1.72 | * | 1.624 | 0.421 | 1.87 | * |

| 0 | No | |||||||||

| FEMA disaster assistance | 1 | Yes | ||||||||

| 2 | No, application denied | 0.245 | 0.141 | −2.45 | ** | 0.368 | 0.206 | −1.78 | * | |

| 3 | Application pending | 1.922 | 0.662 | 1.90 | * | 1.982 | 0.693 | 1.96 | ** | |

| Age | 1 | 18–24 | ||||||||

| 2 | 25–39 | 0.490 | 0.291 | −1.20 | 0.444 | 0.265 | −1.36 | |||

| 3 | 40–64 | 0.315 | 0.183 | −1.99 | ** | 0.268 | 0.156 | −2.26 | ** | |

| 4 | 65 or older | 0.287 | 0.171 | −2.10 | ** | 0.243 | 0.146 | −2.35 | ** | |

| Race/ethnicity | 1 | White | ||||||||

| 2 | Black/African American | 0.566 | 0.177 | −1.83 | * | 0.600 | 0.191 | −1.61 | * | |

| 3 | Hispanic/Latino | 0.422 | 0.117 | −3.12 | ** | 0.499 | 0.137 | −2.52 | ** | |

| 4 | Other | 1.187 | 0.747 | 0.27 | 1.125 | 0.696 | 0.19 | |||

| Income | 1 | $0–$25,999 | ||||||||

| 2 | $26,000–$49,999 | 1.816 | 0.566 | 1.91 | * | 1.865 | 0.590 | 1.97 | ** | |

| 3 | $50,000–$99,999 | 1.801 | 0.581 | 1.82 | * | 1.791 | 0.589 | 1.77 | * | |

| 4 | $100,000–$149,999 | 2.930 | 1.424 | 2.21 | ** | 3.200 | 1.555 | 2.39 | ** | |

| 5 | More than $150,000 | 1.397 | 0.624 | 0.75 | 1.543 | 0.682 | 0.98 | |||

| Wind swath | 1 | Hurricane-force winds | ||||||||

| 0 | Tropical storm winds | 1.048 | 0.249 | 0.20 | 1.089 | 0.261 | 0.36 | |||

| Covariates | Categories | Odds Ratio | Std. Error | Estimate | Sig. | |

|---|---|---|---|---|---|---|

| Damage | 1 | Not at all | ||||

| 2 | Minor | 0.777 | 0.278 | −0.70 | ||

| 3 | Some | 0.277 | 0.968 | −3.67 | *** | |

| 4 | Severe | 0.053 | 0.021 | −7.51 | *** | |

| Infrastructure disruption index | 0.710 | 0.055 | −4.45 | *** | ||

| Homeowners’/renters’ insurance | 1 | Yes | 1.599 | 0.411 | 1.82 | * |

| 2 | No | |||||

| FEMA disaster assistance | 1 | Yes | ||||

| 2 | No, application denied | 0.293 | 0.165 | −2.18 | ** | |

| 3 | Application pending | 1.919 | 0.664 | 1.88 | * | |

| Age | 1 | 18–24 | ||||

| 2 | 25–39 | 0.467 | 0.277 | −1.28 | ||

| 3 | 40–64 | 0.288 | 0.166 | −2.16 | ** | |

| 4 | 65 or older | 0.267 | 0.159 | −2.22 | ** | |

| Race/ethnicity | 1 | White | ||||

| 2 | Black/African American | 0.551 | 0.172 | −1.91 | * | |

| 3 | Hispanic/Latino | 0.452 | 0.124 | −2.89 | ** | |

| 4 | Other | 1.088 | 0.666 | 0.14 | ||

| Income | 1 | $0–$25,999 | ||||

| 2 | $26,000-$49,999 | 1.740 | 0.544 | 1.77 | * | |

| 3 | $50,000-$99,999 | 1.684 | 0.544 | 1.61 | * | |

| 4 | $100,000-$149,999 | 2.795 | 1.357 | 2.12 | ** | |

| 5 | More than $150,000 | 1.428 | 0.633 | 0.80 | ||

| Wind swath | 1 | Hurricane-force winds | ||||

| 0 | Tropical storm winds | 1.026 | 0.243 | 0.11 | ||

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Mitsova, D.; Escaleras, M.; Sapat, A.; Esnard, A.-M.; Lamadrid, A.J. The Effects of Infrastructure Service Disruptions and Socio-Economic Vulnerability on Hurricane Recovery. Sustainability 2019, 11, 516. https://doi.org/10.3390/su11020516

Mitsova D, Escaleras M, Sapat A, Esnard A-M, Lamadrid AJ. The Effects of Infrastructure Service Disruptions and Socio-Economic Vulnerability on Hurricane Recovery. Sustainability. 2019; 11(2):516. https://doi.org/10.3390/su11020516

Chicago/Turabian StyleMitsova, Diana, Monica Escaleras, Alka Sapat, Ann-Margaret Esnard, and Alberto J. Lamadrid. 2019. "The Effects of Infrastructure Service Disruptions and Socio-Economic Vulnerability on Hurricane Recovery" Sustainability 11, no. 2: 516. https://doi.org/10.3390/su11020516

APA StyleMitsova, D., Escaleras, M., Sapat, A., Esnard, A.-M., & Lamadrid, A. J. (2019). The Effects of Infrastructure Service Disruptions and Socio-Economic Vulnerability on Hurricane Recovery. Sustainability, 11(2), 516. https://doi.org/10.3390/su11020516