1. Introduction

An economic cluster is a “geographically proximate group of interconnected companies and associated institutions in a particular field, linked by commonalities and complementarities” ranging in size from a city to a country [

1]. Common examples of economic clusters include Silicon Valley in California and the Research Triangle in North Carolina. Agricultural economic clusters include the wine industry in Napa Valley and the cheese industry in Wisconsin. Garkovich, Brown and Zimmerman [

2] propose that the equine industry in Kentucky meets the criteria to constitute an agricultural economic cluster. Agricultural economic clusters can provide many local and regional market and non-market benefits.

As an informal nod to its organization of an equine economic cluster, Kentucky is often called “The Horse Capital of the World.” The equine industry is deeply ingrained in the culture, history, and lifestyle of Kentucky and more specifically Central Kentucky [

3]. In 2012, a comprehensive study of Kentucky’s equine industry was undertaken with two main objectives: (1) to estimate the number of equine in the state, where they were housed, and what they were used for, and (2) to estimate the economic impact of the equine industry on the state of Kentucky. The results were reported in the

2012 Kentucky Equine Survey [

4]. However, if an agricultural economic cluster provides non-market benefits by contributing to the culture, history, and lifestyle of a region, then focusing only on market value of the land underestimates the total value of the land to the area [

5]. Therefore, as a companion to the

2012 Kentucky Equine Survey, this study was undertaken to estimate the value Kentucky residents place on the presence of the equine industry, and more specifically horse farm land, in their communities. This is done by estimating their willingness to pay (WTP) to preserve horse farms and horse farm land. Using a contingent valuation approach, the non-market value of horse farm land is estimated via responses collected from a survey distributed to residents in eight Central Kentucky counties which constitute “the Bluegrass region” in 2012. We hypothesized that in addition to the market value of horse farm land, Central Kentuckians have a positive value for the non-market amenities of the land and are willing to pay additional taxes to support a horse farm preservation program in the state [

5]. The additional taxes would make up for lost revenue from development of the land.

In this paper, the non-market value of the horse farm land in the Central Kentucky is estimated using contingent valuation [

5]. This stated preference approach is used to capture the monetary value of non-market goods through the use of surveys [

6] which create a hypothetical marketplace in which respondents have the opportunity to “buy” the non-market good and state their individual maximum willingness to pay for the good or resource in question [

7,

8]. The data collected from the survey are then analyzed using regression modeling while controlling for various characteristics [

8]. In the survey, respondents are asked to choose from a set of dollar values they would be willing to pay in additional taxes based upon a range of values pre-determined by researchers. This method, called the payment card approach, imitates real life experience by allowing individuals to search for the value that is the maximum amount they would pay [

9,

10]. Because each respondent is given one chance to select the amount they are willing to pay from a set of values, the analysis is less complicated than responses from an open-ended question of how much they are willing to pay [

11].

Results from the study showed, on average, a Central Kentucky household was willing to pay $55.14–$67.78 in additional annual taxes to maintain the equine industry at its current levels, although this value varies according to demographic characteristics. Fayette County residents were willing to pay more ($62.55–$77.43) than residents of surrounding counties.

Literature Review

Agricultural economic clusters can provide many local and regional benefits, which are often categorized as having either market or non-market value. Market benefits are typically measured by market prices [

5]. In an agricultural industry, market benefits include jobs created, revenue and income generated from the production and sale of agricultural products, and the transformation of various agricultural inputs into other agricultural products. Conversely, non-market benefits are not traded in markets and, therefore, market prices cannot be used to measure value [

12]. Non-market benefits include direct use values (e.g., recreational services provided by farms/ranches and these farms’ scenic “amenity” value) and non-direct use values (e.g., cultural and heritage values associated with the lifestyle of agriculture, bequest values for preserving agricultural traditions, and existence values of wildlife living on agricultural operations) [

13]. If an agricultural economic cluster provides non-market benefits by contributing to the culture, history, and lifestyle of a region, then a standard economic impact analysis undervalues total economic benefit for these industries [

5].

