How Does Entrepreneurial Orientation Influence the Sustainable Growth of SMEs? The Role of Relative Performance

Abstract

1. Introduction

2. Literature Review and Hypothesis Development

2.1. Sustainable Firm Growth of SMEs and the Role of Entrepreneurial Orientation

2.2. Boundary Conditions in the EO–SME Growth Relationship

2.3. The Role of Past Performance in the EO–SME Growth Relationship

3. Hypothesis Development

3.1. The Interaction Effect of Performance below Historical Aspirations

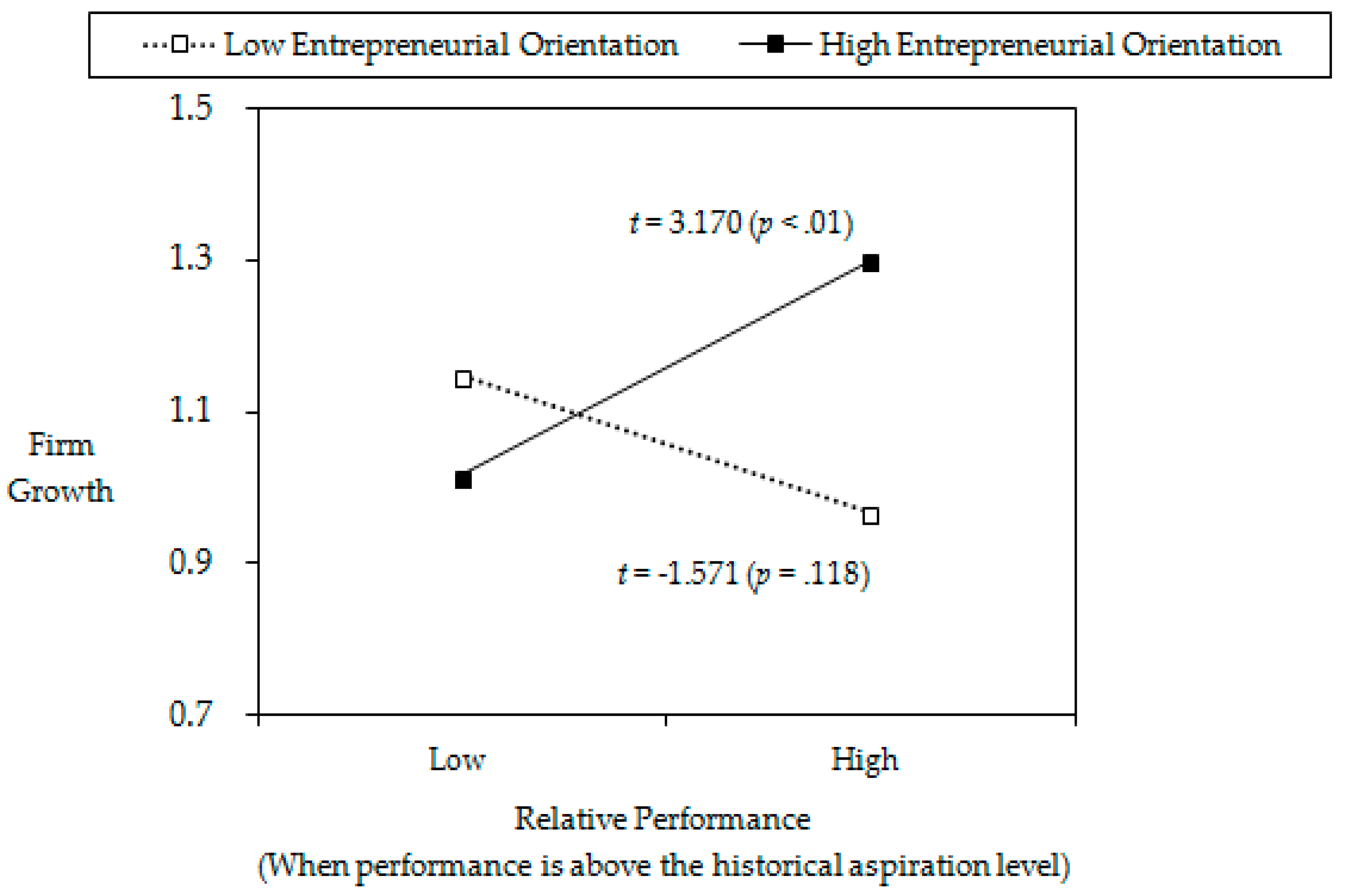

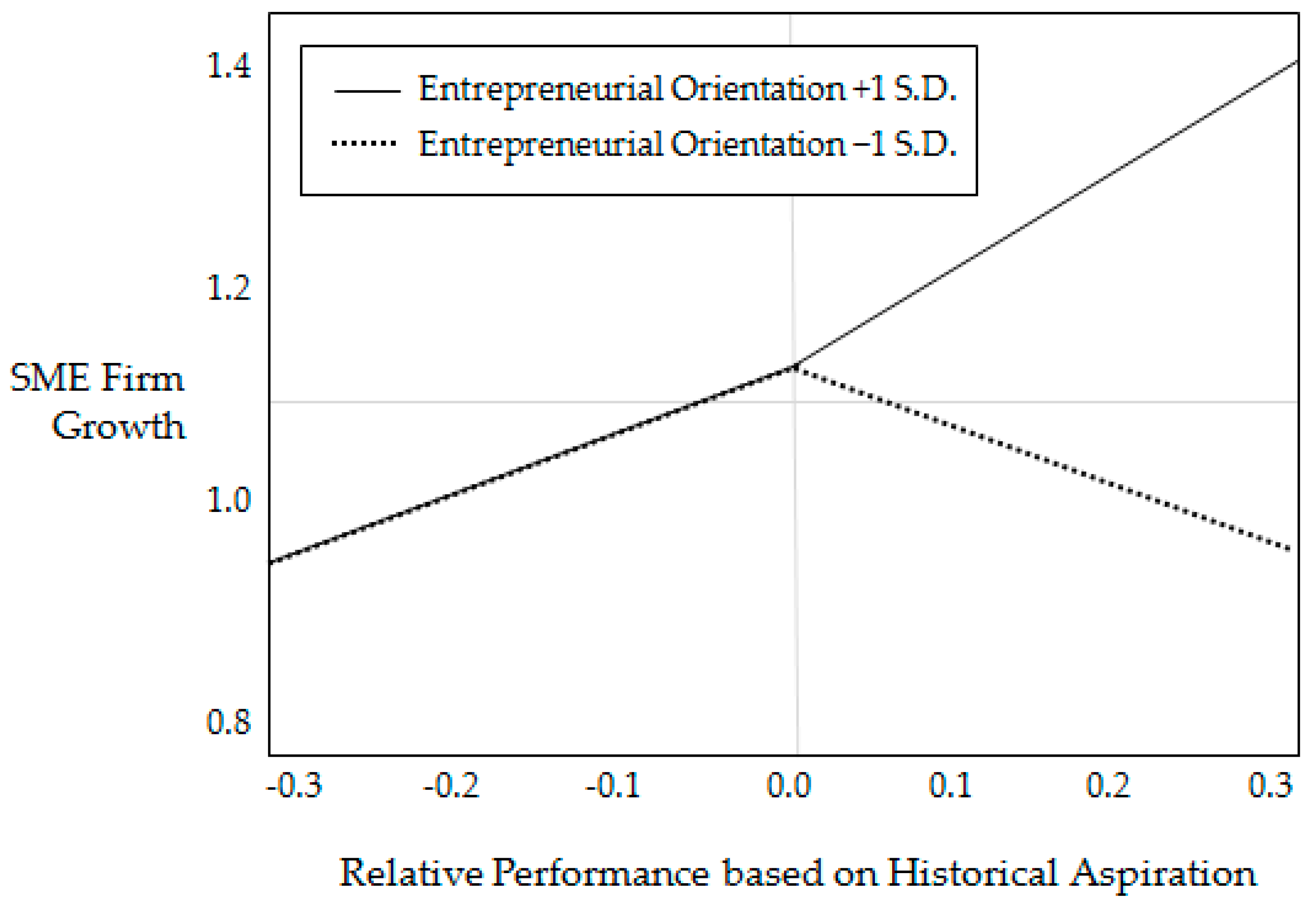

3.2. The Interaction Effect of Performance above Historical Aspirations

4. Methodology

4.1. Data and Sample

4.2. Variable Measurement

4.2.1. SMEs’ Firm Growth

4.2.2. Entrepreneurial Orientation

4.2.3. Relative Performance

4.2.4. Control Variable

4.3. Model Specification

5. Results

5.1. Descriptive Statistics and Correlations

5.2. Hypothesis Testing

6. Discussion

6.1. Research Summary

6.2. Theoretical Contributions

6.3. Practical Contributions

6.4. Limitations and Suggestions for Future Research

Author Contributions

Funding

Conflicts of Interest

Appendix A

References