In the

2012 Kentucky Equine Survey, the equine industry was estimated to have total sales and income of

$1.1 billion. The additional increase in sales of goods and services because of the industry in the state was estimated to be

$3 billion [

4]. Much of this market-based activity was concentrated in the eight counties of the Bluegrass region. The survey results estimated 4.3 million acres of land used for equine operations, of which 1.1 million acres were devoted to equine-related activities [

4]. In Fayette County, equine operations existed on an estimated 89,000 acres, or 49% of the acreage in the county. The top three counties, all in the Bluegrass, in terms of the percent of land used for the equine activities were Fayette (49%), Woodford (36%) and Bourbon (26%) counties [

4].

Ready, et al. [

14] estimated the non-market value of the horse farm land in Kentucky in 1990. Using a contingent valuation survey, they estimated the willingness to pay to prevent a decrease in the number of horse farms. They proposed a hypothetical “horse farm preservation program” in the state that was financed by money from wagers placed at racetracks. Under this scenario, survey respondents were asked for the maximum additional tax they were willing to pay to make up for lost tax revenue from commercial or residential development of horse farm land. The authors estimated the median willingness to pay depended on the level of decline in the industry: to avoid a 25 percent loss in horse farms, Kentuckians were willing to pay

$24.84; for a 50 percent loss,

$89.56; and for a 75 percent loss,

$681.05. Viewed differently, Kentuckians’ average willingness to pay to avoid the loss of one farm was

$0.49.

The hypothetical scenario shares some similarities with a land preservation program currently in place in two Kentucky counties. Fayette County has implemented two programs to limit development on horse farm land: an Urban Service Boundary (USB) program, implemented in 1957 and updated in 1996, and a Purchase of Development Rights (PDR) program, implemented in 2001. Among other things, the USB program established a strict minimum area requirement of 40 acres to maintain open space in the rural service area outside the urban services boundaries. The Fayette County USB succeeded in containing development and creating a more compact city than the plan in another equine cluster area, Ocala-Marion County, Florida [

15]. The PDR program was established in Fayette County in 2001 to preserve land in perpetuity for agricultural uses. The program allows farmers with at least 20 acres located in agricultural-rural zones to apply to sell the development rights to the rural land management board. The owners receive a cash payment for the development rights. Scott County offered a similar but smaller program. The other counties did not have a similar program in 2012.

2. Materials and Methods

2.1. Sample

Data were collected using a household survey. The survey instrument, designed and refined with input from a focus group and approved by the University of Kentucky’s Office of Research Integrity (protocol #12-0727-P4S), was distributed to 5836 residents of the eight Bluegrass region counties: Bourbon, Clark, Fayette, Harrison, Jessamine, Madison, Scott, and Woodford. Each mailing included a hard copy of the survey, a postage paid, self-addressed return envelope, and instructions on how to access the survey online if preferred. A reminder postcard was mailed ten days after the distribution of the survey. A second mailing was performed approximately eight weeks later. About 92% of respondents completed the hard copy.

Addresses for respondents were obtained from two different sources. In total, 3176 surveys were distributed to Fayette County residents who were randomly selected from a database obtained from the Fayette County Property Valuation Administrator. The database contained all residential properties sold between January 2005 and July 2012 with sale prices between $75,000 and $3 million. The sample selection was a ten percent stratified random sample within five property sale price groups. The remaining 2660 surveys (after accounting for invalid addresses) were distributed to residents of the other Bluegrass region counties using addresses obtained from USADATA, Inc. The randomly selected sample of households in each county was weighted by county population, and the surveys were addressed to specific individuals in the household. The final sample of households in the Bluegrass region represented about 2.7 percent of all households. A total of 1538 survey forms were returned for a 26.4% response rate. Approximately 56% of the respondents were from Fayette County, while the remaining 44% were from the other Bluegrass counties.

2.2. Survey Design

The survey used in this study was designed using the Ready, et al. [

14] survey tool as a guideline. The survey instrument consisted of five sections, labeled A–E. In Section A, respondents were asked to what extent they agreed or disagreed with eight “attitude statements.” These responses were used to measure respondents’ a priori attitudes toward the equine industry and to serve as a “warm up” to prepare the respondent for the hypothetical scenario in the following section. For each statement, respondents were able to choose from among the following alternatives: strongly disagree; disagree; neutral; agree; strongly agree; and do not know.