- McKelvie, A.; Wiklund, J. Advancing Firm Growth Research: A Focus on Growth Mode Instead of Growth Rate. Entrep. Theory Pract. 2010, 34, 261–288. [Google Scholar] [CrossRef]

- Wright, M.; Roper, S.; Hart, M.; Carter, S. Joining the dots: Building the evidence base for SME growth policy. Int. Small Bus. J. 2015, 33, 3–11. [Google Scholar] [CrossRef]

- Schumpeter, J.A. Entrepreneurship as innovation. Entrep. Social Sci. View 2000, 51–75. Available online: https://ssrn.com/abstract=1512266 (accessed on 30 August 2019).

- Doern, R. Investigating barriers to SME growth and development in transition environments: A critique and suggestions for developing the methodology. Int. Small Bus. J. 2009, 27, 275–305. [Google Scholar] [CrossRef]

- Freeman, J.; Carroll, G.R.; Hannan, M.T. The Liability of Newness: Age Dependence in Organizational Death Rates. Am. Sociol. Rev. 1983, 48, 692–710. [Google Scholar] [CrossRef]

- Gallagher, C.; Miller, P. New fast-growing companies create jobs. Long Range Plan. 1991, 24, 96–101. [Google Scholar] [CrossRef]

- Covin, J.G.; Green, K.M.; Slevin, D.P. Strategic Process Effects on the Entrepreneurial Orientation-Sales Growth Rate Relationship. Entrep. Theory Pract. 2006, 30, 57–81. [Google Scholar] [CrossRef]