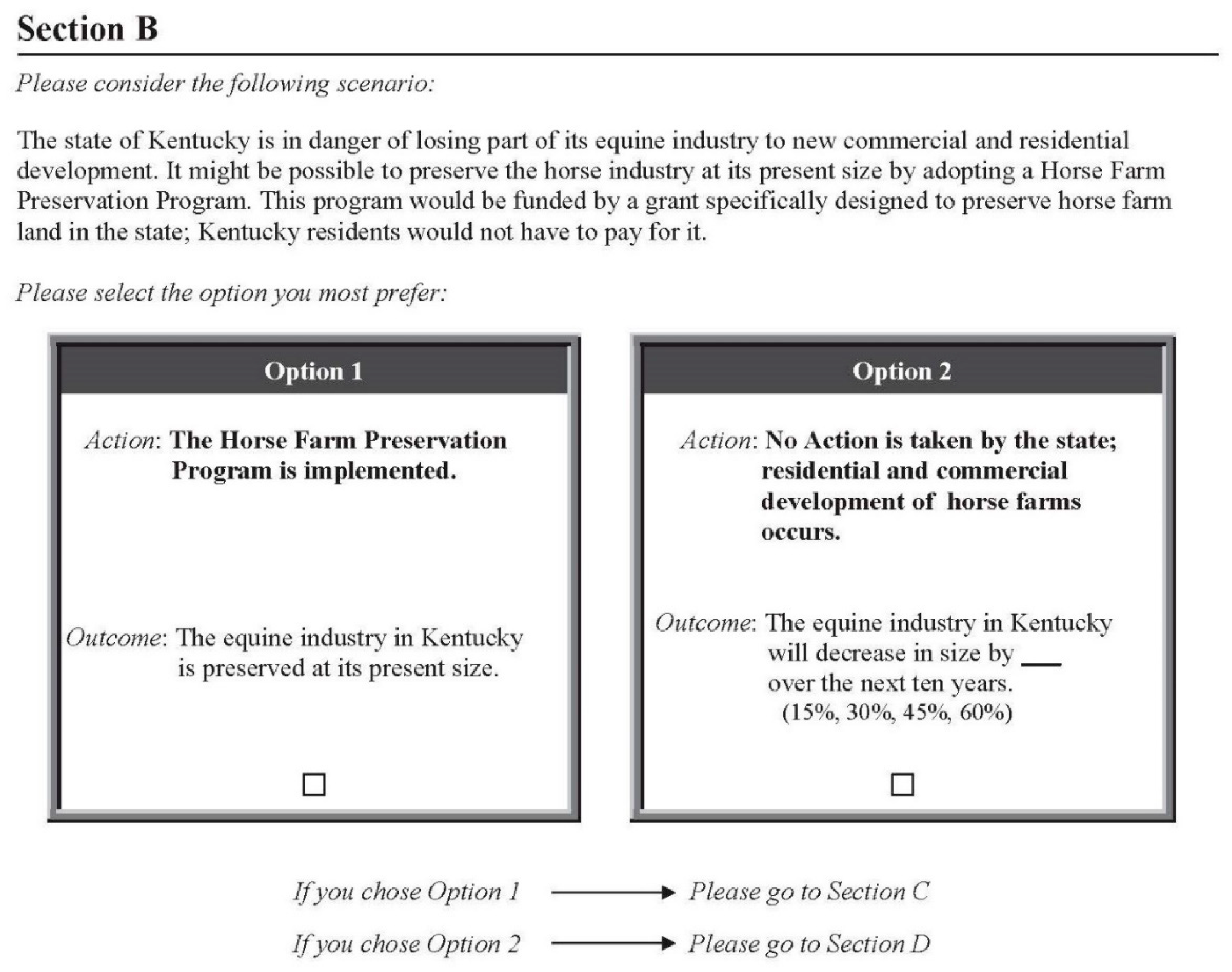

In Section B, respondents’ general support of the equine industry was assessed using their choice to support, at no cost to them, a hypothetical “Horse Farm Preservation Program.” The choice scenario is provided in

Figure 1. The respondents were offered two options: (1) to implement the Horse Farm Preservation Program and maintain the equine industry at its current size; or (2) do not implement the preservation program and the equine industry would decrease by a determined percentage in the next ten years. The percentage decline varied according to the survey form at 15%, 30%, 45% or 60%.

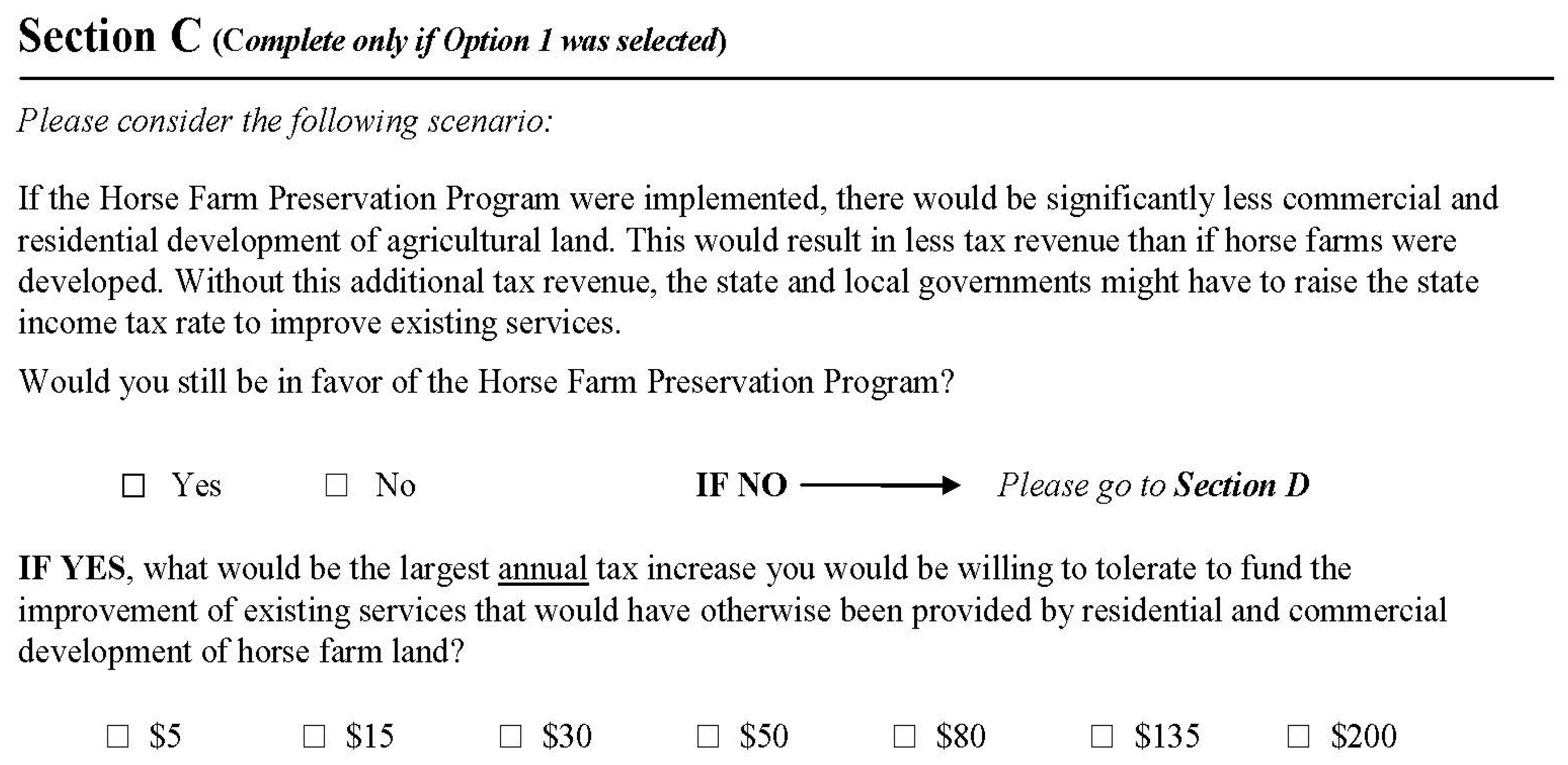

Respondents selecting Option 1 in Section B were then presented with a new scenario in Section C. The choice scenario is provided in