- Moreno, A.M.; Casillas, J.C.; Moreno-Menendez, A.M. Entrepreneurial Orientation and Growth of SMEs: A Causal Model. Entrep. Theory Pract. 2008, 32, 507–528. [Google Scholar] [CrossRef]

- Rauch, A.; Wiklund, J.; Lumpkin, G.; Frese, M. Entrepreneurial Orientation and Business Performance: An Assessment of Past Research and Suggestions for the Future. Entrep. Theory Pract. 2009, 33, 761–787. [Google Scholar] [CrossRef]

- Wang, C.L.; Altinay, L. Social embeddedness, entrepreneurial orientation and firm growth in ethnic minority small businesses in the UK. Int. Small Bus. J. 2012, 30, 3–23. [Google Scholar] [CrossRef]

- Hult, G.T.M.; Ketchen, D.J., Jr. Does market orientation matter? A test of the relationship between positional advantage and performance. Strateg. Manag. J. 2001, 22, 899–906. [Google Scholar] [CrossRef]

- Covin, J.G.; Slevin, D.P. A Conceptual Model of Entrepreneurship as Firm Behavior. Entrep. Theory Pract. 1991, 16, 7–26. [Google Scholar] [CrossRef]

- Miller, D. The Correlates of Entrepreneurship in Three Types of Firms. Manag. Sci. 1983, 29, 770–791. [Google Scholar] [CrossRef]