Figure 2. These respondents were informed that while a grant would pay for the preservation program, state and local governments would forfeit tax revenue due to land remaining undeveloped for residential and commercial use. Respondents were then asked to select between two choices: (1) to maintain the current size of the equine industry and pay additional income tax; or (2) allow the industry to decrease in size by the amount stated on their survey form. Respondents indicating a willingness to pay for preservation of horse farm land were then asked to indicate the largest annual tax increase they “would be willing to tolerate to fund the improvement of existing services that would have otherwise been provided by residential and commercial development of horse farm land” using a payment card approach. The payment cards were

$5,

$15,

$30,

$50,

$80,

$135 and

$200. The range of tax increase choices, pre-determined by researchers, was replicated from Ready, et al. [

14], with the exception of excluding the highest value of

$500. The payment card values were reviewed by a focus group, and given the slow recovery from the Great Recession of 2008–2009, it was felt that

$500 was too high. Framing the contingent valuation as a tax is appropriate because this is how a transfer from residents to horse farms would occur. After making that choice, respondents were asked to select three statements that best reflected why they would be willing to tolerate an annual tax increase to preserve horse farm land.

Respondents selecting Option 2 in Section B, or if choosing “No” in Section C, were directed to Section D and asked to select three statements that best reflected why they did not support paying additional taxes.

Section E collected information on respondents’ basic demographic information including age, education, income and gender. In addition, respondents answered a consequentiality question as external validity for the WTP responses. Finally, in order to evaluate whether any potential connections with the equine industry influenced WTP results, respondents were asked questions regarding their involvement in the equine industry, either directly or indirectly.

2.3. Sample Description

The purpose of

Table 1 is to clarify how the final sample to be used in the WTP analysis was determined. First, of the 1538 returned surveys, 15 individuals did not respond to the primary question in Section B and were dropped from the analysis. An additional 134 respondents that did not complete Section E and were also dropped from the analysis. Income nonresponse was distributed evenly across the counties. Of the remaining 1389 surveys, Part I of

Table 1 illustrates that 87% of respondents favored implementing, at no cost to them, the Horse Farm Preservation Program. The 13% not supporting the program were assigned a WTP of

$0.

Among those supporting the free preservation program, nearly 84% were willing to pay for preservation through increased taxes (Part II), while 16% were no longer willing to support the program and were assigned a WTP of

$0. In the follow-up questions in Section D, about half of these respondents objected to “any form of government funding”, believed “state should not intervene” and believed they “should not have to pay to preserve” horse farms. These respondents did not believe in the hypothetical scenario presented and were labeled as “protesters” [

14]. Another group labeled as protesters were an additional 49 respondents (Part III) because, despite indicating support for the preservation program in Section B and C, they failed to select a payment card, and we were unwilling to assign a WTP value.

The literature has debated whether to include or exclude protesters [

16,

17]. Excluding the protesters means the sample is not representative of the population, while including those who object to the scenario can bias WTP results [

17]. For our analysis, protesters represented about 13% of returned survey forms. These respondents were on average lower income and less educated than the average of all respondents. Assuming WTP is positively related to income and education, excluding protesters would bias the WTP upward. We expect some upward bias due to having to exclude the 61 respondents in Part III. For the other protesters in Part II who were assigned a WTP of

$0 including these respondents would bias the results downward. Later, in

Section 3, WTP results with and without the protesters who have WTP of

$0 are compared.

Finally, Part IV of

Table 1 shows that overall, 72% of respondents were willing to pay a tax amount greater than

$0, while 28% were treated as having chosen

$0. The final number of respondents used in the analysis was 1340.

For the 72% of respondents willing to pay a tax greater than $0, the most common choice was $50 in additional annual tax (17.9%), followed by $200 (14.2%). The remaining frequency of choices for each available amount was: $5 (9.7%); $15 (9.1%); $30 (8.3%); $80 (7.6%); and $135 (5.5%). There was no statistically significant difference in the mean WTP amounts between the hypothetical decline groups.

2.3.1. Descriptive Statistics

This section presents selected descriptive statistics from Sections A and E of the survey. Summary statistics for WTP choices (Section C) will be presented in

Section 3.

Survey Respondents a Priori Attitudes towards Horse Farms

Table 2 shows a generally positive attitude towards the presence of the horse farms based on responses in Section A.

Consequentiality

In Section E, we asked respondents the following consequentiality question: “How likely do you think it is that the results of this survey will shape the direction of future policy for Kentucky’s equine industry?” Carson [

18] showed that measuring respondents’ beliefs about the likelihood that the policy being proposed will be implemented is important for evaluating how the choices proposed would be predictive of the true response. Most people responded “unlikely” or “do not know” (63.9%), while 36.1% percent responded “very likely” or “somewhat likely.”

Interaction with Equine Industry

Respondents were also asked to characterize their involvement in the equine industry. Direct connections to the equine industry through employment (5.2%) or horse ownership (16.5%) were uncommon, but over 50% of respondents attended at least one equine event in the past year, with the most common type of equine event being a race meet (47.3%).

Demographics and Income Weighting Adjustment

Summary statistics for demographic variables are presented in

Table 3. Median income, age and educational attainment were compared to the relevant population using U.S. Census data. On average, the respondents were better educated and wealthier than the average Bluegrass resident. Fayette County respondents were about the same age on average as the total population, whereas the other counties’ respondents were older than average.

Household income is an important determinant in willingness to pay.

Table 4 shows the comparison of the distribution of the median household income estimated from the American Community Survey (ACS) by the U.S. Census Bureau for Fayette County and the remaining Bluegrass Counties excluding Fayette. Because respondents’ income was significantly greater than the average resident in all counties, responses were weighted according to the final columns in

Table 4 to re-apportion the survey respondents to the population proportions. This adjustment ensures that results are more representative of the population.

2.4. Theoretical Model

The objective of a contingent valuation study is to measure an individual’s monetary value for some item, be it a single commodity, a single program, a mix of commodities, etc. In this study, the objective is to measure a Central Kentucky household’s monetary value for the hypothetical horse farm preservation program. Following the notation used by Carson and Hanemann [

20], assume that an individual has a utility function defined over a vector of quantities of other market commodities (

x) and the horse farm preservation program (

q),

u(

x,

q). If the consumer’s income is given by

y and the vector of commodity prices is given by

p, then the corresponding indirect utility function is

v(

p,

q,

y). It is assumed that

u(

x,

q) is increasing and quasi-concave in

x so that

v(

p,

q,

y) is homogeneous of degree zero in

p and

y, increasing in

y, non-increasing in

p, and quasi-convex in

p.

In a valuation scenario, a consumer is comparing a situation with the item to a situation without. In the context of this study, call q0 the state without the horse farm preservation program and q1 the state with the program. The resident’s utility changes from u0 ≡ v(p, q0, y) to u1 ≡ v(p, q1, y) if the program is implemented. This change is an improvement (for the worse, leaves the resident indifferent) if u1 > u0 (u1 < u0, u1 = u0).

The value of the change to the resident in monetary terms is represented by v(p, q1, y − C) = v(p, q0, y), where C is the compensating variation and measures the consumer’s maximum willingness to pay to implement the program. In other words, if C = C(q0, q1, p, y), then WTP(q0, q1, p, y) = C(q0, q1, p, y) for C ≥ 0.

To specify the measurement of WTP, suppose

y =

m(

p,

q,

u) is the expenditure function corresponding to the direct and indirect utility functions,

u(

x,

q) and

v(

p,

q,

y), respectively. The compensating variation, and hence WTP, is defined as

The first term on the right-hand side of the equality is the amount of expenditures the resident needs to reach utility u0 without the horse farm preservation program, while the second term represents the amount of expenditures the resident needs to reach utility u0 with the horse farm preservation program. If the horse farm preservation program is a “good,” then C ≥ 0.

2.5. Empirical Model and Data Description

For the 1340 respondents, the amount of additional tax each household is willing to pay to maintain horse farm land is estimated using three different approaches. First, we calculate simple averages: the unweighted mean levels of WTP, the weighted mean levels of WTP, and the weighted mean levels of WTP without the protesters. Second, we estimate WTP using an ordinary least squares (OLS) regression with robust standard errors as a baseline using the values of the tax selected by the respondents weighted by income. Protesters are included and are assigned a WTP of $0 in order to provide more conservative WTP estimates.