- Wiklund, J.; Shepherd, D. Entrepreneurial orientation and small business performance: A configurational approach. J. Bus. Ventur. 2005, 20, 71–91. [Google Scholar] [CrossRef]

- Anderson, B.S.; Eshima, Y. The influence of firm age and intangible resources on the relationship between entrepreneurial orientation and firm growth among Japanese SMEs. J. Bus. Ventur. 2013, 28, 413–429. [Google Scholar] [CrossRef]

- Avlonitis, G.J.; Salavou, H.E. Entrepreneurial orientation of SMEs, product innovativeness, and performance. J. Bus. Res. 2007, 60, 566–575. [Google Scholar] [CrossRef]

- Cyert, R.M.; March, J.G. A Behavioral Theory of the Firm; Wiley-Blackwell: Hoboken, NJ, USA, 1963. [Google Scholar]

- Greve, H.R. A Behavioral Theory of R&D Expenditures and Innovations: Evidence from Shipbuilding. Acad. Manag. J. 2003, 46, 685–702. [Google Scholar]

- Greve, H.R. A Behavioral Theory of Firm Growth: Sequential Attention to Size and Performance Goals. Acad. Manag. J. 2008, 51, 476–494. [Google Scholar] [CrossRef]

- Penrose, E.T. The Theory of the Growth of the Firm; John Wiley: New York, NY, USA, 1959. [Google Scholar]

- Stevenson, H.H.; Jarillo, J.C. A paradigm of entrepreneurship: Entrepreneurial management. Strateg. Manag. J. 1990, 11, 17–27. [Google Scholar]

- Nason, R.S.; Wiklund, J. An assessment of resource-based theorizing on firm growth and suggestions for the future. J. Manag. 2018, 44, 32–60. [Google Scholar] [CrossRef]

- Golovko, E.; Valentini, G. Exploring the complementarity between innovation and export for SMEs’ growth. J. Int. Bus. Stud. 2011, 42, 362–380. [Google Scholar] [CrossRef]

- Campa, J.M.; Kedia, S. Explaining the Diversification Discount. J. Financ. 2002, 57, 1731–1762. [Google Scholar] [CrossRef]

- Matsusaka, J.G. Corporate Diversification, Value Maximization, and Organizational Capabilities. J. Bus. 2001, 74, 409–431. [Google Scholar] [CrossRef]

- Hitt, M.A.; Bierman, L.; Uhlenbruck, K.; Shimizu, K. The Importance of Resources in the Internationalization of Professional Service Firms: The Good, the Bad, and The Ugly. Acad. Manag. J. 2006, 49, 1137–1157. [Google Scholar] [CrossRef]

- Wolff, J.A.; Pett, T.L. Small-Firm Performance: Modeling the Role of Product and Process Improvements. J. Small Bus. Manag. 2006, 44, 268–284. [Google Scholar] [CrossRef]

- Uhlaner, L.M.; van Stel, A.; Duplat, V.; Zhou, H. Disentangling the effects of organizational capabilities, innovation and firm size on SME sales growth. Small Bus. Econ. 2013, 41, 581–607. [Google Scholar] [CrossRef]

- Rodriguez, A.; Nieto, M.J. Does R&D offshoring lead to SME growth? Different governance modes and the mediating role of innovation. Strateg. Manag. J. 2016, 37, 1734–1753. [Google Scholar]

- Love, J.H.; Roper, S. SME innovation, exporting and growth: A review of existing evidence. Int. Small Bus. J. 2015, 33, 28–48. [Google Scholar] [CrossRef]

- Davidsson, P.; Steffens, P.; Fitzsimmons, J. Growing profitable or growing from profits: Putting the horse in front of the cart? J. Bus. Ventur. 2009, 24, 388–406. [Google Scholar] [CrossRef]

- Covin, J.G.; Wales, W.J. The measurement of entrepreneurial orientation. Entrep. Theory Pract. 2012, 36, 677–702. [Google Scholar] [CrossRef]

- Hamel, G. Leading the revolution: An interview with Gary Hamel. Strategy Leadersh. 2001, 29, 4–10. [Google Scholar] [CrossRef]

- Lumpkin, G.T.; Dess, G.G. Clarifying the Entrepreneurial Orientation Construct and Linking It to Performance. Acad. Manag. Rev. 1996, 21, 135. [Google Scholar] [CrossRef]

- Nohria, N.; Gulati, R. Is slack good or bad for innovation? Acad. Manag. J. 1996, 39, 1245–1264. [Google Scholar] [CrossRef]

- Casillas, J.C.; Moreno, A.M.; Moreno-Menendez, A.M. The relationship between entrepreneurial orientation and growth: The moderating role of family involvement. Entrep. Reg. Dev. 2010, 22, 265–291. [Google Scholar] [CrossRef]

- Schneider, S.L. Framing and conflict: Aspiration level contingency, the status quo, and current theories of risky choice. J. Exp. Psychol. Learn. Mem. Cogn. 1992, 18, 1040–1057. [Google Scholar] [CrossRef] [PubMed]

- Iyer, D.N.; Miller, K.D. Performance feedback, slack, and the timing of acquisitions. Acad. Manag. J. 2008, 51, 808–822. [Google Scholar]

- Shapira, Z. Entering new markets: The effect of performance feedback near aspiration and well below and above it. Strateg. Manag. J. 2017, 38, 1416–1434. [Google Scholar]

- Audia, P.G.; Greve, H.R. Less Likely to Fail: Low Performance, Firm Size, and Factory Expansion in the Shipbuilding Industry. Manag. Sci. 2006, 52, 83–94. [Google Scholar] [CrossRef]

- Brush, C.G.; Greene, P.G.; Hart, M.M. From initial idea to unique advantage: The entrepreneurial challenge of constructing a resource base. Acad. Manag. Perspect. 2001, 15, 64–78. [Google Scholar] [CrossRef]

- Gilbert, B.A.; McDougall, P.P.; Audretsch, D.B. New Venture Growth: A Review and Extension. J. Manag. 2006, 32, 926–950. [Google Scholar] [CrossRef]

- Pettus, M.L. The Resource-Based View as a Developmental Growth Process: Evidence from the Deregulated Trucking Industry. Acad. Manag. J. 2001, 44, 878–896. [Google Scholar]

- Lu, J.W.; Beamish, P.W. The internationalization and performance of SMEs. Strateg. Manag. J. 2001, 22, 565–586. [Google Scholar] [CrossRef]

- Singh, J.V. Performance, Slack, and Risk Taking in Organizational Decision Making. Acad. Manag. J. 1986, 29, 562–585. [Google Scholar]

- Argote, L.; Greve, H.R. A Behavioral Theory of the Firm—40 Years and Counting: Introduction and Impact. Organ. Sci. 2007, 18, 337–349. [Google Scholar] [CrossRef]

- Tversky, A.; Kahneman, D. The framing of decisions and the psychology of choice. Science 1981, 211, 453–458. [Google Scholar] [CrossRef] [PubMed]

- Lopes, L.L. Between Hope and Fear: The Psychology of Risk. Adv. Exp. Soc. Psychol. 1987, 20, 255–295. [Google Scholar]

- Sitkin, S.B.; Pablo, A.L. Reconceptualizing the Determinants of Risk Behavior. Acad. Manag. Rev. 1992, 17, 9. [Google Scholar] [CrossRef]

- Staw, B.M.; Sandelands, L.E.; Dutton, J.E. Threat Rigidity Effects in Organizational Behavior: A Multilevel Analysis. Adm. Sci. Q. 1981, 26, 501–524. [Google Scholar] [CrossRef]

- Baum, J.A.C.; Rowley, T.J.; Shipilov, A.V.; Chuang, Y.-T. Dancing with Strangers: Aspiration Performance and the Search for Underwriting Syndicate Partners. Adm. Sci. Q. 2005, 50, 536–575. [Google Scholar] [CrossRef]