The final approach is explored due to the survey’s reliance on the payment card method. When utilizing the payment card method, the respondent’s true WTP may not be the value selected. Instead, it identifies a range of values that encompasses the individual’s true WTP. A respondent’s true willingness to pay may lie between the selected value and the next available option [

21,

22]. Consequently, in the third and final estimation, we allow for a less restrictive approach with an interval regression. As opposed to the OLS estimation which calculates a point estimate, the interval regression can reflect the uncertainty about a person’s real tax amount choice by using a maximum likelihood estimator for each interval. Across the intervals, it calculates the probability that the outcome value lies within the range designated. Yang, Hu, Mupandawana and Liu [

23] chose the interval regression for their WTP estimations since it is more efficient than a discrete choice model. Given the design of the payment card, we know the categorical interval in which each chosen tax amount falls. In addition, this approach also allows for censoring from those indicating they would pay

$200; these respondents, in fact, may be willing to pay far more than

$200.

For the interval regression, the unobserved latent variable is estimated by

where the probability for each interval is

The lower bound of the WTP interval, lwtp, is equivalent to $0, $5, $15, $30, $50, $80, $135, or $200, and the upper bound of the WTP interval, uwtp, is equivalent to $0, $5, $15, $30, $50, $80, $135, $200, or ∞. Since the interval regression uses the maximum likelihood estimator, homoscedasticity and normality must be assumed.

The

Xs are the percent decline in the horse industry

perdown; the consequentiality question

implication; demographic variables

male,

education,

age,

income; equine industry involvement variables horse ownership

history, employment in the horse industry, attended a horse race

racemeet, attended equine auction

equinesaleauction; and Fayette County

fayette. We control for Fayette County because it already has an established horse farm preservation program (PDR program) and the highest percentage of acres of land used as horse farms. Familiarity with a program and horse farms could affect respondent responses either positively or negatively. Scott County had a similar program at the time, but it was very small.

Table 5 summarizes the sample statistics for each variable and provides definitions.

3. Results

Table 6 presents the respondent mean value of the willingness to pay using with and without the income-related nonresponse weight adjustment provided in

Table 4. Results are presented overall, by level of industry decline, and by respondent income. The unweighted (weighted) mean willingness to pay to support the Horse Farm Preservation Program is

$55.29 (

$50.18). In general, mean willingness to pay for each hypothetical scenario increased as the percentage decline in the industry increased, although the magnitude of the increase is small. In addition, willingness-to-pay generally increased across income categories for both unweighted and weighted responses. We utilize weighted means for the subsequent analysis.

The last column shows the weighted mean values minus the 113 protesters. The protesters all have $0 for WTP. As expected, excluding these respondents increases the WTP values. Protesters are included in the regression analysis to provide a more conservative WTP estimate for the entire population of the Bluegrass counties.

In

Table 7, results from the two regression models are presented: OLS (Model 1), and interval (Model 2). Responses from protesters are included and are assigned a WTP of

$0.

The results from Models 1 and 2 are similar in terms of signs, significance, and magnitude of the coefficient estimates. For the sake of brevity, we focus on the results from the interval regression because that model is most efficient.

Three variables which indicate some previous level of interaction with the equine industry (owning a horse in the past 5 years, or attending an equine sale or race meet in the past year) are positively related to willingness to pay to preserve horse farm land and are significant at the 5% level or better. In addition, individuals who reside in Fayette County are willing to pay an average of about $11 more to preserve horse farm land than respondents in other Bluegrass counties (p < 0.05). Respondents who believe that results from this survey are “somewhat likely” or “very likely” to affect future policy report higher WTP amounts; the coefficient estimates are significant at the 5% level or better.

In general, the other demographic variables appear to have little influence on WTP estimates. Among the education controls, only those in the highest education category (some graduate or graduate degree) report higher willingness to pay, but the coefficient estimate is only significant at the 10% level. Respondents in the two oldest age groups (45–64 years old and 65 years or older) report higher willingness to pay than respondents in the youngest age group; again, these estimates are significant at the 10% level. Respondents reporting household income in the $100,000–$120,000 bracket and $120,000+ bracket are willing to pay more than respondents in the lowest income bracket (less than $20,000) (p < 0.10 and p < 0.01, respectively).

Including education, age, and income in the same model raises multicollinearity concerns. Post-estimation tests suggest that a small degree of multicollinearity may exist, as evidenced by variance inflation factor (VIF) results slightly above the common threshold of 10 (10.64 for education category 3, 11.12 for education category 4, and 11.78 for education category 5). However, we choose to include all three variables in our final models because we are primarily focused on the WTP predictions, and including all three demographic variables produces the most conservative WTP estimates. Regardless of model choice, the WTP estimates vary only slightly.