- Altinay, L.; Madanoglu, M.; De Vita, G.; Arasli, H.; Ekinci, Y. The interface between organizational learning capability, entrepreneurial orientation, and SME growth. J. Small Bus. Manag. 2016, 54, 871–891. [Google Scholar] [CrossRef]

- Wiklund, J.; Shepherd, D. Knowledge-based resources, entrepreneurial orientation, and the performance of small and medium-sized businesses. Strateg. Manag. J. 2003, 24, 1307–1314. [Google Scholar] [CrossRef]

- Aldrich, H.; Auster, E.R. Even dwarfs started small: Liabilities of age and size and their strategic implications. Res. Organ. Behav. 1986, 8, 165–198. [Google Scholar]

- Bromiley, P.; Miller, K.D.; Rau, D. Risk in strategic management research. In The Blackwell Handbook of Strategic Management; Wiley-Blackwell: Hoboken, NJ, USA, 2001; pp. 259–288. [Google Scholar]

- Fombrun, C.J.; Wally, S. Structuring small firms for rapid growth. J. Bus. Ventur. 1989, 4, 107–122. [Google Scholar] [CrossRef]

- March, J.G.; Shapira, Z. Managerial Perspectives on Risk and Risk Taking. Manag. Sci. 1987, 33, 1404–1418. [Google Scholar] [CrossRef]

- Kim, Y.; Ployhart, R.E. The effects of staffing and training on firm productivity and profit growth before, during, and after the Great Recession. J. Appl. Psychol. 2014, 99, 361–389. [Google Scholar] [CrossRef] [PubMed]

- Shaw, J.D.; Park, T.Y.; Kim, E. A resource-based perspective on human capital losses, HRM investments, and organizational performance. Strateg. Manag. J. 2013, 34, 572–589. [Google Scholar] [CrossRef]

- Baek, J.-S.; Kang, J.-K.; Park, K.S. Corporate governance and firm value: Evidence from the Korean financial crisis. J. Financ. Econ. 2004, 71, 265–313. [Google Scholar] [CrossRef]

- Chang, S.J. Ownership Structure, Expropriation, and Performance of Group-Affiliated Companies in Korea. Acad. Manag. J. 2003, 46, 238–253. [Google Scholar]

- Keh, H.T.; Nguyen, T.T.M.; Ng, H.P. The effects of entrepreneurial orientation and marketing information on the performance of SMEs. J. Bus. Ventur. 2007, 22, 592–611. [Google Scholar] [CrossRef]

- Miller, D.; Friesen, P.H. Innovation in conservative and entrepreneurial firms: Two models of strategic momentum. Strateg. Manag. J. 1982, 3, 1–25. [Google Scholar] [CrossRef]

- Vidal, E.; Mitchell, W. Adding by Subtracting: The Relationship Between Performance Feedback and Resource Reconfiguration Through Divestitures. Organ. Sci. 2015, 26, 1101–1118. [Google Scholar] [CrossRef]

- Nugent, J.B.; Yhee, S.-J. Small and Medium Enterprises in Korea: Achievements, Constraints and Policy Issues. Small Bus. Econ. 2002, 18, 85–119. [Google Scholar] [CrossRef]

- Sudhir, K.; Talukdar, D. The “Peter Pan Syndrome” in Emerging Markets: The Productivity-Transparency Trade-off in IT Adoption. Mark. Sci. 2015, 34, 500–521. [Google Scholar] [CrossRef]

- Aloulou, W.; Fayolle, A. A conceptual approach of entrepreneurial orientation within small business context. J. Enterprising Cult. 2005, 13, 21–45. [Google Scholar] [CrossRef]

- Levinthal, D.; March, J.G. A model of adaptive organizational search. J. Econ. Behav. Organ. 1981, 2, 307–333. [Google Scholar] [CrossRef]

- Greve, H.R. Performance, Aspirations, and Risky Organizational Change. Adm. Sci. Q. 1998, 43, 58. [Google Scholar] [CrossRef]

- Festinger, L. A Theory of Social Comparison Processes. Hum. Relat. 1954, 7, 117–140. [Google Scholar] [CrossRef]

| Variable | 1 | 2 | 3 | 4 | 5 | 6 | 7 |

|---|---|---|---|---|---|---|---|

| 1. SMEs’ firm growth | 1.000 | ||||||

| 2. EO | 0.017 | (0.749) | |||||

| 3. Performance below historical aspirations | 0.208 *** | −0.030 | 1.000 | ||||

| 4. Performance above historical aspirations | 0.191 *** | 0.012 | 0.124 * | 1.000 | |||

| 5. Firm age | −0.072 | 0.016 | −0.032 | 0.049 | 1.000 | ||

| 6. Firm size | 0.077 | −0.025 | −0.241 *** | 0.099 | 0.052 | 1.000 | |

| 7. Capital intensity | −0.057 | 0.018 | −0.219 *** | −0.046 | 0.142 * | 0.098 | 1.000 |

| M | 1.102 | 3.625 | −0.054 | 0.048 | 29.643 | 199.544 | −1.233 |

| S.D. | 0.400 | 0.354 | 0.154 | 0.138 | 13.793 | 115.584 | 1.216 |

| Variables | Model 1 | Model 2 | Model 3 | Model 4 | Model 5 |

|---|---|---|---|---|---|

| Constant | 0.603 † (0.360) | 0.316 (0.436) | 0.283 (0.444) | 0.690 (0.444) | 0.704 (0.457) |

| Firm age | −0.002 (0.002) | −0.002 (0.002) | −0.002 (0.002) | −0.001 (0.002) | −0.001 (0.002) |

| Firm size | 0.106 * (0.048) | 0.108 * (0.048) | 0.107 * (0.048) | 0.074 (0.048) | 0.075 (0.048) |

| Capital intensity | −0.025 (0.028) | −0.022 (0.028) | −0.022 (0.028) | −0.014 (0.027) | −0.014 (0.027) |

| Year dummy | Included | Included | Included | Included | Included |

| Industry dummy | Included | Included | Included | Included | Included |

| Performance below historical aspirations | 0.611 *** (0.154) | 0.616 *** (0.153) | −0.442 (2.362) | 0.650 *** (0.151) | 0.977 (2.374) |

| Performance above historical aspirations | 0.330 † (0.188) | 0.328 † (0.188) | 0.329 † (0.188) | −8.371 * (3.306) | −8.468 * (3.384) |

| EO (entrepreneurial orientation) | 0.091 (0.080) | 0.106 (0.087) | 0.027 (0.081) | 0.021 (0.090) | |

| Performance below historical aspirations × EO | 0.287 (0.638) | −0.088 (0.640) | |||

| Performance above historical aspirations × EO | 2.361 ** (0.896) | 2.387 ** (0.917) | |||

| Overall R2 | 0.235 | 0.239 | 0.239 | 0.257 | 0.257 |

| F-value | 82.85 *** | 85.36 *** | 84.97 *** | 96.25 *** | 95.93 *** |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ok, C.; Ahn, H.S. How Does Entrepreneurial Orientation Influence the Sustainable Growth of SMEs? The Role of Relative Performance. Sustainability 2019, 11, 5178. https://doi.org/10.3390/su11195178

Ok C, Ahn HS. How Does Entrepreneurial Orientation Influence the Sustainable Growth of SMEs? The Role of Relative Performance. Sustainability. 2019; 11(19):5178. https://doi.org/10.3390/su11195178

Chicago/Turabian StyleOk, Chiho, and He Soung Ahn. 2019. "How Does Entrepreneurial Orientation Influence the Sustainable Growth of SMEs? The Role of Relative Performance" Sustainability 11, no. 19: 5178. https://doi.org/10.3390/su11195178

APA StyleOk, C., & Ahn, H. S. (2019). How Does Entrepreneurial Orientation Influence the Sustainable Growth of SMEs? The Role of Relative Performance. Sustainability, 11(19), 5178. https://doi.org/10.3390/su11195178