Table 8 shows the mean WTP estimates from Models 1 and 2 for all counties combined and then Fayette County separately. Recall that protestors’ responses are included in these WTP estimates. Since Model 1 utilizes only the lower bound of the tax interval, the WTP estimates do not reflect the uncertainty in respondents’ true willingness to pay and, consequently, are lower than the estimates from the interval regression approach in Model 2. Focusing again the results from Model 2, Bluegrass county households are willing to pay an average of

$67.78 each to preserve horse farm land; focusing only on Fayette County, a household’s average willingness to pay is

$77.43.

4. Discussion

In 2012, Central Kentuckians on average were willing to pay $67.78 to maintain the equine industry at its current levels. Willingness to pay differed according to previous interaction with the equine industry, residing in Fayette County, income, and whether respondents thought that the results from the survey were likely to shape future policy. The WTP estimate is conservative because protesters are included in the analysis with an assigned WTP of $0.

Directly comparing the WTP estimate from this paper to Ready, et al. [

14] is not possible because the levels of decline differed in the two studies. Adjusted for inflation, the estimated WTP for our study is equivalent to

$38.58 in 1990 dollars. This inflation-adjusted estimate lies between the Ready, et al. [

14] WTP estimates for a 25% decline in the number of horse farms (

$24.84) and a 50% decline (

$89.56), suggesting that our estimate is reasonable. It should also be noted that the percent level of decline did not influence WTP in our study, although it had significant implications on WTP estimates in the Ready, et al. [

14] study.

Fayette County has the most horse farm land of all Bluegrass counties and implemented an active horse farm preservation program about 10 years after the Ready, et al. [

14] study. Some of the difference in WTP estimates may be explained by the implementation of the PDR program; however, even with such a program in place, Bluegrass residents continue to be willing to pay to preserve horse farm land, and Fayette County residents are willing to pay more than the average amount.

To put the estimated WTP amount of

$67.78 in context, in FY2012, the average Kentuckian paid

$803 in state individual income tax,

$1033 for state and local individual income tax combined,

$698 in sales tax, and

$716 in property tax [

24]. In 2012, the real median income was

$44,629; the estimated WTP is about 0.2% of that value.

The U.S. Census Bureau estimated there were 255,197 households in the eight Bluegrass counties from 2013 to 2017. Given our mean WTP estimates, this suggests an additional

$14 million to

$17 million annually in revenue for the preservation of horse farms. The WTP for Fayette County residents alone would amount to nearly

$11 million in revenue for horse farm preservation; in contrast, the annual amount budgeted by the urban-county government (Lexington-Fayette Urban County Government, or LFUCG) for the PDR program is

$2,000,000 [

15].

The results from this paper are reasonable and non-trivial; however, the study still has its limitations. First, the contingent valuation method may be subject to hypothetical bias, in which respondents may overstate their true WTP since money will not change hands [

18,

25]. The consequentiality question was included to help address this concern; understanding respondents’ beliefs about the likelihood that the proposed policy will be implemented aids in understanding how predictive the respondents’ choices were of their “true” response. However, another follow-up question could have been included to measure the respondent’s certainty of their willingness to pay. Second, the paper assumes that

$0 is the lower bound of WTP when, in fact, some people may dislike horse farms and feel the need to be compensated for their existence. While this may be unlikely, if the assumption is incorrect, our estimates would be biased upward. A final limitation may be a consequence of the authors’ decision to keep the survey short to encourage participation and reduce mailing costs. As a result, the choice scenario explanation was limited compared to the study of Ready, et al. [

14], which may have left respondents to infer their own information from what was not on the page. This design may bias the results, but that bias may be upward or downward depending how respondents interpreted the scenario.

In spite of the limitations, the results from this study are reasonable and suggest that Central Kentucky residents value the presence of the horse industry in the area and are willing to pay extra to preserve it from development. Furthermore, while the equine industry is one of the biggest contributors to the state’s economy in the agricultural sector, the non-market value of the culture, history, and lifestyle of Kentucky should be considered to fully understand the value of the industry to the state and in informing future policy. Finally, the approach taken in this study can be used to understand the non-market benefits of other agricultural clusters around the nation.